4.1. The State of Digital Financial Inclusion in Developing Economy?

Digital transformation has resulted in changes in the financial services industry and enhanced access to and utilization of financial services due to rapid technical breakthroughs such as artificial intelligence, the internet, and cloud technology, among others. Sub-Saharan Africa's developing financial industry, in collaboration with banks, governments, and other organizations, has established a digital payments ecosystem. The Ecocash system in Zimbabwe is used as an example by the academics. A well-publicized success story, implying that the network processed over US$78.4 billion in 2019, increasing financial inclusion from 32 percent to almost 90 percent. As a result, financial, economic, and social inclusiveness have improved.

The outbreak of the COVID-19 pandemic in 2020 has increased the importance of innovation in financial services. First, limits on migration and the shutdown of bank offices in several countries have underlined the necessity of digital payment services and electronic banking. Furthermore, many SMEs in poor nations continue to pay staff salaries with cash and checks. Nevertheless, e-wallets may readily be used for such reasons in order to assist the unbanked population, which is highly reliant on cash. In Jordan, for instance, the government suggested that citizens use digital wallets to pay their wages and make purchases. The Central Bank of Jordan (CBJ) has authorized seven different telecommunications and payment service companies to supply these wallets [31]. To encourage digital payment service suppliers and retailers to embrace digital payments, the CBJ introduced Mobile Money for Resilience (MM4R) (COVID-19 Response Challenge Fund) (CBJ, 2020). One service provider in the nation reported a 300% rise in digital wallet account applications during the initial month of the crisis. These initiatives resulted in a considerable rise in transaction volume (over 36.5 million JOD), and the number of newly enrolled wallets exceeded 190,000 between the end of March and the end of April 2020. Additionally, the government said that roaming groups will be sent around the country to instruct individuals on how to use digital wallets, emphasizing the significance of financial literacy in deciding the viability of such operations.

An inclusive financial sector is seen as critical for the growth and development of economies in all nations throughout the world, as it facilitates access to, availability of, and usage of financial services by all members of the population. Population groupings include the banked, underbanked, and financially excluded, as well as individuals of all genders. Sustainable Development Goal 5 (SDG5), which emphasizes the necessity of tackling gender equality, is made possible through financial inclusion. According to Ref. [32] women and girls are still marginalized, defenseless, and disadvantaged. They are regarded as lacking economic, financial, and societal independence, indicating a gender discrepancy in African financial inclusion. Notwithstanding the fourth industrial revolution making advances in Africa, women are still struggling to attain digital financial inclusion in countries such as Kenya, Lesotho, Ghana, Namibia, South Africa, and Zimbabwe.

In the past few decades, African countries' ability to access monetary services has grown dramatically. Individuals and organizations are receiving a growing amount of financial services, notably credit. Modern technologies like mobile currency have, however, contributed to improving the availability of financial services, including savings and remittance options. Nevertheless, until recently, very little was known concerning the banking industry's reach—the extent to which vulnerable populations such as the poor, women, and young are barred from official banking firms in Africa and elsewhere. In recent years, technology improvements such as mobile money, innovation, and the development of new distribution channels such as "mobile branches" or banking services using third-party agents have played a significant role in increasing access to finance in Africa. Mobile money, for example, has had the most widespread success in Africa, where 14% of people reported using mobile money in the previous 12 months.

Although people who do not possess an official bank account may lack the assurance and trust that such a relationship provides, they regularly employ sophisticated strategies to control their everyday finances and make future plans. A growing number of Africans are resorting to new funding options readily accessible through mobile phone use. The fast growth of mobile money, commonly known as "branchless banking," has allowed millions of people who are ordinarily prohibited from using mainstream banking applications to perform monetary transactions cheaply, safely, and reliably. In Sub-Saharan Africa, 16% of individuals estimate utilizing mobile devices to pay invoices or send or receive funds across the preceding 12 months (in Africa, 14% of adults used digital payments in the prior 12 months) and about 44% of the adult population in the developing economy is unbanked [33, 34]. In Kenya, where M-Pesa was initially commercially available in 2007, 68% of adults utilize digital payments. Likewise, in Sudan, mobile money was utilized by more than 50% of individuals. And over 35% of adults in East Africa indicate utilizing mobile money. North Africa is one of the regions with low mobile money use (with the exception of Algeria, where 44% of people report using a mobile device to pay expenses or send or receive money), which might be attributed to governmental restrictions put on mobile money carriers and banks. Adults use mobile money at a rate of barely 3%. In all other locations, the proportion of adults utilizing mobile money is a little less than 6% [35].

