1. Introduction

In the evolving landscape of financial management, the assessment of enterprise financial asset risk has become increasingly complex. Traditional risk assessment methods may fall short in addressing the dynamic and multi-faceted nature of financial risks in contemporary enterprises. Reinforcement learning (RL), a powerful subset of machine learning, offers a novel approach to enhance financial decision-making processes by optimizing risk assessment strategies. This paper presents a reinforcement learning-based model designed to improve enterprise financial asset risk assessment and facilitate intelligent decision-making.

The need for advanced risk assessment models in enterprises is driven by the growing complexity and volatility of financial markets [

1]. Traditional methods often rely on static models and historical data, which may not adapt well to rapidly changing conditions. Reinforcement learning, with its capability to learn from interactions with the environment and adapt over time, presents a promising solution. This section delves into the background of financial asset risk management and the limitations of conventional approaches, setting the stage for the introduction of RL-based methodologies.

Effective risk assessment is crucial for enterprises to safeguard their financial assets and ensure stability [

2]. Accurate risk evaluation helps in anticipating potential financial pitfalls and making informed decisions. This section explores the significance of robust risk assessment frameworks in the context of enterprise financial management and highlights how RL can address gaps in existing risk assessment practices.

Reinforcement learning has emerged as a transformative tool in various domains, including finance. By leveraging RL, enterprises can develop models that continuously improve their decision-making processes based on real-time feedback and evolving data. This section provides an overview of RL principles and their application to financial decision-making, illustrating how RL algorithms can optimize risk assessment and enhance overall financial strategy.

The primary objective of this paper is to introduce and validate a reinforcement learning-based model for enterprise financial asset risk assessment. The model aims to address current limitations by incorporating RL [

3] techniques to improve accuracy and adaptability in risk evaluation. This section outlines the research goals, methodology, and expected contributions of the study, emphasizing how the proposed model advances the field of financial risk management and decision-making.

2. Literature Review

2.1. Traditional Methods for Financial Risk Assessment

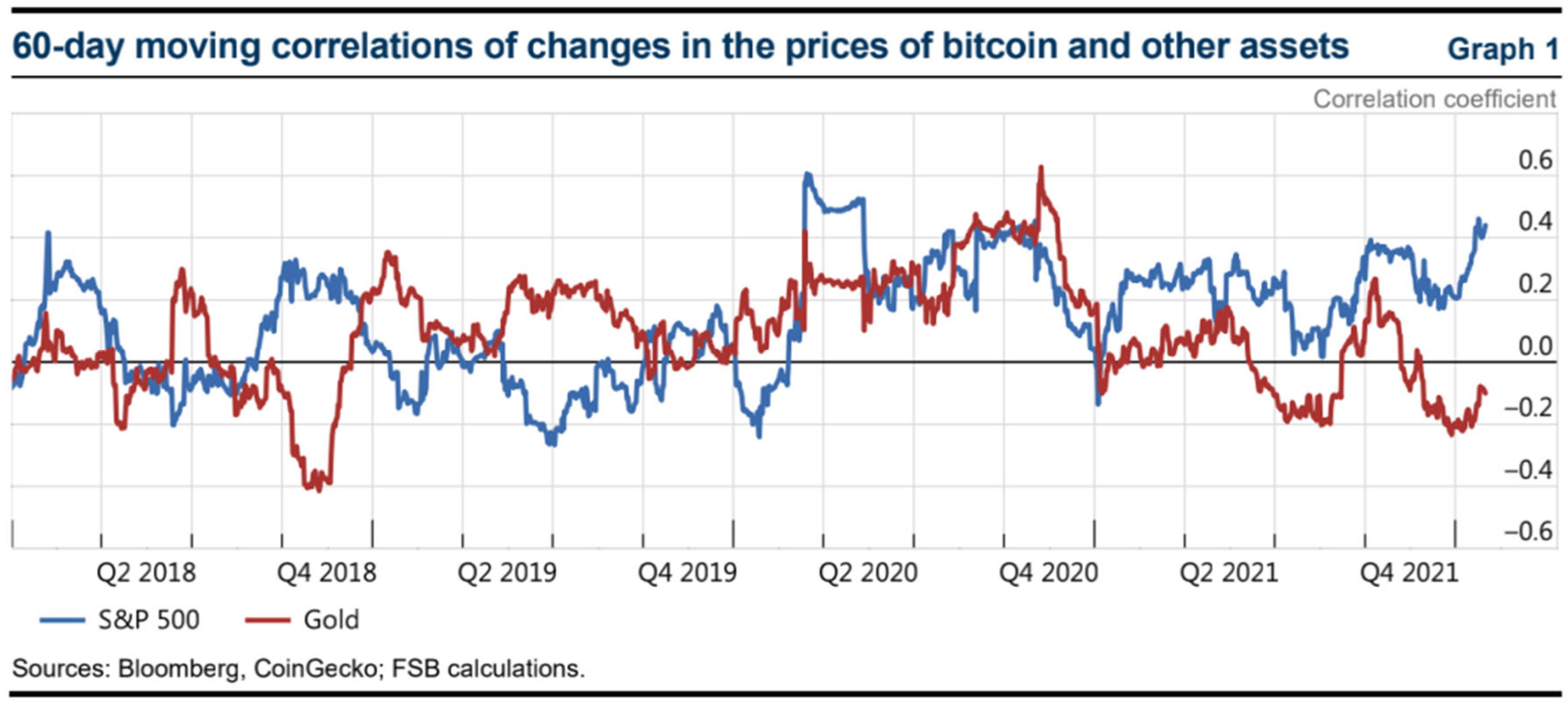

In a complex and evolving ecosystem, these three parts are closely linked and therefore need to be considered comprehensively when assessing the associated financial stability risks. The report notes that while the extent and nature of crypto asset use varies across jurisdictions, financial stability risks can escalate rapidly, highlighting the need for timely and pre-emptive assessment of possible policy responses [

4]. In 2020-21, in addition to the large retail ownership of crypto assets, institutional investor participation in crypto assets is also increasing. Hedge funds are allocating more and more money to crypto assets [

5]. Nevertheless, among mainstream asset managers, interest in crypto investments remains limited due to high volatility, lack of regulatory compliant products and platforms, shortage of regulatory custody services, and broader regulatory uncertainty. The increasing involvement of institutional investors in crypto asset derivatives may increase crypto asset exposure and increase the risk of "spillovers" to core markets, such as investors needing to sell other assets to meet margin requirements on their crypto asset positions.

