I. Introduction

Convenience and speed are one of the life steps that people in the world are pursuing. It should be available in various fields and various services so that people do not have to slow down the pace of life because of the inconvenience of certain things. In addition, convenience and speed are the goals of the current trading system, because it is very important in various fields [

1].

Mobile Payments Pay for services and digital or physical goods using your mobile device without the need for cash, checks, or credit cards. The widespread adoption of mobile devices has spawned a new value transfer method that retains the characteristics of mobile devices. With the advent of smartphones and advancements in technology, technology is now required in most areas of business payments. After the survey, many people want and call for the use of cutting-edge technology in mobile payment methods [

2,

3].

With the intensification of the Covid-19 pandemic, making payments using mobile payments has become popular in many parts of Malaysia [

4]. Since COVID-19 is an airborne disease, the virus will inevitably attach to objects and migrate through physical contact. People will gradually reduce the use of cash because they are worried that it will carry the virus and increase the risk of contracting covid-19. With the reduction of the use of cash, mobile payment services are getting deeper and deeper into people’s daily life and spread across various fields. Although mobile payment applications solve the problem of not having to carry cash or cards when going out, there are still some restrictions when paying [

5,

6,

7].

NFC provides a new solution to solve the limitations of mobile payment. It highlights contactless communication and applications using smartphone host card emulation technology. The integration of NFC technology and mobile payment will more thoroughly realize the vision that people no longer need to carry cash or other cards to go out. Unless people have other needs to carry cash or bank cards, people can make any payment with just a mobile phone. This minimizes the risk of people losing their property [

8].

II. Problem Statement

With the advancement of technology, convenience, and speed are very important goals and concepts in mobile payment means [

9]. Most people in our country use debit/credit cards or scan-based mobile payment apps to pay these days. These two payment methods allow customers to execute payments faster and easier than traditional cash transactions. It eliminates the need for citizens to carry large amounts of cash in their handbags. To travel freely, people only need to carry a small amount of cash and a few debit/credit cards. People are less likely to lose money because of it. Additionally, COVID-19 has had a severe impact on traditional payment methods. The number of times people use traditional payment methods has dropped sharply, and they have used mobile payments one after another [

10].

Every industry benefits from mobile stands. The benefits of mobile payments for consumers have already been discussed; the advantages for retailers are discussed next. The use of mobile payments can significantly reduce merchant operating expenses and can reduce merchant operating costs through employees and labour. Its merchants may have fewer problems managing cash, and the use of mobile payments can significantly reduce the number of merchants handling cash [

7].

Although these two payment methods are now commonly used, there are still some limitations that cannot be ignored. Each person must carry several cards, and when paying, the card must be removed from the wallet and scanned. Also, carrying a card increases the chances of losing it and possible fraud. Before starting to apply for a new card, people will ask the bank to cancel the service of the card. Although there is no need to carry cash or other items when shopping using the scanning code mobile payment method, users still need to turn on the mobile device, log in to the application, and then scan the code to complete the transaction. Therefore, the POS system with an NFC function may be a solution that can solve various problems in the mobile payment system. Due to the limitations of the above methods and the impact of the COVID-19 epidemic, there is an urgent need for technology that uses NFC technology to complete the means of payment [

8].

III. Research Objective

RO1: Ensure that users experience a high degree of convenience for transactions when using mobile payments.

RO2: Provide users with a comfortable contactless payment experience when using mobile payments.

RO3: Innovative contact virus defence technology in mobile payments.

IV. Research Hypotheses

RH1: NFC payment allows people to reduce carrying other payment tools.

RH2: NFC payment will reduce the process when users conduct transactions.

RH3: The use of NFC payments can reduce the pandemic infection of contact payment tools.

V. Project Limitation

Even while NFC payment enables people to leave the house with nothing but their smartphones, there are certain constraints in today’s world. To use NFC payments, consumers must first have a mobile phone with an NFC module. Phones without this module cannot support the technology. This will be a significant barrier to the first marketing of NFC payments [

11].

Since NFC is still a relatively new technology in Malaysia, many are taking a wait-and-see approach to see how practical and secure the new technology will be. Therefore, the reputation of service providers is a signal of service quality to users who are not familiar with them [

12].

Because the user uses the mobile phone to bind the card, the user’s mobile phone may have problems such as stealing and swiping the card. If their mobile device is stolen or hacked, the user’s information will be obtained, and the attacker will then be able to access their account.

VI. Literature Review

The Covid-19 pandemic has had a very sensational impact on Malaysia’s financial trading system. For traditional financial transactions, the epidemic has been catastrophic. To protect the well-being and safety of the people, and to make the entire transaction process more convenient, the payment method is bound to undergo a major adjustment. [

13]

It is well known that COVID-19 poses a major threat to global human health and has an impact on the global economy. It attacks the human respiratory system and can cause death in some people with existing health problems; the risk increases with the age of those affected. The virus is mainly spread through saliva droplets or contact with people and surfaces carrying the pathogen. The cash thus becomes more expensive in terms of health risks, ease of use, and the likelihood of acceptance. Industry and academia need to conduct research in the financial field to provide safer and more convenient means of payment [

14].

