Introduction

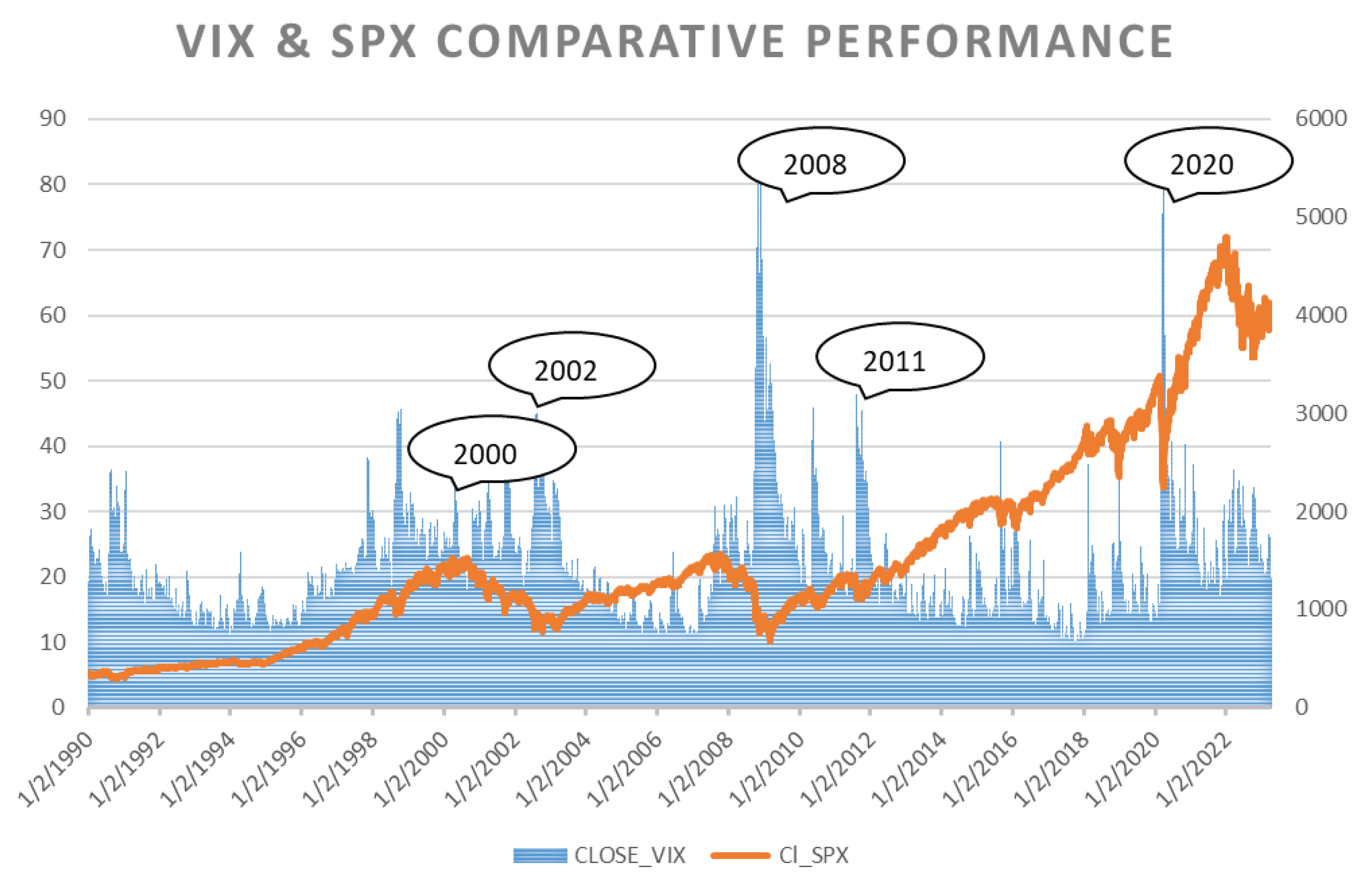

The research is a deep study of the CBOE Volatility Index (VIX), which represent the market sentiments of the S & P 500 Index (SPX) over 33 years, three months and five days. During the study, the research elaborates on occasions when the market crash happened, and it happened on three occasions during the study period, the dot-com bubble, the year 2008 financial crisis and in 2020 COVID period. The research distributes the market rally in two forms, and one is a trust rally, when investors are happy to see the market in a stable form, and investors’ sentiments are positive towards the stock market. Second is a fear rally, where investors’ sentiments are negative, and their outlook is bearish for various reasons.

The research studies the two rallies (trust and fear) over a long period of 33 years. It tries to measure how the two indexes, VIX and SPX, relate with each other and various inferences that can be drawn from the data.

Also, it evaluates how the two indexes perform in the stock market crash and how reliable VIX is in predicting market sentiments. The nature of the study is descriptive, as the research analyzes the historical data to reach a meaningful conclusion. It observes the pattern of rallies, like the longest trust or fear rally, in which year and its duration.

CBOE Volatility Index (VIX)

CBOE Global Markets maintain Chicago Board Options Exchange’s Volatility Index (VIX). It is a highly valued global index representing a quantifiable measure of risk and rewards situation for a certain period and symbolizes investors’ sentiments.

It is a real-time index representing investors’ sentiments, where prices are derived from the SPX index options and the volatility in terms of trust and fear. It projects volatility in the coming 30 days, which is helpful for investors in making their investment decisions based on their interpretation of SPX in terms of the level of stress, risk and fear. There is a general understanding that VIX will fall when stock prices rise, whereas it will rise when stock prices fall, representing an inverse relationship. It happens as VIX higher values represent stressful situations in the market, whereas lower values mean stability in stock prices and the presence of positive sentiments.

Literature Review

