1. Introduction

Change-point theory is a classical branch of statistics. In a series or process, when a statistical characteristic changes at a point in time due to systematic factors instead of chance, we define that point in time as a change-point. The generation mechanism of many actual observations can be altered by many factors such as unexpected events, which may change the statistical characteristics of one’s observed time series, i.e., containing change-points. Examining these change-points can prevent some potential risks and provide a reference basis for decision-making, which makes change-point testing an active research topic in many disciplines such as statistics and econometrics.

In general, the problem of testing parameter changes in time series models is usually called the time series structural change-point test. Since its introduction by Page[

1],[

2], the problem of the time series structural change-point test has attracted the attention of scholars in different fields and has been one of the important research areas in statistics. With further development, the time series structural change-point test is now widely used in different research fields. For example, the structural change-point test on epidemiological time series data[

3] can find the moment of change in the transmission rate of infectious diseases during their transmission process, which is important for determining reasonable treatment and control measures. The structural change-point test on economic and financial time series data can find the existence of a subprime mortgage crisis[

4] and provide feasible suggestions for macroeconomic control to stabilize the market in advance. The structural change-point test on meteorological time series data can find the existence of a subprime mortgage crisis[

5]. Therefore, the study of the time series structural change-point test problem has important theoretical significance and practical significance.

In the study of the time series structural change-point test, the traditional method of time series structural change-point test[

6],[

7] must usually provide a consistent estimate of the long-term variance, which is used to derive the limiting distribution of the statistic[

8]. However, estimating the long-term variance involves selecting redundant parameters such as the bandwidth parameter. The selection of parameters strongly affects the test effect. With the advent of the era of big data, the observed and recorded data of people continue to increase and provide a rich data source for the time series structural change-point test in terms of statistical analysis. However, the data structure becomes increasingly complex and may contain more diverse types of change points, which introduces higher requirements for the change-point test method[

9],[

22]. Meanwhile, the support vector regression (SVR)[

23],[

29] and self-normalization test method[

30] can effectively avoid these problems.

In the study of time series change-point tests, the construction of the test statistic is important, and the commonly used test statistic usually carries an unknown long-term variance, which is more difficult to consistently estimate. Self-normalization is a method to turn the statistical inference problem of time series or test statistic into a pivotal quantity, where the basic idea is to use inconsistent variance estimators to absorb unknown serial correlations in the data. Self-normalization has become an important method to study the change-point test because it can avoid estimating the long-term variance. Meanwhile, the accuracy of model fitting has an important impact on improving the efficacy of the test statistic. Compared with traditional model-fitting methods, the SVR method has often been used to fit various types of time series models in recent years because it has many advantages such as the wide range of applicable models and few tuning parameters. Another important step in constructing the self-normalization test statistic is the accurate estimation of the residuals. The residuals originate from prediction errors, which makes it particularly important to correctly predict the time series. Some nonparametric forecasting methods such as SVR have a greater advantage when the time series has significant nonlinear characteristics. Because SVR has flexible use, excellent prediction accuracy, and few required tuning parameters, it can obtain a more accurate prediction error, which leads to accurate residual estimates. Thus, this paper investigates the problem of testing the structural change points of autoregressive moving average (ARMA) time series models based on SVR and self-normalization methods.

The remainder of the article is organized as follows.

Section 2 introduces the model and hypothesis testing, presents our test statistics, and investigates their asymptotic properties.

Section 3 presents simulation experiments and results.

Section 4 introduces the example analysis.

Section 5 concludes the paper and summarizes the entire paper.

2. Model and Hypothesis Testing

To implement the self-normalization test in a time series model, we considered the self-normalization test for the ARMA(p , q) model. To implement a change-point test, we constructed the self-normalization test using only the observations and residuals in ARMA models. Let us consider the stationary ARMA (p , q) model:

where

are real numbers, and

are independent identical-distribution-mean zero random variables with covariance

.

Here, our objective is to test whether the conditional mean of over past information or the variance of the error terms experiences a change point over time . Since a change occurs if the parameter vector changes, given observations , we set up the null hypothesis and alternative hypothesis as follows:

Under the alternative hypothesis, we consider the situation in which for for some and with for .

To test the above hypothesis, we recursively obtain the estimated value of residual with for all, where and are consistent estimators of and . We can obtain a consistent estimate to Gaussian quasi-maximum likelihood estimates in Francq and Zakoan (2004).

