Submitted:

03 September 2024

Posted:

03 September 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Literature Review

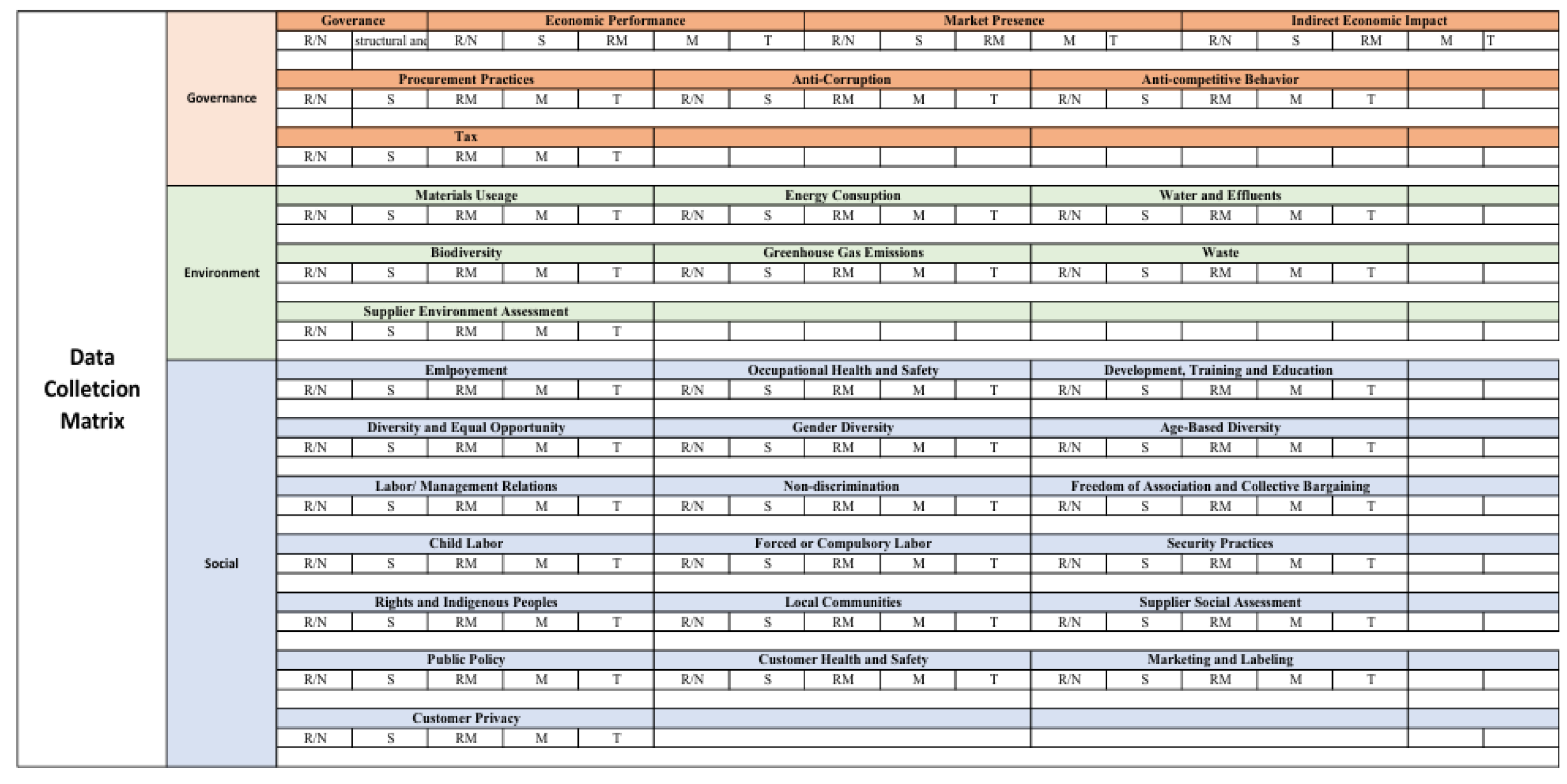

3. Materials and Methods

3.1. Regulation Review

3.2. Listed Companies Sustainability Reporting Review

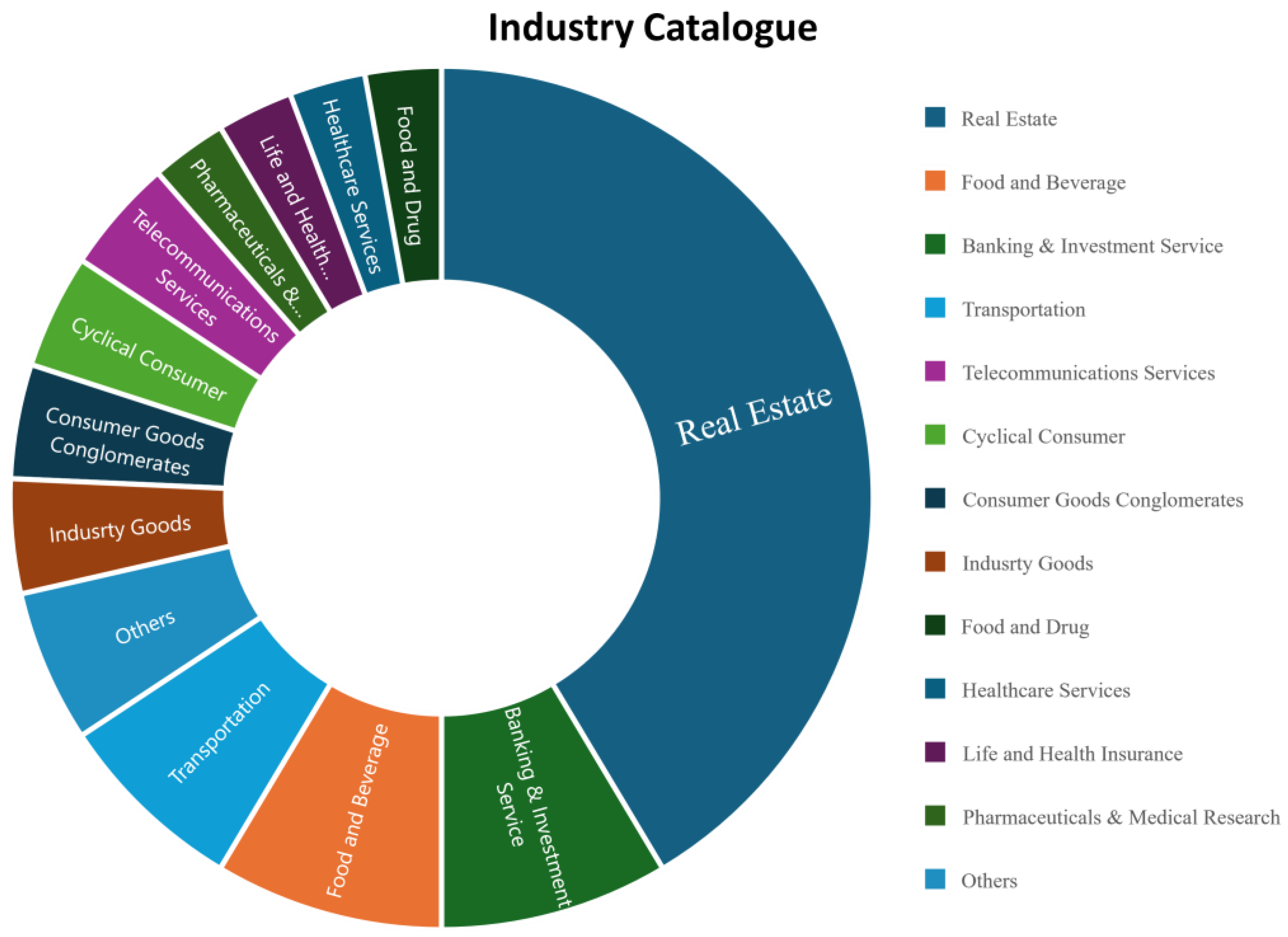

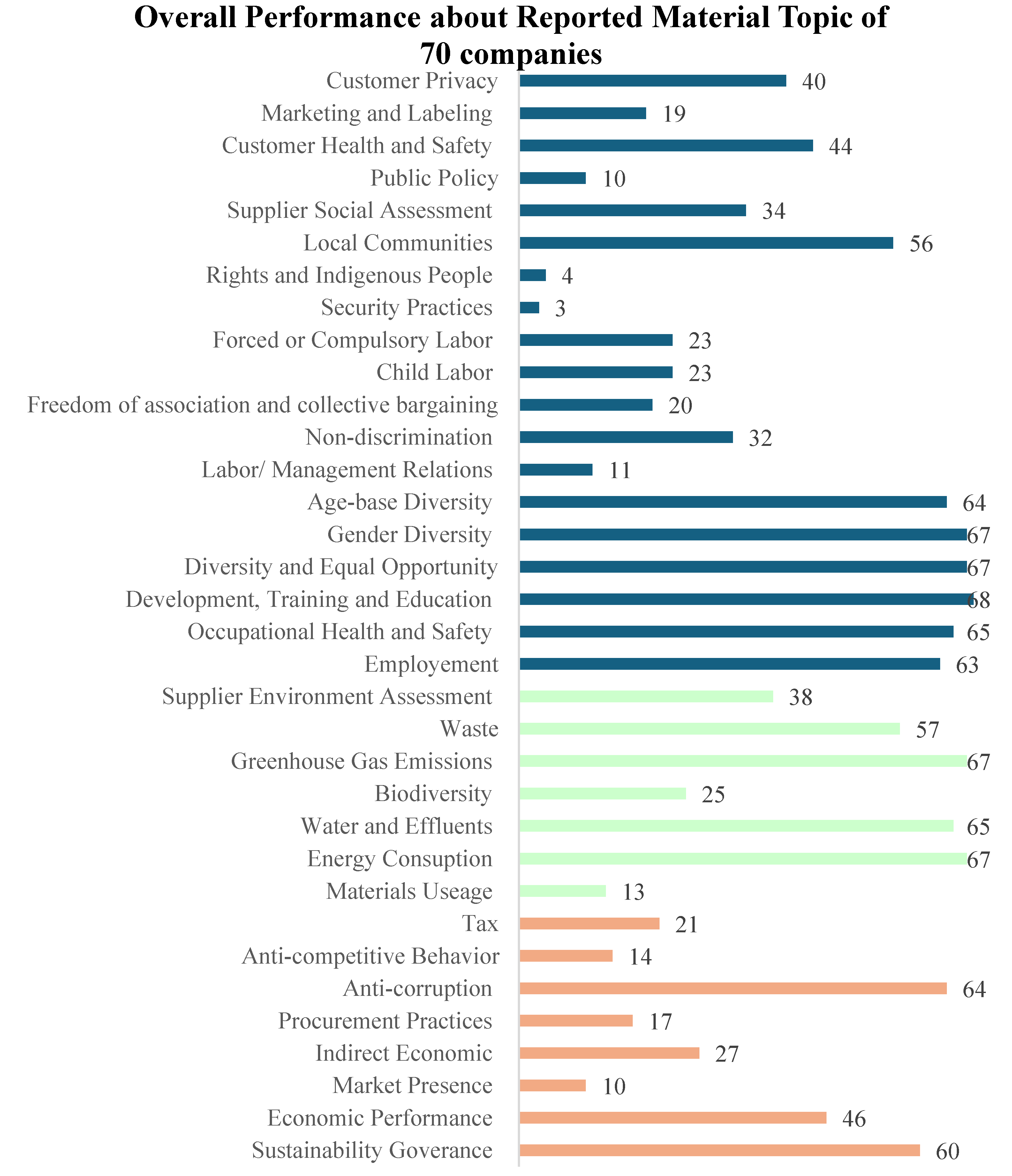

4. Results

4.1. Regulation Review

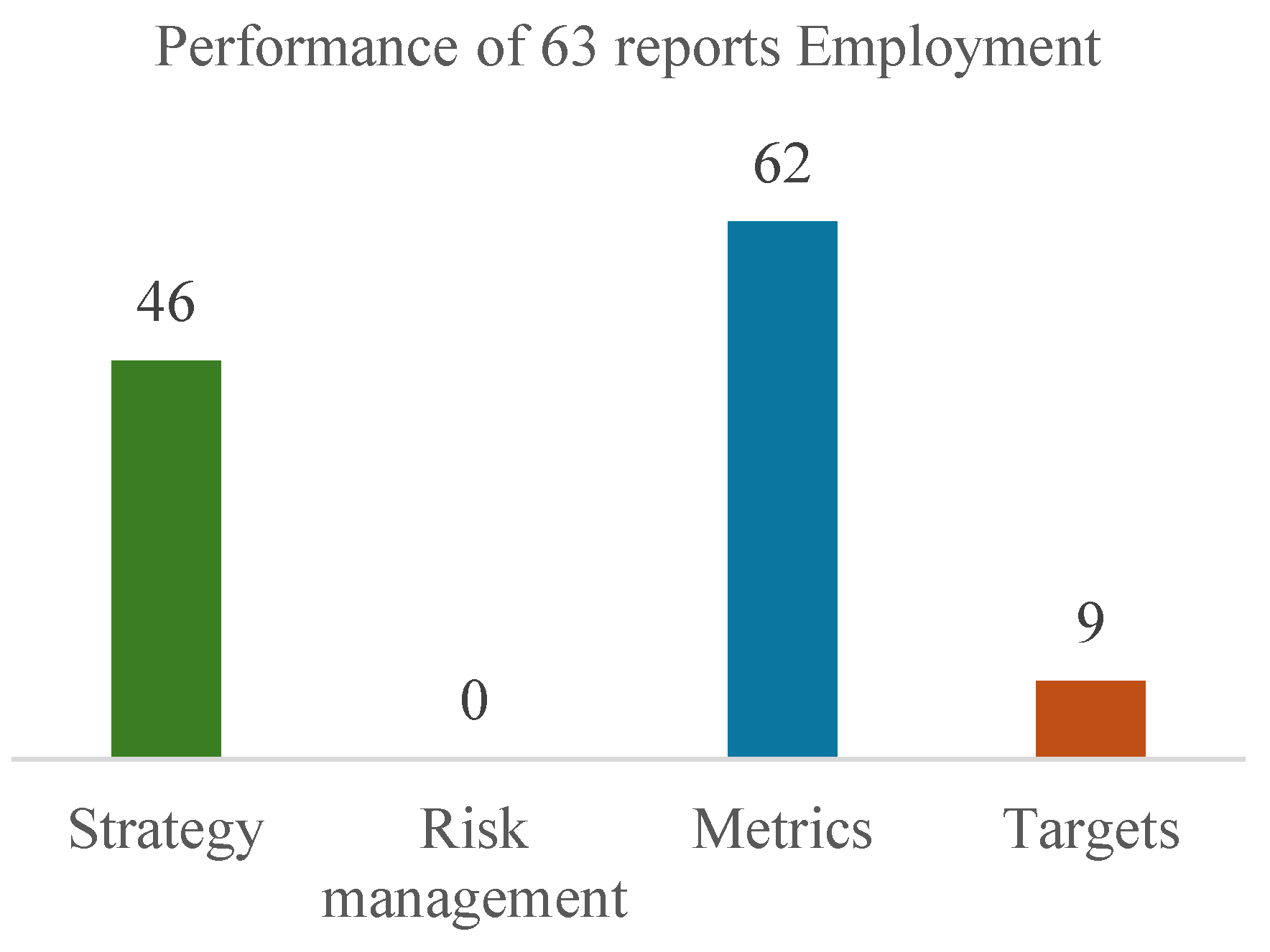

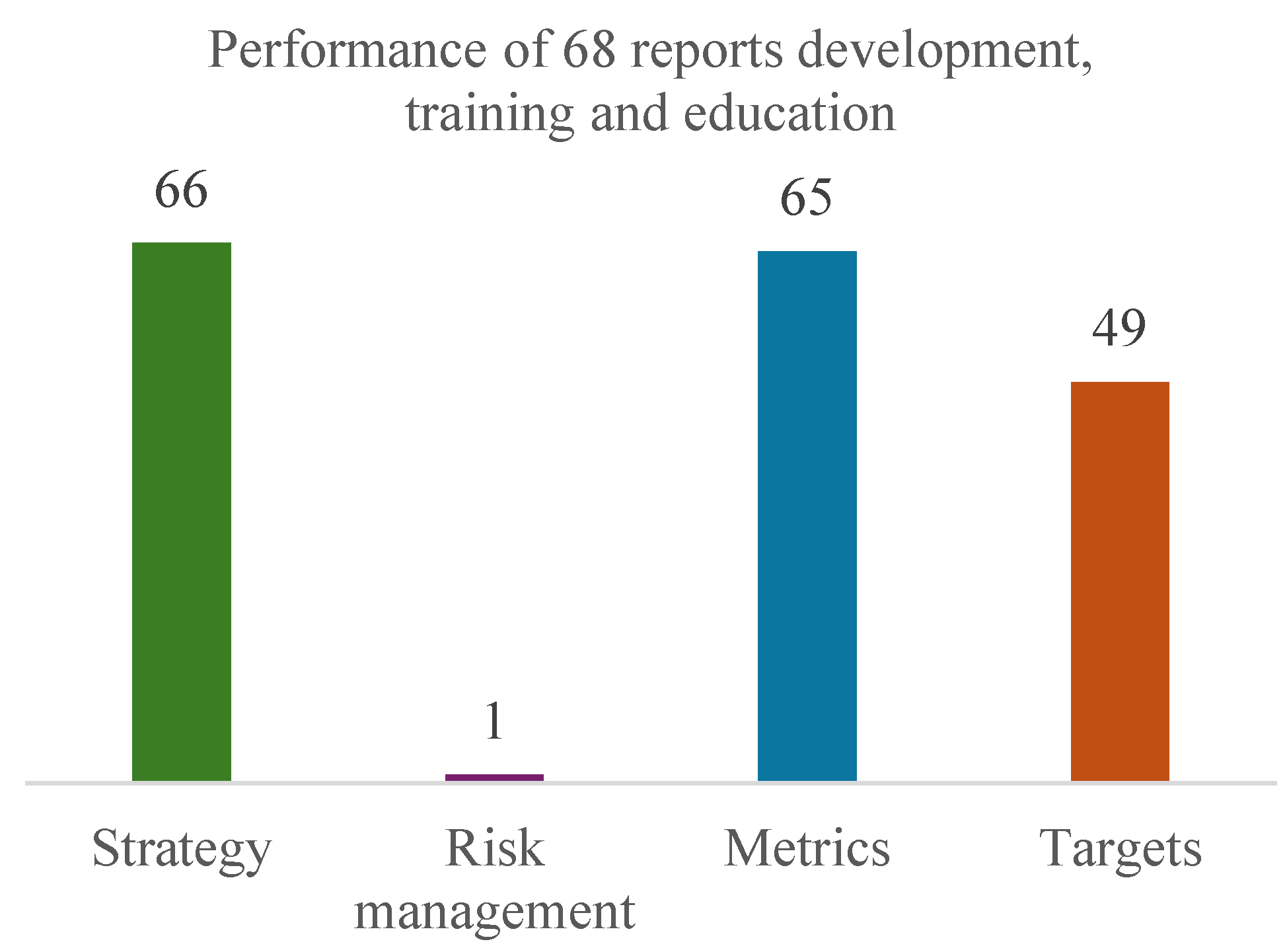

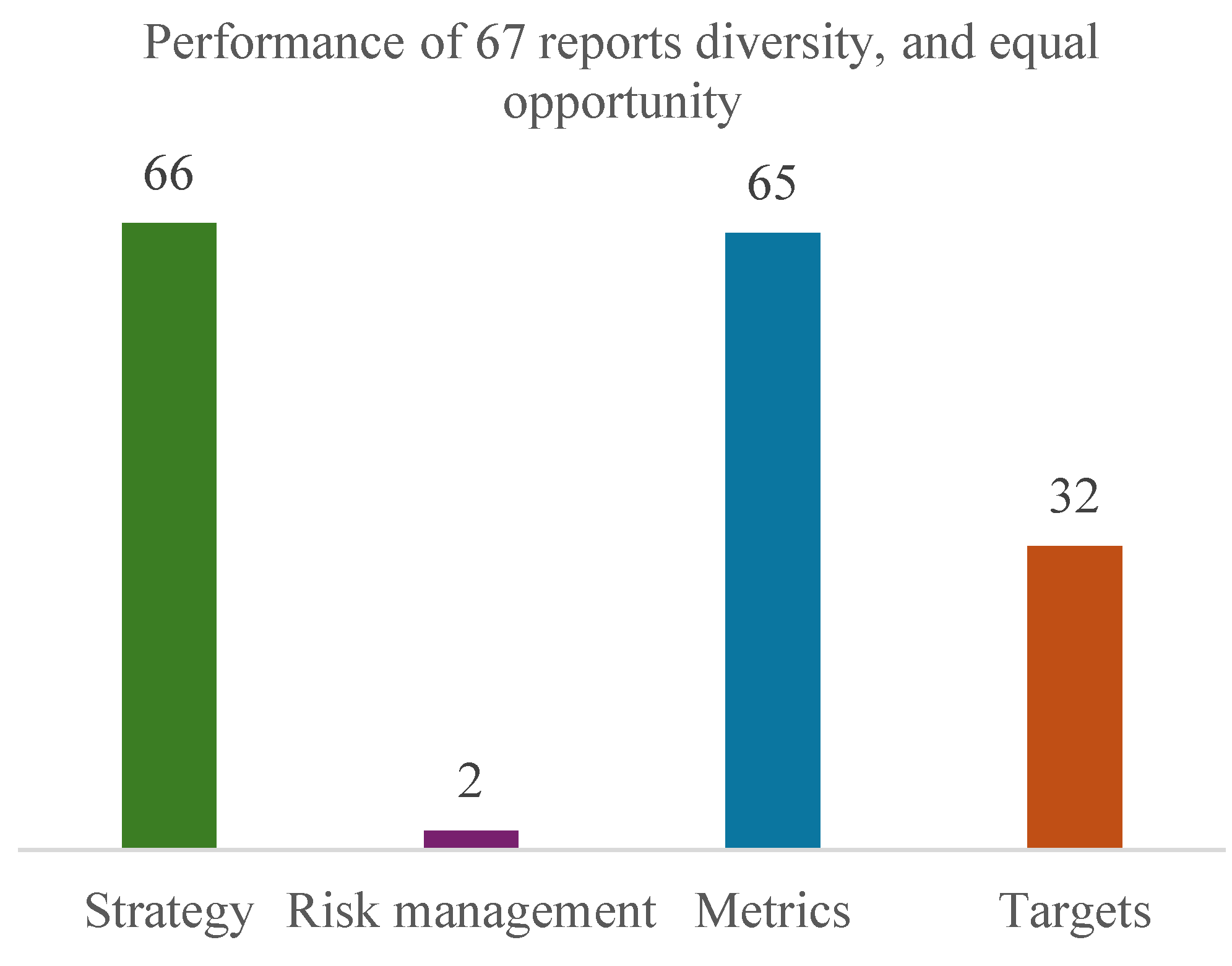

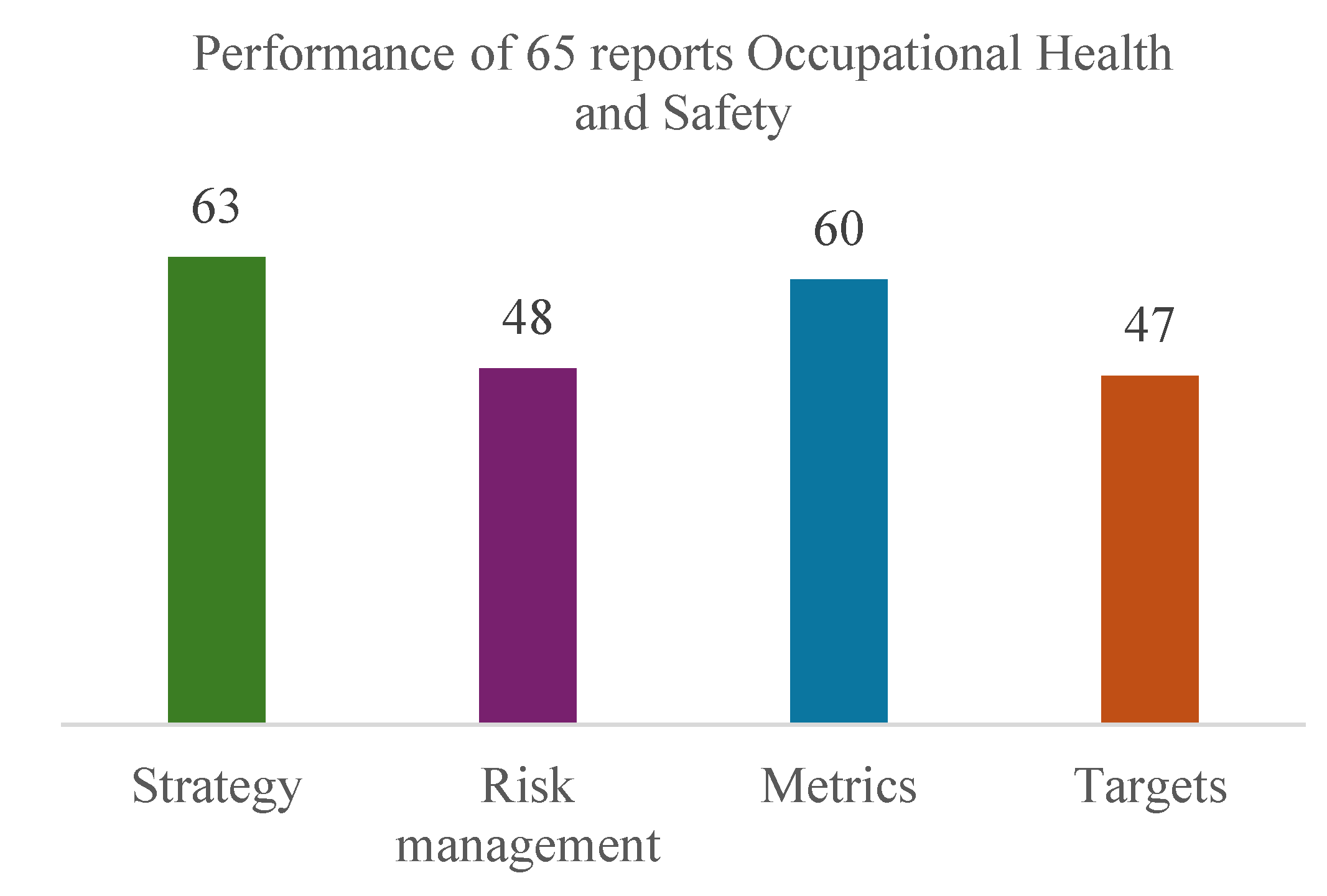

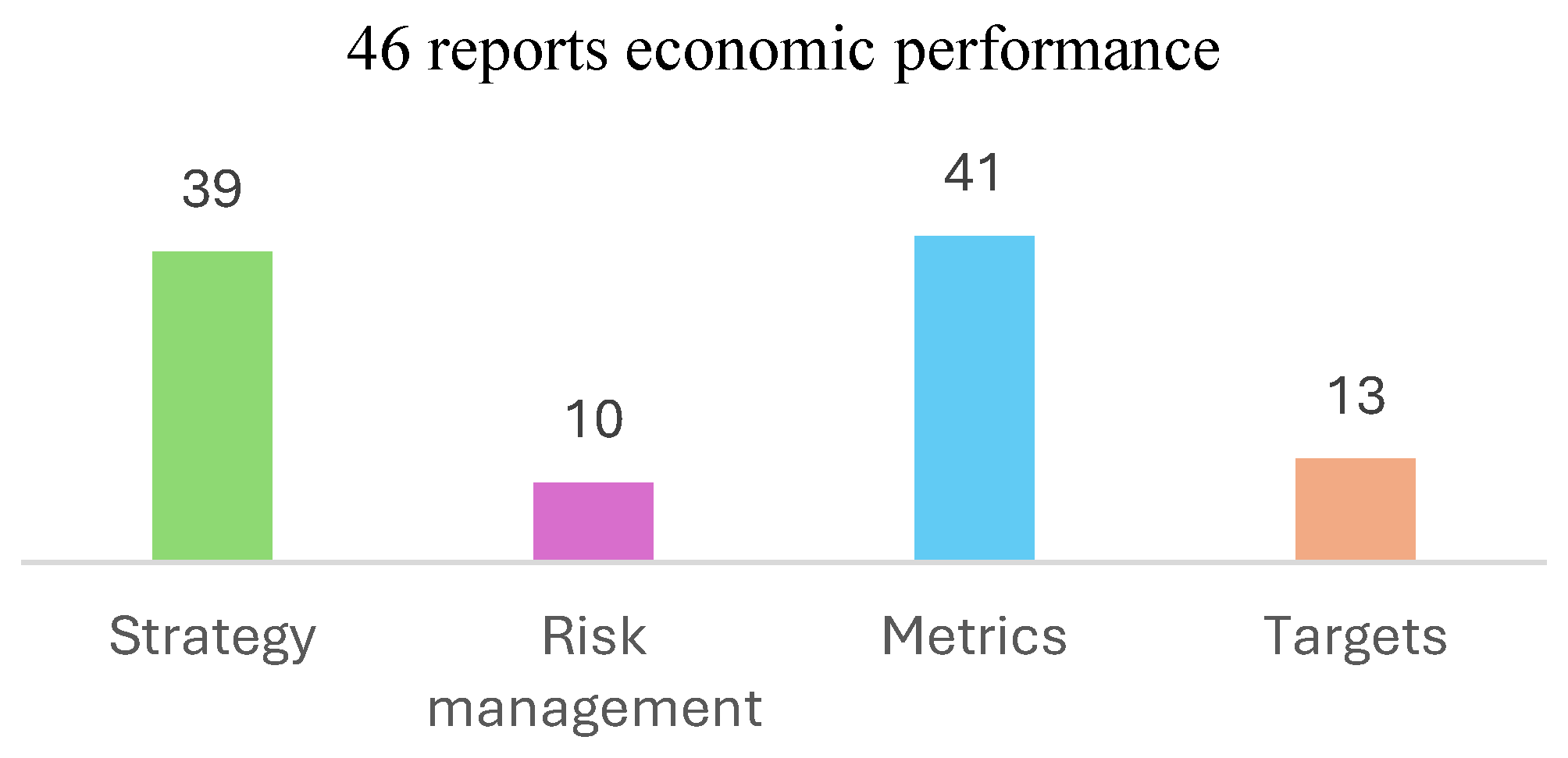

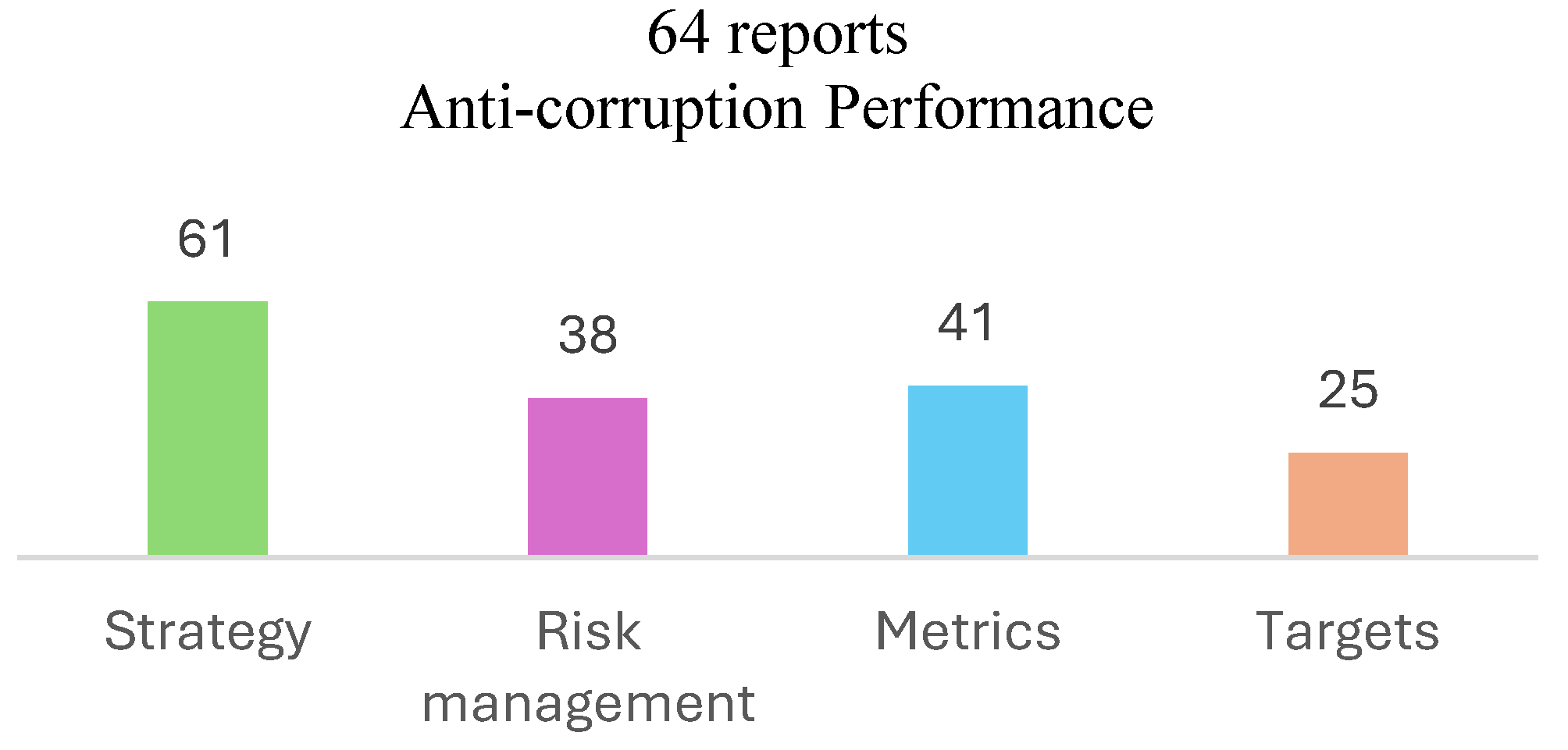