One potential indicator of the link between crypto assets and the mainstream financial system is the correlation of crypto assets with price changes in other financial assets (

Figure 1). Over the past few years, the correlation between changes in crypto assets and stock prices has generally been negligible, but it becomes more positive in 2020 and 2021 (

Figure 1, blue line).

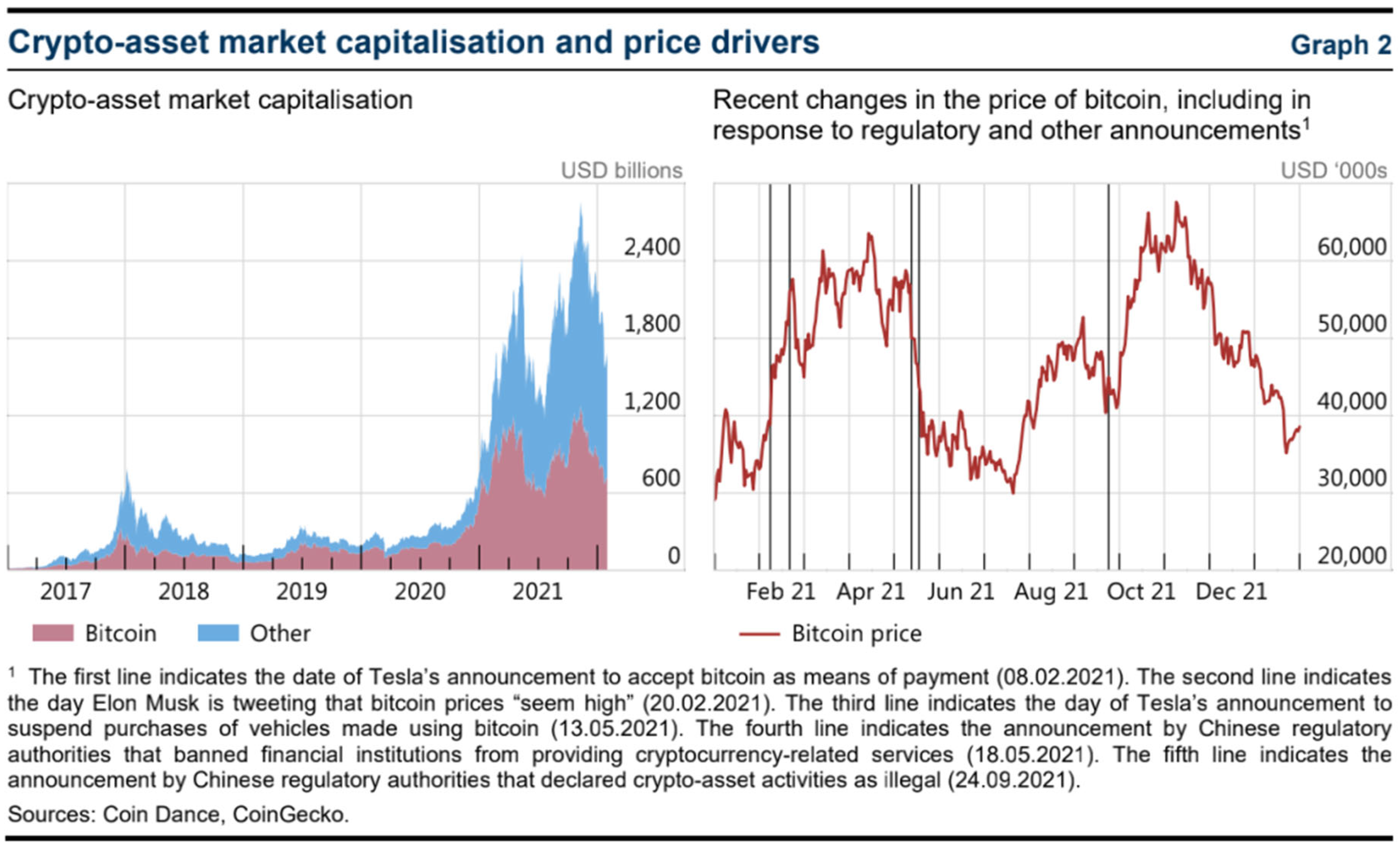

The second is the significant growth of the traditional unsecured crypto asset valuation market, which increases the potential impact of the wealth effect. Moreover, even though the impact may be limited globally, the wealth effect can have a significant impact domestically. However, precise measurement of crypto asset exposure is a challenge. At its peak in November 2021, the

$2.6 trillion unsecured crypto asset market was worth about 3.5 times what it was at the beginning of 2021, although that figure has declined recently (

Figure 2 left). The recent peak was equivalent to about 1 per cent of global financial assets.

Traditional approaches to asset risk assessment often rely on static models and historical data, which can make them seem inadequate when dealing with complex and dynamic financial environments. In traditional methods, asset risk assessment is often based on historical price fluctuations, financial statement analysis, and market trends [

6]. However, these approaches may not be effective in capturing systemic risk from emerging asset classes such as crypto assets. While historical data provides a basis for risk assessment, with rapid changes in financial markets and the growth of emerging assets, such as crypto assets, traditional assessment tools may face challenges. In particular, the volatility of crypto assets and the lack of compliant regulatory products make traditional models ineffective in dealing with these assets.

In recent years, the rapid expansion of the crypto asset market and its potential linkages with mainstream financial markets have increased challenges to traditional risk assessment methods [

7]. While the correlation between the price changes of crypto assets and traditional financial assets has been relatively low over the past few years, this correlation has strengthened significantly in 2020 and 2021. This trend suggests that traditional risk assessment methods may not be able to capture the impact of crypto assets on mainstream financial markets in a timely manner. In addition, the growth of the crypto asset market, which peaked at

$2.6 trillion in November 2021, has receded recently, but its potential impact on wealth effects remains significant. This rapid change and high volatility make traditional risk assessment methods less precise when measuring crypto asset risk. Therefore, adopting more dynamic and adaptable evaluation tools, such as reinforcement learning models, maybe more helpful in addressing the risk challenges posed by emerging financial assets.

