1. Introduction

Entrepreneurial startups (ES) have emerged as the most valued idea since the beginning of 21st century compared to earlier years all around the world. These ventures could fuel the economy to be more productive and self-sustain for the domestic requirements, new job creations, and the resource utilization. The increasing demand of international products with the global distribution network has created an opportunity for export. Sustainability of entrepreneurial startup [

1] depends on many factors of the economy like economic situation, tax system, law, competition, funding opportunities, geographic region, and labor supply etc. [

2,

3,

4,

5] considered as the external determinants. The entrepreneurial start-ups may play an important role in achieving sustainable and inclusive growth by empowering marginalized and disadvantaged groups to start their own ventures. Inclusive entrepreneurship policies should be designed to ensure that everyone has equal opportunities for business creation and self-employment [

6].

At the same time factors motivates an individual to establish an entrepreneurial venture are no/low job satisfaction, professional experience, need for independence and autonomy, willingness to take risk, irregular working hours, influence of family/friends, opportunity to develop own skills, opportunity into market for own [

7] idea as the preferred choice option of internal determinants. Furthermore, internal determinants can be categorized with individual traits as skills identification of exploitation of potential market opportunities, creativity and innovation, delegation of decision-making, openness for change, leadership, ethics, communication ease of establishing contacts, resolving conflicts, personal culture, cooperation in achieving goals, pursuit of results, conscientious and reliable, stress resistance, and flexibility [

8,

9]. A holistic approach is required from different ESs engaging different agencies towards the implementation of policies contributing towards the capacity building process [

10].

The motivation for entrepreneurial startups is invisible and difficult to say about an individual. The comparison of success and failure of all entrepreneurial ventures [

11,

12] can provide the status of involved important success factors. This study is focusing on the assessment of selected determining factors from the literature on their importance based on the responses from sustaining entrepreneurial startups. Economic growth is depending upon the production capacity enhancement by startups. The participation in economic activities may be possible by promoting innovation, allocation of financial and non-financial resources to entrepreneurial startups. Though there is modification in factors of production in the era of entrepreneurial advancement. Still knowledge, capital as physical or human are basic requirements to transform entrepreneurship to become profitable to the economy stated by Adam Smith [

13]. There is a need for universities and research institutions to work towards development through collaboration from different industries in order to train the scholars regarding ESs that would contribute towards social inclusion and capacity building at the ground level [

14].

Nevertheless, the right information about determinants can make the system to plan for future startups. Entrepreneurial startups are based on three constituents, first is the entrepreneur [

15,

16], second is the government/non-government supports [

17], and the third is the geographical region [

18,

19]. Understanding of these three dimensions and their impact can be an evolution for shaping startups to be sustainable [

20]. This research is processing and filtering the existing determinants based on their priority to develop a conceptual model and justifying statistically for their incorporation. This study is required for individuals willing to venture for entrepreneurial startups and the training institutions to prepare themselves according to the framework. The ESs have the real potential to make a positive impact in the society in number of ways. The impact can be seen in the form of creation of employment, bringing in innovation, and addressing social issues to support economic growth of any country. The outcome model will uncover the internal conflict among determinants for their importance.

Entrepreneurial startups are always the interest area for academicians and researchers [

21,

22] with the motivation to provide additional support for the sustainability of entrepreneurial ventures. Society is the contributor and beneficiary [

23] of any entrepreneurial startups. Society is the consumer market that decides success or failure of any business entity. The entrepreneurial start-ups and society have a symbiotic relationship. The start-ups can benefit when a supportive ecosystem is provided by the society while on the other hand the society benefits from the creation of employment along with the new products and services [

24]. At the same time the growing number of startups produce competitive offers effecting the price structure of the market. These startups are the job creators for the work force in the society [

25]. Gross domestic product (GDP) is one of the important parameter to assess the development of an economy [

2]. It depends on the final production of products and services in the economy during a specific period. The higher the entrepreneurial startups the higher the GDP, they are directly proportional to each other.

The current research is aiming to gauze the importance of different determinant statistically on a comparative scale to find the most important factor as the determining factor for sustainability of entrepreneurial startups. Moreover, the outcome of this research will develop a model which may help academician and researchers to focus on specific determining factors to explore more support with their education and research contributions [

26]. The research will produce the model which can help the budding entrepreneurs to evolve themselves to those determinants. Entrepreneurial startups would be able to benefit with this work in reshaping their venture model to make it more efficient, which may lead to the sustainability. These entrepreneurial ventures have the potential to significantly impact society in a positive way by developing innovative solutions that take care of social economic and environmental sustainability.

This research is presented with a systematic flow of study in seven sections. The starting is with introduction which is presenting a detailed information about the study with its requirement and benefits following the presentation of research [

27]. It is the most important part in the sense of understanding the main theme of the study. The second section is theoretical background, which has the literature support for the justification of existing concept as decision criteria and determining factors for the selection of entrepreneurial startups. The third section is methodological approach explaining the measuring instrument, conceptual model, empirical and statistical approach adopted for the testing of hypothesis in this study. The fourth section is the empirical justification of hypothesis justifying the concept. The fifth section is the findings and results presentation based on analysis of framed conceptual model. The sixth section is discussion and conclusion drawn from the research. The seventh as the last section is discussing limitations of the research and opportunities for the future research [

28].

2. Theoretical Background

This section is providing an extensive but narrowed approach exploring the criteria and factors responsible for the sustainability of the ES. For this purpose, the research has collected a series of published work explaining different dimensions of ES. Employer business startups are disproportionate contributor to job creation and productivity growth. The complexity of the establishment goes through the trial and error leads to failure or rare to be successful [

29]. United States of America (USA) also has seen a fall in entrepreneurial startups post 2000 due to the necessity of innovation. There should be some structural changes to the business dynamism aligning with young entrepreneur requirements.

Societal challenges can get reduced with the intervention of ES, but the implementation and suitability completely depend on the entrepreneurial ecosystem (EE). New startups face challenges with scalability, and societal change for venture sustainability. Studies are comparatively less interested in the study regarding social sustainability of the venture compared to economic and ecological sustainability [

30]. Though innovative solutions, rapid decision making, flexibility, strategic focus, collective contribution, purpose driven vision, stakeholder collaboration are outcomes of challenges to become social sustainable.

An organized network to cater the financial and knowledge support to new ventures is the most basic requirement [

31]. A venture capital (VC) investment structure is the most advocated structure to strengthen the EE. There should be an arrangement to introduce entrepreneurs with other actors of the EE for a better sustainability of the startup. Another research focuses over the knowledge as a challenge for the innovation and development. It is an inherent challenge for such ventures to assess their knowledge capital which restricts them from expansion [

32].

An ES must be capable enough to transform their organization with knowledge. It is the basic requirement to convert the knowledge to innovation. Though there is a lack of commitment among actors and VCs, who are mostly interested to see the growth in their funds rather nourishing an entrepreneurial startup. Self-employment among young adults is being lucrative because of the drive by socio-economic, demographic, and geographical factors. It is evident from research that the young age and male gender are positive components rather an increasing educational development acts as a negative component [

33]. The study reveals that startups created for the self-employment are more opportunity driven rather necessity driven, questions the suitability of venture.

Market uncertainty can be seen in both ways positive or negative but in any case, the lack of confidence and exposure may drag the business to many other challenges. Entrepreneurship is a learned skill can be instilled through the systematic entrepreneurship education and business interest with academic discipline enhances competence as an entrepreneur, manager, and leader to establish and scale up a startup [

34]. Desire to achieve, power, fulfilling the market demand, supporting government, risk tolerance, and self-efficacy etc. are key entrepreneurial motivations act as determinant for an individual to have a desire significantly influences the success of an entrepreneurial startup [

35].

Individual psychological and social conditions are the major determinant for venturing and entrepreneurial startup. Entrepreneurial behavior has evolved as a new determinant shaped by self-perceptions and perceived subjective norms [

36]. The success of an entrepreneurial startup depends on the EE also, where the pre operationalized environment provides an easy launching pad for an entrepreneur. Generally the contextual determinants are considered but equal importance is required for EE [

37]. Environmental and individual conditions together determine the entrepreneurial success. Environmental conditions, human capital, and social capital is determined by individuals’ skills, experiences, and relationships [

38]. Nevertheless, the detailed analysis and understanding of individual and entrepreneurial ecosystem components are required to filter for the segregation of each component.

2.1. Entrepreneurial Startups Decision Criteria

Entrepreneurship needs courage to afford startup failure risk over an earning as an employee. Entrepreneurial courage and optimism motivate an individual to approach investors with their convincing startup model. Any entrepreneurial venture needs fund or financial resource for establishing startup. A very common structure adopted are the equity sharing or debt investment. An entrepreneur must plan well with the financing structure, where only equity, only debt or the mixed of equity and debt can fiancé the venture. A right financing ratio varies for each venture depends upon entrepreneur’s competence on financing decision.

Equity investors assess the venture investment potential based on entrepreneurial team, product/service, market, and financials. They evaluate startup based on potential return on investment within expected time duration [

39]. Investor’s decisions are data driven using machine learning approach for equity investment decision making process. Venture capitalists and angel investors evaluates a project on key criteria. However, each investor evaluates the project on different criteria generates a divergent approach in the decision making process [

40]. It is suggested to adopt the data driven decision making approach applying data science techniques.

Acquiring financial resources for a venture is a tiresome and time-consuming process. Equity investment mobilization rate is very low for new startups [

41]. It is more about networking and selling the future of venture must be visible to investor’s imagination. It is an essential requirement for an entrepreneur to develop a model to increase the likelihood and potential to convert an investor’s motive to equity. Equity investment necessarily does not guarantee the startup success, many ventures with the equity investment also failed in the European world [

42]. For sure, it decreases the risk for the failure of individual investment.

An initial startup faces more challenges for financial resources. Debt financing is comparative easier process to access financial support. Though, debt is not a preferable option generally because of a heavy burden of interest payment in any case to lender [

43]. Still, irony of the fact is debt financing is inevitable for an early age startup. Ratio of debt financing may vary depending upon proposed financial structure of venture by an individual depends on the nature of the venture. Debt is a burden acts as resistance in growth of the startup. Empirical evidence shows that the income of the venture is fundamental for the sustainability of the venture which may help in debt reduction for venture’s financial sustainability.

Though venture financing is critical to decide and depends on many factors like market conditions, economy, legal and regulatory guidelines. Still, debt financing is assumed as one of the best methods to generate financial sources for a startup [

44]. Debt financing needs to get utilized smartly as the short term and long-term usage to reduce the interest payments. It is easier to payback from sales earnings. Bank debt sourcing is challenging for a startup [

45,

46]. A bank evaluation criterion looks for the equity holding and financial valuation of the venture. Moreover, the entrepreneur’s credentials and business operating history restrict banks for a debt financing to a startup.

