Submitted:

19 October 2024

Posted:

21 October 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

1.1. Research Questions

- How is customer satisfaction measured and monitored in SMEs using the BSC framework?

- Which role does technology play in implementing an effective BSC in SMEs?

- What is the impact of the BSC on the performance and motivation of employees in SMEs?

- What challenges do SMEs face when integrating the BSC methodology into their existing management practices?

- How do SMEs customize the BSC framework to align with their specific strategic goals as well as operational contexts?

1.2. Research Motivation

1.3. Research Contribution

1.4. Research Novelty

2. Materials and Methods

2.1. Eligibility Criteria

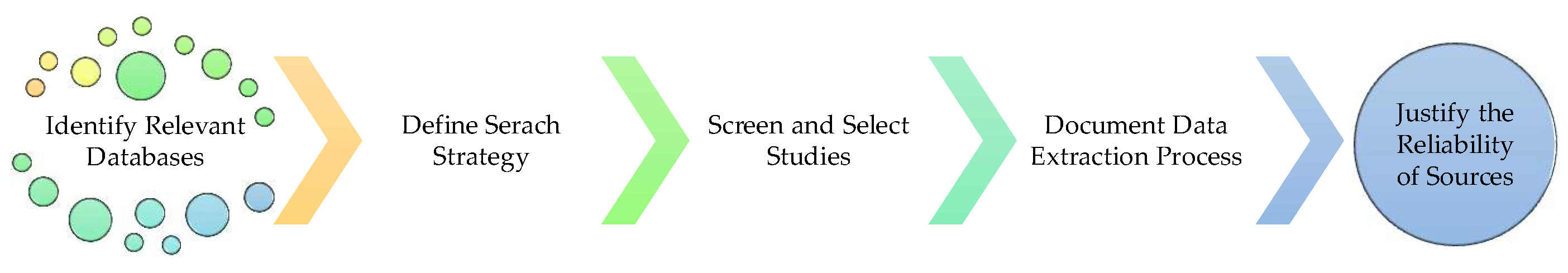

2.1. Information Sources

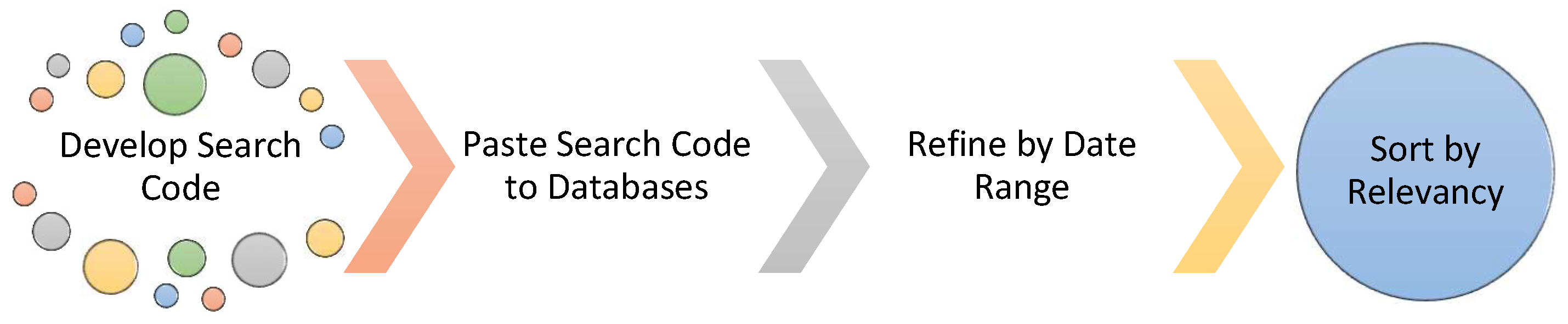

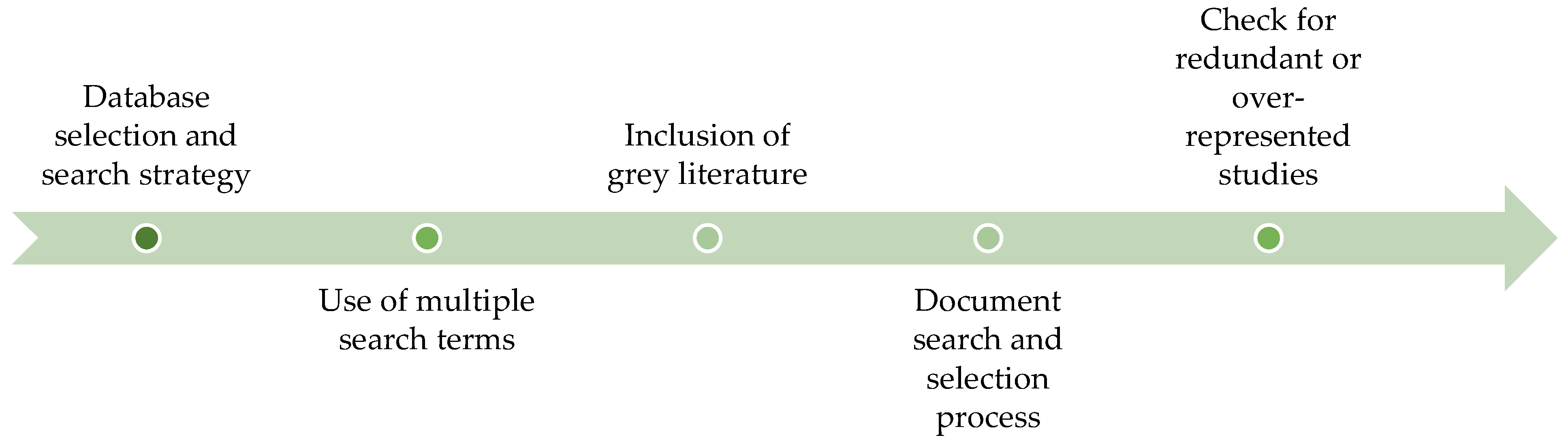

2.1. Search Strategy

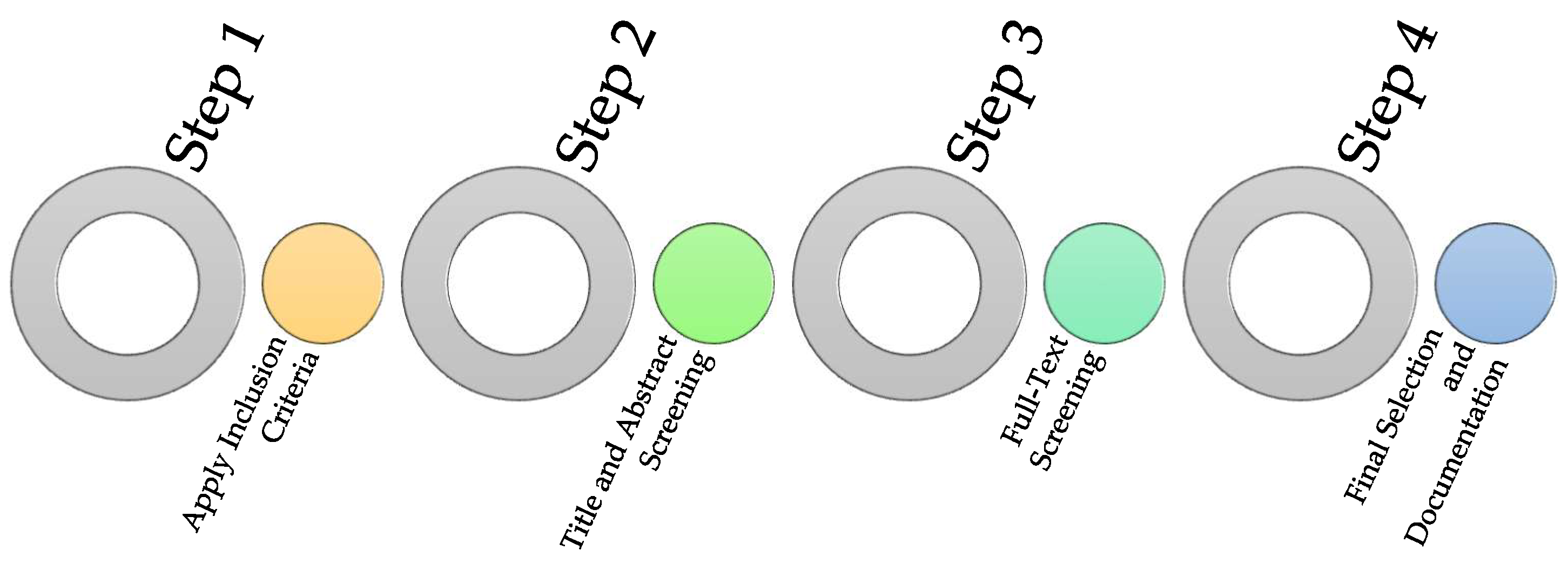

2.1. Selection Process

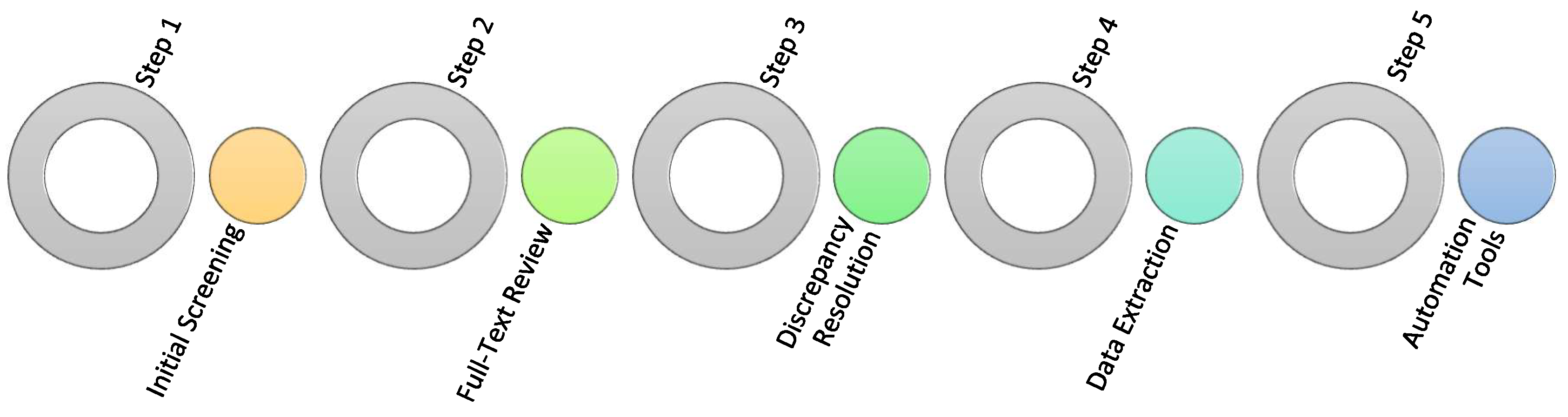

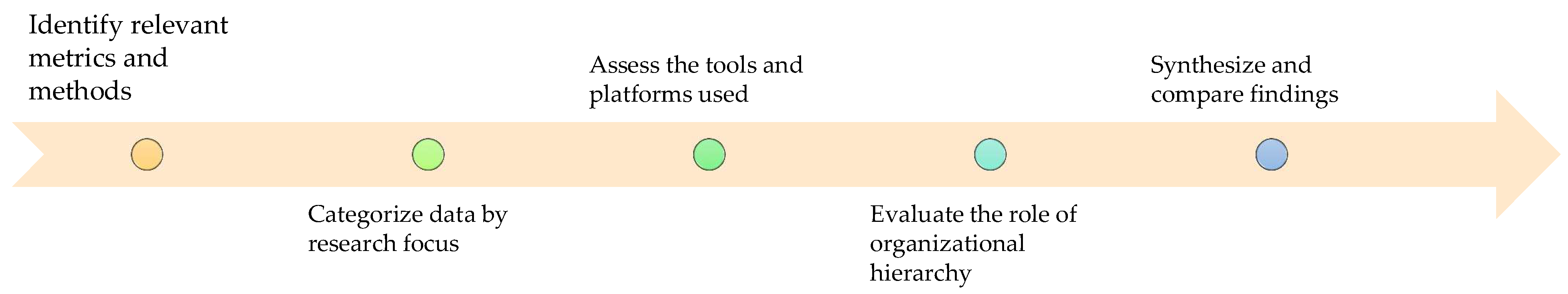

2.1. Data Collection Process

2.1. Data Items

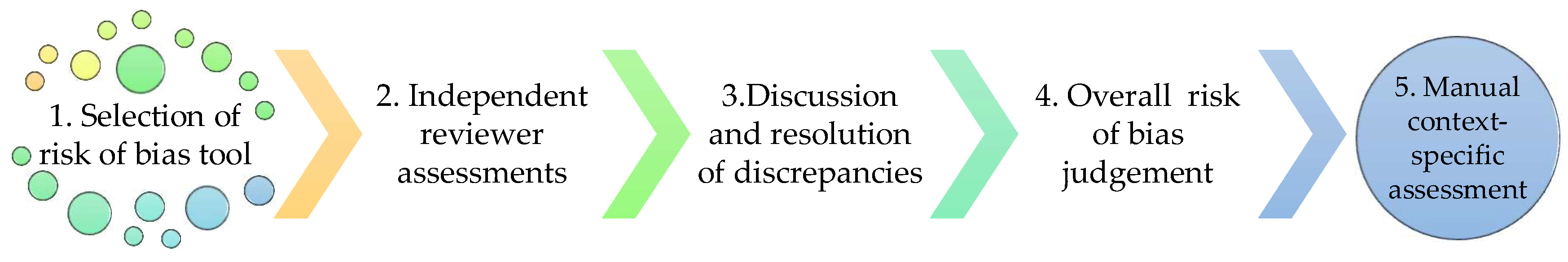

2.1. Study Risk of Bias Assessment

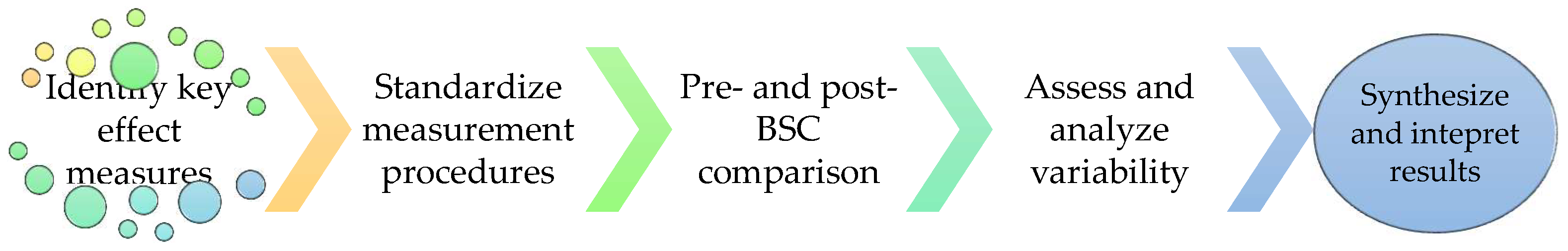

2.1. Effect Measures

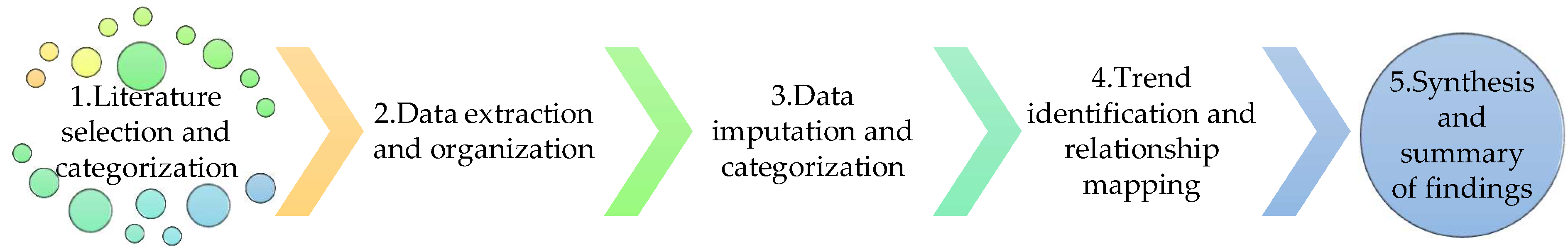

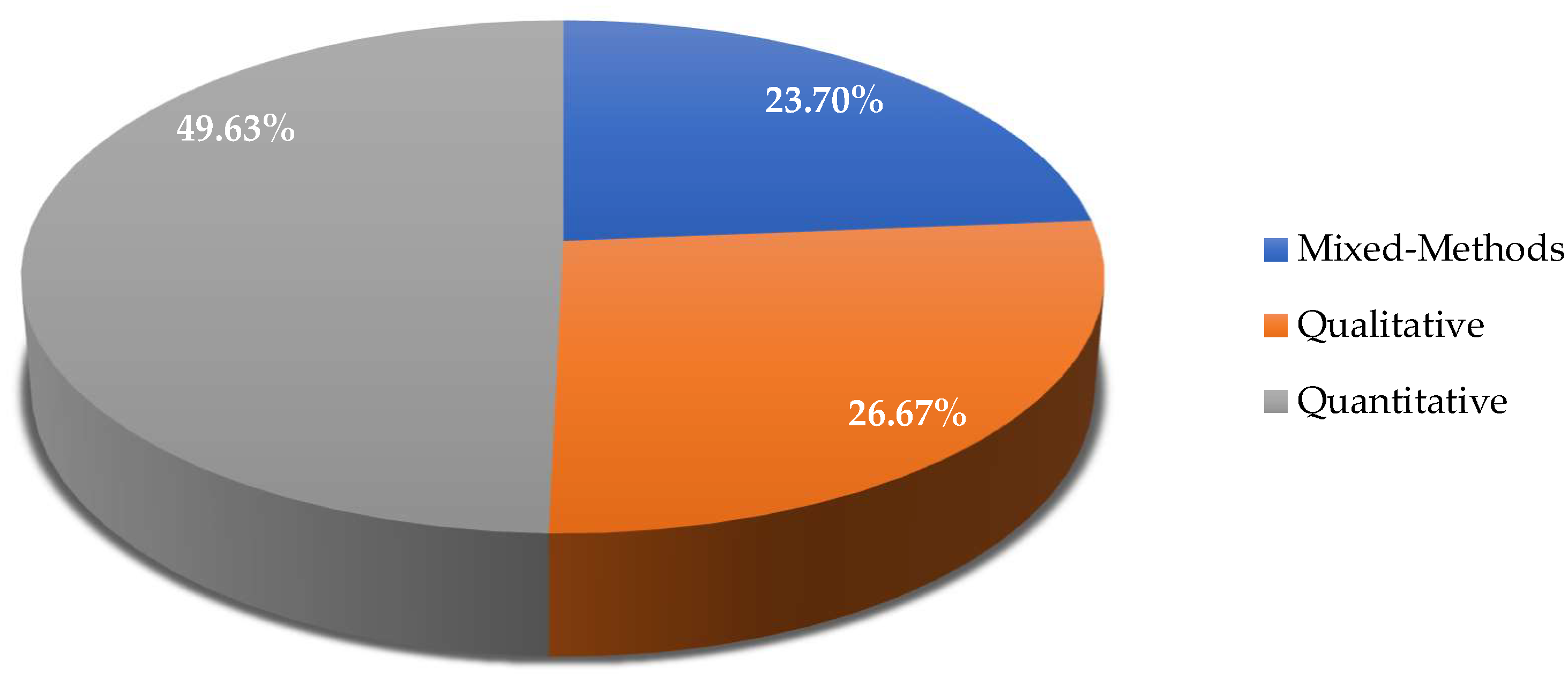

2.1. Synthesis Methods

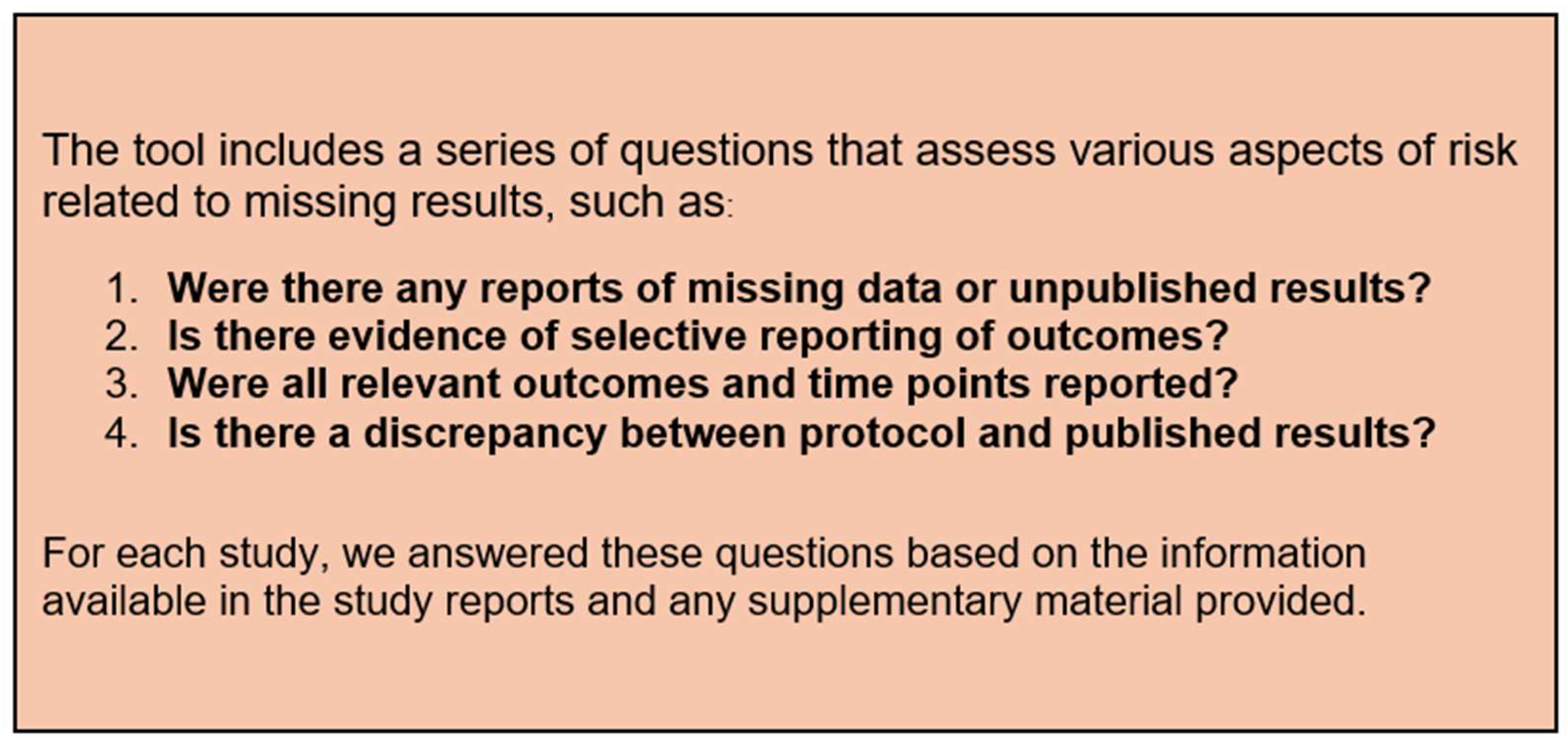

2.2. Reporting Bias

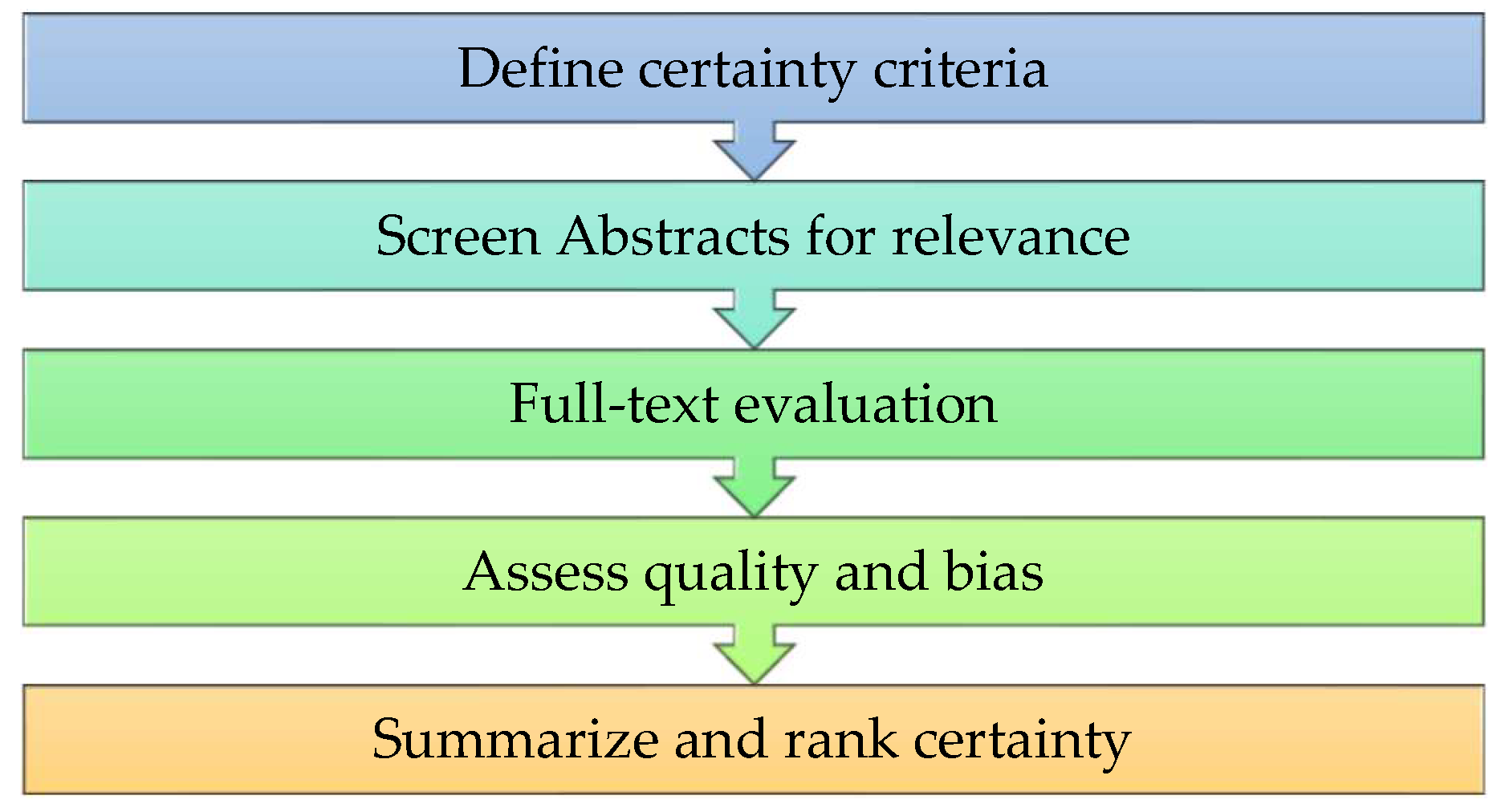

2.2. Certainty Assessment

3. Results

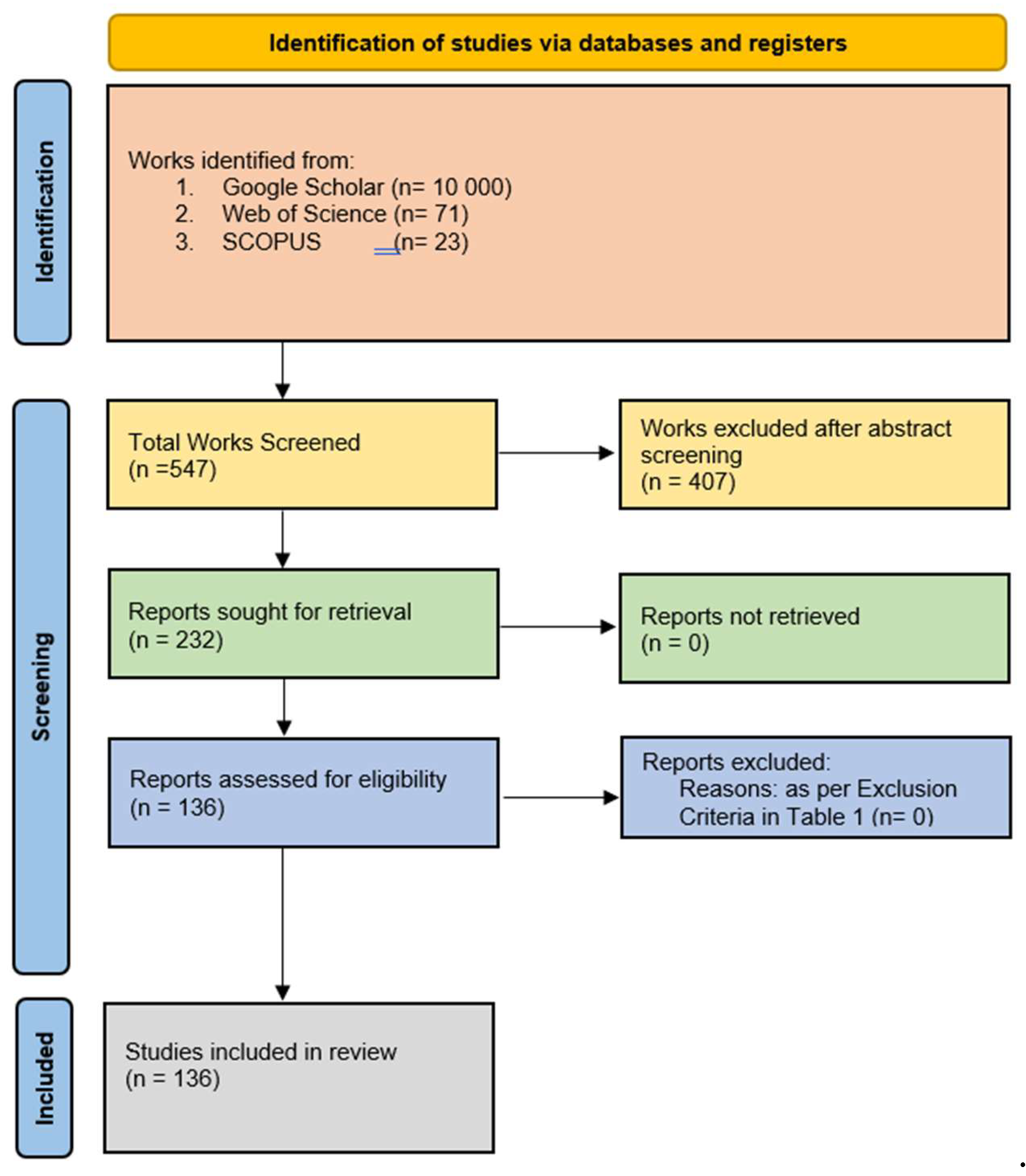

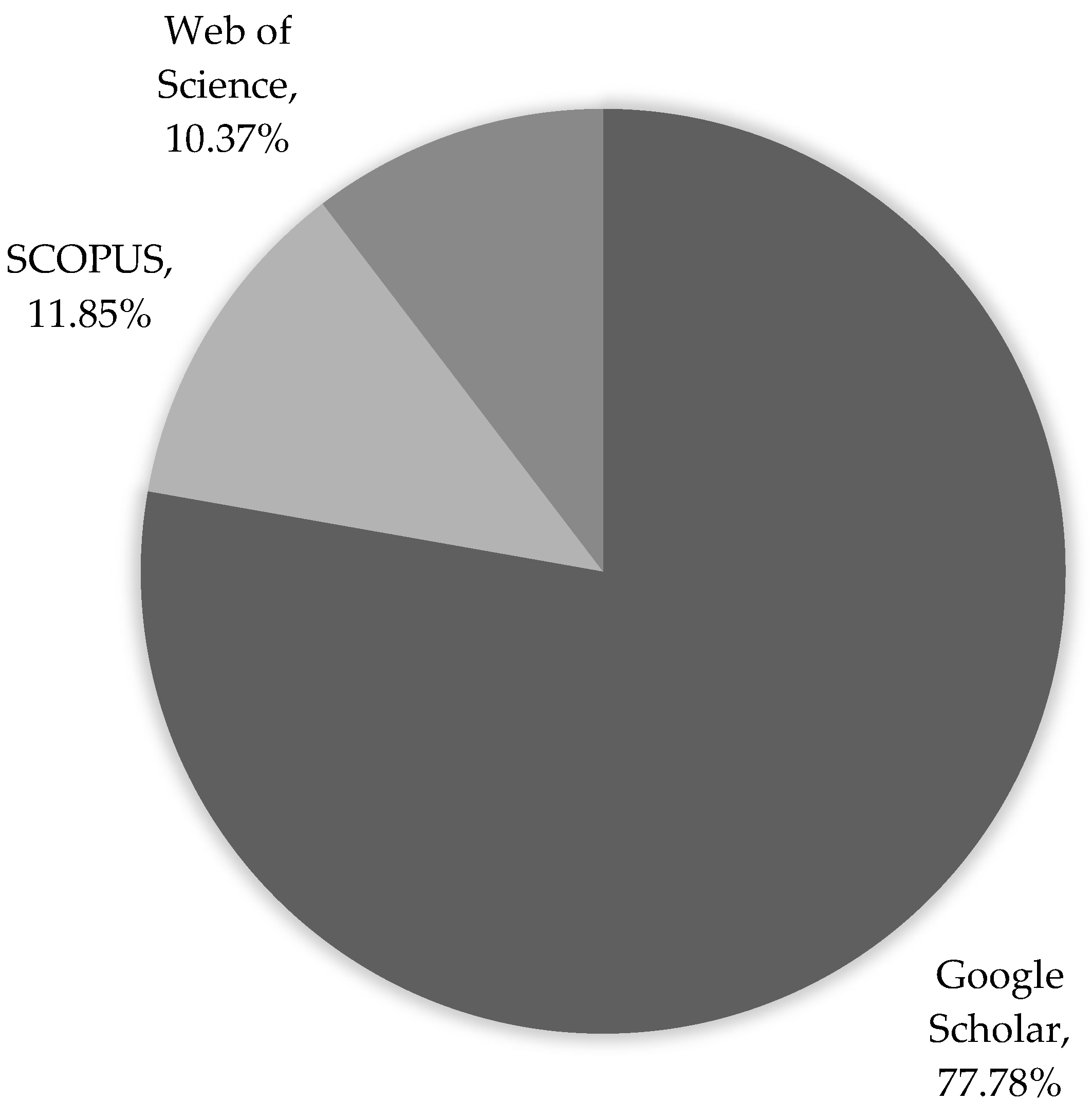

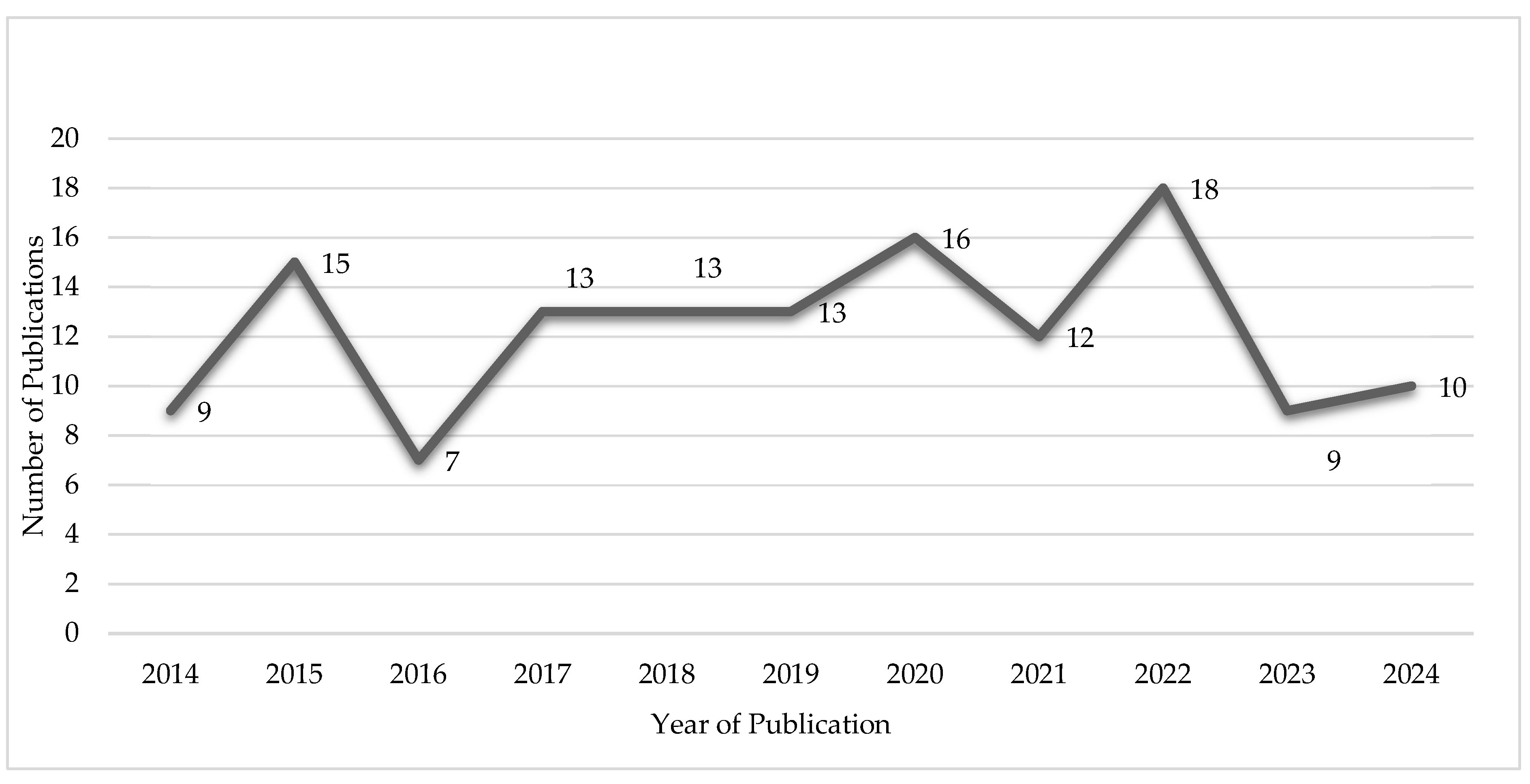

3.1. Study Selection

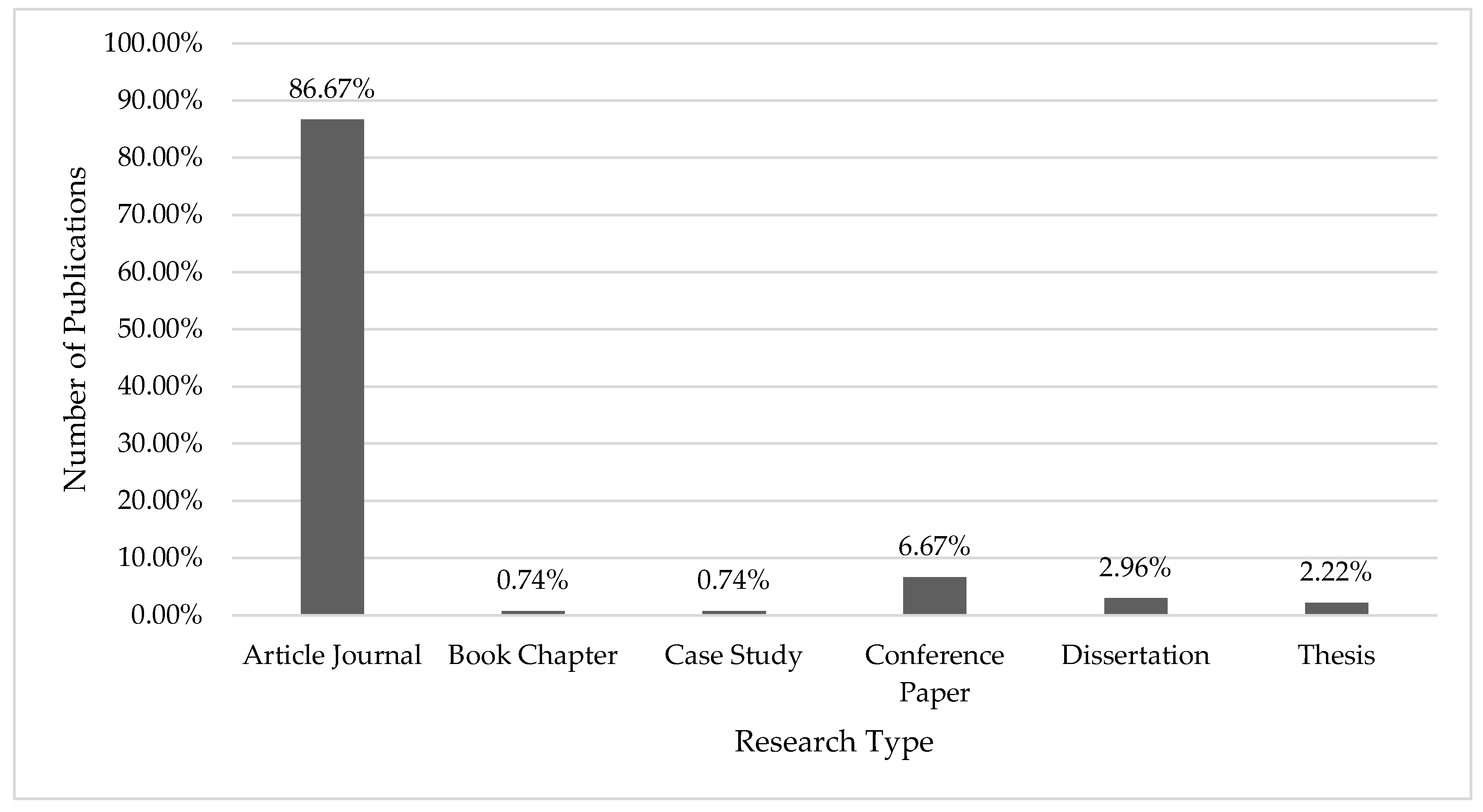

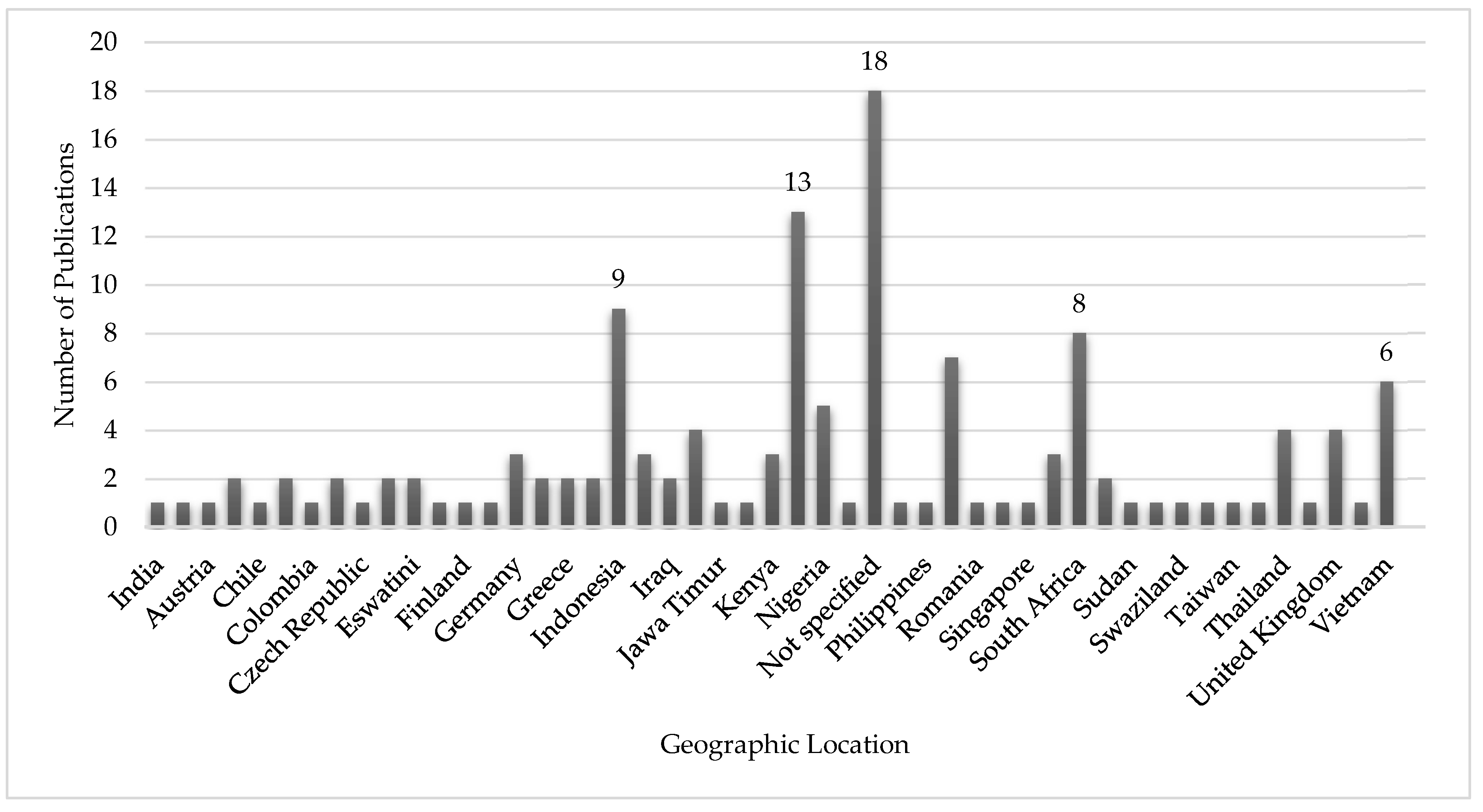

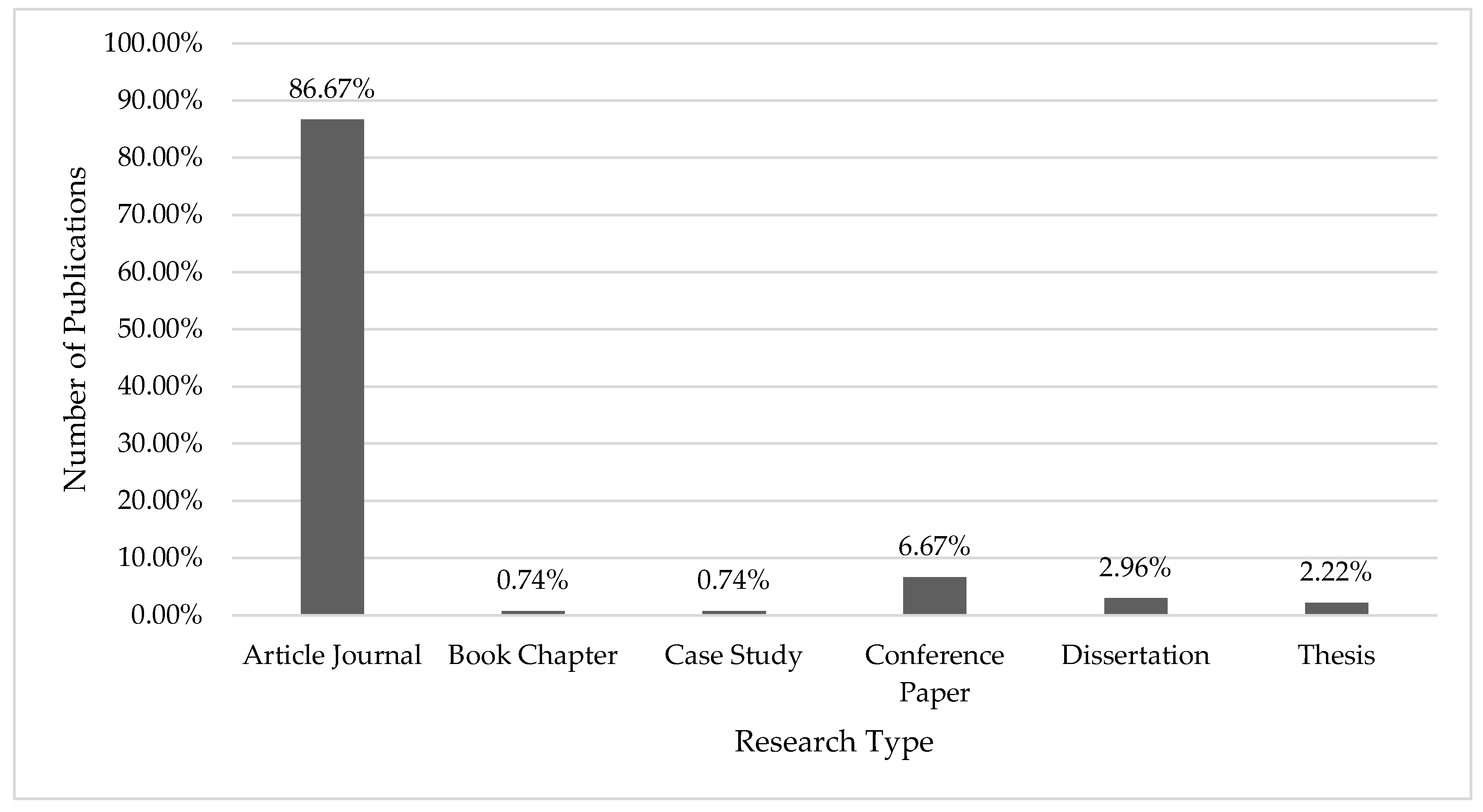

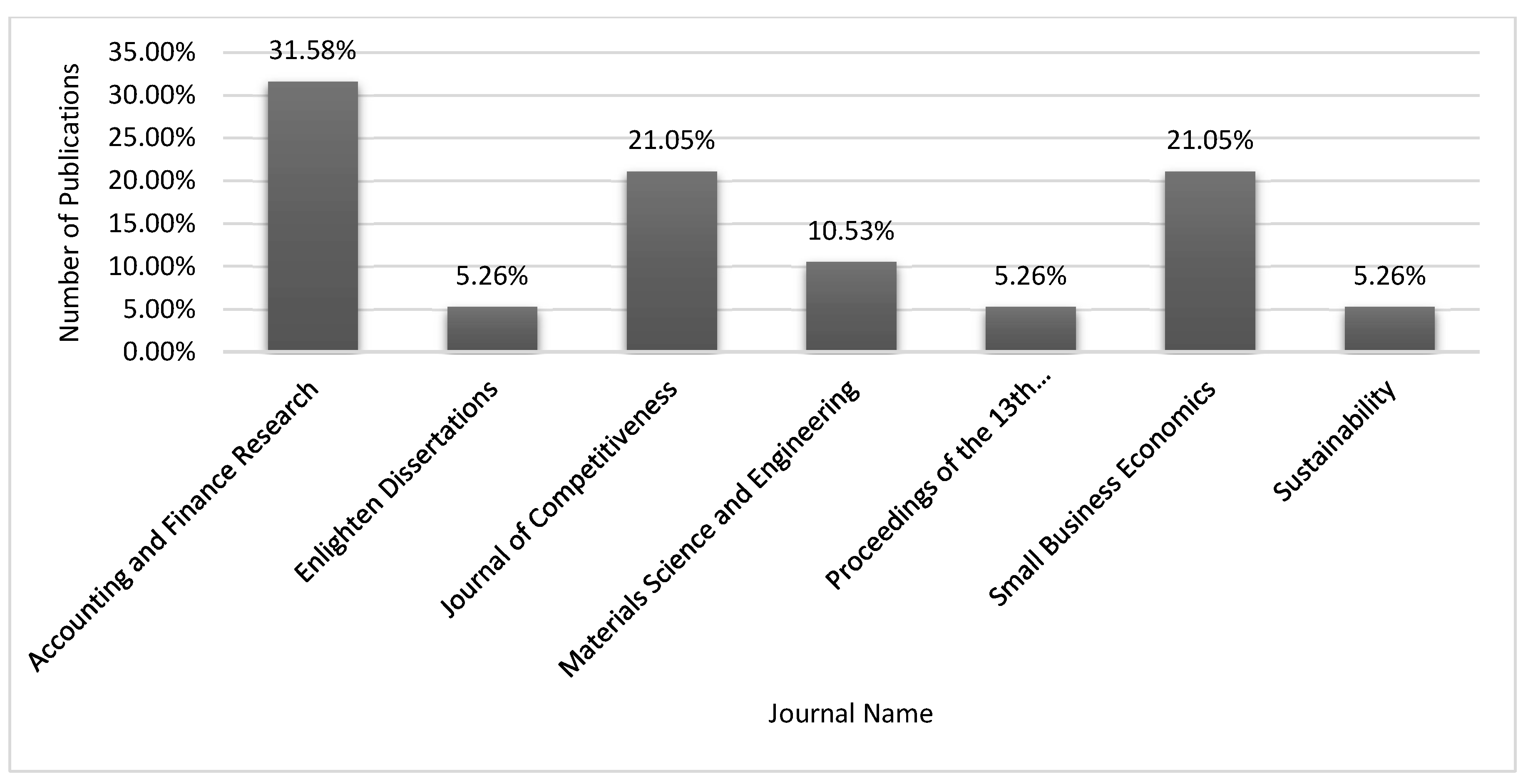

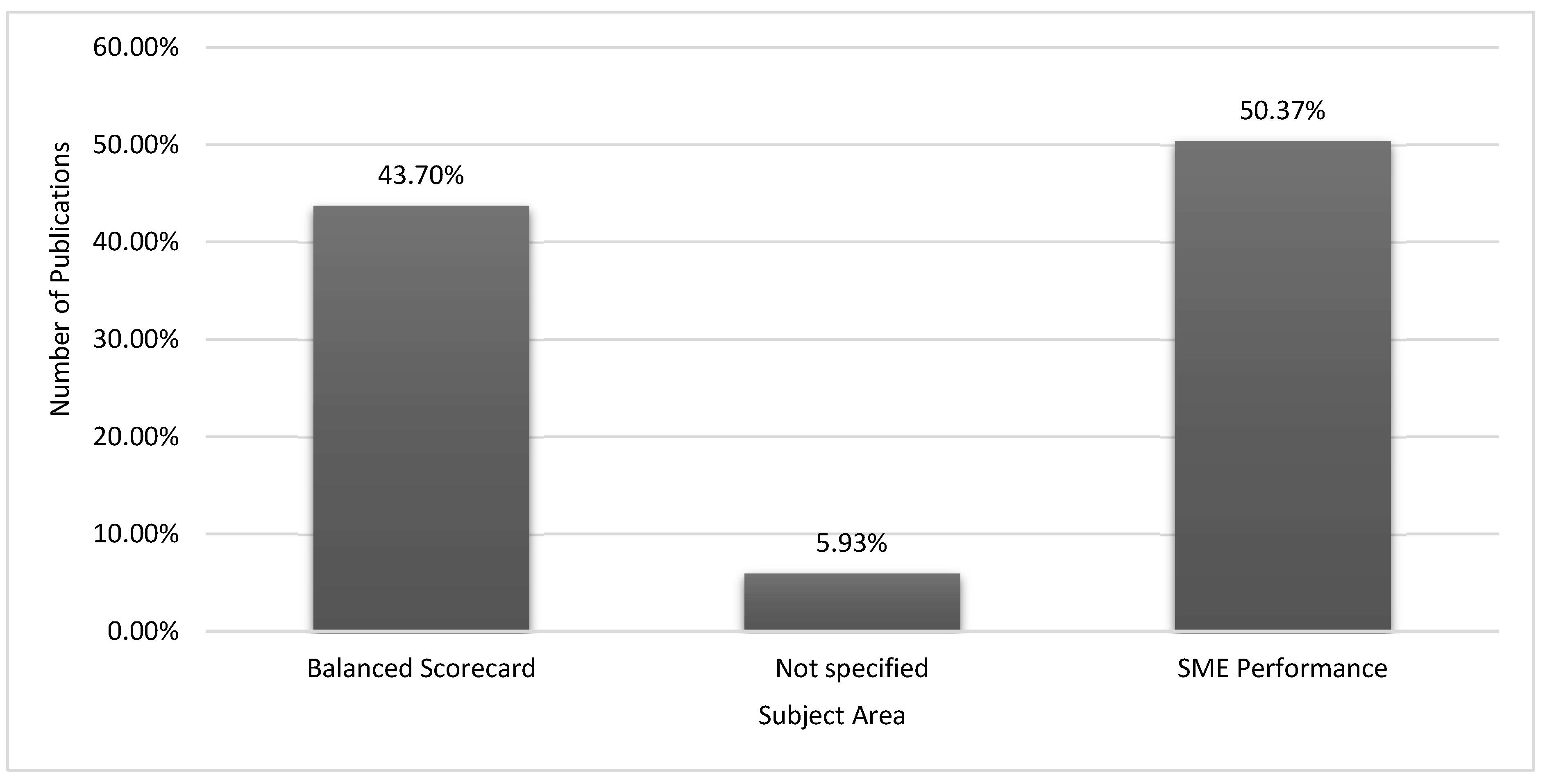

3.2. Study Characteristics

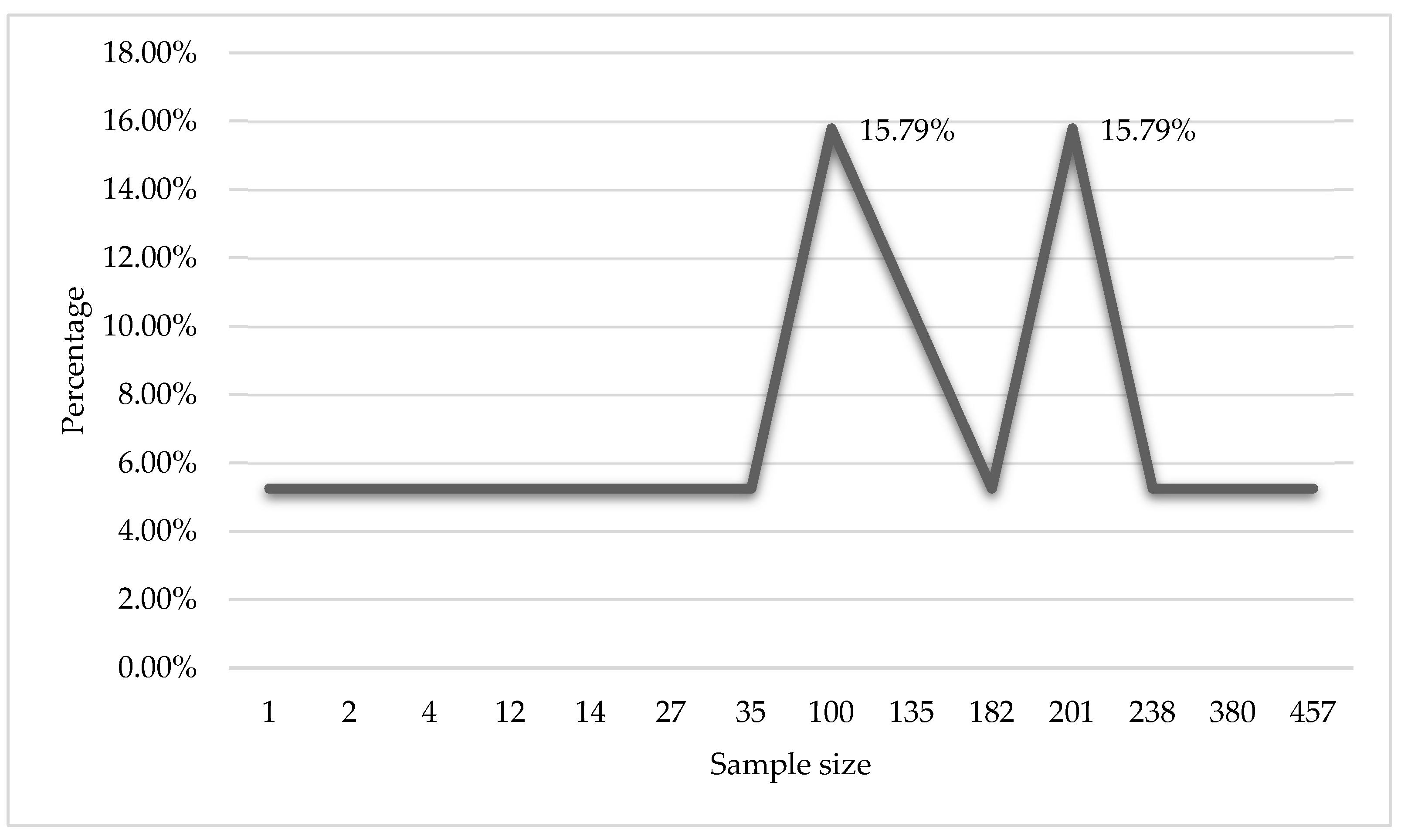

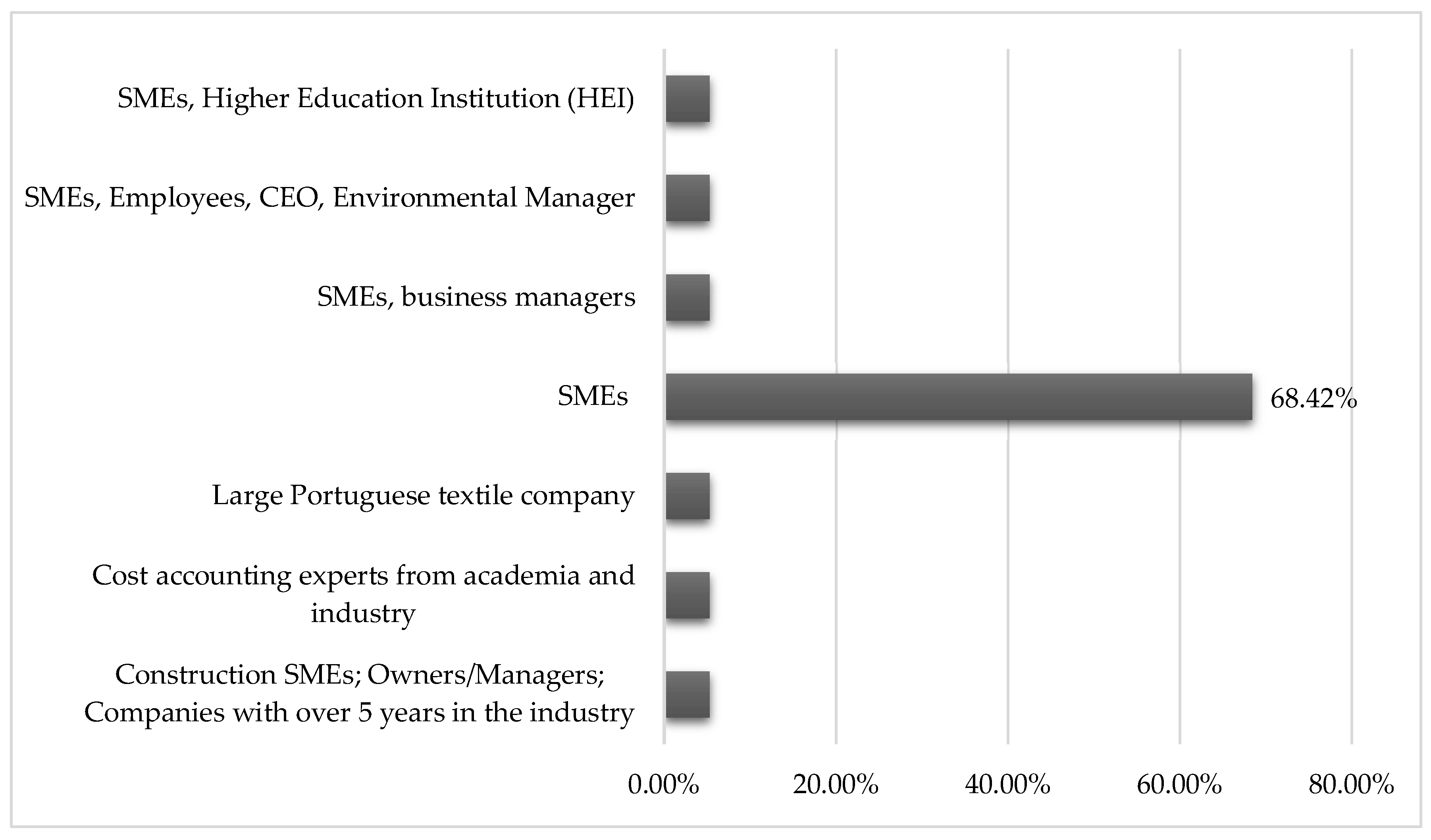

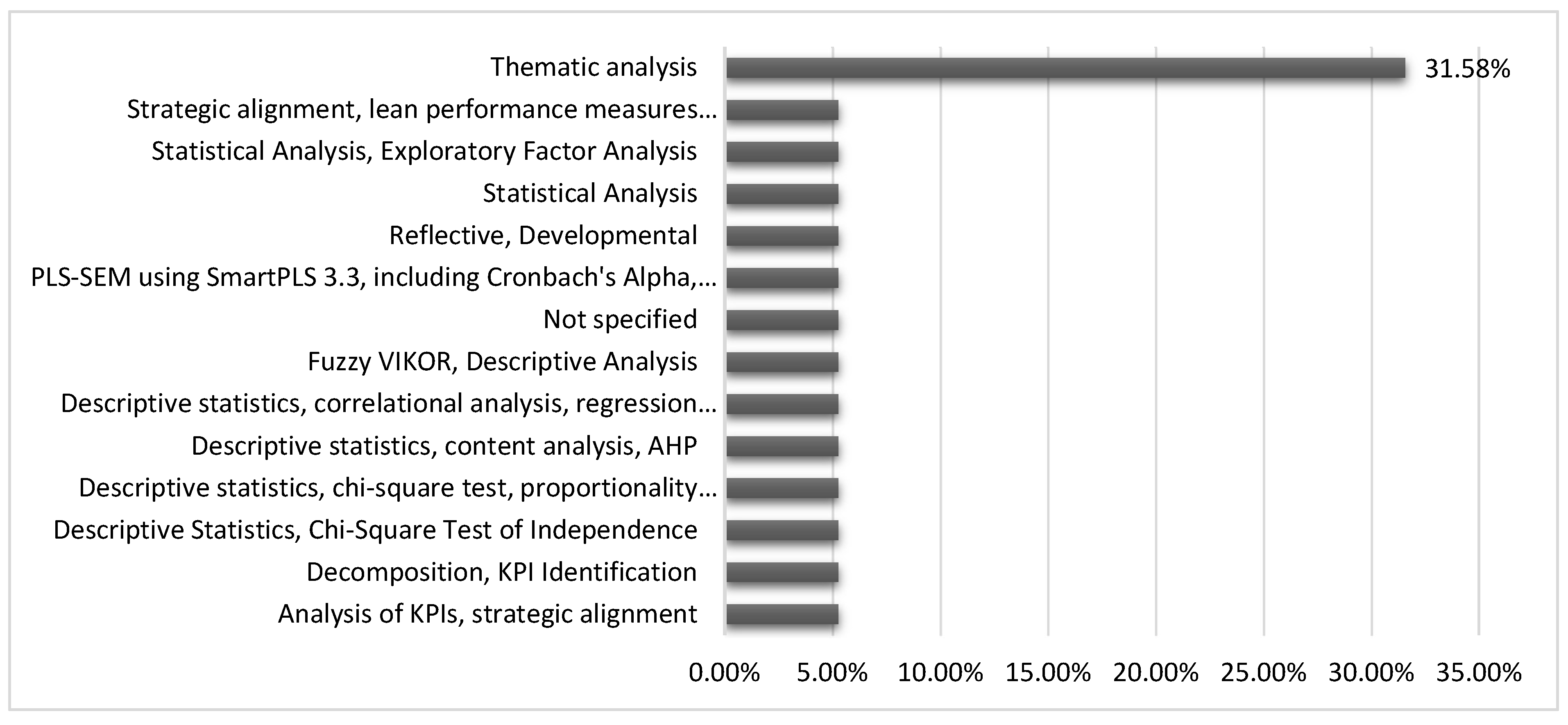

3.3. Risk of Bias in Studies

3.4. Results of Individual Studies

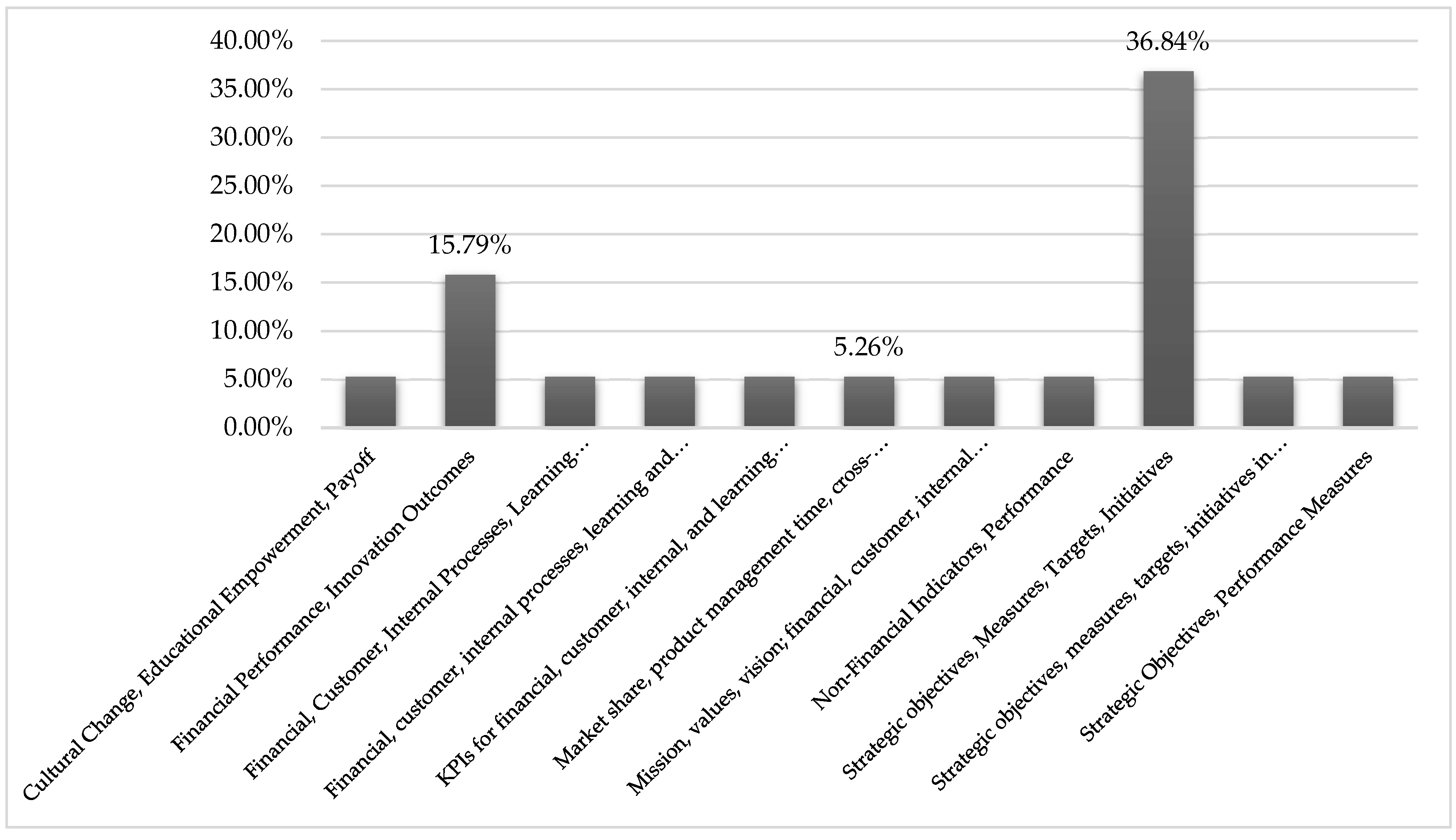

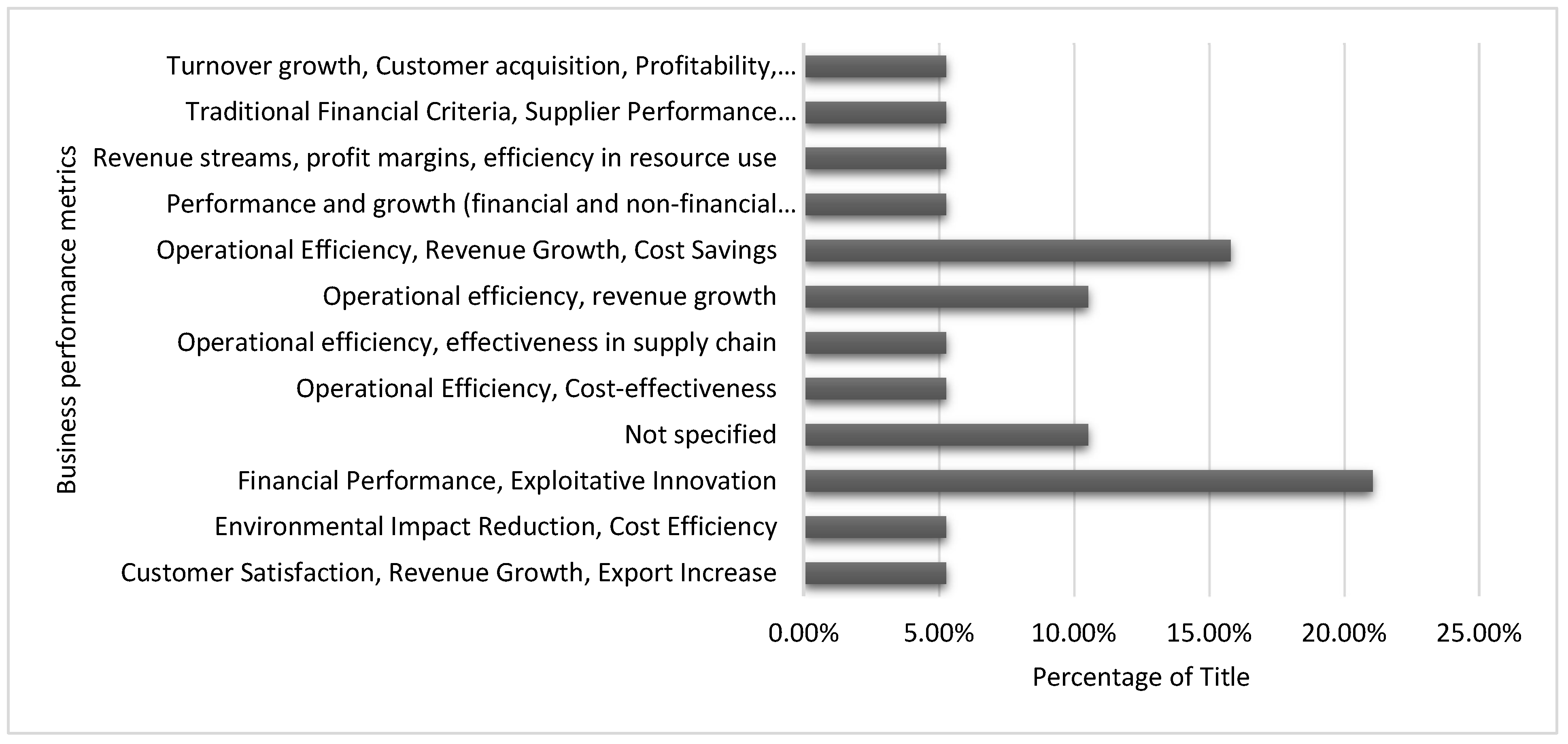

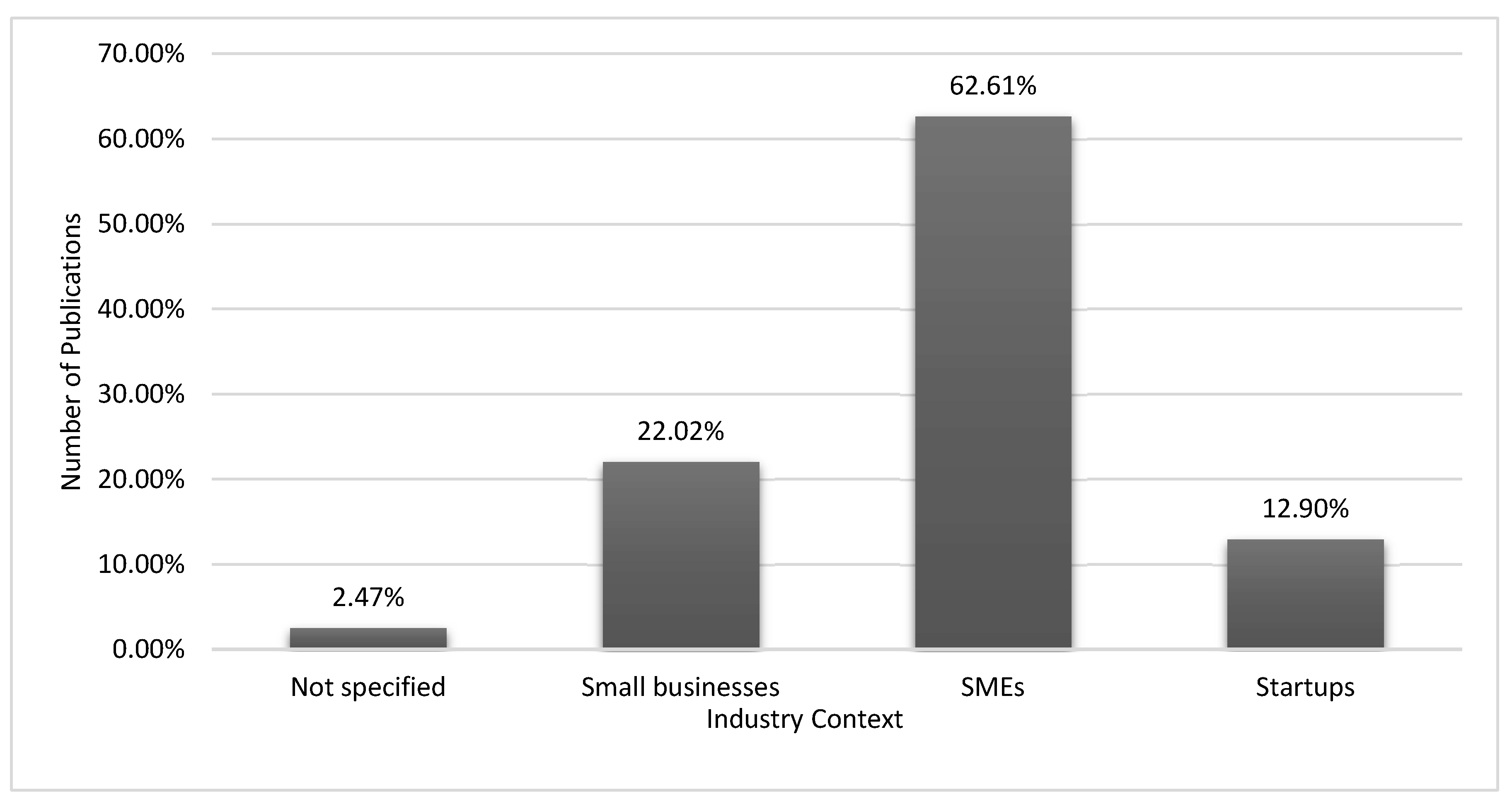

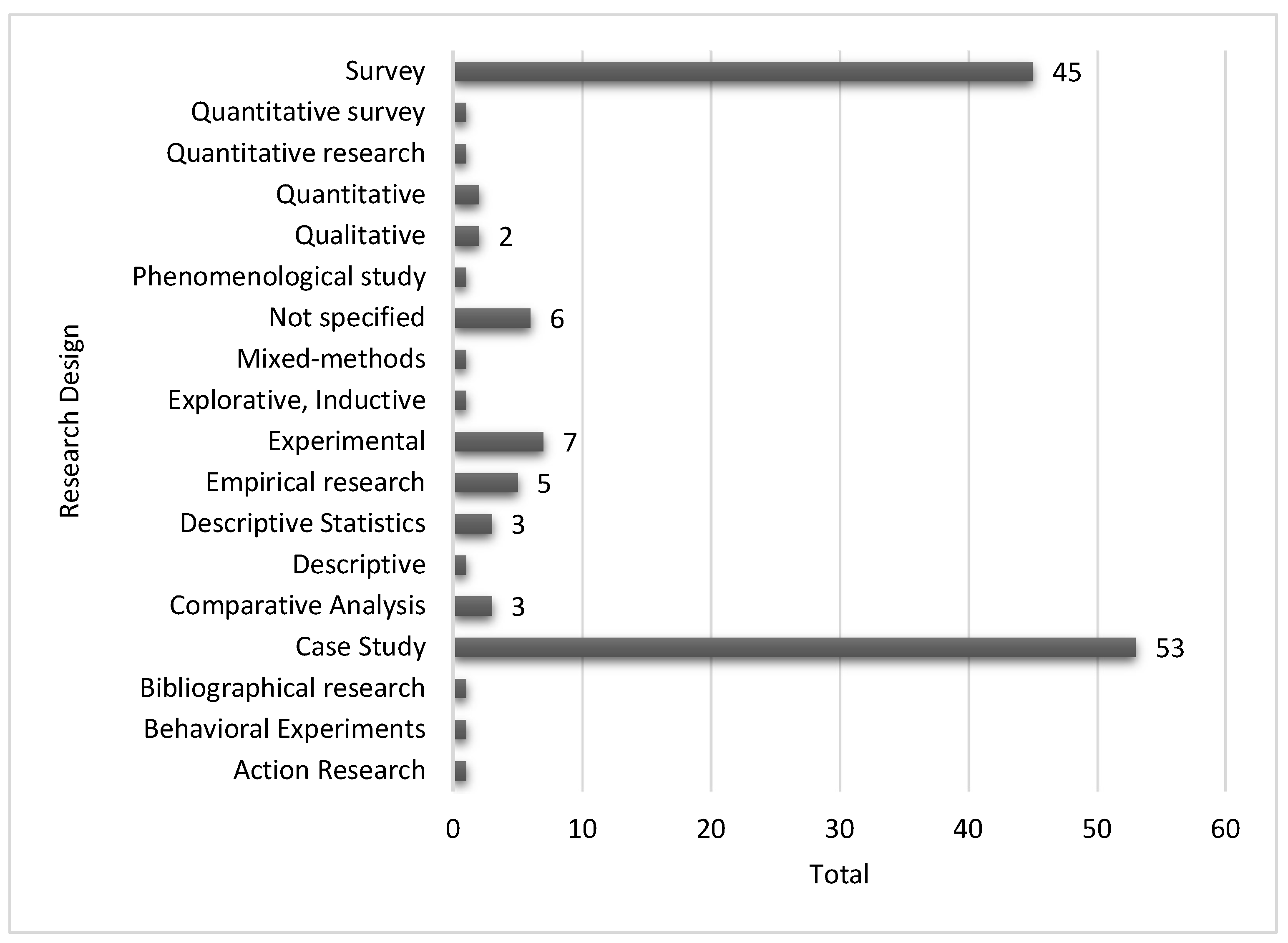

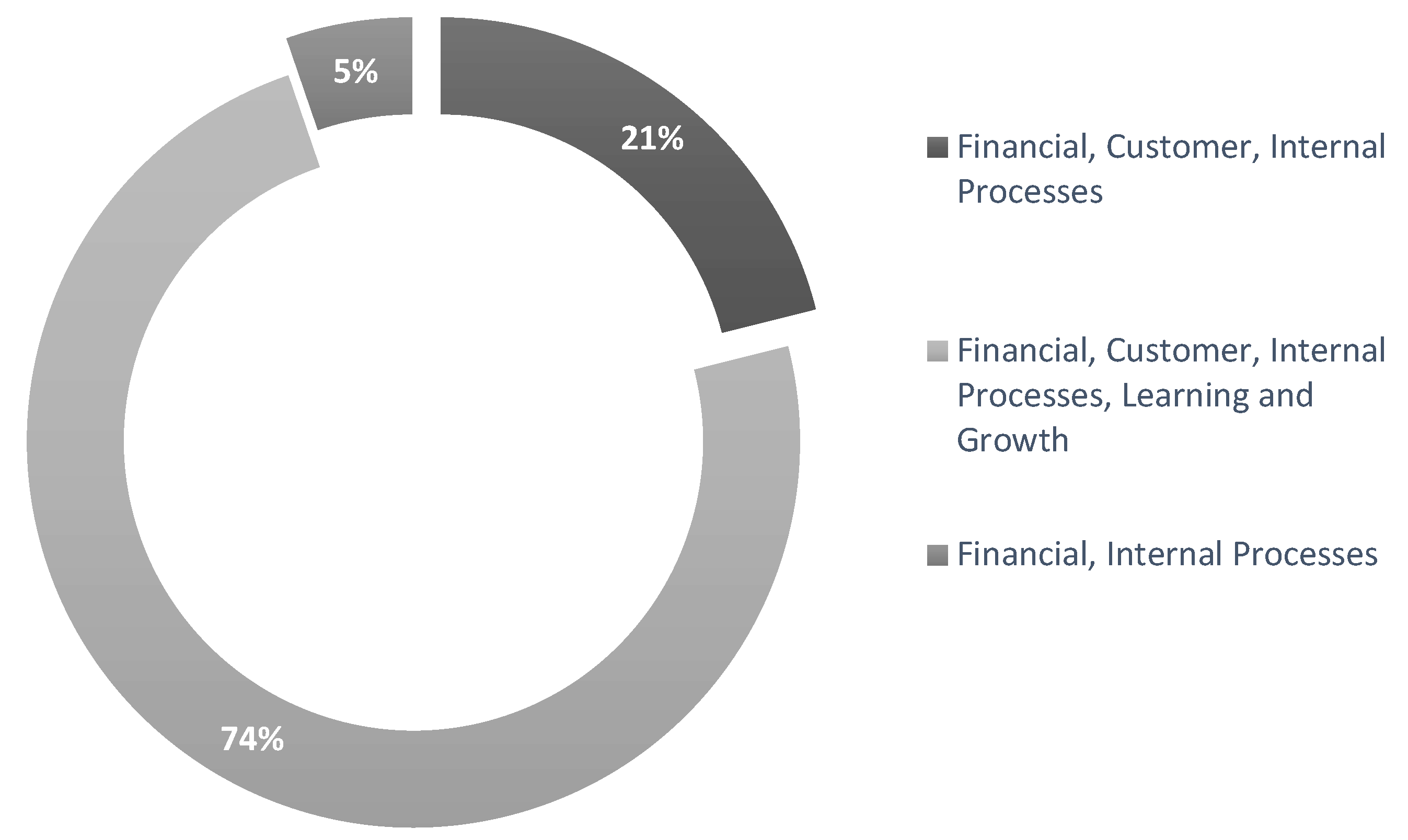

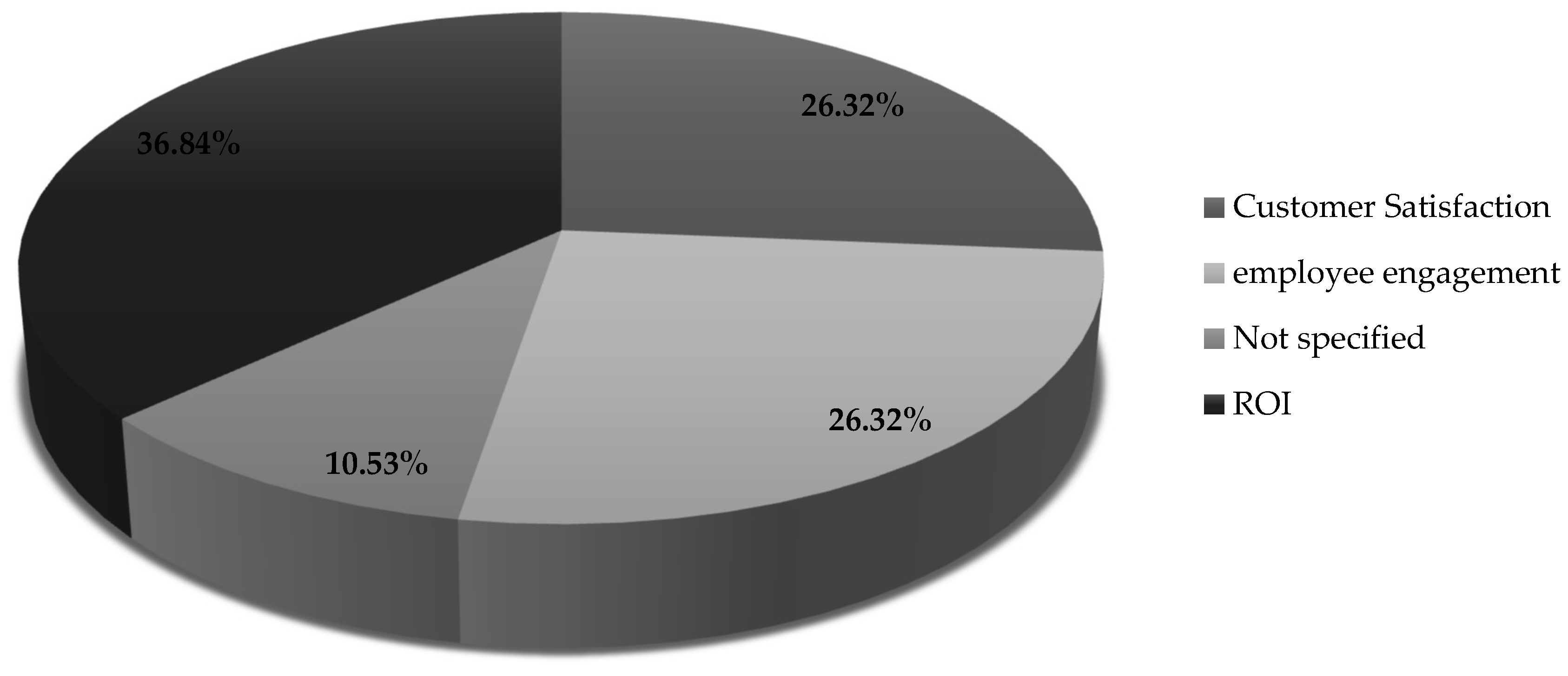