There are numerous research studies available on sentiment analysis based on news feed analysis under compute science department, like (Shri Bharathi, 2017), analysis of Twitter feed (Shah, 2019), and (Kolasani, 2020) classifying the sentiments as positive, and negative or neutral. Most of the research uses text mining to process textual content and then divide the news feed into various categories for analysis. Numerous data mining conference papers and research are available on the subject, using AI for the analysis purpose to predict sentiments.

(Ruan, 2018), research also confirms the negative relationship between the VIX and the stock market, and the stock market response time is two months, and the results are based on 5-year data between 2011-2016. The research emphasizes the need to advance China’s financial system and take advantage of VIX in predicting stock indices, and it is true for all developing markets. (Sophia, 2017) research focuses on a comparative analysis of Indian VIX with US VIX, Brazilian VIX and China based on the two-year data set, and findings indicate that individual markets do not relate to US VIX.

(Bantwa, 2020), his research findings establish that portfolio returns can be adjusted by shifting from mid-cap to a large cap depending on the VIX movement. He suggests when sentiments are negative. It means VIX is at a higher level. It is better to move in a large cap and do the vice-versa when sentiments are positive. It is a general truth as large caps are believed to be secured during the bear run as they have more resources to survive financial or economic crises.

Methodology of the VIX

The index value is inferred from the options prices, which are the derivatives whose probability of price movement is gauged by options traders where they bet on the movement of the current price of a stock to reach a particular level called strike price in order to make a profit. As the price movement is predicted for a given time frame, it is taken as the input for measuring the volatility. The option prices of underlying securities are used to drive the implied volatility (IV).

At the beginning (1993), VIX calculation was a weighted measure of the IV when the derivative market was growing. After ten years, when it reached a certain level of maturity, the CBOE and Goldman Sachs jointly updated the methodology using a wider set of options based on the S&P 500. The changes portray more accuracy regarding investors’ sentiments and future stock volatility.

General investors assume that a VIX value of greater than 30 means large volatility is expected in the near future as the market is in a stressful situation due to various economic reasons and an indicator of a bear market, whereas a number less than 20 means market is in a positive frame and investors are looking towards a stress-free condition in the near future.

