1. Introduction

Health and environmental concerns are increasingly influencing consumer food choices, leading to a rising demand for free-from (FF) and organic products (OP) [

1,

2] These products are often perceived as healthier and more sustainable, appealing to consumers with specific dietary needs and those committed to environmentally friendly practices [

3]. Consequently, the market for FF and OP is expanding, mirroring a broader shift towards improved health and environmental consciousness.

Free-from products

Food hypersensitivity, which includes both food allergies and intolerances, represents a significant health concern globally [

4,

5]. Food hypersensitivity is characterized by reproducible adverse reactions to a specific food that clinically resemble allergies. In the United States, approximately 19.0% of the population is affected by food hypersensitivity, while in Europe, the prevalence ranges from 2% to 37%, highlighting regional variability but may also reflect differences in screening and monitoring efforts across various countries [

5].

The distinction between food allergies and intolerances, as defined by the National Institute of Allergy and Infectious Diseases (NIAID), is critical yet often blurred in public perception [

6]. Food allergies involve an immune response, typically mediated by the production of specific IgE antibodies, which trigger immediate allergic reactions upon exposure to the allergen. Common examples of food allergens include peanuts, tree nuts, shellfish, and eggs. In contrast, food intolerances are nonimmune reactions that can result from metabolic, pharmacologic, or toxic mechanisms [

7]. Despite these clear definitions, the general population frequently conflates these conditions, leading to misunderstandings about their management and implications [

6].

Food intolerances, distinct from allergies, are widespread and often mistaken for allergic reactions. Lactose intolerance (LI), for example, affects an estimated 57% of the global population, though prevalence varies significantly across different ethnicities and regions [

8]. LI arises from the inability to absorb lactose, a disaccharide sugar (glucose and galactose) naturally occurring in milk and various dairy products, due to a deficiency in lactase [

1]. This deficiency leads to gastrointestinal symptoms such as bloating and diarrhea [

8].

Similarly, nonceliac gluten sensitivity (NCGS) and celiac disease (CeD) are conditions associated with gluten consumption. Gluten, a protein found in wheat, barley and rye, contributes to dough viscoelastic properties, making it essential for products like bread and pasta [

1]. CeD is an inflammatory disorder of the small bowel caused by an immune response to dietary gluten, leading to adverse gastrointestinal symptoms, such as bloating, gas, and diarrhea [

8]. NCGS, although not immune-mediated, mimics CeD in both gastrointestinal and extraintestinal symptoms, such as headaches and fatigue. The prevalence of NCGS ranges from 0.6% to 13%, with its diagnosis complicated by the absence of specific biomarkers [

8].

Market research indicates a rise in the availability and sales of gluten-free products, driven not only by gluten-intolerant individuals but also by those who perceive these products as healthier [

1,

3] However, studies suggest that gluten-free products may have a lower protein content and not necessarily a better nutritional profile than their gluten-containing counterparts [

1]. Therefore, while the gluten-free diet is known to alleviate symptoms and promote gastrointestinal healing in patients with gluten-related disorders, long-term adherence to the diet may have concurrent nutritional limitations [

9]. Gluten-free products often consist of ingredients like corn, rice, soy, cassava, and potato, replacing gluten-containing grains [

9]. These products tend to be higher in fat, sugar, and sodium and lower in protein and dietary fiber compared to their gluten-containing counterparts. Furthermore, gluten-free products are not typically fortified with essential nutrients such as folate, iron, niacin, thiamin, and riboflavin. Hence, if consumed in high amounts at the expense of a diversified diet and not properly managed, these may lead to potential nutritional deficiencies [

9].

Indeed, allergies and intolerances towards specific food components like gluten or lactose, are among the multiple factors that currently drive consumers in their food choice. While satiation, nutrient content, flavor, and price remain fundamental drivers, modern food consumption in industrialized societies is increasingly influenced by health concerns, sustainability, and convenience [

3]. Health concerns are driven not only by affluence but also by the rising incidence of food and lifestyle-related diseases such as diabetes and obesity [

3].

