1. Introduction

The COVID-19 pandemic has exacerbated financial risks. In this research, financial (budgetary) risks are defined as a decrease in the balance of the state (national) budget as a result of a decrease in revenues or an increase in expenditures (Polukhin and Panarina, 2022; Popkova and Sergi, 2021; Vagin et al., 2022; Yelikbayev and Andronova, 2022). This research considers production in the main sectors of the economy as a key factor of financial risk in the COVID-19 pandemic.

A study of the current Russian tax and budgetary policies in the context of the restrictions imposed due to the spread of COVID-19 and a systemic analysis of financial measures carried out by the state authorities is necessary to assess the effectiveness of the measures introduced and develop proposals for improving tax and budgetary policies at the regional and federal levels.

The research aims to analyze the impact of restrictive measures introduced by the state and regions on the economic activity of certain sectors of the economy, the employment level, and consumer demand, as well as to develop proposals in the sphere of public financial policy, which will mitigate the negative consequences of the adopted restrictive measures for the welfare of the country’s citizens and the financial stability of business entities.

The authors attempt to summarize the risks and possible measures taken at the state level aimed at overcoming the consequences of COVID-19. So far, the economic literature lacks this kind of research, and the publications available are mainly devoted to highly specialized areas of the microeconomic level.

2. Literature Review

The fundamental basis of the research in this research is the concept of financial (fiscal) risks. According to this concept, Huang et al. (2022) note the strong impact of the COVID-19 pandemic on systemic financial risks (based on data from China’s financial and real estate sectors). Based on a field study of three state-owned enterprises in China, Jermias et al. (2022) proved the necessity of institutionalizing budgetary controls to improve financial risk management.

Ríos et al. (2018) also noted the benefits of legislative budgetary controls to reduce financial risks. Mobin et al. (2022) pointed out the close link between the COVID-19 pandemic and the financial risk dynamics of the G7 countries. Consequently, all economies, even the most advanced and progressive ones, are negatively affected by the COVID-19 pandemic. This negative impact includes increased financial risks. Moslehpour et al. (2022) noted increased financial risks due to the panic effect of COVID-19 on the European and Vietnamese stock markets.

Stockemer et al. (2022) substantiated the high differentiation of the level and the manifestation of financial risks among economic systems due to differences in the measures used to contain the COVID-19 pandemic. Rahim et al. (2021) pointed out the close link between financial risks and the financial situation of business entities during the COVID-19 pandemic. Heo et al. (2021) noted the significant impact of the COVID-19 pandemic on the risk tolerance of financial decision-makers.

Nguyen and Hoang Dinh (2021) the experience of Vietnamese firms and proved the usefulness of proactive financial risk management to maintain financial stability during the COVID-19 pandemic. Haroon et al. (2021) pointed to increased financial market risks during the COVID-19 pandemic. Guo et al. (2021) identified the phenomenon of the spread of tail risk between international financial markets during the COVID-19 pandemic. Jabbar et al. (2020) suggested reducing the overall level of uncertainty through in-depth analysis of financial statements to improve financial risk management under COVID-19.

The risks of the business sector during the pandemic have also been the subject of a number of scientific studies. In such studies, the occurrence of risk is understood as the possibility of a loss in the framework of entrepreneurial activity. These include such risks as: lower revenue and net profit (Kharlanov et al. 2022; Popkova and Sergi 2021); risks of depreciation of the value of assets and the company itself within the framework of VBM (Marobhe 2022; Pospíšil et al. 2021); competitiveness risks (Łasak and Wyciślak 2022; Vagin et al. 2022); risks of losing the company's talent pool (Gavlovskaya and Khakimov 2022; Ho et al. 2022; Zaheer et al. 2022).

A separate aspect of entrepreneurial research was logistics, which was severely limited in the context of the spread of a previously unknown disease. Beata Sz. G. Pato et al. (2022) suggests that the current situation will contribute to the long-term flexibility of economic entities, and not just the growth of short-term efficiency in the most difficult times. The challenge is to find the right balance between a lean and efficient supply chain that is not redundant (like just-in-time) but is sensitive and adaptable to unexpected shocks. The introduction of electric vehicles, unmanned vehicles, automated factories and carsharing are not only logistical, but also general economic consequences that have manifested themselves and continue to intensify in Russia.

In addition, there are a number of review monographs on various aspects of the impact of COVID-19 at the macroeconomic level. A detailed analysis of various subtopics (e.g., monetary and fiscal policy, health inequality) is reviewed in the monograph (Koen B., 2022), which provides a balanced explanation of why Covid-19 policy has failed in Western countries. The article provides an overview of possible adjustments to the systems of the socio-economic order.

