The bid simulator has the task of creating the agents, give them the possibility to submit an offer at a certain time, decide the quantity and the price of the offer and adjust their strategy following the market conditions.

4.2.1. Agent creation

For each agent, four characteristics are defined:

the identification number (I), an integer number varying in the range [1,] with the maximum number of agents

the kind of the agent (a), an integer number varying in the range [0, 9] (from 0 to 4 for buyers and from 5 to 9 for sellers)

the volume of energy (MWh) that an agent wants to buy (sell) in the ID market;

the ‘private value’ () defined as the maximum (minimum) price (€/MWh) that a buyer (seller) is willing to spend (accept) for buying (selling) energy.

The I number is assigned at the beginning of the algorithm, and it is useful to understand which players obtained the best results at the end of the simulation. The five typologies of buyers and sellers are:

dispatchable generators that need to buy or sell energy to don’t incur in penalty imbalances;

dispatchable generators that could buy or sell energy to earn more money;

non-dispatchable generators that are willing to enter in the market;

non-dispatchable generators that want to earn more money taking the risk to get penalties imbalances;

agents that submit offers very close to the equilibrium price of the market.

The volume of energy is a constant quantity and agents submit a slice of it every time they decide to place an order. The private value is calculated with the following procedure: a random number extrapolate from historical prices of imbalance penalties

With and . And calculates as indicate in Table II.

Table 1.

Methodology of unbalanced prices.

Table 1.

Methodology of unbalanced prices.

| |

Agent positive unbalancing |

Agent negative unbalancing |

| Zonal positive unbalancing |

Agent receives:

|

Agent pays:

|

| Zonal negative unbalancing |

Agent receives:

|

Agent pays:

|

So, agents with a positive imbalance can sell energy and they will be remunerated at the day-ahead market price () if he is bidding in a zone with negative unbalancing while he will be remunerated at the minimum price between the day-ahead market price and the balancing market price () if the bidding zone presents a positive unbalancing. On the contrary, agents with negative imbalances will pay if they are bidding in a positive unbalancing zone or the maximum price between and if they are bidding in a zone with negative unbalancing.

The other three variable parameters are assigned to the agents in order to develop our algorithm properly for an energy market model. These variables are the number of submissions (n), the remaining quantity of energy (

) to buy or sell and the aggressiveness (

). n and

are important indices for agent submission strategy of an order. Aggressiveness is a key parameter to model price strategy of players inspired by the

adaptive-aggressiveness (or AA) strategy [

17] and it is the key characteristic that agent uses to lead their behavior as well as the ‘genes’ of the population that NSGA-II modifies to find the optimal solutions. It is defined as the inclination to be more active in the market. An aggressive agent submits better bids than the equilibrium price, increasing the chance of find a match but renouncing big profits. On the other hand, a passive player submits bids worse than the equilibrium price taking the risk to not reach a match but trying to find a more profitable transaction. For instance, an aggressive seller (buyer) will submit offers with a lower (higher) price than the equilibrium one while a passive seller (buyer) will present offers with a higher (lower) cost than the equilibrium price. High level of aggressiveness has a range between 0 and 1:

while low level of aggressiveness has a range between -1 and 0:

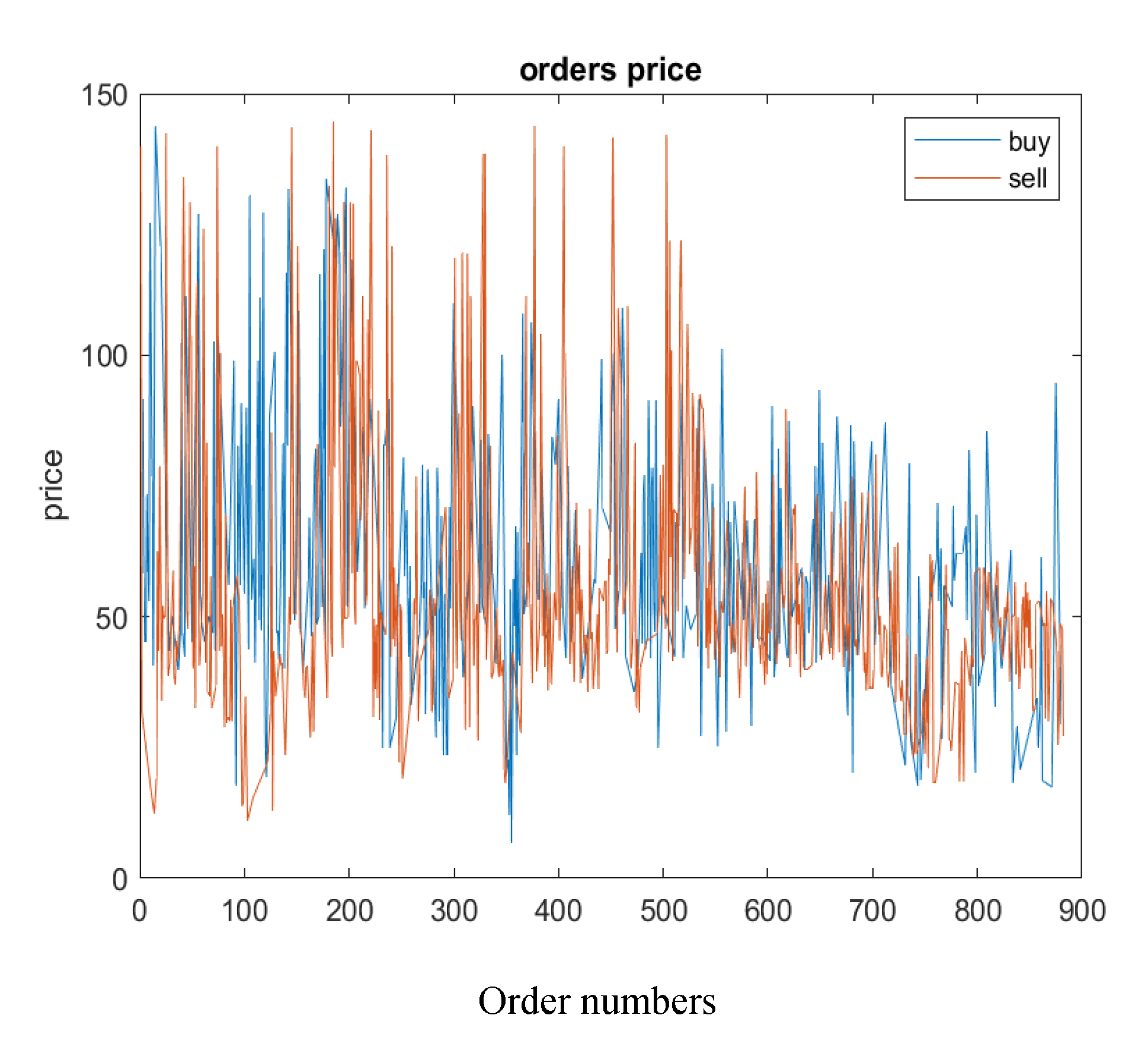

4.2.2. Offer submission

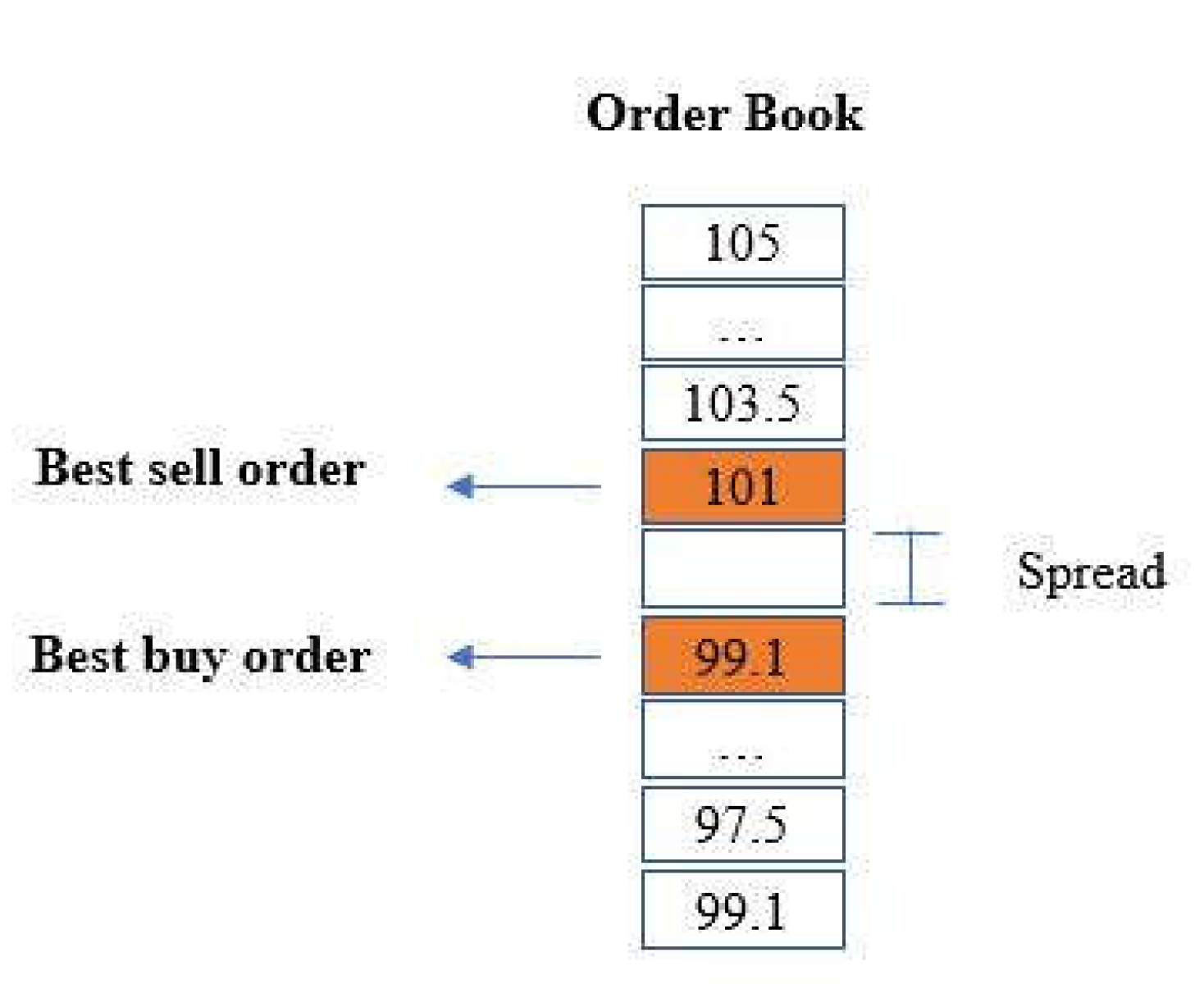

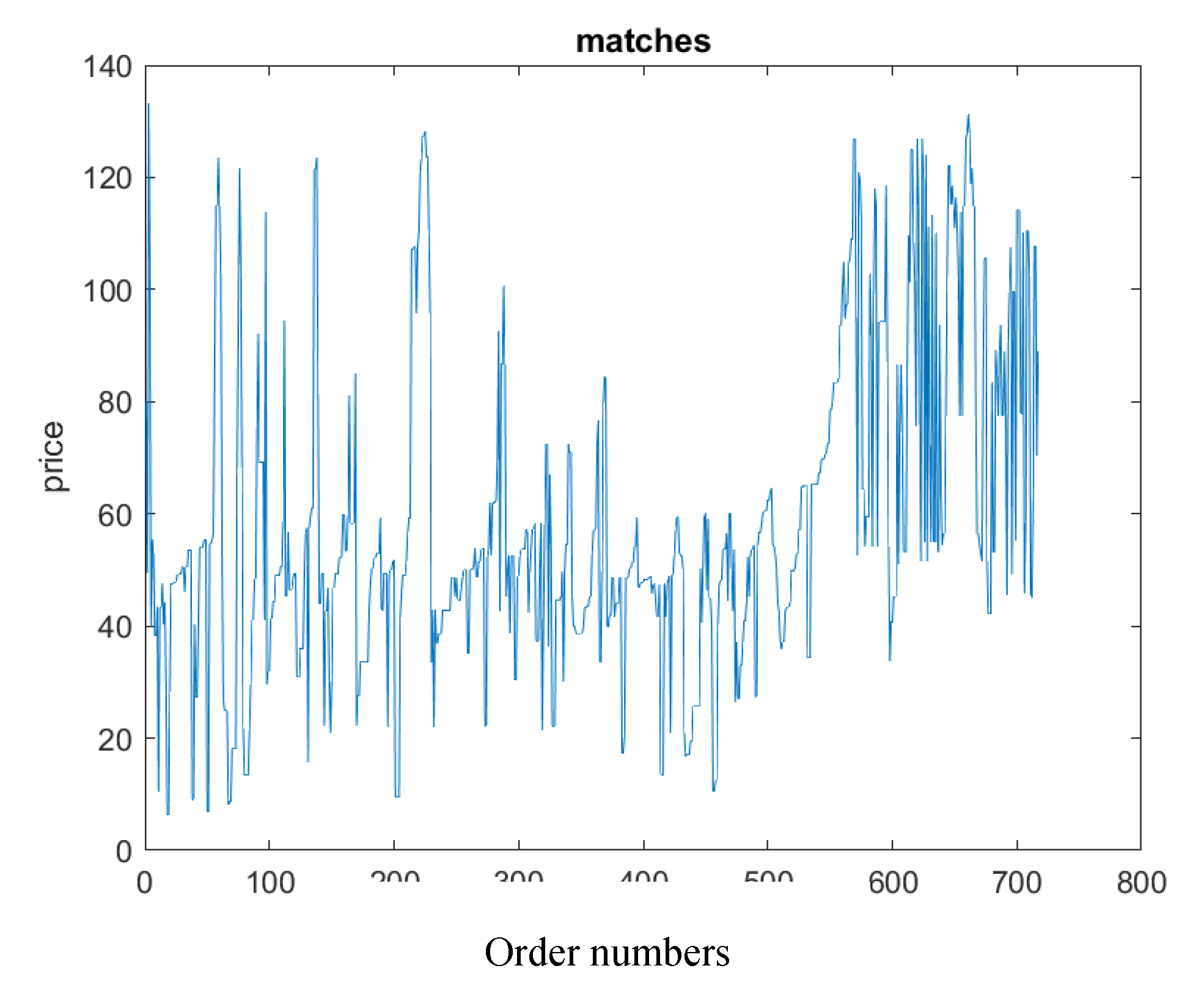

In the SIDC the trading starts one hour after the closing of day-ahead market at and end one hour before the delivery time at so we call the trading time: . In our model we discretize the continuous trading time into different step . At each time step an agent is selected by the system and he can decide whether buy or sell an amount of energy or not. The agent’s selection is made by three different methods: randomly, following the average match prices or depending on the quantity submitted. The random method is the easiest and it is also the one that give more random results: the algorithm selects casually an identify number and the associated agent decide whether submit a bid or not as showed in the algorithm1. Let’s give some notation to facility the reading of the algorithm: indicate the player’s i decision of submission, is the total volume of the agent i, and is the volume submitted by the agent i. is the price submitted by the agents i, is the equilibrium market price, is the price average of the last 5 matches as maximum, and are respectively the best buy order and the best sell order present in the order book and maxP is the maximum price offer allows in the market.

Algorithm 1: random selection of a participant

1: Open order book = 2: while < do

3: agent= rand (I)

4: Order: 5: Sending the order to the order book

6: Update agent’s strategy

7: end while

8: Close order book

Point 3 of algorithm 1 can be set with other two methods mentioned before. In particular:

Algorithm 1.1: selection depending on the average matched prices

3: for <10

3.1: agent= rand (I)

3.2: end for

3.3: Calculation of match price average:

3.4: if <

3.5: agent= 75% buyer, 25% seller

3.6: else

3.7: agent= 75% seller, 25% buyer

3.8: end for

This procedure states that when the market price () is lower than the equilibrium market price, buyers are more willing to enter in the market trying to find a more profitable deal, while is higher than the equilibrium price, sellers enter in the market to gain better revenues.

Algorithm 1.2: selection depending on the volume submitted

3: for <10

3.1: agent= rand (I)

3.2: end for

3.3: Percentage of the volume submitted over total volume for all agents

3.4: for i=1: number of agents

3.5: end for

3.6: agent= choose by a vector of probabilities depending on

In this method the agent with the highest probability to be selected is the one who presents the lowest value of . This happens because an agent who has not been able to sell/buy its volume of energy is more willing to submit an offer than agents who have already sold the majority of the volume. Agent selection is chosen at the beginning of the analyses, and it cannot be changed by NSGA-II algorithm, but it is useful to represent different scenarios of continuous market.

