Submitted:

02 August 2024

Posted:

02 August 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Methodology

2.1. Search Strategy

2.2. Eligibility Criteria

- Language: Include studies published in English and exclude articles written in languages other than English [25].

- Full-text accessibility: Include documents available and downloadable in full-text, exclude not-found and not downloadable articles [26].

- Focus: Include articles with coverage of ESG in the construction industry especially ESG indicators [27].

2.3. Selection of Relevant Documents

2.4. Data Extraction and Analysis

3. Findings and Discussions

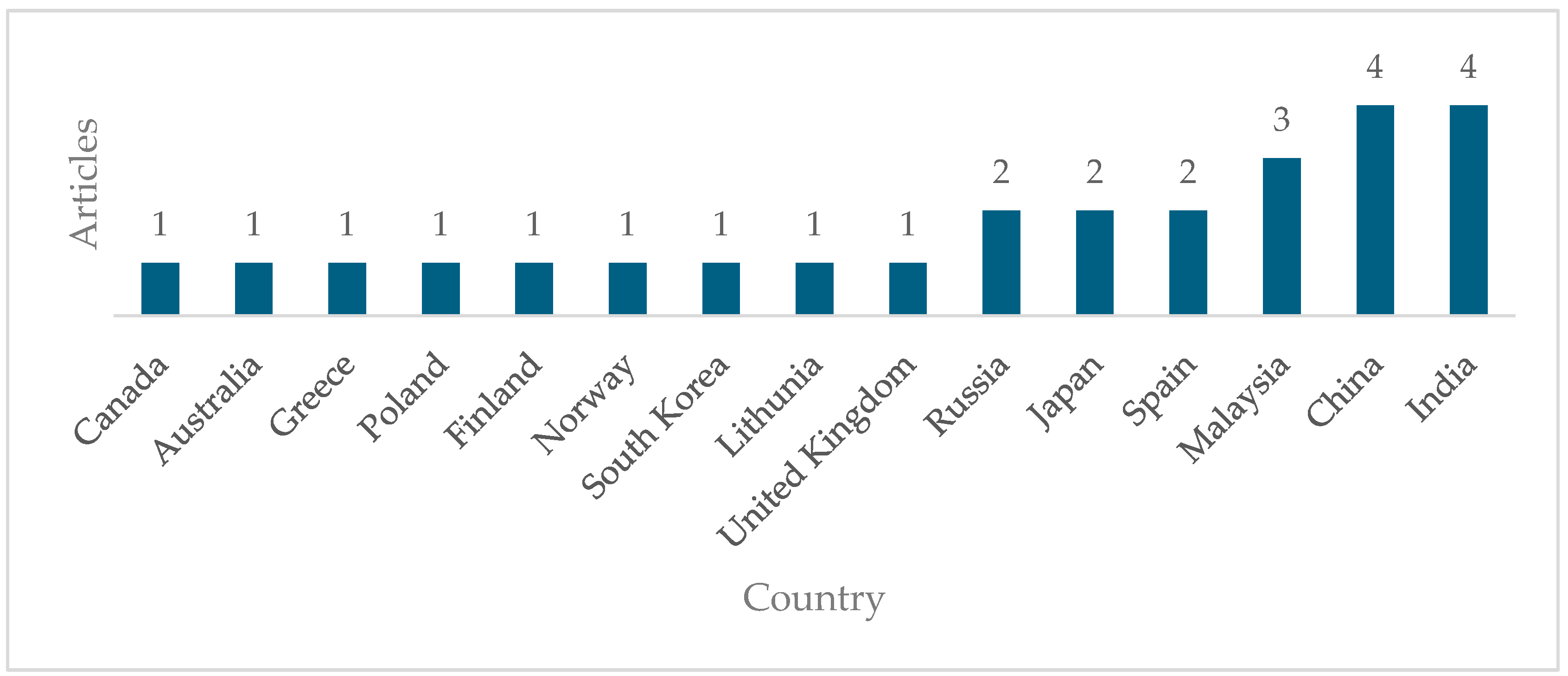

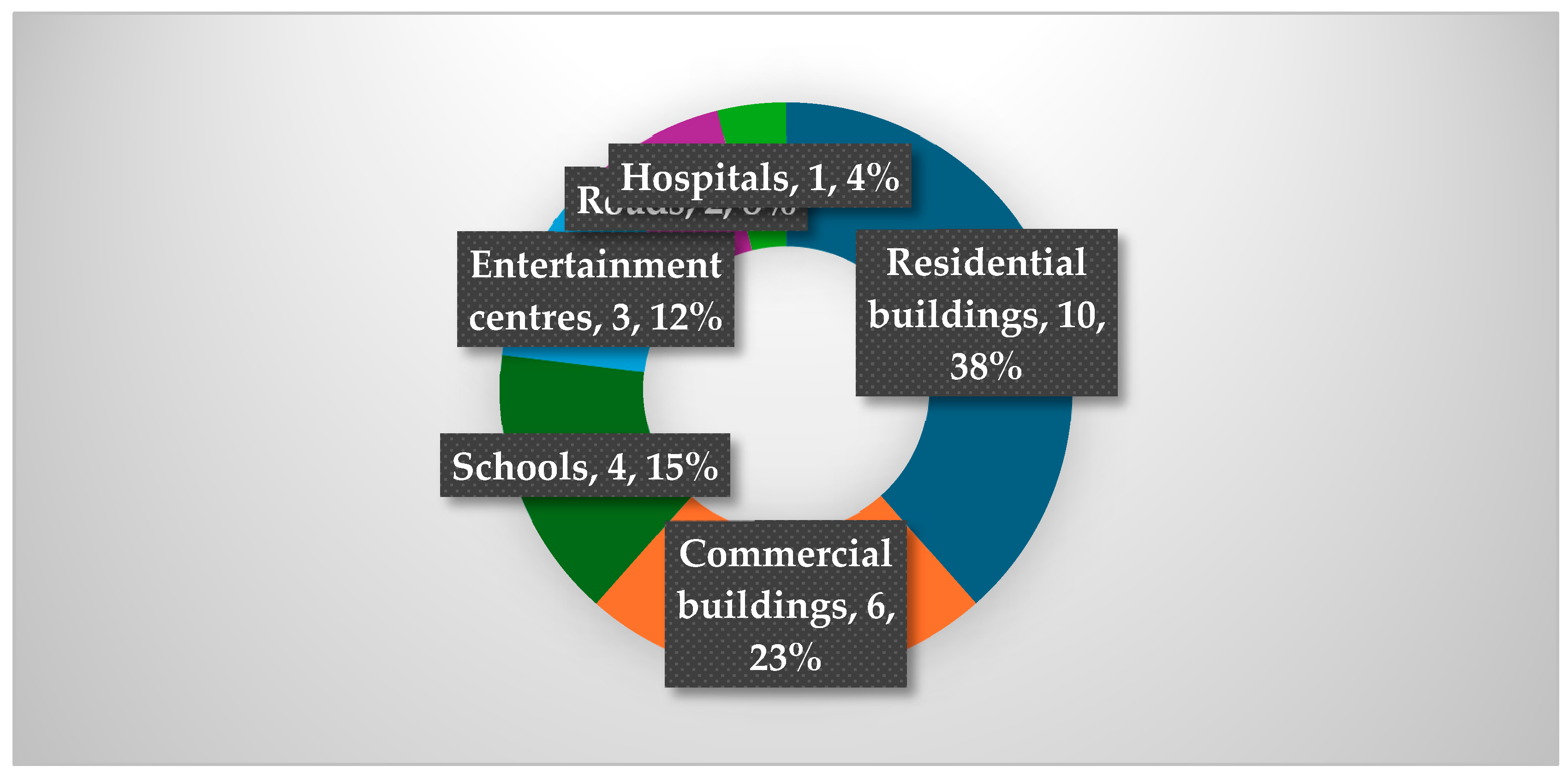

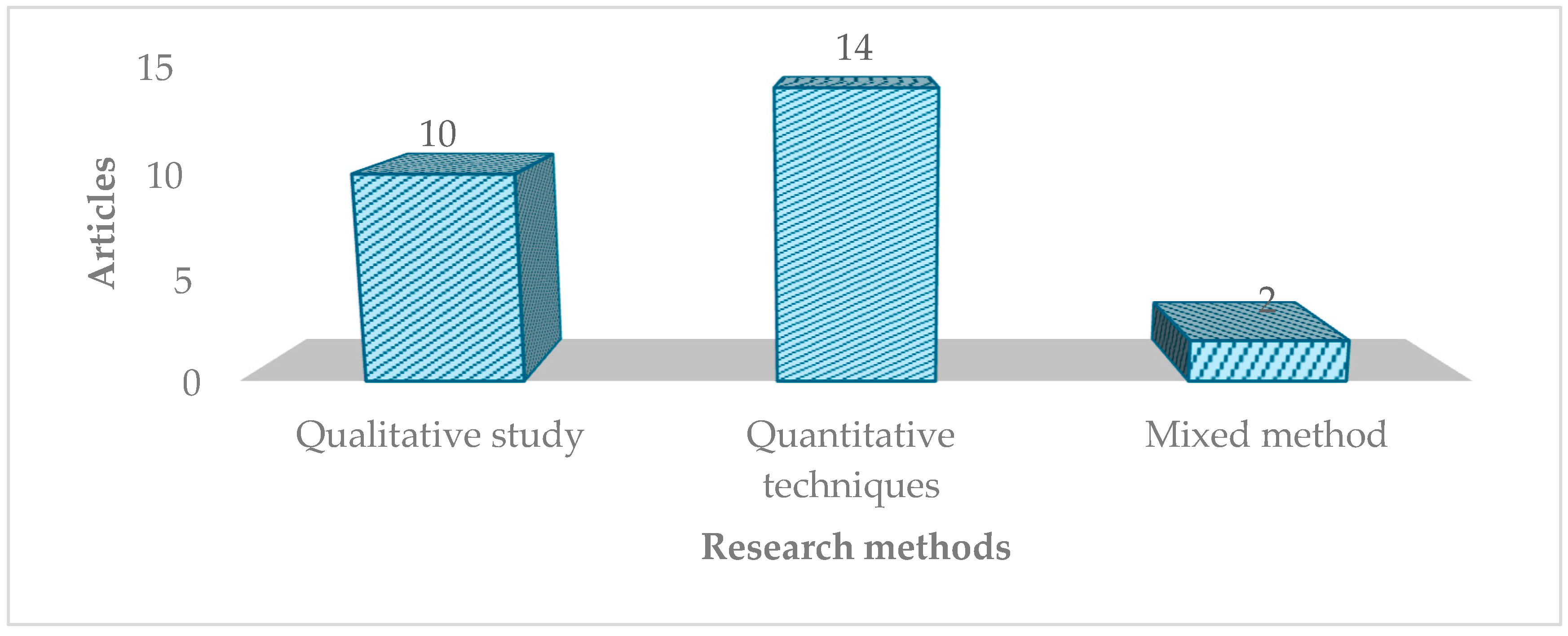

3.1. Description of Selected Studies

3.2. ESG Indicators in Construction Industry

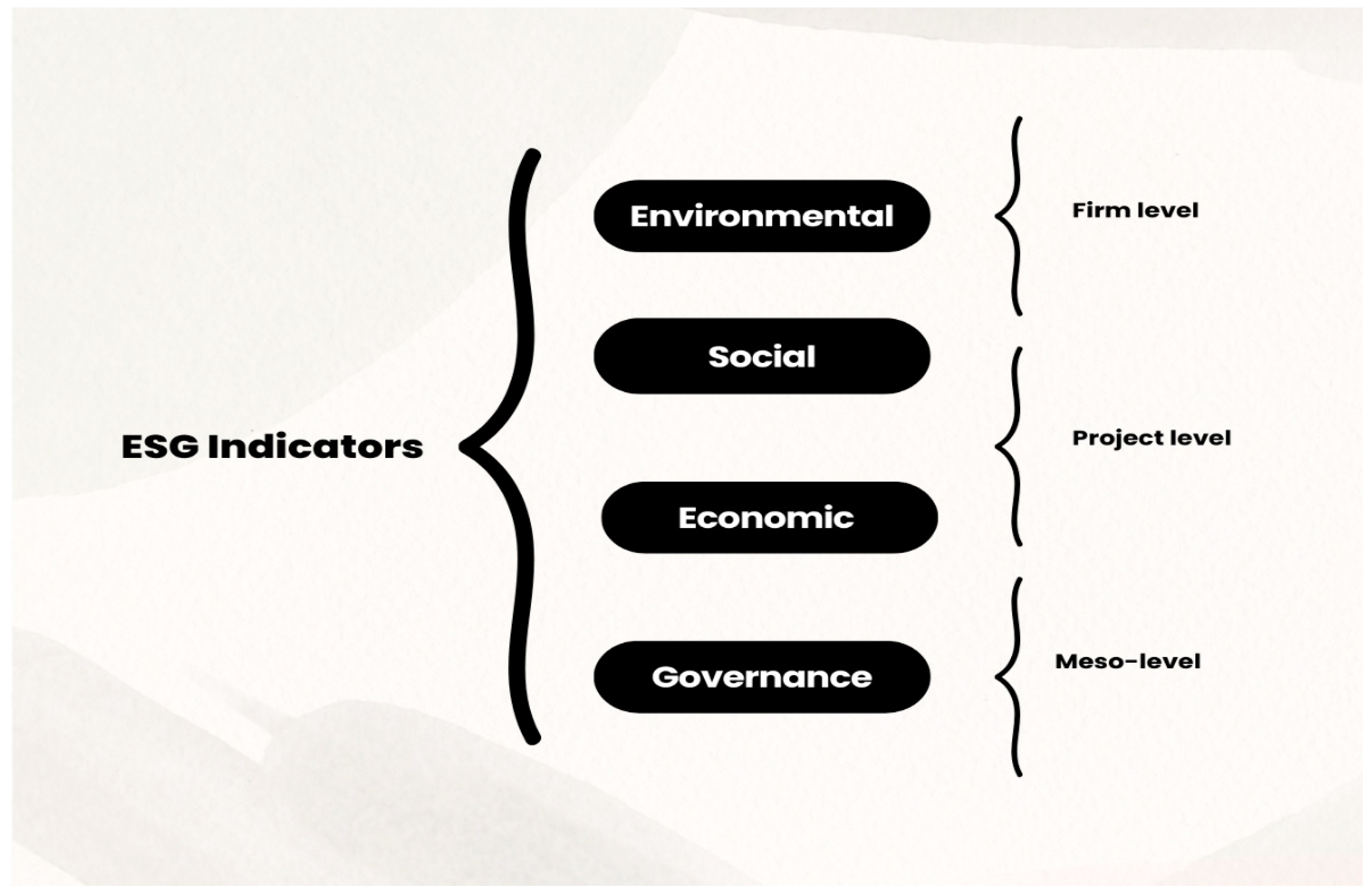

3.3. Conceptualising the Review Findings

Environmental Indicators

Social Indicators

Governance Indicators

Economic Indicators (4th Rank)

| Environmental indicators | Economic indicators | Governance indicators | Social indicators | |

|---|---|---|---|---|

| 4 | 3 | 1 | 2 | |

| 2 | 2 | 2 | 4 | |

| 5 | 3 | 3 | 3 | |

| 2 | 1 | 3 | 2 | |

| 1 | 2 | 2 | 1 | |

| 3 | 3 | 5 | 1 | |

| 1 | 2 | 2 | 4 | |

| 4 | 2 | 2 | 3 | |

| 3 | 2 | 3 | 3 | |

| 1 | 1 | 2 | 4 | |

| 2 | 2 | 3 | 3 | |

| 2 | 1 | 1 | 1 | |

| 1 | 1 | 4 | 4 | |

| 5 | 1 | 3 | 1 | |

| 6 | 2 | 4 | ||

| 5 | 3 | 1 | ||

| 3 | 2 | 3 | ||

| 2 | 2 | 3 | ||

| 3 | 1 | 5 | ||

| 1 | 3 | 4 | ||

| 4 | 2 | 2 | ||

| 3 | 4 | 2 | ||

| 3 | 3 | 3 | ||

| 2 | 3 | 1 | ||

| 3 | 3 | 3 | ||

| 3 | 2 | |||

| 1 | 3 | |||