2.2. The Potential Combination of Artificial Intelligence and Fintech

The application of financial technology aims to use advanced scientific and technological means to promote the innovation and change of financial services, so that financial services can be more convenient, inclusive, efficient and safe. The development process of financial technology is closely related to information technology: [

8]in the 19th century, the invention of telegraph and telephone accelerated the transmission speed of financial information, making the financial market more responsive to various information; In the 20th century, the development of computers provided strong technical support for fintech, pushing fintech into a new era (X L ZHENG,M Y ZHU,Q B LI. et al., 2019); In the 21st century, with the emergence of the Internet and big data, cloud computing, artificial intelligence and other technologies, the deep integration of finance and technology is promoting the transformation of the global economy to intelligence.

It is in this context that the potential of artificial intelligence and fintech is getting more attention. Through methods such as machine learning and deep learning, artificial intelligence models can process and analyze large amounts of complex financial data to assist financial institutions in rapid and accurate analysis and decision-making, thereby improving the efficiency and quality of financial services. With the increasing maturity of artificial intelligence technology, many financial institutions, such as commercial banks, investment banks, insurance companies, and private equity funds, have begun to try to apply artificial intelligence in asset management, automatic trading, financial customer service, fraud monitoring, and other aspects and have achieved remarkable results. However, under the bright surface, the application of artificial intelligence in the financial field still has some limitations and challenges [

9]. The Party's 20th National Congress report pointed out that many major problems must be solved to prevent financial risks. Issues such as data security, transparency, and model interpretation are included. In today's financial market, addressing these challenges and making fintech and artificial intelligence more secure and effective will be important issues.

Successful AI models cannot be built without the support of data. Take the recently popular Large Language Model as an example. Bard's LaMDA model uses 137B parameters for training, and OpenAI's GPT3.5 model uses 175B parameters for training. The most effective GPT4 uses up to 1T parameters as training data (S SOMAN, H G RANJANNI, 2023). It follows that the quality, quantity, and diversity of the training data directly affect the model's performance. At present, the mainstream [

10]AI models make predictions through training data, and good training data can help artificial intelligence models get more accurate results (BLi, PQI, B LIU, 2022). Therefore, data has an irreplaceable role as the basis of artificial intelligence models.

The unique nature of financial data prevents AI models from maximizing benefits. First, financial data's huge scale and complexity make the data pre-processing stage particularly difficult. For example, there are great differences in data categories, and the data characteristics of equity assets, fixed-income assets, real estate, alternative assets, and other types of assets are significantly different. This makes pre-processing AI models adapted to various data characteristics more complex. Second, relevant data in the financial sector usually comes from multiple sources, including central banks, stock exchanges, investment banks, etc. Although these data belong to the same category, there may be small differences between similar data due to differences in the number of days each institution counts, the number of samples selected, etc. Such small differences can significantly impact the predictions of AI models. Third, data privacy and security are important issues for financial institutions. One study showed that 62% of bankers are cautious about using big data (B FANG, P ZHANG, 2016). Some private financial institutions may be reluctant to disclose or share data due to the need to protect business competitiveness and customer privacy. This undoubtedly increases the difficulty of data collection and analysis of artificial intelligence models in the financial field [

11]. Fourth, AI models usually require a large amount of training data. However, for some financial institutions with large short-term fluctuations in returns, such as private equity funds, the stability of their data is insufficient, and the hasty use of such data may produce extreme values. These extreme values can impact the training and results of AI models. Fifth, the immediacy of data in the financial industry is also one of the factors limiting the widespread application of AI models. For the financial data flow to be updated in real-time, the artificial intelligence model needs to process a large amount of data in a short time, which puts high requirements on the computing power and processing speed of the model, and the required computing resources will also bring huge costs to the enterprise. Sixth, the volatility of the financial market will lead to data often accompanied by noise and outliers, which will interfere with the learning and prediction of the AI model, thus affecting the accuracy and stability of the model.

2.3. Reinforcement Learning in the Field of Finance

In finance, Reinforcement Learning (RL) is a cutting-edge machine learning technique that is revolutionizing the way asset risk is assessed and managed. For example, research from 2020 showed that optimizing a portfolio using the RL algorithm can significantly improve returns, with one experiment on the S&P 500 index showing that an [

12,

13] RL-optimized portfolio improved annualized returns by about 15% over traditional mean-variance optimization methods. RL can dynamically adjust investment strategy and asset allocation by modeling complex market environment in financial asset risk assessment. In the field of high-frequency trading, RL algorithms can process data in real time and make fast decisions, helping investors grasp market opportunities in a very short period of time. For example, certain HFT strategies utilize RL to optimize within seconds, significantly reducing trading costs and increasing returns.

In risk management, the application of reinforcement learning provides more refined risk prediction and control capabilities. Traditional approaches often rely on static models, such as risk assessments based on historical volatility, but these models may not accurately predict the impact of unexpected events. For example, during the global market volatility in 2021, the RL algorithm successfully identified potential market crash risks by analyzing market data in real time and simulating different scenarios, and adjusted risk management strategies in a timely manner. A study of financial institutions found that applying RL to risk management can reduce potential losses by approximately 20%, providing more precise risk control than traditional methods.

Although reinforcement learning has demonstrated significant advantages in the risk assessment and management of financial assets, it also faces some challenges. Online reinforcement learning (Online RL) has advantages in real-time data processing, but its low sample efficiency can lead to policy adjustments that are too frequent. A 2022 study showed that online RL experienced data noise issues in some high frequency trading strategies, affecting trading effectiveness. On the other hand, Offline reinforcement learning [

14](Offline RL) can improve sample efficiency by using historical data for training but may not reflect new market dynamics in a timely manner. For example, some offline RL models fail to accurately capture the impact of unexpected events when simulating market crises. The method of combining online and offline reinforcement learning, that is, hybrid reinforcement learning, can make full use of historical data while retaining real-time adaptability and improve the accuracy and stability of the model. Research shows that the hybrid approach can reduce the model prediction error by about 10% in actual trading, providing a more comprehensive and intelligent solution for the risk assessment and management of financial assets.