COVID-19 has temporarily changed the relative costs and benefits of different payment methods: using cash has become expensive in every way while using debit cards has become cheaper. As a result, consumers have moved away from cash. According to the survey, the pandemic accelerated the increase in POS debit card usage, especially in the first year of the pandemic [

14]. In addition, the widespread adoption of mobile devices has spawned a new way of value transfer that retains the characteristics of mobile devices, namely mobile payment [

2]. From a technical point of view, mobile payments are services that use mobile devices to make payments. Consumers can use mobile devices to pay for services and digital or physical goods without the need for cash, checks, or credit cards. The popularity of mobile payments has created a proliferation of payment methods for mobile service operators and bankers. Operators include financial institutions and banks, Internet companies, mobile communication service operators, communication network infrastructure builders, and companies that produce mobile devices. Mobile payment has changed the way people consume and the business models of related industries and has had a huge impact on the economy. From this, we can see the influence of other countries. For example, the Danish central bank stopped printing banknotes and minting coins in 2014, and announced in January 2016 that it would stop banknote transactions, and vigorously promote digital transaction mechanisms across the country [

3].

The financial industry has already provided some methods for payment methods, and this writing method does make users more convenient and secure. But unfortunately, there are many defects in the existing technology:

Internet is required to use in-app transactions.

Requires the user to manually enter or scan a code to pay with the app.

Different cards need to be carried.

Table 1 lists, explores, and compares the technologies that can be used in the POS system, and lists the advantages and disadvantages of each technology. Therefore, the proposed system can be identified according to the disadvantages of competing technologies in

Table 1.

Table 2 shows the payment methods that common hypermarkets in Malaysia offer to the people. Although these hypermarkets have a variety of payment methods, they have not implemented NFC payment.

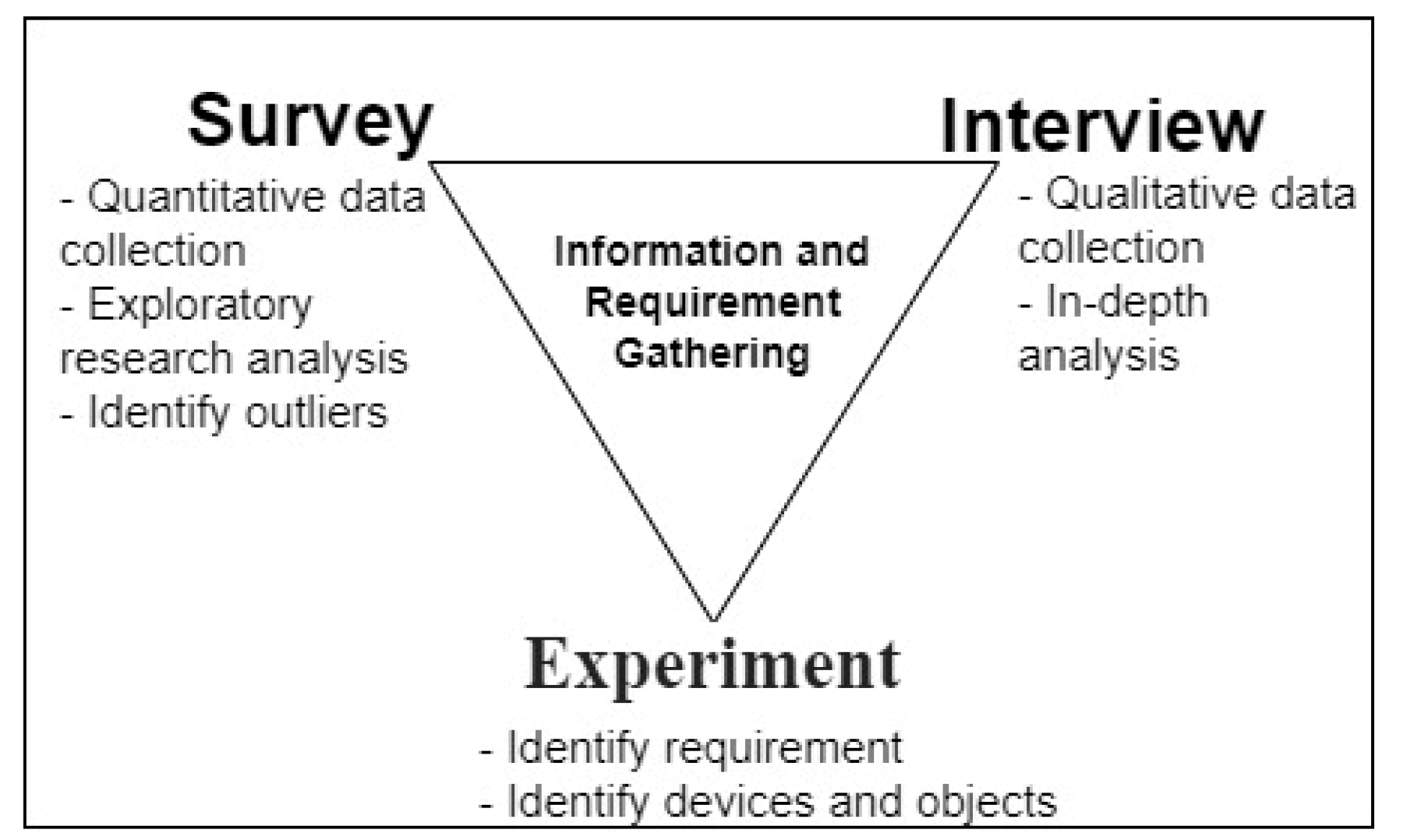

VII. Methodology

The research methodology section describes gathering requirements and information from the target audience and users and understanding their expectations of the application. Triangulation methods will be used for project research as shown in

Figure 1. It is a matter of understanding the basic requirements and concerns of the target audience and users.

Fact-finding refers to gathering information, usually as part of the initial task, to gather facts for subsequent work. The main purpose of fact-finding is to gain an initial understanding of what people know about the environment the team wants to know. In an investigation or investigation, fact-finding is the discovery phase. In this stage, questionnaires and interviews are among the widely used methods to collect information. Quantitative research and qualitative research will be used in questionnaires and interviews to obtain key and effective information from the target audience. After the investigation team collects information through these tools, all the data are aggregated into a report so that information research and exploration can be carried out.

