In the 2.2 we define the essential element to contain uncertainty and risk in the NHs.

In 3 we will present our PPP approach to assess the risk-return profiles of insurance and reinsurance private and public companies through advanced modeling techniques and implementing a new Early Warning System.

2.1. The Italian De-Risking State and Its New Public-Private Insurance Program

Climate change and NHs can rapidly and severely hit the financial stability of economies. Due to scarce information and awareness on their impact on the economies and lack of financial literacy, the effective demand for insurance may be scarce and public and private finance may end up being extremely exposed. Thus financial “protection gaps”, happening whenever those who may be directly or indirectly injured by the NHs cannot rapidly recover from a disaster due to absence of insurance coverage and other financial protection, can be very far to be closed through a genuine demand for insurance protection. This can justify the choice of the Italian de-risking government to adopt a compulsory coverage as that introduced by the last Italian Budget Law (2024) [

11].

Starting from 31 December 2024, the Italian Budget Law introduces the obligation to stipulate insurance contracts to cover damages to their tangible fixed assets as lands and buildings, plants and machinery, industrial and commercial equipment caused by natural disasters and catastrophic events that occurred on the national territory, for companies registered in Italy and abroad but operating in Italy through an establishment, excluding agricultural companies.

This is a novelty in the Italian insurance panorama (within which the perimeter of compulsory insurance coverage was limited to a few activities, the main one being that relating to the circulation of vehicles) whose purpose would appear to be that of replacing the public system with the private one, relieving the public sector from the burden of paying compensation in case of calamitous and catastrophic events, and inducing the private system to seek conditions of mutuality that allow the restoration of economic and productive conditions more rapidly than State intervention.

Any failure to stipulate insurance coverage will determine the exclusion, for the uninsured party, from the assignment of contributions, subsidies, financial benefits to be drawn from public resources, also with reference to those provided for in the event of calamitous and/or catastrophic events (paragraph 102 of the Italian Budget Law 2024) [

11].

With reference to the hazards to be covered, pending the detailed indications that the Ministers of Economy and Finance and of Enterprise and Made in Italy, in agreement with the Institute for Insurance Supervision, IVASS, the current list (i.e. earthquakes, floods, landslides, inundations and overflows) is merely exemplary.

Similarly to civil liability arising from the circulation of vehicles and vessels, insurance companies will not be able to avoid the obligation to contract, under penalty of applying an administrative pecuniary sanction ranging between Euro 100,000 and 500,000 to be paid by them.

Given the nature of the insurance commitment that they will have to assume, paragraph 103 of article 1 of the Budget Law 2024 [

11] allows insurance companies not only to directly underwrite the risk, having the financial capacity to do so, but also to act in co-insurance or by establishing consortia with other insurance companies; the latter must however be registered and approved by IVASS which will evaluate their stability.

Acting as a public re-insurer, then, SACE, an Italian insurance-financial group directly controlled by the Ministry of Economy and Finance, will ensure that the obligations undertaken by the insurance companies are fulfilled by acting as reinsurer, indemnifying the insurance and reinsurance companies of the private market up to 50% of the compensation paid by the latter, for an amount not exceeding 5000 million Euro for the year 2024 and, for each of the years 2025 and 2026, not exceeding the greater amount between 5000 million Euro and the free resources at December 31 of the immediately preceding year, not used for the payment of compensation in the reference year.

To further ensure the overall solvency of the system, it is expected that the obligations assumed by SACE will be guaranteed by the State on first demand and without the possibility of recourse. The State guarantee is explicit, unconditional and irrevocable (paragraph 109 of article 1 of the Budget Law 2024) [

11].

The eventual expansion of the scope of insured risks will also have an effect on the verification of the solvency conditions of companies by IVASS: it cannot be excluded that, in order to meet the obligations to contract imposed by the provisions mentioned above, companies will seek greater diversification of the risks present in their portfolio and, possibly, alternative forms of reinsurance, with respect to which greater flexibility is hoped for by the Insurance Supervisory Authority, regarding their admissibility. It will also be interesting to see how the pricing of coverage and its tax treatment will be declined, since different areas of our country correspond to a more or less marked exposure to calamitous and/or catastrophic events (which should lead to a different declination of the premium to be paid) and that private intervention replaces public intervention in the management of compensation (and, as such, should have a preferential tax treatment, strictly speaking).

