1. Introduction

Studies of the earth's climatic history show how, over the centuries, there have always been more or less rapid and more or less cyclical phases of climate change. However, the last 150 years, from industrial development onwards, have witnessed a progressive and anomalous increase in temperatures as well as the intensification of extreme climatic events such as heat waves, droughts or very intense and protracted rainfall. Undoubtedly, one of the main causes of these sudden variations is mankind with its activities and related greenhouse gas (GHG) emissions [

1,

2]. In fact, according to the report "Global Warming of 1.5°C" by the Intergovernmental Panel on Climate Change (IPCC), these have already caused global warming of about 1°C compared to pre-industrial levels, and it is likely that this value will increase further, reaching 1.5°C between 2030 and 2052 [

3]. The future of natural and anthropogenic systems depends on the temperature increase, its magnitude and the speed with which it occurs [

3,

4]. With this in mind, the European Commission recently (December 2019) adopted the 'Green Deal', a new growth strategy that aims to achieve climate neutrality in 2050 with zero CO

2 [

5]. By 2030, GHG emissions will have to be reduced by 55 per cent compared to 1990 values, so many transformative policies will have to be developed and financed in various sectors, from energy to industry or even, for example, in transport. A key role will certainly be played by buildings [

6,

7,

8], regardless of their intended use. These, in fact, besides being highly energy-consuming (responsible for 40% of final energy consumption), are also responsible for 36% of GHG emissions [

9]. It is believed that in order to reach the 2030 targets, actions taken on buildings should be able to reduce GHG emissions by 60% [

10]. However, the average annual rate of energy refurbishment of the EU building stock is currently too low (around 1% per year [

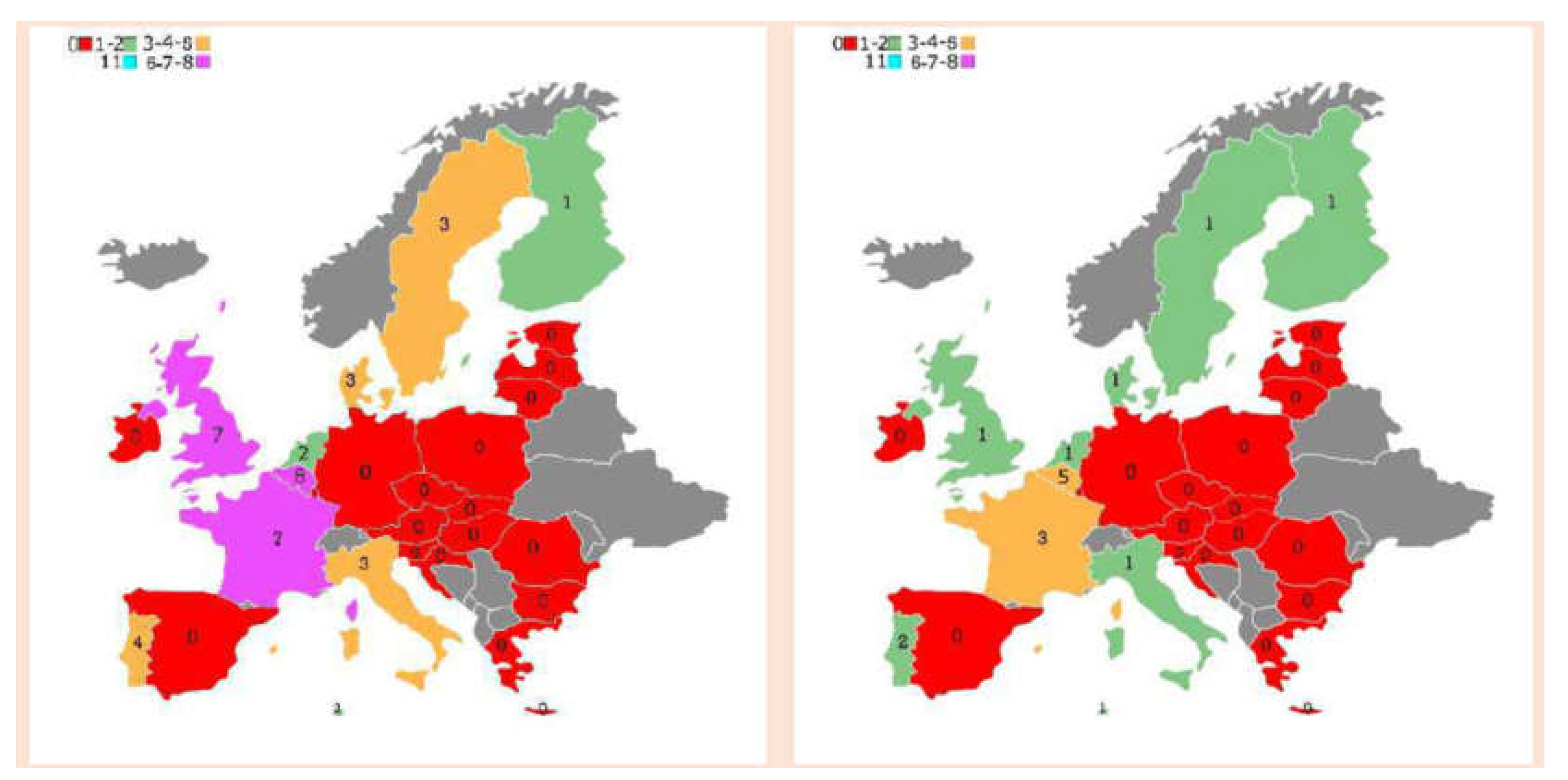

10]). Therefore, in order to stimulate energy efficiency measures, tax incentives have been developed and adopted in some EU countries in the residential, commercial and public administration sectors [

11] (

Figure 1). In particular, as far as the residential sector is concerned, the country that has introduced the most incentive measures is Belgium, followed by France and Portugal.

As far as the Italian case is concerned, until the end of 2019, there was only one incentive measure (Ecobonus [

12]), but since July 2020 a new one has been introduced (Superbonus [

12]), which, due to the rates introduced, is expected to be very impactful not only in terms of energy efficiency and seismic upgrading of buildings, but also for the creation of new jobs and, more generally, for the fact that it is expected to stimulate the recovery of a sector that has been struggling to recover since the crisis that started in the US in 2007 with the deflation of the real estate bubble [

