1. Introduction

The top management staff focus on individual tasks and team goals and provide strategic guidance for achieving the organization's overarching goal, while the company's managers are responsible for giving the go-ahead for these initiatives and making decisions that are crucial to the company's vision and direction (Auden, W.C., et.al., 2006). In a company's daily planning, innovation, cost-cutting, and strategic direction, managers act as a filtering mechanism or mirror image, influencing how employees view and interpret facts in accordance with their own cognitive habits and beliefs (Habersang, S., et.al., 2019). Researchers generally agreed that a manager's skills and aptitude have some bearing on a company's success, but there are still several schools of thought that offer little evidenced as to which management skills are most important for a company's performance (Berlew, D. E., & Hall, D. T., 1966). This raised the question of whether a manager's character attributes are crucial to a company's success in the cutthroat business environment of today. Although the subject of this study is not entirely novel, there are a few aspects that set it apart from other studies (Waddock, S., & McIntosh, M., 2009).

The relationship between the agent and the principle is explained by agency theory. Top managers are viewed as agents rather than principals as compared to shareholders. Since the agent is said to be self-interested, the manager's aims and interests may differ from those of the owners (Bendickson, J., et.al., 2016). It is predicated on the fundamental notion that, in the absence of an effective governance structure to protect the interests of the owners, agents would act selfishly and use their better knowledge of the company or of marketing to their own benefit (Isaac Mostovicz, E., et.al., 2011). The theory's proponents assert that losses occur when agents fail to act or respond in a way that would be advantageous to the shareholders (Jensen, M. C., 2005).

Despite this, the interests of the owners would only be optimally served if the managers did not simultaneously hold the positions of chairman and chief executive officer or if, as a result of a carefully thought-out incentive structure, the managers' interests were congruent with those of the shareholders (Denis, D. J., & Denis, D. K., 1994). Managers are viewed as genuine, collectivist, and accountable for the organization's resources under the stewardship paradigm (Caldwell, C., et.al., 2008).

2. Materials and Methods

2.1. Age of Managers and its Impact on Organization’s Performance

The literature has extensively covered the importance of the manager's age in relation to the firm's success. Researchers claimed that senior managers lack the mental and physical agility of their younger counterparts and are less risk-averse (Herrmann, P., & Datta, D. K., 2005). This is in line with the assertion made by MacCrimmon and Wehrung in 1990 that an executive's risk aversion will increase with age. Typically, they choose steady income over lucrative but risky business ventures. Senior managers are also less inclined to accept new changes since they struggle to come up with novel ideas (Maitlis, S., & Sonenshein, S., 2010). For the purpose of determining how ageing impacts a company's financial success, several academic research have been carried out. The success of a firm is favourably connected with a manager's age, tenure, ownership, financial education, and professional experience. They also found that managers who have held onto their positions for a long time, are older, and have a high degree of ownership perform better (Maitlis, S., & Sonenshein, S., 2010).

2.2. Gender of Managers and its Impact on Organization’s Performance

Gender diversity is an issue that is discussed more frequently today in both political discourse and literary works. Nations have started to set quotas requiring a certain percentage of women to be selected for the board of directors. They argue that women should be given the chance to work in managerial roles in the company (Einarsdottir, U. D., et.al., 2018). There is a link between gender diversity and business performance. Women usually employ a range of decision-making techniques when it comes to investing, which tends to strengthen the board's oversight duties (Rao, K., & Tilt, C., 2016). However, despite being aware of potential investment opportunities, males tend to trade excessively and invest more confidently than women (Odean, T., 1999).

2.3. Tenure of Managers and its Impact on Organization’s Performance

Academics' perspectives on how managerial tenure impacts business performance vary. While some of them claim there is no relationship between management tenure and company success, others claim there is a direct link between executive duration and business performance (He, L. 2008). Managers who have been with a company for a longer amount of time are better equipped to comprehend its effective strategy (Adams, R., et.al., 2009), since they have access to more information, power, and experience. This could enable people to exercise better control in challenging circumstances. The success of the business will therefore rise with long-term managers. It has been noted a favourable relationship between managers' tenure and environmental performance (Kanter, R. M., 2017).