| 4 | 2 | |||

| 3 | ||||

| Sum | 79 | 26 | 64 | 77 |

| Mean score | 2.82 | 1.86 | 2.56 | 2.66 |

| Ranking | 1st | 4th | 3rd | 2nd |

5. Implications of the Study

6. Conclusions

Appendix: Retrieved Articles for the Analysis

| Article (Authors, Year) |

| 1. Li, et al. [66] |

| 2. Mukhlisin, Ibrahim, Jaafar and Razali [31] |

| 3. Li, et al. [67] |

| 4. Baabou, Bjørn and Bulle [6] |

| 5. Wang, Zeng, Xia, Wu and Xia [36] |

| 6. Siew, Balatbat and Carmichael [32] |

| 7. Chastas, Theodosiou, Kontoleon and Bikas [39] |

| 8. Barykin, Strimovskaya, Sergeev, Borisoglebskaya, Dedyukhina, Srklyarov, Sklyarova and Saychenko [49] |

| 9. Hayashi, Hiyama and Kubo [16] |

| 10. Chen, Wang, He and Zhang [40] |

| 11. Musarat, Alaloul, Irfan, Sreenivasan and Rabbani [37] |

| 12. Lin and Zhang [68] |

| 13. Hadro, Fijałkowska, Daszyńska-Żygadło, Zumente and Mjakuškina [59] |

| 14. Siew [11] |

| 15. Aksenova, Kiviniemi, Kocaturk and Lejeune [5] |

| 16. De Castro, Pacheco and González [64] |

| 17. Norang, Støre-Valen, Kvale and Temeljotov-Salaj [9] |

| 18. Park, Kim, Lee, Kim and Kong [10] |

| 19. Apanaviciene, Daugeliene, Baltramonaitis and Maliene [38] |

| 20. Kempeneer, Peeters and Compernolle [13] |

| 21. Adewumi, et al. [69] |

| 22. Balon, et al. [70] |

| 23. Srivastava, et al. [71] |

| 24. Zhang, et al. [72] |

| 25. Singh and Kumar [73] |

| 26. Halder and Batra [74] |

Author Contributions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Darnall, N.; Ji, H.; Iwata, K.; Arimura, T.H. Do ESG reporting guidelines and verifications enhance firms' information disclosure? Corporate Social Responsibility and Environmental Management 2022, 29, 1214–1230. [Google Scholar] [CrossRef]