Based on the literature review results, we can conclude that the available publications clearly show an increase in financial risks under the influence of the COVID-19 pandemic. Nevertheless, the available literature does not fully disclose the national specifics of changes under the influence of the COVID-19 pandemic and financial risk management, in particular in Russia. Thus, these areas remain understudied. This research seeks to fill this gap through a detailed study of the experience and prospects of financial risk management of the Russian economy during the COVID-19 pandemic.

3. Methods and Materials

The tools for analyzing financial risks are considered in a number of international studies. So Kashif Saleem et al. (2023) have explored the problem of the impact of the pandemic on the process of portfolio investment management. The dynamics of gold and the Islamic financial sector as a whole during the period of high volatility was considered on the basis of the multivariate VAR–GARCH–BEKK procedure. However, such specific methods for modeling the volatility of financial instruments are not suitable.

The authors use the methodology of a systematic review: from the general to the specific..

A similar approach was implemented as part of the analysis of risk management in a smart city in the context of the spread of the virus, considered by Mariana Petrova et al. (2022). The study analyses risk basing on a systematic review, which differs from the traditional in that it is formally planned and carefully thought out. The main stages of this method include the preparation of the study, the conduct of the study, and the disclosure and dissemination of the results. This approach is closest to the framework of our study.

At the first stage of the study, macroeconomic indicators are collected. Commonly authors mean the main sources of the tax law in the analyzed country, which contain the final reliable indicators for a particular period. These sources include:The budget law (Federal law “On the federal budget for 2020 and for the planning period of 2021 and 2022” (December 2, 2019 No. 380-FZ)) (Russian Federation, 2019) reflected the main directions and priorities of the country’s development. It was based on the provisions of the Decree of the President of the Russian Federation “On national goals and strategic objectives of the development of the Russian Federation for the period up to 2024” (May 7, 2018 No. 204) (President of the Russian Federation, 2018) and the key provisions outlined in the President’s Address to the Federal Assembly of the Russian Federation of February 20, 2019 (President of the Russian Federation, 2019).

The listed sources are the main targets that may or may not be achieved under certain circumstances. In the framework of our study, such circumstances are the spread of a viral infection, previously unknown to the medical system of all countries of the world.

At the second stage, the result of achieving the initially planned indicators is carried out on the basis of actual data collected from official sources - state statistics departments, the scientific community and expert opinions in a particular area of economic activity.

The data collected and visualised by the authors will allow to our circle the problematic areas of the Russian economy. In our study, we will take a closer look at the industry, broken down by sector. At the same time, zero dynamics will be the limit, below which the industry will need serious support, an early revision of the profile financial and economic policy, and the adoption of stimulating and stabilizing measures. Otherwise, we will identify leading sectors, the practice of implementing the financial policy of which should be taken into account by the country's leadership as a reference, which can be fully translated to the sub-federal level of government, as well as other areas of regulation.

The applied methods of time series analysis, the formation of a trend model, and the visualization of statistical data make it possible to conduct a generalized assessment of the impact of the pandemic on Russia's financial policy. The presented experience can be fully translated to countries with a similar level of economic development, which emphasizes the international component of the usefulness of the conclusions made by the authors.

4. Results

The federal budget for 2020–2022 was of a pronounced social nature, which was manifested in the growth of spending on social programs and financial support for the constituent entities of the Russian Federation. The leading role in the budget was played by healthcare expenditures. The growth of healthcare expenditures was envisaged to be 320 billion rubles in 2020 and 160 billion rubles in 2019.

Specific budget indicators (Dagaev et al., 2019; Mishakov et al., 2021) are given in

Table 1.

Simultaneously, significant support for small and medium-sized businesses has been preserved. The law provides for four special tax regimes for small and medium-sized businesses, the use of which makes it possible to significantly reduce the tax burden on businesses and minimize risks during tax control measures. The scientific and technological innovation complex “Skolkovo” has been created to provide significant tax benefits for small businesses operating in the field of innovation. Additionally, support is provided through concessional lending for business projects, a mandatory quota for small businesses in the public procurement system, free consulting services, and budgetary funding for advanced training of employees of small businesses.

However, the fight against the COVID-19 pandemic required additional investments. According to the calculations of the Federal Service for Surveillance on Consumer Rights Protection and Human Wellbeing (Rospotrebnadzor), the damage to the Russian economy from the COVID-19 pandemic has amounted to 997.06 billion rubles (0.94% of GDP in 2020), which is 1.4 times more than the annual loss from the fight against all other infectious diseases. It should be noted that global forecasts in this relation are much more pessimistic, ranging from 3.5 to 10 global GDP.