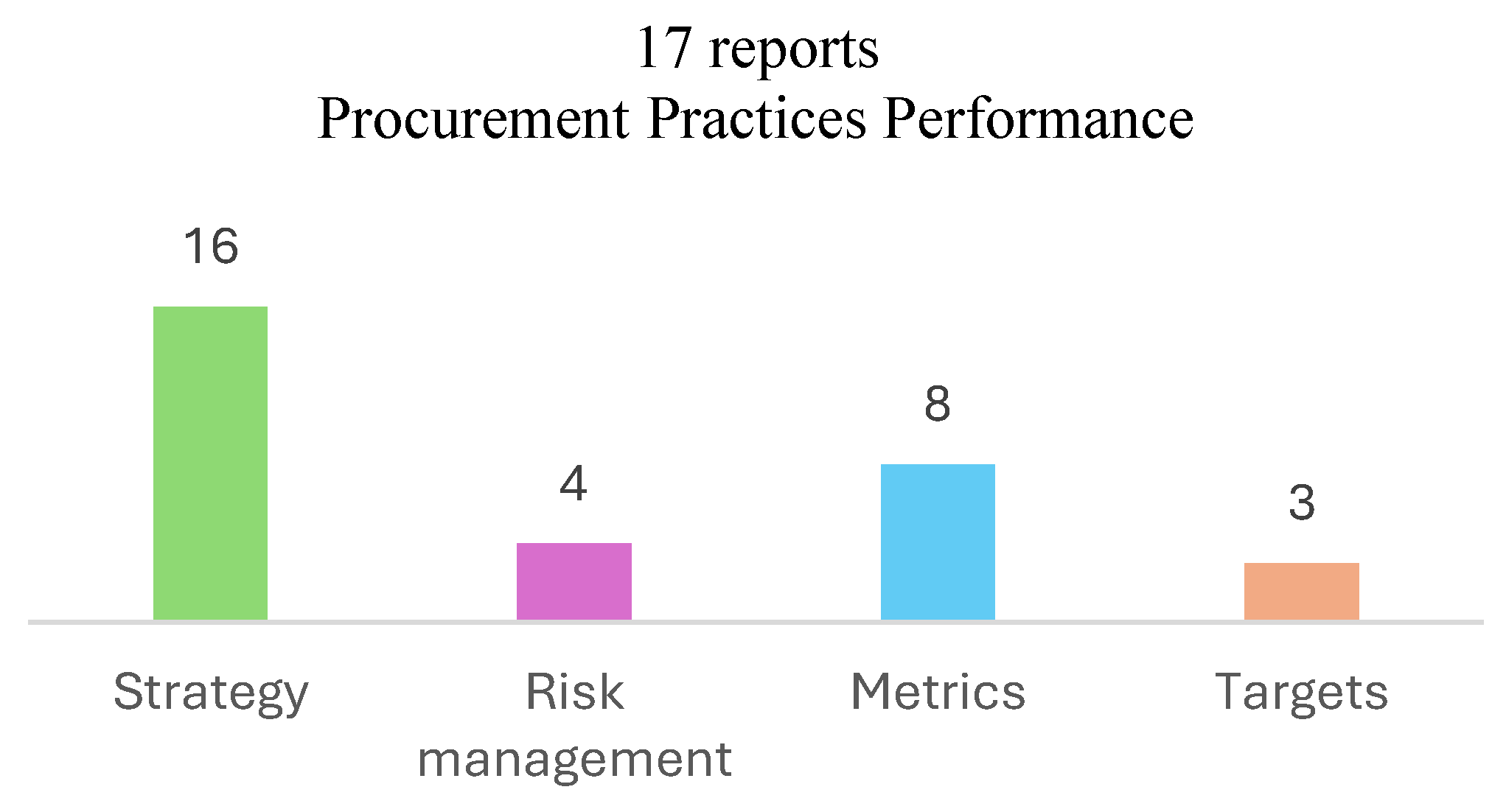

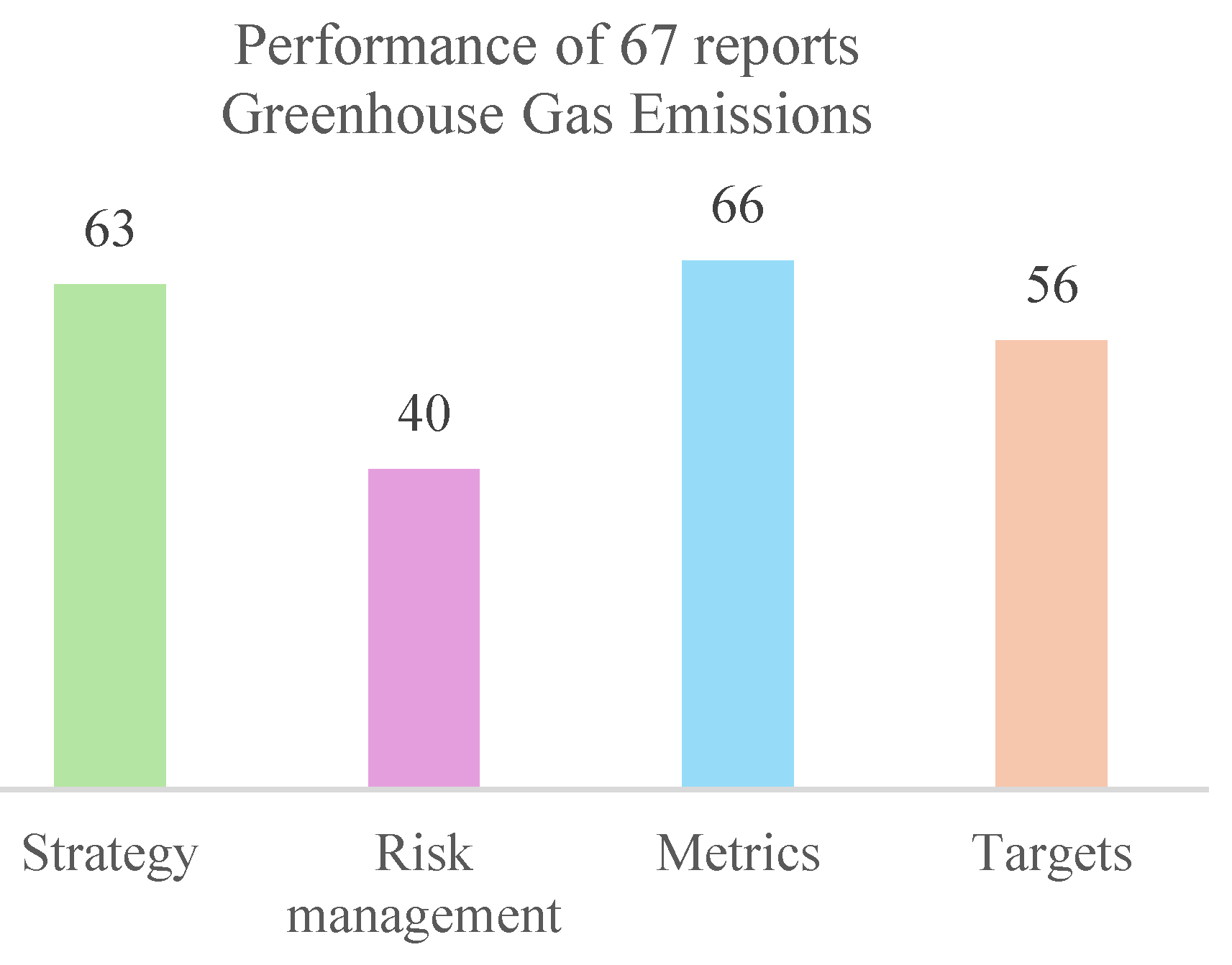

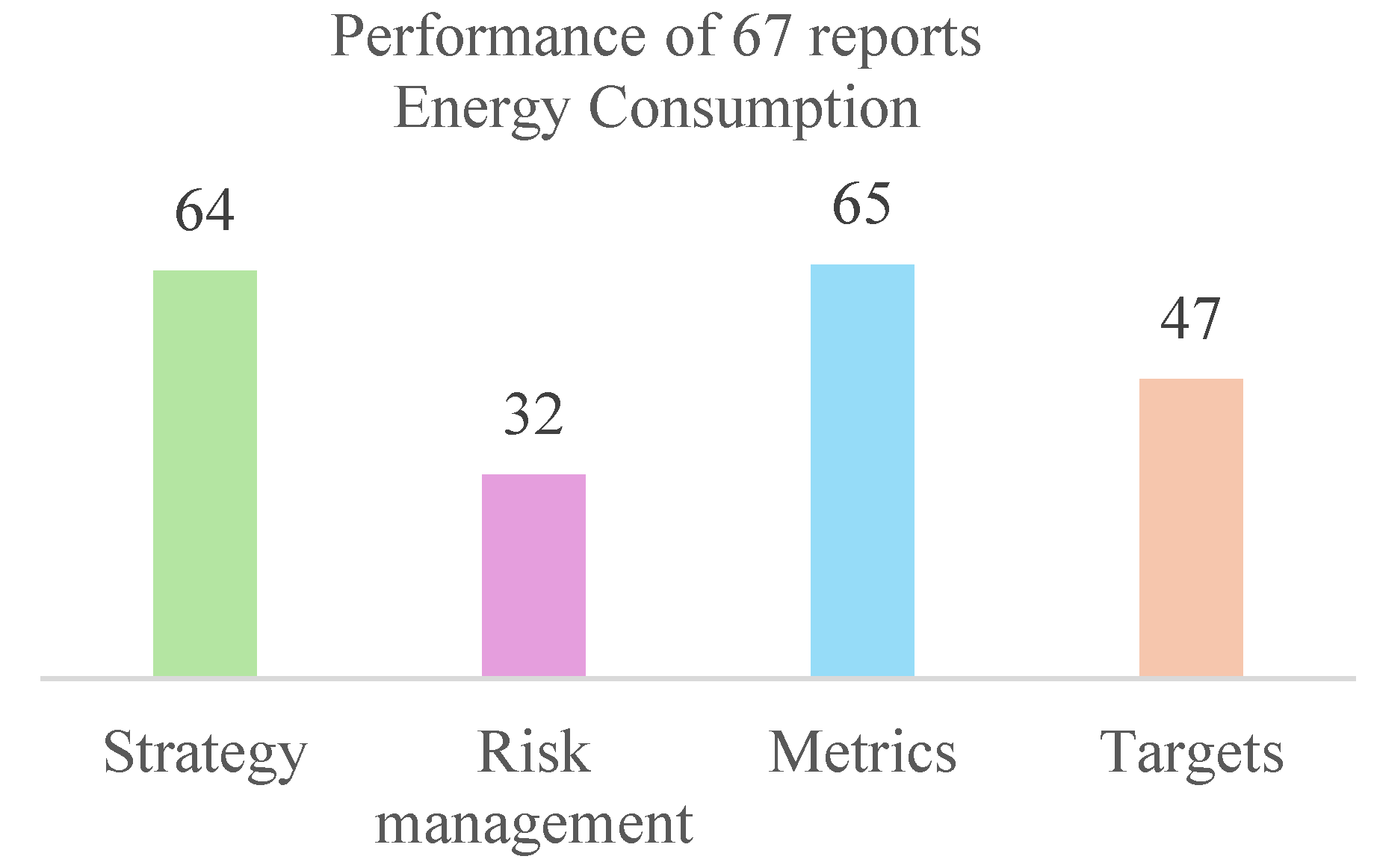

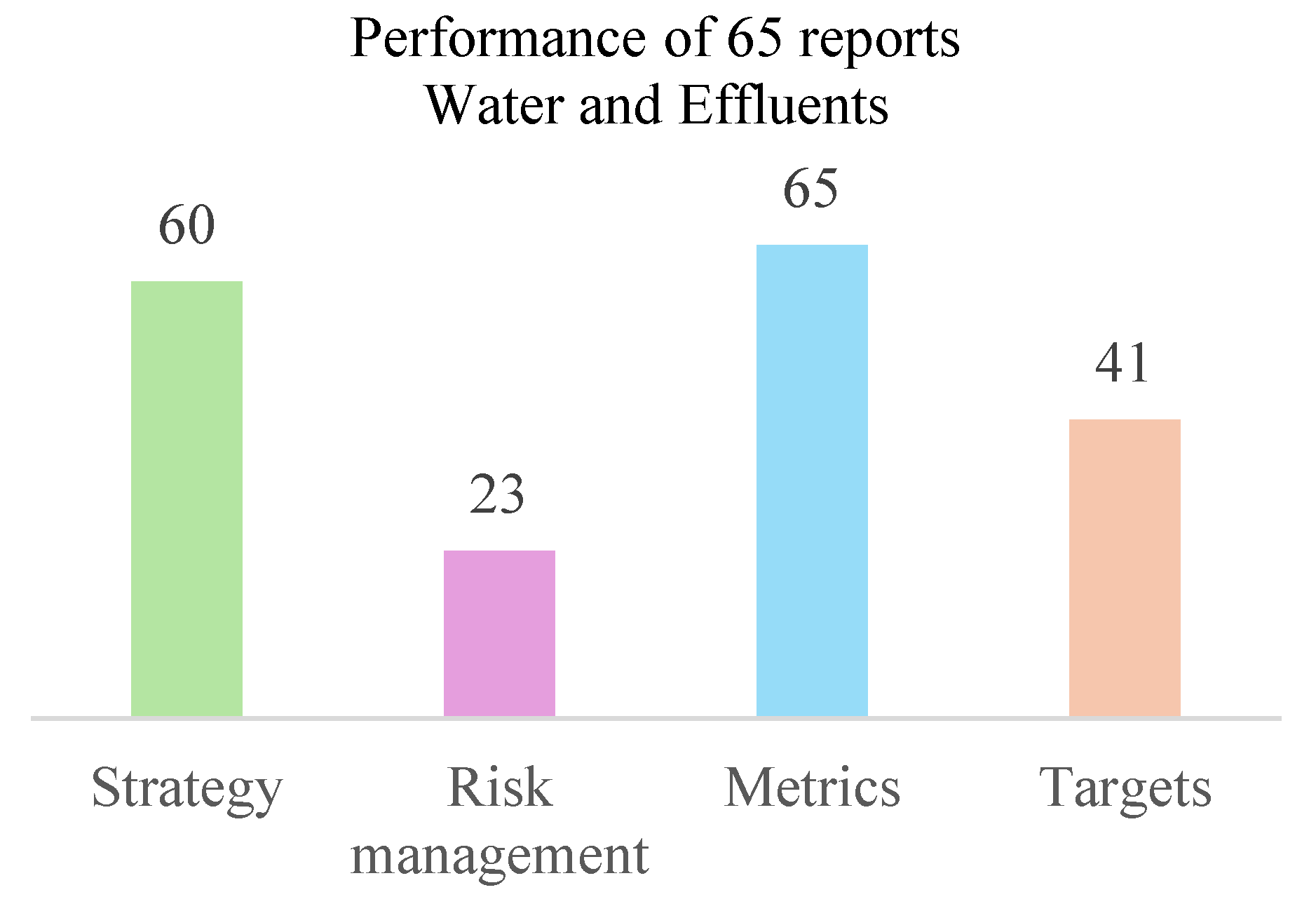

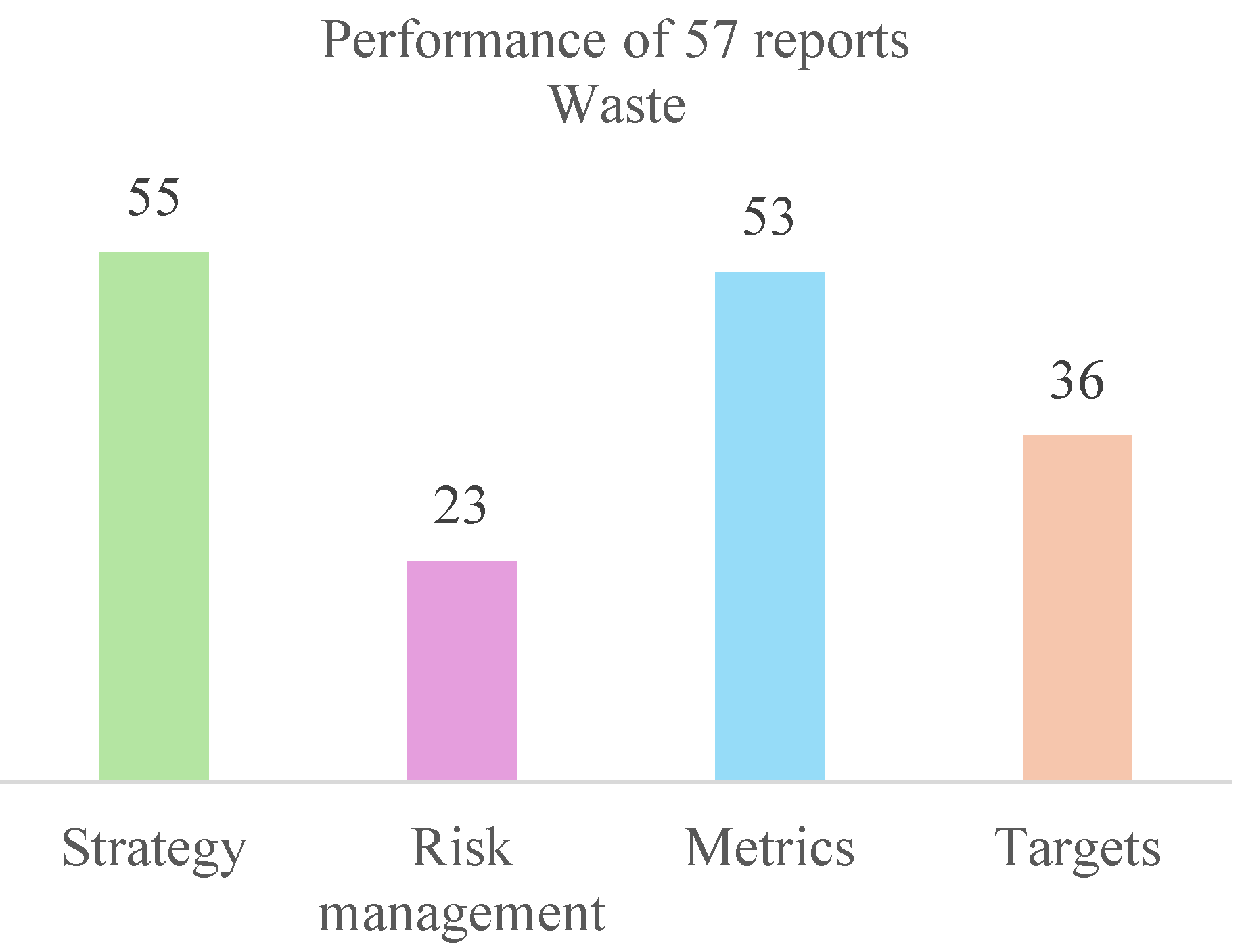

4.2. Sustianbaility Reporting Review Result

4. Discussion

5. Conclusions

References

- Burton, I., Report on reports: Our common future: The world commission on environment and development. Environment: Science and Policy for Sustainable Development, 1987. 29(5): p. 25-29.

- Waseem, N. and S. Kota. Sustainability definitions—An analysis. in Research into Design for Communities, Volume 2: Proceedings of ICoRD 2017. 2017. Springer.