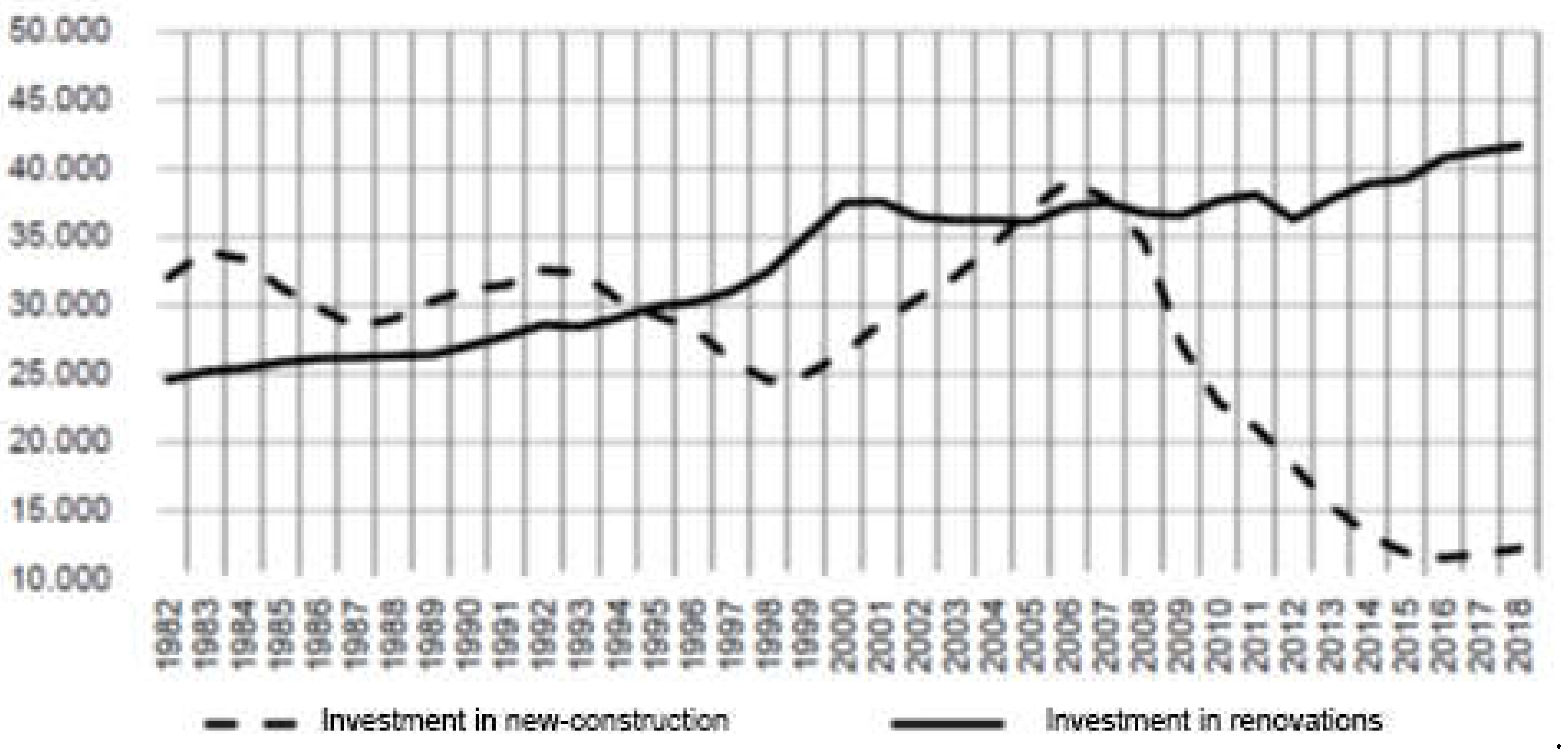

13]. Analysing the trends over the last twenty years of investments in redevelopment and new construction (

Figure 2), it is easy to see that these have had completely different trends. In fact, while the latter recorded a strong growth between 1998 and 2006 and then collapsed from 2007 onwards, investments in redevelopment activities have almost always recorded a slightly increasing trend, except for the period between 2000 and 2013 in which they basically remained constant.

Undoubtedly, the positive trend in recent years is due to the introduction of tax incentive measures and the increase in the respective rates. In fact, between 1998 and 2019 there was a significant increase in private building renovation interventions and, of these, the percentage of investments channelled by tax incentives rose from 12.9 % to 55.3 % [

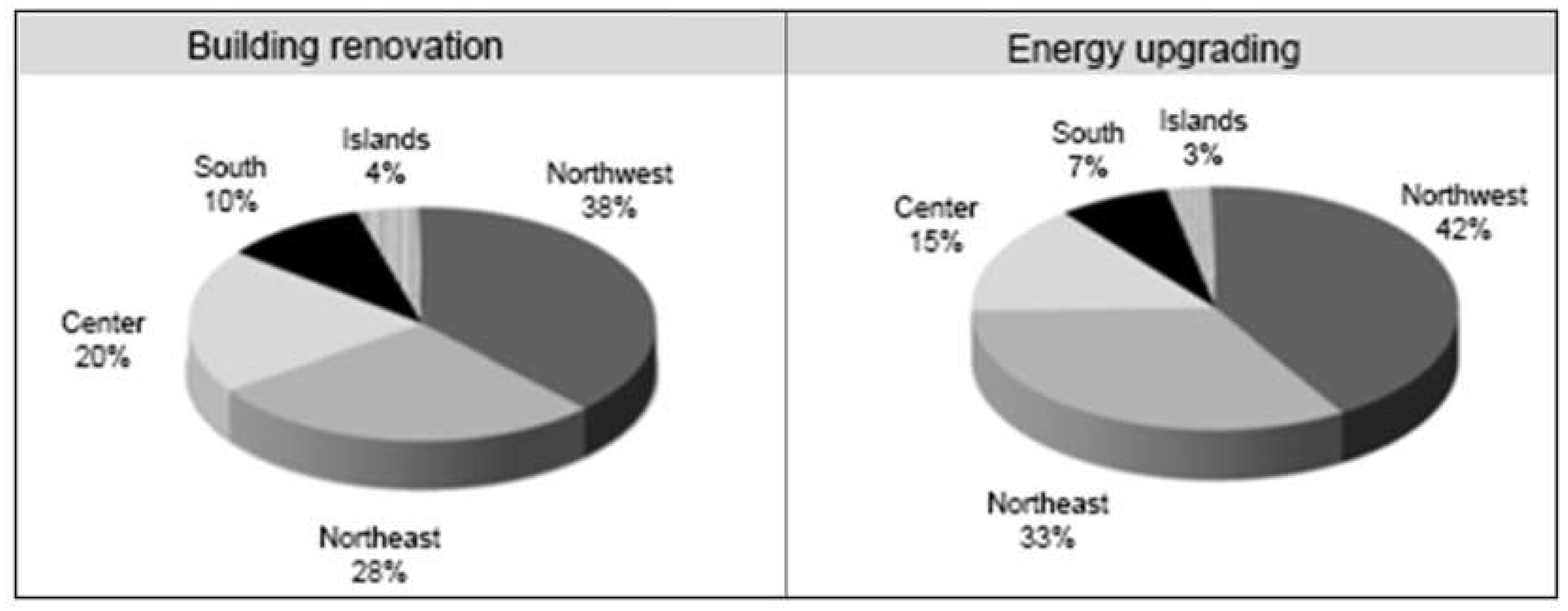

14]. Thus, in practice, at least one intervention out of two is today channelled by the use of tax incentives. According to the report of the Study Service - Environment Department of 26 November 2020 [

14], the analysis of taxpayers' tax returns (observation interval 2011-2019) showed that the territorial distribution of incentives was not at all homogeneous. In fact, for both energy requalification and building renovation interventions, it was recorded that most of the deduction amounts came from the North-West (Liguria, Lombardy, Piedmont, Valle d'Aosta) and North-East (Emilia-Romagna, Friuli-Venezia Giulia, Trentino-Alto Adige, Veneto) areas, (

Figure 3).

Lombardy is the Italian region with the highest total amount of deductions in the period from 2011 to 2018, while Trentino-Alto-Adige has the highest amount of deductions per dwelling. The latter two phenomena may have been caused by larger amounts of work on a limited number of buildings in the case of Trentino-Alto-Adige (think of the renovation of old rural buildings), or by modest but more widespread amounts of work in the case of Lombardy (think of the replacement of boilers and windows in apartment buildings) [

14].

In any case, however, it is believed that the energy upgrading of the existing building stock is only in its infancy. In fact, an analysis of the existing residential stock shows that on the national territory 7.2 million buildings, i.e., about 60%, were built before 1980 and are more than 40 years old, while 5.2 million buildings, i.e., 42.5%, are more than 50 years old [

14]. Moreover, perhaps the most significant fact is that 51% of all dwellings were built before 1970, i.e., before the first energy saving law (Law 373/76) and are therefore definitely energy intensive [

15].

In order to cope with the long paying back times of building renovations, to stimulate the building sector, which is in deep crisis, and to achieve the challenging goals of energy saving and emission reduction by 2030, as mentioned above, a new incentive measure was introduced in Italy: the Superbonus tax incentive. With the research work reported here, the authors decided to analyse it in order to understand its potential and criticalities from the perspective of building owners.

Therefore, in what follows, we will briefly describe the Superbonus measure by identifying the resources required for its activation and the possible short, medium and long-term effects. Starting from this schematisation, we will then proceed to verify, with the support of a theoretical case study, one of the short-term objectives identified. In particular, the increase in the attractiveness of energy efficiency interventions in existing buildings by the owners of the building units that comprise them will be verified, since it is believed that this element is the catalyst for an extensive and consistent requalification of the private building stock.

2. The new Italian incentive measure: the Superbonus

The spread of the COVID-19 epidemiological emergency has forced the Italian government to swiftly activate a series of measures on health, work and economic support, as well as social policies to cope with it (Relaunch Decree: -DR [

16]). Among them, as far as the construction sector is concerned, the 'Superbonus' (SB) certainly stands out, which aims to make Italian homes more efficient and safe by facilitating energy efficiency works (with the 'Super Ecobonus') and those for structural earthquake-proof improvements (with the 'Super Sismabonus') [

17].

