1. Introduction

One of the largest infrastructure initiatives ever created is China's Belt and Road Initiative (BRI), often known as the Modern Silk Road [

1]. The massive investment and development programs launched by President Xi Jinping in 2013 were originally planned to build physical infrastructure to connect East Asia and Europe [

2]. China's economic and political power has increased dramatically over the past ten years because of project expansion into Africa, Oceania, and Latin America [

3]. The vision of the modern Silk Road mainly includes building infrastructure on a megalomaniac scale. The BRI represents a geopolitical project through which China wants to become a global hegemon [

4,

5].

The BRI is becoming the focus of China's foreign policy. But in most participating countries, the risk of unsustainable debt is created since Chinese investments are mainly in the form of loans [

6]. These investments are financed by China's state-owned banks, commercial banks, and the State Investment Fund. But these countries had no choice because, apart from China, no one was willing to invest in them [

7,

8,

9]. However, the main objective of the BRI is not to create debt traps or improve the economies of the participating countries, but to drive the momentum of economic growth in China and support the domestic market [

10]. However, it is not all one-sided. Poor countries along the BRI are getting richer, and economic cooperation between continents and countries is intensifying. The construction of infrastructure will cause a reduction in transport costs, which will benefit the economic development of China and its trading partners. In addition, China provides cooperation in science and technology [

11]. International trade creates opportunities for long-term development and cooperation among the countries participating in the initiative. Trade between countries within regions, subregions, and continents will undoubtedly contribute to their economic development.

The BRI officially has five goals [

12]: Policy coordination, infrastructure connectivity, free trade, integration of financial systems, and connecting cultures. Connecting and building new infrastructure will promote the exchange of capital and goods between China and participating countries. Policy coordination and cultural integration will provide a political and social basis for investment in the infrastructure. In practice, this means that the BRI is tasked with building land, sea, and air routes, which will take the connectivity between BRI participants to a higher level [

12,

13,

14].

This will mean [

15]: trade and investment facilitation; the creation of a network of free trade areas; maintaining closer economic ties and deepening political trust; and strengthening cultural exchange. Although China has stated that cultural exchange will be the official goal of the BRI, the reality is quite different. Internal "globalization" does not exist in China; the only exception is the economy [

16]. Although it tries to spread its own culture and ideas towards the west, it does not accept outside ideas, cultures, or opinions.

The current regime in China can be compared to the dystopian novel 1984 by the writer George Orwell [

17]. The initiative also includes the development of economic corridors to increase the quality of the infrastructure and the connectivity of the international logistics network [

18]. The "Economic Belt" is focused on land infrastructure, and the "Maritime Road" is its maritime version. China intends to create its own era of globalization. China has excess production capacity; it invests in the development of countries that will eventually demand their goods. The BRI leverages China's expertise in infrastructure development and uses it to forge closer ties with other countries, create trade channels for China, and help failing economies by providing infrastructure that will ultimately benefit China [

19,

20]. The debt trap idea has been repeatedly debunked by researchers through various investigative reports. However, China and other interested nations are making extremely risky loans for projects that are likely to fail or are not financially viable without sufficient cost-benefit analysis.

The initiative aims to become an economic partner to nations in the rest of the developing world, including Africa, Latin America, and the rest of Asia, to further expand markets and develop these nations infrastructure. But it also has a political side in securing votes for China in international organizations. Begin to change the institutional structures and value assumptions of the international system in a way that is more in line with the Chinese worldview. For example, at the International Human Rights Council, China is beginning to remove human rights provisions from various UN resolutions and replace them with state sovereignty rather than individual rights [

21].

2. Materials and Methods

In this part of the post, based on available data from the American Enterprise Institute [

22], US Energy Information Administration [

23,

24], BP [

25,

26], MOFCOM [

27,

28], OECD [

29], World Bank [

30], Global Infrastructure Outlook [

31], and International Energy Agency [

32], the outflow of Chinese investments within the BRI countries was analysed and calculated and shown which sectors have the largest percentage shares of China´s Outflow of Foreign Direct Investment (OFDI).

Subsequently, we focused on the sector with the largest percentage share, i.e., the energy sector. The current goal of the BRI initiative is to transform Eurasia into a region of economic potential for Beijing as well as a region of economic development, creating a chain of economies increasingly dependent on China [

33,

34,

35]. If they succeed in Eurasia, South Asia, the Middle East, and finally Eastern and Western Europe, they will be affected later. BRI directly leads to increased Chinese OFDI in host countries as well as improved trade relations. BRI host countries have increased their overall level of Chinese OFDI. The initial construction projects, initially supported by loans, eventually provide all Chinese enterprises involved with the opportunity to learn more about international markets, build business networks, and open new market prospects. Therefore, infrastructure has been found to serve as a significant initial stimulus for the later development of FDI in various forms [

36].

