1. Introduction

Players in the industrial sector have taken actions to adapt their industrial processes to the precepts of the energy transition, in which the decarbonization of the production chain, the efficient use of energy resources and the greater share of renewable energy are some examples of strategies to be followed to achieve the lowest environmental impact.

In this context, players could face relevant issues to their business in the efforts undertaken for the energy transition, such as the cost of energy acquisition (and market competition), the use of locally available energy resources and the technologies specificities required in their industrial process, among others.

Minimizing energy purchasing costs is an important decision-making process for large energy consumers, particularly those operating in the aluminum, metal, and petrochemical sectors. Owing to the amount of energy demanded in these industrial processes, agents seek to diversify their energy supply alternatives by investing in self-production and equipment powered by fuels, in addition to the traditional alternative of procuring electrical energy on the market or through bilateral contracts [

1].

By owning energy generation assets to satisfy their demands, that is, being self-producers, large consumers (LCs) represent both load and generation, and they may use different strategies for energy transactions in the market, including selling their surplus besides purchasing to satisfy their loads.

Another strategy employed by LCs to minimize their energy supply costs is the use of fuel-powered equipment in industrial processes to partially supply their demand (for example, by using heat boilers driven by natural gas (NG)) as an alternative to exclusive dependence on electricity.

The decision to contract energy and NG involves decision-making under uncertain conditions, for example, in relation to energy and NG market prices, energy generation (self-production), and demand forecasts.

Strategically, LCs plan to satisfy their energy demands within different timeframes. Long-term strategies involve investment in generation assets for the self-production of energy. Medium-term strategies involve the contractual portfolio, which defines positions under uncertain conditions, to provide predictability about the expected cost over a given horizon (e.g., for one year). In addition, short-term decision-making should be faced, which, with hourly granularity, aims at to satisfy the demand by utilizing managerial flexibility in using NG or electricity.

In this context, the decision-making process of a large energy consumer comprises a relationship between those decision taken at the strategic level (medium-term; monthly basis) and the decision to be taken on the operational level (short-term; hourly basis). Similarly, long-term decisions, such as investment in self-production, are related to medium- and short-term decisions because self-production determines the basic conditions to satisfy demands.

Considering the decision-making process of a large energy consumer with renewable generation assets as a self-production strategy, demand-supply will occur under uncertain conditions of actual generation. If self-production is not sufficient to fully satisfy demand, decisions should be made for the medium term based on existing alternatives, for example, by purchasing energy and/or NG for use in equipment, if this operational flexibility exists. Because NG contracts have specific delivery clauses (e.g., take-or-pay and flexibility), this condition serves as a guideline for short-term decisions.

In all these decisions, prices (e.g., of energy and NG) are important drivers. Additionally, as an energy self-producer, an agent can sell electricity on the market if consuming NG instead of electricity is more advantageous.

In summary, as these decisions are significant and involve different constraints and uncertainties, this paper presents an optimization model structure that can support the decision-making of LCs in the medium and short-term horizons, considering the relationship between decisions in each horizon.

Some studies have addressed the electricity procurement problem of LCs. Reference [

2] presented a mixed-integer programming model to minimize the expected cost and conditional value-at-risk (CVaR) of a LC’s weekly portfolio operation, considering energy purchased on the pool market, through bilateral contracts or self-generation investment, as alternatives for its load supply. The authors calculated the levelized electricity price as the investment representation, which is essentially a long-term decision, on a weekly basis, obtaining the energy price per unit produced and assuming that this can be compared with the energy spot price. Although the consideration of self-production investment proved innovative compared with other studies, such as [

3], the study did not examine the selling of the LC’s surplus energy or renewable generation (used as self-production) as an uncertainty source.

Similar study could be found in reference [

4] where some alternatives renewable self-production investments were investigated in terms of efficient and cost-effective energy use and the renewable generation uncertainty was represented by a scenario generator model.

The limitation of not examining the selling of LC’s surplus energy was addressed in [

5] through the proposal of a model where the LC has the option of selling the surplus energy on the pool market. The risk-averse optimization model also considers as uncertainties the photovoltaic generation of the self-production and the price of energy on the spot market. However, the study focused on short-term decisions without considering investment or medium-term contractual portfolio decisions.

The above-mentioned studies presented risk-averse solutions based on forward contracts and self-generation production as hedging strategies against pool market volatility. In this type of modelling, the decision is guided by the relationship between the expected cost and associated risk. Similar results were obtained in [

6,

7,

8].

Other studies focused on daily LC operation and demand response to market prices [

9,

10,

11,

12,

13] and the results emphasize the consumption allocation at lower market hour prices. Reference [

13] analyzed an LC in the Brazilian market; however, the study did not consider an alternative for satisfying demand via self-production and, therefore, did not consider the possibility of selling surplus energy on the spot energy market. These aspects were considered in this paper.

Reference [

14] analyzed a similar LC problem from the perspective of investing in a wind power plant to compose, in conjunction with a hydroelectric plant, a generation portfolio for the self-production of energy. A risk-averse optimization model was applied to support decision-making, and the results indicated that the complementarity of the portfolio’s asset generation contributed to minimizing energy supply risks.

In [

15] the LC methodology developed by [

6,

7] was applied to a hydrothermal system, where uncertainties in energy prices are dependent on the river flow’ stochastic behavior.

Reference [

16] presented some originalities from [

13,

14,

15] by connecting long, medium and short term decisions of a LC problem, considering the possibility to have power purchasing agreements (medium term) and the installation of a photovoltaic self-unit (long term decision), where the hourly energy adjustment is traded at day-ahead and real time markets (short term). However, the paper presents some gaps by not permitting a longer medium-term analysis at the same time of a dynamic short-term analysis. This is circumvented in our paper by the regret cost function which allows the coupling between the medium- and short-term models, enabling the application of a stochastic medium model and a more detail deterministic short-term model.

Reference [

17] proposed the application of a regret cost in the LC problem, although focus on a simple LC framework design (only short-term operation without option to establish any contract) and theoretical analysis, not considering numerical and simulation studies.

It is important to note that, although reference [

18] addressed both NG and electricity for heat load management, the study did not represent a model of a self-producing agent with the capability to sell surplus energy and establish bilateral contracts. Instead, it focused on a microgrid model with some self-generation options to meet the load, in addition to relying on the electrical grid.

This paper shows originalities from all studies cited before by applying a stochastic optimization model to support the LC energy-procurement problem, considering the relationship between a monthly contractual portfolio medium-term decision and hourly short-term operations such as (i) load shutdown or startup and (ii) settlement in the spot market. The relationship between the two models is represented through a regret cost.

The main contributions of this paper are:

An optimization modelling framework is developed considering optimal decisions to be taken in the medium-term and how they constrained optimal decisions in the short term.

A decision-making structure for LCs is developed considering managerial flexibility in consuming electricity or NG to satisfy the demands of industrial processes.

A penalty mathematical function is modelled to represent the regret cost and the connection of medium- and short-term decisions.

The CVaR metric is applied to manage financial risks associated with uncertainties such as electricity, renewable generation (hydro) and NG prices.

2. Large Consumer Decision Problem

An energy-related LC decision problem encompasses various uncertainties and decisions that vary depending on the analysis time horizon. Long-term decisions have implications for medium- and short-term operations. By owning both load and electricity production assets, the LC’s power management entails critical aspects of generation, commercialization, and load supply, as well.