4.2.4. Order prices

The agent’s formulation of prices follows the AA strategy [

17] of the continuous double auction (CDA) [

28] and it is enhanced by the introduction of the NSGA-II algorithm. In fact, in order to comply the objective functions regarding the welfare and the unsold quantity, agents must be able to submit their bids with the optimal price in a certain market timeframe. For instance, following the market results, a seller will decide whether to enter in the market presenting a high price offer (that could increase his welfare while taking the risk to not find a bid in the opposite direction) or to submit a low-price offer that increase the possibility to sell his imbalance volume. These analyses show how the NSGA-II algorithm is able to optimize the agent’s decision in the session of continuous market. The price formulation is also strictly dependent to the characteristics of the power plant. The function used to generate prices is continue and dependent to the aggressiveness

and ϴ that represents the magnitude of the gradient [

30]. For the fivekinds of agents previously mentioned we defined 5 different strategies for buyers and 5 for sellers (for all strategies: if the match average price has not been already calculated

):

Strategy 1b: dispatchable buyer generator with high risk of imbalances due to a breakdown

1: set initial aggressive () value between [0.6;1]

2: if buyers’ book-depth is empty

3: price (6)

4: if buyers’ book is not empty

5: (7)

These generators that need to buy/sell energy are power plant that faced a breakdown after the closing of day-ahead market and cannot respect the bids previously accepted so they want to be sure to enter in the ID market to adjust their position even without obtaining big revenues.

Strategy 2b: dispatchable buyer generator that buys energy only if the trade is highly profitable.

1: set initial aggressive () value between [-1; -0.6]

2: if buyers’ book-depth is empty

3: price (8)

4: if buyers’ book is not empty

5: price (9)

These are dispatchable generators that could buy/sell energy in the market. They are already balanced but with the possibility to produce or take more energy from the market with high costs. So, they decide to enter only if obtaining big revenues.

Strategy 1s: dispatchable seller generator with high risk of imbalances due to a breakdown

1: set initial aggressive () value between [0.6;1]

2: if sellers’ book-depth is empty

3: price (10)

4: if sellers’ book is not empty

5: price (11)

This strategy refers to the strategy 1b but for sellers.

