Submitted:

20 April 2023

Posted:

21 April 2023

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Materials and Methods

Data

Estimation Procedures

Models and Variables

3. Results

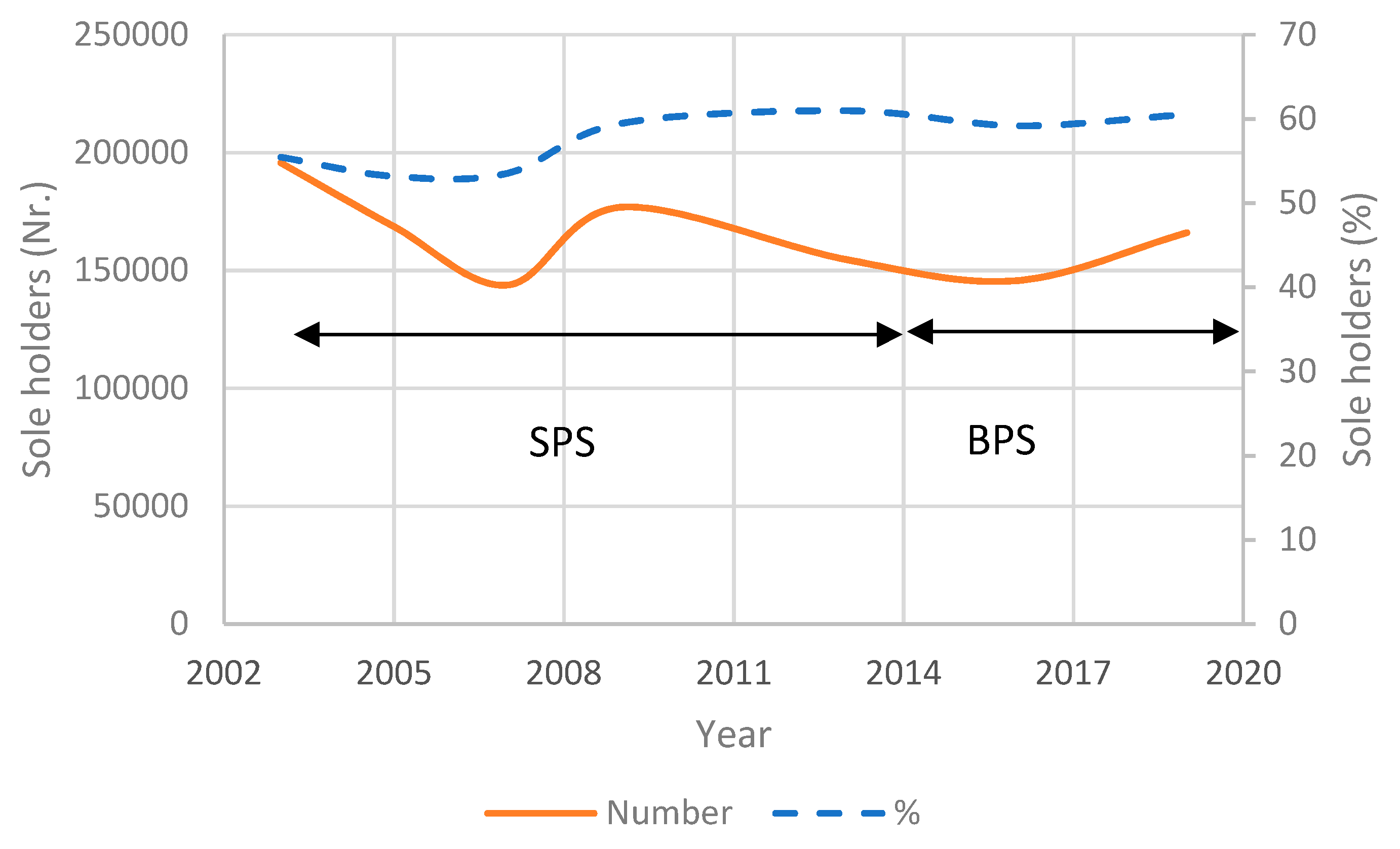

Descriptive Statistics

Multiple Linear Regression

Logit Model

4. Conclusions

Conflicts of Interest

References

- M. Brady et al., Impacts of Direct Payments Lessons for CAP post - 2020. Lund, Sweden: AgriFood Economics Centre, 2017.