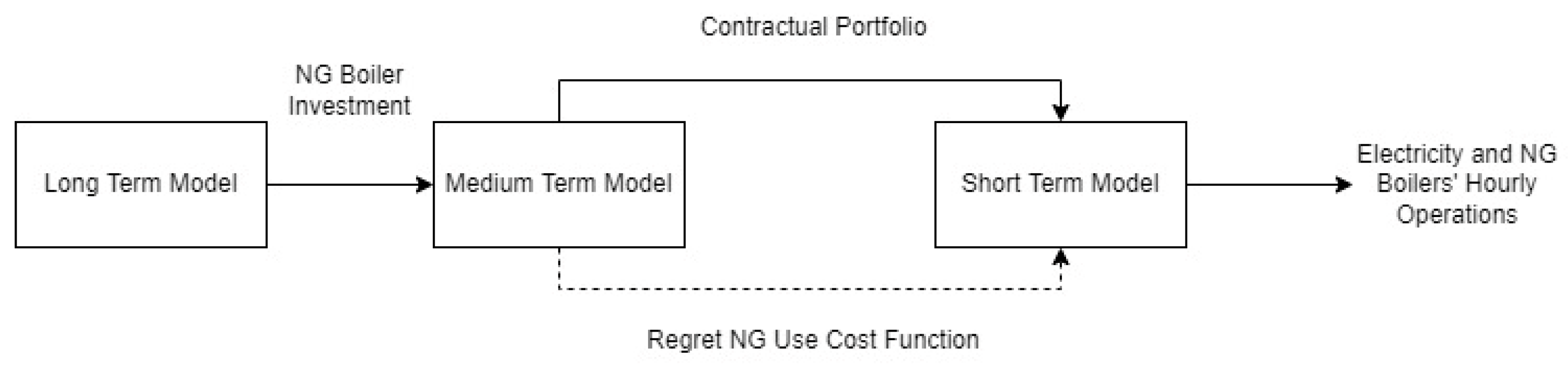

Figure 1 summarizes the LC decision problem, where long-term decisions are represented by investments in NG boilers to enable load-supply flexibility through electricity or NG. Medium-term decisions focus on contractual portfolios, and short-term decisions consist of the utilization of either the NG boiler or electricity consumption to satisfy the LC load. All analysis horizons consider spot market operations, where the difference between energy resources and load is settled at the spot price; therefore, different decisions drive different results in the spot market.

Figure 1.

LC decision problem by analysis horizon.

Figure 1.

LC decision problem by analysis horizon.

The long-term decision to invest in an NG boiler provides load-supply flexibility between electricity and NG, which is inserted as an input in medium- and short-term operations.

Subsequently, a linear stochastic optimization model is applied to the medium-term horizon to optimize the electricity contractual portfolio by considering the spot energy price and hydrogeneration as uncertainties.

Note that the medium-term results indicate the NG use for the subsequent months, and the short-term model details the solution driven by the medium-term model. For coherency of the solutions, a regret cost function is included in the short-term model to relate the daily operation to previous medium-term decisions, thereby associating the short-term deterministic operation with uncertainties from the medium-term stochastic model.

Within this framework, the LC decision problem is comprehensive because decisions formulated within a specific analysis horizon exert significant impacts across the entire analysis spectrum.

For simplicity, following it is presented a case study in which the investment in the NG boiler has already been made and amortized, focusing the decision-making process only in medium- and short-term operations. The investment model equation for an LC is detailed in [

14].

3. Mathematical Formulation

3.1. Medium-Term Operation

The medium-term model aims to determine the optimal contractual electricity portfolio by considering the domains of candidate contracts with different volumes, prices, and delivery horizons.

The following equations describe the linear stochastic optimization model applied to the market intelligence tool:

s.t.:

The objective function in Equation (1) follows the methodology proposed by Camargo et al. [

19], in which the objective is to maximize the convex function composed of the expected return and risk metrics. The parameter

[%] and its complement (1-

) embody the notion of risk aversion as they apply weights to the two constituents of the equation, representing the decision-maker’s risk-aversion profile. The equation considers a defined number of scenarios

s belonging to a set of scenarios Ω [

20]. The variable A [U

$] corresponds to the value at risk (VaR) with a confidence interval α ∈ (0,1),

[%] is the probability of scenario s belonging to Ω, and a_s is an auxiliary variable used to calculate the CVaR of scenario s [

21].

Equation (1) under ρ of 100% represents a completely risk-averse agent, where the decision is taken only by accounting for the CVaR. In contrast, for a completely risk-neutral agent, ρ is zero, and the decision is taken based on the expected return. Intermediate values of ρ correspond to risk-aversion profiles that weigh both the expected return and CVaR in the decision.

The expected return in Equation (2) comprises two components: one related to electricity operation and the other to NG consumption. The electricity operation is calculated as the sum of the earnings from selling contracts , spot market results , and purchasing contract expenses (), whereas the NG component is represented by the NG acquisition cost (). The expected return is represented by the present value, where r is the interest rate, and t is the time step in analysis horizon .

The decision variables correspond to the selling percentage of contract (sc) belonging to a set of contracts SC (), purchasing percentage of contract (pc) belonging to the set of contracts PC (), and NG consumption (), all in %.

The revenue from selling contracts, as shown in Equation (3), is obtained by multiplying by the maximum amount of energy that can be sold from the contract () and its price () at each time t.

The spot result in Equation (4) is obtained by multiplying the spot position () by the spot price (), where , calculated using Equation (5), depends on the difference between the energy owned by the LC and energy committed to selling contracts and consumption. In Equation (5), corresponds to self-hydrogeneration, and is the electricity demand for each s and t.

The expense from purchasing contracts is calculated using Equation (6) by multiplying the purchasing percentage by the maximum amount of energy that can be acquired from the contract () and its price () at each t.

Equation (7) expresses the NG acquisition cost which depends on the product of NG consumption and its price (). represents the maximum amount of NG purchased through a bilateral contract with an NG distributor.

Equations (8) are the constraints applied to the decision variables, which must be between one and zero.

Furthermore, Equations (9) are constraints used to compute the CVaR. The result is obtained considering all analysis horizons T and for each s.

3.1.1 Flexibility between NG and Electricity

In Equation (5),

corresponds to the electricity demand at

and in

. The formulation reduces

while enabling its fulfilment through the utilisation of NG, as shown in Equation (10), where

represents the load amount that can be supplied using NG in MWh, and

is the total energy demand, also in MWh.

Equation (11) provides the relationship between NG use and its electricity equivalent, where

is expressed in MWh/Nm

3 (As a mathematical simplification, the thermal inertia of the boilers was indirectly considered in the minimum shutdown time; however, the cost of state transition was not taken into account).

