1. Introduction

Maritime transport is an essential foundation for global supply chains and economies. According to United Nations Conference on Trade and Development statistics, global shipping and ports accounted for more than 80% of the global merchandise trade volume and more than 70% of the transaction value in 2019 [

23]. The price of marine transport varies with the trade volume. The BDI is a metric that reflects the worldwide shipping costs of major goods and materials through significant shipping routes. Its direct correlation with supply and demand conditions makes it an indicator of economic production [

5].

COVID-19 exploded in 2020, severely disrupting international trade and causing inefficiencies, delays, and supply chain disruptions on an unprecedented scale [

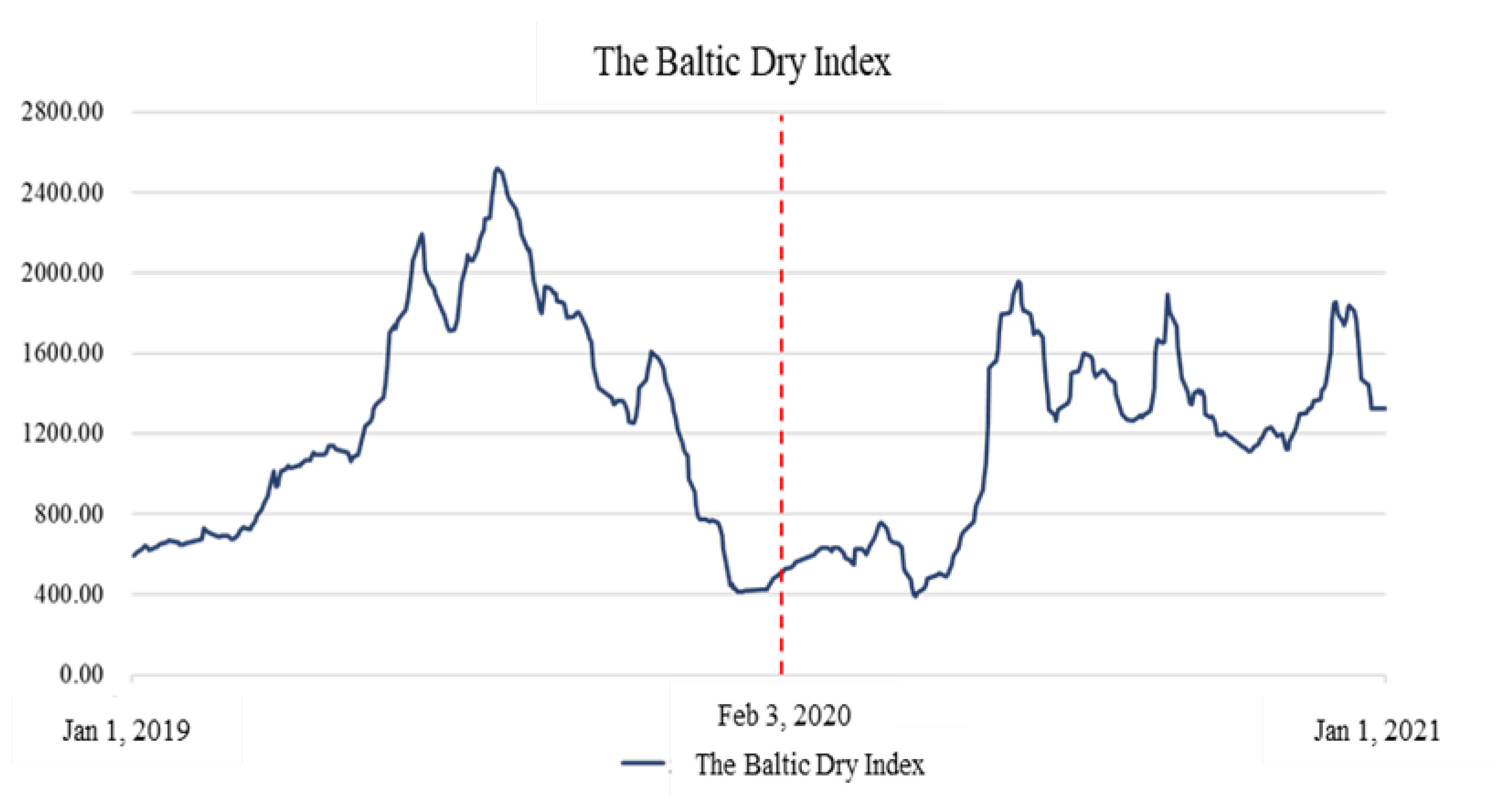

18]. However, with the continued development of the epidemic, the freight index has increased several times. It is interesting to explore why the freight index fell to the bottom at the beginning of the COVID-19 epidemic and suddenly rose explosively shortly afterward, as shown in

Figure 1. The magnitude of the increase is the reason for this study. Therefore, we will explore the critical factors affecting the freight index before and after the COVID-19 epidemic.