However, a combination of debt and equity financing can be an advantageous proposition for a nascent startup. The ratio may keep changing over the business life cycle and other conditions to keep the venture financially healthy [

47]. A new startup should aim to create a value proposition and must be able to uplift valuation by reducing the total cost of invested capital. Venture capital (VCs) firms are the best to evolve and shape a new venture with their financing support and non-financial nurturing at the same time. In simple terms equity financing preference defines entrepreneur’s confidence with own venture [

48]. In this case the entrepreneur looks for a lesser debt financing. Capital structure is an individual own choice for preference of debt over equity or vice-versa.

Entrepreneurial startup decision criteria are constituted of funding or financing support to the startup. The current research looked for many studies discussing financing opportunities and implications. Funding is mostly divided in two criteria debt and equity. Investors chose the either of the option or sometimes a mix of both criteria [

49,

50]. After having the extensive exploration of existing financing structure, still the available funding to startups is unclear in a broader sense. An entrepreneurial startup may have a comparative weak business proposal, but the rejection for the fund kills the venture at an early stage of conceptualization.

The research in the area of financing preferences the hierarchy considered by pecking order theory makes the clarification on choice of the owner for their financing decision. Believe in their own business is keeps them motivated for own equity rather external financing [

51]. It shows that the orientation of the firm is also very important, there is a comparatively less debt than the equity in the case of high worth business. In one of the study the findings report that a lower level of debt has a strong support to the “credit rationing” theory. These findings may be interpreted like the almost same level of business borrowers having a lower level of financing structure will not receive the credit. It is a challenge for minority borrowers in the terms of credit quality rating, the chance of approval is very less when they apply for a loan.

It is well understood that the capital structure is the personal preference of choice for an entrepreneur. Here again the evidence for the owner preference on equity and debt ratio is about the attitude of the decision maker considering the risk factor and the capability to play on debt and equity requirements. In fact, the personal choice may have a better capital structure for private business entities [

51]. Applicability of the capital structure theories is much crucial for financing decisions compared, as it looks with an overview for private companies. Moreover, the effect of capital structure components is also very important for private firms, which impacts owner preferences on investment criteria. The study over existing firm’s capital structure may be a more structured way for new establishing firms, where the cited challenges can be fixed by some other way.

2.2. Entrepreneurial Startups Determining Factors

Entrepreneurial startups mushrooms on the ground having conducive support system. The motivation for an individual for sure is an internal factor but the compelling stimuli is external factor. These internal and external factors are considered as internal determining factors and external determining factors. An extensive exploration for existing determining factors conducted to develop the concept. Factors accepted in existing literature further tested empirically to adopt in this study. Methodology section critically explains the process and requirement for evaluation.

Economic situation of the country is a major determinant to attract entrepreneurial startup. Entrepreneurial ventures have a proven track record of job creation and contribution to gross domestic product (GDP). More positively creates a competitive advantage for the country [

52]. Contrary to this, the possibility of entrepreneurial startup is possible in the country with a stable economy and economy with the vision to grow. Though research shows there are different types of ventures which may survive in different economic situations [

53]. Macroeconomic environment of the country and commitment to support entrepreneurial startup is proportional to each other.

Tax system of the country is the determinant to make or break the financial structure. Relationship between tax system and business startups has been tested [

54]. An entrepreneur’s decision to sustain with a startup is largely challenged by tax system. Economic freedom with tax exemption reduces the burden on a newborn firm. Research has witnessed the likelihood of a higher density of entrepreneurial startups in tax free country and reversely a higher tax decreases entrepreneurial participation in the economy. A country must create a culture providing incentives in the system for laws and policies. Regulatory freedom is the same important for a startup [

55]. A trust and positive motivation towards venture creation can be possible by implementing the legislative changes. In the case of innovation driven startups needs the legal protection and regulatory support to save from unexpected failures in the process of development [

56].

Market competition can be seen in both senses as positive and negative. A healthy competitive market generates a wider clientele and opportunity to grow [

57]. At the same time a tough competition with the offering narrows the path for a new startup unless it is innovation with differentiation. An entrepreneur looks for the existence of a fair competition in the market with some window to showcase their offerings. Financial offerings in the economy from government and private investors in the form of debt or equity attract entrepreneurs [

58]. Geographic region is the determinant for required resources with uninterrupted supply keeps the startup sustainable [

59,

60]. Competent labor requirement for the venture is a problem, which is not easy to solve. Labor force is not about the human being, but the employable and capable labor available in the market [

61].

Internal determinants are divided in two parts as individual preferences and individual traits. Preferences are internal motivation which comes with intuition or experience. In the lack of job satisfaction, the motive for own startup germinates [

62]. Professional experience builds competence and confidence to establish own startup. Success rate of this is not very high, but a sensible step and continuous learning brings success [

63]. Humans by nature want to be independent and seek for autonomy, which looks achievable with entrepreneurial ventures. Individuals self determination to work independently is a string driving force to be an entrepreneur [

64]. Risk taking abilities and willingness to take risk is another important determinant. Entrepreneurial ventures are always risk involved, where the future is unknown. A compensatory return on risk with any venture acts as a behavioral determinant for startup [

32,

35].

Entrepreneurship is a choice option in some cases where irregular working hours which does not keep bounded for working hours [

65]. Family and friends act as influencer for any career choice. The same is with the choice to enter for entrepreneurial startup and they become the informal business partners also [

66], and sometimes they become investors too [

51]. Entering for own startup on a small scale is a good opportunity to develop own skills as an entrepreneur before jumping for something big [

67], which at least connects with many entrepreneurs and strengthens networking. Another important self-preferred internal determinant is opportunity to showcase own business idea. An entrepreneur not necessarily always dreams a big picture of the business, rather most of them believe to showcase their idea and search for potential with value creation [

68].

Another set of internal determinants are individual traits which is not the same with everyone, but some are available with every human being, and many can get learned over time. Potential market opportunities exploration skill excites an individual to establish entrepreneurial startup [

69,

70]. Creativity and innovation are the most important requirement for any enterprise to bring differentiation. A startup with creativity and innovation has a higher potential to be successful [

71]. Decision making delegation makes one feel competent, trust, and authority [

72] in their own venture. Change is constant, entrepreneurship brings change every now and then during executions for an entrepreneur [

73]. A leadership choice is best suited to an entrepreneur [

34,

74] to lead self-life, business and the life of dependent on their venture.

Ethical practices are prerequisite for a long-term sustainable venture. An individual believing and following ethics would love to own the business to work with ethical values [

75]. A communicative and good in networking person can establish and expand the business [

76]. Resolving conflict is a skill always required with an entrepreneur [

77]. Culture is not same for everyone, one’s own personal culture preference and motivation to implement with others inspires to setup a venture [

78]. Cooperation in achieving goals behavior makes an entrepreneur successful and establishes a sustainable venture [

79]. An orientation to deliver result is a committed approach for an entrepreneur [

80]. Conscientious and reliable characteristics energies an individual for their contribution [

81]. Stress is together with an entrepreneur, the dare to cope with stress can keep an entrepreneur calm in challenging situation [

15]. An entrepreneur must possess a flexible nature as per requirement [

82].

3. Methodological Approach

The skeleton and structure of the research process is the backbone of a good research. Here, this section is discussing the detailed view on the adopted methodological approach [

83]. The complete research methodological approach encompasses through an organic process of understanding of research design, type of study, method selected, scope of the study, sampling design, sample size, measuring instrument, and analysis techniques and tools applied [

28,

84,

85]. The research problem sentenced in an articulated frame to keep aligned with introduction, and theoretical background section. At the same time research questions, and objectives formulated to keep the study controlled towards the aforesaid orientation. Furthermore, a conceptual model proposed, and some logical hypotheses assumed for the requirement of justification of the study.

The current research has chosen the descriptive research design approaching the research problem qualitatively [

86]. Entrepreneurial startups sustainability decision criteria, and the determining factor are the outcome of entrepreneurial ecosystem, which is still in the process to exploration and expansion. Still, the chosen concepts for this study are some explored and expected variables. This research is testing those variables for revalidation with empirical data applying statistical tools. It is a cross sectional study conducted in a phased distribution, where the first phase was conceptualization and variables selection [

87]. The second phase was the instrument development and the data collection. The third phase is the reporting of study, for this complete process of three phases all together a duration of eighteen months devoted [

88,

89,

90].

The survey method adopted applying the questionnaire as an instrument to collect data from entrepreneurial startups [

91]. A purposive sampling design of non-probability sampling is the best suited and most acceptable for choosing the right respondent. A sample size of 124 valid respondent’s data is incorporated in the study [

92,

93]. The questionnaire applied with six different segments having relevant items related to demographical, and conceptual variables. Statistical tests of One-Sample Kolmogorov-Smirnov Test, Automatic Linear Modeling, Importance Matrix, Correlation and Regression applied to validate the conceptual model with the testing of hypotheses [

94,

95]. The study can be devised as conceptual scope, geographical scope, and industrial scope. This research is themed around the decision criteria and determining factors as two major conceptual variables. The study is conducted in the West Pomeranian voivodship mostly named as Szczecin city in Poland. Entrepreneurial startups are the core of industrial scope, focused to the specific discussion only with new ventures [

61,

75,

81].

A comprehensive discussion provided about the concept and underpinning variables as the theoretical background section. The introduction section is also well presenting the present, and past of the scenario uncovering each variable as separate paragraphs. There are many concepts and models presented justifying the entrepreneurial research from many multidimensional approaches [

96,

97,

98]. As stated in earlier sections about the aim and scope of the study with a cushioned background about the selected concept and the specific dimension of entrepreneurial startups, the study requires a structured research problem with the clarity of thought to make it clear for other researchers.

The study frames a specific research problem that is based on the detailed discussions. Entrepreneurship and the entrepreneurial startups are the continuous phenomena required for every economy. The lack of an efficient ecosystem and incompetent trait of an entrepreneur drags the entrepreneurial startup to a failure [

84,

88]. Therefore, an assessment on decision criteria and determining factors categorizing them with their importance may provide requisites to lead a successful entrepreneurial startup contributing to the social inclusion and capacity building.

Solving the above stated research problem needs to have intriguing research questions, which must be able to extract the right answers providing an acceptable solution to the problem [

99,

100,

101]. Research question framed are stated further. (1) What are the hidden components of decision criteria of successful entrepreneurial startups? (2) Which are underlying components of determining factors of successful entrepreneurial startups? (3) Which are the correlated components of decision criteria, and determining factors of entrepreneurial startups?

