Submitted:

23 October 2024

Posted:

24 October 2024

You are already at the latest version

Abstract

Keywords:

1. Introduction

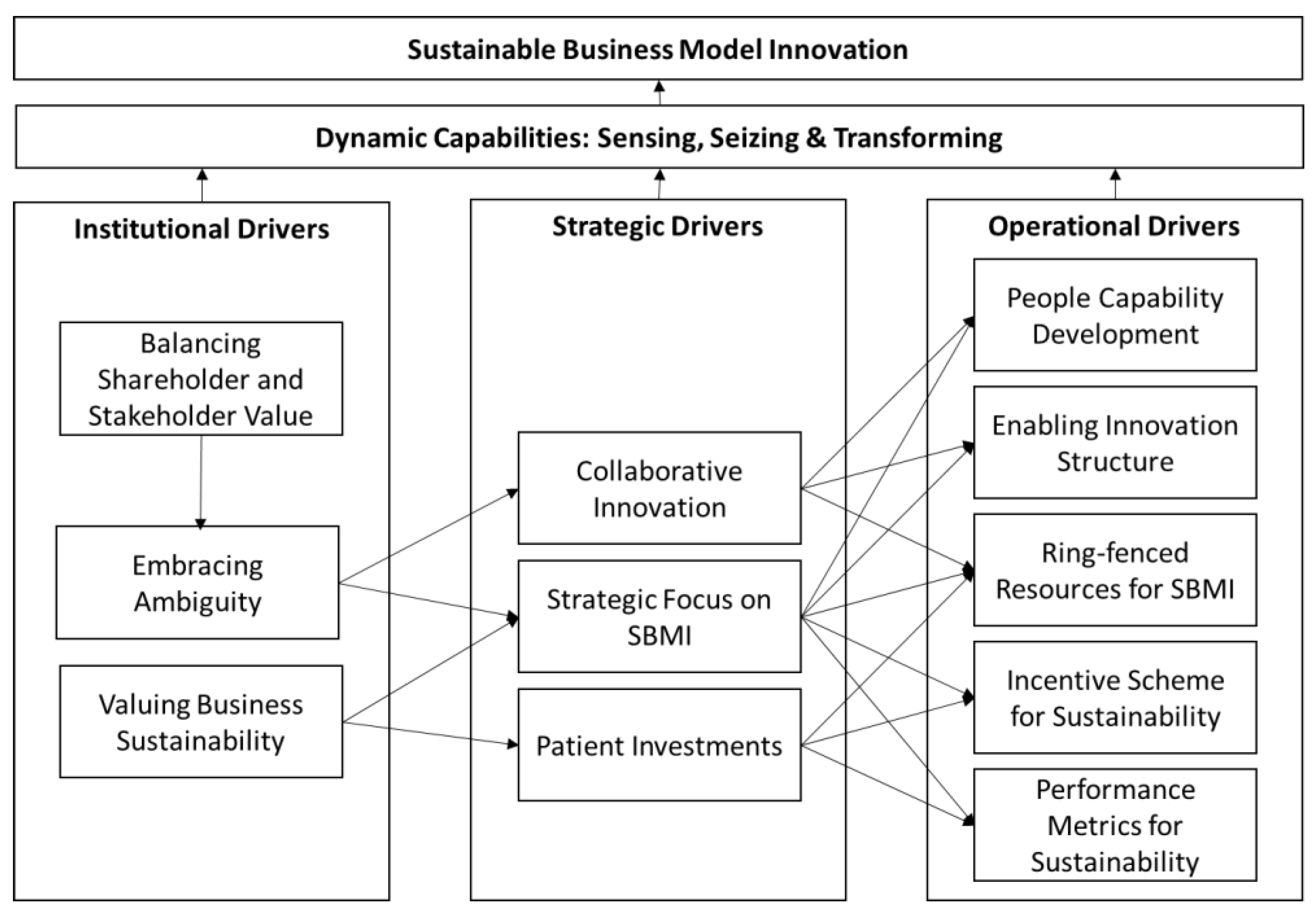

2. Literature Review

2.1. Local Sustainable Business Models

2.2. Multi-Actor Collaboration and Governance