The current manuscript is structured as follows. The second part of the paper constitutes the literature review, while the third part delineates the variables and methodology. This section elucidates the variable selection technique utilized in Stepwise Regression models. The fourth part entails the results section along with a corresponding discussion. Finally, the last section of the paper presents the study's conclusion.

2. Literature Review

Global trade transportation includes air transport and marine transport. However, the majority of goods are transported via large container ships. The global container freight index is critical, mainly the Baltic Dry Index. BDI indicates shipping costs for transporting commodities, including coal, iron ore, and grain, through the sea. It plays a significant role in the economy by providing insights into the demand for these commodities, primarily in emerging economies, and the potential alterations in worldwide trade patterns. Consequently, this study examines which factors affect the BDI and how the COVID-19 pandemic influences the BDI.

2.1. The Baltic Dry Index

Grammenos and Arkoulis [

10] analyzed data from 1989 to 1998 to investigate the relationship between international maritime transport volumes and global economic risk indicators. Specifically, they examined the BDI, Brent, and US Dollar Index as potential relationship indicators. In this study, the authors establish significant connections between the returns of international shipping stocks and global risk factors using a sample of 36 shipping companies listed on ten stock exchanges worldwide. The study's findings revealed a negative relationship between shipping stocks and both oil prices and shipping stocks. At the same time, there is a positive relationship between the US Dollar Index. Utilizing data from 1989 to 2010, Alizadeh and Muradoglu [

1] examined the BDI, West Texas Intermediate (WTI), and ten different stock markets (including petroleum, natural gas, and finance) to investigate the suitability of freight tariffs in explaining short and long-term stock returns. The study found that while long-term movements in freight prices are insufficient in explaining stock returns, short-term movements in freight prices can significantly impact stock returns. Furthermore, the authors observed that data from developed markets such as the United States, Europe, and China have a more pronounced effect on freight rates than data from emerging markets.

Andriosopoulos et al. [

2] investigated the shipping stock and freight markets, utilizing data from 2006 to 2012. Specifically, the BDI, Baltic Dirty Tanker Index (BDTI), daily closing price, and the Dow Jones Industrial Average (DJIA) transportation index were employed, drawn from the stock market of 95 maritime companies worldwide. The models developed for the indices exhibited significant forecast errors attributable to the differences in risk profiles among the constituent firms of the transportation stock market index. By contrast, the DJIA model was observed to have a smaller error margin. Erdogan et al. [

8] conducted a study utilizing daily and weekly data from 1999 to 2012 to examine the correlation between the Dow Jones Industrial Average and the BDI. The results indicated that the two markets exhibited mutual feedback during financial turmoil, strengthening their correlation. Furthermore, the extent of information spillover between the markets was found to vary. Over the long term, changes in the BDI were observed to offer insights into changes in the Dow Jones Industrial Average. These findings have significant implications for market participants seeking to mitigate risks and enhance their understanding of market behavior. As the BDI is a crucial indicator of global trade and economic activity, the paper's findings may have important implications for more broadly understanding and predicting movements in the BDI and the dry bulk shipping market.

The BDI is a widely used measure of shipping costs for bulk commodities. Several studies have examined the relationship between the BDI and other economic indicators. Ruan et al. [

18] analyzed the correlation between the BDI and crude oil prices using data from 1988 to 2015. They found that the interaction between the BDI and crude oil prices is significant in the short term but less in the long term. Papailias et al. [

17] investigated the cyclical nature of the BDI and its impact on predictive performance using monthly data from 1993 to 2015. They found that the periodicity of BDI is best for 3-5 years, and variables such as Brent, coal prices, and steel prices have a significant impact on the BDI. Lin et al. [

14] examined the spillover effects of the BDI on commodity futures, currency, and stock markets using data from 2007 to 2018. They found that the spillover effect of the BDI is time-varying and insignificant, except during the financial crisis of 2009 and the European debt crisis. Gong et al. [

9] analyzed the impact of the China-United States trade war on the freight and stock markets using weekly data from 2002 to 2019. They found that the shipping and U.S. stock markets are more likely to crash together than to rise together, and the impact is higher during economic downturns. Additionally, the U.S. stock market has a more substantial influence on and is more sensitive to the shipping market than China.

