1. Introduction

The Belt and Road Initiative is one of the most significant development projects in the contemporary global world. Economically, it may provoke increased economic growth and trade by improving social development in developing countries that are project members. Since its inauguration in 2013, the Initiative attracted over 140 countries in Asia, Africa, Europe, and Latin America to participate in infrastructure construction to facilitate economic cooperation between these geographical regions to enhance the exchange of information and expert knowledge [

1]. As much as most discourses on BRI are likely to focus on the economic and infrastructural angles, there has been negligence in profiling the social pillars for change in these nations. Social development, as an indicator of change in living standards, education, health, and other rates of quality of life, has a significant role in human and sustainable development. Thus, this paper aims to examine both the involvement of economic and social drivers and the participation of BRI to analyze social determinants of growth in developing nations.

The experience of developing nations involved in BRI regarding the potential and challenges related to the attempts to strike a balance between economic growth and social sustainability remains significant. This has ensured that foreign direct investment has been encouraged in these nations, with projects aimed at developing infrastructure, improving commerce, and, most importantly, fostering industrialization. However, there is the question of whether these economic developments also entail better social improvements such as improved living standards, quality education (human capital), and better access to health care. In this context, social development is another complex concept that comprehends changes in living standards, equal and reasonable provision of infrastructure services, and other aspects of the overall welfare of society. It is determined by the income, but not only monetary, including the gross domestic product per capita and annual growth rate; the latter depends on the non-economic indicators, like education, health, technology [

2]. While an increasing amount of research has been authored concerning the socio-economic effects of BRI, significant gaps remain in understanding the impacts of BRI on social advancement, specifically in the context of developing countries. To date, the majority of the current research has mainly focused on measures like GDP and expenditure on infrastructure more often than pays attention to social factors of development [

3]. This study aims to address that gap by focusing on the impact of a social composite, which consists of the quality of education, availability, health care, and technological growth, on social development and the conventional economic variables.

Therefore, this present study develops an integrated social growth index. On the other hand, the index accumulates several aspects of social change and human progress, in contrast to the previous works that have analyzed each social factor separately. Hence, this is an integration involvement, offering better comprehensiveness of the concept of social growth. The Technology Innovation Index in this study is an independent variable that measures the relationship of technology breakthroughs to the development of societies through cross-border partnerships through BRI. Thus, even when technological advancement is viewed as a solution for economic development [

4]. The link between welfare and social development within society is difficult to decipher, and this research aims to argue for it. This study attempts to add to the current knowledge about social growth in developing countries included in the BRI when investigating the nature and relationship of economic and non-economic factors. Indeed, it examines the effect of education quality, health, and technological advancement on social development while engaging with economic predictors such as GDP per capita, GDP growth rate, inflation, and FDI. They also look at the interactions and the potential relationships between these characteristics and their relationship to associated tradeoffs. The study acknowledges, therefore, that economic growth is welcome to the entire economic platform. However, it carries a social development multiplier or divider depending on spending on human capital and the needed social infrastructure.

This research is further organized as follow: section 2 comprises the literature review. section 3 focuses on data, variables, and econometric models. section 4 is more practical, including empirical results and discussion. section 5 is a conclusion, policy practice, and future research direction.

2. Theoretical and Empirical Related Literature

However, since BRI defines economic and geopolitical environment, it also determines the social environment or community impacting nations in the initiative. Better education, health, and living standards are articulations of this development, not just economic parameters such as GDP per capita and GDP growth. For this reason, we need to understand the dynamics of social development under the BRI strategic framework to formulate sustainable development policies. The section presents the examination of the given theories and empirical findings based on these factors, analyzing the dependent variable of the social growth index, taking into account some essential independent variables such as the quality of education index, technological innovation index, healthcare quality and access index, inflation, GDP per capita, GDP growth, and FDI.

2.1. Theoretical Perspectives on Social Growth

Following the human capital theory, increasing labor productivity and promoting economic growth requires expenditures in health and education [

5]. Education and healthcare should be made better because striving for better education and healthcare brings more extensive social benefits, including better revenues, innovations, and overall socioeconomic results. Education helps people learn and be creative, while improved health makes people work harder and live longer [

6]. In developing nations participating in the BRI, human capital is a crucial determinant of growth since a healthier and more educated populace will optimize the benefits of BRI initiatives. Endogenous growth theory acknowledges the role of technology and human capital as key ingredients of enduring growth [

7]. Unlike past concepts that point out the foreign causes of efficiency, this one suggests that future accretions to knowledge, research, development, and teaching can help steadily improve productivity. The technological innovation index, focal to this study, captures the soul of this idea, especially in the BRI context, where infrastructural projects and cross-border collaborations aim to disseminate innovation. Technology affects the economy and boosts living quality by improving health, education, and information competence [

8].

Modernization theory asserts that as the economy becomes more developed, the social factors in society will alter and so transform education, health, and other indices [

9]. These growth rates of GDP per capita and GDP embody the economic growth required to fuel modernization. Regarding the place of FDI and consequent economic growth under the BRI, the tenet of modernization theory helps uncover how social conversion may be realized from that process. This paper has highlighted that the BRI can yield vast social benefits in developing states by upgrading infrastructure, education systems, and technical competence of healthcare facilities. Of all these, FDI has been ranked as the key driver of economic and social transformation [

10]. FDI introduces market funds, technologies, and competencies that facilitate knowledge transfer and employment development, as well as the emergence of an autochthonous industry. Thus, in the Belt and Road Initiative, where infrastructure development and industrialization matter, FDI has a special significance; its function contributes to speeding up social progress. The business can improve health care by developing medical facilities through FDI, technological development through the spread of education [

11]. Several assumptions are made that the influence of FDI depends on a host nation's capacity to absorb the investment, which, in turn, seems to depend on certain host country factors, including institutional quality and human capital.

2.2. Empirical Evidence on Social Growth

Scholars have reviewed the various strategies used to establish the link between economic development and social development; this has often combined the use of GDP per capita in measuring economic growth. The nations that achieved a higher GDP per capita had a relatively better status in education and health; however, the results may vary from place to place [

12]. When expressed in the context of the BRI, infrastructure endeavors spurred by the BRI boost GDP by raising social standards, including healthcare and education [

3]. However, higher general inflation can reduce the ability of households to obtain good health care and education, which is already a source of inequality among the populace [

13]. Education is characterized as a social factor that defines its quality and a significant factor that describes social and economic mobility. Available studies show that the quality of education is the key factor determining the improvements in economic and social conditions; global enrollment rates cannot guarantee that quality education achieves a better or higher level of academic results than the enrolment rate [

14]. Education spending in BRI countries regarding construction, often aided by foreign aid or FDI, has paved the way for improved education quality, especially in the disregarded areas. Furthermore, education makes it possible for social advancement by helping the absorption of technology within the stock of communities [

15].

Primary health care services are paramount in any society as the results from other sources affirmed the positive impacts of health on economic transformation and human well-being. According to the study, it was found that an increase in health sector investment has a positive effect on labor productivity, a decrease in mortality level, and efficient utilization of society’s welfare [

16]. In developing countries especially, necessary inputs like hospitals and telemedicine projects would make a big difference [

17,

18]. There is also a need for a study in BRI-developing countries that shows that health care and its quality are often improved by using new technologies and innovations, which BRI's emphasis on technical cooperation can promote. Reemphasizing that technological advancement is a primary causative factor in societies’ social and economic development is pertinent. Higher innovation rates are characterized in such nations as experiencing faster improvement in the health sector, education, and the standard of living [

19]. In the framework of the BRI, skill-enhancing cooperation between China and its partner countries as cooperation in bringing innovation to transform society forward has been promoted [

20]. Some of these advances, new teaching methods and techniques, plus tele-consultancy and health systems, have contributed positively to social growth by enhancing education and medical facilities. In addition, applying innovative technology will create new employment opportunities and advancements in skills in BRI countries. According to the literature, it becomes clear that FDI could have a unique and hugely positive impact on society, especially in the developing world. FDI can improve access to health and education and fund infrastructure projects that create employment opportunities and expand knowledge and technology [

11]. Intensive papers illustrate the broad spread of FDI in increasing levels of health and education [

3,

21]. Foreign direct investment inflows have a favorable co-movement with technological innovation, which in turn enhances social advancement [

10].