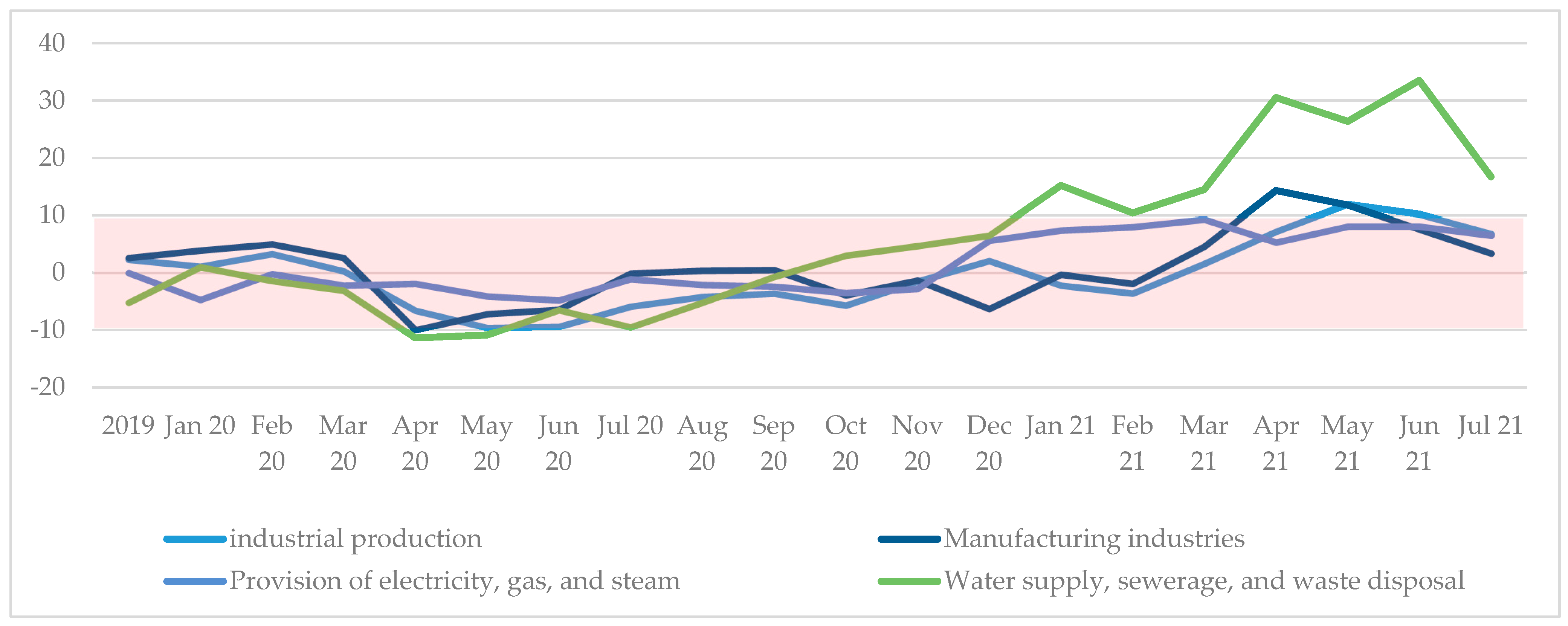

The COVID-19 pandemic has made adjustments not only to the current execution of federal and regional budgets in terms of revenues and expenditures but has also created high uncertainty for the future. During the first wave of the pandemic, a lockdown caused extremely negative consequences for many sectors of the economy, including air transportation, passenger transportation and airport services, culture, leisure and entertainment, fitness, tourism, hotel, restaurant business, retail non-food products, the activities of non-governmental educational organizations, the provision of consumer services to the population, etc. The dynamics of the listed sectors of the Russian economy are shown in Graphic 1.

Graphic 1.

Dynamics of production in the main sectors of the Russian economy, %. Source: compiled by the authors.

Graphic 1.

Dynamics of production in the main sectors of the Russian economy, %. Source: compiled by the authors.

As a result of the second and third “waves” of the COVID-19 pandemic, temporary and territorial restrictions remain negatively affecting their profitability and wages. According to some expert estimates, revenues in some industries have decreased by 60%–70%, which jeopardized the very possibility of the business functioning.

The contraction of business occurred against the backdrop of a negative trend towards the reduction of enterprises and those working for them, which has developed in recent years despite all incentive measures taken by the government.

Based on the information in

Table 2, we can conclude that the number of small businesses in 2020 decreased by 15.4% compared to 2016 and by 11.2% compared to 2019. For four consecutive years leading up to the COVID-19 pandemic, there was a decline in small business employment.