3.5. Results of Syntheses

3.6. Reporting Biases

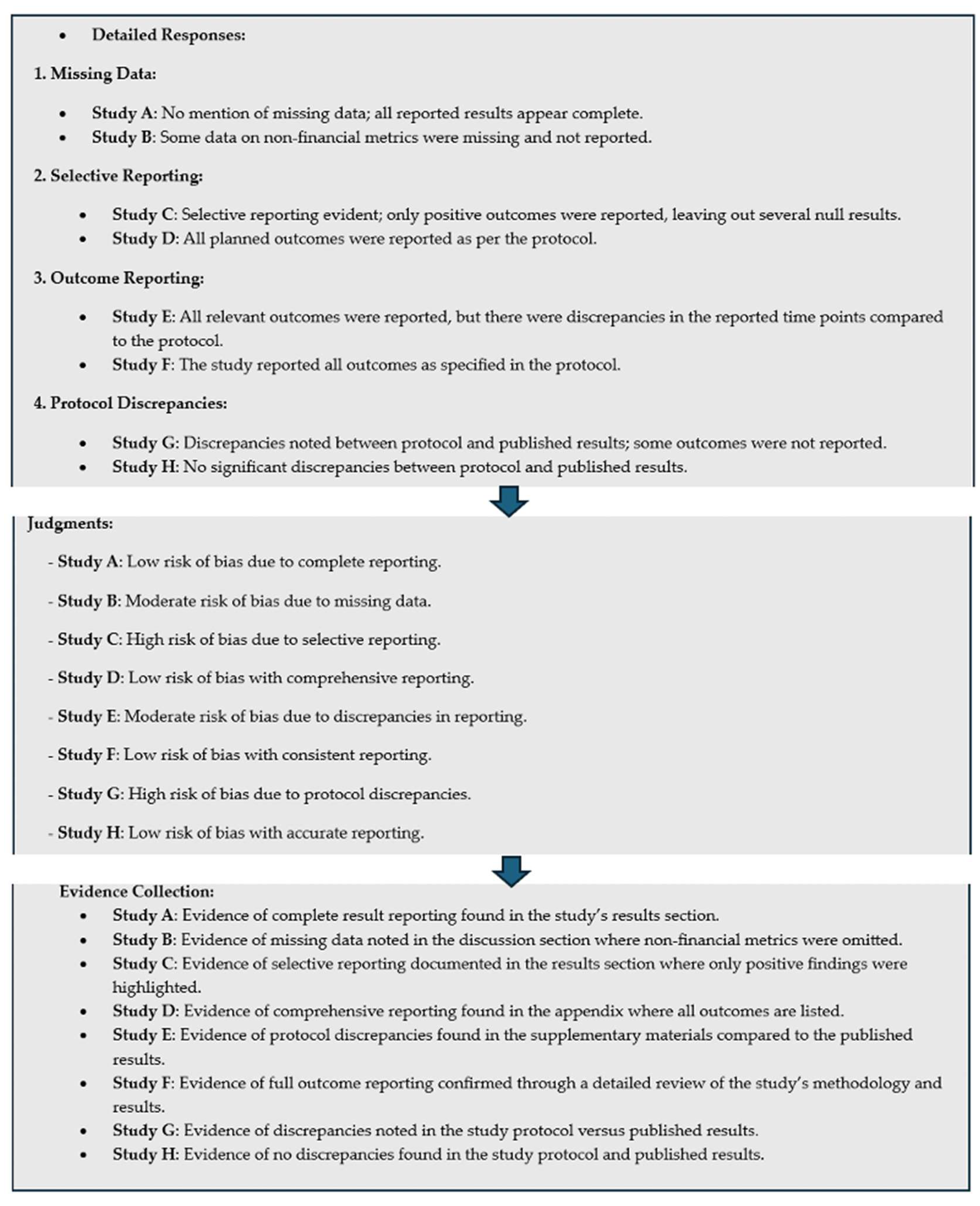

3.6.1. Assessment of Risk Bias

3.6.2. Tools Utilized

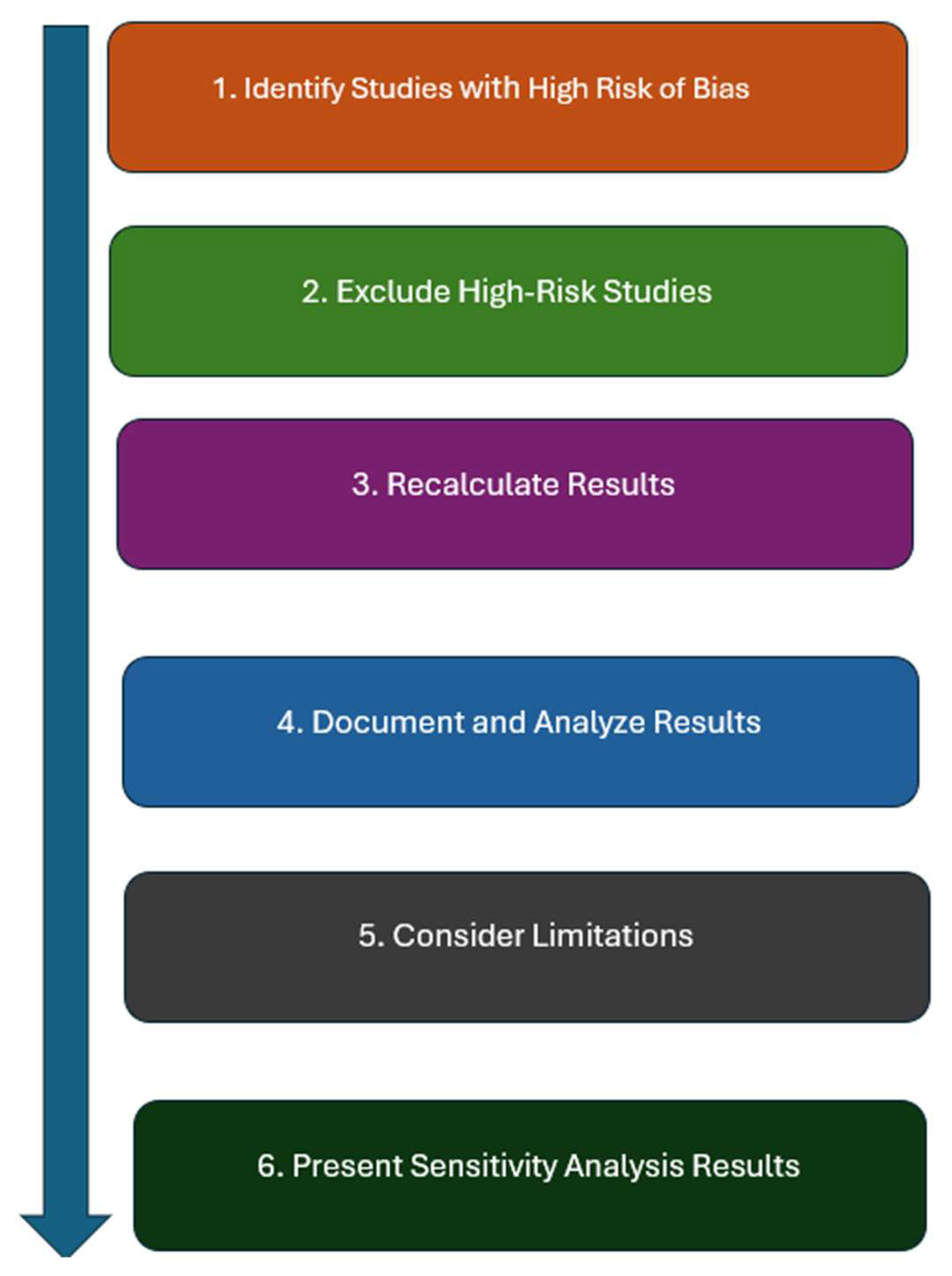

3.6.3. Sensitivity Analysis

3.7. Certainty of Evidence

3.7.1. The Summary of Evidence

4. Practical Recommendations

4.1. Key Findings and Strategic Implications for Business Leaders

4.2. Decision-Making Framework for Implementation

4.3. Proposed Best Practices for Successful Implementation

4.4. Metrics and KPIs for Measuring Performance

4.5. Real Case Studies from Various Industries

4.5 Proposed Roadmap for SMEs Businesses and Policy Recommendations

| Industry | Roadmap Focus | Policy Framework | Strategic Link | Strategic Drivers | Expected Outcome | Ties to Proposed Study | Timeline | Duration | Champion |

|---|---|---|---|---|---|---|---|---|---|

| Automotive | Implement digital transformation initiatives | Industry 4.0 Roadmap | Enhances automation and operational efficiency | Technological advancement, quality improvement | Increased productivity, reduced downtime | Linked to improving manufacturing KPIs in SMEs | Start in Q1 2025 | 18 months | Chief Technology Officer (CTO) |

| Healthcare | Integrate BSC with patient management systems | National Health Policy | Improves patient outcomes through systematic monitoring | Patient safety, healthcare quality | Enhanced patient care, better resource allocation | Relevant to improving healthcare service delivery KPIs | Start in Q2 2025 | 12 months | Chief Medical Officer (CMO) |

| Retail | Align supply chain management with sustainability goals | Sustainable Development Goals (SDG 12) | Encourages sustainable consumption and production | Environmental compliance, supply chain resilience | Reduced environmental footprint, increased customer satisfaction | Ties with optimizing supply chain management and customer satisfaction | Start in Q3 2025 | 24 months | Supply Chain Manager |

| Telecommunications | Enhance network infrastructure through BSC frameworks | National ICT Policy | Boosts connectivity and customer service | Innovation, service quality | Improved network reliability, increased market share | Supports tracking performance improvements in telecom services | Start in Q1 2026 | 15 months | Chief Operating Officer (COO) |