Quantitative data collection is primarily used to collect general facts and information. Respondents in this poll will be randomly selected among people from different backgrounds. Respondents with different backgrounds will have different views on NFC POS systems and NFC payments. Quantitative data will be collected through a google form and information will be collected using Likert scale questions and multiple-choice questions to ensure the accuracy of each question. After the quantitative data collection is completed, qualitative data collection or interviews will be conducted. Qualitative data collection will also be conducted through interviews collected via google forms. Interviews provide an interpretation of the quantitative research survey. Finally, all data will be aggregated and analyzed [

27].

A questionnaire is a series of questions or items. Its purpose is to gather information from the respondents about their attitudes, experiences, or opinions, mainly to gather quantitative research information about the target users. This report uses questionnaires as one of the information collection tools for the fact-finding survey to understand the use of mobile payment by target users, the problems existing in using mobile payment, and the prospect and application of NFC mobile payment in Malaysia. Respondents’ feedback will be divided into three parts. The first section is Demographics, which aims to understand the background and lifestyle of the respondents. The second part is to collect the experience and problems encountered by the respondents in using mobile payment. Finally, the questionnaire will allow respondents to express their suggestions and outlook for the proposed system [

28].

The interview questions will be designed into three parts like the questionnaire questions. The first part is the demographic survey, which captures the background information of the respondents. The second part is to investigate the experience and difficulties encountered by the respondents when using mobile payment. The final section will collect the respondents’ requirements for the system [

29].

The actual data collection will involve 49 respondents and 5 interviewers. All respondents were randomly selected to complete the questionnaire. People who frequently use mobile payments will be invited for interviews to be able to share their views on mobile payments and the use of NFC.

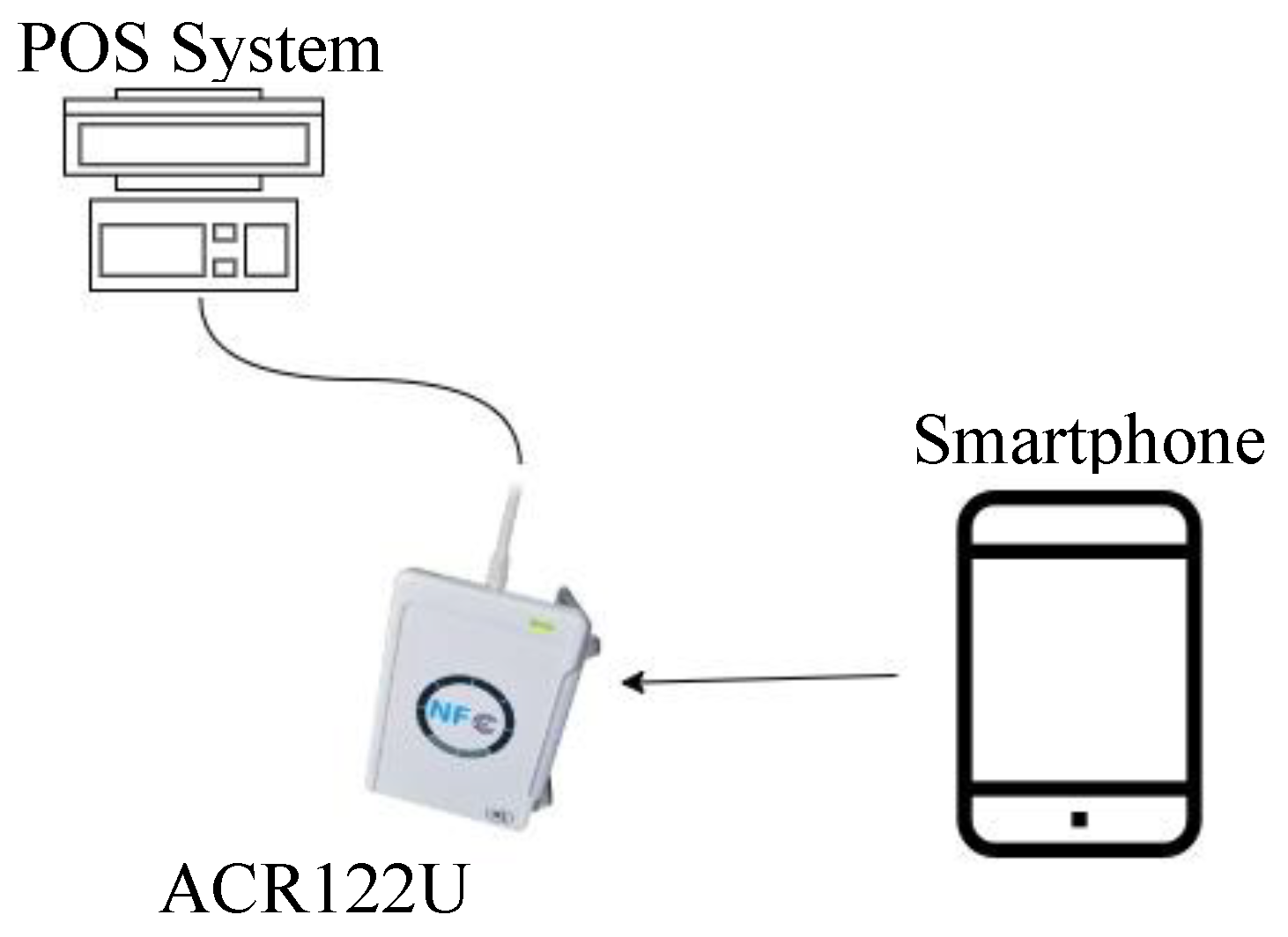

This study explores an innovative POS system capable of designing contactless technology with NFC cutting-edge technology for various shopping malls in Malaysia. The system enables people to easily interact with POS terminals through a simple application. Since the virtual card is used on the smartphone without the need to carry the card used for payment, it reduces travel costs and improves safety for people travelling. NFC payment can also reduce the payment process. As shown in

Table 3, the necessary tools must be used to realize the proposed system.