In recent history, increasing digital banking services have caught the attention of various stakeholders (particularly politicians and scholars) as a method for achieving financial engagement. Particularly, digital payment channels, Internet-enabled remittance service systems, and the use of smartphone technology have all made banking firms more accessible. Promotion and utilization of digital services may have an impact on and shape everyday financial activities, which may play a role in a society's economic progress. Financial inclusion looks to be a potentially revolutionary force in many developing nations, with the ability to reduce poverty and provide a more financially inclusive society. Although financial inclusion is frequently seen as a critical component of development, Bangladesh continues to lag in ensuring financial institutions' access to a broader environment. The World Bank Group (WBG) designated Bangladesh as one of twenty-five nations where 73% of the world's economically disadvantaged people reside under the Universal Financial Access framework (UFA). A recent Financial Inclusion Insights (FII) study on Bangladesh found that 47% of the population is economically included via digital payments (17%), banking (5%), and non-bank financial firms (23%). It also finds that fewer than one-third of women (32%), compared to 56% of men, complete payment systems [36].

Moreover, the country has witnessed significant development in the MFS market, accounting for more than 8% of all registered mobile money accounts worldwide. MFS has proven and revolutionized digital finance in Bangladesh, which is the eighth largest payment country in the world. While all of these MFS are supplied by private and commercial banks, the government has launched an effort called Nagad in collaboration with the Bangladesh Post Office to deliver digital financial services. Furthermore, MFS providers play a critical role in minimizing the economic impact of the COVID-19 outbreak in Bangladesh. In April 2020, MFS operators opened approximately 0.3 million additional accounts to disperse the government's catalyst package for export-oriented companies. From March 20 to April 20, 2020, 163,924 people gave more than TK 50 million to various charity organizations via bKash. The COVID-19 pandemic has necessitated the closure of countless smaller companies, causing unprecedented disturbance to young businesses ranging from stores to road hawkers who use the MFS for everyday transactions and transfer funds to support their loved ones who reside in rural areas [36].

In West Africa, very few countries (such as Nigeria and Ghana) make significant progress in DFI. For instance, in Nigeria, the banked population increased steadily from 30 percent in 2010 to 32.5 percent, 36 percent, and 38.3 percent in 2012, 2014, and 2016. Between 2010 (6.3 percent) and 2016 (10.3 percent), the number of institutions, which includes microfinance banks, insurance firms, retirement funds, and related service providers, increased. However, the informal sector (NGOs and financial cooperatives) fell from 17.4 percent in 2010 to 9.8 percent in 2016. This demonstrated that, as anticipated in the strategy, more Nigerians are already accessing formal banking services [37].

According to the ACI Worldwide Report (2022), in 2021, the Nigerian country reported 3.7 billion real-time transactions, placing it sixth in the world's most advanced real-time financial markets, below India, China, Brazil, Thailand, and South Korea. The broad use of innovative digital and real-time payment technologies enabled Nigeria to generate an additional US$3.2 billion worth of economic production in 2021, or 0.67% of the nation’s GDP. Real-time transactions are expected to reach 8.8 billion per year by 2026, representing an 18.6% 5-year compound annual growth rate (CAGR). This would generate an additional US$6 billion in GDP in 2026, approximately 1.01% of the nation’s GDP, putting Nigeria in fourth place among the world's nations reaping the full economic advantages of real-time transactions. Nigeria is quickly becoming a model for effective digital transformation of the economic growth of the country throughout Africa. Nigerians are now expecting better speeds, more simplicity, and current thinking from financial institutions, thanks to the COVID-19 epidemic. While cash is still commonly utilized, the trend toward digital and real-time financial transactions demonstrates government authorities' achievement in supporting rapid development in digital transparency, especially transactions. Moreover, according to the 2020 Access to Financial Institutions in Nigeria Survey, half (45%) of Nigeria's adult population uses banking institutions, while 33 percent uses informal banking services, including savings organizations, village organizations, and cooperatives. About 64.7% and 38.9% of people possess and utilize a mobile in Nigeria and Ghana, respectively.

According to Ref. [38] given the challenges caused by COVID-19, this accelerated push toward digitalization of the banking system may bring an unanticipated gain for digital banking inclusion. Digital banking (especially mobile money) has previously been demonstrated to be a critical component of financial inclusion in developing nations. Due to the outbreak, the quick surge in demand for fintech services by authorities, companies, and the general public is projected to enhance opportunities for digital channels to promote global financial inclusion. When provided responsibly and sustainably within a well-regulated framework, digital economic inclusion promotes growth and accelerates achievement toward the Sustainable Development Goals (SDGs). Nonetheless, the problem is that achieving the SDGs to eliminate penury throughout nations would require global effort and partnership, whether from developed or developing countries. Young people in industrialized nations have over 90% access to and use of critical financial products, including internet banking. Meanwhile, people who may be inadequate to access digital financial services, such as rural dwellers, the impoverished, and the elderly, will hinder progress toward digital financial inclusion and, as a result, may fall short of meeting the SDGs by 2030. Digital financial inclusion has the potential to be critical in minimizing the economic and social consequences of the current COVID-19 crisis. Increasing low-income households' and small businesses' financial access may also contribute to a more inclusive financial recovery. Such opportunities, therefore, ought not to be underestimated because the epidemic could exacerbate forgoing concerns about economic prohibition and introduce new hazards to the use of digital banking services.

