I. INTRODUCTION

Mobile payment refers to the financial service that allows individuals to carry out transactions using their mobile devices. This service has gained popularity in recent years, especially due to the emergence of smartphones and mobile applications. While some argue that mobile payment is a mere means of accessing internet payment services through mobile devices, others observe that the context differs, despite the similarity in functionality. In Nigeria, internet usage is high, with over 70% of the population having internet access (Auxier & Monica, 2021).

Additionally, many Nigerians own smartphones, creating a solid foundation for mobile payment adoption. Nonetheless, the adoption rate of mobile payment in Nigeria has been relatively slow compared to other countries such as China, the United States, and some European countries. Although small mobile payments are becoming more prevalent, widespread adoption has been impeded by concerns regarding security, standardization, and inconsistent user experience (Adebiyi, et al., 2013). Nonetheless, experts forecast that the mobile payment market will keep expanding in Nigeria, and it is expected to reach $465 billion in 2030 (Bukvic, 2021).

Compared to the United States and China, Nigeria, being the "giant of Africa," currently lacks the infrastructure and consumer base required to support the growth of mobile payment adoption. Moreover, further enhancements in security, standardization, and user experience are necessary to increase the widespread usage of mobile payments. There is a need for additional research on mobile payment acceptance, particularly in the Nigerian context where the technology is accessible, but adoption is still limited. This paper employs the Unified Theory of Acceptance and Use of Technology (UTAUT) to explore the factors that influence the intention to use mobile payment. UTAUT includes four primary predictors, performance expectancy, effort expectancy, social influence, and facilitating conditions (Qasim & Emad, 2016).

However, since technology adoption models are specific to the technology being studied, this paper also incorporates two additional constructs. Trust is a significant factor in financial transactions, especially when conducted over wireless networks, and it has been shown to affect the intention to use technology. Additionally, this paper considers network externality, which is particularly relevant in developing countries where users' choice of a mobile network can impact their use of mobile technology applications. This paper's structure is as follows: the literature review section examines UTAUT, trust, and network externalities, as well as mobile technology and mobile payment in a fourth subsection. The third section describes the empirical model, also known as the methodology, followed by data analysis and further discussion in section four. The paper concludes with recommendations and conclusions for future research.

II. LITERATURE REVIEW

The primary objective of investigating technology adoption is to acquire a thorough comprehension of the factors that impact individuals' choices to adopt a particular technology. The Unified Theory of Acceptance and Use of Technology (UTAUT), developed by (Venkatesh, et al., 2003), is a well-known model in this field. However, when analyzing the adoption of mobile payment technology, it is critical to consider the influence of factors such as trust and network externalities. In the subsequent three sections, we will explore the three elements of the proposed conceptual framework that we plan to adopt in detail.

- A.

UTAUT, Network Externalities, and Trust

The Unified Theory of Acceptance and Use of Technology (UTAUT) was developed by Venkatesh et al. (Venkatesh, et al., 2003), and it integrates eight theories and models, including TAM, MM, MPCU, TPB, TRA, IDT, SCT, and C-TAM-TPB. UTAUT is considered a comprehensive model for technology acceptance, and it includes dynamic influences through the addition of four moderating variables, which enhance its explanatory abilities. The model consists of four main constructs, namely performance expectancy, effort expectancy, social influences, and facilitating conditions (Zhou, et al., 2010) (Oshlyansky, et al., 2007) (Sarabadani, et al., 2017). UTAUT is a suitable model for cross-cultural studies, as it is sensitive to cultural aspects, and it has been extended to include hedonic motivation, price value, and habit. Empirical investigations have shown that UTAUT outperforms competing models in studying the factors influencing technology acceptance and behavioural intentions (Venkatesh, et al., 2003) (Zhou, et al., 2010).

Effort expectancy, performance expectancy, facilitating conditions, and social influences are identified as important predictors of technology acceptance. Effort expectancy refers to the

ease of use and complexity of a technology, which indirectly impacts behavioural intentions through performance expectancy. Performance expectancy includes perceived usefulness, relative advantage, and outcome expectation, and it is considered one of the strongest predictors of technology acceptance. Facilitating conditions refer to the technical and organizational infrastructure that makes using technology easy, and social influences refer to the pressure exerted by an individual's social surroundings to perform or not perform a behaviour (Abu-Shanab & John, 2009) (Ajao, 2019).

Network externalities are the phenomenon where the perceived value of a product or service increases as the number of users increases. Direct, positive, and indirect network externalities are the three types of network externalities that explain the relationship between utility and the number of buyers. Trust is a critical factor in the acceptance of mobile payment technology, particularly in developing countries (Economides, 1996) (Katz & Carl, 1985). Trust refers to the willingness of one party to be vulnerable to the second party and allow it to conduct important actions on its behalf. Inexperienced customers tend to build their perceptions and opinions of other people in their social surroundings (Van der, et al., 2003). Trust is an under-investigated variable in the context of mobile payment technology, and it is essential for the technology's acceptance. Boosting customer trust can significantly predict mobile payment adoption when combined with other factors such as perceived usefulness, perceived ease of use, price, and peers' influence (Ainsworth, et al., 2022) (Dass & Sujoy, 2011).

- B.

Previous Studies – Mobile Payment

The UTAUT model has been extensively used to investigate the factors that contribute to the adoption of mobile payments (Qasim & Emad, 2016). Previous studies have found that customers' mobile payment intentions are directly influenced by effort expectancy, performance expectancy, social influence, and facilitating conditions. Most of the studies that employed the UTAUT model used survey research as the primary method of data collection (Jaysingh, et al., 2021).

