1. Introduction

In recent years, climate change has led to the frequent occurrence of extreme weather events, which has garnered widespread attention. Extreme weather has emerged as a significant impediment to global economic development and has become a crisis for property owners and insurers.

As losses from extreme weather events such as floods, hurricanes, cyclones, droughts, and wildfires are expected to intensify and the insurance protection gap is set to widen further, the property insurance industry currently faces a dual crisis in terms of profitability for insurers and affordability for property owners. Consequently, the insurance industry needs to adapt existing insurance business models, develop insurance and protection models, enhance the capacity of insurers, provide appropriate customer services, and promote ecosystem building. In this way, the three main stakeholders, namely insurers, customers, and ecosystems, can better adapt to extreme weather issues.

Extreme weather events are generally defined as meteorological events that are historically rare, such as extreme high temperatures, extreme low temperatures, extreme droughts, extreme precipitation, and so on. These events occur in a specific area within a certain period of time, and their probability of occurrence is usually less than 5 or 10 percent. However, extreme weather events have become more frequent in recent years, with recent occurrences significantly breaking long-standing records. A recent report released by the Swiss Re Institute shows that global insured losses from natural disasters reached

$42 billion in the first half of 2021, mainly due to the impact of winter cold snaps, hail, and wildfires. As we progress into the second half of the year, extreme weather events continue to unfold globally. In 2021, global natural catastrophes totaled

$270 billion in economic losses, of which insured losses amounted to approximately

$111 billion, the fourth-highest loss year in sigma’s recorded history, continuing a long-term trend of global insured losses increasing by an average of 5 to 7 percent per year. As we move further into the second half of the year, extreme weather events continue to occur globally, and climate change is expected to lead to more frequent and extreme weather events. In disaster-prone regions, growing populations, rapid urban development, and the continued accumulation of economic wealth are all contributing to a continuous rise in catastrophe losses. 2021 was a year of catastrophes, with devastating floods in Europe, China, the US, and elsewhere. Major flooding in eastern Australia in the first quarter of 2022 has already caused widespread damage and significant insurance losses [

1].

New research reveals that as the world warms, New Zealand will face more extreme rainfall and extreme drought. Researchers from the University of Waikato, the New Zealand Institute of Atmospheric and Water Resources (NZIAWR), and the University of Canterbury have quantified how New Zealand’s uneven annual rainfall will change with global warming. They accomplished this by calculating how often New Zealand will experience extreme high and low rainfall under global warming scenarios using larger-than-usual climate model data. Project leader Luke Harrington, a senior lecturer in climate change at the University of Waikato’s Faculty of Science, stated that as global warming occurs, many parts of New Zealand will experience significant changes in rainfall during both the wettest and driest periods, even though there will only be small changes in average annual rainfall. According to climate model projections, with global temperatures 3 degrees Celsius above pre-industrial levels, some parts of New Zealand are likely to receive at least 10 percent more rainfall during the wettest season of the year than they currently do, while rainfall during the driest season is likely to decrease by at least 10 percent. Research team member, University of Canterbury Professor Dave Frem said that as temperatures continue to rise, it can be expected that many areas of New Zealand will be simultaneously in a “wet areas getting wetter and dry areas getting drier” predicament [

2].

In June of this year, many parts of the United States experienced severe weather. Extreme heat swept through Arizona, New Mexico, and parts of Texas, Colorado, and Kansas. Meanwhile, the Pacific Northwest witnessed unseasonably cold weather, with a band of snowfall moving toward the northern Rocky Mountains and heavy rainfall expected from the northern Great Plains region to the Upper Midwest. More than 63 million people were under a heat advisory from the Southwest northward all the way to Denver and Chicago. Temperatures in Phoenix had reached 44.4 degrees Fahrenheit and lasted for more than a day. Weather Service forecasters said that the average temperature in Phoenix during the first two weeks of June was 3.1 degrees Celsius higher than usual, making it the hottest first half of June on record [

3].

Abnormal ecological deterioration and the frequent occurrence of natural disasters have led to an increase in the types of extreme weather risks. The complexity is becoming more prominent, the conductivity is significantly increasing, and the impact is gradually magnified. Under the influence of extreme weather, people’s property losses are incalculable. Insurance has become a lifeline after disasters, providing a certain degree of protection for the property safety of residents in disaster areas. At the same time, in the face of the devastated city after the disaster, the government’s post-disaster reconstruction also requires a considerable amount of money. If there is insurance at this time, the government’s pressure will be much smaller. In recent years, global insurance losses caused by natural disasters have repeatedly reached new highs, indicating that the impact of natural disasters is expanding, and the damage to humans is becoming more and more obvious. More people are realizing that with extreme weather becoming more and more frequent, buying an insurance policy is a cost-effective and wise choice. Insurance companies are offering more programs and options to provide people with more protection.

However, the increasing frequency of extreme weather ravaging the world has brought new challenges to the profitability and risk screening ability of the insurance industry. Facing the growing incidence of severe weather and the unprecedented sky-high claims it brings, the insurance industry is under tremendous pressure and challenges. As more and more natural disasters have changed from “once in a century” to “once in ten years” and from “once in ten years” to “once in a year”, the value of assets has been greatly affected. Given the rising vulnerability to natural disasters and the increasing cost of insurance claims, the current catastrophe insurance coverage and reserves are far from adequate as the value of assets has been significantly affected by natural disasters that have changed from “once in a century” to “once in a decade” or “once in a decade” to “once in a year”. It is understood that global warming is still ongoing, and the future climate will only become more and more variable. Humans are no strangers to extreme weather, but climate change has undoubtedly increased the frequency and severity of extreme weather. Insurance companies are facing more challenges and risks. While insurers are highly vulnerable to climate change, they are also increasingly recognizing the potential of natural disaster events and realizing that the cost of future natural disasters is rising. Changnon et al. [

4] mentioned in their study that faced with numerous extreme weather phenomena, the insurance industry is urgently seeking to identify the causes and develop a plan to try to more effectively integrate weather and climate information into its operations to face these extremes. Accordingly, how to minimize risk exposure and maintain sustainable solvency has become a key concern for the insurance industry in recent years [

5]. To achieve risk reduction, weather data and damage forecasts that are updated more frequently and predicted more accurately are crucial for the insurance industry.

Most of the current literature discusses the causes of extreme weather, such as global warming, how to avoid extreme weather, and how to mitigate global warming through carbon reduction and other means. However, there is less discussion on how insurance companies choose whether or not to insure in a certain region in the face of increasing extreme weather and other risk-mitigating countermeasures. Based on this, this study conducts simulation modeling on whether insurance companies should take out insurance in regions where extreme risks have occurred and obtains conclusions through experimental data analysis. This is to facilitate insurance companies to judge the proportion of risks and benefits and be able to make judgments more accurately to expand profits and reduce risks.

The remainder of this paper is organized as follows. In

Section 2, new thinking is presented based on the existing literature.

Section 3 discusses the models and methods employed in this article.

Section 4 is dedicated to simulation and prediction. On this basis, in

Section 5, the experimental results are analyzed and relevant suggestions are proposed.