Strategy 2s: dispatchable seller generator that sells energy only if the trade is highly profitable

1: set initial aggressive () value between [-1; -0.6]

2: if sellers’ book is empty

3: price (12)

4: if sellers’ book is not empty

5: (13)

This strategy refers to the strategy 2b but for sellers

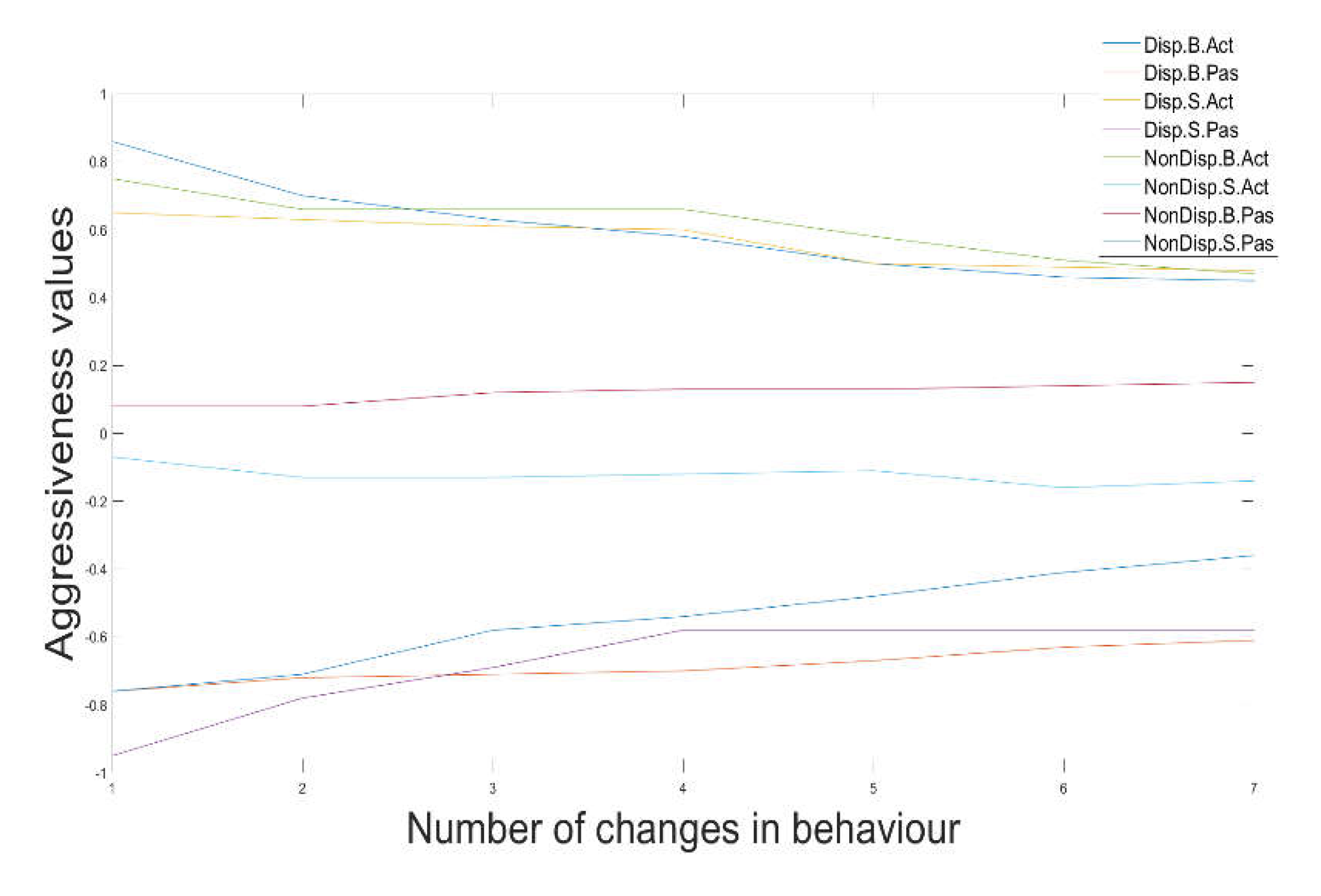

For non-dispatchable generators, formulas for bids prices are the same of the dispatchable generators. The main differences are the initial aggressiveness and the possibility to switch from an aggressive strategy to a passive one and vice-versa depending on the market conditions. We report the strategies of a non-dispatchable buyer that starts active and a non-dispatchable seller that starts passive. The strategies adopted respectively buy passive buyer and active follows the same rules

Strategy 3b: non-dispatchable buyer generator

1: set initial aggressive () value between [0; 1]

2: price (14)

3: processing the bid in the order book

4: update

5: if >0 restart from point 2

6: else, price (15)

Strategy 4s: non-dispatchable seller generator

1: set initial aggressive () value between [-1; 0]

2: price (16)

3: processing the bid in the order book

4: update

5: if )<0 restart from point 2

6: else, price (17)

Strategies 3b and 4s represent dispatchable generators with the characteristics of switching between an aggressive to a passive behavior. This represents the hard forecast of energy production for a no-programmable resource that has to face the random climate conditions.

The last type of agent introduced are the one who submits bids only following the market equilibrium price, that statistically [

17] is the price at which most of the match occurred. For this type of player, the aggressiveness is not necessary

Strategy 5: non-dispatchable seller or buyer generator

They want to buy/sell energy without a particular strategy, but they submit bids focusing on the fact that the majority of transactions takes place around the prices that come out form the day-ahead market [

23].

For four typologies of agents out of five, the aggressiveness is the parameter that defines the prices of their bids and that is the reason why it is set as the ‘gene’ of each individual in the NSGA-II simulation.

