Introduction

Over its 40 years, Proton has experienced successes, challenges, and failures. The company went from market share leader in the 1980s and 1990s to severe financial losses with declining market shares since the mid-2000s. This case study explains the effectiveness of the Post Geely acquisition's ten-year master plan to enhance Proton's self-reliance and global competitiveness. This case study suggests the need to review the business strategy given the challenges of climate change's impact on the automotive industry. To develop the necessary long-term competitive advantage, the company must evaluate the potential impact of the Electric Vehicles (EVs) market and the Internet of Things (IoT).

Proton is the first Malaysian national car company started in 1983. Over its 36 years, the company has experienced successes, challenges, and failures. The company went from market share leader in the 1980s and 1990s to severe financial losses with declining market shares since the mid-2000s. It also noted a change of ownership via the acquisition by DRB-HICOM in 2012 with an attempt to improve its performance with little success. In 2017, DRB-HICOM disposed of 49.9% of the Proton shareholding to China's Zhejiang Geely Holding Group Co., Ltd. It marked the first foreign ownership since the joint venture with Mitsubishi Motor Corporation, which exited the experience in the 2000s.

Several studies have examined the reasons for Proton's failure. The general studies suggest that the cost efficiency of Proton is one of the critical reasons that adversely affected its financial performance (Salang, 2018) (Abdullah, Lall, & Tatsuo, 2008). Other studies suggest its failure to penetrate export markets, leading to a lack of economies of scale, technological capabilities and limitations to meet international standards, a lack of skilled workforce and weak global marketing capabilities (Wad & Govindaraju, 2011). Some of these studies highlighted that Proton has entered into various technological cooperation with some of the international players such as Mitsubishi, Honda, Suzuki, Citroen and Renault to address its technological shortcoming in the past. Nevertheless, it notes that these technical agreements seem more beneficial to these partners as an entry to the host market and limit their ability to market them overseas (Rasiah. 2003). It also argued that most of these technological collaborations have restrictions over the use of the technology and, on most occasions, yielded less than satisfactory market success.

Proton must embark on a strategy reform to survive and remain relevant in the competitive marketplace. It is due to the increasing trade liberalization and intense competition within the automotive industry (Ahmed & Humphreys, 2008).

Background of the Company: The Proton Overview

Several literature and case studies on Proton have been published since the company's inception in 1983. Proton's aspiration as Malaysia's first national car producer as well as the first of its kind in the ASEAN region, marked a critical milestone in Malaysia's industrial history with a grand vision to emerge as a global player, which is in line with the Vision 2020 agenda (

Figure 1). In general, the company's history can be illustrated along five eras concerning a 4Ps framework (

Figure 2). As one of the iconic projects in Malaysia's industrialization history, many resources have been invested in the project since the creation of Proton, ranging from imposing new economic/ industrial policies to substantial financial investments in both public and private sectors (Jayasankaran & Jomo,1993). Despite significant resources commitment to Proton over the last four decades, the performance generally can be summarised as a highly policy-protected company (Wad & Govindaraju, 2011), (Fujita, 1998), (Kuchiki, 2007), (Tan, 2007), lack of technological know-how and product design innovation (Noor, & Lingam, 2014), (Mooi, & Khean, 2007) and lack of operational competitiveness/efficiency (Jomo, Rasiah, Alavi, & Gopal, 2005), (Khalifah & Abdul Talib, 2008). In general, Proton's marketing mix strategy mainly remained more or less the same since its inception 40 years ago.

Since the aftermath of the 1997/98 Asian Financial Crisis, the 21st century has continued to pose a series of challenges to Proton. By the mid-2010s, Proton's performance continues to degrade both financially and in terms of market shares due to a lack of competitiveness in domestic and international markets, despite several measures and attempts by both public and private initiatives taken to restructure the company over the decade. In the fiscal year 2016/17, Proton posted a net loss of RM 975 million, while its market share slipped to 14% in 2016 from 20% in 2014. Turnaround efforts were hampered by weak demand and stiff industry competition.

The Geely ERA

In 2016, the Malaysian Government intervened by extending a soft loan amount of RM1.5 Billion to Proton, with the mandatory condition for the company to identify a global strategic partner within a year. In 2017, DRB-HICOM and Zhejiang Geely Automobile Holdings agreed with the latter, acquiring a 49.9% stake in Proton. As a result of the acquisition, Geely injected RM 170.3 million in cash and helped Proton develop its first-ever sports utility vehicle based on its Boyue model with immediate access to a platform for a new car model with minimum lead time from R&D to production and launch. As part of the acquisition, Proton secured the intellectual properties to the design, development, production, sale, marketing & distribution of the Geely Boyue, Geely

Binyue and Geely Jiaji for Brunei, Indonesia, Malaysia, Singapore and Thailand. In addition to that, Proton also disposed of its UK subsidiary, namely Lotus, for a consideration of GBP 100 Million to Geely and Etika Automotive. In the same year, Dr Li Chunrong, a leading automotive specialist, was appointed as the Chief Executive Officer of Proton.

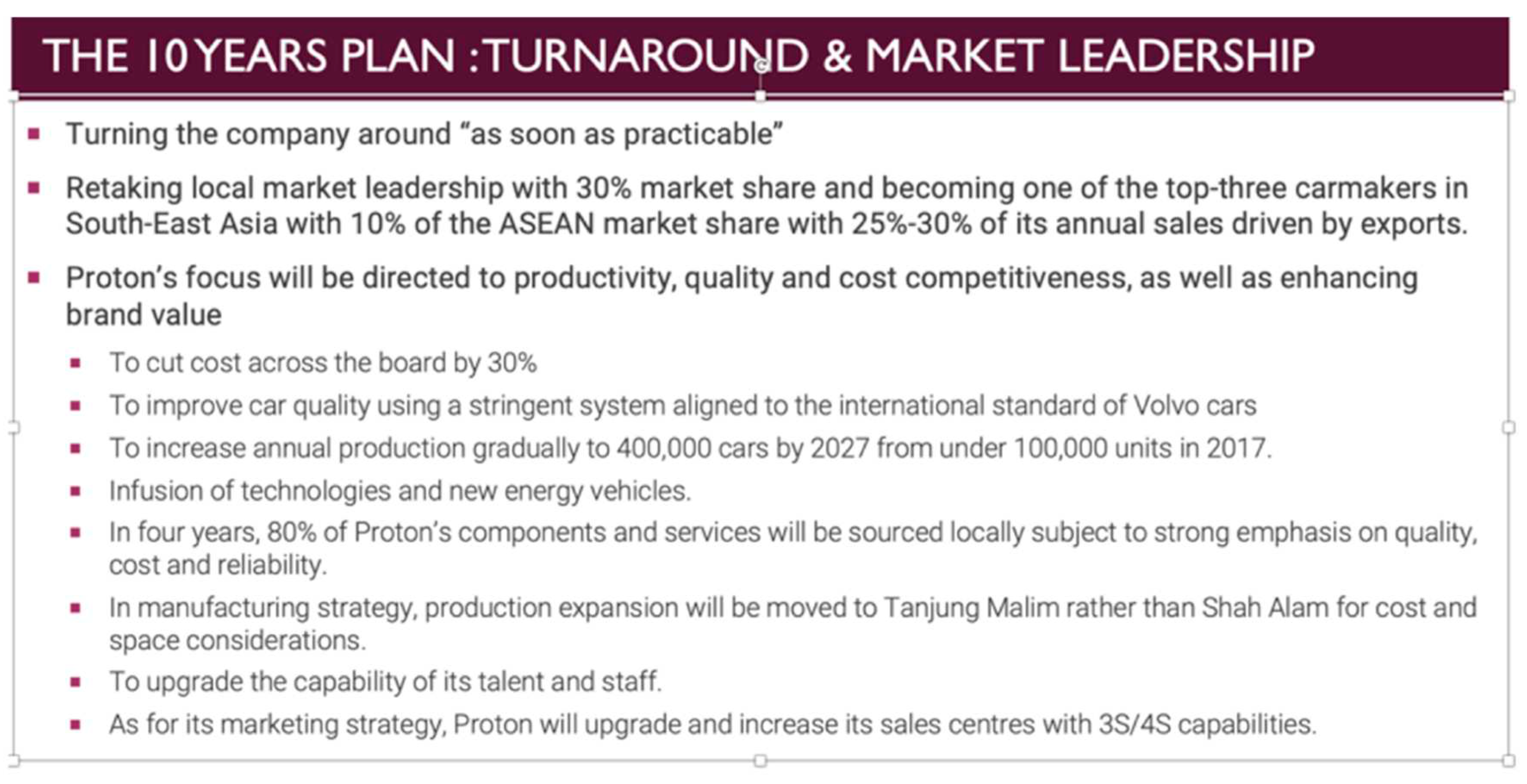

Figure 3.

