1. Introduction

Climate change has evolved into a critical issue for contemporary society. Extensive research underscores its potential to affect all dimensions of human well-being, shaping community vulnerability and resilience (Camp et al., 2023; He, 2023; He et al., 2023a, b; He and Guan, 2024; He et al., 2024a, c), as well as influencing drinking water resources and climate ecosystems (He and Ding, 2021, 2023; He and Guan, 2021a, b; He and Guan, 2022a, b). To address this challenge, various measures have been implemented, including the widespread adoption of electric vehicles (EVs) and advancements in lithium-ion battery recycling technologies to mitigate environmental pollution (He et al., 2024b). Among these climate mitigation strategies, solar energy has emerged as a crucial avenue for accelerating the energy transition and furthering emissions reduction initiatives. By the end of 2023, it was estimated that the United States had installed over 91 gigawatts (GW) of utility-scale solar electricity-generation capacity, a significant increase from approximately 314 megawatts (MW) in 1990 (U.S. EIA, 2024a). In the residential sector, around 6.8 GW of solar capacity was installed in 2023, representing a dramatic increase from the 0.027 GW capacity installed in 2005—approximately 250 times higher (Statista, 2024). This growth underscores the rapid expansion of solar energy infrastructure across the nation, driven by technological advancements and supportive policies.

Utility-scale solar projects are large-scale installations designed to generate electricity for direct feed into the public electrical grid, typically exceeding 1 megawatt (MW) in capacity (U.S. EIA, 2019). These projects, often consisting of extensive solar farms or solar power plants, predominantly utilize photovoltaic (PV) systems with centralized inverters. Developed and operated by utility companies or independent power producers, utility-scale solar installations supply substantial electricity to a wide geographic area, meeting the energy needs of thousands of households, industrial, and commercial entities. They play a vital role in achieving renewable energy targets and enhancing grid reliability.

In contrast, residential solar projects are smaller-scale systems intended for individual homes or small communities. These installations are primarily rooftop systems or modest ground-mounted arrays, generally ranging from a few kilowatts (kW) to several dozen kilowatts. Residential solar systems are designed to meet the electricity demands of the specific property on which they are installed, often incorporating net metering to allow homeowners to export excess electricity back to the grid. This arrangement not only reduces utility bills but also contributes to energy independence and supports broader sustainability efforts by reducing reliance on fossil fuels.

Previous research has predominantly concluded that the cost of residential solar installations is significantly higher compared to utility-scale solar projects (Ramasamy et al., 2023; Awan et al., 2020; Benalcazar et al., 2024). This cost differential arises from various factors, including economies of scale, with utility-scale projects benefiting from larger installations that reduce per-unit costs (Bolinger et al., 2023). Additionally, utility-scale projects often have better access to more favorable financing terms and purchasing power for equipment and materials, further lowering overall expenses (Siregar et al., 2023). In contrast, residential solar systems, being smaller in size and less centralized, tend to have higher per-unit costs due to less favorable financing, smaller purchase volumes, and the additional costs associated with individual installation processes. Nonetheless, to the best of our knowledge, no research has yet conducted a comprehensive economic analysis comparing solar projects of different scales, particularly from a life-cycle perspective. This gap in the literature indicates a need for a thorough investigation that considers not only the initial capital and operational costs but also the long-term environmental and economic benefits and challenges associated with both residential and utility-scale solar installations. Such an analysis would provide valuable insights into the overall cost-effectiveness and sustainability of solar energy deployment at various scales.

Recent academic literature on the economic analysis of utility-scale solar projects focuses on critical areas such as the Levelized Cost of Electricity (LCOE), capital expenditures, and operational costs. A study by Wiser et al. (2020) surveyed solar industry professionals and analyzed various data sources to identify trends in the expected useful life and operational expenditure (OpEx) of utility-scale photovoltaic (PV) plants across the United States. The study highlighted that while the range in average lifetime OpEx for utility-scale projects is broad, there has been a noticeable decline in levelized, lifetime OpEx and average Operation & Maintenance (O&M) cost estimates, with expectations for further reductions in the future (Wiser et al., 2020). This trend underscores the ongoing improvements in the efficiency and cost-effectiveness of solar power technology, bolstered by advancements in materials, economies of scale, and more efficient operational practices (Wiser et al., 2020). Such findings are essential for understanding the economic viability and sustainability of solar projects as a key component of the global energy transition. However, their analysis is confined to operational expenditures, including OpEx and O&M costs, while overlooking the comprehensive consideration of projects’ End-of-Life management costs, such as decommissioning and demolition expenses. Another study from Michaud et al., (2020) provided a detailed economic impact analysis for solar projects in the state of Ohio. It examined scenarios ranging from low to aggressive deployment of solar projects assessing factors such as job creation, tax revenues, and overall economic benefits (Michaud et al., 2020). The study emphasizes the importance of large-scale solar projects in supporting reginal economic development and energy transitions (Michaud et al., 2020). Nonetheless, the study primarily addresses the macroeconomic effects of utility-scale solar project deployments from a state or a region’s perspective, but it does not delve into the detailed financial analysis needed to evaluate the investment returns of a typical utility-scale solar project. This oversight leaves out critical considerations such as cash flow analysis, internal rate of return (IRR), and net present value (NPV), which are essential for assessing the financial viability and attractiveness of individual projects to investors. Siregar et al. (2023) introduced an analytical framework aimed at evaluating the cost-benefit analysis of utility-scale solar projects, encompassing the entire lifecycle from research and development to the end-of-life phase of demolition. However, the study's scope was limited to proposing this framework conceptually, as it did not include a detailed analysis based on case studies or authentic market data (Siregar et al., 2023). This limitation underscores the need for further empirical research to validate the framework's practical applicability and to assess its effectiveness in real-world scenarios (Siregar et al., 2023).

Recent literature on the economic analysis of residential-scale solar projects covers various aspects, including system costs, financial viability, and the impact of different tariff structures. For instance, a study by Cucchiella et al. (2017) analyzed residential photovoltaic (PV) systems using metrics like Net Present Value (NPV), Discounted Payback Time (DPBT), and Levelized Cost of Electricity (LCOE). The research found that self-consumption significantly enhances financial performance, especially in mature markets with supportive fiscal policies (Cucchiella et al., 2017). Sensitivity analyses indicated that higher self-consumption rates and favorable electricity pricing are critical for maximizing economic benefits (Cucchiella et al., 2017). Nonetheless, they didn’t incorporate the consideration of residential solar and batteries that could potentially affect the investment return ratio of the system. Another study by Chand et al., (2019) focused on grid-tie solar systems highlighted the economic advantages of such systems over stand-alone configurations. The grid-tie systems not only reduce grid electricity consumption but also have lower maintenance costs due to the absence of battery storage systems (Chand et al., 2019). This study emphasized that while initial costs are high, the long-term economic benefits and reduced dependence on grid electricity make grid-tie systems an attractive option for residential users (Chand et al., 2019). However, the study only focuses on comparing two different types of residential solar systems, neglecting the evaluation of economic return of these systems from a comprehensive End-of-Life (EOL) perspective. Furthermore, research by Zeraatpisheh et al. (2018) evaluated different building types and PV system sizes, assessing their economic viability under various demand charge tariffs. The findings suggested that, despite environmental benefits, the economic justification for PV systems is limited in regions with high demand charges, highlighting the importance of local regulatory frameworks in determining the financial attractiveness of solar investments (Zeraatpisheh et al., 2018). A comprehensive analysis of solar PV systems with battery storage in Brazil revealed that current regulatory frameworks significantly affect the economic feasibility of such systems (Deotti et al., 2020). The study proposed various business models and policy interventions to make PV systems with battery storage more economically viable (Deotti et al., 2020). Similar study by Kizito (2017) also assessed the residential photovoltaic systems with and without energy storage from an economic perspective. The study proposed a mathematical approach to compute a return of investment (ROI) under 3 different scenarios, highlighting the significant role of energy storage plays in the residential solar sector. Nonetheless, the study did not encompass utility-scale solar systems, thereby omitting a crucial aspect of the comparative analysis between utility-scale and residential solar energy production. This gap indicates the necessity for an integrated framework that incorporates financial metrics, regulatory considerations, and technological advancements to facilitate a more comprehensive and streamlined evaluation of both utility and residential solar investments. This approach should especially emphasize the entire project life cycle, ensuring a thorough assessment from initial investment through to operational sustainability and end-of-life considerations. Such a framework would aid in better understanding the economic viability and optimizing decision-making processes for stakeholders involved in developing residential solar projects.

This research aims to address the existing gap by developing a comprehensive economic analysis framework to compare solar investments at both utility and residential scales from a full life-cycle perspective. The study applies this framework to three distinct states—California, Texas, and Tennessee—to examine the sensitivity of various influencing factors on the investment return ratio for solar projects in both scales. By integrating a wide range of geographical and policy contexts, the analysis aims to deliver a detailed and sophisticated understanding of the economic feasibility and operational performance of solar energy systems. This comprehensive approach is essential for providing robust consultative guidance on economic investment opportunities and returns, particularly for prospective developers interested in utility and residential-scale solar projects. The analysis addresses critical variables that influence these investments, offering insights that are crucial for making informed, strategic decisions in the renewable energy sector.

The manuscript is structured as follows:

Section 2 provides an overview of the data and study area utilized in this research.

Section 3 details the methodology applied in the analysis.

Section 4 presents the results and discussions arising from the study's findings. Finally,

Section 5 offers conclusions drawn from the research, summarizing key insights and implications.

2. Data and Study Area

In this section, we present the cost and revenue data utilized to calculate the investment return ratio for both residential and utility-scale solar projects. Additionally, we introduce the case study regions—Tennessee, California, and Texas—selected for this analysis based on their distinct market conditions, regulatory environments, and their current standing in solar industry.

2.1. Data

To calculate the IRR for both residential and utility-scale solar projects, various cost data were collected, including capital costs for procurement and installation, operation and maintenance (O&M) expenses, as well as permitting and environmental study fees. For utility-scale solar projects, land acquisition costs specific to the three selected states were also gathered. Regarding solar revenue data, federal tax incentives, the retail price of solar-generated electricity for both residential and utility scales, and the annual solar electricity generation capacity were included in the analysis. Specifically, the average retail price of residential electricity and net metering rates for the three states were collected to perform the cost-benefit analysis for residential solar projects.

