1. Introduction

In general, the main challenges businesses face are leaving their competitors behind, being a pioneer in the competition, and being a sustainable business. However, one of the most important strategic challenges today’s businesses face is how to become socially and environmentally sustainable (Crosbie & Knight, 1995). Having sustainable business performance is the main goal of almost all businesses (Fauzi et al., 2018; Chou et al., 2018). Sustainable business performance can be defined as the harmonization of financial, social, and environmental objectives in the performance of core business activities to maximize value (Haseeb et al., 2019). For businesses, this includes sustaining and expanding economic growth, shareholder value, prestige, corporate reputation, customer relationships, and the quality of products and services. This also means adopting and maintaining ethical business practices, creating sustainable businesses, creating value for all the company’s stakeholders, and meeting the needs of the underserved (Székely, & Knirsch, 2005). Adopting sustainability aspects helps industries achieve corporate strategy (Agrawal et al., 2022). For this reason, businesses need to change the way they create, deliver, and capture value in environmental, social, and economic perspectives in line with sustainability (Goni et al., 2021). Green business ethics and green financing are increasingly coming to the fore as the key to sustainability and are the subject of this study.

Green financing refers to the deployment of traditional capital markets to create and distribute a range of financial products and services that provide both investable returns and environmentally positive outcomes (Lee, 2020). Green financing is an important phenomenon to effectively manage environmental risks, reasonably balance economic resources (Wang and Zhi, 2016), promote environmental improvement, and improve resource utilization (Ng, 2018). Green financing emerges as a type of financial innovation that emphasizes ecological development. Reasonable selection of financial instruments can effectively supervise enterprises, reasonably guide the development direction of enterprises, limit environmental pollution, promote financial innovation, and enhance green finance (Wang et al., 2022).

Green business ethics constitute an important component of green practices (Pervez, 2020). Green practices include sustainability activities in the use of natural resources. It is important for businesses to carry out their work in environmental, social and economic sustainability dimensions while continuing their activities and to act ethically in this process. According to Bayram and Öztırak (2023), issues such as businesses complying with ethical values, exhibiting honest and transparent business practices, and protecting consumer health and safety constitute a part of green business ethics. In other words, green business ethics means supporting green practices in all areas of the business and managing this process ethically.

The importance of green business ethics and green finance is increasing day by day for the survival of a business and the success of sustainable business performance. However, another issue that has become a necessity for business success is the phenomenon of corporate social responsibility. Businesses with ethical values can adopt CSR practices more effectively and thus develop successful practices in being more sensitive to society (Yalçın, 2024). Corporate social responsibility can be expressed as the way businesses manage their business processes in a way that creates an overall positive impact on society (Sammy, Odemilin & Bampton, 2010). Although the responsibility expressed here varies, what constitutes corporate social responsibility varies from business to business. Saw (2010) states that CSR is a great responsibility of businesses and that all businesses must follow accounting practices, adhere to international norms, and fulfill their social responsibilities in practices such as giving importance to transparency in reporting.

It is possible to consider the concept of corporate social responsibility as a set of studies put forward to create the rules of sustainable development of businesses (Hys & Hawrysz, 2012). Because the basis of both concepts is first the environment and society, and then economic growth (Boran, 2023). Therefore, in this study, it would be useful to examine sustainable business performance in the context of green financing and green business ethics, with the mediating effect of CSR. Another benefit of the study that is considered for the literature is the country in which the businesses that make up the research population operate. As one of the important countries connecting the European and Asian continents, Turkey is one of the countries where important steps must be taken regarding sustainability with its businesses operating in different industries. Although various researches and analyzes have been conducted on sustainability on a global scale and in Turkey, there is no study investigating the impact of green business ethics and green finance on sustainability. In addition, no study has been conducted to examine the impact of green business ethics and green finance on sustainability through the mediating effect of corporate social responsibility and to investigate this in the context of Turkey. Therefore, this study is one of the attempts to fill the literature gap.

The study aims first to investigate the impact of green business ethics and green finance on the sustainability performance of businesses and then to reveal how this impact is realized through corporate social responsibility (CSR).

The sub-objectives of the research can be listed as follows;

To examine the role of green business ethics on sustainable business performance.

Examining the role of green financing on sustainable business performance.

To examine the role of corporate social responsibility on sustainable business performance.

To examine the role of green business ethics on corporate social responsibility.

To examine the role of green financing on corporate social responsibility.

Examining the mediating effect of corporate social responsibility on sustainable business performance in the context of green business ethics and green finance

The findings obtained in the context of the purpose of the research provide an important basis to guide the use of green business ethics and green financing practices in developing sustainability-based strategies in the business world. The remaining sections of the study are organized as follows: First of all, a literature review was conducted on green business ethics, green financing, sustainable business performance and corporate social responsibility, and hypotheses were presented based on the theoretical framework developed for these variables. Then, the methodology and findings of the study are presented, followed by the interpretation of the findings and the practical implications and limitations of the study.

2. Theoretical Background and Hypothesis Development

2.1. Relationship between Green Business Ethic and Sustainable Business Performance and CSR

While the green business ethics approach encourages environmentally friendly practices, it also aims to use energy carefully, ensure resource efficiency, reduce carbon footprint, ensure waste recycling and not harm natural resources. The green business ethics approach contributes to guiding businesses to focus on ethical values while achieving their goals. . In terms of social responsibility, businesses are expected to take care of the welfare of their employees, respect human rights, contribute to local communities and adopt fair trade practices (Bayram & Öztırak, 2023). In this regard, issues such as businesses complying with ethical values, exhibiting honest and transparent business practices, and protecting consumer health and safety constitute important elements of green business ethics.

In the context of corporate social responsibility, businesses are expected to not only seek profit but also fulfill their responsibilities towards society and the environment. In this context, it is important for businesses to take an active role and provide social benefit in areas such as sustainability, environmental protection, education and social welfare (Ay, 2003).

Green business ethics can give businesses a competitive advantage, strengthen their reputation, and increase consumer loyalty. This approach encourages companies to do business not only focused on economic gain but also by considering their environmental and social impacts. Green business ethics can contribute to businesses creating a sustainable and successful business model by taking into account not only their own interests but also the interests of society and the environment.

According to Lin Shanyu’s (2022) study on Corporate Social Responsibility (CSR) and sustainable business performance in BRICS countries; There appears to be a positive relationship between CSR activities and sustainable business performance in BRICS countries. CSR practices have been found to have a significant impact on the financial situation of developing countries such as BRICS, highlighting the importance of CSR in workforce empowerment.

Additionally, the study states that CSR activities play an important role in increasing the effectiveness of business performance and that there is a positive relationship between CSR and economic position. These findings highlight the importance of CSR initiatives to support sustainable business performance and economic growth in emerging economies such as BRICS. Based on this information, the hypothesis that green business ethics is effective on sustainable business performance and corporate social responsibility was put forward and the H1 and H2 hypothesis expressed below were developed.