2.4. Review on Organization’s Financial Performance

The value of the company's cash may vary depending on its size. As the company gets more prosperous and successful, it expands in size (Acs, Z. J., et.al., 1997). Large firms frequently have more consistent cash flows. Although it is generally accepted that large corporations are "too big to fail," the argument that this may not always be the case (Grullon, G., et.al., 2018). Economies of scale, or the money made by lowering manufacturing costs per unit as output levels rise, benefit large businesses. Companies are sized using the natural logarithm (Ln) of their total assets (Asongu, S. A., & Odhiambo, N. M. 2019).

2.5. Problem Identification of the Study

The key reason of this research was to determine if the managers' age, gender, educational background, tenure in the firm, and tenure as managers explain the cross-sectional predictability of anticipated returns on performance, this study employed the parameters for performance indicators, i.e., return on assets (ROA) and return on equity (ROE) (Kulich, C., et.al. 2011). The researcher has adopted the methodology and testing methods of prior research, such as those by Fama and French (1992), making revisions where appropriate in order to compare our results with those of other studies on this issue and to be consistent with the underlying theory of portfolio models.

2.6. Hypothesis and Objectives of the Research

A hypothesis is a claim that is made to test a theory or presupposition. It is a clear, verifiable prediction of the findings from the study as determined by the researchers (Hawkesworth, M., 2015). The two variables that are frequently suggested to be associated with a hypothesis are the independent variable and the dependent variable. The following is a list of the hypotheses that were taken into account for this investigation:

H01: There is no significant impact of managers Traits on the overall performance of NIFTY 50 listed companies with reference to Return on Assets (ROA) parameters.

H02: There is no significant impact of managers Traits on the overall performance of NIFTY 50 listed companies with reference to Return on Equity (ROE) parameters.

The measures for assessing the financial performance of these NIFTY 50 listed enterprises are return on assets (ROA) and return on equity (ROE) for the few (five) financial years commencing in 2017–18 and ending in 2021–2022, from the NIFTY 50 Index. The goal is to examine how the characteristics of the managers affect the performance of NIFTY 50 listed firms while taking into account the following elements: Return on equity as well as return on assets:

2.7. Sampling Plan of the Research

Table 1.

Sampling Plan of the Research.

Table 1.

Sampling Plan of the Research.

| Sampling Technique |

Snowball Sampling |

| Elements of Sample |

Independent Variables: Traits of Managers: Age, Gender, Experience as a Managers and Total Experience as a Managers.

Dependent Variables: Return on Assets (ROA) and Return on Equity (ROE) |

| Sampling Size |

Independent Variable: All (27) NIFTY 50 Companies listed Companies Managers Traits.

Dependent Variable: Financial Excellence of NIFTY 50 listed companies for last five years i.e., 2017 – 2018 to 2021 – 2022. |

| Target Population |

Independent Variable: All the company Managers data in terms of their traits.

Dependent Variable: All Financial Performance Parameters of NIFTY 50 listed companies for the last five years, i.e., 2017–2018 to 2021–2022. |

2.8. Limitations of the Research

The study has been limited to the four primary characteristics of the managers of NIFTY 50 listed businesses, namely age, gender, tenure in the company, and tenure as a manager (Manna, A., et.al., 2016). The financial performance of NIFTY 50 companies listed with the limited parameters that were taken into account, i.e., return on assets (ROA) and return on equity (ROE), has been considered the control signal to check the impact of independent variables that have been taken into account under this study (Tandon, K., et.al., 2016). To determine the influence of managerial traits, i.e., age, gender, and tenure in the company, on the Nifty 50’s selected companies' overall financial performance, the outcomes of the study were only examined for a small subset of managerial traits. As a result, the outcomes may vary if researchers apply this research to different indexed firms throughout the globe. In addition, the analysis was only carried out from the 2017–2018 fiscal year to the 2022–2023 fiscal year. As a result, if researchers do more research to investigate how manager traits affect the total financial success of NIFTY 50 listed businesses, the outcomes may vary.