2.2. Case Study Area

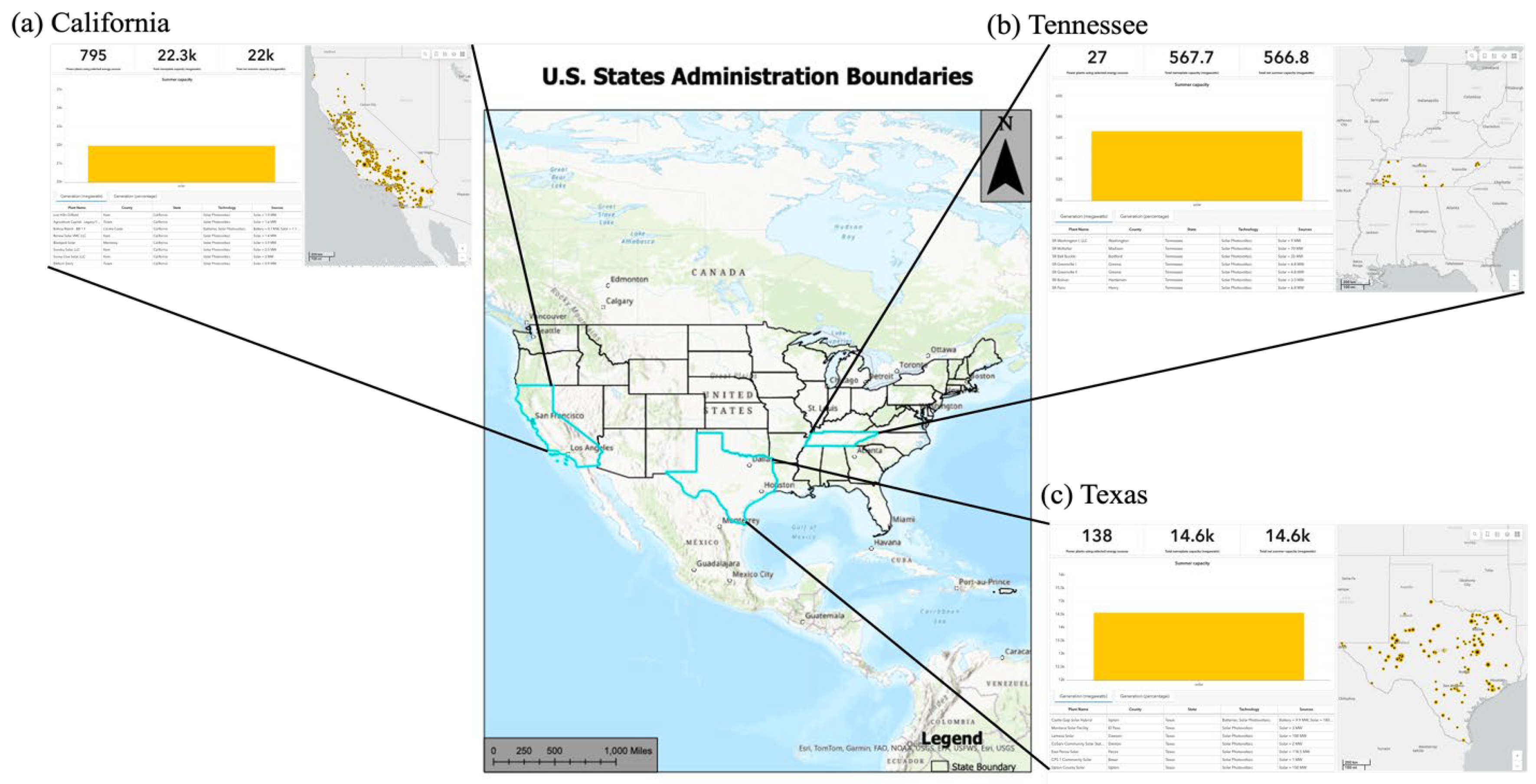

In this study, California, Texas, and Tennessee (Fig. 1) were selected as case study areas. These three states present distinctive profiles in terms of installed solar capacity distributions, shaped by their geographical, regulatory, and economic landscapes.

California possesses an approximately 39 million residents across an area of around 163,696 square meters (California Department of Finance, 2023). The state stands as a leader in solar energy production within the United States. As of early 2024, California's utility-scale solar capacity is over 20,000 megawatts (MW) shown in Fig. 1(a), with utility-scale solar alone contributes approximately 16% of the state's total electricity generation, and small-scale solar projects increasing this contribution to around 28% (CEC, 2024a). The state's solar capacity is a testament to its robust policies, favorable climate, and significant investments in renewable energy infrastructure. California's solar initiatives are supported by an extensive legislative framework, including the California Solar Initiative and the Renewable Portfolio Standard, which mandates that a substantial percentage of electricity come from renewable sources (CPUC, 2024; CEC, 2024b). For instance, The California Solar Mandate, which passed in 2018 and began in 2020, has been expanded that as of January 2023, most new homes, apartments, and commercial buildings are required to include residential solar systems (CEC, 2018). The state's abundant sunlight, especially in the southern and central regions, further enhances its suitability for solar energy generation (Tabassum et al., 2021). It is reported that the average solar irradiance for California, measured in Global Horizontal Irradiance (GHI), varies across the state but generally falls within a range of approximately 5.5 to 6.5 kWh/m2/day (Sengupta et al., 2018). As of the 2019 data, California's solar capacity surpasses that of any other state, with approximately 44.92% of all homes installed with residential solar systems, positioning it as a crucial player in the transition to clean energy (Gavop Analysis, 2019). In this study, California is recognized as the state benchmark with the most established solar infrastructure and supportive renewable policies.

Texas, known for its vast oil and natural gas reserves, has also emerged as a significant player in the solar energy sector. The state has a population over 30 million as of 2023, covering 695,660 square kilometers (U.S. Census Bureau, 2023). The state's large geographical area and high levels of solar irradiance, particularly in the western regions, provide ideal conditions for solar power generation. Research found that the average solar irradiance in Texas varies depending on the region and seasons. For example, a study by Slusarewicz and Cohan (2018) indicates that the average daily solar irradiance can reach up to approximately 981 W/m2 during peak summer months, while it decreases to around 440 W/m2 in winter. This variability is influenced by seasonal changes and cloud cover, with summer typically providing the highest levels of solar irradiance. These figures also highlight the potential for solar energy projects across Texas, especially in regions with consistently high solar irradiance levels, such as the western and southern regions. It is estimated that in 2023, installed solar capacity in Texas totaled more than 14 GW (Fig. 1(c)), with utility-scale solar alone contributes approximately 8% of the state's total electricity generation, reflecting the repaid growth in solar capacity within the state (Antonio and Peterson, 2024). Texas's deregulated energy market and supportive regulatory environment are also reasons that fostered a competitive landscape for renewable energy projects. The state's solar capacity has been growing rapidly, driven by both utility-scale projects and distributed solar installations. As of 2024, Texas ranks third in the U.S. for residential solar power generation, with approximately 264,000 residential solar installations have been completed (Blake, 2024). Texas's commitment to renewable energy is further underscored by its ambitious renewable energy targets and substantial investment in grid infrastructure to support solar and wind integration (Blake, 2024). Thus, Texas is recognized as the state benchmark that combines its traditional energy strengths with a burgeoning solar market in this study.

Tennessee, while not traditionally recognized as a solar powerhouse, has been gradually increasing its solar capacity. The population of the state reaches approximately 6.9 million based on the recent 2020 census (U.S. Census Bureau, 2020). The state's growth in this sector can be attributed to both public and private sector initiatives aimed at expanding renewable energy sources. Tennessee benefits from moderate solar irradiance, making it suitable for solar installations, albeit on a smaller scale compared to states like California. The average solar irradiance in Tennessee varies across the state but generally ranges from 4.5 to 5.0 kWh/m2/day (NSRDB, 2024). Recent policy developments, including tax incentives and net metering policies, have encouraged both residential and commercial investments in solar energy. One example is the Green Energy Property Tax Assessment, which caps the property tax increase due to solar installations at 12.5% of the total system value (Olizarowicz, 2024). Although the state's overall solar capacity remains modest, the trend indicates a growing recognition of the potential benefits of diversifying its energy portfolio through solar power. As of 2024, Tennessee has seen significant growth in utility-scale solar capacity, largely driven by initiatives from the Tennessee Valley Authority (TVA). The state's total solar power capacity reached approximately 560 megawatts (MW) by mid-2023 (Fig. 1(b)), with plans for an additional 550 MW to be added, including a significant 254 MW solar farm expected to come online by the end of the year (TVA, 2023). This expansion is part of TVA's broader strategy to incorporate 10 GW of solar capacity by 2035, with a target of 5 GW by 2030 (TVA, 2023). These developments reflect a growing commitment to renewable energy in Tennessee, where solar photovoltaic (PV) facilities now account for about 7% of the state's renewable energy generation. Most of this capacity comes from utility-scale installations, with ongoing projects set to further increase the state's solar capacity and contribute to TVA's goals of reducing carbon emissions (TVA, 2023). Additionally, as of 2024, residential solar power in Tennessee contributes approximately 1.36% to the state's total electricity generation (SEIA, 2024). Meanwhile, the state has experienced an annual growth rate in residential solar installations of approximately 10-12% (Chester, 2023). This includes both rooftop solar installations and small-scale solar projects (SEIA, 2024). The state's total solar capacity stands at around 895 MW, which is enough to power approximately 93,737 homes (SEIA, 2024). In summary, in this study, Tennessee is recognized as the state with strong emerging potentials in solar infrastructure developments and investments.

Figure 1.

Utility solar project distribution of selected case study areas: (a) California; (b) Tennessee; (c) Texas (Adapted from US EIA: Renewable Electricity Infrastructure and Resources Dashboard).

Figure 1.

Utility solar project distribution of selected case study areas: (a) California; (b) Tennessee; (c) Texas (Adapted from US EIA: Renewable Electricity Infrastructure and Resources Dashboard).

