1. Introduction

Risk exists in everything. After careful consideration and dissection of these words, it becomes clear that no activity, no movement is without risk. When you go for a walk, there is a risk of falling and breaking your foot; when you invest, you can lose your money. The same applies to companies. Internal and external developments that could influence the organization’s aims are defined as risks (Wolf & Runzheimer, 2003).

Especially in times of crisis, the concept of risk is widely discussed by the public and society. Current events such as the still ongoing health crisis caused by COVID-19 or the war situation between Russia and Ukraine are probably the most famous illustrations of risk. This causes companies must handle the resulting economic implications. Therefore, thorough risk management should be an essential component of economic decisions (Schwenzer et al., 2020). Recent market analyses and current research indicate that risk management, which is defined by data collection, aggregation, evaluation, and reporting is becoming increasingly important (Lange & Quast, 1995). Hedging transactions are conducted to reduce risks and compensate for any potential financial losses (Franz & Bauernfeind, 2016). Effective and open handling of potential risks contributes to the higher achievement of corporate goals (Hornung et al., 1999). Hedging transactions are conducted to reduce risks and compensate for any potential financial losses (Franz & Bauernfeind, 2016). There is no denying the subject's volatile nature.

Thus, the state of knowledge leads to the fundamental hypothesis of this paper, that the more measurable the value of risk, the greater the application of Risk management, especially Hedge Accounting. The pandemic is expected to increase the usage of Hedge Accounting. The purpose of this paper is to contribute to the identification and classification of individual risks. In this regard, the objectives and relevance of risk management are high-lighted. The aim is to add new dimensions to hedging transactions and, particularly, express the benefits and opportunities of Hedge accounting.

The paper is divided into two major sections. Based on a literature review, chapter one of this paper fundamentally reviews different types of risk in corporate setting (e.g., strategic, financial, and operational) and defines technical terms. Subsequently, the possibilities and trends of risk management, especially Hedge Accounting are listed and justified in detail. The second chapter describes the technique utilized for the literature review as well as the findings achieved. Investigation is conducted into the issue of how frequently listed Austrian companies employ hedging instruments. These practice-relevant data will support the findings of the literature review.

2. Literature Review

2.1. Risks and uncertainties

2.1.1. The scientific definition of risks

There is no consensus on the origin of the term “risk” itself. Commonly occurring you can find the assumption that the perception is derived from the Italian word “risico”, some is translated as venture or hazard. Basically, this means the possibility of a wrong decision due to human error or imperfect information.

In the financial glossary, the meaning of risk is not different. Risk implies uncertainty regarding the expected returns on investments (Surbhi, 2017).

Nowadays risk describes the deviation of the recent result from the original expectation. The interpretation is value-neutral, as the deviation from the result can be either positive or negative.

Risk is a danger that is simultaneously associated with an opposing opportunity.

2.1.2. Definition of uncertainty

Uncertainty refers to a situation, where multiple alternatives may result in a specific outcome. However, the probability of achieving the expected result is questionable (Surbhi, 2017). Insufficient information or knowledge about the present condition prevents defining or predicting future results or events.

Uncertainty cannot be measured in quantitative terms. Probabilities are unknown.

2.1.3. Key differences between risk and uncertainty

Table 1.

Differences Risk and uncertainty.

Table 1.

Differences Risk and uncertainty.

| |

RISK |

UNCERTAINTY |

| meaning |

probability of winning or loosing something worthy |

implies a situation, where the future event is unknown |

| ascertainment |

measurable |

not measurable |

| outcome |

possible outcome is common |

unknown |

| control |

monitorable |

not monitorable |

| minimization |

Yes |

No |

| probabilities |

assigned |

not assigned |

2.2. Risks in corporate life

2.2.1. Different types of risk

Based on the definition of risk, it emerges, every transaction, taken in uncertainty, is characterized by a risk factor that occurs to varying degrees (Wolf & Runzheimer, 2003). Thus, potential risk factors must be recognized and identified in advance (Lange & Quast, 1995).

