Literature review

The Malaysia Airport Industry Overview

At the point of this case study, there are 58 airports in Malaysia, of which 37 handle scheduled passenger services. Thirty-six airports are located in East Malaysia and 22 in Peninsular Malaysia. Malaysia currently consists of 8 international airports: Kuala Lumpur International Airport (KLIA), Penang International Airport, Malacca International Airport, Langkawi International Airport, Senai International Airport on the peninsular of Malaysia; and Kota Kinabalu International Airport, Kuching International Airport, and Tawau International Airport in East Malaysia. KLIA has been Malaysia's main Airport and has served as the central hub for Malaysia Airlines, AirAsia, AirAsia X and Firefly.

The airport operating industry is considered highly monopolistic under its concessionaire agreement. Except for two Malaysian airports not operated by MAHB, the Senai International Airport is managed by Senai Airport Terminal Services Sdn Bhd (SATS), a subsidiary of MMC Corporation Berhad, which took over the airport operation from MAHB in 2003. And Terengganu's Kerteh Airport by Petronas, a government-owned oil and gas company, serves the purpose of airlifting oil and gas companies' employees to their oil platforms located in the South China Sea as receiving domestic scheduled flights.

The industry revenue streams are highly governed and regulated by the Malaysian government. Both aeronautical and non-aeronautical charges must obtain approval from DCA before any revision of accounts can be implemented.

The Air Traffic Management sector at the DCA continues to hold under its responsibility. Security control functions are air navigation, aeronautical regulation and communications, meteorology, and rescue services. In general, the technical aspects of air navigation services. At the airport level, airport operators employ and supervise airport personnel and subcontractors, while the responsibilities for maintaining and operating air traffic operations remain under DCA jurisdiction.

Global Aviation Industry Outlook and Trends

Connectivity is an essential component of economic activity and a catalyst for business growth. Since the invention of aircraft, air connectivity has expanded businesses and markets, facilitating trade, encouraging Foreign Direct Investment (FDI) and enabling tourism. Since the early 20th century, the aviation industry has grown exponentially, taking a significant role in military and economic human history. Today, 1,303 airline operators with a fleet of 31,717 aircraft serve 3,759 airports through a route network managed by 170 air navigation service providers. The International Air Transport Association (IATA) projected 8.0 billion passengers to travel in 2039, doubling the 3.9 billion air travellers in 2019 at an estimated CAGR of 3.7%. Aviation is expected to contribute $1.5 trillion to world GDP by 2036 directly (IATA, 2020).

As the gateways to aviation, airports are the critical link in the air transport system. They, therefore, play an essential role in facilitating economic growth via tourism, business travel, and global supply chains (Karlsson et al., 2008; Batey et al., 1993). The Airport forms the first impression of a city or country for incoming and outbound travel, especially on short-haul flights. The time that travellers spend at the Airport may be as much or even more time as they do in the air. Thus, operational and technological innovation is becoming crucial to improve the airline/passenger experience to compete among airports in the world.

Airline competition has resulted in efficiency gains across all operators in terms of increased choice and value, increasing innovation on business models and leveraging extensive data analysis. It enables airlines to serve markets effectively and efficiently where they can achieve sustainable levels of traffic and yield. Therefore, costs and revenue effects are among the main factors regarding airport selection. In summary, where airlines can benefit economically on a particular route, it makes commercial sense to continue operating it. When airlines switch capacity between roads and airports, this should be seen as part of a business process of network optimization. Therefore, the competition among airports to provide better efficiency has increased rapidly to attract its primary customers – the airlines' operators.

Aviation passengers' behaviour is also changing on the other side. In the past, the flying experience was new and exciting and confined to specific demographic profiles. Since the turn of the 21st century, the emergence of low-cost carriers has made air travel affordable, which has expanded a much broader spectrum of passengers. The number of frequent business travellers is booming across the globe.

Belt and Road Initiative (BRI) Impact on Aviation

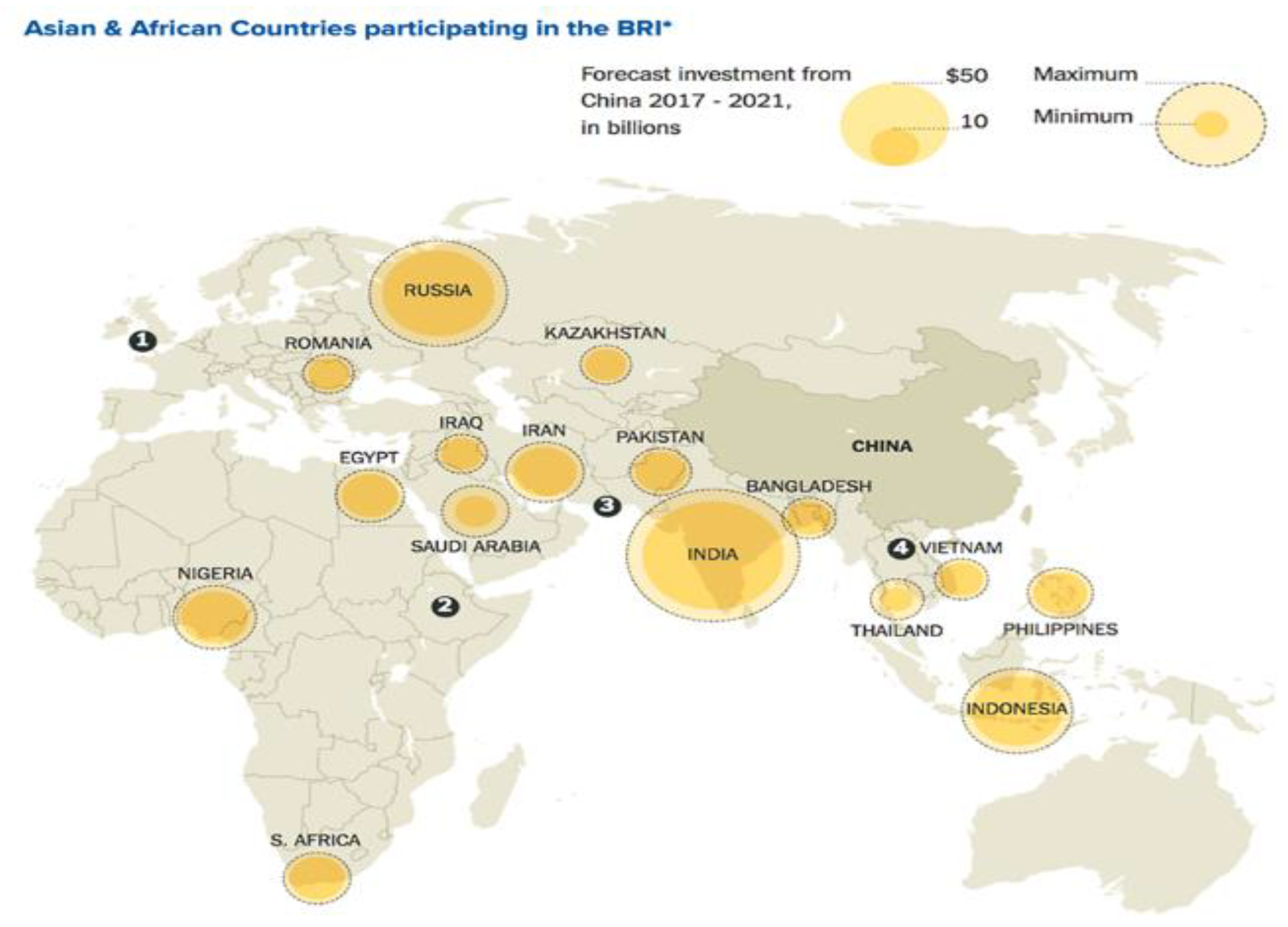

Belt and Road Initiative (BRI) is a regional development initiative pioneered by the People's Republic of China's government. It primarily focuses on connectivity and cooperation between Eurasian countries along the land-based Silk Road Economic Belt (SREB) and the ocean-routing Maritime Silk Road (MSR). Up to 2016, China's total trade value along the Belt and Road Initiative exceeded USD3 trillion, while China's investment in these nations surpassed USD50 billion (

Figure 3).

Aviation networks provide vital connectivity to passengers and shippers and are critical in local, regional and national economic development. Airports provide the essential infrastructure and services that facilitate air transport. The trade-friendly regulations to ensure airports operate efficiently and cost-effectively are vital for sustainable air transport development and the economy (CAPA, 2018).

In 2015, the General Administration of Civil Aviation of China (CAAC) proposed the need to adopt a proactive, more liberal and flexible aviation policy for an active, orderly and progressive approach to liberalization among BRI nations to incorporate key flightpaths and significant projects, such as joint investment and construction of the Airport, and air traffic control facilities into China's regional support program under the BRI initiatives.

Results

ASEAN Single Aviation Market - One Sky, One Region

ASEAN Single Aviation Market (ASEAN-SAM) is an aviation open sky policy to develop a single aviation market among ASEAN nations in Southeast Asia initiated in 2015. The ASEAN Air Transport Working Group made the policy proposal, supported and endorsed by ASEAN nations. The ASEAN-SAM is deemed instrumental in accelerating the economic development of the region.

The ASEAN-SAM initiative forms part of the vital component of the ASEAN Economy Community (AEC) blueprint 2025, which is coherent with the vision and goals of the Master Plan on ASEAN Connectivity (MPAC). It enhances economic connectivity involving various sectors: transport, telecommunication and energy. It creates an integrated economic region to maximize their contribution to improving the overall competitiveness of ASEAN and strengthening soft and hard networks in the area (AEC, 2016).