- Akomea-Frimpong, I.; Agyekum, A.K.; Amoakwa, A.B.; Babon-Ayeng, P.; Pariafsai, F. Toward the attainment of climate-smart PPP infrastructure projects: a critical review and recommendations. Environment, Development and Sustainability 2023. [Google Scholar] [CrossRef]

- Chastas, P.; Theodosiou, T.; Kontoleon, K.J.; Bikas, D. The Effect of Embodied Impact on the Cost-Optimal Levels of Nearly Zero Energy Buildings: A Case Study of a Residential Building in Thessaloniki, Greece. Energies 2017, 10. [Google Scholar] [CrossRef]

- Bose, S. Evolution of ESG reporting frameworks. Values at Work: Sustainable Investing and ESG Reporting 2020, 13–33. [Google Scholar]

- Aksenova, G.; Kiviniemi, A.; Kocaturk, T.; Lejeune, A. From Finnish AEC knowledge ecosystem to business ecosystem: lessons learned from the national deployment of BIM. Construction management and economics 2019, 37, 317–335. [Google Scholar] [CrossRef]

- Baabou, W.; Bjørn, A.; Bulle, C. Absolute Environmental Sustainability of Materials Dissipation: Application for Construction Sector. Resources 2022, 11, 76. [Google Scholar] [CrossRef]

- Erkens, M.; Paugam, L.; Stolowy, H. Non-financial information: State of the art and research perspectives based on a bibliometric study. Comptabilité-Contrôle-Audit 2015, 21, 15–92. [Google Scholar] [CrossRef]

- Heal, M. Sustainability in Construction Practices as Emphasis on Environmental Investing in ESG Model Grows. 2022. [Google Scholar]

- Norang, H.; Støre-Valen, M.; Kvale, N.; Temeljotov-Salaj, A. Norwegian stakeholder's attitudes towards EU taxonomy. Facilities 2023, 41, 407–433. [Google Scholar] [CrossRef]