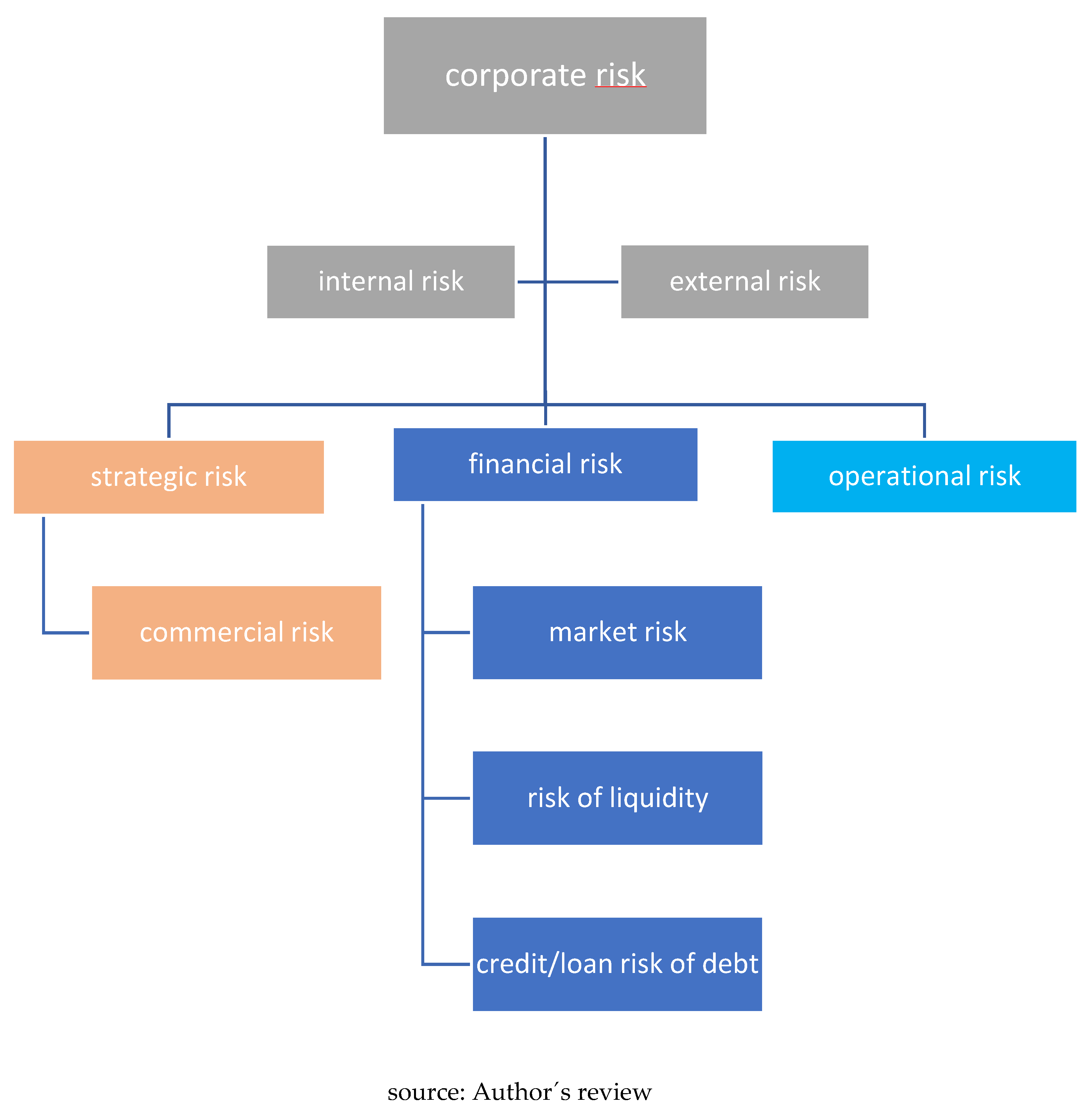

The following illustration provides an overview about various occurring types of risk in corporate life:

Figure 1.

Overview of risk types.

Figure 1.

Overview of risk types.

Fundamentally, one distinguishes three main groups strategic risk, financial risk, and the operational risk of a company (Meyer, 2008). The commercial risk embraces the strategic risk. In addition, the various types of risks are divided into internal and external. The causes of external risks lie outside the company, while the causes of internal risks can be influenced by the company (Schellenberger, 2008).

The focus of this paper concentrates on the financial risks and their management. Hence, the subsequent paragraph elucidated those financial risks, who appear frequently.

Financial risk refers to the possibility of incurring losses on a business venture or prospective expenditure (Verma, 2022). It describes the chance that a company's cash flow does not allow to cover all commitments in the scenario of a financial risk. In government sectors, financial risk implies the inability to control monetary policy and or other debt issues (Verma, 2022). This type of risk is one with high priority for every business. A distinction is made between market risk, risk of liquidity and risk of debt.

Market risk is triggered by fluctuations in the prices of financial instruments (Diller, 2008). Directional Risk and Non-Directional Risk are two main categories for market risk. Directional risk can occur from shifts in stock prices, interest rates, and other factors. On the other hand, volatility risks might be non-directional risks (Verma, 2022).

The general interest rate risk is an illustrative example of a recognized market risk. Interest rate risk is the term for variations in market interest rates caused on by a positive or negative deviation from the expected outcome (Eichhorn, 2006). Furthermore, interest rate risk involves unexpected modifications to the current structure of rates. Thus, this sort of hazard is considered as external risk, which an economic entity cannot influence in any way.

Risk of liquidity results from inability to complete due transactions. Asset Liquidity Risk and Funding Liquidity Risk are two categories for liquidity risk. Asset liquidity risk originates when there are insufficient sellers or customers to execute buy and sell orders, respectively.

On the contrary, credit risk arises when an economic entity is unable to fulfill its obligations to counterparties. The two categories of credit risk are sovereign risk and settlement risk (Verma, 2022). Foreign exchange policies that are challenging to implement often result in sovereign risk. The other perspective, settlement risk develops when one taxpayer receives but the other fails to comply out the agreements.

Credit spread risk is a unique type of credit risk. Credit spread is the term used to describe the spread between two interest rates, the hazardous interest rate and the risk-free interest rate, known as the credit, spread. The yield of a transaction, put simply. The riskier the transaction, the bigger the yield. Whether the default probabilities of interest and redemption payments are above, or average depends on economic trends, which fluctuate daily, sometimes even hourly (Ramming, 2015).

2.2.2. Risk identification

The first step of successful risk management is identification. Before appropriate risk management activities to minimize several risks are considered, the relevant uncertainties of the respective business must be exposed.