| Manufacturing | Adopt lean practices for quality improvement | Lean Manufacturing Policy | Aligns production processes with quality standards | Operational efficiency, cost reduction | Reduced production waste, enhanced product quality | Pertains to integrating lean principles within BSC for manufacturing | Start in Q4 2025 | 20 months | Production Manager |

5. Discussion

6. Conclusions

References

- R. Malagueño, E. Lopez-Valeiras, and J. Gomez-Conde, Balanced scorecard in SMEs: effects on innovation and financial performance. Small Bus. Econ. 2018, 51, 221–244. [Google Scholar] [CrossRef]

- SSRN. (n.d.). Balanced Scorecard in SMEs. Available at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3154266. (accessed on 12 September 2024).

- H. Afonso and M. do R. Cabrita, Developing a lean supply chain performance framework in a SME: A perspective based on the balanced scorecard. Procedia Eng. 2015, 131, 270–279. [Google Scholar] [CrossRef]

- UCDC. (n.d.). Knowledge Horizons - Economics. Available at: http://www.orizonturi.ucdc.ro/arhiva/KHE%20nr.%204%20-%202018/10.%20CASE%20STUDY%20-%20KPIS.pdf. (accessed on 12 September 2024).

- H. Zaheer, A. Ramzan, K. Mahmood, and M. N. Nagra, Implementation of balanced scorecard and financial performance of SMEs. JAMEB 2023, 8, 50–61. [Google Scholar]

- ResearchGate. (n.d.). Balanced Scorecard Usage for Hotel and Tourism Small and Medium Enterprises Growth in Eswatini: A Proposed Conceptual Framework. Available at: https://www.researchgate.net/publication/341131461_Balanced_scorecard_usage_for_hotel_and_tourism_small_and_medium_enterprises_growth_in_ESwatini_Former_Swaziland_A_Proposed_conceptual_framework. (accessed on 12 September 2024).

- IPB. (n.d.). Biblioteca Digital. Available at: https://bibliotecadigital.ipb.pt/handle/10198/21522. (accessed on 12 September 2024).

- Reynolds, H. Fourie, and L. Erasmus, A generic balanced scorecard for small and medium manufacturing enterprises in South Africa, South. Afr. J. Entrep. Small Bus. Manag. 2019, 11. [Google Scholar]

- S. Falle, R. Rauter, S. Engert, and R. Baumgartner, Sustainability management with the Sustainability Balanced Scorecard in SMEs: Findings from an Austrian case study. Sustainability 2016, 8, 545. [Google Scholar] [CrossRef]

