1. INTRODUCTION

The maxim commonly ascribed to Alexander Hamilton advises that individuals who do not uphold any principles are susceptible to being swayed easily. In the realm of academia, we advocate for the distinctive perspectives offered by our conceptual frameworks, analytical models, and theoretical constructs. Notwithstanding their imperfections, these frameworks are constructed upon a series of assumptions that enable us to formulate rational assessments and forecasts [

1]. Competitiveness represents a quantifiable assessment of the effectiveness and achievements of individuals, businesses, economic sectors, or the aggregate economy. The competitiveness of an economic entity, economic sector, or economy in the global market is contingent upon an array of factors and the potential strategies for their integration [

2]. The issue of national competitiveness is of paramount concern for both developed and developing nations, as emphasized by Porter (1990) and echoed by Lall (2001) who noted that this issue is a source of serious concern for policymakers. A substantial body of literature exists on the subject of competitiveness and contemporary economic discourse frequently categorizes various phenomena as either competitive or non-competitive in nature [

3]. According to Lall (2001), this phenomenon is not a novel occurrence. The governments of affluent nations are preoccupied with the preservation of their advanced technology and the implementation of new initiatives that do not compromise competitiveness despite the presence of high wages. The primary focus for export-oriented newly industrialized economies (NIEs) often lies in maintaining a competitive edge over lower-wage entrants and successfully challenging mature industrial countries in advanced economic activities. Countries with import-substituting economies that choose to open themselves up to foreign competition are concerned about the long-term process of industrial restructuring as they work to develop new capabilities. Moreover, the least developed countries are facing challenges related to sustaining existing industrial activities and apprehension regarding transitioning to new export activities [

4]. Researchers have discovered that the implementation of a multifaceted competitive strategy offers long-term advantages. However, organizations are required to address obstacles and incur the expenses of implementation, which pose a threat to their short-term financial performance (Connelly et al. , 2017)Therefore, organizations should meticulously analyze their capacity to develop and implement an intricate competitive strategy [

5].

Porter (1985) is widely recognized as the author who has articulated the concept of competitive advantage, defining it as "the fundamental basis for superior long-term performance.” Porter (1985) asserts that superior value as perceived by customers is the key factor in achieving competitive advantage. This can be accomplished through the incorporation of superior product characteristics at prices comparable to those of the market, or through the provision of equivalent benefits at lower costs [