The BDI is a metric that reflects the worldwide shipping costs of major goods and materials through significant shipping routes. Its direct correlation with supply and demand conditions makes it an indicator of economic production. BDI relates to other economic factors such as crude oil prices [

6], global GDP, and stock market indices. Yang et al. [

25] used data from 1999 to 2019 to explore the risk assessment of the BDI, crude oil, and the stock market, finding that the maritime transportation market is the riskiest in the world. Siddiqui and Basu [

20] analyze the interrelationships between four major global tanker routes and find a growing relationship mainly driven by oil and fuel prices. Angelopoulos et al. [

3] analyzed the economic relationship between 65 commodities and maritime transportation, finding a close economic relationship from commodity markets to freight markets. Michail [

15] quantified the relationship between the world macroeconomic environment and maritime transport demand, finding that changes in the world economic environment affect oil demand differently across high, middle, and low-income countries. Finally, Tsioumas et al. [

22] use maritime-related literature to construct a composite indicator to understand the relationship between economic conditions and maritime trade.

2.2. COVID-19

The COVID-19 pandemic has significantly impacted the BDI, which measures global shipping rates. The closure of factories and reduced demand for goods have led to decreased shipping rates and lower BDI values. As a result, the maritime industry has been affected [

7]. The impact of Covid-19 on the BDI has been significant and continues to be a concern for the industry. Ashraf [

4] examined the correlation between the number of COVID-19 cases and the stock market performance, finding that stock market returns declined as the number of cases increased. Michail and Melas [

16] analyzed the impact of COVID-19 on the maritime industry and found that it had a significant impact on the BDI and the Baltic Clean Tanker Index. Hasan et al. [

12] explored the impact of COVID-19 on global economic activity, stock markets, and energy markets, finding that the stock market was more affected than the BDI, but COVID-19 influenced both. Shrestha et al. [

19] developed the Pandemic Vulnerability Index to assess global mobility and economic impact, finding that some countries were more vulnerable than others. Chen and Yeh [

5] analyzed the performance of the stock, raw material, and energy markets during the global financial crisis of 2008 and the COVID-19 pandemic, finding that quantitative easing policies significantly impacted market performance. Kitamura et al. [

13] is focused on exploring the impact of the COVID-19 pandemic on the economy, environment, and tourism industry. Xu et al. [

24] examined the impact of COVID-19 on cargo throughput in 14 major ports in China and found that it significantly impacted imports and exports, with a greater impact on imports. Overall, these studies provide important insights into how the COVID-19 pandemic has affected various aspects of the global economy.

3. Methodology

3.1. Variables

This study utilized a literature review to select the BDI and 13 associated indicators as the primary focus for defining and explaining the variables under examination. The BDI was employed as the dependent variable, while other selected indicators were used as independent variables in a prediction model to investigate the impact of the BDI. The variables related to this study are described as follows

Baltic Dry Index (BDI): The BDI, a composite of the Capesize, Panamax, and Supramax Timecharter Averages, is a shipping freight-cost index of dry bulk commodities issued daily by the London-based Baltic Exchange. It mainly transports staple raw materials and industrial raw materials such as steel, grain, coal, etc. There is an inextricable relationship between the BDI, the global economic outlook, and raw material prices, so the BDI is commonly perceived as a leading economic indicator.

Brent: Brent is an international crude oil evaluation and observation system. It is considered a light, sweet crude oil (low-sulfur crude oil) and is used to measure the level of oil prices. Brent is the most used and referenced oil price figure.

Standard & Poor's 500 (SP500): The SP500 is one of the top 500 most traded stocks in the U.S. Compared to the Dow Jones Industrial Average (DJIA), The SP500 includes more companies, so it reflects a broader range of market changes and the fundamental importance of a company's stock in the stock market.

Volatility Index (VIX): The VIX is the ticker symbol for the Chicago Board Options Exchange's CBOE Volatility Index, a popular measure of the stock market's expectation of volatility based on S&P 500 index options.

Shanghai Index: The Shanghai Index is a Capitalization-weighted Index that reflects statistical indicators of the overall trend of listed stocks on the Shanghai Stock Exchange. It is a basis for observing the China stock market and market boom.

Buker Index: The Buker Index uses the average price of Bunker Index 180 CST and Bunker Index 380 CST published by Bunker Research. It is an average of bunker prices at ports worldwide, such as Singapore and other international commercial ports.

Global Steel Price (Steel Price): Global steel transaction price is mainly provided by the Shanghai Futures Exchange (SHFE) and the London Metal Exchange (LME).

Iron Price (Iron Price): London Metal Exchange (LME) mainly provides global iron ore transaction prices.

Steel Scrap Price (Steel Scrap): London Metal Exchange (LME) mainly provides global steel scrap transaction prices.

