1. Introduction

To be achieved, the objective of a complete ecological transition requires the transfer of a huge amount of financial resources and in this context the banking sector can play a crucial role.

This paper intends to satisfy two objectives:

propose a theoretical reflection on the possible impacts of ESG factors on the management of the relationship between financial risks and new social, environmental and governance risks through a systematic analysis of the most recent literature;

analysis of data relating to access to credit at a global level with application of the k-Means machine learning algorithm for clustering.

The role that can be taken on by banks consists of catalysing if they manage to direct private and public capital to finance ESG investments. The success of this objective would produce important returns, both reputational (i.e. greater customer trust in those banks that take a more active role for the growth of their territories, financing initiatives with environmental and social impact) but also economic for the banks. In this regard, Murè et al. (2021) consider Italian banks that have suffered sanctions demonstrate that banks with strong ESG profiles tend to recover more quickly from the reputational damage associated with sanctions. This finding highlights the protective and rehabilitative role of ESG practices in maintaining and restoring stakeholder trust and market reputation. Galletta et al. (2023) conclude that banks with higher ESG scores tend to experience lower operational risks and better reputation. This report highlights the importance of ESG activities in mitigating risks and building trust with stakeholders, thus ensuring more stable and resilient banking operations. The path to completing the ESG transition by banking institutions is not yet concluded as highlighted by La Torre (2021) who states: "to date, the sustainable transition of banks seems motivated more by branding issues and compliance obligations, rather which gives performance and financial sustainability objectives". In one of his studies which will be illustrated in detail in a subsequent section of this paper, he highlights some of the possible motivations that push banks to implement strategies with an environmental and social impact. According to these authors, the transition from financial sustainability to ESG (Environmental, Society, Governance) sustainability requires the implementation of changes in three directions: 1) the implementation of integrated accounting that links accounting metrics and market-based ones with ESG metrics; 2) from the point of view of the regulatory authorities, the challenge to be faced is the construction of a harmonized ESG rating framework and giving incentives to financial institutions to acquire impact-oriented business models; 3) from the point of view of individual banking institutions it is necessary to move from a credit risk management approach to sustainability risk management approaches. These new risk management approaches aim to reduce the volatility that threatens the financial stability of banking institutions (and not only) by integrating financial risk with ESG risks. In particular, these risk management models focus on sustainability risk, i.e. the set of environmental, social and governance factors that can negatively impact the assets of banking institutions, investment funds and companies as well as their overall performance.

This paper starts from the belief that has emerged in recent years in the debate between academics, managers and finance experts that sustainability has become a crucial strategic driver for the competitiveness of banking companies and can play an important role in the transformation of banking business models. In this regard, a research group from the Polytechnic University of Milan conducted a survey in 2021 on a sample of banks representing 71% of the total assets of the Italian banking system to give a snapshot of the state of the art of the integration of ESG factors in the credit sector and identify some possible lines of development. According to this survey, 92% of the banks interviewed are aware of the long-term financial relevance of ESG factors. Only 9% of them consider the financial impacts of ESG in their risk appetite statement. To confirm this, with reference to the policies adopted, for 91% of banks the percentage of credit flows destined for businesses and projects with a high environmental impact is below 25%. Among the ESG factors, it is the environmental one that is capturing the attention of banks the most; in fact, more than half of them have already activated sustainable credit lines from an environmental point of view and the other half plan to do so in the short term. The integration of ESG factors has made further progress in investment activity: for 25% of banks, up to 75% of investment flows are influenced by sustainability policies. 33% of banks adopt ESG risk assessment and screening processes in building their investment portfolio. With reference to ESG risks, despite pressure from regulators, climate risk assessment is poorly developed. This is because there is a lack of dedicated risk management, there is little use of stress testing techniques and analysis of climate scenarios and there is particular divergence regarding the most appropriate time horizon in which physical and transition climate risk manifests itself. From an organizational point of view, 37% have not yet developed governance dedicated to sustainability or do not follow a structured approach. Almost 50% of them do not systematically consider ESG factors as part of their business strategy and if they do, they go beyond corporate social responsibility principles and place sustainability at the heart of the business. A critical issue that most of the banks interviewed have in common and which is one of the impacts attributable to the inclusion of ESG factors in banking businesses according to many of the studies that will be illustrated below, is the poor integration of ESG factors in the associated risk management techniques to lending and investment activities (almost 67% of banks report a significant delay in this regard). This criticality highlights that ESG profile evaluations are almost completely absent both in loan pricing decisions and in the evaluation of guarantees. The banks interviewed denounce as the cause of these delays in the adoption of ESG factors the presence of unclear regulatory requirements, the lack of data which hinders the integration of ESG factors, the persistence of high uncertainty regarding the economic benefits deriving from from their inclusion.

In light of the previous considerations, the future of any financial institution can no longer ignore a new approach to finance, namely that of sustainable finance. For these reasons, the topic of sustainable finance or social impact finance has become the focus of the regulation of the main national and international supervisory institutions in the credit sector. This last consideration should not lead one to think that the application of ESG (Environmental, Society, Government) factors is an obligation rather a real opportunity for change in banking businesses in all their facets from the configuration of the strategies to be adopted, from the type of product and services to offer, from the management of relationships with customers and the assessment of the risks affecting them. The introduction of risks linked to ESG issues expands the taxonomy of banking risks and in particular by managing in a more conscious way the interconnections between environmental risks and financial risks, primarily credit risk, allows a reduction in the incidence of non-performing loans in balance sheets of financial institutions. Therefore, the ability of banks to grow in the near future must be commensurate with the creation of an increasingly complete introduction of ESG factors into their businesses supported by regulatory evolution. To confirm what has just been said, the supervisory institutions have introduced "ambitious" packages of measures/regulations aimed at sustainability. Above all, it was environmental problems (therefore relating to the first ESG pillar) that attracted the majority of global initiatives. When we talk about sustainability we are referring to environmental, social and governance-related sustainability. In the first case, reference is made mainly to climate changes to be reduced and adapted to, ecological behaviours, environmental risks, primarily natural disasters. Social sustainability is interconnected with environmental sustainability because climate shocks can generate inequalities and increases in poverty. The sustainability of governance concerns, for example, relations with employees and their remuneration and that of managers. In particular, the European Commission has developed a community action plan "the Action Plan" for sustainable finance which intends to achieve a compensation between the financial needs of the world and European economy and the protection of the quality of the environment and of our society.

To meet this macro objective, this action plan sets three micro objectives: 1) reorient capital flows towards a more sustainable economy, 2) integrate sustainability into risk management, 3) promote transparency and long-term perspective term. The European Union has invested at least 20% of its budget in the fight against climate change. Another supervisory institution, the European Banking Association (EBA) has designed an Action Plan structured in three mandates: the first mandate provides for the inclusion of ESG factors in the supervisory review and evaluation process (SREP), the second mandate concerns the inclusion of ESG factors in the third pillar, the third mandate explains how a prudential treatment of ESG exposures is to be achieved in the first pillar. The EBA has also published three important documents with a view to the ESG transition in the credit sector: the guidelines on the granting and monitoring of loans and the discussion document on the management and supervision of ESG risks and finally a guide on climate and environmental risks . The first document is aimed at encouraging greater inclusion of considerations relating to ESG issues in the credit management process. In particular, this inclusion requires banks to implement ten-year long-term plans. The second document represents a first attempt to propose the inclusion of ESG factors in the regulatory and supervisory framework. In particular, the objective is to achieve climate neutrality by 2050. Among environmental risks, climate risks generated by physical and meteorological events and transition risks that derive from rapid changes in the values of assets occupy a prominent place. The management of risks that integrate with financial risks requires banks to adopt a "holistic" approach since ESG risks cannot be configured as "stand alone" risks whose effects can only be seen in financial terms. In light of these considerations which define the theoretical framework within which this paper is inserted, banks must adopt a new credit culture and at the same time will guide companies towards building a more resilient and sustainable bank-business relationship.

The governance of credit institutions must be able to approach the risks associated with lending in a context of sustainability, must have in-depth knowledge of the social context of the person requesting the loan and finally guarantee sustainability conditions in the medium to long term. These challenges for banking governance will translate into a change in the approach of the European regulator from a reactive nature which proposes an ex post management of non-performing loans to a proactive ex ante approach which is characterized by a precautionary vision of credit management. Another important consideration that explains the important role that banking institutions can assume in this process of transition towards sustainable finance is that they play the role of both suppliers and users of information relating to environmental factors, primarily changes climate. In this sense, banks can exacerbate the risks if, through their investments, they finance the economic activities that represent the originating causes of climate shocks and natural events or at the same time they can promote the creation of a low-carbon economy, focusing their strategies of future investments on the reduction of climate impacts. The implementation of ESG factors in the credit sector concerns not only risk management processes but also internal control systems and the compliance function. In fact, banks will have to tend to be increasingly ESG compliant, guaranteeing greater information transparency on environmental and social risks, starting from compliance with environmental and safety regulations. The ESG Compliance function can help the bank evaluate the materiality of the impacts of ESG factors on financial performance from a long-term management perspective. The compliance function may require a refocus towards internal regulations (rather than being structured looking exclusively at external supervisory requirements) i.e. greater integration of ESG risks into the governance structures of banking institutions.