Then, to test for a parameter change in

, we constructed the self-normalization[

30] test as follows. Let us denote

for

. For

, we define

and

, where

. Here,

and

correspond to the trimming proportions from the left and right of the sample, respectively. Trimming is quite common in the literature on change point detection. Our test statistic resembles the sup-Wald type test statistic, which is commonly used in testing for a change point. However, we use an inconsistent normalization in the denominator to avoid consistently estimating the variance of the normalized sample mean, which is usually involved in the sup-Wald type test in the time series setting and requires a choice of tuning parameters. The self-normalization idea was used by Lobato(2001) and Shao(2010) for inference problems related to weakly dependent time series. To the best of our knowledge, its use for the inference of structural change-point detection for time series is new.

To test the above null and alternative hypotheses, we apply the following two tests proposed by Lee [

29], we use

and

to express Lee's statistics, which are as follows:

where

,

.

We reject if at the nominal 0.05 level. The critical values of these two tests are obtained though Monte Carlo simulations using two-dimensional standard Brownian motion.

3. Asymptotic Property

In this section, we discuss the asymptotic properties of the above statistics. In order to derive the asymptotic distribution of statistic , we begin with the following assumption and related lemmas. Here, we verified that under regularity conditions, behaves asymptotically the same as under as n tends to ,and thus, the limiting null distribution of is the same as , where denotes a Brownian bridge on the unit interval because converges to the supremum of a Brownian bridge in distribution due to Donsker’s invariance principle.

Given an interval , Riemann Integrals of the test statistic are defined as follow: . When the value of greater than the critical value. We reject the null hypothesis and consider that there are change points in the sequence . When .

The following theorem illustrates the asymptotic zero distribution of test statistics.

Theorem 2.1.

Under the null assumption of parameters no change, when, the limit distribution of statistics is

Proof Under the null assumption of parameters no change, we write , we consider .The statistics will converge to the degenerate distribution, which is not listed here for simplicity.

When under the null hypothesis

, the following formula can be obtained by applying the continuous mapping theorem:

Therefore, theorem 1 established by us is true.

Theorem 2.2Under the alternative assumptionand that the change point position is constant, when

Proof Under the alternative assumption

, we let

and

is fixed constant, we have

We can get

from the above theorem 2.1.

Due to , that is .

Due to

, that is

.

4. Simulation

In this section, we investigate the finite sample performance of the self-normalization test in testing the structural change points of the time series. Based on the described data generation process, data with sample sizes of 200 and 500 were generated. All results were reported based on 1000 replicate experiments. The level of each simulation test was 0.05. The empirical size and empirical power were calculated as the frequency of rejection of the no-change null hypothesis over 1000 replications. Under the alternative hypothesis, it is assumed that the change point occurs in the middle of the test sample. For SVR, we used the R package “e1071.” The simulation process is as follows.

Step 1. Generate a time series of length n with the ARMA(1,1) model.

Step 2. Estimate the model parameters of the SVR-ARMA model from a training time series sample, where an AR model is used to fit the data. Perform SVR on the first k data and the last n-k data. Establish ARMA models for the first k data and the last n-k data. Use the established models to predict the last n-k data and the first k data, and conduct cross-validation to obtain the residual.

Step 3. Conduct the self-regularization test to calculate the critical value and evaluate the size and power. To compute the size, generate a time series with no changes. To examine the power, generate a time series with a change point in the middle of the sequence.

Step 4. Iteratively repeat the above steps 1000 times and subsequently compute the empirical sizes and powers.

-

(1)

Linear AR and ARMA Model

The following section outlines the theory of the SVR-ARMA model-based prediction methods and how to determine an optimal SVR-ARMA model and its methodology. For a given sample of training time series, we obtained the residuals of the best SVR-ARMA model by dividing it into two subsequences. A long AR model was fitted to the first subsequence to obtain the initial values of the residuals, which were used as error terms in the SVR-ARMA(p , q) model and recursively updated until the obtained residuals converged to a limit. Then, for each estimated SVR-ARMA(p, q) model, we calculated the root mean square error based on the second subsequence and selected the optimal order of the ARMA model based on the principle of minimum RMSE. The determined SVR-ARMA(p, q) model was applied to obtain the prediction errors or residuals and construct the self-normalization test. We discussed the finite sample performance of test statistics . We used the following data-generation process:

Model 1:

Model 2:

where

;

is an SVR-ARMA(p , q) process with parameter

being 0.5, 0.7, or 2. It can be generated using the function “arima.sim” in the R package “arima.sim.” For simplicity, we fixed

. We focused on the influence of the change in ϑ, i.e.,

and

, on the empirical power. Under the null hypothesis, the parameters were set as follows:

Table 1 shows the empirical sizes and empirical power of the AR(1) model in different cases. The test statistic can well control the empirical size for different parameter values, and almost no empirical size distortion occurs. For example, at n = 200 and ϕ = 0.5, the empirical power of the SVR-based self-normalization test statistic is 0.637, while the empirical powers of

and

are 0.523 and 0.484, respectively. From

Table 1, the self-normalization test has better empirical powers than

and

in most cases. This result proves the effectiveness of our proposed SVR-based self-normalization test in approximating the critical values of the statistics.

