Submitted:

29 August 2024

Posted:

29 August 2024

You are already at the latest version

Abstract

Keywords:

1. INTRODUCTION

2. METHODS

2.1. Model Development

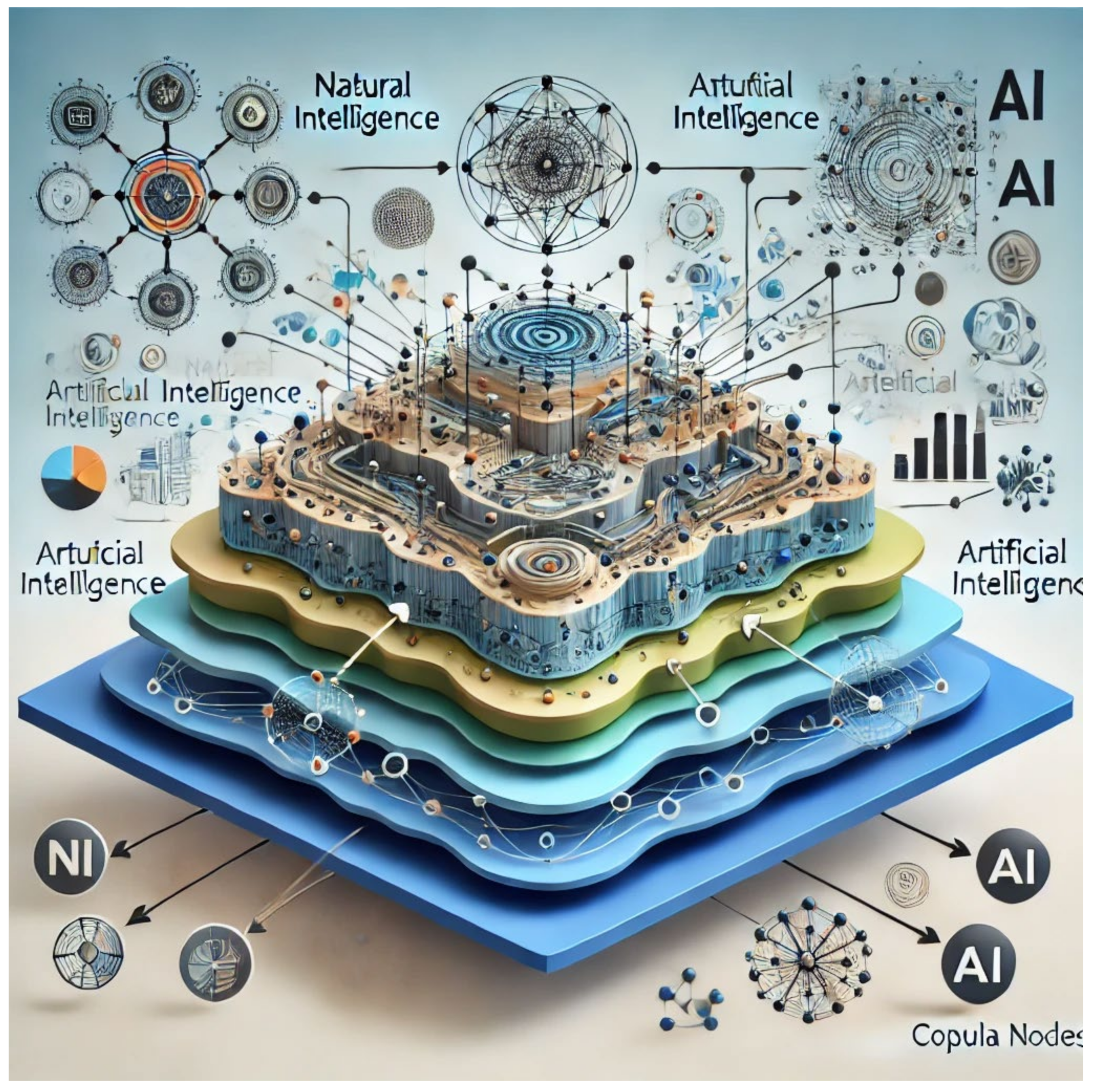

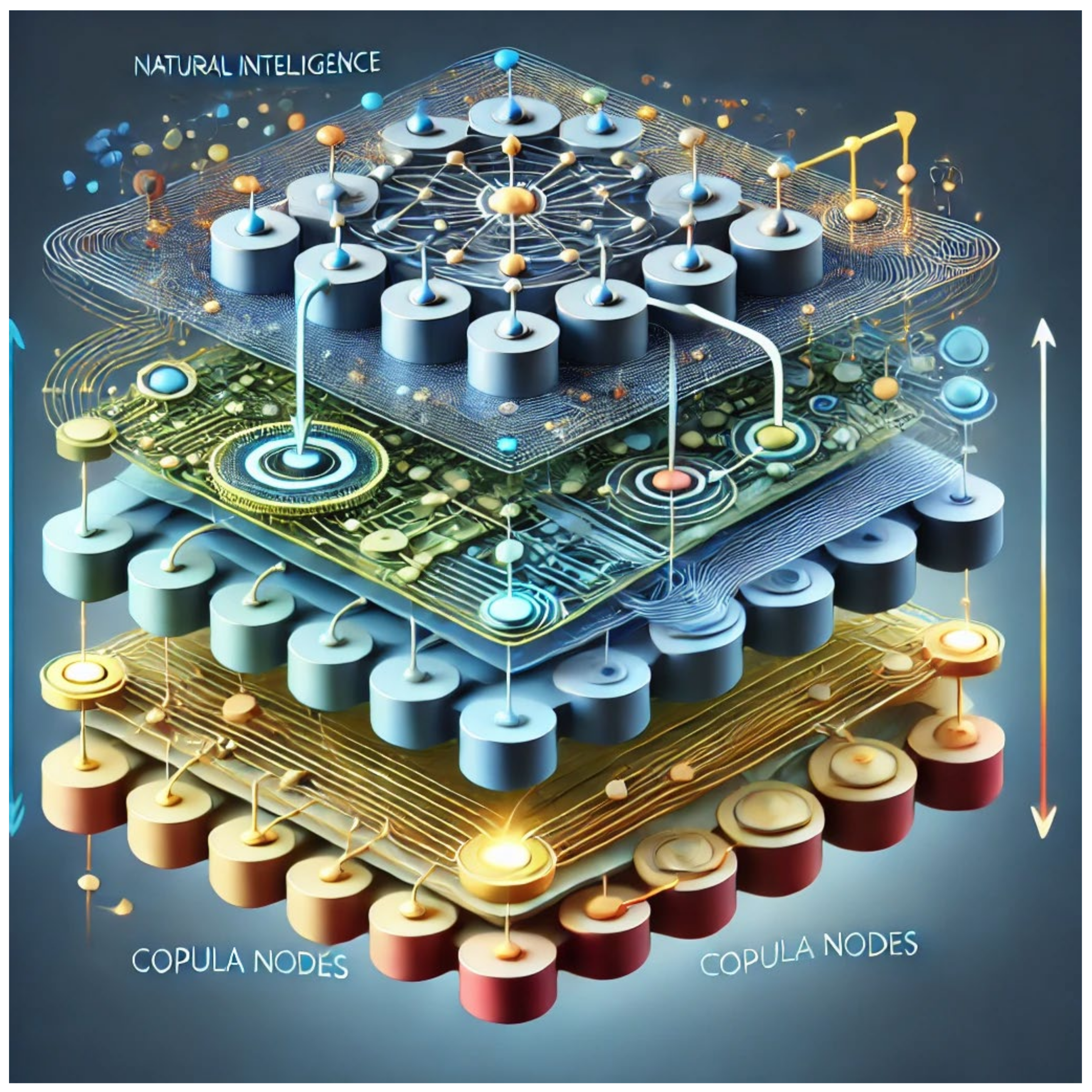

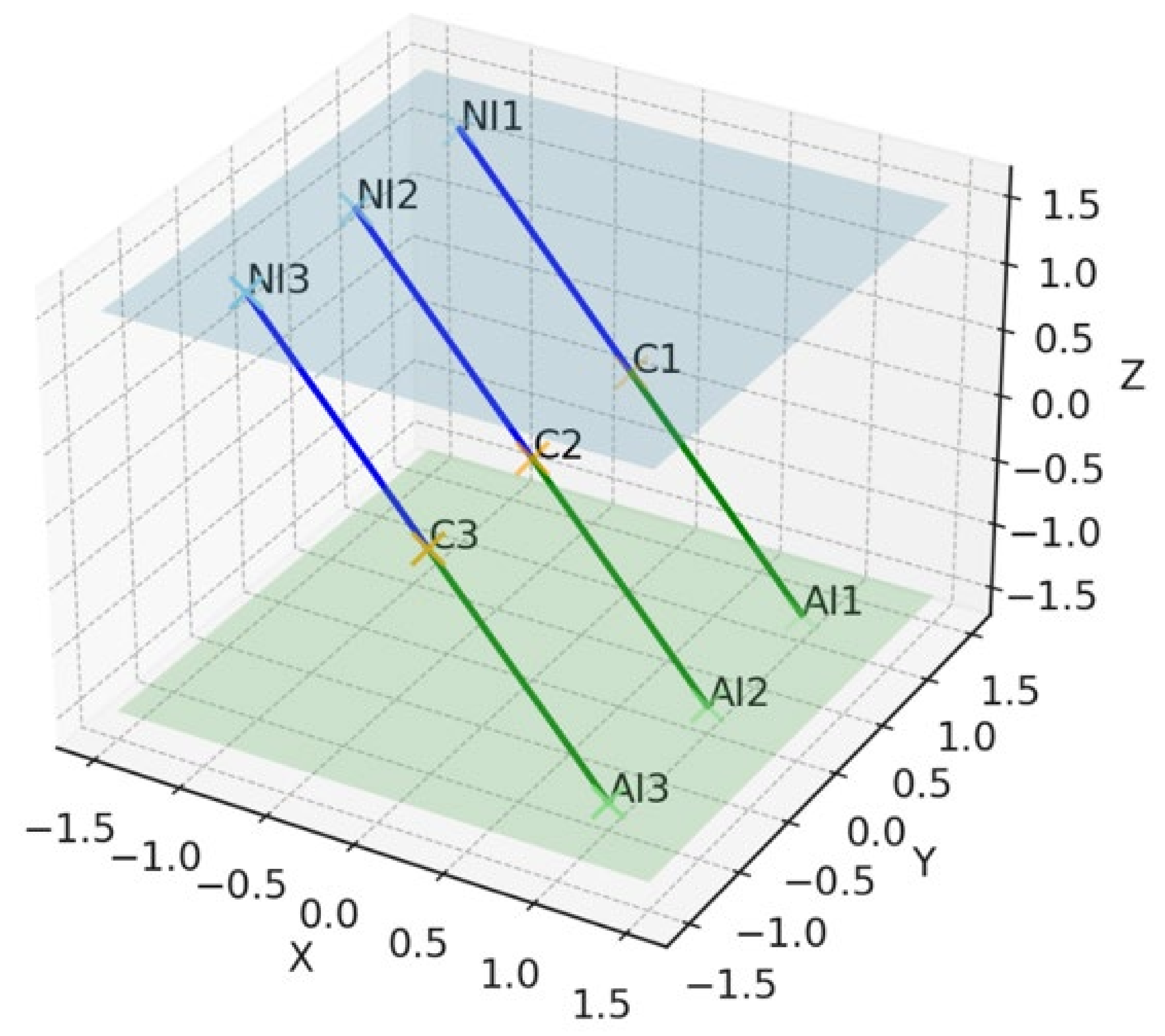

- NI Layer: This layer encompasses human-driven activities such as strategic decision-making, creativity, and complex problem-solving that require intuition, experience, and ethical judgment.

- AI Layer: This layer represents computational processes, including data analysis, predictive modeling, and automation.

2.2. Cost-Benefit Analysis

-

Benefits of Integration:

- ◦

- Increased Efficiency: AI-driven systems improve operational efficiency by reducing downtime, increasing throughput, and optimizing resource utilization (e.g., predictive maintenance in manufacturing).