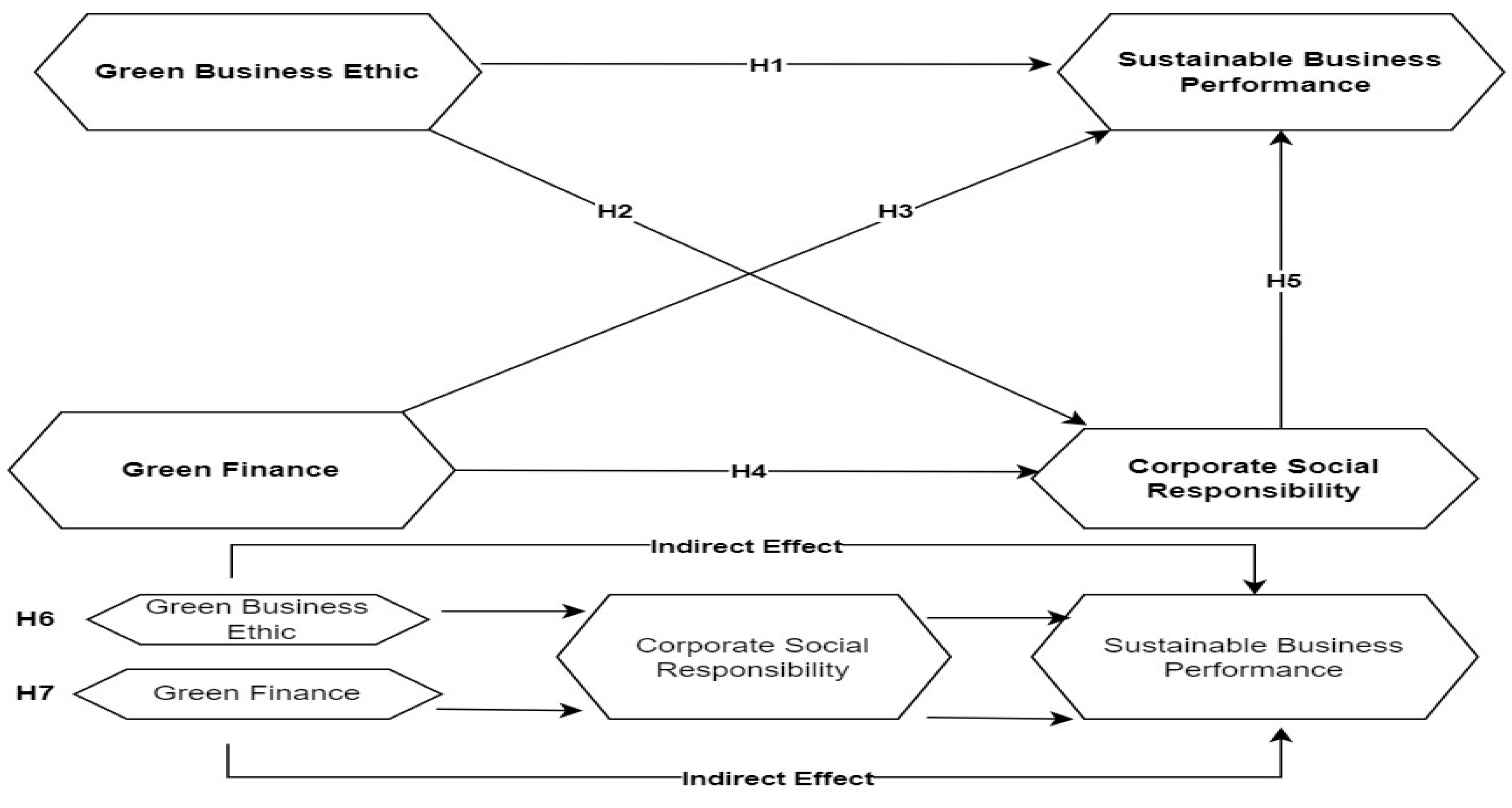

H1: Green business ethic and sustainable business performance are positively correlated.

H2: Green business ethic has a positive significant effect on CSR practice adoption

2.2. Relationship between Green Finance and Sustainable Business Performance and CSR

In recent years, the intersection between finance and environmental concerns has begun to rapidly grow. From a corporate and financial strategies perspective, green is the new black, leading companies are embracing sustainability goals and endeavors. Furthermore, green framework activities have been implemented and scrutinized within business settings. Many corporations start implementing Corporate Social Responsibility (CSR) as a well-defined role in their business, providing Corporate Social Responsibility with substantial responsibilities towards the interaction of business with communities, interest groups, and other stakeholders (Falcone, 2020). Green finance is the financing of a new or existing business activity that manages environmental externalities in a way that generates sustainable long-term economic models by allowing all economic agents to participate through fair pricing in capital markets. Within the developed paradigm of green finance, sustainable investment is a subcategory that has a very specific measurement overload at the global level (Rizzello,2022).

On a practical level, corporate managers are increasingly asked about the environmental (and CSR) consequences of their operations, and can expect inquiries about their ability to access green financial markets. Discussions with financial stakeholders about a firm’s environmental risk or operational sustainability can have positive or negative implications for investment valuations. To make it effective, managers might have an incentive to engage in these discussions that cover financially material environmental activities (Gangi et al.2020). The convergence of green finance and corporate social responsibility (CSR) is expected to increase motivation for companies to adopt environmentally friendly practices. CSR offers a framework for companies to consider their impact on the environment and society, and integrating CSR into the decision-making process has become a significant priority for businesses (Carroll,2015). Some companies are prioritizing CSR by incorporating it into their core strategies and creating relevant content, aiming to maximize the benefits of their CSR efforts. However, the level of CSR adoption by companies appears to be influenced by their primary business activities, with companies generating higher revenues generally allocating more resources to CSR initiatives. (Bacinello et al.2021). The rapid development of eco-friendly financial products and stock markets has been closely linked to efforts to incorporate environmental considerations into corporate strategy and management. Both of these financial markets and the companies they represent are influenced by the incentives of investors and corporations, and there is a growing focus on aligning these incentives when feasible and suitable. As a result, there has been a substantial increase in the utilization of green financial products and the business performance of the companies (Li & Yang, 2022). Based on the literature, the hypothesis that Green finance has a significant positive impact on sustainable business performance was put forward and the H3 hypothesis expressed below was developed.

H3: Green finance has a significant positive impact on sustainable business performance

The adoption of corporate social responsibility (CSR) practices with the help of green finance adoption can be analyzed in terms of some green financial products. Looking at the big picture, supporting both public and private interests, on a local to global level, it’s important to have good plans in place to guide banks, investors, and market players toward a “Net-Zero pathway” (Tan et al., 2020). Some countries have developed their green finance regulations and guidelines for bonded projects from their central banks or financial institutions, representing Poland, the Netherlands, and the UK; each provides detailed application forms, procedures, and evaluation and certification institutions. However, Japan and Saudi Arabia have their green finance/PRB requirements/guidelines set by their financial authority instead (Steffen, 2021).

