1. Introduction

Personal financial management is a crucial skill that significantly influences the economic stability and overall well-being of individuals [

1]. For university students who are scholarship recipients of the National Program of Scholarships and Educational Credit (Pronabec) in Peru, the effective management of their personal finances is even more critical due to the limited and specific nature of their income. These students, often coming from socioeconomically vulnerable backgrounds, face significant challenges in planning and managing their monthly scholarships, which can affect their academic performance and psychological well-being [

2].

The ability of students to manage their finances effectively is crucial not only for their economic stability but also for their academic success and general well-being [

3]. Financial software platforms can play a vital role in improving students’ financial management skills [

4], allowing for better planning and control of economic resources, facilitating informed decision-making, and reducing the risk of risky financial behaviors [

5].

The impact of the COVID-19 pandemic has highlighted the importance of digital financial literacy and the need for tools that can quickly adapt to unexpected changes in the financial environment [

6]. The ability of students to use digital platforms effectively is essential for their financial well-being and their ability to adapt to contemporary economic challenges [

7]. Recent research has shown that digital financial literacy has a significant impact on students’ financial well-being [

8].

Furthermore, merely providing funds is not sufficient; it is essential that students also receive support in managing these resources to maximize their utility and minimize financial stress [

9]. Mutevere et al. [

10] emphasize the need for scholarship programs that go beyond economic aid, providing monitoring and evaluation to ensure a lasting positive impact.

In response to this need, Finanz365, a web application specifically designed to help Pronabec scholarship students in Puno, has been developed to manage their personal finances efficiently. Finanz365 offers a series of integrated features, including income and expense recording, financial graph visualization, budget planning, and PDF report generation [

11].

Combining financial support with appropriate management tools can result in a significant reduction in the time required to complete studies and better long-term socioeconomic outcomes [

3]. Therefore, the development of comprehensive financial software platforms that offer these solutions as personalized management tools is an imperative need [

12].

This article focuses on the design and implementation of a comprehensive software platform that addresses these needs, providing scholarship students with a powerful tool that promotes effective financial management among university students, contributing to their academic success and overall well-being [

13].

2. Methodology

In this research, we will use applied research, which focuses on solving specific practical problems and improving the personal financial management of Pronabec scholarship students in Puno. Applied research is especially useful when seeking concrete results that can be directly implemented in practice [

14]. Furthermore, we will employ a mixed method, combining qualitative and quantitative techniques to provide a comprehensive understanding of the problem [

15]. This approach allows us to leverage the strengths of both methods and compensate for their respective weaknesses, thus achieving a more complete and robust view of the phenomenon studied [

16].

2.1. Literature Review

Personal financial management among university students, especially those who receive scholarships such as the Pronabec scholarship recipients in Peru, is crucial for their academic success and general well-being. Previous research has highlighted the importance of strong financial skills for these students, not only to manage their funds effectively but also to mitigate financial stress that could negatively affect their academic performance [

17,

18]. Financial software platforms, like those mentioned in previous studies, play a vital role by providing tools that facilitate budget planning, expense tracking, and financial data visualization, which can significantly improve students’ ability to manage their economic resources efficiently [

19,

20].

Additionally, current literature emphasizes the importance of digital financial literacy, especially in a context like the current one marked by the COVID-19 pandemic. This event has underscored the need for adaptable and accessible tools that can help students face unexpected economic challenges and manage their finances resiliently [

21,

22]. Recent studies have shown that improving digital financial literacy not only enhances students’ ability to make informed financial decisions but also can have a positive impact on their overall well-being and their ability to adapt to economic fluctuations [

10,

23].

3. Population and Sample

The study focuses on university students who are scholarship recipients of the National Program of Scholarships and Educational Credit (Pronabec) in Puno. This population includes all Pronabec scholarship beneficiaries in this region, who come from diverse socioeconomic and academic backgrounds. This diversity ensures that the sample is representative and adequate to evaluate the effectiveness of the intervention in the personal financial management of the students.

To evaluate the effectiveness of the project, several specific objectives were established. These include analyzing students’ perceptions of the usefulness and ease of use of the provided tools, measuring the impact on personal budget planning and control, and evaluating overall user satisfaction. Additionally, the architecture and design of the application will be documented and analyzed to identify possible future improvements.

A stratified sampling method was used to ensure that the sample was representative of the total population. This approach considered the various faculties and academic levels of the scholarship students. The final sample included students from different disciplines and academic levels, allowing for the collection of a wide variety of perspectives and experiences. To ensure the validity and reliability of the data, surveys and semi-structured interviews were used, as well as expert reviews and pilot tests.

