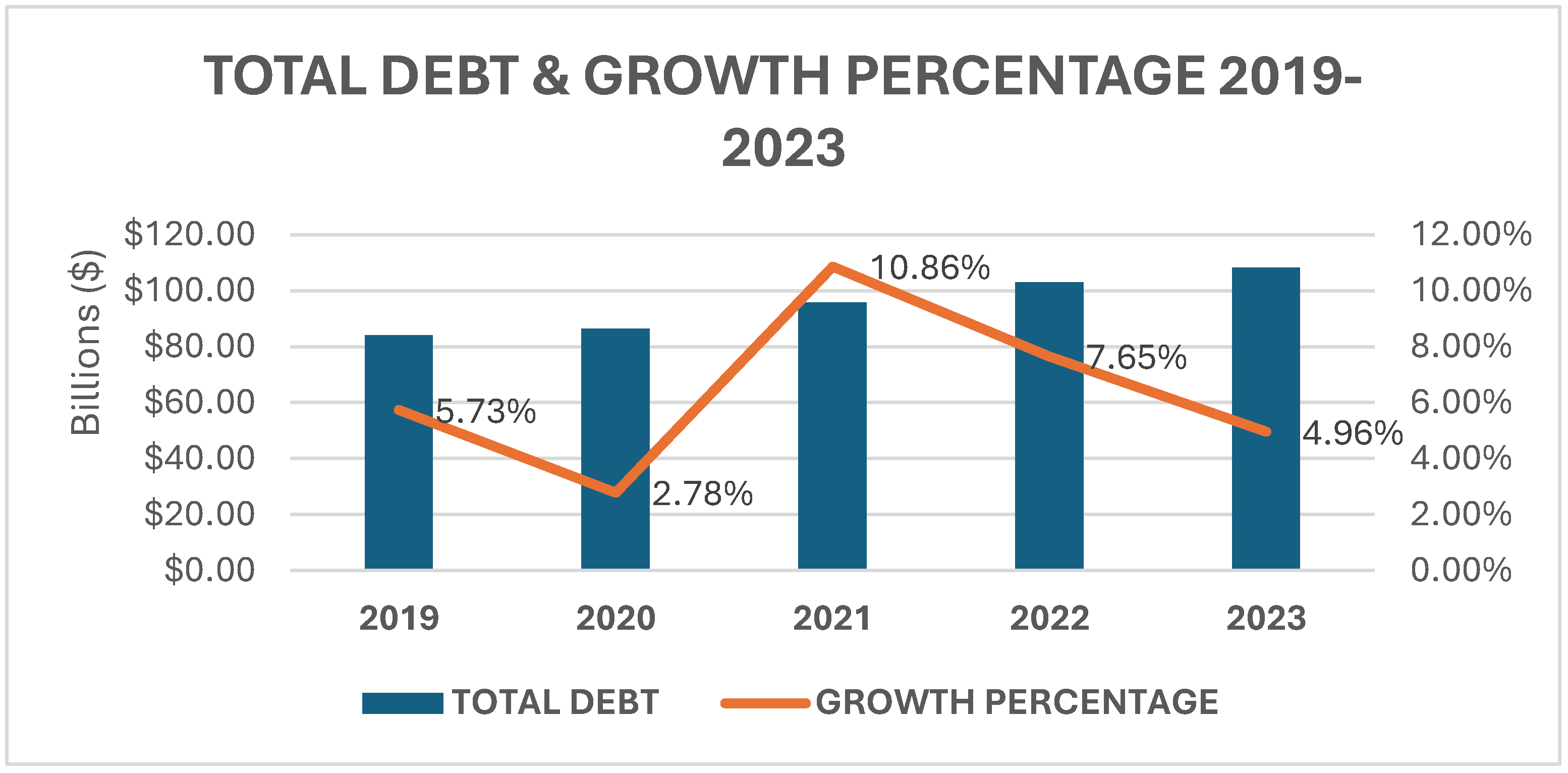

2.1. National Economy and the Housing Affordability Situation in Sub-Saharan Africa

Countries of the world have been classified into three general classes; developed, economies in transition, and developing economies [

14]. These classifications were made with consideration of their gross national income (GNI) which could be high-income, upper-middle income, lower-middle income, and lower income. These classifications are also shared by the World Bank, whose rankings per class are based off Atlas gross domestic product per capita. Economies of the world are classified by [

16] into; advanced, emerging market, middle-income economies and low-income developing countries. Their criteria for classification are based on per capita income, export diversification and integration into the international financial system.

Table 1.

Gross National Income per capita classification for countries.

Table 1.

Gross National Income per capita classification for countries.

| GNI PER CAPITA |

GENERAL CLASSIFICATION |

SPECIFIC CLASSIFICATION |

| < $1,035 |

Developing Countries |

Low-income countries |

|

$1,036 - $4,085 |

Developing Countries |

Lower-middle income countries |

|

$4,086 - $12,615 |

Economies in Transition |

Upper-middle income countries |

| > $12,615 |

Developed Countries |

High-income countries |

The importance attached to this classification is shown in the purchasing power of a country’s currency and its potential for development captured in the GNI per capita. There exists the common conception that the propensity of households to afford housing is a reflection of their country’s economic performance. If one is to follow that thought, then advanced economies have a greater propensity for affordable housing than emerging or developed economies. In a study on housing affordability, [

18] discovered that housing in more productive cities, tend to be less affordable and housing affordability worsens as city population, urban extent density and regulatory restrictions in land supply increase. Lagos and its ‘seam bursting’ population agrees with [

18] discovery and its effect has become evident even in its subprime areas.

Table 2.

Gross National Income per capita classification for countries.

Table 2.

Gross National Income per capita classification for countries.

| GROUP |

GNI PER CAPITA |

| Low-income countries |

< $1,145 |

| Lower-middle income countries |

$1,146 - $4,515 |

| Upper-middle income countries |

$4,516 - $14,005 |

| High-income countries |

> $14,005 |

The state of the economy has an overarching impact on housing affordability, as it presents the metrics by which the economic performance of a nation for a fiscal year, can be adjudged. The works of [

20,

21,

22] revealed the impact of a nation’s economic state on the condition of housing affordability within it. Under economic performances rated by international regulatory commissions like The World Bank, International Monetary Fund, United Nations, etc. most nations of the world have been grouped into classes based on their level of development. Nigeria falls in the class of lower-middle-income countries.

2.2. Fundamental Factors Contributing to the Present Contracted Economy

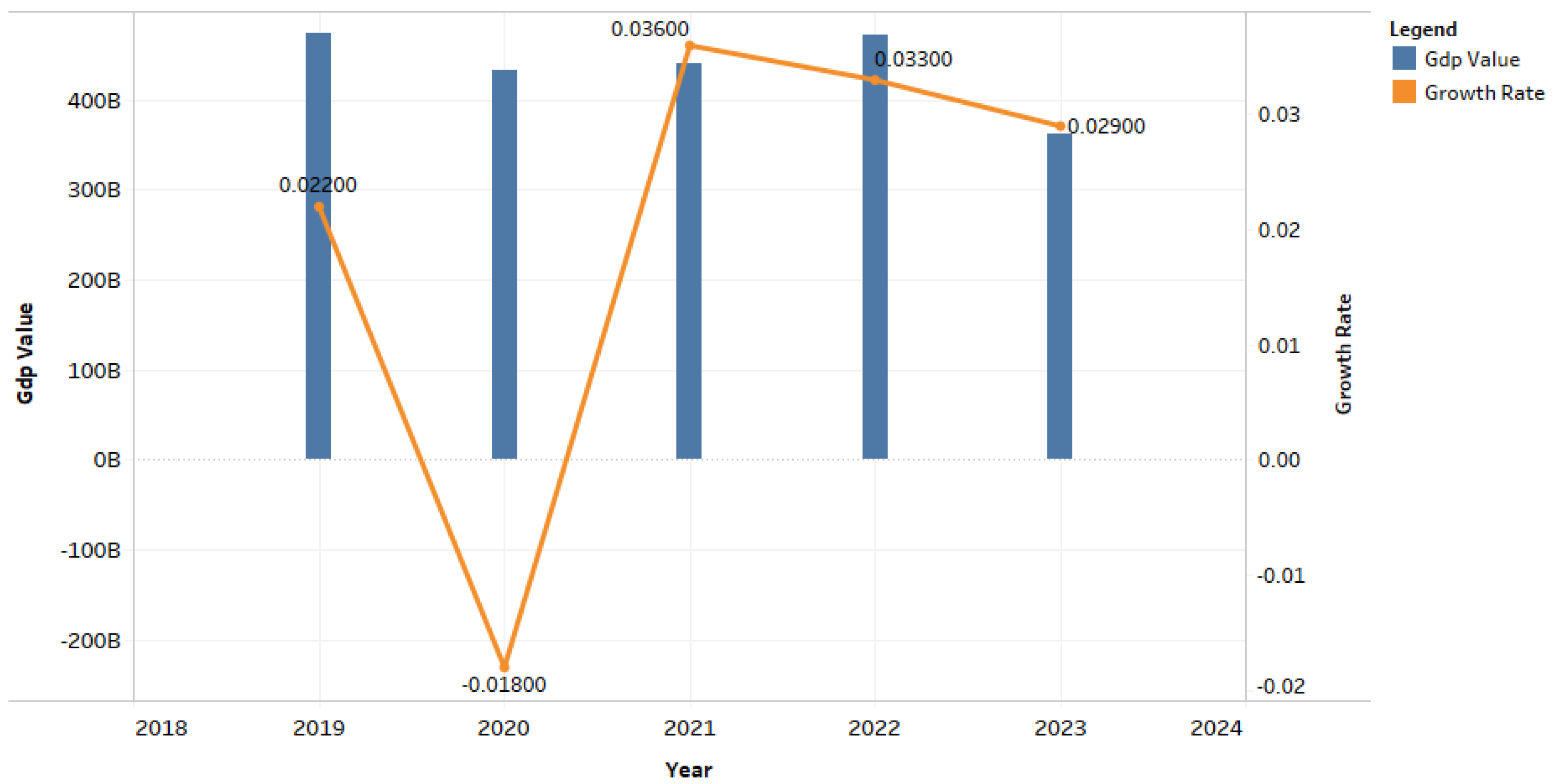

The Nigerian Gross Domestic Product has been witnessing a drop in economic performance before the Global pandemic years, which witnessed an international drop in the economic performance of most nations. From 2019, this drop in economic performance would also be seen in the per capita for both Gross Domestic Product (GDP) and Gross National Income (GNI).

With external shocks playing a role in the recessed economic performance of the nation, the wrong mix of domestic policies has largely been attributed to its poor performance. The issue of fuel subsidy which was powering unsustainable costs and growing domestic and foreign debt, would lead to the government removing the fuel import subsidy. As [

23] observed, high macroeconomic instabilities are prone to occur in such removal of fuel subsidies, without the deployment of ‘economic safety nets’ and ‘adjusted mechanisms’ to cushion the harsh impact. The systematic change of local currency value determination by the dollar to its determination by market forces; the sustained minimum wage of ₦30,000 since 2019 and the exit of over twenty-plus multinational companies between 2020 to 2023 contributed to the wrong mix of domestic policies that influenced the Nigerian GDP and GDP growth rate performance between 2019-2023.

Figure 1.

Gross Domestic Product (

$) and Growth rate Figures between 2019-2023.

Source: [

24].

Figure 1.

Gross Domestic Product (

$) and Growth rate Figures between 2019-2023.

Source: [

24].