- R. Henke et al., Implementation of the First Pillar of the CAP 2014-2020 in the Member States. Brussels: European Parliament, 2015.

- European Commission, “Overview of CAP Reform 2014-2020,” Agric. Policy Perspect. Br. N.o 5, no. December 2013, p. 10, 2013.

- S. Davidova and T. Kenneth, Family farming in Europe: challenges and prospects (in-depth analysis), European P. Brussels, 2014.

- S. Davidova, A. Bailey, E. Erjavec, M. Gorton, and K. Thomson, “Semi-subsistence Farming: Value and Directions of Development,” Brussels, 2013. [Online]. Available: https://www.europarl.europa.eu/thinktank/en/document/IPOL-AGRI_ET(2013)495861.

- T. Hennessy, CAP 2014-2020 Tools to Enhance Family Farming: Opportunities and Limits. Brussels: European Parliament, 2014.

- J. A. Segrelles, “Agricultural subsidies and their repercussions on family farming in the latest common agricultural policy reforms (2014-2020) in the european union: CHanging everything so that everything remains the same?,” Bol. la Asoc. Geogr. Esp., vol. 2017, no. 74, pp. 161–184, 2017. [CrossRef]

- R. Beluhova-Uzunova, K. Hristov, and M. Shishkova, “Small farms in Bulgaria - trends and perspectives.,” Agric. Sci. - J. Agric. Univ. - Plovdiv, vol. 11, no. 25, pp. 59–65, 2019. [CrossRef]

- European Commission, Direct payments to agricultural producers - graphs and figures. Financial year 2019. European Commission: DG Agriculture and Rural Development, 2020.

- European Commission, Statistical Factsheet: European Union, no. June. European Commission: DG Agriculture and Rural Development, 2021.

- European Comission, “Farming Income Support,” Directorate-General for Agriculture and Rural Development. https://agridata.ec.europa.eu/extensions/DashboardIndicators/FarmIncome.html (accessed Mar. 14, 2023).

- European Commission, Statistical Factsheet: Portugal, no. June. European Commission: DG Agriculture and Rural Development, 2021.

- M. Espinosa, K. Louhichi, A. Perni, and P. Ciaian, “EU-Wide Impacts of the 2013 CAP Direct Payments Reform: A Farm-Level Analysis,” Appl. Econ. Perspect. Policy, vol. 42, no. 4, pp. 695–715, 2020. [CrossRef]

- J. Dixon, A. Gullivre, and D. Gibbon, Farming systems and poverty: Improving Farmer’s Liveihoods in a Changing World. Rome and Washington D.C: FAO and World Bank, 2001.

- K. E. Giller, “Guest editorial: Can we define the term ‘farming systems’? A question of scale,” Outlook Agric., vol. 42, no. 3, pp. 149–153, 2013. [CrossRef]

- Y. Buitenhuis, J. J. L. Candel, K. J. A. M. Termeer, and P. H. Feindt, “Does the Common Agricultural Policy enhance farming systems’ resilience? Applying the Resilience Assessment Tool (ResAT) to a farming system case study in the Netherlands,” J. Rural Stud., vol. 80, no. March, pp. 314–327, 2020. [CrossRef]

- V. Becvarova, “Economic and regional consequences of direct payments under the current CAP philosophy,” Acta Univ. Agric. Silvic. Mendelianae Brun., vol. 59, no. 4, pp. 19–26, 2011. [CrossRef]

- F. Bartolini and D. Viaggi, “The common agricultural policy and the determinants of changes in EU farm size,” Land use policy, vol. 31, pp. 126–135, 2013. [CrossRef]

- S. O’Neill and K. Hanrahan, “The capitalization of coupled and decoupled CAP payments into land rental rates,” Agric. Econ. (United Kingdom), vol. 47, no. 3, pp. 285–294, 2016. [CrossRef]

- G. Guastella, D. Moro, P. Sckokai, and M. Veneziani, “The Capitalisation of CAP Payments into Land Rental Prices: A Panel Sample Selection Approach,” J. Agric. Econ., vol. 69, no. 3, pp. 688–704, 2018. [CrossRef]