2.4. Integration of AI in Financial Risk Assessment

The practical integration of artificial intelligence (AI) techniques into financial risk assessment frameworks has marked a transformative shift in how financial institutions manage risk. Reinforcement learning (RL) models, for instance, are now employed to dynamically adjust investment strategies and asset allocations in real-time, enhancing decision-making capabilities in complex market environments [

15]. These AI models leverage vast amounts of historical and real-time data to optimize risk management strategies, offering more nuanced insights compared to traditional approaches.

Despite the promising benefits, implementing AI models in financial risk assessment presents several challenges. One significant issue is the integration of AI systems with existing financial infrastructure, which requires considerable adjustments to accommodate the advanced computational needs and data requirements of AI models [

16]. Additionally, there are concerns about data quality, model interpretability, and the potential for overfitting or underfitting, which can affect the reliability of risk predictions and decision-making processes.

Nevertheless, the adoption of AI in financial risk assessment has yielded notable benefits. AI models can provide more accurate and timely risk assessments, reduce potential losses, and improve overall financial stability. By incorporating AI techniques, such as RL, institutions can better adapt to rapidly changing market conditions and unforeseen events, leading to more robust risk management practices and a competitive edge in the financial industry.

2.5. Future Directions and Innovations in Financial Risk Management

As financial markets continue to evolve, emerging trends and innovations are shaping the future of financial risk management. One significant trend is the integration of advanced AI technologies, such as deep learning and natural language processing, into risk assessment models. These technologies enable more sophisticated analysis of complex datasets, including unstructured data from news sources, social media, and financial reports [

17,

18,

19]. By harnessing the power of AI, financial institutions can gain deeper insights into market dynamics and enhance their ability to predict and mitigate potential risks.

In addition to technological advancements, new methodologies are being developed to improve risk assessment. For example, hybrid models that combine AI with traditional financial techniques are gaining traction. These models leverage the strengths of both approaches: the predictive power of AI and the established frameworks of traditional risk assessment. Such integration can provide a more comprehensive view of financial risks, incorporating real-time data and dynamic market conditions while maintaining the robustness of traditional methods.

Future research directions in financial risk management are likely to focus on further enhancing the integration of AI with traditional financial models. This includes developing more adaptive and resilient AI algorithms that can better handle market volatility and unexpected events. Research will also explore ways to improve the transparency and interpretability of AI models, addressing concerns about model complexity and ensuring that risk management strategies are both effective and understandable. Additionally, ongoing work will aim to refine data privacy and security measures, ensuring that the benefits of AI in risk management are achieved without compromising sensitive financial information.

3. Methodology

This study adopts the deep reinforcement learning (DRL) [

20]method for risk assessment and intelligent decision-making of enterprise financial assets. Specifically, we model stock market trading as a Markov decision process (MDP), which is consistent with traditional portfolio optimization methods. By building a DRL-based trading environment, we define the trading objective as maximizing the value of the asset portfolio. We trained our model using single stock data from the Yahoo Finance API, including the opening price, high price, low price, closing price, and volume. This framework enables us to evaluate and optimize investment decisions under diverse market conditions, thus providing scientific decision support for enterprise asset management.

In this study, we have implemented various technologies, including Reinforcement Learning (RL) and deep learning algorithms, to improve the intelligence level of investment decisions. We pay special attention to the design of the DRL model's action space, reward function, and state space, where the action space is used to define the weight of stocks in the portfolio, and the reward function is used to quantify the impact of each decision on the value of the portfolio. By carefully adjusting these components, we can more accurately simulate market behaviour and verify the model's performance through backtest analysis to provide strong data support and a theoretical basis for corporate financial decisions.

3.1. Dataset

This dataset from Yahoo Finance contains historical market data for 30 DOW 30 stocks. The data range is from January 1, 2008 to October 31, 2021, with an interval of 1 day. The dataset has a total of 101,615 records and contains the following nine fields:

Table 1.

Historical Stock Data for DOW 30 Companies (2008-2021).

Table 1.

Historical Stock Data for DOW 30 Companies (2008-2021).

| date |

open |

high |

low |

close |

adjcp |

volume |

tic |

day |

|

| 0 |

2008/1/2 |

7.116786 |

7.152143 |

6.876786 |

6.958571 |

5.94145 |

1079178800 |

AAPL |

2 |

| 1 |

2008/1/2 |

46.599998 |

47.040001 |

46.259998 |

46.599998 |

35.172192 |

7934400 |

AMGN |

2 |

| 2 |

2008/1/2 |

52.09 |

52.32 |

50.790001 |

51.040001 |

40.326855 |

8053700 |

AXP |

2 |

| 3 |

2008/1/2 |

87.57 |

87.839996 |

86 |

86.620003 |

63.481602 |

4303000 |

BA |

2 |

| 4 |

2008/1/2 |

72.559998 |

72.669998 |

70.050003 |

70.629997 |

46.850491 |

6337800 |

CAT |

2 |

Sample data displays information for January 2, 2008, including the opening, highest, lowest, and closing prices, adjusted closing price, trading volume, and stock ticker. The dataset's broad time span and diverse stock coverage offer rich historical market information suitable for various financial analyses and modelling tasks.

3.2. Preprocess Data

Data preprocessing is crucial for training a high-quality machine learning model. We need to check for missing data and do feature engineering to convert the data into a model-ready state.

Add technical indicators. In practical trading, various information needs to be considered, such as historical stock prices, current holding shares, technical indicators, etc. This article demonstrates two trend-following technical indicators: MACD and RSI.

Add turbulence index. Risk aversion reflects whether an investor will choose to preserve the capital. It also influences one's trading strategy when facing different market volatility levels. To control the risk in a worst-case scenario, such as the financial crisis of 2007–2008, FinRL employs the financial turbulence index that measures extreme asset price fluctuation.

Table 2.

Preprocessed Stock Data with Technical Indicators and Covariance Matrix Summary.

Table 2.