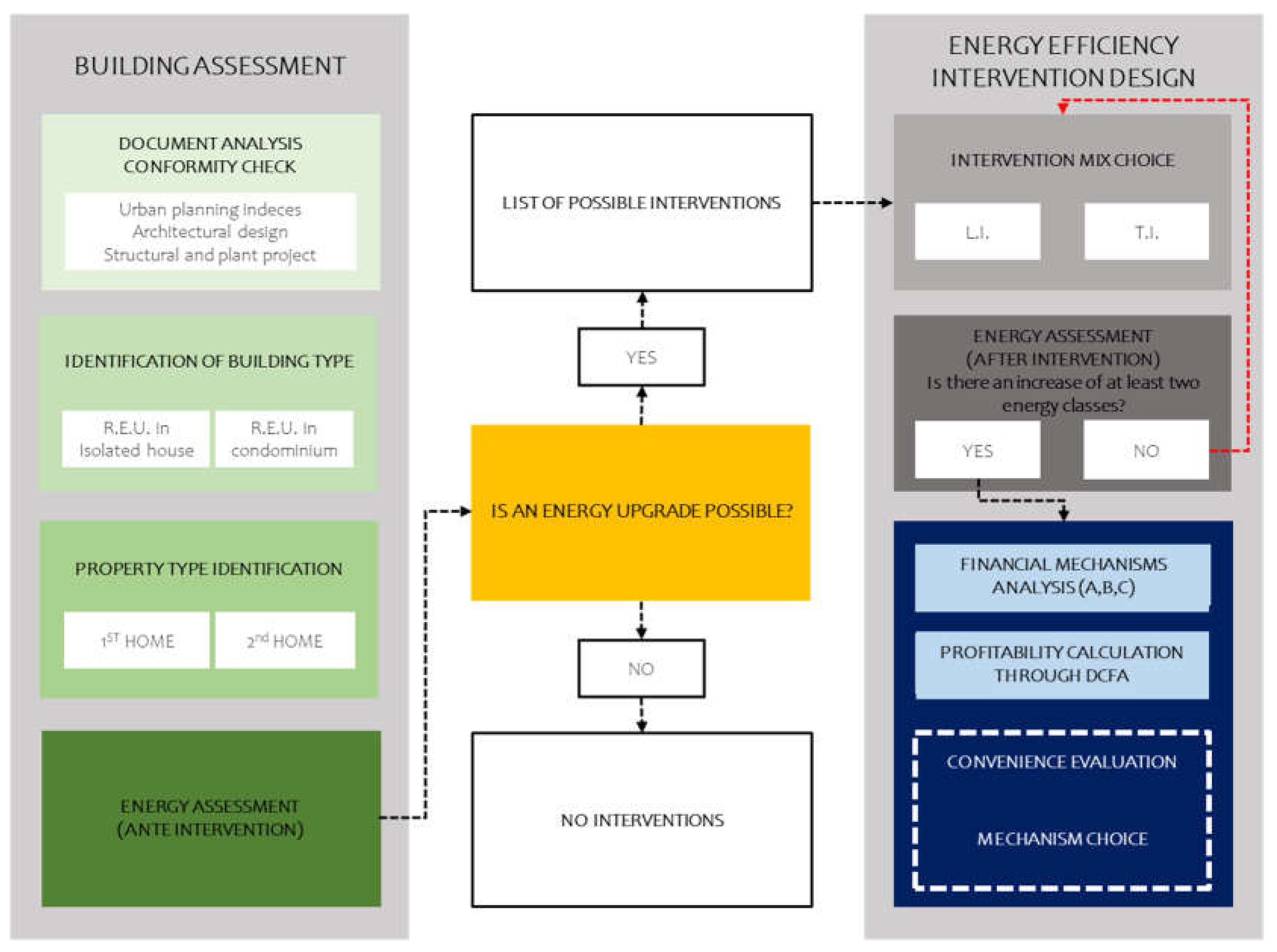

However, this measure does not apply indiscriminately to all types of buildings. These, in fact, in addition to having to be intended for residential use, must also prove that they comply with urban planning and building regulations, ensuring the correspondence between the state of affairs and the building title with which the municipality authorised their construction and/or subsequent renovations and extensions (

Figure 1).

Eligible interventions under this new measure are those carried out on the common parts of condominium buildings on functionally independent real estate units (i.e., units with exclusive ownership of at least three of the following installations: water supply systems; gas systems; electricity systems; winter air-conditioning systems [

17]) and with one or more independent accesses from the outside, or carried out on units inside multi-family buildings, or applied on individual real estate units (up to a maximum of two).

Respecting the basic conditions listed above, the expenses incurred for the efficiency and safety of existing buildings can be deducted at 110%. In particular, limiting the study to the Super Ecobonus, the eligible works are divided into 'Driving Intervention' (DI) and 'Towed Intervention' (TI). In particular, the former include:

interventions for the thermal insulation of vertical, horizontal and inclined opaque surfaces affecting the building envelope, including single-family buildings, with an incidence of more than 25% of the building's gross dispersion surface;

interventions for the replacement of existing winter air-conditioning systems with systems for heating and/or cooling and/or the supply of domestic hot water;

In addition to these, which are the predominant ones, 'Towed Interventions' (TI), which consist of:

further energy efficiency measures such as, for example, the replacement of windows and doors, the installation of biomass heat generators and thermal solar panels, ..., etc;

interventions for the installation of grid-connected solar photovoltaic systems on buildings;

interventions for the installation of storage systems integrated in subsidised solar photovoltaic systems;

interventions for the installation of infrastructure for recharging electric vehicles in buildings.

Starting from these two categories of interventions, for each energy efficiency project -for which one intends to access the SB- it must be demonstrated that the mix of interventions chosen leads to an effective improvement in the energy conditions of the building. To do this, the DR requires two energy analyses to be carried out on the building, one "ante" intervention and one "post", and that there has been an improvement of at least two energy classes between the two.

As regards the tax modalities by which the Superbonus can be enjoyed, Article 121 of the DR identifies three alternatives: the Direct IRPEF Deduction (DD) [

18], the Invoice Discount (ID) and the Credit Transfer (CT), nowadays heavily revised in their general application (as will be mentioned below).

The DD, recognised to the extent of 110%, is to be divided among those entitled in five annual instalments of equal amount and for expenses incurred in 2022 in four annual instalments of equal amount, within the limits of the annual tax liability resulting from the tax return [

19]. This arrangement also allows the full amount of the deductions to be used without it being reduced by expenses caused by transactions by third parties.

The ID, on the other hand, provides that suppliers may discount to the principal, in part or in full, the amount due for their services. The discounted amount may then be recovered by the suppliers themselves in the form of a tax credit equal to 110% of the amount, or alternatively, they may in turn assign the credit accrued to credit institutions or other financial intermediaries [

19].

Finally, the CT mechanism allows the creditor to transfer the accrued credit to suppliers, credit institutions and financial intermediaries, or to other parties such as natural persons, self-employed or business persons, or companies and entities [

19]. It is clear that the latter alternative, for the owner of the property, will entail an economic 'sacrifice' equal to the discounting of the tax; thus, the deduction enjoyed will be lower (approximately 100-104%), but the amount will be payable immediately by the taxpayer [

19].

Lastly, a workflow summarising the actions to be carried out in the case of implementing an energy efficiency intervention benefiting from the SB measure is outlined in

Figure 4.

2.1. Analysis and objectives

In the research work presented here, an attempt was made to trace the mechanism that led to the formulation of the SB measure, identifying the reasons and objectives for which it was devised.