- ◦

- Improved Decision-Making: AI provides data-driven insights that complement human intuition, leading to better decisions (e.g., personalized marketing strategies in retail).

- ◦

- Cost Reduction: AI reduces costs by automating repetitive tasks, optimizing supply chains, and minimizing human errors (e.g., AI-driven automation in finance).

-

Costs of Integration:

- ◦

- Initial Setup Costs: Investments in AI technology, infrastructure, and employee training.

- ◦

- Ongoing Operational Costs: Maintenance, updates, and continuous training.

- ◦

- Potential Hidden Costs: Challenges related to system integration and scalability.

2.3. Validation and Sensitivity Analysis

- Efficiency Gains: The model showed high sensitivity to AI prediction accuracy and the effectiveness of copula nodes in integrating AI insights with human decision-making.

- Decision-Making: Improvements in decision-making were linked to the speed and quality of AI-driven insights, with copula nodes playing a critical role.

- Cost Reductions: AI's impact on cost reduction was consistent across scenarios, highlighting the stability of its economic benefits.

3. RESULTS

3.1. Efficiency Gains

- Manufacturing Sector: AI-driven predictive maintenance systems reduced machine downtime by 30%, enhancing operational efficiency (Dalenogare et al., 2018). Copula nodes aligned AI predictions with human expertise, ensuring optimal outcomes.

| Industry | Pre-Integration Downtime | Post-Integration Downtime | Efficiency Gain |

|---|---|---|---|

| Manufacturing | 40% | 10% | 30% |

- Retail Sector: AI-enhanced inventory management systems optimized stock levels, reducing overstock and stockouts by 25%, improving inventory turnover (Grewal et al., 2021).

| Metric | Pre-Integration Value | Post-Integration Value | Improvement |

|---|---|---|---|

| Overstock Reduction | 20% | 5% | 15% |

| Stockout Reduction | 15% | 5% | 10% |

- Finance Sector: AI applications in risk management and algorithmic trading improved decision-making speed by 40% and reduced error rates by 20% (Fernández-Maestro et al., 2022).

| Metric | Pre-Integration Value | Post-Integration Value | Improvement |

|---|---|---|---|

| Decision Speed | 60% | 100% | 40% |

| Error Rate | 25% | 5% | 20% |

3.2. Enhanced Decision-Making Processes

- Manufacturing Sector: Decision-making related to maintenance and production scheduling improved by 35% (Moro-Visconti et al., 2023).

- Retail Sector: AI-driven customer analytics led to a 20% increase in sales conversion rates (Grewal et al., 2021).

- Finance Sector: AI integration improved return on investment (ROI) by 15%, with copula nodes playing a crucial role in merging AI insights with human expertise (Fernández-Maestro et al., 2022).

3.3. Cost Reductions

| Industry | Pre-Integration Costs | Post-Integration Costs | Cost Reduction |

|---|---|---|---|

| Manufacturing | €1,000,000 | €700,000 | 30% |

| Retail | €500,000 | €375,000 | 25% |

| Finance | €750,000 | €600,000 | 20% |

4. DISCUSSION

4.1. Synergistic Integration of NI and AI

4.2. The Role of Copula Nodes

4.3. Industry-Specific Insights

4.4. Practical Implications

5. CONCLUSIONS

References

- Arora, M., & Sharma, R. L. (2023). Artificial intelligence and big data: ontological and communicative perspectives in multi-sectoral scenarios of modern businesses. Foresight, 25(1), 126-143.

- Barabási, A.-L. (2016). Network Science. Cambridge University Press.

- Bianconi, G. (2018). Multilayer Networks: Structure and Function. Oxford University Press.

- Boccaletti, S., Bianconi, G., Criado, R., Del Genio, C. I., Gómez-Gardeñes, J., Romance, M., & Zanin, M. (2014). The structure and dynamics of multilayer networks. Physics Reports, 544(1), 1-122.

- Braun, M., Greve, M., Brendel, A. B., & Kolbe, L. M. (2024). Humans supervising artificial intelligence–investigation of designs to optimize error detection. Journal of Decision Systems, 1-26.