The Proton's 10 Years Plan Overview. Source: Malaysia Investment Development Authority (MIDA; 2018).

Figure 3.

The Proton's 10 Years Plan Overview. Source: Malaysia Investment Development Authority (MIDA; 2018).

Since the entry of Geely, Proton revealed the company's ten years masterplan (Exhibit 3.0) to regain the number 1 spot as the largest market share in Malaysia and become the third biggest car manufacturer in ASEAN in terms of sales volume. The core focus of the Plan is to address the long due issues within the company, i.e. productivity and efficiency.

As a result, Proton has experienced a series of reforms, from streamlining the supply chain with an aggressive cost reduction strategy, launching the new Sports utility vehicle (SUV) segment model X70 (

Figure 4), improving and updating the Proton Person and Iriz models, to upgrading of Sales & Service Centers to 3S/4S nationwide. A new service and maintenance package was introduced to enhance the customer experience.

These aggressive measures resulted in Proton's performance turning profitable for the first time in nine years with the success of the X70 model launch. They regained the second position as the nation's market share, with a 16.7% share in 2019, above Honda and Toyota. Proton saved RM250 million in costs in 2018, has also cut its warehouses to four from sixteen and sold 1,000 of its 1,500 company cars.

In 2018, Proton announced the launch of the Proton first SUV which is based on Geely Boyue, with touches of local design elements introduced for the Malaysian market. The first batch of the locally named Proton X70 will be imported from China, with localization plans in conjunction with the Tanjong Malim plant expansion plan.

The 2nd model of the product lineup, the X50 compact SUV Model, was targeted to be released in 2020. Based on the latest development, the company is expected to break even in 2019 and turn profitable by 2020.

The Proton 2.0: The Post GEELY (10 Years Plan) Analysis - The Success Stories So Far

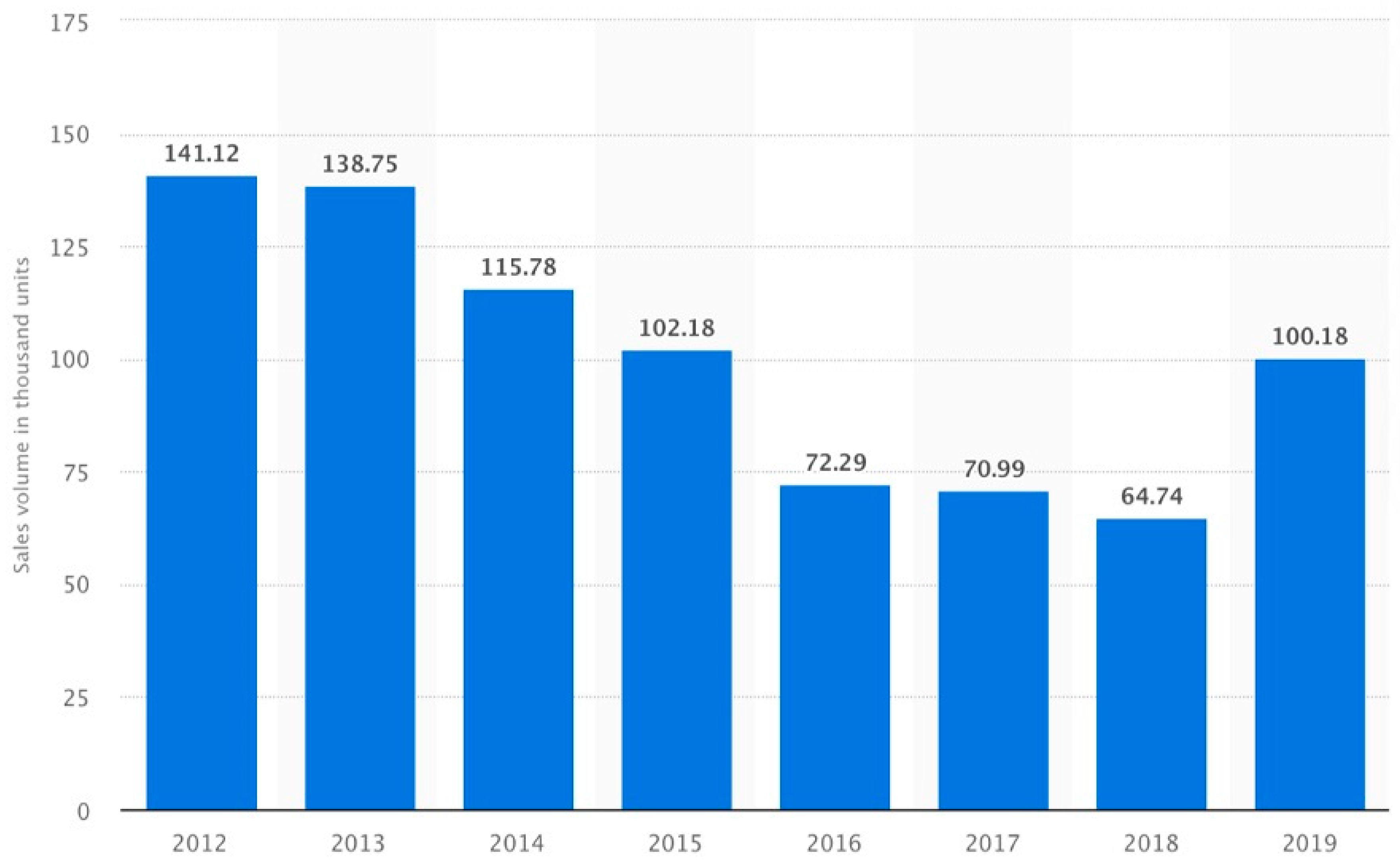

When reviewing the progress of the post-Geely era, it is undeniable that the 10 Years Plan measures have shown commendable results after three years into implementation. Sales have exceeded the 100,000 units mark for the first time since 2015 (Exhibit 5.0). However, suppose these accomplishments are measured against its 2012 position. In that case, there is still a big gap and premature to conclude the effectiveness of the 10 Years Plan for Proton's survival in the long run or, worse, a mere "temporary fix" than a strategic plan.

Figure 5.

Proton Sales Performance (Unit) 2012-2019. Source: Statista (2020).

Figure 5.

Proton Sales Performance (Unit) 2012-2019. Source: Statista (2020).

Since the emergence of Geely as Proton's strategic shareholder, it is undeniable that Proton's dynamics have changed so, as the business environment.