With specific reference to the real estate sector, the legislator also intended to extend the range of subjects obliged to perform the insurance obligations in question. In this regard, in fact, on February 27, 2024, Italian Law 17/2024 [

13] was published in the Official Journal, converting Legislative Decree no. 212 of 29 December 2023, according to which, all those who have benefited from the tax benefits under the so-called " superbonus " (see art. 119, paragraph 8-ter, Italian Legislative Decree 34/2020) [

14], in relation to expenses for interventions started after 30 December 2023, are also obliged to obtain insurance to cover damage caused to the related properties - including, therefore, even residential properties - by natural disasters and catastrophic events, all within one year of the conclusion of the works subjected to the benefits of the "superbonus". The beneficiaries of the "superbonus", therefore, could find themselves in a delicate position: while, on the one hand, they are entitled to the enjoyment of specific tax breaks, on the other they will now be required to take out additional insurance policies, representing a further financial burden for them.

On the 4th of July 2024 SACE (SACE, 2024) [

15], in partnership with Facile.it, launched Smart Climate Risk Protection a catastrophic damage policy for micro-enterprises. That is, SACE, an Italian insurance-financial group, directly controlled by the Ministry of Economy and Finance, and Facile.it, a national reference price comparison site for the insurance sector, announced a partnership in favor of Italian micro-enterprises and SMEs for the dissemination of the new Smart Climate Risk Protection policy specifically for catastrophic damage.

The partnership between SACE and Facile.it marks an important point in the world of insurance and, for the first time, two leading companies join to allow micro-enterprises to obtain maximum benefits with the best technology available on the market. The aim of the agreement is to make Climate Risk Protection smart, accessible in a simple and fast way, with a direct link to MySACE.it, also through the Facile.it platform.

With this initiative, SACE extends its commitment to serving micro-enterprises, providing them with tailor-made products and digital promotion channels, while Facile.it confirms its desire to become a point of reference in savings not only for end consumers, but also for the B2B sector.

The compulsory regime chosen by de-risking Italian government can be mitigated by big data and technologies, useful to better adapt the insurance products or services to customers’ needs, but even to prevent NHs and their consequences. Reflecting actual risk a policyholder is exposed, risk-based pricing as premiums and deductibles can produce safer behavior helping climate change adaptation and mitigation of the risks. This then reflects on a reduction in risk, less money to afford losses and decreasing premiums. For example, a Lloyd’s catastrophe insurance policy in the Netherlands, allowed purchasing coverage for flood damage, earthquake and terrorism risks. As far as flood risk, policyholders received premium discounts if they take measure to “floodproof” their home. They found flood risk information on the insurer’s website on which they could enter their zip code to extract information about flood probabilities, potential water levels, quality of flood protections and the risk-based insurance premium. Four different measures allow each a 5% premium discount: 1) installing electrical equipment, 2) the central heating installation above the ground floor level, 3) having flood shields available, 4) having a water-proof floor on the ground floor level, such as tiles.

It was the European Insurance and Occupational Pensions Authority (EIOPA), a European Union financial regulatory institution, that introduced the concept of

“Impact Underwriting

” that is “the development of new insurance products and the engagement with public authorities, without disregard for actuarial risk-based principles of risk selection and pricing” (EIOPA, 2019, 2021) [

12,

16]. A contest of changing climate, expectedly growing climate-related losses and increasing premiums, justifies the intervention of public re-insurances and PPIPs to contain the “protection gap”. The unaffordability for the policyholder on one hand and a crowding of the private insurances and re-insurances out of the market due to their incapability to remain profitable were, in fact, other sources of long-term financial instability to economies. Moreover, NHs and extreme severe catastrophic events underlie the necessity for the whole insurance sector to privilege non-life underwriting. Through non-life underwriting the insurance sector not only is able to transfer and pool the risk but even to contribute, through insurance-based solutions, to climate mitigation and adaptation. To this aim the EIOPA (2019) [

16] used the categorization of financial climate change risks introduced by the Bank of England (Carney, 2015) [

4], for example, to measure how increasing underwriting, counterparty default risk or market risk for (re)insurers, affect the value of the assets and liabilities. The example cited above of the Lloyd’s catastrophe insurance policy in the Netherlands offers us the occasion to stress the importance of our PPP contribution as a kind of flood risk assessment based on a zip-code identification is certainly based on an extremely simplified territorial schematization and a static evaluation of the areas that could eventually been involved by the inundation. Even the use of big data, nowadays very important, is based on extremely simplified hypothesis founded on phenomenology of damage. But the climate change effect, on the contrary, may produce dynamic extreme tail events that very simplified and static systems of evaluation are not able to detect. The next section is essentially devoted to highlight these aspects.