Dahlberg and Mallat conducted a qualitative study to explore the impact of network externalities on mobile payment adoption (Dahlberg & Mallat, 2002). They found that network externalities play a role in this process, but the external validity of their findings was limited due to a small sample size. Subsequently, Mallat used focus groups to further investigate the impact of network externalities on mobile payment adoption, but the generalization of the results was still an issue (Mallat, 2007) (Karnouskos, 2004). The term "mobile payment" generally refers to payments made using mobile devices with phone capabilities, although it can include all mobile devices. For this study, any form of activity initiation, activation, and confirmation is considered a form of mobile payment (Wang, et al., 2010).

Mobile payments are divided into two categories: proximity payments and remote payments, depending on the customer's location, relationship with the merchant, and usage scenario. Proximity payments involve exchanging credentials within a small distance using RFID technology or bar-code scanning and are also known as point-of-sale payments. Among proximity payment technologies, NFC is the most promising due to its convenience and security. NFC devices offer three operating modes: peer-to-peer mode, reader/writer mode, and card emulation mode, enabling contactless payments or ticketing. Remote payments are similar to online shopping and are conducted through mobile web browsers or smartphone applications (Qasim & Emad, 2016) (Slade, et al., 2013) (Ajao, 2015). Although remote payments seem to be more mature than proximity payments, both types can be integrated to improve the mobile payment market in the future.

III. EMPIRICAL APPROACH AND MODEL

This study chose the UTAUT model due to its comprehensive approach to technology acceptance theories and its high explanatory power (Venkatesh, et al., 2003). The goal of this research is to examine the factors that impact customers' intentions to use mobile payments. Through a literature review, certain constructs were identified as essential predictors of mobile payment acceptance that were not initially included in the UTAUT model. Conversely, some constructs in the model were discovered to have no significant influence on customers' acceptance of mobile technology.

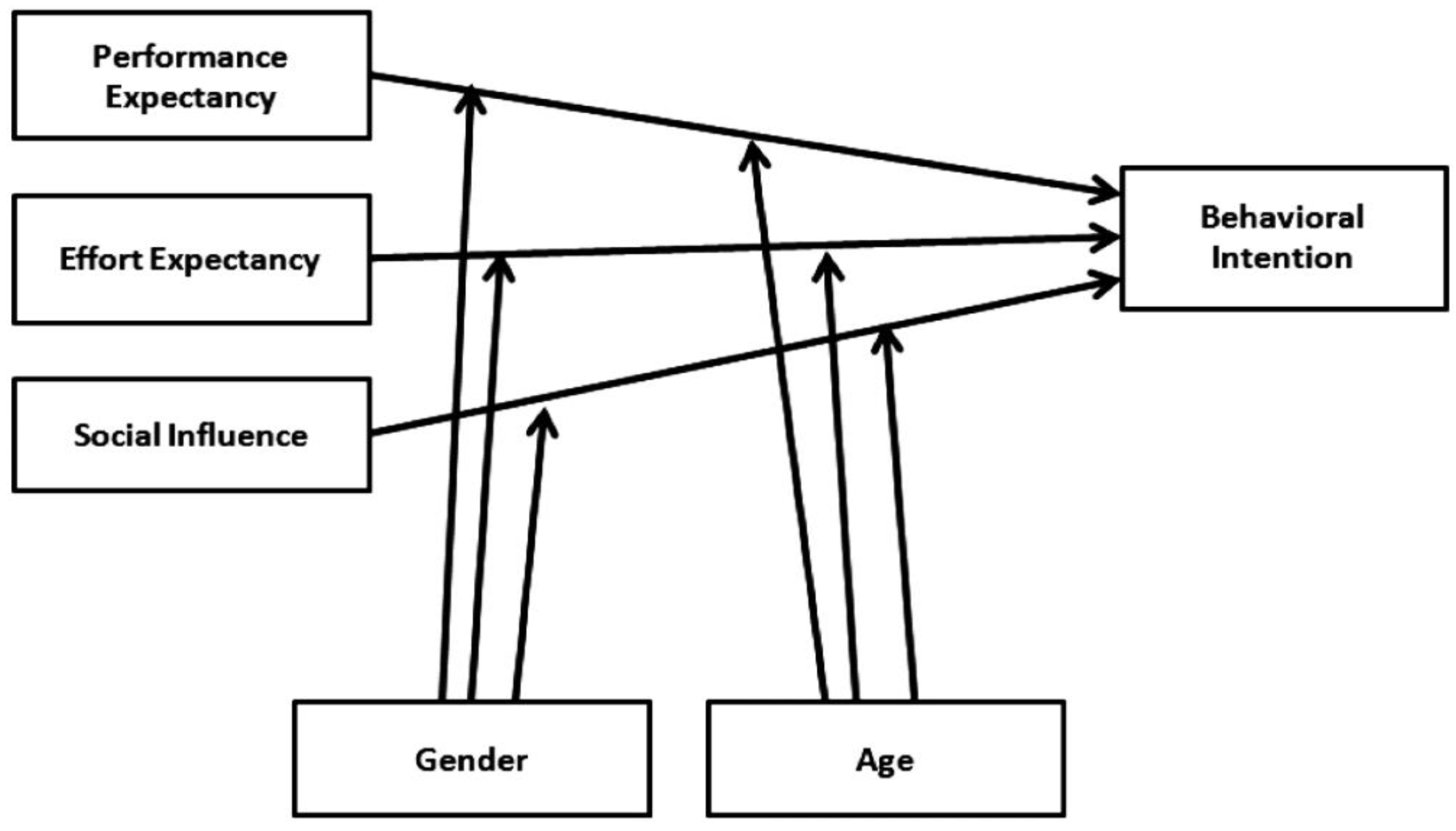

Figure 1.

Empirical Model.

Figure 1.

Empirical Model.

To improve the UTAUT model's explanatory power, trust was integrated, as it is a crucial factor in financial transactions literature. As with many mobile services, network externalities play a role in mobile payment adoption (Wang, et al., 2010). As this study is focused on behavioural intention, the facilitating conditions construct, one of the original UTAUT constructs, was removed from the model as it was not deemed to have a significant impact on mobile payment acceptance.

Figure 1 outlines the proposed research model.