The primary hazards to the company are the focus of risk identification. Typically, a SWOT analysis (Strengths, Weaknesses, Opportunities, Threats) is the first step in identification process. A swot analysis examines the connection between the relevant weak points and the company's business aims even while providing a general picture of a company's risk management. The aim of this analysis is to identify the main internal and external factors that have an influence on the company's development and value. The awareness of the risks present is the output, to put it simply.

The following methods have been established for identifying financial risks:

Reviewing corporate balance sheets

Studying statements of financial positions

investigating the operating plan's inadequacies for the company

Comparing metrics to other companies of the same industry

Employing statistical analysis techniques to identify the company’s risk areas

2.2.3. Risk classification

Risk classification is based on the outcome of the contemporary, regular, and complete identification of corporate risks. To keep the classification simple and comparable, it is essential to find a standardized definition of risks for the whole entity before starting the identification. The objective is a quantitative evaluation of the identified risks according to their probability of occurrence and possible level of damage. After this analysis, a suitable risk strategy can be discussed.

In general, risks are classified during categorization to be assigned to the appropriate dimension of the risk model. The next step is the risk assessment.

This is subdivided into two dimensions:

A risk map is used to visually display the outcome of the risk assessment. This serves as the foundation for creating a risk management strategy.

2.2.4. Risk strategies

Identification and ensuing classification serve as the foundation for creating a viable risk strategy (Kantox, 2019). By combating the potential concerns that have been identified, risk factors are reduced.

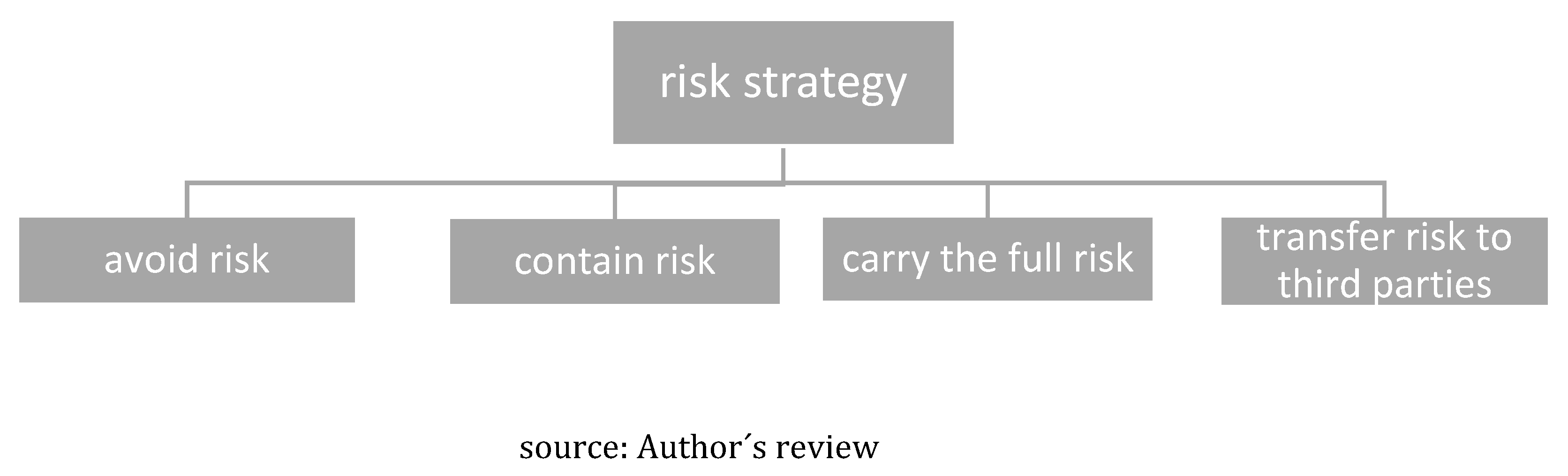

A general overview of how risks can be managed in businesses is shown in the accompanying graphic:

Figure 2.

Risk strategies.

Figure 2.

Risk strategies.

To avoid risks, a business operation must eliminate refrain from engaging in an activity that entails those risks. It works well to prevent losses for a business, but it also has the unintended consequence of sacrificing the chance to make money (Wanner, 2020).

The process of minimizing a risk's impact and probability of occurrence, along with the risk factor, is known as risk mitigation (Wanner, 2020). Essentially, a distinction is made between cause- and effect-related risk minimization. Effect-related means that precautions are taken against possible effects of the risk. Cause-related means that the risk itself is acted upon, such as in the case of automatic shutdown of a machine when a certain engine temperature is exceeded.

Risk management must determine how significant the risk entails for the organization. Carrying risks implies fully accepting the danger and resting there.

When risks have a financial consequence, they are frequently transferred. A typical example is insurance. Nevertheless, clauses and other comparable terms generally belong to the category of risk transfer, whereby risk is transmitted (Wanner, 2020).

2.2.5. Risk management

Risk management is often considered to be the process of minimizing or reducing risks. The goal of risk management is not the complete elimination of risks or the creation of perfect security. Rather, successful risk management focuses on conscious and controlled risk-taking to secure the associated opportunities (Fasse,1995). Scope for action is set for the management of a company so that it can successfully adapt to changing conditions and continue to exploit future potential for success (Hornung et al., 1999).