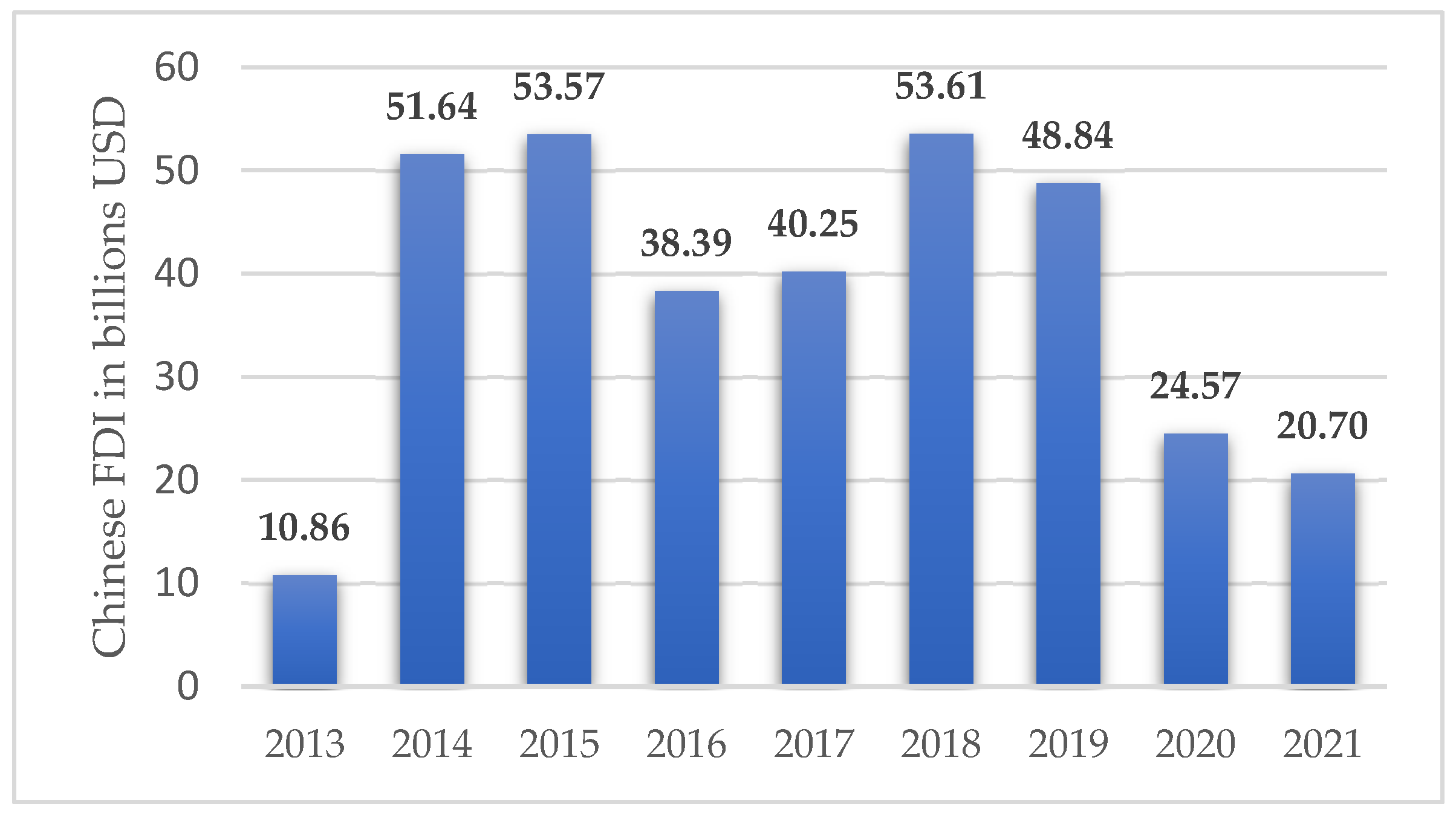

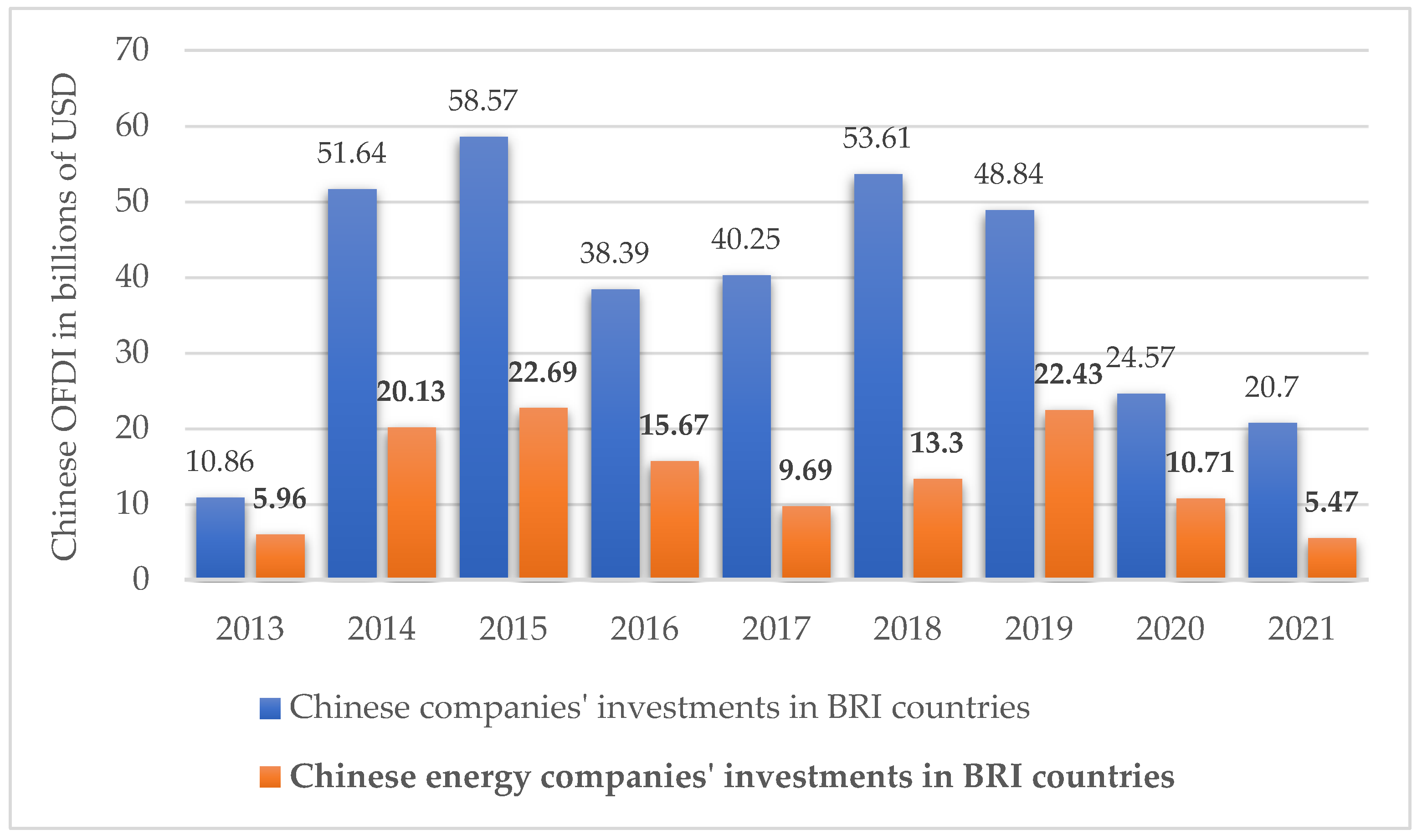

Figure 1.

China's OFDI along the BRI initiative from 2013 to 2021 [

22].

Figure 1.

China's OFDI along the BRI initiative from 2013 to 2021 [

22].

Although China's OFDI to countries along the BRI tended to grow from 2013 to 2018 and almost doubled from 2013's value of

$10.86 billion to

$53.61 billion in 2018, MOFCOM reported a decrease in budget for overseas expansion in its 14th Five-Year Plan from 2021 to 2025. China's total investment will be

$550 billion (including non-BRI countries), down 25% from

$740 billion in 2016-2020 (the 13th five-year plan). Also, China's contract volume is projected to decrease from

$800 billion in the previous five-year plan to

$700 billion in this five-year plan [

27,

28].