- A.

Empirical Objective and Research Hypotheses

The objective of this paper is to investigate the factors influencing the intention to use mobile payment methods. To achieve this, a literature review was conducted to identify the significant factors affecting behavioural intentions (BI). The proposed set of hypotheses based on the research model is discussed below. Effort expectancy refers to the perceived ease of use associated with a particular technology (Venkatesh, et al., 2003). When an individual perceives using a technology as easy, they are more likely to use it (Teo, et al., 1999). Prior studies have demonstrated that customers' belief that using mobile payment methods is effortless strengthens their intentions to use them (Qasim & Emad, 2016).

Therefore, the following hypothesis is proposed:

H1: Effort expectancy (EE) has a positive effect on customers' intentions.

(BI) to use mobile payment methods. (1)

The concept of Performance Expectancy refers to an individual's perception of the degree to which a technology can enhance their performance (Venkatesh, et al., 2003). If a user perceives that a technology will improve their performance, they are more likely to use it (Qasim, 2023). The existing literature on mobile payment acceptance suggests that users are more likely to adopt mobile payment if they believe it will be helpful (Qasim & Emad, 2016). Therefore, the following hypothesis is proposed:

H2: Performance Expectancy (PE) positively influences customers' intentions.

(BI) to use mobile payment. (2)

Social Influence is the pressure exerted on an individual by their social network to use or not to use an innovation (Venkatesh, et al., 2003). This factor has been shown to be a significant predictor of technology acceptance in various contexts. In the area of mobile payment acceptance, research confirms that social pressure affects a user's willingness to use mobile payment systems (Qasim & Emad, 2016). Thus, the following hypothesis is proposed:

H3: Social Influence (SI) positively influences customers' intentions.

(BI) to use mobile payment. (3)

Trust in the online environment refers to a customer's willingness to be vulnerable to a vendor after evaluating the vendor's characteristics, who is expected to provide an agreed-upon service (McKnight, et al., 2002). Trust influences a customer's likelihood of accepting a given technology (Gefen, et al., 2003). In the mobile payment context, customers' trust in the security and reliability of mobile payment systems is expected to drive their acceptance of it (Zhou, 2011) (Arvidsson, 2014). Thus, the following hypothesis is proposed:

H4: Trust positively influences customers' intentions.

(BI) to use mobile payment. (4)

Network externalities occur when the benefits of using a product increase as more people use it (Haruvy & Ashutosh, 1998). Payment systems are subject to the network externality effect (Van Hove, 2000). In the mobile payment context, customers seem to be sensitive to the number of users of a technology and consider a large customer base a prerequisite for their adoption decision (Dahlberg & Mallat, 2002). Additionally, the more merchants that offer mobile payment services, the more willing customers are to adopt them (Au & Robert, 2008). Thus, the following hypothesis is proposed:

H5: The number of mobile payment users (merchants and customers)

positively influences customers' intentions to use mobile payment. (5)

The model depicted in

Figure 1 was utilized to employ the UTAUT model to investigate the acceptance of mobile payment technology. This include the impact of age and gender on the four fundamental factors of the UTAUT model, including effort expectancy, performance expectancy, facilitating conditions, and social influence, and found that all four factors significantly influenced the acceptance of mobile payment technology in the specific region. This shows the importance of considering demographic factors such as age and gender when evaluating the acceptance and usage of new technologies across different countries (Luis, et al., 2020).

- B.

Model Development

This study utilized a questionnaire to measure the proposed constructs in the developed model. To ensure the questionnaire's validity, the items were adapted from existing literature and customized to fit the context of mobile payment technology. The questionnaire utilized a 5-point Likert scale ranging from strongly disagree to strongly agree. As the original questionnaire was in the Arabic language (refer to Appendix

Table 8), it was necessary to translate it into English for use in Nigeria. To ensure the translation's accuracy, back translation was employed (Brislin, 1970). Furthermore, to guarantee that the translated questions were culturally appropriate and easily understood by the specific population being studied, the questionnaire underwent back translation (Harkness & Alicia, 1998). The final translated questionnaire was then distributed to the survey participants.

- C.

Survey and Data Collection

Recruiting participants for a study in Nigeria can be challenging and is influenced by various factors such as research design and target population. Similarly, this study adopted a meticulous approach to recruit participants and distribute questionnaires to ensure a representative sample that accurately reflects the research objectives. Recruitment methods used include personal distribution, contact persons, or online survey platforms depending on specific factors.

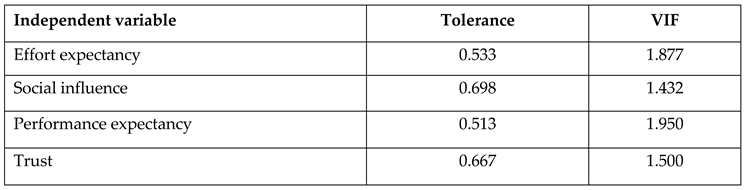

Table 2.

Collinearity Statistics.

Table 2.

Collinearity Statistics.

As in previous studies, participation was voluntary, and incentives were used to encourage participation. The target sample size was 300, with most surveys administered in person. To aid in data collection, six contact individuals consisting of secondary school teachers, university undergraduates, graduate students, and researchers themselves were utilized. The research team randomly selected participants in natural settings such as schools and assessed their familiarity with mobile payments before administering the survey. The survey was distributed between July 4th to 15th, 2022, with no incentives given to participants. Although the target sample size was not achieved, 258 out of 280 surveys were retrieved, and 253 were considered usable after a preliminary visual assessment. Despite some deviation from distribution percentages, the study participants were considered representative of the Nigerian population, including individuals from various age groups, educational levels, and average income levels. Ensuring a representative sample and the validity and reliability of survey instruments are essential in producing trustworthy and generalizable research findings, despite any differences between previous studies and research in Nigeria.

