1. Introduction

The study delves into the Multifractal Model of Asset Returns (MMAR), a financial model developed by [

1,

2], a Polish-born French mathematician, is renowned for his pioneering work in fractal mathematics, which has been applied across various disciplines, including finance [

3,

4,

5,

6,

7]. This study applies the MMAR model to three distinct financial markets—equities, interest rates, and foreign currency exchange—examining its capacity to model price movements and offer insights into market dynamics. By utilizing fractals to simulate financial data, the study aims to present an alternative to traditional financial models, which often fail to account for the unpredictable and complex nature of markets. The MMAR model is rooted in the concept of fractals, which are self-similar objects with intricate patterns repeating at different scales. In finance, Mandelbrot observed similar scaling properties across different time frames on price charts, indicating that fractal mathematics could more accurately model market behaviour than conventional models [

8,

9,

10]. The MMAR focuses on three key features of financial markets: large price swings, non-independence in price movements, and volatility clustering, all of which are frequently overlooked by standard models. One of the primary objectives of this study is to meticulously explore the MMAR model and compare its performance to other well-known financial models such as GARCH and random walk models. Traditional financial models are based on assumptions such as normally distributed returns, time-static volatility, and independent price movements. However, critics like Mandelbrot argue that these models fail to account for real-world phenomena such as market booms and busts, extreme price fluctuations, and periods of high volatility. Mandelbrot’s fractal-based models, including the MMAR, attempt to address these shortcomings by accounting for non-linear, complex behaviours in markets.

We also underscore some of the criticisms of modern financial theory. Critics argue that standard models underestimate the risks in financial markets, leading to inadequate risk management strategies. Despite their flaws, these models are still widely used due to their simplicity and familiarity among financial professionals. Therefore, the study questions whether such models are still useful in today’s increasingly volatile financial environment and explores the potential of fractal-based models like the MMAR to provide more realistic risk assessments. To test the MMAR model, the study analyses three different markets: the USD/NOK foreign exchange rate, the Swedish OMXS30 equity index, and the LIBOR interest rate. The choice of these markets was arbitrary, but they represent three distinct areas of finance. The data used for these analyses’ spans approximately 30 years, which [

11] argues is the minimum period required for robust fractal analysis. For all datasets, both raw price data and logarithmic returns were examined. The study also encompasses a visual and statistical comparison of the MMAR simulations to real market data. The simulations aim to replicate the patterns of volatility clustering and large price swings observed in actual financial markets. The results indicate that the MMAR model captures some of the key features of financial data that traditional models overlook. However, the MMAR is not without its limitations. The study identifies several potential drawbacks, such as the model's complexity and the difficulty of estimating accurate parameters for different markets. One of the key critiques addressed is whether the MMAR is purely descriptive or if it can be used for practical applications, such as risk management. While the MMAR provides valuable insights into market dynamics and can help investors prepare for extreme events, it is not designed to predict future price movements. Instead, it aims to provide a qualitative understanding of how financial markets function. The model is particularly useful for highlighting risks that standard models tend to underestimate, such as extreme price fluctuations and periods of high volatility. The study underscores that while fractal-based models may not make investors rich, they can help avoid significant losses by better accounting for rare but catastrophic events in financial markets.

The study is as follows; the background will be seen in the next section. The related works are listed in Section III. The materials and methods are covered in Section IV. The experimental analysis is carried out in Section V, and in Section VI, we provide a conclusion and future directions for the research.

2. Background

The conventional financial models, which often assume that asset returns adhere to a normal (Gaussian) distribution, tend to underestimate the probability of extreme price movements significantly. Under the Gaussian model, rare events, such as a 25-sigma move, are expected to occur much less frequently than what real-life financial data suggests. For instance, Goldman Sachs reported several 25-sigma days in a row, a phenomenon that standard models struggle to account for. A more plausible explanation is that extreme price swings are more prevalent than assumed, primarily due to excess kurtosis in the data. Kurtosis is a statistical property that makes a dataset more concentrated around the mean while allowing for significant outliers. While the normal distribution has an excess kurtosis of zero, many financial datasets exhibit leptokurtosis, or "fat tails", signifying that extreme events are more likely than in a normal distribution. To address this, some researchers utilize stable (Levy) distributions, which generalize the Gaussian distribution and allow for fat tails and higher kurtosis. These distributions are characterized by four parameters: the location parameter (δ), the scale parameter (γ), the skewness parameter (β), and the tail-thickness parameter (α). When α is less than 2, events farther from the mean become more likely, and the distribution exhibits fatter tails, as opposed to the normal distribution's α = 2. Stable distributions are valuable for modelling markets with extreme price movements. However, one limitation of these distributions is that they have an undefined variance when α is less than 2. This implies that the variance increases with the sample size and never converges to a single value. Empirical evidence, such as from the Dow Jones Industrial Index (DJII), demonstrates that market returns do not possess a constant variance, with significant jumps and discontinuities indicating that markets follow stable distributions with a lower α-value. This poses a challenge for traditional asset pricing models, which rely on a stable variance to compute prices. If the variance does not converge, the resulting asset price heavily depends on the chosen sample period, making it challenging to determine an accurate price. Furthermore, real market dynamics may exhibit dependence, where price movements are correlated over time, making them less random and more predictable. This is quantified by the Hurst coefficient (H), where H > 0.5 indicates persistent trends in price movements, and H < 0.5 suggests that price movements dissipate quickly. Mandelbrot's concept of "trading time", represented by multifractals, offers another tool to simulate financial markets with extreme events. Trading time reflects the varying pace of market activity, with periods of high volatility clustering together, followed by periods of calm. Multifractals capture this clustering through a multiplicative cascade, introducing volatility clustering into simulations and mirroring real market behaviour.