The paper presents a structure divided into the following sections: the second section contains a literature review focused above all on the possible relationships between ESG risks and the financial risks that weigh on the bank-business relationship, the third section presents the performance of the macro-trends relating to access to credit at a global level, the fourth section presents the machine learning analysis through the application of the k-Means algorithm optimized with the Elbow Method, the fifth section presents the policy implications, the sixth section concludes.

2. The Relationship between ESG Factors and Banking Intermediaries: A Review

This section has the main objective of illustrating how issues relating to ESG aspects have entered into the construction of strategies, business models and the assessments and management of the main risks inherent in the bank-business relationship. To do this, we propose a systematic analysis of recent studies that have fueled the scientific debate on these aspects, highlighting how ESG factors represent a fundamental driver for greater competitiveness of banking intermediaries in a context that is becoming increasingly uncertain and in which the ability creating value can no longer be measured by looking exclusively at the achievement of financial sustainability objectives. In order to strengthen its ability to influence territorial development processes, any company, and therefore also banking companies, must be able to plan operational choices that produce significant impacts at an environmental and social level and on the related internal governance (i.e. on the three dimensions ESG). Therefore, it is necessary for banking companies to also be able to seize all the opportunities coming both from the external environment in which they operate and within themselves, which can facilitate the transition from financial sustainability to ESG sustainability.

The contributions reported in this section have analyzed the ESG challenge for banks, favoring as a point of view the relationship between ESG risks and traditional financial risks, primarily credit risk.

The contributions cited in this section connect the topic of risks (ESG and financial) to the more complex problem of the financial stability of banks. This is because, above all, new social and environmental risks can have repercussions that can involve multiple industrial sectors/sectors and geographical areas. The interest in the relationship between these new risks and the traditional ones, primarily credit risk, is also motivated by the fact that the impacts of ESG factors manifest themselves in a medium/long-term time horizon and are difficult to identify with a high degree of certainty and depend heavily on decisions made in the short term.

Several studies emphasize the need to make the credit sector more resilient and capable of monitoring and managing the effects of climate shocks (Feridon and Gungor 2020, Thoma and Gibhardt 2019). In this regard, Feridon and Gungor (2020) and Thoma and Gibhardt (2019) highlight that banks should anticipate regulatory developments on climate risks by promoting greater integration of climate risk considerations into credit, operational and market risk management processes. and also adapt governance structures. In this way they will be able to monitor the mechanisms of transformation of climate risks into traditional financial risks. In other words, to become more sustainable from an ESG perspective, banks can no longer wait for the regulatory progress that is not yet completed. These authors also identify four areas of intervention for banks to promote this transition to ESG factors: 1) greater commitment by the Board of Directors in the assessment of climate risks and their integration within governance models; 2) inclusion of climate risks in risk management models; 3) identification of the most relevant exposures to climate risks and risk reporting thanks to specific metrics; 4) assessment of the impact of climate risks on the adequacy of capital endowments by carrying out scenario analyzes and stress tests (in compliance with the requirements set by the first pillar of Basel). Thoma and Gibhardt (2019) evaluate the potential impact of the introduction of Green Supporting Factor (GSF) on the capital requirements of European banks compared to the introduction of a "brown penalty". (BP) . The GSF would have the function of reducing the capital requirements of banks to allow them to have a greater availability of financial resources to allocate to the financing of green investments. Instead, BP would have the function of increasing capital requirements for banks financing brown projects in order to discourage the allocation of resources to such uses. The GSF would generate a smaller reduction in capital requirements (equal to 3-4 billion) than the BP given the broader universe of assets on which such a sanction would be applied. In terms of cost of capital, the GSF would produce a reduction of 5 to 26 basis points for green projects.

On the contrary, the introduction of a brown penalty would reduce brown financing by approximately 8%. Stellner et al. (2015) test whether superior performance in terms of corporate social responsibility is associated with lower credit risk (measured by S&P credit ratings and corporate bond z-spreads). Social performance is measured based on scores in the Thomson Reuters ASSET4 ESG database. Their investigative sample consists of 872 corporate bonds issued by non-financial companies located in twelve European countries (Austria, Belgium, Finland, France, Germany, Greece, Ireland, Italy, Luxembourg, the Netherlands, Portugal and Spain) over the years 2006-2012. The explanatory variables concern both specific characteristics of companies, countries and corporate bonds. As a result, a weak influence on social performance and credit risk emerges. However, the best social performances are found in those countries that record above-average ESG performance for both metrics used to measure credit risk. Furthermore, companies obtain better ratings and lower spreads if their ESG performance (above average) is perfectly in line with that of the corresponding country (above average). The identity of an ESG company that operates in a country that rewards social performance can lead to a reduction in the spread of around 7.7%, unlike companies that have social performance (below average) not in line with that of the corresponding country (below the average). Di Tommaso and Thornton (2020) consider a sample of 81 banks operating in 19 European countries from the third quarter of 2007 to the fourth quarter of 2018. To select the variables, they use Bank Focus by Bureau Van Dijk and Asset4 by Thomson Reuter as databases. They intend to test basically three hypotheses: 1) European banks with higher ESG are riskier than those with lower ESG scores; 2)European banks with higher ESG are valued less than those with lower ESG scores; 3) The impact of higher ESG scores on banks' risk-taking decisions indirectly reduces bank value. The main results they arrive at are basically four.

A first result is that better ESG performance is associated with a greater reduction in risk taking. This negative correlation holds regardless of whether European banks are high or low risk. As a second result, the impact of ESG factors on banks' risk appetite is strongly mitigated by the presence of smaller boards of directors. Therefore, the size and composition of banks' boards of directors are crucial for ESG management of limiting risk taking. As a third result, the authors find that high ESG scores achieved by European banks slightly reduce their value, thus justifying an acceleration of ESG investments. The last result denotes the existence of a positive indirect link between ESG scores and value thanks to the risk mitigation action exerted by ESG factors. In other words, ESG factors reduce risk taking, but not enough to outweigh the direct negative impact on value. These four results can be united by this conclusion: the adherence to ESG factors by smaller banks with diversified executive committees reduces the risks assumed by European banks and allows them to achieve more stable performances at the expense of a reduction in their value. This trade-off between risk and value puts shareholders at a disadvantage compared to other stakeholders. Galletta and Mazzù (2023) find that banks involved in ESG controversies are more likely to engage in higher risk-taking activities. This suggests that negative ESG incidents can compromise a bank's risk management protocols and lead to more aggressive and potentially dangerous financial practices. The study highlights the importance of maintaining robust ESG standards to mitigate risk and ensure sustainable banking operations. Lagoarde and Segot (2020) and Schoenmaker (2021) focus not on bottom-up approaches promoted directly by banking institutions but rather on top-down approaches starting from the supervisory authorities (the European central banks). In fact, central banks must expand their monetary policy tools to increase the liquidity that can be allocated to financing the 17 sustainable development goals of Agenda 2030. Among these green bonds which could act as guarantees for exposures making financing less expensive and easier of those companies very active in the ecological transition process. To these tools Schoenmaker (2021) also adds changes to the collateral framework and reduction of regulatory capital requirements. In particular, the author proposes a modification to the collateral framework in order to reduce the emissions linked to it by 50%, demonstrating that it is possible to increase the sustainability of the program without compromising the transmission mechanisms of monetary policy.

Some studies (Grove et al. 2011, Harkin et al. 2020 and Srivastav and Hagendorff 2016 Danisman and Tarazi2024, Agnese et al. 2023) focus on the effects that ESG risks understood as governance risks can generate on financial risks. The analysis conducted by Grove et al. (2011) follows two steps on a sample of 236 banks. In the first they analyze the relationship between 13 governance factors and the financial performance of American banks (measured by the quality of revenues, return on assets, Tobin's Q). In the second, they test the existence of a relationship between these 13 governance factors and the quality of loans disbursed (measured by loan loss reserves, non-performing loans and loan write-offs). This paper highlights the importance of multiple dimensions of banking governance as each dimension produces a different impact on financial performance. Harkin et al. (2020) considering a sample of 115 banks operating in the United Kingdom in the period 2003-2012, try to understand how different governance systems can influence the risks and returns of banks. The dependent return and risk variables used are Return on assets and Loan Impairments. We also use a random variable that measures bank failure and takes the value 1 when banks become insolvent or participate in a government scheme aimed at preventing insolvency, zero otherwise. The explanatory variables are the presence of a CEO and joint president, the presence of a Chief Risk Officer as a member of the Board of Directors, the number of non-executive directors, the presence of a Remuneration Committee, squares and cubes of Board. Control variables concerning the financial characteristics of the banks are also added (mutual exposures of the banks, shareholdings in securities, extent of paid consultancy services, current account deposits, dummies variables relating to state majority ownership, mutual ownership and majority ownership by a foreign parent, the growth rate of total assets and loan interest income.