Preprocessed Stock Data with Technical Indicators and Covariance Matrix Summary.

| Date |

Ticker |

Close |

MACD |

RSI 30 |

Covariance Matrix Summary |

| 2008/12/31 |

AAPL |

3.048 |

-0.097 |

42.25 |

Mean Cov: 0.0013, Std Dev: 0.0004 |

| 2008/12/31 |

AMGN |

57.75 |

0.216 |

51.06 |

Mean Cov: 0.0013, Std Dev: 0.0004 |

| 2008/12/31 |

AXP |

18.55 |

-1.192 |

42.52 |

Mean Cov: 0.0013, Std Dev: 0.0004 |

| 2008/12/31 |

BA |

42.67 |

-0.391 |

47.29 |

Mean Cov: 0.0013, Std Dev: 0.0004 |

| 2008/12/31 |

CAT |

44.67 |

0.98 |

51.07 |

Mean Cov: 0.0013, Std Dev: 0.0004 |

3.3. Design Environment for Stock Trading

This section describes the design environment for simulating stock trading tasks using reinforcement learning. The trading environment is modelled as a Markov Decision Process (MDP) due to the stochastic and interactive nature of stock trading. This approach involves observing changes in stock prices, taking actions, and calculating rewards to adjust the trading strategy iteratively. The trading agent aims to develop a strategy that maximizes cumulative rewards over time.

Our trading environment is implemented using the OpenAI Gym framework, which facilitates the simulation of livestock markets based on historical data. The environment is configured to simulate trading with real market data in a time-driven manner. The training data spans from January 1, 2009, to July 1, 2020, providing a comprehensive dataset for model training. The environment's state space includes technical indicators and a covariance matrix, while the action space represents the portfolio weights for trading different stocks. The environment's reward is calculated based on the portfolio value at each time step, reflecting the trading strategy's performance.

3.4. Implementation of DRL Algorithms

Model 1: A2C

The A2C (Advantage Actor-Critic) algorithm is employed to train the trading agent using actor and critic methods to stabilize training. With parameters including `n_steps` set to 5, `ent_coef` at 0.005, and a learning rate 0.0002, A2C focuses on efficiently updating the policy and value function. This model was trained with 50,000 timesteps and utilized GPU acceleration to enhance computational efficiency, aiming to refine the agent's trading strategy by balancing exploration and exploitation.

Model 2: PPO

The PPO (Proximal Policy Optimization) algorithm is applied with settings such as `n_steps` of 2048, `ent_coef` of 0.005, a learning rate 0.0001, and a batch size of 128. PPO is known for its robustness and ability to handle high-dimensional action spaces by optimizing the policy. Trained over 80,000 timesteps, PPO benefits from GPU acceleration and focuses on ensuring that policy updates remain within a specified range to prevent drastic changes, thereby improving the trading agent's performance and stability.

Model 3: DDPG

The DDPG (Deep Deterministic Policy Gradient) algorithm is implemented with parameters such as a batch size of 128, a buffer size of 50,000, and a learning rate of 0.001. DDPG is particularly effective for continuous action spaces, making it suitable for portfolio management tasks. This model was trained for 50,000 timesteps and leverages GPU capabilities to enhance learning efficiency. DDPG aims to optimize the trading agent’s actions based on observed market conditions by focusing on learning deterministic policies. The effectiveness of the DRL models is reflected in their daily returns. The table below shows the daily returns for a sample period:

This data highlights the trading strategy’s performance over time, indicating the algorithm's ability to generate returns while managing risk. The variability in daily returns demonstrates the models' responsiveness to market conditions and their potential for effective trading strategy optimization.

Table 3.

“Daily Returns of Trading Strategies”.

Table 3.

“Daily Returns of Trading Strategies”.