3. Results

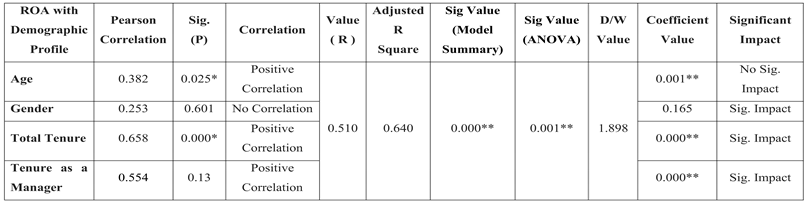

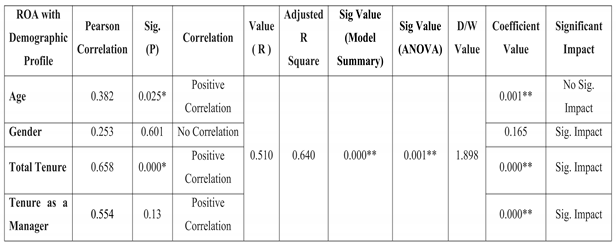

Table 2.

Correlation and Regression Result for Impact of Managers Traits on Financial Performance (ROA) of NIFTY 50 Listed Companies.

Table 2.

Correlation and Regression Result for Impact of Managers Traits on Financial Performance (ROA) of NIFTY 50 Listed Companies.

H01: There is no significant impact of managers Traits on the overall performance of NIFTY 50 listed companies with reference to Return on Assets (ROA) parameters

H11: There is significant impact of managers Traits on the overall performance of NIFTY 50 listed companies with reference to Return on Assets (ROA) parameters.

Regression line in the context of Impact of Managerial traits on the financial performance (ROA) of the Nifty 50 companies.

Y (ROA) = α + β1(Gender of managers) + β2 (Total Tenure in Company by managers) + β3 (Tenure as a managers) + β4 (Age of managers) + ϵi

Y (ROA) = -3.780 - 0.331 (Gender of managers) + 0.160 (Total Tenure in Company by managers) + 0. 335 (Tenure as a managers) + 0.014 (Age of managers) + ϵi

Y (ROA) = -3.780 + + 0.160 (Total Tenure in Company by managers) + 0. 335 (Tenure as a managers) + 0.014 (Age of managers) + ϵi

(1)

Table 3.

Correlation and Regression Result for Impact of Managers Traits on Financial Performance (ROE) of NIFTY 50 Listed Companies.

Table 3.

Correlation and Regression Result for Impact of Managers Traits on Financial Performance (ROE) of NIFTY 50 Listed Companies.

H02: There is no significant impact of managers Traits on the overall performance of NIFTY 50 listed companies with reference to Return on Equity (ROE) parameters

H12: There is significant impact of managers Traits on the overall performance of NIFTY 50 listed companies with reference to Return on Equity (ROE) parameters.

Regression line in the context of Impact of Managerial traits on the financial performance (ROE) of the Nifty 50 companies.

Y (ROE) = 0.502 + 0.781 (Gender of Managers) + 0.234 (Total Tenure in Company by Managers) + 0. 348 (Tenure as a Managers) + 0.440 (Age of Managers) + ϵi

Y (ROE) = 0.502 + 0.234 (Total Tenure in Company by Managers) + 0. 348 (Tenure as a Managers) + 0.440 (Age of Managers) + ϵi ……………………………..…… (2)

4. Discussion

The Result that has been derived out of this in terms of the Return on Assets and Return on Equity are having their different values and way of explaining power in terms of the impact of different managerial traits of the managers with reference to Nifty 50 companies. The detailed discussion of the result has been mentioned below:

4.1. Return on Assets

From the above table for the regression model regarding the impact of traits of manager for the NIFTY 50 listed companies on their financial performance with consideration of the return on assets (ROA) parameter, it has been noted that there is a significant correlation between the return on assets as a financial result parameter of the NIFTY 50 listed firms along with the traits of managers, i.e., total tenure as a manager in the company and the age of managers in it, as seen by the Pearson correlation value (Manna, A., et.al., 2016). For the regression model, the R-value is 0.510, which indicates the 51.0% impact of exogeneous variables, i.e., traits of managers, on the financial performance of the company, and the adjusted R square is 0.640, which represents 64.8% of the impact for the same. The sig value for the Model Summary table is 0.000, which indicated the model fit to run the regression analysis, and the P value for the ANOVA table is 0.001, which represents the significant impact of manager traits on the Return on Assets (ROA) parameter of the firm (Ahmed Sheikh, N., et.al., 2013). The coefficient P values for the total tenure of managers as employees, tenure as managers in companies, and age of managers in companies are 0.001, 0.000, and 0.000, respectively, which significantly affected the financial performance (ROA) of the NIFTY 50 listed companies, while on the other hand, the gender of the managers has a coefficient table P value of 0.165, which is above the significant level of 0.05. Hence, the researcher needs to accept the null hypothesis, and hence, it has been proven that there is no significant impact of the gender of managers on the financial performance of the NIFTY 50 listed companies (Pareek, R., et.al., 2023). The value of Durbin Watson is 1.898, which is nearest to 2, which indicated that the data is free from autocorrelation among the series of data that the researcher has taken (Akter, J., 2014).

4.2. Return on Equity

From the above table for the regression model regarding the impact of traits of managers for the NIFTY 50 listed companies for their financial performance with consideration of the return on equity (ROE) parameter, it has been noted that there is a significant correlation between the return on equity as a financial result parameter of the NIFTY 50 listed firms along with the traits of managers, i.e., total tenure in the company, total tenure as a manager in the company, and age of managers, as seen by the Pearson correlation value (Buvanendra, S., et.al., 2017). For the regression model, the R value is 0.866, which indicates the 86.6% impact of exogeneous variables (Traits of Managers) on the financial performance of the company, and the adjusted R square is 0.754, which represents 75.4% of the impact for the same. The sig value for the Model Summary table is 0.000, which defined the model fit to run the regression analysis, and the P value for the ANOVA table is 0.000, which represents the significant impact of manager traits on the Return on Equity (ROE) parameter of the firm (Mahmoud Abu-Tapanjeh, A. 2006). The coefficient P values for the total tenure of managers as employees, tenure as managers in companies, and age of managers in companies are 0.000, 0.014, and 0.003, respectively, which are significantly affecting the financial performance (ROE) of the NIFTY 50 listed companies (Chahal, H., & Sharma, A. K. 2020). On the other hand, the gender of managers has a coefficient P value of 0.114, which is above the significant level of 0.05, hence, the researcher needs to accept the null hypothesis, and hence, it has been proven that there is no significant impact of the gender of managers on the financial performance (ROE) of the NIFTY 50 listed companies (Goel, P., 2018). The value of Durbin Watson is 2.132, which is nearest to 2, which indicated that the data is free from autocorrelation among the series of data that the researcher has taken in it for the return on equity measurement as a part of the performance indicators of the Nifty 50 companies managers traits (Akter, J.,2014).

5. Conclusions

In this study, the basic focus was on proving the impact of the traits of managers of NIFTY 50 listed companies on financial revenues and ultimately the performance of the firm. It has been noted that there is a significant impact on other parameters, such as the age of managers, the total tenure of managers in the company, and the total tenure of managers in the company, which has been reflected in the performance of these companies in terms of the return on assets (ROA) and return on equity (ROE). Gender as a trait of managers has no significant impact on the performance of these firms. There are certain other parameters that have a direct or indirect impact on the performance of the firm that remain constant in this particular study when taking the impact of the Nifty 50 manager traits into consideration. The in-depth discussion in terms of the impact of the different characteristics that have been covered under this particular study has been mentioned below:

5.1. Regression Line for the Impact of Managerial Traits on the Return on Assets (ROA)

Y (ROA) = -3.780 + + 0.160 (Total Tenure in Company by managers) + 0. 335 (Tenure as a managers) + 0.014 (Age of managers) + 𝜖i ………………………… (1)