- Park, E.; Kim, Y.; Lee, A.; Kim, J.; Kong, H. Study on the Global Sustainability of the Korean Construction Industry Based on the GRI Standards. International Journal of Environmental Research and Public Health 2023, 20. [Google Scholar] [CrossRef]

- Siew, R.Y.J. Critical evaluation of environmental, social and governance disclosures of Malaysian property and construction companies. Construction Economics and Building 2017, 17, 81–91. [Google Scholar] [CrossRef]

- Yu, E.P.-y.; Van Luu, B.; Chen, C.H. Greenwashing in environmental, social and governance disclosures. Research in International Business and Finance 2020, 52, 101192. [Google Scholar] [CrossRef]

- Kempeneer, S.; Peeters, M.; Compernolle, T. Bringing the user Back in the building: an analysis of ESG in real estate and a behavioral framework to guide future research. Sustainability 2021, 13, 3239. [Google Scholar] [CrossRef]

- Zhao, E.; May, E.; Walker, P.D.; Surawski, N.C. Emissions life cycle assessment of charging infrastructures for electric buses. Sustain. Energy Technol. Assess. 2021, 48, 14. [Google Scholar] [CrossRef]

- Ebolor, A.; Agarwal, N.; Brem, A. Sustainable development in the construction industry: The role of frugal innovation. Journal of Cleaner Production 2022, 380. [Google Scholar] [CrossRef]

- Hayashi, T.; Hiyama, K.; Kubo, R. CASBEE-Wellness Office: An objective measure of the building potential for a healthily built environment. Japan Architectural Review 2021, 4, 233–240. [Google Scholar] [CrossRef]

- Chen, G.; Wei, B.; Dai, L. Can ESG-responsible investing attract sovereign wealth funds’ investments? Evidence from Chinese listed firms. Frontiers in Environmental Science 2022, 10, 935466. [Google Scholar] [CrossRef]

- Brogi, M.; Lagasio, V.; Porretta, P. Be good to be wise: Environmental, Social, and Governance awareness as a potential credit risk mitigation factor. Journal of International Financial Management & Accounting 2022, 33, 522–547. [Google Scholar]

- Clementino, E.; Perkins, R. How do companies respond to environmental, social and governance (ESG) ratings? Evidence from Italy. Journal of Business Ethics 2021, 171, 379–397. [Google Scholar] [CrossRef]

- Buniamin, S.; Nik Ahmad, N.N. An integrative perspective of environmental, social and governance (ESG) reporting: A conceptual paper. 2015. [Google Scholar]

- Page, M.J.; McKenzie, J.E.; Bossuyt, P.M.; Boutron, I.; Hoffmann, T.C.; Mulrow, C.D.; Shamseer, L.; Tetzlaff, J.M.; Akl, E.A.; Brennan, S.E. The PRISMA 2020 statement: an updated guideline for reporting systematic reviews. International Journal of Surgery 2021, 88, 105906. [Google Scholar] [CrossRef]

- Kukah, A.S.; Akomea-Frimpong, I.; Jin, X.; Osei-Kyei, R. Emotional intelligence (EI) research in the construction industry: a review and future directions. Engineering, Construction and Architectural Management, 2021; ahead-of-print. [Google Scholar]

- Jandrić, P. A peer-reviewed scholarly article. Postdigital Science and Education 2021, 3, 36–47. [Google Scholar] [CrossRef]

- Mahood, Q.; Van Eerd, D.; Irvin, E. Searching for grey literature for systematic reviews: challenges and benefits. Research synthesis methods 2014, 5, 221–234. [Google Scholar] [CrossRef] [PubMed]

- Brenya, R.; Akomea-Frimpong, I.; Ofosu, D.; Adeabah, D. Barriers to sustainable agribusiness: a systematic review and conceptual framework. Journal of Agribusiness in Developing and Emerging Economies 2022. [Google Scholar] [CrossRef]

- Panic, N.; Leoncini, E.; De Belvis, G.; Ricciardi, W.; Boccia, S. Evaluation of the endorsement of the preferred reporting items for systematic reviews and meta-analysis (PRISMA) statement on the quality of published systematic review and meta-analyses. PloS one 2013, 8, e83138. [Google Scholar] [CrossRef] [PubMed]

- Kukah, A.S.; Akomea-Frimpong, I.; Jin, X.; Osei-Kyei, R. Emotional intelligence (EI) research in the construction industry: a review and future directions. Engineering, Construction and Architectural Management 2022, 29, 4267–4286. [Google Scholar]

- Kennedy, R.A.; McKenzie, G.; Holmes, C.; Shields, N. Social support initiatives that facilitate exercise participation in community gyms for people with disability: a scoping review. International Journal of Environmental Research and Public Health 2022, 20, 699. [Google Scholar] [CrossRef] [PubMed]

- Chan, A.P.; Nwaogu, J.M.; Naslund, J.A. Mental ill-health risk factors in the construction industry: systematic review. Journal of construction engineering and management 2020, 146, 04020004. [Google Scholar] [CrossRef]

- Björk, B.-C.; Solomon, D. The publishing delay in scholarly peer-reviewed journals. Journal of informetrics 2013, 7, 914–923. [Google Scholar] [CrossRef]

- Mukhlisin, M.; Ibrahim, A.; Jaafar, O.; Razali, S.F.M. Electrochemical assessment of water quality as an effect of construction. Int.J.Electrochem.Sci. 2012, 7, 5467–5483. [Google Scholar] [CrossRef]

- Siew, R.Y.; Balatbat, M.C.; Carmichael, D.G. The relationship between sustainability practices and financial performance of construction companies. Smart Sustain. Built Environ. 2013, 2, 6–27. [Google Scholar] [CrossRef]

- Akomea-Frimpong, I.; Jin, X.; Osei-Kyei, R.; Kukah, A.S. Public–private partnerships for sustainable infrastructure development in Ghana: a systematic review and recommendations. Smart Sustain. Built Environ. 2023, 12, 237–257. [Google Scholar] [CrossRef]

- CHIA. An ESG Reporting Standard for Australian Community Housing; Community Housing Industry Association, 2023. [Google Scholar]

- Eisenkopf, J.; Juranek, S.; Walz, U. Responsible Investment and Stock Market Shocks: Short-Term Insurance without Persistence. British Journal of Management 2023, 34, 1420–1439. [Google Scholar] [CrossRef]

- Wang, G.; Zeng, S.; Xia, B.; Wu, G.; Xia, D. Influence of financial conditions on the environmental information disclosure of construction firms. Journal of Management in Engineering 2022, 38, 04021078. [Google Scholar] [CrossRef]

- Musarat, M.A.; Alaloul, W.S.; Irfan, M.; Sreenivasan, P.; Rabbani, M.B.A. Health and safety improvement through Industrial Revolution 4.0: Malaysian construction industry case. Sustainability 2022, 15, 201. [Google Scholar] [CrossRef]

- Apanaviciene, R.; Daugeliene, A.; Baltramonaitis, T.; Maliene, V. Sustainability Aspects of Real Estate Development: Lithuanian Case Study of Sports and Entertainment Arenas. Sustainability 2015, 7, 6497–6522. [Google Scholar] [CrossRef]