3. Methodology

Here, in methodology section, we present the mathematical approach to calculate the economic performance of investments associated with solar projects of both scales: utility and residential. Specifically, two scenarios are considered in residential solar projects that include roof-top solar only and roof-top solar paired with battery energy storage system (BESS).

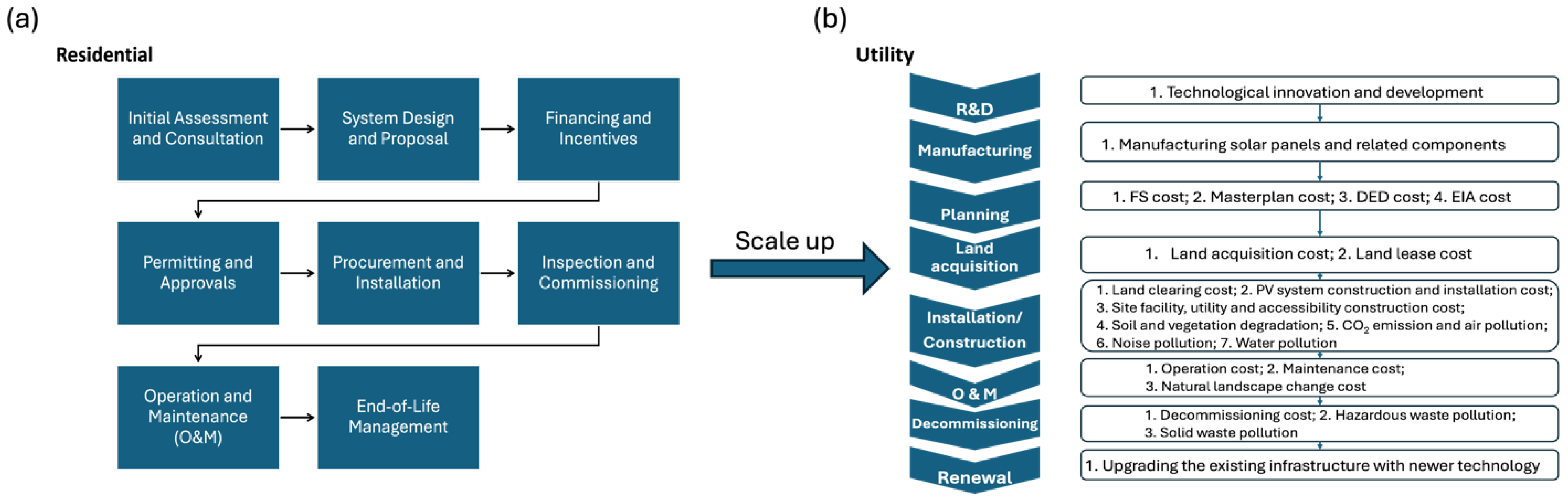

The economic performance of the projects is evaluated using the internal rate of return (IRR) as the primary metric. To calculate the IRR, both the costs and revenues associated with the projects are considered. For residential solar projects, the cost analysis encompasses the entire lifecycle, including initial assessment and consultation, system design and proposal, financing and incentives, permitting and approvals, procurement and installation, inspection and commissioning, operation and maintenance (O&M), and end-of-life management (EOL) (Fig. 2(a)). Specifically, the costs for the initial assessment, consultation, permitting, and approvals are consolidated under the category of permitting costs. Similarly, system design, proposal development, procurement, and installation are grouped under installation costs. Additionally, inspection, commissioning, and operation and maintenance (O&M) are combined under the category of O&M costs. In terms of revenue, the analysis primarily accounts for avoided electricity costs offset by solar-generated energy, potential income from net metering (where applicable), and federal tax incentives.

For utility-scale solar projects, the costs considered include research and development (R&D), manufacturing, planning, land acquisition, installation and construction, O&M, decommissioning, and renewal (Fig. 2(b)). Specifically, the costs associated with research and development (R&D), manufacturing, planning, and installation are collectively categorized as installation costs in this study. Additionally, a notable distinction between residential and utility-scale solar projects is that land acquisition represents a significant cost component for utility-scale installations, whereas the use of residential rooftops is typically cost-free. Regarding revenue, utility-scale solar projects benefit from the sale of generated electricity to utility companies, federal tax incentives, and potential income from net metering.

The detailed model for calculating the cost and revenue for residential and utility solar projects is elaborated in the following.

3.1. Utility Solar Project

In our analysis, we adopt the Investment Return Ratio (IRR) as the primary metric to evaluate the economic viability of utility-scale solar systems. This metric is calculated by comparing the total economic gains and costs of the solar farm, exclusive of any energy storage solutions, against the overall capital investment. Specifically, the IRR is derived from the ratio of the net economic benefits of the utility-scale solar farm to its total capital costs. This approach provides a robust measure of the project's financial performance under the specified scenario. Specifically, the internal rate of return is defined as:

where:

= overall capital gains of the utility-scale solar project investment;

= overall capital costs of the utility-scale solar project investment.

Development process of a typical utility-scale solar project is shown in

Figure 2(b). The overall capital costs of the project can involve all processes beginning from research and development of solar panels and inverters, manufacturing of the necessary equipment, to the land acquisition and leasing, down to the project demolition (

Figure 2(b)). The capital gains of an utility-scale project typically involves the retail revenues of the energy production of the project, and tax incentives from the solar policies.

Specifically, the total capital gain of a utility-scale solar project is defined as follows

where:

= tax incentives for the utility solar investment for year

= capital gains from power purchase agreement (PPA) from utility solar project for year

= utility scale solar project operational life period, which is typically around 25 years for utility scale project

Typically, the total tax incentive consists of contributions from both federal and state, defined as

where:

= federal tax incentive for utility scale solar project for year

= state tax incentive for utility scale solar project for year

Specifically, in the utility solar project scenario, the federal tax incentive includes the solar investment tax credit (ITC) (IRS, 2023a) and Modified Accelerated Cost Recovery System (MACRS).

Additionally, the capital gain from a utility-scale solar project is calculated as the multiplication between the electricity generation and the retail price of the power purchase agreement (PPA) that is derived from LevelTen Energy (2024), defined as follows

where:

= retail price of the PPA between utility solar farm and utility power companies for year

= electricity generated by utility solar farm for year

In the context of total capital costs for a utility-scale solar project, the capital investments required for purchasing or leasing land typically constitute a significant portion of the overall project capital investments shown in

Figure 2(b). Meanwhile, the R&D, manufacturing, as well as transportation costs associated with PV system and accessory equipment are included in the total capital investments of PV system. Specifically, the total capital costs of a utility-scale solar project can be defined as the follows

where:

= total capital investments of PV system for utility-scale solar farms

= total installation costs, installer profits, and commissioning costs of the utility-scale solar project

= O&M costs for utility-scale solar farm for year

= capital costs on acquiring or leasing land for utility scale solar project for year

= total demolition cost of the utility scale solar project

= total planning cost for the utility scale solar project

= utility scale solar project operational life period

Among these mentioned above, the O&M costs, demolition costs, and land acquisition costs were derived from NREL (2023).

Within the total capital investments of PV system

, it typically involves solar modules cost, central/string inverters cost, balance of system cost, permitting cost, sales tax, shipping cost of the components, defined as

where

= total capital investments of utility-scale solar project

= total capital investments of solar modules for utility-scale solar project

= total capital investments of balance of sheet for utility-scale solar project

= total capital costs of permission application for utility-scale solar project

= sales tax costs of solar equipment procurement for utility-scale solar project

= transportation costs of utility-scale solar equipment

The capital costs for utility solar investments and installations were derived from Ramasamy et al., (2023).

3.1. Residential Solar Project

In terms of residential solar projects, a significant difference from the utility-scale solar project is that instead of assuming all the electricity generated from solar will be sold to utility company, only partial of solar-generated electricity can be consumed by residents. Additionally, we consider two scenarios for calculating the investment return ratio (IRR) of residential solar systems: (1) scenario 1: solar panels only without residential energy storage solution; (2) scenario 2: solar and residential energy storage solution. With the consideration of residential solar batteries as energy storage solution, we assume that all the solar-generated electricity can be consumed by residents in this scenario. For both scenarios, the IRR is calculated as the division of the overall net economic gains and the capital investment costs throughout the project life cycle.

where:

= capital gains of the residential solar investment of scenario 1;

= overall capital costs of the residential investment of scenario 1.

3.1.1. Scenario 1: Residential Solar Only

The investment gain of the residential solar investment scenario 1 includes the: (1) the annual energy savings from solar generated electricity; (2) the federal and state tax incentives associated with the residential solar investment; (3) the credit from net-metered energy sold back to the grid.

Specifically, the federal and state tax incentives for the year

are defined as

where

and

are federal tax incentives (IRS, 2023b) and state tax incentives, respectively. It should be noted that while federal tax incentives are generally the same across states, the state tax incentive is subjected to each state’s individual residential solar policy. Specifically, the state incentives are ignored in the calculation due to the uncertainty and fluctuations associated with each state’s local incentive to solar projects.

Then, annual energy savings from solar generated electricity contributes to the main part of the capital gains of the residential solar systems. It is the difference between the average annual energy consumption of a residence and the energy consumed from the grid, defined as

where:

= annual energy savings from solar generated electricity for year

= annual energy consumption for year

= annual energy consumed from the grid by a residence in year

= capital gain from the annual energy savings from solar generated electricity for year

= average retail price of electricity consumed from grid

Specifically, the average retail price of residential electricity consumed from grid was derived from U.S. EIA (2024b), and the mean annual energy consumption profiles of residents across states were derived from U.S. Energy Information Administration (2024c).

Finally, there is an additional benefit from the net-metering policy, which credits residences for selling excess solar energy back to the grid. Typically, the retail price for solar-generated electricity sold back to the grid under the net-metering policy is significantly discounted compared to the retail price of electricity purchased from the grid. The credit for net-metered energy injected back into the grid is defined as follows:

where:

= credits by net-metering policy

= excess energy sold to grid by net-metering policy

= retail price of the excess energy sold to grid by net-metering policy (usually at a discount price compared to the retail price of electricity coming from the grid)

Specifically, the net metering effects are only considered in calculating California state’s residential solar IRR as NEM 3.0 based on CPUC (2022) in this study since the policy is minute in the other two states (TN and TX).