The ASEAN-SAM is expected to maximize the liberation of air travel between ASEAN member nations and enable ASEAN nations. Airlines operating in the region benefit from the positive growth in global air travelling by promoting tourism, trade, investment, and service flows between member nations.

In 2017, via the adoption of the Air Traffic Management Master Plan, the region furthered its collaborations to facilitate the movement of aircraft and airspace capacity across the member countries, which aims to reduce delays and operational costs for the airlines. The initiative sees the gradual removal of ownership restrictions in air transport services and the harmonization of regulatory requirements for technical personnel and flight crews.

The National Transport Policy (NTP) and National Aviation Strategic Plan (NASP)

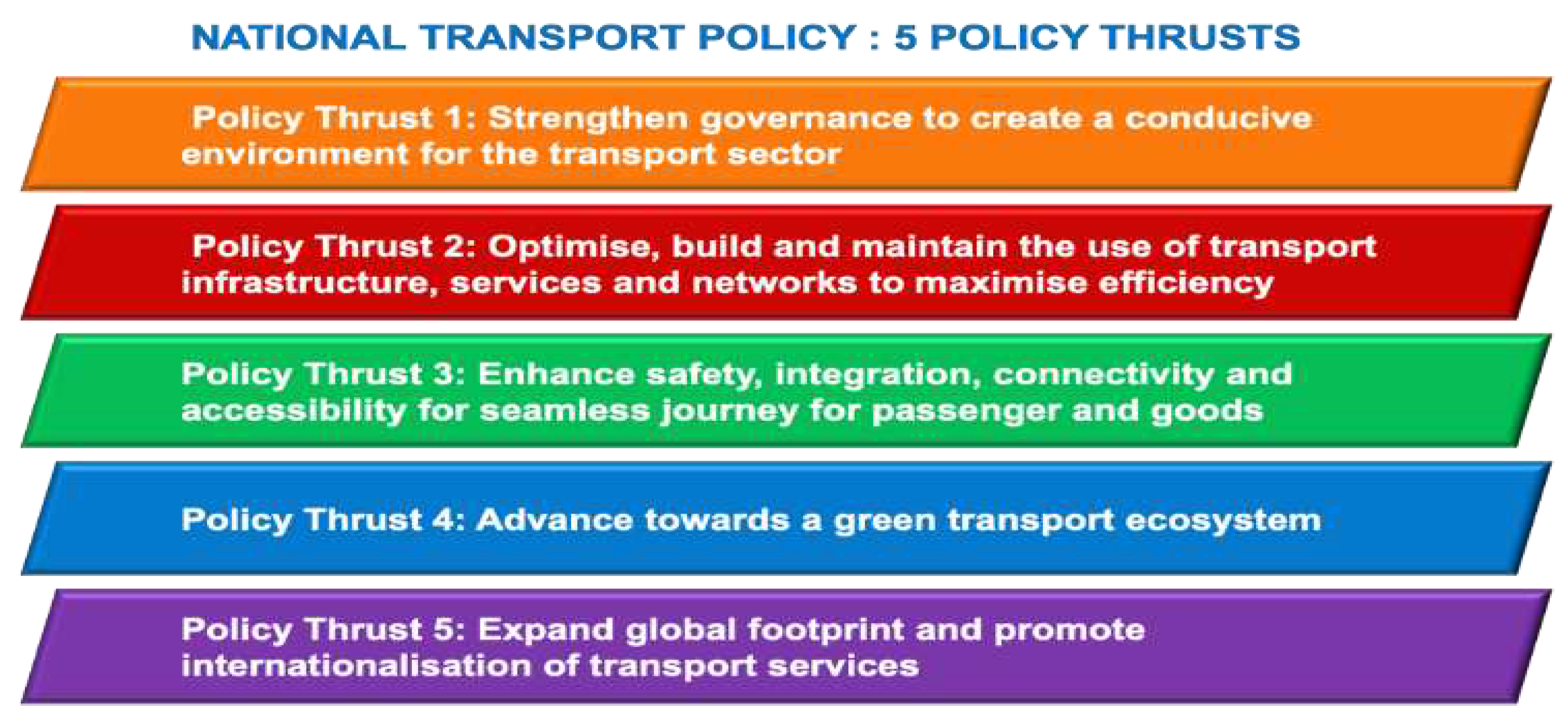

In 2019, the Malaysia Transport Ministry announced the National Transport Policy to address the needs driven by rapid transport sector growth and Malaysia's position as a transport hub for the Southeast Asia region. The NTP was developed with the objectives:

Create a conducive ecosystem for the transport industry to enhance productivity and competitiveness

Facilitate seamless movement of goods to boost trading activities & ease of doing business

Provide mobility that meets the expectations of people and promotes inclusivity

Increase modal share for public transport

Deliver an intelligent, safe and secure transport system

Ensure efficient & sustainable use of resources & minimize environmental pollution

For the nation's aviation outlook, the government projected the annual growth in passengers in three primary airports, namely KLIA (4.1%), Penang International Airport (6.1%) and Kota Kinabalu International Airport (5.5%). The policy also identified eight critical future trends and five policy thrusts (

Figure 4).

It recognizes the importance of the aviation industry's impact on the nation's economic growth. The transport ministry announced the development of the National Airports Strategic Plan (NASP) to facilitate the future blueprint for the government in decision-making for airport developments in Malaysia. The NASP outlines the long-term strategic plan to develop an efficient and competitive airport system, emphasize the continuity with the transportation network and enhance connectivity between the various transport modes in Malaysia. The NASP is expected to be revealed by the end of 2020.

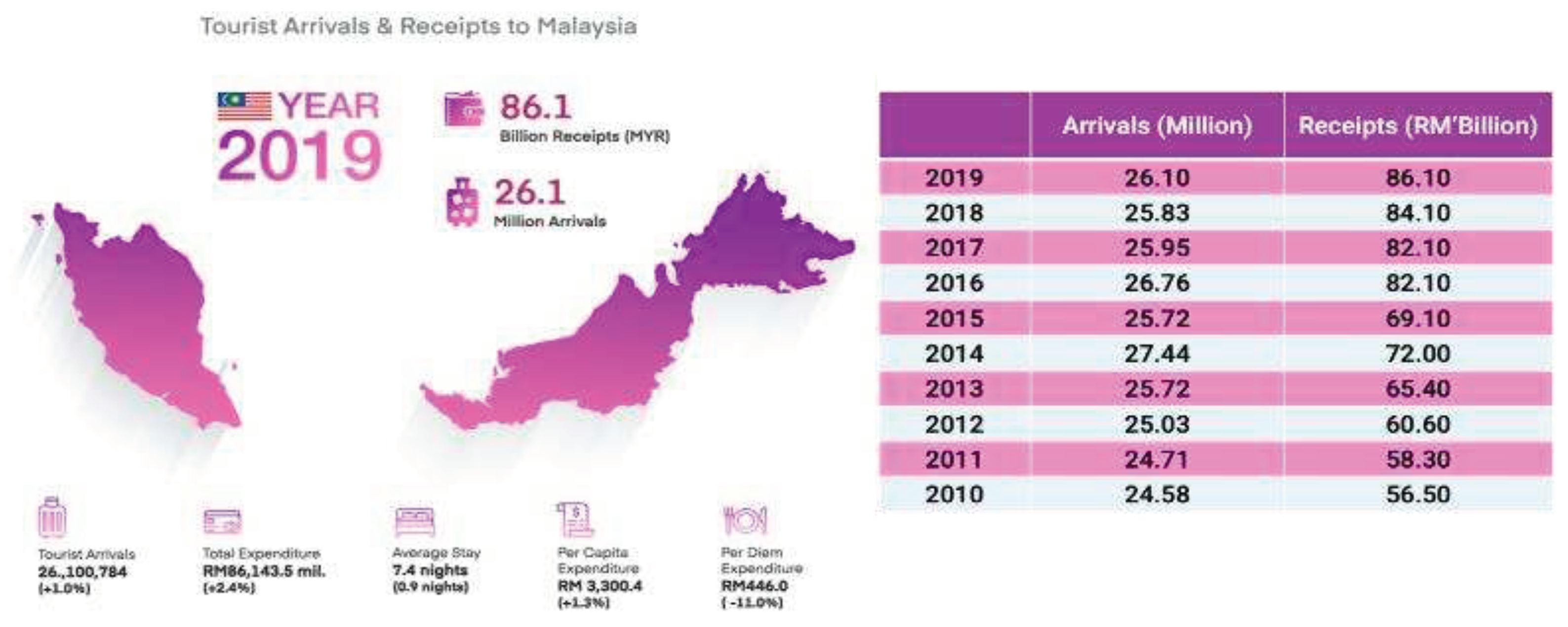

Figure 5.

Malaysia Arrival and Receipts 2019. Source: MOTAC (2020)

Figure 5.

Malaysia Arrival and Receipts 2019. Source: MOTAC (2020)

The Potential New Players in the Malaysia Airport Industry

Before 2003, MAHB monopolized the airport operating sector under its exclusive concession right. MMC Corporation Berhad became Malaysia's second international airport operator when it took over the operating right from MAHB. At the same time, Petronas operates Kerteh Airport in Terengganu to airlift oil and gas companies' employees to their various oil platforms located in the South China Sea and receives domestic scheduled traffic.