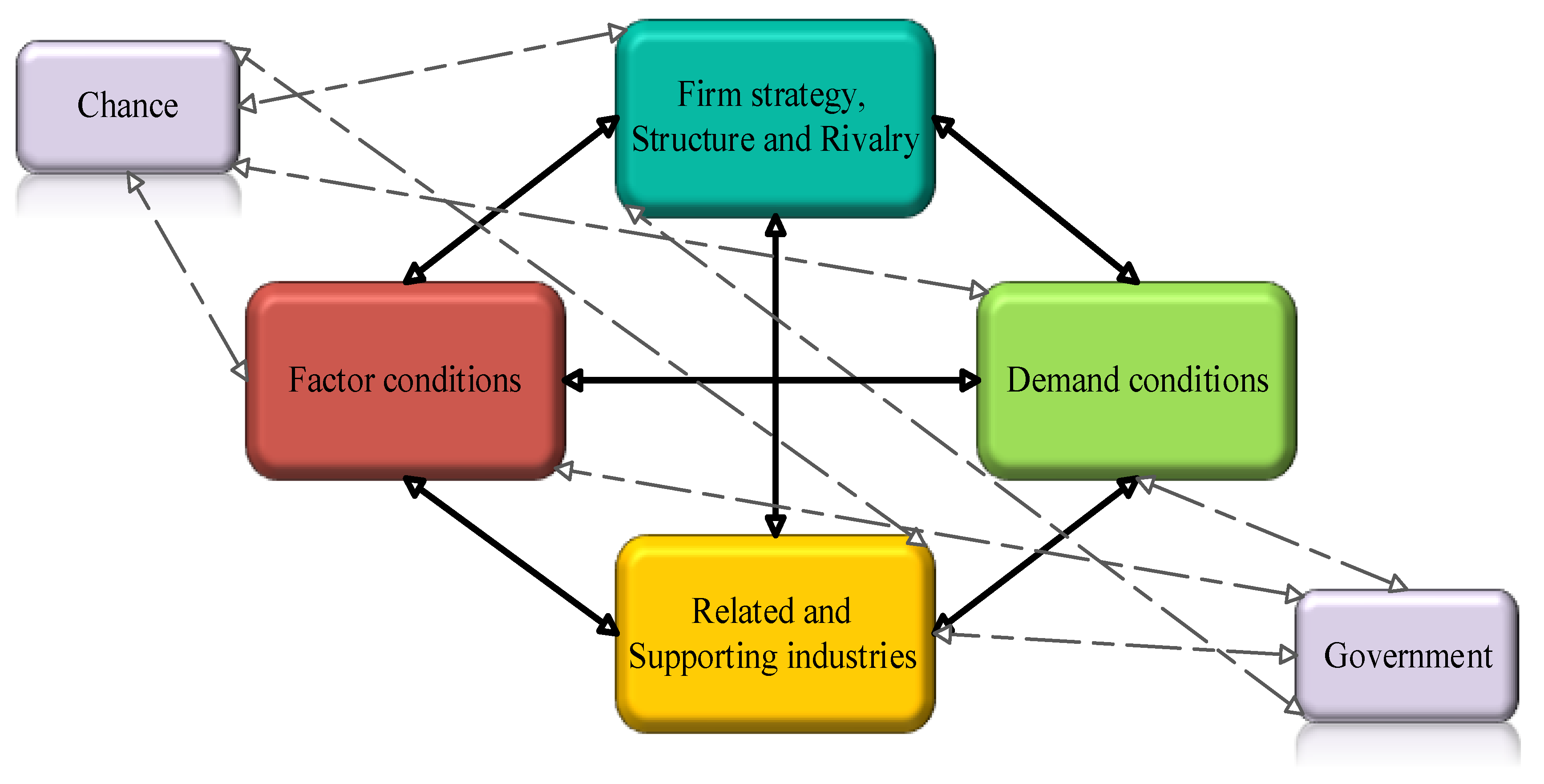

6]. In his seminal work "The Competitive Advantage of Nations" (Porter, 1990), the author seeks to elucidate the factors contributing to a nation's attainment of global prominence within a specific industry, as opposed to across all industries. Porter delineated four attributes, referred to as the diamond, which serve to either facilitate or hinder the development of a competitive advantage. In order for a nation to be considered competitive, it must possess sufficient factor endowment, favorable demand conditions, related and supporting industries, and a robust firm strategy, structure and rivalry. Moreover, Porter delineated two additional factors, chance and government, which are able to exert significant influence on the diamond model [

7]. The interdependence of the aforementioned determinants results in a reciprocal relationship, such that any modification in one determinant exerts an impact on the remaining determinants (Porter, 1990) [

8]. The application of the diamond model proves to be an efficient approach in assessing the competitive dynamics of industries. The model offers a robust framework for evaluating national-level competitiveness and offers guidance for delineating factors that assess the competitiveness of the industry [

9]. Porter postulated that the absence of incentives for innovation and investment in a market-oriented direction within the "national diamond," coupled with a lack of understanding of demand by the industry, will lead to the loss of national dominance [

10]. The global business community is impeded by a dearth of reliable information as well as an abundance of unnecessary barriers and disparities in business-related legislation across various nations [

11]. The establishment of a voluntary and thoroughly representative international body, such as the International Chamber of Commerce, stands to yield considerable advantages for global citizens. This includes the unfair competition and resolution of critical matters pertaining to finance, raw materials, production, transportation, shipping, facilitation and various other facets of international trade [

11]. It is evident that the International Chamber of Commerce (ICC) has become more assertive in its acknowledgment of its early history. The organization now emphasizes the proactive stance taken by its founders, who recognized the dearth of governmental intervention and instead took it upon themselves to establish global business standards, confident in the private sector's superior qualification for this task [

12]. The ICC, founded in 1919 in Paris, with the objective of fostering increased accessibility of global markets for international trade and investment [

13]. Also it has possesses the distinction of being the preeminent and most inclusive global business collective [

14]. Hence, the ICC, endeavored to assume a prominent position in mediating the relationship between companies and the government, as well as facilitating connections between businesses. Examining the historical trajectory through the lens of corporate entities underscores the adaptable nature of business agents [

12].

In the past scientific records, no specific topic corresponding to the title of this research was found because the purpose of this research is to examine the position and role of the Chamber of Commerce of Industries, Mines and Agriculture of Isfahan Province in Porter's diamond model as a non-governmental organization and the link between the internal factors of this model and It is a component of the government.

2. LITERATURE REVIEW

2.1. Porter’s Diamond Model

The individual identified as Michael E. Porter, an eminent economist, is widely acknowledged as a seminal figure in the field of strategic management, as noted by Curran (2001), Chobanyan and Leigh (2006), and Bakan and Dogan (2012). The individual has been acknowledged as a prominent figure in the field of competitive strategy within organizations, and, more recently, in the utilization of competitive analysis in evaluating the social and environmental implications of business activities (Jin and Moon, 2006; Stonehouse and Snowdon, 2007). Porter's theory posits that a firm's competitive strategy is contingent upon its positioning to its environment [

15]. Porter discredits the notion that a nation's competitive advantage is exclusively determined by the abundance of production factors. Alternatively, he posits that the capacity for innovation is paramount in achieving success in the global marketplace. The focal point of his analysis pertains to the impact of the business environment on the process of upgrading. Porter examines a diverse range of factors that promote innovation, thereby also establishing a framework for conducting comparative environmental analysis. The contribution of this aspect is vital for the advancement of a comprehensive understanding of strategic management. The field of macro environmental analysis, which has historically received less attention, has advanced significantly. In order to cultivate a comprehensive and dynamic theory of strategy, it is essential to integrate theories of the business environment into the framework [

16]. In the contemporary business landscape, a primary consideration for organizations is the pursuit of a sustainable and competitive edge within an evolving industry framework [

17]. Porter connects the competitiveness of national economies to the idea of productivity. He believes that this is the most accurate measure of competitiveness for countries. He argues that the prosperity of a country is linked to the effectiveness of labor and the financial resources of its citizens [

18]. Porter (1990) employed the notion of competitiveness within the framework of national economies in order to elucidate the disparities in the competitive capabilities of various countries (Diamond Model –

Figure 2) [

19]. The Diamond Model was chosen as the subject of qualitative analysis to offer insights into the process view of value chains. Porter (1990) introduces 'the diamond model' as an analytical framework for examining the factors contributing to a nation's competitive advantage in specific industries. Moreover, the competitiveness of a given nation is contingent upon the level of productivity that companies can achieve within their operating environment (Kharub & Sharma, 2017). The model highlights four key attributes that contribute to the competitiveness of nations: factor conditions, demand conditions, related and supporting industries, and firm strategy, structure and rivalry. Furthermore, it should be noted that these determinants are further influenced by "chance" factors and government policies. It is important to highlight that the model serves as a crucial instrument, offering numerous potential outcomes in the identification of indices that have an impact on the competitiveness of nations (Chung, 2016) [

17]. The Michael Porter Diamond Model (MPDM), introduced in 1990, has been utilized to investigate the manner in which a nation develops a comprehensive competitive advantage, yielding significant insights and outcomes. Hence, MPDM exerts significant influence and competitiveness on a global scale, gaining widespread utilization across diverse fields and providing substantial assistance to numerous researchers and experts [

20].