The following risk management principles can be encapsulated:

preserving the business's existence

preserving future success

market value increase of the economic entity

minimizing or lowering risk-related expenses

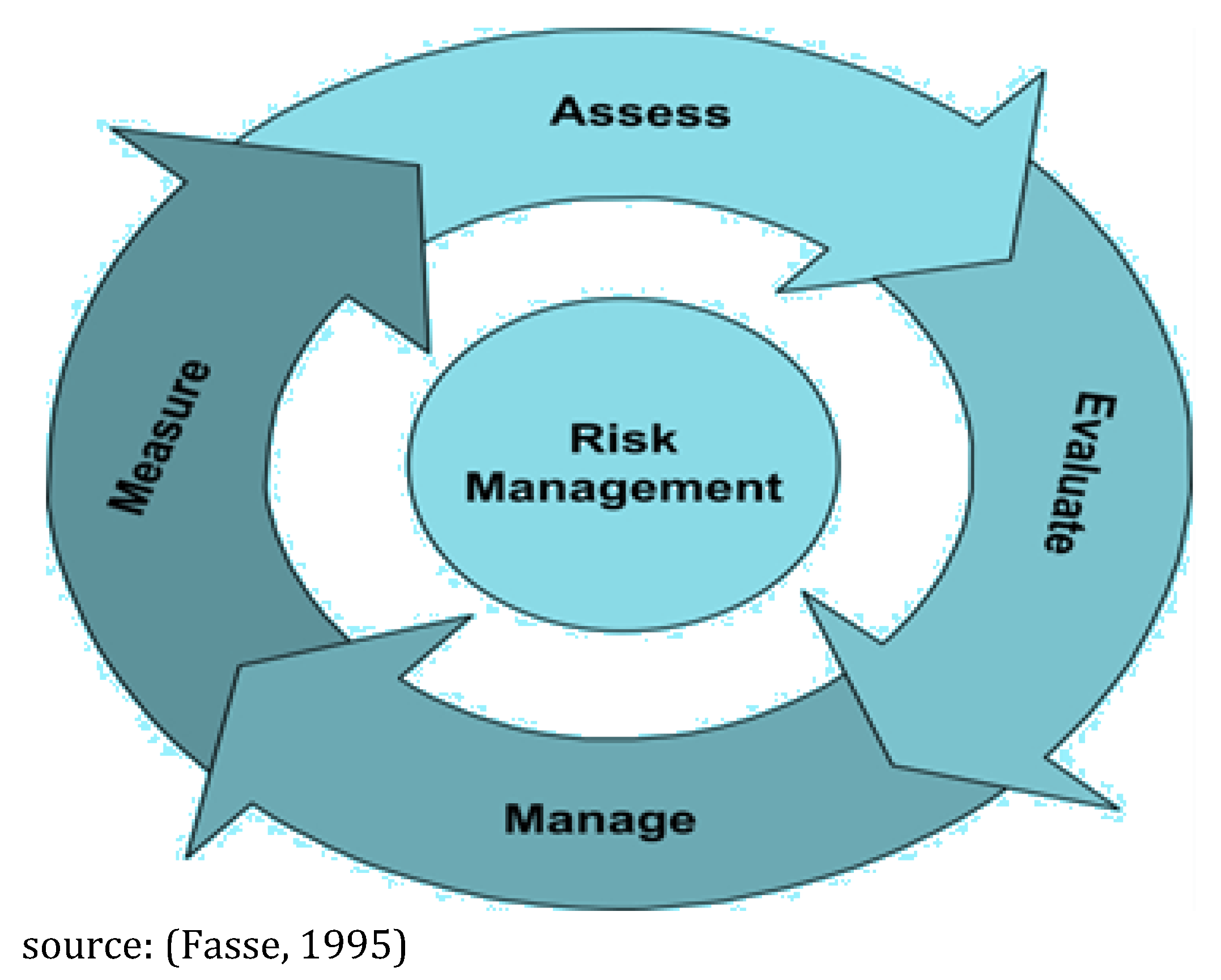

Figure 3.

Risk management process.

Figure 3.

Risk management process.

To achieve these requirements, risk awareness is the first step. Therefore, the management must demonstrate this awareness and error-tolerant culture. This can initiate a continuous risk management process that includes identification, assessment, control, monitoring, and reporting.

Risk management changes the culture of a business organization. Companies that tend to focus more on risk management tend to be more proactive as compared to other companies which can be reactive. Risk management forces the companies to take a hard look at each of their business processes and decide what can possibly go wrong. This detailed what-if analysis helps companies become more proactive and forecast probable issues. Businesses that heavily utilize risk management typically have fewer business interruptions.

With proper procedure every company can prepare for any potential shocks. On the one hand, the daily issues are dealt with, but catastrophic situations are also considered. Despite the minimal likelihood of actual disasters occurring, every economic organization should be ready for them. More than ever, the still-going Corona crisis has demonstrated this. The unexpected lockdown and total shutdown of the economy took many businesses off guard, and many lacked a backup plan (Fasse, 1995). In times of crisis, awareness, and management to minimize losses and keep them under control. It also improves competitiveness. Effective risk management also assists in the creation of budgets. Business processes are continually improved, and this leads to a greater understanding of them, which also results in more knowledge when it comes to budgeting. One can make a more precise projection.

Risk management may be summed up as a creative yet controlled process of becoming ready for any event that might arise in the future.

2.3. The hedging of risks

2.3.1. Hedging

Risk management with derivative financial instruments is referred to as hedging (Lange & Quast, 1995). To reduce risks and compensate potential asset losses, hedging transaction are concluded (Franz & Bauernfeind, 2016). A hedging relationship requires an underlying transaction and a and a corresponding hedging transaction.