Malaysia's tourism industry has been on the decline since 2014. One of the strategic roles of MAHB is to develop KLIA as an ASEAN air travel hub due to its strategic role in the country's tourism industry. The issue became even more critical when the data on foreign visitors' arrival to Malaysia for 2018 showed a 0.4% drop, whereas there was an increase for other ASEAN countries. The example is Vietnam (+29%), Indonesia (+22%), Thailand (+9%) and Singapore (+6%).

In recent years, MAHB has been criticized for its lack of government transparency, archaic rules, regressive procedures and non-competitiveness with its regional rivals. One of the main arguments relates to MAHB's monopolistic position in the industry. The inefficiencies and resistance to changes resulted in poor management of several adverse incidents.

Since the change of Pakatan Harapan led government in the 14th General Election, the call for the government to break MAHB's monopoly by both politicians and critics who believed that via liberalization of Malaysia's airport industry, it would compel MAHB to be more competitive and robust. In 2019, the industry saw the emergence of privately funded proposals such as Kulim International Airport (KXP) and Northern Malaysia International Airport (NMIA) instead of the MAHB monopolistic model. Swiss-listed Flughafen Zürich AG, which operates nine airports, including the Zurich International Airport in five countries, express its keen interest in venturing into the Malaysian aviation market, especially in expanding the Penang International Airport.

The Effect of Digitalisation on the Airport Industry

The idea of digitalization is not something new. Since the invention of computers, digital transformation has changed how businesses are conducted, from the mountains of document archive warehouses to a virtual cloud storage system, to complex currency notes to e-wallet apps in a smartphone. The Internet of Things (IoT) concept describes this enhanced connectivity of systems, people and things. The airports are impacted by the digitalization trend, which saw the emergence of opportunities and threats to Sharing the same fate as every other industry (Zaharia & Pietreanu, 2018; Kovynyov & Mikut, 2019).

Traditionally, aviation revenue is the main income stream for the airport business model. With the Landing fees, fuel, and other operational charges steadily increasing and being challenged by airlines, airport operators seek revenue growth via non-aviation revenue, which is gaining importance as the primary source of income for today's modern airports. At the global level, approximately 50% of total revenues are from non-aviation sources making these revenues the most crucial financial pillar of airports. Accordingly, non-aviation is one of the strategic areas for the future.

However, the evolving E-Commerce industry and digitalization are disrupting traditional revenue streams and business models of airports and airlines. The digitalization trend brought economic benefits to the aviation industry, witnessing the paperless checking facilities, which enhance the efficiency of the boarding process and many more. The passenger's buying behaviour has also fundamentally changed. Nevertheless, digitalization presents an enormous opportunity to find new ways to generate core non-aviation revenues. This present a need to create a digital airport commerce ecosystem together, which is the potential to be developed as a sustainable competitive advantage (Arup & CGK, 2017).

The Impact of Climate Change – Airport Carbon Accreditation

Similar to any mode of fuel-based transportation, air transport energy consumption and its effects contribute to the global carbon emission footprint. In airports, the global aviation industry accounts for 2% of human-induced Carbon Dioxide (CO2), accounting for 5% of the worldwide aviation CO2 emission. The industry has invested in developing revolutionary new materials that enable next-generation aircraft to be lighter, faster, and more fuel-efficient to address the challenges of climate change.

Airports' contribution towards society is indisputable and unmatched by any other mode of transport. While the Airport's contribution to the carbon emission footprint is relatively insignificant, the drive to improve aviation's reputation concerning environmental efficiency & carbon reduction does yield economic gain in terms of energy bill savings and efficiency improvement via the application of energy savings materials (e.g. LED, Solar Energy), electric ground vehicles and green building designs (Mosvold Larsen, 2015; Chao, Yeh & Yeh, 2017). As a resolution on Climate Change commitment by the airport industry, Airport Carbon Accreditation (ACA) was adopted by ACI EUROPE's member airports in June 2008 and globally by 2014 with the responsibility to managing, reducing and ultimately neutralizing airport carbon footprint.

U.S. FAA Downgrade of Malaysia CAAM Air Safety Rating to Category 2

In November 2019, the Civil Aviation Authority of Malaysia (CAAM) was found not to comply with International Civil Aviation Organization (ICAO) safety standards by the U.S. Department of Transportation's (DOT) Federal Aviation Administration (FAA). The non-compliance resulted in a downgrade to a Category 2 rating based on a reassessment of the country's civil aviation authority (FAA, 2019). The downgrade indicates CAAM is deficient in one or more areas set by the standards, such as technical expertise, trained personnel, record-keeping, and inspection procedures.

The impact of a Category 2 rating indicates Malaysia's carriers will not be allowed to establish new services to the United States.

Category 1 rating indicates the country's civil aviation authority complies with ICAO standards. With an IASA Category 1 rating, a country's air carriers can establish service routes to the United States; the United Nations specialized agency for Aviation sets international standards and recommended practices for aircraft operations and maintenance to achieve a Category 1 rating. The country must adhere to ICAO's safety standards.

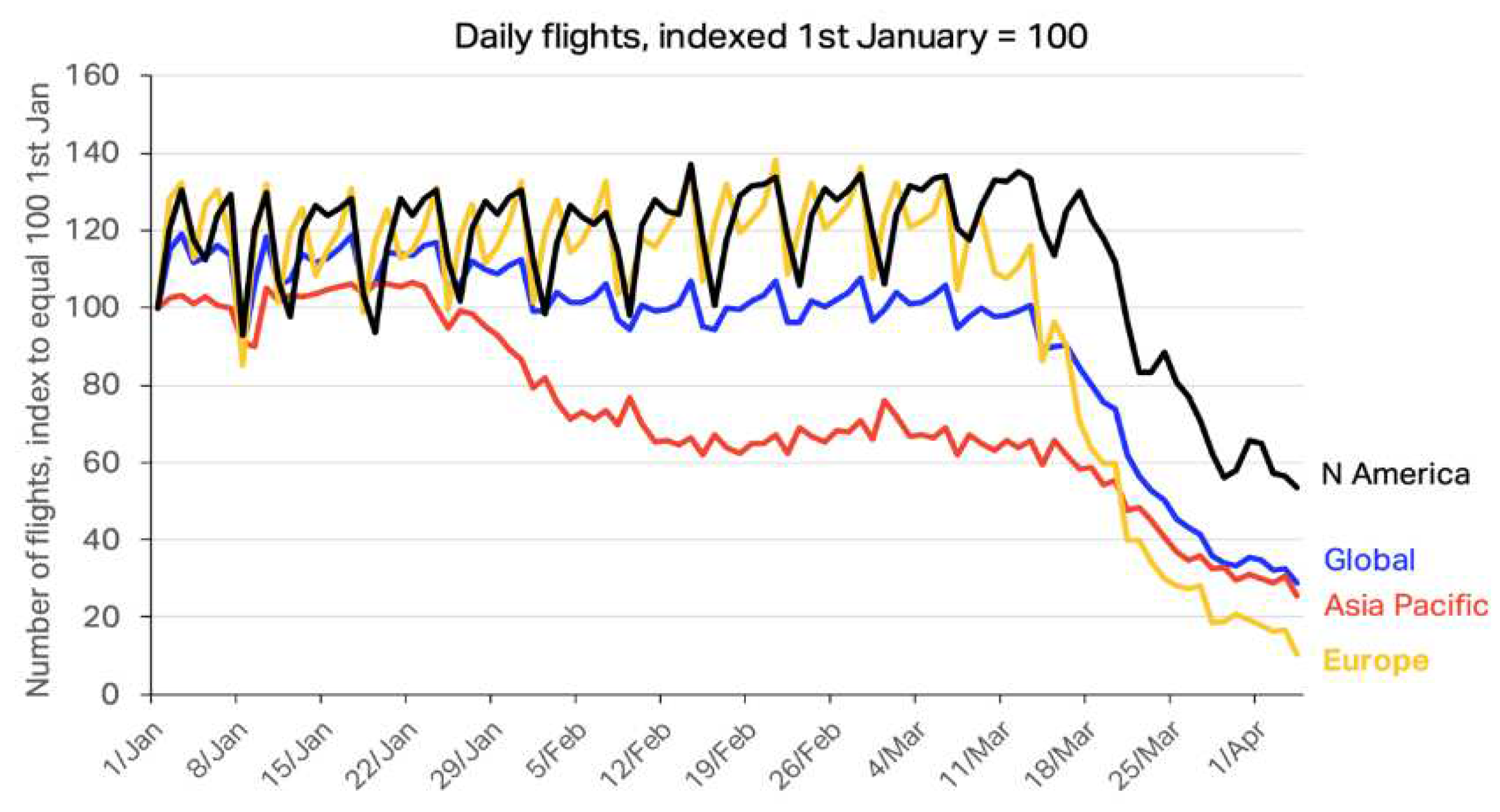

The Impact of COVID-19 on the Global and Malaysia Aviation Industry

The impact of the COVID-19 pandemic on the global economy is significant. The effect of the worldwide stock market and oil price crashes has put the global economy into recession mode. The decline marked the highest setback since the 2008 Global Financial Crisis. Global lockdowns by many nations to contain the spread of the pandemic in the world has led to economic contractions. The second quarter of 2020 saw more than 2/3 of the worldwide flights grounded. The aviation industry estimated cash burn to be over USD60 billion in the second quarter alone due to the significant contraction of Revenue Passenger Kilometers (RPKs). Many airlines are struggling for survival due to cash flow issues. Estimated 25 million jobs supported by air transport worldwide are at risk due to the pandemic.