- C. Oliveira, C. Leal, and A. Pinho, Existing differences between SMEs that apply BSC and those that do not. J. Inf. Organ. Sci. 2021, 45, 375–397. [Google Scholar]

- Social Space Journal. (n.d.). The Impacts of Management Competence on Small and Medium-Sized Enterprises Performance: From the Balanced Scorecard Perspective. Available at: https://socialspacejournal.eu/menu-script/index.php/ssj/article/view/166/73. (accessed on 12 September 2024).

- Dergipark. (n.d.). Tekderg. Available at: https://dergipark.org.tr/en/pub/tekderg/issue/60700/977849. (accessed on 12 September 2024).

- Cloudfront. (n.d.). Non-Financial Indicators and Their Importance. Available at: https://d1wqtxts1xzle7.cloudfront.net/78270105/284-libre.pdf?1641534648=&response-content-disposition=inline%3B+filename%3DNon_Financial_Indicators_and_Their_Impor.pdf&Expires=1724019074&Signature=SjnPpWgOVf4vWTGzTvw5YA0LZuMvl-3xMFJSeaCzzkp9rmoZQDyE~vTtCOvZgViA2m5RRx7QopJFjRb6IhL9pPXN3E5cR5G4Ex2ZVRGWiD6bxR4rmjunTYn7uHPjbpvj~iEwJ6DqtVcisxEmRkICw76udGVKlmP1RcbYNNYgYnem4ntyWT4zgsUmZpaQdXNItjW1Ya~gUiRkgicsDEEbHlUnCrlslMz5jBwyRdX8TIKIPaeSHFRIOdZgG3dy-BVR9Bzu0WcTrVxdG5gKeDyixn98~YhmswLpMI~DsO1SL988pwlvxqDTlN1mnYjNP1PuujO8l4yLXoNfH~M-d8~-EA__&Key-Pair-Id=APKAJLOHF5GGSLRBV4ZA. (accessed on 12 September 2024).

- E. Benková, P. Gallo, B. Balogová, and J. Nemec, Factors affecting the use of Balanced Scorecard in measuring company performance. Sustainability 2020, 12, 1178. [Google Scholar] [CrossRef]

- ResearchGate. (n.d.). Supporting Open Innovation with the Use of a Balanced Scorecard Approach: A Study on Deep Smarts and Effective Knowledge Transfer to SMEs. Available at: https://www.researchgate.net/publication/323150172_Supporting_Open_Innovation_with_the_use_of_a_Balanced_Scorecard_Approach_A_Study_on_Deep_Smarts_and_Effective_Knowledge_Transfer_to_SMEs_Supporting_Open_Innovation_with_the_use_of_a_Balanced_Scorecard. (accessed on 12 September 2024).

- B. W. Permadi, A. Y. Ridwan, and W. Juliani, SCOR-BSC integrated model for a small-medium enterprise clothing industry using MTS-based production strategy in Indonesia, IOP Conf. Ser. Mater. Sci. Eng. 2019, 598, 012079. [Google Scholar]

- P. Quesado, S. Marques, R. Silva, and A. Ribeiro, The Balanced Scorecard as a strategic management tool in the textile sector. Adm. Sci. 2022, 12, 38. [Google Scholar] [CrossRef]