3.1. Procedure

The development of Finanz365 followed a structured software engineering approach to ensure the efficient and effective implementation of the platform. The process included requirements definition, architecture design, development and implementation, and evaluation.

3.1.1. Requirements Specification

Functional Requirements

The platform should allow users to record all their financial transactions, including income, expenses, and transfers. It should also provide tools for creating, managing, and tracking personalized budgets, adapted to the users’ financial goals and spending habits. Additionally, it should offer detailed expense analysis by category to identify areas for savings and budget optimization. The ability to export financial data in formats such as CSV or PDF is essential to facilitate sharing and external analysis. Finally, the platform should have an intuitive and easy-to-use interface that enhances the user experience and facilitates navigation.

Non-Functional Requirements The application must be secure and protect the user’s financial information. It should load quickly, ideally in less than two seconds. Additionally, it should be easy to learn and use, even for users with no financial experience. The application must be scalable to handle a large volume of transactions and users. It should be reliable and available when users need it, with minimal downtime. It must comply with data privacy regulations and protect users’ personal information. The application should be easy to maintain and update to ensure its long-term functionality. Lastly, it should have an attractive and modern user interface to improve user satisfaction.

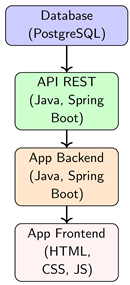

3.2. System Architecture

Finanz365 was developed using a distributed microservices architecture. The REST API, developed in Java with Spring Boot, connects to a PostgreSQL database hosted in a Docker container. The application consumes this API and is also built in Java with Spring Boot, using HTML, CSS, and JavaScript for the user interface.

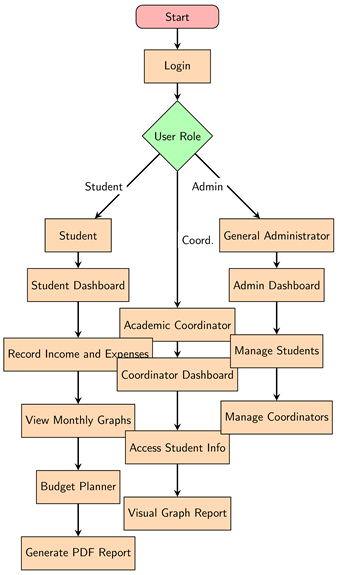

This diagram represents the general operation of the Finanz365 application, highlighting the main functionalities available for the three user roles: Scholarship Student, Academic Coordinator, and General Administrator.

3.3. Program Description and Flowchart

Finanz365 offers a series of integrated functionalities. The following figure shows the application flowchart:

3.3.1. Flowchart of the Finanz365 Application

Explanation of the Diagram

This flowchart represents the general operation of the Finanz365 application, highlighting the main functionalities available for the three user roles: Scholarship Student, Academic Coordinator, and General Administrator.

3.4. Scrum Methodology

Scrum is the agile framework selected for the development of the "Finanz365" project, based on the iterative and incremental delivery of functionalities.

3.4.1. Artifacts

In Scrum, artifacts are concrete elements that facilitate the planning, tracking, and transparency of the work. We use three main artifacts: the Product Backlog, a prioritized list of all the features, improvements, and bug fixes that are desired to be implemented in the product; the Sprint Backlog, which consists of a set of items selected from the Product Backlog that the team commits to completing during a sprint; and the Increment, the potentially deliverable version of the product that includes all the features completed to date.

3.4.2. Scrum Adaptation to the Project

The Scrum framework will be adapted to meet the specific needs of the "Finanz365" project. Processes and practices will be established to enable effective implementation of Scrum in the context of financial management application development.

3.4.3. Stakeholders

Within this project, three groups of direct users of the developed system were identified: the Scholarship Student, responsible for entering income and expenses and managing their budget; the Academic Coordinator, responsible for coordinating and communicating with the scholarship holders about Pronabec training or events; and the General Coordinator, who supervises and coordinates with the academic coordinators of each university campus. Effective communication with stakeholders was established to understand their needs and expectations.

