1. Introduction

As a high energy-consuming industry, construction machinery usually has the large manufacturing investment, complex working environment and high maintenance requirements which are closely related to safety risks and high carbon emissions [

1,

2]. As a sustainable development approach, the construction machinery leasing industry has become popular with the rapid increase of international market demand by which the construction company can obtain the equipment with relatively low cost and professional maintenance [

3]. It has been shown that leasing can yield greater supply chain profits than sales, while reducing carbon emissions [

4].

However, there are some dilemmas that hinder the development of construction machinery leasing industry at present, which is caused by excessive restriction of service life. To ensure equipment quality avoiding safety accidents on the construction site, construction companies often prefer lease newer machinery from leaser, thus resulting in great waste because many products within design expectancy are abandoned. Since the actual available life of the equipment is shortened, the lease return is correspondingly decreased and inadequate maintenance often occurs. Both leaser and manufacturer of construction machinery choose cheap and low-performance product. Therefore, the safety risks on the construction site increase instead and a vicious circle has come into being.

The application of Industrial Internet can not only help to get out of the dilemma of construction machinery leasing industry but also promotes recycling and remanufacturing by life cycle data acquisition and sharing [

5]. In recent years, various Industrial Internet platforms such as GE Predix, ABB Ability, Siemens Mind Sphere and PTC Thing Worx, have emerged to support industry chain collaboration [

6]. For construction machinery, the "Han Yun" Industrial Internet platform developed by XCMG China has been put into practice and three major functions are realized including equipment access, data collection and fault diagnosis online [

7]. The Industrial Internet platform is generally developed and operated by the manufacturer to provide the performance data of the construction machinery for the leaser and the consumer. When the equipment cannot be used normally, the manufacturer recycles it from the leaser and resells it after remanufacturing which is to restore the end-of-life products to an initial or even better performance by professional treatment [

8,

9]. On this basis, a closed-loop supply chain for the machinery leasing industry has been able to be formed. With the powerful information support, one of the urgent problems to be solved is how to take advantage of the Industrial Internet platform to promote leasing and recycling, while improving supply chain profit. It has become a focus of practical concern but receives limited research attention so far.

Lots of work has been done in the design of contract to improve the collaboration of member enterprises and the performance of supply chain, achieving supply chain coordination [

10,

11]. Common supply chain contracts include wholesale price contract [

12], buyback contract [

13], revenue-sharing contract [

14], quantity-flexibility contract [

15], two-part pricing contract [

16], quantity discount contract [

17] etc. As a supply chain incentive contract, the two-part pricing contract can effectively improve the cooperation revenue of water supply chain [

18], closed-loop supply chain [

19], fresh supply chain [

20] and other systems, effectively solving the problem of double marginalization effect [

21]. Besides, the Shapley method can also be deployed to reasonably allocate the profits for the participant parties in different scenarios, which can strengthen enterprise cooperation [

22,

23,

24]. In this paper, the effect of the above two contracts on the improvement of closed-loop supply chain revenue will be investigated.

At present, there are relatively few studies on the leasing of construction machinery which can be regarded as a kind of durable product because of its high price and long design life. For the leasing of durable products, two aspects research have been conducted. One is the channel selection, the other is leasing pricing and coordination strategy. For the former, Bulow [

25] established a dual-channel model for durable product leasing and sale. By comparing the profits under sales and leasing, it was found that the latter can make more profits. Lgal et al. [

26] proposed that manufacturers who dominated the market can benefit from leasing contracts. Zhang et al. [

27] found that under carbon trading and carbon tax policies, leasing can help manufacturers to obtain more profits while reducing carbon emissions. Cheng et al. [

28] found that leasing can provide consumers with better experience value than purchasing by investigating the leasing of automobile manufacturers. Li et al. [

29] found that the overall profit increased significantly under the hybrid strategy when leasing dominated the market.

For the research on pricing and coordination of the leasing supply chain, Van et al. [

30] studied the pricing of video leasing supply chain and employed revenue-sharing contracts to optimize the supply chain. Long et al. [

31] studied the car battery rental supply chain under uncertain demand and found that it is necessary to consider the recycling policy preference to reasonably formulate the old battery repurchase price and wholesale price. Sadat et al. [

32] constructed a dual-channel supply chain model and found that the optimal dynamic rental pricing will be affected by customer consumption patterns, production costs, and sales prices. Sarang et al. [

33] found that the lease term will affect the profit of the leaser by influencing the rental price and inventory. The supply chain profit can be optimized when the lease term is within a certain range.

It has been shown in the literature that leasing can enhance both economic and social benefits, helping achieve green and low-carbon development of the industry. This paper considers the application practices of the platform environment for the whole life cycle business support of construction machinery, besides leasing, recycling and remanufacturing are also considered.

So far, little research has been conducted on the closed-loop supply chain of construction machinery. Yi et al. [

34] found that reasonable allocation of recycling efforts in dual recycling channels can reduce reverse logistics costs and thus enhance market acceptance of remanufactured products. Deng et al. [

35] discussed the influence of equipment quality on recycling prices and remanufacturing cost under the uncertainty of construction machinery quality, applying a modal interval algorithm for dynamic pricing and recycling strategies. Xu et al. [

36] established a quality evaluation method for construction machinery used parts by using ontology and hierarchical analysis, which effectively improved the recycling efficiency.

Considering the contribution of Industrial Internet platform to the construction machinery business, there are even fewer ones to tackle. Most studies have been conducted on platforms as a recycling channel. Wang et al. [

37] considered a closed-loop supply chain by joining a web-based recycling platform and found that a reasonable platform cost could better facilitate product recycling. Zhu et al. [

38] constructed a dual-channel closed-loop supply chain model and designed a revenue-cost sharing contract.