- Kolk, A., The social responsibility of international business: From ethics and the environment to CSR and sustainable development. Journal of World Business, 2016. 51(1): p. 23-34. [CrossRef]

- Halkos, G. and E.-C. Gkampoura, Where do we stand on the 17 Sustainable Development Goals? An overview on progress. Economic Analysis and Policy, 2021. 70: p. 94-122. [CrossRef]

- Colglazier, W., Sustainable development agenda: 2030. Science, 2015. 349(6252): p. 1048-1050.

- Huang, D.Z., Environmental, social and governance (ESG) activity and firm performance: A review and consolidation. Accounting & finance, 2021. 61(1): p. 335-360. [CrossRef]

- Eccles, R.G., L.-E. Lee, and J.C. Stroehle, The social origins of ESG: An analysis of Innovest and KLD. Organization & Environment, 2020. 33(4): p. 575-596.

- Karwowski, M. and M. Raulinajtys-Grzybek, The application of corporate social responsibility (CSR) actions for mitigation of environmental, social, corporate governance (ESG) and reputational risk in integrated reports. Corporate Social Responsibility and Environmental Management, 2021. 28(4): p. 1270-1284. [CrossRef]

- Gillan, S.L., A. Koch, and L.T. Starks, Firms and social responsibility: A review of ESG and CSR research in corporate finance. Journal of Corporate Finance, 2021. 66: p. 101889. [CrossRef]