Organic products

The demand for organic products has been notably shaped by health and environmental considerations. Consumers increasingly seek healthier food choices that support long-term health and well-being and reduce the risk of disease [

10]. Additionally, sustainability has become a crucial factor, largely due to growing awareness of environmental pollution associated with conventional agricultural practices [

11]. This awareness has fueled the expansion of organic agriculture and its associated markets, as consumers demonstrate a preference for organic and environmentally friendly products, even when these are sold at higher [

3,

12]

OP are derived from agricultural systems that prioritize natural inputs and processes, minimizing or excluding synthetic agricultural inputs such as pesticides, growth regulators, highly soluble mineral fertilizers, supplements, preservatives, flavoring agents, aromatic substances, and genetically modified organisms [

13]. These practices aim to maintain and enhance soil fertility and quality through methods like crop rotation, polyculture, intercropping, ecosystem management, cover crops, legumes, organic and bio-fertilizers, mechanical cultivation, and biological control methods [

13]. As a result, organic farming is often perceived as more environmentally friendly and sustainable than conventional farming, leading to the production of foods that many consumers view as healthier and more natural [

13,

14,

15]

The demand for organic products has been rapidly increasing worldwide, driven by consumers' growing awareness of health, environmental safety, and the perceived harmfulness of pesticides [

2,

16] Consumers perceive organic foods as healthier, safer, and more environmentally friendly, which often leads them to pay a premium for these products [

2,

12,

13] Factors influencing consumer preferences for organic products include personal health motivations, concerns about synthetic pesticide residues, and the desire for foods produced through more sustainable and ethical farming practices [

2,

13,

15] considerations, including animal welfare and local origin, are also increasingly significant in consumer decision-making [

12].

However, the sustainability and environmental benefits of organic farming are complex and context-dependent. While some studies suggest that organic farming practices may result in lower nitrate levels, fewer pesticide residues, and reduced exposure to antibiotics and other pollutants [

13], there are also significant challenges associated with organic agriculture. For instance, organic farming typically yields lower crop outputs compared to conventional farming, requiring more extensive land use to produce the same quantity of food. This increased land use can have far-reaching environmental consequences, including the potential for greater deforestation, loss of biodiversity, and increased greenhouse gas emissions due to land-use changes [

17,

18].

Additionally, while some studies suggest that organic foods may contain slightly higher or comparable levels of certain mineral elements, vitamins, secondary metabolites, phenolic compounds, and antioxidants, the overall nutritional differences between organic and conventional foods are generally modest and not consistently significant [

11,

13] Furthermore, there is some evidence suggesting that organic food consumption may reduce the risk of allergic diseases, overweight, and obesity, although these findings are not conclusive due to potential confounding factors such as healthier lifestyle choices among organic food consumers [

15]. Despite these potential benefits, the scientific community acknowledges that more research, particularly long-term interventional studies, is needed to draw definitive conclusions about the overall health impacts of consuming organic foods [

13,

15]

Moreover, consumers’ understanding of what constitutes 'organic' and the various labels associated with organic certification remains inconsistent and, at times, limited. Research indicates that many consumers are unaware of the rigorous control systems underlying organic certification, with knowledge about the differences between various organic labels generally lacking [

19]. This lack of understanding can lead to subjective perceptions of organic products, which are not always grounded in objective knowledge [

20].

Furthermore, trust in organic labeling is highly variable across different regions. For instance, in Scandinavian countries, where there is substantial government involvement in organic certification, consumer trust in these labels is notably high [

21]. In contrast, in countries like the USA and the UK, trust in organic labels is less pronounced, partly due to the multiplicity of certification bodies and labels, which can create confusion among consumers [

22]. The existence of multiple labels can also dilute the perceived reliability of organic products, making it challenging for consumers to discern the authenticity of what they are purchasing.

Given these challenges, there has been a growing call for more transparent and accessible verification methods in the organic sector. One proposed solution is the inclusion of QR codes on organic product packaging, which would allow consumers to trace the entire production chain and verify the product’s organic status. This approach aligns with the findings that consumers value certification and labeling as key indicators of organic products [

23]. However, to fully capitalize on this trend, it is essential to enhance consumer education regarding organic certification and labeling systems. By doing so, consumer trust and confidence in organic products can be strengthened, thus supporting sustained market growth.

Despite the increasing global demand for free-from (FF) and organic products (OP), there is still limited research specifically focused on the Portuguese market. Studies exploring consumer behavior and attitudes towards these products in Portugal remain scarce, leaving a gap in understanding the unique preferences, motivations, and concerns of Portuguese consumers. Although the international literature provides valuable insights into global trends, it does not adequately capture the specific context of Portugal, where factors such as cultural food habits, economic conditions, and local agricultural practices may influence consumption patterns. Furthermore, little is known about the awareness and trust in product certifications within the Portuguese market, especially regarding how consumers perceive the health benefits and environmental impact of these products.