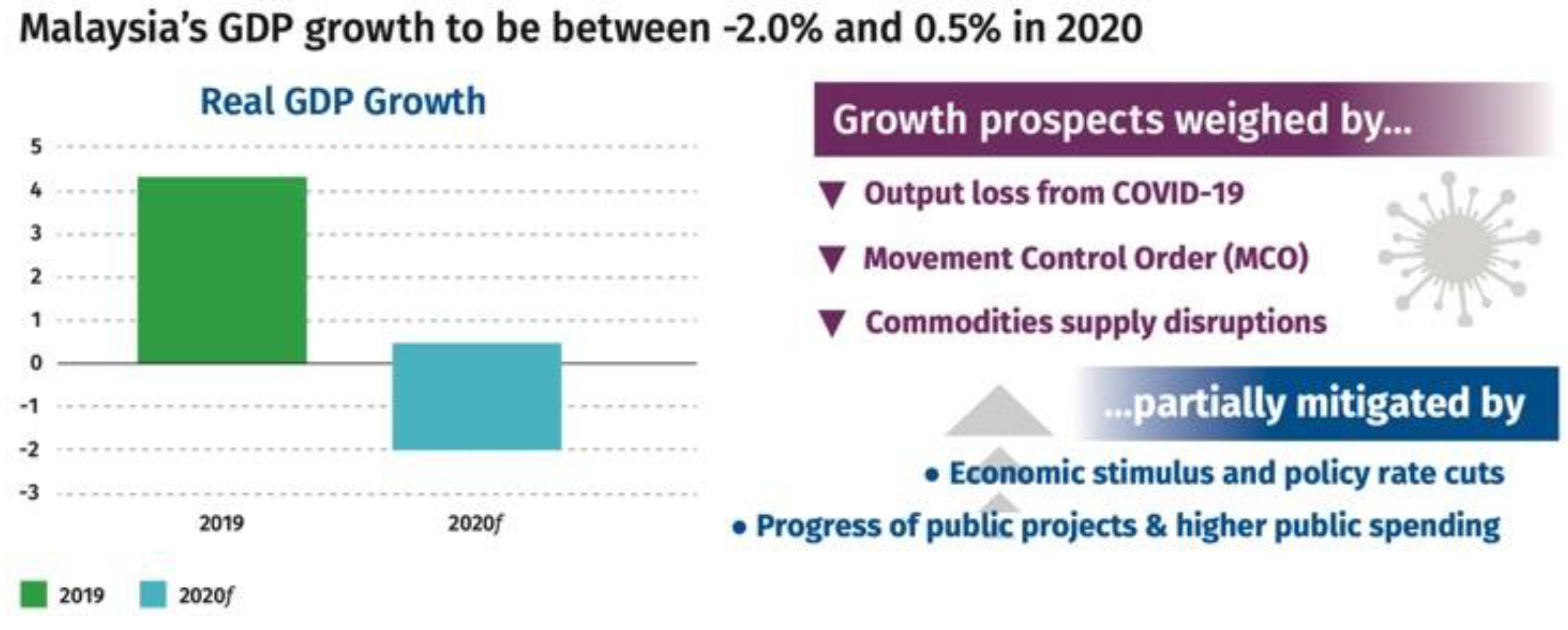

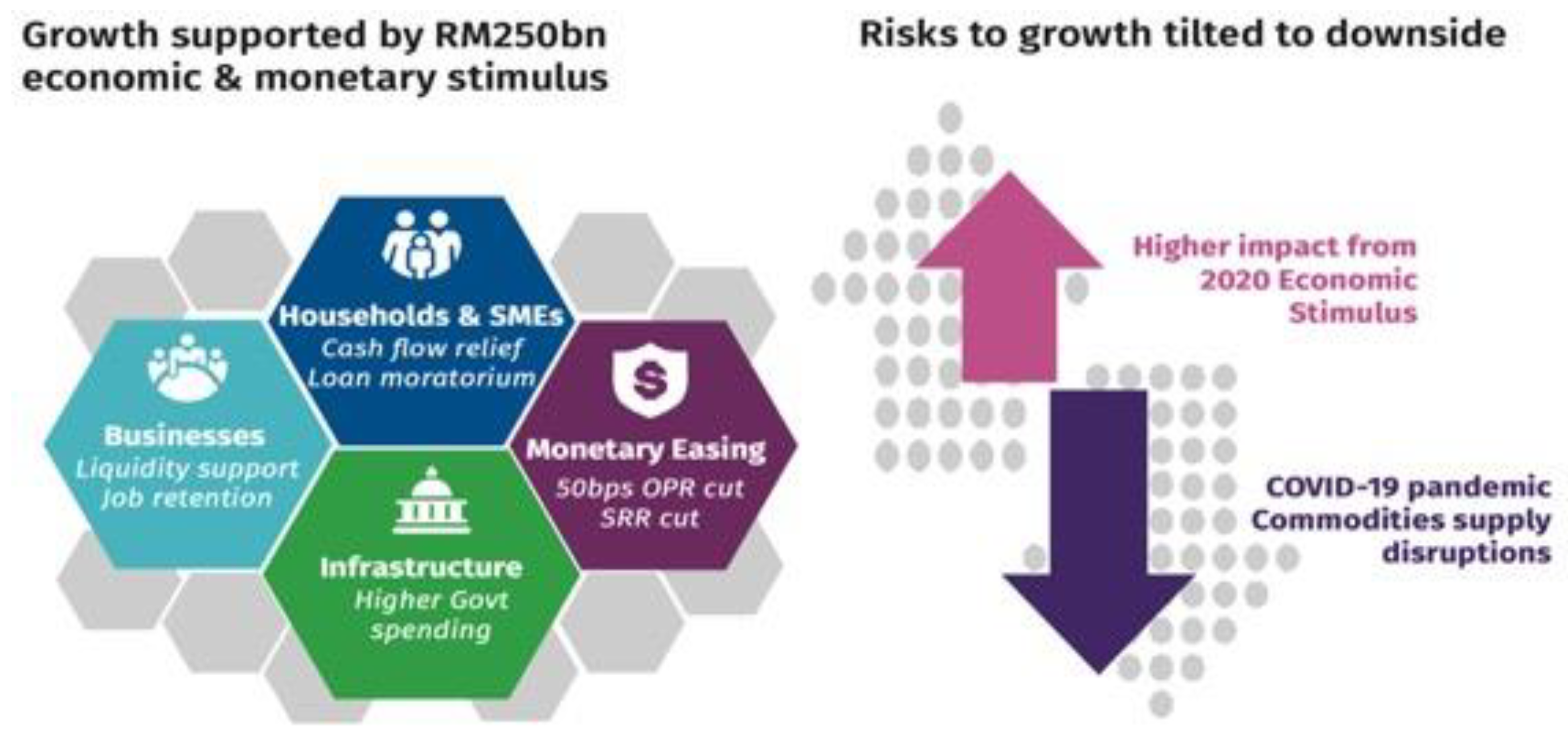

Malaysia's Gross Domestic Product (GDP) growth is projected between -2% to 0.5% in 2020 against a highly volatile global economic outlook due mainly to the COVID-19 pandemic (BNM, 2020). Malaysia's economy suffered the same fate due to low global demand, supply chain disruption, low tourism receipts and lower domestic income due to the domestic containment measures, namely Movement Control Order (MCO), since Mid-March 2020.

Figure 7.

Highlights of Malaysia's Economy Outlook 2020. Source: BNM (2020)

Figure 7.

Highlights of Malaysia's Economy Outlook 2020. Source: BNM (2020)

The ongoing COVID-19 pandemic has significantly impacted global economic growth prospects, with the outlook heavily contingent on countries' ability to contain the pandemic over the remainder of the year successfully. The International Monetary Fund (IMF) is anticipating a recession impact in 2020 that is equivalent to the 2009 global financial crisis and is projecting a recovery in 2021. According to Bank Negara Malaysia (BNM), Malaysia's domestic growth is expected to remain susceptible to a recurrence of commodity supply shocks. It continued low commodity prices, wh

The federal government has implemented various economic stimulus measures (

Figure 8), and several state governments have implemented additional measures to reduce the impact of the pandemic-driven recession.

MAVCOM projected its 2020 passenger traffic forecast between -36.2% to -38.1% Year-on-Year (YoY), which translates to 67.7millions to 69.7millions passengers (2019:109.2millions passengers), due to the impact COVID-19 pandemic. MAVCOM estimated the revenue-at-risk for Malaysian carriers and aerodrome operators at RM7.2bn in 2020. International Air Transport Association (IATA) estimated the global airline industry to lose USD252.0bn in revenue and face a liquidity crisis in 2020. The Centre for Aviation (CAPA) predicted bankruptcy among airlines by mid-2020. The financial situation of airlines will be worsened by lower passenger demand due to fears of air travel, leading to reduced flight frequencies or cancelling services. Travel bans for pandemic containment will affect Malaysia's air connectivity to various destinations, such as Australia, China, and India.