Under the banner of "digital Bangladesh," the government of Bangladesh (GoB) has adopted digital policies such as native connectivity, human capital development, and the digitalization of public services. To speed the growth of electronic frameworks for the promotion of public and financial services, a variety of online enterprises have formed in collaboration with international aid operations (such as UNDP and USAID) governed by the Public-Private Partnership (PPP) framework. One of the notable government projects to assure financial services is the Digital Financial Service (DFS) Lab+. DFS Lab+ is a cooperative project launched by Bangladesh Bank (BB), the country's central bank, to create and increase digital financial inclusion. DFS Lab + provides various suggestions for digital financial inclusion, such as launching 'rural e-commerce' projects, strategies for behavior modification conversations and financial literacy, and reforming legal and regulatory frameworks. There are over fifty-seven financial institutions in the nation, with about 10,000 branches. However, because the majority of bank clients reside in cities, these banking systems are more valuable to people in cities than to individuals in rural regions. Mobile Financial Services (MFS) were developed in 2011 to guarantee that financial services reach the underprivileged in rural regions. Furthermore, the overall MFS market in Bangladesh was estimated to be worth 15 billion BDT, with bKash (owned by Brac Bank) holding 75% of the market share, followed by Rocket at 18% (Naima & Aziz, 2020).

It is hardly surprising that Kenya, where electronic banking initially gained traction, would have the highest score in contactless transactions. Kenya has begun the development of its second generation of official digital remittances standards, which builds on and aspires to expand the previous one. In 2014, new legislation encouraged interoperability and introduced a new type of digital operator of mobile networks. Both initiatives promote a more competitive industry in order to offset Safaricom's market dominance with its MPesa mobile payment service. Kenya, on the other hand, does poorly in terms of consumer protection, particularly market behavior regulation. It lacks specialized financial consumer rights legislation and regulation. However, authorities are striving to implement systematic interest rate disclosure standards that will allow customers to compare rates more readily across organizations.