This study aims to address this gap by gaining a deeper understanding of the factors influencing Portuguese consumers' behaviors towards FF and OP. We seek to explore the current market availability, identify potential gaps, and evaluate consumer trust in product certifications and perceived benefits. By doing so, this research will provide valuable insights to marketers, the food industry, and farmers in Portugal, contributing to the evolving landscape of food consumption in the country. These findings will not only assist in developing targeted marketing strategies but also support policy recommendations that can foster greater transparency, consumer education, and market growth in the FF and organic sectors.

3. Results

In this study, we considered a sample of 2268 adults living in Portugal, almost all of whom had Portuguese nationality (98.5%). Three-quarters of respondents were women, with a median age of 41.0 years, ranging between 18 and 85 years. The majority of respondents had completed higher school (68.7%), 85.5% were employed, and 80.5% considered their income enough or comfortable (

Table 1).

Free-from foods

Almost all participants (2209 (97.4%)) had already heard about FF foods. The most well-known were lactose-free milk (95.3%), gluten-free bread (92.5%), and gluten-free cookies (90.7%).

Although only 38% of the participants recognized that someone in their household benefits from using FF products due to allergies and/or food intolerances, 60% admitted regularly buying those products. The more prevalent allergies and/or food intolerances were lactose (27.9%) and gluten (13.4%) intolerances.

The subjects bought those products at supermarkets (1327; 97.6%), specialized shops (501; 36.8%), and local markets (63; 4.6%).