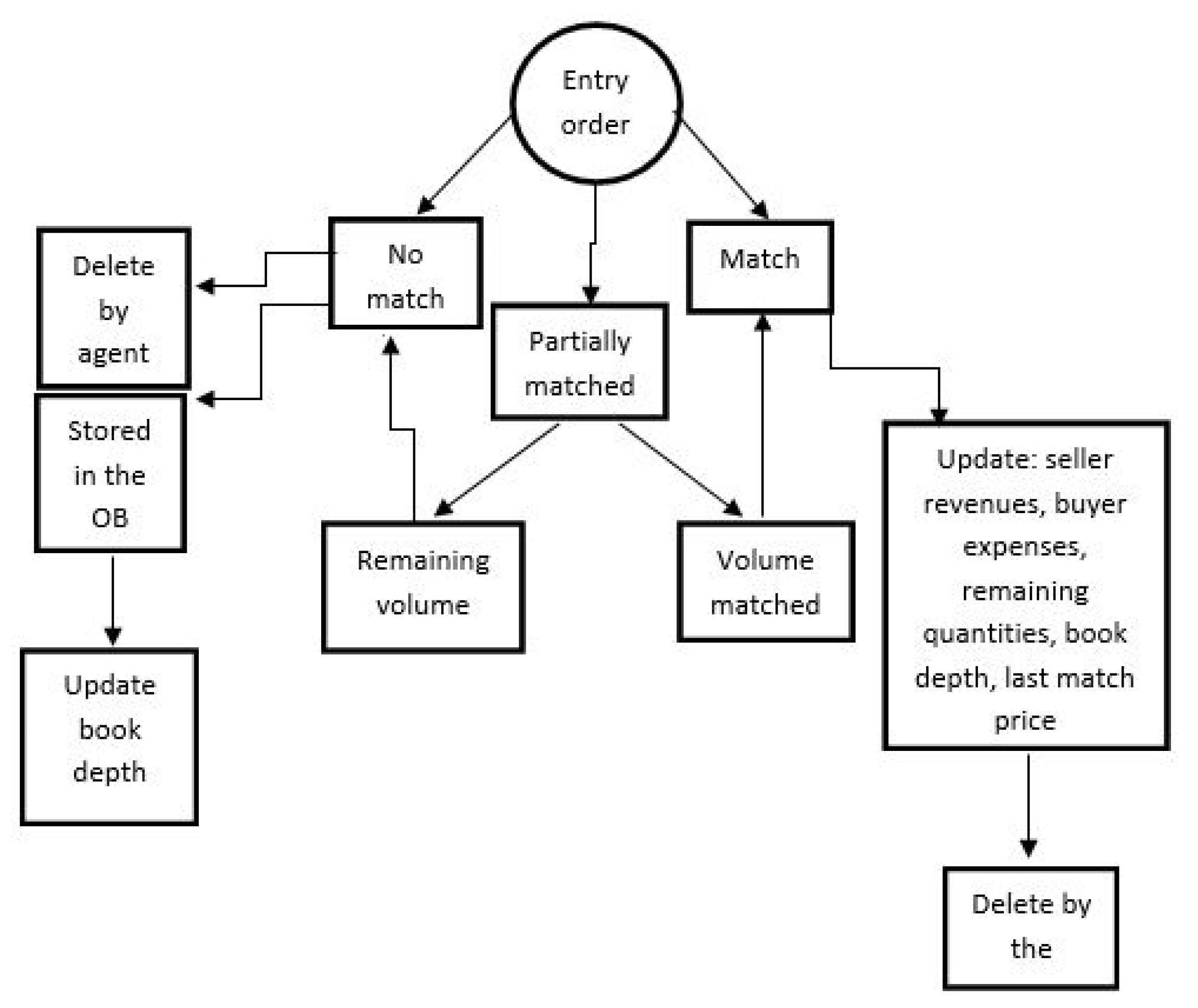

4.2.5. Submission of a bid

In [

29] is stated that most of the bids submitted are then deleted by agents and only a small percentage remain in the order book. To replicate this trading in our model we introduced the possibility to delete a bid submitted upon the occurrence of certain conditions. Algorithm 2 explains the agent’s decision:

Algorithm 2: decision to submit or delete a bid for buyer

1: if buyers’ book is empty submit bid

2: if submit bid else don’t submit

3: bid processing in the order book

4: if no-match occurs and if sellers’ book > ψ delete bid

5: if no-match occurs and if sellers’ book <= ψ don’t delete bid

Algorithm 2.1: decision to submit or delete a bid for seller

1: if sellers’ book is empty submit bid

2: if submit bid else don’t submit

3: bid processing in the order book

4: if no-match occurs and if buyers’ book > ψ delete bid

5: if no-match occurs and if buyers’ book <= ψ don’t delete bid

Where ε is a parameter in the range [0;1] that determine the choice of an agent if submitting or not depending on how far the position of the bid in the order book ranking is. An ε close to 1 increases the willingness of submission while an ε close to 0 decreases the willingness of submission. Ψ is aositive value that determine the choice of deleting a bid stored in the order book or not. For example, if a seller submits a bid, it is not matched and ψ=5 it means that there are five buy bids that cannot be matched with the one just submitted due to its high price. So, it is hard that the bid will find a match later and it is better to delete it and submit another one.

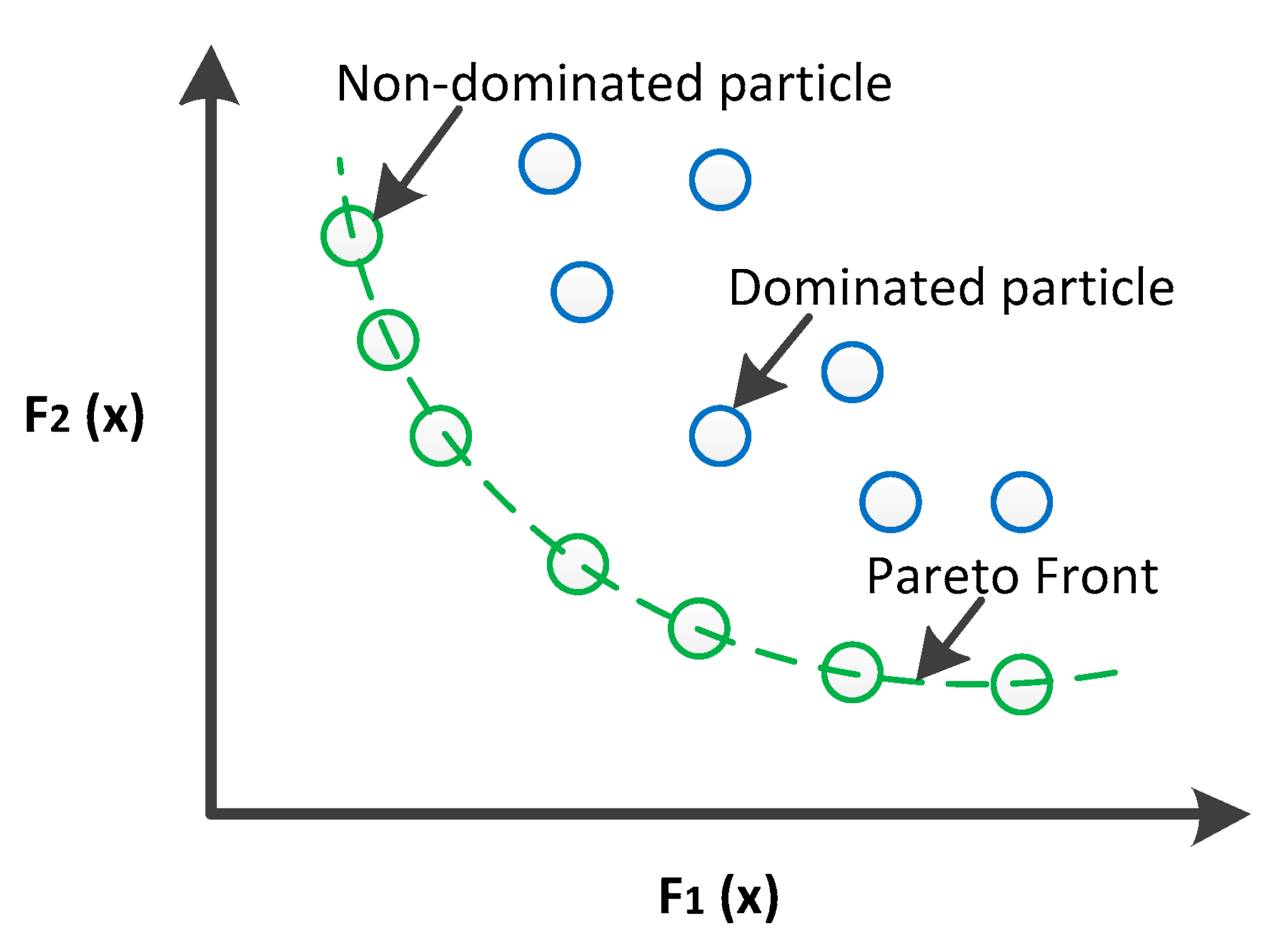

4.2.6. NSGA-II Optimization strategy

Each agent starts the market session with a given level of aggressiveness (

ϵ [-1; 1]) and can modify this level following the market events. In more detail, an aggressive agent that find a match can decide to decrease his aggressiveness to obtain a match with bigger revenues and on the other hand, a passive agent that does not find a match can decide to increase his aggressiveness to have more chance to enter in the market. The general aim of anagent is to obtain the optimal level of aggressiveness that enables to enter in the market and maximize the profits. In our model we first replicated the method presented by Vytellingum et all. [