3.2. Short-Term Operation

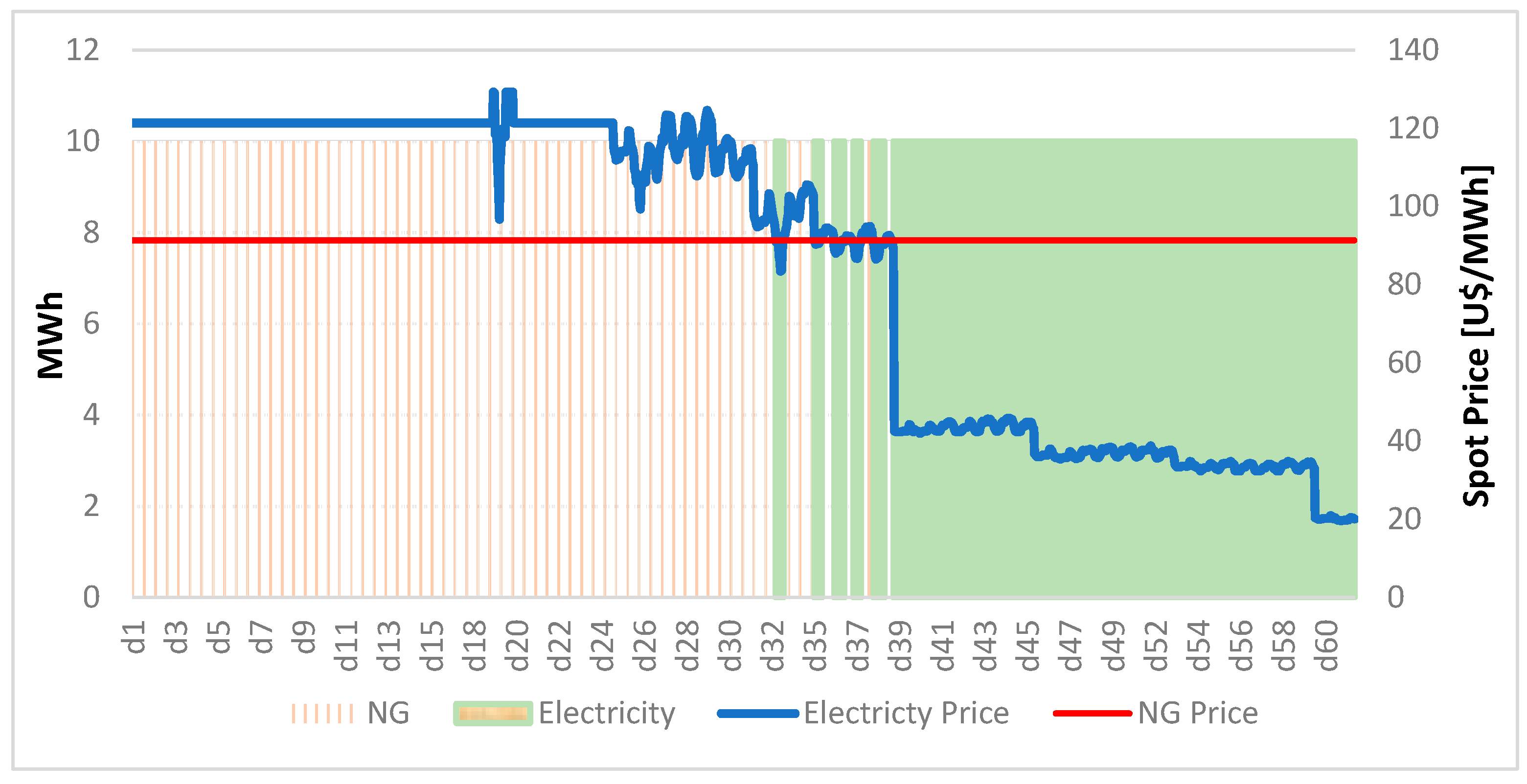

The short-term model takes into account the electricity and NG boiler operations required to supply the LC demand, considering electricity and NG price estimations for the subsequent months.

The objective in Equation (12) aims to maximise the expected return from electricity and NG operations, where corresponds to the revenue from selling contracts, is the electricity spot result, is the cost of purchasing contracts, is the charging of the electricity transmission network, and is the NG acquisition cost.

The decision variables are represented by the electricity boiler activation at (), the contracted plus transmission network activation (), and the NG consumption percentage ().

Equation (13) calculates the revenue from selling contracts obtained using the product of , , and at each .

The spot result, shown in Equation (14), is obtained by multiplying by , which results from the difference between the energy owned by the LC and the energy committed by selling contracts and consumption, as indicated in Equation (15), where corresponds to self-hydrogeneration, and is the electricity demand for each t.

Equation (16) presents the flexibility between NG and electricity to satisfy the load supply, where is the NG consumption, and is the total energy demand for each t.

As in the medium-term model, Equation (17) provides the relationship between NG use and its electricity equivalent, where β is expressed in MWh/Nm³.

The purchasing contract cost, shown in Equation (18), is obtained by multiplying by and at each t.

The restrictions presented in Equations (19) and (20) are related to the unit commitment process of the electric boiler, where the startup and shutdown times should satisfy the minimum amount of time ().

In addition, the electricity operation has a minimum () and maximum () power to be delivered, as specified by Equations (21) and (22), where is a binary variable representing the state of the NG boiler.

Equations (23) and (24) determine the charge related to the transmission network usage agreement. The LC has the option of increasing the limit value of the network usage agreement in periods with more electric consumption. is the total network transmission charge, where is the fixed amount contracted, and is the additional amount that can be contracted. corresponds to the decision variable of activating the additional amount, which is equal to 1 if the electricity demand exceeds the amount of contracted network usage () for any t belonging to . Note that if the electricity demand exceeds the network usage limit at any time within the analysed horizon, an additional transmission rate is charged. The rate comprises fixed and variable values. In Equation (24), represents the set of hours for each month in the analysis, and it belongs to the total analysis horizon .

The NG cost acquisition is given by Equation (25), which is the product of NG consumption and its price (

.

represents the maximum amount of NG that differs from the bilateral contract with the NG distributor, and

is the function that relates the NG consumption at short term with the medium-term indication, expressing a cost if the result differs from that of the medium-term output.

3.3. Regret Cost Function

According to [

22] the regret cost notion addresses future costs required to execute a change, which is associated with the potential short-term benefits by changing the course of action.

In Equation (25) the parameter expresses a regret cost if the short-term output of NG consumption differs from that obtained from the medium-term model.