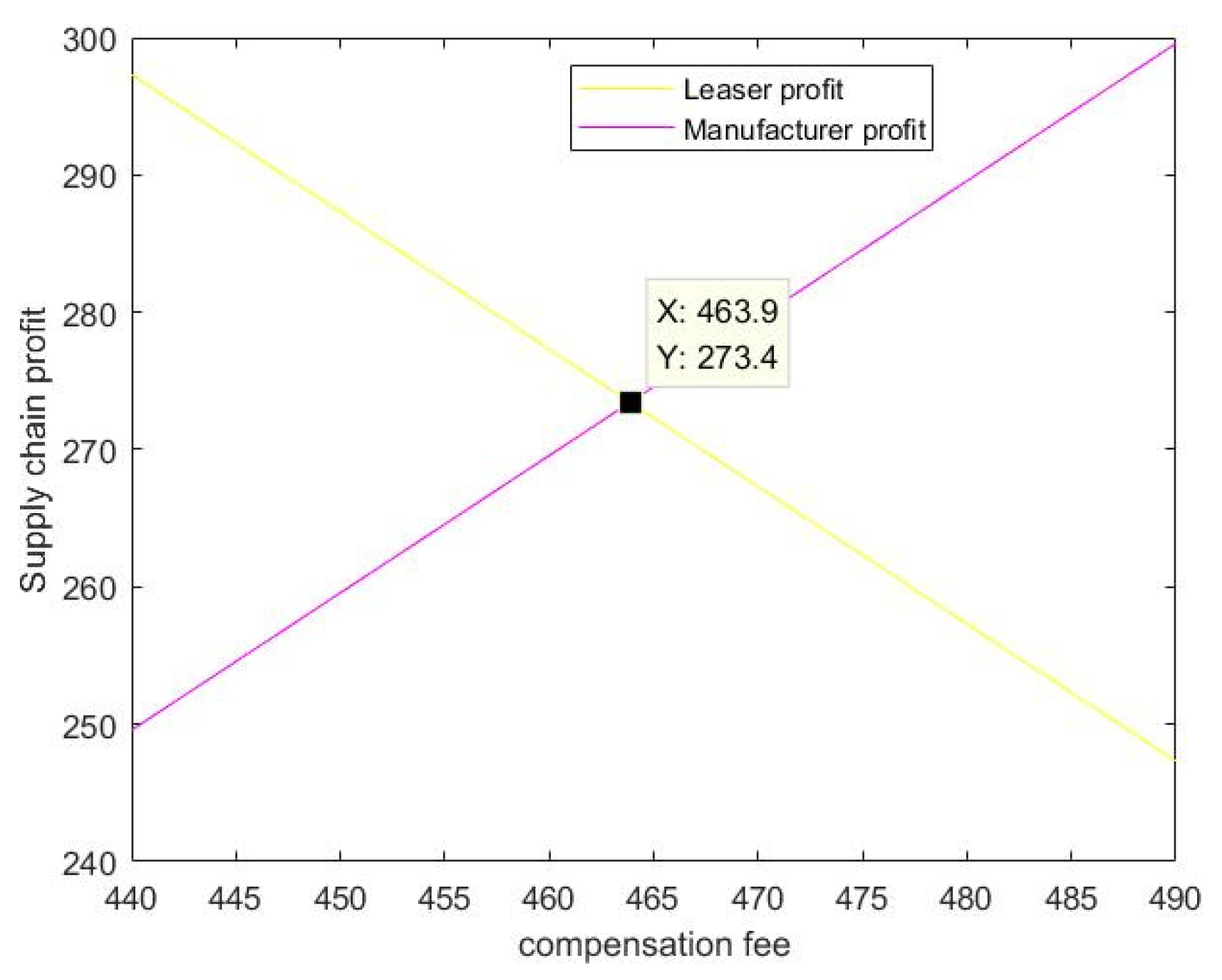

Therefore, to meet practical needs for the dilemma of construction machinery industry, it is necessary to establish relevant model and conduct useful theoretical exploration to promote leasing and recycling, achieving low carbon development. Aiming at exploring new perspectives on this issue by supply chain coordination, the current work started with a two-stage leasing closed-loop supply chain model with the Industrial Internet platform as a member in

Section 2. On this basis,

Section 3 established the Stackelberg game model for centralized/decentralized decision-making respectively, the Shapley value method and two-part pricing contract are designed to achieve supply chain coordination. In

Section 4, the performance of different contracts on the improvement of closed-loop supply chain returns was investigated and the correlation among different parameters, decision variables and profit function were explored through sensitivity analysis and numerical simulation.

Section 5 concluded this research.

3. Model Solutions and Contract Coordination Design

3.1. Demand Functions and Profit Functions

According to the symbol definition and problem assumptions, the product demand function of leasing oriented closed-loop supply chain for construction machinery can be expressed as:

where is the impact of daily maintenance by the leaser on supply chain demand. The higher the maintenance efforts level, the greater the demand for the supply chain.

The total market demand includes the demand for new products and remanufactured products, so the product recovery quantity is:

It can be seen that the total profits of manufacturer, leaser and closed-loop supply chains can be expressed as:

3.2. Centralized Decision-making Scenario Analysis

Under centralized decision-making, manufacturer and leaser don’t consider their benefit. They always work in close cooperation, share information, and make joint decisions to maximize supply chain profits. At this time, the Hessian matrix is constructed to solve

,

and

.

The Hessian matrix is negative for

and

. Therefore, with respect to

,

and

,

is strictly a concave function. By solving

, ,

, we can obtain the equation:

Because of

,

needs to be satisfied at this time:

Substituting equations (6) to (8) into equations (1), (2) and (5), the optimal values of the product demand, product recovery quantity and total supply chain profit under centralized decision-making can be obtained as follows:

Proposition 1. Under the centralized decision, the total supply chain profit, product demand and product recovery quantity are negatively correlated with the maintenance cost coefficient, unit remanufacturing cost and Industrial Internet platform cost coefficient. And they are positively correlated with the maintenance sensitivity coefficient and maximum market demand.

Proof 1. Find, , , , , , , , , , , , . We can obtain:

Proposition 1 shows that under centralized decision-making scenario, the total supply chain profit, product demand and product recovery quantity decrease with the increase of the maintenance cost coefficient, unit remanufacturing cost and Industrial Internet platform cost coefficient increase. At the same time, they will also increase with the increase of the maintenance sensitivity coefficient and maximum market demand. It illustrates that consumers pay attention to the safety of construction machinery. As the market demand for construction machinery expands, both manufacturer and leaser need to make improvements to increase the total supply chain profit. Manufacturer needs to continuously improve product remanufacturing technology to reduce the unit remanufacturing cost and upgrades Industrial Internet platform operation and maintenance technology to reduce the Industrial Internet platform cost. Leaser needs to pay more attention to the daily maintenance of mechanical equipment to improve the maintenance efforts level.

Proposition 2. Under the centralized decision, the leasing price is positively correlated with the unit remanufacturing cost, the maintenance effort level and product recovery rate are negatively correlated with the unit remanufacturing cost. The recovery rate is negatively correlated with the Industrial Internet platform cost coefficient.

Proof 2. Find , , , . We can obtain:

Proposition 2 shows that, in a centralized decision-making scenario, the leasing price increases as the unit remanufacturing cost increases, the maintenance effort level and product recovery rate decrease as the unit remanufacturing cost increases. And the recovery rate decreases as the Industrial Internet platform cost coefficient increases. The analysis of Proposition 1 shows that the total supply chain profit, product demand and product recovery quantity continue to decline as the unit remanufacturing cost increases. The manufacturer and leaser are a community of benefit under centralized decision-making scenario. The leaser has to increase the leasing price to compensate for the loss of higher cost and reduced demand, which causes the leaser not to have excess funds for daily maintenance of construction machinery. Due to the increase of the unit remanufacturing cost and Industrial Internet platform cost, manufacturer is unable to undertake more remanufacturing work, so the product recovery rate is reduced.

3.3. Decentralized Decision-making Scenario Analysis

Under decentralized decision-making, manufacturer and leaser aim to maximize their profits. The decision is divided into two stages. In the first stage, the manufacturer first decides the selling price

and product recovery rate

. In the second stage, the leaser determines the leasing price

and maintenance effort level

according to the decision made by the manufacturer. Based on the reverse solution method, the Hessian matrix is constructed to solve

and

.

The Hessian matrix is negative for

and

. Therefore, with respect to

and

,

is strictly a concave function. By solving

,

, we can obtain the results of the equation:

By substituting formula (9) and formula (10) into formula (3):

To analyze the impact of

on

, and the impact of

on

, the Hessian matrix is constructed.

The Hessian matrix is negative for

and

. with respect to

and

,

is strictly a concave function. By solving

,

, we can obtain the results of the equation:

Because

, then

needs to satisfy:

By substituting formula (12) and formula (13) into formula (9) and formula (10):

By substituting formula (12) ~ (15) into formula (1) ~ (5), the optimal values of the product demand, product recovery quantity, manufacturer profit, leaser profit and total supply chain profit under decentralized decision-making can be obtained:

Proposition 3. Total supply chain profit under centralized decision-making is always greater than the level under decentralized decision-making.

Proof 3. Find . We can obtain:

Proposition 3 shows that the total supply chain profit under centralized decision-making is greater than the level under decentralized decision-making. It indicates that there is a double marginalization effect in the leasing-oriented closed-loop supply chain operation for construction machinery based on the Industrial Internet platform, and further design contracts are needed to optimize.

Proposition 4. The values of the maintenance effort level, product recovery rate, product demand and product recovery quantity under centralized decision-making are all greater than under the decentralized decision-making, but the leasing price under the centralized decision-making is less than under the decentralized decision-making.

Proof 4.: Find

,

,

,

,

, we can get:

Proposition 4 shows that the values of the product recovery rate and product recovery quantity are greater under the centralized decision-making. From the view of product recovery quantity, a cooperative strategy will be preferred. Due to the maintenance effort level is higher under the centralized decision-making, but the leasing price is lower, this will inevitably stimulate the product demand growth. The leasing price is higher under the decentralized decision-making and proposition 3 shows that the total supply chain profit is always greater under the centralized decision-making. So, there is room for profit improvement for both the manufacturer and the leaser.