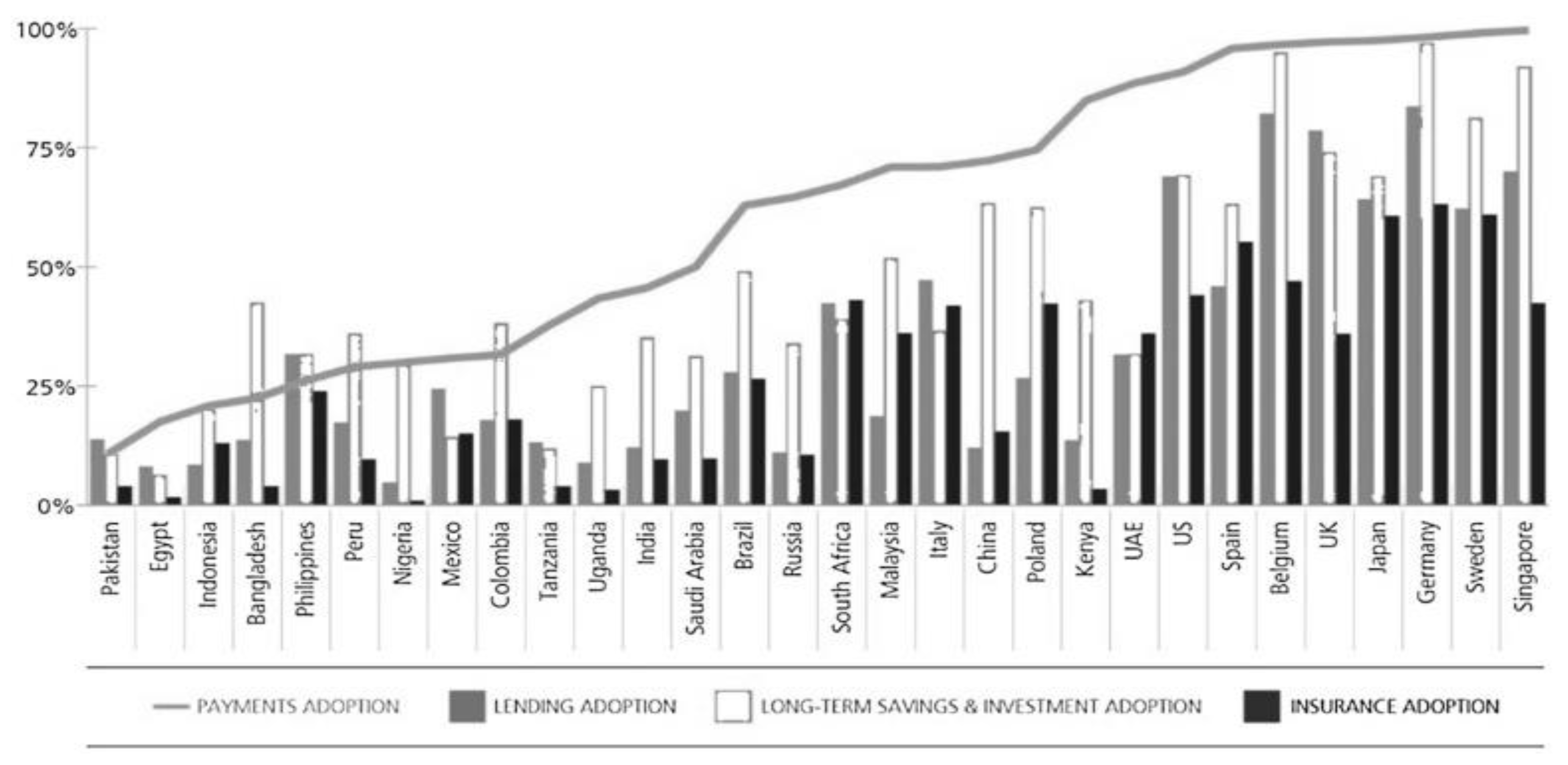

Adoption of financial products revolves around time.

Figure 1 shows the adoption of financial products by country. Adoption of a payment product is described as the possession of a private transactional account in which users may save, receive, and utilize money (for example, preloaded cards, digital payment accounts, and current accounts). Payment use is separated into two categories: payment inflows and payment outflows. Utilization of inflows relates to the usage of payment systems to receive wages, state assistance, and remittances in non-cash ways. The use of payments services for outflows relates to the usage of payments services for cashless expenditures (e.g., retail purchases, bill payments) and cashless transfers.

Figure 1 shows that the performance of the developing economy is relatively low in terms of payment adoption, lending adoption, long-term adoption, and insurance adoption. This has implications for digital financial inclusion, especially for the unbanked. Payments' product penetration outpaces other product uptake in all nations, indicating that transactions are the best access point for promoting worldwide financial inclusion. For instance, several people in each of these nations only possess a payment product (for example, at least 40% of adults in Kenya and approximately 20% in the United States). Rising payment product acceptance promotes the acceptance of payment services as the initial financial instrument as product acceptance increases over time. Some nations with very minimal adoption rates, such as Peru, Colombia, and Bangladesh, have generated more headway in payments by offering a savings option via microfinance institutions (MFIs). However, even within these nations, the savings account is a fictitious payment instrument since it is often the sole account in which individuals save money and make regular withdrawals to make payments. Additionally, as these nations progress, they will be required to focus on actual payment solutions that permit non-cash payments, similar to other nations. While adopting a payment product is in the preliminary stage, some use is likely to follow. Obtaining the product is often motivated by a particular payment requirement (e.g., receiving a salary), and the consumer is likely to utilize the product to solve that need at the very least. The remittance product could also function as a gateway for users to embrace other items. Moreover, digital remittance transactions can reveal valuable information about consumers (for example, creditworthiness) and allow suppliers to offer additional goods. All those other items entail remittances and the utilization of effective digital payment channels in order to enhance the economics both for customers and suppliers. A greater association between remittance product usage (acceptance) and lending, prolonged savings and investment, and insurance product uptake across the nations studied supports this view.