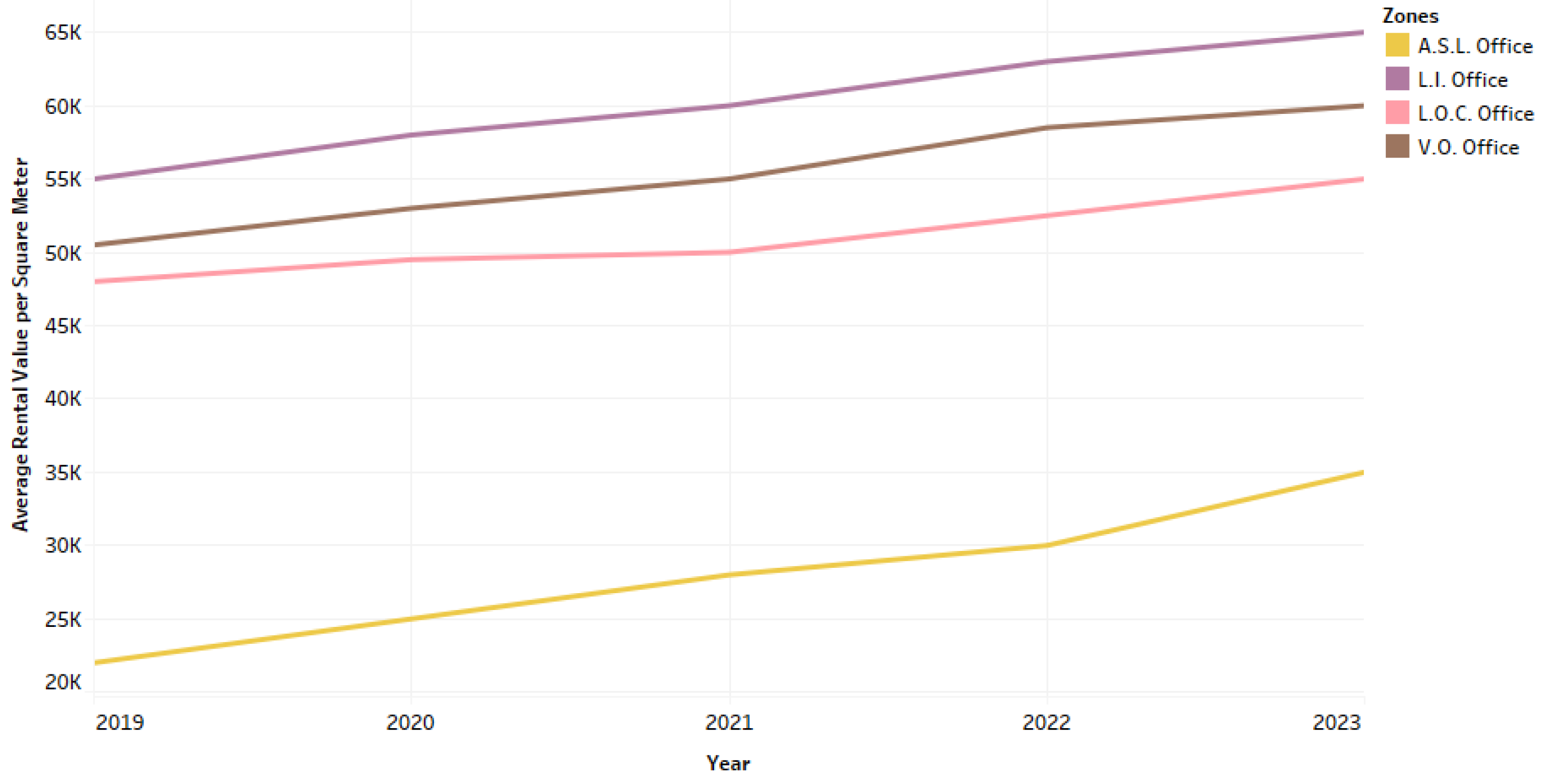

Figure 2.

Exited Companies from Nigeria between 2019-2022.

Source: [

25,

26].

Figure 2.

Exited Companies from Nigeria between 2019-2022.

Source: [

25,

26].

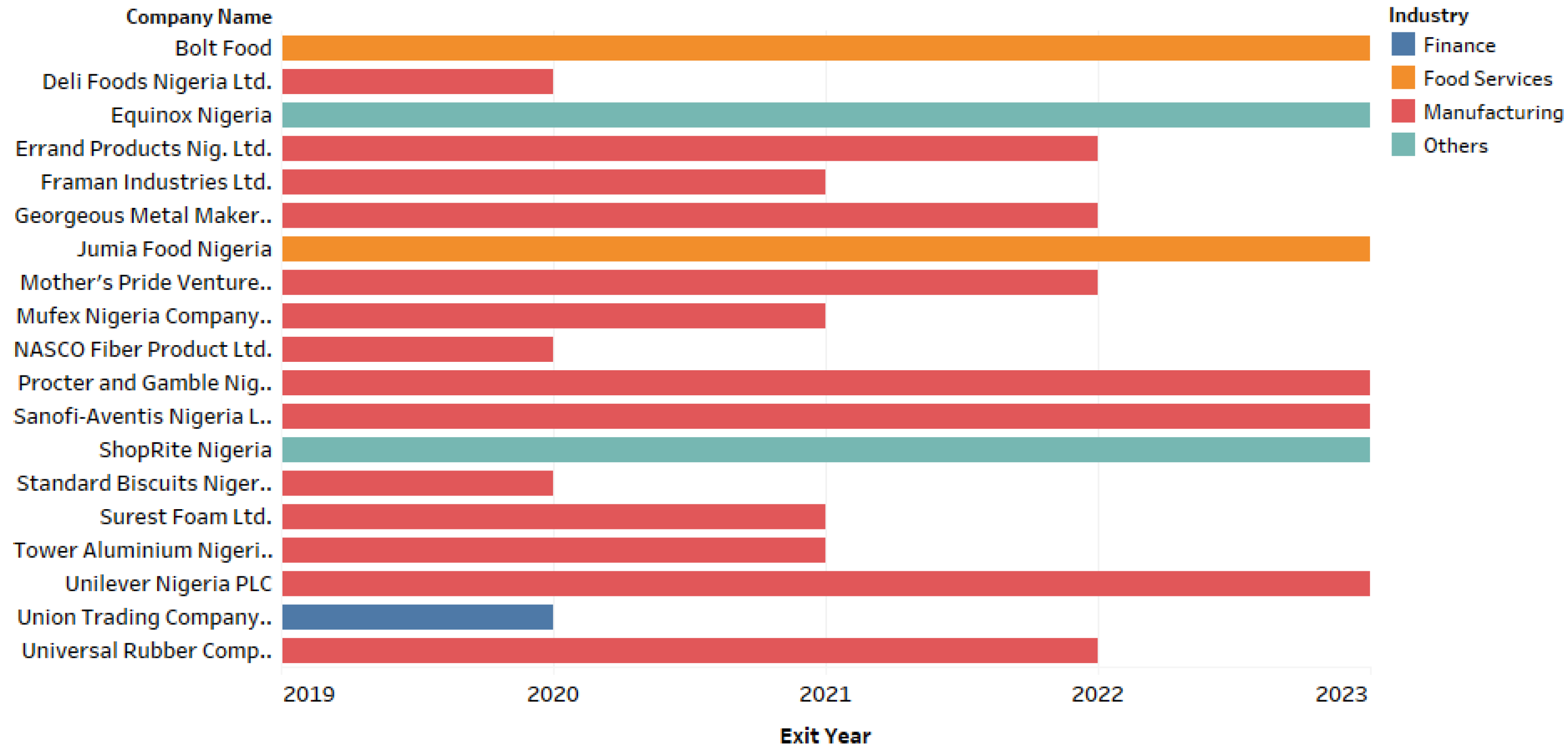

With the lifting of some forex controls and the direction of banks by the Central Bank of Nigeria to quote the naira at prevailing market rates, the Nigerian currency experienced another devaluation which has taken a toll on its purchasing power. Between 2022 and 2023, there is almost a 100% increase in its exchange equivalent to the naira and by the end of the first quarter of 2024, it is approaching 200%.

Figure 3.

Dollar to Naira Exchange equivalent between 2019-2023.

Source: [

27,

28,

29,

30,

31].

Figure 3.

Dollar to Naira Exchange equivalent between 2019-2023.

Source: [

27,

28,

29,

30,

31].

Table 3.

Naira per International Purchasing Power Parity (PPP).

Table 3.

Naira per International Purchasing Power Parity (PPP).

| YEAR |

$ |

₦ |

| 2019 |

1 |

129.269 |

| 2020 |

1 |

134.6 |

| 2021 |

1 |

146.7 |

| 2022 |

1 |

152.6 |

| 2023 |

1 |

165.8 |

Table 4.

Nigeria’s GDP and GNI per Capita between 2019-2023.

Table 4.

Nigeria’s GDP and GNI per Capita between 2019-2023.

| YEAR |

GDP ($) |

GNI ($) |

| 2019 |

2,334 |

2,110 |

| 2020 |

2,074.6 |

2,110 |

| 2021 |

2,065.8 |

2,160 |

| 2022 |

2,162.6 |

2,160 |

| 2023 |

1,621.1 |

1,930 |

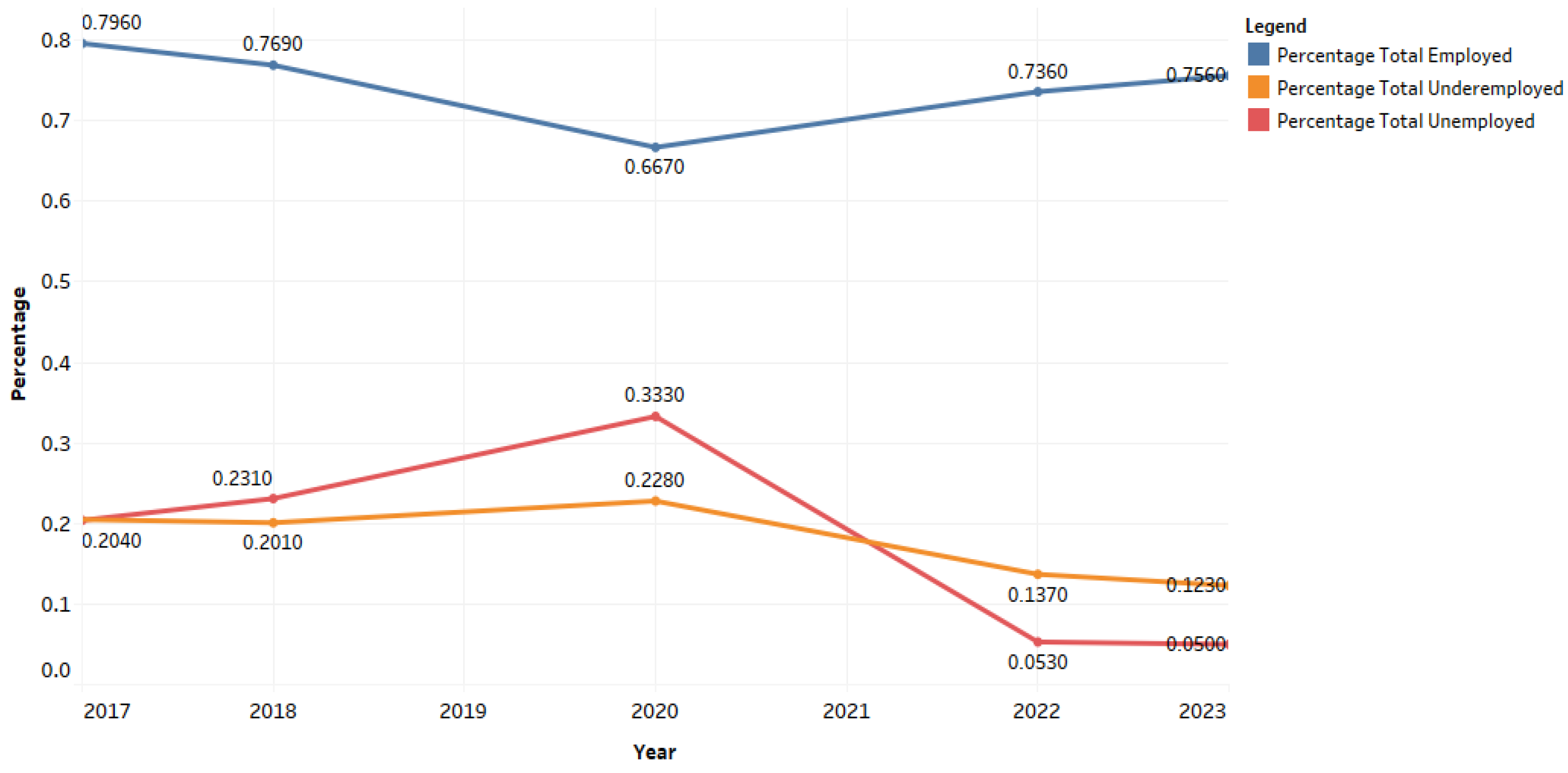

Table 5 serves as a productivity and prosperity measure for Nigeria between 2019-2023. With a drop in both GDP and GNI per capita, the average Nigerian citizen still falls within the lower-middle income countries classified by the United Nations and the World Bank. These fundamentals are used in appraising the consumer well-being and investment situation in the country. Thus, even with an improving workforce statistic, an average Nigerian worker faces the possibility of not affording basic needs such as housing due to dwindling economic performances.