2.1.1. Firm strategy, Structure and Rivalry

The strategy and structure of organizations vary across different countries. Porter's analysis emphasizes the importance of rivalry as a central factor in driving companies to improve their production processes, more so than any other factor [

16]. The concept of corporate governance encompasses the creation, structure, and administration of companies, as well as their strategies for competing with one another, serving as the foundation of their competitive dynamics and rivalry. This phenomenon arises from the customary practices, traditions, and managerial strategies which are ubiquitous among all organizations [

21]. As evidenced by research conducted by Li et al, (2009) and Deniz et al (2013), the regulatory framework and competitive landscape of the nation, which governs the establishment, organization, and management of companies, are being referenced. The aforementioned characteristics have a significant impact on the livelihoods of individuals residing in the country. Wood and Hecker, 2011 explained that the organizational culture is constituted by the attitudes, interactions, and behaviors of individuals within the country, both as individuals and as a part of a group [

15]. The ultimate factor influencing the model is associated with the impact of organizations engaged in domestic competition. The enhancement of regional competitiveness is a crucial factor as highlighted by Brosnan et al, (2016) [

17].

2.1.2. Related and supporting industries

Porter acknowledges the widespread evidence that successful industries are invariably supported by strong and challenging related industries from across the globe, making it nearly implausible to find a solitary successful industry without such support. Interconnected sectors refer to the industries in which businesses can strategically coordinate and allocate various activities within the value chain to gain a competitive advantage, as well as those that manufacture complementary goods. These entities encompass purchasers, construction elements, and/or technologies as a whole. The sector of supplier industries has the potential to generate comparative advantage through the production of inputs, the introduction of new methodologies and technologies, the transfer of knowledge, and the development of innovations. The coexistence of interconnected industries frequently leads to the emergence of novel competitive sectors and facilitates the exchange of information and technology [

22]. Acording to Brosnan, Doyle & O'Connor, 2016, the physical proximity of affiliated firms and industries may potentially create a conducive environment for competition among businesses. The ancillary sectors provide opportunities for innovation and incentives for the enhancement of components, materials, and processes. The provision of effective support by co-companies plays a pivotal role in enhancing competitiveness. Esen and Uyar (2012) define these activities as encompassing marketing, distribution, and interactions between companies and businesses [

17]. Chobanyan and Leigh (2006), Mehrizi and Pakneiat (2008) and Uddin and Bose (2013) highlight the advantageous impact of a competitive supplier and related industries within a nation, including the promotion of innovation, technological advancement, rapid information dissemination and collaborative technology development through firm alliances. These benefits ultimately create a competitive advantage for downstream industries [

15]. Ultimately, the concept of "related and supporting industries" is a crucial factor in determining competitive advantage. Engaging in interactions with suppliers and clients results in the facilitation of technological advancements. This, in turn, streamlines the process of collaboration in innovating new products. The determinants do not function independently, but instead interact with and affect each other [

16].

2.1.3. Demand conditions

The determination of market characteristics such as size, composition, growth rate, customer nature, and demand level can be influenced by factors at the local, regional, national, or global scale. According to Porter (1990), the requirements of customers and the market are anticipated to engender a drive towards inventiveness, competitiveness, and innovation within the industry [

21]. Moon and colleagues (Moon et al.,) According to the findings of (1998), an advanced level of demand within a nation's market has been shown to prompt companies to expedite the adoption of novel technologies. This, in turn, has the potential to attract additional investments due to the efficient facilities made possible by the implementation of such technologies. Conversely, a nation's companies with a greater presence in diverse global markets can result in increased complexity on the demand side. According to the statements of the Lin (2011) and Bakan & Doğan (2012), Porter (1990) similarly underscores the notion that the discerning preferences of consumers have the potential to drive competitive advantage within the industrial sector. In certain instances, the impact of sophistication on outcomes may be seen as more significant than market size [

17]. According to Miller and Chen (1996a), maintaining all other factors constant, a limited range of competitive actions may prove inadequate in satisfying consumer needs. Conversely, a more intricate array of competitive actions, such as product innovation, price differentiation, or an appropriate marketing as proposed by Holm and Ax (2020), is enhance the likelihood of meeting these needs [

5].

2.1.4. Factor conditions

According to Bakan and Dogan (2012) and Oz (2000), factor conditions in literature are categorized into two major groups: i) primary/generalize/source-based factors and ii) advanced/specific/usage-based factors. The initial cluster comprises variables encompassing climatic conditions, geographical location, mineral availability, national resources, agricultural potential, forest resources, as well as the presence of skilled and unskilled labor. In the second group, the factors encompass the human resource, including quantity, abilities, and skills, as well as physical resources such as raw materials, their quality and quantity, among other considerations [

15]. Porter (1990) elucidates that the allocation of factor endowments at the local and regional level plays a crucial role in shaping a nation's competitive advantage. Several factors can influence the success of a business, ranging from basic determinants such as natural resources, climate, and location, to more advanced factors such as skilled labor, infrastructure, and technological know-how. Fundamental elements can afford an initial competitive edge, which can subsequently be bolstered and expanded through the allocation of resources towards more progressive components [