- Chastas, P.; Theodosiou, T.; Kontoleon, K.J.; Bikas, D. The effect of embodied impact on the cost-optimal levels of nearly zero energy buildings: A case study of a residential building in Thessaloniki, Greece. Energies 2017, 10, 740. [Google Scholar] [CrossRef]

- Chen, Y.; Wang, G.; He, Y.; Zhang, H. Greenwashing behaviors in construction projects: there is an elephant in the room! Environmental Science and Pollution Research 2022, 29, 64597–64621. [Google Scholar] [CrossRef] [PubMed]

- Emmitt, S.; Ruikar, K. Collaborative design management; Routledge, 2013. [Google Scholar]

- Huang, R.; Huang, Y. Does internal control contribute to a firm’s green information disclosure? Evidence from China. Sustainability 2020, 12, 3197. [Google Scholar] [CrossRef]

- Paganin, G. Sustainable finance and the construction industry: New paradigms for design development. Techne 2021, 22, 79–85. [Google Scholar] [CrossRef]

- He, Q.; Wang, Z.; Wang, G.; Zuo, J.; Wu, G.; Liu, B. To be green or not to be: How environmental regulations shape contractor greenwashing behaviors in construction projects. Sustainable Cities and Society 2020, 63, 102462. [Google Scholar] [CrossRef]

- Friedman, H.L.; Heinle, M.S.; Luneva, I.M. A theoretical framework for ESG reporting to investors. Available at SSRN 3932689 2021. [Google Scholar]

- Kim, J.; Lee, Y. Association between Earnings Announcement Behaviors and ESG Performances. Sustainability 2023, 15, 7733. [Google Scholar] [CrossRef]

- Deamer, L.; Lee, J.; Mulheron, M.; De Waele, J. Building sustainability impacts from the bottom up: Identifying sustainability impacts throughout a geotechnical company. Sustainability (Switzerland) 2021, 13. [Google Scholar] [CrossRef]

- Cao, Y.; Xu, C.; Kamaruzzaman, S.N.; Aziz, N.M. A systematic review of green building development in China: Advantages, challenges and future directions. Sustainability 2022, 14, 12293. [Google Scholar] [CrossRef]

- Barykin, S.E.; Strimovskaya, A.V.; Sergeev, S.M.; Borisoglebskaya, L.N.; Dedyukhina, N.; Srklyarov, I.; Sklyarova, J.; Saychenko, L. Smart City Logistics on the Basis of Digital Tools for ESG Goals Achievement. Sustainability 2023, 15, 5507. [Google Scholar] [CrossRef]

- Gillan, S.L.; Koch, A.; Starks, L.T. Firms and social responsibility: A review of ESG and CSR research in corporate finance. Journal of Corporate Finance 2021, 66, 101889. [Google Scholar] [CrossRef]

- Yue, X.; Han, Y.; Teresiene, D.; Merkyte, J.; Liu, W. Sustainable funds’ performance evaluation. Sustainability 2020, 12, 8034. [Google Scholar] [CrossRef]

- Giamporcaro, S.; Gond, J.-P.; O’Sullivan, N. Orchestrating governmental corporate social responsibility interventions through financial markets: The case of French socially responsible investment. Business Ethics Quarterly 2020, 30, 288–334. [Google Scholar] [CrossRef]

- Brice, J.; Cusworth, G.; Lorimer, J.; Garnett, T. Immaterial animals and financialized forests: Asset manager capitalism, ESG integration and the politics of livestock. Environment and Planning A: Economy and Space 2022, 54, 1551–1568. [Google Scholar] [CrossRef]

- Lokuwaduge, C.S.; De Silva, K.M. ESG risk disclosure and the risk of green washing. Australasian Accounting, Business and Finance Journal 2022, 16, 146–159. [Google Scholar] [CrossRef]

- EY. The current state of ESG reporting in the engineering and construction industry; 2021. [Google Scholar]

- Gałecka-Drozda, A.; Wilkaniec, A.; Szczepańska, M.; Świerk, D. Potential nature-based solutions and greenwashing to generate green spaces: Developers’ claims versus reality in new housing offers. Urban Forestry & Urban Greening 2021, 65, 127345. [Google Scholar]

- Akerlof, G.A. The market for “lemons”: Quality uncertainty and the market mechanism. In Uncertainty in economics; Elsevier, 1978; pp. 235–251. [Google Scholar]

- Zhang, K.; Pan, Z.; Janardhanan, M.; Patel, I. Relationship analysis between greenwashing and environmental performance. Environment, Development and Sustainability 2023, 25, 7927–7957. [Google Scholar] [CrossRef]

- Hadro, D.; Fijałkowska, J.; Daszyńska-Żygadło, K.; Zumente, I.; Mjakuškina, S. What do stakeholders in the construction industry look for in non-financial disclosure and what do they get? Meditari Accountancy Research 2022, 30, 762–785. [Google Scholar] [CrossRef]

- Galvin, P. Building Blocks of the Future Our Story: How My Company Developed Modular Construction with Recycled Shipping Containers is Advancing Solutions to the Affordable Housing Crisis and Environmental Sustainability. Real Estate Issues 2020, 44, 1–8. [Google Scholar]

- Siano, A.; Vollero, A.; Conte, F.; Amabile, S. “More than words”: Expanding the taxonomy of greenwashing after the Volkswagen scandal. Journal of Business Research 2017, 71, 27–37. [Google Scholar] [CrossRef]

- Lyon, T.P.; Maxwell, J.W. Greenwash: Corporate environmental disclosure under threat of audit. Journal of economics & management strategy 2011, 20, 3–41. [Google Scholar]

- Marquis, C.; Toffel, M.W.; Zhou, Y. Scrutiny, norms, and selective disclosure: A global study of greenwashing. Organization Science 2016, 27, 483–504. [Google Scholar] [CrossRef]

- De Castro, A.V.; Pacheco, G.R.; González, F.J.N. Holistic approach to the sustainable commercial property business: analysis of the main existing sustainability certifications. International Journal of Strategic Property Management 2020, 24, 251–268. [Google Scholar] [CrossRef]

- Willan, C.; Janda, K.B.; Kenington, D. Seeking the Pressure Points: Catalysing Low Carbon Changes from the Middle-Out in Offices and Schools. Energies 2021, 14, 8087. [Google Scholar] [CrossRef]

- Li, R.Y.M.; Li, B.; Zhu, X.; Zhao, J.; Pu, R.; Song, L. Modularity clustering of economic development and ESG attributes in prefabricated building research. Frontiers in Environmental Science 2022, 10, 977887. [Google Scholar] [CrossRef]

- Li, X.; Huang, Y.; Li, X.; Liu, X.; Li, J.; He, J.; Dai, J. How does the Belt and Road policy affect the level of green development? A quasi-natural experimental study considering the CO2 emission intensity of construction enterprises. Humanities & Social Sciences Communications 2022, 9. [Google Scholar] [CrossRef]