It has been concluded that, when all independent variables, i.e., selected Nifty 50 total tenure in the company by managers, tenure as a manager, and age of managers, are zero, the intercept reflects the baseline ROA. It has shown the anticipated return on assets (ROA) in the absence of management qualities. According to the Coefficient for Total Tenure in Firms by Managers, if all other factors remain the same, there will be a 0.160 unit rise in ROA for every unit increase in the total tenure of managers in the firm (Livnat, J., et.al., 2021). It suggested that managers who have worked for the Nifty 50 firms for a longer period of time often have a favorable impact on ROA. It has been observed that, in the context of the Coefficient for Tenure as a Manager, all other things being equal, the ROA is predicted to grow by 0.335 units for every unit increase in the tenure as a manager (Tandon, K., et.al., 2016). It implied that managers who have held their positions for extended periods often have a favorable influence on the ROA. Keeping other factors equal, it has been observed in the context of the Coefficient for Tenure as a Manager that the ROA is predicted to rise by 0.014 units for each year that managers get older. It found that, maybe as a result of their cumulative experience and knowledge, senior managers often have a somewhat favorable impact on the ROA of the organization (Daellenbach, U. S., et.al., 1999).

5.2. Regression Line for the Impact of Managerial Traits on the Return on Equity (ROE)

Y (ROE) = 0.502 + 0.234 (Total Tenure in Company by Managers) + 0. 348 (Tenure as a Managers) + 0.440 (Age of Managers) + 𝜖i ………………………… (2)

This was the baseline ROE when all independent variables i.e. selected Nifty 50 managers' age, tenure as managers, and total tenure in the company were zero. It has shown that the anticipated return on equity (ROE) in the absence of management qualities. According to this coefficient, if all other factors remain equal, the ROE should rise by 0.234 units for every unit increase in managers' overall duration in the organization. It suggested that managers who have worked for the firm longer on average have a tendency to make a favorable contribution to ROE (Zollo, M., & Singh, H., 2004). In the case of the coefficient of tenure as a manager, the ROE is expected to increase by 0.348 units, all else being equal. It was implied that managers with longer tenure often have a favorable effect on the ROE of the organization (Tanikawa, T., & Jung, Y., 2016). It has been noted that, while all other factors remain constant, the ROE is predicted to rise by 0.440 units in the case of the coefficient for age of managers. It was determined that, presumably as a result of their cumulative experience, knowledge, and ability to make decisions, senior managers often have a favorable impact on the ROE of the organization (Karahanna, E., & Preston, D. S., 2013). Thus, it has been observed that this implied that businesses might gain from having a broad mix of managers from various age groups as well as from keeping experienced managers with longer tenures, both inside the organization and in management roles (Wiersema, M. F., & Bantel, K. A., 1992).

Author Contributions

All the authors, K.S., R.S., J.V., P.D., D.T. and R.K., contributed equally to all parameters of this manuscript. Conceptualization, R.S.; methodology, P.D.; software, K.S.; validation, D.T.; formal analysis, K.S. and P.D.; research, J.V. and R.S.; resources, R.K., R.S. and P.D.; data curation, K.S. and P.D.; preparation of the original draft, R.S. and D.T.; revision and editing of the draft, R.K., visualization, J.V.; supervision, K.S. and P.D. All authors have read and agreed to the published version of the manuscript.

Funding

The research done under this manuscript received no funding.

Data Availability Statement

Data will be available upon the request.

Conflicts of Interest

The Author declares no conflict of Interest.