- PublishPK. (n.d.). Article. Available at: https://www.publishpk.net/art/2015%202.pdf. (accessed on 12 September 2024).

- S. Singh, E. U. Olugu, S. N. Musa, and A. B. Mahat, Fuzzy-based sustainability evaluation method for manufacturing SMEs using balanced scorecard framework. J. Intell. Manuf. 2018, 29, 1–18. [Google Scholar] [CrossRef]

- ResearchGate. (n.d.). SMEs' Perspective on Venture Capital Investment Criteria: A Study of Croatian SMEs. Available at: https://www.researchgate.net/publication/324902645_SMEs_perspective_on_venture_capital_investment_criteria_-_A_study_of_Croatian_SMEs. (accessed on 12 September 2024).

- Dergipark. (n.d.). IRM. Available at: https://dergipark.org.tr/en/pub/irmm/issue/32094/355444. (accessed on 12 September 2024).

- P. Achenbach, Sustainability Balanced Scorecard as a cost accounting instrument for small and medium sized companies. SHS Web Conf. 2021, 115, 03002. [Google Scholar] [CrossRef]

- . ResearchGate. (n.d.). Assessing the Impact of Electronic Supply Chain Management on the Performance of Small and Medium Sized Enterprises using the Sustainable Balanced Scorecard Approach: Case Study of Online Stores and In. Available at: https://www.researchgate.net/profile/Arshia-Taimouri/publication/333419475_Assessing_the_Impact_of_Electronic_Supply_Chain_Management_on_the_Performance_of_Small_and_Medium_sized_Enterprises_using_the_Sustainable_Balanced_Scorecard_Approach_Case_Study_of_Online_Stores_and_In/links/5ceccc96458515026a613c18/Assessing-the-Impact-of-Electronic-Supply-Chain-Management-on-the-Performance-of-Small-and-Medium-sized-Enterprises-using-the-Sustainable-Balanced-Scorecard-Approach-Case-Study-of-Online-Stores-and-In.pdf. (accessed on 12 September 2024).

- ResearchGate. (n.d.). The Influence of Enterprise Risk Management on Firm Performance Measured by the Balanced Scorecard: Evidence from SMEs in Southern Thailand. Available at: https://www.researchgate.net/profile/Muttanachai-Suttipun/publication/335899816_The_Influence_of_Enterprise_Risk_Management_on_Firm_Performance_Measured_by_the_Balanced_Scorecard_Evidence_from_SMEs_in_Southern_Thailand/links/62e0f78f7782323cf17ec8c6/The-Influence-of-Enterprise-Risk-Management-on-Firm-Performance-Measured-by-the-Balanced-Scorecard-Evidence-from-SMEs-in-Southern-Thailand.pdf. (accessed on 12 September 2024).