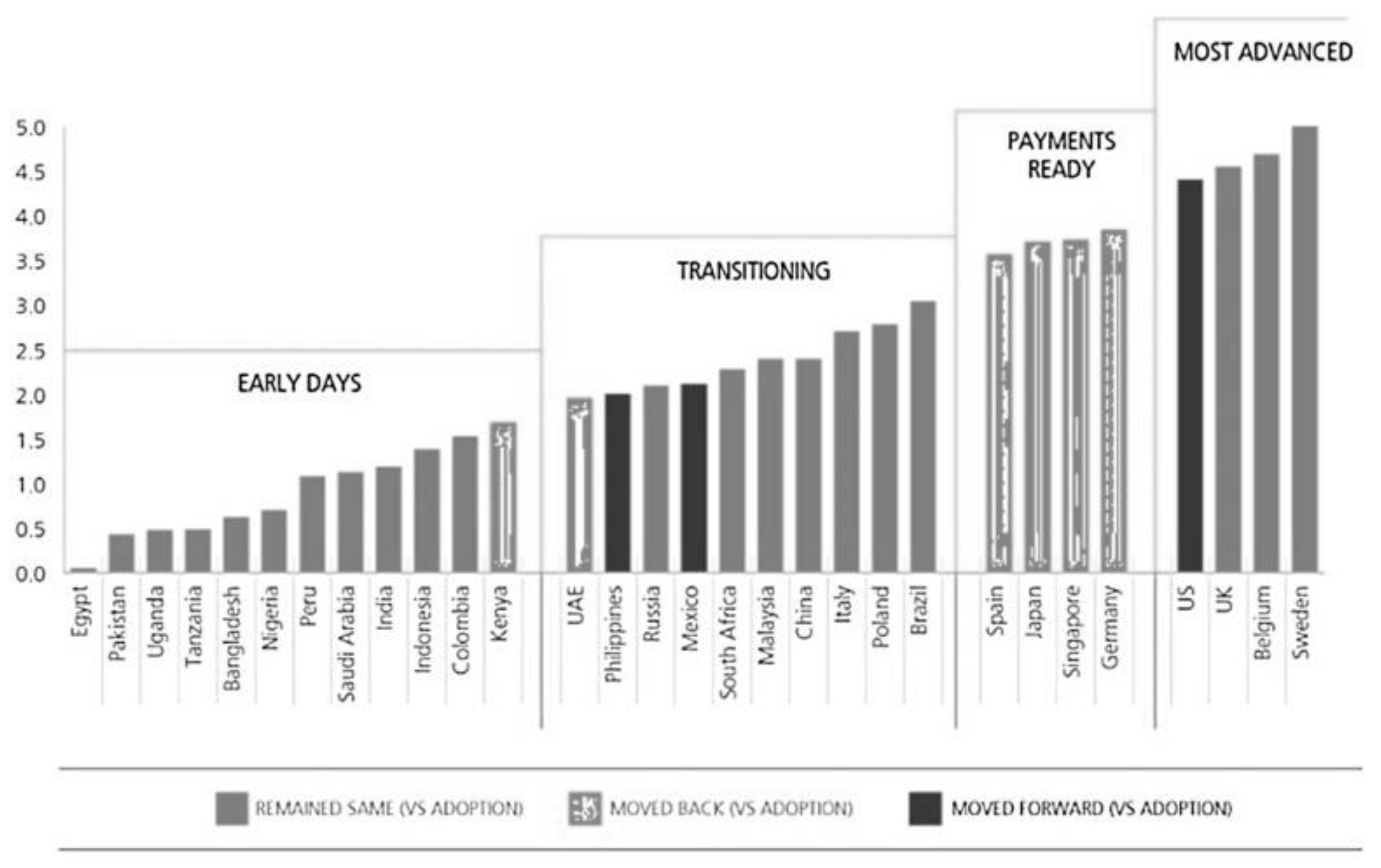

Four stages of financial inclusion progression based on adoption are documented in

Figure 2. Countries seem to move through four phases. Considering that remittances are the best way to get started with financial inclusion, the above four phases are defined by the extent of payment product usage. The first stage is the early days. This level marks the start of the process. Acceptance of a remittance product is lower than 50% in all nations, while consumption of other goods is often quite low (below 25%). Bangladesh, Peru, and Colombia are ahead of their rivals in terms of savings due to their MFI concentration. Second, transitioning—Payment’s usage begins to break through at this level, with more than 50% perforation. In a number of countries, usage of one or even more products is gaining pace and starting to catch up to remittances adoption (for example, prolonged savings and investments in China, credit in Italy). Third, ready payments: At this level, remittances adoption has reached a crucial bulk adoption threshold (over 75%). Countries are anticipated to be prepared in terms of payments (for example, infrastructure) to permit elevated stages of some additional items. Developed levels differ per product and thus are determined by the previous levels of consumption in the thirty nations, which are described as more than 60% for loans, more than 70% for prolonged savings or investments, and more than 45% for insurance. This is normal performance, with loans progressing and investments and insurance reaching completion. Last and most advanced: remittance adoption is widespread at this point, and consumption of all other items is likely to progress. Sweden, Germany, and Belgium exhibit this predictable behavior, whereas Singapore and Japan are extremely nearby. The United Kingdom is ahead in financing and prolonged savings and investments but behind in insurance. This might be due to market-specific variables, which should be looked into further.

Furthermore, the reason for adoption should be stated explicitly. Product implementation is a critical first step toward monetary incorporation, but usage and the extent of utilization are equally crucial. As previously specified, the utilization of remittance products can, however, help people adopt and use additional new products. Nevertheless, adoption does not necessarily result in utilization, and not every individual who owns a payment product uses it for capital flows. Usage must be actively promoted. In all nations studied, the adult population that utilizes a remittances product to receive anything of their capital flows is lower than the number of adults that own a remittances product. The disparity varies by country.