- D. Valenti, D. Bertoni, D. Cavicchioli, and A. Olper, “The capitalization of CAP payments into land rental prices: a grouped fixed-effects estimator,” Appl. Econ. Lett., vol. 28, no. 3, pp. 231–236, 2021. [CrossRef]

- B. Czyzewski and K. Smedzik-Ambrozy, “The regional structure of the CAP subsidies and the factor productivity in agriculture in the EU 28,” Agric. Econ. (Czech Republic), vol. 63, no. 4, pp. 149–163, 2017. [CrossRef]

- M. Garrone, D. Emmers, H. Lee, A. Olper, and J. Swinnen, “Subsidies and agricultural productivity in the EU,” Agric. Econ. (United Kingdom), vol. 50, no. 6, pp. 803–817, 2019. [CrossRef]

- P. Ciaian, D. Kancs, S. Gomez, and Paloma, “Income distributional effects of CAP subsidies: Micro evidence from the EU,” Outlook Agric., vol. 44, no. 1, pp. 19–28, 2015. [CrossRef]

- H. Hansen and R. Teuber, “Assessing the impacts of EU’s common agricultural policy on regional convergence: Sub-national evidence from Germany,” Appl. Econ., vol. 43, no. 26, pp. 3755–3765, 2011. [CrossRef]

- S. Severini, A. Tantari, and G. Di Tommaso, “Do CAP direct payments stabilise farm income? Empirical evidences from a constant sample of Italian farms,” Agric. Food Econ., vol. 4, no. 1, 2016.

- S. Severini and A. Tantari, “The impact of agricultural policy on farm income concentration: The case of regional implementation of the CAP direct payments in Italy,” Agric. Econ. (United Kingdom), vol. 44, no. 3, pp. 275–286, 2013. [CrossRef]

- M. Svatoš and M. Chovancová, “The influence of subsidies on the economic performance of Czech farms in the regions,” Acta Univ. Agric. Silvic. Mendelianae Brun., vol. 61, no. 4, pp. 1137–1144, 2013. [CrossRef]

- G. Trnková and Z. Malá, “Analysis of distribution impact of subsidies within the common agricultural policy on field production businesses in the czech REPUBLIC,” Acta Univ. Agric. Silvic. Mendelianae Brun., vol. 60, no. 7, pp. 415–424, 2012. [CrossRef]

- A. Kazukauskas, C. Newman, D. Clancy, and J. Sauer, “Disinvestment, farm size, and gradual farm exit: The impact of subsidy decoupling in a European context,” Am. J. Agric. Econ., vol. 95, no. 5, pp. 1068–1087, 2013. [CrossRef]

- M. Weltin, I. Zasada, C. Franke, A. Piorr, M. Raggi, and D. Viaggi, “Analysing behavioural differences of farm households: An example of income diversification strategies based on European farm survey data,” Land use policy, vol. 62, pp. 172–184, 2017. [CrossRef]

- A. Volkov, T. Balezentis, M. Morkunas, and D. Streimikiene, “Who Benefits from CAP? The way the direct payments system impacts socioeconomic sustainability of small farms,” Sustain., vol. 11, no. 7, 2019. [CrossRef]

- Š. Bojnec and I. Fertő, “Do different types of Common Agricultural Policy subsidies promote farm employment?,” Land use policy, vol. 112, no. September 2021, 2022. [CrossRef]

- S. Coderoni and R. Esposti, “CAP payments and agricultural GHG emissions in Italy. A farm-level assessment,” Sci. Total Environ., vol. 627, no. 627, pp. 427–437, 2018. [CrossRef]

- K. Heyl, T. Döring, B. Garske, J. Stubenrauch, and F. Ekardt, “The Common Agricultural Policy beyond 2020: A critical review in light of global environmental goals,” Rev. Eur. Comp. Int. Environ. Law, vol. 30, no. 1, pp. 95–106, 2021. [CrossRef]

- A. Žičkienė, R. Melnikienė, M. Morkūnas, and A. Volkov, “CAP Direct Payments and Economic Resilience of Agriculture: Impact Assessment,” Sustain., vol. 14, no. 17, 2022. [CrossRef]

- Sadłowski et al., “Direct payments and sustainable agricultural development—the example of Poland,” Sustain., vol. 13, no. 23, 2021. [CrossRef]

- R. Grochowska, A. Pawłowska, and A. Skarżyńska, “Searching for more balanced distribution of direct payments among agricultural farms in the CAP post-2020,” Agric. Econ. (Czech Republic), vol. 67, no. 5, pp. 181–188, 2021. [CrossRef]

- M. De Castris and D. Di Gennaro, “Does agricultural subsidies foster Italian southern farms? A Spatial Quantile Regression Approach,” arXiv: 1803.05659v1 [econ.EM], pp. 1–29, 2018, [Online]. Available: http://arxiv.org/abs/1803.05659.