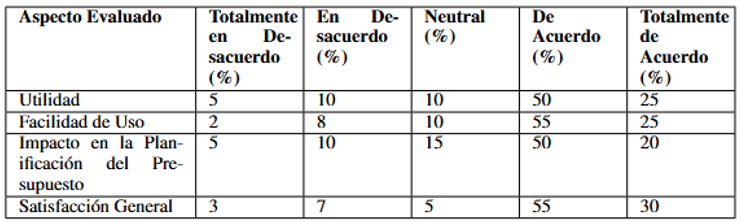

3.5. Application Evaluation

The evaluation of the Finanz365 application was conducted by analyzing user satisfaction and the impact on personal financial management. Both qualitative and quantitative techniques were used to measure the application’s effectiveness and efficiency. Quantitative data were obtained from surveys and application usage records, while qualitative data were collected through semi-structured interviews.

In terms of user satisfaction, the results were positive. Most users found the platform useful and easy to use. Below are some key satisfaction metrics:

Table 1.

Students’ Perception of the Finanz365 Platform.

Table 1.

Students’ Perception of the Finanz365 Platform.

Users also provided valuable feedback on areas for improvement. Notable suggestions included the implementation of a financial education module, financial advice notifications, and the ability to export data in Excel format.

3.6. Ethics

The Finanz365 project requires the collection, storage, and analysis of users’ financial and personal data, necessitating strict adherence to ethical principles to ensure privacy, security, and confidentiality of information. Specific measures were taken to protect users’ information, such as obtaining informed consent before collecting and using their data and developing a clear and accessible privacy policy detailing the handling, storage, use, and deletion of such data.

4. Results and Discussion

4.1. Results

The survey results showed that 50% of users considered Finanz365 to be "useful" and 55% found the application "easy to use." Additionally, 70% of users indicated that it had a positive impact on their personal budget planning, and 85% expressed overall satisfaction with the platform. These results reflect positive acceptance and satisfaction with the tool, underscoring its effectiveness in managing students’ finances.

Table 2 provides a detailed summary of user satisfaction responses.

4.2. Implemented Website

Below are some screenshots of the implemented Finanz365 website:

Figure 1.

Finanz365 Homepage

Figure 1.

Finanz365 Homepage

Figure 2.

Monthly Graphs in Finanz365

Figure 2.