MAHB Strategic Planning Framework Analysis – What We Know So Far

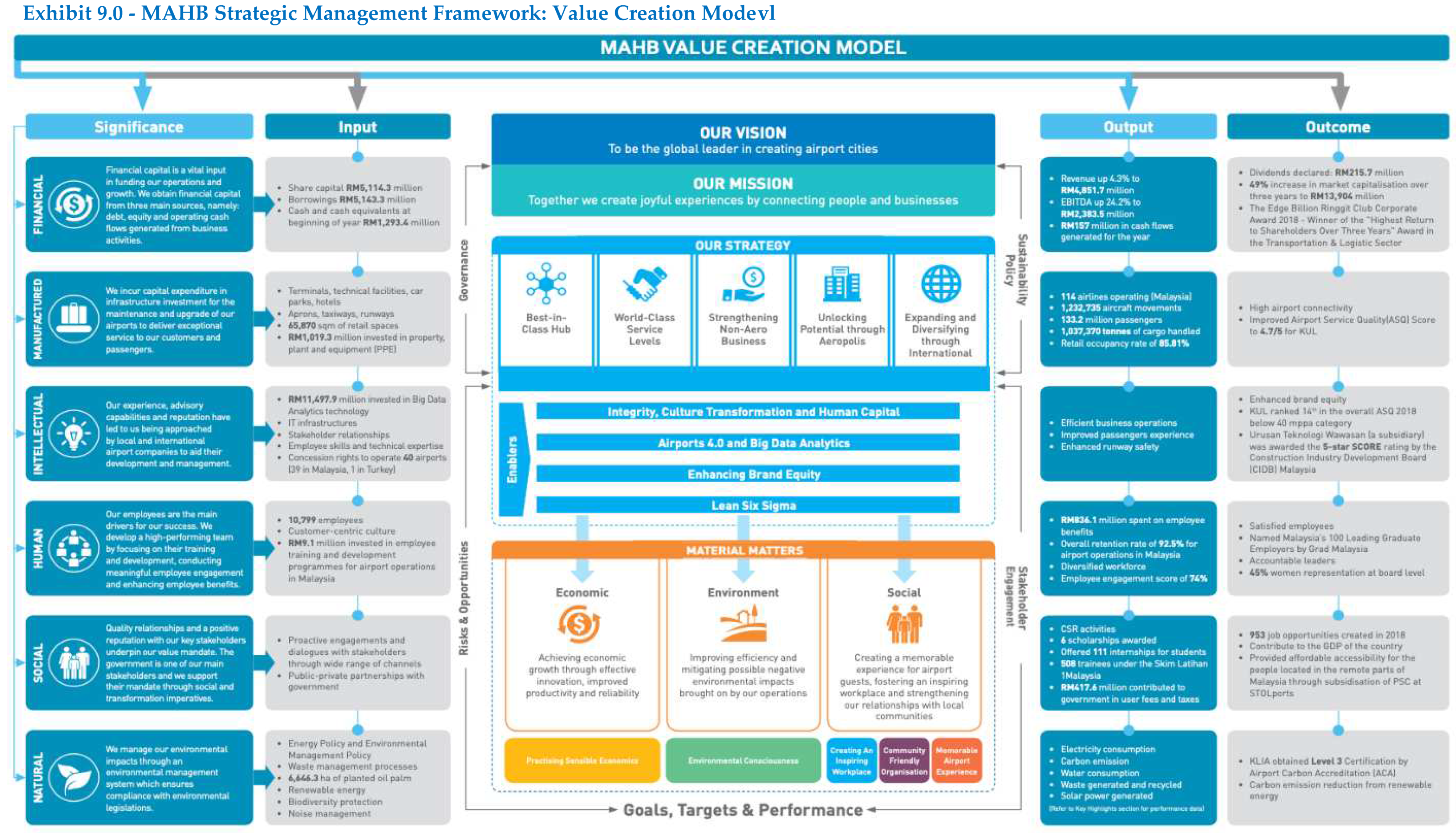

MAHB places a strong emphasis on strategic planning. It is evidenced by its value creation model (

Figure 9), which recognizes the importance of vision, mission and strategies to achieve the goals and actual performance. While the model is consistent with the traditional strategic planning framework practice, several fundamental aspects present challenges and opportunities to the MAHB business outlook.

MAHB Key Challenges: From the Past, at the Present and Into the Future

-

1.

Cross-Subsidizing Model: Inefficiency on Value Maximization

MAHB monopolistic airport operates concession. It is because of the perception that airport operators mostly have monopolistic control. It is over key infrastructure gateways to particular geographic locations. As such, investors can directly tap into the stability of a virtual public transportation network and the economic growth of a given region. Besides, investors gain access to the expected boost from population increases due to their correlation with increased flight travel. While all the facts mentioned above are reasonably valid, the MAHB concession may not seem straightforward due to the cross-subsidizing model since 1992. According to MAHB, over 75% of the 39 airports under its management are non-profit. It leads to the non-optimization of MAHB's full earning potential as profit-making airports subsidize those loss-making airports.

-

2.

Safety and Security Risk: Drug Trafficking and Kim Jong-Nam's Assassination

Since the 9-11 incident, the Airport's safety and security measures have been tightened tremendously in anti-terrorism efforts. The aftermath saw the implementation of facial recognition surveillance systems, biometrics fingerprints and multi-tier security checkpoints at both arrivals and departures. These additional measures affect the efficiency level of passenger clearing time. While MAHB recognized safety and security as top priorities of its performance, recent incidents at KLIA raised concerns about MAHB's competencies to address the issue.

In 2017, a North Korean was attacked and murdered with a V.X. nerve agent at Kuala Lumpur International Airport in daylight. Four North Korean suspects left the Airport shortly after the assassination and reached Pyongyang without being arrested. In 2019, the Malaysian Royal Police Force acknowledged the increase in drug trafficking activities in recent years and involved seizures of hundreds of millions of ringgit worth of drugs involving flight crews and Malaysian citizens. These incidents raised public concerns about MAHB's vigilance in managing safety and security matters. These weaknesses may have contributed to the downgrade of CAAM's rating.

-

3.

Lack Sense of Crisis on Technology Debt: KLIA System Failure Crisis 2019

The Airport ecosystem is comparable to a miniaturized version of a country. At any point, multi-dimensional activities are taking place in real-time, from air traffic management to retail operations within the Airport. Operating an airport requires deploying various highly integrated yet complex management systems. The effectiveness and efficiency of these systems are instrumental in ensuring smooth operations of the entire airport functions (Jaffer & Timbrell, 2014). Disruptions of these systems can be potentially catastrophic, which leads to financial losses.

On 21st August 2019, KLIA experienced an unprecedented system disruption when it is Total Airport Management System (TAMS) crashed at both terminals in KLIA. Affected the failure affected check-in counters, flight information display systems (FIDS), baggage handling, airport mobile app, as well as payment systems which rely on its networks. The event's impact was devastating, with flight delays and multiple systems malfunctions, from immigration processing to retail credit card transactions, which lasted for days. Airports are part of the nation's critical infrastructure. The incident exposed the Cyber-vulnerabilities of MAHBs in both preventive and proactive measures on emergencies and the need for MAHB to evaluate its exposure to technology debts which in this case is the inability to backup and restore the system on a timely basis.

-

4.