3. Related Works

The application of mathematical models to financial markets has a rich history, dating back to the seminal work of [

12,

13] pioneering efforts laid the groundwork for modern financial theories, including the Efficient Market Hypothesis (EMH), Efficient Portfolio Theory (EPT), the Capital Asset Pricing Model (CAPM), and the Black-Scholes option pricing model. However, the limitations of [

14] assumptions about price movements have been revealed by empirical data, leading to the development of alternative models. [

15] work in fractal finance has been particularly influential, as they introduced the concept of stable distributions with heavy tails, suggesting that large price movements are more common than traditional models assume. MMAR has been shown to better capture the complexity of price changes over different timescales, accounting for volatility clustering and extreme events such as [

16,

17]. Despite its promise, fractal finance remains a niche field due to its technical complexity and mathematical rigor according to [

18,

19]. Nevertheless, its ability to provide more consistent results across various timescales and its potential to better reflect market realities make it a compelling alternative to traditional models such as [

20,

21]. As empirical evidence continues to challenge the assumptions of Gaussian models, the relevance of multifractal approaches like the MMAR may grow, providing deeper insights into market dynamics and the inherent risks in financial systems [

22,

23,

24].

4. Research Methodology

The Multifractal Stochastic Process (MSP) and the MMAR provide a sophisticated framework for modelling financial markets, leveraging advanced mathematical techniques to capture the unique characteristics of financial data, including volatility clustering and fat tails [

25,

26,

27,

28,

29,

30]. The MSP is defined by two key features: stationary increments and a scaling relationship, which describes the evolution of the process's moments over time. Specifically, the scaling relationship is characterized by the equation

, where

q is a raw statistical moment, and

c(q) and

r(q) are parameters. The MMAR model simulates market returns by combining two elements: Fractional Brownian Motion (fBm) and a Multifractal Cascade as shown in

Figure 1,

Figure 2,

Figure 3,

Figure 4 and

Figure 5. The former generalizes regular Brownian motion to account for memory or dependency in price changes, through a parameter called the Hurst exponent (H). The latter is a multiplicative process used to model volatility clustering and extreme variations in prices. The stochastic process

X(t), representing log-returns over time, is modelled as

, where

is a fractional Brownian motion with a Hurst exponent

H, and

θ(t) is the cumulative distribution of a multifractal cascade. Constructing the MMAR model involves several steps:

Data Collection: Gather historical price data, ideally using a highly composite number of data points (such as 7560+1), which simplifies partitioning for multifractal analysis.

Log-Returns Calculation: Define the stochastic process as log-returns of the asset prices, such as .

Partition Function Calculation: For different time increments, compute the partition function that reflects the scaling behaviour of returns at different time resolutions.

Estimating Scaling Function: Using a linear regression approach, estimate the scaling function r(q) for various moments q.

This formal framework enables the capture of complex market dynamics and provides a robust tool for financial analysis and modelling.

5. Experimental Analysis

This study presents a comprehensive analysis of the MMAR in simulating financial time series as shown in

Figure 6,

Figure 7,

Figure 8 and

Figure 9. The MMAR incorporates multifractality and non-linear scaling behaviour in asset returns, capturing the complexity of financial markets. The Hurst exponent, a critical parameter, measures the degree of persistence or anti-persistence in time series data. The MMAR simulations demonstrate realistic behaviour, including high kurtosis, volatility clustering, and non-independence in returns. The model's multifractal assumptions align with observed market behaviour, and it outperforms basic Gaussian random-walk simulations. However, the MMAR has limitations in simulating extremely high-kurtosis events in certain markets. Overall, the MMAR provides a robust framework for analysing financial time series and simulating realistic price paths.