This section serves as the background to the following analysis. It reviews the existing literature and highlights some of the research gaps limiting our understanding of the social development of BRI countries. While economic consequences have been discussed in many previous types of research, little attention has been paid to BRI from the social angle and, particularly, its relationship with education, healthcare, technology advancement, and economic development. This research aims to fill that gap by comprehensively analyzing the factors behind social progress in developing BRI-participating countries.

3. Methodology and Econometric Model

In this research, composite indices are constructed to measure essential characteristics of societal advancement, which include social growth, technological innovation, quality of education, healthcare accessibility, and economic prosperity, including per-capita GDP, the rate of GDP growth, inflation, and FDI. However, three interaction terms, TI * GDPg, BRI * TI, and BRI * GDPg, are included to enhance the analysis. The formulation of these indices is described in the following subsections.

3.1. Construction of Indices

3.1.1. Social Growth Index

This index summarizes all forms of social development, including human life expectancy, health care costs, use of internet facilities, and the number of mobile phone connections, concerning social development. The obtained factors are standardized and weighted by the relevance criterion, ranking among the essential criteria in other studies as well [

22,

23].

3.1.2. Technological Innovation Index

This index evaluates technical diffusion, considering the number of patents by residents and non-residents, applications, R&D costs, science publications, and exports of high-technology products. The variables are also normalized and summed to obtain a standardized, normalized index through weights wherein the patent application and the R&D expenditure have larger weights as they are fundamentals of innovation [

7,

24].

3.1.3. Quality of Education Index

This index measures education standards by school enrolment rates and teacher tallying to pupils. The government also attaches similar importance to primary and tertiary education enrollment rates. Conversely, the student-to-teacher ratio favors a low student-to-teacher ratio (fewer students per teacher), which improves the index score. This confirms the acknowledged correlation between small classes and improved performance that has also been pointed out in other studies [

14].

3.1.4. Health Quality and Access Index

This index measures the quality of health systems based on several indicators –Immunizations (DPT & Measles), number of people having per capita expenditure on health, and mortality (neonatal & infant). Mortality rates are the focal points here as these rates are believed to be the optimal indicators of the healthcare system's performance [

25]. The index is obtained by taking the arithmetic mean of the normalization results of these indicators.

The general econometric model of the investigation is articulated as follows;

In equation (A), Y represents the dependent variable, X_1….X_n are independent, while β_1…..β_n represents parameters of the variables. This equation can be written in the form of an actual variable as follows;

Equation (B) gives the model utilized in this study to test hypotheses concerning the impact of different independent variables on the dependent variable—sustainable growth (SG). Further, to test the combined effects of these variables on sustainable growth, we have created interaction terms like GDPg × TI, BRI × GDPg, and BRI × TI.

3.2. Data Sources and Measurements

The data for this research is collected from the World Bank, an international organization that provides credible information for analysis. The sample of this study comprises 42 BRI developing countries and covers the period 1995-2022. Using panel regression methods, the study examines how the indicators stated in

Table 1, such as the commencement of the BRI, quality of education, healthcare accessibility, technological advancement, and GDP growth—all influence social development in a given year. Through this analysis of these dimensions collectively, this study focuses on the broader effects of the BRI and the accompanying socio-economic factors on positive social growth throughout these developing states.

3.3. Econometric Methods and Procedures

This study adopts a wide-ranging econometric framework with a cross-sectional dependence test and slope homogeneity to minimize the chances of spurious results. All the potential non-stationarity problems within the data are checked with four procedures: ADF Fisher Chi-square test, Levin-Lin-Chu, PP Fisher Chi-square, IPS W-stat, [

26,

27,

28]. To evaluate long-run equilibrium relationships, two-panel cointegration tests are the Johansen-Hendry-Juselius cointegration rank test based on both the trace and maximum eigenvalue statistics and the Kao residual panel cointegration as explained by Johansen and Kao, respectively [

29,

30]. To support the argument further, this study employs the PMG test, which captures both short-run and long-run associations across panels. In addition to checking temporal connections, we use the PMG test, which has advanced features compared to the standard Mean Group (MG) test by allowing endogenous series in level equations and allowing the cross-sectional dependence to be heterogeneous across panels [

31]. To increase the panel analysis efficiency, fully modified least squares (FMOLS) and dynamic least squares (DOLS) models are applied here as these models are sensitive to deal with serial correlation and endogeneity in the context of cointegration among panel data [

32,

33]. Also, causality testing analysis is performed. Specifically, the pairwise Dumitrescu Hurlin panel causality test establishes the directionality and causality between variables across countries [

34].

3.4. Model Estimations

The Pesaran Cross-Sectional Dependence (CD) is widely accepted in detecting cross-sectional dependence in panel data; this is important while working with large panels since cross-sectional dependence can give biased and inconsistent estimation results [

35]. We use Pesaran’s CD test for cross-sectional dependence among the panel units. The test statistics are given by the following;

In equation (1), T denotes the periods. The cross-sectional units are represented by N. , which symbolizes the sample correlation coefficient of the residuals of two cross-sectional units, i and j. If the observed test statistic CD is different from zero, it gives evidence of cross-sectional dependence, implying that shocks in one unit affect the others.

The Slope Homogeneity Test (SHT) is used to establish whether or not the slopes of the panel data model are homogenous across the cross-sectional units. This is particularly vital in panel econometrics and when the researcher predicts unit heterogeneity. We apply the SHT to test for slope homogeneity across cross-sectional units in panel data [

36]. The test statistics for slope homogeneity are formulated as follows;

where in equation (2a), N is the sample size in the cross-sectional units, k is the number of regressors, and

is the average of individual slope coefficients from the auxiliary regression. To adjust for the potential non-normality of Δ, Pesaran and Yamagata propose the following modified version;

In equation (2b), where and stands for the mean and variance. Under the null hypothesis, the distribution Δ and Δadj are asymptotically standard normal. A large value of the test statistic implies that the slopes differ across cross-sectional units, implying slope heterogeneity.

3.5. Panel Unit Root Tests

To check the stationary of panel data, a series of unit root tests are applied, which are important for panel data techniques;

The Levin-Lin-Chu test assumes identical forms of unit root processes across the cross-sectional units. It is carried out under the assumption that each series is nonstationary or has a unit root against which all panels are stationary. The test statistic is computed as follows;

In equation (3a), where are individual panel unit root statistics. N is the panel's sample size. The LLC test accounts for the unit-root problem by demeaning the data.

The ADF-Fisher test, developed from the ADF test, is that the p-value can be combined into cross-sectional units. Meanwhile, it conducts an LM test on the null hypothesis that unit roots characterize all panels;

Where in equation (3b), is the p-value of the ADF test taken for each cross-sectional unit for evaluation, the given statistic is used to test the hypothesis and, under the null hypothesis, is distributed as a Chi-square distribution.

The Im, Pesaran, and Shin test permits the existence of cross-section dependence in the model for the autoregressive parameter. It compares the null hypothesis that all the panels integrated against the hypothesis, stating that at least one is stationary. The test statistic, known as the W-stat, is given by;

In equation (3c), the symbol refers to the ADF statistic of concern in cross-section and E(t) is the expected average value of the test statistic under the hypothesis that a unit root exists.