Commodity Research Bureau Index (CRB Index): The CRB Index was compiled by the U.S. Commodity Research Bureau and appeared in 1957. Futures Contract includes energy, metals, agricultural products, animal products, and soft commodities. The CRB Index is a critical reference indicator of international commodity price volatility.

London Metal Exchange Index (LME Index): The LME Index is six metals from the London Metal Exchange, with the following weights: aluminum (42.8%), copper (31.2%), zinc (14.8%), lead (8.2%), nickel (2%) and tin (1%).

U.S. Dollar Index: The U.S. Dollar Index measures the value of the U.S. dollar relative to a basket of foreign currencies, often referred to as a basket of U.S. trade partners' currencies. It is a weighted geometric mean of the dollar's value relative to six main currencies (Euro (EUR), Japanese yen (JPY), Pound sterling (GBP), Canadian dollar (CAD), Swedish krona (SEK), and Swiss franc (CHF)). Also, The index started in 1973 with a base of 100. It means that if the U.S. Dollar Index, the U.S. dollar is gaining value. Because most of the significant international commodities are denominated in U.S. dollars, the rise and fall of the U.S. dollar are one of the indicators of the global economy and trade.

Port Calls (Port Calls): The Global Port Calls is a global port index composed of 82 international ports worldwide, covering more than 60% of global port trade. It is an important indicator of global trade.

Covid-19 global confirmed cases (Coronavirus): Based on the World Health Organization (WHO) is starting to count confirmed cases worldwide. Take the time as a unit and start on February 3, 2020.

3.2. Variables Selection Method—Stepwise Regression

Stepwise regression is a method used in multiple regression to select independent variables for inclusion in the regression equation. This approach reduces computation time by adding or removing variables individually during each model iteration, enabling the best parameter evaluation for the regression model. The criterion for adding or removing variables is based on the F-statistic, which determines whether the X2 of the added variable has a significant effect on the reduction of the error sum of squares. In this study, we utilize the stepwise regression model to identify the variables that affect BDI (before and after Covid-19) and select variables with significant effects for description. F-statistic:

The F-statistic molecular degrees of freedom is the number of independent variables added to the model, and the denominator degrees of freedom is n-p-1.

4. Results

4.1. Correlation Analysis

This study aimed to examine the correlation between the BDI and 13 related indicators, including Brent, Standard & Poor's 500 (SP500), Volatility Index (VIX), Shanghai Index, Buker Index, Global Steel Price, Global Iron Ore Price, Global Steel Scrap Price, Commodity Research Bureau Index (CRB Index), London Metal Exchange Index (LME Index), US Dollar Index, Global Port Calls, and Covid-19 global confirmed cases, before and after the Covid-19 outbreak. The dataset included daily observations from February 3, 2019, to February 3, 2021, totaling 732 data points, consisting of the BDI, 13 raw materials, energy, and stock market indicators. After eliminating non-matching missing data, the resulting time series comprised 453 observations. The present study examines the Pearson Product-Moment Correlation Coefficient (PPMCC) between the BDI and 13 related indicators. The results, as presented in

Table 2 and

Table 3, indicate a negative correlation between the BDI and Brent, Shanghai Index, Buker Index, Global Steel Price, Global Iron Ore Price, Global Steel Scrap Price, VIX, and LME Index. However, a positive correlation is observed between the BDI and US Dollar Index and Global Port Calls before the outbreak of COVID-19 in 2019.

Interestingly, after the outbreak of COVID-19 in 2020, the results show a positive correlation between the BDI and Brent, SP500, Shanghai Index, Buker Index, Global Steel Price, Global Iron Ore Price, Global Steel Scrap Price, VIX, LME Index, Global Port Calls, and COVID-19 global confirmed cases. Specifically, a highly positive correlation is observed between the BDI and Shanghai Index, Global Iron Ore Price, and Global Port Calls. Furthermore, the study finds a highly positive correlation between the Covid-19 global confirmed cases and Shanghai Index, Global Steel Price, Global Iron Ore Price, Global Steel Scrap Price, LME Index, and Global Port Calls. These findings highlight the significant impact of the pandemic on the shipping industry.

4.2. Build Stepwise Regression Model

The variable selection method of stepwise regression was employed in this study, where each variable was added or excluded from the model one by one. The Akaike Information Criterion (AIC) was used to determine each step. If adding a variable reduced the AIC value of the model, the variable was included. Conversely, if excluding a variable reduced the AIC value of the model, the variable was removed. The final selected independent variable was the one that minimized the AIC value of the model.

where ln(L) is the maximized log-likelihood and P is the coefficient.

During constructing a linear regression model, it is necessary to assess whether multicollinearity exists among the independent variables. Typically, if the Variance Inflation Factors (VIF) value exceeds 10, it indicates the presence of multicollinearity among the independent variables.