According to the international accounting standard board (IASB) definition, recognized assets and liabilities, off-balance sheet liabilities, unrecognized firm commitments (e.g., a machine that has already been ordered but will only be delivered in the (e.g., a machine that has already been ordered but will not be delivered until the following year). serve as an underlying transaction (Ferro, 2015).

Hedging instruments are designated derivative or non-derivative assets, financial liabilities or financial liabilities whose fair value or cash flows are expected to offset changes in the fair value or cash flows of a designated hedged item. Financial instruments that are primary and derivative can both be utilized as hedging tools.

Different hedging strategies can be distinguished. Basically, it has to be decided whether a single transaction (Micro-Hedging), several similar transactions (Portfolio-Hedging) or a portfolio of different risks (Makro-Hedging) is to be hedged (Buschmann, 1992). With micro-hedging, a single, precisely defined forward position is hedged (Steiner et al., 1995). The hedged item and the related hedging instrument can be clearly assigned to each other. Similar underlying transactions are pooled together and hedged as one distinct underlying transaction in a portfolio hedge. Contrary to micro hedges, a direct distribution of gains and losses resulting from the underlying holdings and hedging instruments is not conceivable.

Macro hedging involves hedging one or more underlying transactions of different types. As opposed to the micro hedge and portfolio hedge, this hedging strategy accounts for the existing countervailing risk-compensating effect and mitigates the risk associated with the overall position of the bank's portfolio (Scheffler, 1994).

2.3.2. Hedge Accounting

Hedging concentrated on financial risks. It addresses reducing ventures plus compensation of potential asset losses via corresponding safeguards (hedging) transactions. Hedge Accounting is the denotation for the illustration of these hedging activities. The requirements for Hedge Accounting are regulated by the accounting standards of the international accounting standard board IAS 39 and IFRS 9. Companies have the suffrage to choose between both standards for their annual reporting.

If a business has hedged its risks and engaged in hedging, this procedure must also be followed. The consolidated financial statements must also provide a numerical representation of this process. Hedge accounting's goal is to reveal how an entity's risk management has an impact on its financial position. Both IAS 39 and IFRS 9 distinguish between the hedge accounting models of fair value hedge, cash flow hedge and net investment hedge.

Changes in the market value of assets that have already been recognized are offset by the fair value hedge. Changes in the fair value of firm commitments that occur off-balance-sheet are hedged. The cash flow hedge protects against the risk of volatility by hedging fixed or highly probable future cash flows. Net foreign investment investments are protected from currency risk by the net investment hedging (IASB, 2019).