Figure 6.

Labour force statistics between 2017-2018, 2020 and 2022-2023 in Nigeria.

Source: [

34,

35,

36,

37,

38].

Figure 6.

Labour force statistics between 2017-2018, 2020 and 2022-2023 in Nigeria.

Source: [

34,

35,

36,

37,

38].

The growth in a country’s workforce should indicate that productivity is its goal and revenue generation should witness an increase, but the Nigerian economy has witnessed less productivity and more spending in the last five years. The spending streak has not been outrageous like its sister countries with top economic performances in Africa, but it has been concerning for a nation trying to shake off its dependence on the oil sector.

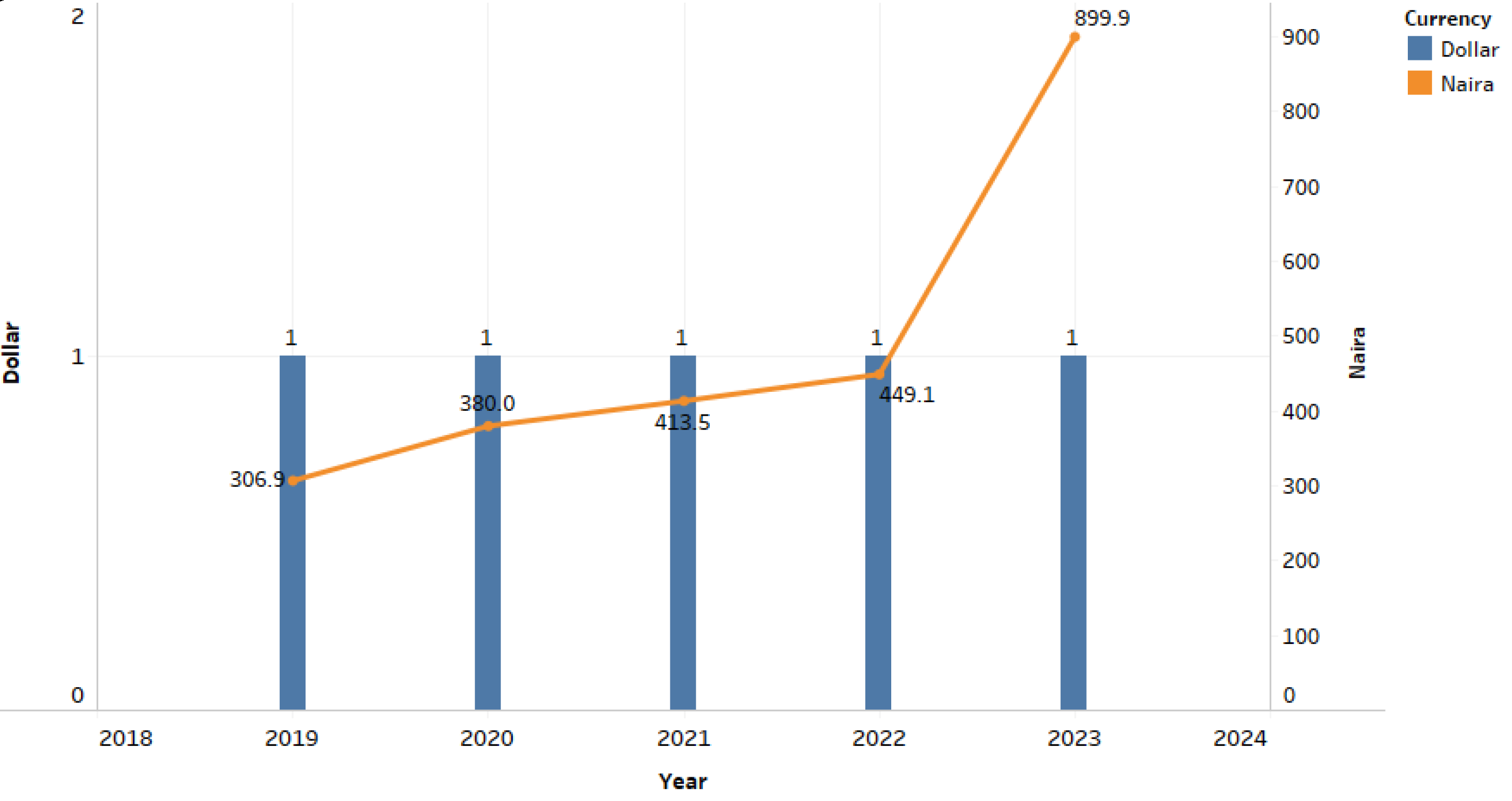

Figure 7.

Nigeria’s debt profile 2019-2023.

Source: [

39,

40,

41,

42,

43].

Figure 7.

Nigeria’s debt profile 2019-2023.

Source: [

39,

40,

41,

42,

43].

Nigeria’s debt profile has grown considerably, with a portion of its budget set out each year to offset it. Its largest leap in debt earned was recorded in 2020-2021 when a 10.86% increase in debt burden was realized. With the Buhari administration on one end, keen on executing key infrastructure within the nation, the monstrous fuel subsidy expenditure was eating deep into the financial resources of the nation on the other end and this further occasioned more borrowings.

Figure 8.

Total debt & growth percentage 2019-2023.

Source: [

39,

40,

41,

42,

43].

Figure 8.

Total debt & growth percentage 2019-2023.

Source: [

39,

40,

41,

42,

43].

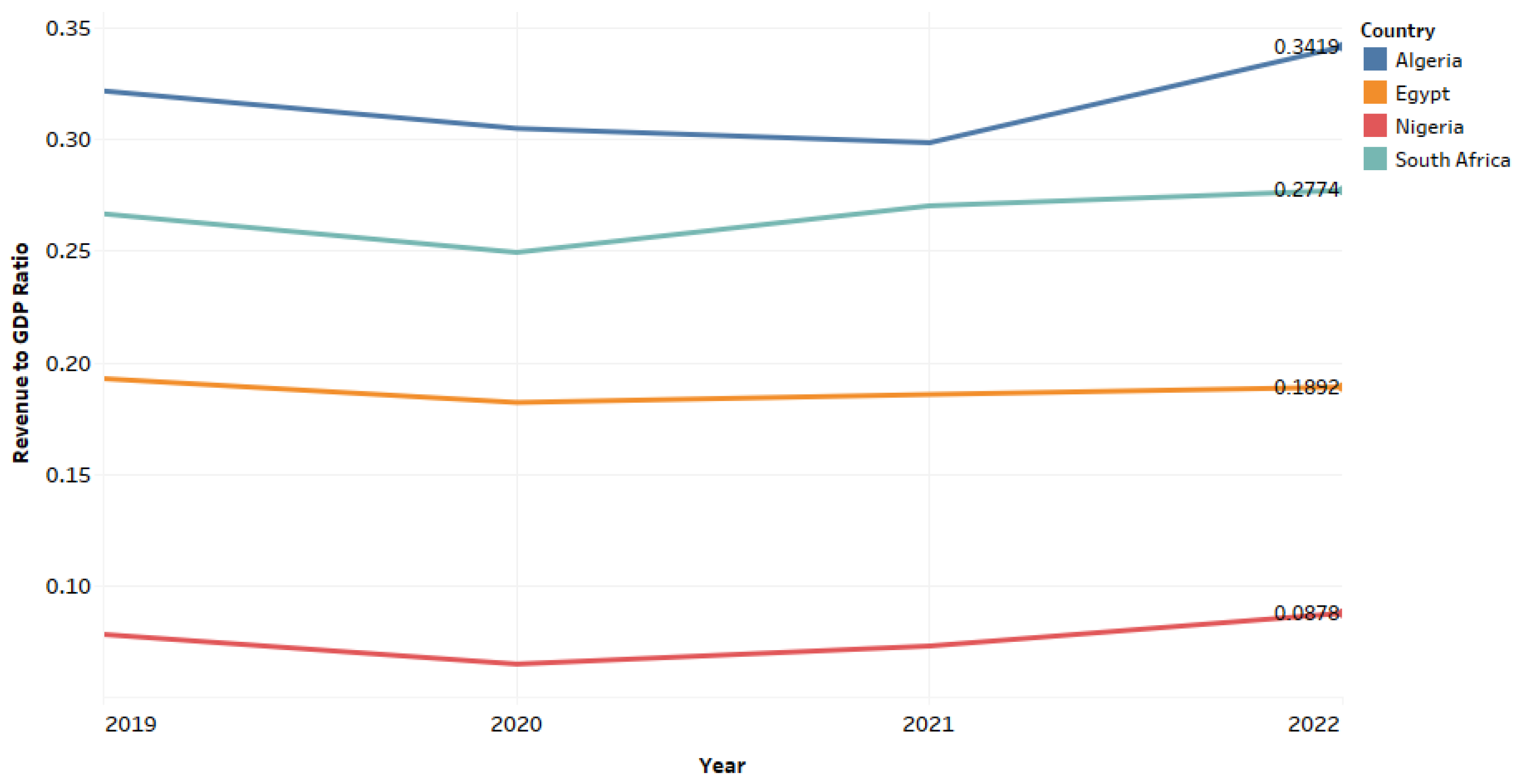

What is considered worrisome is the increased debt profile of the nation by the end of 2023, as the Tinubu administration had devoted itself to the removal of the fuel subsidy. Most high-performing economies in the world possess debt burdens but it doesn’t erode their performance and sustainability, as there are policies in place to ensure productivity and revenue are maximized. Nigeria has a lot to learn in that regard, as our policies are failing productive sectors from hitting their full potential and lacking the capacity to be taxed optimally in supporting the government’s revenue.

Figure 9.

Revenue to GDP ratio of top economic African countries between 2019-2022.

Source: [

15,

16,

17].

Figure 9.

Revenue to GDP ratio of top economic African countries between 2019-2022.

Source: [

15,

16,

17].

The above figure shows that other top-performing African economies have a revenue-to-GDP ratio higher than 10-20%. Nigeria has not hit the 20% landmark since its fall to 10% in 2009 [

16]. Its last recorded revenue-to-GDP ratio higher than 10%, was recorded in 2011 at 17%. From 2014, it had not crossed beyond 10%.