Proposition 5. Under the decentralized decision-making scenario, the selling price and leasing price are positively correlated with the unit remanufacturing cost, the maintenance effort level and product recovery rate are negatively correlated with the unit remanufacturing cost. And the product recovery rate is negatively correlated with the Industrial Internet platform cost coefficient.

Proof Find , , , , . We can obtain:

Proposition 5 shows that, in a decentralized decision-making scenario, the selling price and leasing price increase as the unit remanufacturing cost increases, while the maintenance effort level and product recovery rate decrease. And the product recovery rate decreases as the Industrial Internet platform cost coefficient increases. Under decentralized decision-making, manufacturer has to increase the selling price of construction machinery due to the unit remanufacturing cost. So, the leaser must also pay more to purchase the construction machinery which is unfavorable for daily maintenance. Due to the unit remanufacturing cost and Industrial Internet platform cost, the recover rate and quantity of the used products decreased which is not good for the sustainable development of the construction machinery leasing industry.

Proposition 6. The leaser profit is negatively correlated with the maintenance cost coefficient, and positively correlated with the maintenance sensitivity coefficient and the maximum market demand. Manufacturer profit is negatively correlated with the Industrial Internet platform cost coefficient and positively correlated with the maximum market demand. The product demand and product recovery quantity are negatively correlated with the maintenance cost coefficient, unit remanufacturing cost and Industrial Internet platform cost coefficient, and positively correlated with the maintenance sensitivity coefficient.

Proof 6. Find, , , , , , , , , , , , , . We can obtain:

Proposition 6 shows that the leaser profit and product demand decrease as the maintenance cost coefficient increases, while increasing as the maintenance sensitivity coefficient and the maximum market demand increase. The manufacturer profit and product recovery quantity decrease as the Industrial Internet platform cost coefficient and unit remanufacturing cost increase. In order to increase profits and product demand under decentralized decision-making, leaser must improve maintenance technology to reduce the maintenance cost, and manufacturer needs to improve remanufacturing technology, Industrial Internet platform operation and maintenance technology to reduce the unit remanufacturing cost and Industrial Internet platform cost.

From Propositions 3 to 6, it is clear that there needs further improvement for the supply chain on the base of decentralized decision. The objective of the coordination in this chapter is to improve the performance of the closed-loop supply chain for construction machinery leasing with platform access, so the Shapley value method and the two-part pricing contract are designed.

3.4. Coordination Contract Model

It can be seen from propositions 3 to 6 that it is necessary to design contract to coordinate the supply chain so that the supply chain profits can achieve rational distribution. This section studies the coordination effect of the Shapley value method and two-part pricing contract on the supply chain

In order to make the subsequent analysis more intuitive, this section makes:

3.3.1. Shapley value method

In order to coordinate the leasing closed-loop supply chain of construction machinery, the Shapley value method is used to distribute the overall profit of the supply chain. Let set

, any subset

of

correspond to a function

,

, if it satisfies:

Then is called a multi-player cooperative game, and the characteristic function represents the maximum benefit obtained from the interaction in the alliance . It means that there is no benefit without cooperation, which means that the benefits of cooperation are greater than the simple sum of their benefits, and member activities are non-confrontational.

Using

to represent the profit obtained by member

of

from

, it is obvious that the establishment of the cooperation must satisfy:

In the Shapley value method, the benefit value allocated by the member

is the Shapley value, which can be expressed as:

Among them,

is the number of elements,

is the weighting factor,

represents the benefits of cooperation between both parties in the supply chain when

companies participate, and

represents the benefits of supply chain cooperation without the participation of

companies. Therefore,

represents the contribution value made by company

in supply chain cooperation.

According to the Shapley value method, the profit distribution values for manufacturers and leasers are:

Proposition 7. Under the Shapley value method, when the selling price satisfies , both the manufacturer profit and the leaser profit increase compared with the decentralized decision-making. The total supply chain profit reaches the level under centralized decision-making.

Proof 7.

and are the profits coordinated by Shapley value method. When satisfies the following equation, the closed-loop supply chain can be coordinated.

Among, the leasing price, maintenance effort level and product recovery rate are respectively equal to those under centralized decision-making, so:

The simultaneous equations can be obtained:

When

, finding

,

,

. We can get:

It can be seen from Proposition 7 that when formulas (24) and (25) are satisfied under the Shapley value method, the manufacturer profit and the leaser profit both increase by compared with the decentralized decision-making. The total supply chain profit reaches the level under centralized decision-making. It indicates that the closed-loop supply chain reaches the Pareto optimal under the Shapley value method.