The main result is that, according to agency theory, the distinction between the roles of CEO and President increases the bank's risk without causing a simultaneous increase in return. The presence of a Remuneration Committee and non-executive Directors reduces the probability of bank failure probably because there is no risk of overlap between individual roles and responsibilities. Srivastav and Hagendorff (2016), through an analysis of the literature that focuses on banking governance and its implications on risk taking, intend to suggest future research areas on the relationship between governance and banking stability. The authors identify three lines of governance research that can influence financial stability: the effectiveness of the functioning of boards of directors, the structure of remuneration systems, and risk management systems and practices. Danisman and Tarazi (2024) explore the role of ESG activity on bank lending during financial crises. They find that banks with strong ESG practices tend to maintain more stable lending practices during financial turmoil. This stability is attributed to robust risk management frameworks and increased stakeholder confidence associated with high ESG standards. The study highlights the importance of ESG integration in promoting financial stability and resilience, especially in times of economic uncertainty. Miranda et al. (2023) examine the impact of board characteristics and social trust on ESG performance in the European banking sector. Their research indicates that diverse and well-composed boards of directors, characterized by a mix of skills, experiences and gender diversity, positively influence ESG performance. Furthermore, high levels of social trust within the community further strengthen banks' commitment to ESG principles. The study highlights the fundamental role of governance structures and social capital in promoting sustainable practices within banks.

Agnes et al. (2023) delve deeper into the link between ESG issues and governance in the banking sector. Their findings indicate that banks facing ESG controversies often have weaker governance structures. This report suggests that robust governance mechanisms are key to preventing ESG controversies and managing their fallout effectively. Strengthening governance frameworks can therefore improve overall ESG performance and mitigate risks associated with ESG lapses. Gurol and Lagasio (2022) investigate the impact of women on boards of directors on ESG disclosure in the European banking sector. Their research finds that greater female representation on bank boards is positively correlated with more complete ESG disclosures, particularly in the environmental and social dimensions. This finding highlights the value of gender diversity in improving transparency and accountability in ESG reporting, suggesting that diverse leadership can drive better ESG performance. Other studies focus on the effects that a more integrated risk management which therefore also takes ESG risks into account can produce on the society in which banks and businesses are located. In this regard, Aras et al. (2018) attempt to verify whether there is a relationship between Turkish banks' commitment to ESG sustainability dimensions and their ability to create value. The period investigated is the years from 2013 to 2015. They demonstrate that the transfer of a greater amount of information about the bank's commitment to sustainability projects increases the value of the banks because it creates greater customer trust towards them in the long term. Therefore, the completion of a very detailed non-financial disclosure on five dimensions of sustainability (economic, environmental, social, governance and financial) could shift investments from the short to the long term.

Other studies focus on the effects that ESG risks understood as risks related to climate change can generate on financial risks. Among these, Erhemjamts et al. (2024) explore the relationship between climate risk, ESG performance and ESG sentiment in US commercial banks. Their research shows that banks with higher ESG performance and positive ESG sentiment are better positioned to manage climate-related risks. This study highlights the critical role of ESG practices in mitigating the impacts of climate risk, thereby improving the overall resilience and sustainability of banks in the face of environmental challenges.

3. Analysis of Trends Relating to Access to Credit at a Global Level

Analysis of the trend in access to credit in 2023 at a global level. The data on domestic credit to the private sector as a percentage of GDP provides valuable insights into the varying levels of financial development across different countries. High percentages, as observed in economies like Hong Kong SAR, China (247.95%) and China (194.67%), indicate the presence of robust financial sectors characterized by significant lending activity. These economies utilize credit as a tool to stimulate economic growth and support the expansion of the private sector. However, while high levels of credit availability can drive growth, they also pose potential risks of over-leverage and financial instability. This necessitates careful monitoring and management to prevent financial crises that can arise from excessive borrowing. In contrast, countries such as Sierra Leone (0.01%) and Afghanistan (3.95%) exhibit minimal credit to the private sector. This suggests limited financial intermediation, where financial institutions may struggle to channel funds effectively to businesses and individuals. Such low levels of domestic credit often reflect underdeveloped banking sectors, inadequate financial infrastructure, or regulatory challenges that inhibit access to credit. These barriers can stifle private sector growth and impede broader economic development, as businesses may find it difficult to secure the necessary funding for expansion. Mid-range countries, including Brazil (71.65%) and Malaysia (117.16%), present a more balanced scenario. These nations leverage credit to fuel economic growth while simultaneously striving to maintain financial stability. Their financial systems support growing private sectors by ensuring that credit is accessible, which in turn contributes to their overall economic resilience. This balance indicates a well-regulated financial environment where credit is sufficiently available to promote growth without leading to excessive risk-taking. Overall, the data on domestic credit levels serves as a reflection of each country’s financial health, potential for economic growth, and inherent risk factors. Countries with higher levels of domestic credit may enjoy rapid economic growth due to robust lending practices but must remain vigilant to manage the associated risks of over-leverage. Conversely, countries with lower levels of credit are likely to face challenges related to financial access, which may hinder their development efforts. Enhancing financial intermediation in these nations could stimulate economic growth and development, helping them catch up with their more developed counterparts.

Analysis of the trend in access to credit during the period 2009-2023 at a global level. Countries like Cambodia and Armenia experienced substantial growth in domestic credit, with Cambodia's credit skyrocketing by over 600%. Such dramatic increases indicate expanding financial sectors and enhanced access to credit, which can significantly stimulate economic development by enabling businesses and individuals to invest and consume more. Similarly, Ecuador and Georgia also witnessed considerable growth, underscoring improvements in their financial systems and increased availability of credit. In contrast, nations such as China, Qatar, and Korea showed moderate but consistent growth, reflecting stable financial systems that support ongoing economic expansion. These countries likely benefited from favourable economic policies and increased investment in their private sectors, fostering a conducive environment for steady growth. On the other hand, some countries, including Argentina and Botswana, exhibited minimal changes in their credit ratios, suggesting stable but possibly stagnant credit markets. This stability could reflect a balanced approach to credit management or indicate potential constraints in financial sector development, limiting further expansion. In stark contrast, countries like Cyprus and Ireland experienced significant decreases in domestic credit, likely due to economic crises or tightened credit conditions, which may have dampened economic activity. Similarly, Slovenia and Ukraine faced notable declines, possibly driven by financial instability or external economic pressures. Overall, increased domestic credit availability typically correlates with higher economic activity, as businesses and consumers gain greater access to funds for investment and consumption. However, excessive credit growth can lead to financial instability, particularly in cases of overleveraging, which can pose risks to long-term economic health. The varied changes in domestic credit to private sectors across these countries highlight the complex interplay between financial policies, economic conditions, and market developments. Countries that manage to increase credit availability without compromising financial stability are likely to experience sustained economic growth, while those with declining credit ratios may face challenges in stimulating economic activity.