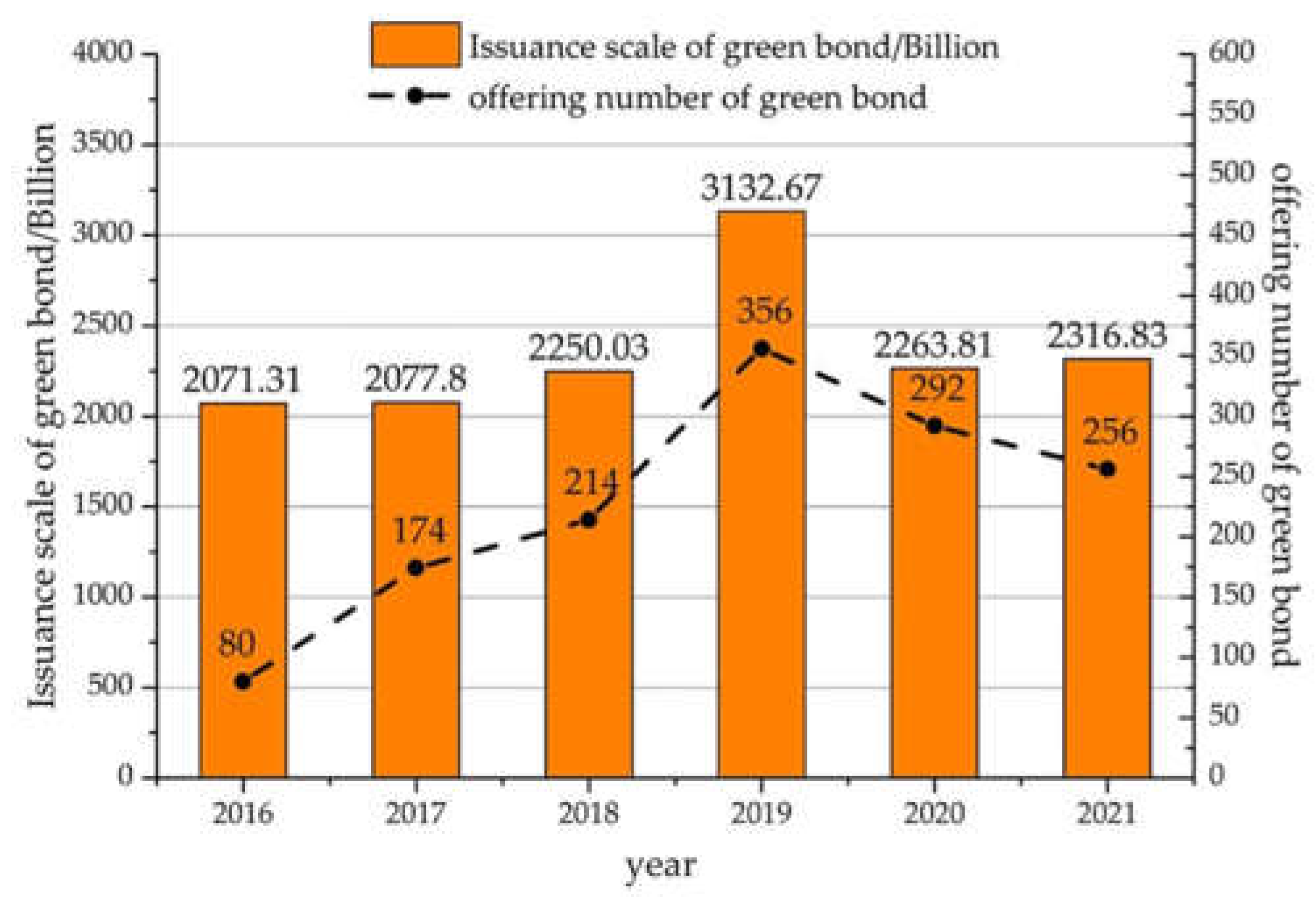

As the world’s largest carbon emitter and a developing economy, China’s economic growth has had a significant environmental impact. (Wenfang Feng et al., 2023) China has developed a green bond market and implemented innovative policies like the guarantee system and regulatory standardization. These efforts have diversified green bond types and attracted more green companies and investors to the Chinese market. The establishment of a green bond market is one of the steps taken by the government to address this issue, and recent studies have shown a booming issuance of green bonds in China (Zhou et al.,2019). Green bonds can be issued by not just states but various entities, including banks, corporations, local authorities. Since the impact of financial activities on the environment is not always reflected in their costs, green bonds can help to attract a wide range of investors and alleviate this issue. By engaging with a broader investor base, financial institutions and banks can play a crucial role in minimizing negative environmental effects such as pollution. (Lyu et al., 2022). Wenfang Feng et al. have studied the number of green bonds to be used in the green insurance system in China for a 5 year period. see

Figure 1, below.

Green credit is a crucial financial product for supporting green finance and combating climate change. Many companies are eager to obtain it, as it is considered the most influential tool in green finance. The primary objective is to reduce carbon emissions by investing in energy-efficient, low-pollution production. Green credit was first introduced in China in 2007 as part of a conservation plan and was developed by the State Ecological Safety Management, the People’s Bank of China, and the China Banking Regulatory Commission. In 2012, the Chinese government issued guidelines for green credit, allowing major banks to oversee green credit products and increase credit to businesses, thus improving green credit products (Wenfang Feng et al., 2023).

The use of green insurance products is really important for helping the environment and dealing with climate change. According to Belozyorov and Xie (2021), the Chinese financial industry has introduced these new insurance products to handle environmental risks and help protect the environment. These products specifically focus on issues like pollution liability to reduce pollution and encourage eco-friendly production. Researchers have also pointed out how environmental damage can hurt the financial markets, so the Chinese financial industry is teaming up with the government and others to fight against the harm we’re causing to the environment. One big part of this effort is prioritizing the development of green insurance products to encourage environmentally friendly practices.

In the domain of green finance and CSR, various national regulations and guidelines have been issued in G20 countries or jurisdictions, mainly for the financial and banking sectors, and for investor information disclosure and strategy. The majority have focused on information disclosure and institutional innovation, like the green bonds or sustainable investment guidelines imposed by the G20, China, the European Commission “Action Plan” (ECAP), and India (Nayak et al.,2024).

As a result, the financial industry is undeniably important in creating a greener future. Switching to green finance or green accounting and reporting, releasing green bonds and indices, and adopting SCM practices and international socially responsible standards shows the progress. When a company takes a clear stand on its environmentally friendly investments or activities and aligns its CSR policy with the relevant aspect, it already enhances the financial aspect. Based on the literature, the hypothesis that Green financing positively impacts the adoption of CSR practice was put forward and the H4 hypothesis expressed below was developed.

H4: Green financing positively impacts the adoption of CSR practice

2.3. Relationship between CSR and Sustainable Business Performance

Corporate social responsibility is a topic that is receiving more attention in discussions about business and sustainability (Székely & Knirsch, 2005). While it was previously argued that the only obligation of businesses was to provide financial benefits to their stakeholders, social welfare, which was a part of the responsibilities of businesses, was ignored. Nowadays, new dimensions such as corporate social responsibility and sustainable business are being adopted (Bahadur & Waqqas, 2013). The support of the H5 hypothesis in the research conducted with the findings confirms this in a sense. CSR significantly affects sustainable business performance, and this result has supported other previous studies in the literature. Abbas et al. (2019), in their research on corporate social responsibility and the sustainable performance of companies, stated that CSR has a direct effect on performance. KKS confirms that the interaction relationship between business competitors improves relationship resources, the strength of firm resource control, cohesion, and trust resulting from communication and interaction between business industries and other members of the business network. Bacinello, Tontini & Alberton (2021) stated in their research that evaluated how a business develops in a certain field in CSR in order to follow a strategic path towards developments in economic, social and environmental dimensions, and stated that CSR enables businesses to achieve sustainable competitive advantage. Li et al. (2022)’s research in the context of tax avoidance and employee behavior through the regulatory role of CSR revealed that corporate social responsibility has a significant and positive effect on sustainable business performance. It confirms that CSR activities are an important driving force of sustainable economic development and that this force encourages the enterprise’s contribution to the protection of the environment and motivates to initiate green innovations. Based on the literature, the H5 hypothesis was developed that corporate social responsibility is effective on sustainable business performance.

H5: CSR significantly influences sustainable business performance.

2.4. Relationship between CSR and Green Business Ethic and Sustainable Performance

Corporate social responsibility is the management of a company’s activities with a focus on sustainability, ethical values and social benefit, taking into account the effects of its activities on society, the environment and its stakeholders. Corporate social responsibility involves companies aiming to produce solutions to social and environmental problems by taking into account the needs of society and the environment, rather than acting only for the purpose of making profits. The relationship between green business ethics and corporate social responsibility plays an important role in the process of businesses managing their environmental and social impacts. The study conducted by Carroll and Shabana (2010) examined how the concept of corporate social responsibility can be used in the process of managing and improving the social impacts of businesses. In Waddock and Bodwell (2011); It states that businesses’ adoption of green business ethics and corporate social responsibility practices can increase their financial performance. This study emphasizes that green business ethics and corporate social responsibility should be considered as part of the long-term sustainability strategies of businesses. Based on this information, the hypothesis that corporate social responsibility is effective on sustainable business performance and green business ethics was put forward and the H6 hypothesis expressed below were developed.