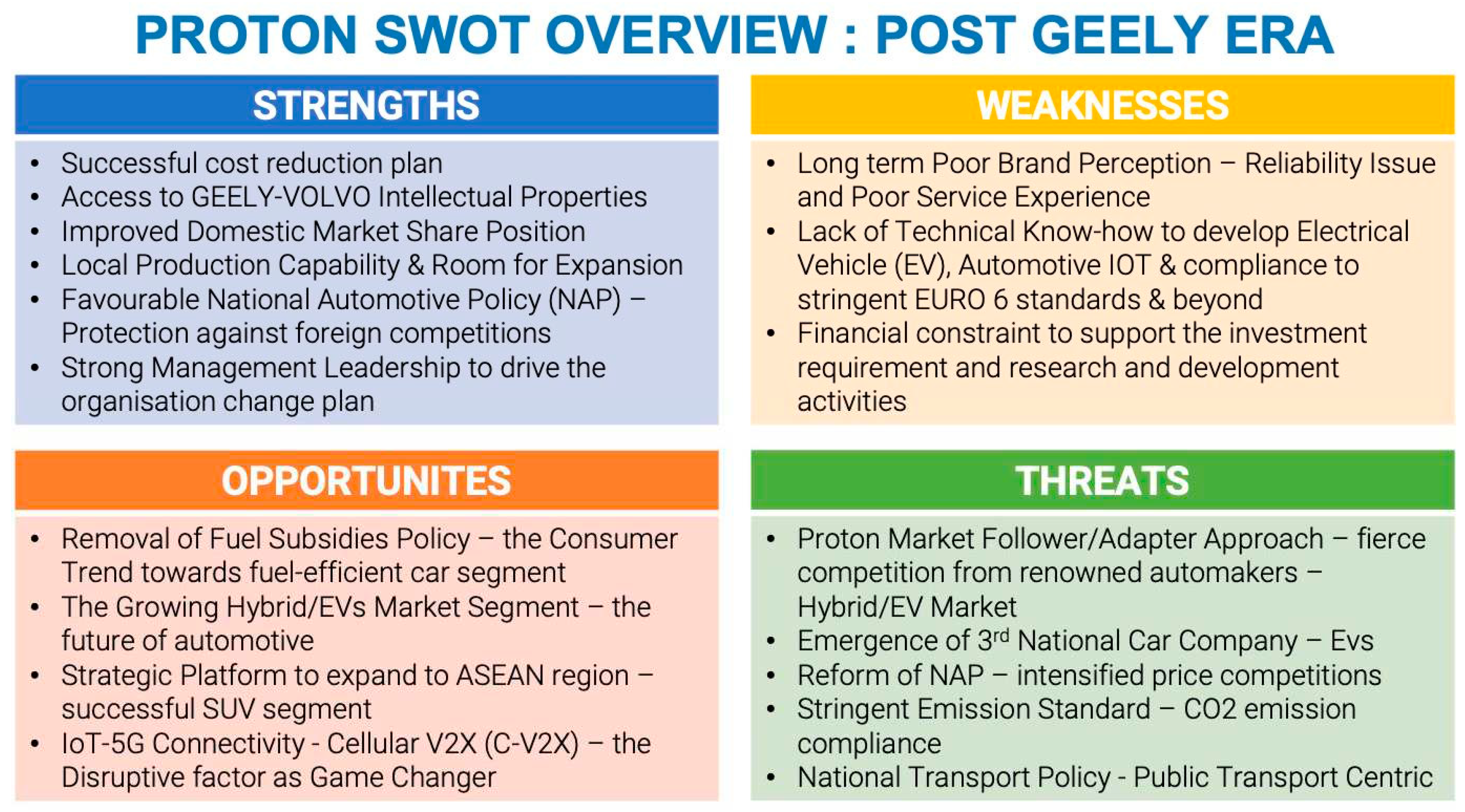

Figure 6 summarises Proton's SWOT position, considering the company's internal and external conditions post-Geely era. In summary, it is noted that while the Proton 10-year plan improved the company's market share and profitability, the SWOT analysis also revealed several important aspects that the ten years plan needs to enhance to address the opportunities and threats ahead.

Literature Review

Asean Market Expansion: The Needed Critical Mass for Proton

Firms' primary objective is to maximize their shareholder return. The firm develops products and expands markets to increase its revenue and profitability to achieve this objective. The cost leadership strategy aims to establish a competitive advantage by enhancing its operational efficiency with economies of scale. In the case of Proton, a regional market expansion will potentially create the critical mass needed to lower overall costs.

The Association of Southeast Asian Nations (ASEAN) region represents a market with a combined GDP over US$ 2.4 trillion, which collectively put the region as the 6th largest economy globally. With a population of approximately 630 million, ASEAN is the world's 3rd most populous market, behind only China and India. In 2015, the ASEAN Economic Community (AEC) WAS established to foster regional economic integration for a more liberated market, with intra-regional tariffs virtually eliminated and formal restrictions gradually removed, reducing cross-border trade costs. According to IHS Markit consultancy, Toyota leads ASEAN car sales with a 30% market share, Honda with 13% and Mitsubishi with 10%. Proton is in 11th place with about 3%, mainly from Malaysia.

The revival of Proton brought mutual gains to both Proton and Geely, which sees performance turnaround for Proton and Geely now gaining a solid footprint in the SouthEast Asia market, both brand and operational advantage. Given the strategic local of Malaysia in the centre of the ASEAN region, it provides Geely with the needed geographical advantage to expand across Southeast Asia and beyond.

In 2019, Geely revealed its Plan to expand its market presence via Proton's brand across the ASEAN region. It initially focused on Thailand, Indonesia, Singapore and Brunei, given that these right-hand drive markets require fewer car modifications which present an ease of market entry. At the same time, Proton also aims to drive into the Middle East and increase sales to Egypt. Proton indicates its Plan to grow 40% of its sales from foreign markets by 2027, identifying Thailand and Indonesia as the key markets and launching a new model each year.

Climate Change – Opportunity or Threat?