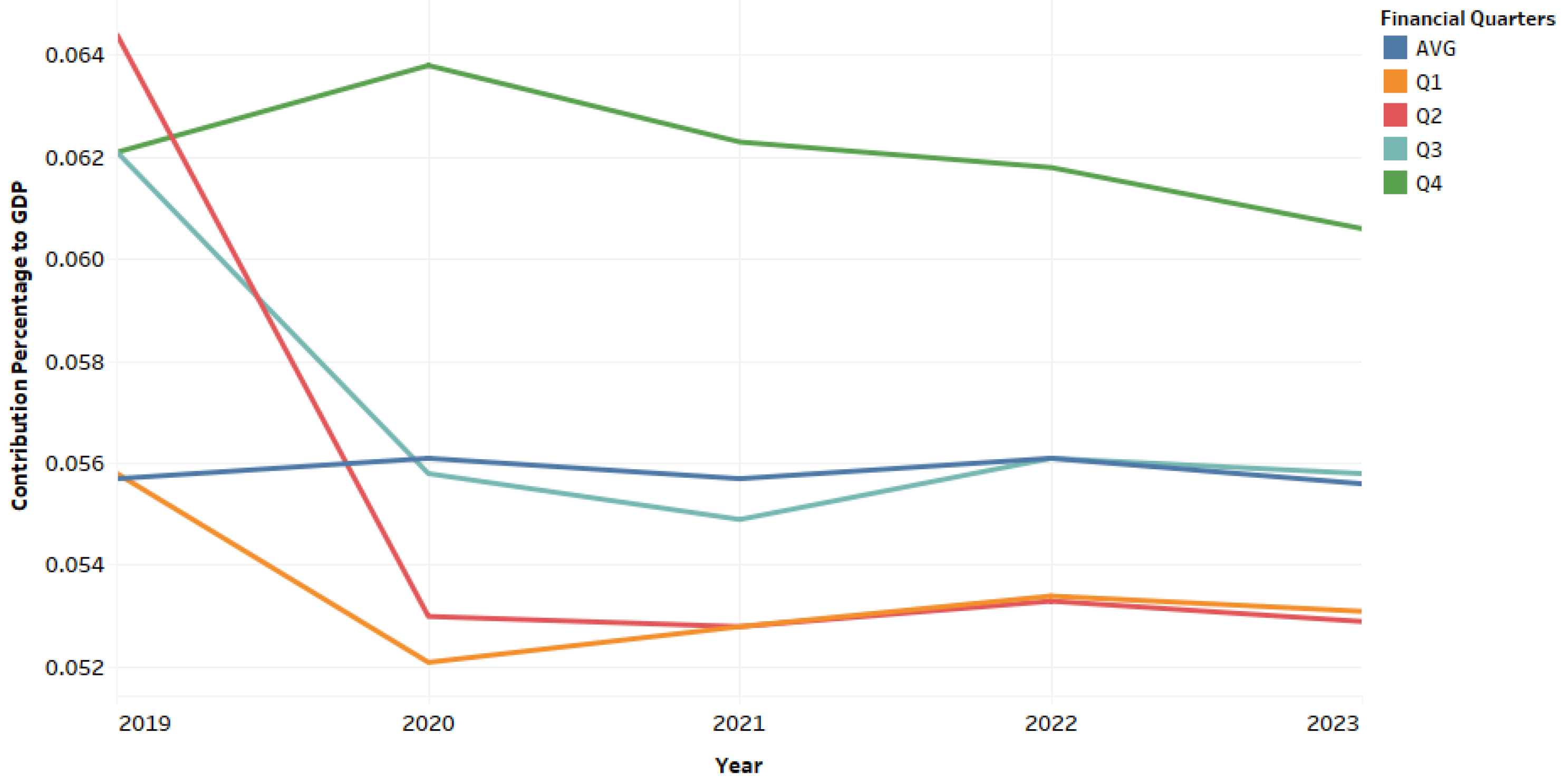

Figure 10.

Real Estate Sector’s Quarterly Contribution to GDP between 2019-2023.

Source: [

44,

45,

46,

47,

48].

Figure 10.

Real Estate Sector’s Quarterly Contribution to GDP between 2019-2023.

Source: [

44,

45,

46,

47,

48].

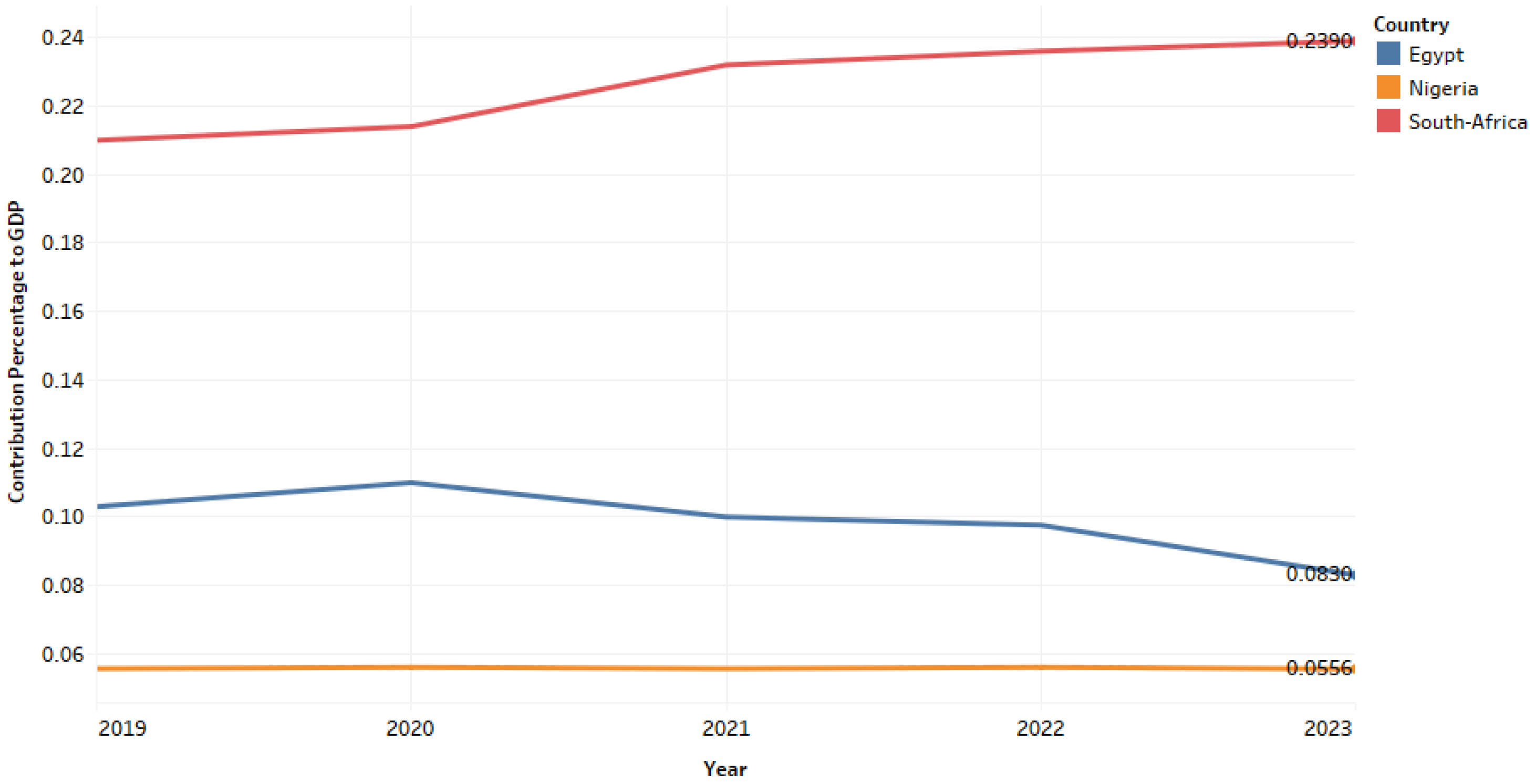

Even the contributions of the real estate sector are not spared from this recession, as there has been a drop in its sector contribution to the national real GDP from 6.41% recorded in 2018 to 5.56% at the end of the 2023 fiscal year. A quick comparison between top-performing African economies and their real estate contribution to real GDP between 2019 to 2023 impresses a lot about how improvement is needed in the Nigerian situation.

Figure 11.

Comparisons of top performing African GDPs and their real estate contributions.

Source: [

32,

44,

45,

46,

47,

48,

49,

50,

51,

52,

53,

54].

Figure 11.

Comparisons of top performing African GDPs and their real estate contributions.

Source: [

32,

44,

45,

46,

47,

48,

49,

50,

51,

52,

53,

54].