3.3.2. Two-part pricing contract

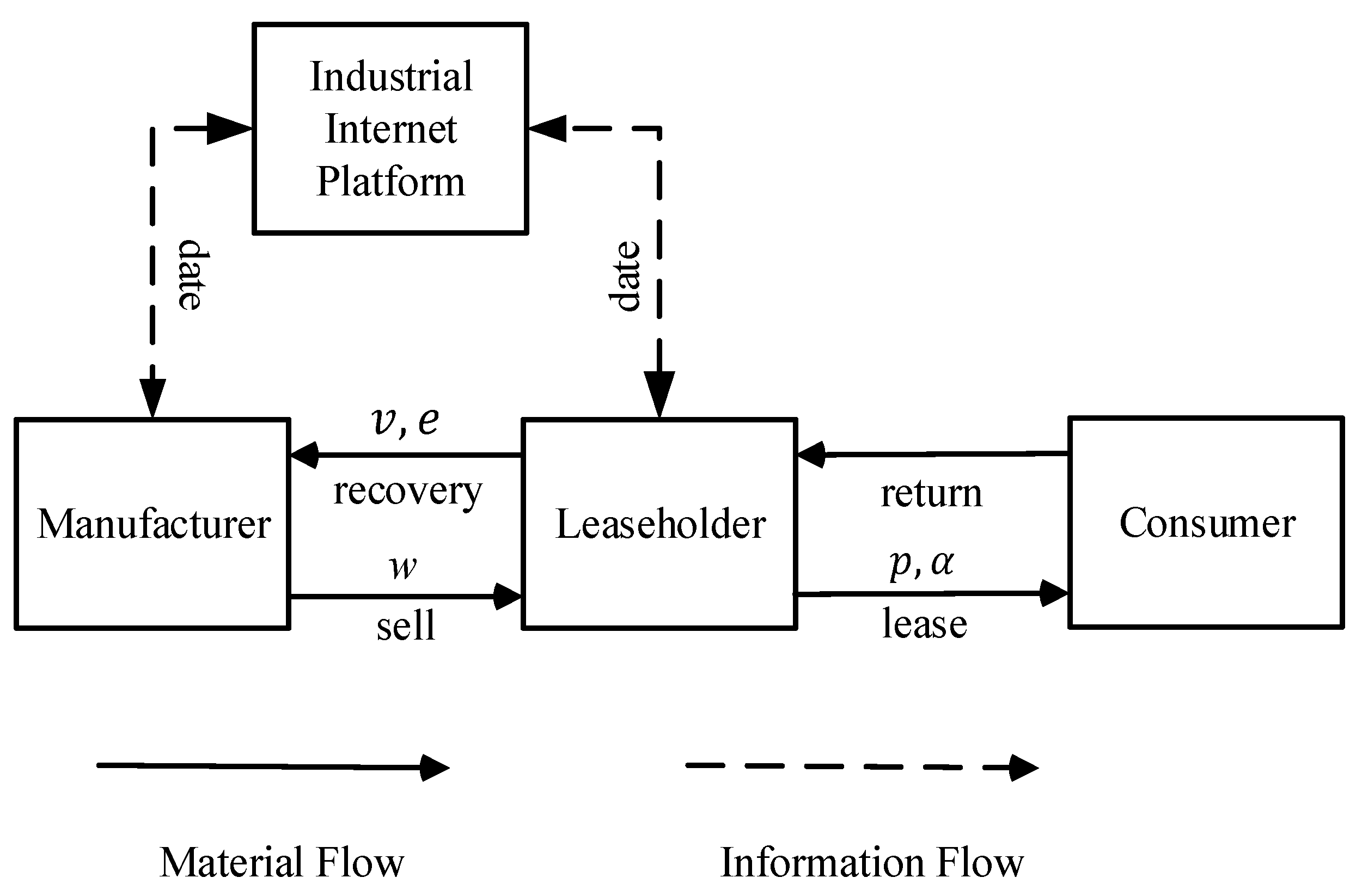

In the construction machinery closed-loop supply chain, it is manufacturer who determines the selling price and product recovery rate, operates the Industrial Internet platform and remanufactures the used product. So, the two-part pricing contract can be designed as follows. The manufacturer offers a contract to the leaser and sells the product to the leaser by finance lease. Since the leaser does not have to pay the product cost at the beginning, the manufacturer has no return at the beginning. Subsequently, the leaser is required to compensate the manufacturer at the end of a leasing cycle for a portion of its profit. Which is recorded as .

At this time, the profit functions of the manufacturer and the leaser are:

In order for supply chain profits under the two-part pricing contract to reach the level under centralized decision-making. The following conditions need to be met.

Substituting Equation (28) into Equation (26) and Equation (27), the optimal values of the manufacturer profit and the leaser profit under the two-part pricing contract can be obtained:

Proposition 8. Under the two-part pricing contract, when the compensation fee is

, the supply chain achieves coordination.

Proof 8. If the two-part pricing contract is to be effective, it is necessary to satisfy that the manufacturer profit and the leaser profit under the two-part pricing contract are greater than those under the decentralized decision-making, namely , , then the interval of is set to . We get:

Find . We can get:

From the calculation, can be obtained. Therefore, the leaser needs to compensate the manufacturer, and the scope of the compensation fee is . When , the manufacturer does not profit at this time and the two-part pricing contract does not have effect. When , the leaser is not profitable at this time and the two-pricing contract does not coordinate the supply chain. Therefore, a reasonable range of compensation fee should be , when the supply chain reaches Pareto optimal.

4. Numerical Analysis

As the optimal expressions for the decision variables and profit functions are complex, numerical simulation is used to demonstrate the simulation to verify the validity of the model. The relevant parameters are setting as: , , , , , , , .