Monthly Graphs in Finanz365

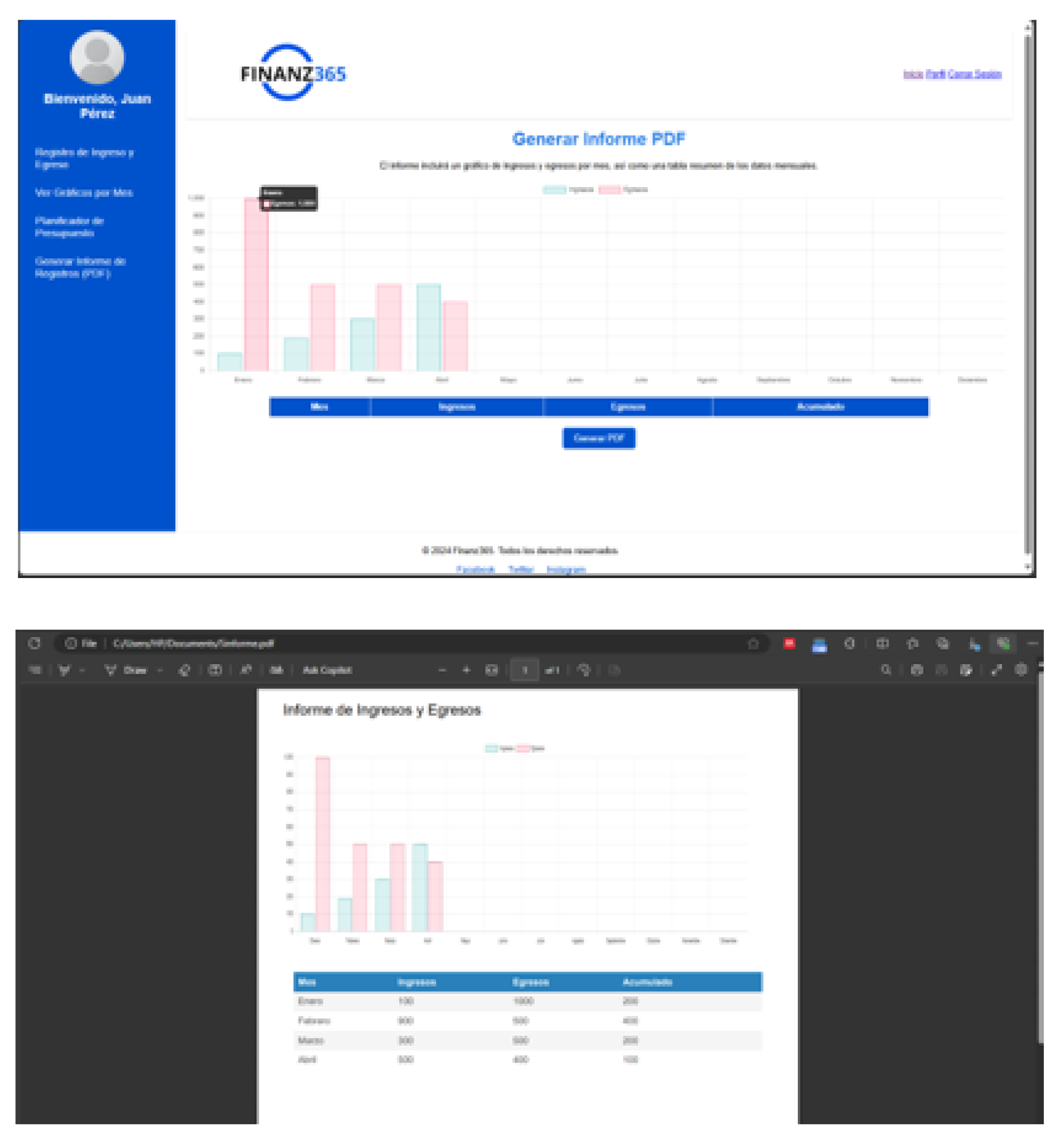

Figure 3.

PDF Report Generation in Finanz365

Figure 3.

PDF Report Generation in Finanz365

4.3. GitHub Repositories

The source code for Finanz365 is available in the following GitHub repositories:

4.4. Discussion

The results obtained with Finanz365 align with previous studies highlighting the importance of financial management and literacy in the academic success and economic stability of university students. For example, Cunningham (2018) in his thesis titled "Financial Literacy: Impact on Student Success" found that students with better financial knowledge showed superior academic performance and lower anxiety in their accounting classes [

24].

Similarly, Brausch (2018) in his study "The Relationship between Financial Literacy, Financial Status, and Academic Success in College Students" concluded that students who took a personal finance course had significantly higher retention and graduation rates compared to those who did not. This study used archived data to measure differences in retention rates, graduation rates, and final GPA between the groups [

25].

Finally, research conducted by Peng et al. (2007) in "The Impact of Personal Financial Education Delivered in High School and College on Financial Management Behaviors" suggests that financial education programs in university significantly improve students’ financial management behaviors. These findings underline the need to integrate tools and educational programs that promote financial literacy from early stages [

26].

The findings of this study confirm the importance of providing personal financial management tools to university students, especially those from socioeconomically vulnerable backgrounds. The Finanz365 platform proved to be an effective tool for improving financial planning and control, which is crucial for the academic success and general well-being of students [

22].

References

- R, V.; Sudha, B.; Farouk, M.; Ahmed, G. An Empirical Study of Association Among Financial Literacy, Financial Attitude and Financial Behaviour of Gen – Z. 2022 International Conference on Cyber Resilience (ICCR), 2022, pp. 1–6. [CrossRef]

- Ruiz-Palomo, D.; Galache-Laza, M.; Cisneros-Ruiz, A.; García-Lopera, F. Financial knowledge of pre-university students: Effects of age and gender. Heliyon 2023, 9, e15440. [Google Scholar] [CrossRef] [PubMed]

- Wang, X.; Liu, C.; Zhang, L.; Yue, A.; Shi, Y.; Chu, J.; Rozelle, S. Does financial aid help poor students succeed in college? China Economic Review 2013, 25, 27–43. [Google Scholar] [CrossRef]

- Liao, J. Financial ERP System Management and Design Based on Grid Algorithm. 2022 IEEE Asia-Pacific Conference on Image Processing, Electronics and Computers (IPEC), 2022, pp. 1093–1097. [CrossRef]

- Liu, L.; Zhang, H. Financial literacy, self-efficacy and risky credit behavior among college students: Evidence from online consumer credit. Journal of Behavioral and Experimental Finance 2021, 32, 100569. [Google Scholar] [CrossRef]

- Csiszárik-Kocsir, Á.; Garai-Fodor, M.; Varga, J. Generation-specific analysis of the pandemic’s impact on financial culture. 2022 IEEE 20th Jubilee World Symposium on Applied Machine Intelligence and Informatics (SAMI), 2022, pp. 000201–000206. [CrossRef]