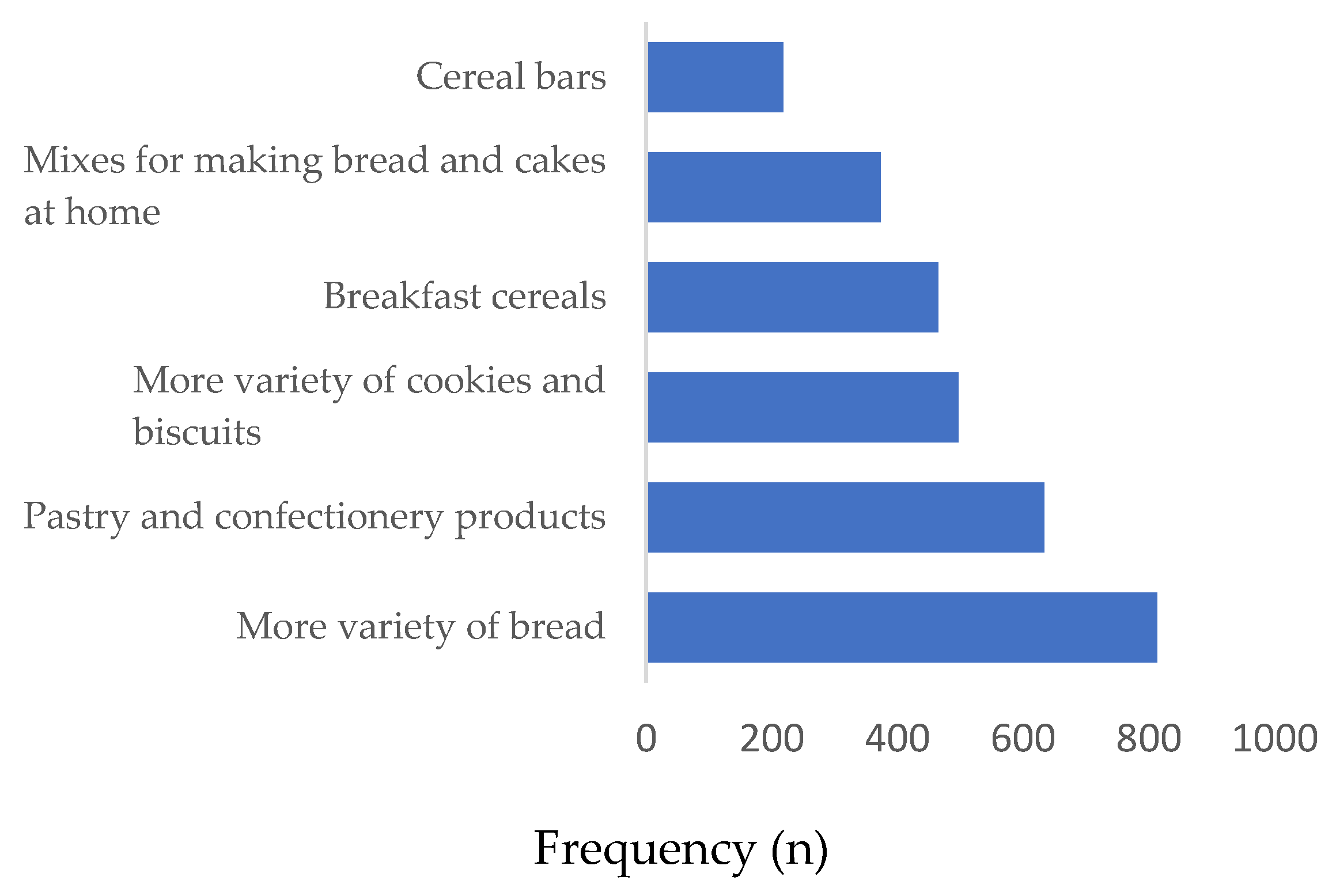

Participants were asked about the gluten-free products that they would like to see available in the market, and 57% of them (n=1295) expressed their opinions. Their answers are depicted in

Figure 1. The most popular answer was “more variety of bread” (62.8%). Pastry, confectionery products, cookies, and biscuits were also highly desired.