Thus, the total economic investments gain of the residential solar projects are as follows:

where

N represents the project's lifetime, the total economic investment gains are determined by summing up the annual economic gains for each year throughout the project's duration.

One notable distinction between residential and utility-scale solar projects in terms of investment costs lies in the need for property investments. Unlike utility-scale projects, residential solar projects do not necessitate investments in the property itself, as they typically utilize the existing roof space of a residence to install the solar panels and associated equipment (

Figure 2). Consequently, the total capital costs for typical residential solar projects encompass the following components: (1) Capital costs of the photovoltaic (PV) system; (2) Installation and labor costs for the PV system; (3) Operation and maintenance (O&M) costs of the PV system; (4) Capital costs associated with the loan used to finance the project; (5) End-of-life demolition costs. Thus, the total capital costs for residential solar projects can be defined as the sum of these specific cost elements.

where

is the O&M costs in year

that were derived from Walker et al., (2020).

N signifies the project's lifetime,

represents the permitting costs,

indicates the total demolition cost of the project at the end of project life cycle, and

defines the total capital costs of PV system that include installation costs. Consequently, the total project costs comprise the sum of these individual costs over each year of the project’s operational life period. It should be noted that investments in the PV system and associated equipment, planning of the project and demolition are typically one-time expenditures rather than recurring annual costs throughout the project's operational period.

Additionally, the total capital costs of PV system include solar module costs, inverter costs, labor installation cost, balance of system cost, permit, grid-interconnection, inspection cost, sales tax, shipping cost of the components, and the sales and marketing, overhead, and installer profits costs, defined as follows:

where:

solar modules costs

= solar inverter costs

= labor installation costs

= balance of system cost

= permit cost

= inspection cost

= sales tax cost

= shipping cost of the components

= installer profits

Specifically, the total capital costs for residential solar installations were derived from Ramasamy et al., (2023).

3.1.1. Scenario 2: Residential Solar and Battery Integrated System

For residential solar energy systems, an additional scenario is considered in which the solar installation is integrated with a battery energy storage system (BESS). Unlike the first scenario, which involves only a residential solar system, the inclusion of a BESS allows the electricity generated by rooftop solar panels during the daytime to be stored and utilized during nighttime hours when the sunlight is absent. This integration significantly enhances the overall efficiency of energy utilization in residential solar projects. However, the addition of a BESS also increases both the installation and operation and maintenance (O&M) costs. In this study, it is assumed that the residential battery completes a full charge and discharge cycle each day, optimizing the use of the electricity generated by the residential solar system. Under this scenario, the system is capable not only of offsetting the resident's electricity consumption during the daytime but also of offsetting an equivalent amount of energy during nighttime hours for a typical resident, determined by the battery's storage capacity.

The internal rate of return (IRR) for the residential solar system under this scenario was calculated. The methodology employed mirrors that used in Scenario 1, with certain values adjusted to reflect the specifics of this particular scenario with battery storage system equipped with the roof-top solar panel. A detailed breakdown of the input parameters and their corresponding values for this scenario is provided in the Results and Discussion section.

3.1. Case Study

In this study, simulations were conducted to evaluate the investment return ratios for solar energy projects at two scales: residential and utility-scale. For the residential scale, two scenarios were considered: (1) a solar-only system, and (2) a solar system combined with a residential battery energy storage system (BESS). In Scenario 1, the residential solar system is designed with a capacity of 8 kWdc for a typical resident, while in Scenario 2, the system includes an 8 kWdc solar installation combined with a 12.5 kWh residential BESS. At the utility scale, the model simulates a 100 MWdc solar farm. Specifically, these capacity numbers designed for the simulation were derived from Ramasamy (2023) as a typical solar project configuration for residential and utility scales. The simulations were performed for three distinct geographic locations: Tennessee, California, and Texas. Specifically, California is widely regarded as a representative example of an established leader in the solar industry, while Texas serves as a key representative of a rapidly growing solar market. Tennessee, on the other hand, is characterized as a representative state with moderate solar adoption. These classifications correspond to states with aggressive, progressive, and moderate development statuses within the solar industry. A detailed summary of these simulations is provided in the following

Table 1.

Specifically, the input data for both residential and utility-scale solar installations were utilized to calculate the investment return ratio for solar projects in three states—Tennessee, California, and Texas—based on simulation model configurations, as outlined in

Table 1. Additionally, since there is uncertainties associated with the input data source, thus a high end and low end of the input data are provided in the model calculations. A comprehensive analysis was derived based on the economic model presented above and the results are provided in

Section 4, which presents a detailed discussion of these findings.

4. Results and Discussion

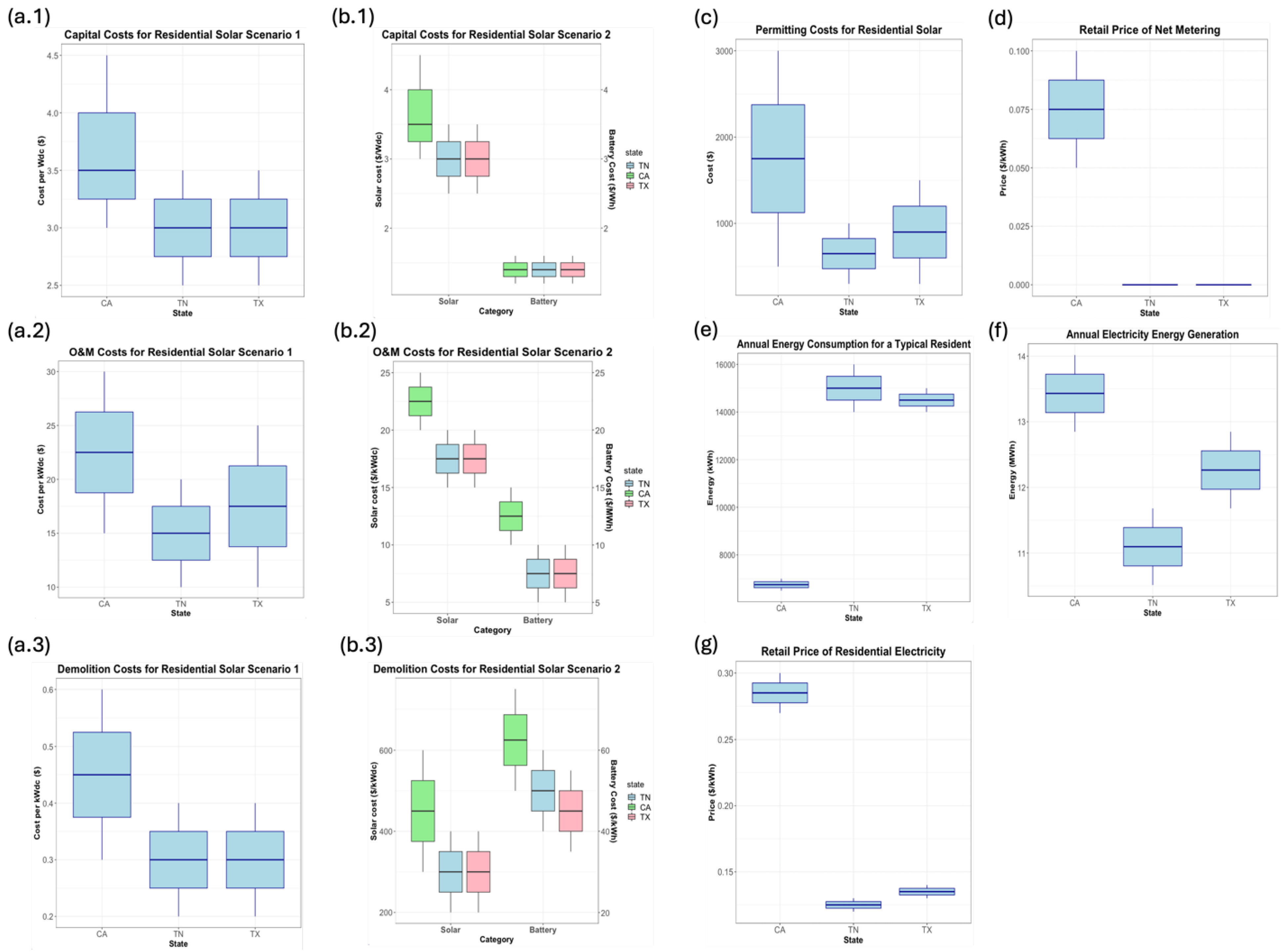

Figure 3 provides a detailed overview of the input data used in the economic model for residential solar projects across California, Tennessee, and Texas, with a particular focus on capital costs, operations and maintenance (O&M) costs, and demolition costs. The analysis reveals significant regional disparities that highlight both the economic and regulatory differences across these states, which in turn impact the overall financial feasibility of residential solar projects.

In terms of capital costs, as shown in

Figure 3(a.1), California emerges as the state with the highest costs, ranging from

$3.0/Wdc to

$4.5/Wdc, compared to Tennessee and Texas, where the capital costs are lower and range between

$2.5/Wdc and

$3.5/Wdc. The higher costs in California may reflect a combination of more stringent building codes, higher labor costs, and complex regulatory hurdles, all of which contribute to a more expensive solar installation process. In contrast, Tennessee and Texas present a more favorable cost structure for homeowners considering solar, likely due to lower labor costs and fewer regulatory barriers.

Operations and maintenance (O&M) costs, displayed in

Figure 3(a.2), further emphasize the cost variance across these regions. California’s O&M costs range from

$15/kWdc/year to

$30/kWdc/year, significantly higher than Tennessee’s

$10/kWdc/year to

$20/kWdc/year and Texas’

$10/kWdc/year to

$25/kWdc/year. These differences may be attributed to the diverse environmental conditions in California that necessitate more frequent maintenance, as well as a more competitive service market that drives up prices. Meanwhile, Tennessee and Texas offer lower O&M costs, suggesting that the maintenance of solar installations in these states is less intensive, likely due to favorable climate conditions or market dynamics.