ISGIA, Turkey - The Elephant in the Room: Constraints for Domestic Needs

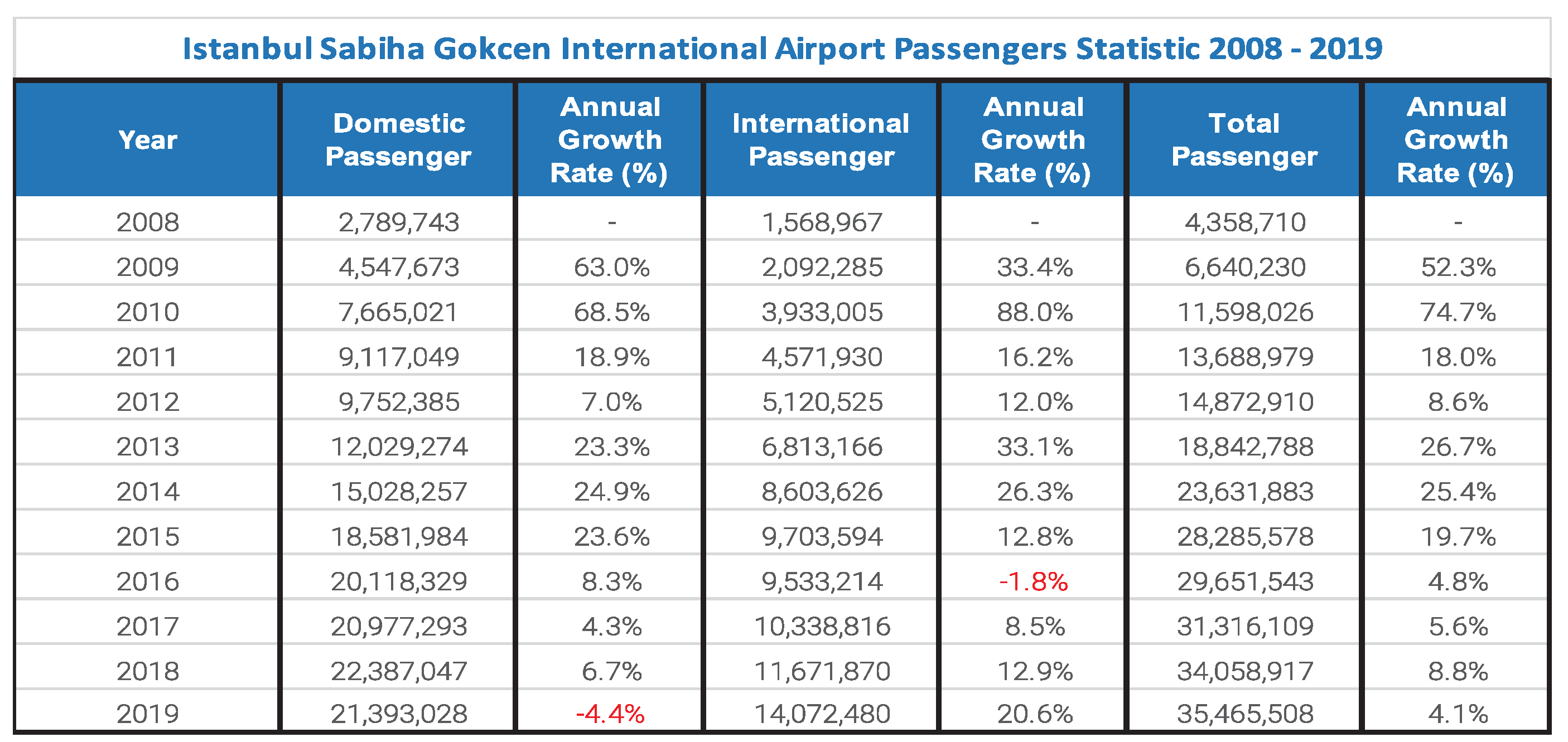

MAHB inspiration for expanding overseas can be traced back to 2008 when it successfully won the bid for a 20 years concession on ISGIA Turkey. The request is consistent with the group's direction to expand into foreign markets as an alternative source of income growth and mitigate its dependence risk on the domestic market. Istanbul, one of Europe's busiest and most rapid growth air travel hubs, presents an excellent opportunity for MAHB and the strategic potential of bridging the spillover effects of air traffic, linking Europe, the Middle East and Malaysia.

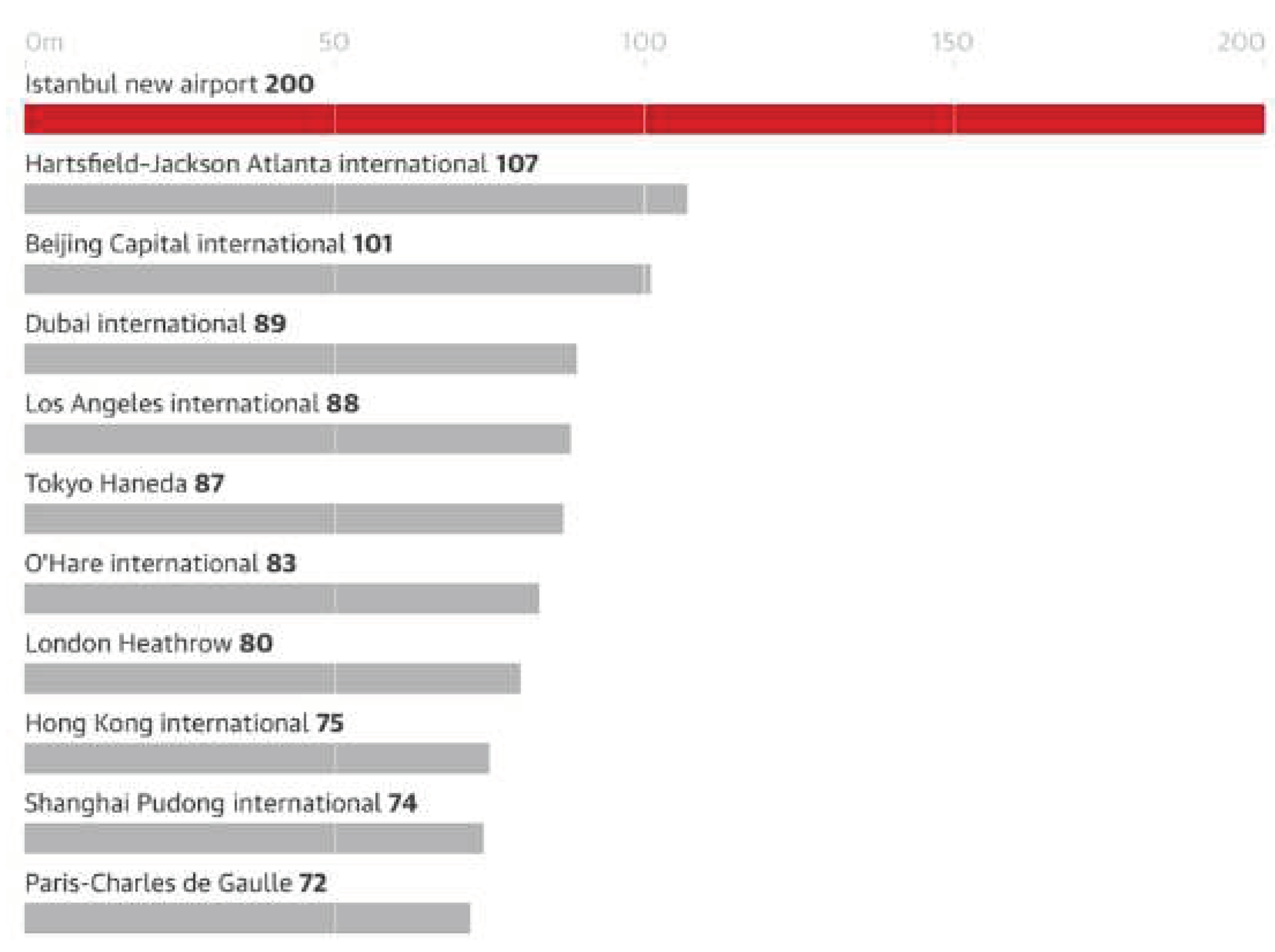

However, the reality is far from the truth. While ISGIA has achieved commendable passenger growth since 2008 (Exhibit 10.0), it remains a struggle with its ability to achieve profitability, especially after MAHB acquire a 100% stake in ISGIA (Exhibit 11.0). It is mainly associated with the high depreciation and amortization of the concession investment premium. The uncertainties become more alarming with the opening of Istanbul Airport (I.A.), which is within 70 kilometres away from ISGIA, in October 2018, replacing Istanbul Atatürk Airport, the fifth busiest Airport in the world before decommissioning. With a master plan of six runways, and four terminals capable of handling 200 million passengers per annum (Exhibit 12.0), I.A. is deemed to become the largest Airport in the world upon its completion by 2027. With ten remaining years left of the concession, it is questionable now on ISGIA's ability to achieve its expected return on investment.

Figure 10.

ISGIA Passenger Statistics 2008-2019. Source: ISGIA corporate website (2020).

Figure 10.

ISGIA Passenger Statistics 2008-2019. Source: ISGIA corporate website (2020).

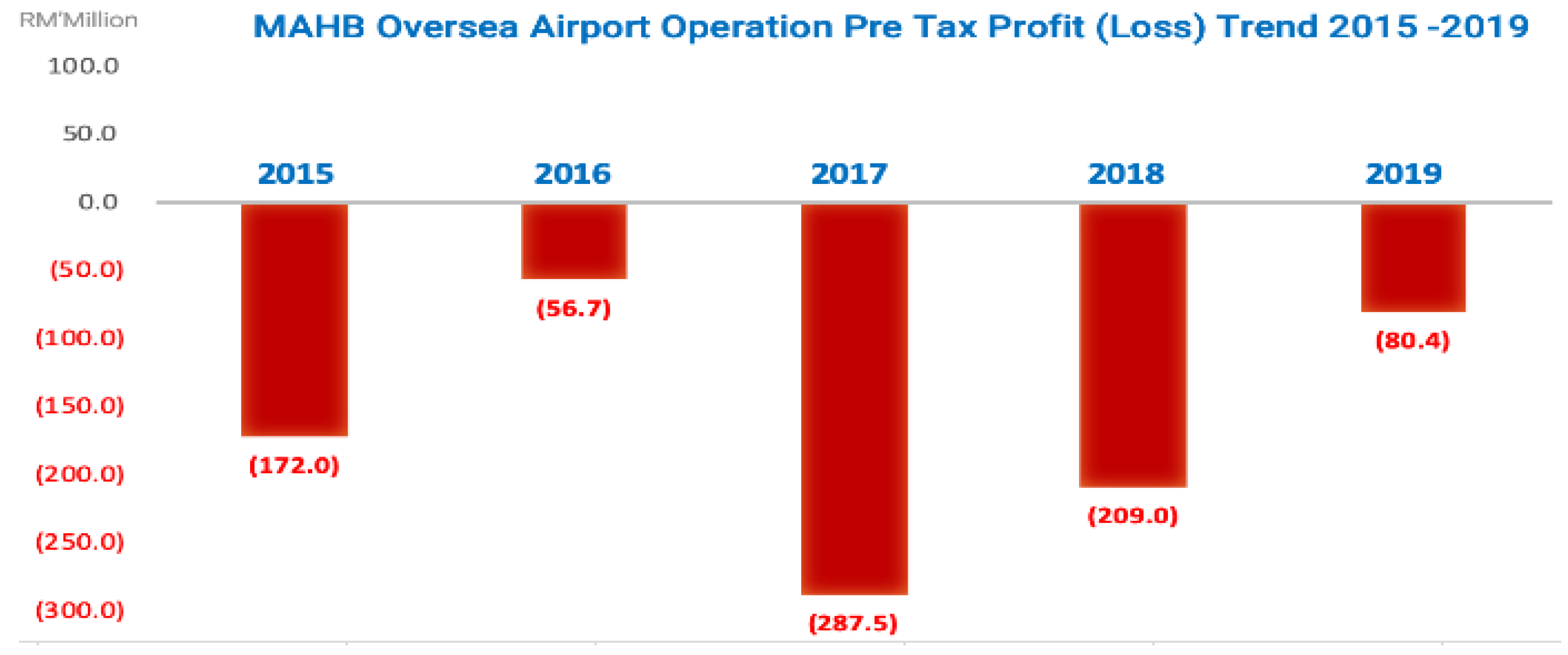

Figure 11.