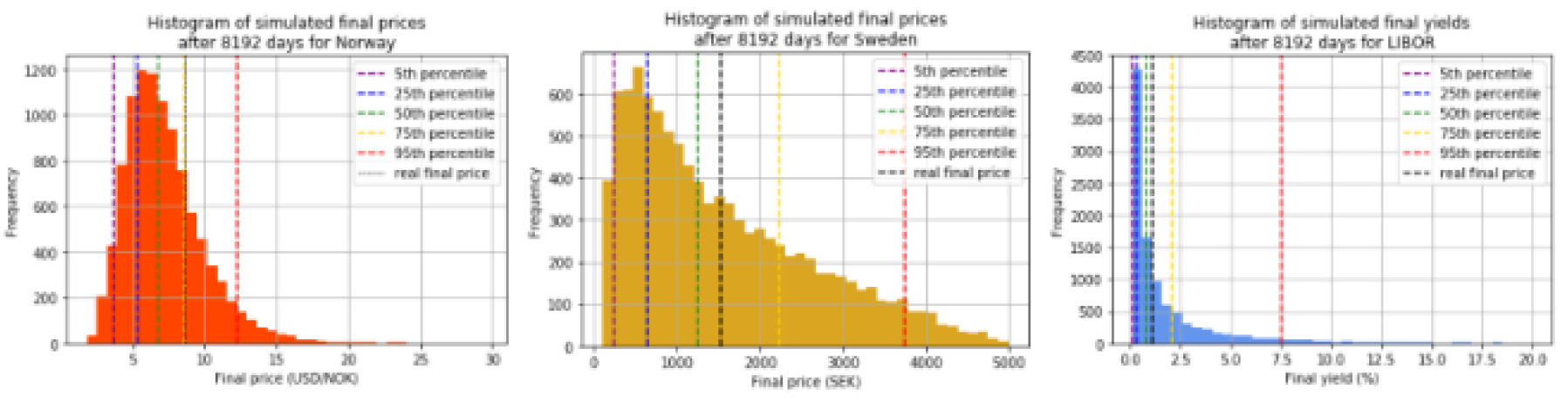

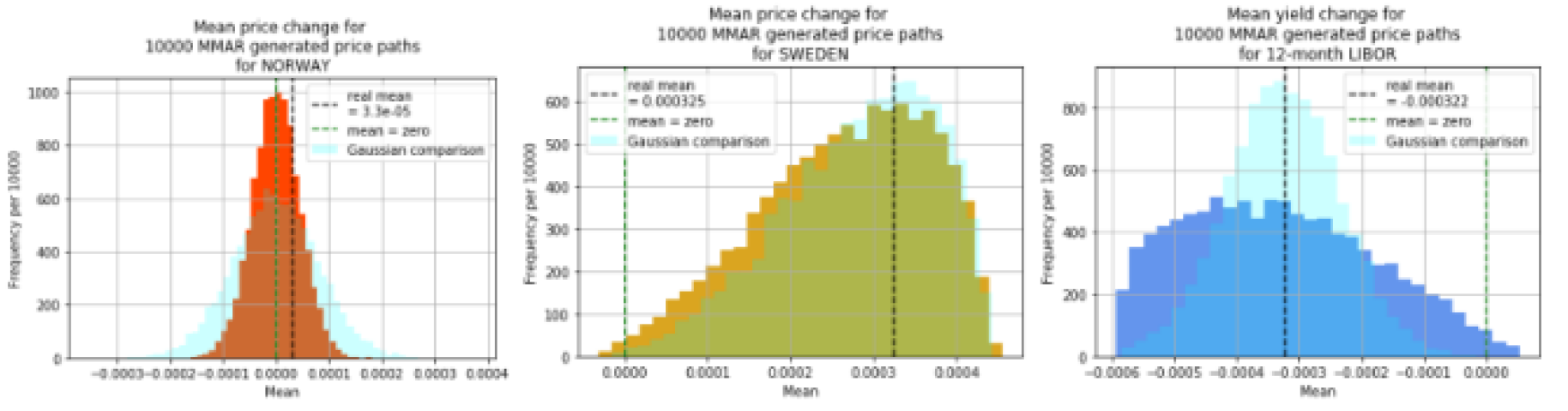

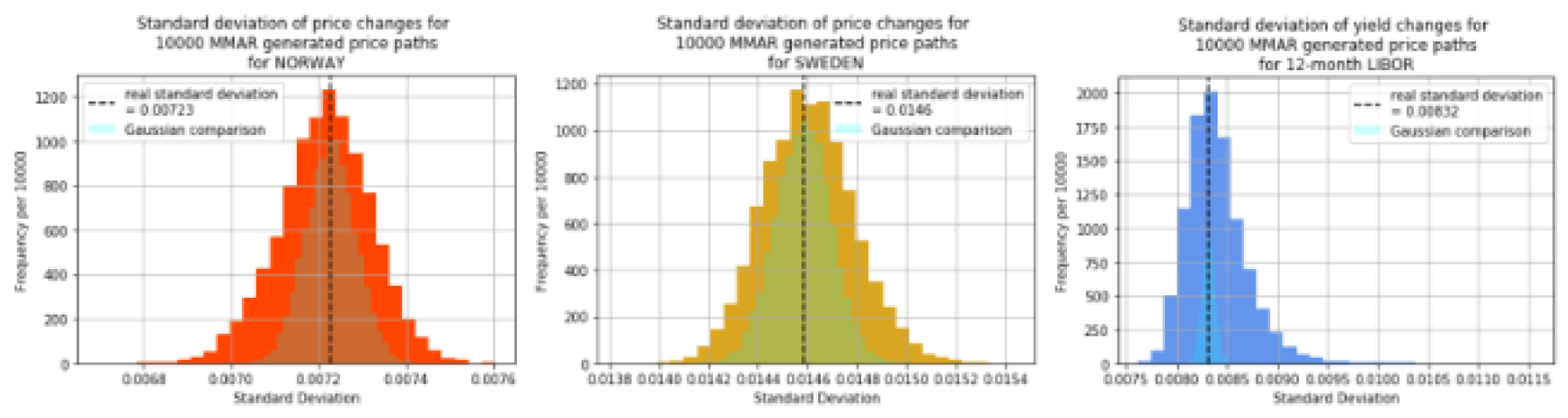

The MMAR's ability to capture multifractality and non-linear scaling behaviour makes it a powerful tool for modelling financial markets. The model's parameters, including the Hurst exponent and scaling functions, are estimated using empirical data. The simulations generated by the MMAR are visually compared to real-world data, demonstrating the model's ability to capture realistic behaviour as shown in

Figure 10,

Figure 11 and

Figure 12. The statistical analysis of the simulations reveals that the MMAR can generate probabilistic forecasts about future price movements. The histograms of key moments, including the zeroth, first, second, and fourth moments, demonstrate the smoothness and consistency of the simulations. The MMAR's ability to capture high kurtosis and volatility clustering is a significant improvement over basic Gaussian random-walk simulations. However, the MMAR has limitations in simulating extremely high-kurtosis events in certain markets. The model's performance is assessed using histograms and statistical analysis, revealing that it can generate realistic simulations of financial time series. The MMAR's multifractal assumptions align with observed market behaviour, making it a valuable approach for studying financial time series.

6. Conclusion and Future Works

This study investigates the MMAR and its application to three distinct markets: the Norwegian USD/NOK exchange rate, the Swedish OMXS30 stock index, and the 12-month British pound LIBOR-rate. The MMAR is a sophisticated model that captures non-independent price movements, high-kurtosis events, volatility clustering, and scaling behaviour, making it an effective tool for simulating complex market dynamics. The model reveals that the Hurst exponent (H) significantly influences long-term price paths, with high H amplifying trends and low H muting them. Additionally, the MMAR produces smooth distributions of statistical moments, which can be utilized for probabilistic forecasts and stress-testing portfolios. Despite its potential, the MMAR is a challenging model to work with, requiring advanced mathematical expertise, extensive data, and offering primarily qualitative predictions. Nevertheless, the MMAR offers an improvement over simpler models like the random walk by highlighting important phenomena such as volatility and market extremes. Although its real-world application is limited, the model provides valuable insights into market dynamics and offers a quantitative approach for stress-testing portfolios, potentially helping investors avoid bankruptcy during extreme market events. Further research on fractal financial models could yield additional insights into market behaviour, and more accessible studies on this topic could facilitate a deeper understanding of the MMAR and its applications.