2. Literature Review

Numerous studies have explored the impacts of extreme weather events on the insurance industry and the industry’s responses, including climate change adaptation instruments. Kraehnert et al. [

6] examined the current status of insurance against extreme weather events. They analyzed the advantages and limitations of three major types of insurance, namely indemnity-based insurance, index-based insurance, and insurance-linked securities, and put forward some policy recommendations by reviewing the current situation. Specifically, they proposed two main approaches in insurance-linked securities: catastrophe bonds (cat bonds) and weather derivatives. Regarding ILS, Hofmann et al. [

5] contended that ILS are financial instruments whose value is linked to multiple forms of insurance risks. With the continuous progress of current technology, Lyubchich V et al. [

7] suggested that insurance companies are concerned about losses due to underestimation of risks and should assess climate risks from an interdisciplinary perspective using various statistical and machine learning methods. Hermann A et al. [

8] proposed risk transfer methods such as catastrophe bonds and weather derivatives, which can further address the issue of insurance companies’ payouts in the face of extreme weather through risk sharing. Botzen et al. [

9] proposed reinsurance as a strategy that does not compromise the accessibility and affordability of insurance for coping with the increasing risks associated with extreme weather. For the traditional coping strategies of insurance companies, Dlugolecki et al. [

10] stated that insurance companies can manage their exposure to natural disasters through four traditional strategies: limiting their exposure, adjusting premiums, controlling damages, and transferring the risk. Michel-Kerjan et al. [

11] argued that when insurance companies suffer significant losses, they can choose financial instruments such as catastrophe bonds, options, or futures to hedge risks in the capital market, although their use in dealing with large weather risks is still limited.

The Geneva Papers [

12] propose “Insurability of Climate Risks,” which identifies and quantifies the probability of an event occurring and the magnitude of the loss by matching the Pareto distribution to the loss distribution of the largest claim. They also point out that catastrophe risk is virtually non-diversifiable.

The current experience of insurers in the face of extreme weather remains insufficient. Valverde Jr LJ et al. [

13], using an econometric approach to explore the relationship between insurers’ profitability and extreme weather, suggest that the insurance industry has a high level of macro-resilience. They also suggest that insurers cannot grow without a series of price and volume adjustments in the face of extreme weather, as well as changes in regulation and public policy. Regarding the areas where insurers need improvement, Dlugolecki et al. [

14] argue that insurers are not well-prepared to respond to climate change due to factors such as the inapplicability of historical models, incorrect underestimation of risk, excessive risk triggering erroneous reinsurance, low claims handling capacity, and overly generous credit ratings.

Some studies have discussed specific measures for insurers to cope with climate change. Changnon et al. [

4] classify weather insurance into two fundamental types: crop-related and property-related, using the weather insurance industry and its data. The impacts of the two types of insurance are analyzed separately, and countermeasures are proposed for reinsurance, which is considered the primary form of weather insurance. Additionally, specific measures are suggested to address extreme weather events through reinsurance. However, Kunreuther et al. [

15] argue that after costly catastrophe events, the available capital in the reinsurance market is limited, which has some impact on the reinsurance market.

The stable development of the insurance industry cannot be achieved without the assistance of all social forces. In Springer Science & Business Media [

16], from the perspective of the insurance industry, it is suggested that property insurance companies should take active measures to reduce losses to ensure the financial security of property insurance companies and the whole society. They propose effective interaction with insurance interests. The stable operation of the insurance industry cannot be achieved without the help of atmospheric scientists and governmental departments.

In this study, we utilize the BP neural network model, a modeling method, to determine whether the insurance company can make a profit by insuring by comparing the predicted insurance losses with the expected premiums to be received. This helps determine whether the insurance company should insure or not. For the increasingly frequent impacts of extreme weather, we propose methods such as reinsurance and insurance securitization to resolve insurance company property crises through risk transfer and the use of financial instruments to hedge risks in the capital market.

3. Research Methodology

3.1. Assumptions and Justifications

The accuracy of our model is contingent upon several key simplifying assumptions, which are as follows.

(1) For the convenience of calculating the final value coefficient, we assume that n is set to 1.

(2) We suppose that the price of a catastrophe bond can be modeled as a multiple of expected loss, as indicated in the equation.

(3)We assume that disasters occur as discrete downward jumps to the capital stock and can be modelled as Poisson arrivals with a mean arrival rate . Here we assume this probability to be fixed, at least in the short-term. For simplicity, we assume that the loss given event is independent of risk adaptation, i.e., households and firms cannot reduce the damage. is the insurance payout in the event of a disaster and is equal to the total amount of insured capital that is damaged, where indicates the share of damaged capital covered by the insurance. The insurance payout cannot be larger than the damaged capital , therefore . Under these basic

assumptions, we can set about building our model.

(4) We assume that the references and conclusions cited in this paper are reliable and accurate.

(5) We assume that the quantitative data of each indicator can precisely represent the indicator change.

Based on these fundamental assumptions, we can commence building our model.

3.2. Notations

The primary notations used in this paper are listed in

Table 1.

3.3. Data Sources and Processing

This study utilized nearly 20 years of data on losses from natural disasters caused by extreme weather in the United States and New Zealand. Empirically, a larger amount of data has higher accuracy because more years have a more trend effect, which facilitates our modeling for prediction. The relevant disaster and loss data are from Emergency Events Database (EM-DAT)[

16] , NatCatSERVERICE [

17], and Sigma research [

错误!未找到引用源。]. We use the US dollar as the unit of data because it is more representative as an international currency. Disaster-related losses we take the average disaster losses to discuss, which can synthesize the impact of disasters and exclude chance, as well as being more convenient to calculate. Since the adopted data come from different countries and there may be price level differences, we take the U.S. Consumer Price Index as the only measure for conversion.