- ResearchGate. (n.d.). The Influence of Sufficiency Economy Philosophy Practice on SMEs' Performance in Thailand. Available at: https://www.researchgate.net/publication/343284749_The_Influence_of_Sufficiency_Economy_Philosophy_Practice_on_SMEs%27_Performance_in_Thailand. (accessed on 12 September 2024).

- IEMSJL. (n.d.). Article. Available at: http://www.iemsjl.org/j. (accessed on 12 September 2024).

- ResearchGate. (n.d.). The Application of a Balanced Scorecard in SME: A Case Study of Milanzo Kids. Available at: https://www.researchgate.net/publication/358593020_THE_APPLICATION_OF_A_BALANCED_SCORECARD_IN_SME_A_CASE_STUDY_OF_MILANZO_KIDS. (accessed on 12 September 2024).

- Cruscottodicontrollo.it. (n.d.). The Balanced Scorecard in Large Firms. Available at: https://www.cruscottodicontrollo.it/wp-content/uploads/2020/04/The_Balanced_Scorecard_in_Large_Firms_an.pdf. (accessed on 12 September 2024).

- F. Owolabi, Balanced score card and performance evaluation in Small and Medium Enterprises (SMEs) in Nigeria, Core.ac.uk. Available at: https://core.ac.uk/download/pdf/95550704.pdf. (accessed on 12 September 2024).

- G. K. Muli, Extent of Balanced Scorecard Implementation and its Effect on the Financial Performance of Small and Medium Enterprises in Nairobi County, 2016.

- ResearchGate. (n.d.). Leveraging the Balanced Scorecard - A Tool for SME Advancement. Available at: https://www.researchgate.net/publication/351639712_Leveraging_the_balanced_scorecard_-_a_tool_for_SME_advancement. (accessed on 12 September 2024).

- ResearchGate. (n.d.). Internationalization and Innovation on Balanced Scorecard (BSC) Among Malaysian Small and Medium Enterprises (SMEs). Available at: https://www.researchgate.net/publication/333509677_Internationalisation_and_innovation_on_balanced_scorecard_BSC_among_Malaysian_small_and_medium_enterprises_SMEs. (accessed on 12 September 2024).

- Z. Dudic, B. Dudic, M. Gregus, D. Novackova, and I. Djakovic, The Innovativeness and Usage of the Balanced Scorecard Model in SMEs. Sustainability 2020, 12, 3221. [Google Scholar] [CrossRef]

- Mohammed, S. Sulaiman, N. Md Zin, and N. Abdul Rahman, Exploring the Agile-Adaptive Balanced Scorecard Benefits Towards Improving the Management Accounting System: A Case Study of Iraqi SMEs. Social & Management Research Journal 2022, 19, 139–168. [Google Scholar]

- ResearchGate. (n.d.). Effect of Innovation, Knowledge Sharing, and Trust Culture on Hotels' SMEs Growth in Eswatini. Available at: https://www.researchgate.net/publication/354186670_Effect_of_Innovation_Knowledge_Sharing_and_Trust_Culture_on_Hotels%27_SMEs_Growth_in_Eswatini. (accessed on 12 September 2024).

- Assumptionjournal.au.edu. (n.d.). The Balanced Scorecard as a Performance Management Tool for Small and Medium Scale Enterprises in Nigeria. Available at: http://www.assumptionjournal.au.edu/index.php/eJIR/article/view/4074/2400. (accessed on 12 September 2024).

- C. Suárez-Gargallo and P. Zaragoza-Sáez, How the Balanced Scorecard is Implemented in the Spanish Footwear Industry. Sustainability 2021, 13, 5641. [Google Scholar] [CrossRef]

- Psarras, T. Anagnostopoulos, N. Tsotsolas, I. Salmon, and L. Vryzidis, Applying the Balanced Scorecard and Predictive Analytics in the Administration of a European Funding Program. Adm. Sci. 2020, 10, 102. [Google Scholar] [CrossRef]

- F. Ahmad, N. Abdul Hamid, A. Nur Aizat Ahmad, M. N. Mohd Nawi, N. A. Abdul Rahman, and N. A. Abdul Hamid, The Impact of TQM on Business Performances Based on Balanced Scorecard Approach in Malaysia SMEs. Int. J. Qual. Res. 2022, 16, 231–242. [Google Scholar] [CrossRef]

- C. Malesios, P. K. Dey, and F. B. Abdelaziz, Supply Chain Sustainability Performance Measurement of Small and Medium Sized Enterprises Using Structural Equation Modeling. Ann. Oper. Res. 2020, 294, 623–653. [Google Scholar] [CrossRef]

- ResearchGate. (n.d.). Balanced Scorecard Practices of Medium and Large Enterprises in the Province of Pampanga. Available at: https://www.researchgate.net/profile/Ma-Cristina-Naguit/publication/321081765_Balanced_Scorecard_practices_of_medium_and_large_enterprises_in_the_Province_of_Pampanga/links/5a0c58be4585153829b1441b/Balanced-Scorecard-practices-of-medium-and-large-enterprises-in-the-Province-of-Pampanga.pdf. (accessed on 12 September 2024).

- ResearchGate. (n.d.). Explaining the Impact of a Customer-Oriented Strategy on SMEs' Global Performance: Lessons from the Balanced Scorecard and the CUSTOR Scale Model. Available at: https://www.researchgate.net/publication/322466991_Explaining_the_impact_of_a_customer-oriented_strategy_on_the_small_and_medium-sized_enterprises%27_SMEs_global_performance_Lessons_from_the_Balanced_Scorecard_and_the_CUSTOR_scale_model. (accessed on 12 September 2024).

- ResearchGate. (n.d.). Advantages and Contributions in the Balanced Scorecard Implementation. Available at: https://www.researchgate.net/publication/323323907_Advantages_and_contributions_in_the_balanced_scorecard_implementation. (accessed on 12 September 2024).

- W. Sewell, R. B. Mason, and P. Venter, Socio-Economic Developmental Strategies as Retail Performance Indicators: A Balanced Scorecard Approach. Dev. South. Afr. 2017, 34, 365–382. [Google Scholar] [CrossRef]

- Bing. (n.d.). Effect of Entrepreneurial Orientation on Performance of SMEs in Ethiopia: The Mediation Role of Innovation. Available at: https://www.bing.com/search?pglt=41&q=Effect+of+Entrepreneurial+Orientation+on+Performance+of+SMEs+in+Ethiopia%3A+The+Mediation+role+of+Innovation+Gada+Gizachew+Wakjira1+%2C+Kenenisa+Lemi+Debela2*%2C+Shashi+Kant3&cvid=ba3bc35b92514fcab34ef02a89103fc1&gs_lcrp=EgZjaHJvbWUyBggAEEUYOdIBBzg0OWowajGoAgCwAgA&FORM=ANNTA1&PC=U531. (accessed on 12 September 2024).

- ResearchGate. (n.d.). Effect of Innovation, Knowledge Sharing, and Trust Culture on Hotels' SMEs Growth in Eswatini. Available at: https://www.researchgate.net/publication/354186670_Effect_of_Innovation_Knowledge_Sharing_and_Trust_Culture_on_Hotels'_SMEs_Growth_in_Eswatini. (accessed on 12 September 2024).

- Eamr-accid.eu. (n.d.). Volume 5, Issue 2. Available at: https://eamr-accid.eu/wp-content/uploads/Volume-5-Issue-2.pdf. (accessed on 12 September 2024).

- ResearchGate. (n.d.). Identification of Performance Measures for Textile Supply Chain: Case of Small Medium Size Enterprise. Available at: https://www.researchgate.net/profile/Pranav-Charkha/publication/288841428_Identification_of_performance_measures_for_textile_supply_chain_Case_of_small_medium_size_enterprise/links/5a34b842aca27247eddce429/Identification-of-performance-measures-for-textile-supply-chain-Case-of-small-medium-size-enterprise.pdf. (accessed on 12 September 2024).

- ResearchGate. (n.d.). Employee Retention Practices and the Performance of Small and Medium Enterprises in Nigeria. Available at: https://www.researchgate.net/publication/363317689_Employee_Retention_Practices_and_the_Performance_of_Small_and_Medium_Enterprises_in_Nigeria. (accessed on 12 September 2024).

- ResearchGate. (n.d.). Applicability of Performance Prism in SMEs: A Multiple Case Study. Available at: https://www.researchgate.net/publication/338773870_Applicability_of_Performance_Prism_in_SMEs_a_multiple_case_study. (accessed on 12 September 2024).

- ResearchGate. (n.d.). The Effect of Cloud Accounting Adoption on Organizational Performance in SMEs. Available at: https://www.researchgate.net/publication/364111154_The_effect_cloud_accounting_adoption_on_organizational_performance_in_SMEs. (accessed on 12 September 2024).

- Edu.pe. (n.d.). Inicio. Available at: https://ilagop.edu.pe/. (accessed on 12 September 2024).

- ResearchGate. (n.d.). A Taxonomy of Knowledge Management Outcomes for SMEs. Available at: https://www.researchgate.net/publication/286597565_A_taxonomy_of_knowledge_management_outcomes_for_SMEs. (accessed on 12 September 2024).

- L. Zhang, A Comparative Study of Modern Management Accounting Practices and SMEs Performance in Malaysia and China: The Moderating Role of Power Distance.

- M. Hidayat, C. I. Musa, S. Haerani, and I. Sudirman, The Design of Curriculum Development Based on Entrepreneurship Through Balanced Scorecard Approach. Int. Educ. Study. 2015, 8, 123. [Google Scholar] [CrossRef]

- ResearchGate. (n.d.). Identification and Determination of the Priority of Key Performance Indicators: Perspective of Customers on Cocoa Processing Industry of SMEs Scale in South Sulawesi. Available at: https://www.researchgate.net/publication/326300619_IDENTIFICATION_AND_DETERMINATION_OF_THE_PRIORITY_OF_KEY_PERFORMANCE_INDICATORS_PERSPECTIVE_OF_CUSTOMERS_ON_COCOA_PROCESSING_INDUSTRY_OF_SMEs_SCALE_IN_SOUTH_SULAWESI. (accessed on 12 September 2024).

- Academia.edu. (n.d.). Ranking of Performance Measurement Systems for Smaller Businesses. Available at: https://www.academia.edu/80974837/Ranking_of_Performance_Measurement_Systems_for_Smaller_Businesses. (accessed on 12 September 2024).

- ResearchGate. (n.d.). Revitalizing Small Business Growth Strategies: Exploring the Risk-Benefit of Strategic Management Approaches. Available at: https://www.researchgate.net/publication/281234873_Revitalising_Small_Business_Growth_Strategies_Exploring_the_Risk-Benefit_of_Strategic_Management_Approaches. (accessed on 12 September 2024).

- European Accounting and Management Review.

- Giannoukou and C., C. Beneki, Towards Sustainability Performance Management System of Tourism Enterprises: A Tourism Sustainable Balanced Scorecard Framework. Int. J. Glob. Environ. Issu. 2018, 17, 175. [Google Scholar] [CrossRef]

- Academia.edu. (n.d.). A Green Corridor Balanced Scorecard. Available at: https://www.academia.edu/55344725/A_Green_Corridor_Balanced_Scorecard. (accessed on 12 September 2024).

- Emerald.com. (n.d.). International Journal of Productivity and Performance Management. Available at: https://www.emerald.com/insight/publication/issn/1741-0401. (accessed on 12 September 2024).

- ResearchGate. (n.d.). Effect of Opportunity Recognition and Organization Capability on SME Performance in Indonesia: Moderated by Business Model Innovation. Available at: https://www.researchgate.net/publication/365743414_Effect_of_Opportunity_Recognition_and_Organisation_Capability_on_SME_Performance_in_Indonesia_Moderated_by_Business_Model_Innovation. (accessed on 12 September 2024).

- Bing. (n.d.). Implementation of the Balanced Scorecard in Large Firms: A Systematic Review by Zhijun Liu. Available at: https://www.bing.com/search?pglt=41&q=Implementation+of+the+Balanced+Scorecard+in+Large+Firms%3A+A+Systematic+Review+Zhijun+Liu1*&cvid=a797a40e10ce4a90a04bca21a02028bb&gs_lcrp=EgZjaHJvbWUyBggAEEUYOdIBBzc4OGowajGoAgCwAgA&FORM=ANNTA1&PC=U531. (accessed on 12 September 2024).

- N. Sahraen, Risk Mitigation Using Integration of Enterprise Risk Management and Balanced Scorecard Model: A Case Study in a Consulting Services Company in Indonesia. SPEKTRUM IND. 2021, 19, 73. [Google Scholar] [CrossRef]

- Taylor & Francis. Performance management of supply chain sustainability in small and medium-sized enterprises using a combined structural equation modelling and data envelopment analysis. [Online]. Available: https://www.taylorfrancis.com/chapters/edit/10.4324/9781003018551-6/performance-management-supply-chain-sustainability-small-medium-sized-enterprises-using-combined-structural-equation-modelling-data-envelopment-analysis-prasanta-kumar-dey-guo-liang-yang-chrisovaladis-malesios-debashree-de-konstantinos-evangelinos. (accessed on 18 September 2024).

- P. K. Dey, G.-L. Yang, C. Malesios, D. De, and K. Evangelinos, Performance management of supply chain sustainability in small and medium-sized enterprises using a combined structural equation modelling and data envelopment analysis. Computational Economics 2021, 58, 573–613. [Google Scholar] [CrossRef]

- ResearchGate. Supply Chain Sustainability Performance Measurement of Small and Medium-Sized Enterprises using Structural Equation Modeling. [Online]. Available: https://www.researchgate.net/publication/328253969_Supply_Chain_Sustainability_Performance_Measurement_of_Small_and_Medium_Sized_Enterprises_using_Structural_Equation_Modeling. (accessed on 18 September 2024).

- C. Malesios, P. K. Dey, and F. B. Abdelaziz, Supply chain sustainability performance measurement of small and medium-sized enterprises using structural equation modeling. Annals of Operations Research 2020, 294, 623–653. [Google Scholar] [CrossRef]

- Balanced Scorecard, The Strategy Story - Simplifying Business Strategies, Feb. 6, 2024. [Online]. Available: (accessed on 18 September 2024).

- S. Bakhtiari, R. Breunig, L. Magnani, and J. Zhang, Financial constraints and small and medium enterprises: A review. Econ. Rec. 2020, 96, 506–523. [Google Scholar] [CrossRef]

- Cput.ac.za. [Online]. Available: https://etd.cput.ac.za/bitstream/20.500.11838/3230/1/Masixole_Solani_205047297.pdf. (accessed on 28 September 2024).

- Researchgate.net. [Online]. Available: https://www.researchgate.net/publication/331548047_IMPACT_OF_INNOVATION_PRACTICES_ON_SUSTAINABLE_PERFORMANCE_SMEs. (accessed on 28 September 2024).

- Z. Zhang, H. Zhu, Z. Zhou, and K. Zou, How does innovation matter for sustainable performance? Evidence from small and medium-sized enterprises. J. Bus. Res. 2022, 153, 251–265. [Google Scholar] [CrossRef]

- Academia.edu. [Online]. Available: https://www.academia.edu/39198226/IMPACT_OF_INNOVATION_PRACTICES_ON_SUSTAINABLE_PERFORMANCE_SMEs. (accessed on 28 September 2024).

- Tawse and, P. Tabesh, Thirty years with the balanced scorecard: What we have learned. Bus. Horiz. 2023, 66, 123–132. [Google Scholar] [CrossRef]

- Llorach and, E. Ottosson, The Balanced Scorecard during the early stages of a tech firm: A multiple case study regarding performance management in Swedish tech startups, 2016.

- Diva-portal.org. [Online]. Available: https://www.diva-portal.org/smash/get/diva2:953509/FULLTEXT02.pdf. (accessed on 28 September 2024).

- Dameshifa, A. Azazi, E. Listiana, H. Malini, and H. Heriyadi, The influence of entrepreneurial and Market Orientation on Business Performance through mediation of innovation capability: Implementation of SMEs in Indonesia. East Afr Sch J Econ Bus Manag.

- Abacademies.org. [Online]. Available: https://www.abacademies.org/articles/The-effect-of-entrepreneurial-orientation-on-1528-2651-22-5-461.pdf. (accessed on 28 September 2024).

- V. Oyaneder and S. M. Valderrama, A new balanced scorecard approximation to enhance performance management systems of Chilean wineries. J. Wine Res. 2016, 27, 1–18. [Google Scholar] [CrossRef]

- Researchgate.net. [Online]. Available: https://www.researchgate.net/publication/295396300_A_new_balanced_scorecard_approximation_to_enhance_performance_management_systems_of_Chilean_wineries. (accessed on 28 September 2024).

- Researchgate.net. [Online]. Available: https://www.researchgate.net/publication/318928910_Business_intelligence_systems_and_bank_performance_in_Ghana_The_balanced_scorecard_approach. (accessed on 28 September 2024).

- Owusu, Business intelligence systems and bank performance in Ghana: The balanced scorecard approach. Cogent Bus. Manag. 2017, 4, 1364056. [CrossRef]

- Edu.gh. [Online]. Available: https://pure.ug.edu.gh/en/publications/business-intelligence-systems-and-bank-performance-in-ghana-the-b. (accessed on 28 September 2024).

- Ssrn.com. [Online]. Available: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3481364. (accessed on 28 September 2024).

- Gov.my. [Online]. Available: https://smecorp.gov.my/images/Publication/MSME_Insights/2022_23/3Chapter%202_Performance%20of%20MSMEs%20in%20Malaysia.pdf. (accessed on 28 September 2024).

- Researchgate.net. [Online]. Available: https://www.researchgate.net/publication/375544721_Determining_key_factors_influencing_SMEs'_performance_A_systematic_literature_review_and_experts'_verification. (accessed on 28 September 2024).

- N. M. Mustapha and S. Sorooshian, SME performance measurement: A technical review of Malaysia, Edu.my. [Online]. Available: http://umpir.ump.edu.my/id/eprint/25913/1/SME%20performance%20measurement%20a%20technical%20review%20of%20Malaysia.pdf. (accessed on 28 September 2024).

- Unl.pt. [Online]. Available: https://run.unl.pt/handle/10362/107266?locale=en. (accessed on 28 September 2024).

- Hegazy, K. Hegazy, and M. Eldeeb, The balanced scorecard: Measures that drive performance evaluation in auditing firms. J. Account. Audit. Finance 2022, 37, 902–927. [Google Scholar] [CrossRef]

- Researchgate.net. [Online]. Available: https://www.researchgate.net/publication/359479328_Performance_of_Food_and_NonFood_SMIS_Based_on_Marketing_Entrepreneurs_Entrepreneurship_Marketing_Food_and_Non-Food_SMIs_Performance_Balanced_Scorecard. (accessed on 28 September 2024).

- Neliti.com. [Online]. Available: https://www.neliti.com/publications/410597/marketing-entrepreneurs-performance-of-food-and-non-food-smis-based-on-marketing. (accessed on 28 September 2024).

- Researchgate.net. [Online]. Available: https://www.researchgate.net/publication/336136888_ASSESSMENT_OF_ENTREPRENEURIAL_MARKETING_PERFORMANCE_IN_SMALL_AND_MEDIUM_FOOD_AND_NON-FOOD_INDUSTRY_IN_INDONESIA_USING_IPA_ANALYSIS. (accessed on 28 September 2024).

- D. Gemina, Performance of food and non-food SMIS based on marketing entrepreneurs: Entrepreneurship marketing, food, and non-food SMIs performance, balanced scorecard. International Journal of Economics Development Research (IJEDR) 2020, 1, 243–259. [Google Scholar] [CrossRef]

- Del Baldo, The implementation of integrating reporting in SMEs: Insights from a pioneering experience in Italy. Meditari Account. Res. 2017, 25, 505–532. [CrossRef]

- Jami Pour and, M. Asarian, Strategic orientations, knowledge management (KM) and business performance: An exploratory study in SMEs using clustering analysis. Kybernetes 2019, 48, 1942–1964. [Google Scholar] [CrossRef]

- Researchgate.net. [Online]. Available: https://www.researchgate.net/publication/329819484_Strategic_orientations_knowledge_management_KM_and_business_performance_An_exploratory_study_in_SMEs_using_clustering_analysis. (accessed on 28 September 2024).

- B. Song, Y. Li, and L. Zhao, Complementary effect of knowledge management strategy on firm performance: Evidence from Chinese firms. Sustainability 2019, 11, 3616. [Google Scholar] [CrossRef]

- C. S. Lee and K. Y. Wong, Development and validation of knowledge management performance measurement constructs for small and medium enterprises. J. Knowl. Manag. 2015, 19, 711–734. [Google Scholar] [CrossRef]

- Researchgate.net. [Online]. Available: https://www.researchgate.net/publication/306010707_The_Balanced_Scorecard_vs_Total_Quality_Management#:~:text=Empirical%20investigation%20suggests%20that%20numerous%20organizations%20have%20adopted,customer%2C%20internal%20business%20processes%2C%20and%20learning%20and%20growth. (accessed on 28 September 2024).

- G. Mehralian, J. A. Nazari, G. Nooriparto, and H. R. Rasekh, TQM and organizational performance using the balanced scorecard approach. Int. J. Product. Perform. Manag. 2017, 66, 111–125. [Google Scholar] [CrossRef]

- Z. Hoque, Total quality management and the balanced scorecard approach: A critical analysis of their potential relationships and directions for research. Crit. Perspect. Account. 2003, 14, 553–566. [Google Scholar] [CrossRef]

- Researchgate.net. [Online]. Available: https://www.researchgate.net/publication/274573303_Critical_success_factors_for_implementation_of_supply_chain_management_in_Indian_small_and_medium_enterprises_and_their_impact_on_performance#:~:text=this%20paper%20identi%EF%AC%81ed%2013%20critical%20success%20factors%20%28CSFs%29,emerge%20d%20as%20the%20most%20perti%20nent%20CSFs. (accessed on 28 September 2024).