- ➢

ACR122U NFC Reader

ACR122U NFC reader is a computer-connected non-contact smart card reader. It complies with the ISO/IEC18092 standard for Near Field Communication (NFC) and supports not only MIFARE and ISO 14443 A and B cards, but also all four types of NFC tags. ACR122U allows interoperability with different devices and applications and can read and write quickly and efficiently. Since the ACR122U NFC reader operates as a module, it can be easily integrated into larger machines such as POS terminals, physical access control systems, and vending machines.

Figure 2.

Device Diagram.

Figure 2.

Device Diagram.

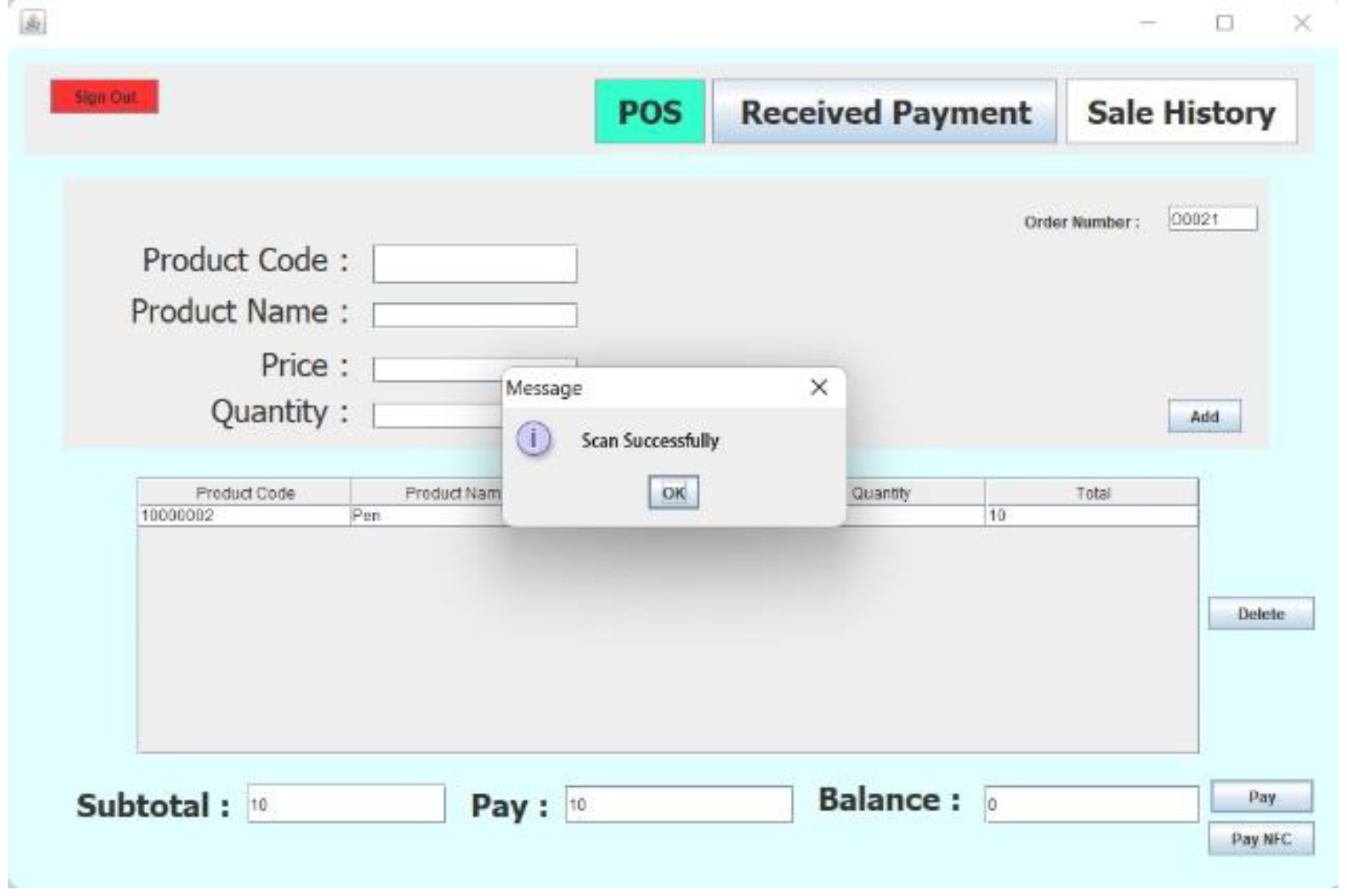

The proposed POS system can satisfy the flow of people conducting post-shopping transactions. Functions such as entering product information, calculating prices, and checking out are all installed on the POS system. In addition to traditional payment methods, this paper adds an NFC payment module to the proposed system, allowing users to use NFC payments to complete transactions.

Figure 3 represents the proposed POS system.

People can use a smartphone emulation card application to interact with the POS system to complete transactions. Users need to create or log in to the account to be able to use the wallet. As shown in

Figure 4. The app requires the user to enable the NFC function of the smartphone.