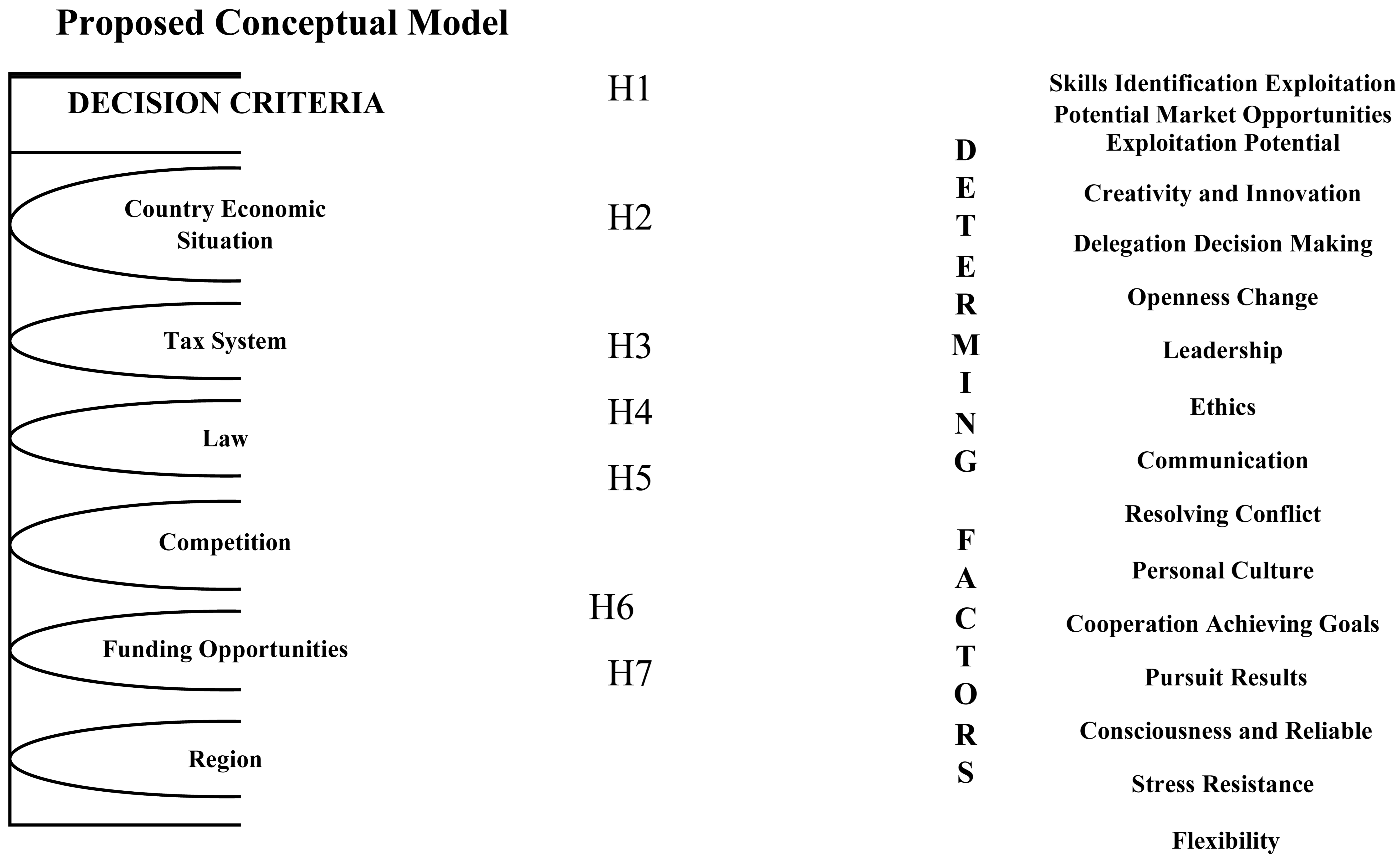

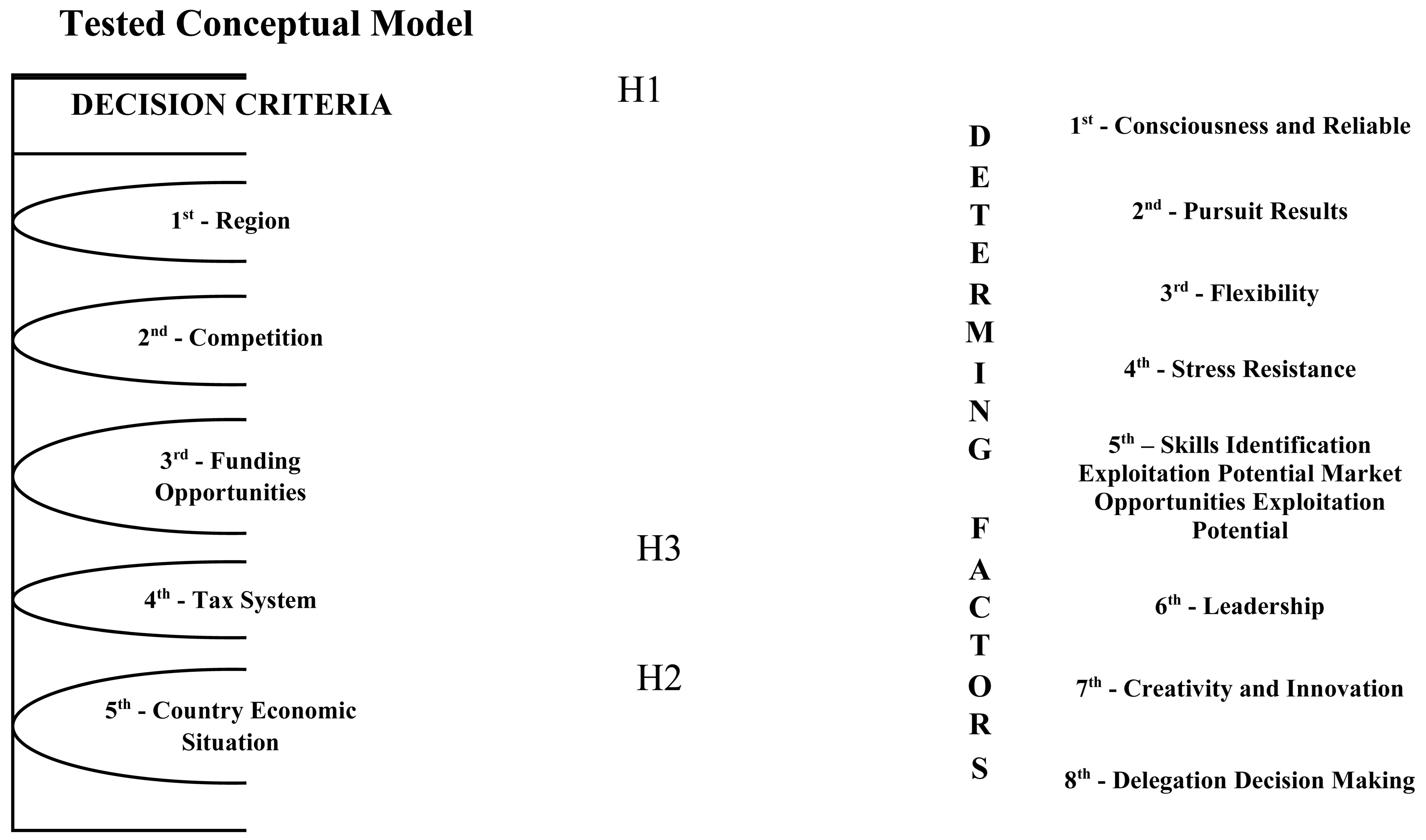

The research objective is the predetermined thought based on the research problem and question framed [

45,

84,

88,

102]. The current study also as a set of objectives to approach the research problem are presented. (1) To know the importance of each decision criteria and determining factors of entrepreneurial startups. (2) To statistically revalidation of correlations of components of decision criteria and determining factors of entrepreneurial startups. (3) To measure and justify the requisites for a successful entrepreneurial startup with respect to decision criteria and determining factors components. The proposed conceptual model is drawn based on the understanding of concept to validate the correlation and effect of decision criteria on determining factors of entrepreneurial startups. Here the study assumes some hypotheses are written for their statistical testing.

H1:

Decision criteria and determining factors of entrepreneurial startups are correlated.

H2:

Country economic situation effects determining factors of entrepreneurial startups.

H3:

Tax system of decision criteria influences determining factors of entrepreneurial startups.

H4:

Law is one of the most important criteria effecting entrepreneurial startups determining factor.

H5:

Competition is the compelling criteria for determining factors of entrepreneurial startups.

H6:

Funding opportunities are decisive criteria effects determining factors of entrepreneurial startups.

H7:

Region as a decision criteria effect determining factors of entrepreneurial startups.

4. Empirical Analysis and Hypothesis Testing

This section is presenting the empirical support to the concept based on data collected through the survey questionnaire. The research has tested the acceptance of conceptual variables applying the One-Sample Kolmogorov-Smirnov test [

103] conducted on the data set (

Table 1 and

Table 2). A non-parametric test is chosen because of the non-probability sample selection for the data collection. The test is applied to check if the sample is showing a normal distribution. The most important analysis for this study is conducted as the Automatic Linear Modeling (ALM) of regression analysis to rank predictors based on their importance. Lastly, the correlation and regression analysis conducted to test hypothesis statistically based on data for their acceptance or the rejection in this study [

84].

The analysis presented in the above table (

Table 1) is for the total sample of 124 respondents. This reveals that the population is not normally distributed as the asymptotic p value is below 0.05 as the selected level of significance, for all the six decision criteria variables. The Kolmogorov-Smirnov Z value for each variable is presented in decreasing order as: Law-5.127 > Funding Opportunities-3.874 > Region-3.505 > Country Economic Situation-3.410 > Tax System-3.275 > Competition-3.274. Therefore, it can be interpreted that the influence of Law is highest while making decisions followed by the influence of the funding opportunities available to the population. The role of region as decision making criteria is also important and tax system as well as competition are close to each other when it comes to influence the decision of the respondents. These all variables are qualified for the further tests and analysis.

Table 2.

Determining Factors One-Sample Kolmogorov-Smirnov Test.

Table 2.