IV. DATA ANALYSIS AND DISCUSSION

After collecting 253 surveys, the data was entered into an Excel sheet and imported into SPSS and AMOS 20 for analysis to answer the research questions and test the hypotheses. The upcoming sections will explain the data analysis and discuss the obtained results.

- A.

Initial Analysis

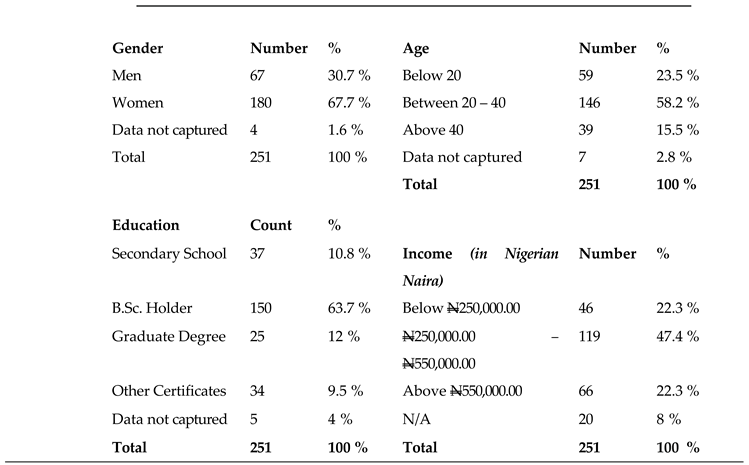

To assess the potential impact of outlier data on the results, the study conducted an initial multiple regression test on 253 responses, after excluding two cases based on case-wise diagnostics. The demographic characteristics of the sample are presented in

Table 1, including gender, age, education, and income. The sample comprises more females, middle-aged individuals, bachelor's degree holders, and middle-income subjects. The second preliminary analysis examined the correlations between independent variables, which can affect the magnitude and direction of betas in the regression equation.

The analysis involved two tests, inspection of the correlation matrix and collinearity statistics. To test for collinearity, the study computed tolerance and variance inflation factor (VIF), as presented in

Table 2. Tolerance values measure how much a variable influences other independent variables, while VIF values measure how much the variance of each regression coefficient increases when independent variables are correlated. The study concluded that there were no issues with multicollinearity, as all tolerance and VIF values in

Table 2 were within acceptable limits. Cronbach’s alpha was also utilized to assess the internal consistency between the survey items measuring each independent variable and the dependent variable. In social sciences, alpha values greater than 0.6 are considered acceptable for reliability.

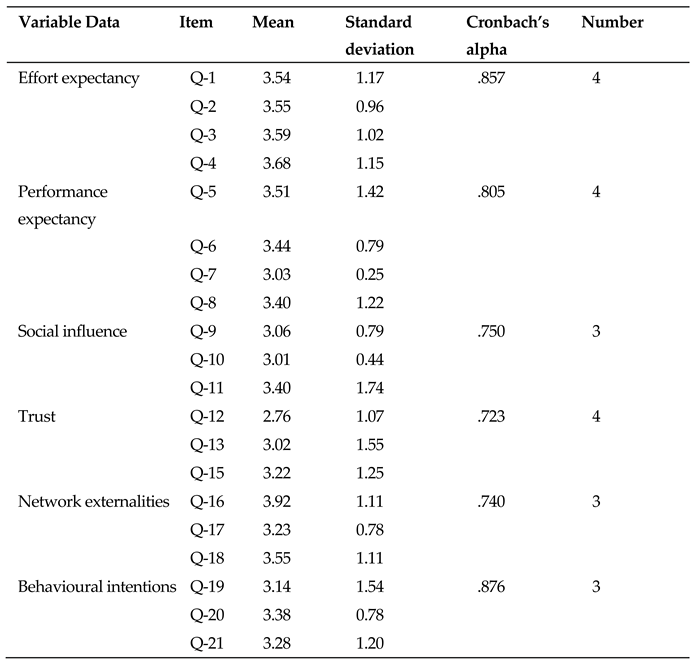

Table 3 reports the reliability measures, which indicate that the survey items used to measure each variable were highly consistent.

- B.

VIF Analysis

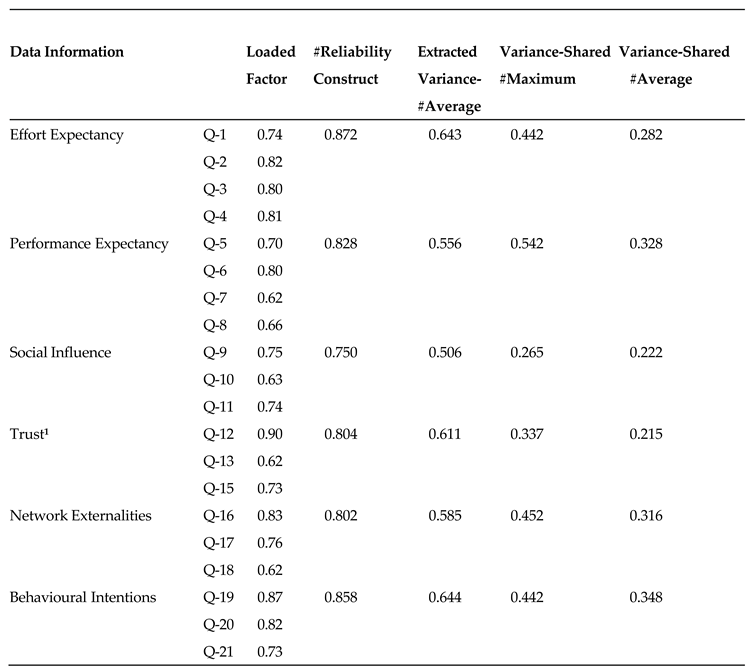

A confirmatory factor analysis was conducted to comprehend how the variables measure the factors they signify. The outcomes of this analysis, presented in

Table 4, include the factor loadings, construct reliability, average variance extracted, maximum shared variance, and average shared variance. Factor loadings exceeding 0.5 are deemed significant, and except for Q14, all factors exhibit significant loadings.