VIII. Result and Discussion

During the process of collecting responses, a total of 52 responses were received. In addition to collecting the data in the questionnaire, additional suggestions and requests from the interviewers were also collected. When sufficient quantitative data has been collected, the data in the questionnaire will be analyzed to transform them into useful information for further development of the system. Qualitative research is to select some people who often use mobile payment or work at the cash register. This can effectively define the problem or deal with the problem, deeply study the specific characteristics or behaviour of the object, and further explore the reasons for its occurrence.

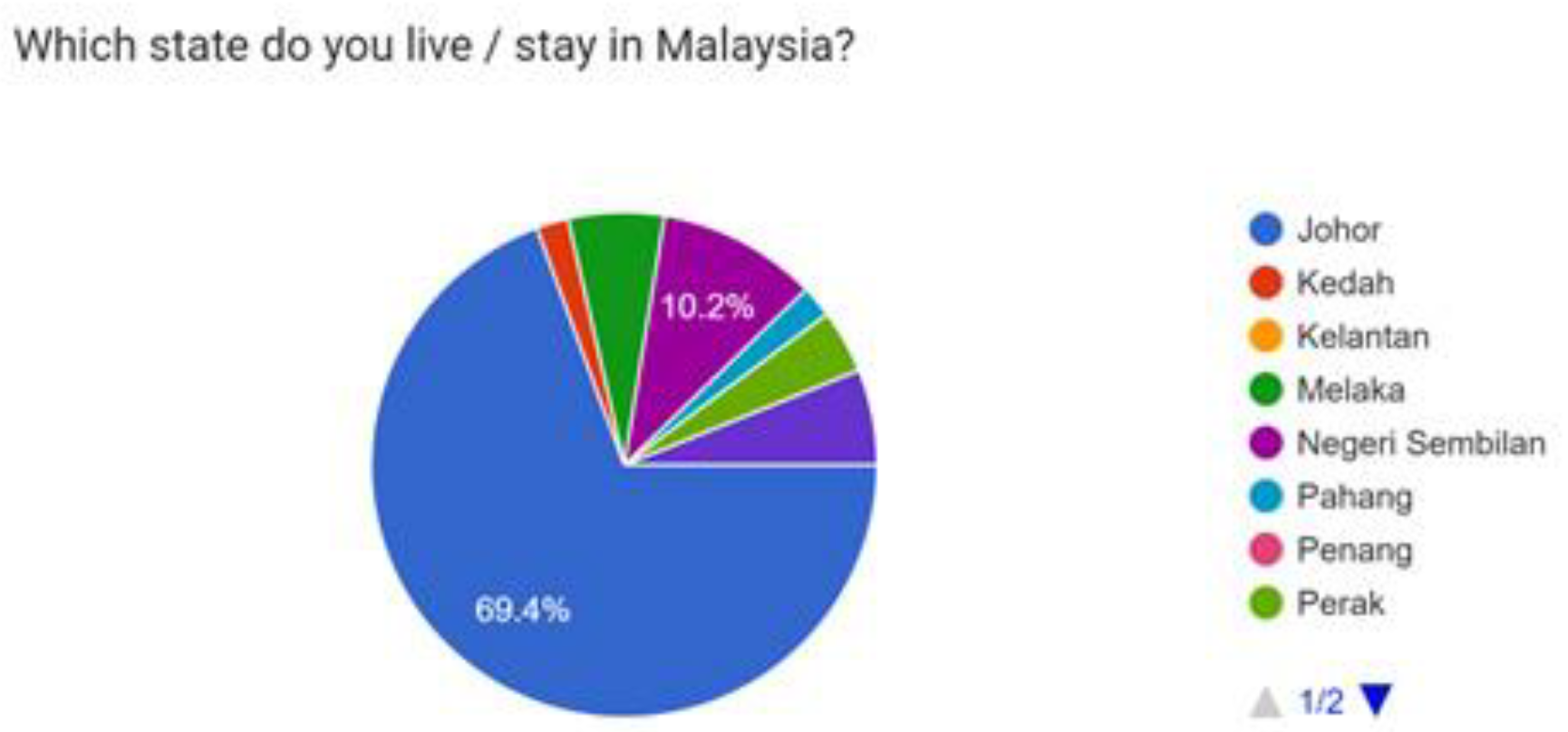

The data in

Figure 5 shows that the respondents are mainly from Johor, Negeri Sembilan, Kuala Lumpur, Malacca, Kedah, Perak, and Pahang. Therefore, the study of payment methods will focus on these few states.