4. Clusterization with k-Means Algorithm with the Elbow Method

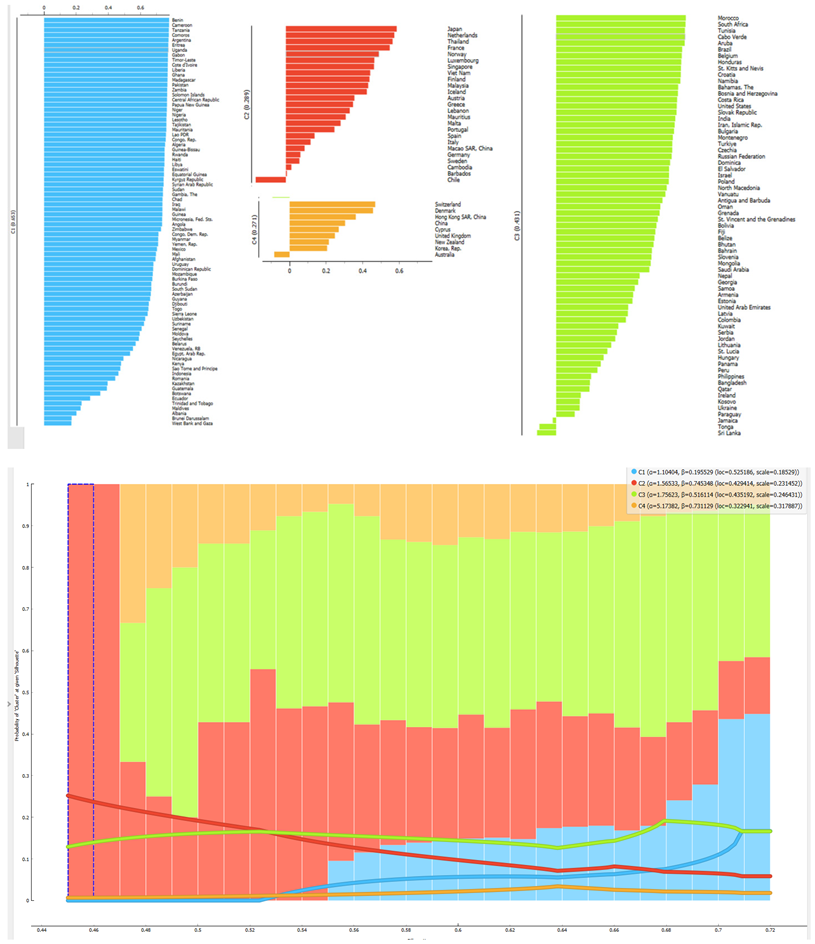

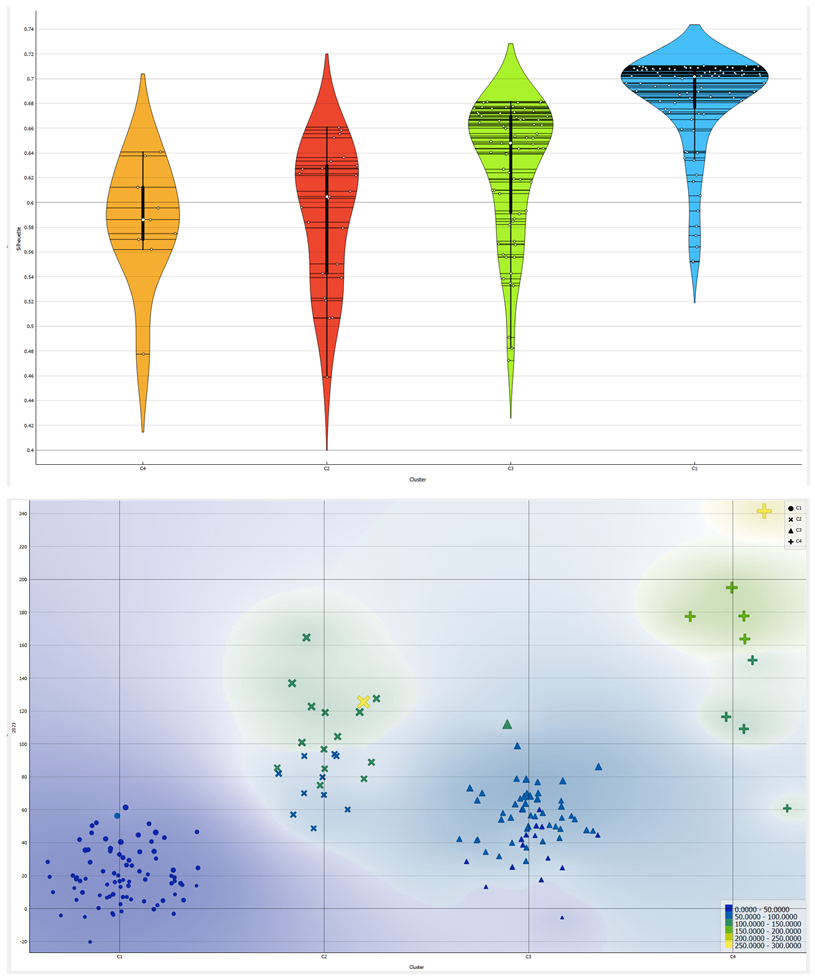

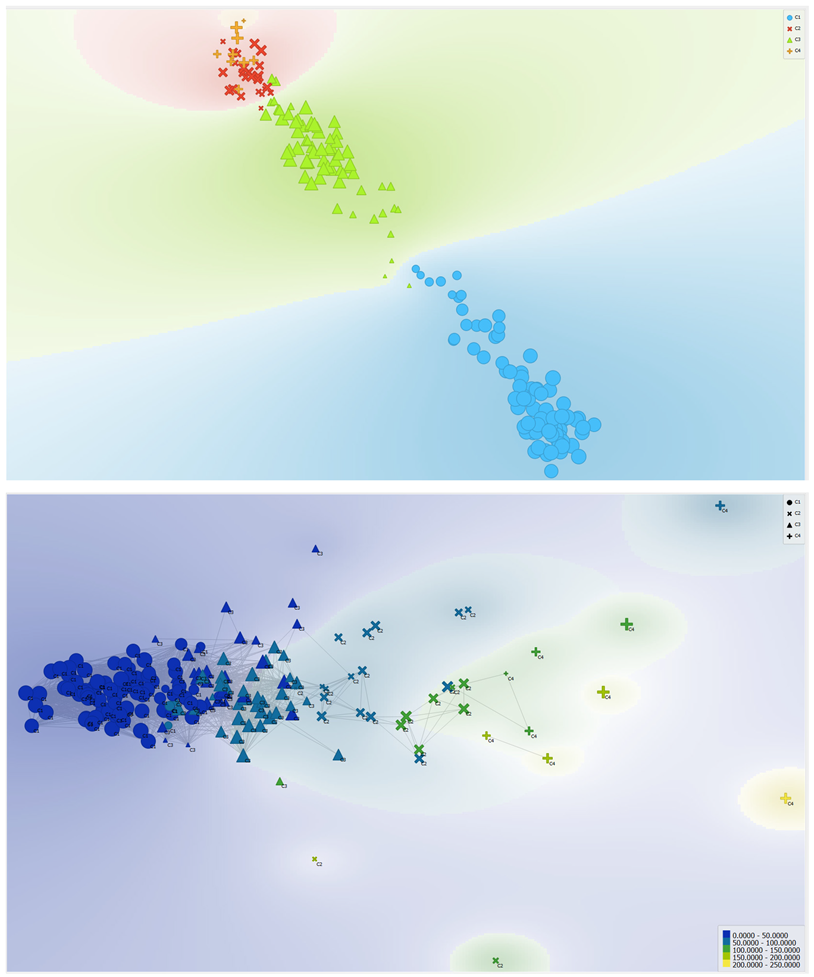

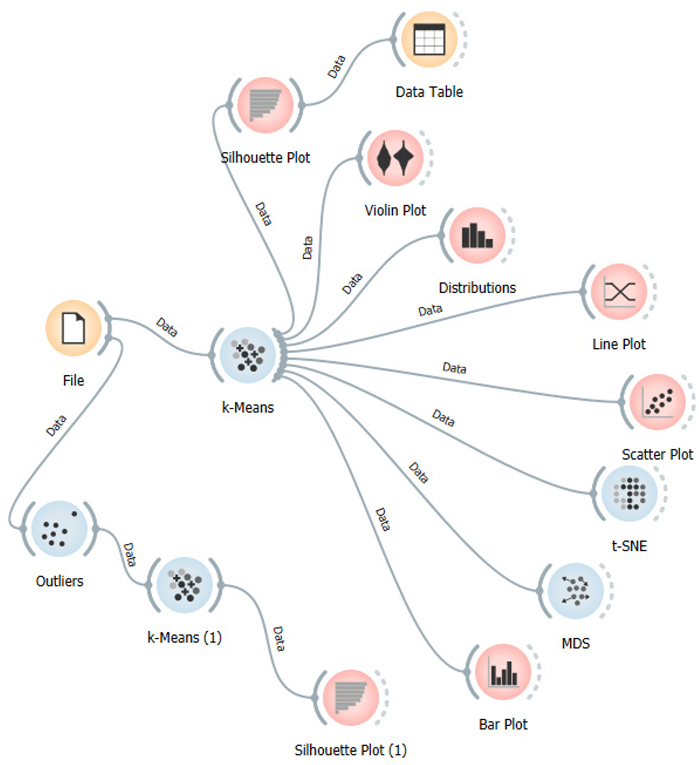

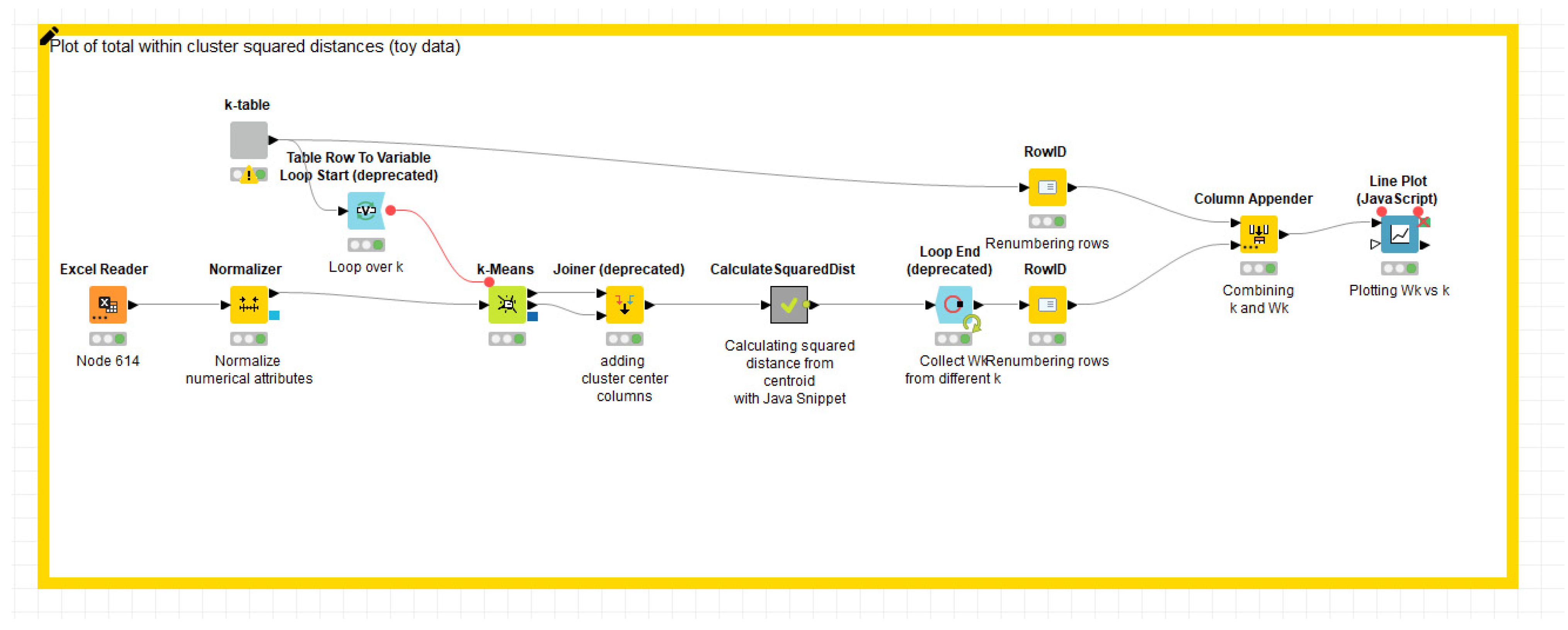

In the following analysis we present a clustering with k-Means algorithm optimized with the Elbow method. Clustering is proposed to verify the presence of groupings among the countries analyzed at a global level by level of access to credit. The k-Means algorithm is a widely used clustering method characterized by its simplicity and efficiency. It operates by partitioning data into k distinct clusters, each represented by a centroid, which is the mean of the points within the cluster. The algorithm iteratively assigns each data point to the nearest centroid and then updates the centroids based on the current cluster memberships. This process continues until the centroids stabilize, indicating convergence. Typically, k-Means uses the Euclidean distance metric to measure similarity between data points and centroids. While it is efficient and scalable for large datasets, it requires the number of clusters (k) to be predetermined and can be sensitive to initial centroid selection, leading to potential variations in results. Moreover, k-Means is most