H6: CSR mediates significant on the relationship between green business ethic and sustainable performance

2.5. Relationship between CSR and Green Financing and Sustainable Performance

It is supported by various studies that CSR practices increase green financing opportunities and positively affect sustainable business performance in the processes of businesses fulfilling their environmental and social responsibilities. CSR covers the activities of businesses that aim not only for profit but also to provide social and environmental benefits (Carroll & Shabana, 2010). In this context, CSR practices of businesses overlap with green financing strategies. Green financing refers to financial instruments used to finance environmentally sustainable projects, and these instruments are often developed in line with CSR policies (Ng, 2018). In the study conducted by Wang and Zhi (2016), it was stated that CSR practices encourage the effective use of green financing tools and thus contribute to businesses achieving their sustainability goals.

The impact of CSR on sustainable business performance has also been extensively studied in the literature. For example, Abbas et al. (2019) stated that CSR helps businesses create sustainable business models by increasing their financial performance. At the same time, Li et al. (2022) emphasized that CSR practices enable businesses to avoid unethical behavior such as tax evasion, thus supporting long-term sustainable business performance.

In addition, it is stated in the literature that the relationship between green financing and CSR increases the competitive advantage of businesses. Waddock and Bodwell (2011) stated that CSR and green financing strengthen the reputation of businesses and increase customer loyalty. This allows businesses to manage both their financial performance and sustainability goals more effectively. As a result, the effects of CSR on green financing and sustainable business performance are strongly supported in the literature. Based on the literature, hypothesis H7 was developed on the mediation effect of corporate social responsibility on the relationship between green finance and sustainable business performance.

H7: CSR mediates significantly on the relationship between green finance and sustainable performance.

3. Materials and Methods

3.1. Population and Data Collection

Due to the lack of data reflecting the universe of companies in Turkey that use green financing and implement green business ethics practices, the target audience of the research consists of managers (CEOs, general managers, deputy general managers, business function managers, unit managers, etc.) of leading institutions in Turkey, identified from independent and reliable research (such as Fortune 500 Turkey, Bilişim 500, Capital 500, Most Successful Financial Institutions, etc.) for their reputation and success in their respective sectors. The research was conducted using the frequently used probability-based simple random sampling method (Saruhan & Özdemirci, 2016, p. 202), which includes elements with an equal chance of being selected and has a high representativeness of the universe. For determining the sample size, the study benefited from research on acceptable minimum sample sizes for different universes in social sciences (Yazıcıoğlu & Erdoğan, 2004). According to this study, even in a universe exceeding 100 million, 384 people are said to represent the universe at a 95% confidence level. For this study, 451 surveys were completed, and after adjustments, analyses were conducted on 427 surveys. Therefore, it can be said that the sample of the research represents the universe.

3.2. Measurement Instruments

In the research, demographic data were gathered by asking questions regarding gender, education level, company age, number of employees, the sector in which the company operates, and participant position. The measurement tools used in the research are scales whose validity and reliability have been established by reputable studies. The details of the measurement tools are as follows: The Green Finance scale, consisting of 5 questions, was developed by Afraz et al. The Corporate Social Responsibility scale, consisting of 5 questions, was developed by Costa et al. The Sustainable Business Performance scale was developed by Fernando et al. The Green Business Ethic scale, consisting of 20 items, was developed by Bayram and Öztırak (2023). The data were collected using an online survey method, and the research measurement tools were designed in a 5-point Likert scale format. The scale ranges are as follows: “5; strongly agree, 4; agree, 3; neutral / no opinion, 2; disagree, 1; strongly disagree.”

3.3. Statistical Analysis

In this study, data obtained from 427 participants were analyzed using the AMOS 24 software. Structural Equation Modeling (SEM), frequently used in the literature to examine complex relationships, was employed in the developed model. SEM is preferred due to its ability to simultaneously analyze complex relationships and multiple variables. It controls measurement errors, disentangles direct and indirect effects, and tests the accuracy of theoretical models, resulting in more comprehensive and reliable outcomes. SEM generally involves the combined application of factor analysis and regression analysis (Hox & Bechger, 1998). However, the uniqueness of SEM lies in its ability to account for potential measurement errors, address these errors in the model evaluation process, and discover relationships not initially identified. These features allow for improvements up to the third-level factors, enhancing the quality of the research model (Bagozzi & Yi, 2012). Additionally, SEM offers the advantage of performing all these analyses simultaneously.

4. Results

When examining the demographic characteristics of the sample, it is observed that the majority of participants are relatively young, have attained a high level of education, and primarily work in the private sector. This indicates that the sample predominantly consists of well-educated, young adults with an average income. Of the 427 participants, 47.8% are male (n = 204) and 52.2% are female. Nearly 94% of the participants are between the ages of 25 and 35 (n = 405). Among the participants, 62.5% are single and 37.5% are married. Approximately 60% (n = 258) hold a bachelor’s degree, and around 83% (n = 358) are employed in the private sector (see

Table 1).

The reliability of the factors in the scale used in this study was tested using Composite Reliability (CR). Additionally, to assess the convergent and discriminant validity of the factors, Average Variance Extracted (AVE), Maximum Shared Variance (MSV), and Average Shared Variance (ASV) values were considered. For convergent validity, AVE should be greater than 0.5, CR should be less than 0.7, and CR should be greater than AVE. For discriminant validity, MSV should be less than AVE, AVE should be greater than ASV, and ASV should be less than √AVE. These criteria indicate a low correlation between factors, demonstrating the presence of discriminant validity. Meeting these values confirms the reliability and validity of the measurement model (Hair et al., 2010; Gürbüz, 2019). Accordingly, the reliability and validity analyses of the factors were meticulously conducted.

The calculated CR, AVE, MSV, and ASV values for the scale used are presented in

Table 2. The fit indices obtained from Confirmatory Factor Analysis (CFA) indicate how well the predefined model fits the sample data. The fit indices are as follows: χ²/df = 1.952, CFI = 0.864, TLI = 0.948, RMSEA = 0.058, and SRMR = 0.0489. CFA was used to evaluate the factor structure of the dataset and confirmed that the model showed a good fit with the observed data.

Upon examining the obtained results, it is observed that all factor values are above 0.70. The situation where the Average Variance Extracted (AVE) value of a factor is lower than its Composite Reliability (CR) value and the AVE value is above 0.5 indicates that the factors exhibit convergent validity. Additionally, if the AVE value of a factor is higher than its Maximum Shared Variance (MSV) and Average Shared Variance (ASV) values, it indicates that the factors exhibit discriminant validity. Moreover, when the square root of the AVE (√AVE) scores are higher than the inter-factor correlations, it further confirms the presence of discriminant validity.

Hypothesis Tests

Following the completion of testing and validating the measurement model, the study proceeded to the latent variable structural modeling phase to test the research hypotheses. This phase aimed to examine the relationships among latent variables.