3.6. Johansen Fisher Panel Cointegration Test

For the panel data to capture the long-run associations between the variables, this study uses the Johansen-Fisher panel cointegration technique in line with the Johansen, Hendry, and Juselius approach [

29,

37]. This approach then seeks to identify the number and ranks of these variables, which are cointegrated across the cross-sectional units. Another feature of the test is the integration of individual cross-sectional trace and maximum eigenvalue statistics based on Fisher. This enables us to detect if, indeed, there is a long-run equilibrium relationship within the panel data structure. The trace statistic is computed as follows;

In equation (4a), where N is the number of cross-sectional units, k is the number of variables and

is the ith eigenvalue from the residual matrix. A significant value of the trace statistic suggests that there is at least one cointegration relationship. The maximum eigenvalue test is used to test the null hypothesis of the number of cointegrating vectors equal to r against the alternative hypothesis that the number of cointegrating is r+1. The greatest eigenvalue statistic is computed as follows;

where in equation (4b), λ(r+1) is the (r+1) largest eigenvalue of A in the application of this algorithm. If the value of the max-eigen statistic is larger, then this suggests the existence of other cointegrating vectors apart from r embedded on the panel units in a deeper long-run perspective. The Johansen-Fisher approach combines individual trace and max-eigen statistics for each cross-sectional unit and then aggregates them using the Fisher statistic;

In equation (4c), where pi is the P-value of cointegration analysis for each unit. This combined statistic follows Chi-square distribution and using it cross sectional can aggregate to check for general panel cointegration. The mentioned test structure significantly increases the validity of our cointegration analysis.

3.7. Kao Residual Panel Cointegration Test

Kao residual panel cointegration test checks cointegration in the panel data observation by examining the residual of the long-run relation. In the second step, it employs an Augmented Dickey-Fuller (ADF) test on the residuals from an estimated cointegrating regression. It is used in the analysis of cointegration variables when the data is cross-sectionally structured [

30]. As with other panel cointegration tests, Kao’s test employs a single equation residual approach but under the assumption of homoscedastic cointegrating vectors across cross-sectional units. The result of this test is used to test the null hypothesis of no cointegration against the alternative hypothesis of cointegration by comparing the degree of residuals from the cointegrating regression model for stationarity.

First, a long-run relationship is estimated for each cross-sectional unit in the form;

Where in equation (5a), is the dependent variable, is the independent variable, is the intercept and denote the residual for each unit at time t.

Thus, Kao uses an ADF test on the residuals

from the estimated cointegrating regression to test for cointegration. The ADF test equation for the residuals is as follows;

Equation (5b), is the lagged level of the residuals, is the coefficient of interest; if , the residuals are stationary, are the coefficients of the lagged differences to control for autocorrelation. is the error term.

3.8. Pooled Mean Group (PMG)

The Pooled Mean Group (PMG) estimator, as the name suggests, is an estimator technique and is applicable in situations where panel data is available to estimate the model [

31]. There is more variation in the short-run dynamics across the cross-sections, but the coefficients are homoscedastic in the long run to allow for pooled estimators. The innovative feature of this estimator makes it informative for investigating the short- and long-run dynamics in Panels with large T and potentially large N. Since this study deals with panel data, to investigate both short—and long-run co-integration between variables, we employ the system estimator PMG. The destination and error term correction of the PMG estimator incorporates the idea of the Mean Group (MG) estimator, which entails heterogeneity across groups, with the pooled estimator, which entertains homogeneity. PMG holds long-run coefficients, while arbitrary short-run adjustments and error variances are allowed to vary across cross-sectional units.

The PMG model is typically specified as an Autoregressive Distributed Lag (ARDL) model, expressed as;

In equation (6a), y is the dependent variable for unit i at time t. stands for the vector of the policy variables. Distinctive from conventional models, and are the coefficients for the lagged dependent variable and the lagged explanatory variables, respectively. denotes the lag length, and is the error term.

Here PMG estimator has given a long-run constant across all the cross-sectional units that provide the equilibrium coefficients. The long-run equation is;

Equation (6b), in which is the coefficient vector under the long-run assumption while these groups are assumed to be homogenous. As with α, the estimation of is done by pooling all units’ long-run coefficients, assuming that is the same for all these groups at equilibrium.

The parameters of the short-run dynamics, such as the speed of adjustments, are allowed to differ between groups. The error correction form of the model is;

In equation (6c), is the error correction term which signifies the rate of speed at which returns to its long-run equilibrium. are the short-run coefficients for the different groups, i. is the error term.

Thus, a theory-consistent prediction is that when is significantly negative, the variable returns to its long-run position with a rate that is faster the higher in absolute terms is.

3.9. The Panel FMOLS and DOLS

The panel FMOLS is intended for estimating long-run relationships in panel data models exhibiting cointegration [

38]. The FMOLS option to eliminate endogeneity and serial correlation adjustment, added to the OLS estimator, produces estimates of the cointegrated relationship appropriate for cross-sectional heterogeneity.

The FMOLS model can be specified as follows;

In equation (7), is the dependent variable of unit i at time t. is a vector of independent variables, model covariates as α_i denote unit-specific fixed effects, is the error term. FMOLS analyses the OLS estimator and includes serial correlation and non-parametric endogeneity in the term. The estimator offers asymptotic unbiased estimates of the parameters in the long run.

The Panel DOLS estimator is also an estimator worthy of consideration instead of FMOLS while modeling cointegrated panels [

39]. Endogeneity is fixed by extending the model with leads and lags of differenced independent variables in DOLS to overcome the serial correlation and endogeneity problem. This method is especially suitable for small sample sizes because of its good properties in finite samples.

In equation (8), denotes unit-specific time-invariant fixed effects for each unit of analysis. Dependent variables are known as . includes leads and lags of first-differenced to address for endogeneity, refers to the long-run coefficients and is the error term. By including leads and lags of , DOLS can give accurate estimates of the cointegrating equation without the problem of biased estimates for different variables in the long run.

3.10. Dumitrescu-Hurlin (DH) Panel Causality Test

To reduce the problem of endogeneity, we employed the pairwise Dumitrescu-Hurlin (DH) panel causality test to analyze causality between variables in our pooled data. This test is an expansion of the Granger causality test suitable for heterogeneous panel data [

34]. Unlike the conventional Granger causality, the DH test enabled a causality relation test in terms of each unit and cross-section dependence, so it is appropriate to implement it for different units in the panel dataset.

The test is based on a standard Granger causality regression for each cross-sectional unit as follows;

In equation (9a), and represent the area of focus. is the lag length, and ,, and are parameters to be estimated.

In each cross-sectional unit, individual Wald statistics are used to conduct hypothesis tests regarding the null hypothesis of

(no causality). The average statistic across the cross-sectional units forms the basis of the DH test statistic, which is expressed as;

Where in equation(9b), is the individual Wald statistic for unit i. Under the null hypothesis of no causality, follows a standard normal distribution as N→∞ and T→∞.

4. Empirical Analysis

4.1. Descriptive Analysis

Table 2 presents descriptive statistics of the variables used for economic analysis using mean, standard deviation, minimum, and maximum coefficients from 1,176 observations. These stand for social growth indicators necessary for implementing SG, such as quality of education, technological innovation, and healthcare quality, while measuring economic development, including GDPc and GDPg, FDI, INF, BRI*GDPg, and BRI*TI.

Arithmetic means offer an understanding of the average scores of each variable, and the standard deviations give the level of dispersion for the given sample. Unfortunately, minimum and maximum values are characterized by big differences in economic indicators, particularly those of GDP and inflation, while extreme values indicate economic diversities between the observed countries. For instance, the distribution of GDPg is from -28.759 to 54.199, which depicts the growth or decline of various economies, meaning that the nature of the economy in developing countries is diverse. The coefficient of variation is relatively high for FDI and INF, as may be expected in developing economies that also experience high capital inflow and fluctuations in inflation rates. This group of interaction terms, including BRI*GDPg and BRI*TI, concerns the effects of participation in the Belt and Road Initiative on growth rates and technological change. Such a positive sign indicates that involvement in the BRI could enhance growth and innovation. However, large dispersion and extreme values mean that one country can significantly differ from another concerning the final influence of BRI involvement. This may partly be because countries differ in implementing BRI resources, where some reap good economic and technological value while others may not. The following table forms the simplest paradigm, which defines how any social, economic, or infrastructural conditions in third-world countries are interconnected. In view of this, BRI may have multiple effects on the development process depending on the conditions in the recipient country.