Table 2 shows the empirical size and power of the ARMA(1 , 1) model in different cases. The test statistic usually well controls the empirical size for different parameters, which proves the effectiveness of the proposed self-normalization test method based on SVR in approximating the critical value of the statistic. For example, at n = 200, ϕ = 0.3, θ = 0.7, and σ = 1, the empirical power of the SVR-based self-normalization test statistic is 0.636, while the empirical powers of

and

are 0.620 and 0.472, respectively. When the sample size increases the empirical powers of the statistics become better and closer to 1, which proves that the proposed self-normalization test method based on SVR outperforms

and

in most cases.

Table 3 summarizes the empirical size and empirical powers of the ARMA(1 , 1) model for different cases. The test statistic usually well controls the empirical size for different parameter values, which proves the effectiveness of the proposed self-normalization test method based on SVR in approximating the critical value of the statistic. For example, when n = 500, ϕ = 0.7, θ = 0.3, and µ = 2, the empirical power of the SVR-based self-normalization test statistic is 0.884, while the empirical powers of

and

are 0.838 and 0.775, respectively. Thus, the proposed SVR-based self-normalization test method outperforms

and

in most cases and is effective.

Table 4 and

Table 5 summarize the empirical sizes and empirical powers of the SVR-based self-normalization test statistic for different scenarios with different parameter values at different change point locations. The changes in parameters, sample size, and location of the change points significantly impact the empirical powers of the statistic. The SVR-based self-normalization test statistic has better empirical powers than

and

under different conditions. The empirical power increases with the sample size, e.g., at n = 500, ϕ = 0.5, θ = 0.3, σ = 1, and µ = 2, the empirical powers of the SVR-based self-normalization test statistic are 0.719, 0.985, and 0.927, while the empirical powers of

are 0.689, 0.857, and 0.925, and those of

are 0.691, 0.777, and 0.870, respectively. Thus, the test powers of this chapter are higher under the alternative hypothesis in most cases. The empirical powers of the SVR-based self-normalization test are higher in the middle position than at the two end positions, which indicates that it will be easier to detect when a change point appears in the middle of the sample. This result confirms our assumption that the change point relatively occurs in the middle position.