Data Availability

Data will be made on reasonable request.

Code Availability

Code will be made on reasonable request.

Funding

No funds, grants, or other support was received.

Conflict of Interest

The authors declare that they have no known competing for financial interests or personal relationships that could have appeared to influence the work reported in this paper.

References

- R. H. Riedi, “Multifractal Processes”.

- Grahovac, D. Multifractal processes: Definition, properties and new examples. Chaos, Solitons Fractals 2020, 134, 109735. [Google Scholar] [CrossRef]

- S. Wazir, G. S. Kashyap, and P. Saxena, “MLOps: A Review,” Aug. 2023, Accessed: Sep. 16, 2023. [Online]. Available: https://arxiv.org/abs/2308.10908v1.

- Marwah, N.; Singh, V.K.; Kashyap, G.S.; Wazir, S. An analysis of the robustness of UAV agriculture field coverage using multi-agent reinforcement learning. Int. J. Inf. Technol. 2023, 15, 2317–2327. [Google Scholar] [CrossRef]

- Kashyap, G.S.; Malik, K.; Wazir, S.; Khan, R. Using Machine Learning to Quantify the Multimedia Risk Due to Fuzzing. Multimedia Tools Appl. 2021, 81, 36685–36698. [Google Scholar] [CrossRef]

- Kanojia, M.; Kamani, P.; Kashyap, G.S.; Naz, S.; Wazir, S.; Chauhan, A. Alternative agriculture land-use transformation pathways by partial-equilibrium agricultural sector model: a mathematical approach. Int. J. Inf. Technol. 2024, 1–20. [Google Scholar] [CrossRef]

- H. Habib, G. S. Kashyap, N. Tabassum, and T. Nafis, “Stock Price Prediction Using Artificial Intelligence Based on LSTM– Deep Learning Model,” in Artificial Intelligence & Blockchain in Cyber Physical Systems: Technologies & Applications, CRC Press, 2023, pp. 93–99. [CrossRef]

- Canhoto, A.I. Leveraging machine learning in the global fight against money laundering and terrorism financing: An affordances perspective. J. Bus. Res. 2020, 131, 441–452. [Google Scholar] [CrossRef] [PubMed]

- Kanaparthi, V.K. Navigating Uncertainty: Enhancing Markowitz Asset Allocation Strategies through Out-of-Sample Analysis. FinTech 2024, 3, 151–172. [Google Scholar] [CrossRef]

- Kanaparthi, V. Robustness Evaluation of LSTM-based Deep Learning Models for Bitcoin Price Prediction in the Presence of Random Disturbances. Regul. Issue 2024, 12, 14–23. [Google Scholar] [CrossRef]

- B. B. Mandelbrot, “The variation of certain speculative prices,” in Fractals and Scaling in Finance, Springer, New York, NY, 1997, pp. 371–418. [CrossRef]

- Casgrain, P.; Jaimungal, S. Trading algorithms with learning in latent alpha models. Math. Finance 2018, 29, 735–772. [Google Scholar] [CrossRef]

- Ang, A.; Piazzesi, M. A no-arbitrage vector autoregression of term structure dynamics with macroeconomic and latent variables. J. Monetary Econ. 2003, 50, 745–787. [Google Scholar] [CrossRef]

- D. V. Swamy, “Impact of Macroeconomic and Endogenous Factors on Non Performing Bank Assets,” SSRN Electron. J., Feb. 2012. [CrossRef]

- Roy, S.S.; Chopra, R.; Lee, K.C.; Spampinato, C.; Ivatlood, B.M. Random forest, gradient boosted machines and deep neural network for stock price forecasting: a comparative analysis on South Korean companies. Int. J. Ad Hoc Ubiquitous Comput. 2020, 33, 62–71. [Google Scholar] [CrossRef]

- Indika, A.; Warusamana, N.; Welikala, E.; Deegalla, S. “Ensemble Stock Market Prediction using SVM, LSTM, and Linear Regression,” TechRxiv, pp. 1–6, Oct. 2021. [CrossRef]

- Dahal, K.R.; Pokhrel, N.R.; Gaire, S.; Mahatara, S.; Joshi, R.P.; Gupta, A.; Banjade, H.R.; Joshi, J. A comparative study on effect of news sentiment on stock price prediction with deep learning architecture. PLOS ONE 2023, 18, e0284695. [Google Scholar] [CrossRef] [PubMed]

- D. Cliff, “BBE: Simulating the Microstructural Dynamics of an In-Play Betting Exchange via Agent-Based Modelling,” SSRN Electron. J., May 2021. [CrossRef]

- J. D. Agarwal, M. Agarwal, A. Agarwal, and Y. Agarwal, “Economics of cryptocurrencies: Artificial intelligence, blockchain, and digital currency,” in Information For Efficient Decision Making: Big Data, Blockchain And Relevance, World Scientific Publishing Co., 2020, pp. 331–430. [CrossRef]

- Özcan, M. Forecasting in stock market with Machine Learning: A State of Art. In Proceedings of the 2023 14th International Conference on Computing Communication and Networking Technologies, ICCCNT 2023; Institute of Electrical and Electronics Engineers Inc., 2023. [Google Scholar] [CrossRef]

- Cont, R. Empirical properties of asset returns: stylized facts and statistical issues. Quant. Finance 2001, 1, 223–236. [Google Scholar] [CrossRef]

- V. Kanaparthi, “Exploring the Impact of Blockchain, AI, and ML on Financial Accounting Efficiency and Transformation,” Jan. 2024, Accessed: Feb. 04, 2024. [Online]. Available: https://arxiv.org/abs/2401.15715v1.