effective with spherical clusters and may struggle with high-dimensional data or non-spherical clusters. Despite these limitations, k-Means remains popular due to its straightforward implementation and effectiveness in many clustering applications. The Elbow method is relevant for clusterization because it helps determine the optimal number of clusters by analyzing the variance explained as a function of the number of clusters. It identifies the point where adding more clusters yields diminishing returns, known as the "Elbow." This point indicates a balance between minimizing within-cluster variance and avoiding overfitting, ensuring that clusters are both meaningful and well-defined. By using this method, analysts can enhance the quality and interpretability of clustering results, leading to more accurate insights and decision-making. To perform the clustering we used the following workflow in KNIME (

Figure 1).

Inizio modulo

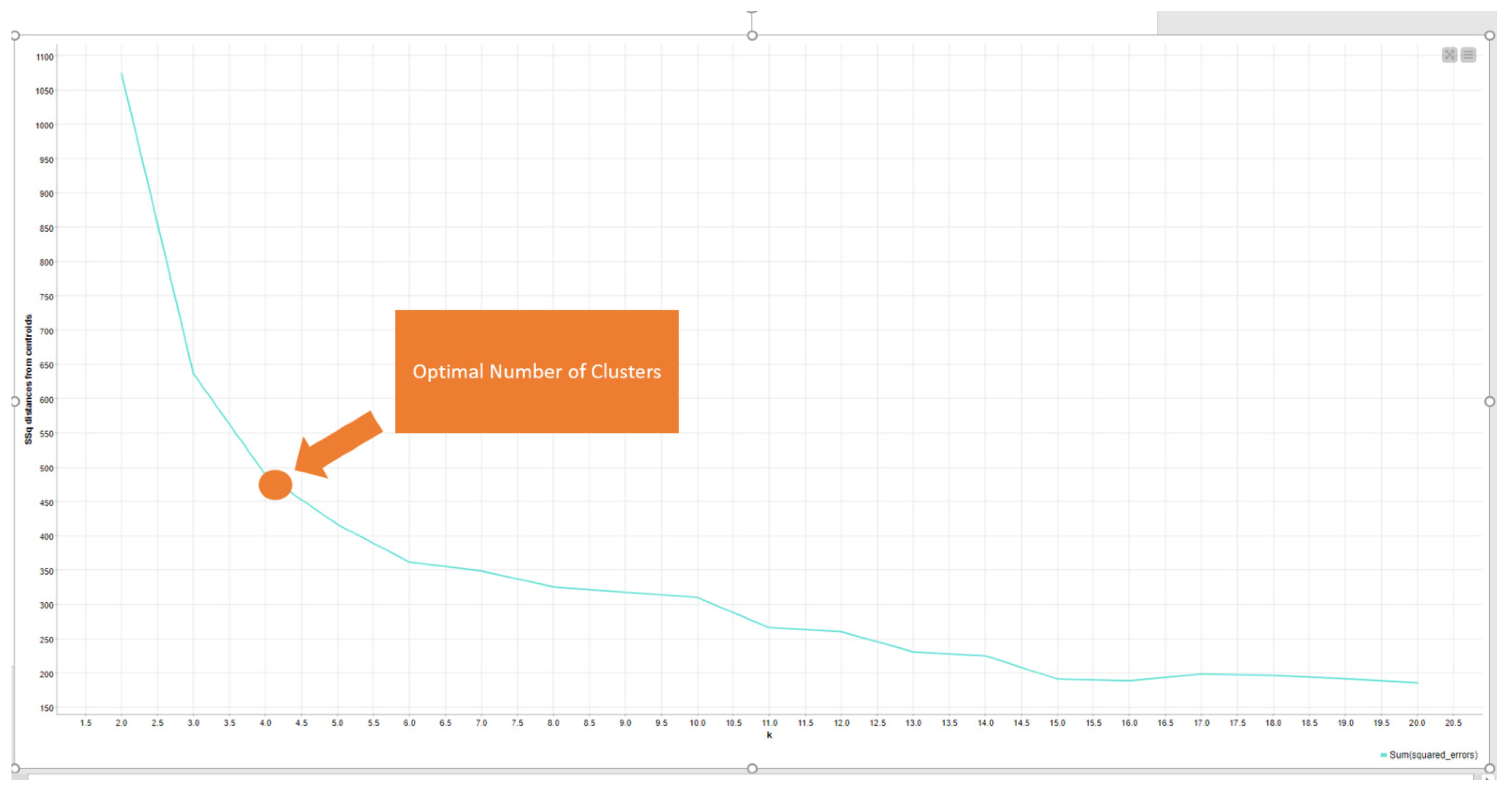

Once the workflow has been executed, an image is displayed that allows you to identify the optimal value of the clusters according to the Elbow method. It is necessary to consider that the Elbow method is a graphical method to identify the optimal number of clusters. In our case we chose the value of k=4 as indicated in the following figure (

Figure 2).