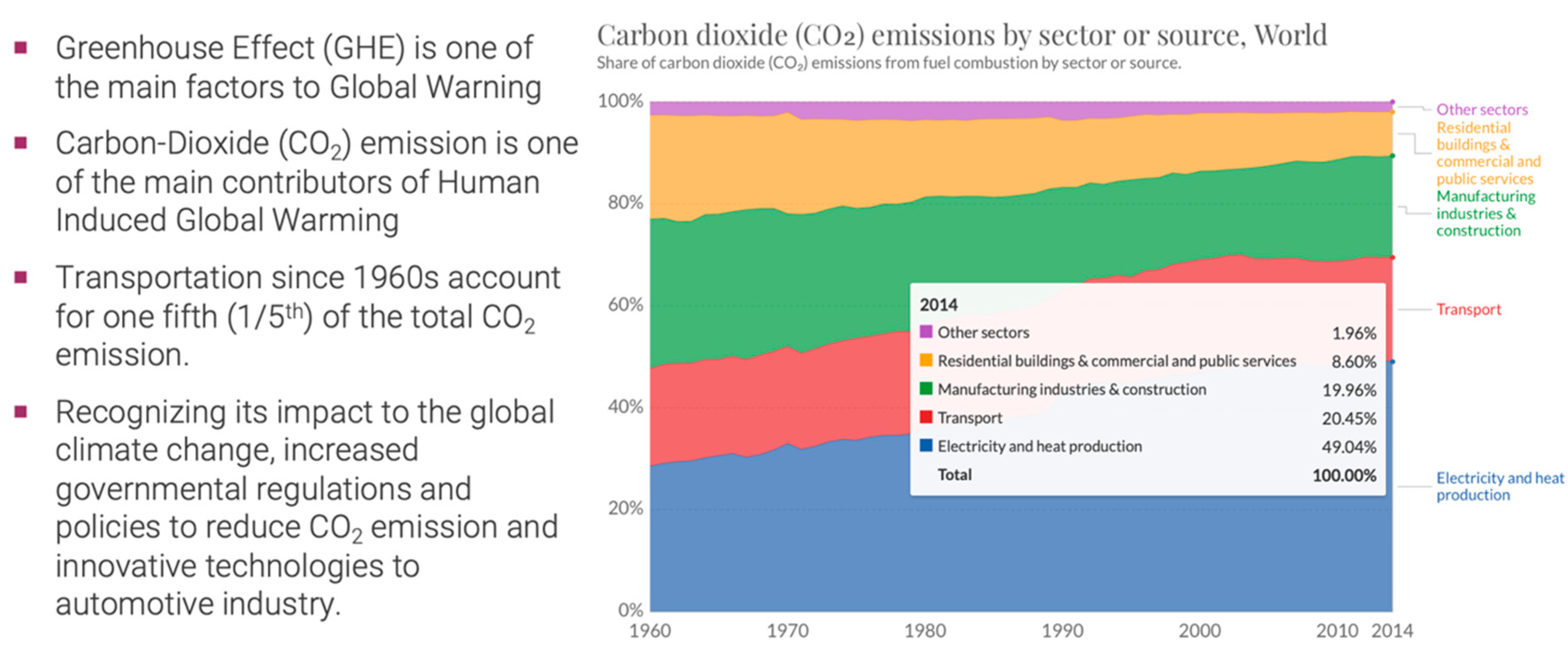

Since the turn of the century, the climate change impact (Exhibit 7.0) has put significant pressure on the world business environment and changed how businesses are conducted. Recognizing the need for actions to combat climate change and to create a sustainable future, the nations of the world reached an accord by endorsing the Paris Agreement 2016 of the United Nations Framework Convention on Climate Change – the 2 degrees Celsius & 20/20/20 policy, which to:

Keep the increase in global average temperature to below two °C above pre-industrial levels,

20% reduction of carbon dioxide (CO2) emissions,

20% increase in renewable energy's market share,

20% increase in energy efficiency.

The impact of the Paris Agreement on the automotive industry is significant. Regulatory and industrial practice reforms are implemented at an unprecedented scale and speed.

Figure 7.

Climate Change Impact on the Automotive Industry. Source: United Nations Food and Agriculture Organization (FAO; 2014).

Figure 7.

Climate Change Impact on the Automotive Industry. Source: United Nations Food and Agriculture Organization (FAO; 2014).

The European Union will cut carbon dioxide emissions by new vehicles by 30% between 2021 and 2030. In the early trend, diesel engine vehicles were favoured due to their better fuel efficiency than petrol engines with a lower average CO2 emission. While lower CO2 emission, it was discovered with issues of toxic emissions, namely nitrogen oxides (NOₓ), poisonous nitrogen dioxide (NO₂), greenhouse gas nitrous oxide (N₂O) and nitric oxide (NO). As a result of raising the Euro Emission Standard regulation, Efficient Fuel Engines of smaller capacity with Turbo technology were becoming the solution for lower emissions and push toward electrification of vehicles.

Hybrid and Electric vehicles (EVs) were introduced gradually to mainstream product offerings by automakers such as BMW, Toyota, Volvo, Porsche and others (Appendix A). Porsche has set to electrify over half its product offering by 2025, while Volkswagen is to reduce the average emissions of its new vehicles by 30% by 2025, & to be carbon neutral by 2050.

The Electric Vehicles Initiative (EVI)

In 2009, the Clean Energy Ministerial (CEM) established the Electric Vehicles Initiative (EVI), a multi-governmental policy forum to accelerate the deployment of electric vehicles worldwide. The EVI improves the understanding of the policy challenges of electric mobility and serves as a platform for knowledge-sharing, particularly on the critical transformations occurring in the transport sector (IEA, Global EV Outlook, 2019).

In 2017, the EV30@30 Campaign was launched at the 8th CEM meeting to accelerate the deployment of electric vehicles further. It sets a collective aspirational goal for all EVI members of a 30% market share for electric cars in all vehicles (except two-wheelers) by 2030. The EV30@30 saw the endorsement of Eleven countries, namely, Canada, China, Finland, France, India, Japan, Mexico, Netherlands, Norway, Sweden and the United Kingdom. The campaign includes five implementing actions to help achieve the goal following the priorities and programmes of each EVI country. These include:

Supporting the deployment of chargers and tracking progress.

Galvanizing public and private sector commitments for EV uptake in company and supplier fleets.

Scaling up policy research and information exchanges.

Supporting governments needing policy and technical assistance through training and capacity building.

Establishing the Global EV Pilot City Programme to achieve 100 EV-Friendly Cities over five years.

At the 9th CEM Meeting 2018, the Global EV Pilot City Programme, one of the implementing actions of the EV30@30 Campaign, was launched to work together to promote electric mobility by building a network of at least 100 cities over an initial period of five years. Thirty-nine towns are participating in the Global EV Pilot City Programme as of 2019.

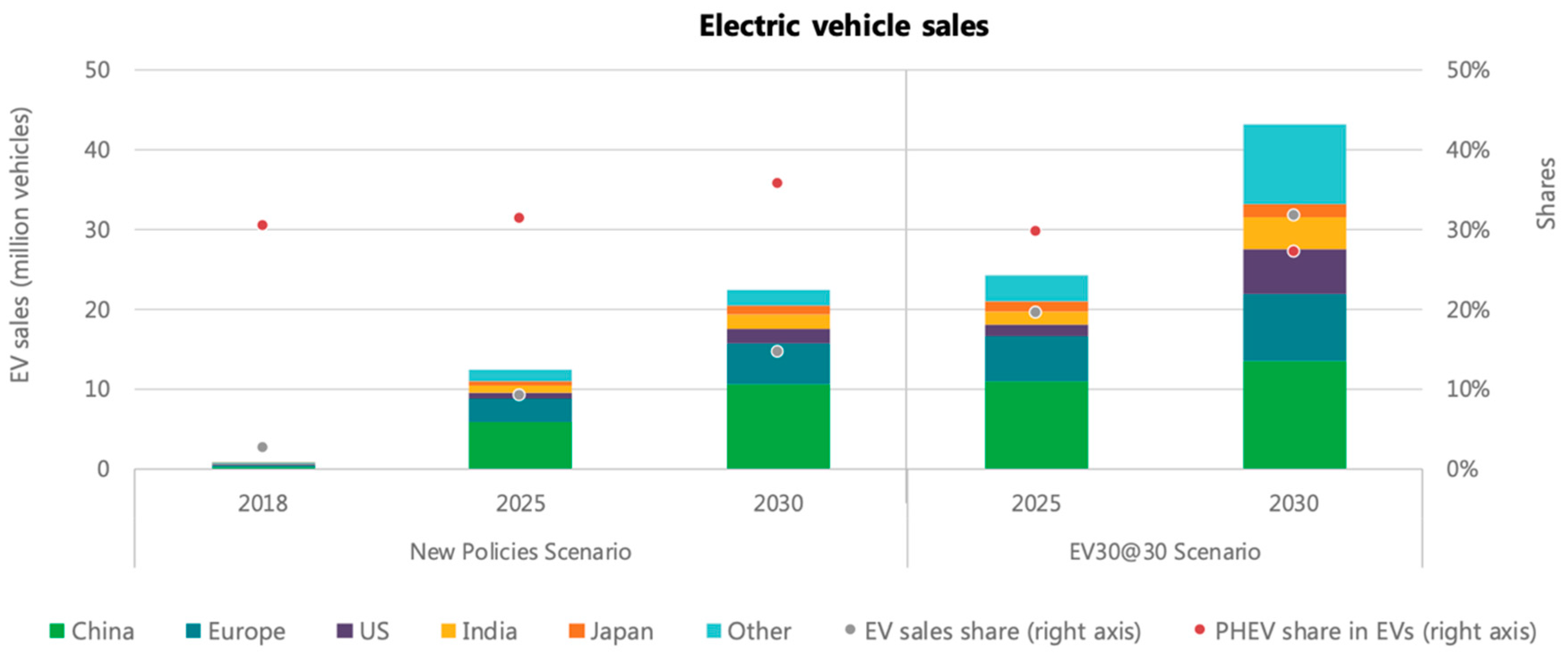

With the increasing commitment from nations towards EVs via the introduction of various new policies and the EVI's EV30@30 movement, the EV segment is projected to take between 15%-30% of mainstream automotive market share by 2030 based on New Policies and EV30@30 scenarios (

Figure 8).