- Brynjolfsson, E., & McAfee, A. (2017). Machine, Platform, Crowd: Harnessing Our Digital Future. W.W. Norton & Company.

- Choudhury, M. D., Lee, M. K., Zhu, H., & Shamma, D. A. (2020). Introduction to this special issue on unifying human-computer interaction and artificial intelligence. Human–Computer Interaction, 35(5-6), 355-361.

- Dalenogare, L. S., Benitez, G. B., Ayala, N. F., & Frank, A. G. (2018). The expected contribution of Industry 4.0 technologies for industrial performance. International Journal of Production Economics, 204, 383-394.

- Dhar Dwivedi, A., Singh, R., Kaushik, K., Rao Mukkamala, R., & Alnumay, W. S. (2024). Blockchain and artificial intelligence for 5G-enabled Internet of Things: Challenges, opportunities, and solutions. Transactions on Emerging Telecommunications Technologies, 35(4), e4329.

- Davenport, T. H., & Ronanki, R. (2018). Artificial Intelligence for the Real World. Harvard Business Review, 96(1), 108-116.

- Durlach, P. J., & Ray, J. M. (2011). Designing Adaptive Instructional Environments: Insights from Empirical Evidence. Advances in Human-Computer Interaction, 2011, Article 7.

- Fernández-Maestro, A. E., Fernández-Vázquez, A., & Pérez-Álvarez, R. (2022). AI and Financial Markets: Challenges, Applications, and Opportunities. Journal of Finance and Data Science, 8, 1-12.

- Górriz, J. M., Ramírez, J., Ortiz, A., Martinez-Murcia, F. J., Segovia, F., Suckling, J., … & Ferrandez, J. M. (2020). Artificial intelligence within the interplay between natural and artificial computation: Advances in data science, trends, and applications. Neurocomputing, 410, 237-270.

- Grewal, D., Roggeveen, A. L., & Nordfält, J. (2021). The future of retailing. Journal of Retailing, 97(1), 3-18.

- Joe, H. (2014). Dependence Modeling with Copulas. CRC Press.

- Kivelä, M., Arenas, A., Barthelemy, M., Gleeson, J. P., Moreno, Y., & Porter, M. A. (2014). Multilayer networks. Journal of Complex Networks, 2(3), 203-271.

- Kulik, J. A., & Fletcher, J. D. (2016). Effectiveness of Intelligent Tutoring Systems: A Meta-Analytic Review. Review of Educational Research, 86(1), 42-78.

- McKinsey & Company (2023). The State of AI in 2023: Generative AI's Breakout Year.

- Moro-Visconti, R., (2024) Artificial Intelligence Valuation, Palgrave Macmillan, Cham.

- Moro-Visconti, R., Cruz Rambaud, S., & López Pascual, J. (2023). Artificial intelligence-driven scalability and its impact on the sustainability and valuation of traditional firms. Humanities and Social Sciences Communications, 10(1), 1-14.

- Russell, S., Moskowitz, I. S., & Raglin, A. (2017). Human information interaction, artificial intelligence, and errors. Autonomy and artificial intelligence: a threat or savior? 71-101.

- Seeber, I., Bittner, E., Briggs, R. O., de Vreede, G.-J., de Vreede, T., Elkins, A., & Maier, R. (2020). Machines as teammates: A research agenda on AI in team collaboration. Information & Management, 57(2), 103174.

- Shulner-Tal, A., Kuflik, T., Kliger, D., & Mancini, A. (2024). Who Made That Decision and Why? Users’ Perceptions of Human Versus AI Decision-Making and the Power of Explainable-AI. International Journal of Human-Computer Interaction, 1-18.

- Wang, J.X. (2021). Meta-learning in natural and artificial intelligence. Current Opinion in Behavioral Sciences, 38, 90-95.

- Zhu, Y., Wang, T., Wang, C., Wang, C., Quan, W., & Tang, M. (2023). Complexity-Driven Trust Dynamics in Human-Robot Interactions: Insights from AI-Enhanced Collaborative Engagements. Applied Sciences, 13(24), 12989.

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).