Under these conditions, the Government of the Russian Federation and the constituent entities of the Russian Federation were forced to introduce emergency measures to support small and medium-sized enterprises affected by COVID-19. Their implementation required significant financial resources against the backdrop of declining tax revenues.

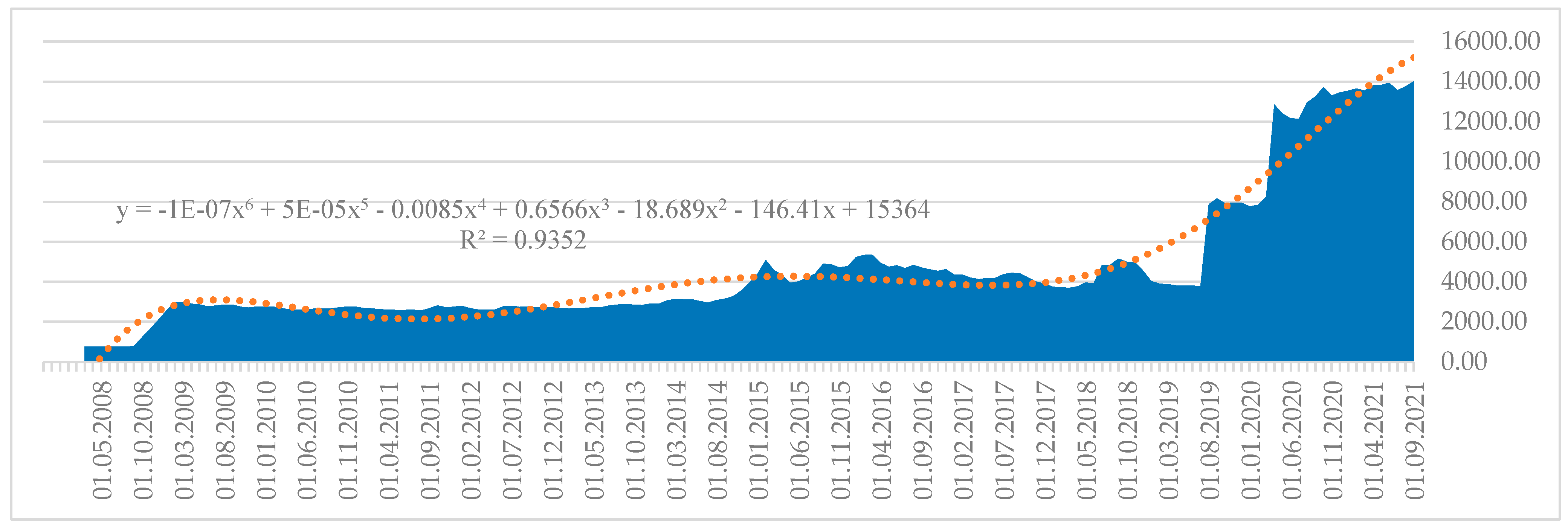

To solve the problems of state support for the economy, the “safety cushion” in the form of the National Wealth Fund (NWF) appeared to be convenient, the volume of which exceeded 8 trillion rubles in mid-2020 and reached 12 trillion rubles by the end of the year (Graphic 2). Favorable conditions in the commodity markets (oil, gas, metals market) allow the fund to continue to grow. The aspect of the efficiency of managing the accumulated financial resources, as well as the possible directions of their investment in projects for the development of their own economy, remains debatable. The uncertainty associated with epidemiological restrictions reduces the investment activity of domestic and foreign investors. The risks of disruption of investment projects are increasing due to restrictions on passenger traffic and the logistics of components and finished goods to the consumer.

Graphic 2.

Dynamics of the NWF volume and trend line, billion rubles. Source: compiled by the authors based on (Mishakov et al., 2021; Zvereva et al., 2020).

Graphic 2.

Dynamics of the NWF volume and trend line, billion rubles. Source: compiled by the authors based on (Mishakov et al., 2021; Zvereva et al., 2020).

The measures taken by state and regional support for business can be classified into tax, budget, and credit.

Tax support (including adjustments) has been introduced in several areas: taxation of corporate profits, personal income taxation, employers’ contributions to the social insurance of employees, VAT, and other taxes on goods and services, as well as other forms of fiscal payments and levies.

Let us consider each of the directions in more detail and characterize the goals and estimated effectiveness of the implemented measures.