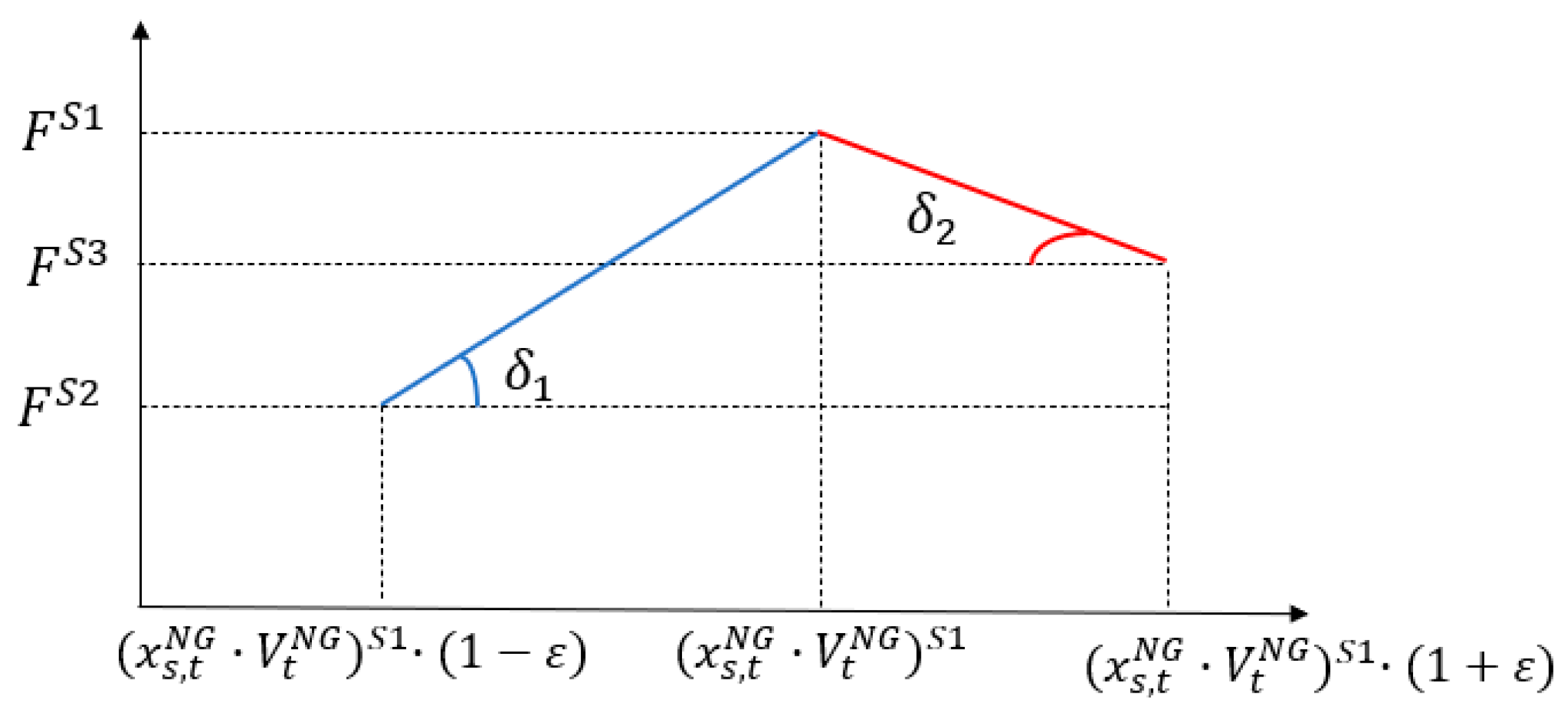

The first step in building this function consists of simulating the medium-term model according to Equations (1) to (11), resulting in the objective function () and the NG consumption , indicated as the NG consumption objective obtained from the medium-term operation.

Therefore, two more simulations are applied to the medium-term model, each with the implementation of the restrictions shown in Equations (26) and (27), resulting in two more objective functions (

and

), where ε represents a small increment to fluctuate the output from the previous optimization.

The three simulations result in the graph presented in

Figure 2, where the angles

and

can be calculated using Equations (28) and (29).

Figure 2.

Variation in the medium-term objective function according to the addition of restrictions.

Figure 2.

Variation in the medium-term objective function according to the addition of restrictions.

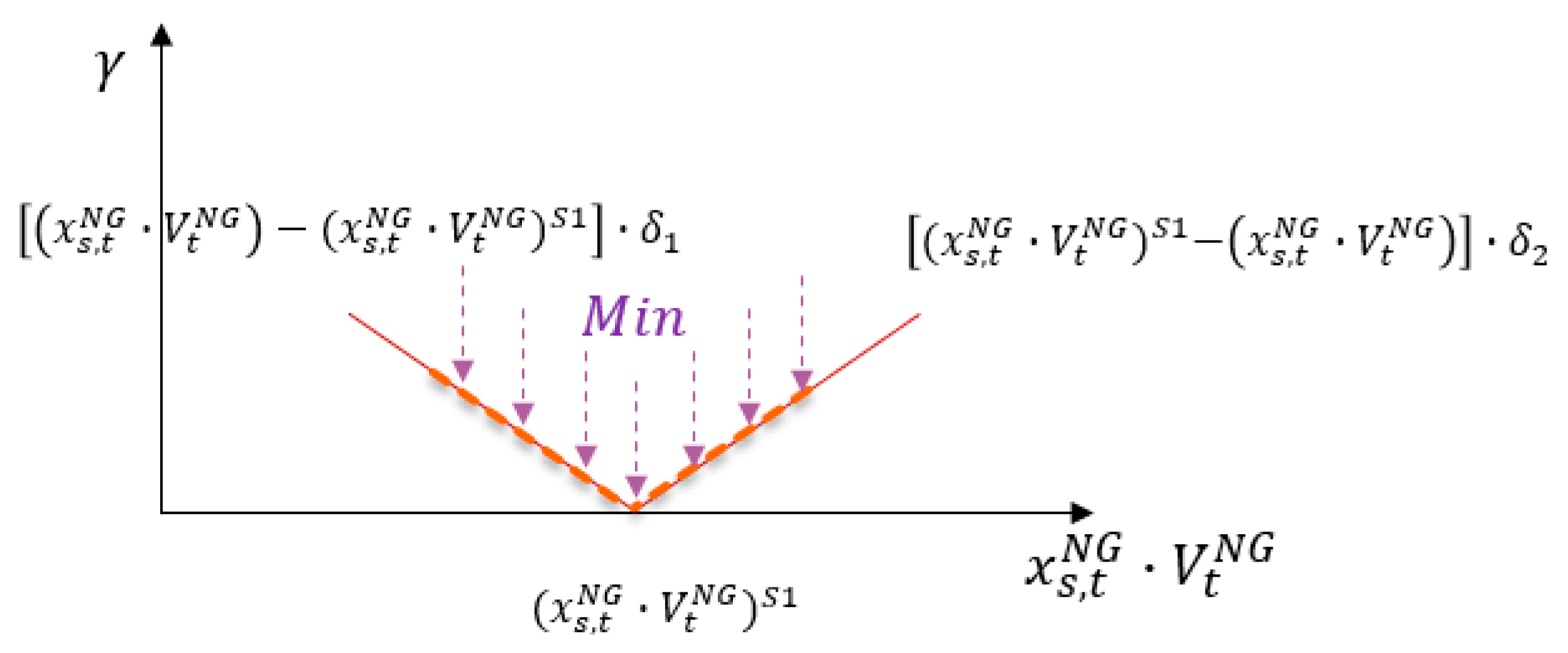

The final step involves adding the restrictions shown in Equations (30)–(32) to the short-term model:

Consequently, by changing the short-term NG consumption from that indicated by the medium-term operation, a regret cost function is added to the objective function. Therefore, the short-term output will differ from that of the medium-term only if the return exceeds the associated regret cost.

Figure 3 summarizes the construction methodology of the regret cost function used in this paper.

Figure 3.

Construction methodology of the regret cost function.

Figure 3.

Construction methodology of the regret cost function.

4. Case Study

The proposed modelling structure for LCs was applied to analyze the decision-making process of an aluminum producer operating under the Brazilian energy market framework (The aluminium producer electricity consumption and energy planning are an important information for planning the Brazilian electricity system, given the significant role that industrial sector plays in overall electricity consumption [

23]). The optimization models were run on the Fico Xpress optimizer [

24].

Although the case study focused on a Brazilian LC, the proposed modelling structure is applicable in other markets worldwide because the particularities of the Brazilian sector were not the main aspect of the modelling, but rather the rational decisions of LCs.