Technology advances have been accelerated rapidly, delivering substantial cost reduction with critical enabling development such as battery technologies and expansion of production capacity in manufacturing plants. The economics of scales derived has improved commercial affordability substantially. The redesign of vehicle manufacturing platforms using simpler and innovative design architecture shared research and development, and applying big data to right-size batteries have made EV production more commercially viable. The result of Charging platforms also has increased rapidly with better technological advancement for shorter charge time and governmental support on the increase in the numbers of charging stations

Methodology

A narrative synthesis was included in this extensive evaluation of the relevant literature. The outcomes of synthesis are recapped and clarified through the use of academic writing in the process known as narrative synthesis. The qualitative research method may be broken down into four steps: the research design stage, the data gathering step, the data analysis step, and the report writing step. A qualitative method known as content analysis makes use of verbal, visual, or written data to provide a systematic and objective description of a given phenomenon. As a result, content analysis makes it easier to arrive at reliable findings. In addition, it is a flexible method of data analysis that may be applied to systematic qualitative reviews. To locate knowledge and theory, those doing systematic qualitative reviews must change or adapt content analysis methods to be compatible with highly organized and contextualized information. In conclusion, this inquiry (2023) used qualitative content analysis (Limna et al., 2022; Jaipong et al., 2022; Jaipong et al., 2023; Viphanphong et al., 2023; Sitthipon et al., 2023).

The keywords for secondary data supporting the literature review are as follows automotive, electric vehicle, market strategy, competitive advantage, and marketing strategy

The Impact of Policy Change on the 10 Years Plan

While Proton is in the process of a "soul searching" mode and focuses on the internal fundamentals in the hope of a speedy recovery, the external factors of the industry which is highly influenced by governmental policies and pressure from climate change. As Porter's diamond model explained, these forces are expected to impose further pressure on Proton's regularisation effort to return to its golden age.

The National Transport Policy (NTP)

In 2019, the Malaysian Government introduced the National Transport Plan (NTP) with the following objectives:

Based on the NTP, a strong emphasis has been on promoting public transportation and environmental pollution control. The impact of digitization enables shared mobility services to become familiar with the proliferation of car-sharing and e-hailing platforms. As a result, the NTP will affect the usage of the entire transport network, including public and private transportation, impacting usage patterns, numbers and types of vehicle ownership. The carbon emission in the transport sector is mainly from land transport, constituting 90% & 67% is from cars. Regulatory control & standards will expect to be more stringent & will have an impact on the conventional & EV segments.

The NTP, while potentially having an impact on the demands for private vehicle ownership, however, at the same time, present an opportunity for public transport, especially in the e-hailing segment. Proton Saga was traditionally the model of choice for taxi services. The NTP may position the iconic model as the preferred vehicle choice for this segment.

The New Fuel Subsidies Policy: Target Subsidies Program (TSP)

In Malaysia's Budget 2020, TSP was introduced to replace the current fuel subsidies mechanism, which targets only those who own a private vehicle are eligible. Those with more than two cars and two motorcycles will not qualify for the subsidy. The vehicle(s) must match the following criteria:

Cars with an engine capacity of 1,600cc and below

Cars with an engine capacity over 1,600cc but ten years and older

Motorcycles with an engine capacity of 150cc and below

Motorcycles with an engine capacity over 150cc but seven years and older

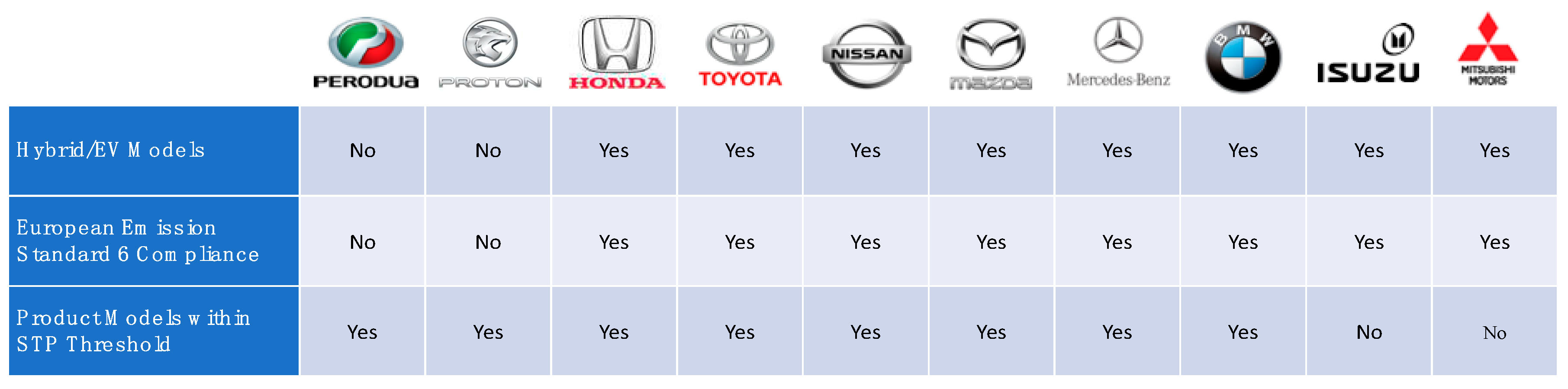

This policy will potentially impact the preference over TSP model segments of cars moving forward. Car models eligible for fuel subsidies will tend to be favourably compared to those not. The product plan must consider these impacts and review its targets and development plan. Based on the current product offering, two models, namely the X70, one of the best-selling models, and Perdana, fall outside the TSP threshold, which accounts for approximately 30% of Proton's total sales in FY2019 to date. Compared with its domestic competitors, PERODUA has all its product offerings within the TSP threshold.

The Convergence of Connected Mobility (C-V2X) and 5G Connectivity

The concept of connectivity and mobility is not new. The idea of wireless communication can be traced back to 1866, when Mahlon Loomis, an American dentist, successfully demonstrated "wireless telegraphy", marking the first known instance of wireless aerial communication. Approximately 30 years later, Italian inventor Guglielmo Marconi proved the feasibility of radio communication with the first radio signal in Italy in 1895.