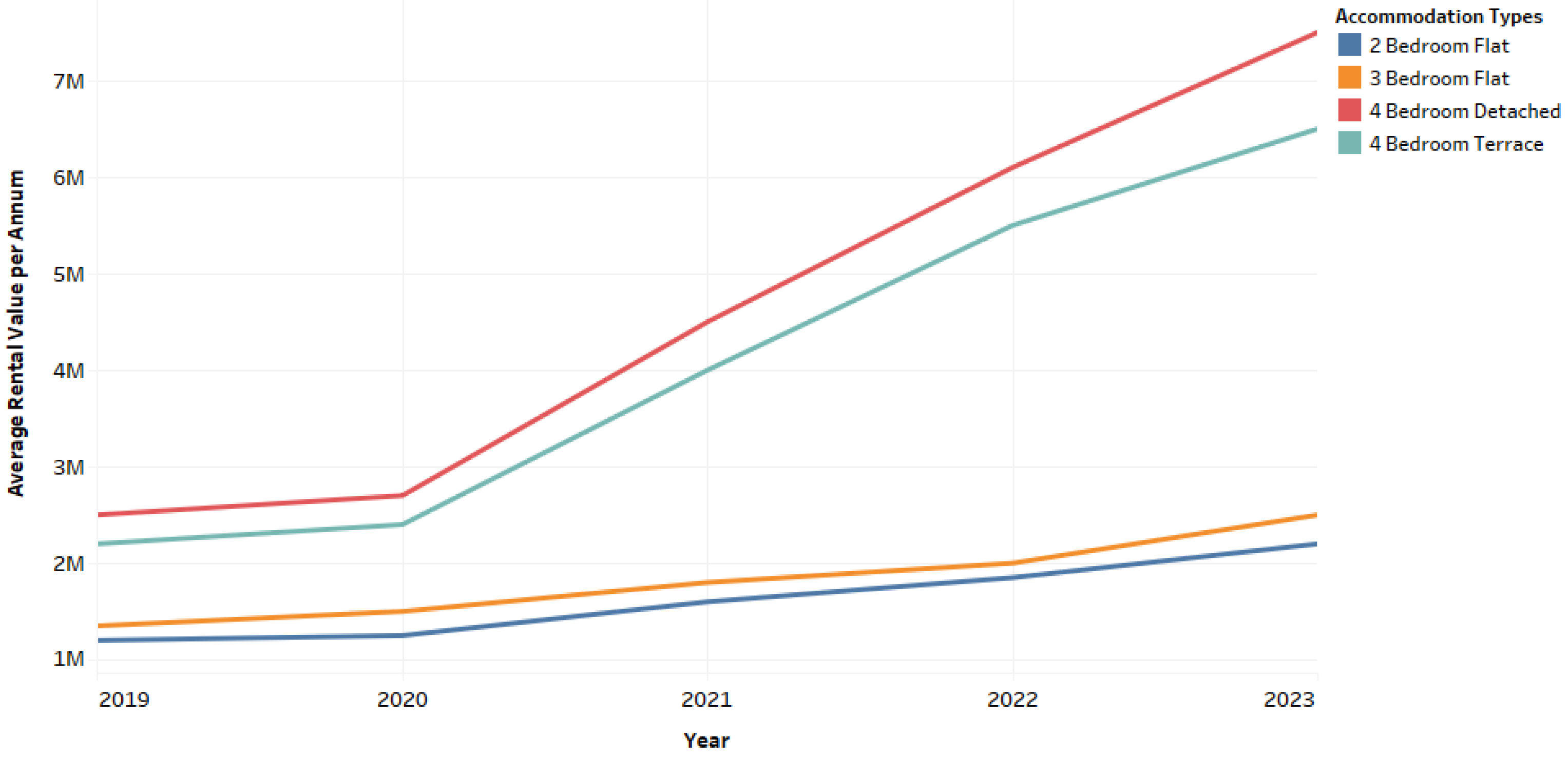

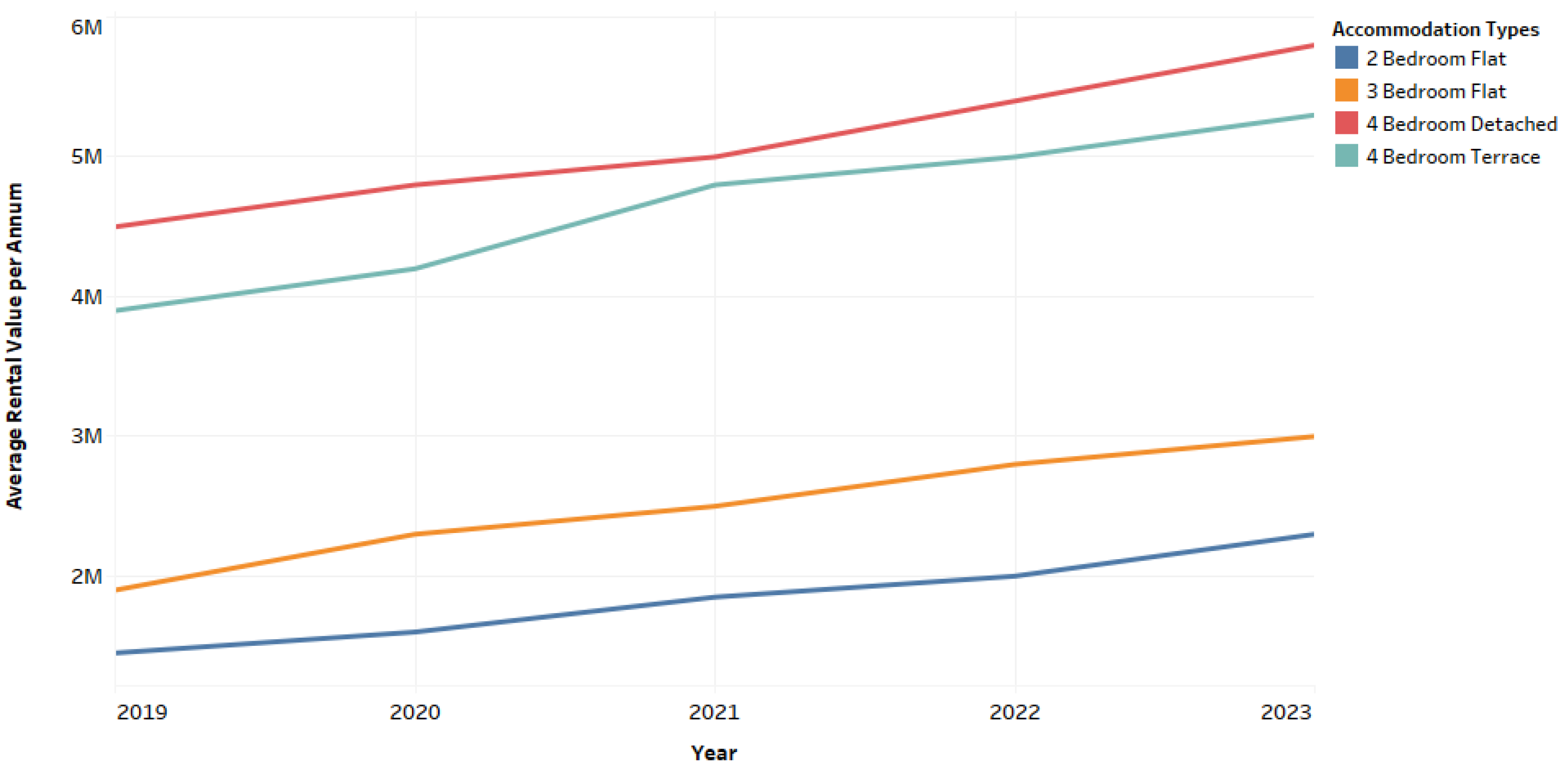

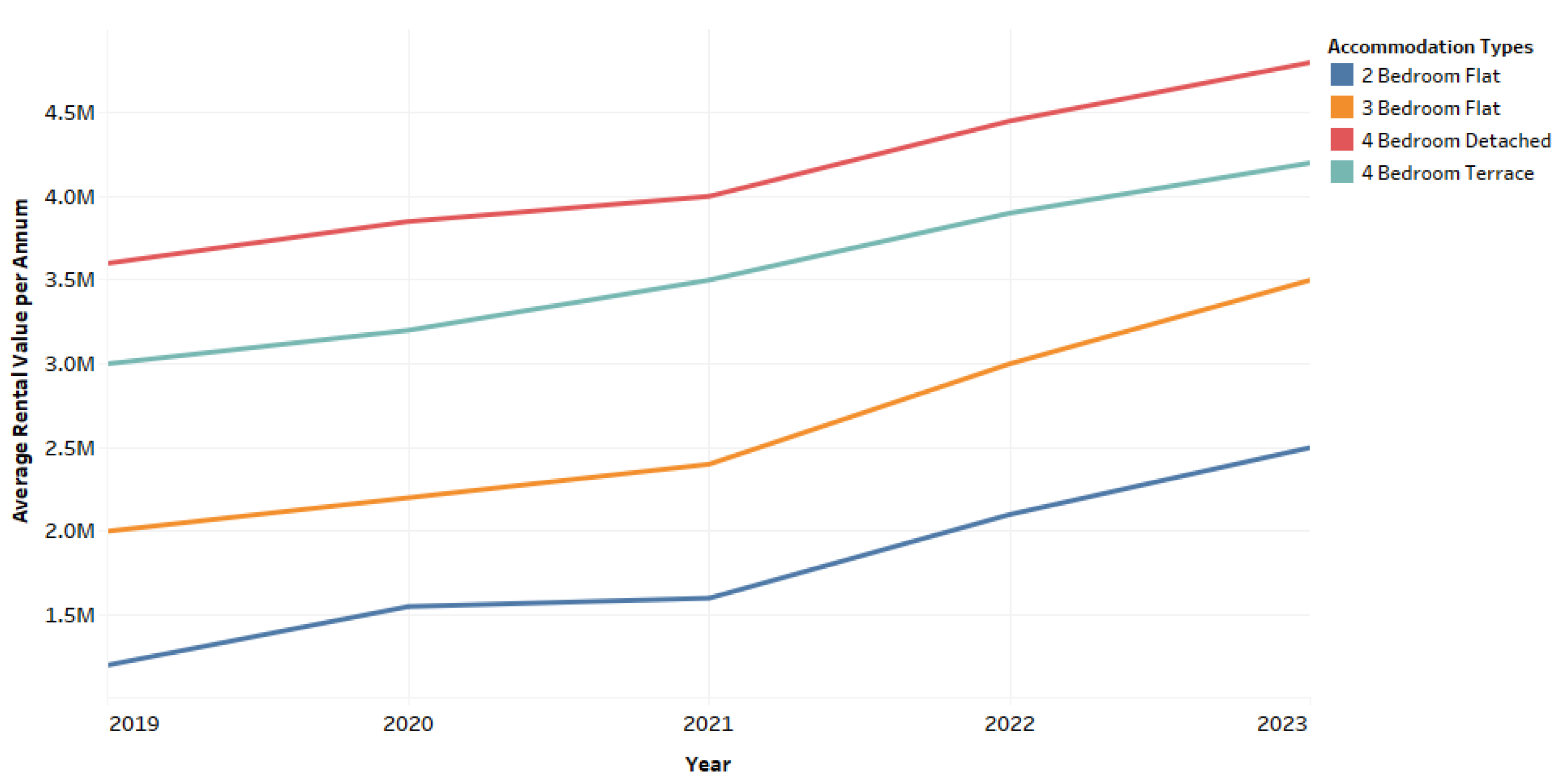

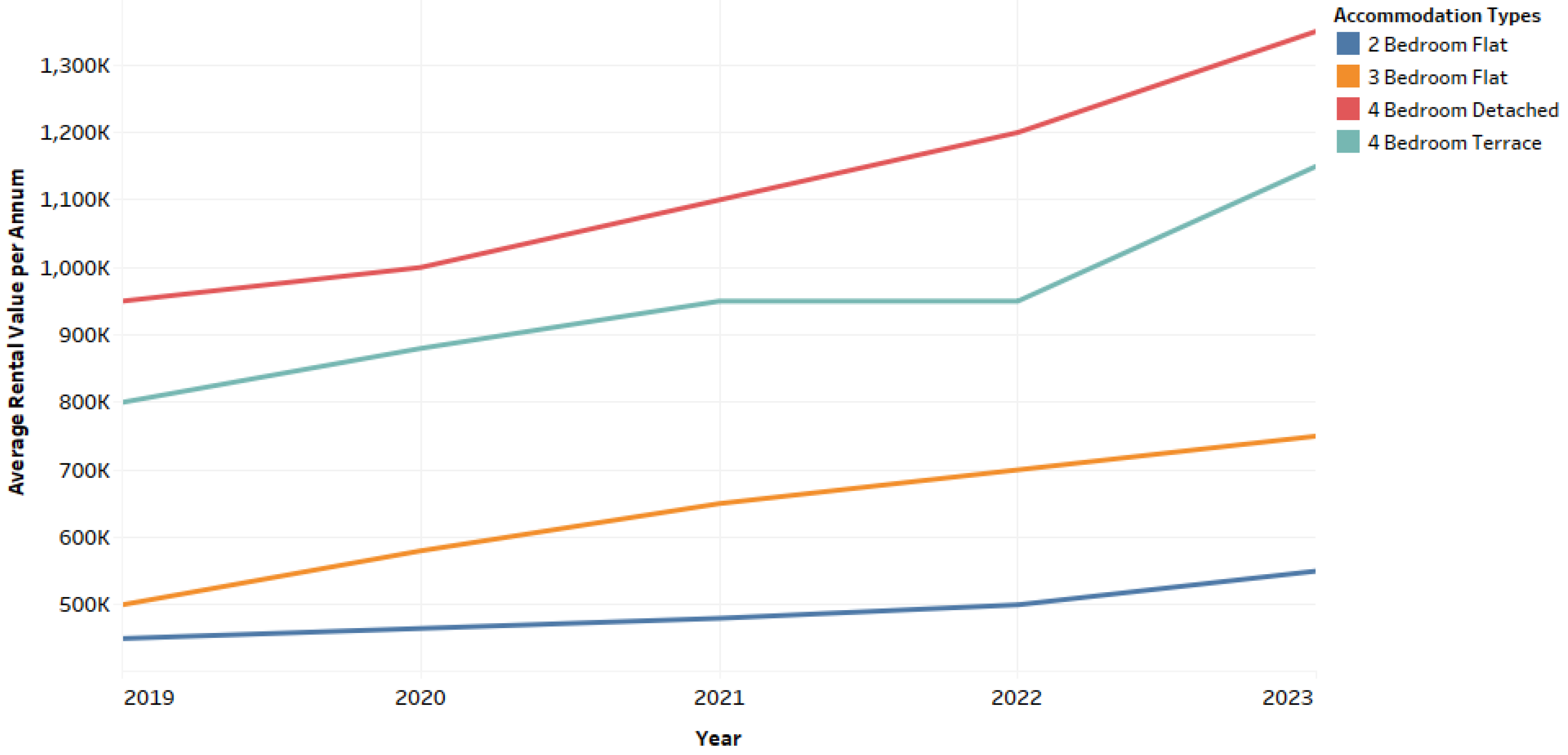

Housing affordability in both rental and sale contexts have been affected by the rising price level of goods and services in the country. It has been adduced that a relationship exists between the rising inflation rate and construction prices in Nigeria [

55]. Their submission correlates with the studies of [

56,

57,

58].