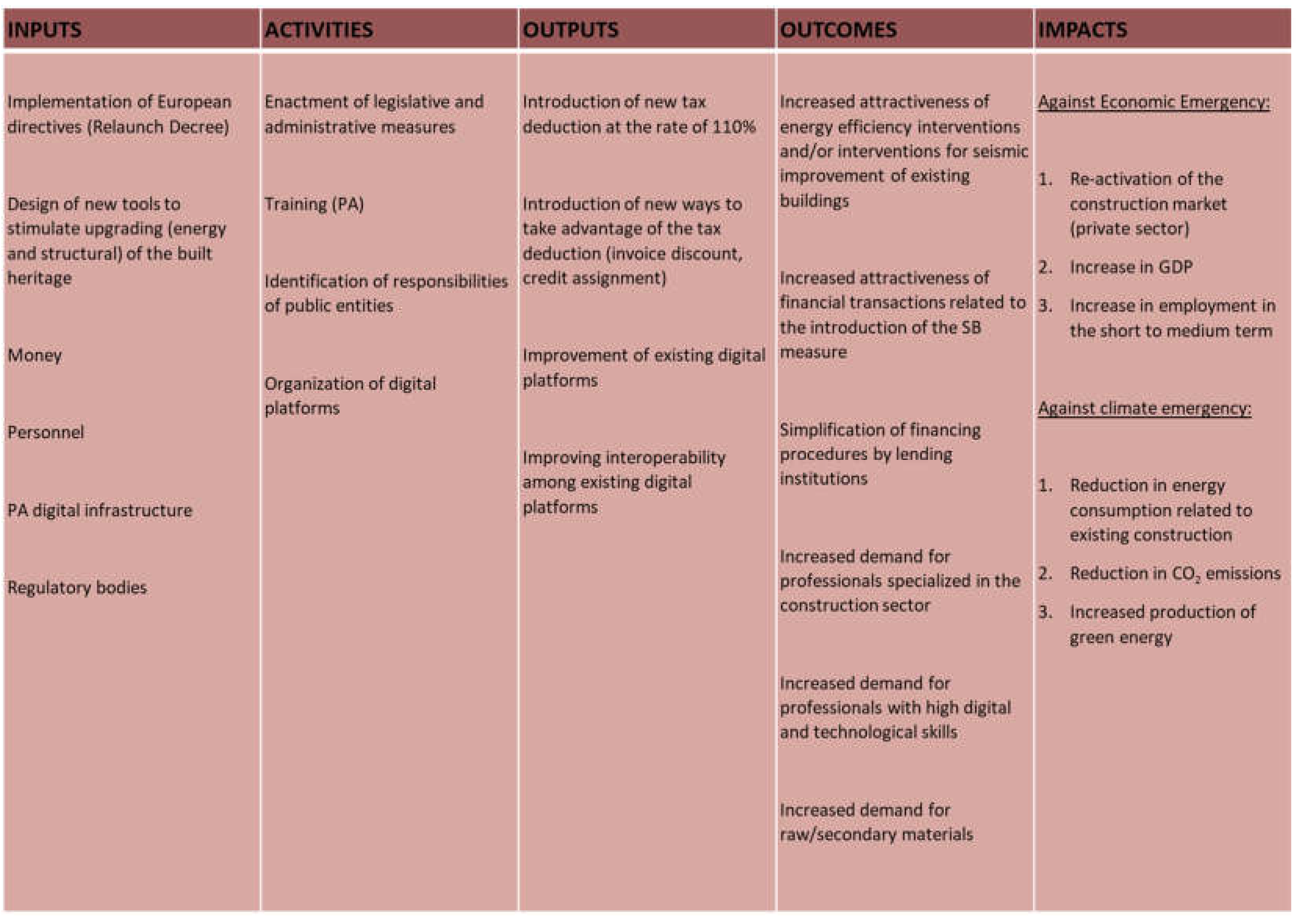

The technique used to coherently reconstruct the complexity associated with the introduction of SB is the Logic Model [

20], which consists of a layer approach. Specifically, the method consists of applying a conditional logic (if-then) that starts from the identification of the resources invested in the programme (inputs) and the practical actions necessary to achieve the objectives (activities), and then goes on to highlight the results (outputs) and the short, medium and long-term changes (outcomes and impacts) resulting from the actions introduced [

21].

Starting from this framework (summarised in

Figure 5), we then focused on verifying the attractiveness of this new measure for an owner who intends to carry out an energy efficiency intervention on his or her property, focusing in particular on verifying the different economic benefits that can be achieved according to the different ways in which the deduction envisaged by the SB can be used.

2.2. The application to the case study

If in the 19th century Italian tourism was only possible for a few wealthy families (aristocrats or upper middle class) [

22], between 1950-1960, thanks to the sudden improvement of general economic conditions and the development of transport routes, it became accessible also to the less well-off. This change led to speculative phenomena and to the proliferation of 'second homes' - i.e., dwellings lived in only at certain times of the year - which had to be sufficiently flexible, 'easy to maintain and abandon', and had to be able to accommodate large families [

23].

The chosen case study is located in Sampeyre, a small mountain municipality in Val Varaita, in the North-West of Italy (Piedmont), and belongs to one of those complexes that arose to satisfy the demand for second homes. From

Figure 6, it is easy to see that these architectures are easily identifiable both because they do not respect the typical construction canons of the place and because of their dimensions, which are completely out of scale.

Due to the changing tourist habits of Italians, who increasingly prefer to explore new places rather than spend their holidays always in the same places, and due to the old age and functional obsolescence of these buildings erected between the 1960s and 1970s, there has been a progressive abandonment of them in recent years.

However, precisely because of the current health epidemic (COVID-19), it would seem that the use of second homes is making a comeback [

24].

From this perspective, the SB measure is therefore of great interest to a wide segment of the population, from those who decide to upgrade their homes for habitual residence to those who intend to re-use them for summer or winter holidays, or those who intend to rent them out to those who intend to sell them for a profit.

In order to better understand the different economic benefits that can be derived from the application of SB, the case of the "Monte Nebin" complex in Sampeyre was chosen [

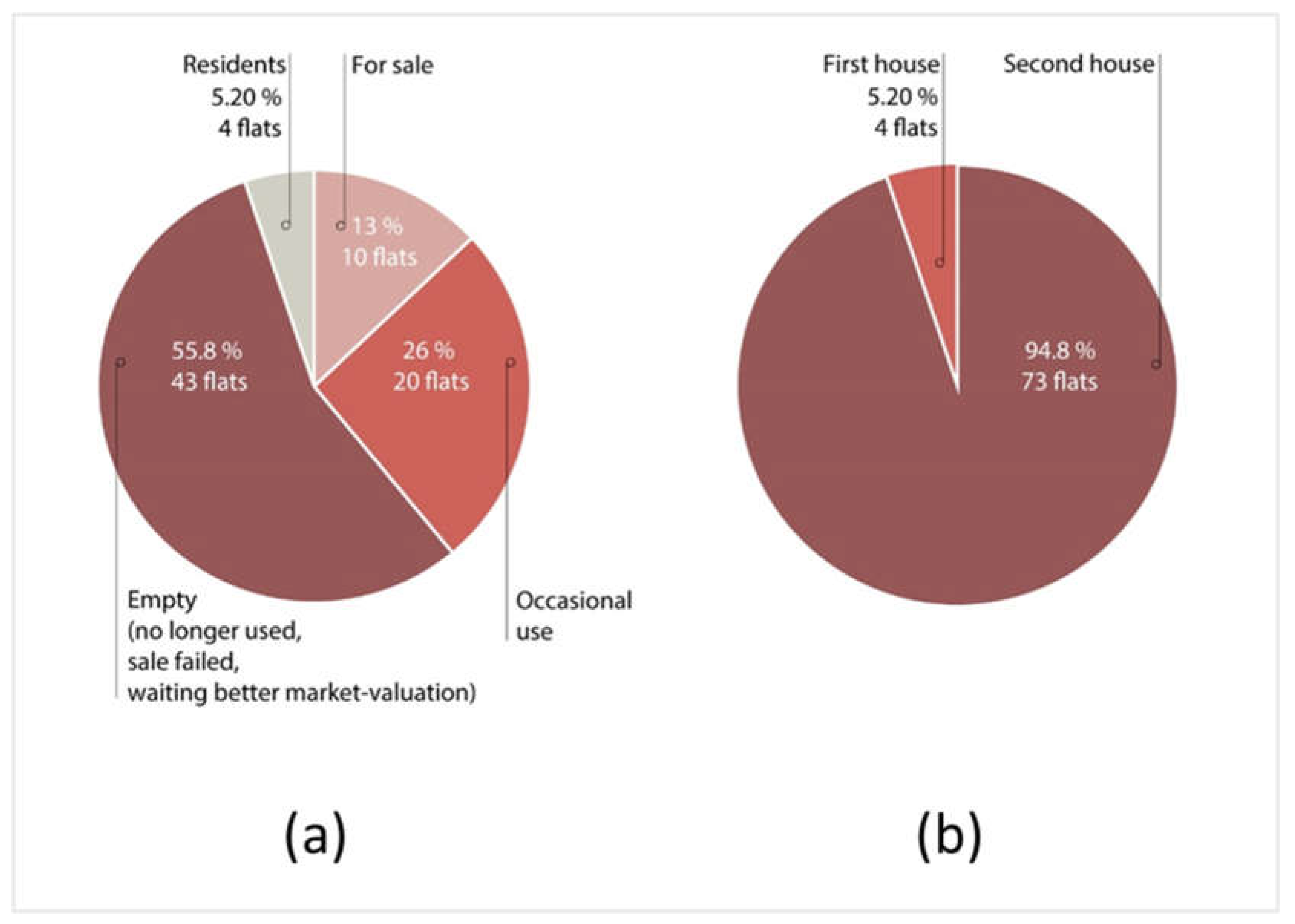

25]. The accommodations that are part of the complex's three buildings are mostly second homes (

Figure 7) and, to date, many of them are empty, having not been used for many years.