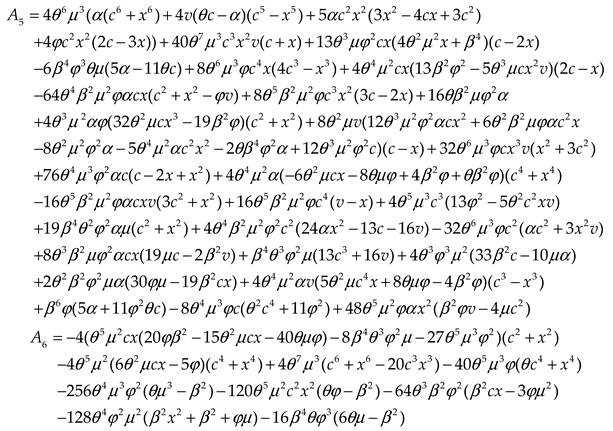

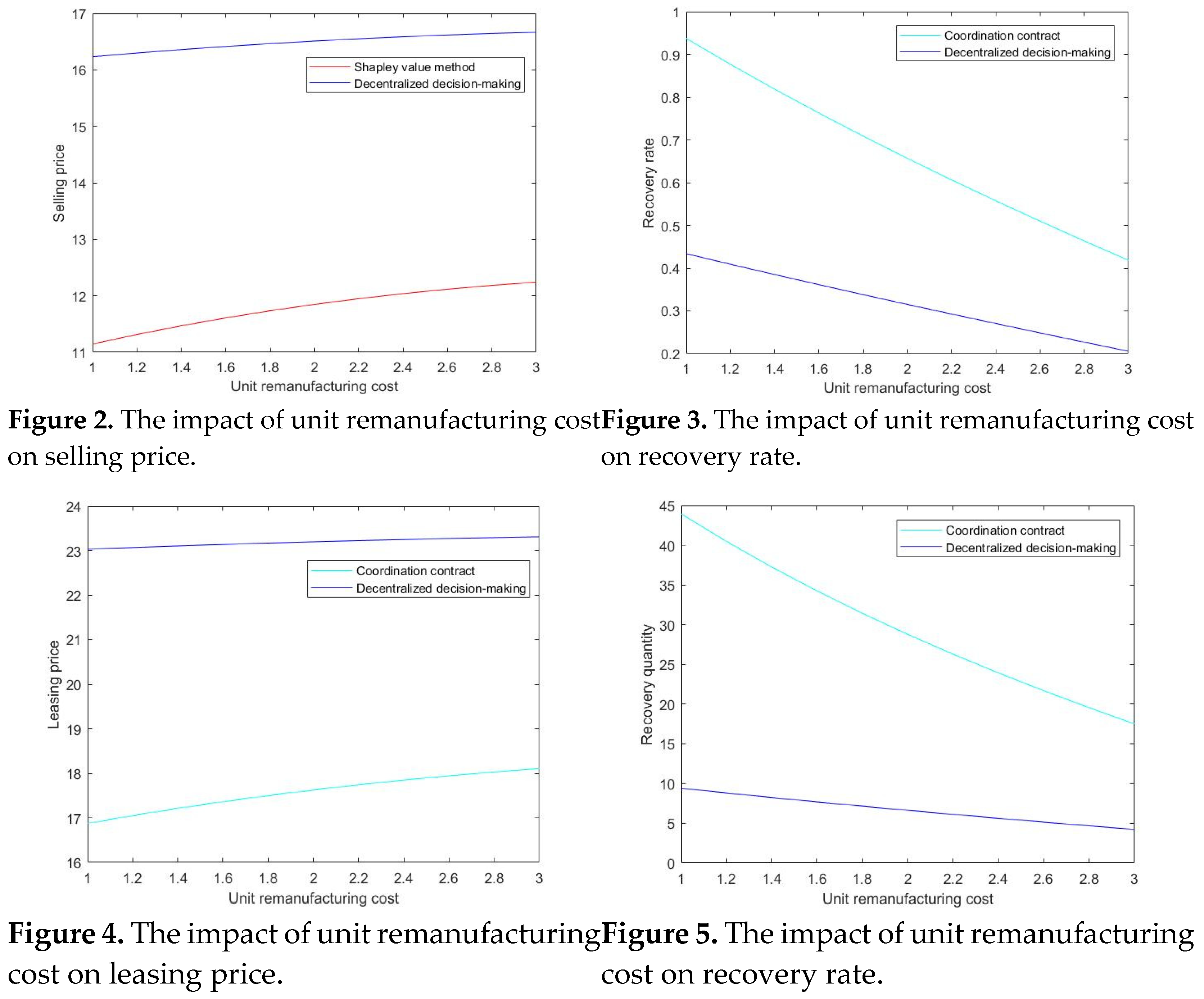

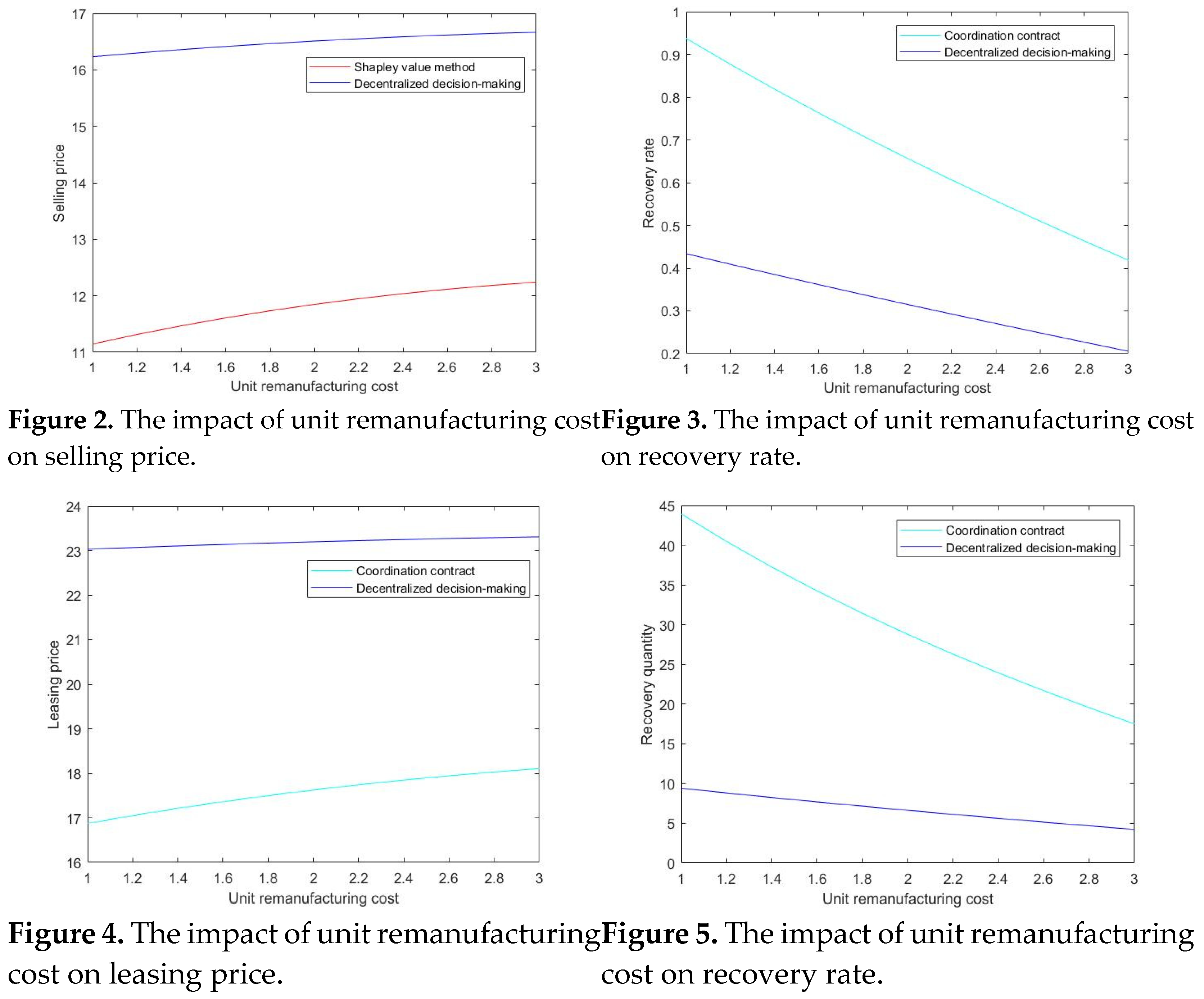

4.1. The Impact of Unit Remanufacturing Cost x

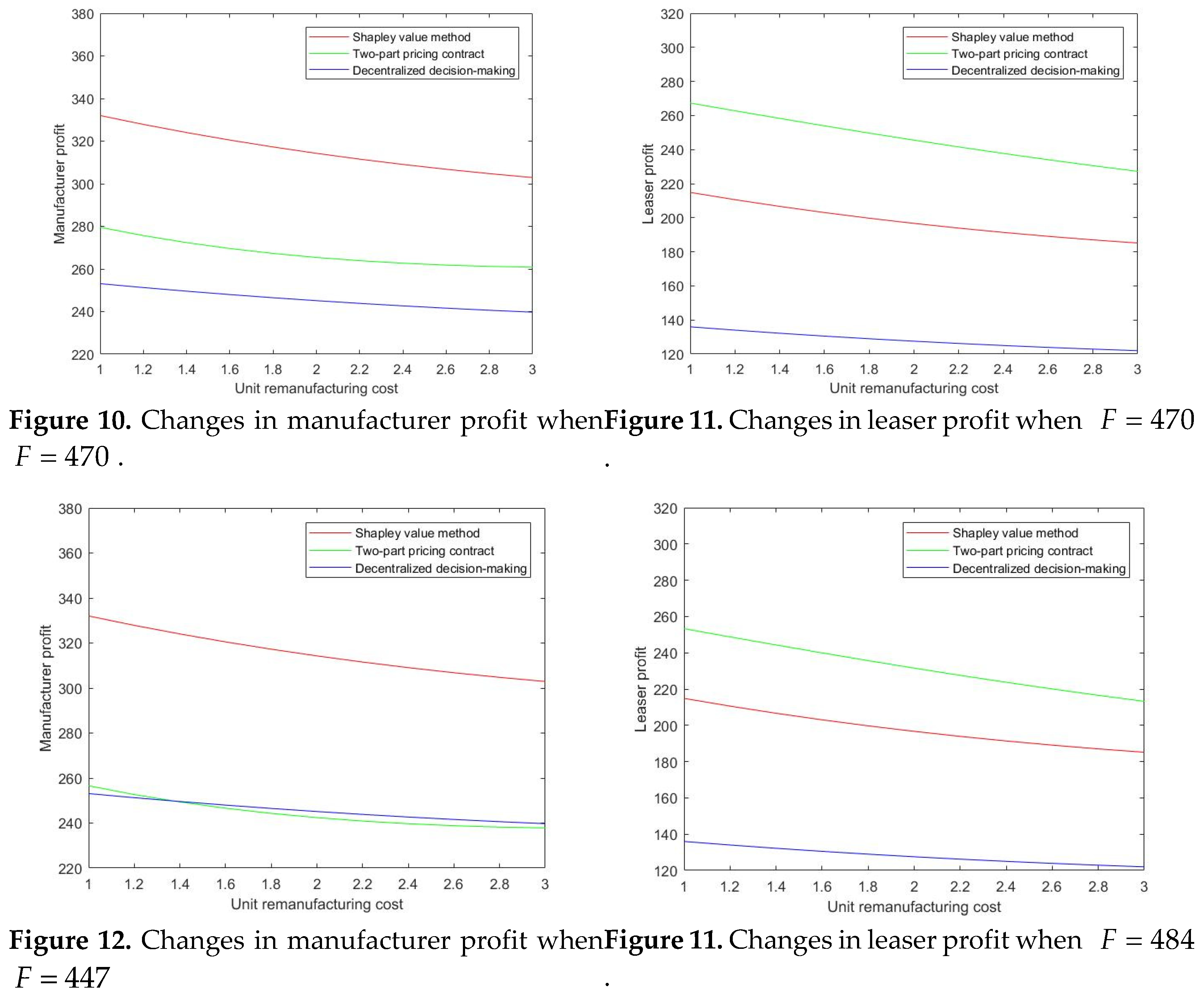

In order to analyze the impact of unit remanufacturing cost on decision variables and recovery quantity, the value range of unit remanufacturing cost is set to while other parameters are unchanged. Figures 2–5 can be obtained

From Figures 2–5, as the unit remanufacturing cost increases, the leasing price and selling price increase under the scenarios of contract coordination and decentralized decision, while the recovery rate and recovery quantity decrease. Under the same unit remanufacturing cost, the recovery rate and recovery quantity of the coordination contract are always higher than that under decentralized decision-making, while the leasing price and selling price are always lower than that under decentralized decision-making. It shows that the decision variables under the coordination contract have reached the level of centralized decision-making. Using the Shapley value method and the two-part pricing contract, the profits of manufacturer and leaser are redistributed and begin to cooperate. Through enhance manufacturing technology, the manufacturer can reduce the cost of production, recovery and remanufacturing and sell the product to the leaser at a lower price with the current recovery rate. Due to the deduction of purchase cost, the leaser can also lower the leasing price and pay more attention to the daily maintenance of the product. With the help of contracts, consumers can obtain high-quality products and maintenance services without excessive restriction of product service life, ensuring safety and avoiding waste.