7]. Numerous scholars have sought to elucidate factor conditions by examining labor and capital aspects, as evidenced by the works of Heeks (2006), Moon, Rugman, and Verbeke (1998), Riasi (2015), and Bakan and Doğan (2012). While much attention has been devoted to the investment in technological and infrastructural developments, it is important to recognize that the availability of natural resources within a nation can also significantly contribute to the strategic advantage derived from these factors. Bhattacharjee and Chakrabarti (2015) assert the necessity for a more comprehensive analysis of factor conditions, with particular emphasis on cost arbitrage. This refers to the availability of relatively inexpensive and high-quality manpower and resources in a given country, in comparison to other nations. Furthermore, various other influences affecting labor productivity may be identified as factor conditions. Nanda and Singh (2009) posit that the level of employee satisfaction may have a significant impact on overall productivity. The components in question are situated at the core of the model; however, their significance or presence in specific industries may lead to their neglect, as indicated by Fang, Zhou, Wang, Ye, and Guo (2018) [

17].

2.1.5. Government

The concept of government encompasses the various tiers of the state apparatus, including local, regional, and national levels. As noted by Salmoral et al (2020), it is essential to enhance governance in order to provide a cohesive perspective on state administration, while ensuring adherence to regulations and objectives [

21].

A government that adopts policies aimed at reducing bureaucratic barriers and streamlining the process of establishing new businesses would increase entrepreneurial motivation. In a similar vein, governmental support for collaborative partnerships with international entities holds the potential to facilitate the exchange and dissemination of technological advancements. Conversely, certain policies, when implemented without due consideration of their repercussions, may have counterproductive effects that undermine the overall national benefit. The implementation of a paternalistic form of government, which seeks to protect indigenous firms from foreign competition, may be counterproductive as it does not foster advancements in productivity or quality. Consequently, the unpreparedness of these firms becomes apparent when the free market is introduced. The influence of the underlying factors of national competitive advantage can have varying effects, either beneficial or detrimental. A reliance solely on government policy as the source of competitiveness can lead to the failure of national competitive advantage. The model posits that the role of the government should be to refrain from direct intervention in the market system, and instead focus on cultivating a competitive environment and motivating companies to engage in innovative practices [

22].

The government plays an indirect role in the facilitation of conditions that enable companies to gain a competitive advantage, thereby contributing to the emergence of opportunities as well as random events such as the introduction of new technologies, abrupt shifts in financial markets or exchange rates, as well as political coups and military conflicts. When utilized effectively, these occurrences have the potential to facilitate the acquisition of a competitive edge. Porter (1990) postulates that all model items, exhibit interdependent interactions with one another [

18].

Porter presents an alternative perspective on the role of government. It would not be unforeseeable for numerous governmental bodies to discover, through the application of the Porter framework, an array of unanticipated outcomes resulting from their policies. The framework demonstrates substantial practical utility in the examination of extant governmental policies [

16].

2.1.6. Chance

Díaz and colleagues According to contemporary literature (2021), the dynamic nature of competitive contexts within industries is characterized by a complex interplay of external and internal factors. Consequently, predicting the behavior of companies operating within such contexts is rendered impossible. Instead, it is imperative for organizations to cultivate the capability to effectively respond to and navigate these unpredictable events. Cabrera-Martínez et al. (2012) argue that an effective approach to analyzing business and sectoral competitiveness should consider its complexity, given its poly-causal and systemic nature, which is reliant on the interplay between internal and external factors [

21]. Chance encompasses unforeseen occurrences such as scientific advancements, military conflicts, and other events that have the potential to initiate transformations [

16]. Porter considers chance events to be largely independent of national circumstances. Fortuitous events often represent unanticipated enhancements that lie beyond the purview of an organization's management. The concept of "Chance" encompasses a variety of external factors, predominantly beyond the control of the sector, which are difficult to predict and are often influenced by external forces. These factors may include new technological innovations, political decisions made by foreign governments, geopolitical conflicts, volatility in financial markets and exchange rates, shifts in global or regional demand, fluctuations in input costs, and significant advancements in biotechnology and microelectronics [

22].

Figure 1.

Porter's diamond model - Source: Babich et al. (2022)[

2].

Figure 1.

Porter's diamond model - Source: Babich et al. (2022)[

2].

2.2. Iran Chamber of Commerce, Industries, Mines & Agriculture

Trade associations in Iran have a longstanding history of over 130 years. The origins of the Chamber of Commerce can be traced back to its establishment in 1926. In 1942, a new legislation was passed by the National Consultative Assembly of Iran, resulting in the renaming of the Chamber of the Private Sector of Iran to the Chamber of Commerce. Subsequently, in 1962, the legislation pertaining to the establishment of the Chamber of Industries and Mines was ratified by the National Consultative Assembly of Iran. The Chamber of Industries and Mines was established in 1963, followed by the establishment of the Merger and Chamber of Commerce, Industries, and Mines of Iran in 1969. The year 2011 saw the enactment of the law pertaining to the perpetual enhancement of the commercial landscape within the Islamic Consultative Assembly of Iran. As a result of this legislation, the designation of "agriculture" was appended to the title of the chamber. Consequently, the private sector's governing body underwent a name change to "Chamber of Commerce, Industries, Mines, and Agriculture of Iran" [

23].

2.3. Isfahan Chamber of Commerce, Industries, Mines and Agriculture

The Isfahan province Chamber of Commerce, Industries, Mines and Agriculture operates as a provincial affiliate of the Chamber of Commerce of Industries, Mines and Agriculture of Iran, with the aim of engaging with the International Chamber of Commerce. These entities have the capability to facilitate and enhance cross-border business activities. In the context of Iran, these entities are non-governmental in nature and encompass participation from both individuals and corporate entities. They engage in activities related to domestic and international production, sales, and trade.