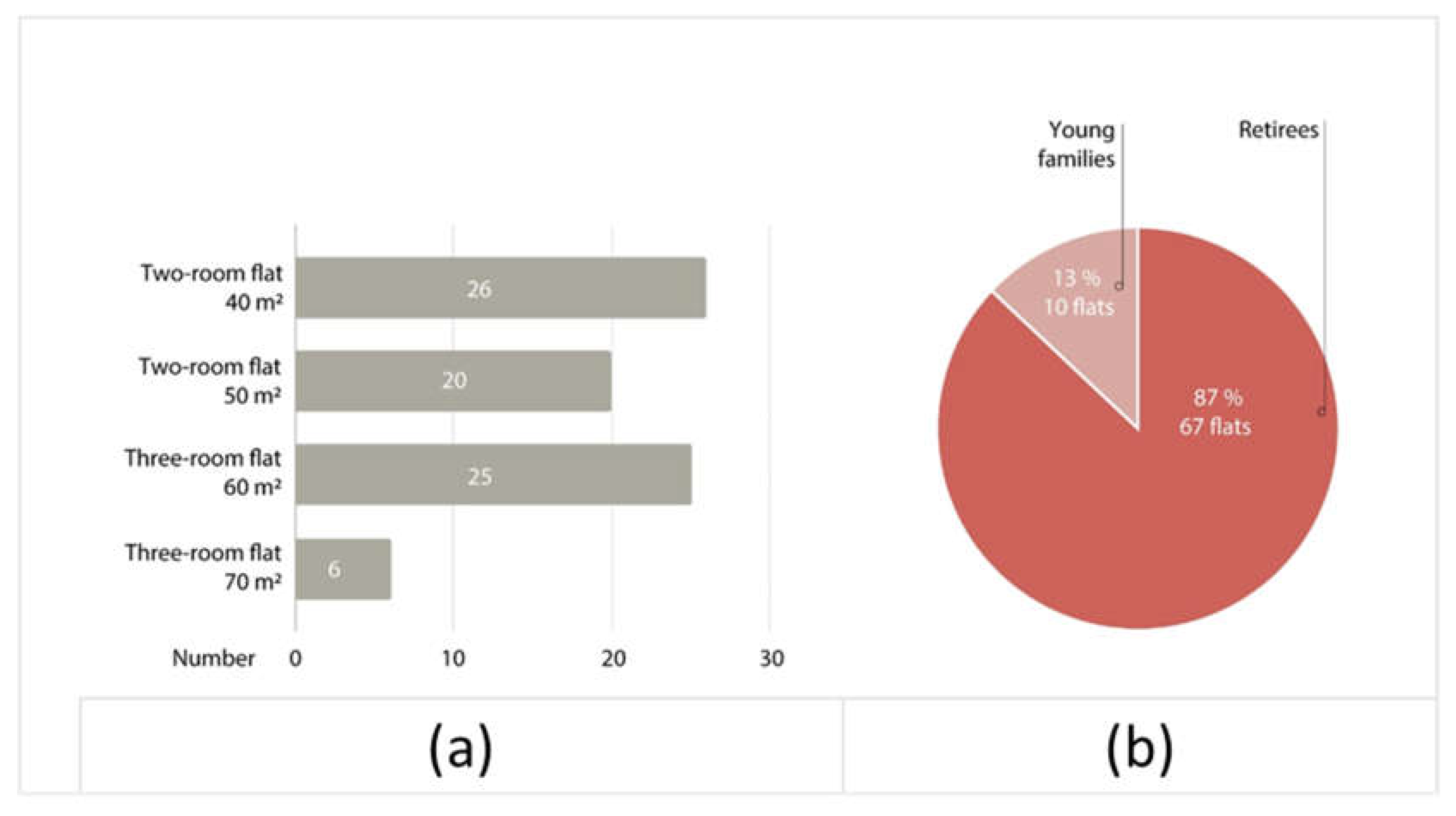

Most of the owners of the flats in the complex are pensioners who bought the flats in the late 1960s with the intention of investing their savings (remember that in that historical period the investment was considered 'safe'). In particular, the most common types of flats are two-room flats, but there are also some three-room flats with a different average size (

Figure 8).

Regarding the maintenance condition, the exterior of the building is in good condition overall as a façade painting job was carried out in 2018, while inside there are numerous architectural barriers as well as some issues related to thermal comfort.

2.3. Design and scenarios

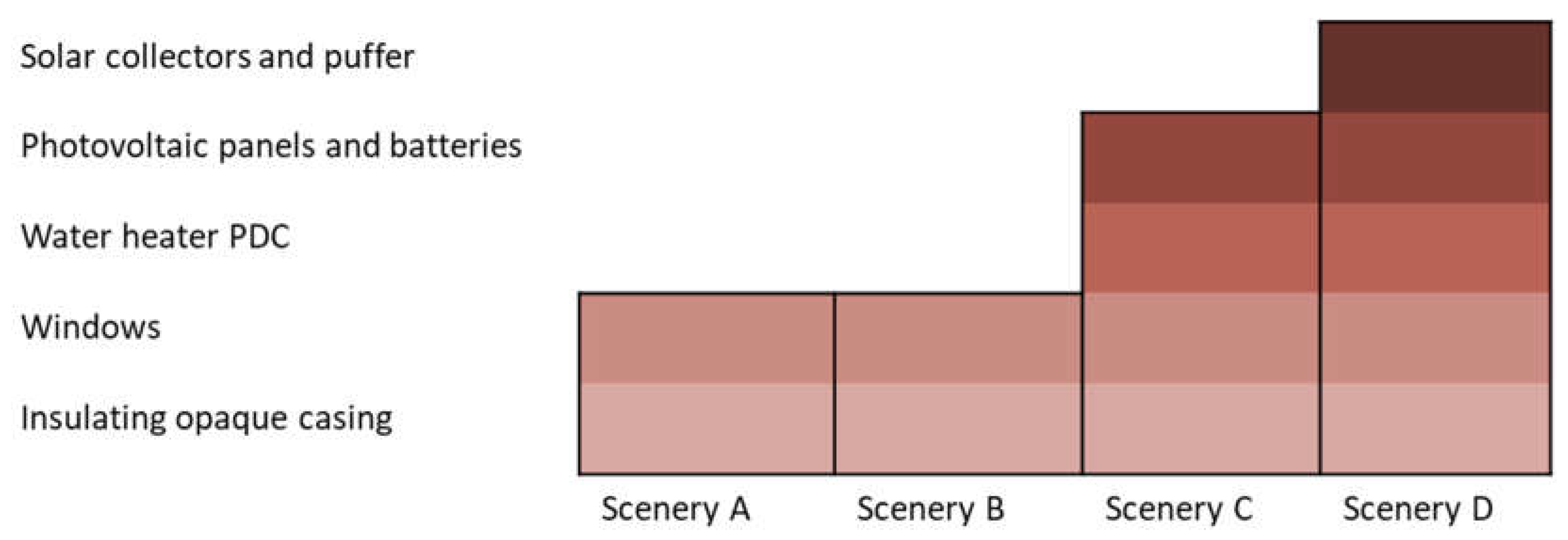

One of the prerequisites for access to the Superbonus measure is the requirement to improve the energy conditions of the building, so that it makes a jump of at least two energy classes. In the specific case study, insulation of the opaque envelope was chosen as the leading intervention for all scenarios (by law, insulation must cover more than 25 % of the dispersing surface), and the following were chosen as leading interventions: replacement of windows and doors with new, low-emission ones, installation of solar screens and insulation of shutter boxes; replacement of old boilers with heat pump water heaters (PDC); installation of solar collectors and puffers and installation of photovoltaic panels and storage batteries. All the scenarios analysed qualify as major second-level renovations, as an opaque dispersing surface greater than 25 % is always insulated.

Below is a diagram (

Figure 9) of the scenarios assumed, resulting from the aggregation of the various interventions. As can be seen, scenario A considers only the insulation of the opaque envelope, while the scenarios that follow add the various towed interventions. Scenario B includes the replacement of window frames and the insulation of shutter boxes as well as the addition of shading systems. Scenario C and D contain not only the actions on the dispersing envelope but also the choices made for the building-plant system. Specifically, photovoltaic panels have been sized for both, which will be connected to the grid in such a way as to be able to cover the auxiliary electricity consumption of the PDC water heaters throughout the year, thanks also to the storage batteries. In scenario C, the water heaters were sized according to the domestic hot water (DHW) needs of each property unit, choosing between models with 80/100/200 litres of storage, based on the estimated number of users. In scenario D, on the other hand, it was decided to maximise the production of DHW, choosing a hybrid installation: 80-litre storage water heaters for each dwelling, chosen as the 'minimum resource' (to avoid the installation of the largest and noisiest models), while to cover the needs of the largest dwellings, each unit was connected to the centralised 750-litre puffer, inside which the water is pre-heated by solar collectors.

Since scenario A, as designed, would not allow access to SB, it was decided not to consider it in the subsequent analysis. Scenario B is therefore the one that contains the minimum mix of interventions to guarantee a jump of two energy classes for the building and therefore access to SB.