2.2. Uncertainties and Risk in NHs

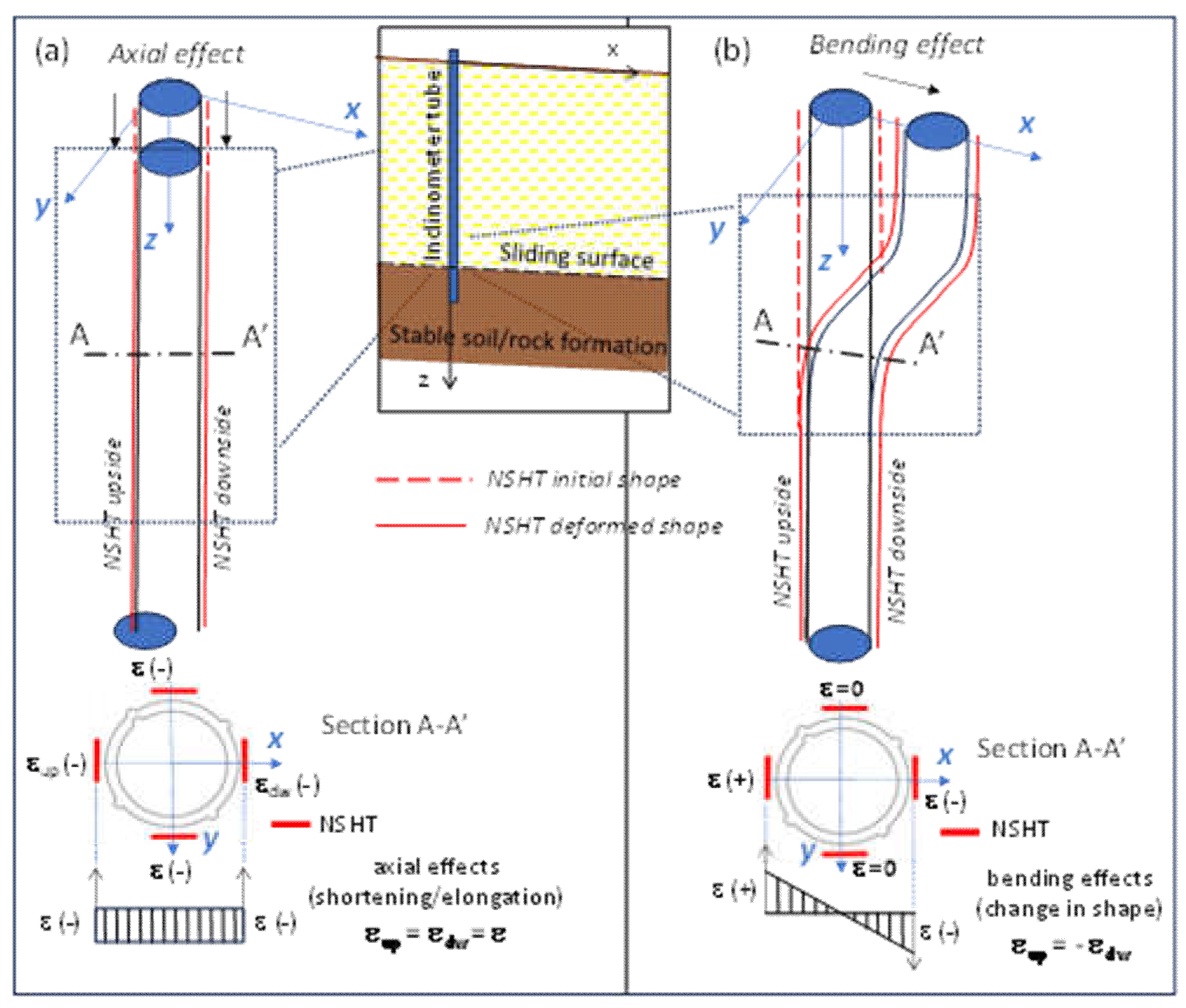

The assessment of the risk of the loss of human lives and material assets (structures and infrastructures) due to catastrophic events is a crucial aspect of civil engineering and emergency management. This risk is closely related with the spatio-temporal probability of a catastrophic event to happen and its potential to strike an engineering work with finite vulnerability with destructive energy. The probability of a catastrophic event is related to the system’s ability to counteract it, depending on the mechanical and geometric characteristics of the natural and built system in question. That is, this probability is based on Mechanical Characteristics (including the properties of soil deposits, materials and structures that influence resistance to catastrophic events, such as earthquakes, floods, landslide, etc.), Geometric Characteristics of Engineering System (soil deposits, structure and infrastructure involved), Historical Data of past catastrophic events (to understand the frequency and magnitude of future events) and Predictive Mathematical Models (to predict the behavior of natural and built systems under stress).

Therefore, the calculation of the probability of occurrence is more accurate the more precise the definition of the models capable of following the underlying physical phenomenon and the physical quantities involved is. Hence, the definition of the probability of occurrence is closely tied to the uncertainties inherent in the definition of behavioral models and the related physical quantities. The following will focus on the techniques available in the engineering field for handling uncertainties (Ferrero et al. 2004 [

17]; Baecher and Cristian 2003 [

18]; Hudson 2013 [

19]).

If we solely isolate the cases caused by landslides and earthquakes among NHs, the engineering system to be monitored consist of soil deposits, structures, and infrastructure that interact with the soil deposit and atmospheric components (wind, rainfall, etc.)

The nature of uncertainties in such a system is widely discussed in engineering, and the sources of uncertainty can be classified as (Einstein and Baecher 1983) [

20]:

- (a)

inherent to the spatial and temporal variability of the soil deposit;

- (b)

due to measurement errors of the monitoring systems (systematic and random);

- (c)

consequent to assumptions and simplifications introduced in the choice of the model;

- (d)

related to the difficulty in defining natural and anthropogenic mechanical actions,

- (e)

relative to omissions due to schematizations and simplifications of different nature or deficiencies in the knowledge phase.

Each source of uncertainty must be adequately considered and addressed in engineering, distinguishing between epistemic uncertainty, which is due to a lack of knowledge, and aleatory uncertainty, which is related to intrinsic variability.