4.1 Description

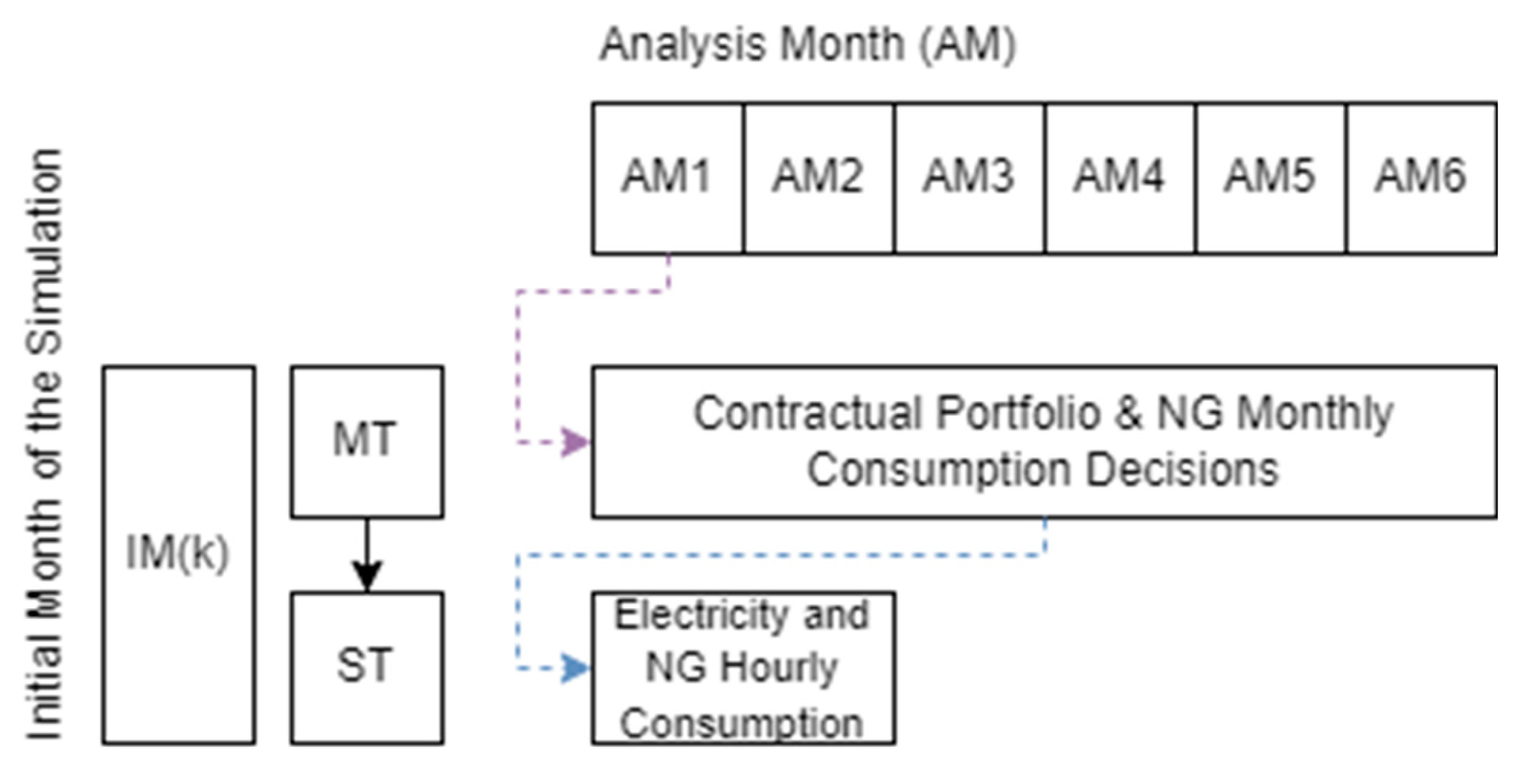

The case study was designed to the optimal operation of the LC considering a planning horizon from July 2021 to December 2021, covering six months.

The medium-term model (MT) and the short-term model (ST) had analysis horizons of six and two months, respectively. The medium-term results, such as the contractual portfolio and NG monthly consumption decisions, were represented as inputs in the short-term model, which aimed to determine the electricity and NG hourly consumption (

Figure 4).

To cover all analysis horizons, the MT and ST were applied six times. Therefore, 12 simulations were run, with both having the same first initial month of simulation (IM1: July 2021) and the last month depending on each analysis horizon (six and two for the medium- and short-term, respectively).

Discretion was applied in the simulations to consider the uncertainty projections closer to operation, where, in a new set of simulations, the generation and price estimations were updated with information from the current month.

The case study considered an LC with a risk-aversion profile (parameter ρ) of 50%, indicating the same weight for both the risk and return in its objective function.

Figure 4.

Case study simulations.

Figure 4.

Case study simulations.

Concerning its load-supply flexibility, the LC had the option of satisfying 50% of its total load by using NG instead of electricity. The conversion factor from NG consumption into electricity was 0.006 MWh/m³, which was obtained according to the data considered by the Brazilian system planner (Energy Research Company - EPE) in its ten-year expansion plan [

25]. The total monthly load was 20 MWavg (MWavg is related to electricity and represents its equivalent in MW if the total electricity consumed in the time it is calculated as the ration between the electricity consumed in MWh and the duration in hours (MWh/h)), meaning that 10 MWavg could be attended by NG or electricity, while the remaining 10 MWavg must be provide by electricity.

Table 1 lists the monthly NG price for the simulations, beginning with the initial month from IM1 to IM6, considering the tariffs applied by NG distributors in Brazil (For simplification, the NG price applied expresses an average cost for NG use in U$/m³. In practice, the NG cost has two terms, one related to contracted demand and other to consumption range. Future works will present the methodology developed to simplify the cost components in one average tariff).

Table 1.

NG price [U$/m³] (Summarizing, the NG price follows brent and dollar prices from the past three months. Future works consist of explain in detail the methodology applied to calculate the NG price).

Table 1.

NG price [U$/m³] (Summarizing, the NG price follows brent and dollar prices from the past three months. Future works consist of explain in detail the methodology applied to calculate the NG price).

| Initial Month |

IM1 |

IM2 |

IM3 |

IM4 |

IM5 |

IM6 |

| NG Price |

0.56 |

0.56 |

0.57 |

0.57 |

0.58 |

0.58 |

By deciding to consume more electricity than previously contracted from the grid, the LC had an additional cost of 38623 U$ to be inserted as in Equation (23), considering 14.8 MWh as the fixed amount of network contracted energy () and 20982 U$ (The addition and fixed network transmission charges were calculated considering Brazilian tariffs (1.43 U$/MWh to peak times and 1.42 U$/MWh to off-peak times)) as the network transmission charge related to the fixed contracted amount.

As a contractual portfolio, quarterly and semi-annual purchasing and selling candidate contracts were considered, taking account the market prices published in [

26] and a maximum volume of 10 MWavg. The decision portfolio of one simulation was applied as the input to the next set of simulations until the contract ended. For example, if, in the simulation beginning at IM1, a 100% of quarterly selling contract was established, this data would be inserted as input in the medium- and short-term simulations beginning in months IM2 and IM3, as well in short-term simulation beginning in IM1. All simulations considered the existence of a selling contract of 5 MWavg at 20.8 U

$/MWh for all time horizons to be considered.

Note that for a negative or positive spot position, the LC would be settled at the spot price; therefore, the model seeks to optimize the contractual portfolio and NG consumption to maximize its result considering electricity and NG estimation prices as well as the results in the spot market.

4.2 Scenarios

In Brazil, the National Electricity Independent System Operator (ONS) uses the optimization models NEWAVE, DECOMP and DESSEM to define optimal centralized generation dispatch for long-term, medium-term planning and short-term operation, respectively, by attempting to minimize system operating costs.

The problem formulation considers the stored water in the system reservoirs, future water inflows to the river basins, demand forecasts, thermal power plant operating costs, and operational restrictions. Consequently, the models calculate the marginal cost of operating the system, which represents the spot price in the Brazilian electricity market after cap and floor prices are applied by the Chamber of Electric Energy Commercialization (CCEE) [

27]. As a consequence of the centralized hydrothermal dispatch from the ONS, the system operator decides the amount of generation that each thermal and hydropower plant produces at any given time, where the energy allocated to the LC depends on the total system hydrogeneration and its energy credit from the electricity trade process [

28].

More information about the mathematical formulation, as well as the restrictions applied in the Brazilian centralized dispatch models could be found in [

29,

30,

31].

4.2.1 Medium-Term Scenarios

The spot prices and generation scenarios provided by NEWAVE [

32] and used in the medium-term simulations are presented in

Table 2 and

Table 3, respectively. P95 and P05 correspond to the 95th and 5th percentiles of the 2000 scenarios provided by NEWAVE outputs.

The generation forecasts shown in

Table 3 were obtained by multiplying the energy credit (firm energy certificates, FEC) of the hydropower plant by the generation scaling factor (GSF), which reflects the total generation of the system, considering a hydropower plant with 8 MWavg of FEC.