MAHB Oversea Airport Operation Profit Trend 2015 – 2019. Source: MAHB Quarterly Results (2015-2019); Author generated (2020)

Figure 11.

MAHB Oversea Airport Operation Profit Trend 2015 – 2019. Source: MAHB Quarterly Results (2015-2019); Author generated (2020)

Figure 12.

World Airport Ranking by passenger capacity. Comparison of Istanbul Airport to its rivals in terms of Passenger Capacity. Source: The Guardian (2019)

Figure 12.

World Airport Ranking by passenger capacity. Comparison of Istanbul Airport to its rivals in terms of Passenger Capacity. Source: The Guardian (2019)

While MAHB overseas is facing stiff competition ahead, its domestic airport network has a different set of challenges that need to be addressed. Based on MAVCOM's analysis, Senai, Kuching, KLIA Terminal 1, Penang, and Tawau are identified to be in the 'sweating' airports category, which experiences a utilization rate of above 100% and a positive CAGR (

Figure 13). These airports must enhance operational efficiencies, optimize flight schedules, and expand airport infrastructure to address the congestion issue. Failure to address congestion may result in passenger flight delays and increased costs for airports and airlines.

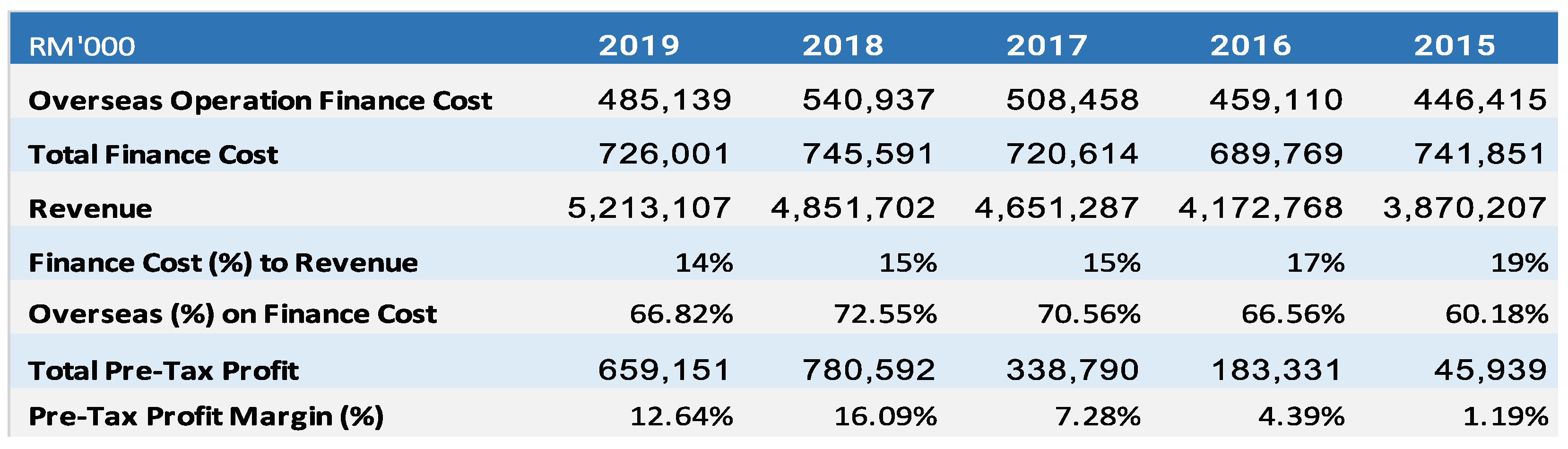

These scenarios suggest the need for MAHB for its domestic capacity expansion to capture revenue growth. Some of these airports have experience congestion over the years, translating to complaints over their service level. Based on MAHB's financial performance, high finance costs form a substantial portion of the revenue, which is between 14% to 19% (Exhibit 14.0). However, it is surprising to note more than 2/3 of the finance costs are associated with oversea operations. The COVID-19 impact might adversely affect MAHB's credit rating and ability to service its financial obligations.

Figure 14.

MAHB Financial Highlights Trend 2015-2019. Source: MAHB, Annual Report 2015-2019

Figure 14.

MAHB Financial Highlights Trend 2015-2019. Source: MAHB, Annual Report 2015-2019

-

5.

Potential Impact of NTP and NASP on MAHB Business Outlook

Under the National Transport Policy, strong emphasis on increasing the share of public and green transportation systems. In general, Malaysia will continue to build and upgrade the transport systems via road and rail network development to support the mobility of people and goods, while ports and airports such as KLIA and Port Klang support business and trade activities. Mega rail projects such as ECRL and High-Speed Rail (HSR), and the Pan Borneo Highway network will potentially affect the mode of travel trend moving forward, especially the domestic segment, due to the improvement of the efficiency of travel. These effects will likely impact domestic aviation travel growth in the future.

The up-and-coming NASP will potentially change the landscape of airport development. The new aviation policy will foresee the government's direction to develop a more efficient and competitive airport system via integration with the various transportation network and enhance its connectivity in Malaysia. Potential consolidations of non-performing airport networks and the ending of airport operator monopoly will potentially impact the MAHB outlook in the future.

-

6.

Competition for ASEAN Regional Aviation Transit Hub

With globalization and the rapid growth of the low-cost aviation industry, aviation is expected to see continuous development. While the ASEAN-SAM initiative that enables further liberation of air travel between ASEAN member nations presents positive opportunities, at the same time foresees an increase in competition for the regional aviation transit hub. Regional competitors are continuously upgrading their facilities to compete as the regional gateway. MAHB's business outlook will depend on its ability to compete effectively with these regional competitors.

Figure 15 indicates the benchmark of the regional rivals to MAHB's KLIA and the airport operator's performance. Based on the analysis, competitive aeronautical and passenger charges do not appear to be a critical advantage to KLIA despite being one of the lowest in the world.

Discussions

Profitability and Role on National Agenda - Too Much to Ask for Both?