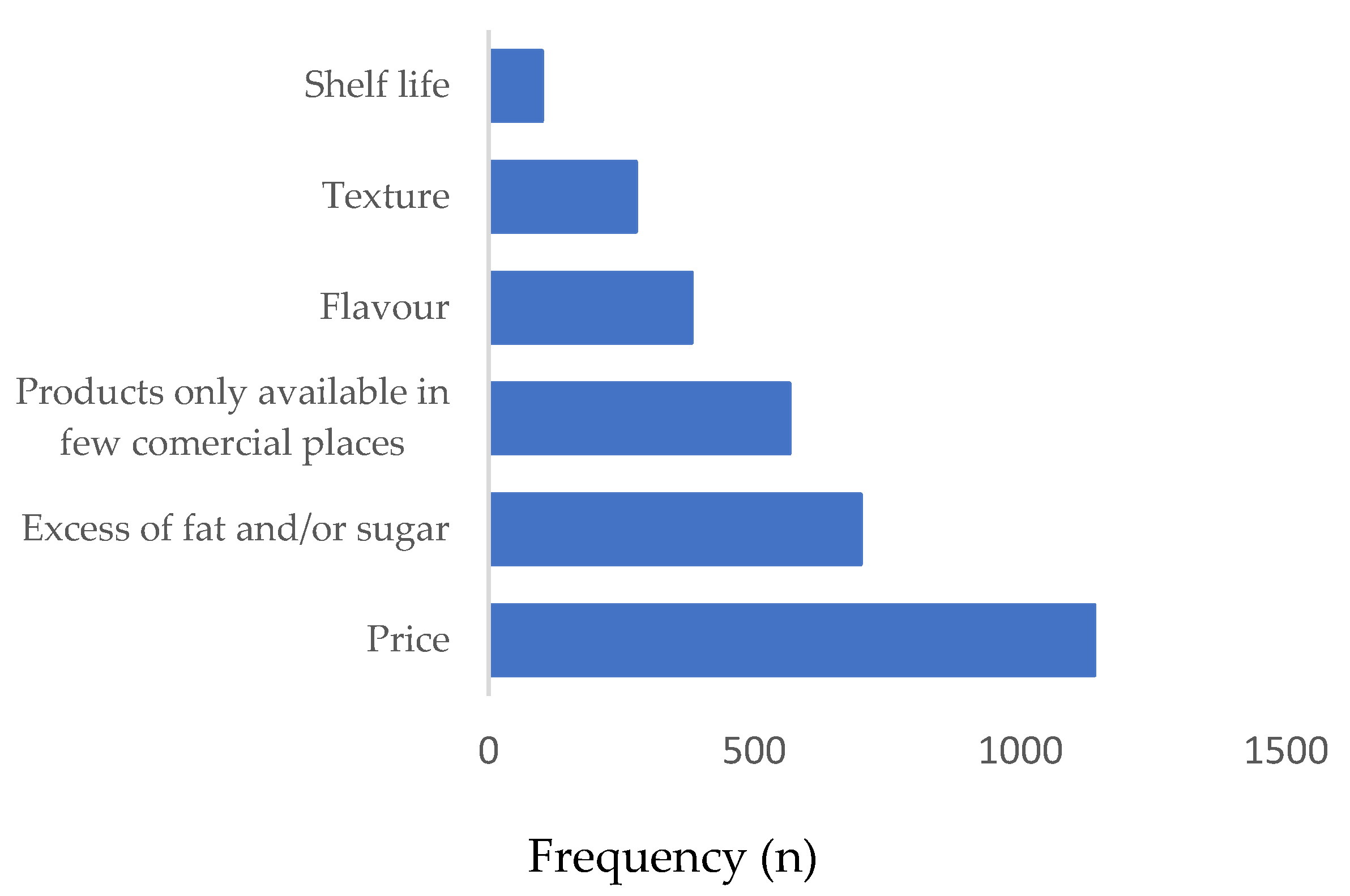

About half of the participants also referred the negative aspects that they identify in FF foods available in the market (59%). The price was undoubtedly the principal negative point referred (84.9%) followed by the perception that those products contain excessive fat and/or sugar (52.1%) (

Figure 2).

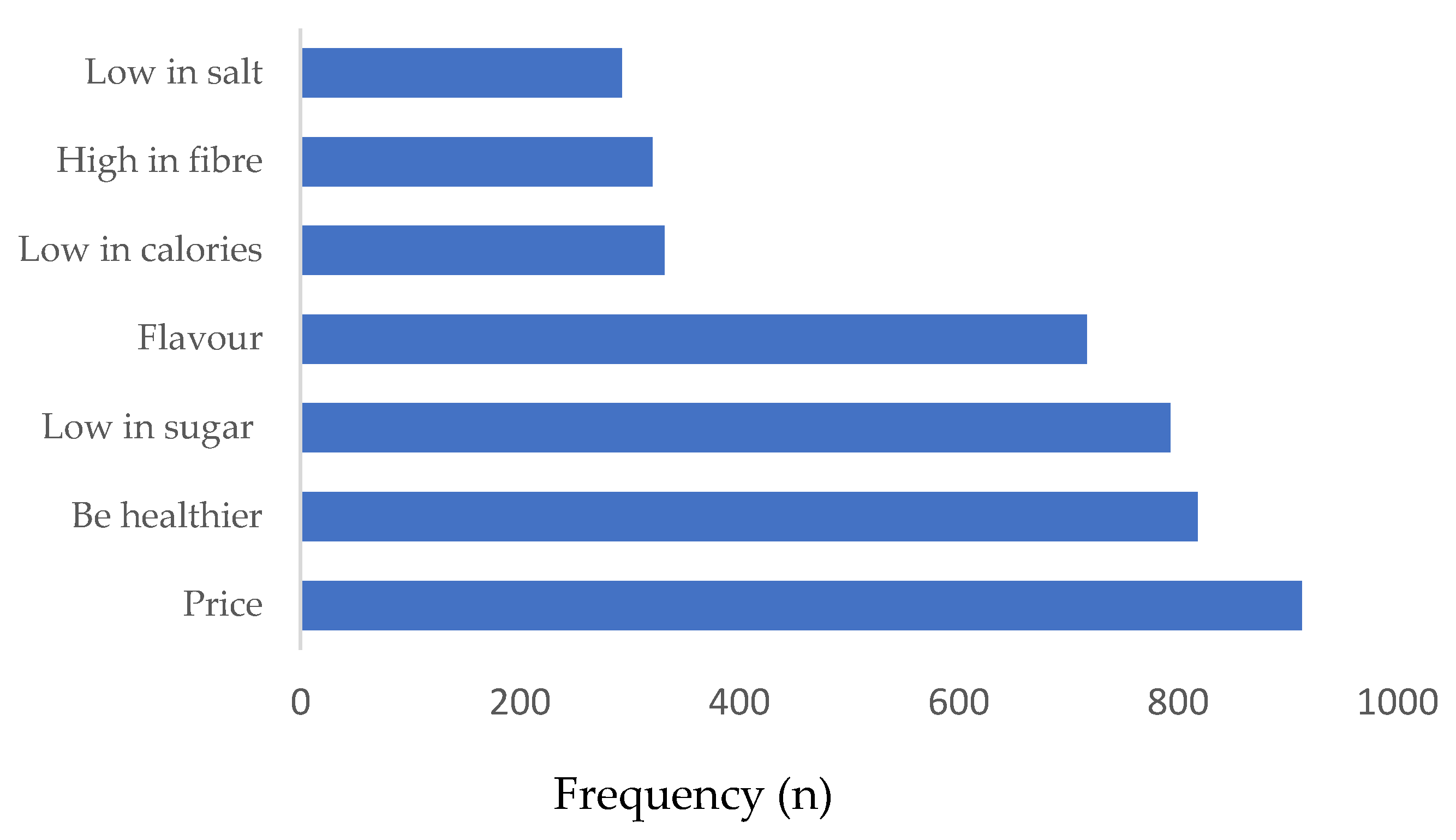

The main drivers in the choice of a FF product were ascertained. For this, the participants were asked to select three main reasons. As shown in

Figure 3, the price (67.6%), healthiness (60.6%), and low sugar content (58.7%) were the most frequently selected features.