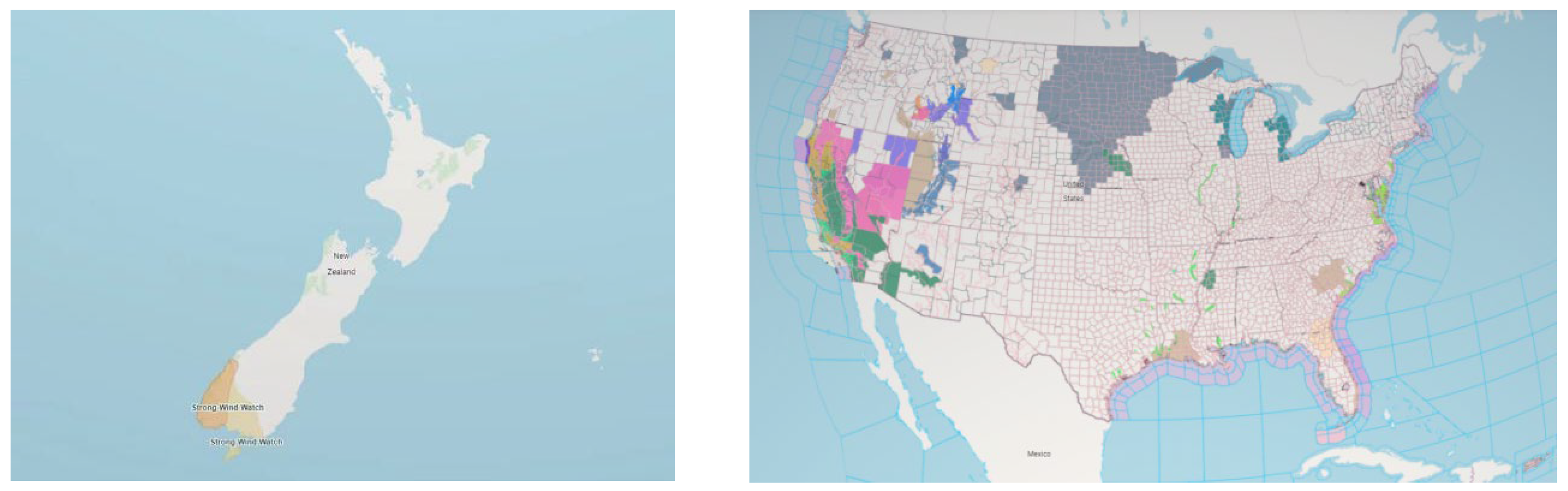

We process raw data collected from a variety of sources to produce high-quality data that is more structured and interpretable. From EM-DAT, we have obtained information on the significant disasters, casualties, and property damage in Texas and New Zealand over the past two decades.

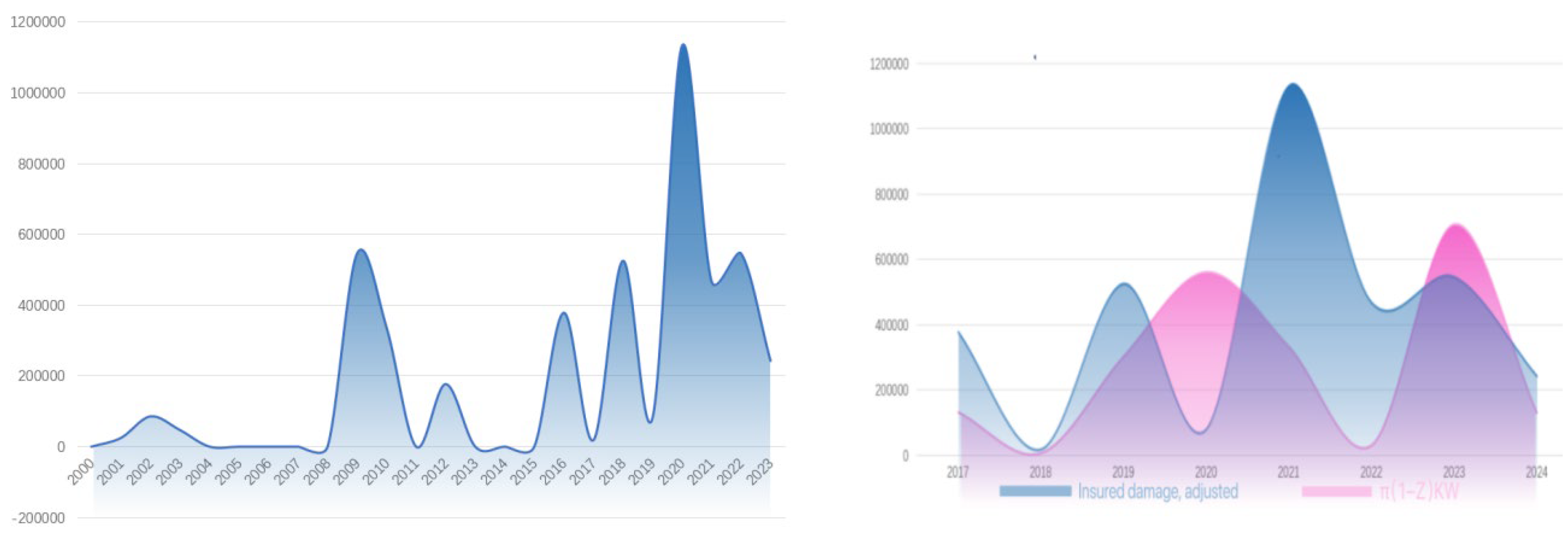

Figure 3

Property loss mainly includes insurance loss, etc. The specific data is shown in the following

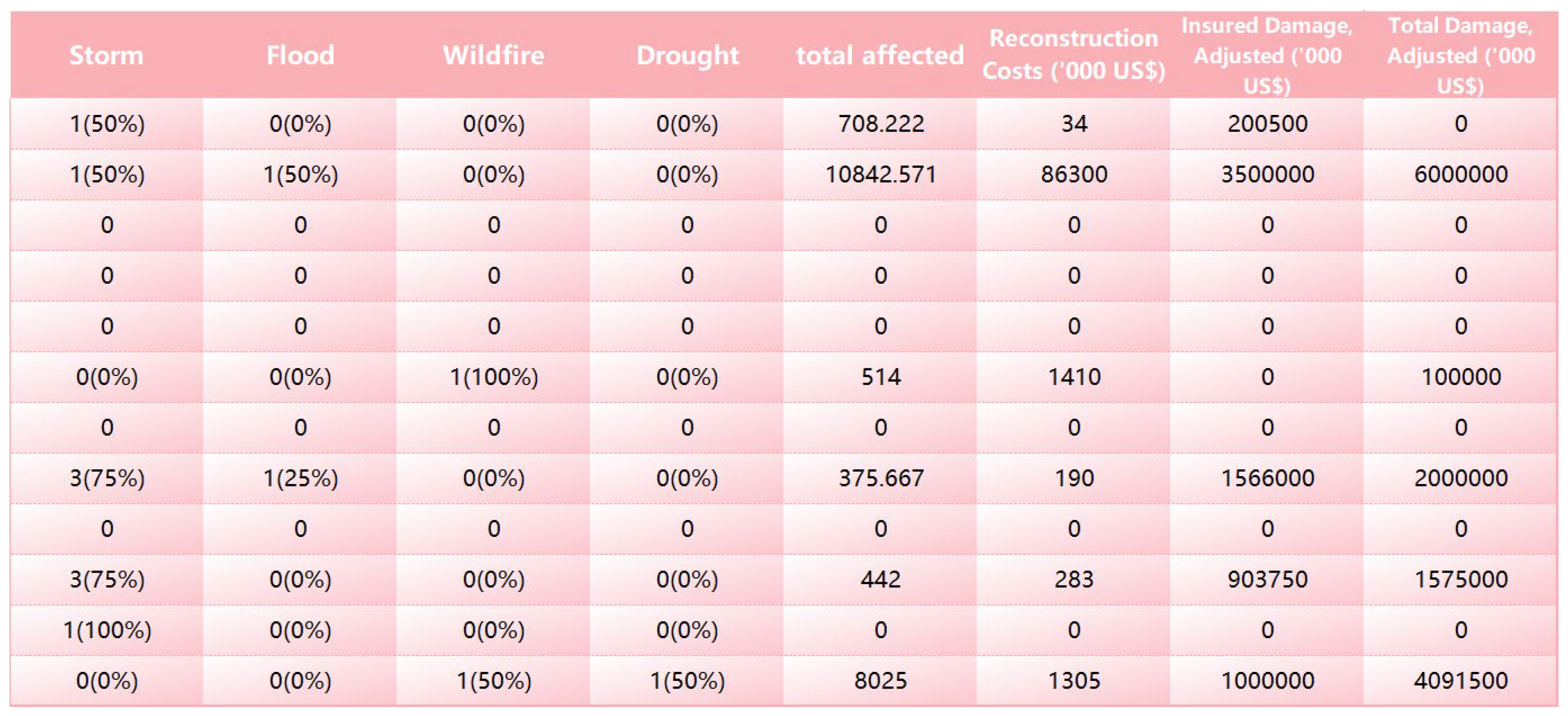

Table 2.