Finally, demolition costs, as seen in

Figure 3(a.3), also demonstrate a regional divide. California once again leads with higher costs, ranging from

$0.3/Wdc to

$0.6/Wdc, while Tennessee and Texas maintain similar and lower demolition costs, both ranging from

$0.2/Wdc to

$0.4/Wdc. This difference can be attributed to California’s stricter environmental and disposal regulations, which may impose additional costs for the safe removal and handling of solar equipment at the end of its lifecycle.

The data in

Figure 3 collectively illustrate the significant cost variations between California, Tennessee, and Texas, pointing to how regional policies, environmental factors, and market conditions directly impact the financial dynamics of residential solar projects. These findings underscore the importance of region-specific strategies for solar energy adoption and indicate that policymakers must consider localized cost drivers when designing incentives and support programs to promote solar energy.

A similar trend is observed in Scenario 2, where residential solar installations are equipped with rooftop solar panels combined with a residential battery energy storage system (BESS) (Fig. 3(b.1) – Fig. 3(b.3)). Horizontally,

Figure 3(b.1) – (b.3) illustrate that for installation, operation and maintenance (O&M), and demolition costs, the solar system incurs significantly higher costs compared to the BESS in residential solar projects. Specifically, in terms of capital costs for residential solar and BESS, the expenses range from approximately

$2.5/Wdc to

$3.5/Wdc plus

$1.2/Wh to

$1.6/Wh in Tennessee,

$3.0/Wdc to

$4.5/Wdc plus

$1.2/Wh to

$1.6/Wh in California, and

$2.5/Wdc to

$3.5/Wdc plus

$1.2/Wh to

$1.6/Wh in Texas (

Figure 3(b.1)).

For O&M costs, the combined residential solar and BESS systems amount to approximately

$15/kWdc to

$20/kWdc plus

$5/MWh to

$10/MWh in Tennessee,

$20/kWdc to

$25/kWdc plus

$10/MWh to

$15/MWh in California, and

$15/kWdc to

$20/kWdc plus

$5/MWh to

$10/MWh in Texas (

Figure 3(b.2)). Regarding demolition costs, these range from approximately

$0.2/Wdc to

$0.4/Wdc plus

$0.04/Wh to

$0.06/Wh in Tennessee,

$0.3/Wdc to

$0.6/Wdc plus

$0.05/Wh to

$0.075/Wh in California, and

$0.2/Wdc to

$0.4/Wdc plus

$0.035/Wh to

$0.055/Wh in Texas (

Figure 3(b.3)).

The data necessary for performing the calculations, including permitting costs, annual electricity consumption, retail residential electricity prices, net metering policies, and annual solar energy generation, are consistent across the two residential solar scenarios under consideration. As demonstrated in

Figure 3(c), the costs associated with permitting and environmental studies range from approximately

$300 to

$1000 per residential solar project in Tennessee,

$500 to

$3000 in California, and

$300 to

$1500 in Texas.

Figure 3(d) highlights that California is the only state offering significant compensation for net-metered electricity, ranging from approximately

$0.05/kWh to

$0.1/kWh. The effects of net metering in Tennessee and Texas are disregarded due to the absence of consistent monetary incentive programs for net metering in these states. Additionally, energy consumption varies by state, with Tennessee residents typically using between 14 MWh and 16 MWh per year, California residents consuming between 6.5 MWh and 7 MWh per year, and Texas residents using between 14 MWh and 15 MWh annually, as shown in

Figure 3(e). For the average retail price of grid electricity, we assume a range of

$0.12/kWh to

$0.13/kWh in Tennessee,

$0.27/kWh to

$0.30/kWh in California, and

$0.13/kWh to

$0.14/kWh in Texas, as depicted in

Figure 3(g).

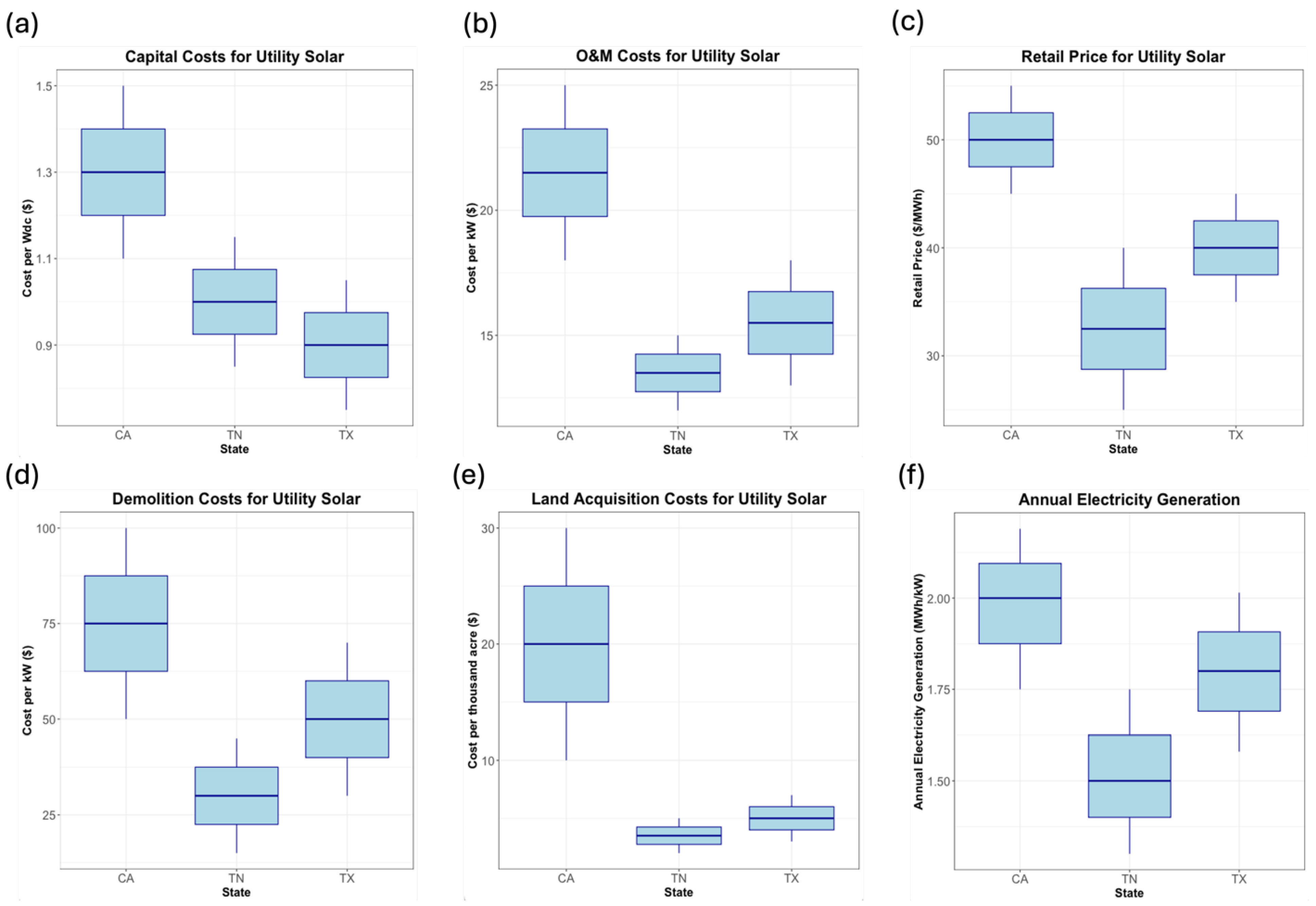

Figure 4 presents a comparative analysis of financial and performance metrics for utility-scale solar projects across three U.S. states: California, Tennessee, and Texas. The box plots illustrate key variables, including capital costs, operations and maintenance (O&M) costs, retail electricity prices, demolition costs, land acquisition costs, and annual electricity generation. These metrics provide insights into the economic and operational factors influencing solar project feasibility and efficiency in different geographic regions and were input to the model simulation and calculation.

The capital costs per watt are highest in California, with a broad range between

$1.1 and

$1.5 per watt, while Tennessee and Texas display lower, more consistent costs, typically ranging between

$0.85 and

$1.15 per watt for Tennessee and

$0.75 and

$1.05 per watt in Texas (

Figure 4(a)). California also exhibits substantially higher O&M costs, with a median cost near

$20 per kW, compared to Tennessee and Texas, where the median O&M costs fall below

$20 per kW, highlighting regional differences in maintaining solar infrastructure (

Figure 4(b)).

In terms of retail electricity prices, California again leads with a higher price range between

$40/MWh and

$55/MWh, while Tennessee and Texas show considerably lower retail prices, with Tennessee's prices clustering between

$25/MWh and

$40/MWh and Texas around

$40/MWh (

Figure 4(c)). These pricing differences reflect the varying state policies and market conditions affecting solar energy pricing, leading to varying utility solar project investment return ratio.

Demolition costs follow a similar pattern, with California’s costs ranging from

$50/kW to

$100/kW, reflecting higher end-of-life decommissioning expenses. Tennessee and Texas, by contrast, show lower median demolition costs, particularly Tennessee, which demonstrates more affordable decommissioning expenses (

$15/kW to

$45/kW) relative to the other states (

Figure 4(d)).

Land acquisition costs are also notably higher in California, with values ranging from

$10,000 to

$30,000 per thousand acres, compared to Tennessee and Texas, where costs are significantly lower and generally below

$10,000 per thousand acres (

Figure 4(e)). This difference indicates the higher land acquisition costs in California, likely due to land availability, demand, and regulatory factors, are playing critical role in determining solar investment decision in the state.

Annual electricity generation potential shows a significant advantage for California, with median values around 2 MWh/kW and a range extending beyond 2.25 MWh/kW. Texas also demonstrates relatively high generation potential, though its upper range is lower than that of California. Tennessee, on the other hand, exhibits the lowest generation potential, with median values under 1.75 MWh/kW, reflecting a less favorable environment for solar energy production.

In summary,

Figure 4 suggests that while California incurs higher upfront and operational costs for utility-scale solar projects, it offers superior solar generation potential and higher retail prices. In contrast, Tennessee and Texas present more cost-effective options, though they yield lower solar energy output, indicating a trade-off between cost efficiency and energy production across different states.