3. Methods

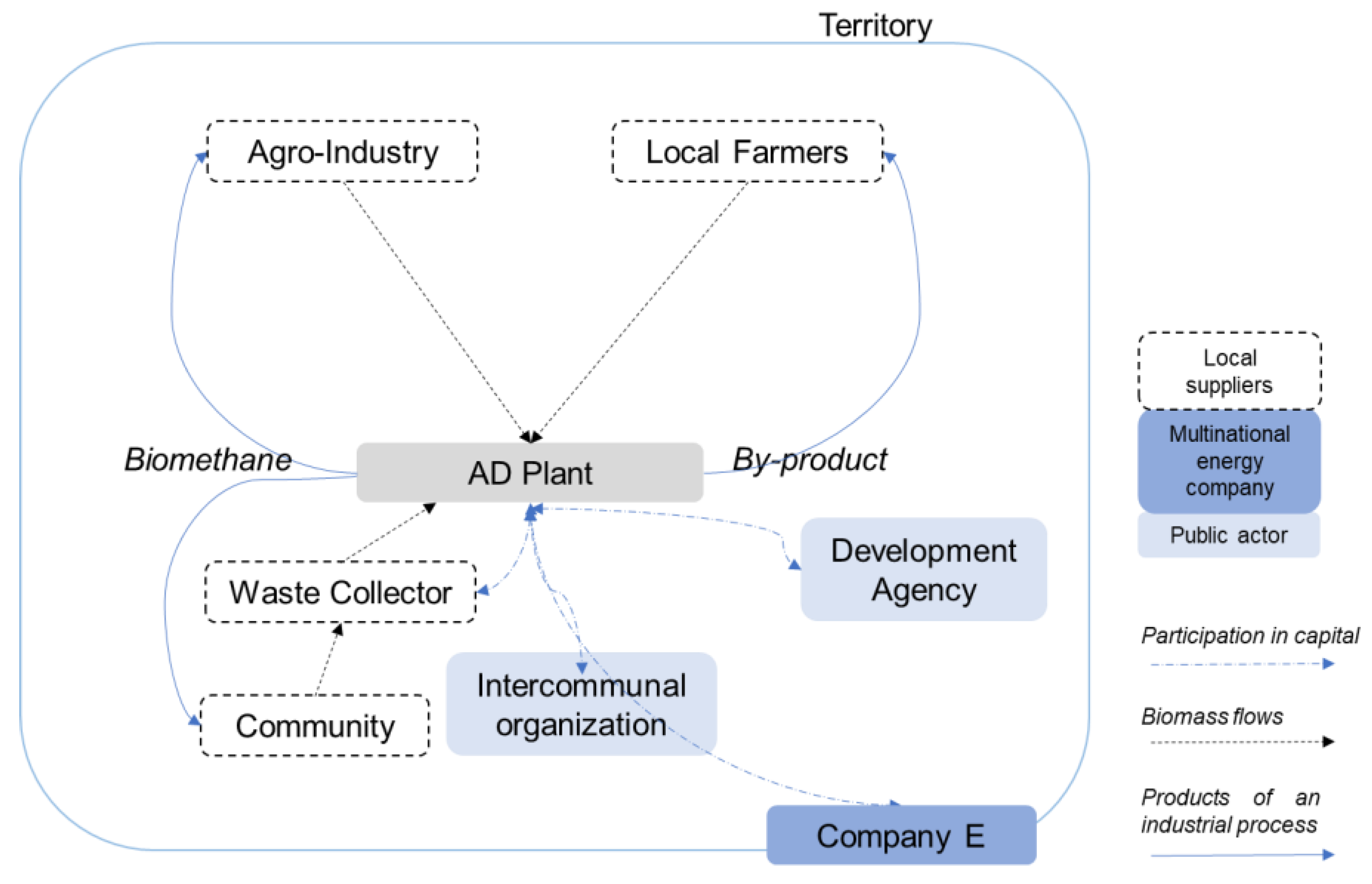

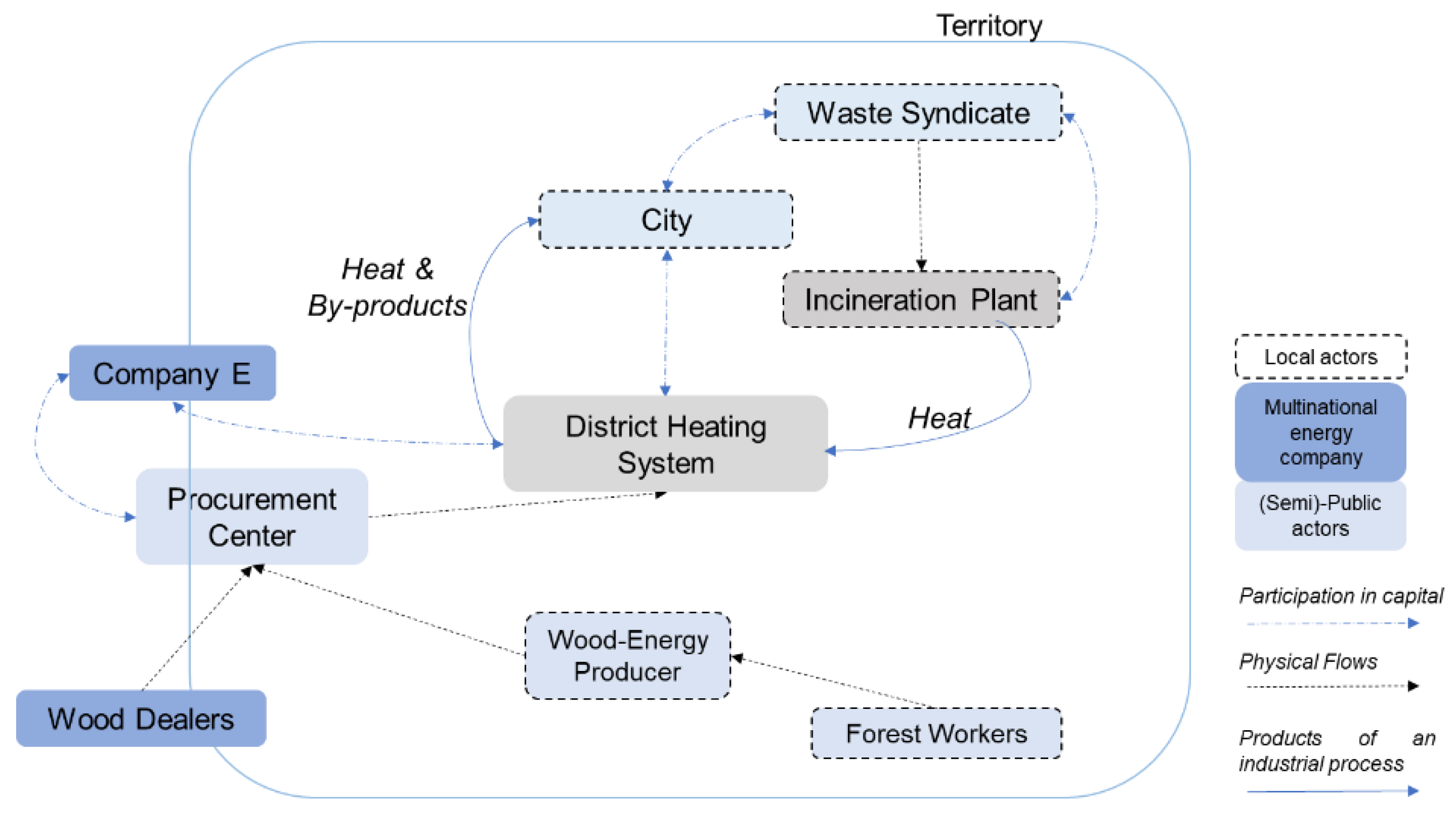

3.1. Two Local Sustainable Energy Systems

3.2. Data Collection and Analysis

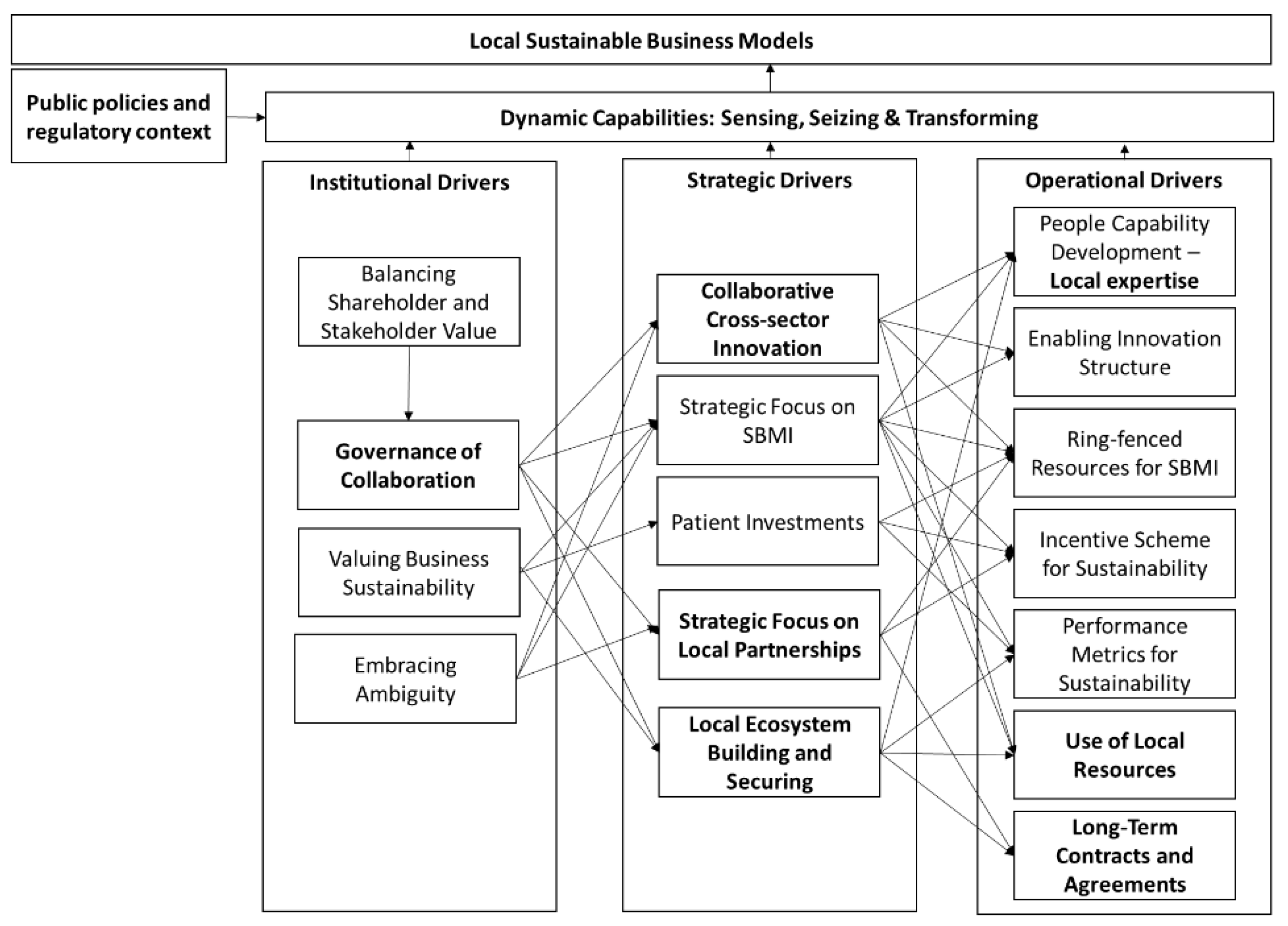

4. Findings

4.1. Governance of Collaboration for a Local Sustainable Energy Ecosystem

4.1.1. Sigma—Shifting to a Local Decarbonized Gas

4.1.1. Beta—Embedding Local Energy into the Wood Ecosystem

4.2. Governing the Interdependencies—Securing Collaboration

4.3. Governance of Collaboration—Securing Collaboration

5. Conclusions—Discussion

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| Case study | Organization (and role) |

Role of the interviewee | Date of the interview |

|---|---|---|---|

| Beta | ADEME – regional office (French expertise center for the ecological transition) |