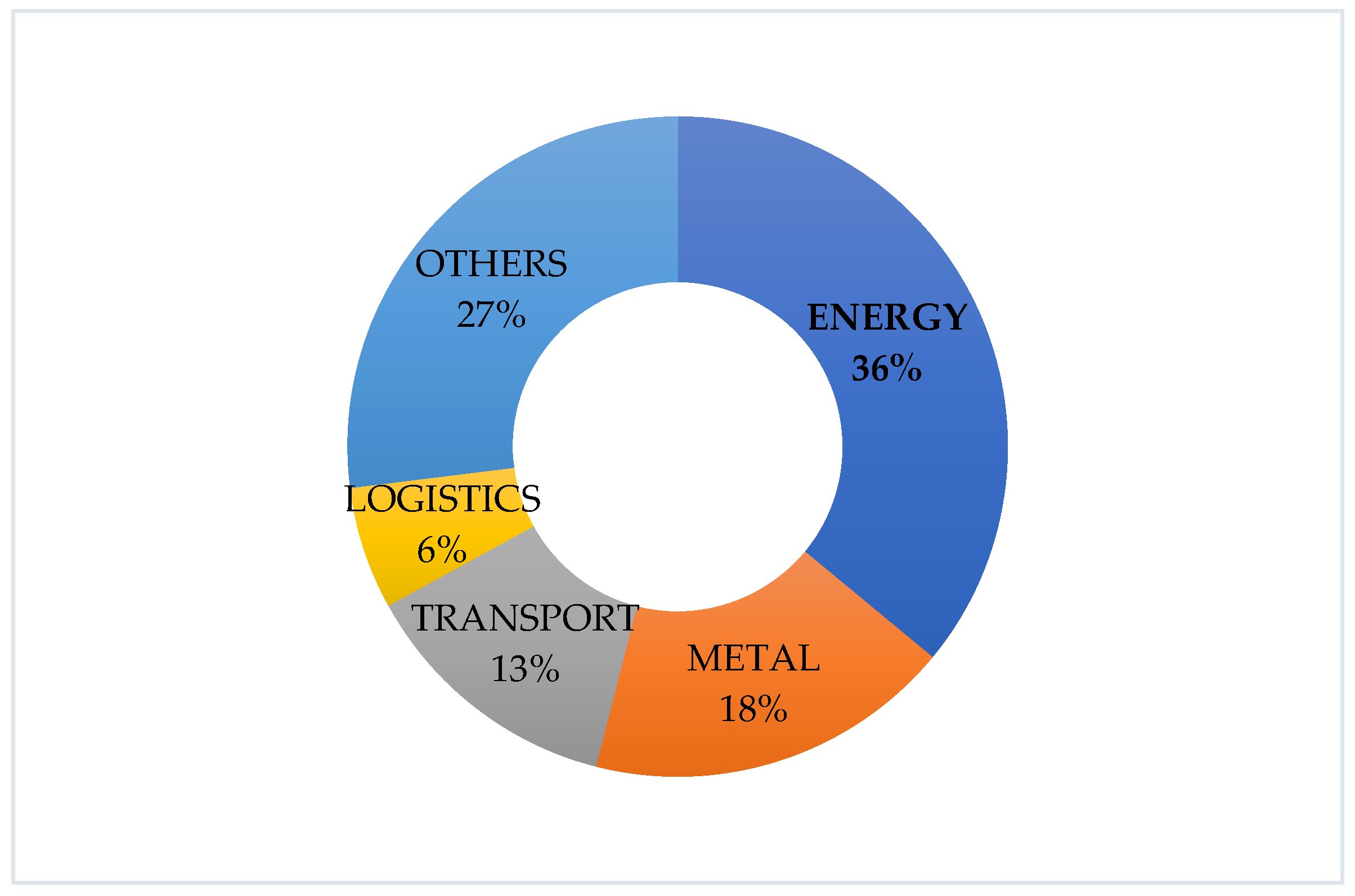

Figure 2.

Chinese investment in BRI countries by sector from 2013 to 2021 [

22].

Figure 2.

Chinese investment in BRI countries by sector from 2013 to 2021 [

22].

Investments in infrastructure are most needed worldwide in the energy, transport, and transportation sectors. According to the [

31], it is expected that approximately 60% of the world's investments are needed in infrastructure, especially in road transport and energy supply. Railroad transportation, telecommunications, and water infrastructure are located behind them. The road and energy infrastructure sectors are expected to experience the highest levels of underinvestment. Chinese investments under the BRI are directed precisely to sectors that represent a large part of the global investment gap [

37,

38].

3. Results and discussion

In recent years, with the progress of the BRI, China's OFDI to the energy sector has increased rapidly [

22,

24,

31]. Shares of direct investment by Chinese energy companies in BRI countries showed a steady upward trend. China's growing OFDI in the energy sector is aimed at increasing China's energy security, given the fact that it is a net importer. Countries participating in the BRI initiative in Central Asia, West Asia, North Africa, and the Middle East are rich in energy resources. Figures from BP, a multinational energy company based in London, from 2021 say that remaining proven oil reserves in the BRI countries are around 1,027 million barrels, representing 60% of global reserves. A similar situation also occurs in the case of natural gas, where the remaining reserves in the BRI countries reach 158 trillion cubic metres, which represents 84% of global reserves [

28,

29,

32].

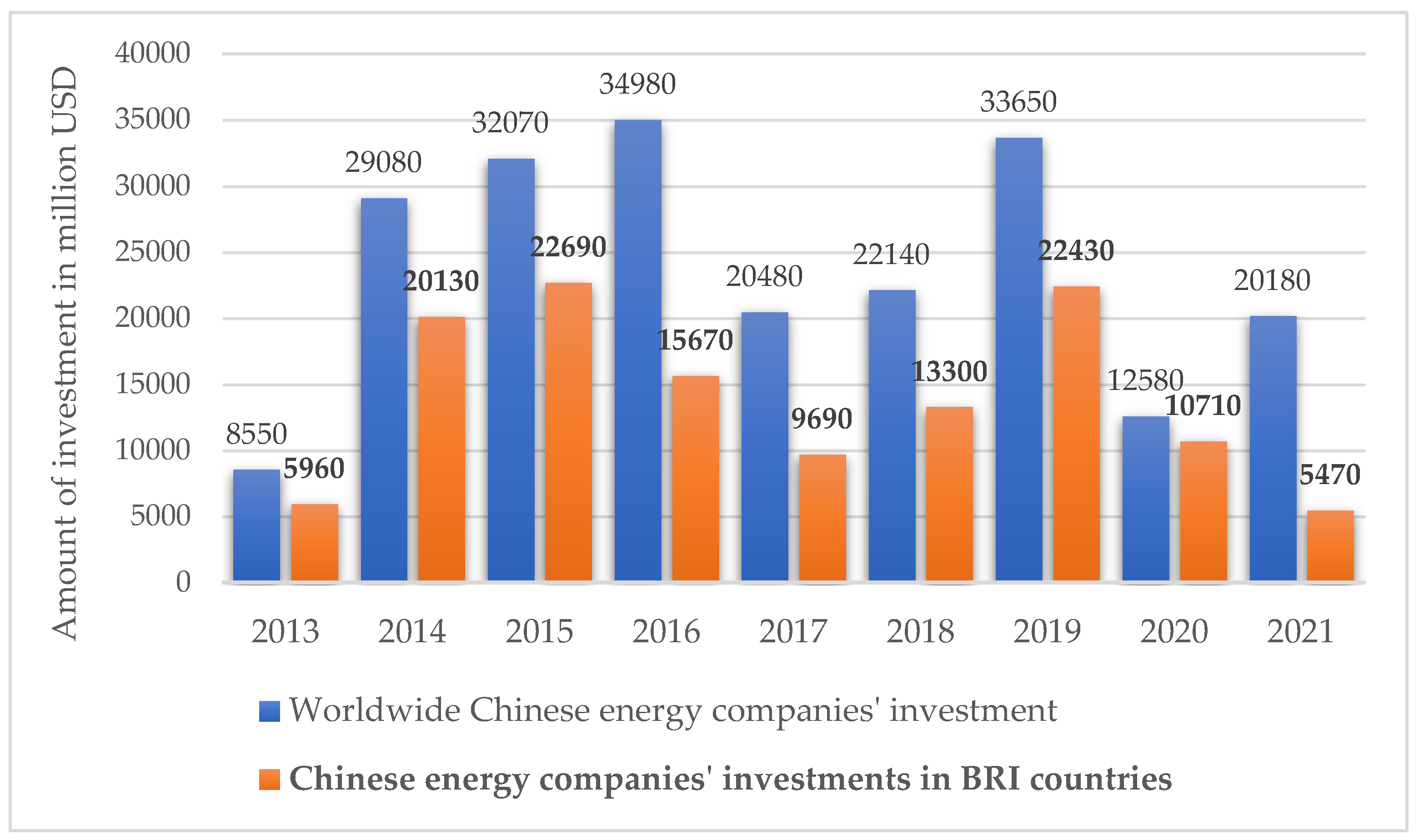

Figure 3.

Chinese investments in all sectors vs. to the energy sector within the BRI [

22,

31].

Figure 3.

Chinese investments in all sectors vs. to the energy sector within the BRI [

22,

31].

Since 2011, China has been the world's largest energy consumer [

39,

40], Two-thirds of the energy consumed in China is used by the industrial sector. The main reason for investments in energy is that China is a net importer of energy, especially oil [

26,

32]. Since 2000, China's oil consumption has increased dramatically. Despite having large domestic oil reserves, China's national oil firms are unable to keep up with demand. According to the [

23,

24] in 2016, imports accounted for approximately 70% of the country's total supply, and in 2021, it was 72%.

According to other estimates [

24,

29,

30], oil consumption will remain high in the short and medium terms, which will significantly tilt the balance of oil reserves in the country in favour of imports. 1/3 of all investments under the BRI initiative go to the energy sector [

41].