References

- Acs, Z. J., Morck, R., Shaver, J. M., & Yeung, B. 1997. The internationalization of small and medium-sized enterprises: A policy perspective. Small business economics, 9, 7-20. [CrossRef]

- Adams, R., Almeida, H., & Ferreira, D. 2009. Understanding the relationship between founder–CEOs and firm performance. Journal of empirical Finance, 16(1), 136-150. [CrossRef]

- Agrawal, A., Mohanty, P., & Totala, N. K. 2019 Does EVA beat ROA and ROE in explaining the stock returns in Indian scenario? Evidence using mixed effects panel data regression model. Management and Labour Studies, 44(2), 103-134. [CrossRef]

- Ahmed Sheikh, N., Wang, Z., & Khan, S. 2013. The impact of internal attributes of corporate governance on firm performance: Evidence from Pakistan. International Journal of Commerce and Management, 23(1), 38-55. [CrossRef]

- Alsharari, N. M., & Aljohani, M. S. 2023. The benchmarking implementation and management control process as influenced by interplay of environmental and cultural factors: institutional and contingency perspectives. Benchmarking: An International Journal. [CrossRef]

- Asongu, S. A., & Odhiambo, N. M. 2019. Size, efficiency, market power, and economies of scale in the African banking sector. Financial Innovation, 5(1), 1-22. [CrossRef]

- Auden, W.C., Shackman, J.D. and Onken, M.H. 2006, "Top management team, international risk management factor and firm performance", Team Performance Management, Vol. 12 No. 7/8, pp. 209-224. [CrossRef]

- Bello, L. 2016. Re: Duplication of corporate governance codes and the Dilemma of firms with dual regulatory jurisdictions. Corporate Governance, 16(3), 476-489. [CrossRef]

- Bendickson, J., Muldoon, J., Liguori, E., & Davis, P. E. 2016. Agency theory: the times, they are a-changin’. Management decision, 54(1), 174-193. [CrossRef]

- Berlew, D. E., & Hall, D. T. 1966. The socialization of managers: Effects of expectations on performance. Administrative Science Quarterly, 207-223. [CrossRef]

- Bolourian, S., Angus, A., & Alinaghian, L. 2021. The impact of corporate governance on corporate social responsibility at the board-level: A critical assessment. Journal of Cleaner Production, 291, 125752. [CrossRef]

- Buvanendra, S., Sridharan, P., & Thiyagarajan, S. 2017. Firm characteristics, corporate governance and capital structure adjustments: A comparative study of listed firms in Sri Lanka and India. IIMB management review, 29(4), 245-258. [CrossRef]

- Caldwell, C., Hayes, L. A., Bernal, P., & Karri, R. 2008. Ethical stewardship–implications for leadership and trust. Journal of business ethics, 78, 153-164. [CrossRef]

- Centinaio, A. 2023. How gender diversity in boards affects disclosure? A literature review. Corporate Social Responsibility and Environmental Management, 1-31. [CrossRef]

- Chahal, H., & Sharma, A. K. 2020. Family business in India: Performance, challenges and improvement measures. Journal of New Business Ventures, 1(1-2), 9-30. [CrossRef]

- Daellenbach, U. S., McCarthy, A. M., & Schoenecker, T. S. 1999. Commitment to innovation: The impact of top management team characteristics. R&d Management, 29(3), 199-208. [CrossRef]

- Denis, D. J., & Denis, D. K. 1994. Majority owner-managers and organizational efficiency. Journal of corporate finance, 1(1), 91-118. [CrossRef]

- Dhaouadi, K. 2014. The influence of top management team traits on corporate financial performance in the US. Canadian Journal of Administrative Sciences/Revue Canadienne des Sciences de l'Administration, 31(3), 200-213. [CrossRef]

- Edmans, A., Gabaix, X., & Jenter, D. 2017. Executive compensation: A survey of theory and evidence. The handbook of the economics of corporate governance, 1, 383-539. [CrossRef]

- Einarsdottir, U. D., Christiansen, T. H., & Kristjansdottir, E. S. 2018. “It’sa man who runs the show”: How women middle-managers experience their professional position, opportunities, and barriers. Sage Open, 8(1), 2158244017753989. [CrossRef]

- Goel, P. 2018. Implications of corporate governance on financial performance: an analytical review of governance and social reporting reforms in India. Asian Journal of Sustainability and Social Responsibility, 3(1), 4. [CrossRef]