Determining Factors One-Sample Kolmogorov-Smirnov Test.

| Determining Factors as Testing Parameter |

Exponential Mean |

Most Extreme Differences |

Kolmogorov-Smirnov Z |

*Asymp. Sig. (2-tailed) |

| Absolute |

Positive |

Negative |

| Skills Identification Exploitation Potential Market Opportunities |

2.63 |

.316 |

.149 |

-.316 |

3.523 |

.000 |

| Creativity and Innovation |

2.54 |

.325 |

.140 |

-.325 |

3.624 |

.000 |

| Delegation Decision Making |

3.50 |

.322 |

.240 |

-.322 |

3.590 |

.000 |

| Openness Change |

3.11 |

.369 |

.201 |

-.369 |

4.111 |

.000 |

| Leadership |

3.22 |

.267 |

.211 |

-.267 |

2.975 |

.000 |

| Ethics |

2.94 |

.288 |

.183 |

-.288 |

3.207 |

.000 |

| Communication |

2.65 |

.315 |

.151 |

-.315 |

3.505 |

.000 |

| Resolving Conflict |

3.44 |

.344 |

.234 |

-.344 |

3.828 |

.000 |

| Personal Culture |

3.00 |

.414 |

.189 |

-.414 |

4.610 |

.000 |

| Cooperation Achieving Goals |

2.97 |

.286 |

.185 |

-.286 |

3.185 |

.000 |

| Pursuit Results |

2.67 |

.312 |

.154 |

-.312 |

3.479 |

.000 |

| Consciousness and Reliable |

2.64 |

.316 |

.150 |

-.316 |

3.514 |

.000 |

| Stress Resistance |

3.13 |

.311 |

.202 |

-.311 |

3.463 |

.000 |

| Flexibility |

2.94 |

.317 |

.182 |

-.317 |

3.526 |

.000 |

The above analysis presented in the above table (

Table 2) reveals that the population is not normally distributed based on the data of 124 respondents, as the asymptotic p value is below 0.05 for all the fourteen determining variables. The Z value for each variable are presented in decreasing order as: Personal Culture-4.610 > Openness Change-4.111 > Resolving Conflict-3.828 > Creativity and Innovation > 3.624 > Delegation Decision Making-3.590 > Flexibility-3.526 > Skills Identification Exploitation Potential Market Opportunities-3.523 > Consciousness and Reliable-3.514 > Communication-3.505 > Pursuit Results-3.479 > Stress Resistance-3.463 > Ethics-3.207 > Cooperation Achieving Goals > 3.185 and Leadership-2.975. Therefore, it can be interpreted that the influence of Personal culture is highest as determining factor followed by the influence of the openness and change available to the population. The determining factors of resolving conflict and creativity and innovation are also close to each other. The least influence is of the leadership as a determining factor. Though all fourteen variables are qualified for further test and analysis.

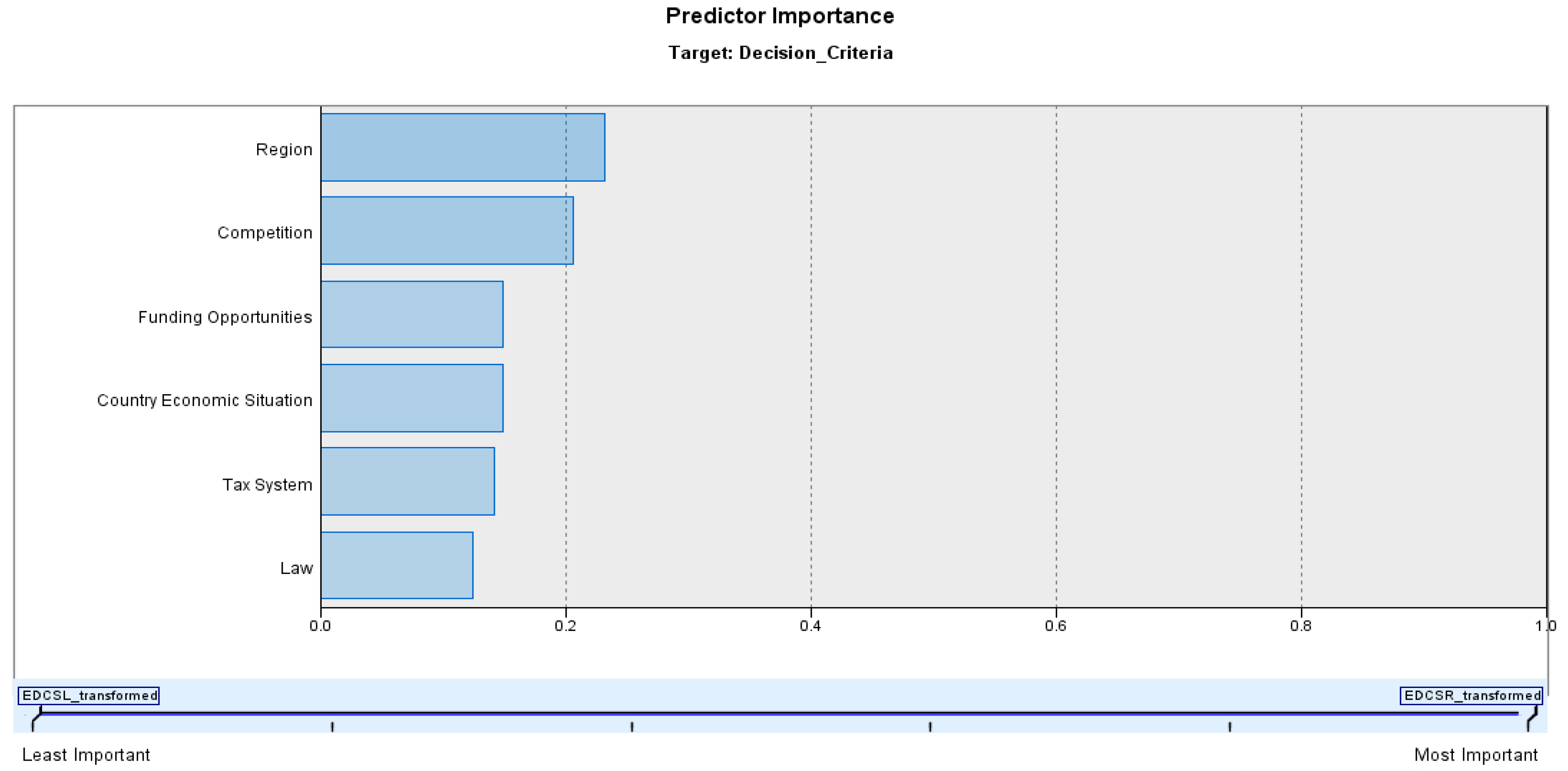

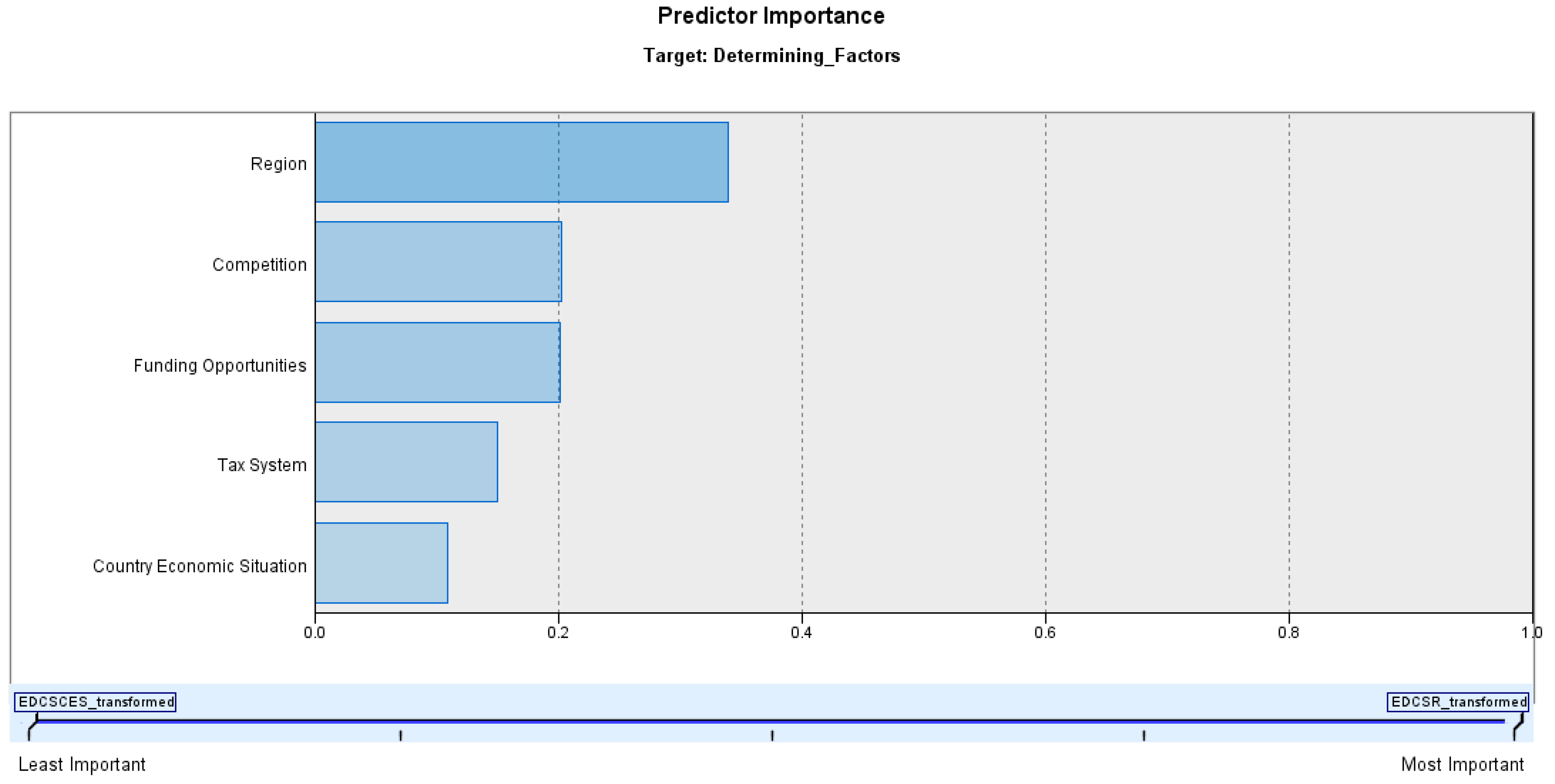

The importance matrix is the outcome of regression analysis applying Automatic Linear Modeling (ALM). The main idea behind this test is to present variables in a hierarchical order based on their importance. The matrix (

Table 3) presented for the variables of Decision Criteria for their importance within themselves taking the Decision Criteria as Target. The importance value is calculated, and the ranking is presented in the decreasing ranking order Region > Competition > Funding Opportunities > Country Economic Situation > Tax System > Law shows that within the condition of Decision Criteria, Region is the most important, but Law is the least important for entrepreneurial startups in Poland. The above presented table (

Table 3) is based upon the outcome from Statistical Package for Social Sciences, Version 23 (SPSS 23) as the figure shown (

Figure 1), which has the more authenticated and trustworthy reporting. Here all these six variables are accepted in the importance ranking.