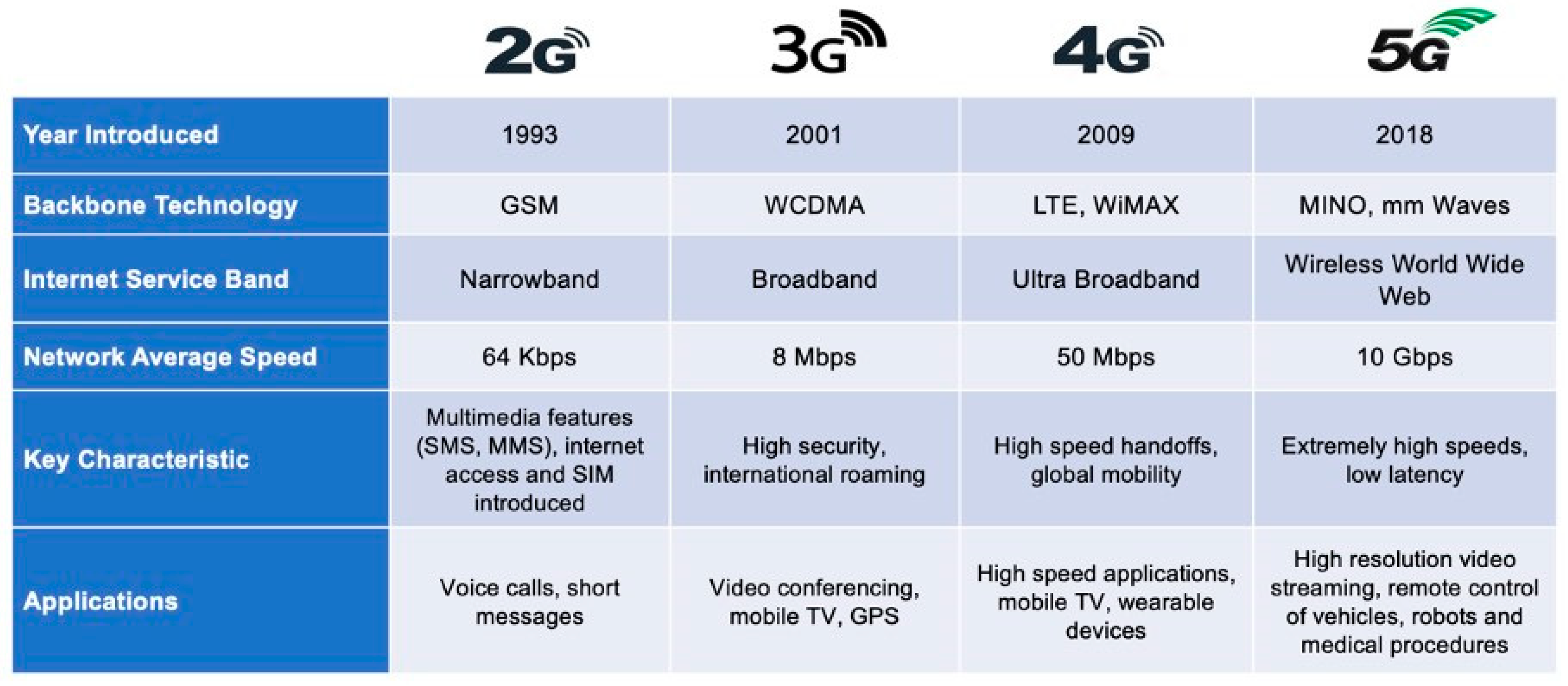

By 1899 he flashed the first wireless signal across the English Channel and two years later received the letter "S", telegraphed from England to Newfoundland, the first successful transatlantic radiotelegraph message in 1902. However, it was not until 1979, when the first-generation commercial cellular network (1G) was launched in Japan, marked the beginning of the wireless revolution, which eventually evolved into the world's first digital commercial cellular network (2G) in 1993 (about the time the commercial internet was launched) and shaped the digital world that we know today (

Figure 9).

According to Ericsson's November 2019 Report, 5G is estimated to have 2.6 billion subscriptions covering up to 65 per cent of the world's population and generating 45 per cent of the world's total mobile data traffic, making it the fastest-developing mobile communication technology to have ever been rolled out on a global scale by the end of 2025. These figures suggested the optimism of the 5G's market potential, considering the figures does not include the Internet of Things (IoT) or connected cars. 5G is therefore not just an issue for the telecommunications sector, but other branches of industry as well. The 5G integration with the automotive presents great potential that will reshape the industry's future, such as the connected cars applications and the ambitious autonomous driving.

Cellular Vehicle-to-Everything (C-V2X) has gained significant momentum as a viable solution for future automotive connectivity, safety needs, and autonomous-driving initiatives (Appendix B). With both regulations around the world committing to the direction of V2X implementation such as the National Highway Traffic Safety Administration (NHTSA) plans to propose the compulsory introduction of vehicle-to-everything technology in 2020 for all US vehicles, as well as automotive players increasing investment into automotive Internet of Things (IoT) and V2X development, the automotive industry is expected to be among the top four sectors in terms of the 5G-enabled opportunity for service providers in 2030.

While Proton is in the progress of a "soul searching" mode and focuses on the internal fundamentals in the hope of a speedy recovery, the external factors of the industry, which is now significantly influenced by governmental policies and pressure from climate change, these forces as explained by Porter's diamond model imposed further pressure and challenges on Proton's quest to return to its golden age.

In 2019 Deloitte's Global Automotive Consumer Study (Exhibit 10.0), the trend of the industry continued to shift over the last ten years towards EVs compared to conventional internal combustion engines (ICE). Thus, it is essential for Proton to continuously evaluate its long-term market strategy to remain resilient and competitive for its survival in this highly competitive industry. As such, this study highlights the unaddressed key issues observed in the 10-Year Plan that is vital given the scenario stated:

1) Absence of A Clear Roadmap for Proton's Technological Development

The Proton 10 Years Plan was announced as part of a corporate communication strategy to reaffirm its new directive and its commitment to provide a better product and service to restore customers' and stakeholders' confidence. The Plan is consistent with the notion that effective communication of corporate identity and directives will suggest a better understanding to its stakeholders, potentially developing a competitive advantage against its competitors (Balmer & Gray,1999).

From the 10 Years Plan, the company intends to emphasize the fundamental principles of 1) Cost Reduction, 2) Quality/Service Improvement, 3) Productivity Enhancement, and 4) Market Share Expansion with the hope of improving its brand value by accomplishing the above goals. The Plan implied its likeliness to remain focused on the ICE path. While the Plan provided a brief statement of incorporating new energy technologies and talent development, its technology directions and any plans to address the future automotive trend remain unclear. The inclusion of the technology roadmap will potentially enhance Proton's stakeholders' confidence as to the certainty of the company's future.

2) The Lack of Action Plans to Address the Climate Change Impact

The disruptive technology of EVs in the automotive industry has developed rapidly since the early 2000s. It has gained tremendous traction since the 2010s due to the global commitment towards combatting Climate Change. Pressure for "greener" transportation and CO2 emission reduction has accelerated the technological advancement of both ICEs and EVs related developments such as better battery performance and fuel-efficient ICEs. Major automotive firms have recently made dramatic changes to their operations in pursuit of sustainability and bold commitments to reduce carbon emissions while simultaneously expanding their offering of EVs as their mainstream offering (Austin, Rosinski, Sauer & Le Duc, 2003). The seriousness of the emission reduction impact reached its height in 2015 due to the notorious Volkswagen emissions scandal, which cost the company over €30 Billion in class action claims.

However, the migration of ICEs towards EVs comes with a catch where the underlying technologies are two distinctive disciplines. Since the introduction of automobiles, nearly all vehicles have been driven by the same combination of an internal combustion engine mated to a mechanical transmission. Further, electric cars are based on a fundamentally different technology, consisting of a battery system and electric motors. This technological migration requires a significant operational revamp.

At the point of this study, Proton has no disclosure over the compliance of its product offering towards any CO2 emission standards in the product specification (Exhibit 11.0). In summary, there is a lack of clarity on Proton's commitment towards addressing climate change and CO2 emission.

Figure 11.

Comparison of Top 10 Auto-Makers in the Malaysia Market. Source: Author generated (2023).

Figure 11.

Comparison of Top 10 Auto-Makers in the Malaysia Market. Source: Author generated (2023).