- Goyal, K., Kumar, S., & Xiao, J. J. 2021. Antecedents and consequences of Personal Financial Management Behavior: a systematic literature review and future research agenda. International Journal of Bank Marketing, 39(7), 1166-1207. [CrossRef]

- Grullon, G., Hund, J., & Weston, J. P. 2018. Concentrating on q and cash flow. Journal of Financial Intermediation, 33, 1-15. [CrossRef]

- Habersang, S., Küberling-Jost, J., Reihlen, M., & Seckler, C. 2019. A process perspective on organizational failure: a qualitative meta-analysis. Journal of Management Studies, 56(1), 19-56. [CrossRef]

- Hatane, S. E., Winoto, J., Tarigan, J., & Jie, F. 2023. Working capital management and board diversity towards firm performances in Indonesia's LQ45. Journal of Accounting in Emerging Economies, 13(2), 276-299. [CrossRef]

- Hawkesworth, M. 2015. Contending conceptions of science and politics: Methodology and the constitution of the political. In Interpretation and method (pp. 27-49).

- He, L. 2008. Do founders matter? A study of executive compensation, governance structure and firm performance. Journal of Business Venturing, 23(3), 257-279. [CrossRef]

- Herrmann, P., & Datta, D. K. 2005. Relationships between top management team characteristics and international diversification: An empirical investigation. British Journal of Management, 16(1), 69-78. [CrossRef]

- Hisrich, R. D., & Smilor, R. W. 1988. The university and business incubation: Technology transfer through entrepreneurial development. The Journal of Technology Transfer, 13(1), 14-19. [CrossRef]

- Holgado–Tello, F. P., Chacón–Moscoso, S., Barbero–García, I., & Vila–Abad, E. 2010. Polychoric versus Pearson correlations in exploratory and confirmatory factor analysis of ordinal variables. Quality & Quantity, 44, 153-166. [CrossRef]

- Isaac Mostovicz, E., Kakabadse, N. K., & Kakabadse, A. 2011. Corporate governance: quo vadis?. Corporate Governance: The international journal of business in society, 11(5), 613-626. [CrossRef]

- Jensen, M. C. 2005. Agency costs of overvalued equity. Financial management, 34(1), 5-19. [CrossRef]

- Kanter, R. M. 2017. Power failure in management circuits. In Leadership perspectives (pp. 281-290), 23(3). Routledge. [CrossRef]

- Karahanna, E., & Preston, D. S. 2013. The effect of social capital of the relationship between the CIO and top management team on firm performance. Journal of management information systems, 30(1), 15-56. [CrossRef]

- Kılıç, M., & Kuzey, C. 2016. The effect of board gender diversity on firm performance: evidence from Turkey. Gender in management: An international journal, 31(7), 434-455. [CrossRef]

- Koufopoulos, D., Zoumbos, V., Argyropoulou, M., & Motwani, J. 2008. Top management team and corporate performance: a study of Greek firms. Team Performance Management: An International Journal, 14(7/8), 340-363. [CrossRef]

- Krug, J. A., & Aguilera, R. V. 2004. Top management team turnover in mergers & acquisitions. Advances in mergers and acquisitions, 121-149. [CrossRef]

- Kulich, C., Trojanowski, G., Ryan, M. K., Alexander Haslam, S., & Renneboog, L. D. 2011. Who gets the carrot and who gets the stick? Evidence of gender disparities in executive remuneration. Strategic Management Journal, 32(3), 301-321. [CrossRef]

- Kunz, J., & Sonnenholzner, L. 2023. Managerial overconfidence: promoter of or obstacle to organizational resilience?. Review of Managerial Science, 17(1), 67-128. [CrossRef]

- Lega, F., Prenestini, A., & Spurgeon, P. 2013. Is management essential to improving the performance and sustainability of health care systems and organizations? A systematic review and a roadmap for future studies. Value in Health, 16(1), S46-S51. [CrossRef]

- Livnat, J., Smith, G., Suslava, K., & Tarlie, M. 2021). Board tenure and firm performance. Global Finance Journal, 47, 100535. [CrossRef]