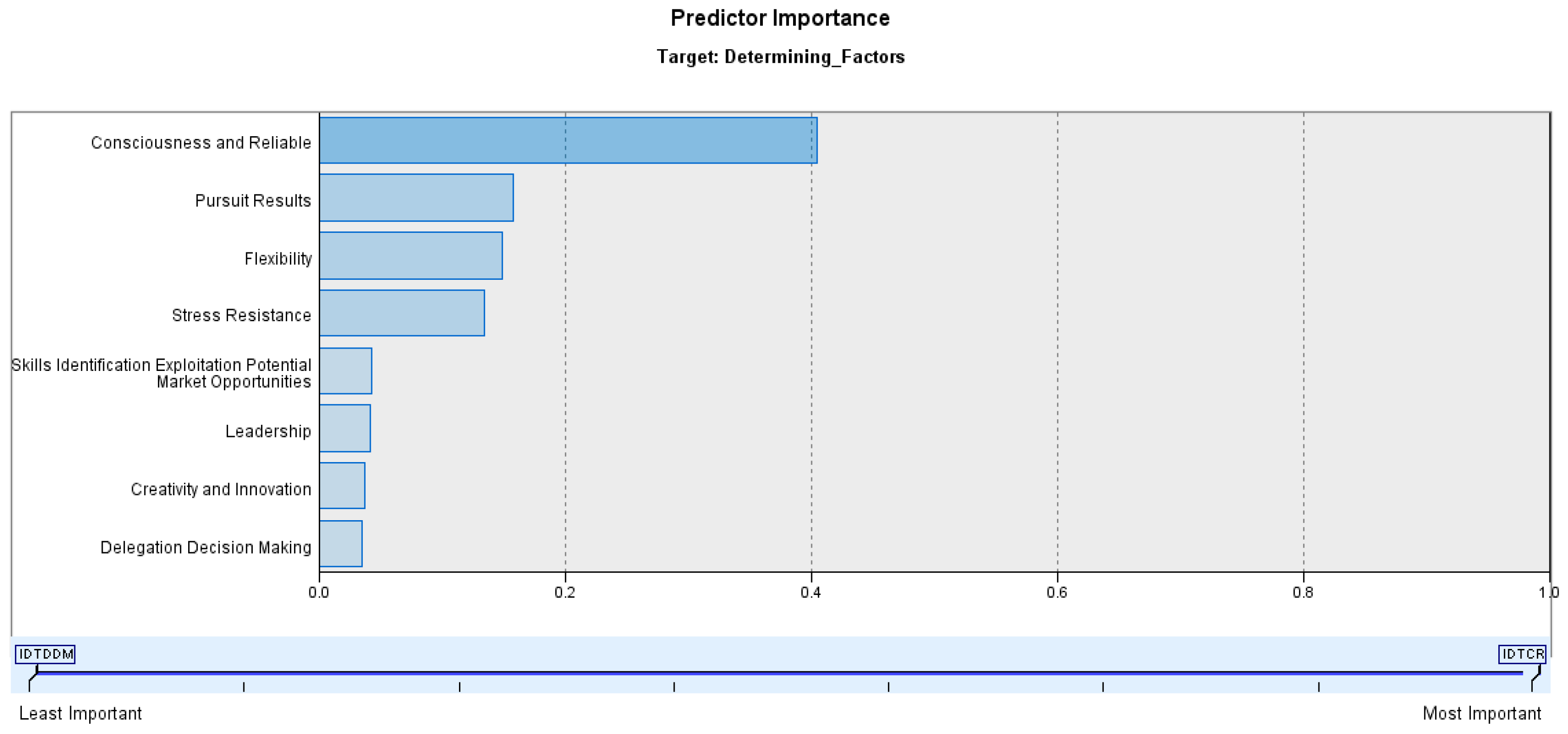

Furthermore, the analysis is conducted for Determining Factor as the target for underlying fourteen variables for their importance rankings. The importance matrix is prepared based on the ALM outcome of regression analysis. The SPSS 23 outcome rejects six variables from the importance listing. Only eight variables are getting accepted for the importance (

Table 4) within the Determining Factor among themselves. The eight variables are ranked with the decreasing importance value as Consciousness and Reliable > Pursuit Results > Flexibility > Stress Resistance > Skills Identification Exploitation Potential Market Opportunities > Leadership > Creativity and Innovation > Delegation Decision Making (

Table 4), and the decreasing ranking order too. The table is created based upon the SPSS outcome (

Figure 2), which clearly shows the listing from the most important to the least important. Consciousness and Reliable is considered the most important variable, though the Delegation Decision Making is the least important variable in the selection of entrepreneurial startups Determining Factors.

The next analysis in the same process is conducted for assessing the importance of the six variables of Decision Criteria with the Determining Factor target (

Table 5). This is the third analysis of the same kind for this specific process of categorization of variables for their importance. The result is rejecting one of the variables though five variables are ranked in the decreasing order of importance as Region > Competition > Funding Opportunities > Tax System > Country Economic Situation (

Table 5). Law is lost with its importance as the effecting variable for the Determining Factor. The table is reported based on the outcome of SPSS 23 (

Figure 3), which clearly shows that Region is the most important variable considering Determining Factor. Whereas the Country Economic Situation is least important variable in consideration of entrepreneurial startups.

The last analysis is the correlation and regression analysis for the hypothesis testing. Based upon the proposed conceptual model, there are seven hypotheses framed as H1-H7. The regression analysis specifically conducted choosing each independent variable, and the corresponding dependent variable for the assessment of correlation value (R/Beta), and the effect value (B) is presented as a tabular form (

Table 6) for concise and clear understanding of the test.

There are seven hypotheses framed where the dependent variable is Determining Factor is fixed for all cases (

Table 6). The H1 (Decision Criteria) shows a significant outcome with a very low R and B. The H2 (Country Economic Situation), H3 (Tax System) are under the acceptance level of p value showing the significant results but the same as the H1 showing a very weak R and B. The H5 (Competition) is somehow near to acceptance range of p value but the similarly very weak in R and B as other hypotheses. The H4 (Law), H6 (Funding Opportunities), and H7 (Region) are insignificant with their p values and a weak value of R and B makes these three hypotheses very incompetent for acceptance.

5. Findings and Results

The research analysis has provided a multidimensional view on the data with statistical tests justifying the chosen concept [

85,

104,

105]. The current section is dedicated to the findings and results of the study. The first analysis is One-Sample Kolmogorov-Smirnov Test which is testing the variables acceptance of both the dimension Decision Criteria (

Table 1) and Determining Factor (

Table 2). Decision Criteria has six variables with exponential mean values are in between 2.34 to 3.24, and the absolute difference values are in between .294 to .460 with a asymptotic significant values p < 0.05 shows that there is no goodness of fit of model. The similar way Determining Factor is analyzed with fourteen variables with exponential mean values are in between 2.63 to 3.50, and the absolute difference values are in between .267 to .414 with a asymptotic significant values p < 0.05 shows that there is no goodness of fit of model. Therefore, both dimensions are not showing the normal distribution of data for their six and fourteen underlying variables respectively.

The second analysis is the justification for the acceptance of underlying six variables, and fourteen variables for Decision Criteria (

Table 3, and

Figure 1), and Determining Factor (

Table 4, and

Figure 2) respectively for their importance and ranking in their specific category based on the ALM regression. Though all the six variables of Decision Criteria are accepted and ranked as the importance of 0.231 as the highest for Region to the 0.124 for law as the least value. For the Determining Factor, all fourteen variables are tested but only eight are accepted as the important factor with the highest value for Consciousness and Reliable with 0.404 which is the highest and 1

st ranked, whereas the Delegation Decision Making scored 0.034 with the least score and the last 8

th rank in the acceptance series. There are six variables from Determining Factor are Openness Change, Ethics, Communication, Resolving Conflict, Personal Culture, and Cooperation Achieving Goals lost their acceptance for ranking in the importance matrix.

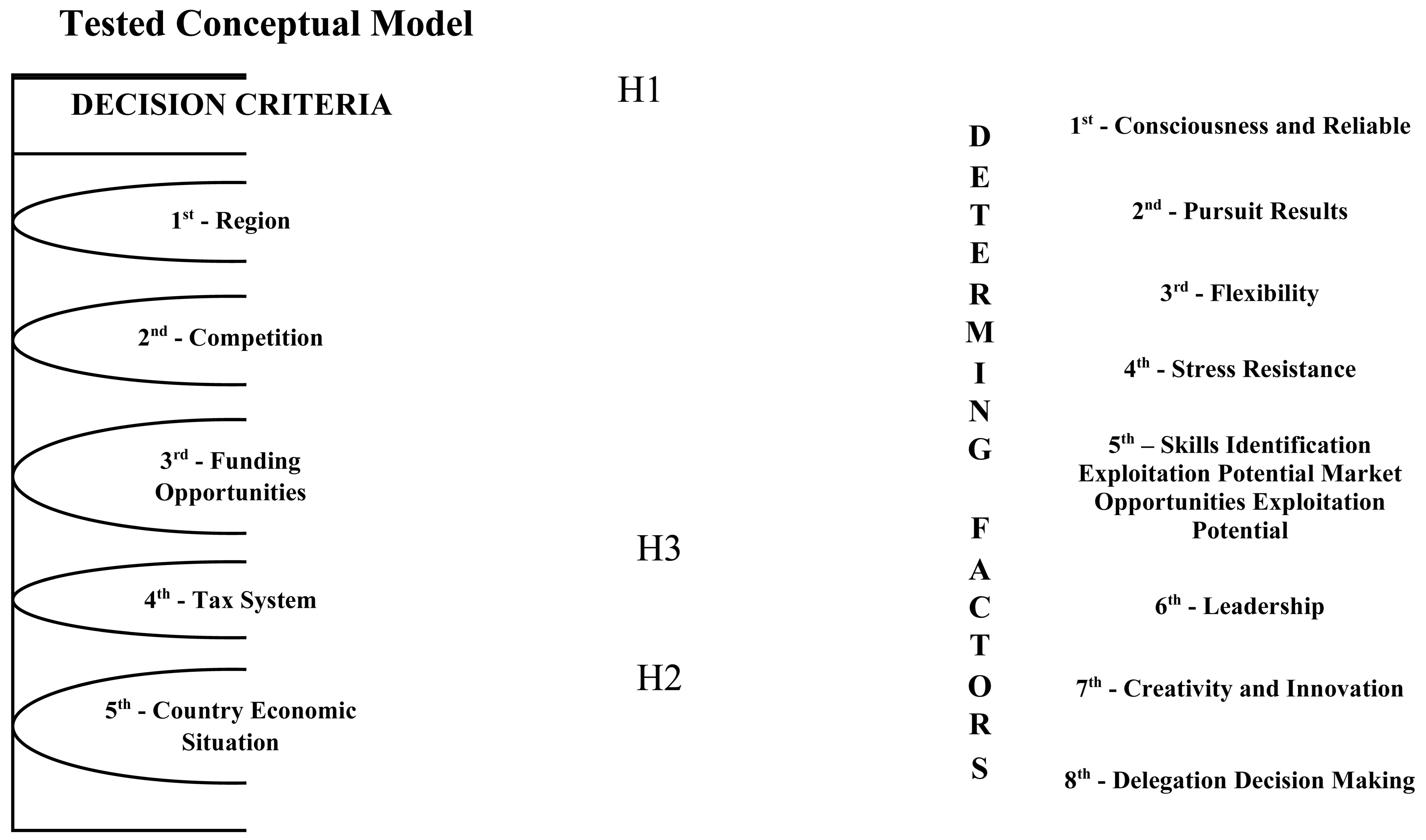

Findings from the third analysis of LAM testing for the variable’s importance of Decision Criteria with respect to Determining Factor as target variable (

Table 5, and

Figure 3) shows that five variables are accepted in the importance ranking out of six variables. The variable left out from the ranking is Law, shows the no importance for this specific criterion of variables. The last analysis is performed for the hypothesis testing of the conceptual model to modify the concept for the better understanding of the budding entrepreneurs. There were seven hypotheses framed, but only H1, H2, and H3 mainly three are accepted as the concept within the accepted p < 0.05 with a significant value. The four hypotheses H4, H5, H6, and H7 are rejected as the concept reasoning p > 0.05 showing an insignificant value.