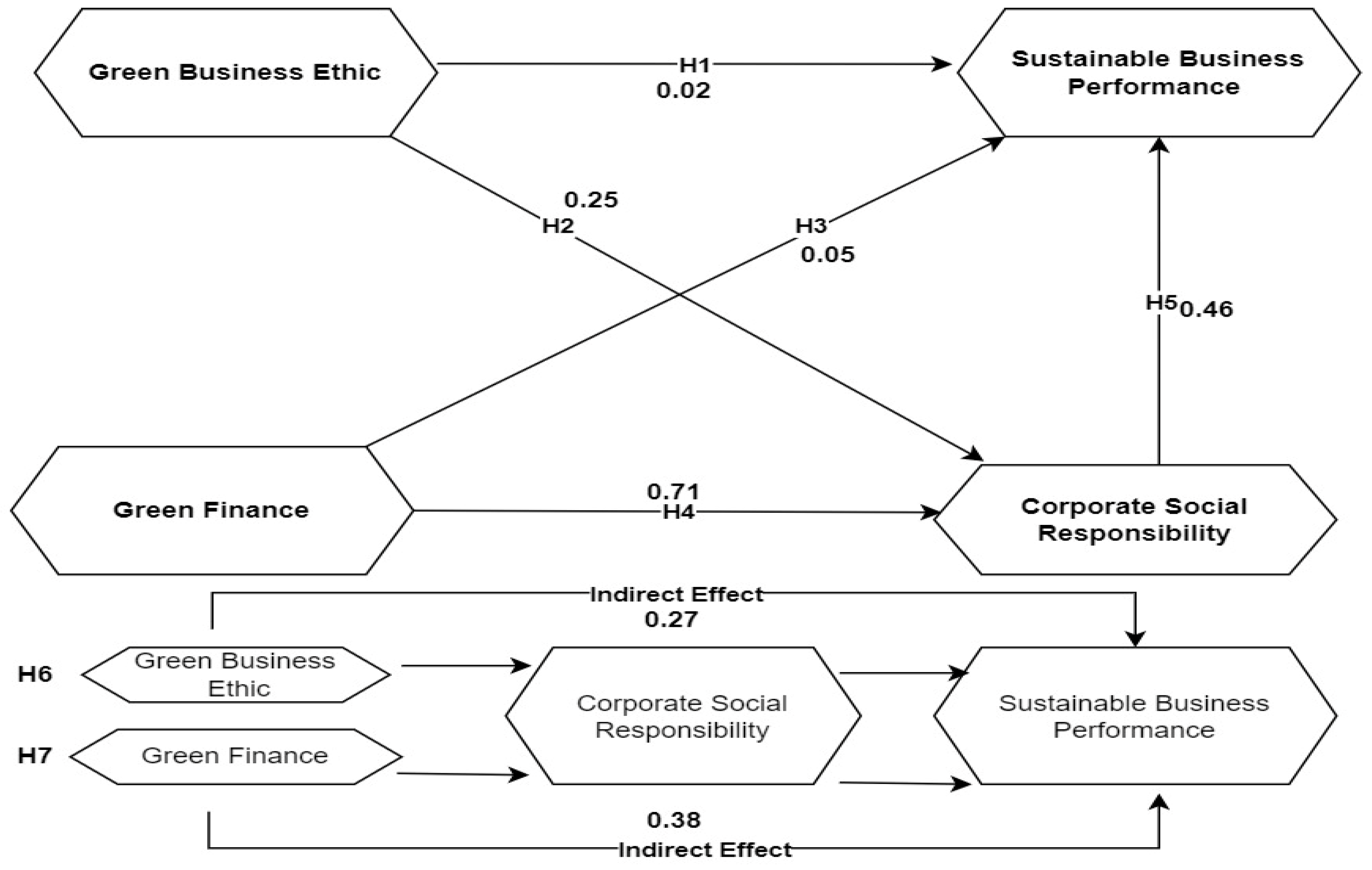

Figure 2 presents the standardized coefficients of the paths obtained from the structural model in detail. The fit indices obtained from the structural model confirm the validity and reliability of the model. Specifically, the calculated fit indices, including χ²/df = 1.55, CFI = 0.982, GFI = 0.931, RMSEA = 0.053, and SRMR = 0.0422, indicate that the model has an overall acceptable fit.

Based on the results obtained from the structural model analysis, it has been found that Green Business Ethic has a positive and significant impact on Sustainable Business Performance (β= 0.026; p<0.01) and Corporate Social Responsibility (β= 0.25; p<0.01). These findings indicate that implementing green business ethics positively influences sustainable business performance and corporate social responsibility. Similarly, it has been determined that Green Finance has a positive and significant relationship with Sustainable Business Performance (β= 0.5; p<0.01) and Corporate Social Responsibility (β= 0.71; p<0.01). These results suggest that green financing practices play a crucial role in enhancing the sustainability performance and social responsibility of businesses.

Furthermore, Corporate Social Responsibility has been found to positively impact Sustainable Business Performance (β= 0.46; p<0.01). This finding underscores the importance of corporate social responsibility activities in improving the sustainable business performance of companies.

These analyses demonstrate that green business ethics, green finance strategies, and corporate social responsibility practices are critical for businesses aiming to achieve sustainability goals. The findings provide valuable insights for companies seeking to enhance their sustainable business performance, highlighting the importance of strategic approaches in these areas.

Table 3.

Path analysis.

| Hypotheses |

Path |

B |

Result |

| H1 |

→ |

Sustainable business performance |

0.02 |

Supported |

| H2 |

→ |

Corporate Social Responsibility |

0.25 |

Supported |

| H3 |

→ |

Sustainable business performance |

0.05 |

Supported |

| H4 |

→ |

Corporate Social Responsibility |

0.71 |

Supported |

| H5 |

→ |

Sustainable business performance |

0.46 |

Supported |

| H6 |

→ Corporate Social Responsibility |

Sustainable business performance |

0.27 |

Supported |

| H7 |

→ Corporate Social Responsibility |

Sustainable business performance |

0.38 |

Supported |

Hypothesis (H6), which examines the mediating role of Corporate Social Responsibility in the relationship between Green Business Ethic and Sustainable Business Performance, and Hypothesis (H7), which assesses the mediating role of Corporate Social Responsibility in the relationship between Green Finance and Sustainable Business Performance, were tested using the bootstrap method. According to Baron and Kenny, the bootstrap method is claimed to provide more reliable results for mediation tests compared to traditional methods (Baron & Kenny, 1986; Hayes, 2018; Gürbüz, 2019). To determine the significance of the mediation effect using the bootstrap method, the lower and upper bounds obtained must be in the same direction (both positive or both negative), and the confidence interval must not contain zero. In this study, 5000 resampling iterations were preferred, and estimations were made at a 95% confidence level.

According to the results, the mediating role of Corporate Social Responsibility in the relationship between Green Business Ethics and Sustainable Business Performance is statistically significant (β= 0.27, C.I [0.181, 0.441]). This indicates that Hypothesis 6, which posits this mediating effect, yielded significant results. Furthermore, the mediating role of Corporate Social Responsibility in the relationship between Green Finance and Sustainable Business Performance was also confirmed based on the obtained statistics (β = 0.387, C.I [0.23, 0.491]).

Figure 3. summarizes the path coefficients and hypothesis test results of the structural equation model, providing a comprehensive overview of the relationships and mediating effects examined in this study.

5. Discussion

The findings obtained in this study examining the impact of green business ethics and green financing on sustainable business performance and corporate social responsibility are very important. First of all, there is a positive and significant relationship between green business ethics and sustainable business performance ((β= 0.026; p<0.01) and a positive and significant relationship between green business ethics and corporate social responsibility (β= 0.25; p<0.01). Green Additionally, there is a positive and significant relationship between financing and sustainable business performance (β= 0.5; p<0.01) and a positive and significant relationship between green financing and corporate social responsibility (β= 0.71; p<0.01). There is a positive and significant relationship (β= 0.46; p<0.01) between sustainable performance.

In the mediation effect model analysis, it was determined that the mediating role of corporate social responsibility in the relationship between green business ethics and sustainable business performance was significant. It has been statistically confirmed that corporate social responsibility has a mediating role in the relationship between green financing and sustainable business performance, where we measured the second mediating effect in the model. The findings reveal that green business ethics and green financing affect the sustainable performance of businesses, and this relationship can increase company performance when decisions are made with social responsibility awareness. From this point of view, it can be said that in a period when internal and external stakeholders of companies are increasingly showing environmental awareness, the sustainable business performance of organizations that adopt green business ethics and use green financing tools will increase and companies will gain a competitive advantage.