Renewable and waste energy missions | June 19th, 2020 |

| Beta | Beta metropolis – energy department | Management of the Public Service Delegation contract | June 18th, 2020 |

| Beta | Beta metropolis – environment department | In charge of the ecological transition roadmap | June 22nd, 2020 |

| Beta | HeatCo (district heating operator) |

Boiler supervisor | June 18th, 2020 |

| Beta | HeatCo (district heating operator) |

Head of HeatCo | June 18th, 2020 |

| Beta | Woodpro | Energy purchaser for HeatCo | June 2nd, 2020 |

| Beta | Albea | Consultant helping the metropolis on its ecological transition | June 26th, 2020 |

| Beta | NationalForestCorp – regional office (national French wood-energy management organization) |

East agency supervisor | June 29th, 2020 |

| Beta | WoodIndustryAssoc (regional interprofessional organization for wood) |

Regional wood-energy supervisor | June 30th, 2020 |

Appendix B

| Case study | Organization (and role) |

Role of the interviewee | Date of the interview |

|---|---|---|---|

| Sigma | TerraAgency (regional development agency) | Director of the Energy and Sustainable Solutions branch | July 5th, 2023 |

| Sigma | Subsidiary of company E | Business developer | October 23rd, 2023 |

| Sigma | Subsidiary of company E | Business developer | November 3rd, 2022 |

| Sigma | Subsidiary of company E | Strategy advisor | October 21st, 2022 |

References

- Huovila, A.; Siikavirta, H.; Antuña Rozado, C.; Rökman, J.; Tuominen, P.; Paiho, S.; Hedman, Å.; Ylén, P. Carbon-neutral cities: Critical review of theory and practice. Journal of Cleaner Production 2022, 341, 130912. [Google Scholar] [CrossRef]

- Ulpiani, G.; Vetters, N.; Melica, G.; Bertoldi, P. Towards the first cohort of climate-neutral cities: Expected impact, current gaps, and next steps to take to establish evidence-based zero-emission urban futures. Sustainable Cities and Society 2023, 95, 104572. [Google Scholar] [CrossRef]

- Bocken, N. M. P.; Schuit, C. S. C.; Kraaijenhagen, C. Experimenting with a circular business model: Lessons from eight cases. Environmental Innovation and Societal Transitions 2018, 28, 79–95. [Google Scholar] [CrossRef]

- Massa, L.; Tucci, C. L.; Afuah, A. A Critical Assessment of Business Model Research. Academy of Management Annals 2017, 11(1), 73–104. [Google Scholar] [CrossRef]

- Demil, B.; Lecocq, X. Business Model Evolution: In Search of Dynamic Consistency. Long Range Planning 2010, 43(2–3), 227–246. [Google Scholar] [CrossRef]

- Osterwalder, A.; Pigneur, Y. Business Model Generation: A Handbook for Visionaries, Game Changers, and Challengers; John Wiley & Sons, Inc.: Hoboken, United-Stated of America, 2010. [Google Scholar]

- Bocken, N. M. P.; Short, S. W.; Rana, P.; Evans, S. A literature and practice review to develop sustainable business model archetypes. Journal of Cleaner Production 2014, 65, 42–56. [Google Scholar] [CrossRef]

- Lüdeke-Freund, F.; Carroux, S.; Joyce, A.; Massa, L.; Breuer, H. The sustainable business model pattern taxonomy—45 patterns to support sustainability-oriented business model innovation. Sustainable Production and Consumption 2018, 15, 145–162. [Google Scholar] [CrossRef]

- Coffay, M.; Bocken, N. M. P. Sustainable by design: An organizational design tool for sustainable business model innovation. Journal of Cleaner Production 2023, 427, 139294. [Google Scholar] [CrossRef]

- Bocken, N. M. P.; Geradts, T. H. J. Barriers and drivers to sustainable business model innovation: Organization design and dynamic capabilities. Long Range Planning 2020, 53(4), 101950. [Google Scholar] [CrossRef]

- Aggeri, F.; Beulque, R.; Micheaux, H. L’économie circulaire; La Découverte: Paris, France, 2023. [Google Scholar]

- Brown, P.; Von Daniels, C.; Bocken, N. M. P.; Balkenende, A. R. A process model for collaboration in circular oriented innovation. Journal of Cleaner Production 2021, 286, 125499. [Google Scholar] [CrossRef]