4.2. Correlation Analysis

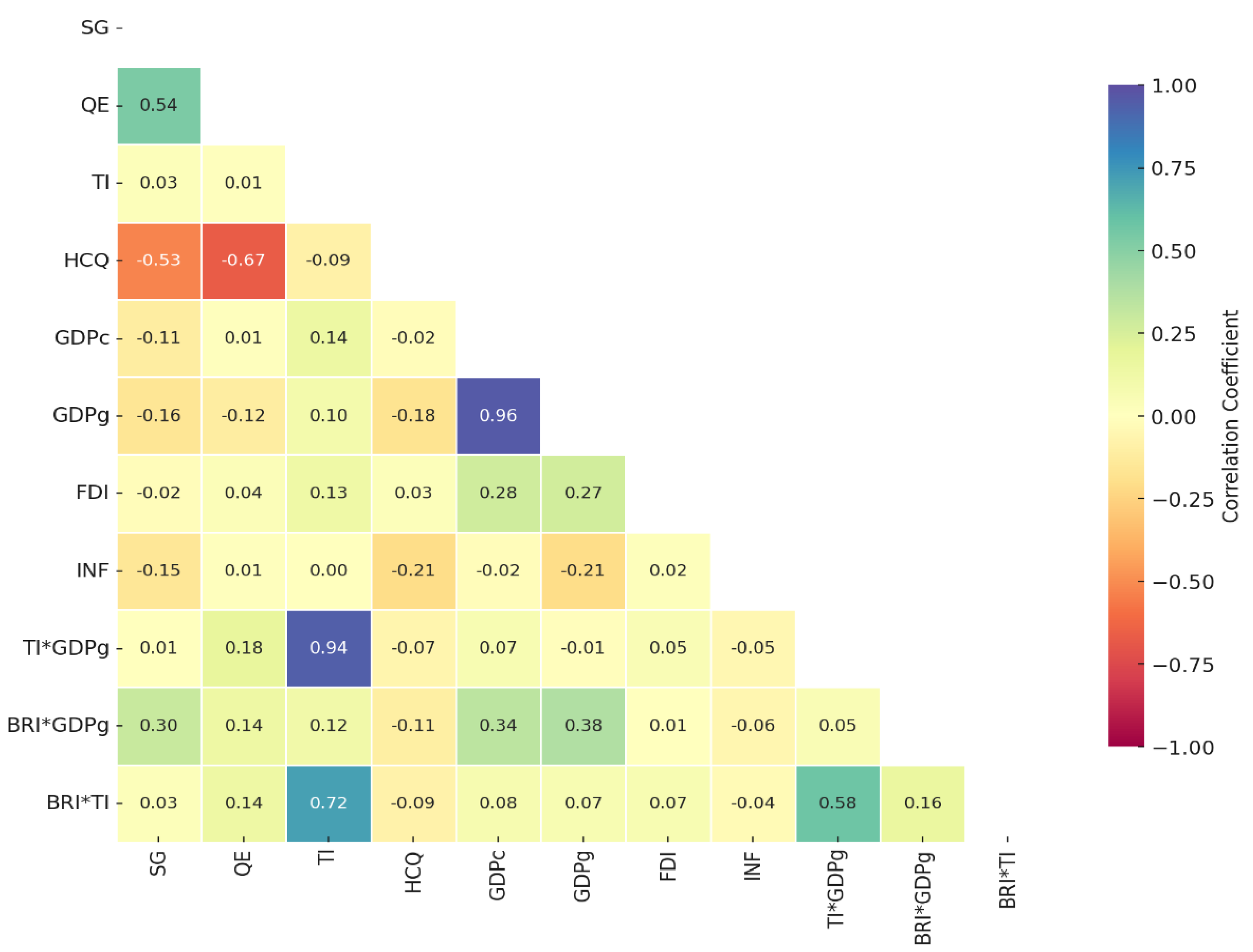

From

Table 3 and

Figure 1, this attempt to capture the kind of relationship prevailing between various economic and social factors in developing countries is depicted as a pairwise correlation matrix and triangular matrix, respectively, where positive signs on the table reveal a positive relation, and a negative sign includes a negative relation.

As can be observed from this matrix, there is a high positive relationship of 0.956 between GDPc and GDPg. Therefore, the assertion is that higher growth rates come hand in hand with higher income levels within developing economies. This further means that countries with higher GDP per capita tend to source higher economic growth because of better investments and resources. FDI is also positively related to the GDP per capita; 0.279 is the increment in GDP, and 0.271 is the emanation of the basic economic belief that foreign investments enhance capital, technology, and employment growth. As we can see, QE and SG are moderately positively related at 0.539, which points to the fact that education fosters social improvements, presumably due to developing skills and people’s capital. However, much to the surprise, HCQ is strongly negatively correlated with social growth at -.530 and quality of education at –.669, leaving the impression that in those countries that pay much importance to these aspects, the social and educational health is worsening; on the other hand, it is indicating the reverse relationship suggesting trade-off in resource allocation. The interaction variables BRI*GDPg and BRI* TI have positive coefficients and first-order interaction terms of 0.342 and 0 .375 with GDP per capita and 0.078 and 0.067 with economic growth, respectively, meaning that the involvement of BRI could lead to a multiplier effect on countries with higher growth or technological index. More importantly, the correlation between TI and BRI*TI is equally high at 0.716, suggesting that the positive influence of BRI on innovation is potentially more profound in those countries that already have a framework for technological advancement – probably owing to better physical and or human facilities for technology absorption.

From the triangular correlation matrix, one can draw useful information on modern socioeconomic dependencies and linkages between global social, economic, and BRI-related indexes in developing countries, demonstrating how way BRI impact may enhance development and technologies in the context of developing countries' education, FDI, and technology environment. Thus, figure 1 is just the lower triangle of the matrix and shows each pairwise correlation between them. The “Spectral” facilitates visual differentiation of positive and negative correlations, with the degree of the relations increasing with the brightness of the hues.

4.3. The Cross-Sectional Dependence Outcomes

Cross-sectional dependence and independence are essential in determining the credibility and robustness of panel data models. For this reason, table 4 illustrates results from different statistical tests in determining cross-sectional dependence and independence of residuals in a panel dataset. When applying the CD test to individual variables in social growth (SG), quality of education (QE), technological innovation (TI), and healthcare quality (HCQ), Pesaran’s CD test produces high CD-test values while the p-value stands at 0.000. This dependence implies that changes in those variables in one unit (say, in a country or region) may bring changes in or may be brought by changes in another unit. For example, growth in technological development or an increase in health knowledge in one country can positively affect others because of the availability of joint capital, diffusion of knowledge, or integration. This is evident in the higher coefficients of correlation presented in the corr and abs(corr) column, arguing that the nature of the relationship between these variables is one of interdependence. Controlling for cross-sectional dependence, the Residual Cross-section Dependence section tests show highly significant p-values (0.000) for the Breusch-Pagan LM, Pesaran scaled LM, Bias-corrected scaled LM, and Pesaran CD. This shows that residuals in one unit are related to residuals in other units, meaning that different sections are not affected separately by external factors or shocks but are likely to be affected jointly [

40]. The residual cross-sectional dependence indicates that various changes in different countries may be caused by global or regional factors in the economy, crises, or policy changes and lead to similar economic conditions in other countries.