Table 3.

Cronbach’s Alpha (factoring means and standard deviations).

Table 3.

Cronbach’s Alpha (factoring means and standard deviations).

The construct reliability (CR) and average variance extracted (AVE) measures suggest that all the model constructs possess reliable and convergent features. Model constructs with CR values above 0.7 are deemed reliable, and all the model constructs meet this standard. Furthermore, constructs with an AVE greater than 0.5 indicate that the construct's variance is more significant than the variance caused by error, and all the model constructs satisfy this requirement. Additionally, the results reveal that the factors within each construct are not excessively correlated, indicating a good level of convergent validity. Discriminant validity occurs when the factors measuring each construct have more correlations with each other than with other factors. To establish discriminant validity, the average shared variance (ASE) and maximum shared variance (MSV) must be lower than the AVE. In this study, the measurement model fulfils these criteria.

Table 4.

Result Analysis.

Table 4.

Result Analysis.

Table 5.

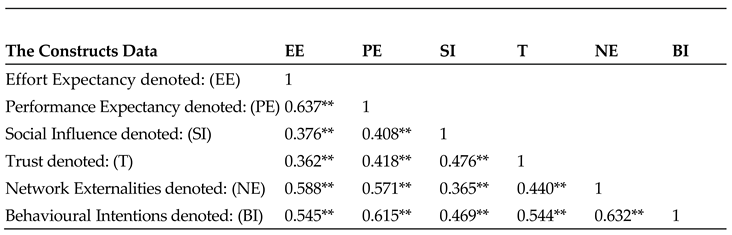

Matrix Data on Correlation. (**At a level of 0.01 denoted as (2-tailed) the Correlation is signifianct).

Table 5.

Matrix Data on Correlation. (**At a level of 0.01 denoted as (2-tailed) the Correlation is signifianct).

- C.

Evaluating the Model fit Measure and Testing of the Hypotheses

Before testing the hypotheses, it is crucial to examine the rationale behind the variables.

Table 5 displays the correlation matrix, which indicates the relationships between the independent variables and the dependent variable, behavioral intentions. The matrix reveals that performance expectancy, effort expectancy, social influence, trust, and network externalities are significantly correlated with behavioral intentions. Performance expectancy and network externalities have the most considerable bivariate impact on behavioral intentions among these variables. All the correlation values in

Table 5 are acceptable, indicating a significant correlation between behavioral intentions and each independent variable.

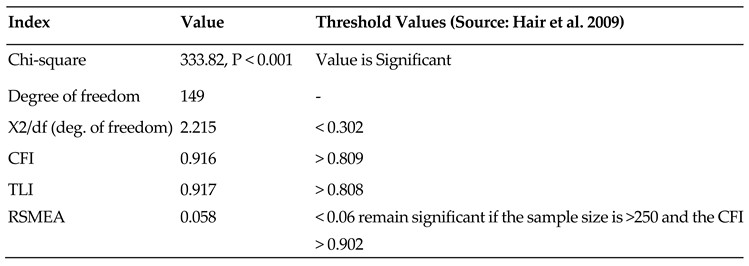

Table 6.

Model fit Value Evaluation.

Table 6.

Model fit Value Evaluation.

To assess the suitability of the research model, we utilized AMOS 20 and evaluated the values of chi-square, degree of freedom, CFI, and RMSEA, which are shown in

Table 6 along with their acceptable thresholds. All reported values fall within the acceptable range, indicating a good fit for the research model. The model is capable of predicting behavioral intentions, with the exception of effort expectancy, and has an explanatory power of 58%.

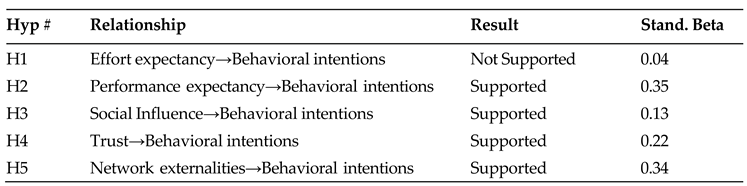

Table 7 shows the standardized beta coefficients for the estimated relationships, as well as the results of hypothesis testing. The prediction equation is provided below:

- D.

Discussion of Results

The results of the research model were largely positive, with the exception of effort expectancy (H1), which did not have a significant impact on customers' behavioral intentions towards mobile payment, despite a significant correlation in the bivariate relationship (as indicated in

Table 5). This implies that while ease of use is somewhat important to Nigerian customers, its importance is diminished by the high penetration and daily use of mobile phones for this relatively new mobile-based technology. This finding is consistent with previous studies but differs from some other research (Wu, et al., 2007) (Alshare, et al., 2004).

On the other hand, performance expectancy (H2) and social influence (H3) were both significant predictors of customers' acceptance of mobile payment. The findings suggest that Nigerian customers value the potential benefits of mobile payment and are influenced by the opinions of others in their social circle, which is consistent with prior studies. Trust (H4) and network externalities (H5), two other variables included in the research model, were also found to be significant predictors of mobile payment acceptance. For customers to conduct financial transactions via mobile payment, they must have confidence in the technology and the service provider, which is where trust (H4) comes in. Network externalities (H5) had the most significant impact on customers' behavioral intentions towards mobile payment, accounting for 23.7% of the variance (Alshare, et al., 2004).

This result indicates that customers are more likely to use mobile payment when more merchants accept this payment method, and they believe that the more people using it, the lower the cost. As previous research has shown, creating a critical mass is essential for driving customers' acceptance of mobile payment (Dahlberg & Mallat, 2002).

Table 7 displays the estimated relationships and their corresponding standardized beta, along with the results of hypothesis testing. The prediction equation is presented below, and the findings are summarized in the table.