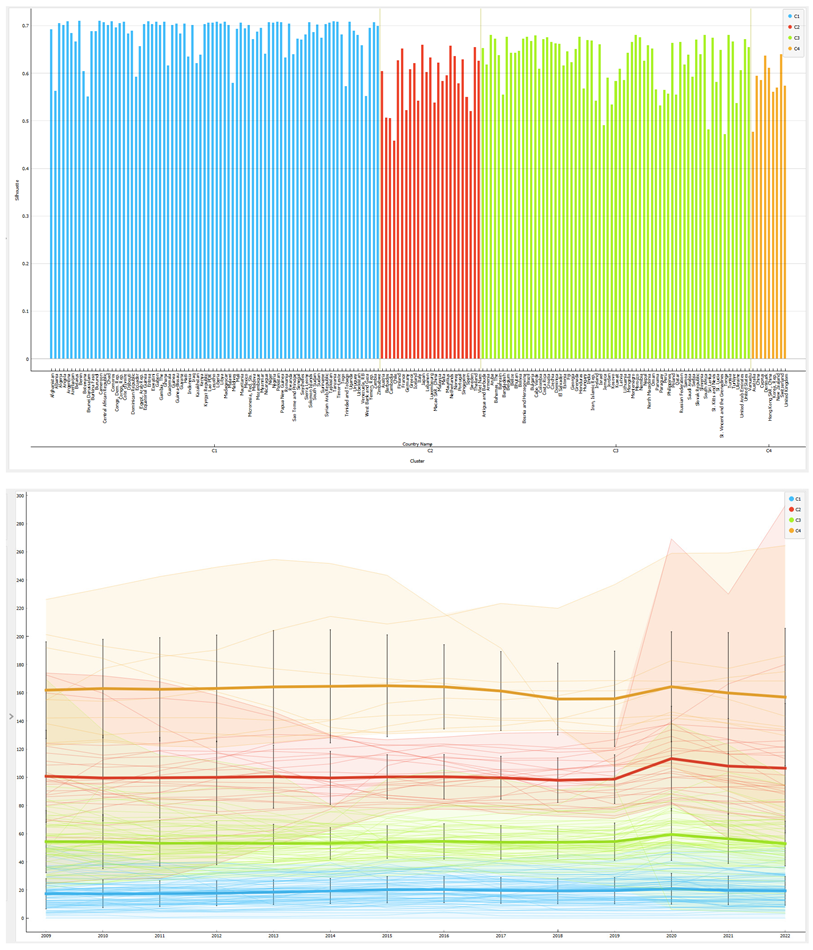

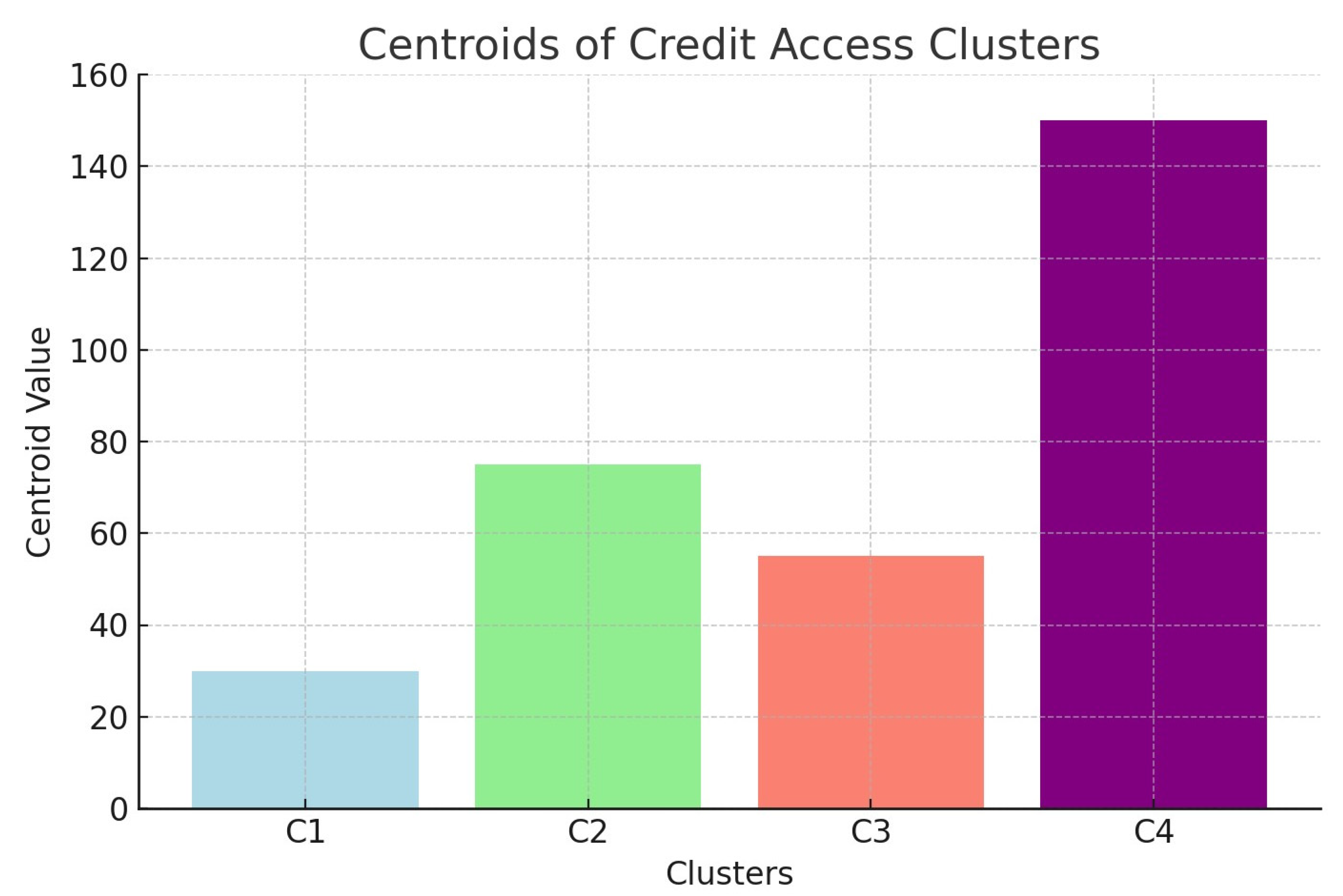

We thus obtained 4 clusters. The level of the cluster centroids is indicated in the figure below (

Figure 3).

Below we describe the geographical and socio-economic characteristics of the clusters by level of access to credit:

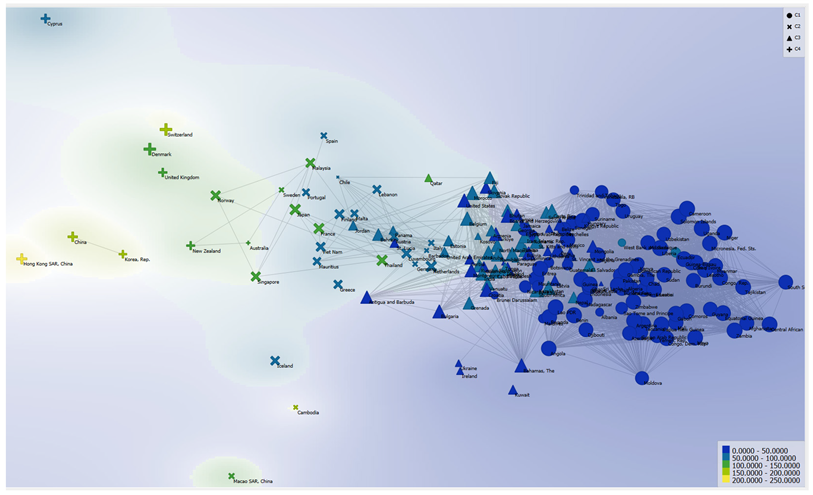

Cluster 1: Afghanistan, Albania, Algeria, Angola, Argentina, Azerbaijan, Belarus, Benin, Botswana, Brunei, Burkina Faso, Burundi, Cameron, Central Africa, Chad, Comoros, Congo Dem Rep, Congo Rep, Cote d'Ivoire, Djibouti, Dominican Republic , Ecuador, Egypt, Equatorial Guinea, Eritrea, Eswatini, Gabon, Gambia, Ghana, Guatemala, Guinea, Guinea-Bissau, Guyana, Haiti, Indonesia, Iraq, Kazakhstan, Mauritania, Mexico, Micronesia, Moldova, Mozambique, Myanmar, Nicaragua, Niger, Nigeria, Pakistan, Papua New Guinea, Romania, Rwanda, Sao Tome, Senegal, Seychelles, Sierra Leone, Solomon Islands, South Sudan, Sudan, Suriname, Syrian Arab Republic, Tajikistan, Tanzania, Timor-Leste, Togo, Trinidad and Tobago, Uganda, Uruguay, Uzbekistan, Venezuela, West Bank and Gaza, Yemen, Zambia and Zimbabwe. These countries generally have low access to credit, with values often below 40. This cluster includes many developing nations, suggesting limited financial infrastructure or higher barriers to obtaining credit. Many African and some Asian countries, indicating potential challenges in credit infrastructure and financial inclusion. Countries in Cluster 1, such as Afghanistan, Angola, and Chad, face low access to credit, typically below 40, with many in the single digits. This is due to underdeveloped financial infrastructure, high entry barriers, political instability, and low financial literacy. These factors limit business growth and investment, increase reliance on informal lending, and slow economic development. Policy recommendations include expanding banking networks, promoting financial literacy, simplifying loan processes, supporting microfinance, and encouraging foreign investment. For example, Afghanistan struggles with conflict, Angola with a fragile economy, and Chad with poverty, all affecting credit access and economic progress. Countries in Cluster 1 can enhance credit access by expanding financial infrastructure, particularly by increasing banking networks in rural areas and promoting mobile banking and fintech solutions. Financial literacy programs are crucial, involving educational campaigns to increase understanding of financial products, with support from NGOs and international organizations to foster inclusion. Regulatory reforms should focus on simplifying loan processes and reducing collateral requirements, complemented by establishing credit guarantee schemes to mitigate lender risks. Promoting microfinance institutions will support small loans to entrepreneurs and SMEs, while encouraging foreign investment through a stable political and economic environment and offering incentives to financial institutions can further bolster access. These measures will collectively stimulate business growth, attract investments, reduce reliance on informal lending, and drive economic development.