| date |

daily_return |

|

| 0 |

2020/7/1 |

0 |

| 1 |

2020/7/2 |

0.005197 |

| 2 |

2020/7/6 |

0.014996 |

| 3 |

2020/7/7 |

-0.013876 |

| 4 |

2020/7/8 |

0.005758 |

4. Financial Asset Forecast Backtest Trading Strategy

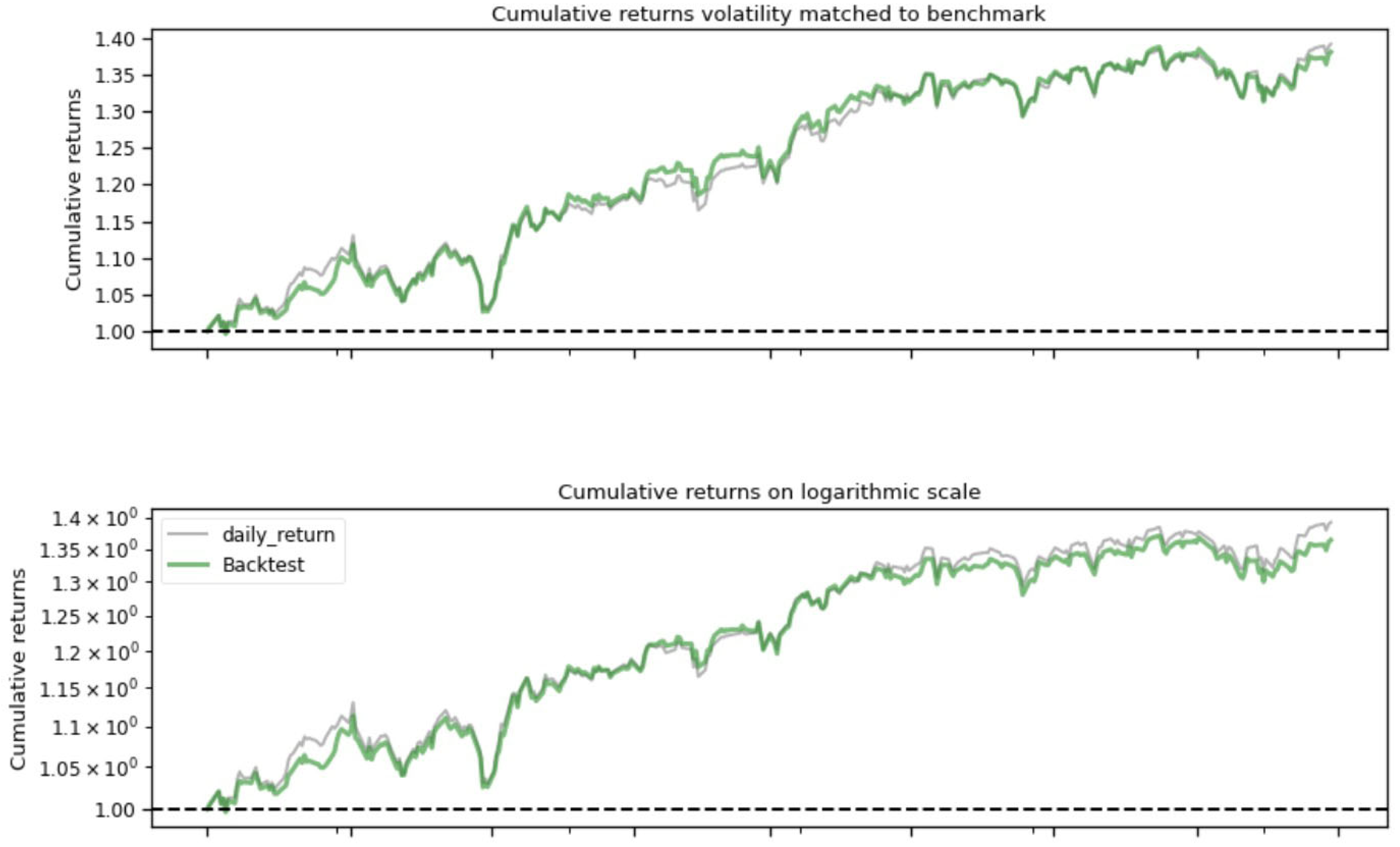

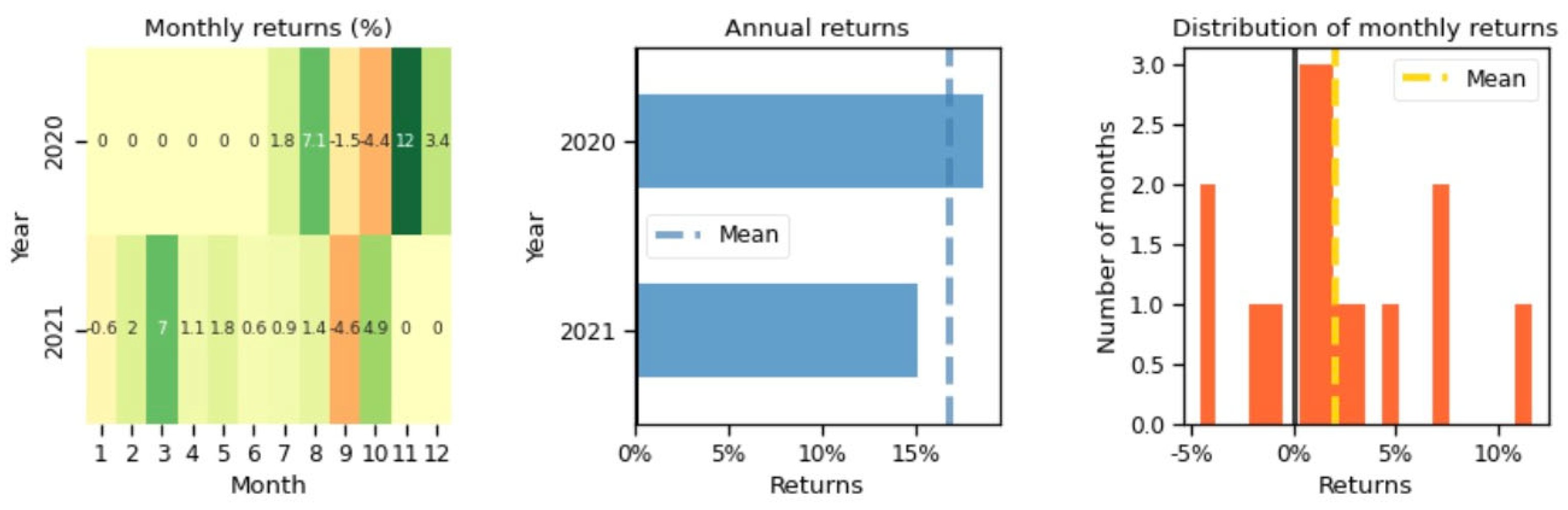

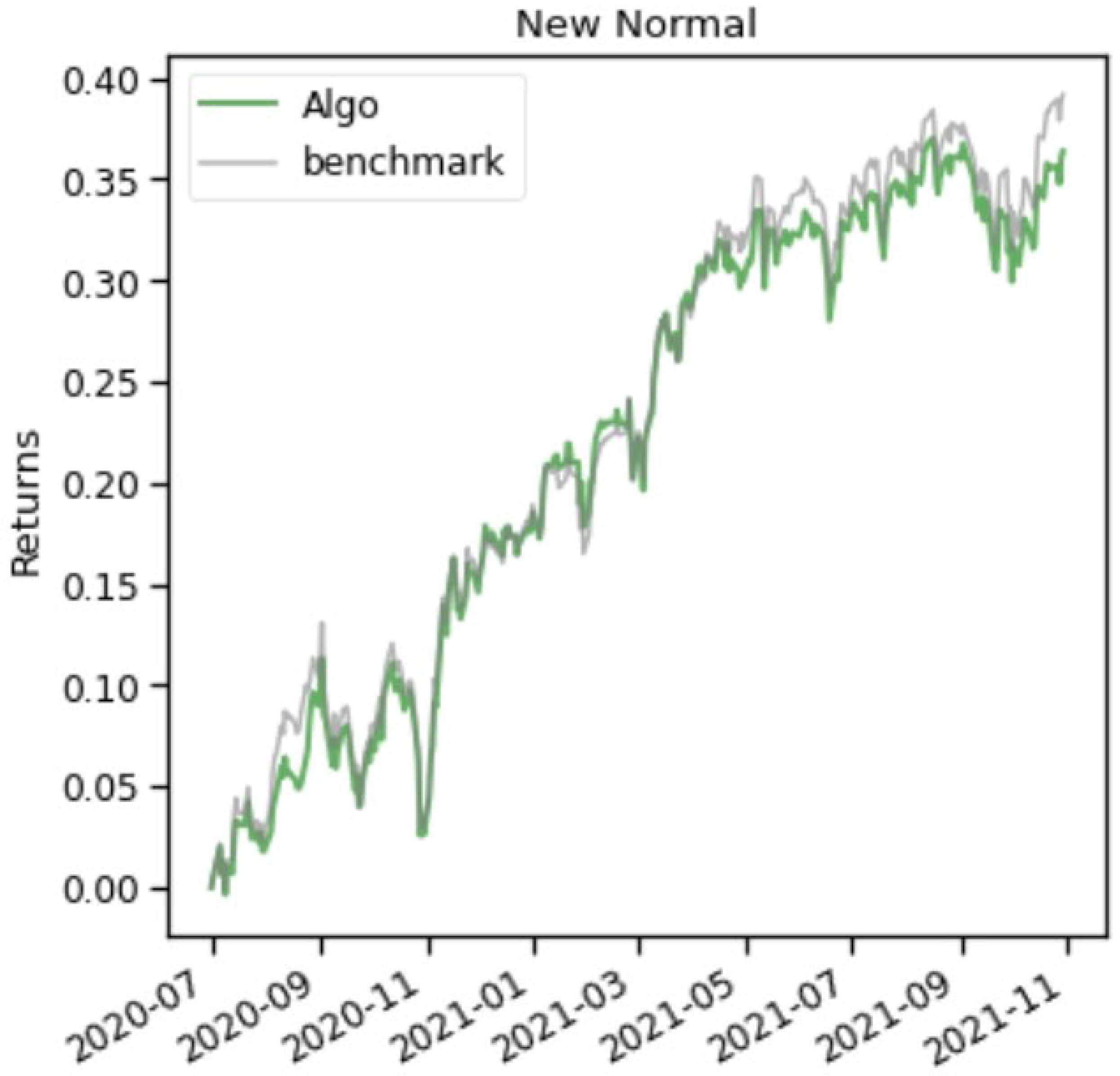

Backtesting is crucial for assessing the effectiveness of a trading strategy. Utilizing automated tools like the Quantopian portfolio package minimizes human error and provides a detailed analysis of performance metrics.

4.1. BackTestStats

We began by evaluating the performance of our DRL-based trading strategy using the portfolio package. The results indicated an annual return of 26.11% and a cumulative return of 36.38%. The strategy demonstrated robust risk-adjusted returns with a Sharpe ratio of 1.81 and a Calmar ratio of 3.32. Notably, the maximum drawdown was 7.87%, showing the strategy's resilience in adverse market conditions. Compared to the baseline stats for the DJIA, our strategy's returns were slightly lower but performed comparably in terms of volatility and risk-adjusted metrics.

4.2. BackTestPlot

The portfolio plotting functions provided a comprehensive visualization of the strategy's performance against the benchmark. The full tear sheet confirmed our earlier metrics, showcasing the DRL strategy's annual return of 26.11% and a Sharpe ratio of 1.81. The backtest revealed several worst drawdown periods, with the most significant being a 7.87% drawdown from September to October 2020. Stress events analysis showed a mean return of 0.10% with fluctuations ranging from -3.32% to 3.32% and a return of 0.10% with fluctuations ranging from -3.32% to 3.32%, highlighting the strategy's robustness in various market conditions.

Table 4.

Worst Drawdown Periods of DRL Strategy.

Table 4.

Worst Drawdown Periods of DRL Strategy.

| Worst drawdown periods |

Net drawdown in % |

Peak date |

Valley date |

Recovery date |

Duration |

| 0 |

7.87 |

2020/9/2 |

2020/10/28 |

2020/11/9 |

49 |

| 1 |

5.17 |

2021/8/16 |

2021/9/30 |

NaT |

NaN |

| 2 |

4.06 |

2021/5/10 |

2021/6/18 |

2021/7/2 |

40 |

| 3 |

3.52 |

2021/2/24 |

2021/3/4 |

2021/3/10 |

11 |

| 4 |

3.4 |

2021/1/20 |

2021/1/29 |

2021/2/5 |

13 |

These results and detailed visualizations offer valuable insights into the strategy's performance and risk characteristics, guiding future refinements and deployments.

Figure 3.

Cumulative returns.

Figure 3.

Cumulative returns.

Figure 4.

Cumulative returns of volatility match to benchmark.

Figure 4.

Cumulative returns of volatility match to benchmark.

Figure 5.

Rolling portfolio beta to daily_return.

Figure 5.

Rolling portfolio beta to daily_return.

Figure 6.

Chart of financial risk retracement analysis in different months.

Figure 6.

Chart of financial risk retracement analysis in different months.

Figure 7.

Risk-adjusted return graph.

Figure 7.

Risk-adjusted return graph.

4.3. Experimental Conclusion

1. The effectiveness of reinforcement learning in financial risk prediction:

As can be seen from the cumulative return graph, the DRL strategy showed significant cumulative return growth during the test period. Compared with traditional financial models, reinforcement learning methods can optimize themselves in a dynamic market environment by learning and adjusting strategies in real-time to adapt to market changes. This adaptive ability enables DRL strategies to show higher stability and accuracy in risk prediction and can effectively cope with market volatility and uncertainty to achieve long-term profitability beyond the benchmark.

2. The advantages of reinforcement learning are reflected in strategy optimization:

The experimental results show that the cumulative yield curve of the DRL strategy is higher than the market benchmark in most periods, indicating its advantage in strategy optimization. By constantly interacting with the environment, reinforcement learning models can find and use the potential patterns and laws in the market to optimize the decision-making process. This optimization ability improves the strategy's overall performance and the effect of risk management so that the strategy can maintain relatively stable returns under different market conditions.

3. Balance between risk management and return fluctuations:

The cumulative return chart also shows the performance of DRL strategies in terms of earnings volatility and retracements. Although the strategy has experienced a pullback in some periods, overall, the speed of its recovery and long-term earnings growth have exceeded its benchmark. This shows that reinforcement learning can provide advanced solutions for predicting and managing financial risks and maintain a better balance of returns in the face of market fluctuations. This ability is difficult to match with traditional methods, further highlighting the potential of reinforcement learning in the financial field.

Figure 8.

Cumulative Returns Comparison.

Figure 8.

Cumulative Returns Comparison.

5. Conclusions

With the continuous evolution of the financial market, traditional financial asset risk assessment methods are increasingly inadequate in coping with the complex risk environment faced by modern enterprises. Although traditional methods provide a basis for financial asset risk assessment based on historical data and static models, their limitations are gradually emerging in the face of the dynamic changes in financial markets and the challenges of emerging asset classes. This paper introduces reinforcement learning (RL) technology to provide a new enterprise financial asset risk assessment solution. The dynamic adjustment ability and real-time feedback mechanism of reinforcement learning enable it to better adapt to the rapidly changing market environment, thus improving the accuracy and adaptability of risk assessment. By applying deep reinforcement learning (DRL) models, this study shows how RL technology can optimize asset portfolios, improve risk prediction, and provide scientific decision support, thereby driving advances in financial risk management.