3.4. Research Variables and Rationale

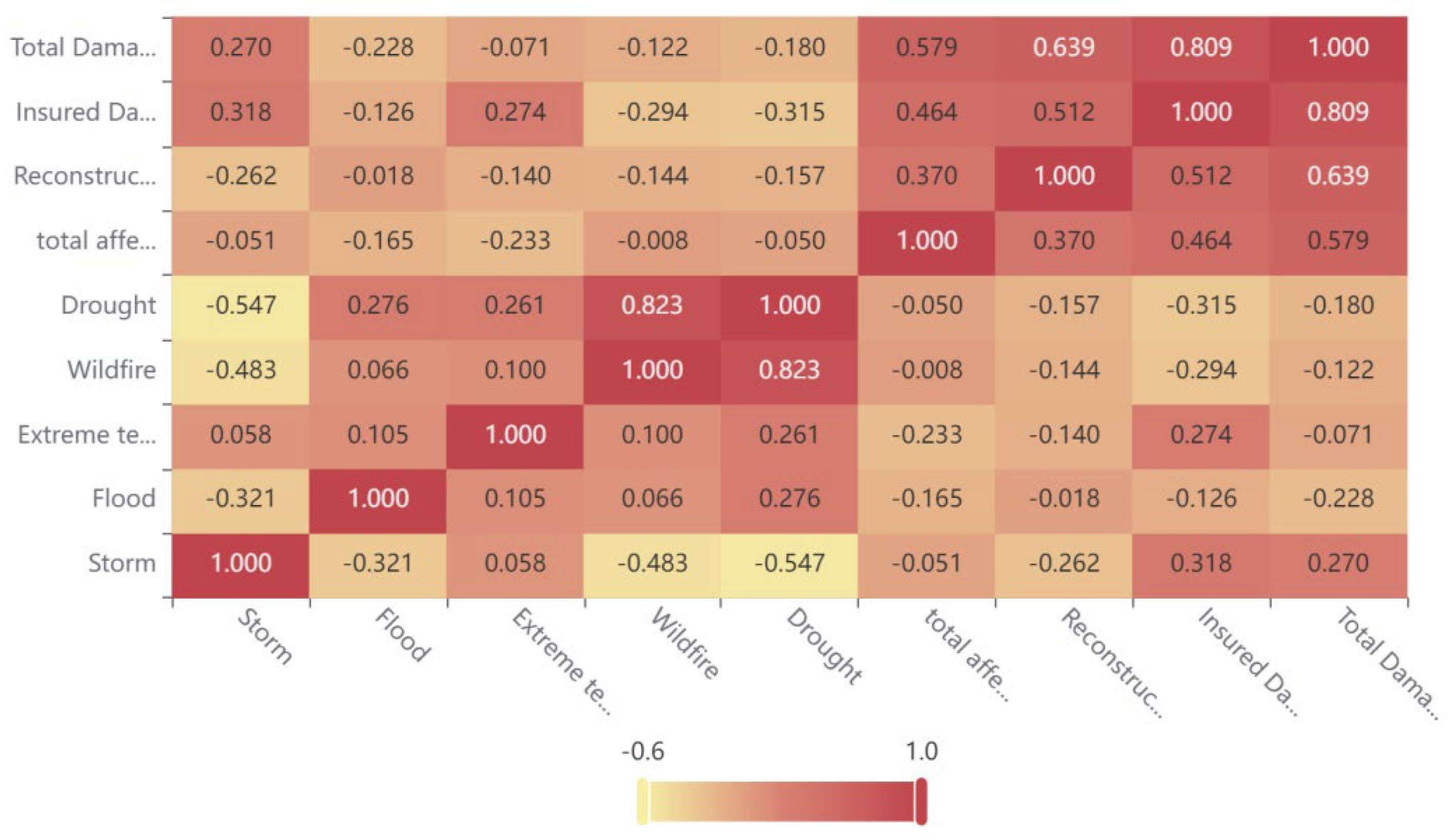

Determine factor weights based on Spearman correlation. Considering that insured losses and total losses are affected by a variety of factors, we assess the magnitude of the weight of each factor through Spearman’s ρ assesses.

From

Figure 4, we can clearly visualize that storms and extremes temperatures have a greater impact on insured damage and total damage compared to the other data. Therefore, we can assign more weights to them in the subsequent model building process.

Based on a review of a large number of studies and relevant papers, we identify the main determinants of the cost of insurance as including the probability of occurrence of extreme-weather events , the insurance risk premium, the share of unimpaired capital , the share of impaired capital covered by insurance , and the total amount of capital that is not subject to a catastrophe . depends on the level of risk aversion of the insurance capital provider.

3.5. Forecast Future Insurance Losses Based on BP Neural Network

This study focuses on the sustainability of the property insurance industry, especially in situations where climate change leads to more natural disasters. They need to determine how to balance risk and return to ensure the long-term health of insurance companies. Previous models often faced limitations due to inadequate or unreliable data, aggregated data at coarse spatial or temporal resolutions and underestimate the tail risk associated with extreme events. Biases can arise from historical data, affecting risk assessments.

Our model will help them decide when to underwrite the policy, when to choose risks, and the role of the owner in it. The model can be used to evaluate whether to insure policies in areas with frequent extreme weather events, such as two regions on different continents.

The model calculates the total premium by predicting future insurance losses and establishing an equation to determine whether to continue underwriting by comparing whether the actual premium received can reach the expected total premium.