5. Empirical Illustration

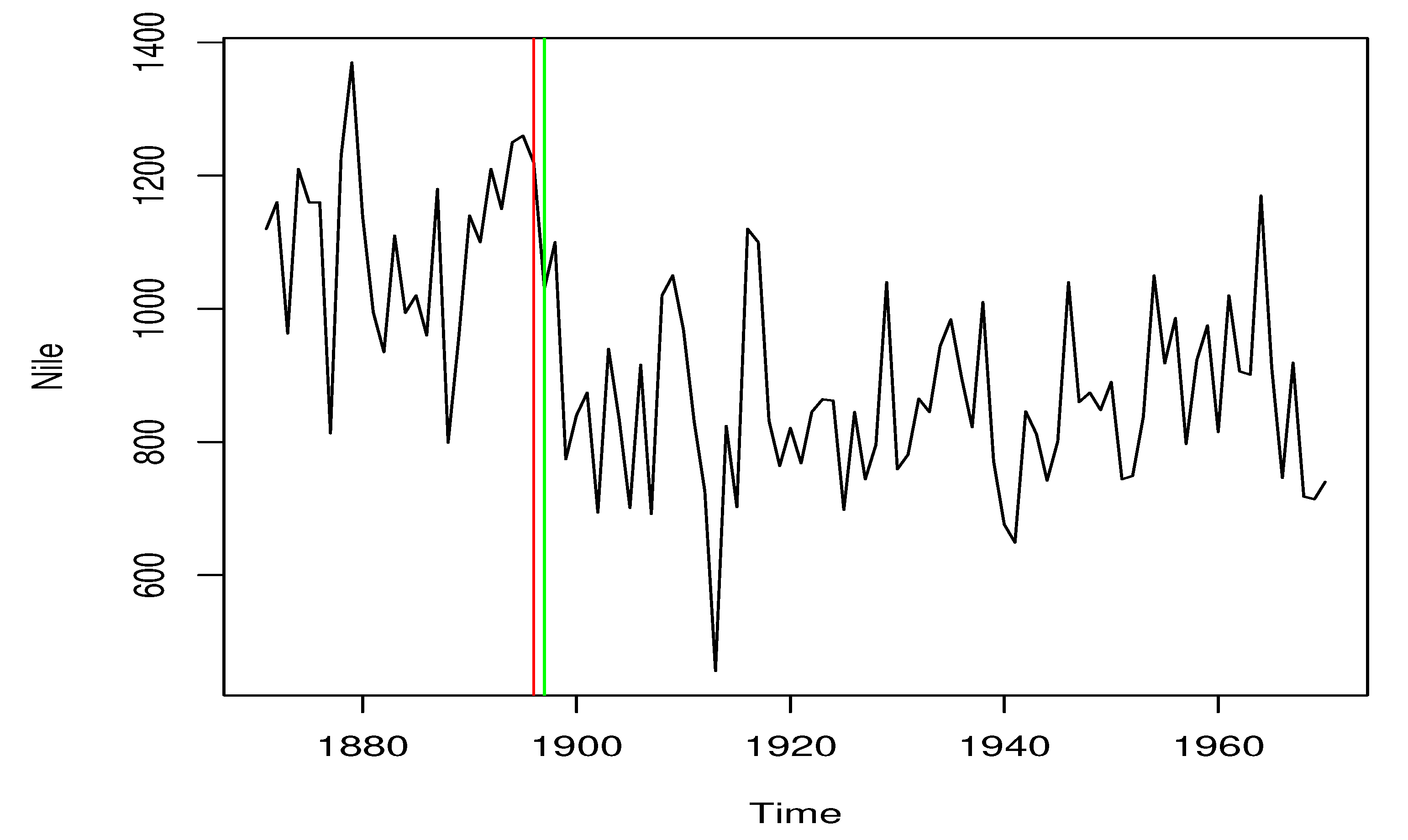

The first data set used in this section of the empirical analysis study is the annual Nile flow data from 1871 to 1970. Using the proposed self-normalization test method based on SVR, the corresponding critical value is 32.81446, and the self-normalization test statistic value is 315.5232. The statistic value is greater than the critical value, which indicates that there are change points in the time series. In

Figure 1, the red vertical line indicates the self-normalization test method, and the green vertical line indicates the method in the literature.

Figure 1 shows that the SVR-based self-normalization test method proposed in this paper is consistent with the results of existing literature on this data variation point test.