The Chinese government has identified China's foreign investment as a key approach to increasing energy security in its five-year plans and long-term energy planning. Increasing oil and gas reserves, increasing production, and diversifying supply sources can contribute to promoting energy security through China's energy investments. [

10,

19,

32].

Figure 4.

Investment by Chinese energy companies [

22].

Figure 4.

Investment by Chinese energy companies [

22].

Since 2013, almost all investments by Chinese energy companies have gone to BRI countries [

22]. A consistent upward trend was evident from 2013 to 2015 in direct investment by Chinese energy enterprises in countries along the BRI. From

$5.96 billion in 2013 to

$22.69 billion in 2015, there was a significant 3.8-fold increase in three years.

China's energy investments include oil, hydropower, alternative energy, natural gas, and coal. The sharp drop in Chinese investment after 2019 was caused by the COVID-19 pandemic [

12,

15,

41]. Although energy has remained China's primary sector for investment within the BRI regions, Chinese capital has gradually diversified into sectors such as transportation, real estate, technology and innovation, and tourism. Among the biggest investments is Malaysia's 1MDB, which struck a deal to sell its power assets in 2015 to China General Nuclear Power Corporation and China Southern Power Grid for

$5.26 billion. Another major investment is China National Petroleum Corp. and China National Offshore Oil Corp.'s 2019 purchase of a 20% stake in the

$4.04 billion Arctic-2 liquefied natural gas project led by Russian gas producer Novatek [

24,

29,

42].