The Nigerian inflation situation is the same for most developing economies, signified by double-digit rates and eroding purchasing power [

59]. Such increase has been deduced as a consequence of sub-Saharan Africa’s poor manufacturing output [

60]. Increased migration and urbanization, which for cities like the Lagos metropolis, leads to increased property demand, low property supply, and increased development costs.

With studies such as [

61,

62] which reveal house prices as stable inflation hedges in the long run, the prospect of affordability dims in the light of the present economic situation in the country. This is captured in the studies of [

12,

63,

64,

65,

66] which reveal real estate hedging potential as intermittent, time-varying, asymmetric, sectorial differential and cyclic in periods. Housing as a product is dependent on inflation and where there is an increase in interest rates, it inspires a search for alternative accommodations and ultimately a depression in housing prices [

67,

68,

69]

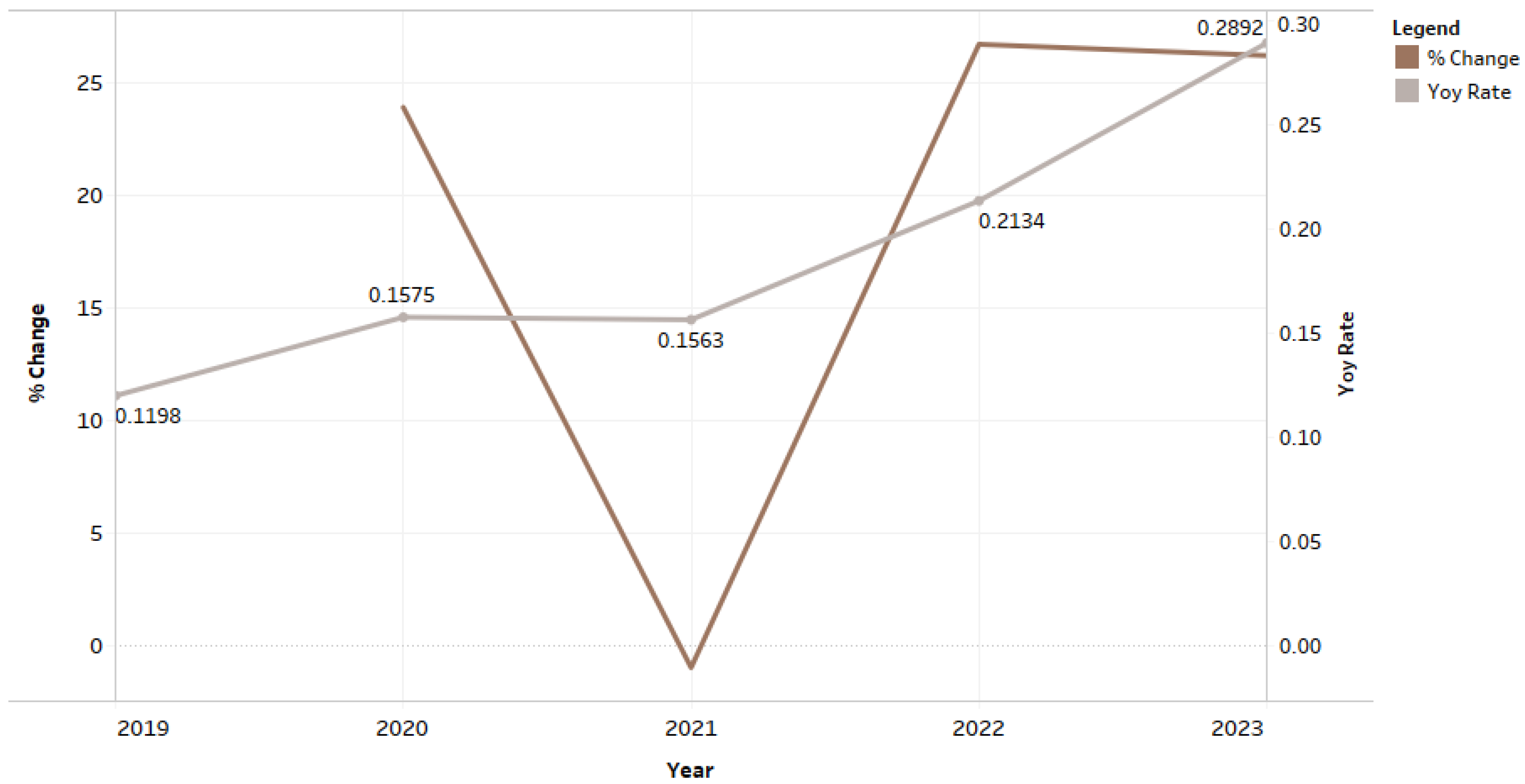

Figure 12.

Year-on-Year inflation in Nigeria between 2019-2023.

Source: [

27,

28,

29,

30,

31,

44,

45,

46,

47,

48].

Figure 12.

Year-on-Year inflation in Nigeria between 2019-2023.

Source: [

27,

28,

29,

30,

31,

44,

45,

46,

47,

48].

With the growing levels in the double-digits of the consumer price index in the country’s economy, its two-fold impact was witnessed in the reduced purchasing power of the naira for certain commodities and the rise in the cost/price of goods and services. This, in turn, has led to the adoption of the cost-transfer alternative by most business enterprises in a bid to stay afloat or break even.

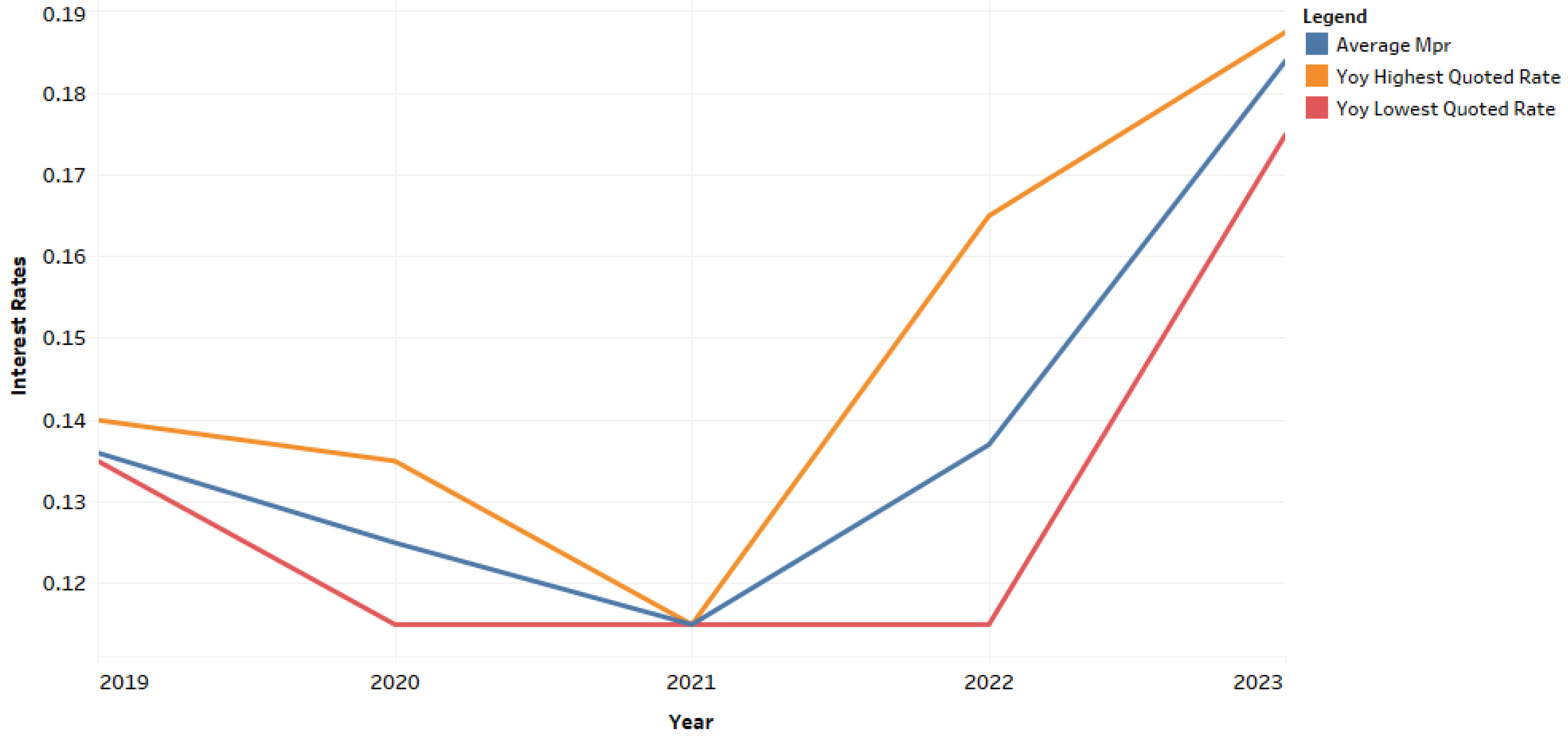

With a steadily rising year-on-year inflation rate (mostly influenced by food inflation), the nation’s interest rate spiked considerably over five years. These spikes were targeted at curbing rising inflation but it has slowed economic growth in 2024, such that the International Monetary Fund revised its economic growth projection for Nigeria in 2024 from 3.3% to 3.1%. With slowed production in the country due to a host of factors, more money chased the available stock of production. These available stocks of production have also begun to command higher costs/prices via transfer costs from producers and distributors alike. Thus, the ability to own and enjoy goods and services is available for those with above average means.

Figure 13.

Nigeria’s interest rate between 2019-2023.

Source: [

27,

28,

29,

30,

31].

Figure 13.

Nigeria’s interest rate between 2019-2023.

Source: [

27,

28,

29,

30,

31].