- R. Kumar, R. K. Singh, and R. Shankar, Critical success factors for implementation of supply chain management in Indian small and medium enterprises and their impact on performance. IIMB Manag. Rev. 2015, 27, 92–104. [Google Scholar] [CrossRef]

- Researchgate.net. [Online]. Available: https://www.researchgate.net/publication/274573303_Critical_success_factors_for_implementation_of_supply_chain_management_in_Indian_small_and_medium_enterprises_and_their_impact_on_performance. (accessed on 28 September 2024).

- Taschner, Improving SME logistics performance through benchmarking, Benchmarking 2016, 23, 1780–1797.

- Researchgate.net. [Online]. Available: https://www.researchgate.net/publication/309103764_Improving_SME_logistics_performance_through_benchmarking. (accessed on 28 September 2024).

- Sciencedirect.com. [Online]. Available: https://www.sciencedirect.com/science/article/abs/pii/S2214785321041511#:~:text=For%20deducing%20supply%20chain%20performance%2C%20the%20Balanced%20Scorecard,Envelopment%20Analysis%20%28DEA%29%20and%20Heuristic%20techniques%20based%20models. (accessed on 28 September 2024).

- M. Balaji, S. N. Dinesh, P. Manoj Kumar, and K. Hari Ram, Balanced Scorecard approach in deducing supply chain performance. Mater. Today 2021, 47, 5217–5222. [Google Scholar]

- Dau.edu. [Online]. Available: https://www.dau.edu/library/damag/july-august2017/balanced-scorecards-supply-chain-management. (accessed on 28 September 2024).

- Kosa, I. Mohammad, and D. Ajibie, Entrepreneurial orientation and venture performance in Ethiopia: the moderating role of business sector and enterprise location. J. Glob. Entrep. Res. 2018, 8. [Google Scholar] [CrossRef]

- R. U. Khan, Y. Salamzadeh, H. Kawamorita, and G. Rethi, Entrepreneurial orientation and small and medium-sized enterprises’ performance; Does ‘access to finance’ moderate the relation in emerging economies? Vis. J. Bus. Perspect. 2021, 25, 88–102. [Google Scholar] [CrossRef]

- N. Sahraen, Risk mitigation using integration enterprise risk management and balanced scorecard model: A case study in a consulting services company in Indonesia. SPEKTRUM IND. 2021, 19, 73. [CrossRef]

- Z. Liu, Implementation of the balanced scorecard in large firms: A systematic review. Asian Journal of Accounting and Finance 2024, 6, 1–11. [Google Scholar]

- Researchgate.net. [Online]. Available: https://www.researchgate.net/publication/365743414_Effect_of_Opportunity_Recognition_and_Organisation_Capability_on_SME_Performance_in_Indonesia_Moderated_by_Business_Model_Innovation. (accessed on 28 September 2024).

- Academia.edu. [Online]. Available: https://www.academia.edu/93437960/The_Effect_of_Opportunity_Recognition_and_Organization_Capability_on_SME_Performance_in_Indonesia_Moderated_by_Business_Model_Innovation. (accessed on 28 September 2024).

- Consensus.app. [Online]. Available: https://consensus.app/papers/opportunity-recognition-organisation-capability-hartono/5834fcd02f535c889d83e40fc527da90/. (accessed on 28 September 2024).

- S. Pekkola, M. Saunila, and H. Rantanen, Performance measurement system implementation in a turbulent operating environment, Int. J. Product. Perform. Manag. 2016, 65, 947–958. [Google Scholar]

- Eifert and, C. Julmi, Challenges and how to overcome them in the formulation and implementation process of a Sustainability Balanced Scorecard (SBSC). Sustainability 2022, 14, 14816. [Google Scholar] [CrossRef]

- W. Sewell, R. B. Mason, and P. Venter, Socio-economic developmental strategies as retail performance indicators: A balanced scorecard approach, Dev. South. Afr. 2017, 34, 365–382. [Google Scholar] [CrossRef]

- University of Gothenburg, S. Sorooshian, N. Aziz, U. M. Pahang, N. Azizan, and Prince Sultan University, Ranking of performance measurement systems for smaller businesses. Int. J. Intell. Eng. Syst. 2020, 13, 108–116. [Google Scholar]

- Researchgate.net. [Online]. Available: https://www.researchgate.net/publication/326300619_IDENTIFICATION_AND_DETERMINATION_OF_THE_PRIORITY_OF_KEY_PERFORMANCE_INDICATORS_PERSPECTIVE_OF_CUSTOMERS_ON_COCOA_PROCESSING_INDUSTRY_OF_SMEs_SCALE_IN_SOUTH_SULAWESI. (accessed on 28 September 2024).

- M. Dahlan, Ramlawati, and Lamatinulu, Identification and determination of priority of key performance indicator of financial perspectives on industry cocoa SMEs in south Sulawesi. IOP Conf. Ser. Earth Environ. Sci. 2018, 175, 012029. [Google Scholar] [CrossRef]

- M. Hidayat, C. I. Musa, S. Haerani, and I. Sudirman, The design of curriculum development based on entrepreneurship through balanced scorecard approach. Int. Educ. Stud. 2015, 8, 123. [Google Scholar] [CrossRef]

- L. Lamatinulu, Identification and determination of the priority of key performance indicators perspective of customers on cocoa processing industry of SMEs scale in south Sulawesi. International Journal of Engineering Sciences & Research Technology.

- L. Zhang, A comparative study of modern management accounting practices and SMEs performance in Malaysia and China: The moderating role of power distance.

- B. D. Dağıdır and B. Özkan, A comprehensive evaluation of a company performance using sustainability balanced scorecard based on picture fuzzy AHP. J. Clean. Prod. 2024, 435, 140519. [Google Scholar] [CrossRef]

- E. Neder, The new relationship among state, market, and political actors in public policies. Mei Zhong Gong Gong Guan Li 2015, 12. [Google Scholar]

- Ssrn.com. [Online]. Available: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4307192. (accessed on 28 September 2024).

- Researchgate.net. [Online]. Available: https://www.researchgate.net/publication/338773870_Applicability_of_Performance_Prism_in_SMEs_a_multiple_case_study. (accessed on 28 September 2024).

- Researchgate.net. [Online]. Available: https://www.researchgate.net/publication/363317689_Employee_Retention_Practices_and_the_Performance_of_Small_and_Medium_Enterprises_in_Nigeria. (accessed on 28 September 2024).

- Researchgate.net. [Online]. Available: https://www.researchgate.net/figure/Innovation-effect-on-SMEs-hotels-growth_tbl1_354186670. (accessed on 28 September 2024).

- V. Tuan, Analysis of managerial factors on the performance of small and medium-sized enterprises (SMEs) in manufacturing sector in Ho Chi Minh City- Vietnam, 2018.

- Researchgate.net. [Online]. Available: https://www.researchgate.net/publication/286597565_A_taxonomy_of_knowledge_management_outcomes_for_SMEs. (accessed on 28 September 2024).

- Building and Deploying a Balanced Scorecard within SMEs, ICAEW. [Online]. Available: https://www.icaew.com/technical/business/business-performance-management/bpm-tools-templates-and-case-studies/building-and-deploying-a-balanced-scorecard-within-small-and-medium-sized-organisations. (accessed on 19 September 2024).

- E. Kirsten, F. Vermaak, and H. Wolmarans, Performance Measurement in Small and Medium Enterprises: South African Accountants’ Perspective. Journal of Economic and Financial Sciences 2015, 8, 13–34. [Google Scholar] [CrossRef]

- M. Lonbani, S. Sofian, and M. B. Baroto, Balanced Scorecard Implementation in SMEs: Addressing the Moderating Role of Environmental Uncertainty. Global Business and Organizational Excellence 2016, 35, 58–66. [Google Scholar] [CrossRef]

- C. J. van Zyl, A Practical Performance Measurement Framework for SMEs in a South African Context, *Stellenbosch University*, [Online]. Available: https://scholar.sun.ac.za/server/api/core/bitstreams/16fc52ae-9ed9-4db8-a610-03602cc6fc0c/content. (accessed on 19 September 2024).

- R. Malagueño, E. Lopez-Valeiras, and J. Gomez-Conde, The Balanced Scorecard in SMEs: Effects on Innovation and Financial Performance. Small Business Economics 2018, 51, 221–244. [Google Scholar] [CrossRef]

- R. Malagueño, E. Lopez-Valeiras, and J. Gomez-Conde, The Balanced Scorecard in SMEs: Effects on Innovation and Financial Performance. Small Business Economics 2017, 51, 221–244. [Google Scholar]

- Balanced Scorecard, Intrafocus, 17 Jun. 2014. [Online]. Available: https://www.intrafocus.com/balanced-scorecard/. (accessed on 19 September 2024).

- D. M. A. Mba et al., Balanced Scorecard. Der Anaesthesist 2003, 52, 947–956. [Google Scholar]

- Balanced Scorecard Course, Udemy, [Online]. Available: https://www.udemy.com/course/building-balanced-scorecard/?utm_source=bing&utm_medium=udemyads&utm_campaign=BG-Search_DSA_Beta_Prof_la.EN_cc.ROW-English&campaigntype=Search&portfolio=Bing&language=EN&product=Course&test=&audience=DSA&topic=&priority=Beta&utm_content=deal4584&utm_term=_._ag_1329311946398319_._ad__._kw_Finance+en_._de_c_._dm__._pl__._ti_dat-2334881661677439%3Aloc-168_._li_137821_._pd__._&matchtype=b&msclkid=14c20d8ce7e9125baf6f6b671a4d2566&couponCode=2021PM20. (accessed on 19 September 2024).

- Balanced Scorecard, The Strategy Story, 06 Feb. 2024.

- Balanced Scorecard Institute, BSC Basics, 23 Nov. 2017. [Online]. Available: https://balancedscorecard.org/bsc-basics/. (accessed on 19 September 2024).

- Jurevicius, Balanced Scorecard, Strategic Management Insight, 22 Jan. 2024. [Online]. Available: https://strategicmanagementinsight.com/tools/balanced-scorecard/. (accessed on 19 September 2024).

- D. Croft, The Four Perspectives of the Balanced Scorecard: Explained and Analyzed, Learn Lean Sigma, 23 Jul. 2023. [Online]. Available: https://www.learnleansigma.com/improvement-methodology/balanced-scorecard-explained/. (accessed on 19 September 2024).

- J. Weller, Everything You Need to Know About the Balanced Scorecard, Smartsheet, 27 Jul. 2017.

- Balanced Scorecard Institute, Nine Steps to Success, 09 Apr. 2018. [Online]. Available: https://balancedscorecard.org/about/nine-steps/. (accessed on 19 September 2024).

- What is a Balanced Scorecard?, Business Insights Blog, 26 Oct. 2023. [Online]. Available: https://online.hbs.edu/blog/post/balanced-scorecard. (accessed on 19 September 2024).

- Balanced Scorecard Institute, Balanced Scorecard Basics, 30 Jun. 2018. [Online]. Available: https://balancedscorecard.org/bsc-basics-overview/. (accessed on 19 September 2024).

- L. Tucci and K. T. Hanna, Balanced Scorecard, CIO, 28 Jul. 2021. [Online]. Available: https://www.techtarget.com/searchcio/definition/balanced-scorecard-methodology. (accessed on 19 September 2024).

- E. Tarver, What is a Balanced Scorecard (BSC), and How is it Used in Business?, *Investopedia*, 18 Nov. 2003. [Online]. Available: https://www.investopedia.com/terms/b/balancedscorecard.asp. (accessed on 19 September 2024).

- Z. Dudić et al., Innovativeness and Usage of the Balanced Scorecard Model in SMEs, *Sustainability* 2020, 12, 3221.

- SMEs and BSC, Bing. [Online]. Available: https://www.bing.com/search?q=SMEs%20and%20BSC&qs=n&form=QBRE&=Search%20%7B0%7D%20for%20%7B1%7D&=Search%20work%20for%20%7B0%7D&=%25eManage%20Your%20Search%20History%25E&sp=-1&ghc=1&lq=0&pq=smes%20and%20bsc&sc=10-12&sk=&cvid=96684DEE8D304762B69E6BC6786AD873&ghsh=0&ghacc=0&ghpl=. (accessed on 19 September 2024).

- Researchgate.net. [Online]. Available: https://www.researchgate.net/publication/330563573_A_generic_balanced_scorecard_for_small_and_medium_manufacturing_enterprises_in_South_Africa. (accessed on 19 September 2024).

- Academia.edu. [Online]. Available: https://www.academia.edu/24487910/THE_BALANCED_SCORECARD_IN_THE_CONTEXT_OF_SMES_A_LITERATURE_REVIEW. (accessed on 19 September 2024).

- Researchgate.net. [Online]. Available: https://www.researchgate.net/publication/358161111_Existing_Differences_Between_SMEs_That_Apply_BSC_and_Those_That_Do_Not. (accessed on 19 September 2024).

- Malagueño, E. Lopez-Valeiras, and J. Gomez-Conde, Balanced scorecard in SMEs: effects on innovation and financial performance. Small Bus. Econ. 2018, 51, 221–244. [Google Scholar] [CrossRef]

- Researchgate.net. [Online]. Available: https://www.researchgate.net/publication/337192218_Balanced_Scorecard_Learning_and_Growth_Perspective. (accessed on 19 September 2024).

- How to implement the balanced scorecard framework (with examples), Cascade.app. [Online]. Available: https://www.cascade.app/blog/how-to-implement-the-balanced-scorecard. (accessed on 19 September 2024).

- MindTools, Mindtools.com. [Online]. Available: https://www.mindtools.com/arlnxwf/the-balanced-scorecard. (accessed on 19 September 2024).

- E. Tarver, What is a balanced scorecard (BSC), how is it used in business?, Investopedia, 18-Nov-2003. [Online]. Available: https://www.investopedia.com/terms/b/balancedscorecard.asp. (accessed on 19 September 2024).

- What is a balanced scorecard?, Business Insights Blog, 26-Oct-2023. [Online]. Available: https://online.hbs.edu/blog/post/balanced-scorecard. (accessed on 19 September 2024).

- Balanced scorecard, Corporate Finance Institute. [Online]. Available: https://corporatefinanceinstitute.com/resources/management/balanced-scorecard/. (accessed on 19 September 2024).

- Balanced Scorecard, The Strategy Story - Simplifying Business Strategies, 06-Feb-2024.

- D. Croft, The four perspectives of the Balanced Scorecard: Explained and analyzed, Learn Lean Sigma, 23-Jul-2023. [Online]. Available: https://www.learnleansigma.com/improvement-methodology/balanced-scorecard-explained/. (accessed on 19 September 2024).

- Lean Transition Solutions LTS, What is Balanced Scorecard (BSC)? Four Perspectives, 2022. [Online]. Available: https://balancedscorecard.ltslean.com/fcil-balanced-scorecard. (accessed on 19 September 2024).

- Savkín, What is a K&N Balanced Scorecard and the role of its perspectives, Bscdesigner.com, 22-Feb-2019. [Online]. Available: https://bscdesigner.com/four-perspectives.htm. (accessed on 19 September 2024).

- Marr, The four perspectives in a Balanced Scorecard, Bernard Marr, 02-Jul-2021. [Online]. Available: https://bernardmarr.com/the-four-perspectives-in-a-balanced-scorecard/. (accessed on 19 September 2024).

- Tsiu, S.; Ngobeni, M.; Mathabela, L.; Thango, B. Applications and Competitive Advantages of Data Mining and Business Intelligence in SMEs Performance: A Systematic Review. Preprints 2024, 2024090940. [Google Scholar] [CrossRef]

- Mkhize, A.; Mokhothu, K.; Tshikhotho, M.; Thango, B. Evaluating the Impact of Cloud Computing on SMEs Performance: A Systematic Review. Preprints 2024, 2024090882. [Google Scholar] [CrossRef]

- Kgakatsi, M.; Galeboe, O.; Molelekwa, K.; Thango, B. The Impact of Big Data on SME Performance: A Systematic Review. Preprints 2024, 2024090985. [Google Scholar] [CrossRef]

- Molete, O. B.; Mokhele, S. E.; Ntombela, S. D.; Thango, B. A. The Impact of IT Strategic Planning Process on SME Performance: A Systematic Review. Preprints 2024, 2024091024. [Google Scholar] [CrossRef]

- Mothapo, M.; Thango, B.; Matshaka, L. Tracking and Measuring Social Media Activity: Key Metrics for SME Strategic Success – A Systematic Review. Preprints 2024, 2024091757. [Google Scholar] [CrossRef]

- Ngcobo, K.; Bhengu, S.; Mudau, A.; Thango, B.; Matshaka, L. Enterprise Data Management: Types, Sources, and Real-Time Applications to Enhance Business Performance - A Systematic Review. Preprints 2024, 2024091913. [Google Scholar] [CrossRef]

- Mohlala, T. T.; Mehlwana, L. L.; Nekhavhambe, U. P.; Thango, B.; Matshaka, L. Strategic Innovation in HRIS and AI for Enhancing Workforce Productivity in SMEs: A Systematic Review. Preprints 2024, 2024091996. [Google Scholar] [CrossRef]

- Chabalala, K.; Boyana, S.; Kolisi, L.; Thango, B. A.; Matshaka, L. Digital Technologies and Channels for Competitive Advantage in SMEs: A Systematic Review. Preprints 2024, 2024100020. [Google Scholar] [CrossRef]

- Ndzabukelwako, Z.; Mereko, O.; Sambo, T. V.; Thango, B. The Impact of Porter’s Five Forces Model on SMEs Performance: A Systematic Review. Preprints 2024, 2024100119. [Google Scholar] [CrossRef]

- Maswanganyi, N. G.; Fumani, N. M.; Khoza, J. K.; Thango, B. A.; Matshaka, L. Evaluating the Impact of Database and Data Warehouse Technologies on Organizational Performance: A Systematic Review. Preprints 2024, 2024100059. [Google Scholar] [CrossRef]

- Gumede, T. T.; Chiworeka, J. M.; Magoda, A. S.; Thango, B. Building Effective Social Media Strategies for Business: A Systematic Review. Preprints 2024, 2024100379. [Google Scholar] [CrossRef]

- Myataza, A.; Mafunga, M.; Mkhulisi, N. S.; Thango, B. A. A Systematic Review of ERP, CRM, and HRM Systems for SMEs: Managerial and Employee Support. Preprints 2024, 2024100384. [Google Scholar] [CrossRef]

- Mudau, M. C.; Moshapo, L. W.; Monyela, T. M.; Thango, B. A. A The Role of Manufacturing Operations in SMEs Performance: A Systematic Review. Preprints 2024, 2024100539. [Google Scholar] [CrossRef]

- Khanyi, M.; Xaba, S.; Mlotshwa, N.; Thango, B.; Matshaka, L. The Role of Data Networks and APIs in Enhancing Operational Efficiency in SME: A Systematic Review. Preprints 2024, 2024100848. [Google Scholar] [CrossRef]

- Skosana, S.; Mlambo, S.; Madiope, T.; Thango, B. Evaluating Wireless Network Technologies (3G, 4G, 5G) and Their Infrastructure: A Systematic Review. Preprints 2024, 2024101331. [Google Scholar] [CrossRef]