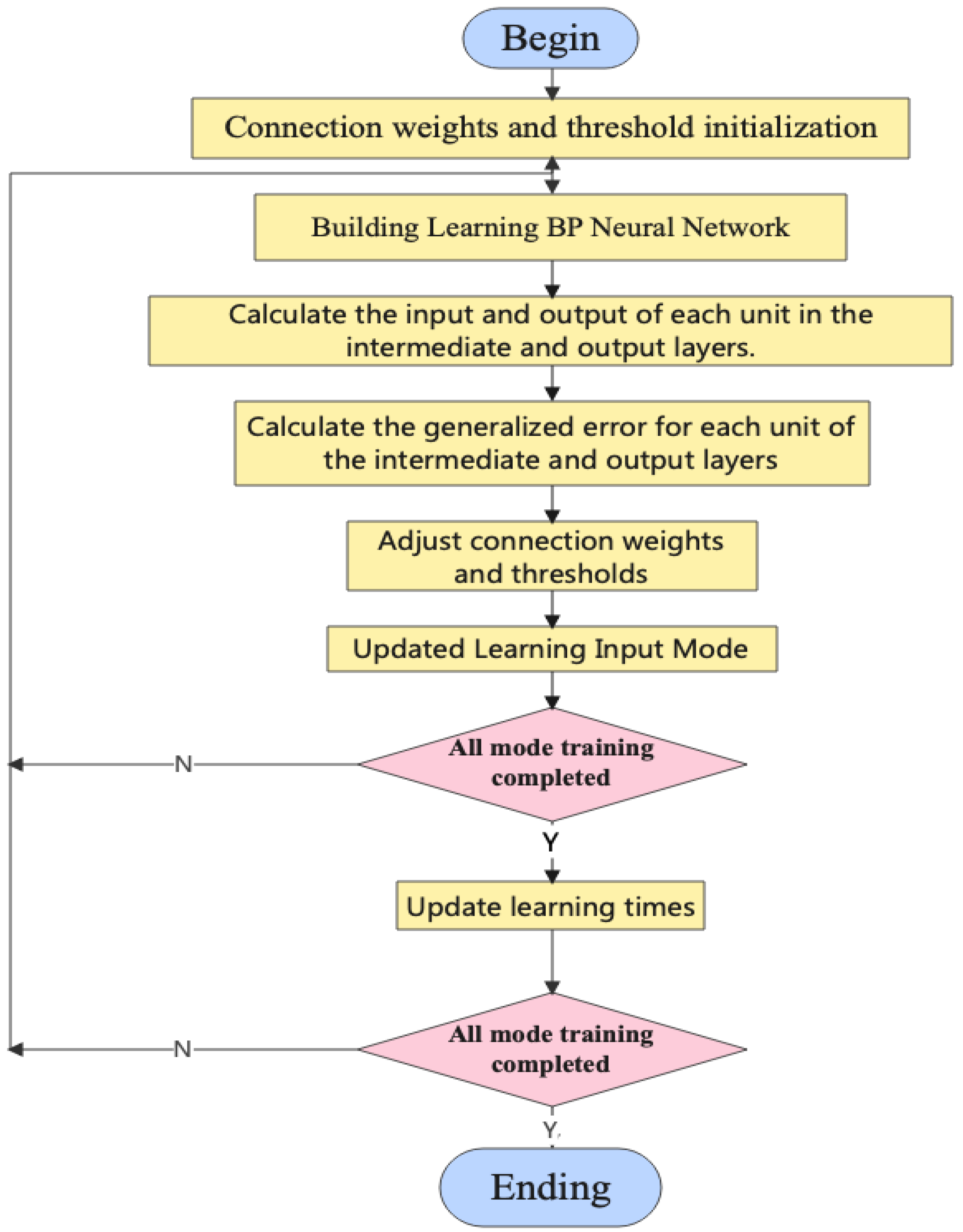

Due to the complexity of the objective and subjective world, it is difficult to predict future insurance coverage losses through traditional linear prediction models. Neural network model is a good way to solve this kind of problem, which is a mathematical model artificially constructed on the basis of human’s understanding of the neural network of the brain to be able to realize a certain function, with a high degree of parallelism, good fault-tolerance, and associative memory. BP learns to get a highly nonlinear mapping between the input and the output through neural network, so using BP neural network can build up a input and output nonlinearity.

The basic flowchart of BP neural network is shown in

Figure 5.

By referring to Linda Fache Rousov á et al.[0] , we refer to the conclusions of one of these studies to construct Eq. In this paper, four indicators, namely, ,,, are selected as input indicators, and the probability of disaster, the loss of insurance caused by the disaster are taken as output indicators, and a BP neural network model is established to analyze and predict whether the place is suitable for insuring or not.

Balance-of-payments equation

According to economics [错误!未找到引用源。],Coefficient of final value of immediate annuity is

(1)

where F/A indicates that the desired is the annuity terminal value factor, i is the interest rate, n is the number of years, the left side of the equation represents the immediate annuity terminal value factor, and the right side of the equation is the specific calculation formula.

Insured loss = share of impaired capital covered by insurance ( W ) * total loss ( Kd ), i.e

(2)

Total cost = variable cost + fixed cost, i.e

(3)

By referring to Linda Fache Rousov á et al.[0] ,We find the relationship with premium and the probability of occurrence of extreme-weather events , the insurance risk premium, the share of unimpaired capital ,i.e

(4)

Combine the above formulas. When the balance is reached, we can get premium × final value coefficient of immediate annuity =risk premium × insured loss + fixed cost, i.e

(5)

where α is the risk premium index, it can be seen that there should be the insurance risk premium α ≥ 1, and the insurance company can be profitable when this given condition is met.

3.6. Insurance Modeling Applications

In this section, we demonstrate our model by choosing New Zealand and the United States, two regions on different continents where extreme-weather events occur, as required by the topic.