3) The Need for a Market Strategy to Address the Emerging EVs & Automotive IoT Market

Since the 2000s, Proton has been proposing and working on the idea of producing its hybrid and EVs for over a decade and announced that it would be collaborating with Bosch for hybrid cars as early as 2010. Since then, the project did not materialize and reached the commercialization stage for unknown reasons. According to Infosys Limited 2018 report, EVs will be the disruptive force of the automotive ecosystem, reshaping the automotive industry we know (Appendix C). The continuous investments from auto-makers and technological innovation to bring down the costs of EVs components will foster rapid growth in the EVs demands. Competition in the EVs segment is anticipated to be fierce, rapid adaption and projected to account for more than one-quarter of the global car market within the next five years.

According to the analysis based on the McKinsey Connected Car Customer Experience (C3X) framework (Appendix D), which describes five levels of user experience in connected cars, ranging from the most basic to the highly complex integration, the research shows that by 2030, nearly half of the new vehicles sold worldwide could be at level three or higher. Although the adoption rate of EVs remains at the infant stage, the year-to-year growth rate has been encouraging and gaining significant traction since 2014 at an average of 60 per cent per annum, illustrated in Exhibit 12.0 (McKinsey & Company, 2019).

While as a market follower with an adapter, the approach does have its advantage in terms of lower development costs as the technology is now becoming more mature. The stability of the technology is compared to the earlier version. Proton's late start in both EVs and Automotive IoT race will anticipate challenges to compete effectively given its lack of access to these technological capabilities due to resource constraints. Its competitors are primarily in the development of second or third-generation EVs & Automotive IoT.

Figure 12.

EVs Market Statistic 2014 to 2018. Source: Mckinsey and Company (2018).

Figure 12.

EVs Market Statistic 2014 to 2018. Source: Mckinsey and Company (2018).

"Running to Stand Still" – The Proton Market Rule of Engagement Ahead

The level of market competition in the automotive industry, both domestically and abroad, will continue to be competitive. One automaker's perceived competitive advantage period is anticipated to shorten incredibly in the EVs and Automotive IoT arena. Market Adapter auto-makers are expected to be more technologically integrated than before. A shift of paradigm from the conventional development cycle, which typically takes five to seven years, as experienced in the past, is shortened tremendously as the industry is moving towards the digitization phase of the industry.

While the Post Geely performance of Proton shows a positive sign of a turnaround, its focus remains internal-centric, i.e., improving operational productivity and efficiency. Since 2017, the new leadership has successfully brought operational level improvement. It upgrades 3S centres to enhance overall customer experience, supply chain streamlining that improves cost and consolidation of manufacturing facilities to improve operational efficiency. On product development, introducing the X70 Sport Utility Vehicle, a rebadge product line from Geely's Boyue model helps improve Proton's market share and sales figures. However, it is still far from recovery compared to FY2012 at 141,120 units and its domestic rival, PERODUA. The technological synergy which is expected from Geely-Volvo's technological innovation and success has yet to be seen. With the disposal of Lotus in 2017, Proton's lack of technical know-how and innovation to address both the opportunities and threats at present and future remain the main challenge that needs to be handled urgently to ensure its long-term sustainability.

The EVs market share growth potential, and the emergence of automotive IoT, coupled with the foreseeable regulatory and policies change, these forces will inevitably emerge as major disruptive factors in the automotive market's future, as Porter's Competitive Model suggests. The strategic relationship of Geely-Volvo (the latter is well-known for its market leadership in EVs technologies development) presents an opportunity for Proton to establish a competitive advantage in Malaysia's EVs market. It is opposed to PERODUA, its immediate rival, facing similar technological disadvantages in the market segment. Indeed, with the ability of Proton to foster the necessary technical know-how and product-market integration. The EVs and the Automotive IoT segment will potentially provide Proton with the long-waited cutting-edge advantage to regain the market share position as the leader in the domestic market and regional market penetration.

Recommendations & Implementation

Geely has struggled, overcome obstacles, and achieved some kind of success. The corporation transitioned from producing low-quality cars to producing new products with advanced technology, such as electric cars. With an advanced idea for digital marketing transformation, Geely will implement highly automated advanced manufacturing technologies, including artificial intelligence and robots. The purpose of this case study is to investigate whether or not the plan developed by Post Geely to improve Geely's ability to compete successfully on a global scale was successful. Given the difficulties that are caused by climate change having an effect on the automobile industry, this case study shows that there is a need for a review of the business strategy that is now in place. In order to build the essential long-term competitive advantage, the company needs to conduct an analysis of the possible impact that the Internet of Things (IoT) industry and the market for electric vehicles (EVs) could have with 5G technology (Lim, 2022).

Traditionally, Proton tends to focus more on its ability to offer products using a cost-leadership strategy, which it believes the low price will translate to a high market share. As observed with the Proton X70 model, price leadership (at least among its product offerings) does not necessarily emerge as the top consideration for a buyer's decision. A differentiation strategy emphasizing product features primarily on safety and user experience differentiation tends to weigh more in the buyer's decision-making process (Banker, Mashruwala & Tripathy, 2014).

The increased competition and complexity of consumer behavior are driven by the fact that customers are better informed (the digitization of information) and more comparisons of choices. It is becoming more crucial for a firm to align its market strategy towards the solutions that best-served the consumers' needs (Kolk & Pinkse, 2004). This study suggests a holistic marketing mix strategy, converging the 4Ps and 4Cs framework.

Strategic Technology-Product Development Plan

Both the challenges and opportunities faced by the company are crucial and immediate, which rely heavily on the ability to respond with technological capabilities within a short period. Proton's current financial conditions, which are highly geared, and the possibility of cash-flow constraints might potentially limit the ability of Proton to acquire the necessary technological know-how for the intended purposes suggested in Appendix E.

Fortunately, via Geely's strategic partnership, Proton could access technological and financial resources subject to the terms and conditions that benefit all parties. Such agreement can only be accomplished with the commitment of the cross-entities management, namely, Geely, Volvo, Lotus and Proton, especially over the technological capabilities for Proton's future ICE Powertrain and EVs development.

Although the proposition might appear logical and viable to Proton, it does come with certain complications: The conflicting relationships: Subsidiary versus Associate Company – Both Volvo (99%) and Lotus (51%) are subsidiaries of Geely, while Geely owns 49.9% of Proton. Any technological transfer is most likely carried out on an arm's length basis, i.e. a price to be paid. Therefore, developing the technology roadmap is needed to address the lack of technological know-how to overcome the challenges, capture the opportunities, and identify the potential conflict of interest on intellectual properties, production rights, and market rights to prevent future disputes. Another aspect to consider is determining the suitable mode of collaboration, such as Partnership, Technology Licensing to arrive at a mutually beneficial arrangement between the entities.

The potential future collaboration of standard platform research and development approach is from cooperative or joint development to optimize the Research & Development costs (comparable to the Porsche-Audi-Volkswagen model) for mutual benefits. Besides, both Volvo and Lotus were acquired by Geely due to their financial difficulties, and the joint development proposition might be attractive to all parties. Volvo's target to be a fully EV or Hybrid car producer by 2040 will have much to offer on Proton's EVs development.

Possibility of an EVs Charging Infrastructure Investment

Based on IEA projections, global electric car sales will reach 23 million, and the stock will exceed 130 million vehicles by 2030, accounting for 30% automotive market share for EVs. Electricity demand to serve EVs is projected to reach almost 640 terawatt-hours (TWh) by 2030. One of the main challenges for EV proliferation is an "egg and chicken" scenario, i.e. the lack of EV chargers stations. Based on the ChargEV report, an EV charging service provider in Malaysia, the current number of public EV charger stations in the country remains low and under-served. ChargEV currently provides its charging service via an annual subscription fee of RM240 per annum, allowing its member access to the 278 stations nationwide.