Reviewing the literature, no studies were found that specifically addressed sustainable business performance in the context of green business ethics, green financing and corporate social responsibility. However, it is seen that the number of studies focusing on green policies in sustainable business performance has increased in recent years. It is thought that this situation arises from the fact that it has many different consequences in both economic and social contexts and that countries focus on green policies. Because today, when sensitivity to environmental concerns increases, green business ethics principles and the use of green financing tools come to the fore in creating a sustainable environment. It is seen that companies that act with the awareness of green business ethics adopt a management style that protects the sustainable environment and that sustainable economy alone is not enough (Adams and Petrella, 2010). It is accepted that environmental ethics awareness, which is linked to green business ethics, is an important issue for companies in terms of sustainability. Environmental ethics is a field that covers the ethical relationship between the natural environment and humans, including not only the human environment but also issues such as environmental law, environmental sociology, ecological technology and economy on a more macro scale. Its basic teaching suggests doing what is good and avoiding what is bad (Öztürk and Cevher, 2015). While green business ethics similarly encourages environmentally friendly practices, it also aims to use energy carefully and ensure resource efficiency, reduce carbon footprint, ensure waste recycling and not harm natural resources (Bayram and Öztırak, 2023).

It is very important for companies that focus on green business ethics with social responsibility awareness to not only seek profit but also to fulfill their responsibilities towards society and the environment, and for businesses to take an active role in areas such as sustainability and social welfare, in order to provide social benefit. According to the study conducted by Süklüm (2020) examining the relationship between green accounting and green auditing and corporate social responsibility, businesses are required to submit reports based on their interactions with the environment as a requirement of the transparency and accountability principles of corporate social responsibility. According to Özkaya (2020), social responsibility in businesses is the adoption of policies, procedures and actions that limit the business in terms of harmful effects on society, force it to contribute to the welfare of society and foresee this, due to the activities carried out at all stages, starting from the production process until it reaches the final consumer. When considered in this context, the way to stop this trend today, when environmental destruction is so high, will be effective through the adoption of green business ethics principles and sustainability policies. In this context, the research findings coincide with the finding that green business ethics is effective on corporate social responsibility and sustainable business performance.

When studies related to green financing and sustainable development are examined, it is seen that renewable energy investments have high costs and due to the insufficient global savings, the parties’ reluctance in this regard prevents the execution of environmentally friendly and socially responsible projects in terms of sustainability, such as renewable energy investments. According to Şimşek and Tunalı (2022), in order to ensure the integration of renewable resources with the economy and to continue sustainable development, companies should be encouraged in this regard, and costs should be reduced by restructuring financing practices in this field. When considered in this context, green finance emerges as an opportunity that aims to provide funding to projects and companies that promote environmental sustainability. According to Odaro (2021), it is very important to connect environmental projects with capital markets and investors and direct capital to sustainable development, and green bonds, one of the green financing applications, are one of the most important methods that provide this connection. This information coincides with the research findings that green financing is effective on sustainable business performance and corporate social responsibility.

Recently, the activities of organizations such as the United Nations League, UNESCO and the EU reveal that sensitivity towards the environment is increasing on a global scale. To ensure sustainable business performance, green business ethics and green financing practices should be prioritized, and for this purpose, sustainable use of natural resources, reduction of waste, development of recycling-oriented policies, effective use of energy, protection of the biosphere and development of carbon neutral organizations, changes in attitudes and lifestyles (Haseeb et al., 2019; Morioka and Carvalho, 2016). Activities aimed at achieving this need to be supported. These activities will ultimately strengthen the reputation of the business and positively affect sustainable business performance (Aksu and Dağan, 2021; Uslu and Kedikli, 2017; Yalçın, 2016; Zengin and Aksoy, 2021; Kuzgun and Gözükara, 2023).

6. Conclusions

This study aims to examine the relationships between green financing, green business ethics, corporate social responsibility and sustainable business performance. The findings highlight that green business ethics and green finance have a significant impact on corporate social responsibility and sustainable business performance. It has also been found that corporate social responsibility plays a critical role in shaping sustainable business performance. These findings emphasize that green policies should be at the forefront in working life and that both employees and managers should improve their awareness of green policies and sustainability. With this awareness, it can be said that businesses that act in accordance with environmental, social and governance criteria can achieve long-term and sustainable success. Moreover, this can create a synergy that will benefit both businesses, communities and the environment.

7. Limitations and Future Research

The sample size was limited due to time and resource constraints during the data collection and analysis process in the study. This may limit the generalizability of the results obtained. Another limitation is that the research was conducted only on industries in Turkey. This makes it difficult to compare results obtained in different cultural and economic contexts. In addition, the effects of green business ethics and green financing may differ in different countries and sectors. Finally, the cross-sectional nature of the study prevents long-term effects from being observed. The effects of green business ethics, green financing and corporate social responsibility practices on sustainable business performance may change over time, and it is important to monitor these changes.

For future studies, it is recommended to increase the sample size and spread it over a wider geographical area, as this will increase the generalizability of the results. At the same time, similar studies to be conducted in different countries and sectors may provide the opportunity to compare the effects of green business ethics and green finance on sustainable business performance. Future research should also examine the effects of green business ethics and green financing on other business performance indicators. For example, considering factors such as employee satisfaction, customer loyalty and brand value will provide a more comprehensive understanding. Such expanded studies can help businesses develop their sustainability strategies more effectively. This research has taken an important step towards understanding the effects of green business ethics and green finance on sustainable business performance. However, overcoming the limitations mentioned above and new findings obtained through future studies will further increase the knowledge in this field.

Author Contributions

Conceptualization, Alay, H.K. and Keskin, A., Taksi Deveciyan, M., Methodology, Alay, H.K. and Keskin, A. Software, validation, formal analysis Keskin, A.; investigation, all authors.; resources, all authors.; data curation, all authors; writing—review and editing, all authors.; project administration, all authors. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

The study was conducted in accordance with the Declaration of Helsinki, and approved by the Balikesir University Social and Human Sciences Research Ethics Committee (protocol code 2024/5 and 05.31.2024).”

Informed Consent Statement

Informed consent was obtained from all subjects involved in the study.

Data Availability Statement

The data supporting reported results can be reached through the corresponding author.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Abbas, J.; Mahmood, S.; Ali, H.; Ali Raza, M.; Ali, G.; Aman, J.; Bano, S.; Nurunnabi, M. The effects of corporate social responsibility practices and environmental factors through a moderating role of social media marketing on sustainable performance of business firms. Sustainability 2019, 11, 3434. [Google Scholar] [CrossRef]

- Adams, C.; Petrella, L. Collaboration, connections and change: The UN global compact, the global reporting initiative, principles for responsible management education and the globally responsible leadership initiative. Sustainability Accounting, Management and Policy Journal 2010, 1, 292–296. [Google Scholar] [CrossRef]

- Agrawal, R.; Wankhede, V.A.; Kumar, A.; Upadhyay, A.; Garza-Reyes, J.A. Nexus of circular economy and sustainable business performance in the era of digitalization. International Journal of Productivity and Performance Management 2022, 71, 748–774. [Google Scholar] [CrossRef]

- Aksu B, Ç.; Doğan, A. Çevresel sürdürülebilirlik ve insan kaynakları yönetimi fonksiyonlarının yeşil İKY bağlamında değerlendirilmesi. Journal Of Aksaray University Faculty Of Economics And Administrative Sciences 2021, 13, 137–148. [Google Scholar]

- Ali, H.Y.; Danish, R.Q.; Asrar-ul-Haq, M. How corporate social responsibility boosts firm financial performance: The mediating role of corporate image and customer satisfaction. Corporate Social Responsibility and Environmental Management 2020, 27, 166–177. [Google Scholar] [CrossRef]