4.2.2 Short-Term Scenario

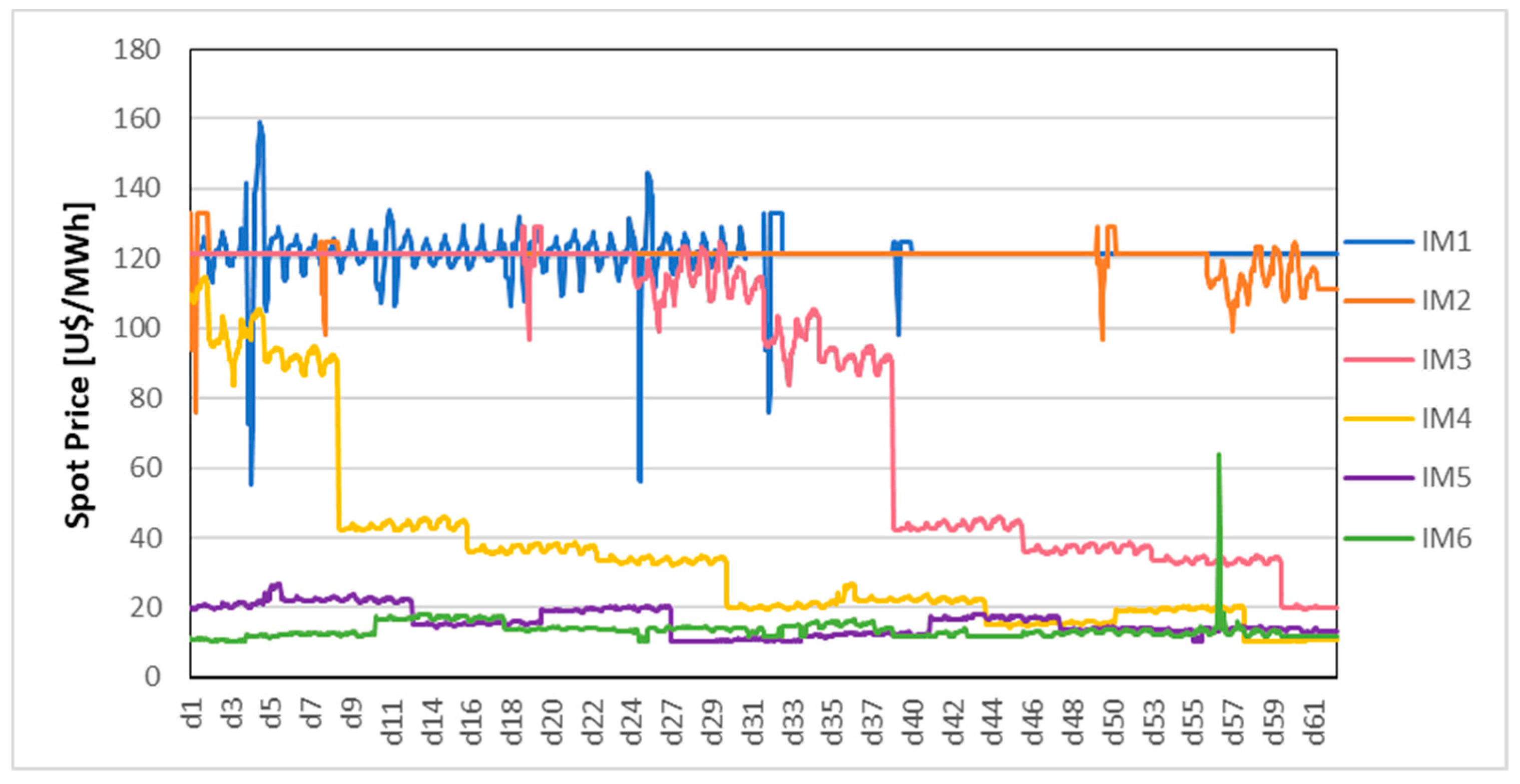

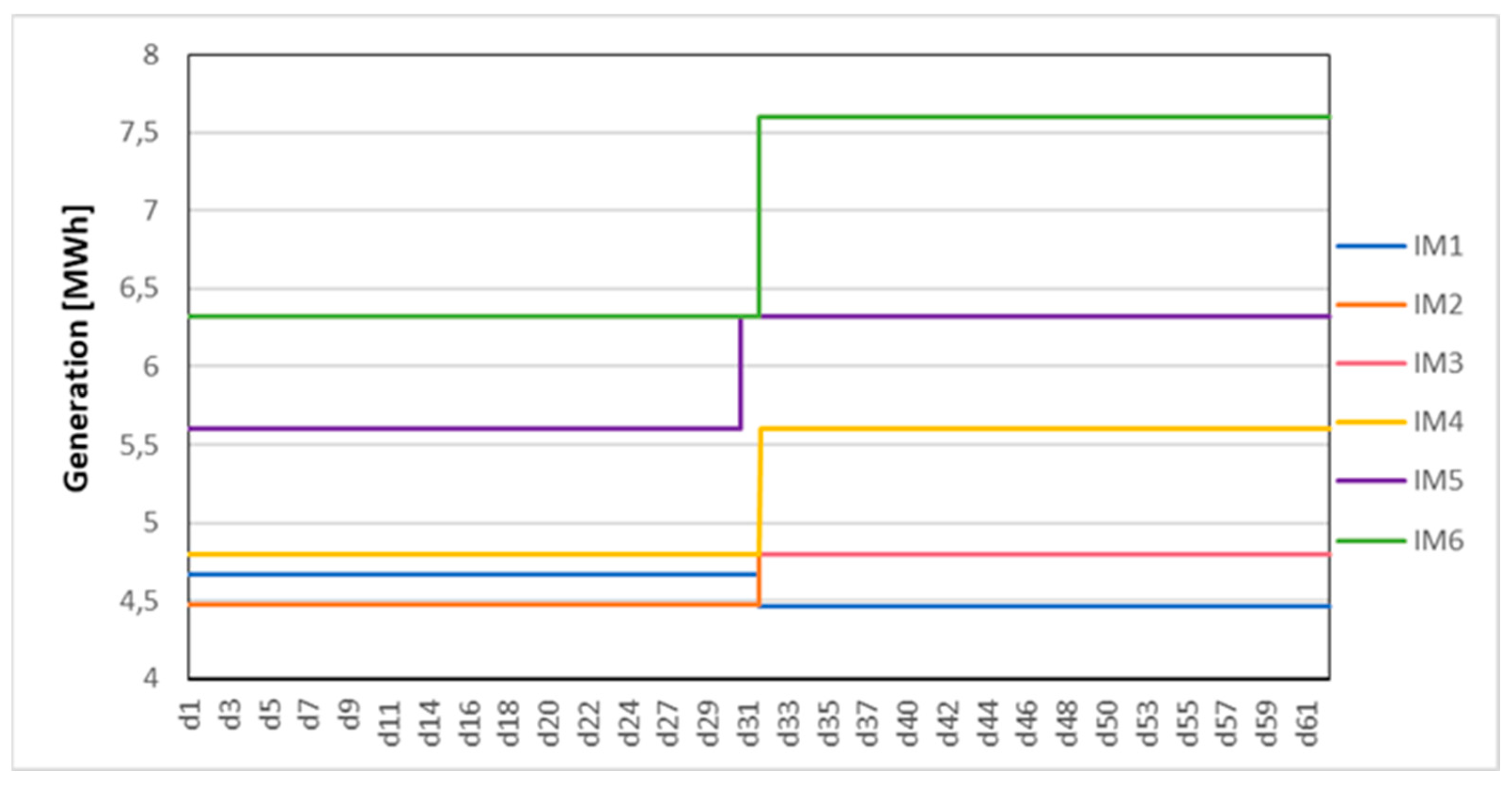

Figure 5 and

Figure 6 the hourly spot price and hourly self-hydrogeneration, respectively, utilized as assumptions in the short-term model based on the outputs published by the CCEE [

32].