An EV charging infrastructure investment will be a strategic plan to complement Proton's EVs models and a spin-off for a recurring income business model. The EVs Charging Infrastructure can potentially capture rival EVs customers. There is also a need to develop a strategic collaboration with Utility Providers, Petrol Kiosks, car-park operators and retail malls. Incorporating the charging costs as part of the cost of ownership over the warranty period might be a good proposition for its EVs market strategy and future recurring income stream.

Market entry strategy which favours a "brown-field" acquisition strategy (i.e. the possibility of acquiring Charge EV) over a "green field" setup given the advantages: 1) the fast entry to the market, 2) avoiding competition and 3) the existing base of EVs Charging Stations, technical and operational experience. A strategic proliferation plan to cover 85% of the urban network over the next five years where high EV users are expected. The estimated target is to expand 10,000 charging stations nationwide in major metropolitan areas to achieve the 85% coverage goal. The cost to set up a charging station is estimated at RM6,000 – 8,000 per station, equivalent to RM 60,000,000 – 80,000,000.

Conclusions

With the backdrop of business, dynamics shift in the automotive industry, Proton needs to accelerate the innovation for technological and marketing changes in preparation for the intensified competition due to national automotive policy reform. Proton's business strategy must incorporate a strategic planning approach and acquire the necessary technical know-how. It also expands the value chain beyond car production to downstream Infrastructure. Geely's strategic partnership no doubt provides Proton with the edge needed, which can be further capitalized to enhance its domestic and international market competitiveness. The emerging EV growth presents both the opportunity and challenges to Proton, which can be a potential game changer for Proton to develop a sustainable competitive advantage for its future product offering.

Discussion Questions

Proton's primary cost reduction strategy is switching to supplier sourcing. To What is the extent of this impact on Proton Pricing Strategy?

One of Proton's key weaknesses is the lack of research and development. Given the EV trend, is it better for Proton to in-house develop these capabilities? What are the potential alternatives that Proton can consider to address its weaknesses?

Proton's strategic partner, Geely, is known for advocating for Electric Vehicle Initiative. What are the possible mode of collaboration and the potential challenges of these collaborations?

What are the potential options for Proton to overcome the financial constraints?

The public transport vehicle segment used to be a key market for Proton. With the emergence of the e-Hailling trend, what are the opportunities and challenges to Proton?

The COVID-19 pandemic has changed the global market dynamics significantly. How does this impact Proton's ten years plan and marketing strategy?

Appendix A. Equipment and Announcement

Appendix B. Illustration of V2X applications Ecosystem

Appendix C. EVs Trend in Automotive Industry Next 5 to 10 Years

Appendix D. The McKinsey Connected Car Customer Experience (C3X) framework

Appendix E. The Proposed Convergence Model of the Proton's Marketing Mix Strategy

References

- Abdullah, R.; Lall, M.K.; Tatsuo, K. Supplier development framework in the Malaysian automotive industry: Proton's experience. Int. J. Econ. Manag. 2008, 2, 29–58. [Google Scholar]

- Ahmed Zafar, U.; John, H.; Humphreys, A. Conceptual Framework for Developing-Country Transnationals: Proton Malaysia. Thunderbird Int. Bus. Rev. 2008, 50, 45–58. [Google Scholar] [CrossRef]

- Austin, D.; Rosinski, N.; Sauer, A.; Le Duc, C. Changing Drivers: The Impact of Climate Change on Competitiveness and Value Creation in the AUTOMOTIVE industry; Sustainable Asset Management: Zurich, Switzerland, 2003. [Google Scholar]

- Balmer, J.M.; Gray, E.R. Corporate identity and corporate communications: Creating a competitive advantage. Corp. Commun. Int. J. 1999, 4, 171–177. [Google Scholar] [CrossRef]

- Banker, R.D.; Mashruwala, R.; Tripathy, A. Does a differentiation strategy lead to more sustainable financial performance than a cost leadership strategy? Manag. Decis. 2014, 52, 872–896. [Google Scholar] [CrossRef]

- Fujita, M. Industrial Policies and Trade Liberalization: The Automotive Industry in Thailand and Malaysia. In The Deepening Economic Interdependence in the APEC Region; APEC Study Center, Institute of Developing Economies: Tokyo, Japan, 1998; pp. 149–187. [Google Scholar]

- Jaipong, P.; Nyen Vui, C.; Siripipatthanakul, S. A case study on talent shortage and talent war of True Corporation, Thailand. Int. J. Behav. Anal. 2022, 2, 1–12. [Google Scholar]

- Jaipong, P. Business Model and Strategy: A Case Study Analysis of TikTok. Adv. Knowl. Exec. 2023, 2, 1–18. [Google Scholar]

- Jayasankaran, S.; Jomo, K.S. Made-in-Malaysia: The proton project. Industrializing Malaysia: Policy, Performance, Prospects. 1993.

- Jomo, K.S.; Rasiah, R.; Alavi, R.; Gopal, J. Industrial Policy and the Emergence of Internationally Competitive Manufacturing Firms in Malaysia; Manufacturing Competitiveness in Asia Routledge: 2005; pp. 124–190.

- Khalifah, N.A.; Abdul Talib, B. Are foreign multinationals more efficient? A stochastic production frontier analysis of Malaysia's automobile industry. Int. J. Manag. Stud. (IJMS) 2008, 15, 91–113. [Google Scholar]

- Kolk, A.; Pinkse, J. Market strategies for climate change. Eur. Manag. J. 2004, 22, 304–314. [Google Scholar] [CrossRef]

- Kuchiki, A. A Flowchart Approach to Malaysia's Automobile Industry Cluster Policy (No. 120). Institute of Developing Economies, Japan External Trade Organization (JETRO). 2007.

- Lim, L. A Case Study on Foreign Acquisitions of Geely Auto: From Zero to Hero. Int. J. Behav. Anal. 2022, 2, 1–10. [Google Scholar]

- Limna, P.; Siripipatthanakul, S.; Jaipong, P.; Sitthipon, T.; Auttawechasakoon, P. A Review of Digital Marketing and Service Marketing during the COVID-19 and the Digital Economy. Adv. Knowl. Exec. 2022, 1, 1–10. [Google Scholar]

- Mooi, L.S.; Khean, H.L. Failure Cases of Malaysia Privatization: MAS, Proton and LRT Putra. Malaysian economic development, issues and debate 2007; pp. 83–92.

- Nag, B.; Banerjee, S.; Chatterjee, R. Changing features of the automobile industry in Asia: Comparison of production, trade and market structure in selected countries (No. 37). ARTNeT Working Paper Series. 2007.

- Noor IB, M.; Lingam, D.V. Malaysians' perceptions toward Proton car. Adv. Environ. Biol. 2014, 8, 513–523. [Google Scholar]

- Rasiah, R. 11. Industrial technology transition in Malaysia. Competitiveness, FDI and technological activity in East Asia 2003, 305.

- Salang, M. Strategic Business Plan for Proton Holdings Berhad 2018.

- Tan, J. Privatization in Malaysia: Regulation, rent-seeking and policy failure. Routledge: 2007.

- Viphanphong, W.; Kraiwanit, T.; Limna, P. Goodness Bank, Volunteer Bank, and Time Bank in the Digital Age. Adv. Knowl. Exec. 2023, 2, 1–14. [Google Scholar]

- Wad, P.; Govindaraju, V.C. Automotive industry in Malaysia: An assessment of its development. Int. J. Automot. Technol. Manag. 2011, 11, 152–171. [Google Scholar] [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).