- Kanaparthi, V. Examining Natural Language Processing Techniques in the Education and Healthcare Fields. Int. J. Eng. Adv. Technol. 2022, 12, 8–18. [Google Scholar] [CrossRef]

- Kanaparthi, V.K. Examining the Plausible Applications of Artificial Intelligence & Machine Learning in Accounts Payable Improvement. FinTech 2023, 2, 461–474. [Google Scholar] [CrossRef]

- Naz, S.; Kashyap, G.S. Enhancing the predictive capability of a mathematical model for pseudomonas aeruginosa through artificial neural networks. Int. J. Inf. Technol. 2024, 16, 2025–2034. [Google Scholar] [CrossRef]

- G. S. Kashyap, A. Siddiqui, R. Siddiqui, K. Malik, S. Wazir, and A. E. I. Brownlee, “Prediction of Suicidal Risk Using Machine Learning Models,” Dec. 25, 2021. Accessed: Feb. 04, 2024. [Online]. Available: https://papers.ssrn.com/abstract=4709789.

- P. Kaur, G. S. Kashyap, A. Kumar, M. T. Nafis, S. Kumar, and V. Shokeen, “From Text to Transformation: A Comprehensive Review of Large Language Models’ Versatility,” Feb. 2024, Accessed: Mar. 21, 2024. [Online]. Available: https://arxiv.org/abs/2402.16142v1.

- G. S. Kashyap et al., “Revolutionizing Agriculture: A Comprehensive Review of Artificial Intelligence Techniques in Farming,” Feb. 2024. [CrossRef]

- Alharbi, F.; Kashyap, G.S.; Allehyani, B.A. Automated Ruleset Generation for “HTTPS Everywhere”. Int. J. Inf. Secur. Priv. 2024, 18, 1–14. [Google Scholar] [CrossRef]

- Alharbi, F.; Kashyap, G.S. Empowering Network Security through Advanced Analysis of Malware Samples: Leveraging System Metrics and Network Log Data for Informed Decision-Making. Int. J. Networked Distrib. Comput. 2024, 1–15. [Google Scholar] [CrossRef]

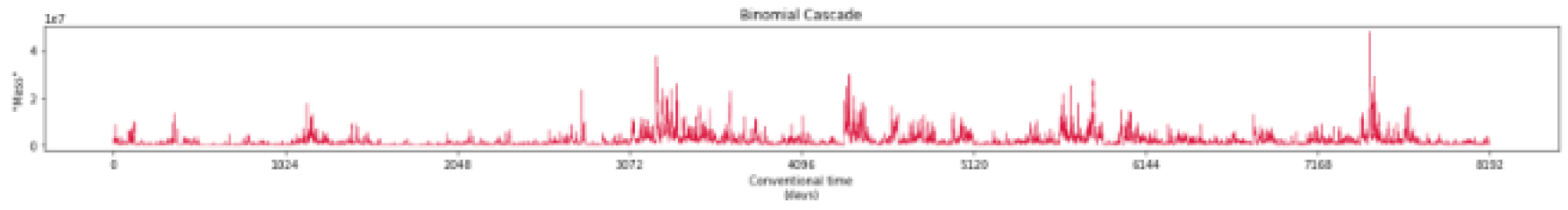

Figure 1.

The cascade of log-normal binomials. An illustration of a canonical cascade simulation with lognormally distributed mass allocations for Norway.

Figure 1.

The cascade of log-normal binomials. An illustration of a canonical cascade simulation with lognormally distributed mass allocations for Norway.

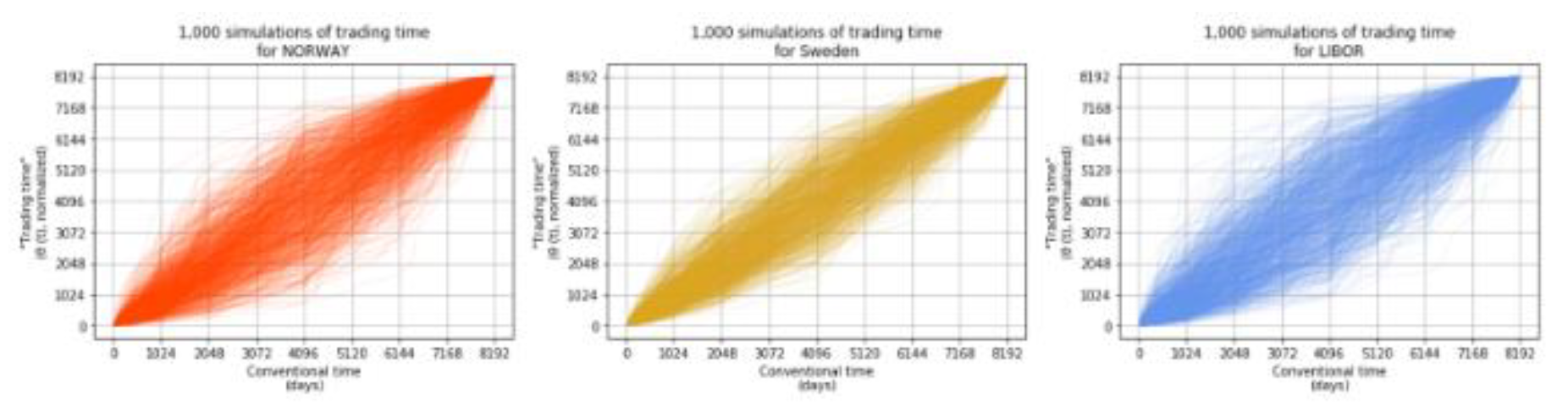

Figure 2.