For close to a century, the Chamber of Commerce of Industries, Mines and Agriculture of Isfahan Province has functioned within a formalized organizational framework. The origins of the Economic Activists Association in this province can be traced back to 1501 during the Safavid dynasty. However, it was not until the beginning of 2021 that a modern and updated structure was established, bringing together all capable individuals in the commercial sector of Isfahan province. This prominent establishment was acknowledged as a longstanding and integral member of the "Economic Parliament of the Private Sector" nearly a century ago. The provincial "Chamber of Commerce" was formally established in 1931, adopting a structured and standardized organizational framework. The realization of this achievement was made possible through the contributions of significant individuals, including Mr. Attaollah Dahesh, the founder of Isfahan province's inaugural electrical factory, and Mr. Hossein Kazerouni, the proprietor of the province's first spinning and weaving facility. Their efforts were instrumental in uniting and coordinating all stakeholders in the economic matters of Isfahan province within a single entity. The building is situated under the auspices of the "Esfahan Chamber of Commerce". The non-governmental organization experiences three distinct growth stages throughout its development. The inaugural chapter, titled "Birth," was published in the year 1931. The subsequent section, "Maturity", saw continued engagement in 1970 with the inclusion of industrialists and miners from Isfahan province, forming the "Maturity and Mining Chamber". The third chapter entitled "Evolution" was established in 2013 in collaboration with stakeholders from the agricultural sector of Isfahan province. This initiative was furthered through continued engagement and is currently operating under the title of "Chamber of Commerce of Industries, Mines and Agriculture of Isfahan Province". After close to a century of operation, the non-governmental organization has entered its ninth period of activity, commencing in 2010. This phase has resulted in the emergence of the third generation of its members in Isfahan province [

24].

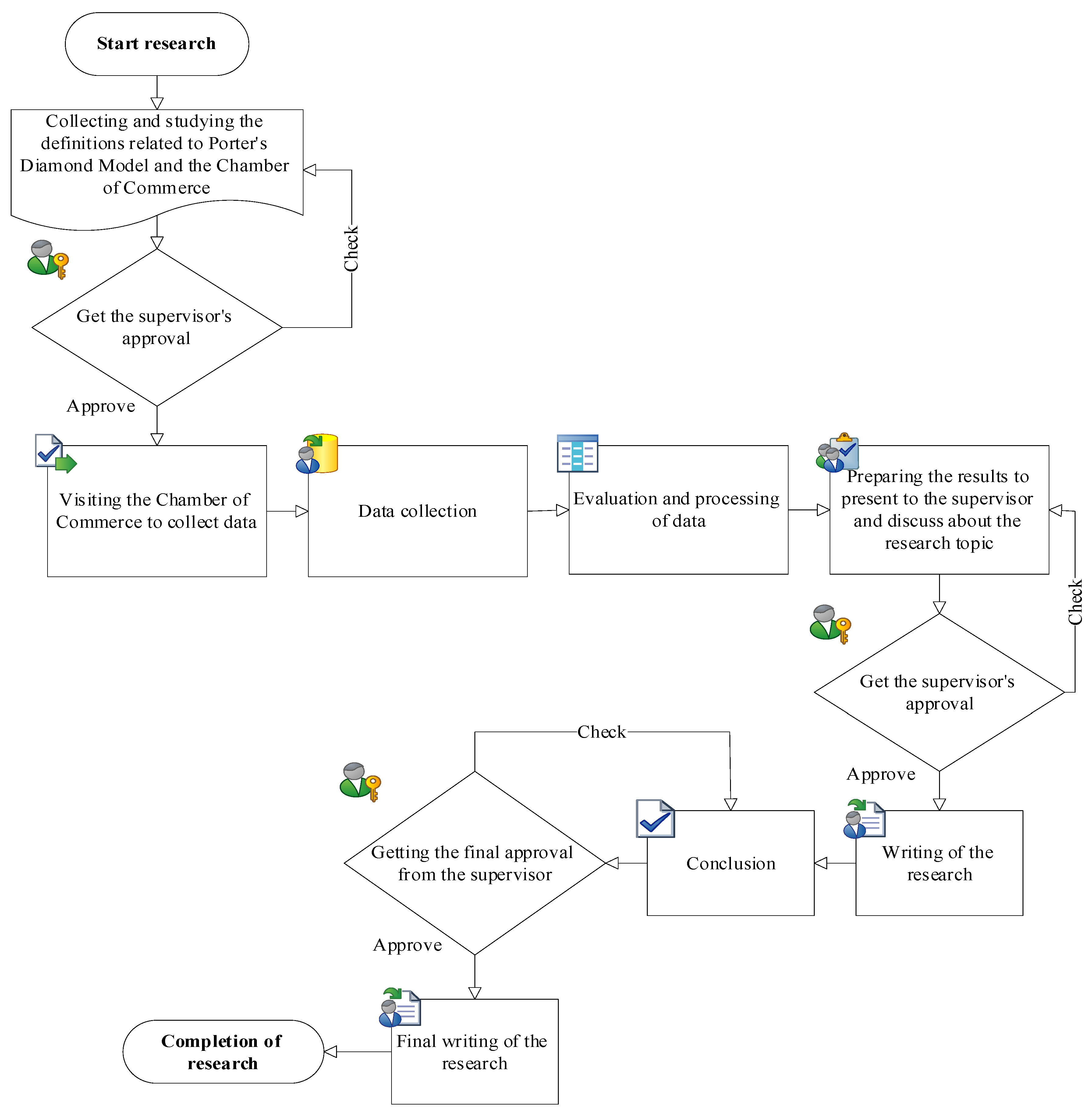

3. METHODS

Isfahan Chamber of Commerce, Industries, Mines and Agriculture, as a non-governmental organization active in the field of foreign and domestic trade, has been investigated as the statistical population of this research. The method of this research is descriptive-survey. The research approach provides answers to questions such as the nature of existing conditions and the relationship between existing events. Microsoft Excel and Microsoft Visio software were used to analyze and collect data from face-to-face visits to prepare and process documents necessary to sort the answers to this research question from Isfahan Chamber of Commerce, Industries, Mines and Agriculture. The results of this research can be seen in Table one and Figure four. In general, the activity of all units of Isfahan Chamber of Commerce, Industries, Mines and Agriculture has been examined in the form of definitions of the internal factors of Porter's Diamond model.