- Ordonez-Ponce, E., A. Clarke, and A. MacDonald, Business contributions to the sustainable development goals through community sustainability partnerships. Sustainability Accounting, Management and Policy Journal, 2021. 12(6): p. 1239-1267. [CrossRef]

- Buallay, A., Sustainability reporting and firm’s performance: Comparative study between manufacturing and banking sectors. International Journal of Productivity and Performance Management, 2020. 69(3): p. 431-445.

- Buallay, A., Is sustainability reporting (ESG) associated with performance? Evidence from the European banking sector. Management of Environmental Quality: An International Journal, 2019. 30(1): p. 98-115. [CrossRef]

- Sisaye, S., The influence of non-governmental organizations (NGOs) on the development of voluntary sustainability accounting reporting rules. Journal of Business and Socio-economic Development, 2021. 1(1): p. 5-23. [CrossRef]

- King, A., The Time Has Come: The KPMG Survey of Sustainability Reporting. KPMG International Limited, diakses tanggal, 2022. 1.

- Almashhadani, M. and H.A. Almashhadani, The Impact of Sustainability Reporting on Promoting Firm performance. International Journal of Business and Management Invention, 2023. 12(4): p. 101-111.

- Boiral, O., I. Heras-Saizarbitoria, and M.-C. Brotherton, Assessing and improving the quality of sustainability reports: The auditors’ perspective. Journal of Business Ethics, 2019. 155: p. 703-721. [CrossRef]

- Standards, I.F.R. International Sustainability Standards Board. 2024 [cited 2024 23 Feb]; Available from: https://www.ifrs.org/groups/international-sustainability-standards-board/.

- Jebe, R., The convergence of financial and ESG materiality: Taking sustainability mainstream. American Business Law Journal, 2019. 56(3): p. 645-702. [CrossRef]

- International, K. Get ready for the next wave of ESG reporting. 2023 [cited 2024 23 Feb]; Available from: https://kpmg.com/xx/en/home/insights/2023/01/get-ready-for-the-next-wave-of-esg-reporting.html.