4.2.1. Result of the BDI Stepwise Regression before COVID-19

Table 4 presents the results of the BDI stepwise regression conducted in 2019, before the onset of the COVID-19 pandemic. The regression employed seven independent variables, including the Global Steel Scrap Price, Global Iron Ore Price, CRB Index, Brent, US Dollar Index, Global Steel Price, and Global Port Calls. The AIC value of the model was 256.537, indicating that no further independent variable could reduce the AIC value or be removed from the model.

The complete result of the BDI stepwise regression model is shown in Table 15, which shows that the export stepwise regression model is:

The significance level is α = 0.05. The F-statistic molecular degree of freedom is 7, the denominator degrees of freedom is 11, and the F-statistic is 118.141 >F0.05=3.012, reject H0. This means the relationship between YBDI and the independent variables of raw materials, energy, and stock market indicators is significant. The p-value is 0.000 < α = 0.05, reject H0, indicating that the relationship is significant and the parameters of the variables are not zero. Therefore, the regression model for 2019 is a good fit, with the coefficient of determination R2= 0.793 and R2adjusted= 0.787, indicating that the independent variables have good explanatory power for the dependent variables.

The Durbin-Watson statistic for this model is 2.018, with α = 0.05, independent variable = 7, and sample size n = 232. With dL=1.675, dU=1.863, 4-dU=2.159, and 4-dL=2.303, the DW value = 2.018 is between dU and 4-dU. This result means that failing to reject H0 also means that the first-order autocorrelation does not exist.

The VIF value of this model is also displayed in

Table 5. The VIF values of the independent variables of Global Steel Scrap Price, Global Iron Ore Price, CRB Index, Brent, US Dollar Index, Global Steel Price, and Global Port Calls are 3.019, 2.324, 4.258, 2.660, 4.851, 2.779, and 1.975, respectively. This result shows no collinearity problem between the variables in the BDI forecast model of 2019.

4.2.2. Result of the BDI Stepwise Regression after COVID-19

Table 6 displays the results of the stepwise regression analysis for the BDI in 2020. The model includes nine independent variables: the Shanghai Index, Global Port Calls, COVID-19 global confirmed cases, US Dollar Index, Global Iron Ore Price, Global Steel Scrap Price, Brent, CRB Index, and Buker Index, entering the model in that order. The final model yielded AIC value of 207.536, indicating that the nine independent variables were significant predictors of the BDI in 2020. No additional variable was found to improve the model fit, and none were removed from the final model.

Table 7 shows the complete results of the BDI stepwise regression model, with the following equation predicting the BDI:

The model has a significant level of 0.05 (α = 0.05), the molecular degrees of freedom of 7, and denominator degrees of freedom of 11. The F-statistic is 104.418 >F0.05=2.796, reject H0. To put it another way, the relationship between YBDI and the independent variable of raw materials, energy, and stock market indicators is significant. The p-value is 0.000 < α = 0.05, reject H0, which means that the relationship is significant and the parameters of the variables are not zero. Therefore, the regression model for 2020 has good fitness, while the coefficient of determination R2= 0.809 and R2adjusted= 0.802, indicating that the independent variables have good explanatory power for the dependent variables.

The Durbin-Watson (DW) statistic for the model is 2.047, with α =0.05, independent variable =7, sample size n =232, dL=1.675, dU=1.863, 4-dU=2.137, 4-dL=2.325, and the DW value =2.047 is between dU and 4-dU. The result means that failing to reject H0 also means that the first-order autocorrelation does not exist.

The VIF value of this model is shown in

Table 7. The VIF values of the independent variables of Shanghai Index, Global Port Calls, Covid-19 global confirmed cases, US Dollar Index, Global Iron Ore Price, Global Steel Scrap Price, Brent, CRB Index, and Buker Index are 8.493, 7.304, 3.966, 9.419, 9.511, 9.250, 4.466, 8.620, and 5.477. The result shows that there is no collinearity problem between the variables in the BDI forecast model of 2020.

4.3. Explore the Factors Affecting the Freight Index under COVID-19

Prior to the COVID-19 outbreak in 2019, the freight index was subject to influence by seven distinct variables, namely the global steel scrap price, global iron ore price, CRB index, Brent, US dollar index, global steel price, and global port calls. The index primarily responded to changes in the international price and port demand indexes rather than fluctuations in the international stock market. Furthermore, the shipping industry was experiencing a period of vessel retirements that prompted a surge in international steel scrap recycling prices and led to a dearth of vessels. These factors, in turn, contributed to a significant increase in shipping prices during July and August. However, freight prices stabilized after that.