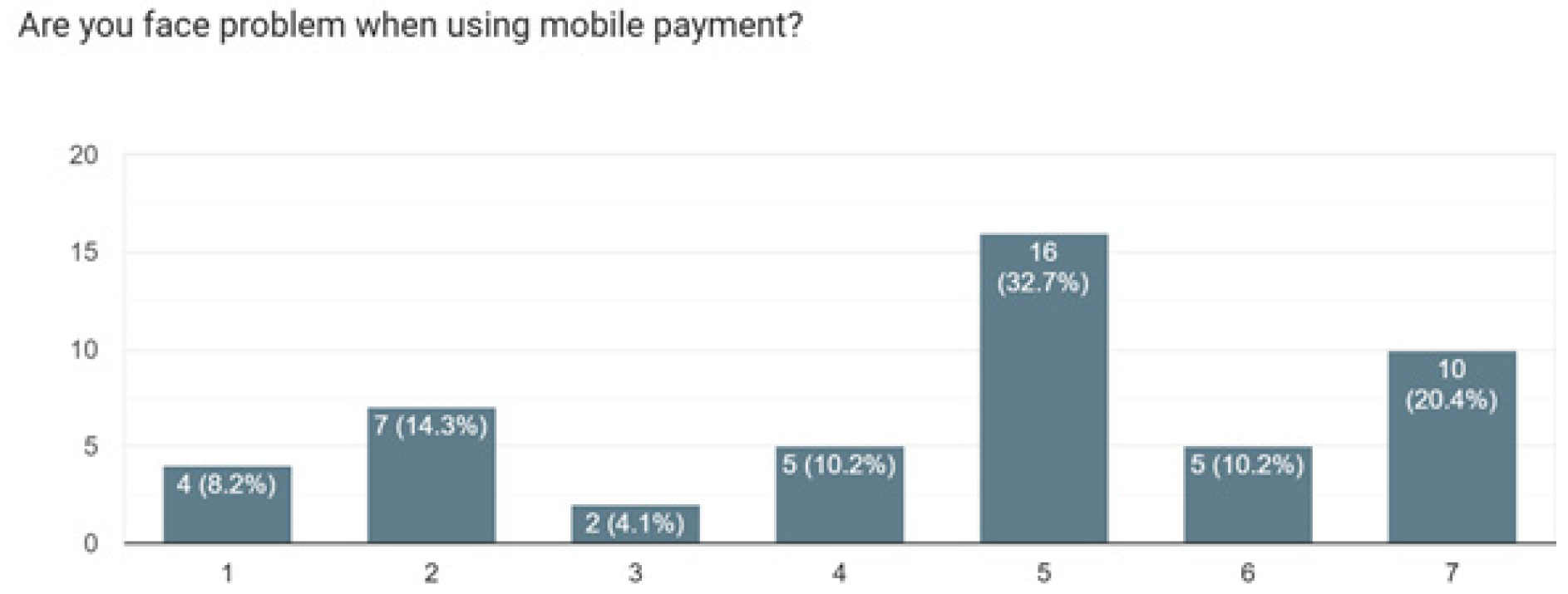

63.3% of the respondents said that they encountered problems when using the existing payment methods, while only 26.6% of the respondents clearly stated that they did not encounter problems with the current payment methods. The problems encountered by 63.3% of the respondents included poor network cables leading to transaction failures or too long transaction times, scanning failures, and complicated transaction processes that were unfriendly to the elderly and inconvenient to use. Therefore, the solution proposed in this paper is to develop a POS system with an attached NFC module to enable them to conduct transactions through smartphones. This can reduce the number of payment instruments that users carry, reducing the risk of loss or damage. And the POS system adds contactless payment, which has high convenience.

Figure 6.

The number of respondents who face problems with the current payment method.

Figure 6.

The number of respondents who face problems with the current payment method.

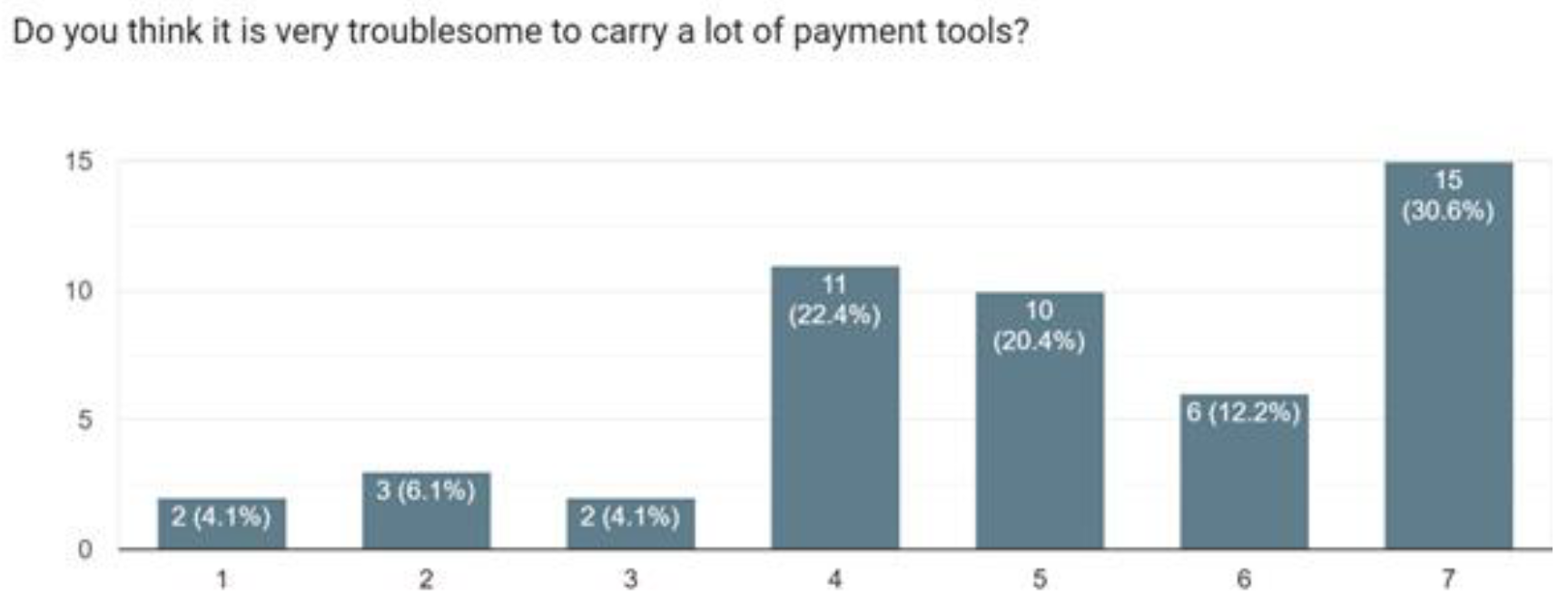

Figure 7 shows the respondents’ willingness to carry a bunch of payment tools when going out. 63.2% of the respondents are troubled by carrying more payment tools when going out, while only 14.3% of the respondents do not mind carrying multiple payment tools. For 63.2% of the respondents, it is very inconvenient to carry multiple payment instruments, and this increases the risk of loss, resulting in an increased chance of financial loss. They look forward to having a payment method that allows people to carry a single device or tool to complete the transaction. Therefore, NFC payment came into being. NFC payment only needs an NFC smartphone to complete the transaction, which is very convenient for users. And most of today’s smartphones have built-in NFC modules, and most users can experience cutting-edge technology without changing devices.