- Calabrese, A., et al., Materiality analysis in sustainability reporting: A tool for directing corporate sustainability towards emerging economic, environmental and social opportunities. Technological and Economic Development of Economy, 2019. 25(5): p. 1016-1038. [CrossRef]

- White, K., R. Habib, and D.J. Hardisty, How to SHIFT consumer behaviors to be more sustainable: A literature review and guiding framework. Journal of marketing, 2019. 83(3): p. 22-49. [CrossRef]

- Giese, G., et al., Foundations of ESG investing: How ESG affects equity valuation, risk, and performance. The Journal of Portfolio Management, 2019. 45(5): p. 69-83.

- Oprean-Stan, C., et al., Impact of sustainability reporting and inadequate management of ESG factors on corporate performance and sustainable growth. Sustainability, 2020. 12(20): p. 8536. [CrossRef]

- Khan, M.A., ESG disclosure and firm performance: A bibliometric and meta analysis. Research in International Business and Finance, 2022. 61: p. 101668. [CrossRef]

- Tsang, A., T. Frost, and H. Cao, Environmental, social, and governance (ESG) disclosure: A literature review. The British Accounting Review, 2023. 55(1): p. 101149. [CrossRef]

- Calabrese, A., et al., Integrating sustainability into strategic decision-making: A fuzzy AHP method for the selection of relevant sustainability issues. Technological Forecasting and Social Change, 2019. 139: p. 155-168. [CrossRef]

- Siew, R.Y., A review of corporate sustainability reporting tools (SRTs). Journal of environmental management, 2015. 164: p. 180-195. [CrossRef]

- Matisoff, D.C., D.S. Noonan, and J.J. O'Brien, Convergence in environmental reporting: Assessing the carbon disclosure project. Business Strategy and the Environment, 2013. 22(5): p. 285-305. [CrossRef]

- Ott, C., F. Schiemann, and T. Günther, Disentangling the determinants of the response and the publication decisions: The case of the Carbon Disclosure Project. Journal of Accounting and Public Policy, 2017. 36(1): p. 14-33. [CrossRef]

- Depoers, F., T. Jeanjean, and T. Jérôme, Voluntary disclosure of greenhouse gas emissions: Contrasting the carbon disclosure project and corporate reports. Journal of Business Ethics, 2016. 134: p. 445-461. [CrossRef]

- Nelson, J. and D. Grayson, World business council for sustainable development (WBCSD), in Corporate responsibility coalitions. 2017, Routledge. p. 300-317.

- Wilkinson, A. and D. Mangalagiu, Learning with futures to realise progress towards sustainability: The WBCSD Vision 2050 Initiative. Futures, 2012. 44(4): p. 372-384. [CrossRef]

- Orazalin, N. and M. Mahmood, Determinants of GRI-based sustainability reporting: evidence from an emerging economy. Journal of Accounting in Emerging Economies, 2020. 10(1): p. 140-164. [CrossRef]

- Abeysekera, I., A framework for sustainability reporting. Sustainability Accounting, Management and Policy Journal, 2022. 13(6): p. 1386-1409. [CrossRef]

- Afanasiev, M. and N. Shash, New Information in Financial Disclosures Related to Sustainable Development in the Concept of ESG (Version IFRS). Studies on Russian Economic Development, 2023. 34(5): p. 696-703. [CrossRef]

- Hasmath, S.W.D.M.E.I.D.B.R., The future of sustainability reporting standards. 2021, EY: Oxford.

- GBADEBO, A.D., REVIEW OF THE GLOBAL-IFRS ACCOUNTING AND THE RECENT SUSTAINABILITY-DISCLOSURE STANDARDS. International Journal of Social and Educational Innovation (IJSEIro), 2023: p. 186-200.

- Park, S.K., Sustainable finance in global capital markets, in Research Handbook on Global Capital Markets Law. 2023, Edward Elgar Publishing. p. 236-250.

- Zaid, M.A. and A. Issa, A roadmap for triggering the convergence of global ESG disclosure standards: lessons from the IFRS foundation and stakeholder engagement. Corporate Governance: The International Journal of Business in Society, 2023. 23(7): p. 1648-1669. [CrossRef]

- Lyons, S., General Requirements for Disclosure of Sustainability-Related Financial Information: Response to ISSB Public Exposure Draft. ISSB Public Exposure Draft: IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information, 2022.

- Zdolšek, D. and S.T. Beloglavec. " The 2023's new and the fresh": the International Sustainability Disclosure Standards. in International Scientific Conference on Economy, Management and Information Technologies. 2023.

- Christofi, A., P. Christofi, and S. Sisaye, Corporate sustainability: historical development and reporting practices. Management Research Review, 2012. 35(2): p. 157-172. [CrossRef]

- Exchange, S. Starting with a Common Set of Core ESG Metrics. 2023; Available from: https://api2.sgx.com/sites/default/files/2023-05/SGX%20Core%20ESG%20Metrics_for%20website%20%28updated%20Apr2023%29.pdf.

- Santos, L.G.B.B.L.P. Brazil Sets Global Precedent: First Nation to Embrace ISSB Sustainability Financial Reports. Eye on ESG: Tracking the Transition to Sustainable Business and Finance 2023 [cited 2024 25 Feb]; Available from: https://www.eyeonesg.com/2023/10/brazil-sets-global-precedent-first-nation-to-embrace-issb-sustainability-financial-reports/#more-3780.

- Gadinis, S., Dissonance in Climate Disclosure: the SEC, EU, California, and ISSB Regimes. EU, California, and ISSB Regimes (May 14, 2024), 2024.

- (HKEX), H.K.E.a.C.L. Exchange Publishes Consultation Paper on Enhancement of Climate Disclosure under its ESG Framework. 2023 [cited 2024 23 Feb]; Available from: https://www.hkex.com.hk/news/regulatory-announcements/2023/230414news?sc_lang=en.

- Lee, G.A.P.J.T.W.N.S.R.K.E.Z.J.C.Y. Asia Regulators’ Responses to the ISSB Disclosure Standards. Eye on ESG: Tracking the Transition to Sustainable Business and Finance 2023; Available from: https://www.eyeonesg.com/2023/08/asia-regulators-responses-to-the-issb-disclosure-standards/.

- IFRS. IFRS Foundation opens ISSB office in Beijing. 2023 [cited 2024 23 Feb]; Available from: https://www.ifrs.org/news-and-events/news/2023/06/ifrs-foundation-opens-issb-office-in-beijing/.

- Limited, D.A.P.S., Asia Pacific's Response to the International Sustainability Standards Board (ISSB)'s Finalised IFRS S1 and IFRS S2 Standards, B.H.C. Kuen, Editor. 2023. p. 20.

- Mariani, S.M., Environmental, Social, and Governance (ESG) Matters: Can the SEC Mandate Disclosure? Should the SEC Mandate Disclosure? Notre Dame JL Ethics & Pub. Pol'y, 2023. 37: p. 369.

- Tolkach, V., The importance of international financial reporting standards (IFRS) and the new sustainability reporting standards, IFRS S1 and IFRS S2, in sustainable business development in the US. Věda a perspektivy, 2023(7 (26)). [CrossRef]

- Saadah, S.L.H., UK commits to new ISSB sustainability disclosure standards for capital markets – are you prepared?, in Financier Worldwide Magazine. 2023.

- UK and Singapore Enhance Cooperation in Sustainable Finance and FinTech, M.A.o. Singapore, Editor. 2023: Singapore.

- Groupp, S. SGX RegCo details how sustainability reports should incorporate ISSB Standards. 2024 [cited 2024 6 Mar]; Available from: https://www.sgxgroup.com/media-centre/20240307-sgx-regco-details-how-sustainability-reports-should-incorporate-issb.

- Pizzi, S., S. Principale, and E. De Nuccio, Material sustainability information and reporting standards. Exploring the differences between GRI and SASB. Meditari Accountancy Research, 2023. 31(6): p. 1654-1674. [CrossRef]

- Group, S., Practice Note 7.6 Sustainability Reporting Guide, in Practice Notes. 2016: Singapore.

- Anderson, D.R., The critical importance of sustainability risk management. Risk Management, 2006. 53(4): p. 66-72.

- Shad, M.K., et al., Integrating sustainability reporting into enterprise risk management and its relationship with business performance: A conceptual framework. Journal of Cleaner production, 2019. 208: p. 415-425. [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).