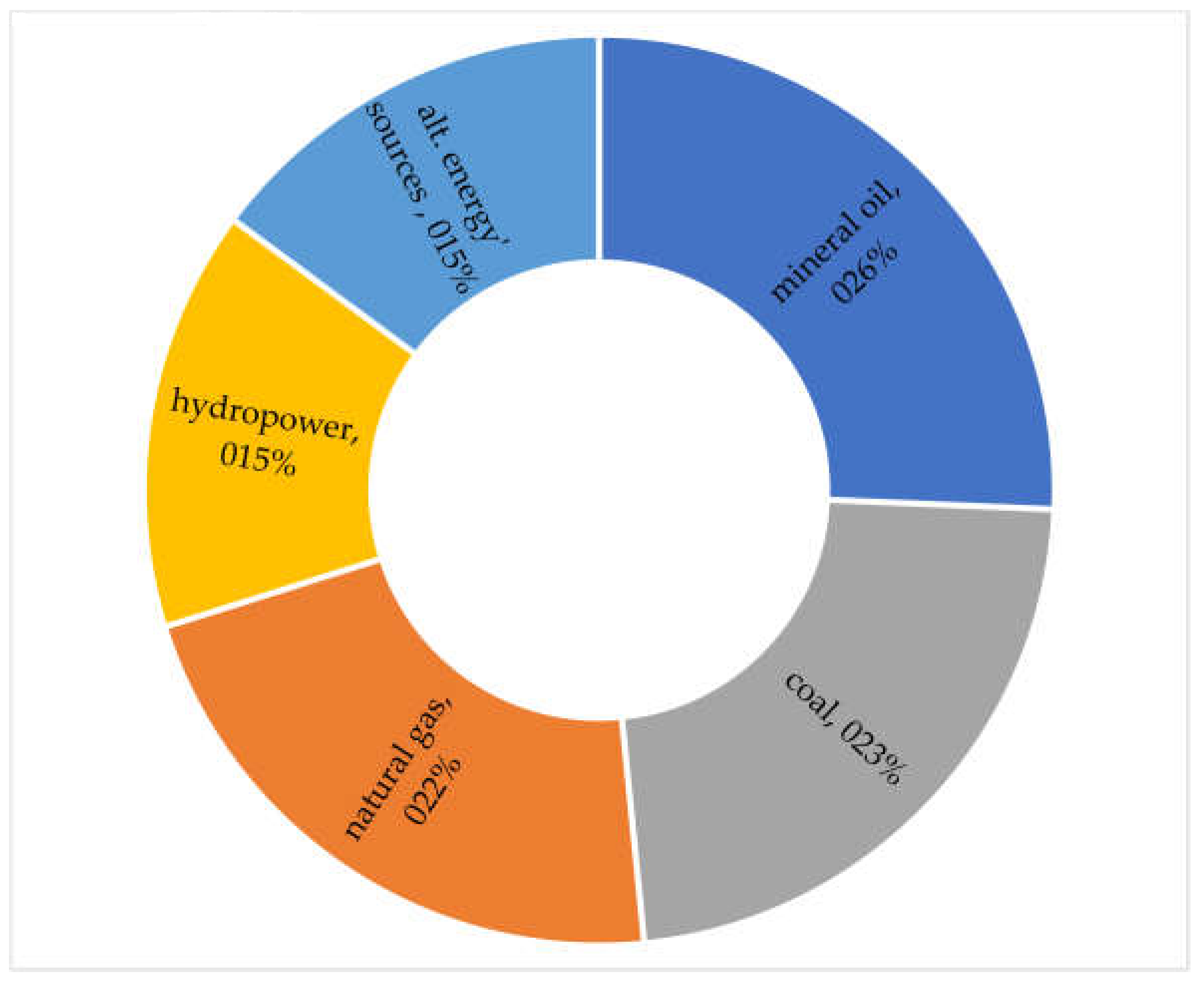

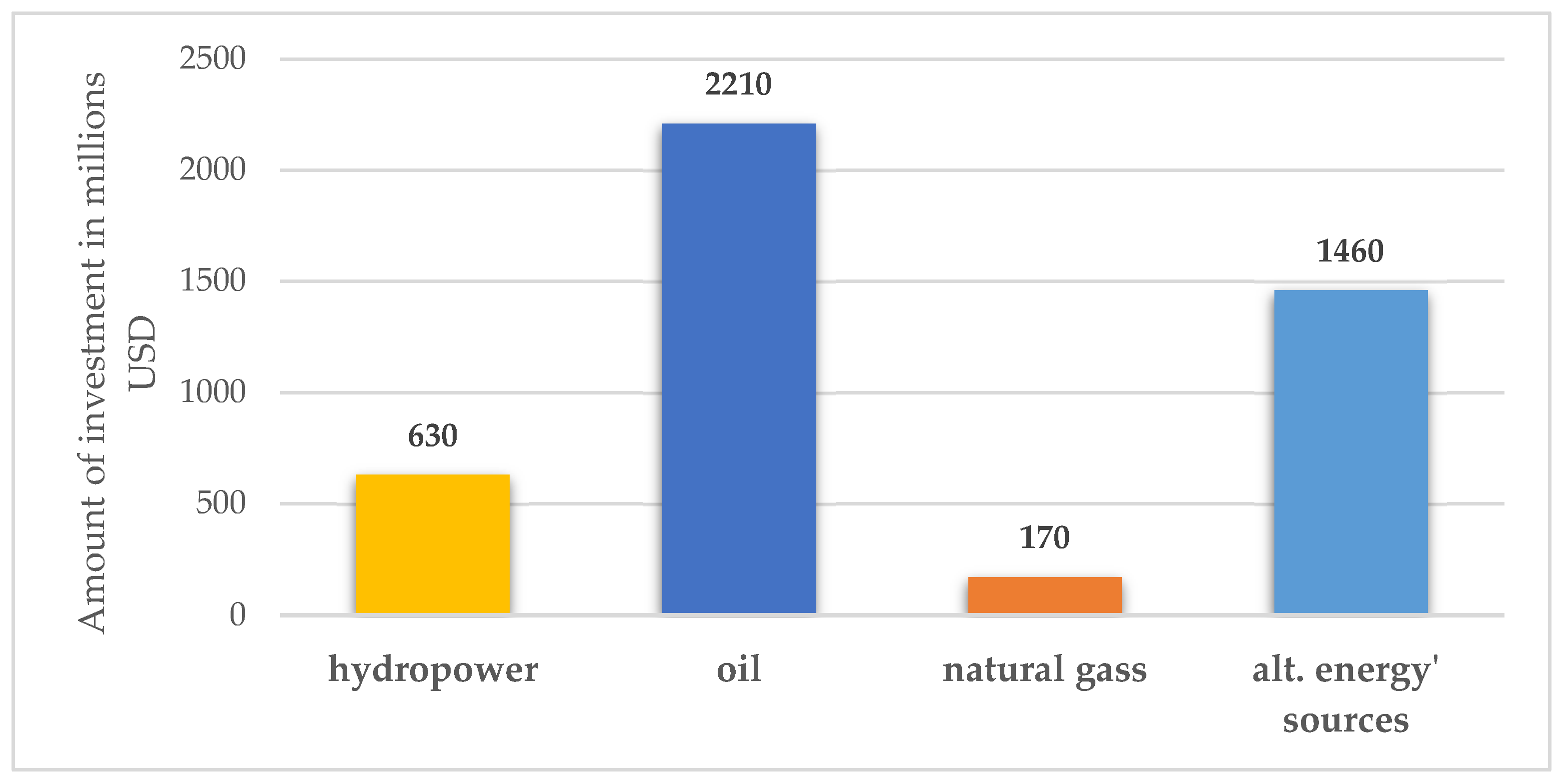

Figure 5.

The share of investments in individual types of energy in the years 2013-2021 [

22].

Figure 5.

The share of investments in individual types of energy in the years 2013-2021 [

22].

Although the focus of the BRI initiative is on traditional fossil fuels, particularly oil and gas projects, investments in alternative energy sources have been growing rapidly in recent years, including investments in hydro, wind, and solar energy, which have increased dramatically. It should also be noted that China has not engaged in coal-related investment projects since 2020. [

22,

29,

30],

Figure 6.

The amount of investments in individual types of energy in 2021 [

22].

Figure 6.

The amount of investments in individual types of energy in 2021 [

22].

China did not invest in coal-related projects in 2021. China's investments in alternative energy sources and hydropower have reached a value of approximately 21 billion dollars. The largest part of Chinese investments went to oil projects, which reached a value of 22.1 billion dollars. To take advantage of exclusive access to supplies from BRI partners such as Russia, Iran, and Venezuela at below-market prices, China has built additional oil refining capacity (around 30%) [

22,

31,

32].

3.1. Investmets in green energy

China is well positioned to help deliver low-carbon technologies to emerging markets and developing economies as part of the BRI initiative. China is the world's largest producer of solar panels, wind turbines, batteries, and electric cars. These technologies are becoming increasingly popular as their costs are reduced for both financial and environmental reasons, and at the same time, these projects would be in line with the commitment to increase support for other developing countries in the development of green and low-carbon energy and not to build new coal-fired power projects overseas [

2,

22,

43,

44].

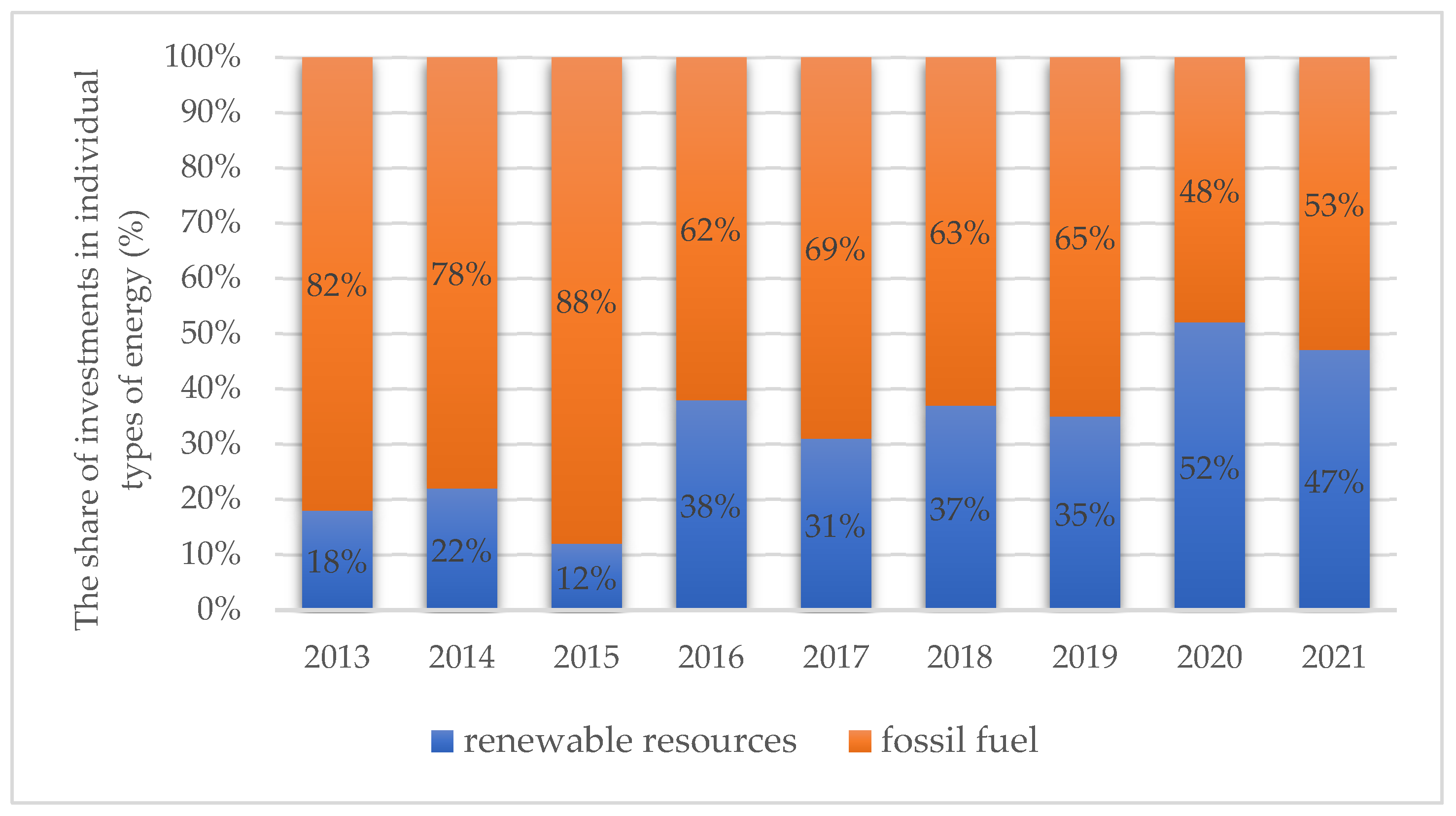

Figure 7.

Comparison of investment in renewable resources vs. fossil fuels [

22].

Figure 7.

Comparison of investment in renewable resources vs. fossil fuels [

22].