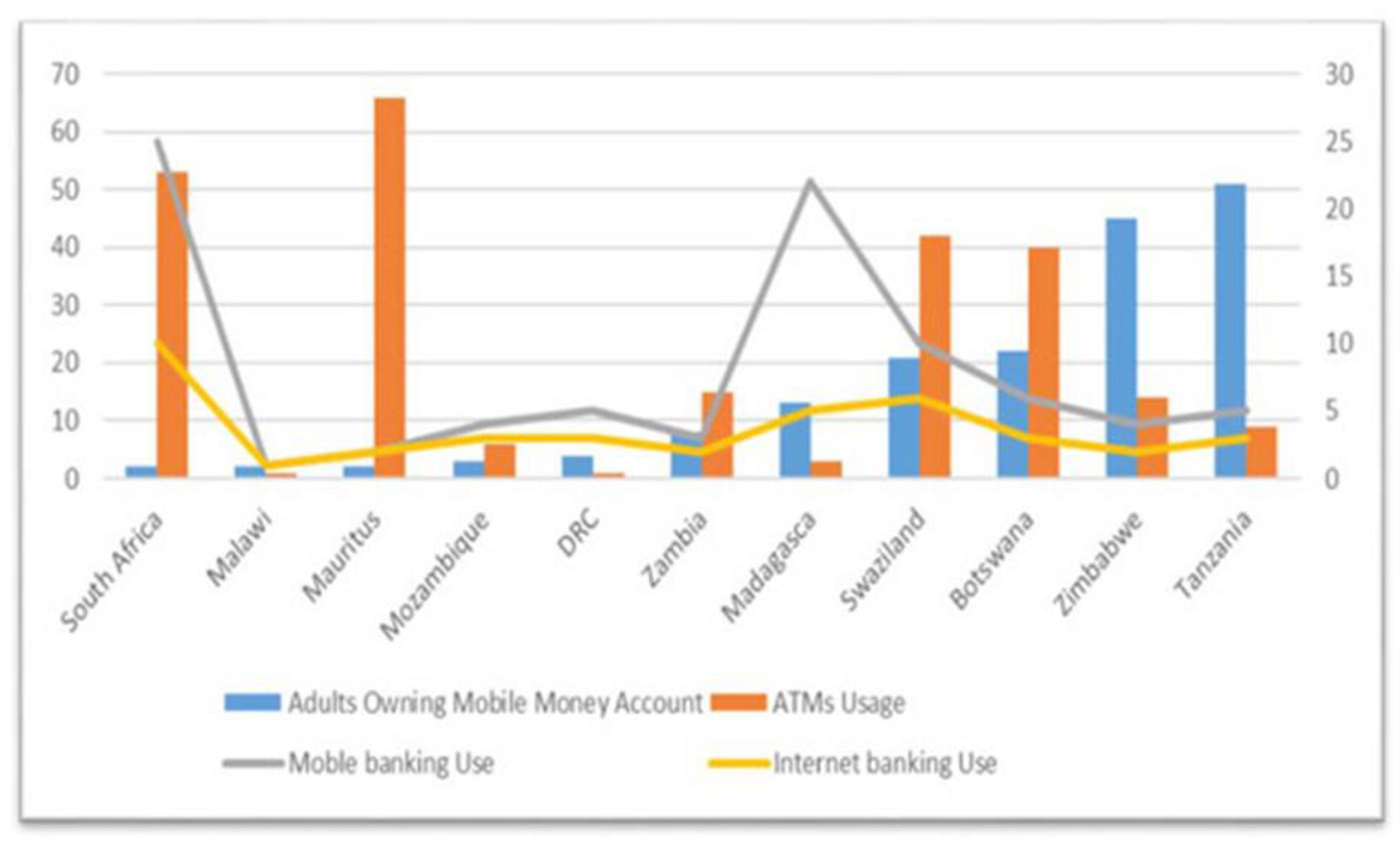

Figure 3 shows the proportion of adults owning mobile money accounts, ATM usage, mobile banking, and Internet banking. The figure shows that Tanzania has the highest proportion of adults with accounts for mobile money (51% among the 11 SADC countries), followed by Zimbabwe (45%). Mauritius, South Africa, Malawi, Mozambique, Madagascar, the DRC, Swaziland, Zambia, and Botswana are the regions with the fewest people. Tanzania leads among these nations because 83% of its adult population who own smart phones have a mobile-money account. This appears to indicate that the advancement of mobile money services necessitates both the progress of mobile telecommunication infrastructure and the availability of mobile money services. Digital financial technology has significant benefits. The advancement of automation has drastically altered the simplicity with which monetary services can be obtained. The introduction of automated teller machines (ATMs) has streamlined 24-hour access to banking accounts, which has been extremely beneficial to consumers of financial products because clients continue to receive bank services after working hours, when banks are closed. Furthermore, banks have launched banking applications and internet banking in order to further change how customers manage their bank accounts. Mobile and online banking are the next generation of ATMs because they allow customers to reach their financial transactions at whatever time and from any location, providing them with both time and place liberty. Moreover, with digital finance, the consumer can obtain banking services even without requiring a bank account. In what could be considered a search for even more simple and quick forms to transact, the smartphone has significantly reinvented the ecosystem of banking delivery services in Africa with a special niche that has tried to complement consumers' preferences. As a result, when an innovative technology is introduced, it is critical to understand the level of customer satisfaction. In terms of consumer preference for utilizing Tanzanian mobile monetary services programs, 6 in 10 consumers were satisfied with electronic remittances in terms of cost, whereas around 4 in 10 customers assigned electronic remittance benefits to being overpriced or not delivering value for money [39].

4.2. What are the challenges to the inclusion of digital finance in Africa?

According to Ref. [40], despite the advantageous effects of financial inclusion, there are certain challenges and debates in the policymaking arena. These disputes are related to difficulties that policymakers face on a daily basis, and they also explain why various nations have diverse financial inclusion approaches. The discussion of the most important challenges is below.