The following measures have been implemented in the sphere of income taxation of individuals:

Exemption of incentive payments from the federal and regional budgets for medical and social workers involved in the fight against COVID-19 from personal income tax;

Exemption from personal income tax of one-time compensation payments financed in accordance with the approved state programs for the income of medical workers and teachers (to increase income, and hence the effective demand of the population);

A 3-month deferral for the payment of personal income tax by individual entrepreneurs, payable for 2019;

An increase from 13% to 15% of the personal income tax rate for certain types of personal income exceeding 5 million rubles for the tax period (to increase the volume of incoming personal income tax for further redistribution to support medical treatment programs for children with orphan diseases);

The introduction of income tax on income from bank deposits of Russian banks in excess of an amount equal to the product of 1 million rubles and the key rate of the Central Bank of the Russian Federation except for the deposits with an interest rate of less than 1% and escrow accounts (to increase the volume of tax revenues to the budget).

In the area of employers’ contributions to the social insurance of employees, the following was carried out:

Reduction of insurance premiums for small and medium-sized enterprises from 30% to 15% for salaries over one minimum wage (12130 rubles, which is equal to 147 euros);

Reduction of the rate of insurance premiums for information and telecommunication companies to 7.6%, subject to certain conditions;

Deferral of insurance premiums for up to six months for micro-enterprises with less than 15 employees.

In the field of taxation of corporate profits, the following was carried out:

The quality of the multilateral mutual agreement program (MAP) and preliminary pricing agreements (APA) has been improved;

The income tax rate for information and telecommunications companies was reduced from 20% to 3%, taking certain conditions into account.

In the sphere of indirect taxation (VAT and other taxes on goods and services), the following was carried out:

Certain medical goods and pharmaceuticals were exempted from VAT and import customs duties when importing;

VAT exemption on the sale and licensing of software and databases of information and telecommunications companies, subject to certain conditions.

In 2022, the VAT rate for restaurateurs and hoteliers may be introduced at 0%, provided that their annual revenue does not exceed two billion rubles yearly.

Other taxation measures include the following:

A six-month grace period for all taxes (excluding VAT) and insurance contributions to social off-budget for small businesses and shopping centers (Semenova, 2020);

Moratorium on on-site tax audits for small businesses, including tax audits initiated earlier, audits of online cash registers, and control measures in the field of currency legislation, has been extended until the end of 2022;

Restructuring of tax payments for the most affected businesses for a period of one year;

A 4-month deferral of tax on the patent taxation system (if payable in the Q2 of 2020);

Provision of installments for 3, 6, 9, or 12 months, depending on the severity of the economic condition of the taxpayer (percentage of income reduction);

Payment by installments of taxes for a period not exceeding five years under certain conditions and at the request of the taxpayer;

Cancellation of the special tax regime – a unified tax on imputed income for certain types of activities, as ineffective in the opinion of the Federal Tax Service of the Russian Federation.

The main measures of budget support include the following:

Subsidizing wages at the rate of one minimum wage per employee;

A deferral of rent payments to the state, regions, municipalities, and commercial real estate;

Direct gratuitous financial support to small and medium-sized businesses to address current urgent tasks;

Reduction of the requirements for securing companies in public procurement;

Compensation payments to medical workers involved in the fight against the COVID-19 pandemic;

One-time payments to parents for each child, including payment upon admission of a child to first grade;

Refunds for the purchase of vouchers for children in sanatoriums and children’s summer camps;

Cashback for buying tourist vouchers for a family for domestic tourism;

Other measures (Semenova, 2019).

Direct payments from the federal budget to support citizens and businesses have amounted to 515 billion rubles. The amount of budget spent directly on the fight against COVID-19 has exceeded one trillion rubles. The budget funds were allocated for the following purposes:

Treatment of patients in hospitals (183 billion rubles);

Testing to detect infection (108 billion rubles);

Organization and provision of medical care to patients (189.4 billion rubles).

As part of the fight against COVID-19 in Russia, the money was directed to the construction and conversion of hospitals, funding the work of laboratories and mobile teams development and production of equipment and drugs for COVID-19, and production of personal protective equipment.

In the sphere of lending, loans and borrowings issued to SMEs and self-employed were restructured. In the event of a significant deterioration in the financial situation of the borrower, a loan program at 0% on wages was developed. In some cases, the requirements for borrowers when obtaining new loans were simplified. The reduced interest rate on loans was extended to the amount of 8.5% for small and medium-sized businesses. The Central Bank of the Russian Federation recommended that commercial banks not charge the borrower a fine and penalties for a penalty for improper performance of a loan or loan agreement; interest and commissions on microcredits were reduced; a six-month grace period was provided for the affected industries repayment of loans. In difficult situations, a businessman obtained the right to temporarily suspend debt servicing and roll over it without penalties.

Additionally, several concessions were introduced in the area of supervision and licensing.