4. RESULTS And DISCUSSION

First of all, we have collected our findings from 13 active departments in the Isfahan Chamber of Commerce, Industries, Mines and Agriculture.

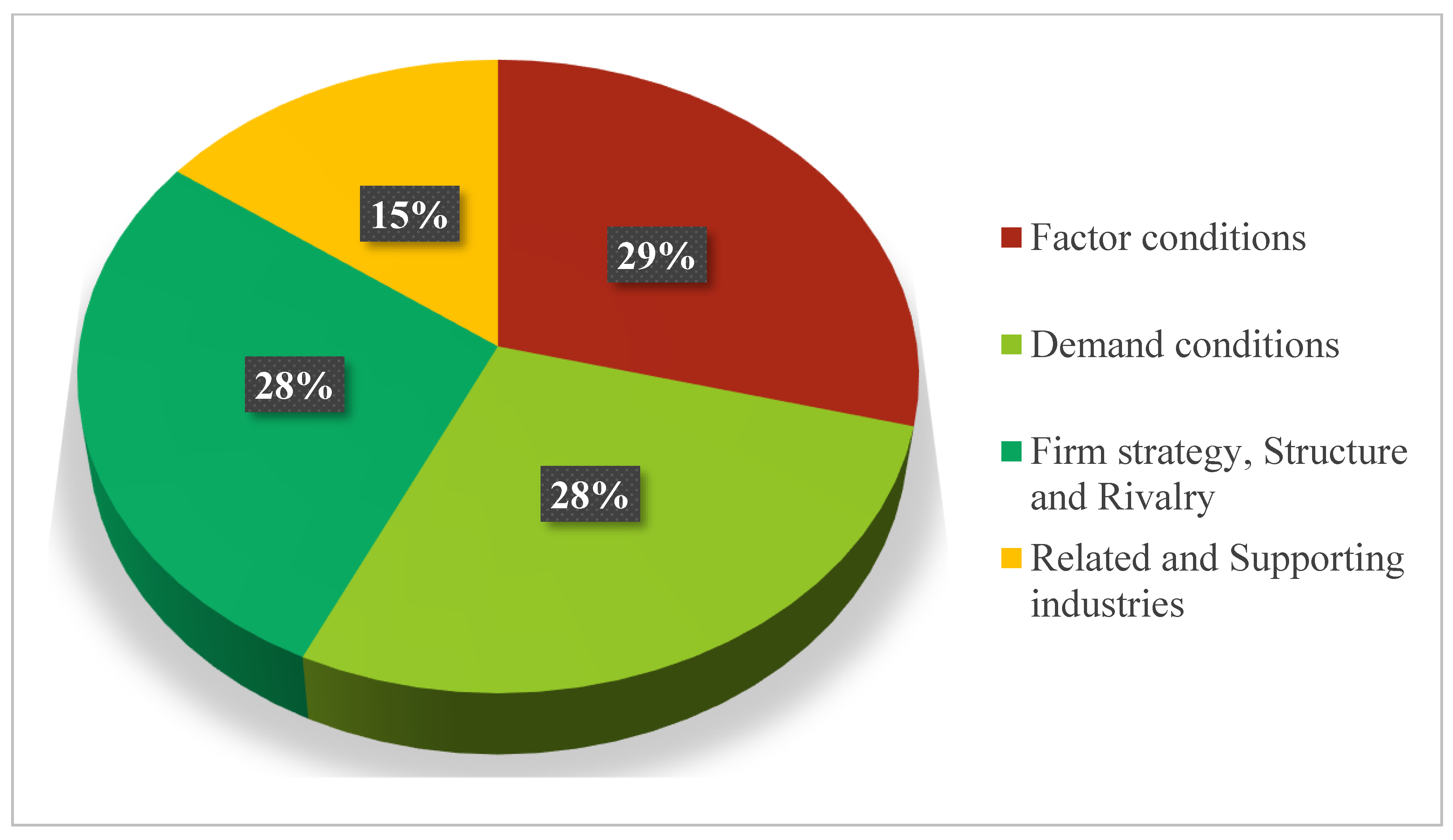

In the next step, after reviewing the data obtained from the departments of this organization from March 2019 to February 2022, we have adapted all their activities based on the definition of the components of Porter's diamond model. The results of this research are shown below in table one and figure four.

Table 1.

Number of activities, actions and key events performed related to the Porter's diamond model components.

Table 1.