(a) Lack of digital infrastructure and services: One major barrier to digital applications in the developing world, particularly in Africa, is a lack of digital infrastructure, including network connections to digital devices as well as software and applications. For example, it has been recorded that more than half of the world's population does not have access to a network [41].

Furthermore, unlike in the developed world, there is a significant barrier to establishing high-speed connections in areas where network connections have been expanded [42].

(b) The "inactive users of financial services’ problem: The inactive user problem is one developing issue in policy debates about financial inclusion. When united, individuals become either engaged or inactive consumers of banking services in the official financial system. Even when enormous effort is expended to integrate the excluded into the financial sector, these individuals may opt to become passive consumers of financial goods and services after a period of time. People open formal accounts but refuse to obtain card payments; they do not even maintain deposits in their official accounts, and they do not conduct financial transactions from their official accounts. They only use their official accounts to earn income and do not use them to transfer money to others. These inactive consumers provide a new dilemma for policymakers since the financial inactivity they generate diminishes the amount of financial transactions, income to financial institutions, and tax revenue to the government, all of which have an impact on economic production.

(c) Lack of cooperation by banks: Another concern is that financial firms may refuse to collaborate with policymakers aiming to promote financial inclusion using banks. Before engaging in financial inclusion programs, banks will often do internal cost-benefit studies. Banks may be hesitant to engage in financial inclusion programs if the expense outweighs the benefit, particularly if the government is reluctant to pay the cost to banks. In nations with both private and state-owned banks, private-sector banks may be hesitant to engage in financial inclusion programs because they believe the government would utilize its own public-sector banks to fulfill its financial inclusion goals. Although bank regulators oblige all banks to engage in the country's financial inclusion program, many banks tend to utilize government cash and enable the use of their banking facilities to meet the program's objectives. In other circumstances, private-sector banks may only engage in the public economic inclusion program during the first two years before withdrawing gradually owing to mounting expenses and sustainability difficulties, similar to the scenario in India. In India, the government established the Pradhan Mantri Jan-Dhan Yojana (PMJDY) as the country's financial inclusivity framework. Commercial and government banks had a great number of Jan Dhan account recipients within the first two years, but during the third and fourth years, the number of Jan Dhan account recipients decreased dramatically for private-sector banks.

(d) Difficulty in identifying the excluded population: When excluded individuals of the community are not recognized, the identification challenge of financial inclusion emerges. Even though researchers do not have complete information about which members of the general public are rejected from the formal financial sector, it can be challenging to precisely identify the excluded population and even harder to depend on the results of studies for which the methodologies and hypotheses are unknown. Financial inclusion studies are frequently confounded by the procedures, assumptions, methodologies, and other unobservable characteristics used to determine the 'excluded members of society' in the sample size of the many studies.

(e) Lack of coordinated efforts (public-private partnership): In most emerging countries, particularly in Africa, there is a significant lack of coordinated effort by government, business, research institutions, and civil society groups to promote social and economic inclusion and equality. For example, when internet service providers (ISPs) enable greater access to the internet for many people but do not provide relevant government agencies with oversight of these service providers' activities, the result can be greater control by the ISPs rather than digital empowerment and inclusion. Similarly, the absence of checks and balances among enterprises that benefit from economies of scale may result in a market monopoly that is often characterized by inefficiency owing to a lack of competition [42].

(f) Lack of digital skills: Lack of digital literacy in Africa makes it difficult for people to effectively use modern technologies and provide value in the ICT or internet space. Physical internet connectivity is a must, but Shenglin et al. (2017) argue that one of the biggest obstacles to fully participating in the digital economy is a lack of skills. For instance, fewer than half of internet users in Africa have the most recent skills necessary to keep up with the rapidly evolving digital landscape. It is important to note that it is challenging to fully use digital technology without the right education and skill development.

Implications for Policy Consideration

The study's conclusions have important policy implications for numerous governments, legislators, and financial sector players, as well as other developmental institutions and organizations that include the World Bank, African Development Bank, and United Nations Development Programme. Over the last several years, the international policy group has increasingly adopted accessibility to financial benefits as a goal for the finance industry and overall economic growth. The G-20 originally committed to promoting a monetary inclusion strategy around 2008, and the Global Partnership for Financial Inclusion was formed in 2010 to advance this aim. The establishment of the Alliance for Financial Inclusion (AFI) in 2008 as a mutual exchange organization for authorities from emerging economies The AFI established the Maya Declaration procedure, by virtue of which countries make explicit state pledges to financial intermediation. Several countries throughout the world have established economic inclusion programs as a consequence of these international events as well as other local reasons.

Furthermore, the availability of extensive cell phone service and smart phone access suggests that a growing number of financially banned individuals may be able to obtain access to financial services online. Given this, ongoing initiatives to improve ICT infrastructure effectiveness, dependability, and security might go a long way toward increasing financial inclusion in the African region. With all this, the World Bank and African Development Bank may provide monetary and technical assistance to the country's numerous financial firms in adapting and adopting these computerized methods of making financial services more accessible and inexpensive to all. This is also expected to increase the amount of financial inclusion in the district, improving wellbeing. Overall, while efforts are made to enhance access to banking services inside the African region, management of financial organizations should pay close attention to overhead expenses to ensure that financial institution earnings are not significantly impacted [43].