The Breusch-Pagan LM Test and Friedman’s Test again show the cross-sectional dependence; hence, the off-diagonal elements in the variance-covariance matrix are not equal to zero with the recorded p-values of 0.000. This interdependence among units has significant consequences for economic modelling since this assumption may lead to biased or inefficient estimates. That is why more appropriate would be spatial econometric models or models that include cross-sectional correlations [

41]. These findings have implications for policy harmonization in a globalizing world economy, as policies, trade relations, or even technological developments in one economy affect others.

Table 4.

Pesaran's Cross-Sectional Dependence (CD) Test.

Table 4.

Pesaran's Cross-Sectional Dependence (CD) Test.

| Cross-Sectional Dependence (CD) Test |

| Variable |

CD-test |

p-value |

corr |

abs(corr) |

| SG |

67.31 |

0.000 |

0.534 |

0.534 |

| QE |

105.43 |

0.000 |

0.837 |

0.837 |

| TI |

125.62 |

0.000 |

0.997 |

0.997 |

| HCQ |

119.58 |

0.000 |

0.949 |

0.949 |

| GDPc |

25.90 |

0.000 |

0.206 |

0.249 |

| GDPg |

20.04 |

0.000 |

0.159 |

0.219 |

| FDI |

41.35 |

0.000 |

0.328 |

0.386 |

| INF |

45.94 |

0.000 |

0.380 |

0.385 |

| TI*GDPg |

122.54 |

0.000 |

0.973 |

0.973 |

| res |

108.98 |

0.000 |

0.902 |

0.902 |

| Residual Cross-Section Dependence |

| Null hypothesis: No cross-section dependence (correlation) in residuals |

| Test |

Statistics |

d.f |

Prob. |

| Breusch-Pagan LM |

7850.862 |

861 |

0.000 |

| Pesaran scaled LM |

168.442 |

0.000 |

| Bias-corrected scaled LM |

167.664 |

0.000 |

| Pesaran CD |

57.509 |

0.000 |

| Breusch-Pagan LM Test |

| Pesaran’s test of cross-sectional independence value |

62.128 |

P-value = 0.000 |

| The average absolute value of the off-diagonal elements value |

0.556 |

| Friedman’s Test |

| Friedman’s test of cross-sectional independence value |

307.545 |

p-value = 0.000 |

4.4. Homogeneity Test

Table 5 shows the results of the slope homogeneity test, where the [

36] test is used to examine the homogeneity of slope coefficients in cross-sectional units in a panel data model. Here in this study, the delta as well as the delta-adjusted statistics come up with very small p-values that are equal to 0.000, suggesting the most significant slope differences. This implies that while holding other variables constant, the magnitude of the effect of the independent variable differs from that of the dependent variable across different units and does not show a systematic difference. Additionally, Pesaran’s test of cross-sectional independence is significant (value: 61.565, p = 0,000), whereby it holds that the cross-sectional units in the dataset display interdependence. The remaining values show a similar pattern: the average of the absolute values of the off-diagonal elements (0.553) supports a moderate cross-sectional dependence between units. Applying the SHT after the CD test is justified because the results of the tests of this type examined in previous tables revealed a high level of cross-sectional dependence across the several variables, which means that the units in the dataset are not independent of each other [

35]. In such a situation, it is necessary to test for homogeneity to ascertain whether this dependence also results in heterogeneity of the effects of variables across units. To continue with this example, if technological innovations or healthcare advancement in one country influences the rest due to international trade linkages, it is also relevant to know if they are balanced or skewed. The SHT suggests that heterogeneity in the units means each unit may behave differently to similar economic variables from local policies or culture and structural conditions [

36]. From an economic perspective, these results suggest that adopting what amounts to a ‘one size fits all’ solution and executing it across cross-sectional units would not be sufficient to capture the variety of economic relationships in the data the models suggested. Measures involving modifying or creating a particular variable, for instance, education quality or social growth, may yield diverse results given the existing features of the unit. This emphasizes the need to incorporate the possibility of different slops in models that associate different units since the global economy is highly correlated. Instead of a general acceptance of the idea of units, accepting that countries are interdependent and heterogeneous in their response to economic factors, policymakers and economists can formulate policies that consider the relations between units and the conditions existing in every unit.

4.5. Cross-Sectional Unit-Root Test

The application of cross-sectional unit root tests posts the SHT and CD test is justified on methodological grounds. Since the previous tests confirmed the presence of cross-sectional dependence and slope heterogeneity, it was essential to analyze whether or not variables were stationary across cross-sections. If we have cross-sectional dependence, this may exaggerate the non-stationarity and make our estimates biased if we do not control for this [

27]. Moreover, previously identified slope heterogeneity indicates that each cross-sectional unit may possess the trend component that needs to be differenced for stationarity. When subjected to first differencing, the stationarity of these variables confirms that any panel data modeling cannot be affected by unit root problems, which inhibit the modeling process by creating spurious relationships.

Table 6 gives the Cross-section unit root test results through ADF-Fisher Chi-square, LLC, PP Fisher Chi-square, and IPS W-stat, which are used for panel unit root test. This makes the test stationary mandatory for eliminating spurious regressions because non-stationary data may cause invalid conclusions. Most tests at levels and first differences produce p values less than a level of significance of 0.05. Some of these variables appear to be stationary at levels and first differences; this establishes that these variables are integrated of order one, I(0) &I(1), hence rejecting the null hypothesis on the non-stationarity of the variables [

42]. This implication means that the variables in the dataset are not time-variant at the level and, therefore, suitable for subsequent econometric analysis. Stationarity results suggest that variables such as social growth, the quality of education, and technological innovation are stationary when differenced. Therefore, it becomes possible to model them relative to each other. The fact that there is stationarity after differencing indicates that these variables can exhibit similar economic cycles or trends despite the heterogeneity of the equations that identified distinct local characteristics across countries. Such observations are helpful for policymakers because a stable pattern of relations contributes to more stable policy effects. Making variables stationary also allows more flexible dynamic panel data analysis models that distinguish between fundamental long-run equilibrium relationships and short-run dynamics, thus yielding more accurate and reliable economic conclusions.

4.6. The Johansen Fisher Panel Cointegration Test

In

Table 7, we have analyzed the results of the Fisher Panel Cointegration Test, which includes the Johansen-Hendry-Juselius Cointegration Rank Test, by adopting both the trace statistic and originating the maximum eigenvalue statistic. This test determines the existence of long-run co-integration relationships between the variables in a panel data set [

37,

43]. Cointegration means that although variables could be moving apart from each other in the short run, they are associated in the long run. In this case, both the trace and the maximum eigenvalue hint at cointegrating relationships with p-values for all hypotheses from zero to three of 0.000. For instance, in the case of “At most 4,” hypothesize, the trace test gives a Fisher Statistic of 1171.0 (p.value 0.000), and the max eigenvalue test provides 293.3 (p-value 0.000), which supports at least four cointegrating relationships in the given data set. Such relationships make it possible to confirm the existence of stable and long-run relationships between the variables.

For this reason, performing the cointegration test after the unit root tests is very important, as for previous analyses, a few variables were found not to be stationary at the level but to become stationary at the first difference. Thus, when variables are integrated in a different order, as indicated in the above table 6, they may be cointegrated to denote a tendency towards long-run equilibrium, although they temporarily deviate from the same [

44]. The primary benefit of the cointegration test is that by using it, we can get around the problems of spurious regression since it establishes that, though each of the variables in isolation follows a random walk, they are stationary in the long run. cointegration means that there is a long-term relationship between some of these economic and social panel variables, including social growth, quality of education, and health care: they may fluctuate in the short run in the face of shocks but always return to an expected long-term path or trend. This discovery has managerial significance in that enabling change to one variable, in the long run, has precise impacts on other variables given that relationships are stable; hence, the possibility of formulating policies that consider these relationships is feasible. For example, the expenditures in education may have had long-run positive feedback on social advancement or health care as both were co-integrated variables. Indeed, for policymakers and researchers, one can use these relationships for forming models that account not only for variability in the short run but also for equilibrium in the long run, which will ultimately help create better economic predictions and policy actions based on the structural relationships that hold between these variables.