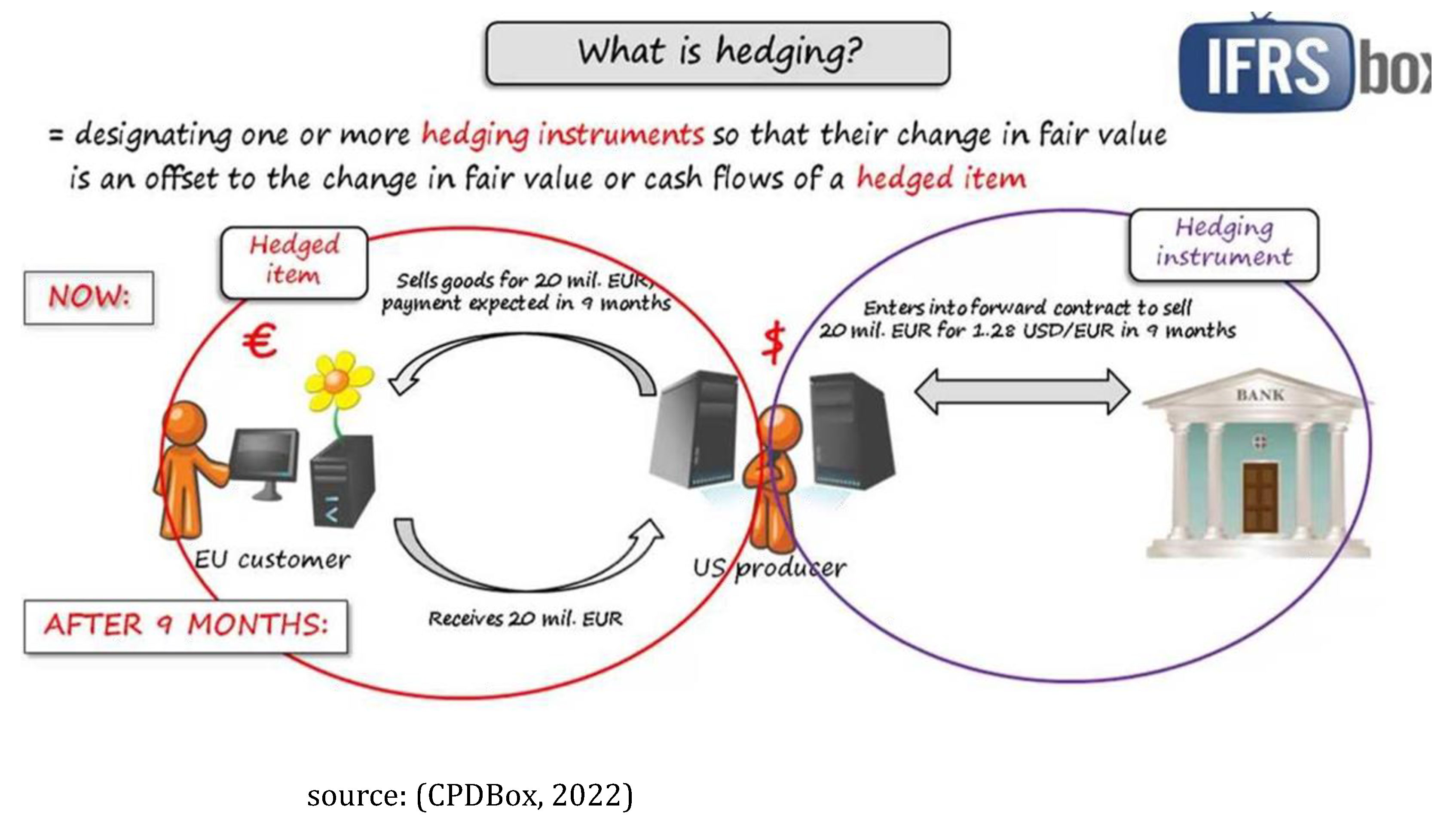

An explanation of hedging and subsequent hedge accounting is shown in the diagram below:

Figure 4.

Example for hedging – cashflow hedge.

Figure 4.

Example for hedging – cashflow hedge.

In this example a US company and sell some goods to European customers for let us say 20 million euros. The European customers invoice is due in 9 months. However, we are afraid that due to foreign currency rate fluctuations we will get significantly less in US Dollars. Therefore, it enters into offsetting foreign currency, we make a forward contract with the bank to sell them 20 million euro for some fixed rate after nine months. This is a common example for a cash flow Hedge.

Summarized the benefits out of Hedge Accounting are the following:

Banks and other lending institutions extend credit to companies based on their creditworthiness, which is determined by several factors. Predictability in future earnings is also a positive factor in creditworthiness.

Executive compensation is usually tied to company performance, which is often measured in quarterly earnings. When earnings are impacted by FX gains and losses caused by hedging exposure, this can also have an impact on executive compensation. By smoothing out the P&L, compensation can be more accurately calculated.

Objective and research question

Risk management and its hedging are integrating, according to scientific community. This article assumes that the measurability of a risk has a significant influence on the risk management activities of a company and that hedging instruments are increasingly used due to crises such as the currently ongoing Covid 19 crisis. Based on a traditional literature review, the existing scope of various risks is elaborated and possibilities for hedging them are identified. The aim is to add new dimensions to the risk managers' education and to show the associated benefits. The primary research questions "How do I identify a risk and its measurability?" and "Are hedging methods such as hedge accounting increasingly used in times of crisis?" accompany the entire research process and form the basis for the technique section of this article.

The emphasis of the technique section is on a descriptive frequency analysis regarding the use of hedge accounting in Austria. The aim is not to present a thorough investigation of which risks are hedged with which hedging instruments. The aim is to reflect the current state of risk identification and to use concrete examples, ten well-known listed Austrian companies, to question whether the use of hedge accounting has increased over the duration of the Corona pandemic and whether the basic hypothesis that crises increase the use of hedge accounting can be confirmed.

Clarification of the evaluation method

This paper used a quantitative research approach. Following the completion of the classical literature research, ten listed Austrian companies were analyzed, and their published annual financial statements and annual reports were collected. During the research, only documents published in the Wiener Zeitung were used. There were no restrictions regarding the companies' sector, such as concentrating on certain industries. The main argument for using all sources was to capture the widest possible range of background information on the existing risk management system of Austrian companies. However, it was obvious that only literature based on sound, comprehensible sources was included in the analysis. All the underlying documentation focuses on publications in 2019, before the pandemic, and 2020, during the pandemic.

Each company has a different focus in its publications, so the consolidated financial statements were categorized in a first step. The underlying objective was to filter which company applies hedge accounting and which does not. This compilation was done for 2019 as well as for 2020. The following figures were outlined:

Table 2.

categories usage of Hedge Accounting.

Table 2.

categories usage of Hedge Accounting.