- Low, J., & Siesfeld, T. 1998. Measures that matter: Non-financial performance. Strategy & Leadership, 26(2), 24-38. [CrossRef]

- Mahmoud Abu-Tapanjeh, A. 2006. An empirical study of firm structure and profitability relationship: The case of Jordan. Journal of Economic and Administrative Sciences, 22(1), 41-59. [CrossRef]

- Maitlis, S., & Sonenshein, S. 2010. Sensemaking in crisis and change: Inspiration and insights from Weick (1988). Journal of management studies, 47(3), 551-580. [CrossRef]

- Manna, A., Sahu, T. N., & Gupta, A. 2016. Impact of ownership structure and board composition on corporate performance in Indian companies. Indian Journal of Corporate Governance, 9(1), 44-66. [CrossRef]

- Monkhouse, E. 1995. The role of competitive benchmarking in small-to medium-sizedenterprises. Benchmarking for Quality Management & Technology, 2(4), 41-50. [CrossRef]

- Neralla, N. G. 2022. Can corporate governance structure effect on corporate performance: an empirical investigation from Indian companies. International Journal of Disclosure and Governance, 19(3), 282-300. [CrossRef]

- Odean, T. 1999. Do investors trade too much?. American economic review, 89(5), 1279-1298. [CrossRef]

- Pareek, R., Sahu, T. N., & Gupta, A. 2023. Gender diversity and corporate sustainability performance: empirical evidence from India. Vilakshan-XIMB Journal of Management, 20(1), 140-153. [CrossRef]

- Rao, K., & Tilt, C. 2016. Board composition and corporate social responsibility: The role of diversity, gender, strategy and decision making. Journal of business ethics, 138, 327-347. [CrossRef]

- Setiawan, B., Afin, R., Wikurendra, E. A., Nathan, R. J., & Fekete-Farkas, M. 2022. Covid-19 pandemic, asset prices, risks, and their convergence: A survey of Islamic and G7 stock market, and alternative assets. Borsa Istanbul Review, 22, S47-S59. [CrossRef]

- Stevenson, M., Huang, Y., Hendry, L. C., & Soepenberg, E. 2011. The theory and practice of workload control: A research agenda and implementation strategy. International Journal of Production Economics, 131(2), 689-700. [CrossRef]

- Tandon, K., Purohit, H., & Tandon, D. 2016. Measuring intellectual capital and its impact on financial performance: Empirical evidence from CNX nifty companies. Global Business Review, 17(4), 980-997. [CrossRef]

- Tandon, K., Purohit, H., & Tandon, D. 2016. Measuring intellectual capital and its impact on financial performance: Empirical evidence from CNX nifty companies. Global Business Review, 17(4), 980-997. [CrossRef]

- Tanikawa, T., & Jung, Y. 2016. Top management team (TMT) tenure diversity and firm performance: Examining the moderating effect of TMT average age. International Journal of Organizational Analysis, 24(3), 454-470. [CrossRef]

- Tharenou, P., Saks, A. M., & Moore, C. 2007. A review and critique of research on training and organizational-level outcomes. Human resource management review, 17(3), 251-273. [CrossRef]

- Tuch, C., & O'Sullivan, N. 2007. The impact of acquisitions on firm performance: A review of the evidence. International journal of management reviews, 9(2), 141-170. [CrossRef]

- Waddock, S., & McIntosh, M. 2009. Beyond corporate responsibility: Implications for management development. Business and Society Review, 114(3), 295-325. [CrossRef]

- Weidman, S. M., McFarland, D. J., Meric, G., & Meric, I. 2019. Determinants of return-on-equity in USA, German and Japanese manufacturing firms. Managerial Finance, 45(3), 445-451. [CrossRef]

- Wiersema, M. F., & Bantel, K. A. 1992. Top management team demography and corporate strategic change. Academy of Management journal, 35(1), 91-121. [CrossRef]

- Zollo, M., & Singh, H. 2004. Deliberate learning in corporate acquisitions: post-acquisition strategies and integration capability in US bank mergers. Strategic management journal, 25(13), 1233-1256. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).