In the wake of the COVID-19 outbreak in 2020, the global shipping industry underwent a fundamental shift in its role within the international maritime transportation system. The widespread shuttering of ports and harbors due to the detection of cases or the need for epidemic prevention measures left containers stranded, creating significant disruptions in the global maritime logistics business and increasing shipping prices. The freight index became subject to influence by nine variables, including the Shanghai Index, Global Port Calls, COVID-19 global confirmed cases, US dollar index, Global Iron Ore Price, Global Scrap Price, Brent, CRB Index, and Buker Price. The Shanghai Index, Global Port Calls, and COVID-19 global confirmed cases emerged as the index's most significant factors.

5. Conclusions

5.1. The Key Factors Affecting the Global Freight Index before COVID-19

Before the Covid-19 pandemic, the freight index was primarily influenced by several key variables, including the global steel scrap price, global iron ore price, and CRB index. These variables were found to be heavily dependent on both the international price index and the demand index within the port sector. Notably, the impact of these three variables on the freight index during the pre-pandemic period was of significant importance.

Global Steel Scrap Price: The analysis of the highly negative correlation in PPMCC between the global steel scrap price and the BDI before the Covid-19 outbreak revealed that these two variables displayed opposite trends. Previous research has suggested that maritime transport prices are susceptible to fluctuations in the raw materials market [

3,

5,

22]. Remarkably, the studies by [

3,

22] have indicated that global raw material prices can indicate the maritime market.

Global Iron Ore Price: Before the COVID-19 pandemic, a positive correlation existed in PPMCC between the global iron ore price and the BDI, indicating a tendency for these two variables to exhibit similar trends. Previous scholarly inquiries conducted by [

14,

17,

22] have posited that maritime transport prices are impacted by the prices of the goods being transported by the vessels. The freight index influences metal prices [

14,

17].

CRB Index: The CRB index is a moderately negative correlation in PPMCC was observed with the BDI, signifying an opposite trend. Past studies have examined the impact of raw material prices, such as soybean, wheat, corn, coal, and fuel oil on maritime transport prices. Agricultural and energy prices were found to directly and significantly impact maritime transport prices. In contrast, the impact of international crude oil was slower and could not directly affect them. Notably, raw material prices significantly affected maritime transport prices [

1,

17,

22].

5.2. The Key Factors Affecting the Global Freight Index after COVID-19

The COVID-19 pandemic has had a notable impact on the relative influence of various variables previously considered significant in 2019. Some of these variables have now been displaced from their previous positions of importance. In contrast, others previously excluded or not considered, such as the Shanghai index and COVID-19 global confirmed cases, have emerged as influential factors affecting the freight index. Consequently, the significant variables that have a discernible impact on the freight index have changed, including the Shanghai index, global port calls, and Covid-19 global confirmed cases. In light of this, the following descriptions are provided for these three variables in the context of this study.

- 4.

Shanghai Index: The Shanghai Index has been found to have a highly positive correlation in PPMCC with the rise and fall of the BDI after COVID-19. In the existing literature, scholars such as [

4,

9,

16] have demonstrated that the stock market can exert a significant influence on the maritime market, particularly during major events. Additionally, Xu et al. [

24] have shown that COVID-19 has resulted in factory shutdowns and disruptions in the upstream and downstream industrial chains, leading to a decline in exports that has had a considerable impact on the Chinese economy and, by extension, on the global economy and trade.

- 5.

Global Port Calls: The variable of Global Port Calls exhibited a highly positive correlation in PPMCC, indicating that its rise and fall after COVID-19 had a similar trend to the BDI. Several previous studies, such as [

9,

16,

19] have analyzed the relationship between economic and maritime markets using global cargo throughput as a measure and have found that cargo throughput has a significant impact on the global economy and is often used to measure global maritime prices. Moreover, Xu et al. [

24] have highlighted that the cargo throughput of global countries plays a crucial role in the upstream and downstream chains of the global economy and trade. Its influence has become even more pronounced under the impact of the COVID-19 pandemic.

- 6.

COVID-19 global confirmed cases: The COVID-19 pandemic has been found to have a moderately positive correlation with the BDI, as indicated by a PPMCC analysis of the rise and fall of COVID-19 global confirmed cases. Previous studies by [

4,

16] have investigated the global impact of COVID-19 and found that it has had a profound effect on the global economy, resulting in significant shocks to stock market prices. Specifically, Ashraf [

4] demonstrated that the confirmation of the epidemic and the number of deaths had a considerable impact on the stock market, while Michail & Melas [

16] identified a strong correlation between maritime prices and the epidemic, primarily due to the decline in international oil prices or stock market shocks, which have had a significant impact on the global maritime market.