At present, it is one of the most popular indices in the world; CBOE Global Market Inc, which owns the Chicago Board Options Exchange and the Stock exchange operator BATS Global Markets, has a market capital of 1.45 TCr in Dollar terms. Due to the wide acceptance of VIX, the company is now providing other market variants to measure volatility; some examples are 9-day, 3-month, and 6-month, and now they are also providing instruments in other markets- Nasdaq-100 Volatility Index (VXN) etc.

Standard & Poor’s 500, or S&P 500, a stock market index, was founded in 1957 in its present form. It represents the largest 500 companies in the USA, with a market cap of $33.8 trillion (2020). It is a free float Weighted-Capitalization index where the top 9 companies account for almost 27.8% of the index’s market capitalization.

Methodology

The research takes 33 years of historical data from the VIX and SPX and studies the rallies that happen during the period. The study’s objective is to mark index movement under two sentiments called fear and trust. In the two categories of trust and fear, a further subdivision is done according to directional movement and how long that rally last. Based on continued directional movement, the longest rally is called an exceptional rally(more than 8-days), then a Major rally (6 & 7 days), a semi-major rally(4-& 5 days), and the rest of the days’ combination we call them minor rally period. Whereas ‘0’ denotes the directional change when a continuous upward movement changes and the index moves down from its previous closing, or it can be a downward movement change to an upward movement when the index moves up from its previous day’s position.

Fear index movements happen when VIX numbers move upward, denoting stressful economic conditions, and investors fear investing the money as too many negatives are circulating. Similarly, there are days when the VIX continually falls, increasing the investors’ trust and reducing stress in the market sentiments. Again we are interested in exceptional, major and semi-major rallies and their period.

During the identification phase, the research focuses on longer rallies and the performance of the index during major stock market crashes, the dot-com bubble in 1999-2000, the 2008 financial crisis and the 2020 COVID crisis. The comparative graphical approach is used to identify highs and lows during the long study period by plotting the numbers taken from VIX and SPX index for the same period.

The period of study starts from the 2nd of January 1990 to the 6th of April 2023; it is 33 years, three months, and five days, comprised of 12,148 calendar days, in which 8381 are available business days rest of them are considered public holidays and weekend days. During comparative analysis, there are 13 days when only one institution works or has the data for that day. We have removed those days from our data sets as we are studying the sentiment attributes from these rallies, and these days are spread over 33 years of long duration, which we consider as of low or no impact on our findings.

On a broader level, we believe there should be an inverse relationship between VIX and SPX, as a higher number of VIX denotes a stressful situation in the stock market. It means SPX will move downward as investors are cautious and negative sentiments dominate the market. Contrary to this, when VIX moves in a downward direction, it shows the investors’ positive sentiments in the coming days and indicates SPX will move up because of investors’ confidence in the market situation.

Stock Market Crash

As such, a stock market crash can not be defined in numeric terms, but it is considered when an index loses more than 10% of its value in a short period of time. It may happen without warning, or it can be an outcome of sudden adverse news that investors perceive as a threat to their investment, and it is caused by panic selling, where the majority of them like to dump stocks during the decline and get out with minimum losses. As per the chosen time period, the research will focus on three stock market crashes, the Dot-com bubble (1999-2000), the Financial Crises in 2008, and the Corona Virus Crush in 2020.

Analysis

Fear Index Movement in the VIX

As per the definition, upward movement in the VIX denotes stressful conditions, where market investors are cautious, and a bear market is expected if the rally is long and investors remain fearful.

During the 33-year study period, only three exceptional rallies were observed where VIX continued to move in an upward direction for 8 and 9 days. The 9-day rally happened in 2016, between 24-10-2016 till 4-11-2016, while 8-day rallies happened from 28-03-2012 to 10-4-2012 and 22-11-2013 to 05-12-2013.