Cluster 2: Austria, Barbados, Cambodia, Chile, Finland, France, Germany, Greece, Iceland, Italy, Japan, Lebanon, Luxembourg, Macao, Malaysia, Malta, Mauritius, Netherlands, Norway, Portugal, Singapore, Spain, Sweden, Thailand, Vietnam. Countries in this cluster show moderate access to credit, with values typically ranging from 40 to 100. These nations have more developed financial systems but may still have some restrictions or higher costs associated with credit access. Includes European countries and some advanced economies with moderate credit systems. Countries in Cluster 2, such as Bahrain, Barbados, Belgium, and others, are characterized by a moderate to high level of access to credit, typically ranging from around 67 to 142. This cluster represents economies that have relatively well-developed financial systems, with infrastructure that supports credit access for individuals and businesses. These nations often benefit from stable banking sectors and effective regulatory frameworks that encourage lending and borrowing activities. The presence of robust credit markets enables consumer spending and investment, contributing positively to economic growth. Many of these countries also have policies aimed at financial inclusion, making credit available to a broader population segment. Overall, Cluster 2 countries show a balance between accessibility and regulatory oversight, promoting a sustainable credit environment. To improve access to credit in Cluster 2 countries, several policies can be implemented. First, enhancing financial literacy programs will empower individuals to make informed borrowing decisions. Additionally, developing credit scoring systems using alternative data can broaden access for those with limited credit histories. Governments can also incentivize banks to expand their lending portfolios by offering guarantees or subsidies for loans to small and medium enterprises (SMEs). Streamlining regulatory frameworks and reducing bureaucratic barriers can make it easier for new financial institutions to enter the market, increasing competition and potentially lowering interest rates. Lastly, promoting digital banking and fintech solutions can reach underserved populations, providing innovative and accessible credit options. Together, these measures can foster a more inclusive and robust financial environment. In Cluster 2 countries, several extra-economic and financial constraints can limit access to credit. Political instability can create an environment of uncertainty, deterring investment and complicating credit market operations. Complex or inconsistent regulatory frameworks may hinder financial institutions' ability to offer expanded credit options. Additionally, cultural factors, such as trust in formal banking systems, can impact individuals' willingness to engage with credit services. Legal systems that are inefficient in contract enforcement and debt recovery discourage lending by increasing risks for financial institutions. Moreover, technological gaps in certain areas prevent the adoption of digital financial services, while inadequate infrastructure hinders the establishment of financial institutions in rural or underserved regions. Addressing these challenges requires a comprehensive approach, involving political stability, regulatory reforms, legal improvements, and efforts to build trust in the financial system.

Cluster 3: Antigua and Barbados, Armenia, Aruba, Bahamas, Bahrain, Bangladesh, Belgium, Belize, Bhutan, Bolivia, Bosnia, Brazil, Bulgaria, Cabo Verde, Colombia, Costa Rica, Croatia, Czechia, Dominica, El Salvador, Estonia, Fiji, Georgia , Grenada, Honduras, Hungary, India, Iran, Ireland, Israel, Jamaica, Jordan, Kosovo, Kuwait, Latvia, Lithuania, Mongolia, Montenegro, Morocco, Namibia, Nepal, North Macedonia, Oman, Panama, Paraguay, Peru, Philippines, Poland, Qatar, Russian Federation, Samoa, Saudi Arabia, Serbia, Slovak Republic, Slovenia, South Africa, Sri Lanka, St. Kittis, St. Lucia, St. Vincent, Tonga, Tunisia, Turkey, Ukraine, United Arab Emirates, United States. This cluster represents countries with higher access to credit, generally between 50 and 100. These countries have robust financial sectors, and access to credit is more readily available. Mix of developing and developed countries with good credit access, highlighting diverse financial systems. Countries in Cluster 3 exhibit moderately high levels of access to credit, generally ranging from around 45 to 95. These nations, including Brazil, Austria, and Morocco, often have well-established financial systems and growing economies, supported by effective regulatory frameworks. They typically enjoy a diverse range of financial institutions, contributing to healthy competition and a variety of credit products available to consumers and businesses. However, some barriers still exist, such as bureaucratic hurdles and limited access in rural areas. These countries may also face challenges with creditworthiness assessments, which can restrict credit access for small enterprises and underserved populations. Overall, Cluster 3 countries are on a positive trajectory, with strong potential for further financial inclusion and credit market development. Access to credit in Cluster 3 countries positively impacts economic growth and development by facilitating increased investment and consumption. With greater credit availability, businesses can invest in expansion, technology, and workforce development, leading to higher productivity and job creation. Consumers benefit from enhanced purchasing power, boosting demand for goods and services. Additionally, improved credit access promotes financial inclusion, allowing underserved populations to participate in the economy. This fosters innovation and entrepreneurship, further driving economic growth. However, it's essential to manage credit risks to avoid potential financial instability. Overall, enhanced access to credit supports sustainable economic development by creating a more dynamic and inclusive economy. In Cluster 3 countries, several extra-economic and financial motives sustain moderate access to credit. Strong institutional frameworks, including effective governance and robust legal systems, ensure contract enforcement and protect creditor rights, creating a reliable lending environment. Cultural attitudes that promote trust in banking and financial institutions encourage both individuals and businesses to engage with formal credit systems. Additionally, educational initiatives aimed at improving financial literacy empower people to manage credit responsibly, maintaining steady demand for credit products. The adoption of digital banking and fintech innovations helps streamline access and reach underserved populations. Furthermore, political stability reduces uncertainty, making it safer for financial institutions to extend credit. Finally, engagement with international organizations and access to global financial markets provide additional funding sources and best practices, supporting the ongoing development of credit systems in these countries.

Cluster 4: Switzerland, Denmark, Hong Kong, China, Cyprus, United Kingdom, New Zealand, Korea Republic, Australia. The countries in this cluster have very high credit access, often exceeding 100. These are typically highly developed economies with advanced financial systems, making credit easily accessible to businesses and individuals. Predominantly developed nations with strong, accessible credit markets, promoting economic growth and entrepreneurship. Countries in Cluster 4, such as the United States, China, and Sweden, are characterized by high levels of access to credit, with figures often exceeding 100. These nations typically have well-developed financial markets, advanced technological infrastructure, and strong regulatory frameworks that facilitate extensive credit availability. The financial systems in these countries are highly diversified, offering a wide range of credit products to both consumers and businesses. High levels of financial literacy and digital banking adoption contribute to widespread access. Additionally, strong legal systems ensure contract enforcement and protect lender and borrower rights, enhancing confidence in credit markets. However, these countries must also manage risks related to high debt levels and financial stability, ensuring sustainable credit growth without leading to economic imbalances. Overall, Cluster 4 countries benefit from dynamic and inclusive financial systems that support robust economic growth and development. Countries in Cluster 4 enjoy high levels of access to credit due to several key institutional and extra-economic factors. Strong regulatory frameworks ensure financial market stability and transparency, fostering an environment conducive to lending and borrowing. Developed financial infrastructures, characterized by diverse and advanced banking systems, offer a wide range of credit products to meet consumer and business needs. High levels of financial literacy enable populations to understand and manage credit responsibly, further enhancing access. Technological advancements, including widespread digital banking and fintech services, expand credit availability, especially in previously underserved areas. Robust legal systems that protect creditor and borrower rights build trust in the financial system, encouraging participation. Additionally, stable macroeconomic environments promote confidence among lenders and borrowers, supporting healthy credit markets. Cultural factors, such as high levels of trust in financial institutions, also play a significant role in sustaining engagement with formal credit systems. Together, these elements contribute to the dynamic and inclusive financial landscapes seen in Cluster 4 countries, underpinning their robust economic growth and development. But, high credit levels can lead to potential over-indebtedness among consumers and businesses, increasing the risk of defaults. This can strain financial institutions and potentially lead to instability in the financial system. Additionally, high levels of credit can contribute to asset bubbles, as excessive borrowing may inflate prices in sectors like real estate. To mitigate these risks, it is essential for these countries to implement robust regulatory frameworks, ensure prudent lending practices, and maintain effective monitoring of credit markets to sustain financial stability while supporting economic growth.

Countries in C1 may benefit from policy interventions aimed at improving financial access and infrastructure. C2 and C3 clusters represent regions with growing credit markets, offering potential investment opportunities. C4 countries demonstrate how advanced credit access supports overall economic growth and financial stability. The clustering reveals significant disparities in credit access across countries, emphasizing the importance of tailored financial policies and investment strategies to enhance credit availability globally.

5. Policy Implications

Evaluating access to credit through the ESG (Environment, Social, and Governance) model has profound policy implications globally. Policies promoting sustainable lending practices encourage financial institutions to prioritize environmentally friendly projects, thus supporting green technologies and reducing carbon footprints. By enhancing social inclusivity, these policies ensure that underserved populations have improved access to credit, thereby reducing inequalities and fostering social equity. Strong governance frameworks within financial institutions promote transparency, accountability, and ethical lending practices, which are crucial for stability. Additionally, incorporating ESG criteria helps in risk management by identifying and mitigating potential risks associated with environmental degradation, social unrest, or governance failures. This approach not only supports sustainable economic development by balancing immediate credit needs with long-term environmental and social goals but also encourages global cooperation. Harmonizing ESG standards across borders facilitates cross-border investments and credit flow, aligning with broader sustainable development goals. Overall, integrating ESG considerations into credit evaluation enhances the resilience and sustainability of financial systems, promoting a more inclusive and environmentally conscious approach to global credit access.