Based on findings result is drawn for the snapshot understanding of the concept. Result is presented for the two broader concepts as Decision Criteria, and Determining Factors separately, then together for the best possible outcome and the modified conceptual model. Based on the One-Sample Kolmogorov-Smirnov test for Decision Criteria with six variables shows the complete acceptance, at the same time Determining Factors with fourteen variables also shows the acceptance of all. The importance matrix of regression, Automatic Linear Modeling (ALM) for the six variables showed the acceptance of ranking for all six variables from the Decision Criteria is ranked from the 1st most important to the last 6th as least important as shown below Region > Competition > Funding Opportunities > Country Economic Situation > Tax System > Law are categorized selection. The importance matrix fourteen variables of Determining Factor show, only the acceptance for eight variables for their ranking from the 1st most important to the last 8th as least important are ranked with the decreasing importance value as Consciousness and Reliable > Pursuit Results > Flexibility > Stress Resistance > Skills Identification Exploitation Potential Market Opportunities > Leadership > Creativity and Innovation > Delegation Decision Making are also categorized variables.

|

The importance matrix for the six variables of Decision Criteria with the Determining Factor target shows the only five variables as important and ranked them from 1st as the most important and the 5th as the least important are ranked and presented in the decreasing order Region > Competition > Funding Opportunities > Tax System > Country Economic Situation as categorized variables. The correlation and regression analysis are the resultant outcome with the acceptance of three hypotheses, though only five variables for Decision Criteria, and eight variables for Determining Factor are arranged in the importance ranking and presented as the modified model.

6. Conclusion, Limitations and Future Research

The research presented with the aforesaid flow of work from conceptualization to analysis, and justification of the concept. Here, this section has a broader discussion on the outcome and results. The main discussion is about the solution to the research problem, and research question as the segmented reach to problem with a systematic approach, which is satisfying all the research objectives by testing of hypotheses, and answer to research questions. The analysis section is the empirical support with statistical justification to the concept, which further shapes the findings, discussion, and conclusion [

28,

106,

107].

The study framed a research problem to address is to measure the ecosystem variables as decision criteria for establishing a more efficient ecosystem, and at the same time to find the entrepreneurial traits as determining factors for an individual, as the requirement for an entrepreneurial startup. The problem solved based on data collected and reported at the findings and results section. The study observes that there are only five variables of the decision criteria are accepted for their importance are Region > Competition > Funding Opportunities > Tax System > Country Economic Situation, in the decreasing order of their importance. Whereas the eight underlying variables of determining factor are Consciousness and Reliable > Pursuit Results > Flexibility > Stress Resistance > Skills Identification Exploitation Potential Market Opportunities > Leadership > Creativity and Innovation > Delegation Decision Making, are only accepted, and ranked in a decreasing importance.

Research questions answered to reach the problem as Region, Competition, Funding Opportunities, Tax System, and Country Economic Situation are the five major components of the decision criteria. The determining factor has the eight components named as Consciousness and Reliable, Pursuit Results, Flexibility, Stress Resistance, Skills Identification Exploitation Potential Market Opportunities, Leadership, Creativity, and Innovation, and Delegation Decision Making of a successful entrepreneurial startup. There are only two correlated components of decision criteria are Tax System, and Country Economic Situation with the determining factors of entrepreneurial startups.

Research objective are always the core of the execution, which all reached by knowing the importance of each decision criteria and determining factors of entrepreneurial startups with their presentation as the decreasing order of importance. The statistical revalidation of correlations of components of decision criteria and determining factors of entrepreneurial startups conducted and presented as findings shows only two components of decision criteria are Tax System, and Country Economic Situation are correlated with the determining factors. The justification of the requisites for a successful entrepreneurial startup with respect to decision criteria are five in their importance, and determining factors as eight in their importance is presented as modified model with their relationships. The above-mentioned criteria impact the growth of start-ups in multiple ways and determine the creation of inclusive opportunities for the population.

Hypotheses are the assumption for the reality check test shows that there are only three hypotheses accepted as the concept, which are further modified and presented with their importance ranking and correlations. The accepted concepts are H1: Decision criteria, and determining factors of entrepreneurial startups are correlated, H2: Country economic situation effects determining factors of entrepreneurial startups, and the H3: Tax system of decision criteria influences determining factors of entrepreneurial startups. The study concludes that there are five components of decision criteria are Region, Competition, Funding Opportunities, Tax System, and Country Economic Situation, whereas the eight components Consciousness and Reliable, Pursuit Results, Flexibility, Stress Resistance, Skills Identification Exploitation Potential Market Opportunities, Leadership, Creativity, and Innovation, and Delegation Decision Making of determining factor are required for a successful entrepreneurial startup.

The research process has been a time-consuming exercise to conceptualize the idea and to structure the flow of work. For this study the major challenge faced is to find the respondent engaged in an entrepreneurial startup with a considerable success though being a new startup. Selecting the entrepreneur was not enough but to get their time to fill up the responses on the asked questionnaire was hard. The study would have collected more samples, but this became a major challenge. The different statistical analysis would have been applied, if the sample would have been comparatively bigger in number. This may give some different view on the study. Overall, it can be concluded that entrepreneurial start-ups have a responsibility to contribute towards social inclusion and capacity building. The contribution can be in variety of ways by adopting different strategies policies and practices that promote accessibility equity and opportunity for all.

The future research will be conducted on a bigger sample size to get more accuracy of responses. The same questionnaire will be implemented in different countries to get the status of the continent and the world on the situation of entrepreneurial startups. Furthermore, a comparative analysis among countries can provide the data of contribution, and situational understanding of different countries. It may provide an idea to understand the most successful entrepreneurial startups of different countries and those ecosystem variables and individual traits can help to train the lower performing countries for the success of their entrepreneurial startups.

Author Contributions

Conceptualization, U.S.S. and J.K.; methodology, S.S.; software, U.S.S.; validation, J.K. and S.S.; formal analysis, U.S.S.; investigation, S.S.; resources, J.K.; data curation, S.S.; writing—original draft preparation, J.K.; writing—review and editing, U.S.S.; visualization, J.K.; supervision, S.S.; project administration, S.S.; funding acquisition, S.S. and J.K. All authors have read and agreed to the published version of the manuscript.

Funding

The research paper is the outcome of the project titled “Multi-Criteria Decision Making Analysis of Social Inclusion and capacity Building within the NEP 2020 in Uttar Pradesh” and is financed by Banaras Hindu University, India as “Seed Grant” under IoE No. R/Dev/D/IoE/Seed & Incentive Grant-III/2022-23/49212 for the year 2022-2024 fund allocated 500,000.00 INR.

Institutional Review Board Statement

Our research is based on the random selection of respondents. They have filled it with their own choice. This research is not applied to humans as such to harm anyone. We do not require any approval; moreover, at the institution, there is no such body to provide any consent in India. This is our individual selection of the area and topic of research. We take the responsibility for the implementation of the research and assure you that Ethics Committee or Institutional Review Board approval is not required.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Hoogendoorn, B.; van der Zwan, P.; Thurik, R. Sustainable Entrepreneurship: The Role of Perceived Barriers and Risk. J Bus Ethics 2019, 157, 1133–1154. [Google Scholar] [CrossRef]

- Doran, J.; McCarthy, N.; O’Connor, M. The Role of Entrepreneurship in Stimulating Economic Growth in Developed and Developing Countries. Cogent Economics & Finance 2018, 6, 1442093. [Google Scholar] [CrossRef]

- Araújo, A.C.M.; Oliveira, V.M.; Correia, S.E.N. Sustainable consumption: thematic evolution from 1999 to 20191. RAM Rev. Adm. Mackenzie 2021, 22, eRAMG210209. [Google Scholar] [CrossRef]

- Svatosova, V. The Importance of Online Shopping Behavior in the Strategic Management of E-Commerce Competitiveness. JOC 2020, 12, 143–160. [Google Scholar] [CrossRef]

- Díaz-Santamaría, C.; Bulchand-Gidumal, J. Econometric Estimation of the Factors That Influence Startup Success. Sustainability 2021, 13, 2242. [Google Scholar] [CrossRef]

- OECD Strengthening Social Inclusion through Inclusive Entrepreneurship. In Strengthening SMEs and Entrepreneurship for Productivity and Inclusive Growth; OECD Studies on SMEs and Entrepreneurship; OECD, 2019; pp. 121–126. ISBN 978-92-64-96791-5.

- Skawińska, E.; Zalewski, R.I. Success Factors of Startups in the EU—A Comparative Study. Sustainability 2020, 12, 8200. [Google Scholar] [CrossRef]

- Molino, M.; Dolce, V.; Cortese, C.G.; Ghislieri, C. Personality and Social Support as Determinants of Entrepreneurial Intention. Gender Differences in Italy. PLoS ONE 2018, 13, e0199924. [Google Scholar] [CrossRef]

- Keidel, J.; Bican, P.M.; Riar, F.J. Influential Factors of Network Changes: Dynamic Network Ties and Sustainable Startup Embeddedness. Sustainability 2021, 13, 6184. [Google Scholar] [CrossRef]

- Entrepreneurship and Productive Capacity-Building: Creating Jobs through Enterprise Development.

- Eklund, J.; Levratto, N.; Ramello, G.B. Entrepreneurship and Failure: Two Sides of the Same Coin? Small Bus Econ 2020, 54, 373–382. [Google Scholar] [CrossRef]

- Klimas, P.; Czakon, W.; Kraus, S.; Kailer, N.; Maalaoui, A. Entrepreneurial Failure: A Synthesis and Conceptual Framework of Its Effects. European Management Review 2021, 18, 167–182. [Google Scholar] [CrossRef]

- Anderson, G.M.; Tollison, R.D. Adam Smith’s Analysis of Joint-Stock Companies. Journal of Political Economy 1982, 90, 1237–1256. [Google Scholar] [CrossRef]

- Ciimem1d9_en.Pdf.

- Kerr, S.P.; Kerr, W.R.; Xu, T. Personality Traits of Entrepreneurs: A Review of Recent Literature. 52.

- Van Ness, R.K.; Seifert, C.F. A Theoretical Analysis of the Role of Characteristics in Entrepreneurial Propensity: The Role of Characteristics in Entrepreneurial Propensity. Strategic Entrepreneurship Journal 2016, 10, 89–96. [Google Scholar] [CrossRef]

- Mason, C.; Brown, D.R. Entrepreneurial ecosystems and growth oriented entrepreneurship. 38.