17] to regulate agents’ aggressiveness and secondly, we compared the results with a model that use genetic algorithm to update the same parameters. In particular we introduced the non-dominating sorting genetic algorithm (NSGA-II) implemented based on [

31] defining two objective functions and a set of variables. Here the NSGA-II is described and explained how it can be applied to our model. The algorithm that simulates the ID market is composed by different phases fundamental to determine how the NSGA-II suits in the context. In fact, every time one generation starts, different market sessions are launched characterized by agents with different peculiarities described in section 4.1 and all individuals (market players) trade among themselves until the market session is finished. Results of each market session depict the welfare of the system, the welfare of buyers and sellers and the unsold quantity that cause imbalances. These are the objectives functions better described further on. Obviously, most of the characteristics of the market are fixed and NSGA-II does not interact with them so the market can be replicated properly. The optimization algorithm will be applied only to aggressiveness characteristic that define the behavior adopted by agents and highlights their strategies defined in section 4.4.

Now all the parameters that we set in the NSGA-II algorithm to be combined with our model are described. The process starts with different sets of players who represent the population. Each set of players is characterized by a set of variables (aggressiveness) individually associated to a player. Thus, variables are scalar values joined into a string to form the solution. How fit is a set of players is evaluated thanks to the objective functions. The algorithm gives a score to the set of individuals to represent the probability to be selected for reproducing and pass the characteristics of aggressiveness to the next set of players. A high score gives more chance to the set of players to be selected for reproducing. For each pair of set of players to be coupled a crossover point is chosen randomly within the sets of aggressiveness and the next generation sets of players are created by exchanging the aggressiveness of the previous sets among themselves until the crossover point is achieved. At this point the new set of players is added to the set of population. When a new set of players is formed, a mutation may occur. This mince that some of the aggressiveness in the new set of players can be changed. The process ends when the sets of aggressiveness converge so there are not significative differences between a set of players and the next one ore when the number of generations is completed by the program. In the following section the objective functions used to determine which are the best sets of aggressiveness that players must utilize to trade in the continuous ID market is described.