- Ay, Ü. İşletmelerde Etik ve Sosyal Sorumluluk; Nobel Kitabevi: İstanbul, 2003. [Google Scholar]

- Bacinello, E.; Tontini, G.; Alberton, A. Influence of corporate social responsibility on sustainable practices of small and medium-sized enterprises: Implications on business performance. Corporate Social Responsibility and Environmental Management 2021, 28, 776–785. [Google Scholar] [CrossRef]

- Bagozzi, R.P.; Yi, Y. Specification, evaluation, and interpretation of structural equation models. Journal of the Academy of Marketing Science 2012, 40, 8–34. [Google Scholar] [CrossRef]

- Bahadur, W.; Waqqas, O. Corporate social responsibility for a sustainable business. Journal of Sustainable Society 2013, 2, 92–97. [Google Scholar]

- Baron, M.; Kenny, D.A. The moderator-mediator variable distinction in social psychological research: Conceptual, strategic and statistical considerations. Journal of Personality and Social Psychology 1986, 51, 1173–1182. [Google Scholar] [CrossRef]

- Bayram, V.; Öztırak, M. Yeşil İş Etiği: Bir Ölçek Geliştirme Çalışması. JOEEP: Journal of Emerging Economies and Policy 2023, 8, 124–135. [Google Scholar]

- Belozyorov, S.A.; Xie, X. China’s green insurance system and functions. In E3S Web of Conferences; EDP Sciences, 2021; Vol. 311, p. 03001. [Google Scholar]

- Boran, T. Kurumsal Sosyal Sorumluluk ve Sürdürülebilirlik Raporlamasında Küresel Standartlara Yönelik Kavramsal Bir İnceleme. Kritik İletişim Çalışmaları Dergisi 2023, 5, 56–77. [Google Scholar] [CrossRef]

- Carroll, A.B. Corporate social responsibility. Organizational Dynamics 2015, 44, 87–96. [Google Scholar] [CrossRef]

- Carroll, A.B.; Shabana, K.M. The business case for corporate social responsibility: A review of concepts, research and practice. International journal of management reviews 2010, 12, 85–105. [Google Scholar] [CrossRef]

- Chen, D.; Hu, H.; Chang, C.P. Green finance, environment regulation, and industrial green transformation for corporate social responsibility. Corporate Social Responsibility and Environmental Management 2023, 30, 2166–2181. [Google Scholar] [CrossRef]

- Chou, S.F.; Horng, J.S.; Liu, C.H.; Gan, B. Explicating restaurant performance: The nature and foundations of sustainable service and organizational environment. International Journal of Hospitality Management 2018, 72, 56–66. [Google Scholar] [CrossRef]

- Costa, A.J.; Curi, D.; Bandeira, A.M.; Ferreira, A.; Tomé, B.; Joaquim, C.; … Marques, R.P. Literature review and theoretical framework of the evolution and interconnectedness of corporate sustainability constructs. Sustainability 2022, 14, 4413. [Google Scholar] [CrossRef]

- Crosbie, L.; Knight, K. Strategy for Sustainable Business: Environmental Opportunity and Strategic Choice; McGraw-Hill: London, 1995. [Google Scholar]

- Dai, R.; Liang, H.; Ng, L. Socially responsible corporate customers. Journal of Financial Economics 2021, 142, 598–626. [Google Scholar] [CrossRef]

- Maibach, E.; Miller, J.; Armstrong, F.; El Omrani, O.; Zhang, Y.; Philpott, N.; Atkinson, S.; Rudolph, L.; Karliner, J.; Wang, J.; Pétrin-Desrosiers, C.; Stauffer, A.; Jensen, G.K. Health professionals, the Paris agreement, and the fierce urgency of now. The Journal of Climate Change and Health 2021, 1, 100002, ISSN 2667–2782. [Google Scholar] [CrossRef]

- Falcone, P.M. Environmental regulation and green investments: The role of green finance. International Journal of Green Economics. 2020, 14, 159–173. [Google Scholar] [CrossRef]

- Fauzi, N.S.; Zainuddin, A.; Nawawi, A.H.; Johari, N. A Pilot Framework of Corporate Real Estate Sustainable Performance Measurement (CRESPM). International Journal of Academic Research in Business and Social Sciences 2018, 8, 725–739. [Google Scholar] [CrossRef]

- Feng, W.; Bilivogui, P.; Wu, J.; Mu, X. Green finance: current status, development, and future course of actions in China. Environmental Research Communications 2023, 5, 035005. [Google Scholar] [CrossRef]

- Gangi, F.; Daniele, L.M.; Varrone, N. How do corporate environmental policy and corporate reputation affect risk-adjusted financial performance? Business Strategy and the Environment 2020, 29, 1975–1991. [Google Scholar] [CrossRef]

- Gilchrist, D.; Yu, J.; Zhong, R. The Limits of Green Finance:A Survey of Literature in the Context of Green Bonds and Green Loans. Sustainability 2021, 13, 478. [Google Scholar] [CrossRef]

- Goldstein, I. Information in financial markets and its real effects. Review of Finance 2023, 2023, 1–32. [Google Scholar] [CrossRef]

- Goni, F.A.; Gholamzadeh Chofreh, A.; Estaki Orakani, Z.; Klemeš, J.J.; Davoudi, M.; Mardani, A. Sustainable business model: A review and framework development. Clean Technologies and Environmental Policy 2021, 23, 889–897. [Google Scholar] [CrossRef]

- Gürbüz, S. AMOS ile Yapısal Eşitlik Modellemesi [Structural Equation Model with AMOS]; Seçkin Yayıncılık: Ankara, 2019. [Google Scholar]

- Hair, J.F.; Black, W.C.; Babin, B.J.; Anderson, R.E. Multivariate data analysis, 7th ed.; Pearson Education International: Upper saddle River, New Jersey, 2010. [Google Scholar]

- Haseeb, M.; Hussain, H.I.; Kot, S.; Androniceanu, A.; Jermsittiparsert, K. Role of social and technological challenges in achieving a sustainable competitive advantage and sustainable business performance. Sustainability 2019, 11, 3811. [Google Scholar] [CrossRef]

- Hayes, A.F. Introduction to mediation, moderation, and conditional process analysis: A regression-based approach (2. baskı); The Guilford Press: New York, 2018. [Google Scholar]

- Hox, J.J.; Bechger, T.M. An introduction to structural equation modeling. Family Science Review 1998, 11, 354–373. [Google Scholar]

- Hys, K.; Hawrysz, L. Corporate social responsibility reporting. China-USA Business Review 2012, 11. [Google Scholar]

- Kuzgun, Ş.; Gözükara, E. Örgütsel Dayanıklılık Kapasitesi, Yeşil Yenilik, Algılanan Yeşil Örgütsel Davranış ve Sürdürülebilirlik Performansı Arasındaki İlişkiler: İSO 500 Uygulaması. Yönetim Bilimleri Dergisi 2023, 21, 399–432. [Google Scholar] [CrossRef]

- Lee, J.W. Green finance and sustainable development goals: The case of China. Journal of Asian Finance Economics and Business 2020, 7, 577–586. [Google Scholar] [CrossRef]

- Li, X.; Yang, Y. Does Green Finance Contribute to Corporate Technological Innovation? The Moderating Role of Corporate Social Responsibility. Sustainability 2022, 14, 5648. [Google Scholar] [CrossRef]

- Li, Y.; Al-Sulaiti, K.; Dongling, W.; Abbas, J.; Al-Sulaiti, I. Tax avoidance culture and employees’ behavior affect sustainable business performance: the moderating role of corporate social responsibility. Frontiers in Environmental Science 2022, 10, 964410. [Google Scholar] [CrossRef]