- S. Ciliberti and A. Frascarelli, “The CAP 2013 reform of direct payments: redistributive effects and impacts on farm income concentration in Italy,” Agric. Food Econ., vol. 6, no. 1, 2018. [CrossRef]

- J. Staniszewski and M. Borychowski, “The impact of the subsidies on efficiency of different sized farms. Case study of the common agricultural policy of the European Union,” Agric. Econ. (Czech Republic), vol. 66, no. 8, pp. 373–380, 2020. [CrossRef]

- Statistics Portugal, “Agricultural Census 2019,” in Destaque 24.October.2019, Lisbon: Instituto Nacional de Estatística, 2019.

- Baffour, T. King, and P. Valente, “The Modern Census: Evolution, Examples and Evaluation,” Int. Stat. Rev., vol. 81, no. 3, pp. 407–425, 2013. [CrossRef]

- P. Cantwell, “Census,” in Encyclopedia of Survey Research Methods, P. Lavrakas, Ed. Sage Publications, Inc, 2008, pp. 90–93.

- P. Ciaian, d’Artis Kancs, and M. Espinosa, “The Impact of the 2013 CAP Reform on the Decoupled Payments’ Capitalisation into Land Values,” J. Agric. Econ., vol. 69, no. 2, pp. 306–337, 2018. [CrossRef]

- Dinis and O. Simões, “Resilience in retrospective: The trajectory of agro-pastoral systems in the centro region of Portugal,” Sustain., vol. 13, no. 9, 2021. [CrossRef]

- S. Severini and A. Tantari, “The effect of the EU farm payments policy and its recent reform on farm income inequality,” J. Policy Model., vol. 35, no. 2, pp. 212–227, 2013. [CrossRef]

- European Commission, “Direct Payments: The Young Farmer Payment under Pillar I of the Common Agricultural Policy.” pp. 1–6, 2016, [Online]. Available: https://ec.europa.eu/agriculture/sites/agriculture/files/direct-support/direct-payments/docs/young-farmer-payment_en.pdf.

- Statistics Portugal, Retrato Territorial de Portugal 2005. Lisboa: Instituto Nacional de Estatística, 2007.

- A. P. Hejnowicz, M. A. Rudd, and P. C. L. White, “A survey exploring private farm advisor perspectives of agri-environment schemes: The case of England’s Environmental Stewardship programme,” Land use policy, vol. 55, pp. 240–256, 2016. [CrossRef]

- M. Cross and J. Franks, “Farmer’s and advisor’s attitudes towards the environmental stewardship scheme,” J. Farm Manag., vol. 13, pp. 47–68, 2007.

- N. Ocean and P. Howley, “Using Choice Framing to Improve the Design of Agricultural Subsidy Schemes,” Land Econ., vol. 97, no. 4, pp. 933–950, 2021. [CrossRef]

- M. Lévesque and M. Minniti, “The effect of aging on entrepreneurial behavior,” J. Bus. Ventur., vol. 21, no. 2, pp. 177–194, 2006. [CrossRef]

- Bohlmann, A. Rauch, and H. Zacher, “A lifespan perspective on entrepreneurship: Perceived opportunities and skills explain the negative association between age and entrepreneurial activity,” Front. Psychol., vol. 8, no. DEC, pp. 1–11, 2017. [CrossRef]

| 1 | The European Commission (2013) and Henke et al. (2015) provide in-depth analyses of the design of direct payments in the 2014-2022 CAP. |