In 2020, investments in renewable energy such as solar, wind, and hydro will account for the majority of China's overseas energy investment, increasing from 35% in 2019 to 52% in 2020. This is particularly important right now, as rising fossil fuel prices and fuel shortages caused by the conflict in Ukraine are crippling poor energy-importing countries. The massive scale of investment in green technology development coming from China can be transferred to other economies in the region. In 2016, the Power Construction Corporation of China invested

$2.03 billion in the Nam Ou Hydropower Project in Laos, which includes seven cascade hydropower plants along the Nam Ou River. For the purposes of this project, a joint venture was created in which Power Construction Corporation of China owns an 85% stake. At the same time this year, the Chinese state enterprise China Three Gorges South Asia Investment Ltd. invested 1.65 billion dollars in the Karot hydroelectric project. The Karot hydropower project is one of China's energy initiatives under the China-Pakistan Economic Corridor, which aims to promote sustainable economic growth in the region while helping Pakistan achieve its renewable energy goals [

7]. The Karot hydropower plant was developed under the auspices of a joint venture in which China Three Gorges South Asia Investment Ltd. owns a 93% share. As part of a scientific study, [

17] found that China has so far invested in 28 renewable power projects in Pakistan. China's investment in renewable energy through the BRI has created approximately 8,905 jobs and

$39.8 million in manufacturing value for Pakistan [

7]. Africa [

32,

36,

38] wants to deepen cooperation with China in the field of renewable energy sources. Chinese investment in renewable energy is growing rapidly in sub-Saharan Africa. The influx of green investment will benefit the continent, which is very underdeveloped and at the forefront of climate change. We can take Nigeria as an example. In trade and investment, China has become a major player in Nigeria. An agreement between the Nigerian and Chinese governments to build important infrastructure, notably the Mambilla hydroelectric plant and two major projects to improve and modernise the national railway system, led to a subsequent significant increase in investment. In 2019, a Chinese consortium consisting of China Energy Engineering, Power Construction Corp., China Petroleum, and Sinopec invested

$2.91 billion in the Mambilla hydroelectric plant, which is expected to start operation in 2030. China and the EU together account for one-third of global final energy consumption and share similar interests in the clean energy transition. The Paris Agreement must be implemented effectively, and clean, sustainable, and cheap energy must be available to the people of both parties. As a result, EU-China energy cooperation focuses on helping both countries transition to clean energy. China Energy Investment has invested

$1.64 billion to acquire a 75 percent stake in four wind farms developed by Copelouzos in Greece through its subsidiary Shenhua Renewable Co. Cooperation between the two countries in the green energy sector aims to expand China's influence in the Balkans as well as other European countries.

3.2. Investment in green energy and infrastructure

To meet the Sustainable Development Goals by 2030 and achieve net zero emissions by 2050, significant investment in robust and sustainable green infrastructure is required. Finding options for implementing new technology or modifying existing assets is the hard part. Businesses must also decide whether to dispose of stranded assets, such as fossil fuel power plants, that are nearing the end of their useful lives due to legislative or market changes [

31].

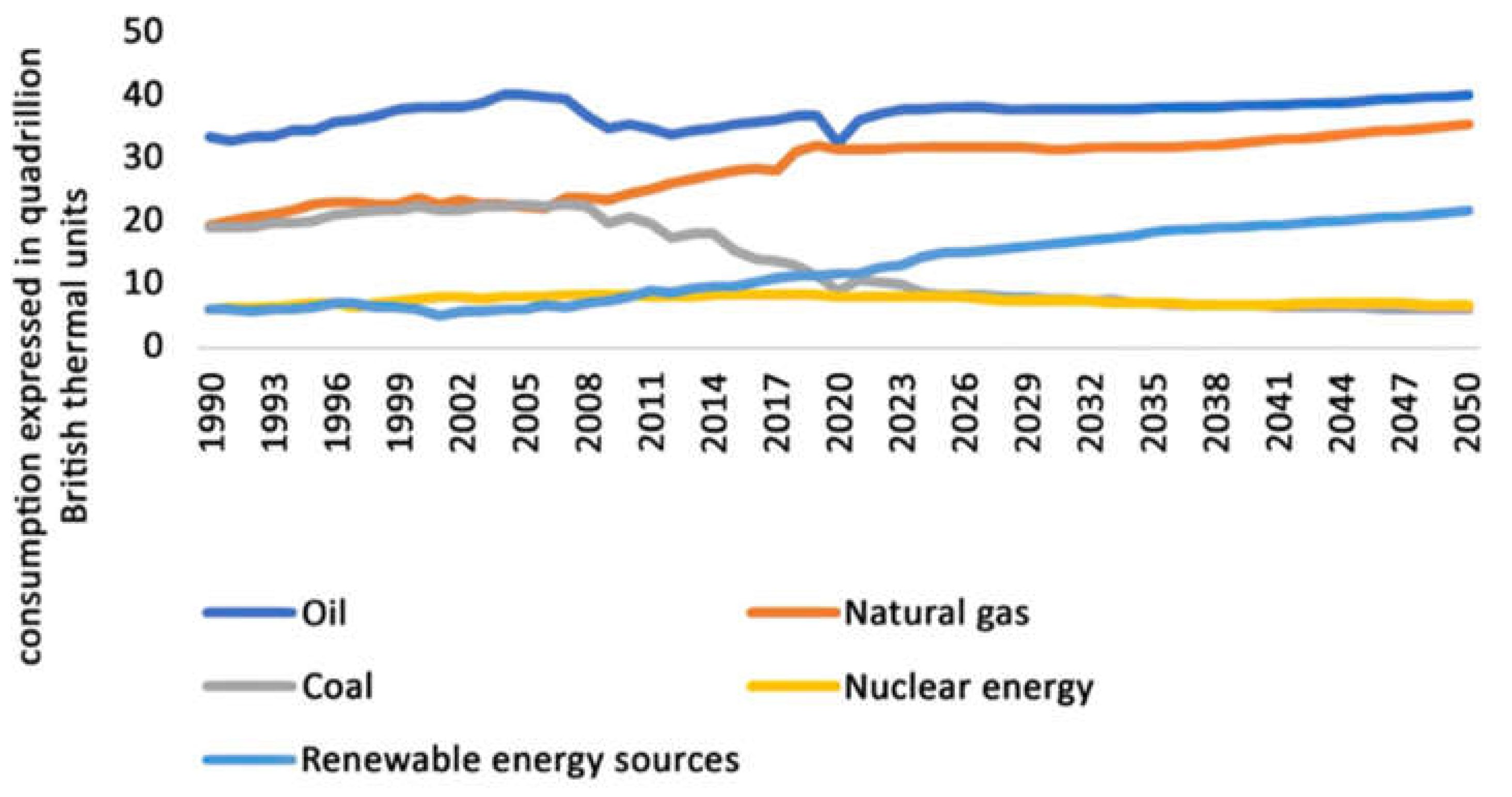

Figure 8.

Global energy consumption forecast [

22].

Figure 8.

Global energy consumption forecast [

22].

According to [

22,

28,

29,

32], developing economies face increasing energy needs as they industrialise. The demand for electricity in developing economies is increasing approximately three times faster than in developed economies. Between 2020 and 2050, global energy consumption will increase by approximately 50% if current economic trends continue.

On September 21, 2021, China stepped up its support for other developing countries in the development of green and low-carbon energy and at the same time promised not to build new coal-burning power projects abroad. But the problem is that they leave the host country without the technical know-how to manage the green infrastructure themselves. The projects are managed and built by Chinese nationals [

28].

The first recommendation is to provide know-how along with the project, which will result in residents gaining the knowledge and understanding to support their own infrastructure and continue to move forward with some basic needs. Further, changes must be made in investment policies such as property ownership, perceptions of corruption, regulatory quality and control, licence fees, permitting systems, and overall investment facilitation for Chinese private enterprises [

31]. We recommend the creation of new guidelines that will more intensively call for the regulation of how companies behave towards the environment abroad and, at the same time, transfer responsibility to companies for their environmental behaviour abroad. The Chinese government should provide advice to enterprises on how to carefully comply with host countries' environmental laws, standards, and conventions. Even though Africans contribute the least to energy-related greenhouse gas emissions of any continent, Africa is the region of the planet most vulnerable to climate change, which can range from severe droughts to catastrophic floods. We see many investment opportunities for Chinese corporations on this continent. There is a growing opportunity for Africa to become a major player in the mining and processing of critical minerals essential to produce batteries and renewable energy sources [

23,

24].