After that, major rallies in which the index moved upward for 6 and 7 days happened 21 and 11 times during the study period. Overall there are 1549 fear rallies where continued upward movement of the VIX index is observed ranging from 2 days to 9 days. And there are 2329 directional days when the index change direction from downward direction to upward direction.

Trust Index Movement in the VIX

The downward movement of VIX denotes positive sentiments from the investors’ perspective, where investors like to invest their money in a positive economic outlook. The more the downward movement, the more positive investors feel; it is a lead sign of a bull market.

In comparison to fear rallies, trust rallies numbers are more, while fear exceptional rallies are 14, while trust exceptional rallies are 32. Whereas fear rallies, the longest rally comprised nine days and only happened in 2016, the longest trust rally was ten days and happened three times during the 33-year study period.

The 10-day exceptional trust rallies were observed in the year 2005, 2009, and 2015, whereas the year 2009 saw two exceptional rallies, but the year 2010, the year when the highest number of exceptional rallies (3), was observed and it was in Feb, March and December.

The VIX Movement in the Stock Market Crash Years (1999-2000, 2008 and 2020)

There is only one exceptional fear rally in each year 2000, 2008 and 2020, when the stock market crashed due to the dot-com bubble, financial crises and Coronavirus. As accepted, there are no exceptional trust rallies in those years. There was only one 6-day and three 5-day rallies in the year 1999-2000, and the years could be seen as the years of smaller rallies where directional changes are more visible from day-to-day changes.

In 2008, only one 5-day fear rally was observed alongside one exceptional rally in the year known for its financial crises. In the 2020 COVID year, two exceptional fear rallies and one 5-day rally are observed. During the Crash years only in 2020, it saw a trust rally of 7 days in the month of August.

In the Stock market Crash years, VIX only showed exceptional fear rallies in 2020. In the other two crises, fear rallies mostly consisted of minor rallies and plenty of days where directional changes occurred. Overall there are 2329 days of directional change in the fear side. In 2000, 129 days of directional changes were observed from a total of 252 days of year-long working. In 2008, the total working days were 253, from which 134 directional changes were observed; similarly, in 2020, the total number of days was 253, from which 142 days of directional change were observed.

In 2000, 64 fear rallies were observed in which 27 days of single-day upward movement were counted. In 2008, 72 fear rallies were observed, 42 days of single-day upward movement were observed, and in 2020, 68 fear rallies and 44 days of single-day movement were observed.

The year 2020 is exceptional as its impact is not limited to the stock market but felt by the commoner, who has nothing to do with stock market operations. It is the time when poverty (Ahmed, Poverty and Deprivation: Study of a most impoverished population for better management of resources, 2021), raises its ugly side, and people who are already living in hard conditions for them the conditions become worst due to the shortage of essential items and affordability during the crises. It was the time when indices sentiments were compared with the valuation of leadership quality (Ahmed, Eight Signs of Leadership Failure-COVID-19, Test of Leadership Quality, 2021) and their capacity to survive the global crises. The market valuation for individual companies at the time represents leadership quality and how they survive the crises with minimum damages or generate new means of earning (Ahmed, Performance Evaluation of a Business Leader During COVID-19, 2021).

The SPX Movement in the last 33 Years of the Study Period

There were 13 SPX exceptional trust rallies during the study period; the longest one was in the year 1995 (from 29-8-1995 to 14-9-1995), then another rally of 11 days happened in the year 1990, then there were 8-day(8) and 9-day(3) rallies in different years. The year 2003 and 2013 saw two exceptional trust rallies in each year. Whereas there were 54 major rallies during the study period and 2010 minor trust rallies in which the SPX index moved upward.

On the fear side, when the SPX index moves downward, there are 04 exceptional rallies during the 33-year to study period; the longest one is in 2016 of 9 days. At the same time, three 8-day rallies are observed in the years 1991, 1996 and 2008. During the period, 23 major rallies were observed, 2126 minor rallies were seen, and 2320 directional change days were observed. In 2011, 3 major fear rallies were observed, whereas in 1991, 1994, 2012, 2018, and 2022 each year saw two major fear rallies.