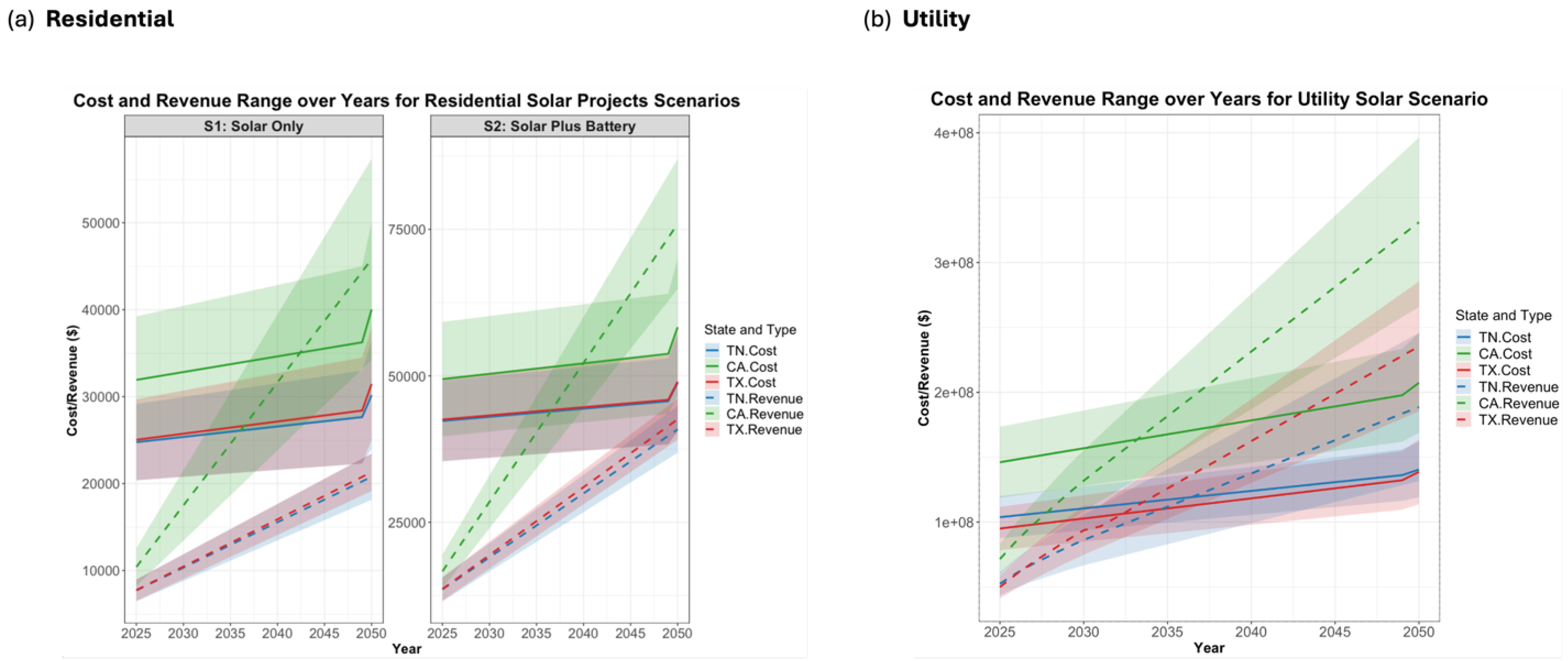

Figure 5 presents the projected cost and revenue ranges for both residential and utility-scale solar project scenarios across three states: Tennessee (TN), California (CA), and Texas (TX), based on the input data and assumptions outlined earlier. The ribbons in

Figure 5 represent both the lower and upper bounds of the estimations for each year within the residential model life cycle. Additionally, the solid line and dashed line represent the cumulative project cost and revenue for each year within the project life period for the three states, respectively. The simulation projections cover the period from 2025 to 2050 and encompass two residential scenarios—Scenario 1 (Solar Only) and Scenario 2 (Solar Plus Battery)—as well as a utility-scale solar scenario.

In the residential solar Scenario 1, both costs and revenues are expected to increase over time, with California demonstrating the highest revenue potential throughout the examined period, as depicted in

Figure 5(a). The cost trajectories for Tennessee and Texas remain comparatively moderate relative to California, which incurs higher initial and projected future costs. The revenue margins across all three states suggest that while California solar projects involve higher costs, they also offer significantly greater revenue potential. Specifically,

Figure 5 illustrates that California residents are projected to recover their initial costs by approximately the 18th year of the project, whereas Tennessee and Texas residents are unable to recover their initial investments within the project’s life cycle. Of these two states, Texas slightly outperforms Tennessee in terms of potential gains and investment return ratio. The marked increase in project costs toward the end of the life cycle underscores the impact of demolition expenses on the overall cost structure of residential solar projects.

The inclusion of battery energy storage systems (BESS) in residential solar Scenario 2 results in higher costs across all states, with a particularly notable increase in California. However, the projected revenue in this scenario also rises more sharply, indicating that the addition of BESS may enhance long-term economic benefits despite the higher upfront capital investment. California once again leads in revenue projections, followed by Texas and Tennessee. More importantly, California residents are expected to recover their initial investments at the 15th year under Scenario 2, which combines rooftop solar and BESS, a faster rate compared to Scenario 1, which features only rooftop solar installations. The cost increase from Scenario 1 to Scenario 2 is more pronounced in Tennessee, suggesting that the integration of BESS may be more cost-sensitive in states with lower baseline solar infrastructure investment. Additionally, the relatively low price of residential electricity in Tennessee, owing to subsidies provided by the Tennessee Valley Authority (TVA), limits the economic impact of integrating residential BESS in the state.

For utility-scale solar projects, as shown in the third panel (b) of

Figure 5, both costs and revenues exhibit significant growth throughout the project life cycle. Unlike residential solar projects, the investment return ratios for utility-scale projects are consistently positive, and revenues recover the initial investment at a much faster rate. Specifically, in utility-scale solar projects, the revenue recoupment is projected to occur within approximately nine years for California, a notably shorter recovery period compared to the general over-ten-year recovery timeline observed in residential solar projects. California continues to display the highest projected costs and revenues among the states analyzed.

Texas, while also incurring relatively high costs, demonstrates strong revenue potential compared to Tennessee, which shows an approximate seven-year recovery period but remains consistently lower in both costs and revenue. Moreover, it is noteworthy that demolition costs contribute significantly less to the overall cost structure of utility-scale solar projects in comparison to residential projects. The trends observed for utility-scale solar suggest that, although such projects require substantial upfront capital investments, they are expected to deliver considerable financial returns, particularly in states like California and Texas, where favorable market conditions support the large-scale deployment of solar infrastructure.

In conclusion,

Figure 5 underscores significant regional disparities in cost and revenue dynamics across both residential and utility-scale solar markets. Among the three states analyzed, California stands out as an aggressive leader in solar adoption, characterized by high costs accompanied by equally high returns, largely driven by supportive policy frameworks and favorable market conditions. Texas, a rapidly expanding solar market, exhibits a balanced trend with comparatively high returns corresponding to moderate cost increases. Conversely, Tennessee, representing more moderate solar adoption, displays the lowest cost and revenue figures, indicating a more conservative market for both residential and utility-scale solar projects.

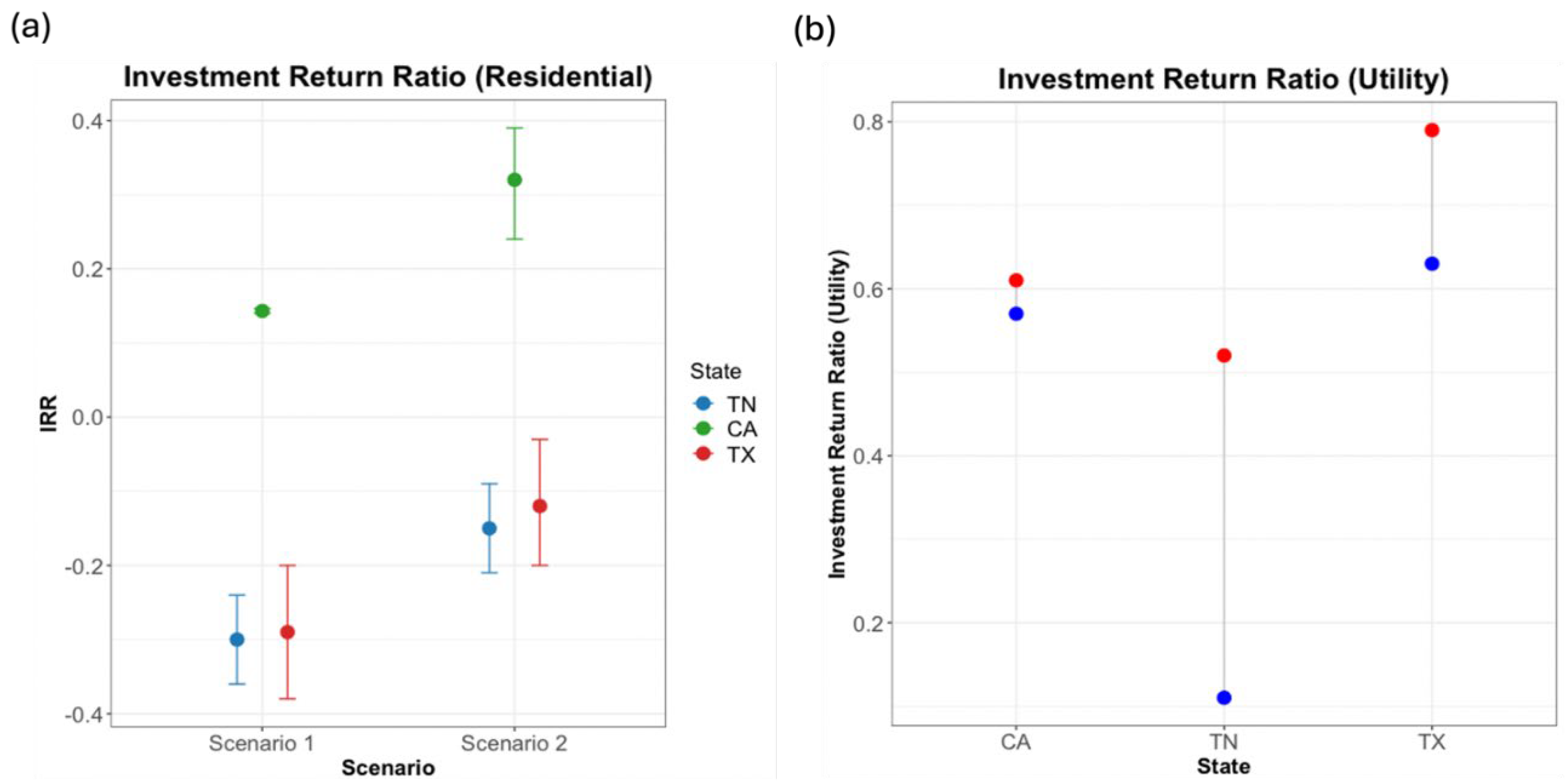

Figure 6(a) illustrates the Investment Return Ratio (IRR) for both residential and utility-scale solar projects across three states: Tennessee (TN), California (CA), and Texas (TX), selected as case study regions for this analysis. The left panel of