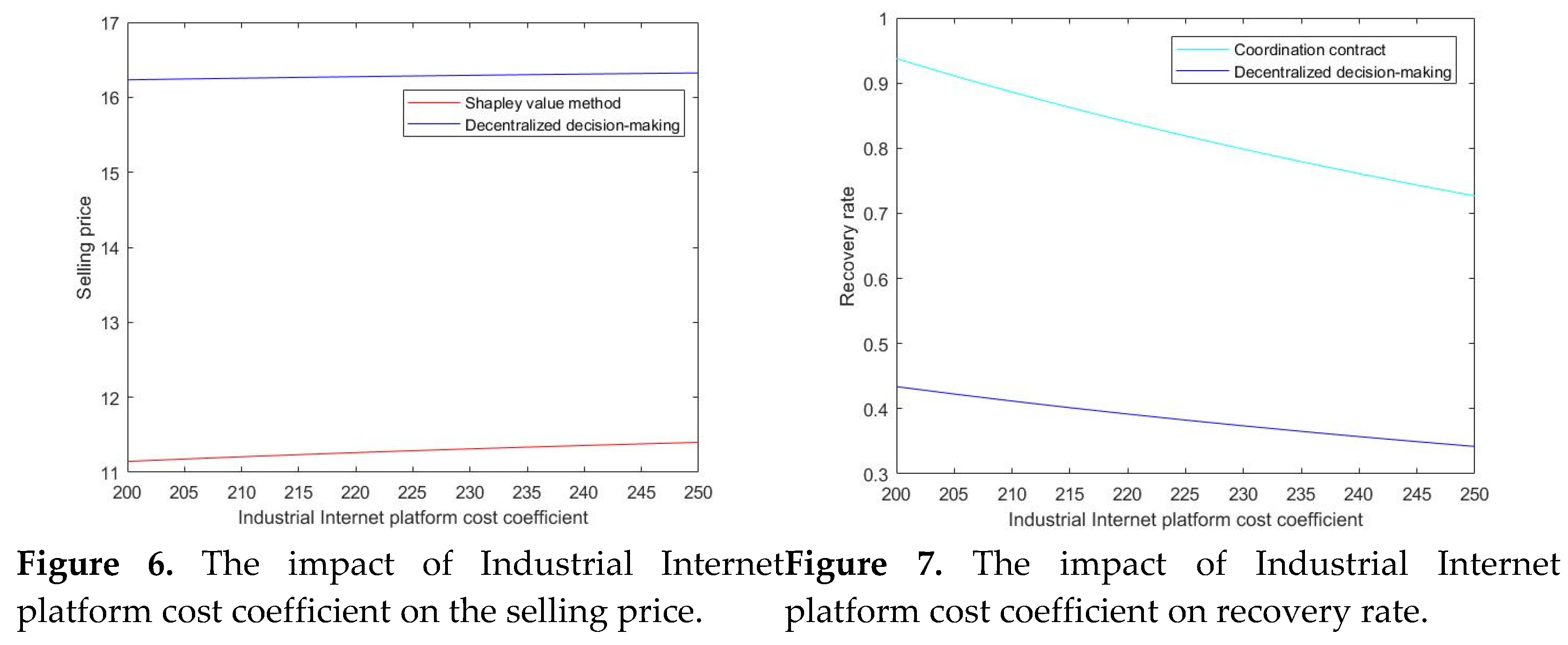

4.2. The Impact of Industrial Internet Platform Cost Coefficient φ

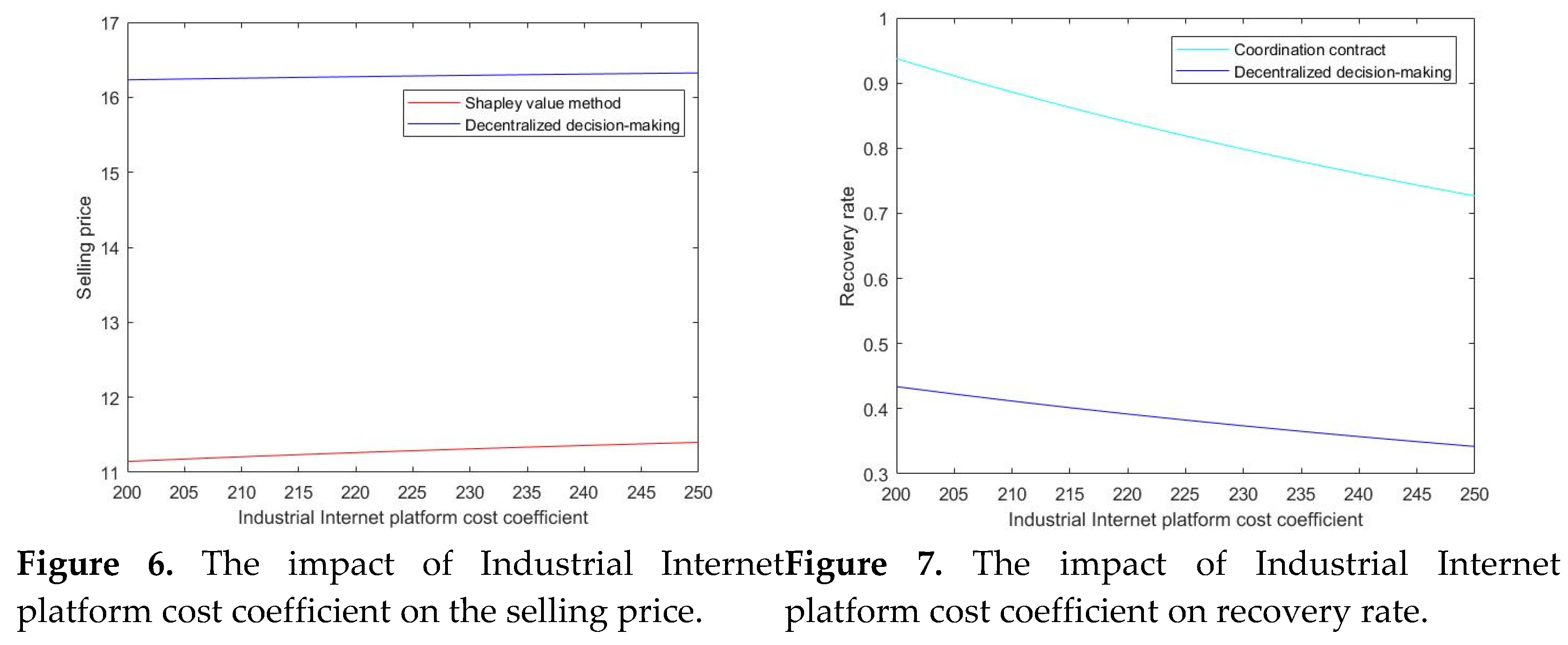

In order to analyze the influence of the Industrial Internet platform cost coefficient on the selling price and recovery rate, the value range of the Industrial Internet platform cost coefficient is set to (200,250) when other parameters remain unchanged. We obtained Figures 6 and 7.

From Figures 6 and 7, it can be seen that with the increase of the Industrial Internet platform cost coefficient, the selling price increase under both the decentralized decision-making and coordination contract, while the recovery rate decrease. Under the same Industrial Internet platform cost coefficient, the selling price of the coordination contract is always lower than that of the decentralized decision-making, and the recovery rate is always greater than that of the decentralized decision-making. This shows that the coordination contract promotes the cooperation between the manufacturer and the leaser. With the contract, the manufacturer can make full use of the Industrial Internet platform to recycle used product so that the recovery rate can be increased, while selling product to leaser at a cheaper price.