The SPX Movement in the Stock Market Crash Years (1999-2000, 2008 and 2020)

There was only one exceptional fear rally in 2008 at the time of the financial crisis and one rally each in 1999 and 2000 when the dot com bubble pulled the index down, whereas, in 2019 and 2020, another major rally was observed during COVID time.

On the trust front, the year 2019 saw one exceptional trust rally, but it was from the 28th of March till the 8th of April, before the reporting of COVID virus. The year 2000 saw one, whereas 2020 saw two major trust rallies of 7-days.

Results

During the study period of 33 years, the business day range remained between 250-254 days in a year, and the lower and the higher side of direction change in the fear sentiments in VIX remained between 123-148, defining the range of negative movement. In contrast, the range of fear rallies each year remains between 23 and 36.

As the objective of our study is to explore the relationship between VIX and SPX Indices movement during the crash years when the stock market fell rapidly, we have identified the year 2000, 2008 and 2020 for reasons well understood and deeply evaluate the conditions during the year and how they differ from the other normal years during the study.

In the year 2000, the dot-com bubble burst; during this, the sentiments are down the numbers were similar to the year 1999; there were more rallies in an upward direction in VIX (35), and in a downward direction in SPX (37), and directional changes are also less in numbers, compared to normal years.

In the year 2008, when financial crises happened, VIX observed 30 fear rallies alongside a single-day upward movement. It shows fear sentiment dominating the market, while in SPX, 32 fear rallies were observed while 40-single day movement when the market moved down from the previous day but rose the next day to deny any downward rally was detected.

In the year 2020, COVID year, more directional changes (142) are observed in VIX, but conversion into fear rallies is less (23), leading to higher single-day (45) upward movement, which indicates negative sentiments. In the SPX, similar to VIX, higher directional movements are visible but saw fewer fear rallies(19).

Overall there is a relational movement between VIX and SPX. Still, they lack proportional strength or numbers to draw any statistical inference other than directional movement indicating similar sentiments dominating both markets. As VIX data is based on the short-term future sentiments of investors, it is only true that there should be a directional relationship, but the investors who invest in these financial instruments may be different in both markets. It is obvious that the impact of one is observed in another, or investors took advantage of available data and took a position accordingly in the market.

The SPX in 2000 saw 1523 as the peak at the beginning of the year but ended the year in a range of 1264. In comparison to the year 2000, the crises in 2008 are more visible in SPX as it saw 752 as the lowest point near the end of the year, whereas the year began with a 1447 range, almost losing half of its height during the year, at the same time VIX shows the value of 80.86 on the 20th of November 2008, when SPX made a low of 752. Similarly, the year 2020 saw up and down of the SPX index; it started from the range of above 3200 and, in between, moved down to above 2400 range and again ended the year in the 3000 range.

Upward and downward movement in VIX shows the sentiments, but the movement is slowly built around the market conditions, and much depends on macroeconomic factors. As we can see, the highest sentimental value was 9.14, when investors’ positive sentiments are most elevated, and that happened in the year 2017 in November month, whereas VIX touched the peak of negative sentiments in the year 2020 in March month at 82.69 that time SPX was at 2386 level almost the 1000 point down from the beginning of the year position. Overall 19.67 is the mean value, which confirms that most of the time, sentiments remain positive. During COVID, travel and tourism companies faced huge losses, while the pharmaceutical and communication services demand increased many times. Although the index gives overall sentiments, individual and profitable sectoral opportunities exist in crises. (Ahmed, COVID-19 impact on Consumer Behaviour, Demand and Consumption, 2021) It is the time when the supply chain saw mega disruption as the whole world stopped exchanges due to covid fears (Ahmed, How Supply Chain Disruption is Destroying MSMEs and the Expectations from WTO, 2021). In many ways, the year 2020 crisis is different from other stock market crashes, and the world saw mismanagement and shortage of resources as companies failed to maintain their supply chain due to global dependence. Not only was national leadership questioned for management of covid crisis, but business leaders also faced action on their performance.