Figure 6(a) presents the IRR for residential solar projects under two distinct scenarios: Scenario 1 (Solar Only) and Scenario 2 (Solar Plus Battery). In both scenarios, California consistently demonstrates a positive IRR, with Scenario 2 (solar combined with battery energy storage systems, or BESS) yielding the highest IRR, approximately 0.4, indicating substantial profitability from the integration of BESS with rooftop solar systems. Although California experiences some of the most expensive costs associated with residential solar projects in the country, the relatively high retail price of residential electricity and net metering incentives make the California state most favorable place to install residential solar projects. In contrast, both Tennessee and Texas exhibit negative IRRs in Scenario 1. Specifically, Tennessee’s IRR ranges from -0.36 (low end) to -0.24 (high end), while Texas shows a range from -0.38 to -0.2, suggesting that solar-only residential projects in these states may not be economically viable without additional incentives such as net metering or the inclusion of energy storage solutions. However, Scenario 2 demonstrates marked improvements in the IRR for both Tennessee and Texas, particularly in Texas, though these returns remain lower than those observed in California. This highlights the critical role of incorporating energy storage solutions in improving solar energy utilization efficiencies and enhancing the overall economic viability of residential solar projects, especially in regions with less favorable standalone solar economics like Tennessee and Texas.

Figure 6(b) depicts the IRR for utility-scale solar projects in the same states. In this case, both California and Texas demonstrate high IRRs, with values from 0.57 to 0.61 for California, and 0.63 to 0.80 for Texas, indicating strong investment potential in utility-scale solar infrastructure in these states. Tennessee, while exhibiting a positive IRR, demonstrates a relatively lower range compared to California and Texas, with a low-end value of 0.11 and a high-end value of 0.52. This reflects Tennessee's more moderate solar market, which can be attributed to its moderate annual solar irradiance and relatively low solar energy selling price.

Figure 6 highlights the significant regional differences in solar project profitability, with California and Texas emerging as favorable markets for both residential and utility-scale solar investments, while Tennessee lags, especially in residential solar returns. Nonetheless, the incorporation of battery energy storage solution can tremendously help the solar energy usage efficiencies, thus improve the comprehensive economic viability of the residential solar project.

5. Conclusions

This study presents a comprehensive economic analysis of both residential and utility-scale solar projects across three distinct U.S. states—California, Tennessee, and Texas—revealing significant regional variations in cost, revenue, and investment return ratios (IRRs). Through detailed modeling and simulation of capital costs, operations and maintenance (O&M) costs, demolition costs, and revenue projections, several key findings emerged that underscore the influence of regional policies, market conditions, energy storage solutions, and environmental factors on the financial feasibility of solar energy adoption across states and scales.

Several key findings emerge from the analysis, demonstrating the complexities of solar project economics and the critical role of regional market conditions.

Residential solar projects do not necessarily yield higher IRRs despite the absence of needs to purchase land for developing solar projects. While residential solar installations generally avoid the significant land acquisition costs for planning solar panels and equipment, their overall economic performance can be hindered by lower energy generation efficiency, the lack of comprehensive net metering programs, and less favorable electricity prices, particularly in states like Tennessee and Texas. The absence of land acquisition expenses, therefore, does not always translate into superior financial returns.

Demolition costs are disproportionately impactful in residential solar projects compared to utility-scale projects. Given the smaller scale and lower total costs of residential solar installations, demolition costs represent a higher percentage of the total project cost. This is particularly evident in states with strict environmental regulations, such as California, where demolition expenses contribute more significantly to the overall project cost structure. By contrast, in utility-scale projects, these demolition costs are diluted by the larger capital and operational costs, which typically constitutes smaller than 2% of the overall project costs.

The integration of battery energy storage systems (BESS) significantly enhances the economic feasibility of residential solar projects. The addition of BESS improves solar energy usage efficiency, enabling homeowners to store excess solar energy for use during periods of low sunlight or high demand. This increased efficiency translates into higher IRRs for residential solar projects, especially in markets like California, where electricity prices and net metering programs make the combination of solar panels and BESS highly profitable. Based on the calculation here, the incorporation of BESS significantly boosts the IRR of residential solar system in California from approximate 0.14 to 0.3. Even in more conservative markets like Tennessee and Texas, BESS can help mitigate some of the financial shortcomings of solar-only installations and diminish the investment loss by almost 50% in these two states.

The economic performance of solar projects is shaped by a complex interplay of regional market conditions, policy environments, and labor costs. As demonstrated by the comparative analysis of California, Texas, and Tennessee, the profitability of solar projects varies significantly based on the state's regulatory landscape, labor market dynamics, and local policies. California, with its aggressive solar incentives, high electricity prices, and supportive policies, leads in both residential and utility-scale solar adoption. Texas, while more moderate in terms of costs, shows strong revenue potential, particularly for utility-scale projects, benefiting from a deregulated energy market and favorable solar irradiance. Tennessee, representing a more conservative market, offers lower costs but lacks the necessary incentives and policy support to fully realize the economic benefits of solar energy, particularly in the residential sector.

In summary, the findings from this study highlight the importance of region-specific strategies for solar energy adoption across scales. Policymakers and resident decision-makers must consider localized cost drivers, such as demolition costs, labor market conditions, and energy policies, when designing incentives and regulatory frameworks to promote solar projects. The integration of energy storage solutions, particularly BESS, is essential for enhancing the economic viability of residential solar projects, making them more attractive even in less favorable markets. Finally, while utility-scale solar projects generally recover initial investments more rapidly, residential projects can achieve improved returns through strategic technological enhancements like the incorporation of energy storage solution and supportive policy environments such as net-metering incentive.

Author Contributions

Conceptualization, B.H., L.W.; methodology, B.H., M.L., P.X. and Q.G.; validation, B.H., A.Z., and H.Z.; formal analysis, B.H., Q.Z., K.T., P.X. and H.Z.; investigation, B.H., A.Z., K.T., P.X., M.L. and l.W.; data curation, B.H., Q.Z., L.W., A.Z., and H.Z.; writing-original draft preparation, B.H. and K.T.; writing-review and editing, H.Z., Q.Z. and M.L.; visualization, B.H., Q.Z., A.Z., and L.W.; supervision, P.X. and Q.G.; project administration, Q.G. and H.Z.; funding acquisition, Q.G. All authors have read and agreed to the published version of the manuscript.

Funding

This work receives no external funding.

Acknowledgments

We would like to thank the several anonymous reviewers for their valuable thoughts and suggestions during the preparation of this manuscript.

Conflicts of Interest

The authors declare that they have no known competing financial interests or personal relationships that could have appeared to influence the work reported in this paper. Author Bowen He was employed by the company DFQ Dwellings, Co., Ltd. Author Karl Tang was employed by the company Sungrow Power Supply, Co., Ltd. Author Ping Xi was employed by the company Sungrow Power Supply, Co., Ltd. The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be constructed as a potential conflict of interest.

References

- Antonio, Katherine, Peterson, Kimberly (2024). Solar capacity additions are changing the shape of daily electricity supply in Texas. Available at: https://www.eia.gov/todayinenergy/detail.php?id=61783 (accessed on Jul. 2024).

- Awan, A. B., Alghassab, M., Zubair, M., Bhatti, A. R., Uzair, M., & Abbas, G. (2020). Comparative analysis of ground-mounted vs. rooftop photovoltaic systems optimized for interrow distance between parallel arrays. Energies, 13(14), 3639.

- Benalcazar, P., Komorowska, A., & Kamiński, J. (2024). A GIS-based method for assessing the economics of utility-scale photovoltaic systems. Applied Energy, 353, 122044.

- Blake, Harriet L. (2024). Texas ranks third for residential rooftop solar in the U.S. Available at: https://greensourcedfw.org/articles/texas-ranks-third-residential-rooftop-solar-us (accessed on Jul. 2024).

- Bolinger, M., Seel, J., Kemp, J. M., Warner, C., Katta, A., & Robson, D. (2023). Utility-Scale Solar, 2023 Edition: Empirical Trends in Deployment, Technology, Cost, Performance, PPA Pricing, and Value in the United States.

- California Department of Finance (2023). May 2023 Population Estimates Press Release. Available at: https://dof.ca.gov/wp-content/uploads/sites/352/Forecasting/Demographics/Documents/E-1_2023PressRelease.pdf (accessed on Aug. 2024).

- California Energy Commission. (2018). 2019 Building Energy Efficiency Standards for Residential and Nonresidential Buildings. Retrieved from https://www.energy.ca.gov/programs-and-topics/programs/building-energy-efficiency-standards/2019-building-energy-efficiency (accessed on Jul. 2024).

- California Energy Commission (2024a). Electric Generation Capacity and Energy. Available at: https://www.energy.ca.gov/data-reports/energy-almanac/california-electricity-data/electric-generation-capacity-and-energy (accessed on Jul. 2024).

- California Energy Commission (2024b). Renewables Portfolio Standard – RPS. Available at: https://www.energy.ca.gov/programs-and-topics/programs/renewables-portfolio-standard (accessed on Jul. 2024).