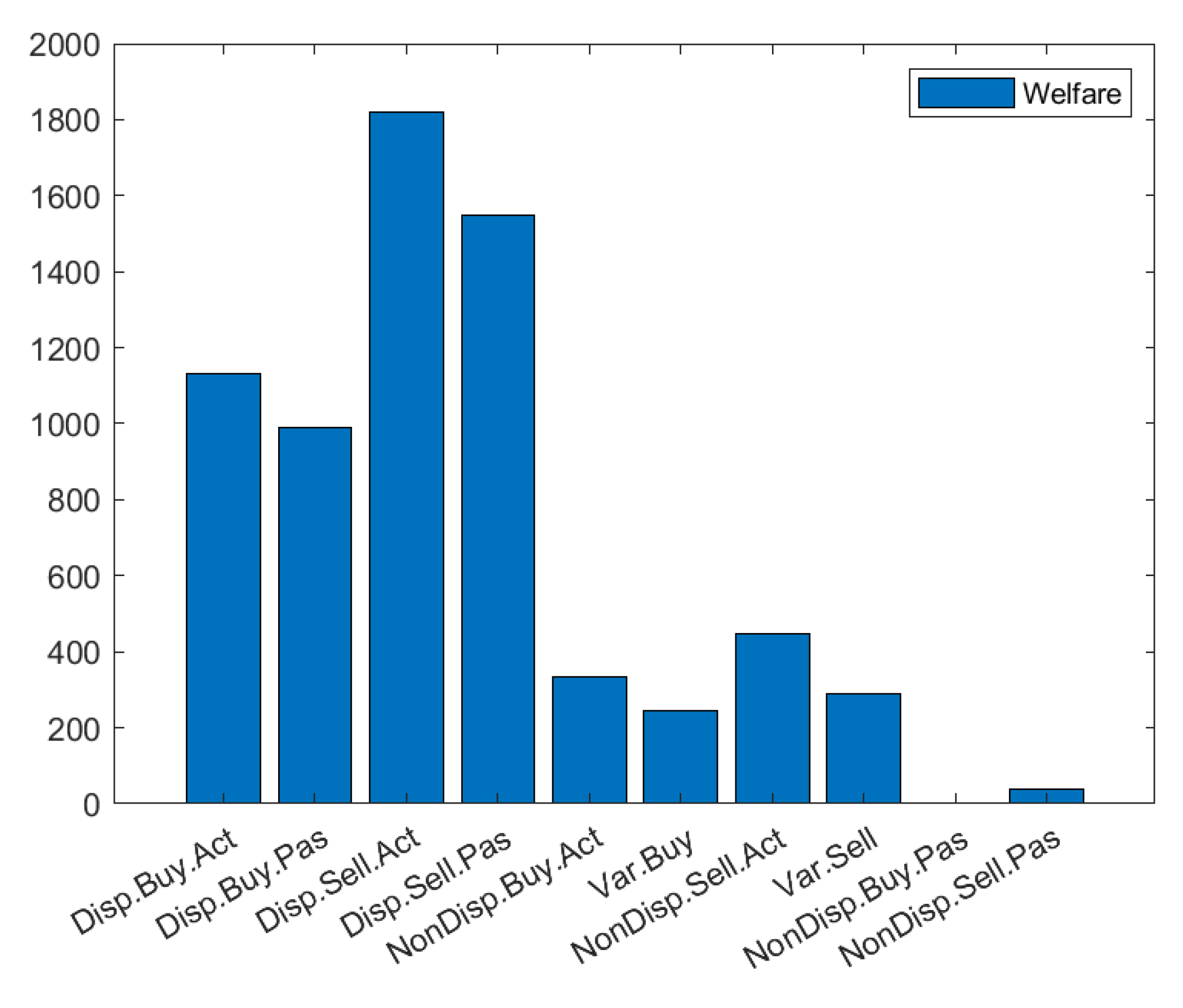

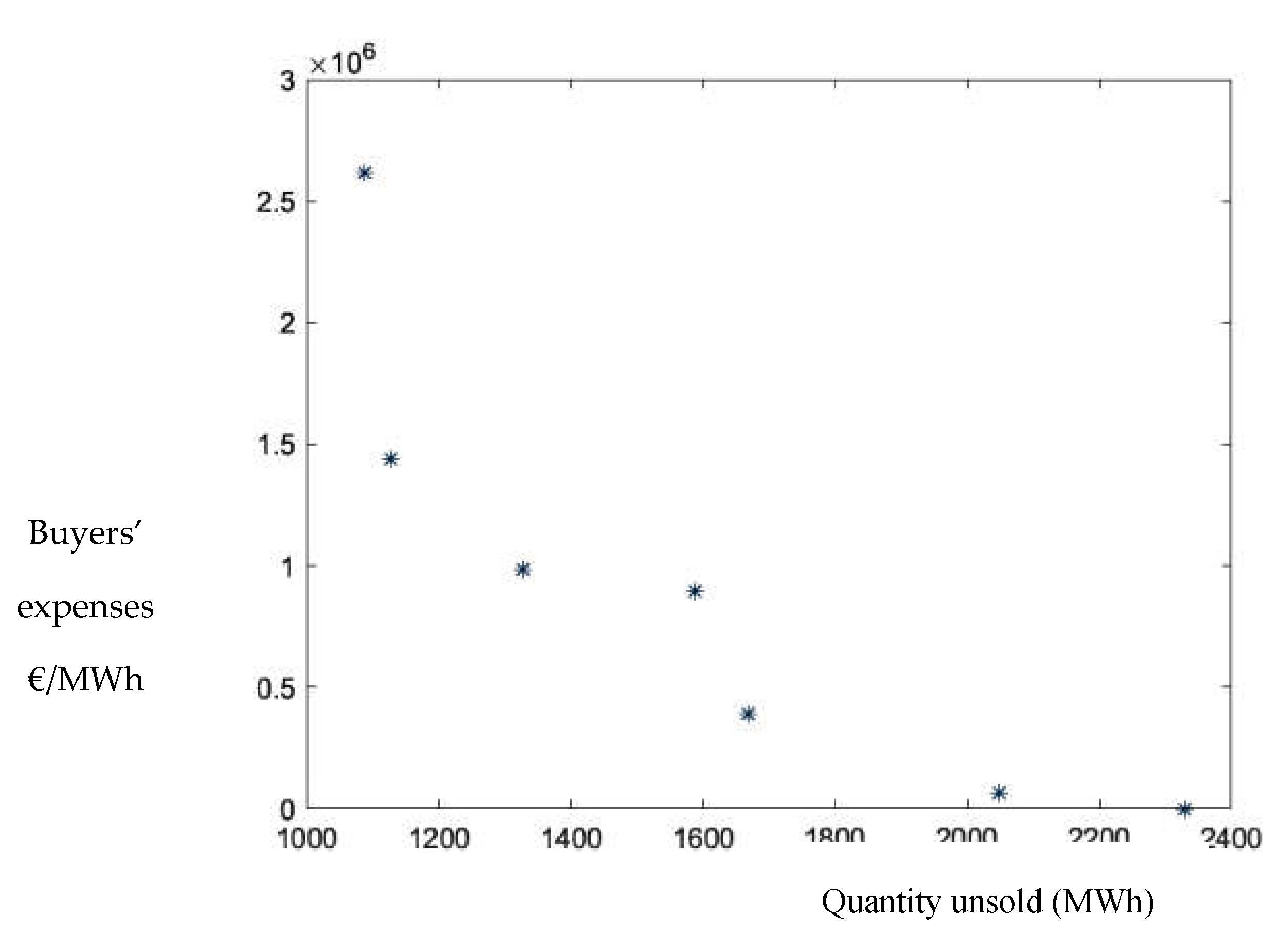

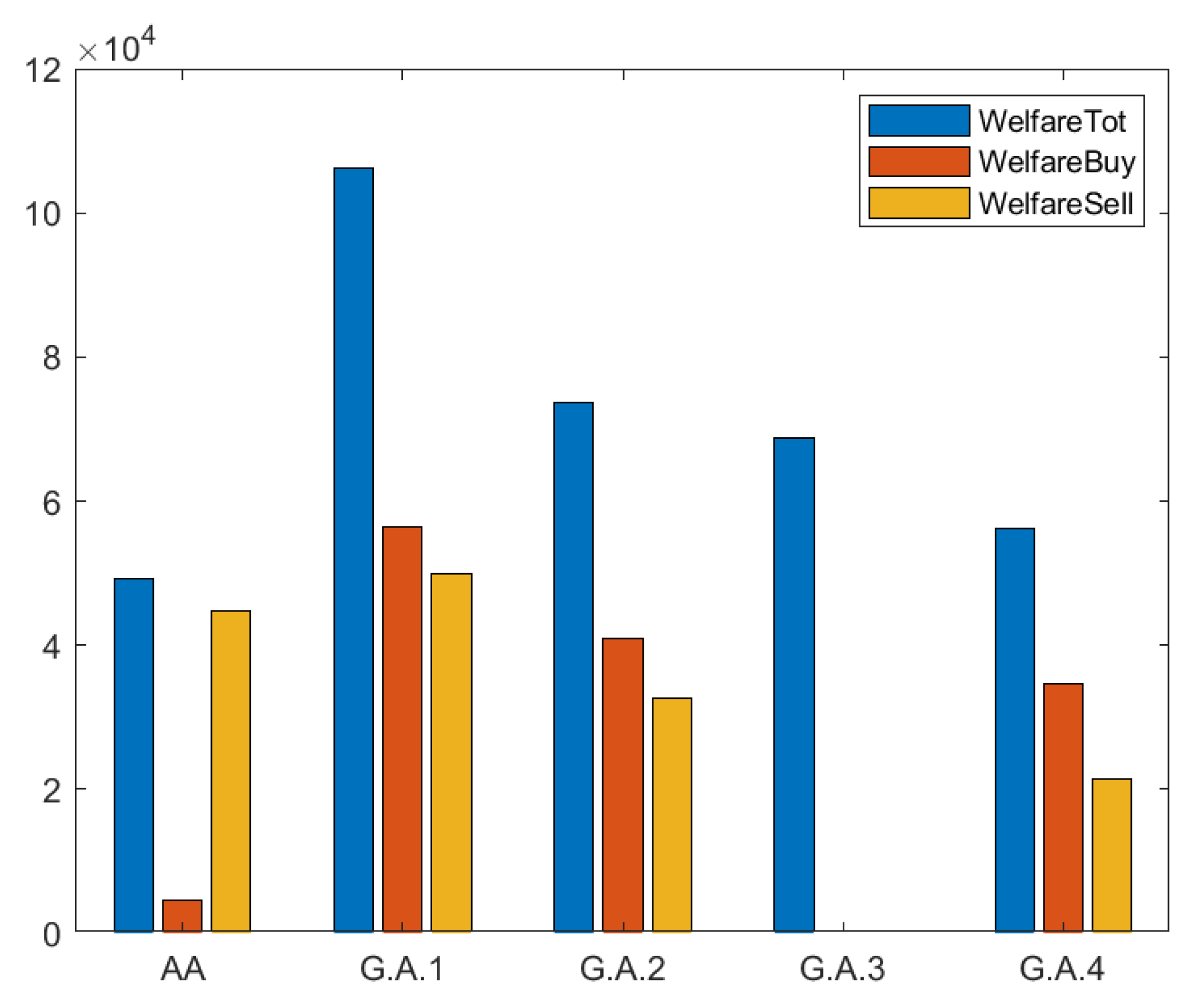

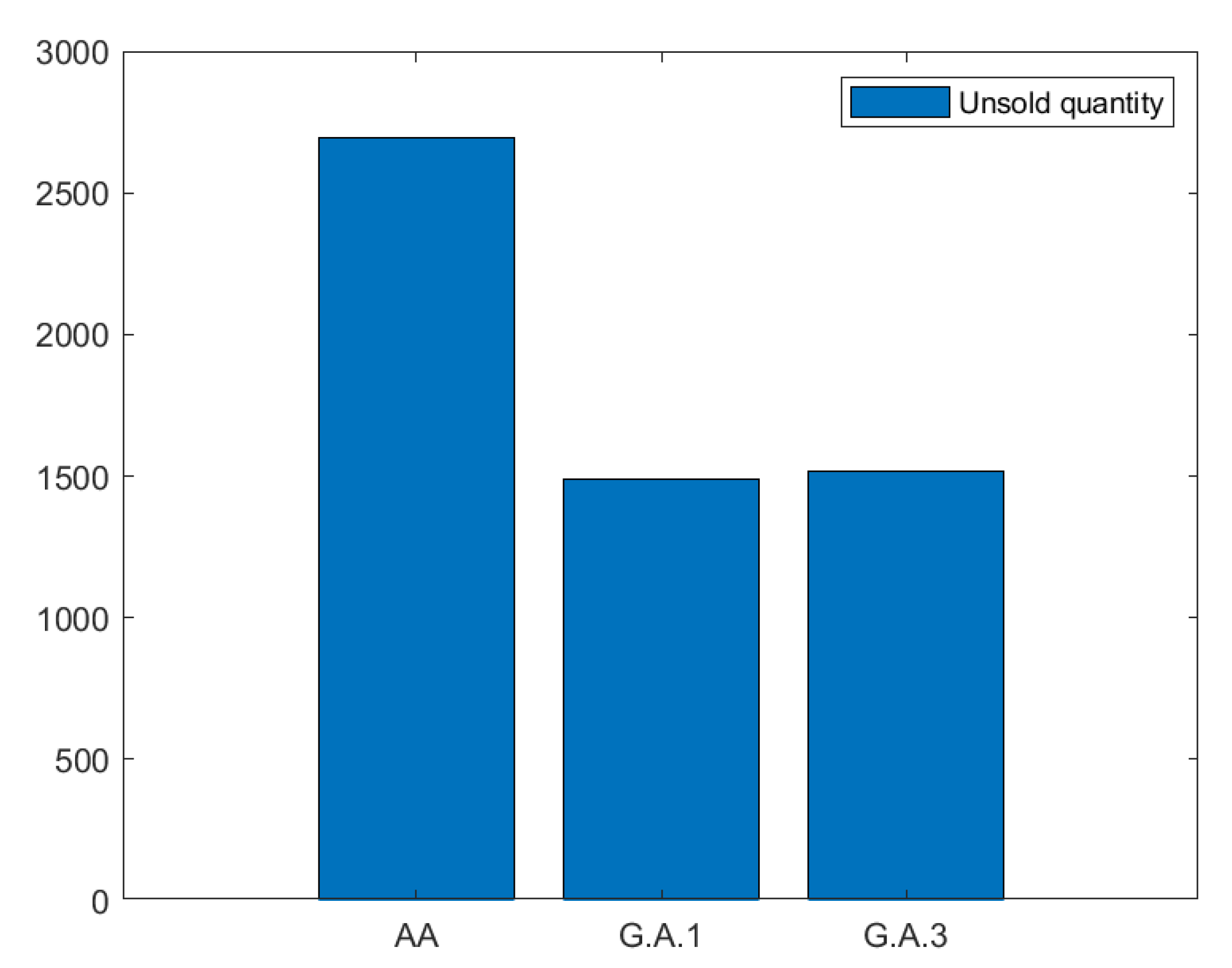

At this point the objective functions are described. Analysis has been focused on the optimization of functions regard the welfare of the agents, the total welfare and the unsold quantity which is the source of penalty imbalances in the market. For each optimization, only two of the aforementioned objective functions have been considered. For instance, the welfare of buyers (related to their expenses) and the unsold quantity are optimized at the same time to find out what is the best compromise of aggressiveness that allows to deliver big amounts of energy without incurring in prices higher and lower compared to the market price. The objective functions considered two by two, depending on the optimization problem to solve, are the following:

A. Welfare sellers

This function represents the revenues of the sellers in respect of what they are expecting to gain. It has to be maximized.

B. Welfare buyers

This function represents the savings of buyers in respect to what they are willing to spend. It has to be maximized.

C. Total welfare

This function represents the general welfare of the system. It has to be maximized

D. Remaining volumes

This function represents the total volumes that agents have not been able to exchange in the market. It has to be minimized.

Where

,

and

are respectively the quantity matched the price of the match the price of the submission of player i.

For every generation a set of aggressiveness is assigned to the population divided equally into sellers and buyers, and the objective functions are calculated. The best set of individuals are the ones that obtain the highest welfare, or the lowest unsold quantity and they get the lowest rank and the highest crowding distance into NSGA-II. The process continues until the end of the generations as previously mentioned. The combination of different objective function has been led to analyze four different problems to evaluate the market efficiency:

Problem 1:(G.A.1) wants to maximize the buyers and sellers’ welfare and minimize the unsold quantity.

Problem 2: (G.A.2) wants to maximize the buyers and sellers’ welfare only.

Problem 3: (G.A.3) aims at maximizing the total welfare and minimizing the unsold quantity

Problem 4: (G.A.4) tries to maximize at the same time the buyers, sellers, and total welfare.