In summary, Guan et al. [

11] conducted a study that illustrated how the extent of the global supply chain impact and loss caused by COVID-19 depended on the countries and regions where the blockade or restrictions were implemented. The outbreak's rapid spread from China to the rest of the world led to the implementation of blockade measures in China and the United States. As the outbreak intensified and the duration of the blockade grew, global economic and trade losses became more severe, particularly in countries with close supply chains to China. Even countries not directly affected by the epidemic were not immune to the impact, supporting the study's view of three more influential variables between COVID-19 and the BDI.

5.3. Suggestion

The results of this study indicate that the factors influencing the BDI have changed the Covid-19 epidemic. Raw material indices such as global steel scrap, iron ore, and steel prices were more influential before the epidemic. In contrast, variables such as the Shanghai Index, global port calls, and COVID-19 global confirmed cases became more significant after the epidemic. The study suggests that the maritime market factors can shift to global port demand, relevant stock markets of each country, or relevant statistics of the event during a significant global epidemic or event. This study's contribution can serve as a reference for future studies by maritime research institutes and companies.

The study employed stepwise regression using the BDI and COVID-19 data for detailed analysis. It sought to understand why the earnings of the maritime transport sector are rebounding while most industries experience sharp decreases under the epidemic. However, the study's scope and results are limited. Future research could consider other prediction models, such as neural networks, artificial intelligence, or data mining techniques, to improve the forecast accuracy of the freight index. Nevertheless, the economy's fluctuations, like the movements of a walrus, are unpredictable, and the index changes fluctuate due to various external factors, including natural disasters, wars, strategies, and environmental factors. Thus, multiple techniques must be employed to improve the target index's prediction accuracy.

Author Contributions

Conceptualization, C.-W.C. and C.-C.H.; methodology, M.-H.H. and C.-N.W.; software, C.-C.H.; validation, C.-W.C., C.-N.W. and M.-H.H.; formal analysis, C.-W.C. and C.-C.H.; investigation, M.-H.H.; resources, C.-N.W.; writing—original draft preparation, C.-W.C. and C.-C.H.; writing—review and editing, C.-W.C. and C.-C.H.; visualization, C.-N.W.; supervision, M.-H.H. and C.-C.H.; funding acquisition, C.-W.C. All authors have read and agreed to the published version of the manuscript.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Alizadeh, A. H.; Muradoglu, Y. G. Stock Market Returns and Shipping Freight Market Information: Yet Another Puzzle! SSRN Electron. J. 2011. [CrossRef]

- Andriosopoulos, K.; Doumpos, M.; Papapostolou, N. C.; Pouliasis, P. K. Portfolio Optimization and Index Tracking for the Shipping Stock and Freight Markets Using Evolutionary Algorithms. Transp. Res. Part E: Logist. Transp. Rev, 2013; 52, 16–34. [Google Scholar]

- Angelopoulos, J.; Sahoo, S.; Visvikis, I. D. Commodity and Transportation Economic Market Interactions Revisited: New Evidence from a Dynamic Factor Model. Transp. Res. Part E: Logist. Trans. Rev. 2020, 133, 101836. [Google Scholar] [CrossRef]

- Ashraf, B. N. Economic Impact of Government Interventions during the COVID-19 Pandemic: International Evidence from Financial Markets. J. Behav. Exp. Finance 2020, 27, 100371. [Google Scholar] [CrossRef] [PubMed]

- Chen, H.-C.; Yeh, C.-W. Global Financial Crisis and COVID-19: Industrial Reactions. Fin. Res. Lett. 2021, 42, 101940. [Google Scholar] [CrossRef] [PubMed]

- Choi, K.-H.; Yoon, S.-M. Asymmetric Dependence between Oil Prices and Maritime Freight Rates: A Time-Varying Copula Ap-proach. Sustainability 2020, 12, 10687. [Google Scholar] [CrossRef]

- Durán-Grados, V.; Amado-Sánchez, Y.; Calderay-Cayetano, F.; Rodríguez-Moreno, R.; Pájaro-Velázquez, E.; Ramírez-Sánchez, A.; Sousa, S.I.V.; Nunes, R.A.O.; Alvim-Ferraz, M.C.M.; Moreno-Gutiérrez, J. Calculating a Drop in Carbon Emissions in the Strait of Gibraltar (Spain) from Domestic Shipping Traffic Caused by the COVID-19 Crisis. Sustainability 2020, 12, 10368. [Google Scholar] [CrossRef]

- Erdogan, O.; Tata, K.; Karahasan, B. C.; Sengoz, M. H. Dynamics of the Co-Movement between Stock and Maritime Markets. Int. Rev. Econ. Finance 2013, 25, 282–290. [Google Scholar] [CrossRef]