5. Results

The general results of the simulations are presented in

Table 4–

Table 6, which show the NG consumption decisions, contractual portfolio outputs, and final electricity balance sheets, respectively. In the first set of simulations, beginning in IM1 until IM3, the model decided to supply the load using NG in the months of higher electricity price, whereas in the next simulations, beginning in IM4 until IM6, the electricity price exhibited a significant decrease, from 81.5 U

$/MWh in average at simulation starting in IM1 to 59.5 U

$/MWh in the simulation beginning in IM4 (

Table 2), resulting in the total load supply by electricity.

For the simulation beginning in IM1, the model decided to purchase 100% of the semi-annual energy contract at 49.38 U$/MWh and a 13.6% quarterly energy contract at 108.21 U$/MWh to hedge against higher electricity price forecasts.

In the next set of simulations, as the electricity price forecast decreased along the planning horizon, risk perception enabled bolder operations, with the model deciding to purchase the semi-annual contract and sell this energy at a higher price in a quarterly contract, performing as a trader of energy, as observed in the simulations beginning in IM2, IM3, IM4, and IM5. For the simulation beginning in IM6, as the electricity spot price estimation was even lower and both quarterly and semi-annual contracts had similar prices, the model decided to sell the total energy, having been exposed to a negative balance sheet to be settled at the spot price.

An interesting result was that, in the short-term operation for the simulation beginning in IM3, the model decided to use more NG than that indicated in the medium-term output, even with 228.3 U

$ as a regret cost, representing 0.3% of the second-month result. This can be justified by the spot price representation closer to an actual operation in short-term operation, as shown in

Figure 7, where, in the transition from higher to lower electricity prices, some scenarios had the electricity price lower than the NG price, and vice versa, showing the importance of having the information update at the final decision This resulted in the transition of fuel consumption considering the startup and shutdown time restrictions of the boilers.

To verify the effectiveness of the model, the LC operation considering the realized market prices, and three scenarios was calculated as follows: (i) model decisions, (ii) no flexibility between NG and electricity for load supply but with contractual portfolio decisions, and (iii) no optimization. As shown in

Table 7, the application of the model led to a cost reduction of 3.98 million U

$ for the total analysis horizon. The use of the tool was particularly important in the first three months, when the electricity spot price reached values close to its cap (121.4 U

$/MWh). The possibility of NG consumption, in addition to the previous establishment of purchasing contracts, enabled a less risky operation. Note that the LC results were mostly negative owing to their load characteristics.

6. Discussion and Future Research

Electricity procurement for an LC is characterized by decisions under uncertainty and involves several different variables. This complexity becomes more challenging when various renewable generation assets exist for self-consumption and operational flexibility in operating production units using electricity and NG.

To contribute to this subject, this paper proposes a modelling structure composed of two optimization models – one for monthly medium-term decisions and another for short-term decisions – considering the integration between analysis horizons by a regret cost. It is very important to consider the two models as this makes feasible to incorporate the medium-term stochasticity, where the associated risk can be examined, in contrast to discretization in the short term, enabling the decision to be closer to an actual operation.

To verify the applicability of the developed model, a case study in the Brazilian context of actual market information is presented. The results showed the medium-term potential of indicating the optimal contractual portfolio considering a range of contracts with different prices, horizons, and types (purchasing or selling), where the associated risk was accounted for using the CVaR metric and the use of a convex function which weights risk and return in the decision-maker’s risk-aversion profile.

In addition, the flexibility between the two resources enables less risky operations, as the electricity boiler or NG consumption is activated according to market price estimations.

The results underscore the significance of incorporating updates in information, highlighting that the Short-term strategy may suggest a deviation from prior medium-term strategies, even when such adjustments incur costs in the medium-term framework. However, the immediate advantages derived from these changes must outweigh the long-term impact of costs, as estimated through regret cost function, to justify changes in medium-term decision-making strategies.

Finally, the proposed modelling structure can be applied in other markets because the particularities of the Brazilian sector considered in the case study were not the main aspect of the modelling, but rather the rational decisions of LCs.

Future research will examine the investment analysis of increasing the flexibility between NG and electricity at the load supply by applying a cash flow calculation that considers the plant lifecycle, capital disbursement schedule, and unitary cost for each source. Therefore, the investment decision can be inserted into medium- and short-term models, for instance, as a fixed purchasing contract, with the monthly price settled as a function of the installed capacity and associated cost.

Author Contributions

Conceptualization, D.S.R., L.D.L, and M.H.B.; methodology, L.D.L., M.H.B., L.S.C., D.S.R., and R.C., software, M.H.B. and L.D.L.; validation, L.D.L., L.S.C., R.C., and F.S.C.; formal analysis, L.D.L, M.H.B. and L.S.C.; investigation, L.D.L., M.H.B. and R.C.; resources, D.S.R. and F.S.C.; data curation, L.D.L. and M.H.B.; writing—original draft preparation, L.D.L., L.S.C., M.H.B., and R.C.; writing—review and editing, L.D.L and D.S.R.; visualization, L.D.L., L.S.C and M.H.B.; supervision, D.S.R.; project administration, D.S.R. All authors have read and agreed to the published version of the manuscript.

Funding

This study was financed in part by the Coordenação de Aperfeiçoamento de Pessoal de Nível Superior – Brasil (CAPES) – Finance Code 001.

Acknowledgments

We acknowledge financial support from Estreito Hydroelectric Power Plant through project PD-06512-0120/2020 (ANEEL Code).

Nomenclature

| Decision Variables |

|

Selling percentage of contract in scenario (%) |

|

Purchasing percentage of contract in scenario (%) |

|

Natural gas consumption percentage at time and in scenario (%) |

|

Electricity boiler activation at time |

|

Contracted plus transmission network activation at time |

|

Percentage of natural gas consumption at time (%) |

| Constants |

|

Interest rate (%) |

|

Level of risk aversion (%) |

|

Confidence level (%) |

|

Maximum amount of energy that can be sold from contract at time t (MWh) |

|

Bilateral contract price of contract at time t (U$/MWh) |

|

Spot price at time t and scenario (U$/MWh) |

|

Spot price at time t (U$/MWh) |

|

Maximum amount of energy that can be purchased from the contract at time t (MWh) |

|

Bilateral contract price of contract at time t (U$/MWh) |

|

Hydro self-generation at time t and scenario (MWh) |

|

Maximum amount of natural gas that can be purchased from the bilateral contract with the natural-gas distributor |

|

Natural-gas price at time t (U$/m³) |

|

Total energetic demand at time t and scenario (MWh) |

|

Conversion factor of natural-gas volume into electricity (MWh/m³) |

|

Minimum amount of energy delivery by the electricity boiler (MWh) |

|

Maximum amount of energy delivery by the electricity boiler (MWh) |

|

Network transmission charge related to fixed amount contracted (U$) |

|

Network transmission charge related to additional contracted amount (U$) |

|

Amount of network use contracted (MWh) |

|

Startup and shutdown time of the electricity boiler (h) |

| Parameters |

|

Expected return in scenario (U$) |

|

Revenue from selling contracts at time t and in scenario (U$) |

|

Spot revenue at time t and in scenario (U$) |

|

Cost from purchasing contracts at time t and in scenario (U$) |

|

Cost from natural gas acquisition at time t and in scenario (U$) |

|

Position in terms of energy in the spot market at time t and in scenario (U$) |

|

Electricity demand at time t and in scenario (MWh) |

|

Natural gas demand at time t and in scenario (MWh) |

|

Variable that corresponds to the value at risk (VaR) (U$). |

|

Auxiliary variable used to calculate the conditional value at risk (CVaR) of scenario (U$) |

|

Revenue from selling contracts at time t (U$) |

|

Spot revenue at time t (U$) |

|

Cost from purchasing contracts at time t (U$) |

|

Cost from natural gas acquisition at time t (U$) |

|

Total network transmission charge (U$) |

|

Incremental cost for a different short-term output of natural-gas consumption than that one obtained from medium-term model (U$) |

| Indices and Sets |

|

Set of time steps in the planning horizon |

|

Set of hours for each month in analysis |

|

Set of scenarios |

|

Set of selling contracts |

|

Set of purchasing contracts |

References

- Rezaee Jordehi, “Risk-aware two-stage stochastic programming for electricity procurement of a large consumer with storage system and demand response,” Journal of Energy Storage, vol. 51, 2022. [CrossRef]