| |

Usage of Hedge

Accounting |

No usage of Hedge

Accounting |

| 2019 |

6 |

4 |

| 2020 |

7 |

3 |

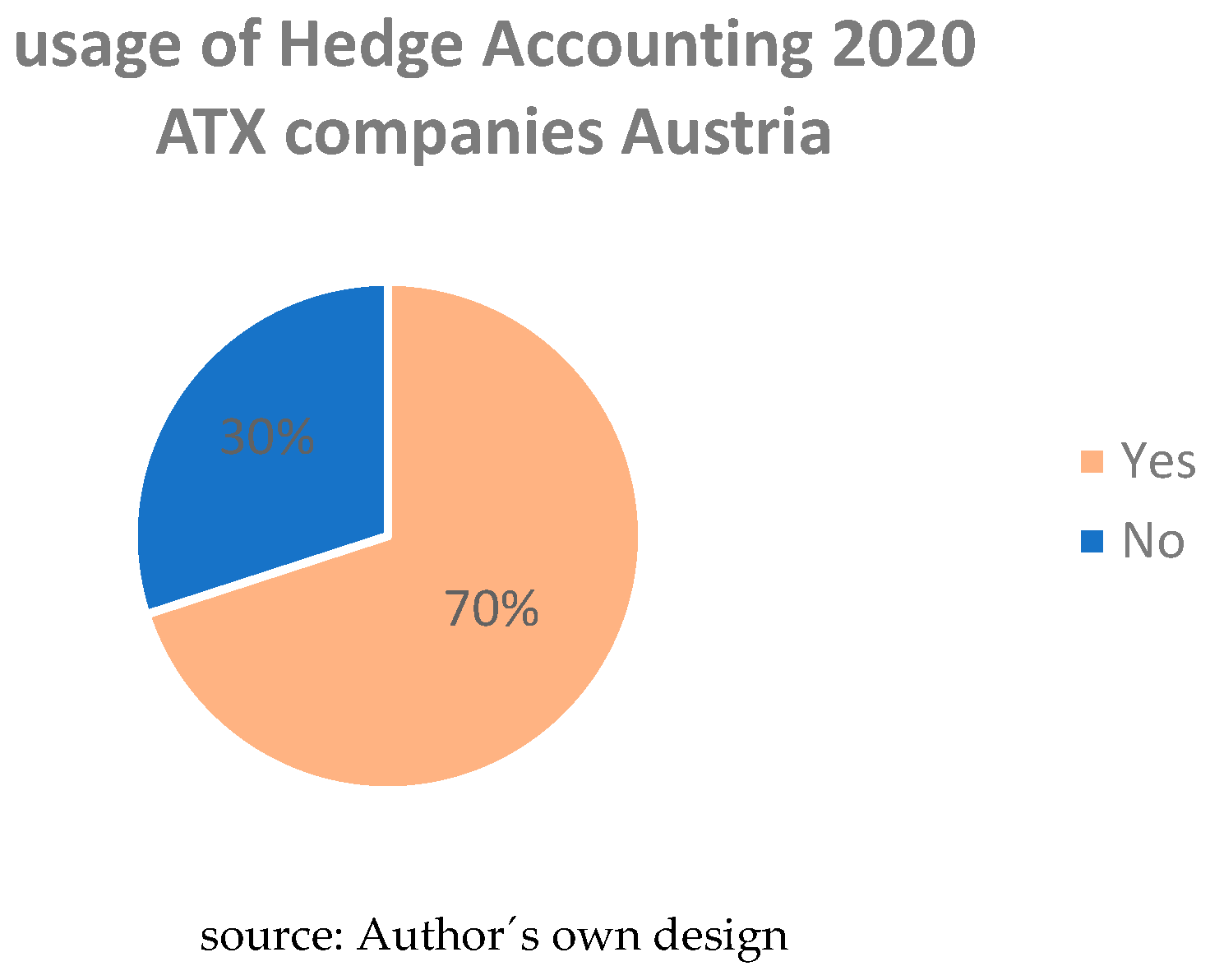

4. Results

As stated in the previous chapter, the quantitative research for this work was conducted by building categories for the criteria if Hedge Accounting was used in the annual statement or not. The hypothesis that in times of crisis during the COVID 19 pandemic the usage of Hegding increases was investigated. The period2 2019 and 2020 were analyzed.

The compilation of the results showed the following outputs:

Figure 5.

Usage of Hedge Accounting 2019.

Figure 5.

Usage of Hedge Accounting 2019.

Figure 6.

Usage of Hedge Accounting 2020.

Figure 6.

Usage of Hedge Accounting 2020.

The results clearly show that the use of hedge accounting has not changed or increased significantly despite the ongoing pandemic. Finding six hits in 2019, seven out of ten companies are using hedge accounting in 2020. That is not a significant difference.

This partly refutes the hypothesis and shows that many companies are certainly aware of potential risks, although, they are still very hesitant to insert hedging instruments.

5. Discussion

The entire research of this article was accompanied by the basic hypothesis that the more measurable the value of risk, the greater the application of Risk management, especially Hedge Accounting. It supports the fundamental hypothesis that the Covid 19 pandemic is expected to increase the usage of Hedge Accounting.

The activity of risk management is facing a transformation. The literature confirms that risk management is becoming increasingly important and extensive. Digitization can provide optimal support in this regard. Risk identification and subsequent classification are the basic building blocks of successful risk management. Looking at the results of the underlying descriptive frequency analysis, it is surprising to see that companies have not significantly increased the use of hedge accounting in their financial statements despite the ongoing pandemic and contrary to expectations. It can be assumed from the results that Austrian companies are aware of existing risks, yet there seems to be uncertainty about the right hedging strategy. According to the literature, there is a suitable hedging instrument for every risk that occurs. However, choosing the right hedge seems to be challenging in practice. Deloitte also supports this assumption and emphasizes in its publications that companies are generally well informed about existing risks but lack the expertise regarding the right hedging strategy (Deloitte, 2016, p.5). The cost factor of professional advice makes companies shy away from involving an expert here.

Risk management expands its competences. However, this also goes hand in hand with newly emerging risks. More captured data also means more attack surface for external hackers who want to access internal company data. The know-how of risk management must change the focus is on putting together the right packages of measures. For this, the necessary knowledge must be acquired.

Therefore, it is worth mentioning that experience with hedge accounting is currently still very limited and has considerable growth potential (Deloitte, 2016, p.5).

This paper is limited to a quantitative investigation of whether hedge accounting is used in Austrian listed companies. The literature was consulted to qualitatively support the results, but not to determine the future hedging instruments to be recommended. Subsequently, it would be interesting to examine exactly the relevant possibilities of risk management in relation to hedge accounting based on concrete entrepreneurs, related to the respective industry, and to show the advantages or also limitations of certain hedging instruments. The present study is limited to a first impression of the Austrian market about hedge accounting and does not offer any representative results.