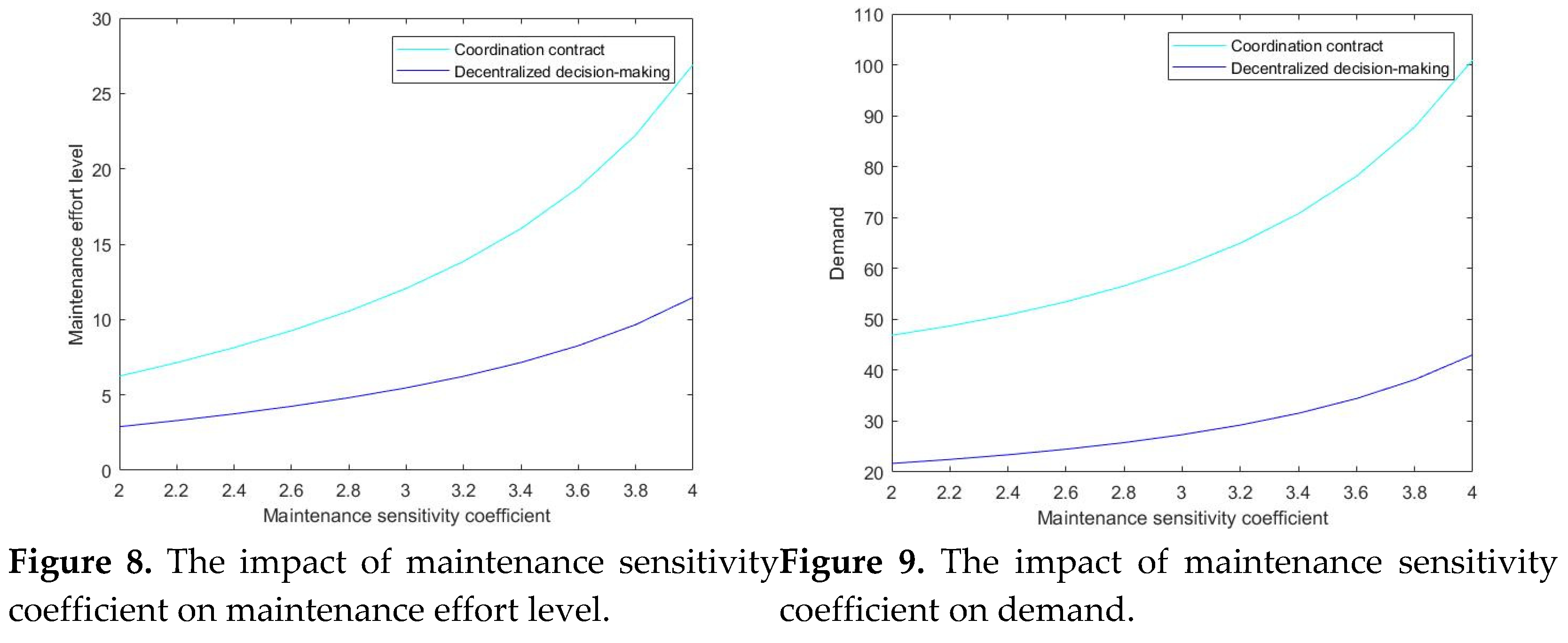

4.3. The Impact of Maintenance Sensitivity Coefficient β

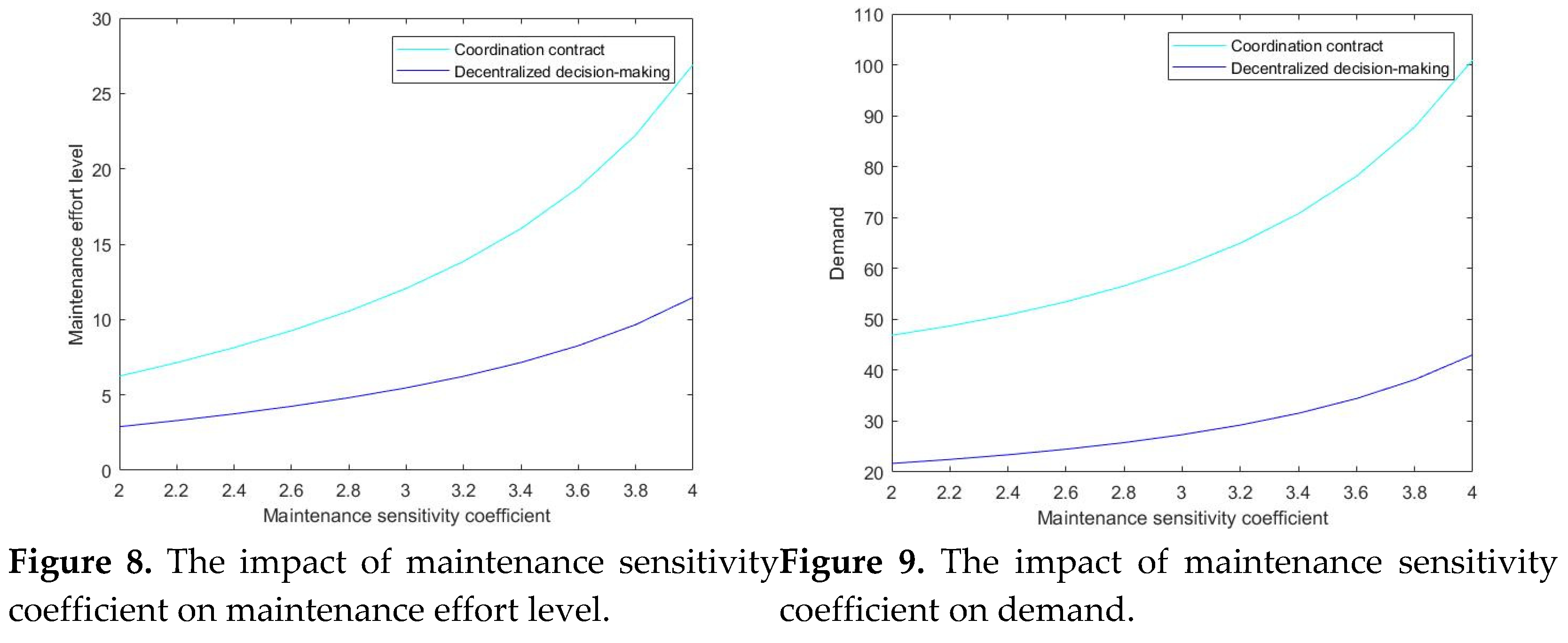

In order to analyze the influence of maintenance sensitivity coefficient on maintenance effort level and product demand, the value range of maintenance sensitivity coefficient is set to (2, 4) while other parameters are unchanged. We obtained Figures 8 and 9

As can be seen from Figures 8 and 9,, with the enhancement of the maintenance sensitivity coefficient, the maintenance effort level and product demand increase under both coordination contracts and decentralized decision-making. With the same maintenance sensitivity coefficient, the maintenance effort level and product demand of the coordination contract are greater than those of decentralized decision-making. In the reality of construction machinery leasing industry, consumers are very concerned about the maintenance status and safety of products. The analysis in Figures 2–5 shows that when manufacturers and leasers cooperate by coordination contract, leaser can provide better maintenance service for product, which ultimately brings an increase in the product demand.