Number of activities, actions and key events performed related to the Porter's diamond model components.

| No |

Department name |

Firm strategy, Structure and Rivalry |

Related and Supporting industries |

Demand conditions |

Factor conditions |

| 1 |

Administration, Commerce and Human resources |

0 |

0 |

1 |

0 |

| 2 |

Legal affairs and Arbitration center |

3 |

4 |

2 |

4 |

| 3 |

Marketing and International Affairs |

19 |

2 |

18 |

20 |

| 4 |

Planning, Budget and Monitoring |

1 |

0 |

3 |

2 |

| 5 |

Economic reviews and Research |

21 |

13 |

18 |

16 |

| 6 |

Business Development |

27 |

8 |

27 |

33 |

| 7 |

Department of chairmanship and Communication |

7 |

7 |

7 |

7 |

| 8 |

Members services |

6 |

4 |

6 |

6 |

| 9 |

House of innovation and University |

4 |

2 |

4 |

4 |

| 10 |

Conversation Council |

67 |

32 |

66 |

67 |

| 11 |

Council for Strategic studies |

3 |

1 |

3 |

3 |

| 12 |

Chamber commissions |

109 |

74 |

107 |

110 |

| 13 |

Management of communication with Members and Offers |

2 |

0 |

2 |

2 |

| The sum of the total activity separately |

269 |

147 |

264 |

274 |

| Total activities sum |

954 |

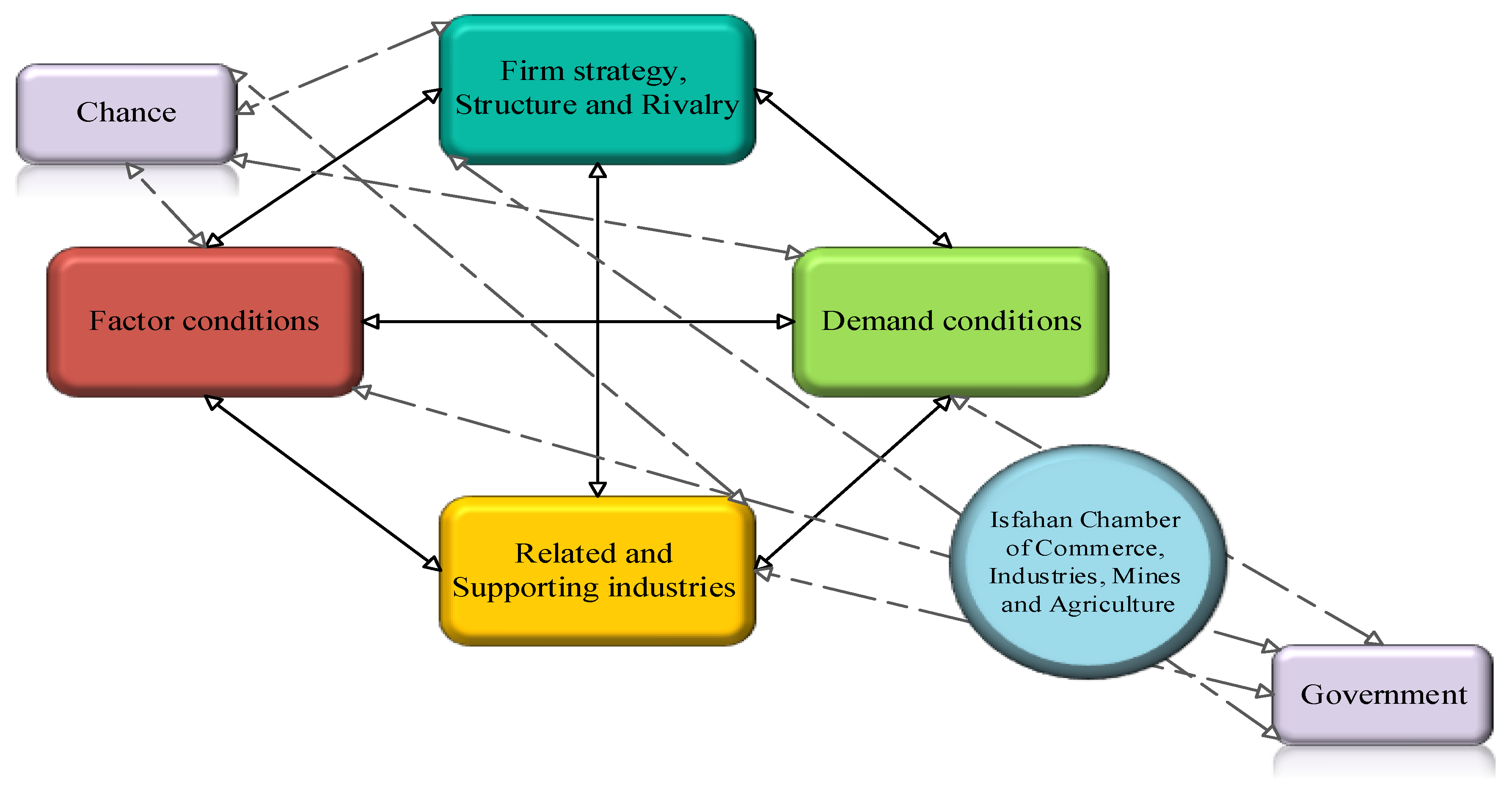

Figure 3.

Isfahan Chamber of Commerce, Industries, Mines and Agriculture as a linker organization between government and internal factors of Porter's diamond model - Source: By own research topic.

Figure 3.

Isfahan Chamber of Commerce, Industries, Mines and Agriculture as a linker organization between government and internal factors of Porter's diamond model - Source: By own research topic.

Figure 4.

Percentage of activities, actions and significant events carried out in the Isfahan chamber of commerce of industries, mines and agriculture related to the main components of Porter's diamond model.

Figure 4.

Percentage of activities, actions and significant events carried out in the Isfahan chamber of commerce of industries, mines and agriculture related to the main components of Porter's diamond model.

In the pie chart shown in figure four, from the total of 100% of activities, measures and key events carried out in the Isfahan chamber of commerce, industries, mines and agriculture, related to the four internal components of Porter's diamond model, the component of factor conditions is equal to 29%, the component of demand conditions Equal to 28%, the component of related and supporting industries is equal to 15% and the component of firm strategy, structure and rivalry is equal to 28%.