- Schultz, F. C.; Valentinov, V.; Kirchherr, J.; Reinhardt, R. J.; Pies, I. Stakeholder governance to facilitate collaboration for a systemic circular economy transition: A qualitative study in the European chemicals and plastics industry. Business Strategy and the Environment 2023, 33(3), 2173–2192. [Google Scholar] [CrossRef]

- Arfaoui, N.; Le Bas, C.; Vernier, M.-F.; Vo, L.-C. How do governance arrangements matter in the circular economy? Lessons from five methanation projects based on the social-ecological system framework. Ecological Economics 2022, 197, 107414. [Google Scholar] [CrossRef]

- Bourdin, S.; Colas, M.; Raulin, F. Understanding the problems of biogas production deployment in different regions: Territorial governance matters too. Journal of Environmental Planning and Management 2020, 63(9), 1655–1673. [Google Scholar] [CrossRef]

- Gomes, L. A. de V.; Farago, F. E.; Facin, A. L. F.; Flechas, X. A.; Silva, L. E. N. From open business model to ecosystem business model: A processes view. Technological Forecasting and Social Change 2023, 194, 122668. [Google Scholar] [CrossRef]

- Madsen, H. L. Business model innovation and the global ecosystem for sustainable development. Journal of Cleaner Production 2020, 247, 119102. [Google Scholar] [CrossRef]

- Balest, J.; Pisani, E.; Vettorato, D.; Secco, L. Local reflections on low-carbon energy systems: A systematic review of actors, processes, and networks of local societies. Energy Research & Social Science 2018, 42, 170–181. [Google Scholar] [CrossRef]

- Chesbrough, H. The role of the business model in capturing value from innovation: Evidence from Xerox Corporation’s technology spin-off companies. Industrial and Corporate Change 2002, 11(3), 529–555. [Google Scholar] [CrossRef]

- Rayna, T.; Striukova, L. 360° Business Model Innovation: Toward an Integrated View of Business Model Innovation: An integrated, value-based view of a business model can provide insight into potential areas for business model innovation. Research-Technology Management 2016, 59(3), 21–28. [Google Scholar] [CrossRef]

- Hamelink, M.; Opdenakker, R. How business model innovation affects firm performance in the energy storage market. Renewable Energy 2019, 131, 120–127. [Google Scholar] [CrossRef]

- Amit, R. H.; Zott, C. Business Model Innovation: Creating Value in Times of Change. SSRN Electronic Journal 2010. [Google Scholar] [CrossRef]

- Boons, F.; Lüdeke-Freund, F. Business models for sustainable innovation: State-of-the-art and steps towards a research agenda. Journal of Cleaner Production 2013, 45, 9–19. [Google Scholar] [CrossRef]

- Lygnerud, K. Challenges for business change in district heating. Energy, Sustainability and Society 2018, 8(1), 20. [Google Scholar] [CrossRef]

- Lüdeke-Freund, F.; Dembek, K. Sustainable business model research and practice: Emerging field or passing fancy? Journal of Cleaner Production 2017, 168, 1668–1678. [Google Scholar] [CrossRef]

- Li, X.; Zhang, L.; Cao, J. Research on the mechanism of sustainable business model innovation driven by the digital platform ecosystem. Journal of Engineering and Technology Management 2023, 68, 101738. [Google Scholar] [CrossRef]

- Neumeyer, X.; Santos, S. C. Sustainable business models, venture typologies, and entrepreneurial ecosystems: A social network perspective. Journal of Cleaner Production 2018, 172, 4565–4579. [Google Scholar] [CrossRef]

- Oskam, I.; Bossink, B.; de Man, A.-P. (2021). Valuing Value in Innovation Ecosystems: How Cross-Sector Actors Overcome Tensions in Collaborative Sustainable Business Model Development. Business & Society 2021, 60(5), 1059–1091. [Google Scholar] [CrossRef]

- Raulet-Croset, N. La question du territoire en sciences de gestion – Point de vue sur le territoire comme ressource pour les organisations. Question(s) de management 2021, 33(3), 33–36. [Google Scholar] [CrossRef]