As China has a footprint in the mining industry in Africa, we recommend increasing investment in this sector. In terms of geology, Africa has some of the most promising areas, such as the Congo or Zimbabwe, which are already part of the BRI. Currently, we are already seeing how the supply chain is starting to focus on Africa as the next lithium mining area. As we can see, currently in the annual change in the production of renewable energy, China has a dominant position, while the whole continent of Africa has not surpassed the annual change in the production of renewable energy of Australia. To this day, Australia has 25.69 million inhabitants, and Africa has 1.3 billion. As Africa gradually industrialises, its energy consumption will also grow. [

45]

Figure 9.

Annual change in renewable energy production in 2021 [

22].

Figure 9.

Annual change in renewable energy production in 2021 [

22].

According to [

32,

36,

38,

46,

47], Africa is home to 60% of the world's potential solar resources, but currently owns only 1% of solar PV capacity. Due to severe air pollution and an urgent need for electricity, China has dramatically increased the use of solar energy. Currently, China has the largest photovoltaic capacity in the world. Chinese companies could capitalise on the expertise in solar energy by investing in science and research within Africa, in addition to investing in the mining sector. In addition to the above, China and Chinese companies should invest significantly in:

the creation of an innovation platform to strengthen research and development of sustainable technologies and their applications in Africa;

building a green hydrogen energy infrastructure to support the production of green hydrogen and its efficient storage and subsequent transportation;

the Chinese government should provide financial incentives, such as grants, loans, rebates, and tax breaks, to enterprises investing in renewable resources within Africa as part of the BRI policy framework to promote the development of renewable energy [

32].

In Africa, a region with great wind potential and great energy demands, wind turbines remain an unusual sight. In places where wind speed would have been considered insufficient just a few years ago, turbines are now much better equipped to capture wind effectively thanks to technological advances. Less than 1.3% of the world's installed wind power capacity is in Africa. China has one of the most efficient supply chains for wind turbines in the world. We also recommend increasing investment in wind energy and outsourcing the green industry to Africa, whereby China would also provide education and experience in this area to African populations. We also see the promising development of new green hydrogen in Africa, another area with huge potential for the continent. By investing in African solar energy to produce green hydrogen, they can secure global energy supplies while creating jobs in the heavy industry sector [

32,

36,

38,

46].

4. Conclusions

China's gradually increasing assertiveness at the international level marked the beginning of several influential geopolitical projects. The largest of them is the Belt and Road initiative, which will be the subject of this work. The Belt and Road is China's geopolitical project, which, according to official words, was created to improve regional integration, increase trade, and stimulate economic growth for all parties involved. Excessive industrial capacity, low domestic demand, and stagnant exports abroad are the real reasons why this project was created. China is constantly looking for new international markets among the poorer developing countries of Africa, Asia, and South America. The problem is that these countries have insufficient infrastructure that does not meet the logistical needs of Chinese trade. As part of the Belt and Road Initiative, China invests in various projects in the form of "loans" and, in many cases, creates debt traps that allow China to seize the assets of participating countries. Countries will face rising debt-to-GDP ratios, which may push them into an economic crisis. The economic situation of developing countries is not suitable for paying off large-scale infrastructure projects. However, infrastructure built on a transformative scale in places where local transport is very slow and unsafe will change transport and the economy for the better and boost tourism. In addition to infrastructure, China is also investing in energy, technology, agriculture, and various other sectors under the BRI. In our contribution, we focused on the energy sector and its development so far within the given initiative, and we also defined what the initiative should focus on within renewable resources.

Author Contributions

Both authors performed the analysis, conducted the experiments, and prepared the original draft. Both authors performed the revision and improved the quality of the draft and have read and agreed to the published version of the manuscript.

Funding

This publication was created thanks to support under the Operational Program Integrated Infrastructure for the project: "The implementation framework and business model of the Internet of Things, Industry 4.0 and smart transport". (ITMS code: 313011BWN6), financed by the European Regional Development Fund.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

The data used in this paper can be obtained from the corresponding author upon request.

Conflicts of Interest

The authors declare that they have no conflicts of interest regarding the publication of this work.

References

- MERICS. 2022. Mapping the Belt and Road initiative: this is where we stand. [2022-11-01] <https://documents1.worldbank.org/curated/pt/264651538637972468/pdf/Connectivity-Along-Overland-Corridors-of-the-Belt-and-Road-Initiative.pdf>.

- Wang Ch. N. 2022. China Belt and Road Initiative (BRI) Investment Report 2021. [2022-12-20] <https://greenfdc.org/wp-content/uploads/2022/02/Nedopil-2022_BRI-Investment-Report-2021.pdf>.

- Wu, SH; Liu, LL; Liu, YH; Gao, JB; Dai, EF; Feng, AG; Wang, WT. The Belt and Road: Geographical pattern and regional risks. Journal of Geographical Sciences 2019 29(4), 483-495. [CrossRef]

- Nedpoil Wang, Ch. 2021. China’s Investments in the Belt and Road Initiative (BRI) in 2020. [2023-01-27] <https://greenfdc.org/wp-content/uploads/2021/01/China-BRI-Investment-Report-2020.pdf>.

- Zhang, S. Protection of Foreign Investment in China: The Foreign Investment Law and the Changing Landscape. European Business Organization Law Review 2022, 23, 1049-1076. [CrossRef]

- Xie, Q. & Hua, Y. Institutional Differences and the Choice of Outward Foreign Direct Investment Mode under the “Belt and Road” Initiative: Experience Analysis Based on China´s Manufacturing Enterprises. Suistanibility 2023, 15(9), 7201. [CrossRef]

- Latief, R. & Lefen, L. Foreign Direct Investment in the Power and Energy Sector, Energy Consumption, and Economic Growth: Empirical Evidence from Pakistan. Suistanibility 2019, 11(1), 192. [CrossRef]

- Dunning, H. J. The eclectic paradigm as an envelope for economic and business theories of MNE activity. International Business Review 2000 9(2), 163-190.

- Derudder, B.; Liu, X. & Kunaka, Ch. 2018. Connectivity Along Overland Corridors of the Belt and RoadInitiative. [2022-11-01] https://documents1.worldbank.org/curated/pt/264651538637972468/pdf/Connectivity-Along-Overland-Corridors-of-the-Belt-and-Road-Initiative.pdf.

- ASEAN. 2019. Belt and Road projects: Past, present, future. [2023-01-21] http://asean.china-mission.gov.cn/eng/ydyl/201904/t20190425_8236063.htm>.

- Castrillon-Kerrigan, D. China-CEE Relations in a New Era: The Drivers behind the Development of the Platform for Regional Cooperation 16+1. REVISTA CS EN CIENCIAS SOCIALES 2022 37, 63-84. [CrossRef]

- Chow-Bing, N. 2020. COVID-19, Belt and Road Initiative and the Health Silk Road: Implications for Southeast Asia. [2022-11-01] https://library.fes.de/pdf-files/bueros/indonesien/16537.pdf.