5. Discussion

The current economic situation does not inspire optimism due to high financial risks. Despite the measures taken, the ongoing pandemic continues to expand, which forces the federal center and the regions to introduce restrictive measures and additional sanitary requirements for businesses that may negatively affect their financial situation.

The least financially stable business – a small business focused on selling goods, works, and services to the population – is under threat of bankruptcy. Quarantine measures have had an extremely negative impact on the profitability of the undertakings in the tourism, sports, and transport industries, as well as enterprises involved in cultural and recreational activities, advertising, leisure activities, etc. The situation worsens due to an increase in unemployment and poverty, the rise of internal political and social tension, continuing decrease in the birth rate, and other negative social consequences.

The depth of the recession and the speed of the subsequent economic recovery in the current force majeure conditions directly depend on the effectiveness of the state budgetary and tax policy.

Factories emit harmful substances such as dust, oil ash, various chemical compounds, nitrogen oxides, and more. Polluted air causes many chronic diseases and affects budget surplus. The COVID-19 pandemic has not ended, but we still need to live and think about the prospects for the development of environmental taxation in Russia. In this case, financial risk management should be the main focus of attention.

6. Conclusions

The current situation requires the development of new instruments of fiscal policy, which will make it possible to respond promptly to the current economic and social situation and provide highly effective financial risk management. These instruments can also be implemented in the long term, including the cases of emergencies alike.

In our opinion, special provisions could be introduced into the budget and tax codes, which would come into force if an epidemiological emergency were declared in the country or any of its regions. These provisions will take effect immediately without any consideration at the government or parliamentary level. Such an approach will help immediately stabilize the situation in “‘problematic” sectors of the economy and make it possible to avoid mistakes related to the proper sequence and synchronization of the measures. Thus, for example, the situation of non-immediate exemption from personal income tax of the compensation payments to doctors and the population could be avoided.

These provisions in the budget and tax codes may be differentiated depending on the level of danger. To begin with, one can enter two color codes – orange and red, by analogy with the national standard GOST R 22.3.13-2018 (ISO 22324: 2015) “Safety in emergencies” (Rosstandart, 2018).

The orange code indicates a real danger of an emergency. Therefore, an orange calls for introducing such measures of state and regional support in the interest of financial risk management as:

Subsidies for low-income and at-risk groups of the population to expand social support for families with children, state guarantees for loans to the population, and medical tax deductions;

Subsidized rent;

The introduction of temporary tax holidays for small businesses that have lost their clientele due to quarantine measures for the entire aggregate of tax payments and levies collected;

Temporary release of these enterprises on contributions to social extra-budgetary funds provided that the staffing table is maintained at the pre-crisis level;

Abolition of the tax on professional income and the single tax under the patent taxation system;

Introducing a moratorium on payment of fines and penalties for tax debts with the subsequent write-off of the debt;

Cancellation of tax control measures in relation to small businesses.

The red code indicates a significant likelihood of catastrophic consequences. Therefore, additional measures of state and regional support in the interest of financial risk management are required:

Subsidies and government guarantees for loans to small and medium-sized businesses;

Doubling of all personal income tax deductions;

Introduction of a non-taxable minimum for personal income tax at the level of two minimum wages;

Doubling the maximum amount of compensation for deposits of the population and small businesses;

Deferral for the collection of all taxes levied under special tax regimes, with their subsequent restructuring;

Subsidizing quarantine measures at the expense of the respective budgets;

One step upward shift of all depreciation groups.

Red code signals a significant likelihood of catastrophic consequences.

Currently, these standards relate exclusively to emergencies and are not linked to the fiscal toolkit. Their application in the monetary sphere will allow the implementation of financial support measures with due efficiency without time losses for additional coordination of measures with the legislature.

In 2022, the parameters of the pandemic period remain.

References

- Byttebier, K. Covid-19 and Capitalism. In Economic and Financial Law & Policy – Shifting Insights & Values; Springer: Cham, Switzerland, 2022. [Google Scholar] [CrossRef]

- Dagaev, A.M.; Novikov, A.V.; Afonin, M.V.; Maximov, D.A.; Golubtsova, E.V. Systems engineering: Tax risk peculiarities in project execution. Int. J. Eng. Adv. Technol. 2019, 8, 2226–2230. [Google Scholar]

- Federal Technical Regulation and Metrology Agency (Rosstandart). GOST R 22.3.13-2018 (ISO 22324: 2015) “Safety in Emergencies”; Rosstandart: Moscow, Russia, 2018; Available online: https://docs.cntd.ru/document/1200159283 (accessed on 16 November 2022).