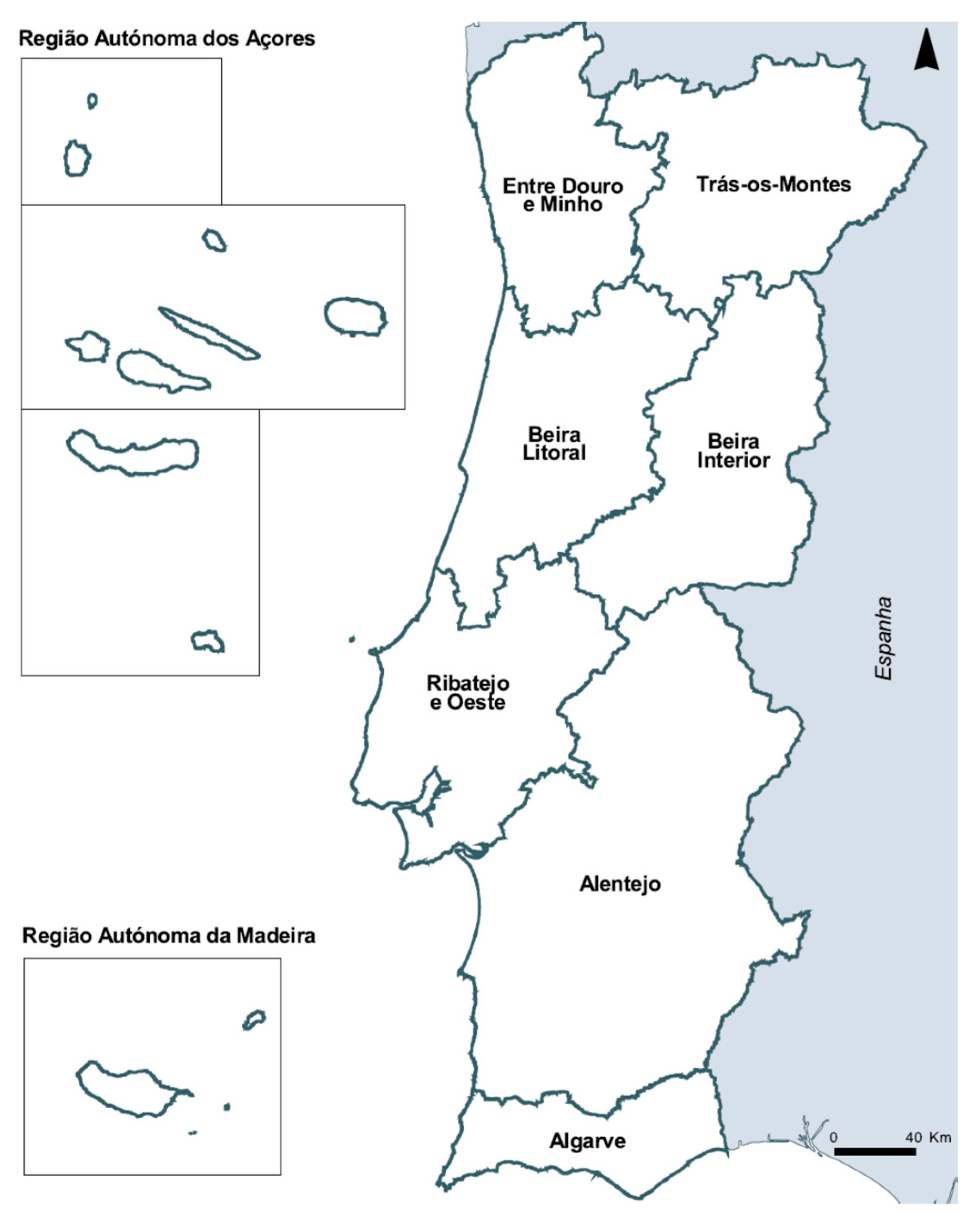

| 2 | In addition to administrative divisions, Statistics Portugal use Agrarian Regions for the dissemination of agricultural statistical information. In this study, Agrarian Regions were chosen as an intermediary geographical entity in place of NUT2 because they better reflect macro-level agroecological differences across the country. |