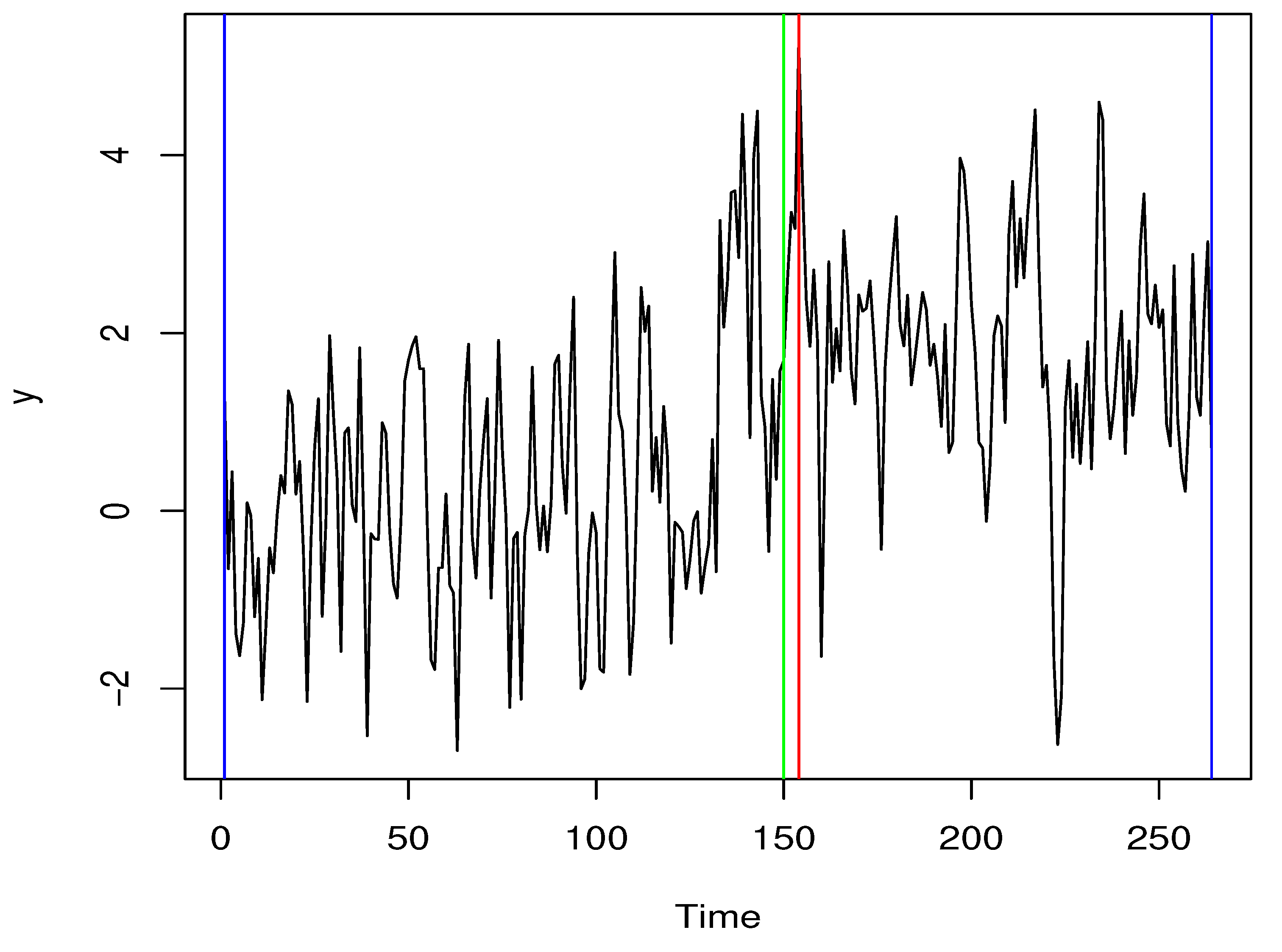

The second data set used for the example analysis in this section is the Nikkei225 index data from January 1, 2000, to December 1, 2021. The calculated critical value is 32.81446, while the self-normalization test statistic value is 70.25469. Since the statistic value is greater than the critical value, it is considered that there are change points in the time series. In

Figure 2, the red vertical line indicates the change points detected by the self-normalization test method, and the green vertical line is the change points detected by the method in the literature. We find that the change points detected by the two methods are very close to each other, which indicates the effectiveness of the proposed method.

6. Conclusions

The problem of testing structural change points of time series has been an active topic in various research fields. In this paper, the structural change points of ARMA time series models are tested based on the self-normalization test statistic and SVR method. The validity of the proposed method on limited samples has been verified through theoretical analysis, numerical simulation experiments, and empirical analysis. The limiting distribution of the test statistic under the original hypothesis was derived, and its consistency under the alternative hypothesis was demonstrated. The simulation results illustrate that the SVR-based self-normalization test can control the empirical size better and achieve a good empirical power, and the SVR-based self-normalization test method is effective.

Acknowledgments

We thank LetPub (

www.letpub.com) for its linguistic assistance during the preparation of this manuscript. And this work was supported by the National Natural Science Foundation of China (Na.12161072), Natural Science Foundation of Qinghai Province (No.2019-ZJ-920).

References

- Page, E.S. Continuous Inspection Schemes. Biometrika. 41(1922), 100-115.

- Page, E.S. A test for a change in a parameter occurring at an unknown point. Biometrika. 42(1955), 523-527.

- Feiyu Jiang, Zifeng Zhao, and Xiaofeng Shao. Time series analysis of COVID-19 infection curve: A change-point perspective. Journal of Econometrics. 232(2023), 1-17.

- Wu-Yi Ye, Bo-Qi Miao, Yu-Chao Ma. Contagion analysis of the U.S. subprime debt crisis based on variation point detection of hazard rate function. Theory and Practice of Systems Engineering. 30(2010).

- Xiongqi Huang, Zhentao Tian, Rui Qin, Xuemei Wang, Chenliang Zheng. Real-time variation point detection of meteorological data based on hybrid model adaptive LASSO method. Journal of Guangxi University for Nationalities (Natural Sciences Edition). 27(2021).