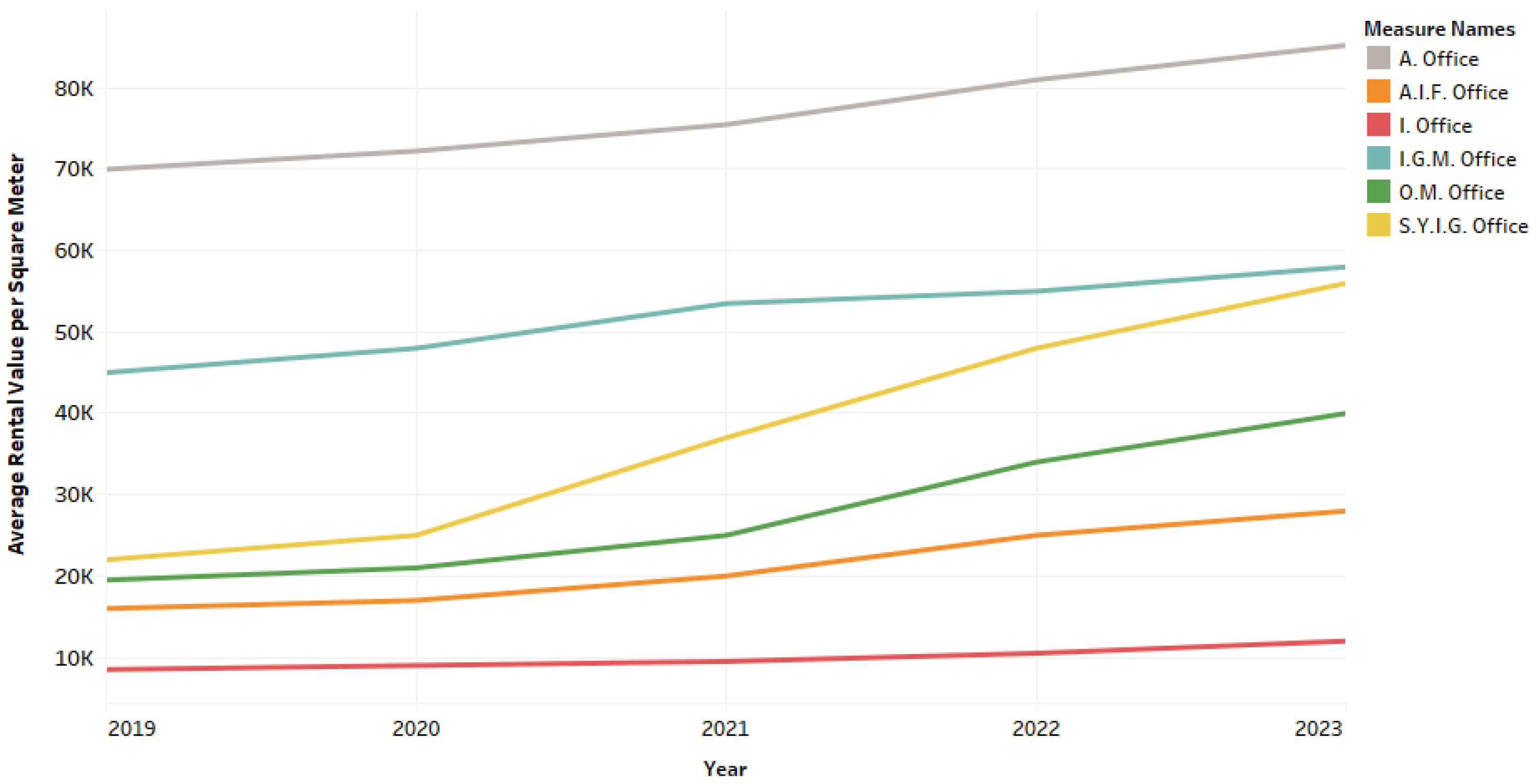

From

Figure 9, we see a 25% increase in the MPR between 2019 and 2023 and when placed side by side with the contributions of the real estate sector to the National real GDP between 2019-2023, we see that the policies instituted by the apex bank have not yet been able to create an investment environment, capable of increasing the country’s real GDP. The control measures adopted by the apex bank to avoid negative returns can be perceived as reactionary responses to the symptoms, as the main causes are yet to be addressed. Rising nominal interest rates are seen as a natural response to an economy experiencing free money and the opposite to one experiencing tight money, but its use as a metric to weigh monetary policy stances are often viewed as imperfect [

70,

71]. Nominal GDP growth and inflation can reveal the stability of a nation’s monetary background and this might explain why the impact of such a rise in interest rate might not necessarily be felt in the prices of various accommodation types in their respective markets [

72,

73]. Fluctuations in the country’s lending rate have been observed to influence price increases in properties [

74,

75]. With the ideology of housing affordability metamorphosing from the concepts of cost-to-income; and ease in accessing housing to sustainability, it has become clear that true housing affordability rests not only on the cost’s comparisons attached to it but also on its sustainability. Thus, a review of the economic trend of the nation, became necessary to reflect on the affordability and sustainability of housing needs today.

From the foregoing fundamentals, the nation Nigeria is going through one of its economic lows and while these events are anticipated to be cyclic, their impact on housing affordability to the common man is morphing into a luxurious choice.

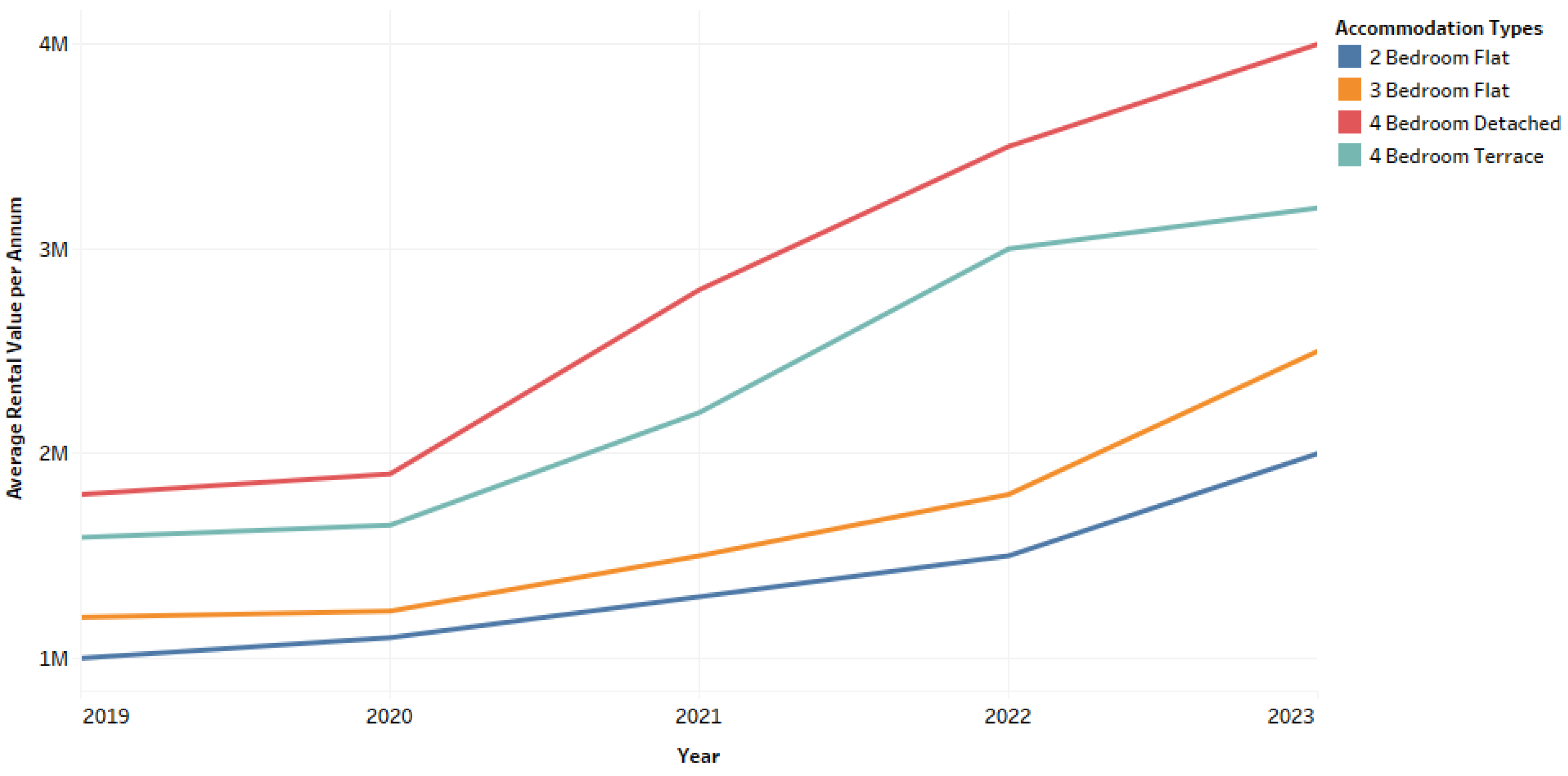

2.3. Methodology

It is appropriate for research to follow a specific methodology. In this study, the mixed research design has been adopted. The mixed research design refers to a combination of qualitative and quantitative research techniques in finding answers to the research question.