- Zaimovic, A.; Meskovic, M.N.; Dedovic, L.; Arnaut-Berilo, A.; Zaimovic, T.; Torlakovic, A. Measuring Digital Financial Literacy. Procedia Computer Science 2024, 236, 574–581. [Google Scholar] [CrossRef]

- Choung, Y.; Chatterjee, S.; Pak, T.Y. Digital financial literacy and financial well-being. Finance Research Letters 2023, 58, 104438. [Google Scholar] [CrossRef]

- Scott-Clayton, J.; Zafar, B. Financial aid, debt management, and socioeconomic outcomes: Post-college effects of merit-based aid. Journal of Public Economics 2019, 170, 68–82. [Google Scholar] [CrossRef]

- Mutevere, M.; Dzinamarira, T.R.; Muzenda, L.; Nyoka, S.; Chokudinga, V.; Mugoniwa, T.; Moyo, E.; Kakumura, F.; Dzinamarira, T. Empowering underprivileged students beyond financial aid: Insights from a scholarship program’s monitoring and evaluation. Evaluation and Program Planning 2024, 105. [Google Scholar] [CrossRef]

- Rawat, R.; Goyal, H.R.; Sharma, S. Artificial Narrow Intelligence Techniques in Intelligent Digital Financial Inclusion System for Digital Society. 2023 6th International Conference on Information Systems and Computer Networks (ISCON), 2023, pp. 1–5. [CrossRef]

- Thompson, L.D.R.; Thompson, P.A. Seven Steps to Financial Health. Head and Neck Pathology 2024, 18. [Google Scholar] [CrossRef] [PubMed]

- Kumar, P.; Pillai, R.; Kumar, N.; Tabash, M.I. The interplay of skills, digital financial literacy, capability, and autonomy in financial decision making and well-being. Borsa Istanbul Review 2023, 23, 169–183. [Google Scholar] [CrossRef]

- Takona, J.P. Research design: qualitative, quantitative, and mixed methods approaches / sixth edition. Quality & Quantity 2024, 58, 1011–1013. [Google Scholar] [CrossRef]

- Tashakkori, A.; Teddlie, C. Mixed Methodology: Combining Qualitative and Quantitative Approaches; Sage Publications, 1998.

- Johnson, R.B.; Onwuegbuzie, A.J.; Turner, L.A. Toward a Definition of Mixed Methods Research. Journal of Mixed Methods Research 2007, 1, 112–133. [Google Scholar] [CrossRef]

- Hairin, N.; Nordin, M.; Hasim, N.; others. Factors Influencing Financial Management Behaviour Among University Students. ResearchGate 2022. [Google Scholar]

- Brau, J.; Holmes, A.; Israelsen, C. Financial Literacy among College Students: An Empirical Analysis. Journal of Financial Education 2019, 45, 179–205. [Google Scholar]

- ERP-SISTEMA. Benefits of Financial Software Systems. https://www.erpsistema.com/articles/financial-software-benefits, 2015.

- Liu, S.; Zhang, L.; Wang, Q. Impact of Financial Software on College Students. International Journal of Financial Studies 2021, 9, 67–82. [Google Scholar]

- Zaimovic, A.; Petrovic, N. Digital Financial Literacy in Post-COVID Era. Digital Finance 2024, 5, 23–35. [Google Scholar]

- Choung, J.; Lee, S.; Kim, D. Effects of Digital Literacy on Financial Decision-Making. Journal of Digital Finance 2023, 7, 112–125. [Google Scholar]

- Scott-Clayton, J. Financial Aid and Student Outcomes: Evidence from California Community Colleges. Journal of Human Resources 2019, 54, 567–590. [Google Scholar]

- Cunningham, A. Financial Literacy: Impact on Student Success. Bryant University Honors Projects 2018. [Google Scholar]

- Brausch, B.D. The Relationship between Financial Literacy, Financial Status, and Academic Success in College Students. Western Kentucky University Dissertations 2018. [Google Scholar]

- Peng, T.M.; Bartholomae, S.; Fox, J.; Cravener, G. The Impact of Personal Financial Education Delivered in High School and College on Financial Management Behaviors. Journal of Family and Economic Issues 2007, 28, 265–284. [Google Scholar] [CrossRef]

Table 2.

Students’ Perception of the Finanz365 Platform

Table 2.

Students’ Perception of the Finanz365 Platform

| Evaluated Aspect |

Satisfaction Percentage (%) |

| Usefulness |

50% |

| Ease of Use |

55% |

| Impact on Budget Planning |

70% |

| Overall Satisfaction |

85% |

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).