- Shrivastava, P.; Guimarães-Costa, N. Achieving environmental sustainability: The case for multi-layered collaboration across disciplines and players. Technological Forecasting and Social Change 2017, 116, 340–346. [Google Scholar] [CrossRef]

- Korhonen, J.; Nuur, C.; Feldmann, A.; Birkie, S. E. Circular economy as an essentially contested concept. Journal of Cleaner Production 2018, 175, 544–552. [Google Scholar] [CrossRef]

- Abreu, M. C. S. de; Ceglia, D. On the implementation of a circular economy: The role of institutional capacity-building through industrial symbiosis. Resources, Conservation and Recycling 2018, 138, 99–109. [Google Scholar] [CrossRef]

- Cramer, J. Effective governance of circular economies: An international comparison. Journal of Cleaner Production 2022, 343, 130574. [Google Scholar] [CrossRef]

- Dagilienė, L.; Varaniūtė, V.; Bruneckienė, J. Local governments’ perspective on implementing the circular economy: A framework for future solutions. Journal of Cleaner Production 2021, 310, 127340. [Google Scholar] [CrossRef]

- Provan, K. G.; Kenis, P. Modes of Network Governance: Structure, Management, and Effectiveness. Journal of Public Administration Research and Theory 2007. [Google Scholar] [CrossRef]

- Assens, C.; Coléno, F. Organiser un réseau d’acteurs pour préserver et/ou valoriser le bien commun. In Dynamiques collectives et territoires 9 défis pour des territoires compétitifs, innovants et durables; Albert-Cromarias, A., Albertini, T., Terramorsi, P., Eds.; ISTE: London, UK, 2023 ; Volume 3, pp. 27-40.

- Assens, C.; Courie Lemeur, A. De la gouvernance d’un réseau a la gouvernance d’un réseau de réseaux. Question(s) de management 2014, 8(4), 27–36. [Google Scholar] [CrossRef]

- Bridoux, F.; Stoelhorst, J. W. Stakeholder governance: Solving the collective action problems in joint value creation. Academy of Management Review 2022. [Google Scholar] [CrossRef]

- Bauwens, T.; Gotchev, B.; Holstenkamp, L. What drives the development of community energy in Europe? The case of wind power cooperatives. Energy Research & Social Science, 2016, 13, 136–147. [Google Scholar] [CrossRef]

- Fagerström, A.; Seadi, T. A.; Rasi, S.; Briseid, T. The role of Anaerobic Digestion and Biogas in the Circular Economy. IEA Bioenergy Task 2018, 37(8). [Google Scholar]

- Net Zero by 2050—A Roadmap for the Global Energy Sector. Available online: Net Zero by 2050 – Analysis - IEA (accessed on 10.05.2024).

- Pettigrew, A. M. Longitudinal Field Research on Change: Theory and Practice. Organization Science 1990, 1(3), 267–292. [Google Scholar] [CrossRef]

- Langley, A. Strategies for Theorizing from Process Data. The Academy of Management Review 1999, 24(4), 691. [Google Scholar] [CrossRef]

- Dumez, H. Méthodologie de la recherche qualitative : Les questions clés de la démarche compréhensive; Vuibert: Paris, France, 2016. [Google Scholar]

- Dana, L.-P.; Dumez, H. Qualitative research revisited: Epistemology of a comprehensive approach. International Journal of Entrepreneurship and Small Business 2015, 26, 154–170. [Google Scholar] [CrossRef]

- Bilal, M.; Khan, K. I. A.; Thaheem, M. J.; Nasir, A. R. Current state and barriers to the circular economy in the building sector: Towards a mitigation framework. Journal of Cleaner Production 2020, 276, 123250. [Google Scholar] [CrossRef]

- Leendertse, W. L.; Schäffner, M. E. M.; Kerkhofs, S. Introducing the circular economy in road construction. In Proceedings of the Sixth International Symposium on Life-Cycle Civil Engineering, Ghent, Belgium, 28-31 October 2018. [Google Scholar]

- Ntsondé, J.; Aggeri, F. Stimulating innovation and creating new markets – The potential of circular public procurement. Journal of Cleaner Production 2021, 308, 127303. [Google Scholar] [CrossRef]

- Circular economy action plan. Available online: https://environment.ec.europa.eu/strategy/circular-economy-action-plan_en (accessed on 10.05.2024).