Countries with lower middle-income levels can take several steps to enhance access to credit. First, they can strengthen financial literacy programs to educate the population on managing credit responsibly. Implementing regulatory frameworks that support microfinance institutions and mobile banking can extend credit to underserved areas. Encouraging the use of alternative credit scoring models, which utilize data beyond traditional credit histories, can help include more people in the financial system. Additionally, governments can create credit guarantee schemes to reduce risks for lenders, making them more willing to provide loans to small and medium enterprises (SMEs). Investing in digital infrastructure also facilitates broader access to financial services, making it easier for individuals and businesses to engage with the banking system. These measures collectively can significantly improve credit access, fostering economic growth and development. Countries with lower middle-income levels face several challenges when implementing credit access models linked to the ESG framework. Limited financial resources hinder their ability to invest in sustainable projects and integrate ESG principles effectively. Regulatory challenges, including weak governance and insufficient legal frameworks, complicate the enforcement of ESG standards. Additionally, there is often a lack of awareness and understanding of ESG among financial institutions and borrowers, making adoption more difficult. Technological gaps further impede the implementation of digital financial services that could support ESG goals. Cultural barriers, such as resistance to change and unfamiliarity with sustainable practices, also pose significant obstacles. Moreover, these countries often prioritize immediate economic growth over long-term sustainability, which can conflict with ESG objectives. Addressing these impediments requires targeted efforts, including international support, education, and investment in both infrastructure and capacity-building.

Countries with upper middle-income levels face several risks associated with high levels of access to credit. Over-indebtedness among consumers can lead to financial instability, as individuals and businesses may struggle to repay loans. This risk is compounded by potential asset bubbles, particularly in real estate, where excessive borrowing can inflate prices unsustainably. Additionally, high levels of credit can lead to increased vulnerability to economic shocks, as borrowers may be more affected by interest rate fluctuations or economic downturns. There is also the risk of reduced credit quality, where lenders might lower their standards to maintain loan growth, potentially leading to higher default rates. To mitigate these risks, it is crucial to maintain robust regulatory frameworks, ensure prudent lending practices, and promote financial literacy among the population. In conclusion, managing high levels of access to credit in upper middle-income countries requires a balanced approach. Implementing robust regulatory frameworks, enhancing financial literacy, and promoting prudent lending practices are crucial to mitigate the risks of over-indebtedness and financial instability. Macroprudential policies can help manage credit growth and prevent asset bubbles, while diversification of credit sources can reduce systemic vulnerabilities. By addressing these challenges, countries can ensure that access to credit supports sustainable economic development without compromising financial stability.

6. Conclusions

The integration of Environmental, Social, and Governance (ESG) factors into the banking sector is increasingly recognized as crucial for sustainable economic growth and effective risk mitigation. Banks are pivotal in the ecological transition, as they channel financial resources toward projects that are environmentally friendly and socially responsible. This shift not only enhances the banks' reputations but also fosters greater customer trust, thereby contributing to long-term financial benefits. Banks serve as essential conduits for promoting sustainability by investing in green projects and supporting businesses that adhere to responsible practices. This role is vital in aligning financial flows with sustainability goals, which is necessary for addressing global challenges such as climate change and social inequality. By prioritizing ESG factors, banks can improve their risk profiles, as investments in sustainable projects tend to be less volatile and more resilient in the long term. Integrating ESG principles offers multiple advantages. Firstly, it enhances a bank's reputation among stakeholders, including customers, investors, and regulators. A strong commitment to ESG factors can lead to increased customer loyalty and attract environmentally and socially conscious investors. Additionally, it contributes to long-term economic stability by reducing risks associated with environmental and social factors, such as regulatory penalties or reputational damage.

Despite these benefits, banks face significant challenges in implementing ESG strategies. These include regulatory inconsistencies across different jurisdictions, which can create confusion and hinder the development of coherent ESG policies. Moreover, there is often a lack of awareness and understanding of ESG principles among stakeholders, including bank employees and customers. Technological gaps also pose a barrier, as the integration of ESG factors requires sophisticated data collection and analysis capabilities. To overcome these challenges, banks need to adopt comprehensive strategies. Robust governance frameworks are essential to ensure that ESG considerations are integrated into all levels of decision-making. Additionally, financial literacy programs can play a crucial role in raising awareness and understanding of ESG principles among stakeholders. By educating customers and employees about the importance of sustainability, banks can foster a culture that supports long-term ecological and social well-being.

The k-Means analysis conducted in this study highlights significant disparities in global access to credit, emphasizing the need for tailored financial policies. By clustering countries based on credit access levels, this analysis provides valuable insights into the diverse economic conditions and challenges faced by different regions. Such a clustering approach allows policymakers to formulate more effective financial strategies that address the specific needs of various countries, promoting financial inclusion and equitable access to resources. The insights gained from the k-Means analysis underscore the importance of targeted policy interventions. By identifying clusters of countries with similar credit access challenges, policymakers can design interventions that are more likely to succeed in promoting financial inclusion. This targeted approach not only enhances the effectiveness of financial policies but also ensures that resources are allocated efficiently to where they are needed most. Ultimately, a proactive approach to integrating ESG factors into the banking sector can lead to a more resilient financial system, reduced risks, and increased stakeholder trust. This fosters not only financial stability but also broader societal and environmental benefits, contributing to a more inclusive and sustainable global economy. The findings of this study underscore the transformative potential of ESG principles and k-Means analysis in reshaping the banking sector and supporting long-term economic development.

References

- Agnese, P., Battaglia, F., Busato, F., & Taddeo, S. (2023). ESG controversies and governance: Evidence from the banking industry. Finance Research Letters, 53, 103397. [CrossRef]

- Aras G., Tezcan N., Kutlu Furtuna O. (2018). The value relevance of banking sectormultidimensional corporate sustainability performance. Corp. Soc. Responsib.Environ. Manag. 25, 1062e1073.

- Danisman G. O., Tarazi A. (2024). ESG activity and bank lending during financial crises. Journal of Financial Stability, 70, 101206. [CrossRef]

- Di Tommaso C. Thornton J. (2020), Do ESG scores effect bank risk taking and value? Evidence from European banks, Corporate Social Responsibility & Environmental Management, 27(5), pp. 2286–2298.

- Erhemjamts O., Huang K., Tehranian H. (2024). Climate risk, ESG performance, and ESG sentiment in US commercial banks. Global Finance Journal, 59, 100924. [CrossRef]

- Feridon M., Gurgon H. (2020), Climate-Related Prudential Risks in the Banking Sector: A Review of the Emerging Regulatory and Supervisory Practices, Sustainability 2020, 12(13), 5325.

- Galletta S., Goodell J. W., Mazzù S., Paltrinieri A. (2023). Bank reputation and operational risk: The impact of ESG. Finance Research Letters, 51, 103494. [CrossRef]

- Galletta S., Mazzù S. (2023), ESG controversies and bank risk taking. Business Strategy and the Environment, 32(1), 274-288. [CrossRef]

- Giorgino M. (2021), ESG, finanza sostenibile e banche in Italia: stato dell’arte e prospettive, 25 Maggio.

- Grove H., Patelli L., Victoravich L.M., Xu P.T. (2011), Corporate governance and performance in the wake of the financial crisis: evidence from US commercial banks. Corp. Govern. Int. Rev. 19, 418e436. [CrossRef]

- Gurol B., Lagasio V. (2022). Women board members’ impact on ESG disclosure with environment and social dimensions: evidence from the European banking sector. Social Responsibility Journal, 19(1), 211-228. [CrossRef]

- Harkin S.M., Mare D.S., Crook J.N. (2020). Independence in bank governance structure: empirical evidence of effects on bank risk and performance. Res. Int.Bus. Finance 52, 101177. [CrossRef]

- Lagoarde-Segot T., (2020), Financing the Sustainable Development Goals, PoCfiN Working Paper 01/2020, Available at SSRN: https://ssrn.com/abstract=3552572. [CrossRef]

- La Torre M. (2021), Banche e sostenibilità: più dell’amor può la compliance. L’anima ESG delle banche europee: chi vince tra autorità e mercato?, Il Sole 24Ore, 7 Aprile.

- La Torre M, Leo S, Panetta I. C. (2021), Banks and environmental, social and governance drivers: Follow the market or the authorities? Corp Soc Responsib Environ Manag. 2021;1–15.

- Miranda B., Delgado C., Branco M. C. (2023), Board characteristics, social trust and ESG performance in the European banking sector. Journal of Risk and Financial Management, 16(4), 244. [CrossRef]

- Murè P., Spallone M., Mango F., Marzioni S., Bittucci L. (2021), ESG and reputation: The case of sanctioned Italian banks. Corporate Social Responsibility and Environmental Management, 28(1), 265-277.

- Schoenmaker D. (2021), Greening monetary policy, Climate Policy, 2021, vol. 21, issue 4, 581-592. [CrossRef]

- Stellner C., Klein C., Zwergel B. (2015), Corporate social responsibility and Eurozone corporate bonds: The moderating role of country sustainability, Journal of Banking & Finance, 59, issue C, p. 538-549. [CrossRef]

- Srivastav A., Hagendorff J. (2016), Corporate governance and bank risk-taking, Corp.Govern. Int. Rev. 24, 334e345. [CrossRef]

- Thomä J., Gibhardt K. (2019), Quantifying the potential impact of a green supporting factor or brown penalty on European banks and lending, Journal of Financial Regulation & Compliance, 27(3),380–394. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).