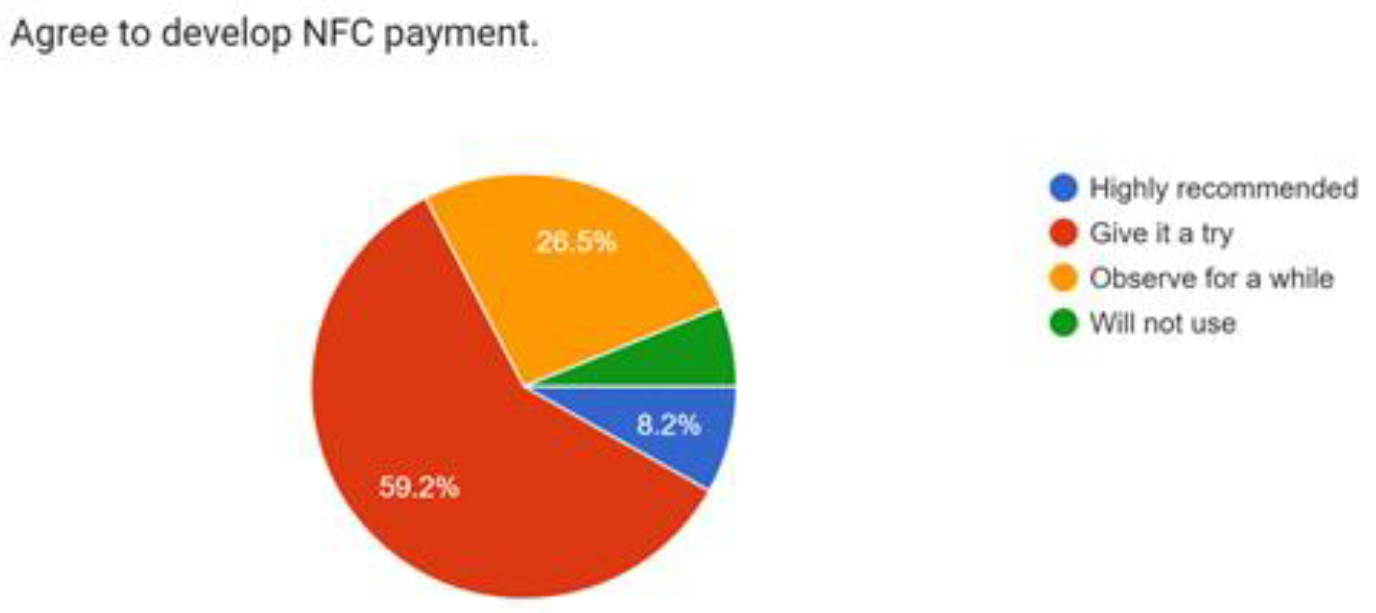

Figure 8 depicts respondents’ willingness to implement NFC payments. Most of the respondents are happy and looking forward to the application of NFC payment. NFC payments will improve the payment process. 67.4% of the respondents expressed high support for the implementation of NFC payment, 26.5% of the respondents held a wait-and-see attitude, and only 6.1% of the respondents refused to use the new payment method. NFC payments allow users to complete transactions without manual or physical interaction. Due to the contactless transaction method, the system reduces the fear of the pandemic virus among users.

IX. Conclusions and Limitation

In this research paper, NFC payment enables users to realize simple and fast contactless and cashless transactions. Using the technological innovation of NFC and HCE can provide a good payment environment for the people of Malaysia. Moreover, the penetration rate of NFC smartphones is not low, and people’s willingness to try new things is also very high, so the development of NFC payments will be relatively smooth. It can improve convenience for people. Significant progress has been made in eliminating the contagiousness of pandemics due to the reduction of necessary physical interactions. However, due to the pandemic lockdown, all evaluation studies were limited to online remote testing and therefore were not tested in actual malls. Testing should be done on-site at the mall so that more accurate data can be obtained. And this study explored the convenience of the system but did not discuss the security in depth. Although NFC payment can provide basic security, many people still have doubts about the security of this technology. Therefore, in the future, it is necessary to explore the security of NFC payment to make Malaysians believe in and use this technology.

References

- See, S.Y. , JosephNg, P.S., Phan, K.Y. and Lim, J.T. (2021). JomWowNFC: Why NFC must be used for Merchant & Consumers? [online] IEEE Xplore. [CrossRef]

- Choi, H. , Park, J., Kim, J. and Jung, Y. (2020). Consumer preferences of attributes of mobile payment services in South Korea. Telematics and Informatics, 51, p.101397. [CrossRef]

- Liao, S.-H. and Yang, L.-L. (2020). Mobile payment and online to offline retail business models. Journal of Retailing and Consumer Services, 57, p.102230. [CrossRef]

- Z. A. Atallah, P. S. JosephNg and K. Y. Phan, “JomNFC: Zero Effort Intelligent Access System,” 2021 Innovations in Power and Advanced Computing Technologies (i-PACT), Kuala Lumpur, Malaysia, 2021, pp. 1–6. [CrossRef]