| Criteria | Lead Role Governance | Shared Governance |

|---|---|---|

| Roles of Manager | Stewards whose authority is delegated by stakeholders | One decision-maker among many stakeholders |

| Decision-Making | Stakeholders have a role in decision-making | Equal participation of stakeholders in decision-making |

| Monitoring and Sanctions | Stakeholders and managers collaborate in monitoring and sanctions | Collaborative monitoring and sanctions by all stakeholders |

| Conflict Resolution Mode | Managers remain accountable to stakeholders | Stakeholders negotiate and resolve conflicts collectively |

| Distribution of Joint Value Created | Stakeholders reach agreements on value distribution | Stakeholders collectively agree on value distribution |

| Trust | Low to moderate, requires trust in stakeholders and managers | High, built on trust among all stakeholders involved |

| Number of Participants | Moderate to many. The lead structure can effectively manage a higher number of diverse participants. | Few, to promote efficiency, effective communication, equal participation, resource optimization, trust-building, and goal alignment among network members. |

| Goal Consensus | Moderate, suggesting that the lead structure takes the lead in setting network-level goals and direction. | High, indicating a strong agreement among participants on network-level goals and objectives. |

| Need for Network-Level Competencies | Moderate to strong to effectively coordinate and govern the network. These competencies are essential for managing the complexities of the network structure. | Little, as the collaborative nature of decision-making and coordination may not require extensive specialized skills at the network level. |

| Features | AD system | DH system |

|---|---|---|

| Ownership of the energy system | Private/Public-Private | Public: public service owned by a local authority but operated by a mandated private operator |

| Contract for operating the energy system | Long-term contract (15-20 years) | Usually long-term contract (20 years), depending on the sharing of the investments. Between the public authority and the private operator |

| Customers of the energy system | Depends on the country (private end-users - Government) | Building owners, buying heat from the private operator |

| Pricing of the energy | Fixed price according to feed-in tariffs/ Green Certificates | Two parts: fixed part for the investments, variable part for the energy |

| Context | Rural | Urban |

| Criteria | AD | DH |

|---|---|---|

| Description of the collaboration | Interdependencies between energy, agriculture, bio-waste sectors and the methanization plant | Interdependencies between the wood-energy sector and the DH system structuring the wood-energy sector |

| Roles of the manager | Project management representative for each stakeholder (TerraAgency, Company E, CivicEco, Durabio). | No defined manager. Purchase center as an interface between DH and the wood-energy sector. |

| Decision-making | Negotiations between the stakeholders | Negotiations between the stakeholders |

| Monitoring and sanctions | Collaborative monitoring among stakeholders on supply of biowaste | Negotiated sanctions on wood-energy supply. Monitoring by the purchase center |

| Conflict resolution mode | Negotiations between the representative of each stakeholder | Not studied |

| Distribution of Joint Value Created | Distribution of value through ownership shares of capital and agreements among stakeholders. As well as specific contract agreement between supply of biomethane and biowaste | Sharing of the value through a cascade of long-term contracts securing the wood-energy sector |

| Level of trust needed | Moderate to high, built on formal agreements and collaboration among stakeholders. | Low to moderate between the DH and the wood-energy sector (formal contracts) Moderate to high within the wood-energy sector (ecosystem structuration) |

| Number of participants | Few to moderate, involving stakeholders in the energy and biowaste sectors in the capital, as well as a public development agency | Few to limit the resources needed for negotiations between DH and the wood-energy sector. Many in the wood-energy sector – participating through representatives |

| Need for a goal consensus | Moderate, with the lead structures (TerraAgency and Company E) setting network-level goals and direction in collaboration with other stakeholders | Moderate, DH sets the needs and the wood-energy sector structures itself accordingly |

| Need for network-level competencies | Moderate to high, requiring negotiation skills and coordination among diverse stakeholders to overcome challenges and adapt to regulatory frameworks | Moderate to high, need to negotiate effectively with unusual stakeholders, to adapt to the requirements of the wood-energy sector, to secure the collaboration, etc. |

| 1 | Territory in the article is a social construction encompassing the local actors and resource flows. It does not refer to any administrative structure. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).