- Lin, Y.-H.; Zhang, H. Impact of contractual governance and guanxi on contractors’ environmental behaviors: The mediating role of trust. Journal of Cleaner Production 2023, 382, 135277. [Google Scholar] [CrossRef]

- Adewumi, A.S.; Opoku, A.; Dangana, Z. Sustainability assessment frameworks for delivering Environmental, Social, and Governance (ESG) targets: A case of Building Research Establishment Environmental Assessment Method (BREEAM) UK New Construction. Corporate Social Responsibility and Environmental Management 2024. [Google Scholar] [CrossRef]

- Balon, V.; Bagul, A.; Kumar, R. Green construction supply chain barriers assessment: Evidence from Indian construction industry. Global Business Review 2024, 09721509241231107. [Google Scholar] [CrossRef]

- Srivastava, S.; Iyer-Raniga, U.; Misra, S. Integrated approach for sustainability assessment and reporting for civil infrastructures projects: Delivering the UN SDGs. Journal of Cleaner Production 2024, 459, 142400. [Google Scholar] [CrossRef]

- Zhang, F.; Liu, B.; An, G. Do Government Subsidies Induce Green Transition of Construction Industry? Evidence from Listed Firms in China. Buildings 2024, 14, 1261. [Google Scholar] [CrossRef]

- Singh, A.K.; Kumar, V.P. Establishing the relationship between the strategic factors influencing blockchain technology deployment for achieving SDG and ESG objectives during infrastructure development: an ISM-MICMAC approach. Smart Sustain. Built Environ. 2024, 13, 711–736. [Google Scholar] [CrossRef]

- Halder, A.; Batra, S. Navigating the Ethical Discourse in Construction: A State-of-the-Art Review of Relevant Literature. Journal of Construction Engineering and Management 2024, 150, 03124001. [Google Scholar] [CrossRef]

| S/N | ESG indicator | Explanation | Source (refer to Table 1) |

|---|---|---|---|

| ESG1 | Climate resilient | Ability of projects to cope with changing weather conditions | [1,2,3,8,10,14,26] |

| ESG2 | Ecological adaptation score | High survival of organisms in an area where a project is built | [1,9,20,22] |

| ESG3 | Efficient project resource management | Maximum and efficient usage of project resources which includes the protection of the environment | [4,7,8,9,11,18,19,21] |

| ESG4 | Affordability and Security measure | Affordable houses for low-income earners | [1,3,16,23] |

| ESG5 | Resident Voice | Concerns of residents and communities are incorporated in ESG framework | [1,11,22,24] |

| ESG6 | Resident Support | Initiatives from builders are supported by the residents and the community. | [7,9,21,25] |

| ESG7 | Collaborative placemaking | More emphasis on the needs of the people who will use the building space | [6,9,13,21,26] |

| ESG8 | Effective corporate systems and controls on governance | The overall structure and approach to governance on ESG implementation | [1,4,6,7,13,14,21,23] |

| ESG9 | Reliable supply chain of construction materials | The housing provider procures responsibly, considering supplier diversity and screening and sustainable procurement practices | [4,8,11,21,25] |

| ESG10 | Environment Management Systems | The practices and established systems to mitigate the environment impact of projects | [3,9,10,19,20] |

| ESG11 | Stakeholder Engagement/ Collaboration | Getting stakeholders to be part of ESG conversation and implementation | [3,4,7,11,14,15] |

| ESG12 | Diversity and inclusion | An open and inclusive work culture | [3,5,9,13] |

| ESG13 | Green biodiversity | This involves developing natural land by restricting some operations to protect plant and animal life | [2,7,9,10,15,17] |

| ESG14 | Lowest waste and Pollution | Few records of wastes and hazardous air pollution | [1,3,4,5,9,12,15,16,17,19,20] |

| ESG15 | Charity and Community Engagement/ Volunteering and Probono Work | This could be in a form of donations and support to various charitable and education-related organisations on a pro-bono basis. | [5,7,9,12] |

| ESG16 | Additional Employment/ Local jobs creation | Providing job opportunities for locals where projects are developed | [1,2,9,10,14,19] |

| ESG17 | Enhancement of professional social and skill development | Continuous training and development of project team members on ESG | [2,14,15,22,25] |

| ESG18 | Positive health status of project teams | Active consideration of the health and wellbeing of project staff including managers and construction workers | [1,2,3,4,5,6,7,8,9,10,22] |

| ESG19 | Minimum carbon emissions | This involves reducing the overall carbon footprint of projects | [1,2,5,7,8,19,24] |

| ESG20 | Robust policies and guidance documentation | These documents govern business activities | [1,2,3,15] |

| ESG21 | Energy consumption/saving rate | Total amount of energy needed for a given process measured in MWh | [3,5,6,7,9,11,12,17,19,20] |

| ESG22 | Least greenhouse gas effects | Minimum of carbon emissions into the environment | [2,5,7,9,12,13,14,16,17,18,19,20] |

| ESG23 | Compliance with environmental regulations and standards | The extent to which the environmental regulations and standards are adhered to by firms | [7,9,21,25] |

| ESG24 | Voluntary environmental practices beyond compliance | Projects should have environment impact levels below the standard limits | [8,10,11,19,21] |

| ESG25 | Level of environmental awareness training and programs | Construction workers and connected stakeholders are trained and influenced by sustainable environmental practices | [6,7,9,12,13,23] |

| ESG26 | Environmental information disclosure score | The level at which environmental information of a project is disclosed against the ESG global standards considered relevant in the industry | [3,7,10,20,25] |

| ESG27 | High return on investment | High ratio between the net income of projects and investments | [8,10,14,21,26] |

| ESG28 | Current assets to liabilities score | Dividing total present assets by recent liabilities incurred | [8,14,16,20,21] |

| ESG29 | Summary of the stakes in the firms | Percentage of ownership of the firm’s green assets | [7,9,16,25] |

| ESG30 | Total assets of the firm | Gross assets of a firm inclusive of environmental and social capital | 13, 14, 20, 15, 10] |

| ESG31 | Longevity of firm existence | The length of firm inception to present | [7,14,15,21] |

| ESG32 | Cost-benefit analysis score | A score to assess the economic viability of methodologies used in projects | [7,11,17,18,19,20,23,25] |

| ESG33 | Firm procurement decisions | The choices made by firms when procuring services affect the environment | [6,11,13,24] |

| ESG34 | Anti-discrimination and equal opportunity | Avoiding the distinction between employees to disadvantage some and advantage others | [6,17,18,21] |

| ESG35 | Gender balance | Percentage of full-time employment, contractor and consultant positions held by women | [3,6,19,20,25] |

| ESG36 | Risk and credit rating score | The potential risks associated with a project and the possible benefits of a project | [1,3,4,7,8,13,20] |

| ESG37 | Level of employee engagement | The degree to which employees identify with the goals and values of the organization | [5,7,10,23] |

| ESG38 | Extent of community investment | The measure of how much is invested into communities enduring the impacts of activities from firms | [5,7,10,19,26] |