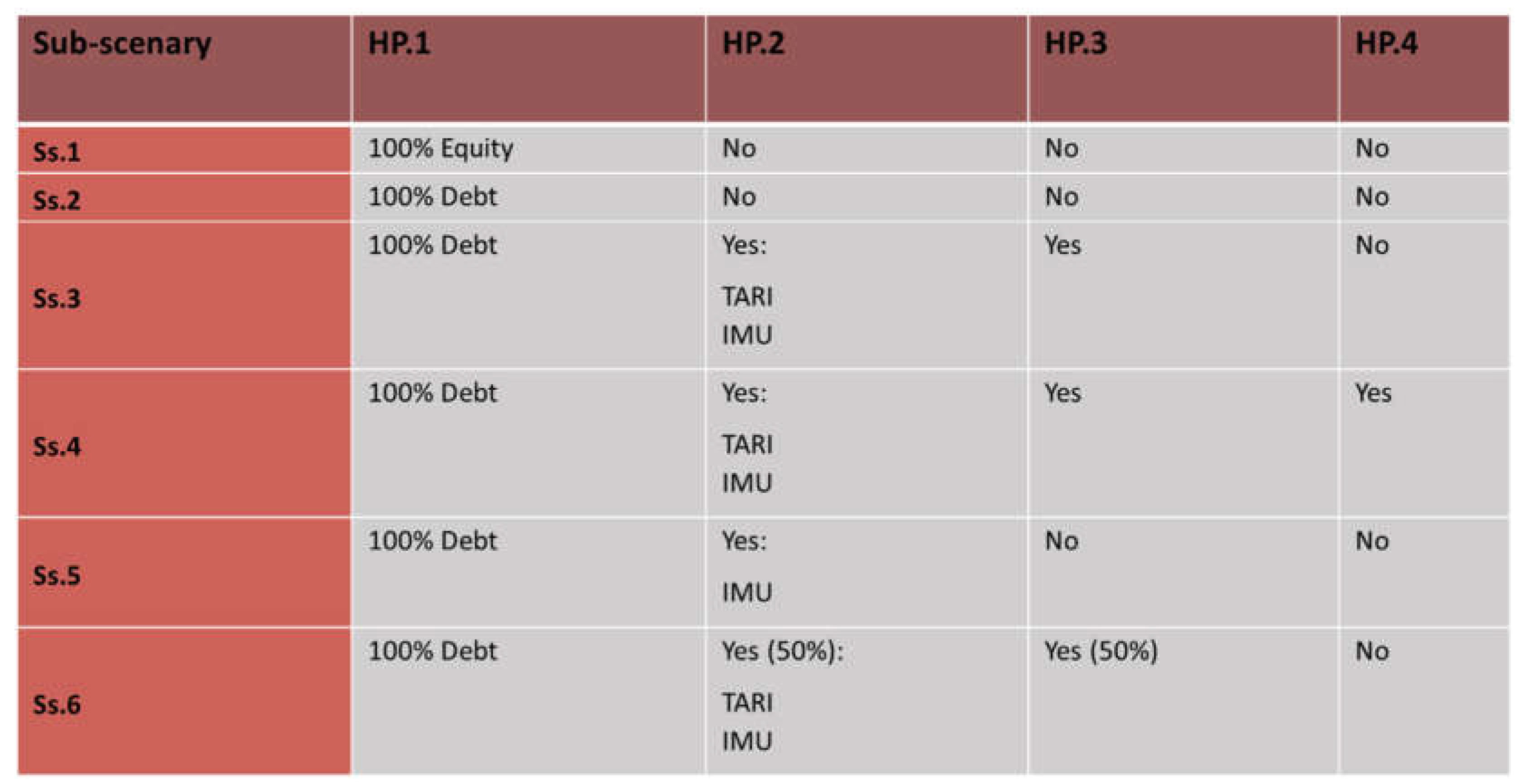

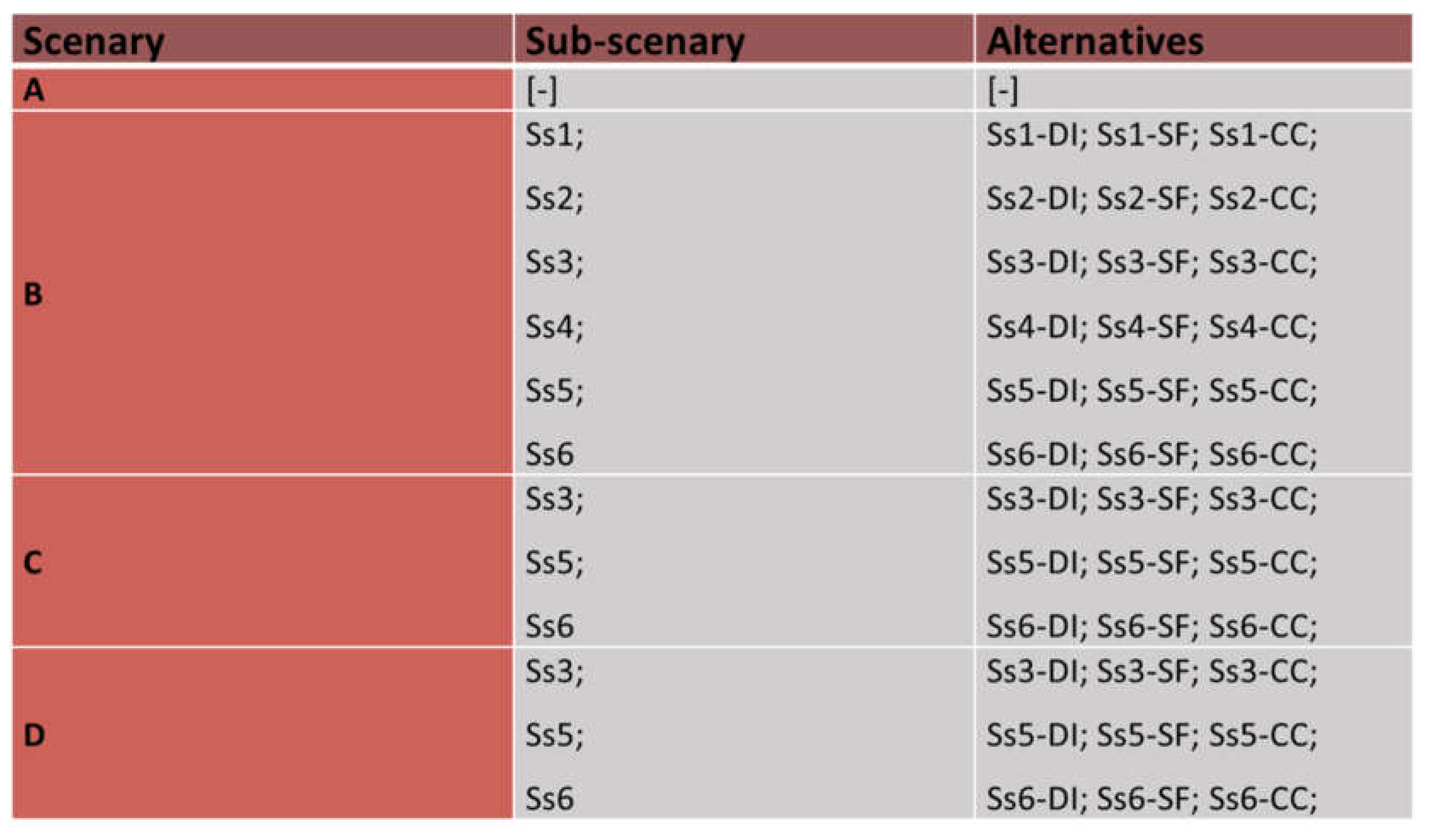

Based on this consideration, the economic tests only covered scenarios B-C-D and were organised in different sub-scenarios according to the different assumptions made (

Figure 10), but in any case, the point of view remains that of the owner of the typical real estate unit (with an average cut-off of 85 m

2).

For sub-scenarios 1-2-3-4 it was assumed that the typical dwelling is used exclusively by the owners as a second home, while for sub-scenario 5 the opposite hypothesis was made, i.e., that the dwelling is rented out all year round, and finally with sub-scenario 6 a 'compromise' hypothesis was analysed in which the dwelling is used for half the year by the owners and the other half is rented out as a 'holiday home'.

The economic analyses reported in the "results" section, as mentioned, vary according to the different assumptions, specifically:

HP.1 determines whether the capital used to carry out the interventions is all of the owner (Equity) or all of the loan (Debt); in the latter case, the interest on the debt incurred with a possible credit institution must be taken into account;

with Hp.2, taxes were taken into account (or not); in particular, the waste tax (in Italy “TAssa sui RIfiuti: TARI”) relating to waste management and intended to finance the costs of waste collection and disposal services, borne by the tenant, and a direct tax of a patrimonial nature, borne by the owner that in Italy is known as “Imposta MUnicipale propria” (IMU);

With Hp.3, the condominium management costs have been considered, i.e., only those dependent on the common parts and thus not related to the consumption of the individual users of the various building units; these costs have been considered to be zero if the building unit is rented, fully, if it is used as a second home continuously, or 50% rented for half a year;

Hp.4 considered the increase in market value resulting from the energy efficiency operation, which is assimilated to an extraordinary maintenance operation; the percentage of increase was considered to be 25% [

13] compared to the market value prior to the operation.