- Madzikanda, B.; Li, C.; Dabuo, F.T. What Determines the Geography of Entrepreneurship? A Comparative Study Between Sub-Saharan Africa and South-East Asia. Journal of Entrepreneurship and Innovation in Emerging Economies 2021, 7, 246–262. [Google Scholar] [CrossRef]

- Malecki, E.J. Geographical Environments for Entrepreneurship. IJESB 2009, 7, 175. [Google Scholar] [CrossRef]

- BGP_Entrepreneurship-in-Education.Pdf.

- Centobelli, P.; Cerchione, R.; Esposito, E. Knowledge Management in Startups: Systematic Literature Review and Future Research Agenda. Sustainability 2017, 9, 361. [Google Scholar] [CrossRef]

- Gonzalez, G. Startup Business Plans: Academic Researchers and Expert Practitioners Still Disagree? MBR 2017, 1, 189–197. [Google Scholar] [CrossRef] [PubMed]

- Luke, B.; Verreynne, M.-L.; Kearins, K. Measuring the Benefits of Entrepreneurship at Different Levels of Analysis. Journal of Management & Organization 2007, 13, 312–330. [Google Scholar] [CrossRef]

- THE SYMBIOTIC RELATIONSHIP BETWEEN STARTUPS AND INCUBATORS-ProQuest. Available online: https://www.proquest.com/openview/6dc09ba3b699eca95806419e8c28ffe4/1?pq-origsite=gscholar&cbl=2033472 (accessed on 30 April 2023).

- Kritikos, A. Entrepreneurs and Their Impact on Jobs and Economic Growth. IZA World of Labor; DIW: Berlin, Germany, 2014. [Google Scholar] [CrossRef]

- Singh, U.S.; Mishra, U.S. Vegetable Supply Chain: A Conceptual Study. Food Science and Quality Management 2013, 15, 45–60. [Google Scholar]

- Singh, S.; Singh, G.A. Assessing the Impact of the Digital Divide on Indian Society: A Study of Social Exclusion. Research in Social Change 2021, 13, 181–190. [Google Scholar] [CrossRef]

- Rutkowska, M.; Bartoszczuk, P.; Singh, U.S. Management of GREEN Consumer Values in Renewable Energy Sources and Eco Innovation in INDIA. Energies 2021, 14, 7061. [Google Scholar] [CrossRef]

- Haltiwanger, J. Entrepreneurship in the Twenty-First Century. Small Bus Econ 2022, 58, 27–40. [Google Scholar] [CrossRef]

- Harlin, U.; Berglund, M. Designing for Sustainable Work during Industrial Startups—the Case of a High-Growth Entrepreneurial Firm. Small Bus Econ 2021, 57, 807–819. [Google Scholar] [CrossRef]

- van Rijnsoever, F.J. Intermediaries for the Greater Good: How Entrepreneurial Support Organizations Can Embed Constrained Sustainable Development Startups in Entrepreneurial Ecosystems. Research Policy 2022, 51, 104438. [Google Scholar] [CrossRef]

- Audretsch, D.B.; Belitski, M. Frank Knight, Uncertainty and Knowledge Spillover Entrepreneurship. Journal of Institutional Economics 2021, 17, 1005–1031. [Google Scholar] [CrossRef]

- Morrar, R.; Amara, M.; Syed Zwick, H. The Determinants of Self-Employment Entry of Palestinian Youth. JEEE 2022, 14, 23–44. [Google Scholar] [CrossRef]

- Santoso, R.T.P.B.; Junaedi, I.W.R.; Priyanto, S.H.; Santoso, D.S.S. Creating a Startup at a University by Using Shane’s Theory and the Entrepreneural Learning Model: A Narrative Method. J Innov Entrep 2021, 10, 21. [Google Scholar] [CrossRef]

- Krishnamoorthy, V.; Vetrivel, S.C.; Rajini, J. Entrepreneurial Motivation in the Establishment of Food Processing Startups in Erode District, Tamil Nadu. Erode: India, 2021; p. 140020. [Google Scholar]

- Barrera-Verdugo, G. Impact of Self-Perceptions, Social Norms, and Social Capital on Nascent Entrepreneurs: A Comparative Analysis by Level of Economic Development in Latin American Countries. J Innov Entrep 2021, 10, 41. [Google Scholar] [CrossRef]

- Pita, M.; Costa, J.; Moreira, A.C. Unveiling Entrepreneurial Ecosystems’ Transformation: A GEM Based Portrait. Economies 2021, 9, 186. [Google Scholar] [CrossRef]

- Guerrero, M.; Espinoza-Benavides, J. Do Emerging Ecosystems and Individual Capitals Matter in Entrepreneurial Re-Entry’ Quality and Speed? Int Entrep Manag J 2021, 17, 1131–1158. [Google Scholar] [CrossRef]

- Ferrati, F.; Muffatto, M. Entrepreneurial Finance: Emerging Approaches Using Machine Learning and Big Data. FNT in Entrepreneurship 2021, 17, 232–329. [Google Scholar] [CrossRef]

- Ferrati, F.; Muffatto, M. Reviewing Equity Investors’ Funding Criteria: A Comprehensive Classification and Research Agenda. Venture Capital 2021, 23, 157–178. [Google Scholar] [CrossRef]

- Hor, S.C. (Timothy); Chang, A.; Torres de Oliveira, R.; Davidsson, P. From the Theories of Financial Resource Acquisition to a Theory for Acquiring Financial Resources—How Should Digital Ventures Raise Equity Capital beyond Seed Funding. Journal of Business Venturing Insights 2021, 16, e00278. [Google Scholar] [CrossRef]

- Hornuf, L.; Schmitt, M.; Stenzhorn, E. Equity Crowdfunding in Germany and the United Kingdom: Follow-up Funding and Firm Failure. Corp Govern Int Rev 2018, 26, 331–354. [Google Scholar] [CrossRef]

- Chung, S.; Ryoo, C.W.; Yim, H.R. A Scenario Approach on Debt Financing and Entrepreneurial Career Path Choice. Asia Life Sciences 2018, Supplement 15, 1865–1874. [Google Scholar]

- Vinturella, J.B.; Erickson, S.M. Alternatives in Venture Financing—Debt Capital. In Raising Entrepreneurial Capital; Elsevier, 2004; pp. 41–83. ISBN 978-0-12-722351-3. [Google Scholar]

- Singh, U.S. Halmet Bradosti Acceptability of Banking Operations in Iraqi Kurdistan. Research Journal of Finance and Accounting 2015, 6, 276–286. [Google Scholar]

-

Experimental and Quantitative Methods in Contemporary Economics: Computational Methods in Experimental Economics (CMEE) 2018 Conference; Nermend, K., Łatuszyńska, M., Eds.; Springer Proceedings in Business and Economics; Springer International Publishing: Cham, 2020; ISBN 978-3-030-30250-4. [Google Scholar]

- Baum, J.A.C.; Silverman, B.S. Picking Winners or Building Them? Alliance, Intellectual, and Human Capital as Selection Criteria in Venture Financing and Performance of Biotechnology Startups. Journal of Business Venturing 2004, 19, 411–436. [Google Scholar] [CrossRef]

- Coleman, S.; Cotei, C.; Farhat, J. The Debt-Equity Financing Decisions of U.S. Startup Firms. J Econ Finan 2016, 40, 105–126. [Google Scholar] [CrossRef]

- Mateusz, P.; Danuta, M.; Małgorzata, Ł.; Mariusz, B.; Kesra, N. TOPSIS and VIKOR Methods in Study of Sustainable Development in the EU Countries. Procedia Computer Science 2018, 126, 1683–1692. [Google Scholar] [CrossRef]

- Piwowarski, M.; Borawski, M.; Nermend, K. The Problem of Non-Typical Objects in the Multidimensional Comparative Analysis of the Level of Renewable Energy Development. Energies 2021, 14, 5803. [Google Scholar] [CrossRef]

- Frid, C.J. Acquiring Financial Resources to Form New Ventures: The Impact of Personal Characteristics on Organizational Emergence. Journal of Small Business and Entrepreneurship 2014, 27, 323–341. [Google Scholar] [CrossRef]

- Pereira, D.; Leitão, J.; Baptista, R. Who’s Winning the “Survivor” Race? Gazelle or Non-Gazelle Startups. In Intrapreneurship and Sustainable Human Capital; Leitão, J., Nunes, A., Pereira, D., Ramadani, V., Eds.; Studies on Entrepreneurship, Structural Change and Industrial Dynamics; Springer International Publishing: Cham, 2020; pp. 169–208. ISBN 978-3-030-49409-4. [Google Scholar]

- Krasniqi, B.A.; Pula, J.S.; Kutllovci, E. The Determinants of Entrepreneurship and Small Business Growth in Kosova: Evidence from New and Established Firms. IJEIM 2008, 8, 320. [Google Scholar] [CrossRef]

- Malone, T.; Koumpias, A.M.; Bylund, P.L. Entrepreneurial Response to Interstate Regulatory Competition: Evidence from a Behavioral Discrete Choice Experiment. J Regul Econ 2019, 55, 172–192. [Google Scholar] [CrossRef]

- Haque, N.U. Entrepreneurship in Pakistan. PIDE Working Papers 2007, 1–54. [Google Scholar]

- Lakoff, S. Upstart Startup: “Constructed Advantage” and the Example of Qualcomm. Technovation 2008, 28, 831–837. [Google Scholar] [CrossRef]

- Afonso, P.; Fernandes, J.M. Determinants for the Success of Software Startups: Insights from a Regional Cluster. In Software Business; Wnuk, K., Brinkkemper, S., Eds.; Lecture Notes in Business Information Processing; Springer International Publishing: Cham, 2018; Volume 336, pp. 127–141. ISBN 978-3-030-04839-6. [Google Scholar]

- Zhao, B.; Ziedonis, R. State Governments as Financiers of Technology Startups: Evidence from Michigan’s R&D Loan Program. Research Policy 2020, 49, 103926. [Google Scholar] [CrossRef]

- Barboza, G.; Capocchi, A. Innovative Startups in Italy. Managerial Challenges of Knowledge Spillovers Effects on Employment Generation. JKM 2020, 24, 2573–2596. [Google Scholar] [CrossRef]

- Pollio, A. Making the Silicon Cape of Africa: Tales, Theories and the Narration of Startup Urbanism. Urban Studies 2020, 57, 2715–2732. [Google Scholar] [CrossRef]

- Ratanova, I.; Voroncuka, I. The Aspects of Entrepreneurship and Innovation Development of SMEs. 2021; pp. 1164–1173. [Google Scholar]

- Shaikh, A.R.; Qazi, A.A. Chohan Decoration Services Pakistan—Survival amid COVID-19. Emerald Emerging Markets Case Studies 2020, 10, 1–17. [Google Scholar] [CrossRef]