- E. Canelas, T. Pinto-Varela, B. Sawik. “Electricity Portfolio Optimization for Large Consumers: Iberian Electricity Market Case Study,”. Energies, v. 13, p. 2249, 2020. [CrossRef]

- A. Najafi, et al. “Short Term Electricity Procurement of Large Consumers Considering Tidal Power and Electricity Price Uncertainties”. 53rd International Universities Power Engineering Conference (UPEC). Glasgow, UK: IEEE. 18. p. 1-5. [CrossRef]

- Zemite, L. , Kozadajevs, J., Jansons, L., Bode, I., Dzelzitis, E. 2024, 17. [Google Scholar] [CrossRef]

- F. Angizeh, M. Parvania, “Stochastic risk-based flexibility scheduling for large customers with onsite solar generation”, IET Renewable Power Generation, v. 13, p. 2705-2714, 2019. [CrossRef]

- A. J. Conejo, M. Carrion. “Risk-constrained electricity procurement for a large consumer”, IEE Proceedings - Generation, Transmission and Distribution, v. 153, p. 407-413, 2006. [CrossRef]

- M. Carrion, et al. “A Stochastic Programming Approach to Electric Energy Procurement for Large Consumers”, IEEE Transactions on Power Systems, v. 22, n. 2, p. 744-754, 07. [CrossRef]

- K. Zare, M. P. Moghaddam, M. K. S. El Eslami, “Electricity procurement for large consumers based on Information Gap Decision Theory ”, Energy Policy, v. 38, n. 1, p. 234-242, 10. 20 January. [CrossRef]

- E. Leo, G. Dalle Ave, I. Harjunkoski and S. Engell, “Stochastic short-term integrated electricity procurement and production scheduling for a large consumer,” Computers & Chemical Engineering, vol. 145, 2021. [CrossRef]

- A. R. Jordehi, “Risk-aware two-stage stochastic programming for electricity procurement of a large consumer with storage system and demand response,” Journal of Energy Storage, vol. 51, 2022. [CrossRef]

- Y. Cao, Q. Wang, Q. Fan, S. Nojavan and K. Jermsittiparsert, “Risk-constrained stochastic power procurement of storage-based large electricity consumer,” Journal of Energy Storage, vol. 28, 2020. [CrossRef]

- , Aalami, H. “Stochastic energy procurement of large electricity consumer considering photovoltaic, wind-turbine, micro-turbines, energy storage system in the presence of demand response program”, Energy Conversion and Management, vol. 103, 2015. [CrossRef]

- D. A. Lima, D. N. T. Paula, “Free contract environment for big electricity consumer in Brazil considering correlated scenarios of energy, power demand and spot prices,” Electric Power Systems Research, vol. 190, 2021. [CrossRef]

- R. Pedrini, E. C. Finardi and D. S. Ramos, “Hedging power market risk by investing in self-production from complementing renewable sources,” Electric Power Systems Research, vol. 189, 2020. [CrossRef]

- R. R. B. Silva, A. C. P. Martins, E. M. Soler, E. C. Baptista, A. R. Balbo, L. Nepomuceno, “Two-stage stochastic energy procurement model for a large consumer in hydrothermal systems”, Energy Economics, vol. 107, 2022. [CrossRef]

- J. Arellano, M. Carrión, “Electricity procurement of large consumers considering power-purchase agreements”, Energy Reports, vol. 9, 2023. [CrossRef]

- Y. Situ, F. Chen, X. Zhang, J. Su, W. Jiang, “Risk aware decomposition of online scheduling for large flexible consumers considering the age of information”, Energy Reports, vol. 9, 2023. [CrossRef]

- Hu, B. , Wang, N., Yu, Z., Cao, Y., Yang, D., Sun, L. 15. [CrossRef]

- Camargo, L.A.S.; Leonel, L. D.; Ramos, D.S.; Stucchi, A.G.D. A Risk Averse Stochastic Optimization Model for Wind Power Plants Portfolio Selection. In 2020 International Conference on Smart Energy Systems and Technologies (SEST), Istanbul, Turkey, , 2020, pp. 1-6.

- Shapiro, A.; Tekaya, W.; da Costa, J.P.; Soares, M.P. Risk neutral and risk averse stochastic dual dynamic programming method. European Journal of Operational Research, 2013, 224, 375–391. [Google Scholar] [CrossRef]

- Rockfellar, R.T.; Uryasev, S.P. Optimization of Conditional Value-at-Risk. J. Risk 2000, 2, 21–41. [Google Scholar] [CrossRef]

- A. Eitan, I. Fischhendler, A. v. Marrewijk, “Neglecting exit doors: How does regret cost shape the irreversible execution of renewable energy megaprojects?”, Environmental Innovation and Societal Transitions, vol. 46, 2023. [CrossRef]

- M. M. L. Cabreira, F. L. C. da Silva, J. S. Cordeiro, R. M. S. 2024, 17. [CrossRef]

- FICO. Available online: https://www.fico.com/en/products/fico-xpress-optimization (accessed on 17 May 2023).

- EPE. Decade Energy Plan 2031. Empresa de Pesquisa Energética. 2019. Available online: http://www.epe.gov.br (accessed on 19 May 2023).

- Dcide. Available online: https://www.dcide.com.br/ (accessed on 17 May 2023).

- CEPEL. System Planning Models. Available online: http://www.cepel.br (accessed on May 17, 2023).

- Leonel, L.D.; Balan, M.H.; Ramos, D.S.; Rego, E.E.; de Mello, R. F. Financial Risk Control of Hydro Generation Systems through Market Intelligence and Stochastic Optimization. Energies 2021, 14, 6368. [Google Scholar] [CrossRef]

- A. L. Diniz, F. Da S. Costa, M. E. Maceira, T. N. dos Santos, L. C. B. Dos Santos and R. N. Cabral, “Short/Mid-Term Hydrothermal Dispatch and Spot Pricing for Large-Scale Systems-the Case of Brazil”, 2018 Power Systems Computation Conference (PSCC), Dublin, Ireland, 2018, pp. 1-7. [CrossRef]

- M. E. P. Maceira et al., “Twenty Years of Application of Stochastic Dual Dynamic Programming in Official and Agent Studies in Brazil-Main Features and Improvements on the NEWAVE Model”, 2018 Power Systems Computation Conference (PSCC), Dublin, Ireland, 2018, pp. 1-7. [CrossRef]

- T.N. Santos, A.L. Diniz, C.H. Saboia, R.N. Cabral, L.F. Cerqueira, “Hourly pricing and day-ahead dispatch setting in Brazil: The DESSEM model”, Electric Power Systems Research, vol. 2020. [CrossRef]

- CCEE/ONS. NEWAVE Outputs. Câmara de Comercialização de Energia / Operador Nacional do Sistema Elétrico. Available online: https://www.ccee.org.br (accessed on May 17, 2023).

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).