During the study period, the SPX has grown by 16 times. Although the upward or downward movement is built from smaller directional movements with the sentiment of fear or trust dominating the market; still, longer rallies are not of dominating nature. Exceptional Fear rallies happened only in 2012, 2013, and 2016, only the year 2016 is supported by major rallies and its months apart June-2016 (major), Oct-Nov-2016 (Exceptional) and Dec-2016 (Major). It shows that fear or trust sentiments are built from smaller minor rallies rather than one-sided rallies dominating in all forms.

In conclusion, the two markets are related by definition as VIX portrays the investors’ sentiments based on SPX short-term positional trade data, but not the exact statistical or proportional relationship. The observation is as SPX is based on 500 companies, all companies are not given equal weightage, and even short-term positioning is not applicable in all companies. The VIX can identify the directional movement and predict the market sentiments, and investors can use the data to gauge the market’s mood. However, stock selection still needs technical and fundamental analysis and study of the macro factors that affect the company’s performance.

References

- Ahmed, M. (2021). COVID-19 impact on Consumer Behaviour, Demand and Consumption. International Journal for Innovative Research in Multidisciplinary Field.

- Ahmed, M. (2021). Eight Signs of Leadership Failure-COVID-19, Test of Leadership Quality. International Journal for Innovative Research in Multidisciplinary Field (IJIRMF) [ISSN:2455-0620], 7(4). Retrieved from https://www.ijirmf.com/wp-content/uploads/IJIRMF202104017.

- Ahmed, M. (2021). How Supply Chain Disruption is Destroying MSMEs and the Expectations from WTO. International Journal of Advanced Research (IJAR), 8(12), 850-857. [CrossRef]

- Ahmed, M. (2021). Performance Evaluation of a Business Leader During COVID-19. International Journal of Law Management & Humanities [ISSN 2581-5369], 4(1). [CrossRef]

- Ahmed, M. (2021, April). Poverty and Deprivation: Study of a most impoverished population for better management of resources. International Journal of Innovative Science, Engineering & Technology, 8(4). Retrieved from http://ijiset.com/vol8/v8s4/IJISET_V8_I04_25.pdf.

- Al, C. G. (2021). Sentiment analysis and prediction of Indian stock market amid Covid-19 pandemic. IOP Conf. Ser.: Mater. Sci. Eng.

- Bantwa, A. (2020). A Study on India Volatility Index (VIX) and its Performance as Risk Management Tool in Indian Stock Market. PARIPEX-INDIAN JOURNAL OF RESEARCH, 6(1). Retrieved from https://www.researchgate.net/publication/345831541_A_Study_on_India_Volatility_Index_VIX_and_its_Performance_as_Risk_Management_Tool_in_Indian_Stock_Market.

- Kolasani, S. a. (2020). Predicting Stock Movement Using Sentiment Analysis of Twitter Feed with Neural Networks. Journal of Data Analysis and Information Processing, 8. [CrossRef]

- Ruan, L. (2018). Research on Sustainable Development of the Stock Market Based on VIX Index. sustainability. [CrossRef]

- Shah, N. (2019). Stock Market Movements Using Twitter Sentiment Analysis. International Journal of Scientific Development and Research (IJSDR), 4(4).

- Shri Bharathi, A. G. (2017). Sentiment Analysis for Effective Stock Market Prediction. International Journal of Intelligent Engineering and Systems, 10(3). [CrossRef]

- Sophia, H. R. (2017). Relationship Between India VIX and other VIX. International Journal of Economic Research, 14. Retrieved from https://www.serialsjournals.com/abstract/21521_ch_28_f_-_73.pdf.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).