4.7. Kao Residual Panel Cointegration Test

Table 8 presents the results of the Kao residual panel cointegration and ADF test equation. After testing the residual for cointegration, the Kao residual investigates the existence of a long-term equilibrium relationship among the panel data variables. ADF test for level shows the critical value of 1% is -2.87 and for 5% is -2.15. The ADF test statistic, which we have calculated, is -8.2788, which means we can reject the null hypothesis, and it confirms that there is cointegration at a 1% level of significance. This result supports the assumption that the variables of the panel dataset are cointegrated, indicating that the variables have a long-term relationship despite any short-term non-stationary. Adjusted R2, which is equal to 0.413, Residual Variance (0,052) & HAC (Heteroskedasticity and Autocorrelation Consistent) Variance is equal to 0.094 as well Residual Variance is used to solve the possible autocorrelation or heteroskedasticity problems. The second part of the same table refers to the results of the Augmented Dickey-Fuller (ADF) test equation for Residuals, and it gives lagged terms of the residuals in terms of D(RESID) with highly significant t-statistics as well as p-values of 0.000 applicable all through lags. The negative and significant coefficient for the variable RESID(-1), which is equal to - 0.1955, also enhances stationarity in the residuals that are required for establishing cointegration [

30].The Durbin-Watson statistic of 2.048 depicts no issue of autocorrelation of residuals, which supplements the authenticity of these results. Hence, the emphasis on lagged residuals, with the help of which past information impacts the current values, can be explained, implying that past changes affect the system’s adjustment to equilibrium.

4.8. PMG (Pooled Mean Group) Test

Table 9 shows the results of the Pooled Mean Group (PMG) Estimation analysis with the specification of long-run and short-run equations. the PMG estimator is suitable for the analysis of long-run and short-run changes of cross-sectional units contained in the panel data test, and it assumes homogeneity in the long-run relationship, whereas short-run adjustments are assumed to be heterogeneous [

31]. In the long run, coefficients suggest positive effects of QE, HCQ, TI, BRI, interaction terms, and FDI on social growth except for GDP per capita and inflation. For instance, the coefficient for QE is 0.855 (p-value 0.000). This means that an increase in education quality has a long-run positive relationship with social growth in support of previous research identifying the significance of education in social and economic progress [

45]. Likewise, HCQ and TI bear positive signs of impact on social development, where TI puts up a relatively larger coefficient of 7.111 with a p-value of 0.01, which denotes the importance of technology innovation for social development, particularly in innovation-led economies supported in [

8,

46].

On the other hand, some variables work negatively for enhanced social growth in the long run, like GDP per capita (GDPc), which is estimated to be – 1.881 and with a p-value equal to 0.025. This may portray income and wealth inequality, whereby high GDP per capita levels do not imply harmonized social development, as envisaged [

47]. According to the analysis, the variable Inflation (INF) has a non-significant impact on social development, which might suggest that moderate levels of inflation do not greatly affect long-run social processes in these countries.

In the coefficients of specification, the error correction term (ECT) (COINTEQ) of -0.0385 (p-value <0.000) reveals that the economic system quickly adjusts to the long-run equilibrium. This result aligns with the error correction mechanism identified in panel studies, whereby short-term departures from equilibrium are adjusted in the long run [

48]. Other differences between the short and long run show the dynamism of social growth variables. FDI and BRI * GDPg interaction terms are significant in the short run, indicating that FDI and related BRI growth bursts advance rapid social change.

In terms of economics, these findings underscore the importance of short-run economic measures, including the attraction of foreign investment, as well as long-term development of education and technological investment for long-term social development. The result confirms the literature on the use of the PMG model to estimate long-run relations as well as short-run transient responses for panels with heterogeneous characteristics [

31]. In general, the consideration of this case implies that social development in an interconnected economy depends on structural, long-term investments and changes and short-term reactions to externalities of the economy.

4.9. Robustness Test

The results based on the FMOLS and DOLS models give more support to the PMG conclusion that social growth in BRI-involved developing countries is promoted to a great extent by the ascending quality of education, improved healthcare, technological progress, and BRI-linked economic integration. In

Table 10, These methods are devised to control potential problems of serial correlation and endogeneity in panel data, making long-term estimates more accurate. These estimates are very close in terms of both the sign and statistical significance of key variables to the previous cross-sectional PMG test that we reported above, showing the robustness of these estimates across different estimation techniques

The first robustness checks are mainly similar to the PMG results regarding the coefficient and significance of the SG variables. The QE, HCQ, TI, and BRI involvement effects remain strong for SG performance. The FMOLS analysis results show that the coefficients of QE and TI are positive (0.329 and 0.523, respectively), supporting the hypothesis that both factors enhance social growth, thus supporting earlier studies examining social progress in developing BRI countries [

49,

50]. Furthermore, the negative coefficient of GDP per capita (GDPc) in both FMOLS and DOLS suggests that higher GDP per capita does not necessarily translate into better social development, possibly due to increased income inequality, a problem that developing economies also face [

47]. The BRI shows a strong positive association with SG across both FMOLS and DOLS at a 5% level of significance, FMOLS (coefficient: 1.139, p-value: 0.000) and DOLS (coefficient: 0.812, p-value: 0.000) confirms that BRI involvement enhances social development in these developing countries. This is in line with coupling BRI with other researcher findings that posited that BRI yields favorable spillover effects, including infrastructure construction, comprehensive connectivity, trade liberalization, and facilitation, all in support of social progress [

51]. The interaction term BRI_GDPg also exhibits a significant positive impact in both estimations, suggesting that economic growth in BRI-involved countries further deepens the initiative's social impacts. The conclusion derived from these estimations is that BRI projects promote socio-economic advancement by generating employment, enhancing resource access, and enhancing economic steadiness in participating countries.

4.10. Panel Causality Test

Table 11 shows the findings of the Pairwise Dumitrescu-Hurlin Panel Causality Tests, focusing on the flow of causality of different economic and social factors in the framework of BRI developing countries. The two-way, bi-directional causality tests indicated large W-statistics and Zbar-statistics with p<0.000 for each of the tests performed.

Quality of Education and Social Growth is a bidirectional causality between the two variables; an increase in any of them will lead to a rise in the other. This finding is similar to the study established, which shows how education could impact sustainable social development and, consequently, how society stability impacts education quality [

45]. The HCQ and SG also mutually influence each other; the study supports health as a crucial component of social development, as people need to be healthy to support social development [

52]. In the same way, Technological Innovation and SG have strong and direct causality, where technology has brought social development. At the same time, the progressive society has fueled demo-oriented technology. This work is consistent with earlier literature in BRI countries indicating that technology transfer and innovations are foundation blocks in the social development agenda, especially with investments in improving technology by BRI [

51]. Additionally, the findings show that BRI-related variables like BRI_GDPg and BRI_TI experience a strong causal relationship with SG, which means that participation in BRI activates social progress through enhanced economic growth and development and enhancement of the technological sector. This concords with research that has it that through investments in BRI, social and economic integration is enhanced leading to the standard of living in member countries being raised [

53]. Also, SG with causality to other variables like FDI and GDPc entails that when social growth is enhanced, FDI is boosted, hence the GDPc. This relationship is in line with the complementary system of social stability and development, improving the economy's attractiveness for investors and increasing the income per capita of the population [

50,

54]. The evidence of a strong causality between SG and INF indicates that social factors might affect the inflation rate since social advancement strengthens an economy's price stability.

Similarly, these causality results show that social and economic development are mutually tied in BRI countries, and social changes can significantly be facilitated through education technology and economic growth through BRI plans. These findings are in consonant with other studies conducted on the BRI and emphasize how the BRI has been launched to spearhead change in enabling sustainable development and socio-economic growth in developing nations.