How the trading time component is put together. With your simulated lognormal cascade, find the cumulative sum of the "mass" as you proceed from time 0 at the beginning to time T at the end (day 8192 in this case). "Trading time” rises rapidly as the cascade gets larger. Then, on the last day, divide everything by the amount and multiply by the time period. This is also helpful. As a result, the trading time becomes more normalized and easier to understand. The cascade has a very large range, with the greatest number being approximately 2x108. As a result of normalizing, every "trading time" CDF ends on 8192 rather than the last day being a random huge figure.

Figure 2.

How the trading time component is put together. With your simulated lognormal cascade, find the cumulative sum of the "mass" as you proceed from time 0 at the beginning to time T at the end (day 8192 in this case). "Trading time” rises rapidly as the cascade gets larger. Then, on the last day, divide everything by the amount and multiply by the time period. This is also helpful. As a result, the trading time becomes more normalized and easier to understand. The cascade has a very large range, with the greatest number being approximately 2x108. As a result of normalizing, every "trading time" CDF ends on 8192 rather than the last day being a random huge figure.

Figure 3.

When there is no linear time. 1,000 normalized trading time simulations for per market. The outcome of converting the multiplicative cascade into a CDF is "trading time". The CDF is adjusted so that it always adds up to one. The range of our trading time simulations is based on the kurtosis of the original data. As a result, the lines get more away from the center; for example, Sweden has the narrowest band and the lowest kurtosis, whilst the British LIBOR has the opposite characteristics.

Figure 3.

When there is no linear time. 1,000 normalized trading time simulations for per market. The outcome of converting the multiplicative cascade into a CDF is "trading time". The CDF is adjusted so that it always adds up to one. The range of our trading time simulations is based on the kurtosis of the original data. As a result, the lines get more away from the center; for example, Sweden has the narrowest band and the lowest kurtosis, whilst the British LIBOR has the opposite characteristics.

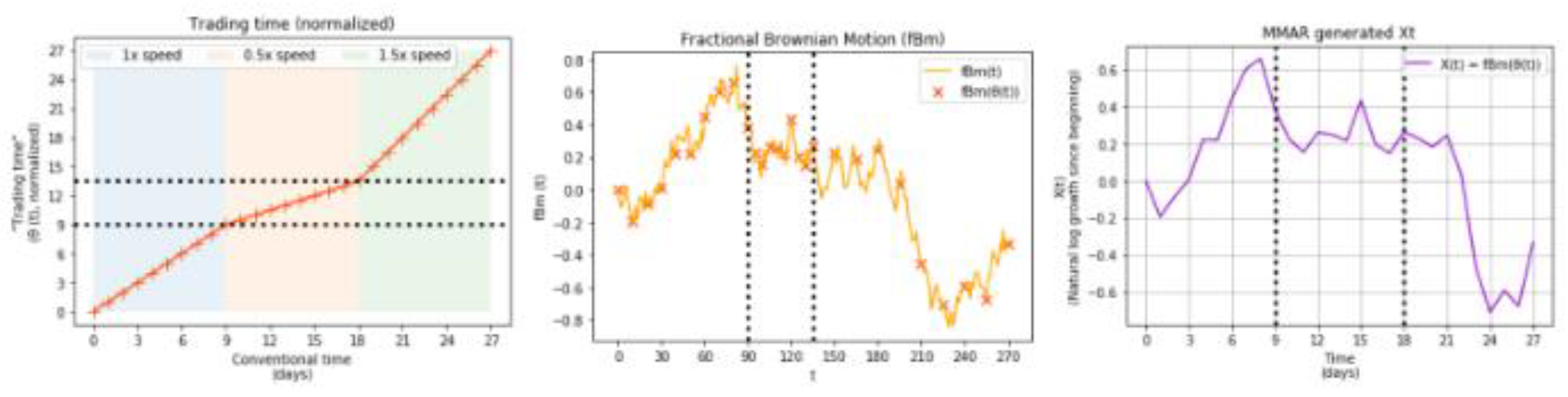

Figure 4.

The intentional stroll. The fBm is comparable to a random walk, with the exception that changes can take on any value rather than being required to be independent. This is a simulation of a fBm for Norway, using a Hurst exponent. Please take note that we intentionally produce ten times as many data points as our trading time CDF in days.

Figure 4.

The intentional stroll. The fBm is comparable to a random walk, with the exception that changes can take on any value rather than being required to be independent. This is a simulation of a fBm for Norway, using a Hurst exponent. Please take note that we intentionally produce ten times as many data points as our trading time CDF in days.

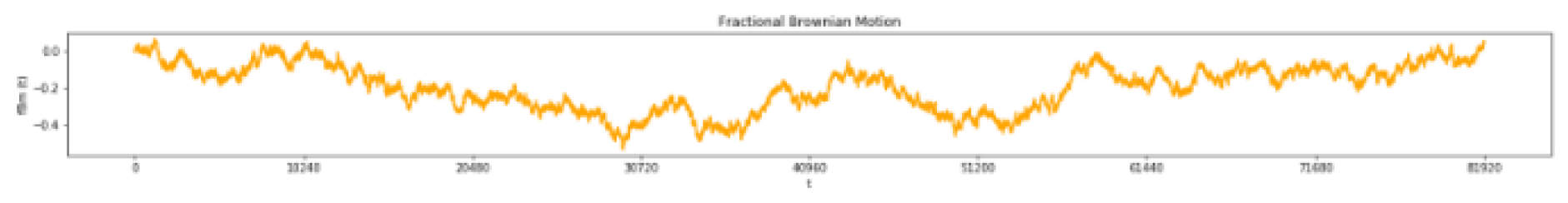

Figure 5.

The MMAR clarified. The MMAR model mimics overall growth over a certain amount of time (in this case, total growth for 27 days at a daily frequency).Growth in the MMAR is a composite process made up of two parts: a fractional Brownian motion and "trading time". The trade time CDF (left graph) allows us to envision that time can travel at various speeds. We reduce the complexity to only three speeds in this example: the standard 1 day increments (blue area); the 0.5 day slow increments (orange area); and the 1.5 day fast increments (green area). The fBm process is then simulated.