- Gavlovskaya, G.; Khakimov, A. Impact of the COVID-19 Pandemic on the Electronic Industry in Russia. In Current Problems of the World Economy and International Trade; Emerald Publishing Limited: Bingley, England, 2022; Volume 42. [Google Scholar]

- Guo, Y. , Li, P.; Li, A. Tail risk contagion between international financial markets during COVID-19 pandemic. Int. Rev. Financ. Anal. 2021, 73, 101649. [Google Scholar] [CrossRef]

- Haroon, O.; Ali, M.; Khan, A.; Khattak, M.A.; Rizvi, S.A.R. Financial market risks during the COVID-19 pandemic. Emerg. Mark. Financ. Trade 2021, 57, 2407–2414. [Google Scholar] [CrossRef]

- Heo, W.; Rabbani, A.; Grable, J.E. An evaluation of the effect of the COVID-19 pandemic on the risk tolerance of financial decision makers. Financ. Res. Lett. 2021, 41, 101842. [Google Scholar] [CrossRef] [PubMed]

- Huang, W.; Lan, C.; Xu, Y.; Zhang, Z.; Zeng, H. Does COVID-19 matter for systemic financial risks? Evidence from China’s financial and real estate sectors. Pac. Basin Financ. J. 2022, 74, 101819. [Google Scholar] [CrossRef]

- Jabbar, A.K.; Almayyahi, A.R.A.; Ali, I.M.; Alnoor, A. Mitigating uncertainty in the boardroom: Analysis to financial reporting for financial risk COVID-19. J. Asian Financ. Econ. Bus. 2020, 7, 233–243. [Google Scholar] [CrossRef]

- Jermias, J.; Fu, Y.; Fu, C.; Chen, Y. Budgetary control and risk management institutionalization: A field study of three state-owned enterprises in China. J. Account. Organ. Change 2022. [Google Scholar] [CrossRef]

- Kharlanov, Alexey S. , Yuliya V. Bazhdanova, Teimuraz A. Kemkhashvili, and Natalia G. Sapozhnikova. The Case Experience of Integrating the SDGs into Corporate Strategies for Financial Risk Management Based on Social Responsibility (with the Example of Russian TNCs). Risks 2022, 10, 12. [Google Scholar] [CrossRef]

- Łasak, P.; Wyciślak, S. Dynamics in Complex Systems Amidst Crisis 2008+: Financial Regulatory and Supervisory Reflections. Risks 2022, 10, 33. [Google Scholar] [CrossRef]

- Litvinova, T.N. Risks of Entrepreneurship amid the COVID-19 Crisis. Risks 2022, 10, 163. [Google Scholar] [CrossRef]

- Mishakov, V.Y.; Daitov, V.V.; Gordienko, M.S. Impact of digitalization on economic sustainability in developed and developing countries. In Sustainable Development of Modern Digital Economy; Ragulina, J.V., Khachaturyan, A.A., Abdulkadyrov, A.S., Babaeva, Z.S., Eds.; Springer: Cham, Switzerland, 2021; pp. 265–274. [Google Scholar] [CrossRef]

- Mobin, M.A.; Hassan, M.K.; Khalid, A.; Abdul-Rahim, R. COVID-19 pandemic and risk dynamics of financial markets in G7 countries. Int. J. Islam. Middle East. Financ. Manag. 2022, 15, 461–478. [Google Scholar] [CrossRef]

- Moslehpour, M.; Al-Fadly, A.; Ehsanullah, S.; Chong, K.W.; Xuyen, N.T.M.; Tan, L.P. Assessing financial risk spillover and panic impact of Covid-19 on European and Vietnam Stock market. Environ. Sci. Pollut. Res. 2022, 29, 28226–28240. [Google Scholar] [CrossRef] [PubMed]

- Nguyen, L.T.M.; Hoang Dinh, P. Ex-ante risk management and financial stability during the COVID-19 pandemic: A study of Vietnamese firms. China Financ. Rev. Int. 2021, 11, 349–371. [Google Scholar] [CrossRef]

- Pató, B.S.G.; Herczeg, M.; Csiszárik-Kocsir, Á. The COVID-19 Impact on Supply Chains, Focusing on the Automotive Segment during the Second and Third Wave of the Pandemic. Risks 2022, 10, 189. [Google Scholar] [CrossRef]

- Petrova, M.; Tairov, I. Solutions to Manage Smart Cities’ Risks in Times of Pandemic Crisis. Risks 2022, 10, 240. [Google Scholar] [CrossRef]