Advise insurance companies on whether to underwrite policies

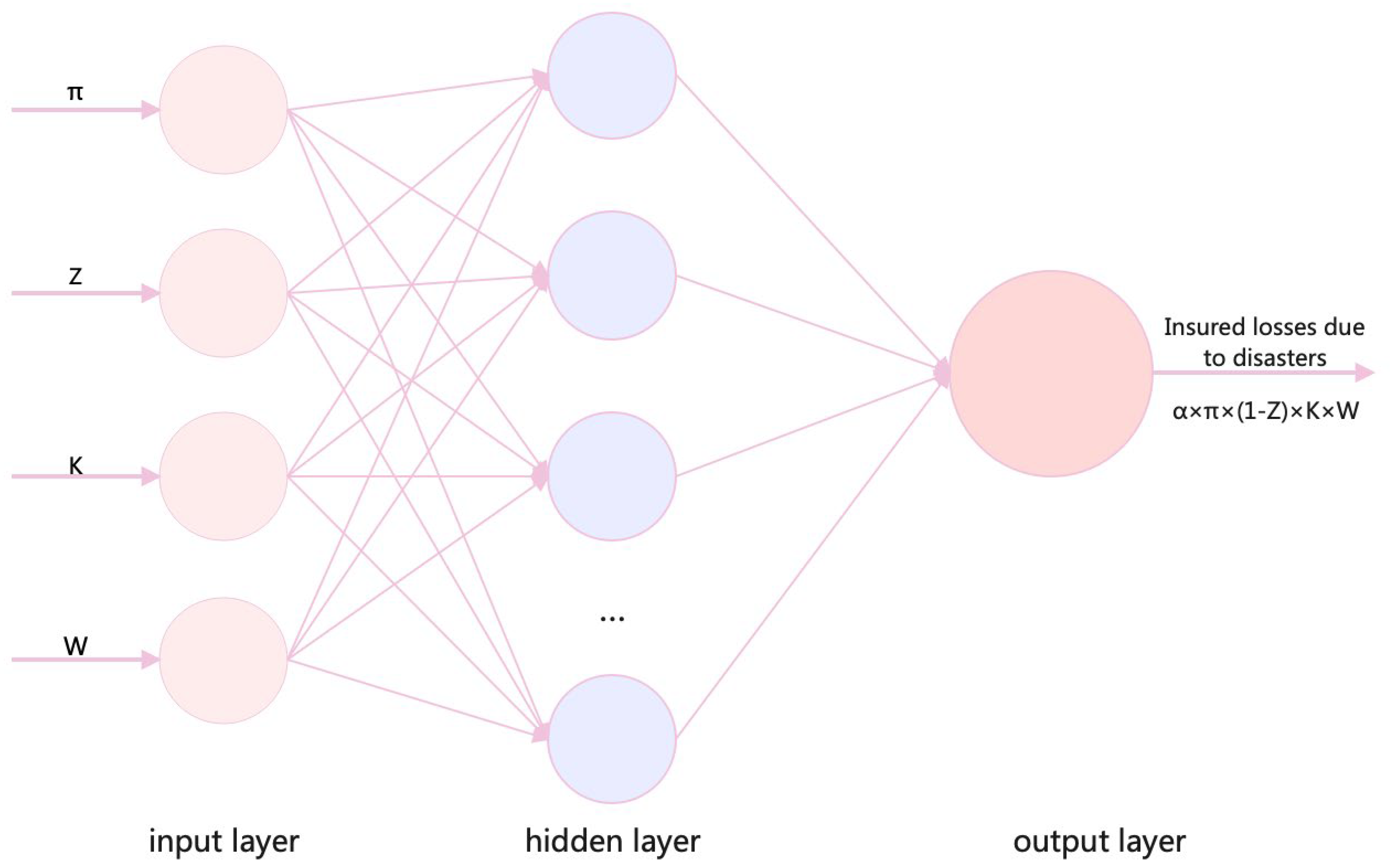

Taking

,

,

,

as inputs and the insurance loss caused by disasters as outputs, the neural network model is established as shown in

Figure 6 below.

We built a 4 × □× 1 model of BP neural network, □ represents the neurons in the middle layer, and the increase in the number of middle layer neurons, although it can improve the mapping accuracy of the network, does not necessarily improve the performance of the network. By assuming a different number of intermediate layer neurons to establish the model, comparing the respective out-of-sample error to get the best network performance of 13 intermediate layer neurons, and then determine the 4 × 13 × 1 BP neural network model, as a way to analyze and predict whether the trained neural network model will be used to analyze and predict whether it should be underwritten.

4. Results and discussion

In this study, we develop a prediction model using back-propagation (BP) neural networks to predict recent insurance loss trends using historical insurance loss data for natural disasters in the United States and New Zealand. By comparing these predictions with actual results, we can assess the consistency of the trends. Insurance companies can utilize this model to proactively determine their underwriting strategy in a given area. This approach not only reduces the reluctance to insure post-disaster areas due to perceived high risk, but also prevents the over-reaching of profits in disaster-prone areas, which can lead to significant economic losses. Our model enables insurers to make informed underwriting decisions in targeted areas by evaluating expected premium returns. This approach enhances the robustness of decisions, reduces exposure to unpredictable risks, and potentially improves profitability.

4.1. Descriptive Statistics

We performed descriptive statistics on the collected data, which had a large upward and downward gap, which is seen to encompass more comprehensive information on climate disaster losses. We counted the losses, modelled them, and used the data on insurance losses for decision-making, which is more relevant.

Table 3

4.2. Analysis of Projected Results

The results of the neural network model solving are shown in

Figure 7 and

Figure 8.

From these two sets of graphs, it can be seen that the BP neural network model is applied to predict the probability of occurrence of extreme-weather events , the share of unimpaired capital, the total amount of capital that is not subject to a catastrophe K, and the share of impaired capital covered by insurance for 2016-2023 using the data from 2005-2015 as the learning material, and the insurance loss caused by disasters is calculated by the formula. Comparing with the insurance loss caused by actual disasters, the trends of both trends are approximate. It is concluded that the model has a good fit and is able to obtain a more accurate prediction, so the idea of predicting insurance losses due to disasters using the values of is reasonable.

In order to facilitate the determination of whether to underwrite policies, we simplify the premium structure, assuming that its unit price is a fixed value a, by predicting the number of policies that can be received, to get the insurance company can receive premium income in the place. Also, the insurance loss obtained through the BP neural network model is brought into Equation (4) to obtain the expected premium income under the profitability condition. Compare whether the premium amount that can be received in the place is up to the expected premium amount or not, so as to decide whether to continue to underwrite the insurance or not.

If the amount of premiums that can be received at the location is greater than or equal to the expected premiums, the insurer should choose to underwrite the policy. If not, the insurer should not choose to underwrite the policy.