V. CONCLUSION AND FUTURE DEVELOPMENT

In this study, the influence of five major predictors on customers' intentions to use mobile payment technology was investigated: performance expectancy, effort expectancy, social influence, trust, and network externality. The bivariate correlations confirmed a significant relationship between each predictor and behavioral intentions. However, when all predictors were considered together in the research model, some predictors lost their significance due to commonalities that may be attributed to an unknown factor. The results revealed that all predictors, except for effort expectancy, significantly predicted behavioral intentions, providing support for all five hypotheses. Notably, network externality had the strongest impact on mobile payment acceptance. Together, the five predictors explained 58% of the variance in behavioural intentions.

- A.

Implications and Recommendations

This paper discusses several implications for future research in the field of mobile payment acceptance. The following recommendations should be considered:

The influence of effort expectancy (ease of use) on mobile payment acceptance should be studied further through path analysis, as it did not have a direct influence in the model but may have an indirect influence through performance expectancy.

Network externalities should be included as a major predictor in future mobile payment acceptance studies, as it is an important factor for technology acceptance but not commonly included in technology acceptance models.

Performance expectancy remains an essential predictor of technology acceptance and should be included in any model, as it is a dominant construct in technology acceptance research. Merchants, banks, and other businesses should monitor the factors influencing the adoption of mobile payment technology and design their marketing policies accordingly. Trust is also a key factor for customers' willingness to accept mobile payment services, and managing the organization's image and creating a trustworthy brand name should precede offering mobile payment services.

System developers should prioritize performance expectancy when designing mobile payment systems, as it is the second most influential predictor of acceptance. To improve uptake, developers should aim to maximize the number of payment types supported, the ability to handle different currencies, and processing speed. Additionally, developers should consider the role of website design in building trust, as features such as system transparency can have a significant impact on customer trust.

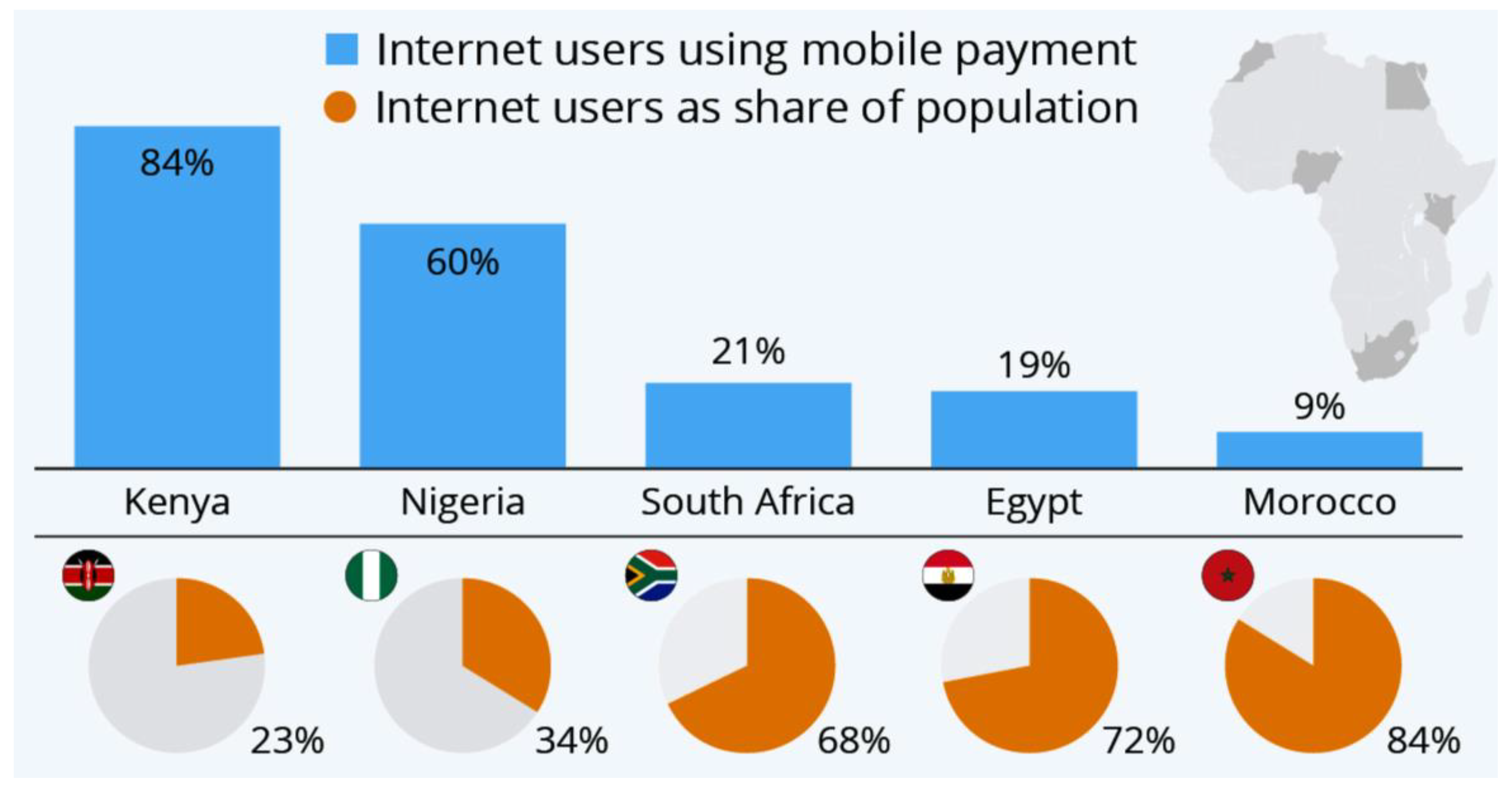

Figure 2.

Potential of Mobile Payment in Africa as at 2021.

Figure 2.

Potential of Mobile Payment in Africa as at 2021.

- B.