Finally, it should be noted that for each sub-scenario of each scenario analysed, different conveniences were calculated depending on whether the owner decides to take advantage of DD, or CT, or ID. Thus, specifically, 36 analyses were conducted (

Figure 11).

The following section shows the results obtained, in terms of Internal Rate of Return (IRR) of the various sub-scenarios.

3. Results

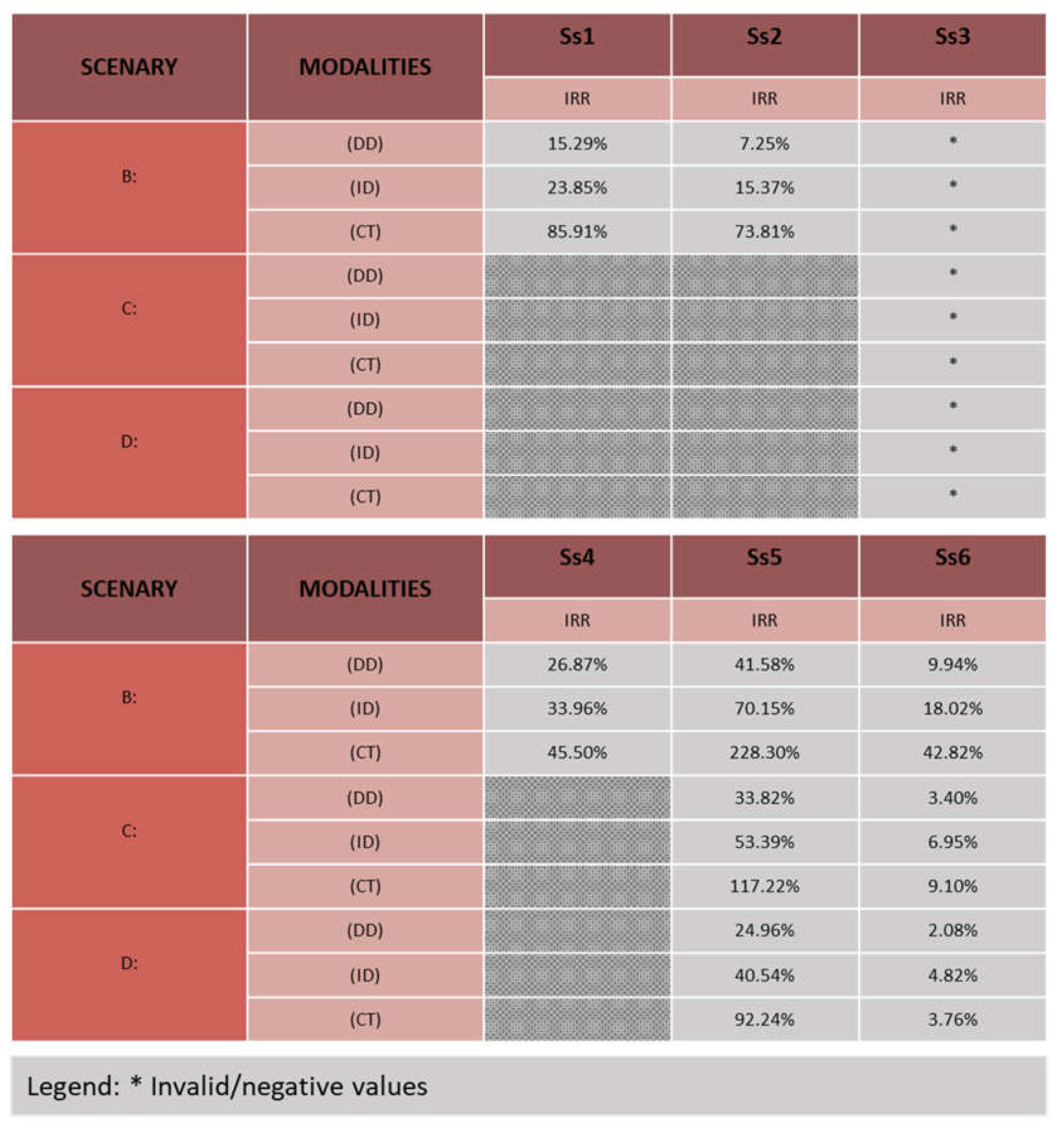

Below are the results obtained from the various processes (

Figure 12).

As can be seen in

Figure 12, the best investment hypothesis is definitely that of using only the owner's capital (Ss1), thus avoiding the payment of interest expenses required by a loan. In this hypothesis, there are all positive returns, demonstrating that the SB instrument is efficient and, above all, that one returns on the investment in only 5 years or less. The best mechanism for taking advantage of SB is the assignment of the credit, which shows the highest profitability, because it allows the investment to be returned in the first year even though the final refund is less than 110% (in the calculations, the assignment to a local bank was hypothesised, which disburses 92.7% of the accrued credit to the assignee).

Comparing the hypothesis Ss2 and Ss3, it can be seen that with the same initial conditions (100% financed), introducing also the fixed costs (IMU, TARI and running costs of the condominium) in the hands of the owner leads to negative results in Ss3. This behaviour is due to the non-influence of the proposed interventions on fixed costs such as IMU and TARI and condominium management. This analysis, however, is a short-term (5 years) view of the SB benefit, because if counted over the long term the results would be much better.

The results of the more realistic approach (Ss4), also taking into account the increase in market value, were also reported, and the results are significantly better than the previous ones (Ss2-Ss3). However, a comparison with Ss1 shows that the profitability for DD and ID increases, while for CT it decreases. This trend shows that CT has a positive effect in the short term, given the repayment in the first year, but in the long term (also taking into account the increase in the real estate value of the asset) it is an instrument that penalises the profitability of the transaction (as there is a final repayment of less than 110%).

Maximum profitability was assessed between scenarios B-C-D, in the three modes: counting the fixed costs of ownership (Ss3), partially leased (Ss6) and fully leased (Ss5). As was to be expected, hypothesis (Ss3) reports all negative results, for all scenarios, while switching to mode (Ss5) and (Ss6) shows a gradual improvement in affordability. Hypothesis (Ss5) achieves IRR values above 100 per cent, confirming that maximising the benefit created by SB through leasing is a winning action, both because tenants are left with the management and TARI costs and because they enjoy the increase in value, which implicitly increases the rent.

An important aspect to keep in mind is that all calculations were made over a very short time span (5 years: duration of the Superbonus incentive disbursement), but the benefits such as savings on heating and domestic hot water production last over time. If the investment were analysed over several years, there would certainly be a positive return in all modes of access to the 110% Superbonus.

The tax incentive put in place by the Superbonus offers unprecedented possibilities, first of all because it allows a tax deduction of 110% on the basis of the expenditure incurred in a very short time and also allows all people with little tax capacity or even incapacity to benefit. This bonus is definitely worth considering, especially in cases such as the one analysed, where one has a property that is not attractive on the real estate market and needs renovation.

4. Conclusions

The high convenience of the measure, in all its forms, suggests the following considerations. As expected, credit assignment is -of the three measures- the one that has the most obvious impact on the convenience of owners. At the moment, due precisely to this extreme attractiveness, the large number of requests for credit assignments has frozen the market, slowing down procedures and creating uncertainty for owners and traders. Consequently, the regulatory situation has been changed.

As a result, the regulatory situation was changed. With the Budget Law of 2023 [

26], the incentive rate (initially 110%) was redefined and modulated differently depending on a number of factors including the type of buildings on which the interventions are applied, compliance with the time limits imposed for the submission of building permits and, in some cases, the income of the property owners. The same Law also partially ended the mechanism of credit assignment and invoice discounting. In fact, as of Feb. 17, 2023, for interventions of building heritage rehabilitation, energy efficiency, seismic improvement, facade rehabilitation or restoration, installation of photovoltaic systems and installation of charging stations, it will only be possible to access the mechanism of direct deduction. However, the other mechanisms, i.e., invoice rebate and credit assignment, remain possible for certain types of buildings provided that, for them, the application for the acquisition of the authorization title has been submitted by February 17, 2023 and, in the case of blocks, the resolution of the condominium assembly also exists.

Recognizing the effectiveness of the legislative instrument (absolutely verified also in terms of number and amount of interventions [

27], we believe it’s meaningful to reduce the incentive rate under the measure; in fact, going from the 110% rate to 90% (and in some cases even lower) will, in our opinion, have multiple benefits. First, the beneficiary (owner) will be "empowered" and will be more judicious in choosing which interventions to carry out, reducing them to a minimum and thus identifying only those that are really necessary. In fact, for example, there will no longer be any replacement of already high-performing shutters (e.g., with double glazing) with others that are little better (e.g., triple glazing), because this would correspond to a waste of money in the face of a very low return from the energy point of view. Secondly, precisely because the beneficiary will have to contribute using its own capital, it will be enticed to carry out more market research, thus identifying economic operators who, under the same conditions required, offered the best price for the performance of their services. These two factors will cascade a series of improvements at the macro level: the market should return to a situation of normality, in which, thanks to healthy competition, the value of interventions will once again become fair; waste (example of windows and doors made earlier) will decrease; the demand for building materials will decrease and thus, with the same materials produced, their price will be lowered until it returns to a sustainable situation.