| ESG39 | Board independence | Availability of independent directors to avoid being unduly influenced by a vested interest | [1,3,5,14,20] |

| ESG40 | Executive compensation | Commendable cash and non-financial benefits to top leaders who are committed to implementation of ESG in project management | [1,5,9,13,17] |

| ESG41 | Ethics and compliance training | Training to educate employees about the rules, regulations, and new policies they should adhere to | [3,5,7,8,10,18,22,25] |

| ESG42 | Count of data privacy and security breaches | Measure of the rate at which unauthorized parties gain access to sensitive data of a firm | [5,9,12,20] |

| ESG43 | Supplier audits | Availability of deliberate plans and controls on purchasing and supply risks | [5,8,14,15,21] |

| ESG44 | Sustainable growth rate | The measure of maximum rate of growth that a company can sustain without additional debt | [4,6,11,14,26] |

| ESG45 | Environmental efficiency | Reducing environmental destruction as much as possible while providing the expected deliverables | [10,14,17,20] |

| ESG46 | Recycled greenhouse gas | This involves capturing more greenhouse gases than releasing | [2,7,9,15,21] |

| ESG47 | Level of drainage contamination | How projects lead to the contamination drainage systems in the communities | [1,6,15,26] |

| ESG48 | Application of circular economy scores | Circular Economy Score considers several parameters for each of the 5 pillars, and the outcome is a value between 0 and 100 | [4,11,15,25] |

| ESG49 | Extent of accountability | The level at which responsibility is accepted for honest and ethical conduct towards others by the firm | [1,2,7,15,20] |

| ESG50 | Lifecycle rating of projects | Rating the projects across the various stages of the project lifecycle phases | [9,15,16,21] |

| ESG51 | Green development | Incorporation of green construction practices into project development. | [16,17,18,19,22] |

| ESG52 | Labour productivity | The total volume of output per unit labour of a firm | [2,4,6,16] |

| ESG53 | Process improvement | Regular upward improvement in processes towards the achievement ESG goals | [1,5,7,16] |

| ESG54 | Achievable project goals | These are stipulated project goals which are specific and achievable | [2,5,7,16] |

| ESG55 | Use of renewable energies | The use of renewable energies in place of fossil fuels during and after project delivery | [7,11,17,19] |

| ESG56 | Promotion of basic human rights | Enforcing and ensuring fundamental rights of employees and stakeholders | [3,5,6,7,9,16] |

| ESG57 | Food security | The measure of the ability of Individuals to access nutritious and sufficient food | [4,10,17,22] |

| ESG58 | Eradication of modern slavery | Avoiding the exploitation of employees and individuals in the community for commercial gains of the project | [7,12,19] |

| ESG59 | Sustainable infrastructure | Undertaking projects which considers the social, economic, and environmental implications | [2,7,15,20] |

| ESG60 | LEED-certified projects | Green construction activities on projects happen within the requirements of LEED framework. | [2,7,9,16] |

| ESG61 | Disaster recovery and response | The rate at which a firm recovers from a disaster or manages a disaster for minimum negative impacts | [1,5,7,25] |

| ESG62 | Smart engineering and technology solutions | A method, processes, and IT tools to design and develop innovative infrastructure | [4,6,7,8,18] |

| ESG63 | Employee attraction and retention | Finding the right kind of people that fit into your company ethos while creating structure, processes, and procedures that keep your employees engaged and working for your firm | [2,8,18,23,26] |

| ESG64 | Presence of ESG Oversight | Regulatory compliance; formal ESG oversight structures; reporting and transparency | [1,6,8,9,11,15] |

| ESG65 | Minimum records of greenwashing (behaviour) | Greenwashing is the overstatement of the environmental and social credentials of an organisation or product | [1,2,4,6,16] |

| ESG66 | Innovation | This could be in a form of embracing new technologies in the industry | [4,5,7,10,19] |

| ESG67 | Balance ecosystem | Provision of projects that support a natural habitat which is sustainable and where there is interdependency | [5,8,11,17] |

| ESG68 | Preserve cultural heritage | Keeping the artifacts and traditions of a community intact while projects are developed | [2,3,6,18] |

| ESG69 | Economic prosperity | The measure of the economic growth, economic security, and economic competitiveness of a firm | [2,7,8,22,25] |

| ESG70 | Enough economic capital | Ensuring that the amount of capital that needed to survive any risks that the firm takes is adequate | [1,7,8,14] |

| ESG71 | Gender pays ratio | Median male salary to median female salary | [2,5,6,23,24] |

| ESG72 | Temporary worker rate | Percentage of full-time positions held by part-time/contract/temporary workers. | [6,15,23,25] |

| ESG73 | Non-discrimination records | This ensures that no one is denied their rights because of certain factors like race and gender | [1,3,13,22] |

| ESG74 | Incentivized pay to construction workers | Additional compensation awarded to construction workers for results they achieved | [1,3,5,17,24] |

| ESG75 | Fair labour practices | Practices that guarantee the equitable and unbiased protection of both employers and employees | [2,3,4,7,21] |

| ESG76 | Supplier code of conduct | Eco-friendly supply chain channels together with respectful and fair workplace for employees. | [3,8,13] |

| ESG77 | Robust internal systems against corruption | There are explicit codes of ethics and governance structures against corruption of all forms | [3,7,10,12] |

| ESG78 | Regular sustainability reports | Regular reporting on the environmental, social, and economic risks and opportunities of a firm | [3,7,9,11,17,18,19,26] |

| ESG79 | External stakeholder assurance | Ensure the interests of different stakeholders are satisfied | [3,4,15,16,21] |

| ESG80 | Effective management and supervision | Measure of the output of employees based on direction, guidance, and control of the working force by management | [2,4,10,11,13] |

| ESG81 | Requirements on ESG are clearly transparent | Open disclosure of ESG requirements for construction firms to follow | [3,4,7,23] |

| ESG82 | Overall firm performance | The total performance of a firm inters of profits, growth, customer satisfaction and sustainability | [2,8,13,18] |

| ESG83 | User satisfaction ratings | This measures a customer's satisfaction with an organization | [1,4,6,18,24] |

| ESG84 | Increased quality of life | The level of satisfaction of employees across all aspects of their lives and well-being | [1,4,9,18,19] |

| ESG85 | Acceptable level of heat and the cooling of indoors of the projects | The acceptable level of heating and the cooling of the building for minimum environmental impacts | [6,7,8,20] |

| ESG86 | Reduction of economic and social disparities between regions | Reducing the unequal distribution of income and opportunity between different groups in society | [2,5,12,19,20] |

| ESG87 | Decreasing rate of poverty | Reducing the ratio of the number of people in each community whose income falls below the poverty line | [1,4,8,19,25] |

| ESG88 | Social inclusion and cohesion | A measure of how all groups have a sense of belonging, participation, inclusion, recognition, and legitimacy. | [2,3,8,19,24] |