- Lyu, B.; Da, J.; Ostic, D.; Yu, H. How does green credit promote carbon reduction? A mediated model Frontiers in Environmental Science 2022, 10, 878060. [Google Scholar] [CrossRef]

- Huang, M.-T.; Zhai, P.-M. Achieving Paris Agreement temperature goals requires carbon neutrality by middle century with far-reaching transitions in the whole society. Advances in Climate Change Research 2021, 12, 281–286. [Google Scholar] [CrossRef]

- Morioka, S.N.; de Carvalho, M.M. A systematic literature review towards a conceptual framework for integrating sustainability performance into business. Journal of Cleaner Production 2016, 136, 134–146. [Google Scholar] [CrossRef]

- Shahbaz, M.; Trabelsi, N.; Tiwari, A.K.; Abakah, E.J.A.; Jiao, Z. Relationship between green investments, energy markets, and stock markets in the aftermath of the global financial crisis. Energy Economics 2021, 104, 105655. [Google Scholar] [CrossRef]

- Nayak, P.; Taher, Z.; Maria, A.V. G20 and Sustainable Finance: A Case for GSS+ Bonds. In NDIEAS-2024 International Symposium on New Dimensions and Ideas in Environmental Anthropology; Atlantis Press, 2024; pp. 182–196. [Google Scholar]

- Ng, A.W. From sustainability accounting to a green financing system: Institutional legitimacy and market heterogeneity in a global financial center. Journal of Cleaner Production 2018, 195, 585–592. [Google Scholar] [CrossRef]

- Orado, D. What you need to know about IFC’s green bonds (The World Bank Climate Explainer Series). 2021. Retrieved from https://www.worldbank.org/en/news/feature/2021/12/08/whatyou-need-to-know-about-ifc-s-green-bonds.

- Özkaya, B. İşletmelerin sosyal sorumluluk anlayışının uzantısı olarak yeşil pazarlama bağlamında yeşil reklamlar-Green advertisements in the context of green marketing as an extension of the social responsibility understanding of companies. Öneri Dergisi 2010, 9, 247–258. [Google Scholar]

- Öztürk, U.C.; Cevher, E. Yeşil İşletmeler Gerçek Mi? Çevre Duyarlılığı ve Etiği Kapsamında Etik Kodların İncelenmesi. Sosyal Bilimler Araştırmaları Dergisi 2015, 10, 145–162. [Google Scholar]

- Pervez, S. Defining Green Business Ethics and Exploring Its Adoption within the Textile Industry of Pakistan. Abasyn University Journal of Social Sciences 2020, 13. [Google Scholar] [CrossRef]

- Rizzello, A. The Green Financing Framework Combining Innovation and Resilience: A Growing Toolbox of Green Finance Instruments. In Green Investing: Changing Paradigms and Future Directions; Springer International Publishing: Cham, 2022; pp. 55–83. [Google Scholar] [CrossRef]

- Roncalli, T. Handbook of sustainable finance; 2022; pp. 205–224, Available at SSRN 4277875. [Google Scholar]

- Sandberg, J.; Juravle, C.; Hedesström, T.M.; Hamilton, I. The heterogeneity of socially responsible investment. Journal of Business Ethics 2009, 87, 519–533. [Google Scholar] [CrossRef]

- Saruhan, Ş.C.; Özdemirci, A. Bilim, Felsefe ve Metodoloji; Beta Yayınları: İstanbul, 2016; pp. 34–42. [Google Scholar]

- Sammy, M.; Odemilin, G.; Bampton, R. Corporate social responsibility: a strategy for sustainable business success. An analysis of 20 selected British companies. Corporate Governance: The international journal of business in society 2010, 10, 203–217. [Google Scholar] [CrossRef]

- Saw, P. A Global Accounting Standard: The Holy Grail? In Theory and practice of corporate social responsibility; Springer Berlin Heidelberg: Berlin/Heidelberg, 2010; pp. 193–207. [Google Scholar]

- Sheehy, B.; Farneti, F. Corporate Social Responsibility, Sustainability, Sustainable Development and Corporate Sustainability: What Is the Difference, and Does It Matter? Sustainability 2021, 13, 5965. [Google Scholar] [CrossRef]

- Steffen, B. A comparative analysis of green financial policy output in OECD countries. Environmental Research Letters 2021, iop.org. [CrossRef]

- Bag, S.; Omrane, A. Corporate Social Responsibility and Its Overall Effects on Financial Performance: Empirical Evidence from Indian Companies. Journal of African Business 2020. [Google Scholar] [CrossRef]

- Süklüm, N. Kurumsal sosyal sorumluluk, yeşil muhasebe ve yeşil denetim ilişkisine kavramsal bir bakış. Bilecik Şeyh Edebali Üniversitesi Sosyal Bilimler Dergisi 2020, 5, (TBMM 100. YIL Özel Sayısı). 151–163. [Google Scholar] [CrossRef]

- Székely, F.; Knirsch, M. Responsible leadership and corporate social responsibility: Metrics for sustainable performance. European Management Journal 2005, 23, 628–647. [Google Scholar] [CrossRef]

- Şimşek, O.; Tunalı, H. Yeşil finansman uygulamalarının sürdürülebilir kalkınma üzerindeki rolü: Türkiye Projeksiyonu. Ekonomi ve Finansal Araştırmalar Dergisi 2022, 4, 16–45. [Google Scholar]

- Uslu, Y.D.; Kedikli, E. Sürdürülebilirlik kapsamında yeşil insan kaynakları yönetimine genel bir bakış. Üçüncü Sektör Sosyal Ekonomi 2017. [Google Scholar]

- Waddock, S.A.; Bodwell, C. Total responsibility management: The manual; Routledge, 2011. [Google Scholar]

- Wang, K.H.; Zhao, Y.X.; Jiang, C.F.; Li, Z.Z. Does green finance inspire sustainable development? Evidence from a global perspective. Economic Analysis and Policy 2022, 75, 412–426. [Google Scholar] [CrossRef]

- Wang, Y.; Zhi, Q. The role of green finance in environmental protection: Two aspects of market mechanism and policies. Energy Procedia 2016, 104, 311–316. [Google Scholar] [CrossRef]

- Xueping, T.; Kavita, S.; Andrew, V.; Xinyu, W. How connected is the carbon market to energy and financial markets? A systematic analysis of spillovers and dynamics. Energy Economics 2020, 90, 104870. [Google Scholar] [CrossRef]

- Yalçın, A.Z. Sürdürülebilir kalkınma için yeşil ekonomi düşüncesi ve mali politikalar. Çankırı Karatekin Üniversitesi İktisadi ve İdari Bilimler Fakültesi Dergisi 2016, 6, 749–775. [Google Scholar]

- Yalçın, B. İşletmelerin Başarı Dinamikleri: Sürdürülebilirlik, Etik ve Kurumsal Sosyal Sorumluluk. Sürdürülebilirlik Odaklı İş Modelleri: İşletmeler İçin Çevresel ve Ekonomik Stratejiler 2024, 41. [Google Scholar]

- Yazicioglu, Y.; Erdogan, S. SPSS Uygulamalı Bilimsel Araştırma Yöntemleri; Detay Yayıncılık: Ankara, 2004; pp. 49–50. [Google Scholar]

- Zengin, B.; Aksoy, G. Sürdürülebilir Kalkınma Anlayışının Yeşil Pazarlama ve Yeşil Finans Açısından Değerlendirilmesi. İşletme Ekonomi ve Yönetim Araştırmaları Dergisi 2021, 4, 362–379. [Google Scholar] [CrossRef]

- Zhou, X.; Cui, Y. Green bonds, corporate performance, and corporate social responsibility. Sustainability 2019, 11, 68–81. [Google Scholar] [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).