It is also believed that by directly involving the capital of those wishing to access the incentive, the risk of related fraud will also decrease, and it will then be possible to reopen the channel of credit assignment (and invoice discounting), perhaps opening up the possibility of credit securitization, which in the face of a "healthy" mechanism will be sustainable.

However, special attention will have to continue to be paid to private convenience, which should never fall below acceptable levels; this would allow, with more simplified rules, to extend the number of applications as well, aiming for that 2035 target that does not seem so easily attainable now.

References

- European Commission. Causes of Climate Change. Available online: https://ec.europa.eu/clima/change/causes_en (accessed on 6 April 2023).

- Mecca, U.; Moglia, G.; Prizzon, F.; Rebaudengo, M. Strategies for buildings energy efficiency in Italy: Financial impact of Superbonus 2020. In Proceedings of the 20th International Multidisciplinary Scientific GeoConference SGEM 2020, Albena, Bulgaria, 18–24 August 2020; SGEM: Sofia, Bulgaria, ; Fasc. 6.2, 2020; Volume 20. [Google Scholar] [CrossRef]

- Intergovernmental Panel on Climate Change (IPCC). Global Warming of 1.5 °C. Available online: https://www.ipcc.ch/sr15/ (accessed on 6 April 2023).

- Gotta, A.; Mecca, U.; Rebaudengo, M. “Fit to 55”: Financial Impacts of Italian Incentive Measures for the Efficiency of the Building

Stock and the Revitalization of Fragile Areas. Lecture Notes in Networks and Systems 2022, 482 LNNS, pp. 201-210. [CrossRef]

- European Commission. A European Green Deal. Available online: https://ec.europa.eu/info/strategy/priorities-2019-2024/european-green-deal_it (accessed on 6 April 2023).

- Manzone, F.; Rebaudengo, M.; Zaccaro, V.L. The Italian response to sustainability in built environment: The match between law and technical assessment. In Advances in Intelligent Systems and Computing; Springer: Singapore, 2019; Volume 797, pp. 527–537. [Google Scholar] [CrossRef]

- Mecca, U.; Piantanida, P.; Rebaudengo, M.; Vottari, A. Green perspectives for Italian buildings facades. In International Multidisciplinary Scientific GeoConference Surveying Geology and Mining Ecology Management; SGEM: Sofia, Bulgaria, 2019; Volume 19. [Google Scholar] [CrossRef]

- Mecca, B.; Lami, I.M. The appraisal challenge in cultural urban regeneration: An evaluation proposal. In Abandoned Buildings in Contemporary Cities: Smart Conditions for Actions. Smart Innovation, Systems and Technologies; Lami, I.M., Ed.; Springer: Cham, Switzerland, 2020; Volume 168. [Google Scholar] [CrossRef]

- European Commission. In Focus: Energy Efficiency in Buildings. Available online: https://commission.europa.eu/news/focus-energy-efficiency-buildings-2020-02-17_en (accessed on 6 April 2023).

- European Commission. Communication from the Commission to the European Parliament, the Council, the European Economic and Social Committee and the Committee of the Regions. A Renovation Wave for Europe—Greening Our Buildings, Creating Jobs, Improving Lives. 2020. Available online: https://eur-lex.europa.eu/resource.html?uri=cellar:0638aa1d-0f02-11eb-bc07-01aa75ed71a1.0003.02/DOC_1&format=PDF (accessed on 6 April 2023).

- Agenzia nazionale per le Nuove Tecnologie, L’energia e lo Sviluppo Economico Sostenibile (ENEA). Energy Efficiency and the Use of Renewables in Existing Buildings. 2020. Available online: https://cdn.qualenergia.it/wp-content/uploads/2020/10/report_detrazioni_2020.pdf (accessed on 6 April 2023).

- Agenzia nazionale per le nuove tecnologie, l'energia e lo sviluppo economico sostenibile (ENEA). Available online: https://bonusfiscali.enea.it/(accessed on 06/04/2023)Agenzia Entrate. Superbonus 110%. Available online: https://www.agenziaentrate.gov.it/portale/superbonus-110%25 (accessed on 06/04/2023).

- Mecca, U.; Moglia, G.; Piantanida, P.; Prizzon, F.; Rebaudengo, M.; Vottari, A. How Energy Retrofit Maintenance Affects Residential Buildings Market Value? Sustainability 2020, 12, 5213. [Google Scholar] [CrossRef]

- Servizio Studi—Dipartimento Ambiente. Il Recupero e la Riqualificazione Energetica del Patrimonio Edilizio: Una Stima Dell’impatto delle Misure di Incentivazione. 2020. Available online: http://documenti.camera.it/leg18/dossier/testi/am0036b.htm?_1613488926013 (accessed on 6 April 2023).

- Sole 24 Ore—Real Estate—Residenziale. Compravendite, 6 Immobili su 10 sono in Classe G. Available online: https://www.ilsole24ore.com/art/compravendite-6-immobili-10-sono-classe-g-AE1bVxDD?refresh_ce=1 (accessed on 6 April 2023).

- Decree-Law, No.; 34 of 19 May 2020. Misure Urgenti in Materia di Salute, Sostegno al Lavoro e All’economia, Nonche’ di Politiche Sociali Connesse All’emergenza Epidemiologica da COVID-19. Available online: https://www.gazzettaufficiale.it/eli/id/2020/05/19/20G00052/sg (accessed on 6 April 2023).

- Camera dei Deputati. Il Superbonus Edilizia al 110 per Cento—Aggiornamento al Decreto-Legge 21 Giugno 2022, n. 73. 2022. Available online: https://documenti.camera.it/Leg18/Dossier/Pdf/FI0136.Pdf (accessed on 6 April 2023).

- Agenzia Entrate. Imposte sui Redditi (Irpef, Ires)—Che Cos’è. Available online: https://www.agenziaentrate.gov.it/portale/schede/pagamenti/imposte-sui-redditi/cosa-imposte-sui-redditi (accessed on 6 April 2023).

- Agenzia Entrate. Superbonus 110%. 2022. Available online: https://www.agenziaentrate.gov.it/portale/documents/20143/233439/Guida_Superbonus_110_2022.pdf/21e9100a-9d7e-f582-4f76-2edcf1797e99 (accessed on 6 April 2023).

- Knowlton, L.W.; Philips, C.C. The Logic Model Guidebook – Better Strategies for Great Results, 2nd ed.; SAGE: California, USA, 2013. [Google Scholar]

- Grosso, R.; Prizzon, F.; Rebaudengo, M. La valutazione dell’impatto del metodo anti turbativa nei contratti pubblici: Le aggiudicazioni di lavori, servizi e forniture in Piemonte. Valori Valutazioni 2019, 22, 19–33. [Google Scholar]

- Focus. Come Andavano in Vacanza i Nostri Nonni? Available online: https://www.focus.it/cultura/storia/come-andavano-in-vacanza-i-nostri-nonni (accessed on 6 April 2023).

- Domus. Le Case per le Vacanze Degli Anni Sessanta, Dall’archivio di Domus. Available online: https://www.domusweb.it/it/architettura/2020/07/14/le-case-per-le-vacanze-degli-anni-sessanta-dallarchivio-di-domus.html (accessed on 6 April 2023).

- L’Economia. Gli italiani e la Pandemia. 2020. Available online: https://www.inu.it/wp-content/uploads/economia-seconde-case-16-novembre-2020.pdf (accessed on 6 April 2023).

- Gotta, A. Riqualificazione di un Complesso Anni ’60 a Sampeyre Come Nuovo Modello di Residenza—Studio di Applicabilità Superbonus 110% = Rehabilitation of a 1960s Complex in Sampeyre as a New Model of Residence—Study of Superbonus 110%. Master’s Thesis, Politecnico di Torino, Turin, Italy, 2020. [Google Scholar]

- Law, No.; 197 of 22 December 2022 (Italian Budget Law 2023). Bilancio di Previsione Dello Stato per L’anno Finanziario 2023 e Bilancio Pluriennale per il Triennio 2023–2025. Available online: https://www.gazzettaufficiale.it/eli/id/2022/12/29/22G00211/sg. (accessed on 6 April 2023).

- ANCE—Direzione Studi, Osservatorio Congiunturale Sull’industria delle Costruzioni; Ottobre 2022. Available online: https://ance.it/2022/10/osservatorio-congiunturale-edilizia-boom-2022-ma-nel-2023-torna-il-segno-meno/ (accessed on 6 April 2023).

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).