6. Conclusion

In conclusion, it can be stated that digitalization is becoming more and more important around risk management. The Big 4 firms provide information and support around hedge accounting and the risk identification and risk classification that is necessary in advance. It is important to emphasize that they are aware that the risk management sector will be affected by the changes brought about by digitalization. It is obvious that risk management will evolve. The hypothesis that the more measurable a risk is, the greater the application of risk management can be confirmed. However, the descriptive frequency analysis shows that no clear statement can be made between the correlation of crises and the application of hedge accounting. Risk management and hedge accounting go hand in hand. This confirms the basic assumption that hedge accounting is applied on the Austrian market, even if only very hesitantly. However, it would be interesting to know which specific hedging instruments should be used for which type of risks and how hedge accounting could become more transparent for companies. This is where the further research of this article comes in, by going through the process of functioning hedge accounting step by step to find out which possibilities lie behind it and which methods could be relevant for companies in the future.

Appendix A

Table A1 – Differences risk and uncertainty

Table A2 – categories usage of Hedge Accounting

Appendix B

Figura B1 – overview of risk types

Figure B2 – risk strategies

Figure B3 – risk management process

Figure B4 – example for heding – cashflow hedge

Figure B5 – usage of hedge accounting 2019

Figure B6 – usage of hedge accounting 2020

References

- Buschmann W., (1992), „Risk controlling“: 720.

- CPDBox, „Hedge Accounting: IAS 39 & IFRS 9”, Hedge Accounting: IAS 39 vs. IFRS 9 - CPDbox - Making IFRS Easy.

- Diller H., (2008), „Preispolitik“: 10.

- Eichhorn, (2006), „Kreditderivate, weiteres Wachstum, neue Strukturen, Zeitschrift für das gesamte Kreditwesen“: 365.

- Deloitte. (2016). Vorstellung der Blockchain-Technologie „Hallo. Welt!”. https://www2.deloitte.com/content/dam/Deloitte/de/Documents/Innovation/Vorstellung%20der%20Blockchain-Technologie.pdf.

- Fasse F.W., (1995), „Risk-Management im strategischen internationalen Marketing“, Universität Duisburg; 73.

- Ferro C., (2015), „The hedge accounting approach: comparison between IAS 39 and IFRS 9”, Edizione Accademiche Italiane.

- Franz M, Bauernfeind T. (2016), „Spannungsfeld Hedge Accounting: IFRS 9 versus IAS 39 – eine Analyse zur bilanziellen Abbildung von Sicherungsbeziehungen“, NBW Verlag: 143.

- Guay W., Kothari S., (2003), „How much do firms hedge with derivates?”, journal of financial economics: 423-461. [CrossRef]

- Hornung K., Reichmann T., Diederichs M., (1999), „Risikomanagement“: 317. [CrossRef]

- International Accounting Standard Board, (2019), „International Financial Reporting Standard 9”, official journal European Union, https://eur-lex.europa.eu/legal-content/DE/TXT/HTML.

- Kantox, (2019): „Fremdwährungsrisiko“, https://www.kantox.com/de/glossary/fremdwaehrungsrisiko/.

- Kathinka K., (2012), „IAS 39- Accounting for financial instruments – Including the amendments of 2004 and 2005 and the new disclosure requirements of IFRS 7”, AV Akademiker Verlag.

- KPMG. (2019). Digitalisiertes Risikomanagement. https://home.kpmg/de/de/home/themen/2019/06/digitalisiertes-risikomanagement.html.

- Lange W., Quast W., (1995). „Quantitative Entwicklung des Derivatengeschäft“, Wissenschaftsförderung Sparkasse Bonn: 28.

- Meyer R., (2008). „Risikomanagement in der Unternehmensführung: Wertgenerierung durch chancen- und kompetenzorientiertes Management, Weinheim, Wiley-VCH: 35.

- Ramirez J., (2015), „Accounting for derivates: advanced hedging under IFRS 9”, John Wiley & Sons Verlag.

- Ramming M., (2015), „Risiken von Unternehmensanleihen und ihre Quantifizierung“, Berlin, Springer Verlag: 11.

- Scheffler J. (1994), „Hedge-Accounting“, Wiesbaden: 57.

- Schellenberger F., (2008), “Risikomanagement in der Unternehmensführung“, Weinheim, Wiley-VCH: 365.

- Steiner W., Tebroke A., Wallmeier A., (1995), „Rechnungslegung“, Bundesverband deutscher Banken: 538.

- Surbhi S., (2017, June 15), „Keydifferences“, Difference Between Risk and Uncertainty (with Comparison Chart) - Key Differences.

- Schwenzer, A., Müllerschön, D., Timm, C., Zwirnmann, H. (2020). Digitalisierung- Neuausrichtung im Risikomanagement. Horvath & Partners. https://www.horvath-partners.com/fileadmin/horvath-partners.com/assets/05_Media_Center/PDFs/Fachartikel/de/20200317_et_Schwenzer_Muellerschoen_Timm_Zwirnmann_g.pdf.

- Verma E., (2022), “Financial Risk and its types”, What Is Financial Risks and Its Types [Updated] (simplilearn.com).

- Wolf K., Runzheimer B., (2003), „Risikomanagement und KonTraG“: 29. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).