Figure 5.

The MMAR clarified. The MMAR model mimics overall growth over a certain amount of time (in this case, total growth for 27 days at a daily frequency).Growth in the MMAR is a composite process made up of two parts: a fractional Brownian motion and "trading time". The trade time CDF (left graph) allows us to envision that time can travel at various speeds. We reduce the complexity to only three speeds in this example: the standard 1 day increments (blue area); the 0.5 day slow increments (orange area); and the 1.5 day fast increments (green area). The fBm process is then simulated.

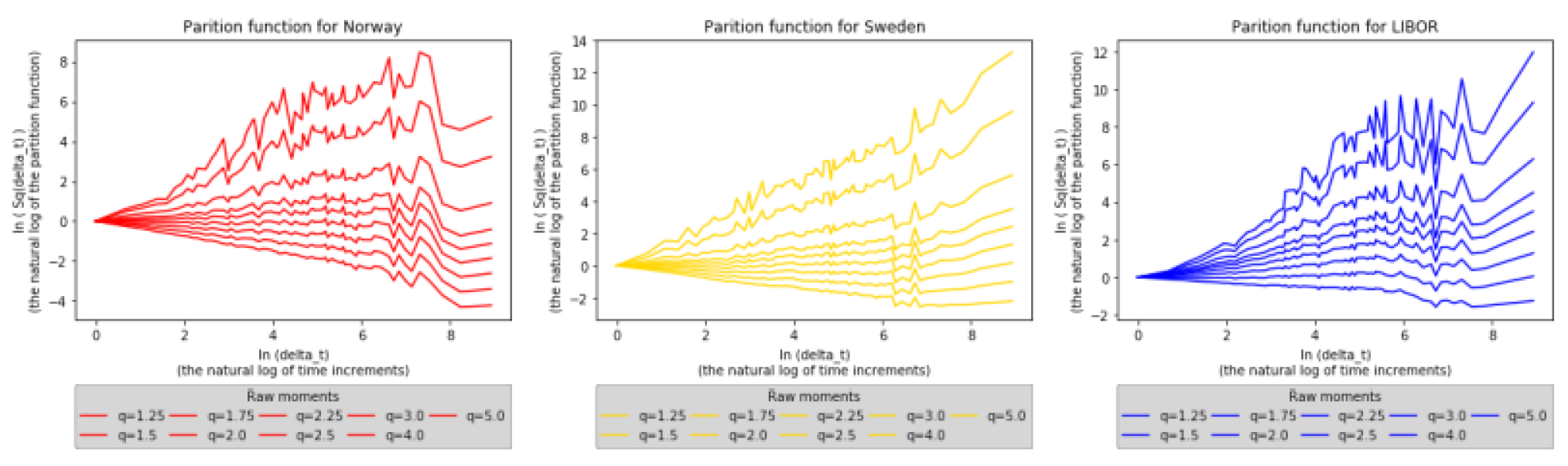

Figure 6.

Are the results fractal? All three markets' partition functions appear to exhibit scaling behaviour. This implies that the fluctuations in price are fractal. Additionally, these graphs have been normalized to begin at zero to facilitate the observation of the scaling behaviour.

Figure 6.

Are the results fractal? All three markets' partition functions appear to exhibit scaling behaviour. This implies that the fluctuations in price are fractal. Additionally, these graphs have been normalized to begin at zero to facilitate the observation of the scaling behaviour.

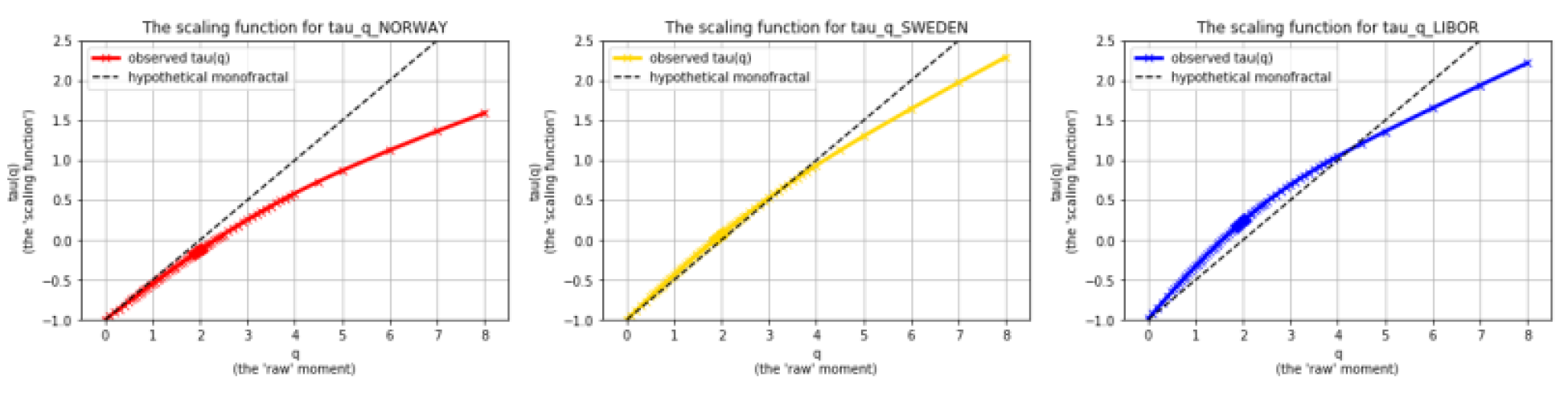

Figure 7.

Is the information multifractal? The fact that the scaling function is non-linear in this instance indicates that, indeed, it is. The partition function and its time increments with regard to the raw instant are described by the scaling function. The most prevalent sign of multifractality is this nonlinearity.

Figure 7.