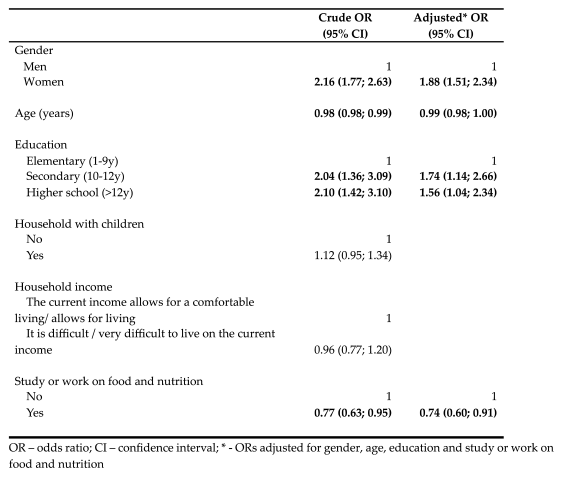

Characteristics associated with the purchase of free-from products

The characteristics of respondents associated with the purchase of FF products were also studied. Being a woman and having higher education were associated with a higher probability of buying these products, while studying or working in the food and nutrition field decreased that probability. Being older also slightly decreased the probability of purchasing those products (

Table 2).

Organic products

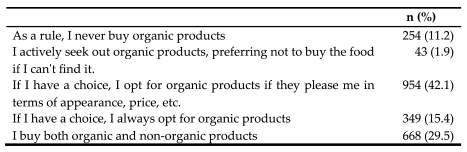

In this study, the perceptions and attitudes of consumers towards OP were also ascertained. Most respondents buy OP if they are appealing (42.1%) or buy both organic and non-organic products (29.5%) (Table 3).

This pattern was not significantly different according to gender, education, income, or having children in the family aggregate, but older participants answered more frequently that if they have the choice, they always opt for OP (< 35 years: 9.4%; 35-49 years: 16.4%; > 49 years: 20.9%, p<0.001). People who study or work in the food and nutrition field answered more frequently, “As a rule, I never buy organic products” (14.8% vs. 10.2%, p=0.002).

We also investigated the degree of consumer confidence in OP available on the market. When we asked if when they see a product on sale that claims to be organic, they trust that it really is, about two-thirds (67.1%) answered “I've wondered if there might be steps in your production that don't respect fully organic production”. Only 21.4% believed in the claim and 11.5% did not. Women (22.8% vs. 16.6%, p<0.001), more educated (elementary: 16.4% vs. secondary: 16.1% vs. higher school 23.8%, p=0.002) and people who study or work in the food and nutrition field (31.0% vs. 18.8%, p<0.001) believe more frequently that OP are really organic. Participants with lower income answered more frequently, “I've wondered if there might be steps in your production that don't respect fully organic production” (73.0 vs. 65.8%, p=0.009). Older people believed less in the claim of OP (< 35 years: 24.1%; 35-49 years: 21.0%; > 49 years: 18.8%, p<0.001).

Respondents were aware that the mention “to have organic ingredients” is not a synonym that the product is 100% organic (78.7%), and, massively, they considered to be important the existence of a QR Code in OP guaranteeing that they really are organic, such as a QR Code with which the necessary care taken throughout the production chain could be accessed (85.1%).

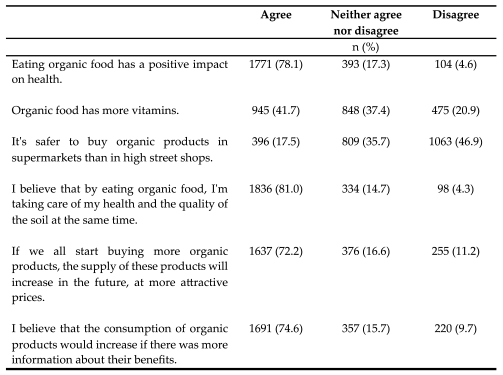

Lastly, we wanted to describe some consumers’ perceptions regarding OP (

Table 4).