Epistemic uncertainty can be overcome as it is linked to a lack of knowledge that can be refined through in-depth investigations. As discussed earlier (section 2.1), the information available today to define the probability of catastrophic events are based on static studies (essentially relying on historical data analysis that cannot adequately account for the dynamic nature of NHs and the changes induced to the effects of climate change) conducted under highly simplified assumptions regarding the modeling of physical phenomena underlying catastrophic events, and on cartographic bases at a regional scale (most studies are based on cartography with geometric schematizations at a 1:25000 scale). In fact, one of the main sources of epistemic and aleatory uncertainty in risk assessment for landslides and earthquakes lies in the quality of the data and the scale to which they refer. For example, in modeling landslide phenomena and earthquake effects, an analysis scale with insufficient level of detail, such as the one too frequently used in nowadays evaluations, induces not only epistemic errors with serious repercussions on the geological and geotechnical model used, but also errors with high aleatory uncertainties due to greater data dispersion resulting from an excessively broad scale of analysis. Thus, having a detailed analysis of the geotechnical model through a combination of conventional monitoring systems and innovative instruments, along with continuous data acquisition, results in a significant reduction of both epistemic uncertainty (allowing previously unavailable information to be obtained) and aleatory uncertainty (availability of a large quantity of high-quality data) (Dubois and Guynnet, 2011) [

21]. For each level of uncertainty (the level of information between complete absence of information and total knowledge), there is an optimal model to be used. A low level of information only permits deterministic analyses, while as the level of information increases, it is possible to achieve a more accurate frequency distribution of a given variable and thus a statistical treatment of it. However, statistical analyses with inaccurate and/or scarce data (such as those currently in use) can lead to unreliable and often misleading results, impacting risk assessment. Our PPP therefore works in the direction of producing information for accurate calculation of the probability of occurrence of catastrophic events and managing the related uncertainties to reduce risk and improve the resilience of infrastructures. In the next section, it is shown how the application of innovation and advanced techniques can be used for managing uncertainties, enabling engineers to develop more reliable and safe solutions, helping to protect human lives and material assets, with direct implications for insurance and re-insurance industries.