- Mtjilibe, T.; Rameetse, E.; Mgwenya, N.; Thango, B. Exploring the Challenges and Opportunities of Social Media for Organizational Engagement in SMEs: A Comprehensive Systematic Review. Preprints 2024, 2024101438. [Google Scholar] [CrossRef]

| Ref | Cites | Year | Contribution | Pros | Cons |

|---|---|---|---|---|---|

| [21] | 21 | 2014 | Address the gap in the literature regarding the use of the Balanced Scorecard in SMEs, and it reviews existing research and suggests an agenda for future studies specific to SMEs. | Emphasizes the lack of SME-focused BSC research. | The paper may not include specific quantitative data from SMEs. |

| [22] | 50 | 2015 | Pinpoints the current state of research and highlights the barriers and limitations faced by small businesses in implementing these concepts. | Offers a comprehensive review of how the BSC can integrate sustainability into small business management. | The research paper may not provide new empirical data or case studies. |

| [23] | 13 | 2016 | It assesses the benefits, implementation, as well as limitations of the BSC, particularly in SMEs. | Provides a comprehensive review of BSC across different sectors. | It is limited to research papers from specific quality ratings (Scopus), missing relevant research from other sources. |

| [24] | 44 | 2016 | Details the use, development, design, as well as consequences of BSC in SMEs, with particular attention to family firms. | Highlights research gaps and it provides guidance for studies in the future. | The review is limited to European, Australian, and North American contexts, and it overlooks other regions. |

| [25] | 10 | 2017 | Examines the BSC's efficacy, attributes, merits, and demerits, which provides a comprehensive evaluation of its application and implementation. | Identifies the potential benefits as well as characteristics of BSCs in large firms. | Only focuses on large organizations, potentially missing insights relevant to smaller organizations. |

| [26] | 5 | 2018 | Explores the constraints of the BSC model, its practice, its execution, and it assesses whether the BSC is a definitive solution for corporate performance measurement. | Contributes to the development of the model for performance measurement research. | Overshadows the benefits of BSCs because it only focuses on the constraints and limitations of BSCs. |

| [27] | 55 | 2020 | Organizes knowledge on the use stage of the Sustainability Balanced Scorecard (SBSC) and provides an overview of recent research. | Provides a comprehensive and literature review, maps research streams, and presents potential future research avenues in SBSC. | Limited to peer-reviewed articles in English from 2000–2020, which might exclude appropriate studies outside this scope. Focuses on ABS-ranked journals, resulting in missing other insights. |

| [28] | 201 | 2021 | Determines the current state of research on SBSCs related to environmental performance outcomes and proposes a conceptual framework. | Systematic literature review with a main focus on environmental performance outcomes; proposes a novel model linking SBSC, environmental performance, and expert managers. | Lacks consensus on the relationship between BSC architecture and environmental performance; constrained to articles published in double-blind peer-reviewed journals from 2001-2020. |

| [29] | 83 | 2021 | Reviews literature on the BSC system, focusing on the BSC-compensation link and its impact on company performance. | Comprehensive analysis of 117 empirical studies; identifies gaps in research, particularly in the BSC-compensation link. | 30 studies adequately capture the BSC as suggested by Kaplan and Norton; BSC's relevance in improving performance stays unproven. |

| [30] | 80 | 2022 | Reviews and evaluates the development of research on the balanced scorecard, exploring in detail its applications and criticisms. | Reviews and evaluates the development of research on the balanced scorecard, exploring in detail its applications and criticisms. | Restricted to studies from Q1 journals, which may exclude accurate research from lower-ranked sources; some skepticism exists regarding BSC's effectiveness. |

| [31] | 1 | 2022 | Reviews the relationship between strategic management and the development of Small and Medium Enterprises, focusing on the variation between ad hoc planning and structured strategic planning. It presents the lack of studies in developing economies. | Addresses a gap in literature regarding strategic management in SMEs, particularly in developing economies. | Limited empirical evidence on the direct relationship between strategic management and SMEs' performance; mainly focuses on theoretical frameworks. |

| [32] | 201 | 2023 | Reviews the application of the Balanced Scorecard across various fields and identifies the perspectives used in measuring organizational performance. | Provides a comprehensive overview of the Balanced Scorecard's implementation in different sectors. | Restricted to 30 articles and focuses solely on Indonesian authors, which may limit generalizability. |

| Summary | The reviewed literature underscore various aspects of Balanced Scorecard implementation in SMEs, including benefits, limitations, as well as regional applications. It identifies gaps in regional focus, empirical data, and scope of research, suggesting areas for further investigation such as integrating sustainability as well as expanding geographical coverage. | Provides a very comprehensive analysis of BSC implementation, underscores barriers, and suggests future research agendas. Covers many sectors and applications, contributing valuable insights to the field. | Limited by sectoral and regional focus, lack of new empirical data, as well as reliance on specific types of publications. Overemphasis on theoretical aspects, and restricted generalizability due to narrow research scopes. | ||

| Proposed Literature | Identifies new trends in the measurement of business performances, and it offers an important evaluation of how the implementation of BSC in SMEs evolved over time. | Provides comprehensive insights of the implementation of BSC in SMEs and helps uncover trends and findings that are new in performance measurement. | Limited by available data. Analysis is complex and time consuming. | ||

| Criteria | Inclusion | Exclusion |

| Topic | Research papers focusing on Balanced Scorecard Methodology: Performance metrics and strategy execution | Research papers not focusing on Balanced Scorecard Methodology |

| Research Framework | The article must include a methodology for the implementation of BSC in SMEs | Articles that lack a clear methodology for BSC implementation |

| Language | Articles must be written in English | Articles written in other languages |

| Period | Publications between 2014 and 2024 | Publications outside the period 2014 and 2024 |

| Ref | Sample size | Subject Area | Perspectives of BSC | KPIs |

|---|---|---|---|---|

| [36] | 201 | Balanced Scorecard | Finance, customer, internal processes | ROI |

| [37] | 238 | Balanced Scorecard | Financial, Internal Processes | Customer satisfaction |

| [38] | 100 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | Customer satisfaction |

| [39] | 1 | Balanced Scorecard | Financial, Customer, Internal Processes | ROI |

| [40] | 380 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [41] | 135 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [42] | 35 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | Customer satisfaction |

| [43] | 4 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | Customer satisfaction |

| [44] | 27 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [45] | 14 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | Employee engagement |

| [46] | 2 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | Customer satisfaction |

| [47] | 457 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | Customer satisfaction |

| [48] | 12 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [49] | 135 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [50] | 182 | Balanced Scorecard | Financial, Internal Processes | Not specified |

| [51] | 100 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | Employee engagement |

| [52] | 100 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [53] | 201 | Balanced Scorecard | Finance, customer, internal processes | Customer satisfaction |

| [54] | 201 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | Employee engagement |

| [55] | 549 | Balanced Scorecard | Financial, Internal Processes | ROI |

| [56] | 14 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | Not specified |

| [57] | 12 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [58] | 160 | SME performance | Financial, Customer, Internal Processes, Learning and Growth | Customer satisfaction |

| [59] | 549 | Balanced Scorecard | Finance, customer, internal processes | ROI |

| [60] | 14 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | Customer satisfaction |

| [61] | Not specified |

SME Performance | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [62] | 111 | SME Performance | Finance, customer, internal processes | ROI |

| [63] | 29 | Balanced Scorecard | Financial, Internal Processes | Not specified |

| [64] | 385 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [65] | 600 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | Customer satisfaction |

| [66] | 12 | SME Performance | Financial, Customer, Internal processes, Learning and growth | Employee engagement |

| [67] | Not specified |

SME Performance | Financial, Customer, Internal Processes, Learning and Growth | Not specified |

| [68] | Not specified |

Balanced Scorecard | Financial, Customer, Internal processes, Learning and growth | Employee engagement |

| [69] | 1 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [70] | 50 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | Customer satisfaction |

| [71] | 67 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | Customer satisfaction |

| [72] | 5 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | Not specified |

| [73] | Not specified |

Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [74] | 202 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | Customer satisfaction |

| [75] | 4 | Balanced Scorecard | Financial, Internal Processes | Customer satisfaction |

| [76] | 225 | SME Performance | Finance, customer, internal processes | Employee engagement |

| [77] | 5 | Balanced Scorecard | Finance, customer, internal processes | Customer satisfaction |

| [78] | 200 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [79] | 7 | Not specified | Financial, Customer, Internal Processes, Learning and Growth | Customer satisfaction |

| [80] | 4071 | SME Performance | Finance, customer, internal processes | Employee engagement |

| [81] | 130 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | Customer satisfaction |

| [82] | 120 | Balanced Scorecard | Finance, customer, internal processes | ROI |

| [83] | 529 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | Employee engagement |

| [84] | 100 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | Customer satisfaction |

| [85] | 5 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | Not specified |

| [86] | 31 | Balanced Scorecard | Finance, customer, internal processes | Customer satisfaction |

| [87] | 5 | Balanced Scorecard | customer, Financial, Customer, Internal Processes, Learning and Growth | Customer satisfaction |

| [88] | 111 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | Employee engagement |

| [89] | 386 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | Customer satisfaction |

| [90] | 40 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [91] | 150 | Balanced Scorecard | Financial, Customer, Internal processes, Learning and growth | Customer satisfaction |

| [92] | 100 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | Customer satisfaction |

| [93] | 2 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | Employee engagement |

| [94] | 154 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [95] | 10 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [96] | 15 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [97] | 8 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [98] | 20 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [99] | 30 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [100] | 12 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [101] | 10 | Not specified | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [102] | 4739 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [103] | 4739 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | Customer satisfaction |

| [104] | 8 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | Employee engagement |

| [105] | 274 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | Employee engagement |

| [106] | 160 | Balanced Scorecard | Financial, Internal Processes | Not specified |

| [107] | 384 | SME Performance | Finance, customer, internal processes | Employee engagement |

| [108] | 135 | SME Performance | Financial, Customer, Internal processes, Learning and growth | Employee engagement |

| [109] | 156 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | Employee engagement |

| [110] | 12 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | Not specified |

| [111] | 309 | SME Performance | Financial, Internal Processes | Employee engagement |

| [112] | 219 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | Customer satisfaction |

| [113] | 135 | SME Performance | Finance, customer, internal processes | Employee engagement |

| [114] | 1 000 | SME Performance | Finance, customer, internal processes | Customer satisfaction |

| [115] | 120 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | Employee engagement |

| [116] | 400 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | Customer satisfaction |

| [117] | 156 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | Customer satisfaction |

| [118] | 40 | Balanced Scorecard | Finance, customer, internal processes | Employee engagement |

| [119] | 107 | SME Performance | Customer, Internal Processes | Employee engagement |

| [120] | 15 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | Employee engagement |

| [121] | 100 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | Customer satisfaction |

| [122] | 16 | SME Performance | Financial, Customer, Internal Processes | Employee engagement |

| [123] | 750 | Not specified | Financial, Customer, Internal Processes, Learning and Growth | Employee engagement |

| [124] | 88 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | Customer satisfaction |

| [125] | 15 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [126] | 4071 | SME Performance | Financial, Customer Satisfaction | Customer satisfaction |

| [127] | 225 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | Customer satisfaction |

| [128] | 5 | SME Performance | Finance, customer, internal processes | Employee engagement |

| [129] | 30 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | Employee engagement |

| [130] | 200 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | Employee engagement |

| [131] | 350 | Balanced Scorecard | Finance, customer, internal processes | Customer satisfaction |

| [132] | 404 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | Customer satisfaction |

| [133] | 5 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [134] | 277 | SME Performance | Financial, Customer, Internal processes, Learning and growth | Employee engagement |

| [135] | Not specified |

SME Performance | Finance, customer, internal processes | ROI |

| [136] | 1 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [137] | 6 | Balanced Scorecard | Finance, customer, internal processes | ROI |

| [138] | 79 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | Customer satisfaction |

| [139] | Not specified |

SME Performance | Finance, customer, internal processes | ROI |

| [140] | 15 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | Not specified |

| [141] | 223 | SME Performance | Finance, customer, internal processes | ROI |

| [142] | 60 | Not specified | Financial, Customer, Internal Processes, Learning and Growth | Employee engagement |

| [143] | 10 | SME Performance | Finance, customer, internal processes | ROI |

| [144] | 20 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [145] | 15 | Balanced Scorecard | Financial, Customer, Internal processes | ROI |

| [146] | Not specified |

Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | Customer satisfaction |

| [147] | Not specified |

SME Performance | Finance, customer, internal processes | ROI |

| [148] | Not specified |

Not specified | Financial, Customer, Internal Processes, Learning and Growth | Employee engagement |

| [149] | 1 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [150] | 100 | SME Performance | Financial, Customer, Internal Processes | ROI |

| [151] | Not specified |

Balanced Scorecard | Financial, customer, internal processes, learning and growth | Employee engagement |

| [152] | Not specified |

Not specified | Financial, Customer, Internal Processes, Learning and Growth | Employee engagement |

| [153] | 451 | SME Performance | Finance, customer, internal processes | Not specified |

| [154] | 399 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [155] | Not specified |

Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [156] | 3 | SME Performance | Finance, customer, internal processes | Employee engagement |

| [157] | 251 | SME Performance | Finance, customer, internal processes | ROI |

| [158] | 933 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [159] | 101 | SME Performance | Finance, customer, internal processes | Employee engagement |

| [160] | 227 | Not specified | Financial, Customer, Internal Processes, Learning and Growth | Employee engagement |

| [161] | 10 | SME Performance | Finance, customer, internal processes | Not specified |

| [162] | 200 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | Employee engagement |

| [163] | 10 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [164] | Not specified |

Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | Not specified |

| [165] | 130 | Not specified | Finance, customer, internal processes | Employee engagement |

| [166] | 813 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| [167] | 130 | SME Performance | Financial, Customer, Internal processes, Learning and growth | Not specified |

| [168] | 143 | Balanced Scorecard | Finance, customer, internal processes | ROI |

| [169] | 346 | SME Performance | Financial, Customer, Internal Processes, Learning and Growth | Not specified |

| [170] | 56 | Balanced Scorecard | Financial, Customer, Internal Processes, Learning and Growth | ROI |

| Ref | Random sequence Generation | Allocation Concealment | Blinding of Participants & Personnel | Blinding of Outcome Assessment | Incomplete Outcome Data | Selective Reporting | Other Bias | Overall Risk of Bias |

|---|---|---|---|---|---|---|---|---|

| [36] | UNCLEAR | UNCLEAR | UNCLEAR | UNCLEAR | LOW | LOW | LOW | UNCLEAR |

| [37] | UNCLEAR | UNCLEAR | LOW | LOW | LOW | LOW | LOW | LOW |

| [38] | UNCLEAR | UNCLEAR | UNCLEAR | UNCLEAR | UNCLEAR | UNCLEAR | UNCLEAR | UNCLEAR |

| [39] | UNCLEAR | UNCLEAR | UNCLEAR | UNCLEAR | LOW | UNCLEAR | UNCLEAR | UNCLEAR |

| [40] | UNCLEAR | UNCLEAR | UNCLEAR | UNCLEAR | LOW | LOW | LOW | UNCLEAR |

| [41] | UNCLEAR | UNCLEAR | UNCLEAR | UNCLEAR | LOW | UNCLEAR | HIGH | HIGH |

| [42] | UNCLEAR | UNCLEAR | UNCLEAR | UNCLEAR | LOW | LOW | LOW | UNCLEAR |

| [43] | UNCLEAR | UNCLEAR | UNCLEAR | UNCLEAR | LOW | LOW | LOW | UNCLEAR |

| [44] | UNCLEAR | UNCLEAR | UNCLEAR | UNCLEAR | UNCLEAR | LOW | LOW | UNCLEAR |

| [45] | UNCLEAR | UNCLEAR | LOW | UNCLEAR | LOW | LOW | LOW | LOW |

| [46] | UNCLEAR | HIGH | UNCLEAR | UNCLEAR | UNCLEAR | LOW | LOW | HIGH |

| [47] | UNCLEAR | UNCLEAR | LOW | UNCLEAR | UNCLEAR | UNCLEAR | LOW | UNCLEAR |

| [48] | UNCLEAR | UNCLEAR | UNCLEAR | UNCLEAR | LOW | UNCLEAR | LOW | LOW |

| [49] | UNCLEAR | UNCLEAR | LOW | UNCLEAR | UNCLEAR | LOW | HIGH | HIGH |

| [50] | UNCLEAR | UNCLEAR | UNCLEAR | UNCLEAR | LOW | LOW | LOW | UNCLEAR |

| [51] | UNCLEAR | UNCLEAR | LOW | UNCLEAR | LOW | LOW | LOW | LOW |

| [52] | UNCLEAR | UNCLEAR | UNCLEAR | UNCLEAR | LOW | UNCLEAR | HIGH | HIGH |

| [53] | UNCLEAR | UNCLEAR | UNCLEAR | UNCLEAR | UNCLEAR | LOW | LOW | UNCLEAR |

| [54] | UNCLEAR | UNCLEAR | UNCLEAR | UNCLEAR | LOW | LOW | LOW | UNCLEAR |

| [55] | UNCLEAR | UNCLEAR | LOW | LOW | LOW | LOW | LOW | LOW |

| *** | *** | *** | *** | *** | *** | *** | *** | *** |

| *** | *** | *** | *** | *** | *** | *** | *** | *** |

| *** | *** | *** | *** | *** | *** | *** | *** | *** |

| [160] | UNCLEAR | UNCLEAR | UNCLEAR | UNCLEAR | LOW | LOW | LOW | UNCLEAR |

| [161] | UNCLEAR | UNCLEAR | LOW | LOW | LOW | LOW | LOW | LOW |

| [162] | UNCLEAR | UNCLEAR | LOW | UNCLEAR | LOW | LOW | LOW | LOW |

| [163] | UNCLEAR | UNCLEAR | UNCLEAR | UNCLEAR | LOW | UNCLEAR | HIGH | HIGH |

| [164] | UNCLEAR | UNCLEAR | LOW | LOW | LOW | LOW | LOW | LOW |

| [165] | UNCLEAR | UNCLEAR | UNCLEAR | UNCLEAR | LOW | LOW | LOW | UNCLEAR |

| [166] | UNCLEAR | UNCLEAR | LOW | UNCLEAR | LOW | LOW | LOW | LOW |

| [167] | UNCLEAR | UNCLEAR | UNCLEAR | UNCLEAR | UNCLEAR | LOW | LOW | UNCLEAR |

| [168] | UNCLEAR | UNCLEAR | UNCLEAR | UNCLEAR | LOW | UNCLEAR | HIGH | HIGH |

| [169] | UNCLEAR | UNCLEAR | UNCLEAR | UNCLEAR | LOW | LOW | LOW | UNCLEAR |

| [170] | UNCLEAR | UNCLEAR | LOW | LOW | LOW | LOW | LOW | LOW |

| Ref | Year | Country | Financial | Customer | Internal process | Learning and growth | Organizational outcomes | Long-term impacts |

|---|---|---|---|---|---|---|---|---|

| [36] | 2017 | Spain | yes | Yes | yes | no | Not specified | Enhanced organizational efficiencies |

| [37] | 2018 | Vietnam | yes | Yes | no | no | Not specified | Improved Performance, Strategic Alignment |

| [38] | 2015 | Portugal | yes | Yes | yes | no | Awareness of lean practices, improved performance | Business sustainability, competitive advantage |

| [39] | 2018 | Romania | yes | Yes | yes | yes | Improved strategic management, high efficiency in resource use | Enhanced strategic management, potential for increased market share |

| [40] | 2023 | Pakistan | yes | Yes | yes | yes | Improved communication, better understanding of goals | Enhanced performance, potential competitive advantage |

| [41] | 2018 | United Kingdom | yes | Yes | yes | yes | Top-management commitment, employee education, organizational buy-in | Positive return on investment, enhanced implementation of BSC in SMEs |

| [42] | 2020 | Eswatini | yes | No | yes | no | Employee satisfaction, customer satisfaction, innovation | Business sustainability, growth, competitive advantage |

| [43] | 2018 | Portugal | yes | No | yes | yes | Employee satisfaction, Customer loyalty, Increased training hours | Business sustainability, Competitive advantage, Market consolidation |

| [44] | 2019 | South Africa | yes | Yes | yes | yes | Improved decision-making, process optimization | Business sustainability, competitive advantage |

| [45] | 2016 | Austria | no | No | no | no | Employee Motivation, Customer Service | Business Sustainability, Competitive Advantage |

| [46] | 2021 | Portugal | yes | Yes | yes | yes | Improved Communication, Organizational Performance | Business Sustainability, Competitive Advantage |

| [47] | 2023 | Vietnam | yes | Yes | yes | yes | Employee Satisfaction, Customer Satisfaction | Business Sustainability, Competitive Advantage |

| [48] | 2022 | United Kingdom | yes | Yes | yes | yes | Employee Satisfaction, Customer Satisfaction | Business Sustainability, Competitive Advantage |

| [49] | 2018 | Slovakia | yes | Yes | yes | yes | Employee satisfaction, customer satisfaction | Business sustainability, competitive advantage |

| [50] | 2020 | Slovakia | yes | no | yes | no | Employee Satisfaction, Customer Satisfaction | Business Sustainability, Competitive Advantage |

| [51] | 2024 | United Kingdom | yes | Yes | yes | yes | Knowledge Transfer Effectiveness, Improved Performance | Business Sustainability, Competitive Advantage |

| [52] | 2019 | Indonesia | yes | Yes | yes | yes | Employee Training Participation, Customer Retention | Business Growth, Improved Performance Monitoring |

| [53] | 2015 | Egypt | yes | Yes | yes | no | Employee satisfaction, Customer satisfaction | Business sustainability, Competitive advantage |

| [54] | 2022 | Portugal | yes | Yes | yes | yes | Employee and organizational alignment, communication of strategic objectives | Potential improvement in organizational performance, strategic alignment, sustainability |

| [55] | 2015 | Portugal | yes | no | yes | no | Not specified | Not specified |

| [56] | 2015 | Malaysia | no | no | no | no | Not specified | Business Sustainability, Competitive Advantage |

| [57] | 2015 | Norway | yes | yes | yes | yes | Not specified | Not specified |

| [58] | 2017 | Malaysia | yes | yes | yes | yes | Not specified | Not specified |

| [59] | 2016 | Portugal | yes | yes | yes | no | Use of BSC | Enhanced Organizational Performance |

| [60] | 2020 | Eswatini | yes | yes | yes | yes | High repeat and new customer visits, Need for continuous improvement and innovations | Business sustainability, Enhanced performance and growth, Competitive advantage |

| [61] | 2016 | Not specified | yes | yes | yes | yes | Improved competitive advantage, Employee focus | Enhanced long-term performance, Better alignment with organizational goals |

| [62] | 2015 | Iran | yes | yes | yes | no | Positive impact on economic and learning and growth performances; limited impact on social and environmental outcomes | Expected increase in use and integration in manufacturing and service sectors |

| [63] | 2017 | Croatia | yes | yes | yes | yes | Not specified | Not specified |

| [64] | 2018 | Thailand | yes | no | yes | no | Employee satisfaction, customer satisfaction | Business sustainability, competitive advantage |

| [65] | 2020 | Thailand | yes | yes | yes | no | Employee satisfaction, customer satisfaction | Business sustainability, competitive advantage |

| [66] | 2022 | Indonesia | yes | yes | yes | no | Increased productivity, Improved performance | Business excellence, Competitive advantage |

| [67] | 2022 | Indonesia | yes | yes | yes | yes | Employee satisfaction, customer satisfaction | Business sustainability, competitive advantage, improvement in performance metrics |

| [68] | 2014 | Egypt | yes | yes | yes | yes | Benefits of BSC (communication, coordination, strategic vision description) | Addressing internal and external factors affecting SME performance, improving strategic planning |

| [69] | 2018 | Italy | yes | yes | yes | yes | Employee satisfaction, partner commitment | Business sustainability, competitive advantage |

| [70] | 2020 | Nigeria | yes | yes | yes | yes | Employee satisfaction, customer satisfaction | Potential for improved performance, competitive advantage |

| [71] | 2016 | Kenya | yes | yes | yes | yes | Increased Profitability, Improved Financial Performance | Increased Profitability, Improved Financial Performance |

| [72] | 2024 | Brazil | yes | yes | yes | yes | Improved decision-making, Strategic alignment | Enhanced competitiveness, Better strategic planning |

| [73] | 2022 | Europe | yes | yes | yes | yes | Employee satisfaction, customer feedback | Business sustainability, competitive advantage |