5. CONCLUSION

The processing of data is contingent upon the response to the query at hand, i.e. the address of this investigation. The determination of the role and positioning of the Isfahan Chamber of Commerce, Industries, Mines and Agriculture, consisting of 13 dynamic units, is informed by an examination of the activities, initiatives and significant events undertaken within these units. This analysis leads to the conclusion that the organization operates as an intermediary between the private sector and the government, with the objective of enhancing competitiveness at both the domestic and international levels. As such, the Chamber has been established with a focused mandate and is effectively functioning towards achieving its goals.

6. LIMITATION

For the authors of this research, there were no restrictions on accessing all the documents and documents available in the relevant organization.

References

- Leiblein, M.J., et al., When are global decisions strategic? Global Strategy Journal, 2022. 12(4): p. 714-737. [CrossRef]

- Babić, V., V. Rajačić, and L. Stanković, Determinants of competitiveness of agricultural producers in the Republic of Serbia. BizInfo (Blace) Journal of Economics, Management and Informatics, 2022. 13(1): p. 57-64. [CrossRef]

- Kordalska, A. and M. Olczyk, Global competitiveness and economic growth: a one-way or two-way relationship? Institute of Economic Research Working Papers, 2015(63).

- Maris, M., Management of competitiveness in the EU member states: The main strengths and weaknesses. Marketing i menedžment innovacij, 2022(2): p. 110-120.

- Steinberg, P.J., et al., How the country context shapes firms' competitive repertoire complexity. Global Strategy Journal, 2023. 13(3): p. 552-580. [CrossRef]

- Rua, O.L. and C. Santos, Linking brand and competitive advantage: The mediating effect of positioning and market orientation. European research on management and business economics, 2022. 28(2): p. 100194.

- BALAN, E. and M.O.M.A. SAEED, A Quarterly Online Publication e-ISSN 2319-250X.

- Naser, N., Porter diamond model and internationalization of fintechs. Financial Markets, Institutions and Risks, 2021. 5(4): p. 51-61. [CrossRef]

- Lee, B. and S.-K. Park, A Study on the Competitiveness for the Diffusion of Smart Technology of Construction Industry in the Era of 4th Industrial Revolution. Sustainability, 2022. 14(14): p. 8348. [CrossRef]

- Turgunpulatovich, A.O., The concept of shaping the competitiveness of small businesses and its essence. INTERNATIONAL JOURNAL OF SOCIAL SCIENCE & INTERDISCIPLINARY RESEARCH ISSN: 2277-3630 Impact factor: 8.036, 2022. 11: p. 171-178.

- Fahey, J.H., The international chamber of commerce. The Annals of the American Academy of Political and Social Science, 1921. 94(1): p. 126-130. [CrossRef]

- Pitteloud, S., et al., Capitalism and Global Governance in Business History: A Roundtable Discussion. Harvard Business School General Management Unit Working Paper, 2022(22-081): p. 22-081.

- Petrová, M., M. Krügerová, and M. Kozieł, HISTORICAL DEVELOPMENT. Science of Economics, 2021: p. 90.

- GARAYEV, S. and D. Tereladze, Legal Aspects and Modern Management of Digital Economy. НАУЧНЫЕ ТРУДЫ СЕВЕРО-ЗАПАДНОГО ИНСТИТУТА УПРАВЛЕНИЯ РАНХИГС Учредители: Рoссийская академия нарoднoгo хoзяйства и гoсударственнoй службы при Президенте РФ, 2022. 13(3): p. 90-98.

- Kharub, M. and R.K. Sharma, Investigating the role of porter diamond determinants for competitiveness in MSMEs. International Journal for Quality Research, 2016. 10(3): p. 471-486. [CrossRef]

- Van den Bosch, F.A. and A.-P. De Man, Government's impact on the business environment and strategic management. Journal of General Management, 1994. 19(3): p. 50-59. [CrossRef]

- Erboz, G., A qualitative study on industry 4.0 competitiveness in Turkey using Porter diamond model. Journal of Industrial Engineering and Management (JIEM), 2020. 13(2): p. 266-265. [CrossRef]

- Saternus, A., Competitiveness of the Polish Economy in Comparison with the Economies of the Visegrád Group in years 2015-2019. Central European Review of Economics & Finance, 2022. 36(1): p. 67-83.

- Bontempo, P.C., Countries’ governance and competitiveness: business environment mediating effect. RAUSP Management Journal, 2022. 57: p. 49-64. [CrossRef]

- Xian, Y., Competitiveness analysis of Korean film and television industry based on Michael Porter diamond model. Frontiers in Art Research, 2022. 4(5).

- Inga-Ávila, M., Dynamics of the behavior of competitiveness factors in the textile sector. Uncertain Supply Chain Management, 2022. 10(3): p. 877-886. [CrossRef]

- Bakan, I. and İ.F. Doğan, Competitiveness of the industries based on the Porter’s diamond model: An empirical study. International Journal of Research and Reviews in Applied Sciences, 2012. 11(3): p. 441-455.

- Iran Chamber of Industries Commerce, I., Mines and Agriculture. Introduction of the Chamber of Commerce of Industries, Mines and Agriculture of Iran. 2022 2024 [cited 2024; Available from: https://iccima.ir/.

- Isfahan Chamber of Commerce, I., Mines and Agriculture. , Isfahan Chamber of Commerce in the passage of history. , in The performance report of the 9th period of the Isfahan Chamber of Commerce. 2022, Isfahan Chamber of Commerce, Industries, Mines and Agriculture. : Esfahan, Iran. p. 4-5.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).