In the future, the convergence of artificial intelligence (AI) and financial technology (fintech) will further drive innovation in financial risk management. With advanced AI technologies such as deep learning and natural language processing, financial institutions can analyze complex data more deeply and improve their ability to predict risks. However, this process still challenges data quality, model interpretation, and privacy security. Nevertheless, the potential of AI technology in risk management cannot be ignored to provide more accurate and timely risk assessment and help financial institutions maintain a competitive edge in changing market conditions. Future research will need to continue to explore the effective integration of AI with traditional financial models, improve the adaptability and transparency of models, and ensure that the benefits of AI technology in risk management are maximized while protecting data security.

References

- Ye, Y.; Pei, H.; Wang, B.; Chen, P.Y.; Zhu, Y.; Xiao, J.; Li, B. (2020, April). Reinforcement-learning-based portfolio management with augmented asset movement prediction states. In Proceedings of the AAAI conference on artificial intelligence (Vol. 34. No. 01; pp. 1112–1119.

- GAO, W. D. , & FEI, Y. M. (2024). Constructing the Financial Asset Allocation Method Using Deep Reinforcement Learning Algorithm for Financial Transactions. Journal of Information Science & Engineering, 40(4).

- Guo, L. , Song, R., Wu, J., Xu, Z., & Zhao, F. (2024). Integrating a machine learning-driven fraud detection system based on a risk management framework. Applied and Computational Engineering, 87, 80-86.

- Li, J. , Wang, Y., Xu, C., Liu, S., Dai, J., & Lan, K. (2024). Bioplastic derived from corn stover: Life cycle assessment and artificial intelligence-based uncertainty and variability analysis. Science of The Total Environment, 174349.

- Ling, Z. , Xin, Q., Lin, Y., Su, G. and Shui, Z., 2024. Optimization of autonomous driving image detection based on RFAConv and triplet attention. Applied and Computational Engineering, 77, pp.210-217.

- He, Z. , Shen, X. , Zhou, Y., & Wang, Y. (2024, January). Application of K-means clustering based on artificial intelligence in gene statistics of biological information engineering. In Proceedings of the 2024 4th International Conference on Bioinformatics and Intelligent Computing (pp. 468-473)., Y. (2024. [Google Scholar]

- Bao, W., Xiao, J., Deng, T., Bi, S., Wang, J. (2024). The Challenges and Opportunities of Financial

Technology Innovation to Bank Financing Business and Risk Management. Financial Engineering and Risk

Management, 7(2), 82‐88.

- Gong, Y. , Zhu, M., Huo, S., Xiang, Y., & Yu, H. (2024, March). Utilizing Deep Learning for Enhancing Network Resilience in Finance. In 2024 7th International Conference on Advanced Algorithms and Control Engineering (ICAACE) (pp. 987-991). IEEE.

- Zhou, Y. , Zhan, T., Wu, Y., Song, B., & Shi, C. (2024). RNA Secondary Structure Prediction Using Transformer-Based Deep Learning Models. preprint. arXiv, arXiv:2405.06655.

- Liu, B., Cai, G., Ling, Z., Qian, J., Zhang, Q. (2024). Precise Positioning and Prediction System for Autonomous Driving Based on Generative Artificial Intelligence. Applied and Computational Engineering, 64, 42‐49.

- Cui, Z. , Lin, L., Zong, Y., Chen, Y., & Wang, S. (2024). Precision Gene Editing Using Deep Learning: A Case Study of the CRISPR-Cas9 Editor. Applied and Computational Engineering, 64, 134-141.

- Zhang, X. , 2024. Machine learning insights into digital payment behaviors and fraud prediction. Applied and Computational Engineering, 67, pp.61-67.

- Ping G, Wang S X, Zhao F, et al. Blockchain-Based Reverse Logistics Data Tracking: An Innovative Approach to Enhance E-Waste Recycling Efficiency[J]. 2024.

- Shang F, Shi J, Shi Y, et al. Enhancing E-Commerce Recommendation Systems with Deep Learning-based Sentiment Analysis of User Reviews[J]. International Journal of Engineering and Management Research, 2024, 14(4): 19-34.

- Xu Y, Liu Y, Xu H, et al. AI-Driven UX/UI Design: Empirical Research and Applications in FinTech[J]. International Journal of Innovative Research in Computer Science & Technology, 2024, 12(4): 99-109.

- Li, J. , & Chan, L. (2006, July). Reward adjustment reinforcement learning for risk-averse asset allocation. In The 2006 IEEE International Joint Conference on Neural Network Proceedings (pp. 534-541). IEEE.

- Li, A., Zhuang, S., Yang, T., Lu, W., Xu, J. (2024). Optimization of logistics cargo tracking and

transportation efficiency based on data science deep learning models. Applied and Computational

Engineering, 69, 71‐77. [PubMed]

- Xu, J. , Yang, T., Zhuang, S., Li, H. and Lu, W., 2024. AI-based financial transaction monitoring and fraud prevention with behavior prediction. Applied and Computational Engineering, 77, pp.218-224.

- Skeepers, T. , van Zyl, T. L., & Paskaramoorthy, A. (2021, November). MA-FDRNN: Multi-asset fuzzy deep recurrent neural network reinforcement learning for portfolio management. In 2021 8th International Conference on Soft Computing & Machine Intelligence (ISCMI) (pp. 32-37). IEEE.

- Xiao, J., Wang, J., Bao, W., Deng, T., Bi, S. (2024). Application progress of natural language processing

technology in financial research. Financial Engineering and Risk Management, 7(3), 155‐161.

- Jiang, Yanhui, Jin Cao, and Chang Yu. "Dog Heart Rate and Blood Oxygen Metaverse Interaction System. arXiv preprint, 2024; arXiv:2406.04466.

- Zhang, Y. , Xie, H., Zhuang, S., & Zhan, X. (2024). Image Processing and Optimization Using Deep Learning-Based Generative Adversarial Networks (GANs). Journal of Artificial Intelligence General science (JAIGS) ISSN: 3006-4023, 5(1), 50-62.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).