- Pavolova, H.; Culkova, K.; Simkova, Z. Influence of covid-19 pandemic on the economy of chosen EU countries. In Multidisciplinary Digital Publishing Institute: World. Basel, Switzerland, 2022; Vol. 3, pp. 672–680. [CrossRef]

- Polukhin, A.A.; Panarina, V.I. Financial risk management for sustainable agricultural development based on corporate social responsibility in the interests of food security. Risks 2022, 10, 17. [Google Scholar] [CrossRef]

- Popkova, E.G.; Sergi, B.S. Dataset modelling of the financial risk management of social entrepreneurship in emerging economies. Risks 2021, 9, 211. [Google Scholar] [CrossRef]

- Popkova, E.; Bruno, G.; Sergi, S. Dataset modelling of the financial risk management of social entrepreneurship in emerging economies. Risks 2021, 9, 211. [Google Scholar] [CrossRef]

- President of the Russian Federation. Decree “On national goals and strategic ob-jectives of the development of the Russian Federation for the period up to 2024”; (7 May 2018); Presidential Executive Office: Moscow, Russia, 2018; Available online: http://static.kremlin.ru/media/acts/files/0001201805070038.pdf (accessed on 16 November 2022).

- President of the Russian Federation. President’s Address to the Federal Assembly of the Russian Federation of 20 February 2019; Presidential Executive Office: Moscow, Russia, 2019; Available online: http://www.en.kremlin.ru/events/president/news/59863 (accessed on 16 November 2022).

- Rahim, H.A.; Zainal, N.; Sabri, M.F. Identifying the Financial status risk factors for single mothers during the COVID-19 pandemic. Int. J. Econ. Management. 2021, 15, 423–436. Available online: https://www.researchgate.net/publication/357116517_Identifying_the_Financial_Status_Risk_Factors_for_Single_Mothers_During_the_COVID-19_Pandemic (accessed on 16 November 2022).

- Ríos, A.-M.; Bastida, F.; Benito, B. Risks and benefits of legislative budgetary oversight. Adm. Soc. 2018, 50, 856–883. [Google Scholar] [CrossRef]

- Russian Federation. Federal law “On the federal budget for 2020 and for the planning period of 2021 and 2022”; (2 December 2019 No. 380-FZ); Consultant Plus Law Assistance System: Moscow, Russia, 2019; Available online: https://www.consultant.ru/document/cons_doc_LAW_339305/ (accessed on 16 November 2022).

- Saleem, K.; AlHares, O.; Khan, H.; Farooq, O. FAANG Stocks, Gold, and Islamic Equity: Implications for Portfolio Management during COVID-19. Risks 2023, 11, 19. [Google Scholar] [CrossRef]

- Semenova, G. Impact of vat raise on Russian economy. E3S Web Conf. 2020, 210, 13028. [Google Scholar] [CrossRef]

- Semenova, G. Taxation of investments into ecological innovations in Russia. E3S Web Conf. 2019, 91, 08047. [Google Scholar] [CrossRef]

- Stockemer, D.; Niemann, A.; Unger, D.; Plank, F. Equally at risk? Perceived financial differences, risk assessment and containment measures in the COVID-19 pandemic. Contemp. Politics 2022, 28, 225–244. [Google Scholar] [CrossRef]

- Vagin, S.G.; Kostyukova, E.I.; Spiridonova, N.E.; Vorozheykina, T.M. Financial risk management based on corporate social responsibility in the interests of sustainable development. Risks 2022, 10, 35. [Google Scholar] [CrossRef]

- Vagin Sergei, G.; Kostyukova, E.I.; Spiridonova, N.E.; Vorozheykina, T.M. Financial Risk Management Based on Corporate Social Responsibility in the Interests of Sustainable Development. Risks 2022, 10, 35. [Google Scholar] [CrossRef]

- Yelikbayev, K.; Andronova, I. The interaction of the EEU Member States and risks of their mutual trade during the COVID-19 pandemic: Implications for the management of corporate social responsibility. Risks 2022, 10, 27. [Google Scholar] [CrossRef]

- Kashif, Z.; Aslam, F.; Mohmand, Y.T.; Ferreira, P. Temporal changes in global stock markets during COVID-19: An analysis of dynamic networks. China Financ. Rev. Int. 2022. [Google Scholar]

- Zvereva, A.; Akhmadeev, R.; Morozova, T.; Bykanova, O.; Avvakumova, I. Improving access to environmental information for the subjects of tax relations. In Proceedings of the SGEM 2020: International Multidisciplinary Scientific GeoConference Surveying Geology and Mining Ecology Management, Albena, Bulgaria, 18–24 August 2020; SGEM Publishing: Vienna, Austria, 2020; pp. 279–284. [Google Scholar]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).