Limitations

To curb the spread of the pandemic, many African governments have been advocating for the use of mobile payments, with some even waiving transaction fees. Kenya, where mobile money was initially developed in Africa, has been most successful in this payment method. According to the Economic and Financial Affairs Council, Kenya experienced a record-high of $55.1 billion in mobile transactions in 2021, representing almost a 20% increase from the previous year. Statista's Global Consumer Survey also revealed that 84% of Kenyan internet users utilized mobile phones to make payments, which is higher than in Europe. While only a quarter of the Kenyan population has internet access, there is still a chance for growth in mobile payments. Similarly, in Nigeria, where internet penetration is approximately 34%, 60% of internet users made mobile payments in 2021 (Mas & Dan, 2010) (Adeleke, 2021) (Ajao, 2023).

In countries like Kenya and Nigeria, where the majority of the population does not have a bank account, mobile payments are crucial for financial inclusion. M-Pesa, developed by Safaricom in Kenya in 2007, is the leading mobile wallet in Africa, with over 50 million active monthly users across the continent. According to Statista's Global Consumer Survey, in 2021, 84% of Kenyan internet users made payments using their mobile phones, indicating a higher adoption rate than in Europe. Similarly, in Nigeria, 60% of internet users used mobile payments, despite the country's low internet penetration rate of approximately 34%. Mobile payments offer benefits such as ease of use and access, reduced transaction time, and the introduction of a cashless economy. However, challenges such as inadequate infrastructure and the need for trustworthy agents could hinder adoption. Researchers have identified the relative advantage, perceived ease of use, compatibility, trust, and security as significant determinants of intention to use mobile payment. Consumers who are comfortable with internet and mobile banking are more likely to try the service and encourage others. Secure and reliable service is essential for the successful transition to a cashless society in Nigeria (Ajao, et al., 2019).

Appendix

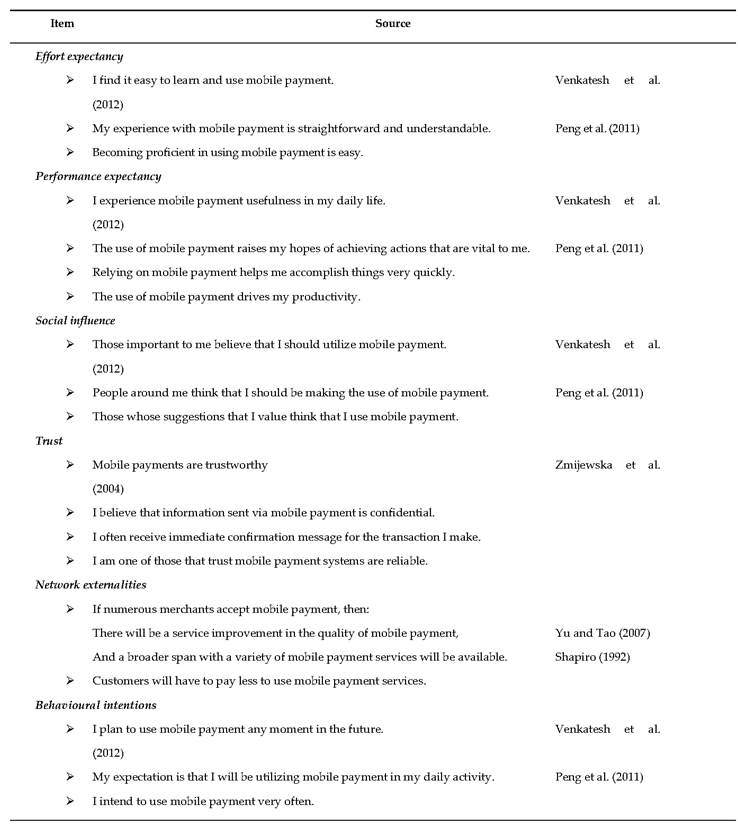

Table 8.

Original Sources (for items used to build the instrument).

Table 8.

Original Sources (for items used to build the instrument).

References

-

Abu-Shanab, E. and Pearson, J.M., 2009. Internet banking in Jordan: An Arabic instrument validation process. Int. Arab J. Inf. Technol., 6(3), pp.235-244.

-

Adebiyi, A.A., Alabi, E., Ayo, C.K. and Adebiyi, M., 2013. An empirical investigation of the level of Adoption of mobile payment in Nigeria. African Journal of Computing & ICT, 6(1), pp.196-207.

-

Adeleke, R., 2021. Digital divide in Nigeria: The role of regional differentials. African Journal of Science, Technology, Innovation and Development, 13(3), pp.333-346.

-

Bailey, A.A., Bonifield, C.M., Arias, A. and Villegas, J., 2022. Mobile payment adoption in Latin America. Journal of Services Marketing. [CrossRef]

-

Qasim Ajao. (2015). Drivers of mobile payment acceptance: The impact of network externalities. Information System Frontiers, 18, 1021–1034. [CrossRef]

-

Qasim, H. and Abu-Shanab, E., 2016. Drivers of mobile payment acceptance: The impact of network externalities. Information Systems Frontiers, 18, pp.1021-1034. [CrossRef]

-

Ajao, Q., 2023. Overview Analysis of Recent Developments on Self-Driving Electric Vehicle. INTERNATIONAL JOURNAL OF ENGINEERING RESEARCH & TECHNOLOGY (IJERT, 12(04). [CrossRef]

-

Ajao, Q.M., 2019. A Novel Rapid Dispatchable Energy Storage System Model Using Autonomous Electric Vehicles to Reduce Grid Dependency. https://digitalcommons.georgiasouthern.edu/etd/1936.

-

Ajao, Q.M., Haddad, R.J. and El-Shahat, A., 2019, April. Comparative Analysis of Residential Solar Farm with Energy Storage between the USA and Nigeria. In 2019 SoutheastCon (pp. 1-8). IEEE. [CrossRef]

-

Alshare, K., Grandon, E. and Miller, D., 2004. Antecedents of computer technology usage: considerations of the technology acceptance model in the academic environment. Journal of Computing Sciences in Colleges, 19(4), pp.164-180.