- Gong, Y.; Li, K. X.; Chen, S.-L.; Shi, W. Contagion Risk between the Shipping Freight and Stock Markets: Evidence from the Recent US-China Trade War. Transp. Res. Part E: Logist. Trans. Rev. 2020, 136, 101900. [Google Scholar] [CrossRef]

- Grammenos, C. T.; Arkoulis, A. G. Macroeconomic Factors and International Shipping Stock Returns. Int. J. Marit. Econ. 2002, 4(1), 81–99. [Google Scholar] [CrossRef]

- Guan, D.; Wang, D.; Hallegatte, S.; Davis, S. J.; Huo, J.; Li, S.; Bai, Y.; Lei, T.; Xue, Q.; Coffman, D.; Cheng, D.; Chen, P.; Liang, X.; Xu, B.; Lu, X.; Wang, S.; Hubacek, K.; Gong, P. Global Supply-Chain Effects of COVID-19 Control Measures. Nat. Hum. Behav. 2020, 4(6), 577–587. [Google Scholar] [CrossRef]

- Hasan, M. B.; Mahi, M.; Sarker, T.; Amin, M. R. Spillovers of the COVID-19 Pandemic: Impact on Global Economic Activity, the Stock Market, and the Energy Sector. J. Risk Fin. Manag. 2021, 14(5), 200. [Google Scholar] [CrossRef]

- Kitamura, Y.; Karkour, S.; Ichisugi, Y.; Itsubo, N. Evaluation of the Economic, Environmental, and Social Impacts of the COVID-19 Pandemic on the Japanese Tourism Industry. Sustainability 2020, 12, 10302. [Google Scholar] [CrossRef]

- Lin, A. J.; Chang, H. Y.; Hsiao, J. L. Does the Baltic Dry Index Drive Volatility Spillovers in the Commodities, Currency, or Stock Markets? Transp. Transp. Res. Part E: Logist. Transp. Rev. 2019, 127, 265–283. [Google Scholar] [CrossRef]

- Michail, N. A. World Economic Growth and Seaborne Trade Volume: Quantifying the Relationship. Transp. Res. Interdiscip. Perspect. 2020, 4, 100108. [Google Scholar] [CrossRef]

- Michail, N. A.; Melas, K. D. Shipping Markets in Turmoil: An Analysis of the Covid-19 Outbreak and Its Implications. Transp. Res. Interdiscip. Perspect. 2020, 7, 100178. [Google Scholar] [CrossRef] [PubMed]

- Papailias, F.; Thomakos, D. D.; Liu, J. The Baltic Dry Index: Cyclicalities, Forecasting and Hedging Strategies. Empir. Econ. 2017, 52(1), 255–282. [Google Scholar] [CrossRef]

- Ruan, Q.; Wang, Y.; Lu, X.; Qin, J. Cross-Correlations between Baltic Dry Index and Crude Oil Prices. Physica A 2016, 453, 278–289. [Google Scholar] [CrossRef]

- Shrestha, N.; Shad, M. Y.; Ulvi, O.; Khan, M. H.; Karamehic-Muratovic, A.; Nguyen, U.-S. D. T.; Baghbanzadeh, M.; Wardrup, R.; Aghamohammadi, N.; Cervantes, D.; Nahiduzzaman, K. M.; Zaki, R. A.; Haque, U. The Impact of COVID-19 on Globalization. One Health 2020, 11, 100180. [Google Scholar] [CrossRef]

- Siddiqui, A. W.; Basu, R. An Empirical Analysis of Relationships between Cyclical Components of Oil Price and Tanker Freight Rates. Energy (Oxf.) 2020, 200, 117494. [Google Scholar] [CrossRef]

- Not so Choppy - How Covid-19 Put Wind in Shipping Companies’ Sails. Economist 2020.

- Tsioumas, V.; Smirlis, Y.; Papadimitriou, S. Capturing the impact of economic forces on the dry bulk freight market. Marit. Transp. Res. 2021, 2, 100018. [Google Scholar] [CrossRef]

- 23. UNCTAD. COVID-19 and Maritime Transport Impact and Responses. UNCTAD Transp. Newsl, 2020.

- Xu, L.; Yang, S.; Chen, J.; Shi, J. The Effect of COVID-19 Pandemic on Port Performance: Evidence from China. Ocean Coast. Manag. 2021, 209, 105660. [Google Scholar] [CrossRef] [PubMed]

- Yang, J.; Zhang, X.; Ge, Y.-E. Measuring Risk Spillover Effects on Dry Bulk Shipping Market: A Value-at-Risk Approach. Marit. Policy Manage. 2022, 49(4), 558–576. [Google Scholar] [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).