- Liao, S.-H. and Ho, C.-H. (2021). Mobile Payment and Mobile Application (App) Behavior for Online Recommendations. Journal of Organizational and End User Computing, 33(6), pp.1–26. [CrossRef]

- JosephNg, P.S. , Al-Rawahi, M.M.K. and Eaw, H.C. (2022). Provoking Actual Mobile Payment Use in the Middle East. Applied System Innovation, [online] 5(2), p.37. [CrossRef]

- Liu, Y. , Luo, J. and Zhang, L. (2020). The effects of mobile payment on consumer behaviour. Journal of Consumer Behaviour, 20(3). [CrossRef]

- Li, D. , Wong, W.E., Chau, M., Pan, S. and Koh, L.S. (2020). A Survey of NFC Mobile Payment: Challenges and Solutions using Blockchain and Cryptocurrencies. [online] IEEE Xplore. [CrossRef]

- Boden, J. , Maier, E. and Wilken, R. (2020). The effect of credit card versus mobile payment on convenience and consumers’ willingness to pay. Journal of Retailing and Consumer Services, [online] 52, p.101910. [CrossRef]

- Szumski, O. (2022). Comparative analyses of digital payment methods from the pre and post-COVID-19 perspective. Procedia Computer Science, 207, pp.4660–4669. [CrossRef]

- Singh, N.K. (2020). Near-field Communication (NFC). Information Technology and Libraries, 39(2). [CrossRef]

- Pu, X. , Chan, F.T.S., Chong, A.Y.L. and Niu, B. (2020). The adoption of NFC-based mobile payment services: an empirical analysis of Apple Pay in China. International Journal of Mobile Communications, 18(3), p.343. [CrossRef]

- Daragmeh, A. , Lentner, C. and Sági, J. (2021). FinTech payments in the era of COVID-19: Factors influencing behavioural intentions of ‘Generation X’ in Hungary to use mobile payment. Journal of Behavioral and Experimental Finance, 32, p.100574. [CrossRef]

- Jonker, N. , van der Cruijsen, C., Bijlsma, M. and Bolt, W. (2022). Pandemic payment patterns. Journal of Banking & Finance, [online] 143, p.106593. [CrossRef]

- Bounie, D. and Camara, Y. (2020). Card-Sales Response to Merchant Contactless Payment Acceptance. Journal of Banking & Finance, 119, p.105938. [CrossRef]

- Cao, K. , Han, G., Xu, B. and Wang, J. (2020). Gift card payment or cash payment: Which payment is suitable for a trade-in rebate? Transportation Research Part E: Logistics and Transportation Review, 134, p.101857. [CrossRef]

- Duan, K.-K. and Cao, S.-Y. (2020). Emerging RFID technology in structural engineering – A review. Structures, [online] 28, pp.2404–2414. [CrossRef]

- Mahmud, A. , Marindra, J., Yun, G., Ula, M., Pratama, A., Yuli Asbar, Fuadi, W., Fajri, R. and Hardi, R. (2021). A New Model of The Student Attendance Monitoring System Using RFID Technology You may also like a Chipless RFID sensor for corrosion characterization based on frequency selective surface and feature fusion A New Model of The Student Attendance Monitoring System Using RFID Technology. Journal of Physics: Conference Series PAPER • OPEN ACCESS Journal of Physics: Conference Series, 1807, p.12026. [CrossRef]

- Camacho-Cogollo, J.E. , Bonet, I. and Iadanza, E. (2020). Chapter 4 - RFID technology in health care. [online] ScienceDirect. Available at: https://www.sciencedirect.com/science/article/pii/B9780128134672000043.

- Landaluce, H. , Arjona, L., Perallos, A., Falcone, F., Angulo, I. and Muralter, F. (2020). A Review of IoT Sensing Applications and Challenges Using RFID and Wireless Sensor Networks. Sensors, 20(9), p.2495. [CrossRef]

- Motroni, A. , Buffi, A. and Nepa, P. (2021). A Survey on Indoor Vehicle Localization Through RFID Technology. IEEE Access, 9, pp.17921–17942. [CrossRef]

- Abugabah, A. , Nizamuddin, N. and Abuqabbeh, A. (2020). A review of challenges and barriers to implementing RFID technology in the Healthcare sector. Procedia Computer Science, 170, pp.1003–1010. [CrossRef]

- Shuran, C. and Xiaoling, Y. (2020). A New Public Transport Payment Method Based on NFC and QR Code. [online] IEEE Xplore. [CrossRef]

- Chou, G.-J. and Wang, R.-Z. (2020). The Nested QR Code. IEEE Signal Processing Letters, 27, pp.1230–1234. [CrossRef]

- ALBATTAH, A. , ALGHOFAILI, Y. and ELKHEDIRI, S. (2020). NFC Technology: Assessment Effective of Security towards Protecting NFC Devices & Services. [online] IEEE Xplore. [CrossRef]

- Escobedo, P. , Bhattacharjee, M., Nikbakhtnasrabadi, F. and Dahiya, R. (2021). Smart Bandage With Wireless Strain and Temperature Sensors and Batteryless NFC Tag. IEEE Internet of Things Journal, 8(6), pp.5093–5100. [CrossRef]

- Wallwey, C. and Kajfez, R. (2023). Quantitative research artefacts as qualitative data collection techniques in a mixed methods research study. Methods in Psychology, 8, p.100115. [CrossRef]

- Grassini, S. and Laumann, K. (2020). Questionnaire Measures and Physiological Correlates of Presence: A Systematic Review. Frontiers in Psychology, 11. [CrossRef]

- Roberts, R. (2020). Qualitative Interview Questions: Guidance for Novice Researchers. The Qualitative Report, 25(9). [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).