- Szerb, L.; Vörös, Z. The Changing Form of Overconfidence and Its Effect on Growth Expectations at the Early Stages of Startups. Small Business Economics 2021, 57, 151–165. [Google Scholar] [CrossRef]

- Lasso, S.V.; Mainardes, E.W.; Motoki, F.Y.S. Types of Technological Entrepreneurs: A Study in a Large Emerging Economy. Journal of the Knowledge Economy 2018, 9, 378–401. [Google Scholar] [CrossRef]

- Reynolds, P.D.; Curtin, R.T. Business Creation in the United States: Entry, Startup Activities, and the Launch of New Ventures. In The Small Business Economy; 2010; pp. 129–187. ISBN 978-1-60741-468-1. [Google Scholar]

- Doyle, W.; Young, J.D. Entrepreneurial Networks in the Micro-Business Sector: Examining Differences Across Gender and Business Stage. Journal of Small Business and Entrepreneurship 2001, 16, 40–55. [Google Scholar] [CrossRef]

- Mian, S.A.; Hattab, H.W. How Individual Competencies Shape the Entrepreneur’s Social Network Structure: Evidence from the MENA Region. International Journal of Business and Globalisation 2013, 11, 399–412. [Google Scholar] [CrossRef]

- Arumugam, B.; Ravindran, S. Success Factors of Incubatee Startups and the Incubation Environment Influencers. International Journal of Applied Business and Economic Research 2014, 12, 1179–1193. [Google Scholar]

- Keller, P.G. Trends of Information Technology Start-up Companies in Europe: A Comparison between Germany and Latvia. 2017; pp. 1018–1034. [Google Scholar]

- Vadera, S. A Study on the Growth of Millennial Entrepreneurs in India. 2018; Volume 2018-September, pp. 831–837. [Google Scholar]

- Solntsev, V.I. Project-Oriented Approach in Postgraduate Training of Engineer Elite. 2013; pp. 373–376. [Google Scholar]

- Agrawal, A.; Gandhi, P.; Khare, P. Women Empowerment through Entrepreneurship: Case Study of a Social Entrepreneurial Intervention in Rural India. International Journal of Organizational Analysis 2021. [Google Scholar] [CrossRef]

- Scotchmer, N.; Duran, J.; Chan, K.R. Optimizing the Next-Generation Resistance Welding Cell. Welding Journal (Miami, Fla) 2010, 89, 34–39. [Google Scholar]

- Da Cruz, E.F.Z.; Alvaro, A. Introduction of Entrepreneurship and Innovation Subjects in a Computer Science Course in Brazil. 2013; pp. 1881–1887. [Google Scholar]

- Hannafey, F.T. Entrepreneurship and Ethics: A Literature Review. Journal of Business Ethics 2003, 46, 99–110. [Google Scholar] [CrossRef]

- Yu, Y.; Perotti, V. Startup Tribes: Social Network Ties That Support Success in New Firms. 2015. [Google Scholar]

- Itani, H.; Sidani, Y.M.; Baalbaki, I. United Arab Emirates Female Entrepreneurs: Motivations and Frustrations. Equality, Diversity and Inclusion 2011, 30, 409–424. [Google Scholar] [CrossRef]

- De Pillis, E.; Reardon, K.K. The Influence of Personality Traits and Persuasive Messages on Entrepreneurial Intention: A Cross-Cultural Comparison. Career Development International 2007, 12, 382–396. [Google Scholar] [CrossRef]

- Parrilli, M.D.; Radicic, D. Cooperation for Innovation in Liberal Market Economies: STI and DUI Innovation Modes in SMEs in the United Kingdom. European Planning Studies 2021, 29, 2121–2144. [Google Scholar] [CrossRef]

- Van de Ven, A.H.; Engleman, R.M. Event- and Outcome-Driven Explanations of Entrepreneurship. Journal of Business Venturing 2004, 19, 343–358. [Google Scholar] [CrossRef]

- Ahmed, M.A.; Khattak, M.S.; Anwar, M. Personality Traits and Entrepreneurial Intention: The Mediating Role of Risk Aversion. Journal of Public Affairs 2022, 22, e2275. [Google Scholar] [CrossRef]

- Zolin, R.; Kuckertz, A.; Kautonen, T. Human Resource Flexibility and Strong Ties in Entrepreneurial Teams. Journal of Business Research 2011, 64, 1097–1103. [Google Scholar] [CrossRef]

- Singh, U.S.; Mishra, U.S. Assessment of Need for Vertical Coordination in Supply Chain of Vegetable Industry. International Food Research Journal 2015, 22, 1417–1423. [Google Scholar]

- Singh, S.; Singh, U.S. A Study Assessing the Brand Loyalty Creation by Promotion Mix for KOTON Brand. Cross Current International Journal of Economics, Management and Media Studies 2020, 14. [Google Scholar] [CrossRef]

- Singh, U.S.; Mishra, U.S. Bibhuti Bhusan Mishra Vertical Coordination for Optimization of the Vegetable Supply Chain. International Food Research Journal 2014, 21, 1387–1394. [Google Scholar]

- Saragiotto, B.T.; Costa, L.C.M.; Oliveira, R.F.; Lopes, A.D.; Moseley, A.M.; Costa, L.O.P. Description of Research Design of Articles Published in Four Brazilian Physical Therapy Journals. Braz. J. Phys. Ther. 2014, 18, 56–62. [Google Scholar] [CrossRef]

- Abutabenjeh, S.; Jaradat, R. Clarification of Research Design, Research Methods, and Research Methodology: A Guide for Public Administration Researchers and Practitioners. Teaching Public Administration 2018, 36, 237–258. [Google Scholar] [CrossRef]

- Singh, U.S. Osman Sahin A Literary Excavation of University Brand Image Past to Present. IJSSES 2017, 3. [Google Scholar] [CrossRef]

- Singh, U.S. Cost estimation using econometric model for restaurant business. QME 2019, 20, 209–216. [Google Scholar] [CrossRef]

- Łatuszyńska, M.; Nermend, K. Energy Decision Making: Problems, Methods, and Tools—An Overview. Energies 2022, 15, 5545. [Google Scholar] [CrossRef]

- Jilcha Sileyew, K. Research Design and Methodology. In Text Mining—Analysis, Programming and Application [Working Title]; IntechOpen, 2019. [Google Scholar]

- Sample Design. In Encyclopedia of Survey Research Methods; Sage Publications, Inc.: 2455 Teller Road, Thousand Oaks California 91320 United States of America, 2008; ISBN 978-1-4129-1808-4.

- Taherdoost, H. Sampling Methods in Research Methodology; How to Choose a Sampling Technique for Research. SSRN Journal 2016. [Google Scholar] [CrossRef]

- Faul, F.; Erdfelder, E.; Lang, A.-G.; Buchner, A. G*Power 3: A Flexible Statistical Power Analysis Program for the Social, Behavioral, and Biomedical Sciences. Behavior Research Methods 2007, 39, 175–191. [Google Scholar] [CrossRef] [PubMed]

- Long, H. An Empirical Review of Research Methodologies and Methods in Creativity Studies (2003–2012). Creativity Research Journal 2014, 26, 427–438. [Google Scholar] [CrossRef]

- Piwowarski, M.; Miłaszewicz, D.; Łatuszyńska, M.; Borawski, M.; Nermend, K. Application of the Vector Measure Construction Method and Technique for Order Preference by Similarity Ideal Solution for the Analysis of the Dynamics of Changes in the Poverty Levels in the European Union Countries. Sustainability 2018, 10, 2858. [Google Scholar] [CrossRef]

- Alsakaa, A.A.; Borawska, A.; Borawski, M.; Łatuszyńska, M.; Piwowarski, M.; Babiloni‖, F.; Nermend, K. Cognitive Neuroscience Techniques in Determining the Right Time of Advertising. IOP Conf. Ser.: Mater. Sci. Eng. 2020, 671, 012033. [Google Scholar] [CrossRef]

- Nermend, K.; Piwowarski, M.; Borawski, M. Decision Making Methods in Comparative Studies of Complex Economic Processes Management. Iraqi Journal of Science 2020, 652–664. [Google Scholar] [CrossRef]

- Singh, S.; Singh, U.S.; Nermend, M. Decision Analysis of E-Learning in Bridging Digital Divide for Education Dissemination. Procedia Computer Science 2022, 207, 1970–1980. [Google Scholar] [CrossRef]

- Nermend, M.; Singh, U.S.; Singh, S. Educational Background as Decision Criteria in Selection of Private Sector Healthcare Service Providers. Procedia Computer Science 2022, 207, 4651–4659. [Google Scholar] [CrossRef]

- Singh, S.; Singh, G.A. Assessing the Impact of the Digital Divide on Indian Society: A Study of Social Exclusion. Research in Social Change 2021, 13, 181–190. [Google Scholar] [CrossRef]

- Singh, U.S. Risk Analysis And Mitigation Plan For Steel Tube Manufacturing Company; 1. Aufl.; LAP LAMBERT Academic Publishing: Saarbrücken, 2013; ISBN 978-3-659-42875-3. [Google Scholar]

- Kolmogorov–Smirnov Test. In The Concise Encyclopedia of Statistics; Springer: New York, NY, USA, 2008; pp. 283–287. ISBN 978-0-387-31742-7.

- Sulich, A.; Rutkowska, M.; Singh, U.S. Decision Towards Green Careers and Sustainable Development. arXiv 2021, arXiv:2106.00465. [Google Scholar] [CrossRef]

- Singh, U.S.; Rutkowska, M.; Bartoszczuk, P. Renewable Energy Decision Criteria on Green Consumer Values Comparing Poland and India Aligned with Environment Policy for Sustainable Development. Energies 2022, 15, 5046. [Google Scholar] [CrossRef]

- Piwowarski, M.; Singh, U.S. Kesra Nermend The Cognitive Neuroscience Methods in the Analysis of the Impact of Advertisements in Shaping People’s Health Habits. European Research Studies Journal 2019, XXI, 457–471. [Google Scholar] [CrossRef] [PubMed]

- Bartoszczuk, P.; Singh, U.S.; Rutkowska, M. An Empirical Analysis of Renewable Energy Contributions Considering GREEN Consumer Values—A Case Study of Poland. Energies 2022, 15, 1027. [Google Scholar] [CrossRef]

- OECD Strengthening Social Inclusion through Inclusive Entrepreneurship. In Strengthening SMEs and Entrepreneurship for Productivity and Inclusive Growth; OECD, 2019; pp. 121–126. ISBN 978-92-64-96791-5.

- Entrepreneurship and Productive Capacity-Building: Creating Jobs through Enterprise Development.

- THE SYMBIOTIC RELATIONSHIP BETWEEN STARTUPS AND INCUBATORS-ProQuest.

- Available online: https://unctad.org/system/files/official-document/ciimem1d9_en.pdf (accessed on 30 April 2023).

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).