| 3 |

Freguesias in Portuguese |

| Agrarian Region | 2013 | 2019 | Change |

|---|---|---|---|

| Entre Douro e Minho | 70.3 | 64.9 | -5.5 |

| Trás-os-Montes | 80.1 | 81.2 | 1,1 |

| Beira Litoral | 51.2 | 44.7 | -6,5 |

| Beira Interior | 60.8 | 58.9 | -1,9 |

| Ribatejo e Oeste | 28.6 | 25.9 | -2,8 |

| Alentejo | 64.4 | 71.4 | 7.0 |

| Algarve | 29.9 | 35.2 | 5,3 |

| Açores | 54.7 | 67.7 | 13,0 |

| Madeira | 77.8 | 81.0 | 3,1 |

| Portugal | 61.0 | 60.5 | -0.4 |

| Variable | Description |

|---|---|

| Location | Categorical |

| LocEDM | =1 if the commune is in Entre Douro e Minho and =0 otherwise |

| LocTM | =1 if the commune is in Trás-os-Montes and =0 otherwise |

| LocBL | =1 if the commune is in Beira Litoral and =0 otherwise |

| LocBI | =1 if the commune is in Beira Interior and =0 otherwise |

| LocRO | =1 if the commune is in Ribatejo e Oeste and =0 otherwise |

| LocALT [Baseline] | =1 if the commune is in Alentejo and =0 otherwise |

| LocALG | =1 if the commune is in Algarve and =0 otherwise |

| LocMD | =1 if the commune is in Madeira and =0 otherwise |

| LocAZ | =1 if the commune is in Azores and =0 otherwise |

| Size | Continuous |

| Acreage | Average UAA measured in hectare |

| Small | % of small holdings (UAA < 5 ha) |

| Landownership | Continuous; % of UAA explored by owner farming |

| Crops | Continuous |

| Fruit | Fruit area in UAA (%) |

| Olive | Olive groves area in UAA (%) |

| Vineyard | Vineyard area in UAA (%) |

| Cereals | Cereals area in UAA (%) |

| Vegetables | Vegetables area in UAA (%) |

| Livestock | Continuous |

| Cattle | Number of cows per ha of UAA |

| Sheep | Number of sheep per ha of UAA |

| Goat | Number of goats per ha of UAA |

| Age | Continuous |

| Age | Average age of farmers measured in years |

| Young | Farmers under the age of 35 (%) |

| Farms | Continuous; number of farms growth rate between 2009 and 2019 (%) |

| Variables | Mean | S.D. | Min. | Máx. |

|---|---|---|---|---|

| Receive09 (%) | 59.9 | 23.7 | 0 | 99.2 |

| Receive19 (%) | 58.8 | 24.4 | 0 | 99.2 |

| ΔDP* | 0.488 | - | 0 | 1 |

| LocEDM* | 0.291 | - | 0 | 1 |

| LocTM* | 0.159 | - | 0 | 1 |

| LocBL* | 0.168 | - | 0 | 1 |

| LocBI* | 0.106 | - | 0 | 1 |

| LocRO* | 0.112 | - | 0 | 1 |

| LocALT* | 0.074 | - | 0 | 1 |

| LocALG* | 0.022 | - | 0 | 1 |

| LocMD* | 0.017 | - | 0 | 1 |

| LocAZ* | 0.050 | - | 0 | 1 |

| Acreage (ha) | 11.9 | 28.3 | 0.1 | 395.5 |

| Small (%) | 21.8 | 18.1 | 0 | 100 |

| Landownership (% UAA) | 77.2 | 20.9 | 0 | 100 |

| Fruit (% UUA) | 4.0 | 10.2 | 0 | 93.3 |

| Olive (% UUA) | 10.2 | 17.0 | 0 | 100 |

| Vineyard (% UUA) | 12.4 | 17.5 | 0 | 97.4 |

| Cereals (% UUA) | 11.0 | 12.1 | 0 | 100 |

| Vegetables (% UUA) | 3.5 | 8.1 | 0 | 83.4 |

| Cattle (animals/ha UAA) | 0.7 | 1.2 | 0 | 10.4 |