Is the information multifractal? The fact that the scaling function is non-linear in this instance indicates that, indeed, it is. The partition function and its time increments with regard to the raw instant are described by the scaling function. The most prevalent sign of multifractality is this nonlinearity.

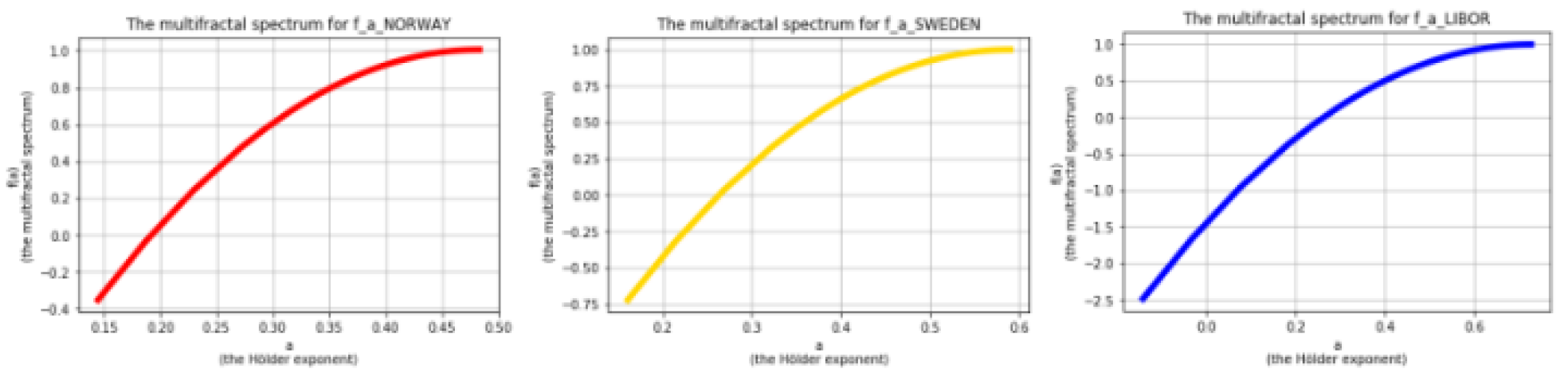

Figure 8.

One of the four MMAR characteristics is determined by the multifractal spectrum.

Figure 8.

One of the four MMAR characteristics is determined by the multifractal spectrum.

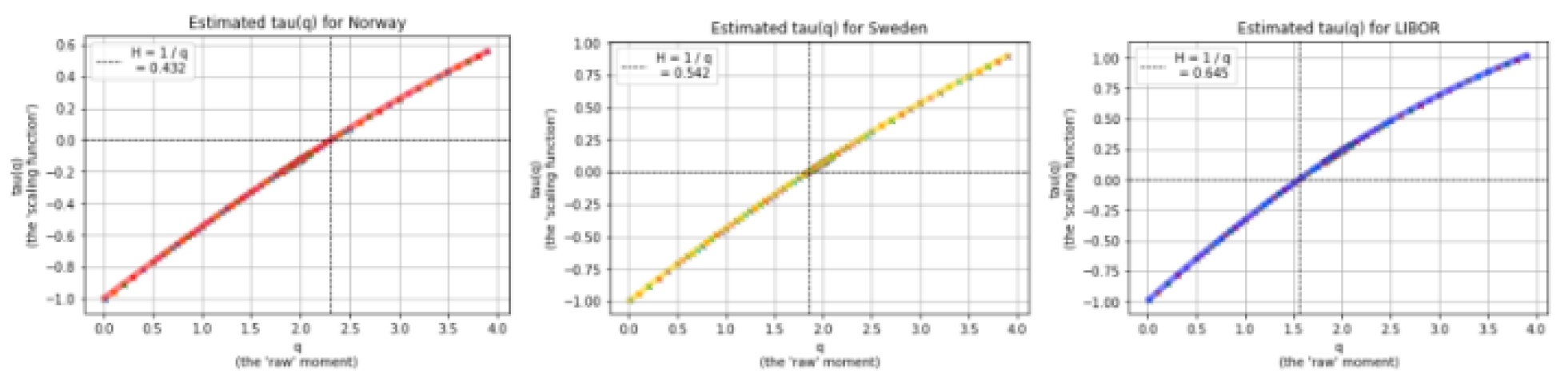

Figure 9.

To get the scaling function in its continuous version, we re-estimate it here, and we utilize the result to find H, another important MMAR parameter. Since the function runs through each actual number extremely closely, estimating it is not difficult.

Figure 9.

To get the scaling function in its continuous version, we re-estimate it here, and we utilize the result to find H, another important MMAR parameter. Since the function runs through each actual number extremely closely, estimating it is not difficult.

Figure 10.

Price histograms for the previous day for every MMAR simulation.

Figure 10.

Price histograms for the previous day for every MMAR simulation.

Figure 11.

The mean variation in price for each simulation. For every MMAR simulation, these histograms display the mean price change over 8,192 simulated days, with light blue Gaussian comparisons. It is evident that a low H narrows the range of means, whereas a large H increases it. The most common mean for Norway was zero, which was intentional. In a similar vein, my deliberate goal was to bring the predicted means of the other two markets into line with their actual mean returns.

Figure 11.

The mean variation in price for each simulation. For every MMAR simulation, these histograms display the mean price change over 8,192 simulated days, with light blue Gaussian comparisons. It is evident that a low H narrows the range of means, whereas a large H increases it. The most common mean for Norway was zero, which was intentional. In a similar vein, my deliberate goal was to bring the predicted means of the other two markets into line with their actual mean returns.

Figure 12.

The average deviations of our hypothetical results. It is evident that the variance of the MMAR simulation is, on average, higher than that of the Gaussian simulations.

Figure 12.

The average deviations of our hypothetical results. It is evident that the variance of the MMAR simulation is, on average, higher than that of the Gaussian simulations.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).