5. Discussion

Therefore, the analysis presents an understanding of economic and social interdependence for BRI member nations concerning social growth, education, healthcare, technological advancement, FDI, and GDP. Based on these results, it can be highlighted that BRI will play a significant role in promoting sustainable development among interconnected global economies. These findings show significant cross-sectional dependence (CD) between the various BRI member countries, which underscore everyday economic interactions whereby they are BRI and regional spill-over effects related to investment policies [

35]. On the other hand, the Slope Homogeneity Test (SHT) reveals a virtually zero correlation between the dependent and independent variables as well as the residuals, which implies structural dissimilarities in the countries under comparison about how such variables related [

36,

51]. The presence of such conflicting empirical results points to an essential fact against the stability of the relationships among the variables, which is either homogenous or heterogeneous. To figure it out, we used four different panel unit root tests to analyze the stationarity of the used variables. Given the results of these tests for the presence of unit roots in our data, we chose an appropriate econometric model to analyze our data, given the characteristics of the data, to make reliable estimates. Going further, cointegration tests also show that the variables preserve long-run relations; thus, the indicated variables demonstrating persistent, though temporary, dynamics emphasize the long-run social growth determinants in these countries [

27,

44,

48]. The positive long-run social impacts of education and healthcare support the human capital theory, given that these two sectors help foster equity more positively [

16]. These results are similar to the identified that investment in education and healthcare is the most critical factor in maintaining the steady progress of growth [

55]. The analysis of PMG confirms that technological innovation and BRI increase social growth in the long run, which supports the endogenous growth theory [

56]. BRI’s infrastructure and connectivity projects coalesce to enhance social and economic integration, leading to sustainable socio-economic values. Several studies have evidenced the potential of FDI in promoting international resource mobilization, besides supplementing the efforts of domestic investments in these economies through resource, technology, and knowledge transfers [

57]. Quite expected, the sign of the GDP per capita (GDPc) coefficient is negative, with policy implication that higher income levels do not help reduce inequalities without progressive taxation and transfers. Further, to help ensure the validity of the relationship, FMOLS and DOLS tests for robustness are performed with no evidence suggesting model misspecification. However, Dumitrescu-Hurlin Panel Causality Tests reveal the bidirectional causal relationship between significant proxies such as education-social growth and health-social growth. This is also consistent with the feedback loop in which social determinants enhance education and health [

45,

52]. The interaction terms comprising BRI, GDP growth, and technological advancement (BRI_GDPg) demonstrate the combined impact of BRI on member countries that suggest a direct relation of BRI to societal economic upliftment and Sustainable Development Goals (SDG) attainment [

58,

59].

6. Conclusions

Thus, this paper explored the compound dynamics between social and economic factors and their joint effects on social growth in 42 developing Belt and Road Initiative (BRI) countries from 1995–2022. Using a cross-sectional dependence, heterogeneity, unit root, and cointegration test, PMG estimation, robustness check, and causality analysis, we established that the quality of education, healthcare quality, technological advancement, and FDI play vital roles in social development in these nations. Additionally, participation in BRI helps to implement sustainable social change through the development of connections, turnover, and infrastructure that strengthens the positive consequences of the participating region.

6.1. Policy Iimplications

Since increasing investment and fair access to education and healthcare have long-run benefits for the growth of BRI member nations, these must take top priority. Developing special human capital programs to fit the needs of specific population sectors and geographic regions will enhance long-run and inclusive economic growth. National development frameworks should then be aligned with the SDGs. This includes applying BRI projects that create and encourage green infrastructure, renewable energy, and environment-friendly cities for future socio-economic and environmental gains. Policymakers need to encourage innovative environments, research, and development because using technologies in BRI countries can bring about more significant social and economic development due to a pull effect facilitated by technology as a result of endogenous growth. Government policies should target FDI and strengthen domestic firms. Enhanced institutional quality and investment incentives in social responsibility will enhance FDI's social impact.

Author Contributions

Conceptualization, T.K., and L.W.; methodology, T.K., and A.K.; validation, F.A. and E.I.; formal analysis, T.K. and M.A.; investigation, T.K., and A.K.; data curation, T.K. and F.A.; writing—original draft preparation, T.K., L.W., and A.K.; writing—review and editing, T.K., F.A.; visualization, E.I.; supervision, L.W.; project administration, L.W. and T.K. All authors have read and agreed to the published version of the manuscript.

Funding

Researchers Supporting Project number (RSPD2025R1060), King Saud University, Riyadh, Saudi Arabia.

Institutional Review Board Statement

Not applicable

Informed Consent Statement

Not applicable.

Data Availability Statement

Data will be made available on request.

Acknowledgments

Not applicable.

Conflicts of Interest

The authors declare no conflicts of interest.

References

- Chin, H.; He, W. The Belt and Road Initiative: 65 countries and beyond. Fung Business Intelligence Centre 2016, 16. [Google Scholar]

- Alkire, S.; Foster, J. Counting and multidimensional poverty measurement. Journal of public economics 2011, 95, 476–487. [Google Scholar] [CrossRef]

- Du, J.; Zhang, Y. Does one belt one road initiative promote Chinese overseas direct investment? China Economic Review 2018, 47, 189–205. [Google Scholar] [CrossRef]

- Solow, R.M. A contribution to the theory of economic growth. The quarterly journal of economics 1956, 70, 65–94. [Google Scholar] [CrossRef]

- Becker, G.S. Human capital: A theoretical and empirical analysis, with special reference to education; University of Chicago press: 2009.

- Grossman, M. On the concept of health capital and the demand for health. In Determinants of health: an economic perspective, Columbia University Press: 2017; pp. 6–41.

- Romer, P.M. Endogenous technological change. Journal of political Economy 1990, 98, S71–S102. [Google Scholar] [CrossRef]

- Aghion, P.; Howitt, P.W. The economics of growth; MIT press: 2008.

- Inglehart, R. Christian Welzel Modernization, Cultural Change, and Democracy The Human Development Sequence; Cambridge: Cambridge university press: 2005.

- Borensztein, E.; De Gregorio, J.; Lee, J.-W. How does foreign direct investment affect economic growth? Journal of international Economics 1998, 45, 115–135. [Google Scholar] [CrossRef]

- Alfaro, L.; Chanda, A.; Kalemli-Ozcan, S.; Sayek, S. FDI and economic growth: the role of local financial markets. Journal of international economics 2004, 64, 89–112. [Google Scholar] [CrossRef]

- Filmer, D.; Pritchett, L. The impact of public spending on health: does money matter? Social science & medicine 1999, 49, 1309–1323. [Google Scholar]

- Easterly, W.; Fischer, S. Inflation and the Poor. Journal of money, credit and banking, 2001; 160–178. [Google Scholar]

- Hanushek, E.A.; Woessmann, L. The role of cognitive skills in economic development. Journal of economic literature 2008, 46, 607–668. [Google Scholar] [CrossRef]

- Lucas Jr, R.E. On the mechanics of economic development. Journal of monetary economics 1988, 22, 3–42. [Google Scholar] [CrossRef]

- Bloom, D.E.; Canning, D.; Sevilla, J. The effect of health on economic growth: a production function approach. World development 2004, 32, 1–13. [Google Scholar] [CrossRef]

- Al-Worafi, Y.M. Healthcare Facilities in Developing Countries: Infrastructure. In Handbook of Medical and Health Sciences in Developing Countries: Education, Practice, and Research, Springer: 2023; pp. 1–21.

- Jones-Esan, L.; Somasiri, N.; Lorne, K. Enhancing Healthcare Delivery Through Digital Health Interventions: A Systematic Review on Telemedicine and Mobile Health Applications in Low and Middle-Income Countries (LMICs). 2024.

- Freeman, C.; Louçã, F. As time goes by: from the industrial revolutions to the information revolution; Oxford University Press: 2001.