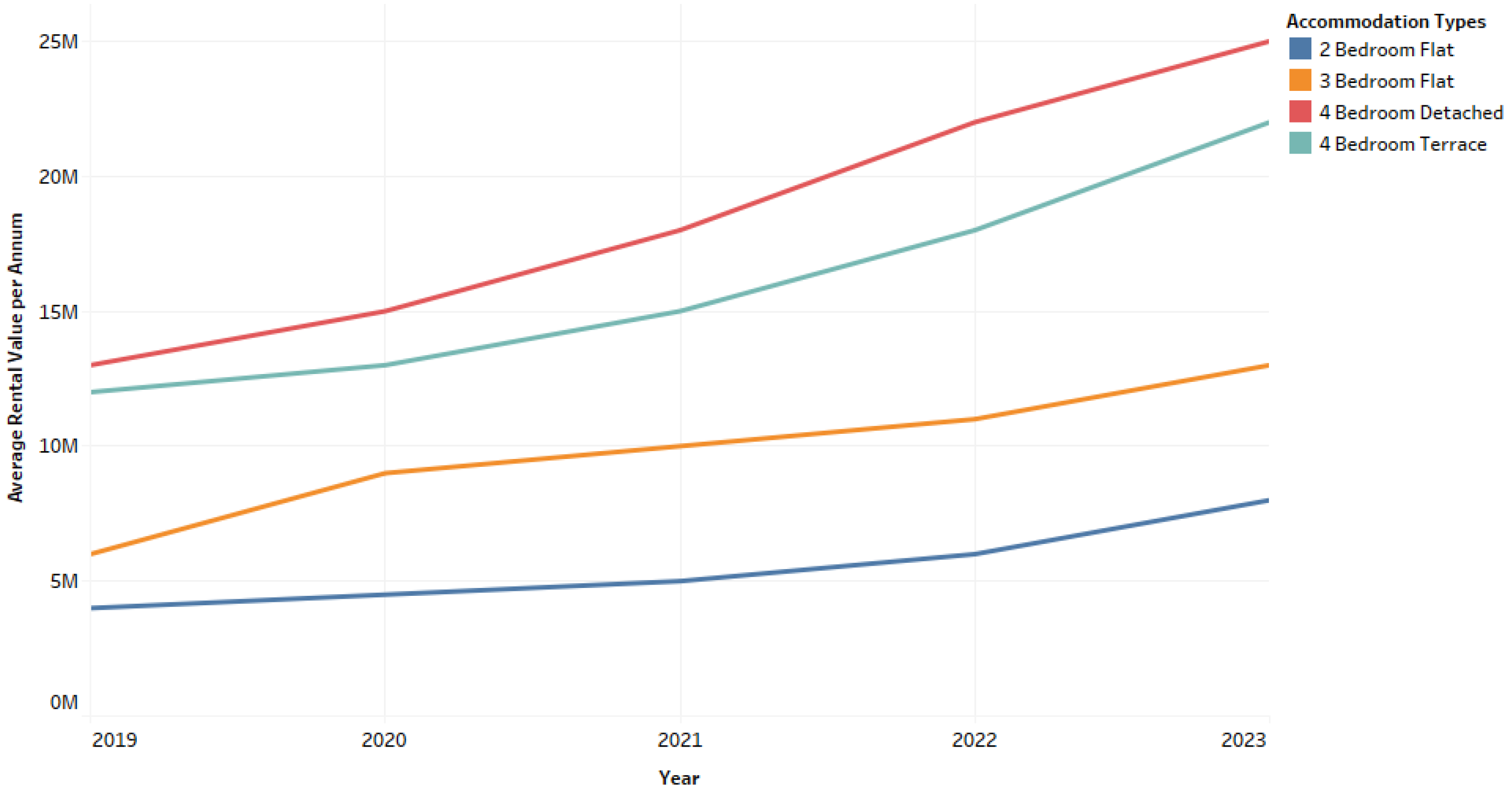

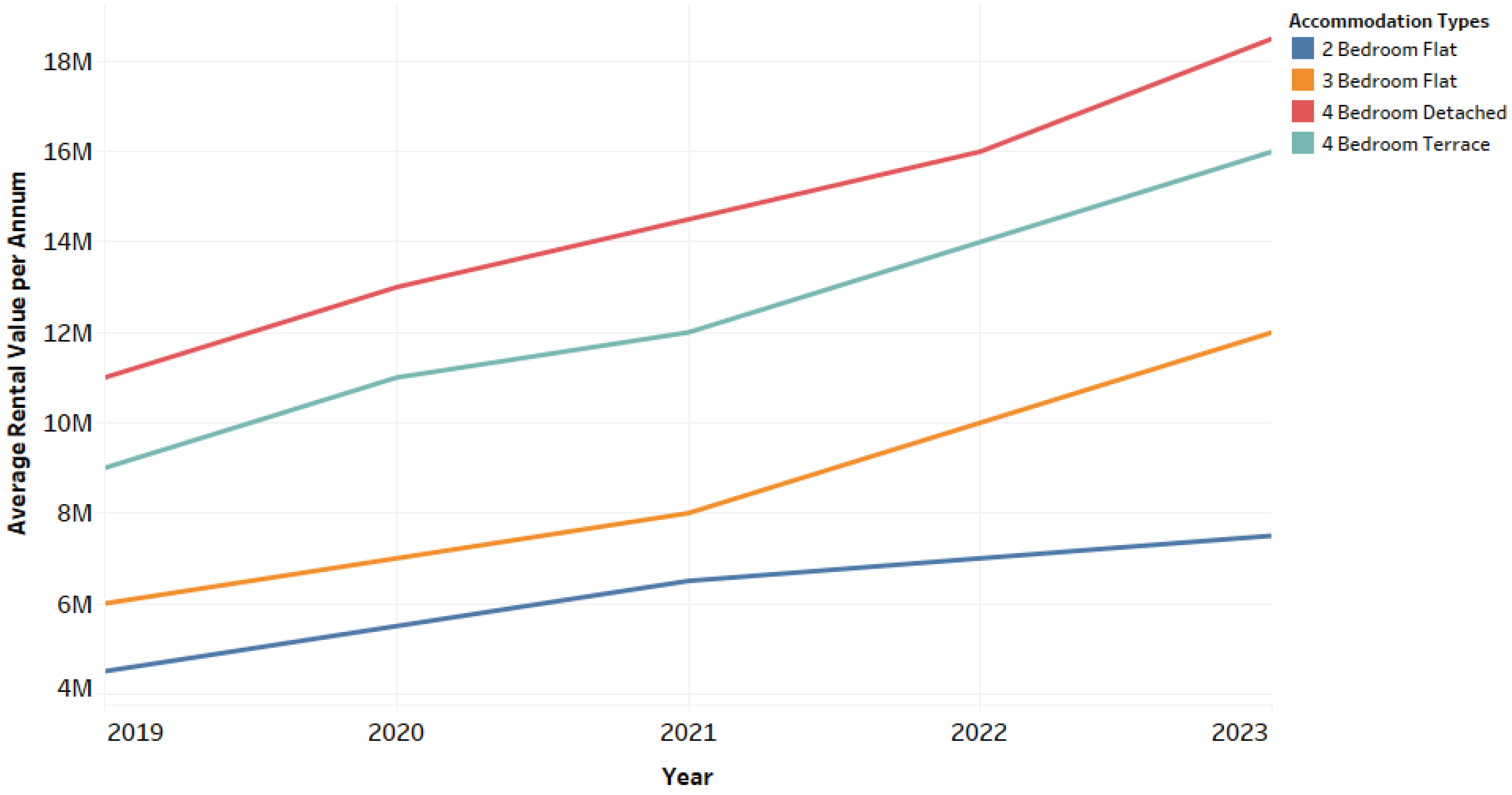

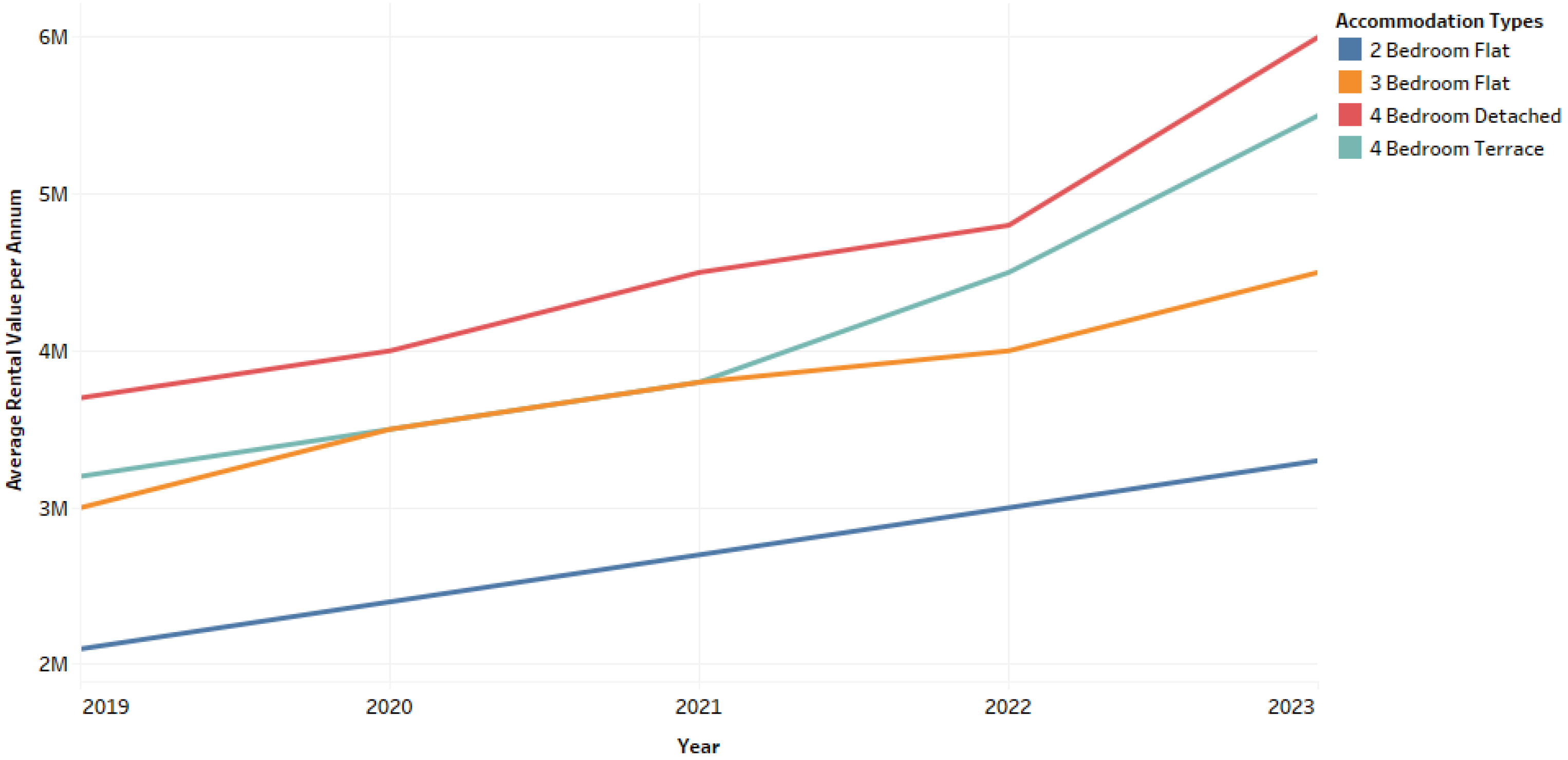

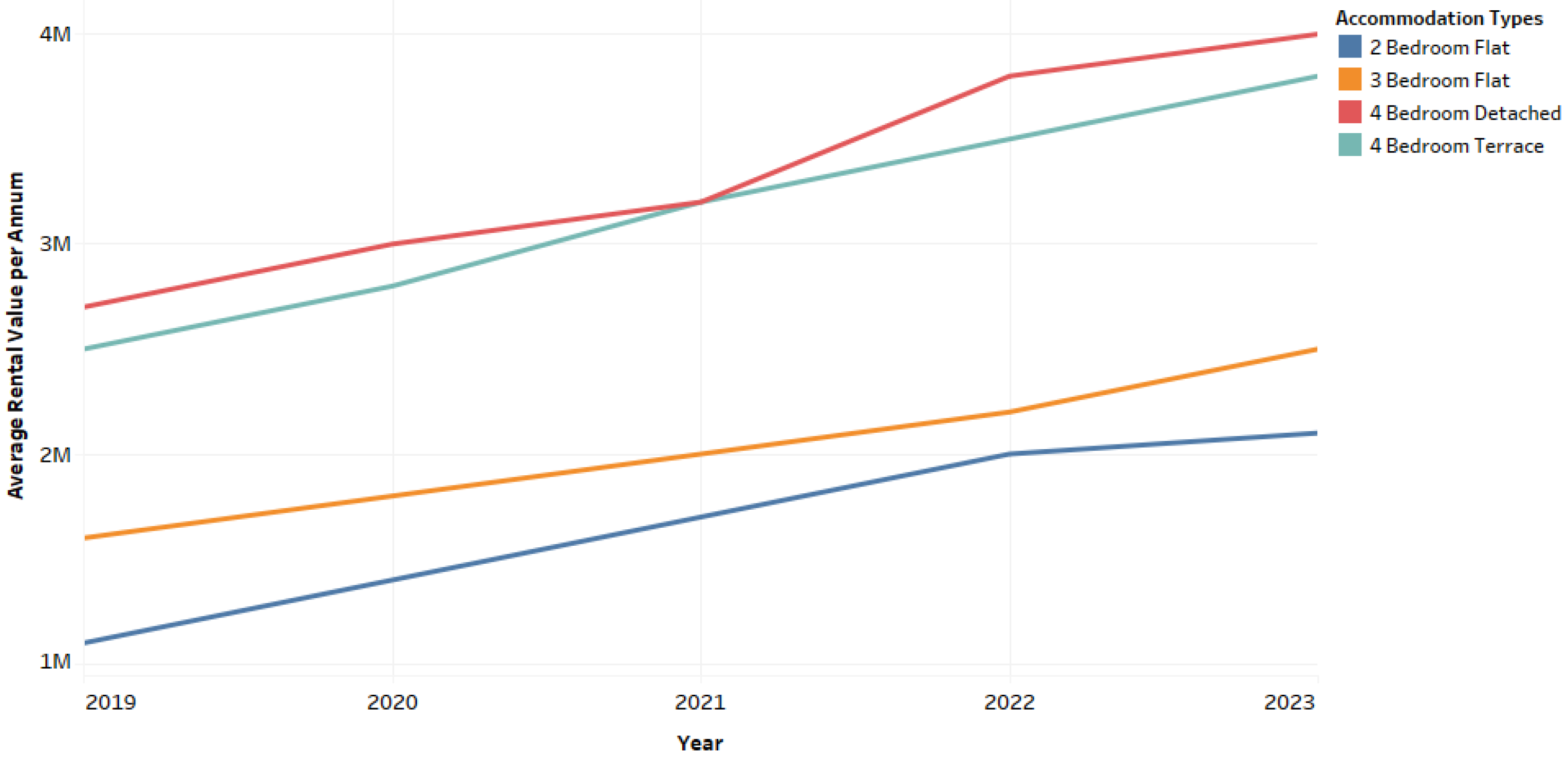

The data used in this study were obtained from both primary and secondary sources via interviews, telephone surveys, and quarterly reports. Information on average passing rent for various rental accommodations within Lagos was sourced from quarterly real estate reports and field surveys, while data on country fundamentals were sourced from the country's online repositories.

Rent data for specific property types in Lagos were further analyzed for affordability convenience via the Rent-to-income Ratio. Several housing affordability indicators have been utilized in indicating the level of housing affordability. There are at least four types of measurement of housing affordability – price to income ratio (PIR), rent-to-income ratio (RIR), housing expenditure-to-income ratio, and residual income measure [

76].

Utilizing average rents for specific housing stock in mainland and island zones, the rent-to-income ratio (RIR) was used to capture the percentage of annual monthly income that home dwellers would be expected to spend in renting homes. The ratio is represented thus;

The rule of thumb for optimum rent-to-income ratio is that anything above 30% and the chances of a tenant defaulting on their payments becomes likely possible. The idea is that the 70% balance should be directed towards other things, of which disposable income is part. The RIR was calculated using 2019 & 2023 rental figures.