- California Public Utility Commission (2024). California Solar Initiative (CSI). https://www.cpuc.ca.gov/industries-and-topics/electrical-energy/demand-side-management/california-solar-initiative (accessed on Jul. 2024).

- California Public Utilities Commission. (2022). Decision adopting net energy metering successor tariff (NEM 3.0). Retrieved from https://www.cpuc.ca.gov/nem (accessed on Aug. 2024).

- Camp, J., Gilligan, J., & He, B. (2023). The Unintended Consequences of Flood Mitigation along Inland Waterways–a Look at Resilience and Social Vulnerabilities through a Case Study Analysis.

- Camp, J., Gilligan, J., & He, B. (2023). The unintended consequences of flood mitigation along inland waterways–a look at resilience and social vulnerabilities through a case study analysis.

- Chand, A. A., Prasad, K. A., Mamun, K. A., Sharma, K. R., & Chand, K. K. (2019). Adoption of grid-tie solar system at residential scale. Clean Technologies, 1(1), 15.

- Chester, Matt. (2023). 2024 Residential Solar Market Outlook: Growing consumer interest faces off against efficiency concerns and misinformation. Available at: https://www.inmyarea.com/research/residential-solar-market-outlook (accessed on Jul. 2024).

- Cucchiella, F., D’Adamo, I., & Gastaldi, M. (2017). Economic analysis of a photovoltaic system: A resource for residential households. Energies, 10(6), 814.

- Deotti, L., Guedes, W., Dias, B., & Soares, T. (2020). Technical and economic analysis of battery storage for residential solar photovoltaic systems in the Brazilian regulatory context. Energies, 13(24), 6517.

- Gavop Analysis (2019). California Leads Nation in Residential Solar Installation Rates, Overall Homes and Total Capacity. Available at: https://www.altenergymag.com/article/2019/04/california-leads-nation-in-residential-solar-installation-rates-overall-homes-and-total-capacity/30812 (accessed on Jul. 2024).

- He, B., & Ding, K. J. (2021). Localize the Impact of Global Greenhouse Gases Emissions under an Uncertain Future: A Case Study in Western Cape, South Africa. Earth, 2(1), 111-123.

- He, B. (2023). Efficient Computational Evaluation Tools to Accelerate the Planning of Vulnerability, Resilience, and Sustainability of the Social-Environmental Systems in the City of Nashville (Doctoral dissertation).

- He, B., Gilligan, J. M., & Camp, J. V. (2024a). Incorporating spatial autocorrelation in dasymetric mapping: A hierarchical Poisson spatial disaggregation regression model. Applied Geography, 169, 103333.

- He, B., & Guan, Q. (2021a). A mathematical approach to improving the representation of surface water–groundwater exchange in the hyporheic zone. Journal of Water and Climate Change, 12(5), 1788-1801.

- He, B., & Guan, Q. (2021b). A Risk and Decision Analysis Framework to Evaluate Future PM2.5 Risk: A Case Study in Los Angeles-Long Beach Metro Area. International journal of environmental research and public health, 18(9), 4905.

- He, B., & Guan, Q. (2024). Investigating the effects of spatial scales on social vulnerability index: A hybrid uncertainty and sensitivity analysis approach combined with remote sensing land cover data. Risk Analysis.

- He, B., & Ding, K. J. (2023). Global greenhouse gases emissions effect on extreme events under an uncertain future: A case study in Western Cape, South Africa. PLOS Climate, 2(1), e0000107.

- He, B., Gilligan, J. M., & Camp, J. V. (2023a). An index of social fabric for assessing community vulnerability to natural hazards: Model development and analysis of uncertainty and sensitivity. International Journal of Disaster Risk Reduction, 103913.

- He, B., and Guan, Q. (2022a). Analysis and prediction of the correlation between environmental ecology and future global climate change. Journal of HFUT: Natural Science, 6 (45), 818-824.

- He, B., & Guan, Q. (2022b). The statistical analysis and prediction associated with nuclear meltdown accidents risk evaluation. International Journal of Nuclear Safety and Security, 1(2), 104-123.

- He, B., Zheng, H., Guan, Q. (2023b). Evaluation of Future-Integrated Urban Water Management Using a Risk and Decision Analysis Framework: A Case Study in Denver-Colorado Metro Area (DCMA). Water, 15, 4020.

- He, B., Zheng, H., Tang, K., Xi, P., Li, M., Wei, L., & Guan, Q. (2024b). A comprehensive review of lithium-ion battery (LiB) recycling technologies and industrial market trend insights. Recycling, 9(1), 9.

- He, B., Zheng, H., & Guan, Q. (2024c). Toward revolutionizing water-energy-food nexus composite index model: from availability, accessibility, and governance. Frontiers in Water, 6, 1338534.

- Internal Revenue Service (IRS). (2023a). Instructions for Form 3468 (Investment Credit).

- U.S. Department of the Treasury. Available at: https://www.irs.gov/forms-pubs/about-form-3468 (accessed on Sep. 2024).

- Internal Revenue Service. (2023b). Instructions for Form 5695 (Residential Energy Credits). U.S. Department of the Treasury. https://www.irs.gov/forms-pubs/about-form-5695.

- Kizito, R. (2017). An economic analysis of residential photovoltaic systems with and without energy storage. University of Arkansas.

- LevelTen Energy (2024), North American Q1 2024 PPA Price Index Report, Available at: https://www.leveltenenergy.com/post/na-q1-2024-ppa-price-index (accessed on Aug. 2024).

- Michaud, G., Khalaf, C., Zimmer, M., & Jenkins, D. (2020). Measuring the economic impacts of utility-scale solar in Ohio.

- NREL (2023), Annual Technology Baseline (ATB), Available at: https://atb.nrel.gov/ (accessed on Aug. 2024).

- NSRDB (2024). National Solar Radiation Database. Available at: https://nsrdb.nrel.gov/#:~:text=URL%3A%20https%3A%2F%2Fnsrdb,100 (accessed on Jul. 2024).

- Olizarowicz, Britt (2024). Tennessee Solar Incentives: Tax Credits and Rebates Guide. Today’s Homeowner. Available at: https://todayshomeowner.com/solar/guides/tennessee-solar-incentives/ (accessed on Aug. 2024).

- Ramasamy, Vignesh, Jarett Zuboy, Michael Woodhouse, Eric O’Shaughnessy, David Feldman, Jal Desai, Andy Walker, Robert Margolis, and Paul Basore. (2023). U.S. Solar Photovoltaic System and Energy Storage Cost Benchmarks, With Minimum Sustainable Price Analysis: Q1 2023. Golden, CO: National Renewable Energy Laboratory. NREL/TP-7A40-87303. Available at: https://www.nrel.gov/docs/fy23osti/87303.pdf. (accessed on Jul. 2024).

- Solar Energy Industries Association (SEIA) (2024). Tennessee Solar. Available at: https://www.seia.org/state-solar-policy/tennessee-solar (accessed on Jul. 2024).

- Sengupta, M., Y. Xie, A. Lopez, A. Habte, G. Maclaurin, and J. Shelby. (2018). The National Solar Radiation Data Base (NSRDB). Renewable and Sustainable Energy Reviews 89 (6): 51-60.

- Siregar, H., Juanda, B., & Indraprahasta, G. S. (2023). Cost-benefit analysis framework for utility-scale solar energy development: a life cycle approach. In IOP Conference Series: Earth and Environmental Science (Vol. 1220, No. 1, p. 012040). IOP Publishing.

- Slusarewicz, J. H., & Cohan, D. S. (2018). Assessing solar and wind complementarity in Texas. Renewables: Wind, Water, and Solar, 5(1), 1-13.

- Statista (2024). U.S. residential sector annual solar PV capacity installations 2023. Available at: https://www.statista.com/statistics/185694/us-residential-annual-pv-installed-capacity-since-2005/ (accessed on Jul. 2024).

- Tabassum, S., Rahman, T., Islam, A.U., Rahman, S., Dipta, D.R., Roy, S., Mohammad, N., Nawar, N. and Hossain, E. (2021). Solar energy in the United States: Development, challenges and future prospects. Energies, 14(23), 8142.

- Tennessee Valley Authority (2023). Solar. Available at: https://www.tva.com/energy-system-of-the-future/solar (accessed on Jul. 2024).

- U.S. Census Bureau (2020). City and Town Population Totals: 2010 – 2019: 2019 Population Estimates. Available at: https://www.census.gov/data/tables/2019/demo/popest/total-cities-and-towns.html (accessed on Aug. 2024).

- U.S. Census Bureau (2023). QuickFacts, Population Estimates. Available at: https://www.census.gov/quickfacts/fact/table/TX/PST045223 (accessed on Aug. 2024).

- U.S. Energy Information Administration (EIA). (2019). Most U.S. Utility-scale solar photovoltaic power plants are 5 megawatts or smaller. Available at: https://www.eia.gov/todayinenergy/detail.php?id=38272 (accessed on Jul. 2024).

- U.S. Energy Information Administration (EIA). (2024a). Electricity explained: Electricity generation, capacity, and sales in the United States. Available at: https://www.eia.gov/energyexplained/electricity/electricity-in-the-us-generation-capacity-and-sales.php (accessed on Jul. 2024).

- U.S. Energy Information Administration. (2024b). Electric power monthly: Average price of electricity to ultimate customers by end-use sector, by state. Retrieved from https://www.eia.gov/electricity/data.php (accessed on Sep. 2024).

- U.S. Energy Information Administration (2024c). State energy profiles. Retrieved from https://www.eia.gov/state/ (accessed on Sep. 2024).

- Walker, H., Lockhart, E., Desai, J., Ardani, K., Klise, G., Lavrova, O., Tansy, T., Deot, J., Fox, B. and Pochiraju, A. (2020). Model of operation-and-maintenance costs for photovoltaic systems (No. NREL/TP-5C00-74840). National Renewable Energy Lab. (NREL), Golden, CO (United States).

- Wiser, R. H., Bolinger, M., & Seel, J. (2020). Benchmarking utility-scale PV operational expenses and project lifetimes: results from a survey of US solar industry professionals.

- Zeraatpisheh, M., Arababadi, R., & Saffari Pour, M. (2018). Economic analysis for residential solar PV systems based on different demand charge tariffs. Energies, 11(12), 3271.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).