The potential association between individual characteristics and respondents’ opinions was investigated, and only the significant associations are described herein. People who study or work in the food and nutrition field agreed less that eating organic food had a positive impact on health (71.3% vs. 79.1%, p<0.001). However, the belief in this statement increased with age (< 35 years: 73.2%; 35-49 years: 79.1%; > 49 years: 82.3%, p<0.001). Women (42.5% vs. 39.0%, p<0.022), those with lower education levels (elementary: 41.8% vs. secondary: 48.8% vs. higher school 38.9%, p<0.001) and people who do not study or work in the food and nutrition field (43.1% vs. 36.5%, p<0.001) agreed more frequently that organic food has more vitamins. Men (22.0% vs. 16.1%, p<0.001) and older people (< 35 years: 15.1%; 35-49 years: 15.6%; > 49 years: 22.0%, p<0.001) agreed more frequently that it is safer to buy OP in supermarkets than in high street shops. Older participants also agreed more frequently that “by eating organic food, I'm taking care of my health and the quality of the soil at the same time” (< 35 years: 76.6%; 35-49 years: 82.7%; > 49 years: 83.8%, p=0.002).

4. Discussion

Our findings revealed a high level of awareness and consumption of FF products among Portuguese consumers and allowed the description of motivations for consumption, desires of new products, and the purchasing patterns, being women, younger people, high educated and people who do not study or work on food and nutrition who are more prone to buy these products. Regarding OP, older people and people who do not study or work on food and nutrition buy these products more frequently.

Nearly all participants had heard of FF foods, with lactose-free milk and gluten-free bread being the most recognized. The high prevalence of lactose intolerance (27.9%) and gluten intolerance (13.4%) among participants aligns with global trends indicating rising food hypersensitivity rates [

7]. Despite only 38% of respondents indicating that someone in their household benefits from FF products due to allergies or intolerances, a significant 60% reported regularly purchasing these products. These findings suggests that beyond addressing specific health needs, FF products appeal to a broader consumer base, likely due to perceived health benefits and lifestyle choices [

1].

Interestingly, our study found that women and younger individuals are more likely to choose FF products. This trend could be attributed to a greater awareness of healthy products within these demographics, the earlier onset of food intolerances, or a higher consciousness about dietary choices compared to older age groups [

24,

25]. Moreover, the preference for purchasing FF products predominantly from supermarkets over specialized stores or local shops probably highlights the importance of availability and convenience in consumer purchasing behavior [

26].

Participants expressed a strong demand for more variety in FF products, particularly in categories such as bread, pastries, cookies, and cereals. This indicates significant opportunities for product development and market expansion in these areas. Professionals in the food and nutrition field showed a tendency to choose FF products less frequently. This could be due to their understanding that consumption of these products is not necessary unless there is a specific deficiency or intolerance, while the general population might perceive them as inherently healthier, leading to their consumption even without clinical justification.

The main drivers for purchasing FF products were price, health benefits, and low sugar content. This aligns with existing literature indicating that modern food consumption is increasingly influenced by health concerns and dietary [

27,

28,

29]. However, the high cost of FF products and perceptions of excess fat and sugar content present challenges that need to be addressed by producers and retailers to enhance market acceptance and growth. The consumers’ perception concerning sugar content in FF products is quite interesting, since it is one of the three main drivers for their purchase, either in favor or against, according to its low or high content, respectively.

Regarding organic products, the study shows that a substantial portion of respondents purchase these items, with 42.1% buying organic products if they find them appealing in terms of appearance and price, and 29.5% feeling indifferent and buying both organic and non-organic products. Interestingly, older participants and those not working in the food and nutrition field exhibited a higher propensity to choose organic products. This is contrary to what one might expect, as professionals in the food and nutrition field might be assumed to have a higher awareness and appreciation for organic products. However, this discrepancy may be due to the fact that these professionals do not necessarily perceive organic products as being inherently healthier, or they might be skeptical about the added value of organic products, particularly given their often higher cost. Additionally, previous studies have also suggested that while nutritional knowledge significantly influences the decision-making process regarding food choices, it does not always result in healthier eating habits [

30].