| Sheep (animals/ha UAA) | 0.9 | 1.3 | 0 | 35 |

| Goat (animals/ha UAA) | 0.4 | 0.8 | 0 | 18.7 |

| Age (years) | 62.3 | 4.0 | 37 | 87 |

| Young (%) | 2.3 | 3.6 | 0 | 50 |

| Number of Farms 2009 | 99.2 | 90.3 | 1 | 918 |

| Number of Farms 2019 | 93.5 | 87.9 | 1 | 831 |

| Variables | Coef. | Std. Err | t | P>|t| |

|---|---|---|---|---|

| LocEDM*** | 6.4379 | 1.6747 | 3.84 | 0.000 |

| LocTM*** | 12.7604 | 1.6797 | 7.60 | 0.000 |

| LocBL*** | -4.8681 | 1.6978 | -2.87 | 0.004 |

| LocBI | -0.1348 | 1.6306 | -0.08 | 0.934 |

| LocRO*** | -28.6888 | 1.7104 | -16.77 | 0.000 |

| LocALG*** | -24.4134 | 2.4061 | -10.15 | 0.000 |

| LocMD*** | 63.3461 | 3.3800 | 18.74 | 0.000 |

| LocAZ*** | -13.3393 | 2.34828 | -5.68 | 0.000 |

| Acreage*** | 0.1443 | 0.1520 | 9.49 | 0.000 |

| Small*** | -0.3866 | 0.02402 | -15.97 | 0.000 |

| Landownership** | 0.0460 | 0.0179 | 2.58 | 0.010 |

| Fruit*** | -0.2501 | 0.0328 | -7.62 | 0.000 |

| Olives*** | 0.2099 | 0.0213 | 9.86 | 0.000 |

| Vineyard*** | -0.1930 | 0.0203 | -9.18 | 0.000 |

| Cereals*** | 0.1982 | 0.0278 | 7.13 | 0.000 |

| Vegetables*** | -0.5493 | 0.0451 | -12.17 | 0.000 |

| Cattle*** | 2.7297 | 0.3219 | 8.48 | 0.000 |

| Sheep*** | -1.2213 | 0.3010 | -4.06 | 0.000 |

| Goat** | -0.8770 | 0.4020 | -2.18 | 0.029 |

| Age*** | -0.8012 | 0.1125 | -7.12 | 0.000 |

| Young | 0.1710 | 0.1219 | 1.40 | 0.161 |

| Constant*** | 113.1000 | 7.6344 | 14.81 | 0.000 |

| R2 = 0.5908 Adjusted R2 = 0.5878 Prob > F = 0.000 | ||||

| Variables | Odds Ratio | Std. Err | z | P>|z| |

|---|---|---|---|---|

| LocEDM*** | 0.1790 | 0.0444 | -6.94 | 0.000 |

| LocTM | 0.8009 | 0.1998 | -0.89 | 0.374 |

| LocBL*** | 0.1408 | 0.0358 | -7.71 | 0.000 |

| LocBI*** | 0.5012 | 0.1199 | -2.89 | 0.004 |

| LocRO*** | 0.4283 | 0.1067 | -3.40 | 0.001 |

| LocALG | 1.5459 | 0.6153 | 1.09 | 0.274 |

| LocMD* | 0.3968 | 0.2003 | -1.83 | 0.067 |

| LocAZ** | 3.3130 | 1.5593 | 2.54 | 0.011 |

| Acreage | 0.9976 | 0.0023 | -1.03 | 0.301 |

| Small | 1.0028 | 0.0037 | 0.76 | 0.450 |

| Landownership* | 1.0046 | 0.0027 | 1.73 | 0.083 |

| Fruit | 0.9935 | 0.0048 | -1.34 | 0.180 |

| Olives*** | 0.9745 | 0.0031 | -8.05 | 0.000 |

| Vineyard* | 1.0052 | 0.0031 | 1.70 | 0.090 |

| Cereals*** | 0.9765 | 0.0043 | -5.41 | 0.000 |

| Vegetables | 1.0031 | 0.0065 | 0.48 | 0.634 |

| Cattle*** | 0.8220 | 0.0401 | -4.02 | 0.000 |

| Sheep | 0.9469 | 0.0418 | -1.24 | 0.216 |

| Goat | 0.9544 | 0.0623 | -0.71 | 0.475 |

| Age | 0.9800 | 0.0165 | -1.20 | 0.230 |

| Young* | 1.0372 | 0.0200 | 1.90 | 0.058 |

| Farms | 0.9937 | 0.0015 | -4.17 | 0.000 |

| Constant** | 11.586 | 13.192 | 2.15 | 0.031 |

| Wald Χ2 = 617.45 Prob>Χ2 = 0.0000 Hosmer-Lemeshow Χ2 =15.38; Prob> Χ2 =0.052 Correctly classified: 70.7% | ||||

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).