| ESG89 | Sustainable property investment | Investing in projects which are sustainable and environmentally friendly both during construction and in use | [1,6,17,19,24] |

| ESG90 | Regulation and compliance requirements | A construction firm adheres to council regulations and local practices | [2,9,10,15,25] |

| ESG91 | Rate of client cancellations and delays | The rate at which projects are delayed by firms and the potential of project cancellation by clients | [1,3,7,10,15] |

| ESG92 | Technological readiness | The proclivity of employees to embrace and use new technologies for sustainable projects | [2,9,12,18,23] |

| ESG93 | Social innovativeness | Design and implementation of modern solutions to enhance the wellbeing and welfare of communities | [2,18,19,23] |

| ESG94 | Green carbon-neutral badge | Application of environmentally conscious technologies and software platforms to monitor ESG performance and LEED compliance in projects. | [1,12,14] |

| ESG95 | Fair and equitable compensation to workers. | Employees are remunerated fairly. | [1,2,5,7,8] |

| ESG96 | Government involvement and advocacy | litigation, lobbying, and public education on ESG by government | [1,3,21] |

| Principal variable | S/N | Specific variable | Level of analysis | ||

|---|---|---|---|---|---|

| Project level | Firm level | Meso-macro level | |||

| Environmental indicators | ESGE | ||||

| ESG1 | Climate resilient | X | |||

| ESG2 | Ecological adaptation score | X | |||

| ESG9 | Reliable supply chain of construction materials | X | |||

| ESG10 | Environment Management Systems | X | X | ||

| ESG13 | Green biodiversity | X | |||

| ESG14 | Lowest waste and Pollution | X | |||

| ESG19 | Minimum carbon emissions | X | |||

| ESG21 | Energy consumption/saving rate | X | |||

| ESG22 | Least greenhouse gas effects | X | |||

| ESG23 | Compliance with environmental regulations and standards | X | X | ||

| ESG24 | Voluntary environmental practices beyond compliance | X | X | ||

| ESG25 | Level of environmental awareness training and programs | X | |||

| ESG26 | Environmental information disclosure score | X | |||

| ESG43 | Supplier audits | X | |||

| ESG44 | Sustainable growth rate | X | X | ||

| ESG45 | Environmental efficiency | X | X | ||

| ESG46 | Recycled greenhouse gas | X | |||

| ESG47 | Level of drainage contamination | X | |||

| ESG51 | Green development | X | X | ||

| ESG55 | Use of renewable energies | X | |||

| ESG57 | Food security | X | |||

| ESG60 | LEED-certified projects | X | |||

| ESG61 | Disaster recovery and response | X | X | ||

| ESG62 | Smart engineering and technology solutions | X | X | ||

| ESG67 | Balance ecosystem | X | X | ||

| ESG76 | Supplier code of conduct | X | |||

| ESG85 | Acceptable level of heating and the cooling of the building | X | |||

| ESG94 | Green carbon-neutral badge | X | |||

| Economic indicators | ESGEc | ||||

| ESG27 | High return on investment | X | X | ||

| ESG28 | Current assets to liabilities score | X | |||

| ESG29 | Summary of the stakes in the firms | X | |||

| ESG30 | Total assets of the firm | X | |||

| ESG31 | Longevity of firm existence | X | |||

| ESG32 | Cost-benefit analysis score | X | X | ||

| ESG52 | Labour productivity | X | X | ||

| ESG69 | Economic prosperity | X | |||

| ESG70 | Enough economic capital | X | X | ||

| ESG74 | Incentivized pay to construction workers | X | |||

| ESG86 | Reduction of economic and social disparities between regions | X | |||

| ESG87 | Decreasing rate of poverty | X | |||

| ESG89 | Sustainable property investment | X | |||

| ESG95 | Fair and equitable compensation to workers | X | |||

| Governance indicators | ESGG | ||||

| ESG3 | Efficient project resource management | X | |||

| ESG8 | Effective corporate systems and controls on governance | X | |||

| ESG20 | Robust policies and guidance documentation | X | X | ||

| ESG33 | Firm procurement decisions | X | |||

| ESG36 | Risk and credit rating score | X | X | ||

| ESG39 | Board independence | X | |||

| ESG40 | Executive compensation | X | |||

| ESG41 | Ethics and compliance training | X | X | ||

| ESG42 | Count of data privacy and security breaches | X | X | ||

| ESG48 | Application of circular economy scores | X | |||

| ESG49 | Extent of accountability | X | |||

| ESG50 | Lifecycle rating of projects | X | |||

| ESG53 | Process improvement | X | X | ||

| ESG54 | Achievable project goals | X | |||

| ESG64 | Presence of ESG oversight | X | X | ||

| ESG65 | Minimum records of greenwashing (behaviour) | X | |||

| ESG66 | Innovation | X | X | ||

| ESG77 | Robust internal systems against corruption | X | |||

| ESG78 | Regular sustainability reports | X | X | ||

| ESG80 | Effective management and supervision | X | |||

| ESG81 | Requirements on ESG are clearly transparent | X | X | ||

| ESG82 | Overall firm performance | X | |||

| ESG90 | Regulation and compliance requirements | X | X | X | |

| ESG92 | Technological readiness | X | X | ||

| ESG96 | Government involvement and advocacy | X | |||

| Social indicators | ESGS | ||||

| ESG4 | Affordability and Security measure | X | |||

| ESG5 | Resident Voice | X | |||

| ESG6 | Resident Support | X | |||

| ESG7 | Collaborative placemaking | X | X | ||

| ESG11 | Stakeholder Engagement/ Collaboration | X | X | ||

| ESG12 | Diversity and inclusion | X | X | ||

| ESG15 | Charity and Community Engagement/ Volunteering and Probono Work | X | X | ||

| ESG16 | Additional Employment/ Local jobs creation | X | |||

| ESG17 | Enhancement of professional social and skill development | X | X | ||

| ESG18 | Positive health status of project teams | X | |||

| ESG34 | Anti-discrimination and equal opportunity | X | |||

| ESG35 | Gender balance | X | |||

| ESG37 | Level of employee engagement | X | X | ||

| ESG38 | Extent of community investment | X | X | ||

| ESG56 | Promotion of basic human rights | X | X | ||

| ESG58 | Eradication of modern slavery | X | |||

| ESG59 | Sustainable infrastructure | X | X | ||

| ESG63 | Employee attraction and retention | X | X | ||

| ESG68 | Preserve cultural heritage | X | X | ||

| ESG71 | Gender pays ratio | X | |||

| ESG72 | Temporary worker rate | X | X | ||

| ESG73 | Non-discrimination records | X | |||

| ESG75 | Fair labour practices | X | X | ||

| ESG79 | External stakeholder assurance | X | |||

| ESG83 | User satisfaction ratings | X | |||

| ESG84 | Increased quality of life | X | |||

| ESG88 | Social inclusion and cohesion | X | |||

| ESG91 | Rate of client cancellations and delays | X | |||

| ESG93 | Social innovativeness | X | X | ||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).