4.3. Sensitivity Testing

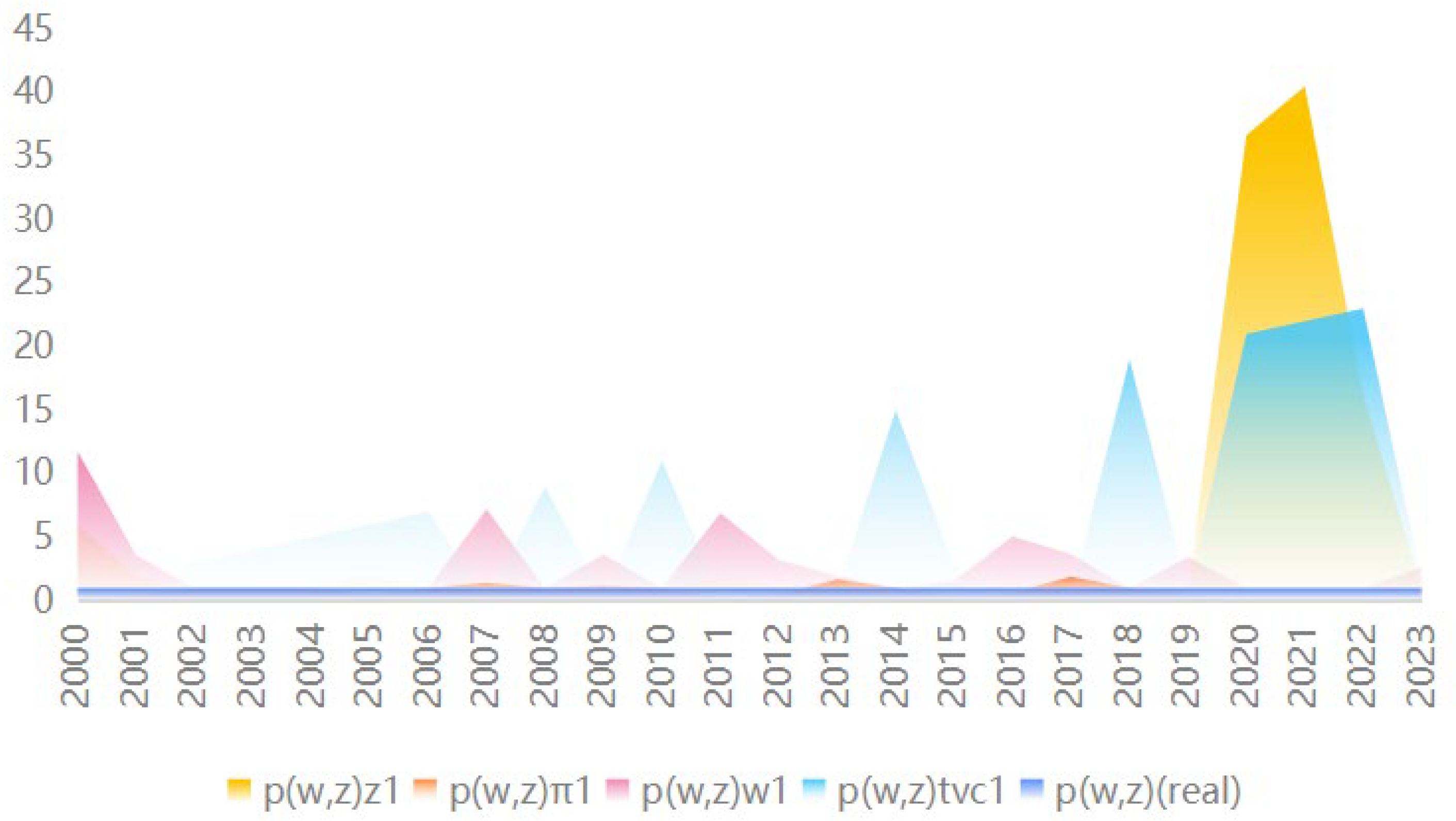

Based on the equation obtained from the balance of payments, we performed sensitivity analysis on and W therein as a means of determining the main factors of property owners that influence insurance companies’ underwriting.

The results obtained from the sensitivity analysis are in

Figure 9.

The figure shows that the fluctuation of π is relatively small, indicating that the modeling is not sensitive to disaster probability. The sensitivities are, in descending order. The degree of influence of the property owner on the insurance company’s underwriting can be determined by the level of sensitivity. Considering the limitations of the property owner’s personal ability, the property owner increases the demand for insurance and then influences the price of premiums mainly by influencing , such as recommending friends around them to take out insurance and allocating more money for premiums.

5. Conclusions and Recommendations

Through the research in this paper, we have actively explored solutions to address the enormous pressure and challenges on the financial stability of insurance companies in the face of increasingly frequent extreme weather and more severe disaster losses. We formulated a formula and constructed a prediction model for determining whether insurance companies should continue to provide insurance in areas where severe weather disasters have occurred and offered some suggestions for insurance companies to make insurance decisions. We used data from the United States and New Zealand for testing and found that the overall trend of insurance losses was consistent with the actual trend, indicating that the prediction has a certain degree of effectiveness. With the forecast results, insurance companies can compare them with the amount of premiums they expect to receive and subtract the manpower and resources required for maintaining customers, etc. By comparing costs with benefits, if costs are greater than benefits, it is not advisable to continue providing insurance in this place in the current year. If benefits are greater than costs, then the policy is profitable and can be implemented. In this way, it can not only prevent insurance companies from missing business opportunities due to having encountered climate disasters and being reluctant to reinsure but also avoid significant losses from climate risks to a certain extent. Overall, obtaining more profits and avoiding large risk losses is extremely beneficial to insurance companies, which is also the purpose of this paper.

5.1. Recommendations to Insurance Companies

In the face of increasingly frequent climate disasters, the following suggestions are offered for insurance companies.

(1) Enhance the risk assessment model by improving data integration and analysis. Establish a comprehensive risk assessment model through the combination of climate change forecasts, historical disaster data, and geographic information systems (GIS). This will enable more accurate assessment of climate risks in different regions and industries. At the same time, make dynamic adjustments to the model and regularly update it to reflect the latest trends in climate change and scientific research results, ensuring the accuracy and timeliness of the assessment. Additionally, conduct scenario analyses and simulations to perform stress tests for different climate scenarios, analyze the impact of potential risks on insurance claims and company finances, and formulate corresponding response strategies.

(2) In the field of insurance product development, innovation is crucial to address the new challenges posed by climate change. This paper advocates the conception and introduction of novel insurance products to reduce climate-related risks. Such innovations include climate adaptation insurance, which aims to insure against specific perils caused by climate change. Additionally, disaster recovery insurance should be considered, which aims to provide financial assistance for losses incurred during the recovery phase of a disaster. It is also recommended that crop climate insurance be developed, which aims to provide income security to agricultural stakeholders based on climate data, thereby reducing the negative impact of climate fluctuations on agricultural endeavors. Moreover, the insurance industry should be encouraged to design customized insurance solutions to meet the diverse needs of different customer segments. By providing personalized insurance solutions, the insurance industry has the potential to increase customer motivation to participate in insurance, thereby creating a more resilient and adaptive social framework in the face of escalating climate risks.

(3) Strengthen cooperation with the government to establish a risk-sharing mechanism and spread climate risks through cooperation, such as jointly financing the establishment of a disaster fund. Actively participate in the formulation of local or national climate policies and disaster management policies to ensure that the voice of the insurance industry is included in the decision-making process. It can also collaborate with local governments to support community infrastructure development and climate adaptation projects to reduce future risks.

(4) Invest in green projects and shift part of the portfolio to green projects such as renewable energy, energy efficiency, and emission reduction to reduce investment risks and promote sustainable development. Meanwhile, actively participate in the green financial market to support climate-friendly investment projects and contribute to the realization of a low-carbon economy.

(5) Set up a specialized climate risk department and a climate risk management team focusing on climate risk assessment, product development, and marketing to ensure the company’s expertise in this area. At the same time, employees should be regularly trained on climate risk and related products to improve the team’s professionalism and enhance their service capabilities.

Through the above measures, insurance companies will be able to respond more effectively to the risks posed by climate change and develop products that meet market demand. At the same time, they will enhance their own risk resistance and sense of social responsibility. This will not only improve the competitiveness of the company but also provide better protection for customers and society in the face of climate change challenges.

In addition to these measures, there are many other options for insurance companies. According to the research of Kraehnert, Kati, Osberghaus, Daniel, Hott, Christian, Habtemariam, Lemlem Teklegiorgis, Wätzold, Frank, Hecker, Lutz Philip, and Fluhrer, Svenja [

6], insurance companies facing climate risk can also opt for risk securitization. In this process, the insurer transfers the risk to a Special Purpose Vehicle (SPV), a separate legal entity that can segregate the risk from the insurer. In exchange, the insurance company pays a premium to the SPV (Charpentier 2008). The SPV then issues securities (catastrophe bonds) to finance the insurance. This diversifies the risk to a certain extent, and the insurance company can also obtain a certain amount of return.

Furthermore, insurance companies can also choose to diversify risk by means of reinsurance. As suggested by Botzen, W.J.W., van den Bergh, J.C.J.M., and Bouwer, L.M., et al. [

9], reinsurance is an insurance policy purchased by the primary insurance company for its own risk and is usually used to transfer risk. It is also an effective way for insurance companies to diversify their risks.