- Li, X. High-quality development and institutionalization of the BRI. East Asian Affairs 2021, 1, 2150004. [Google Scholar] [CrossRef]

- Duan, F.; Ji, Q.; Liu, B.-Y.; Fan, Y. Energy investment risk assessment for nations along China’s Belt & Road Initiative. Journal of cleaner production 2018, 170, 535–547. [Google Scholar]

- Castells, M. The rise of the network society; John wiley & sons: 2011.

- Marmot, M. Social determinants of health inequalities. The lancet 2005, 365, 1099–1104. [Google Scholar] [CrossRef]

- Grossman, G.M.; Helpman, E. Endogenous innovation in the theory of growth. Journal of economic perspectives 1994, 8, 23–44. [Google Scholar] [CrossRef]

- Alkema, L.; Chou, D.; Hogan, D.; Zhang, S.; Moller, A.-B.; Gemmill, A.; Fat, D.M.; Boerma, T.; Temmerman, M.; Mathers, C. Global, regional, and national levels and trends in maternal mortality between 1990 and 2015, with scenario-based projections to 2030: a systematic analysis by the UN Maternal Mortality Estimation Inter-Agency Group. The lancet 2016, 387, 462–474. [Google Scholar] [CrossRef]

- Im, K.S.; Pesaran, M.H.; Shin, Y. Testing for unit roots in heterogeneous panels. Journal of econometrics 2003, 115, 53–74. [Google Scholar] [CrossRef]

- Levin, A.; Lin, C.-F.; Chu, C.-S.J. Unit root tests in panel data: asymptotic and finite-sample properties. Journal of econometrics 2002, 108, 1–24. [Google Scholar] [CrossRef]

- Maddala, G.S.; Wu, S. A comparative study of unit root tests with panel data and a new simple test. Oxford Bulletin of Economics and statistics 1999, 61, 631–652. [Google Scholar] [CrossRef]

- Johansen, S. Estimation and hypothesis testing of cointegration vectors in Gaussian vector autoregressive models. Econometrica: journal of the Econometric Society, 1991; 1551–1580. [Google Scholar]

- Kao, C. Spurious regression and residual-based tests for cointegration in panel data. Journal of econometrics 1999, 90, 1–44. [Google Scholar] [CrossRef]

- Pesaran, M.H.; Shin, Y.; Smith, R.P. Pooled mean group estimation of dynamic heterogeneous panels. Journal of the American statistical Association 1999, 94, 621–634. [Google Scholar] [CrossRef]

- Phillips, P.C.; Hansen, B.E. Statistical inference in instrumental variables regression with I (1) processes. The review of economic studies 1990, 57, 99–125. [Google Scholar] [CrossRef]

- Stock, J.H.; Watson, M.W. A simple estimator of cointegrating vectors in higher order integrated systems. Econometrica: journal of the Econometric Society, 1993; 783–820. [Google Scholar]

- Dumitrescu, E.-I.; Hurlin, C. Testing for Granger non-causality in heterogeneous panels. Economic modelling 2012, 29, 1450–1460. [Google Scholar] [CrossRef]

- Pesaran, M.H. General diagnostic tests for cross section dependence in panels. Cambridge Working Papers. Economics 2004, 1240, 1. [Google Scholar]

- Pesaran, M.H.; Yamagata, T. Testing slope homogeneity in large panels. Journal of econometrics 2008, 142, 50–93. [Google Scholar] [CrossRef]

- Hendry, D.F.; Juselius, K. Explaining cointegration analysis: Part II. The Energy Journal 2001, 22, 75–120. [Google Scholar] [CrossRef]

- Pedroni, P. Fully modified OLS for heterogeneous cointegrated panels. In Nonstationary panels, panel cointegration, and dynamic panels, Emerald Group Publishing Limited: 2001; pp. 93–130.

- Kao, C.; Chiang, M.-H. On the estimation and inference of a cointegrated regression in panel data. In Nonstationary panels, panel cointegration, and dynamic panels, Emerald Group Publishing Limited: 2001; pp. 179–222.

- Breusch, T.S.; Pagan, A.R. The Lagrange multiplier test and its applications to model specification in econometrics. The review of economic studies 1980, 47, 239–253. [Google Scholar] [CrossRef]

- Friedman, M. The use of ranks to avoid the assumption of normality implicit in the analysis of variance. Journal of the american statistical association 1937, 32, 675–701. [Google Scholar] [CrossRef]

- Pesaran, M.H. A simple panel unit root test in the presence of cross-section dependence. Journal of applied econometrics 2007, 22, 265–312. [Google Scholar] [CrossRef]

- Hendry, D.F.; Juselius, K. Explaining cointegration analysis: Part 1. The Energy Journal 2000, 21, 1–42. [Google Scholar] [CrossRef]

- Johansen, S. Statistical analysis of cointegration vectors. Journal of economic dynamics and control 1988, 12, 231–254. [Google Scholar] [CrossRef]

- Barro, R.J.; Lee, J.W. A new data set of educational attainment in the world, 1950–2010. Journal of development economics 2013, 104, 184–198. [Google Scholar] [CrossRef]

- Howitt, P. Endogenous growth theory. In Economic growth, Springer: 2010; pp. 68–73.

- Piketty, T. Capital in the twenty-first century. Trans. Arthur Goldhammer/Belknap, 2014. [Google Scholar]

- Engle, R.F.; Granger, C.W. Co-integration and error correction: representation, estimation, and testing. Econometrica: journal of the Econometric Society, 1987; 251–276. [Google Scholar]

- Razzaq, A.; An, H.; Delpachitra, S. Does technology gap increase FDI spillovers on productivity growth? Evidence from Chinese outward FDI in Belt and Road host countries. Technological Forecasting and Social Change 2021, 172, 121050. [Google Scholar] [CrossRef]

- Xu, X. The Effect of China’s Outward Foreign Direct Investment on the Economic Growth of the Visegrád Group [védés előtt]. Budapesti Corvinus Egyetem, 2023.

- Huang, Y. Understanding China's Belt & Road initiative: motivation, framework and assessment. China economic review 2016, 40, 314–321. [Google Scholar]

- Bloom, D.E.; Canning, D. The health and wealth of nations. Science 2000, 287, 1207–1209. [Google Scholar] [CrossRef]

- Shahbaz, M.; Haouas, I.; Van Hoang, T.H. Economic growth and environmental degradation in Vietnam: is the environmental Kuznets curve a complete picture? Emerging Markets Review 2019, 38, 197–218. [Google Scholar] [CrossRef]

- Murillo Herrera, R. Unravelling the causal associations and path dependencies between Foreign Direct Investment and social development: the case of Panama. University of Bradford, 2023.

- Johnston, L.A. China’s Belt and Road Initiative: Human Capital Implications. In Handbook of Labor, Human Resources and Population Economics, Springer: 2023; pp. 1–29.

- Aghion, P.; Howitt, P.; Brant-Collett, M.; García-Peñalosa, C. Endogenous growth theory; MIT press: 1998.

- Iqbal, K.; Sarfraz, M.; Khurshid. Exploring the role of information communication technology, trade, and foreign direct investment to promote sustainable economic growth: Evidence from Belt and Road Initiative economies. Sustainable Development 2023, 31, 1526–1535. [Google Scholar] [CrossRef]

- Huang, R.; Nie, T.; Zhu, Y.; Du, S. Forecasting trade potential between China and the five central Asian countries: under the background of belt and road initiative. Computational Economics 2020, 55, 1233–1247. [Google Scholar] [CrossRef]

- Wang, P.Z.; Iqbal, H.A. SDGs Contribution to BRI Countries and Its Impact on China’s Export—Based on Stochastic Frontier Approach. Proceedings of 2019 International Conference on Management Science and Industrial Economy (MSIE 2019); pp. 233–240.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).