In relation to the socio-demographic factors, our study did not find significant differences in the purchasing patterns of organic products between men and women, although previous research suggests that women, often seen as primary household shoppers, have a strong influence on food choices and show a greater intention to buy food with nutritional claims [

31,

32]

Although the study did not collect specific frequency data for OP consumption, Table 3 provides insight into demand levels. The high demand for OP indicates a growing market, yet

Table 4 shows gaps in awareness and trust, with many consumers questioning the claims made by marketing communications [

29]. Increased knowledge, trust and availability of organic food products are critical for enhancing market growth. The supply chain market's role in ensuring product availability, as highlighted in the paper from Emerald Insight (2024), emphasizes the need for robust distribution networks to support the rising demand [

33].

Consumers' motivations for buying organic products are primarily driven by balanced nutrition, food safety, and sustainability [

34]. The key factor appears to be the trustworthiness in product claims, as previously reported in the literature [

35,

36]. Ensuring that organic products are perceived as having good quality, appealing attributes, and healthier profiles is crucial for driving consumer behavior [

34].

Our findings provide valuable insights concerning consumer behavior and market demand. The high awareness and consumption of FF products indicate a mature market with significant growth potential. However, the challenges related to price and nutritional content must be addressed to sustain consumer trust and interest. Similarly, the growing preference for OP underscores the importance of health and environmental concerns in shaping consumer choices.

There are significant opportunities for product development and market expansion in the FF and organic sectors. The demand for more variety in gluten-free products, particularly bread, pastries, and confectionery items, indicates a need for innovation and diversification with improved product nutritional formulations. Similarly, the interest in OP suggests a potential for expanding organic offer across various food categories, including dairy, meat, and vegetables. However, the importance of ensuring consumer trust in OP claims cannot be overstated. Skepticism about the authenticity of organic labels can undermine market confidence, making it a prime concern for consumers. This is particularly true in the context of the lack of a robust supply chain market, which impacts product availability [

33].

Enhancing transparency in production processes and improving consumer education are essential for building trust and confidence in FF and OP. Implementing measures such as QR codes on packaging to provide detailed information about product origins and production methods can help reassure consumers about the authenticity of organic claims. Educational campaigns highlighting the benefits and proper management of FF products can also help address misconceptions and promote informed purchasing decisions. Marketing strategies play a crucial role here; labeling, certification, and traceability are effective in communicating the organic nature of food products. Additionally, the use of environmentally friendly packaging and promoting the social and environmental benefits of organic food products can align with consumer values and justify premium pricing [

34].

Marketing tactics are essential for the distribution and promotion of organic food items. Effective marketing strategies include labeling and certification schemes that communicate the organic nature of the product to consumers. Traceability mechanisms ensure the authenticity and purity of organic products throughout the supply chain. Furthermore, the use of environmentally friendly packaging aligns with the sustainability values of organic food consumers. Promoting the social and environmental benefits of OP can raise consumer awareness and their willingness to pay a premium price. Pricing strategies, such as offering discounts or promotions and pricing organic products competitively with conventional products, can also encourage trial and lead to repeated purchases.

Policymakers also play a crucial role in supporting the growth of FF and organic markets. Developing policies that incentivize sustainable farming practices, subsidize organic production, and regulate product labeling can help address some of the challenges identified in this study. Additionally, promoting research and development in the FF and organic sectors can foster innovation and improve product quality, further driving market growth. The organic food market faces challenges such as high production costs, limited availability of organic inputs, restricted distribution channels, and a lack of consumer education and awareness. However, there are significant opportunities within the Portuguese context. With increasing awareness around sustainability and health, Portuguese consumers are becoming more receptive to organic and health-conscious food choices. The country’s rich agricultural tradition, combined with a growing focus on eco-friendly and sustainable practices, provides a favorable environment for the expansion of organic food production. By leveraging these strengths, Portugal could further enhance its organic and FF markets while contributing to the broader European green agenda.

This study provides an in-depth understanding of Portuguese consumers' behavior and attitudes towards FF and OP. By exploring socio-demographic characteristics, purchasing patterns, and motivations, this research offers crucial insights for marketeers, the food industry, and policymakers regarding the opportunities and challenges within the FF and organic markets. However, certain limitations must be acknowledged. The sample, although constituted by more 2200 participants, is not representative of the entire Portuguese population, being highly educated and predominantly female, which may not adequately reflect the country's demographic diversity. Additionally, the potential for socially desirable responses may have influenced the accuracy of the reported data. Another significant limitation is the general analysis of OP consumption without detailing specific food categories, which could limit the applicability of the results across different product segments. Despite these limitations, the study provides valuable insights that can guide market offerings, emphasizing the need for greater diversity and transparency in FF and OP, as well as marketing strategies that reinforce consumer trust in product claims.