-

Arvidsson, N., 2014. Consumer attitudes on mobile payment services–results from a proof of concept test. International Journal of Bank Marketing. [CrossRef]

-

Auxier, B. and Anderson, M., 2021. Social media use in 2021. Pew Research Center, 1, pp.1-4.

-

Au, Y.A. and Kauffman, R.J., 2008. The economics of mobile payments: Understanding stakeholder issues for an emerging financial technology application. Electronic commerce research and applications, 7(2), pp.141-164. [CrossRef]

-

Brislin, R.W., 1970. Back-translation for cross-cultural research. Journal of cross-cultural psychology, 1(3), pp.185-216. [CrossRef]

-

Bukvic, I.B., 2021. Adoption of Online Payments During the COVID-19 Pandemic. Economic and Social Development: Book of Proceedings, pp.58-67.

-

Dahlberg, T. and Mallat, N., 2002. Mobile payment service development-managerial implications of consumer value perceptions. ECIS 2002 Proceedings, p.139.

-

Dass, R. and Pal, S., 2011. Exploring the factors affecting the adoption of mobile financial services among the rural under-banked.

-

Economides, N., 1996. Network externalities, complementarities, and invitations to enter. European Journal of Political Economy, 12(2), pp.211-233.

-

Gefen, D., Karahanna, E. and Straub, D.W., 2003. Trust and TAM in online shopping: An integrated model. MIS quarterly, pp.51-90. [CrossRef]

-

Janet, H., Alicia, S.G. and Harkness, J.A., 1998. Questionnaires in Translation. Germany: World Values Survey, pp.1-40.

-

Haruvy, E. and Prasad, A., 1998. Optimal product strategies in the presence of network externalities. Information Economics and Policy, 10(4), pp.489-499. [CrossRef]

-

Singh, J., Thakur, G., Alexander, J., Rayi, A., Peng, J., Bell, W. and Britton, J., 2021. Predictors of nonconvulsive seizure and their effect on short-term outcome. Journal of Clinical Neurophysiology, 38(3), pp.221-225.

-

Karnouskos, S., 2004. Mobile payment: a journey through existing procedures and standardization initiatives. IEEE Communications Surveys & Tutorials, 6(4), pp.44-66. [CrossRef]

-

Katz, M.L. and Shapiro, C., 1985. Network externalities, competition, and compatibility. The American economic review, 75(3), pp.424-440.

-

González Bravo, L., Fernández Sagredo, M., Torres Martínez, P., Barrios Penna, C., Fonseca Molina, J., Stanciu, I.D. and Nistor, N., 2020. Psychometric analysis of a measure of acceptance of new technologies (UTAUT), applied to the use of haptic virtual simulators in dental students. European Journal of Dental Education, 24(4), pp.706-714. [CrossRef]

-

Mallat, N., 2007. Exploring consumer adoption of mobile payments–A qualitative study. The Journal of Strategic Information Systems, 16(4), pp.413-432. [CrossRef]

-

Mas, I. and Radcliffe, D., 2010. Mobile payments go viral: M-PESA in Kenya.

-

McKnight, D.H., Choudhury, V. and Kacmar, C., 2002. The impact of initial consumer trust on intentions to transact with a web site: a trust building model. The journal of strategic information systems, 11(3-4), pp.297-323. [CrossRef]

-

Oshlyansky, L., Cairns, P. and Thimbleby, H., 2007, September. Validating the Unified Theory of Acceptance and Use of Technology (UTAUT) tool cross-culturally. In Proceedings of HCI 2007 The 21st British HCI Group Annual Conference University of Lancaster, UK 21 (pp. 1-4). [CrossRef]

-

Ajao, Q., 2023. Overview Analysis of Recent Developments on Self-Driving Electric Vehicles.

-

Sarabadani, J., Jafarzadeh, H. and ShamiZanjani, M., 2017. Towards understanding the determinants of employees' E-learning adoption in workplace: a unified theory of acceptance and use of technology (UTAUT) View. International Journal of Enterprise Information Systems (IJEIS), 13(1), pp.38-49. [CrossRef]

-

Slade, E.L., Williams, M.D. and Dwivedi, Y.K., 2013. Mobile payment adoption: Classification and review of the extant literature. The Marketing Review, 13(2), pp.167-190. [CrossRef]

-

Teo, T.S., Lim, V.K. and Lai, R.Y., 1999. Intrinsic and extrinsic motivation in Internet usage. Omega, 27(1), pp.25-37. [CrossRef]

-

Van der Heijden, H., Verhagen, T. and Creemers, M., 2003. Understanding online purchase intentions: contributions from technology and trust perspectives. European journal of information systems, 12(1), pp.41-48.

-

Van Hove, L., 2000. The New York City smart card trial in perspective: A research note. International Journal of Electronic Commerce, 5(2), pp.119-131. [CrossRef]

-

Venkatesh, V., Morris, M.G., Davis, G.B. and Davis, F.D., 2003. User acceptance of information technology: Toward a unified view. MIS quarterly, pp.425-478. [CrossRef]

-

Wang, H., Chen, S. and Xie, Y., 2010. An RFID-based digital warehouse management system in the tobacco industry: a case study. International Journal of Production Research, 48(9), pp.2513-2548. [CrossRef]

-

Wu, Y.L., Tao, Y.H. and Yang, P.C., 2007, December. Using UTAUT to explore the behavior of 3G mobile communication users. In 2007 IEEE international conference on industrial engineering and engineering management (pp. 199-203). IEEE. [CrossRef]

-

Zhou, T., 2011. An empirical examination of initial trust in mobile banking. Internet Research. [CrossRef]

-

Zhou, T., Lu, Y. and Wang, B., 2010. Integrating TTF and UTAUT to explain mobile banking user adoption. Computers in human behavior, 26(4), pp.760-767. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).