Some financial innovations might be used in the fiscal sector to enhance the effectiveness of the state-citizen relationship. Effective revenue collection and the provision of public services and social expenditures have long been difficulties in many African countries. Estimates imply that digitizing government payments might generate around 1% of GDP for most nations. If successfully enforced, there are positive benefits in tax system and compliance, social program targeting, and public monetary management from more widely leveraging current transaction data and merging it with private details. Smart contracts, which are meant to ease, monitor, or enforce contract negotiations or performance, may potentially improve public procurement. As with present fiscal operations, efficient systems will need safeguards to preserve privacy while minimizing the creation of new avenues for fraud and evasion. Additionally, according to [44], digital currencies, if widely embraced, may have far-reaching ramifications for the financial industry. Some digital currencies and other kinds of digital money have been proposed to potentially replace existing currencies. The three main economic functions of money have been frequently mentioned in the economic literature: (1) medium of exchange; (2) unit of account; and (3) store of value. Private-sector cryptocurrency transactions differ in numerous ways and, for the time being, struggle to completely fulfill monetary functions, owing in part to volatile prices. Furthermore, they offer significant dangers as vehicles for laundering money, terrorism funding, tax avoidance, fraud, and other bank fraud. Contrary to the private sector issuing a digital currency, state production would meet the three monetary functions and might further assist public policy objectives, including financial inclusion, privacy, and consumer safety, while also providing a degree of anonymity in transactions. Even so, there are negatives to a digital currency to consider, such as dangers to financial solvency and stability, along with worries from central banks about the ramifications of widespread use of digital currencies and how it may affect monetary policy execution.

FinTech requires investment in both hard and soft infrastructure to create and serve a fast-increasing digital generation. Physical infrastructure refers to the requirement for enterprises to invest in internet connections and electricity in order to benefit from technological advancements. Soft infrastructure refers to the requirement for legislation to promote a good corporate climate as well as talent investment. Allocating resources for these projects would require many trade-offs for policymakers in sub-Saharan Africa. Predictions for physical infrastructure investment are already enormous and demanding, but growing levels of government debt limit the possibility of public funding. Addressing the country's substantial existing hard infrastructure deficit would necessitate thinking about how to collaborate with the private sector to offer finance or service delivery for the suitable provision of energy and internet access. Additionally, soft infrastructure investment must manage the perpetual competition between incredibly rapid innovation and slower-moving policy. There is a trade-off between stimulating, or at least encouraging, fast development, which has significant potential economic rewards, and making the effort to detect and control the risks that come with it using supervision and regulation to maintain financial integrity and stability.

Furthermore, the extraordinary adoption of mobile payment services in the African region, as well as the technology's capacity to expand into an extensively employed means of transaction, is generating worries about the implications for the implementation of monetary policy. Various African central banks use traditional reserve money schemes to manage inflation through monetary objectives. In these nations, assuming the rate of growth of the multiplier effect as well as the speed of movement are constant, targeting saved money pegs inflation (or at least predicts it). Also, it is unclear how electronic banking affects the money multiplier and financial velocity. In theory, any digital payment balances are fully supported by funds deposited in a financial institution by the mobile financial service provider; therefore, no additional money is produced. Financial institutions can utilize this extra cash to boost lending, which creates new money, but this is not different from how banks handle deposits [45]. Mobile money services can also assist the financially excluded population in gaining access to certain other financial services, resulting in increased financial inclusion and a beneficial influence on the money multiplier.

Ref. [46] examined the influence of M-Pesa on the performance of East African monetary aggregates, concluding that the monetary policy implications of digital payments have thus far been minimal in Kenya, Tanzania, and Uganda. They have demonstrated that M-Pesa velocity increases over time, which indicates that users are increasingly likely to utilize the platform as a transactional vehicle. Nonetheless, they did also propose that advancements and innovations in this domain might accelerate the expansion of mobile money to the point where it has monetary policy consequences. It was additionally decided that mobile money had no impact on the implementation of monetary policy in Kenya since the country's (rapid) financial development had not generated fundamental adjustments in the prolonged money-demand relationship. Furthermore, [47] discovered a link between the volatility of money demand in Tanzania following the launch of mobile money and the money's velocity. Ref. [48] discovered only preliminary support that mobile money may impose some decreasing inflationary pressure in Uganda.

Moreover, according [44], an investigation was conducted concerning the determination of whether or not mobile money affects the monetary policy surrounding the main East African economies, utilizing a powerful stochastic general equilibrium approach. Despite the fact that mobile money challenges the traditional money targeting methodologies employed by various national banks throughout the region, these authors discovered that the impact of smartphone money is anticipated to be favorable and enhance the effectiveness of monetary policy execution.