4.4. The Impact of the Coordination Contract on Manufacturer Profit and Leaser Profit

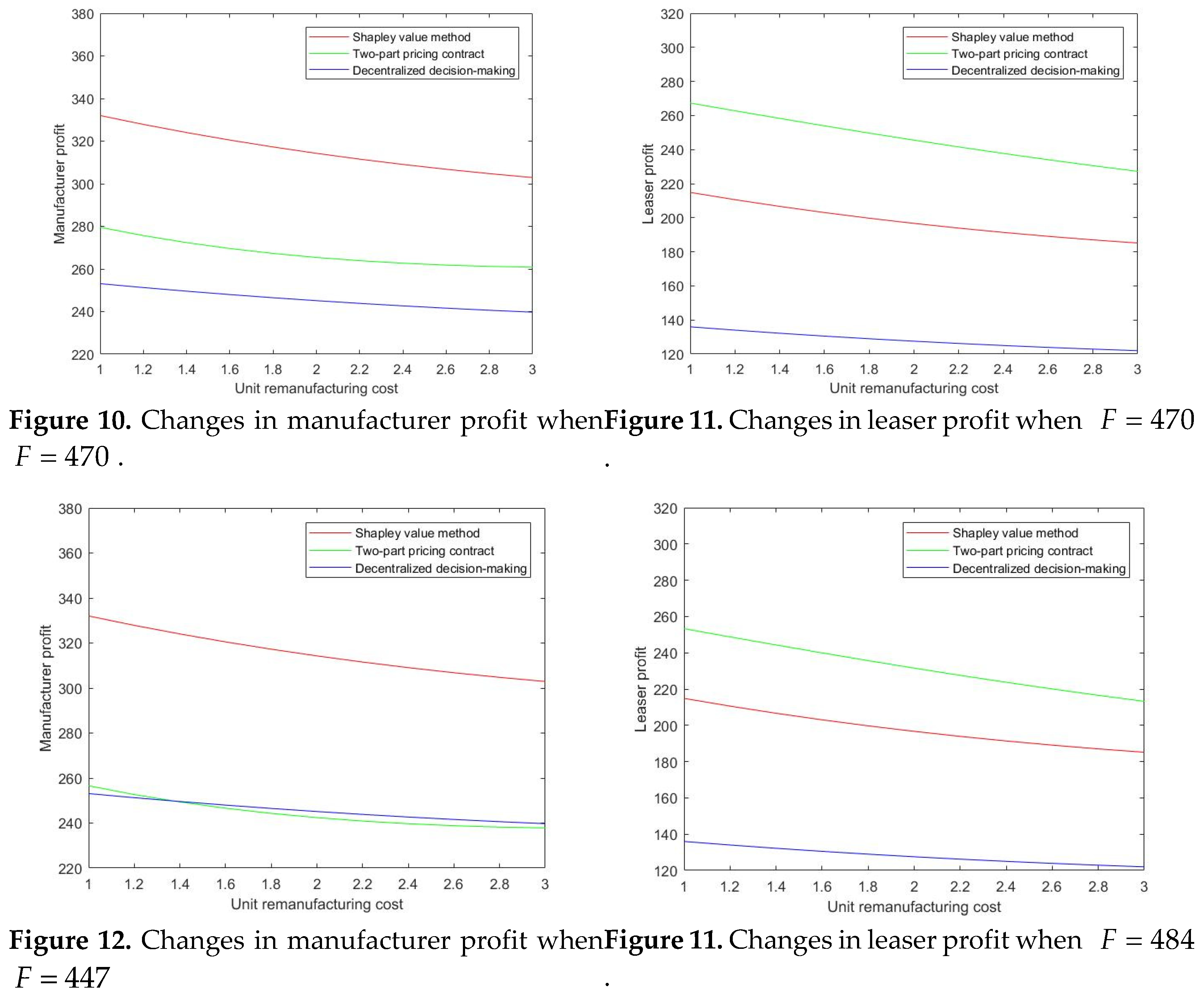

It can be calculated from above that there exists a scope for compensation fee, . In order to comprehensively analyze the changes in the profits of manufacturers and leasers under different decision-making. The unit remanufacturing cost is set to while other parameters are unchanged. We obtained Figures 10–13 as follows. in Figures 10 and 11, in Figure 12, and in Figure 13.

As can be seen in Figures 10 and 11 when compensating fee is , manufacturer and leaser profits decrease in all three decision scenarios as unit remanufacturing cost increase. Under the two coordination contracts, the manufacturer profit and leaser profit are always greater than those under decentralized decision-making. And the change of unit remanufacturing cost does not affect the coordination of the Shapley value method and two-part pricing contract on the supply chain. The manufacturer profit is greater than that under the two-part pricing contract with the Shapley value method, so the manufacturer prefers the Shapley value method. When using the two-part pricing contract, the leaser profit is greater than that under the Shapley value method, so the leaser prefers the two-part pricing contract. Although the manufacturer and the leaser have different biases in the choice of contract, the total supply chain profit under both coordinated contracts reaches the level of centralized decision

In Figure 12, the manufacturer receives a compensation fee that is close to the minimum of the range of compensation fee. The Shapley value method is always effective in this case. But the two-part price contract coordination mechanism fails when the unit remanufacturing cost increases to a certain value. There are two remedies available to the manufacturer, one is to reduce unit remanufacturing cost by improving remanufacturing technology; the other is to require the leaser to pay more compensation fee as much as possible. In Figure 13, the compensation paid by the leaser is close to the maximum of the range of compensation fee. The Shapley value method and the two-part pricing contract are always valid.

4.5. The Impact of Compensation Fee on Each Supply Chain Player Profit

In order to analyze the impact of compensation fee on the profit of manufacturer and leaser under the two-part pricing contract, the range of compensation fee is set to

with other parameters unchanged. We obtained

Figure 14.

As can be seen from

Figure 14, as the compensation fee increases, the manufacturer profit increase and the leaser profit decrease respectively. From the model simulation, it can be seen that when the compensation fee is

, the profits of the manufacturer is equal to that of the leaser which is

. When the compensation fee

, the profits of all parties in the supply chain can be improved. From the perspective of the construction machinery industry, with the two-part pricing contract, manufacturer is willing to sell the machinery product to the leaser by financial leasing in which the leaser compensates the manufacturer with a portion of the profit. So that long-term stable cooperation can be formed and the development of leasing industry can be achieved.

5. Conclusions

To study the impact of Industrial Internet platform access on the closed-loop supply chain for the construction machinery leasing industry, this paper analyzed three aspects. First, introduce the Industrial Internet platform and demonstrate the economics of Industrial Internet platform based leasing and recycling business through the comparison of centralized and decentralized decision models; Secondly, design coordination contracts with the practical operation of construction machinery finance leasing and investigated the improvement of different contracts on the closed-loop supply chain; Thirdly, sensitivity analysis and numerical simulation are conducted to explore the impact of different parameters and the decision variables on the supply chain performance. The relevant management enlightenment can be obtained as below:

(1) In the case of centralized decision-making, decentralized decision-making and coordination contract, the increase of unit remanufacturing cost and Industrial Internet platform cost coefficient can enhance the selling price and leasing price, resulting in the deduction of used product recovery rate and the profit of manufacturer and leaser. The increase of consumer maintenance sensitivity coefficient will not only promote the improvement of the maintenance effort level of the leaser but also increase the demand of the whole supply chain.

(2) There is a double marginalization effect in the closed-loop supply chain under decentralized decision-making. The Shapley value method and two-part pricing contract can solve this problem and make the total profit of the supply chain reach that under centralized decision-making. The selling price determined by the Shapley value method can make more profit for the manufacturer and the leaser than that under decentralized decision. The manufacturer profit is greater than that of the two-part pricing contract and the leaser is just the opposite. The supply chain can be coordinated when the compensation fee is within a certain range with the two-part pricing contract.

This study can provide the following insights for manufacturers and leaser in the construction machinery leasing industry: (1) Manufacturer need to make full use of the Industrial Internet platform to recycle used product, continuously improve remanufacturing technology and reduce unit remanufacturing cost. (2) Leaser needs to enhance the maintenance of mechanical equipment to ensure operational safety. (3) The design of coordination contract can strengthen the cooperation between the manufacturer and the leaser, improving the supply chain performance and promoting sustainble low-carbon development.