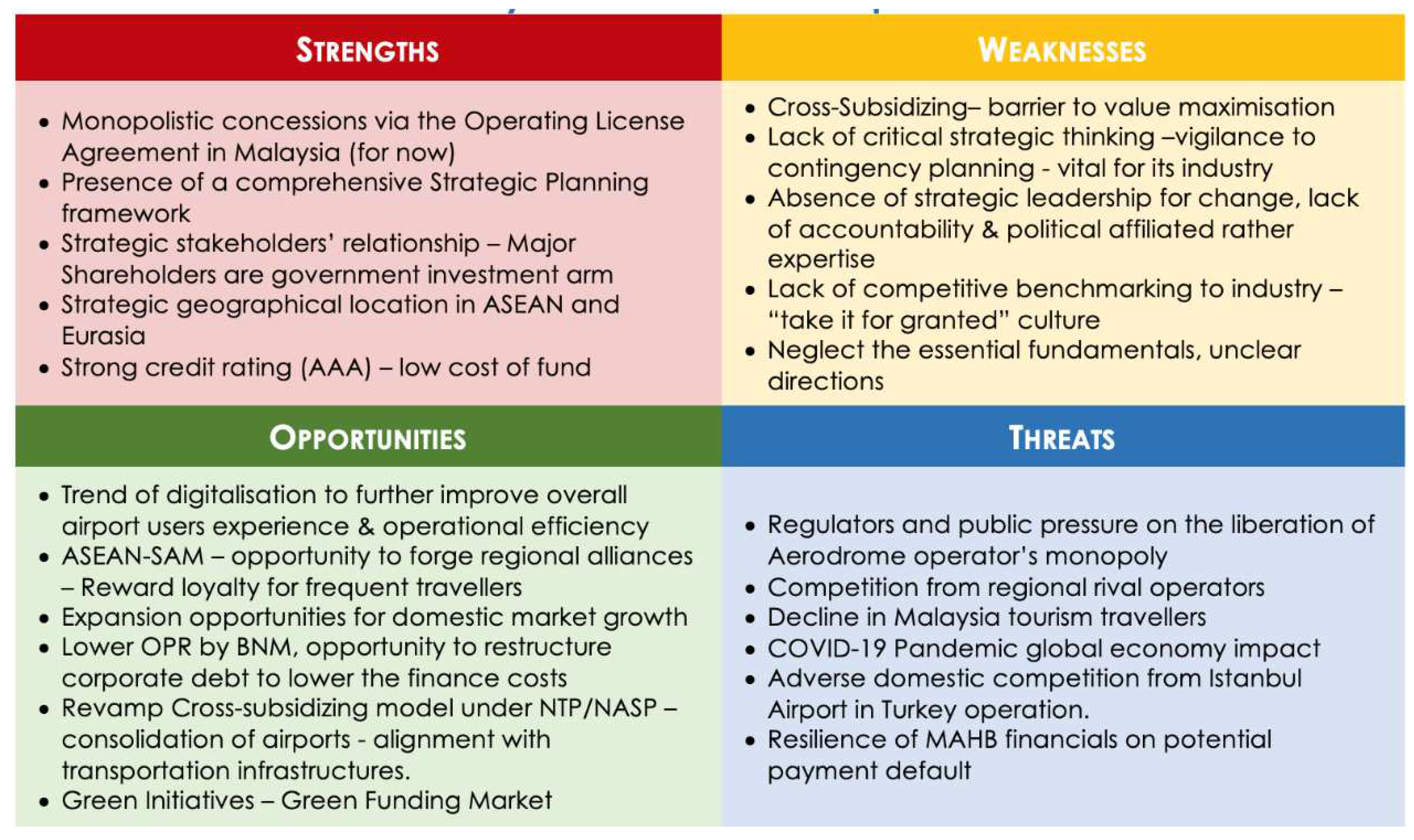

MAHB Value Creation Model is inclined to a strategic planning framework of a hybrid approach which integrates both the Industrial Organization (I/O) Economic (external perspective) and Resource-based Model (internal view). While there is nothing wrong with having a strategy framework that captures the best of both worlds, the issue of MAHB is not the framework itself but the gap between the reality of the market dynamics and the perspective MAHB has chosen to interpret them. Exhibit 16.0 present an alternative SWOT analysis from a strategic thinking perspective.

Figure 16.

MAHB SWOT Analysis – An Alternate Perspective. Source: Author generated (2023).

Figure 16.

MAHB SWOT Analysis – An Alternate Perspective. Source: Author generated (2023).

The role of organizational culture is one of the critical factors that influence the course of the strategic planning process. The fact is that MAHB is a government-linked company (GLC) that inherited the business because of the government's privatization exercise coupled with the monopolistic business model. MAHB's corporate culture remains bureaucratic-centric, political affiliation oriented, and somewhat lacks accountability based on the various incidents discussed in the case study. Management leadership and commitment are essential for effective strategic planning and implementation (Mintzberg, 1994), (Taylor, de Lourdes Machado, & Peterson, 2008). Of course, this notion assumes that the top management leadership possess the strategic foresight, the necessary industrial experience, and the competencies to steer the strategic planning process. The absence or lack of essential leadership and competencies makes the strategic planning exercise not only regressive, at worst, leading the organization in the opposite direction.

Thus, the issues can be summarised into two perspectives of the MAHB strategic management process 1) the lack of strategic thinking and leadership, which sees the misinterpretation of the business dynamics that leads to the inability to formulate the appropriate strategies, and 2) the lack of strategic change management. MAHB needs to review its strategy as illustrated in its value creation model, reprioritization to focus on essential fundamentals and realign its market strategy with natural market dynamics and clear business directions and objectives. A priority for MAHB strategic culture reform is necessary to facilitate the required strategy for change to shape a resilient and accountable for its future performance (Denison, 1990).

Human capital has been recognized as of the critical assets of a firm, especially in the service-oriented sector (Namasivayam & Denizci, 2006). The Airport is the country's first impression point for foreign travellers. Some of the most successful companies attribute their successes to exceptional values. The innovations of their people from the middle-lower level of the organization. The research and development of the frontline staff that interacts with its customers. Besides, the team performs functional tasks that translate to customers' experience. In that context, these people will be in the best position to identify the improvement area that enables them to perform their tasks more effectively and efficiently. In the MAHB value creation model, it scored 74% on its employee engagement scorecard. It indicates room for improvement, suggesting an inclusive culture that encourages innovation and ownership will improve its strategic planning process and reduce the resistance to change.

One of the prerequisites of an effective strategy is a clear vision, business direction and goals indicators (Taiwo, Lawal & Agwu, 2016). As a publicly listed company, MAHB's primary goal to its shareholder is to maximize its investment value, i.e. maximize its profitability. In the case of MAHB, the provision of aerodrome-related services for 39 airports in Malaysia accounted for more than 3/4 of its total FY2019 pre-tax earnings after considering the social obligation effect of cross-subsidizing the non-profit-making airports. The ability to revamp the cross-subsidizing model will potentially enhance MAHB earnings positively.

This case study supports Sinnaiah, Adam & Mahadi (2023) that strategic management and decision-making approaches are crucial for determining the performance of an organization. This paper emphasizes the significance of decision-making styles and constructs a framework for strategic management by analyzing existing literature on strategic management.

The results support Chao et al. (2017) that rapid technological and economic growth has resulted in excessive energy consumption and Co2 emissions, polluting the environment and eroding natural ecology. Airports around the globe are placing a greater emphasis on environmental management. Regular maintenance was considered the most efficient and straightforward method for conserving energy in air conditioning systems. Respondents indicated that increasing regulation and control would be the most effective measure for lighting systems while selecting appropriate light fixtures would be the simplest to implement. It is necessary for developing airports to implement energy conservation strategies.

According to Namazi & Rezaei (2023), the researchers recommend further study that the participation of all managers could reduce budgetary slack. It also increases it; strategic management accounting systems and affective organizational commitment function as mediating factors, whereas autonomous budget motivation cannot play this role. In addition, only the strategic management accounting system substantially impacts budgetary slack for higher-level managers. The evidence regarding middle managers confirms the significant effect of the mediating function of strategic management accounting systems, and only affective organizational commitment reduces budgetary slack for operating managers. Consequently, management levels postulate a significant contingency effect on budgetary slack-affecting constructs. By identifying the mediator variables, this research extends the budgetary slack theory and provides empirical evidence for each public health and medical services management level.

Conclusions and recommendations

In conclusion, MAHB's strategic planning model while is pretty commendable. Still, its lack of strategic thinking and a strategic cultural reform can potentially derail the company's course towards a market mismatch which can be catastrophic. The sector in which MAHB operates is highly operational, complex, competitive and of significant national importance. Therefore, it is both a great privilege and responsibility for MAHB management to observe the highest standards of strategic planning to remain resilient and competitive in the sector.

To address MAHB's issues and challenges, the following are some of the improvements that can be considered at 1) the Strategic Planning Process level, 2) the corporate and business strategy level:

-

1)

The need to strengthen the strategic thinking, leadership, and Strategic plan for organizational cultural change

Leadership-level reform must acquire the necessary competencies at both board of directors and key management levels. Based on the board of directors' profile, most of the members of the panels are mainly former public servants and non-aviation backgrounds. The critical functions of senior management need to be filled by experienced and qualified candidates in the aerodrome sector. The airport operating sector is highly complex and requires years of training to develop a competent professional, as highlighted by the company. Therefore, identifying industrial-related talents with global aviation exposure will be instrumental in bringing valuable experience and the change impact needed to strengthen MAHB's core competencies consistent with the resource-based approach to strategy.

-

2)

The need to revamp the cross-subsidizing model - Overlapping Aerodrome of airports – consolidation of airports network for operational efficiency

One of the main issues and perceived inherited setbacks of MAHB is the cross-subsidizing obligation of its operating license requirements. The over three decades old 39 airports network needs to be reviewed for its relevance to today's aviation needs. With the upgrading of the nation's transportation system over the last three decades, these improvements may potentially render the relevancy of specific airports. For example, the travel time between airports, which used to be 4 hours away, might be shortened to less than 2 hours due to better highway network connectivity and electrified rail systems. Therefore, instead of having multiple airports, MAHB can consider consolidating into a more strategic location that provides better economies of scale.

-

3)

The review of the viability of oversea operation – A crossroad decision

Firms need to expand their existing market driven by the goal of business growth and risk diversification on over-reliance on the single market. However, a rigorous feasibility study and continuous review of the market dynamics are crucial risk management tasks. The threat and concerns about Istanbul Airport operating since 2019 could increase the uncertainties of the ability of ISGIA turnaround. The fact that former concession partner Limak Group's exit from the ISGIA venture and also appears to be the consortium partner of Istanbul Airport should be highlighted by MAHB Risk Management. The ISGIA's low-cost terminal competing model, which suggests a price leadership competitive model, needs to be reviewed on its sustainability. The concept of a low-cost terminal is far from the truth, given that aerodrome infrastructure is highly regulated and observes the most stringent standards and specifications. Therefore, there is no such thing as low-cost runway low-cost airport management systems. The benchmark analysis of MAHB against its rivals also suggests competitive airport charges are not the only main selection criteria. With the remaining concession expiring in 2028 and the Turkish authority likely to fulfil its guarantee to the Istanbul Airport consortium, MAHB needs to anticipate the possible scenarios as part of its risk assessment using the Game theory modelling.

-

4)

Strategic partnership on Airport of the future – multiple strategic gateways competitive strategy & urban development model

Given the government's financial constraints, the existing model of government-invested infrastructure may not be able to meet aviation needs timely. Acknowledging the importance of connectivity for sustainable economic growth and the policy reforms via NTP and NASP presents an opportunity for MAHB to consider an alternative approach via a possible strategic partnership or joint venture for the aerodrome landscape moving forward. Capitalize on MAHB's strengths and expertise as the leading aerodrome operator. Combined with leverage on the potential partner's financial resources and integration real estate development expertise, MAHB will potentially be able to foster a mutually beneficial competitive advantage and sustainable growth moving forward.