5.2. Policy Recommendations

For local governments, we offer the following recommendations.

(1) Strengthen climate monitoring and early warning systems by investing in technology and infrastructure. Establish and upgrade meteorological observation stations, satellite monitoring systems, and climate data centers to obtain more accurate climate data. Additionally, establish a multi-level early warning mechanism with specific early warning criteria and response measures based on the characteristics of different climate events (such as typhoons, floods, droughts, etc.) to ensure that information can be transmitted to the government and the public at all levels in a timely manner.

(2) Formulate an integrated climate adaptation policy. Conduct a comprehensive assessment of climate vulnerability and evaluate the climate vulnerability of different regions, industries, and communities to identify areas that are most in need of support. At the same time, implement adaptive infrastructure development. Incorporate climate adaptation elements into urban planning and promote green building standards to ensure that new buildings and infrastructure are disaster-resistant. Furthermore, actively promote ecological restoration projects and invest in ecosystem restoration projects such as wetland protection and afforestation to improve the resilience of the natural environment to climate change.

(3) Promote sustainable development policies. Formulate green economy development strategies and encourage businesses and investors to focus on environmental, social, and governance (ESG) standards. Promote the development of a low-carbon economy and green technologies. Also, introduce incentives to motivate enterprises and individuals to invest in renewable energy and energy-saving and emission-reduction projects through financial subsidies and tax incentives.

(4) Strengthen infrastructure development. Assess the performance of existing infrastructure under extreme climate conditions and carry out necessary reinforcement and retrofitting. Promote climate-resilient design and incorporate climate-resilient design principles in the construction of new infrastructure to ensure that it can withstand future climate risks. Additionally, establish emergency response infrastructure such as temporary shelters and emergency water supply facilities to ensure rapid response and relief in the event of a disaster.

Through these detailed measures, the government will be able to respond more effectively to the challenges posed by climate change and improve the overall risk resilience of society. At the same time, it will promote sustainable development and protect the environment and public interests.

Funding

This research is supported in part by the National Natural Science Foundation of China (Grant No. 11501203).

Author contributions

Conceptualization, SW and YZ; methodology, CC and SYF; software, SW; validation, YZ, CC and SYF; formal analysis, SW; investigation, YZ; resources, SYF; data curation, CC and SYF; writing—original draft preparation, SW and YZ; writing—review and editing, CC and SYF; visualization, CC; supervision, SYF; project administration, SW and YZ. All authors have read and agreed to the published version of the manuscript.

Conflict of interest

The authors declare no conflict of interest.

References

- Bevere, L.; Remondi, F. Natural catastrophes in 2021: the floodgates are open. Sigma research. Zurich: Swiss Re Institute; 2022.

- New Zealand’s wettest and driest spells to become more extreme, study warns. WAIKATO. Available online: https://www.waikato.ac.nz/int/news-events/news/new-zealands-wettest-and-driest-spells-to-become-more-extreme-study-warns/ (accessed on 3 July 2024).

- Snow, A. Severe, chaotic weather around US with high temperatures in Southwest and Midwest, snow in Rockies. APNEWS.

- Available online:. Available online: https://apnews.com/article/severe-weather-heat-thunderstorms-cold-snow-8b531511f17a8409914473e230d24301 (accessed on 17 June 2024).

- Changnon SA, Changnon D, Fosse ER et al. Effects of Recent Weather Extremes on the Insurance Industry: Major Implications for the Atmospheric Sciences. Bull. Amer. Meteor. Soc 1997, 78, 425–436. [Google Scholar] [CrossRef]

- Hofmann, A.; Pooser, D. Insurance-linked securities: structured and market solutions. In: Pompella M, Scordis NA (editors). The Palgrave handbook of unconventional risk transfer. Switzerland: Springer Nature; 2017. p. 357–373.

- Kraehnert, K.; Osberghaus, O.; Hott, C.; et al. Insurance Against Extreme Weather Events: An Overview. Review of Economics 2021, 72, 71–95. [Google Scholar] [CrossRef]

- Lyubchich, V.; Newlands, N.K.; Ghahari, A.; et al. Insurance risk assessment in the face of climate change: Integrating data science and statistics. Wiley Interdisciplinary Reviews: Computational Statistics 2019, 11, e1462. [Google Scholar] [CrossRef]

- Hermann, A.; Koferl, P.; Mairhofer, J.P. Climate risk insurance: new approaches and schemes. Economic Research Working Paper. Munich: Allianz; 2016.

- Botzen, W.J.W.; Van den Bergh, J.; Bouwer, L.M. Climate change and increased risk for the insurance sector: a global perspective and an assessment for the Netherlands. Natural hazards 2010, 52, 577–598. [Google Scholar] [CrossRef]

- Dlugolecki, A.F. Climate change and the insurance industry. The Geneva Papers on Risk and Insurance-Issues and Practice 2000, 25, 582–601. [Google Scholar] [CrossRef]

- Michel-Kerjan, E.; Morlaye, F. Extreme events, global warming, and insurance-linked securities: How to trigger the “tipping point”. The Geneva Papers on Risk and Insurance-Issues and Practice 2008, 33, 153–176. [Google Scholar] [CrossRef]

- Charpentier, A. Insurability of climate risks. The Geneva Papers on Risk and Insurance-Issues and Practice 2008, 33, 91–109. [Google Scholar] [CrossRef]

- Valverde Jr, L.J.; Andrews, M.W. Global Climate Change and Extreme Weather: An Exploration of Scientific Uncertainty and the Economics of Insurance. New York: Insurance Information Institute; 2006.

- Dlugolecki, A. Climate Change and the Insurance Sector. Geneva Pap Risk Insur Issues Pract 2008, 33, 71–90. [Google Scholar] [CrossRef]

- Kunreuther, H. Has the time come for comprehensive natural disaster insurance? In: Daniels RJ, Kettl DF, Kunreuther HC (editors). On risk and disaster: lessons from Hurricane Katrina. Philadelphia:University of Pennsylvania Press; 2006. p.175.

- Nutter, F.W. Weather and Climate Extremes: Changes, Variations, and a Perspective from the Insurance Industry. The Journal of Risk and Insurance 2001, 68, 529–531. [Google Scholar] [CrossRef]

- Sigma research.

- Available online:. Available online: https://www.swissre.com/institute/research/sigma-research.html (accessed on 5 February 2024).

- Data on natural disasters since 1980 Munich Re’s.NatCatSERVICE.

- Available online:. Available online: https://www.munichre.com/en/solutions/for-industry-clients/natcatservice.html (accessed on 4 February 2024).

- Inventorying hazards & disasters worldwide since 1988.

- Available online:. Available online: https://www.emdat.be/ (accessed on 5 February 2024).

- Fache Rousová L, Giuzio M, Kapadia S et al. Climate Change, Catastrophes and the Macroeconomic Benefits of Insurance. Luxembourg: Publications Office of the European Union, 2021.

- Mishkin, F.S. The economics money banking financial markets. 12th ed. Beijing: China Renmin University Press (CRUP); 2021. p. 54–70.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).