- Hussain, J.; Zhou, K.; Guo, S. & Khan, A. Investment risk and natural resource potential in "Belt & Road Initiative" countries: A multi-criteria decision-making approach. Science Of The Total Environment 2020, 723, 137981. [CrossRef]

- Jiang, L. & Minhe, J. China´s Energy Intensity, Determinants and Spatial Effects. Suistanibility 2016, 8(6), 544. [CrossRef]

- Huang, YY. Environmental risks and opportunities for countries along the Belt and Road: Location choice of China´s investment. Journal of Cleaner Production 2022, 211, 14-26. [CrossRef]

- Jiang, J & Ao, L. Risk evaluation and prevention of China´s investment in countries aleong the belt and road. Journal of Intelligent & Fuzzy Systems 2023 44(2), 1645-4659. [CrossRef]

- Li, R.; Xu, L.; Hui, J.; Cai, W.; Zhang, S. China's investments in renewable energy through the belt and road initiative stimulated local economy and employment: A case study of Pakistan. Science of The Total Environment 2022, 835, 155308. [CrossRef]

- Hu,W; Shan, Y; Deng, Y; Fu, NN; Duan, J; Jiang, HN, Zhang, JZ. Geopolitical Risk Evolution and Obstacle Factors of Countries along the Belt and Road and Its Types Classification. International Journal of Environmental Research and Public Health 2023, 20(2), 1618. [CrossRef]

- Granneman, A. & Van Dijk, M. Foreign Direct Investment in China, the Factors Determining a Preference for Investing in Eastern or Western Provinces. Modern Economy 2015 6(8), 924-936. [CrossRef]

- Yu, KH. Energy Cooperation Under the Belt and Road Initiative: Implications for Global Energy Governance. Journal of World Investment & Trade 2019, 20(2), 243-258. [CrossRef]

- Kratz, A.; Zenglein, M.; Sebastian, G. & Witzke, M. 2022. Chinese FDI in Europe: 2021 Update. [2023-02-02]. Rhodium Group. <https://rhg.com/research/chinese-fdi-in-europe-2021-update/>.

- American Enterprise Institute. 2022. China Global Investment Tracker. [2022-12-21] https://www.aei.org/china-global-investment-tracker/>.

- EIA. 2022. Africa Energy Outlook 2022. [2023-02-07] <https://www.iea.org/news/global-energy-crisis-shows-urgency-of-accelerating-investment-in-cheaper-and-cleaner-energy-in-africa>.

- EIA. 2022. Annual Energy Outlook 2022. [2023-02-07] <https://www.eia.gov/outlooks/aeo/>.

- BP. 2021. Statistical Review of World Energy. [2022-12-21] https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2021-full-report.pdf>.

- BP. 2022. Statistical Review of World Energy. [2022-12-21] <https://www.bp.com/content/dam/bp/business-sites/en/global/corporate/pdfs/energy-economics/statistical-review/bp-stats-review-2022-full-report.pdf>.

- MOFCOM. 2021. The 14th Five-Year Plan for Business Development. [2022-12-19] http://images.mofcom.gov.cn/zhs/202107/20210708110842898.pdf?mc_cid=25492edd68&mc_eid=7d8719095d.

- MOFCOM. 2022. Statistical bulletin of China's outward foreign direct investment. [2022-12-20] http://images.mofcom.gov.cn/fec/202211/20221107152537194>.

- OECD. 2018. The Belt and Road Initiative in the global trade, investment, and finance landscape. OECD Business and Finance Outlook. [2022-11-01] <https://www.oecd.org/finance/Chinas-Belt-and-Road-Initiative-in-the-global-trade-investment-and-finance-landscape.pdf>.

- World Bank. 2019. Belt and Road Economics: Opportunities and Risks of Transport Corridors. [2022-11-17]. Washington, DC: World Bank. Dostupné na internete: < http://worldbank.org/en/topic/regionalintegration/publication/belt-and-road-economics-opportunities-and-risks-oftransport-corridors>.

- Global Infrastructure Outlook. 2022. Forecasting infrastructure investment needs and gaps. [2022-12-21] < https://outlook.gihub.org/>.

- IEA. 2021. Financing clean energy transitions in emerging and developing economies. [2023-02-07] <https://www.iea.org/reports/financing-clean-energy-transitions-in-emerging-and-developing-economies>.

- Liang, PN; Wu, MY; Jiang, LC. Energy Investment Risk Assesssment for Nations along China´s Belt & Road Initiative: A Deep Learning Method. Applied Sciences 2021, 11(5), 2406. [CrossRef]

- Wu, SH; Liu, LL; Liu, YH; Gao, JB; Dai, EF; Feng, AG; Wang, WT. The Belt and Road: Geographical pattern and regional risks. Journal of Geographical Sciences 2019, 29(4), 483-495. [CrossRef]

- Rauf, A.; Ozturk, I.; Ahmad, F.; Shehzad, K.; Chandiao, AA.; Irfan, M.; Abid, S. & Jikai, L. Do Tourism Development, Energy Consumption and Transportation Demolish Sustainable Environments? Evidence from Chines Provinces. Suistanibility 2021, 13(22), 12361. [CrossRef]

- Parente, R.; Rong, K.; Geleilate, JMG. & Misati, E. Adapting and sustaining operations in weak institutional environments: A business ecosystem assessment of a Chinese MNE in Central Africa. Journal of International Business Studies 2019, 50(1), 275-291. [CrossRef]

- The Economist. 2022. The G7 at last presents an alternative to China’s Belt and Road Initiative. [2022-11-19] https://www.economist.com/china/2022/07/07/the-g7-at-last-presents-an-alternative-to-chinas-belt-and-road-initiative?gclid=CjwKCAjw0ZiiBhBKEiwA4PT9z3oBjbPkBen0_pid_0_cdXJ8uGKLVyXoHMwAghJQ30wHrG5f7U2gWBoCQFYQAvD_BwE&gclsrc=aw.ds.

- Abdulsalam, A.; Xu, H.; Ameer, W.; Abdo, AB. & Xia, J. Exploration of the Impact of China´s Outward Foreign Direct Investment (FDI) on Economic Growth in Asia and North Africa along the Belt and Road (B&R) Initiative. Sustainability 2021, 13(4), 1623. [CrossRef]

- Duan, F; Ji, Q; Liu, BY. & Fan, Y. Energy investment risk assessment for nations along China´s Belt & Road Initiative. Journal of Cleaner Production 2018, 170, 535-547.

- Bloomberg News. 2021. China Steps Up Overseas Hunt for Ore Needed to Make Aluminium. [2022-12-28] https://www.bloomberg.com/news/articles/2021-12-09/china-steps-up-overseas-hunt-for-ore-needed-to-make-aluminum.

- Farooki, M. 2018. China’s Mineral Sector and the Belt & Road Initiative. SNL Financial [2022-12-26] < https://www.stradeproject.eu/fileadmin/user_upload/pdf/STRADE_PB_02-2018_One_Belt_One_Road.pdf>.

- Hale, T.; Liu, Ch. & Urpelainen, J. 2020. Belt and Road Decision-Making in China and Recipient Countries: How and to What Extent Does Sustainability Matter? [2022-11-18] http://sais-isep.org/wp-content/uploads/2020/04/ISEP-BSG-BRI-Report-.pdf>.

- Green Finance & Development Center. 2022. Chinese investments in countries of the Belt and Road Initiative (BRI) from 2013 to 2021 (in billion U.S. dollars). [2022-12-11] < https://www.statista.com/statistics/1274991/china-total-investment-in-belt-and-road-countries/>.

- Liu, HY; Wang YL; Jiang, J & Wu, P. How green is the „Belt and Road Initiative“? – Evidence from Chinese OFDI in the energy sector. Energy Policy, 2020 145, 111709. [CrossRef]

- Yuan, Y. & Tan-Mullins, M. An Innovative Approach for Energy Transition in Chine? Chinese National Hydrogen Policies from 2001 to 2020. Sustainability, 2023 15(2), 1265. [CrossRef]

- Nedopil Wang, Ch. 2022. Countries of the Belt and Road Initiative (BRI). [2022-12-19] <https://greenfdc.org/countries-of-the-belt-and-road-initiative-bri/>.

- Huang, YY. Environmental risks and opportunities for countries along the Belt and Road: Location choice of China´s investment. Journal of Cleaner Production 2022, 211, 14-26. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions, or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).