- Lee, S.; Kim, C.K.; Lee, S. Hybrid CUSUM change point test for time series with time-varying volatilities based on support vector regression. Entropy. 22(2020), 578. [CrossRef]

- Lee, S.; Lee, S.; Moon, M. Hybrid change point detection for time series via support vector regression and CUSUM method. Appl. Soft Comput. 89(2020), 106-101. [CrossRef]

- Csörgő, M.; Horváth, L. Limit Theorems in Change-Point Analysis. John Wiley. Sons Inc., New York, 1997.

- Inclán, C.; Tiao, G. Use of cumulative sums of squares for retrospective detection of changes of variance. J. Amer. Statist. Assoc. 89(1994), 913-923.

- Lee, S.; Na, O.; Na, S. On the CUSUM of squares test for variance change in nonstationary and nonparametric time series models. Ann. Inst. Statist. Math. 55(2003), 467-485. [CrossRef]

- Kim, S.; Cho, S.; Lee, S. On the CUSUM test for parameter changes in GARCH(1,1) models. Comm. Statist. Theory Methods. 29(2000), 445-462. [CrossRef]

- Lee, S.; Tokutsu, Y.; Maekawa, K. The CUSUM test for parameter change in regression models with ARCH errors. Japan Statist. Soc. 34(2004), 173–188. [CrossRef]

- Na, O.; Lee, J.; Lee, S. Change point detection in SCOMDY models. AStA Adv. Stat. Anal. 97(2013), 215–238. [CrossRef]

- Lee, J.; Lee, S. Parameter change test for nonlinear time series models with GARCH type errors. J. Korean Math. Soc. 52(2015), 503-522. [CrossRef]

- Gombay, E. Change detection in autoregressive time series. J. Multivariate Anal. 99(2008), 451-464. [CrossRef]

- Oh, H.; Lee, S. On score vector- and residual-based CUSUM tests in ARMA-GARCH models. Stat. Methods Appl. 27(2018), 385-406. [CrossRef]

- Oh, H.; Lee, S. Modified residual CUSUM test for location-scale time series models with heteroscedasticity. Ann. Inst. Statist. Math. 71(2019), 1059-1091. [CrossRef]

- Lee, S. Location and scale-based CUSUM test with application to autoregressive models. 2019.

- Chen, C.W.S.; Lee, S. Generalized autoregressive Poisson models for time series of counts. Comput. Statist. Data Anal. 99(2016), 51-67. [CrossRef]

- Dong, M.C.; Chen, C.W.S.; Lee, S. How strong is the relationship among gold and USD exchange rates? Analytics based on structural change models. Comput. Econ. 53(2016), 343–366.

- Oh, H.; Lee, S. Parameter change test for location-scale time series models with heteroscedasticity based on bootstrap. Appl. Stoch. Models Bus. 2019 Online published.

- Atsalakis, G.S.; Valavanis, K.P. Surveying stock market forecasting techniques Part II: Soft computing methods, Expert Syst. Appl. 36(2009), 5932-5941. [CrossRef]

- Müller, K.R.; Smola, A.J.; Rätsch, G.; Schölkopf, B. Kohlmorgen, Vapnik,J.V. Predicting time series with support vector machines, in: International Conference on Artificial Neural Networks, Springer, Berlin, Heidelberg. 1997, 999–1004.

- Tay, F.E.; Cao, L. Application of support vector machines in financial time series forecasting, Omega. 29(2001), 309–317.

- Sapankevych, N.I.; Sankar, R. Time series prediction using support vector machines: a survey. IEEE Comput. Intell. Mag. 4(2009), 24–38. [CrossRef]

- Cavalcante, R.C.; Brasileiro, R.C.; Souza, V.L.; Nobrega, J.P.; Oliveira, A.L. Computational intelligence and financial markets: A survey and future directions. Expert Syst. Appl. 55(2016), 194-211. [CrossRef]

- Cao, L.J.; Tay, F.E.H. Support vector machine with adaptive parameters in financial time series forecasting. IEEE Trans. Neural Netw. 14(2003), 1506–1518. [CrossRef]

- Chen, S. K.; Jeong, W.K.; Härdle, Recurrent support vector regression for a non-linear ARMA model with applications to forecasting financial returns. Comput. Statist. 30(2015), 821–843.

- Lee, S.; Lee, S.; Moon, M. Hybrid change point detection for time series via support vector regression and CUSUM method. Appl. Soft Comput. 89(2020), 106-101. [CrossRef]

- Xiaofeng Shao. A simple test of changes in mean in the possible presence of long-range dependence, Journal of Time Series Analysis. 32(2011), 598-606.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).