2. Literature Review

The significance of resistant grape varieties is progressively gaining importance. These varieties have been adopted by numerous wine-growing countries, including renowned wine-producing nations such as France, Italy, Germany and the United States. In addition, resistant grape varieties are increasingly being accepted in countries such as Brazil, Denmark and Poland [

5,

6,

7,

8,

9]. Despite their growing popularity, these grape varieties are still considered niche products in a niche market and have not yet made a breakthrough into the mainstream wine market [

10,

11].

Various studies have indicated that the slow adoption of FRGV can be attributed to factors such as these wines’ unique nomenclature and distinct taste profiles as well as the elevated status of traditional grape varieties in the German market. Moreover, the implementation of these grape varieties requires increased advisory efforts, which may further reduce consumer acceptance [

11,

12,

13].

Therefore, Pedneault and Provost [

14] proposed that additional investigation is warranted to establish effective communication strategies for consumer education. Several studies have lent support to this recommendation. For example, Espinoza et al. [

4] demonstrated that consumers’ willingness to pay increases in response to information about the benefits of resistant grape varieties. Additionally, Mann et al. [

15] found that greater familiarity with organic production techniques correlates with a higher likelihood of purchasing organic wines. Several other studies have likewise validated the positive impact of knowledge on purchasing behaviour, particularly with regard to environmentally friendly wine production techniques [

4,

16,

17]. As revealed in the study conducted by Pomarici and Vecchio [

18], nearly half of the survey respondents considered the environmental impact of wine production to be a significant factor in their purchasing decisions. Furthermore, Nesselhauf [

19] observed that consumers are generally receptive to innovations in the organic sector, particularly those consumers with a high degree of engagement, who are more likely to purchase wines made from FRGV. Thus, it is imperative to focus on educating consumers in this area. Therefore, the following research question has been formulated:

RQ 1. How do distinct target consumer groups respond to information concerning resistant grape varieties, and what factors may influence their reactions?

As per the findings of Fechter et al. [

13], the re-purchase rate of FRGV stands at a substantial 82.6% after initial purchase. Therefore, the primary challenge lies in enticing consumers to make their first purchase of this type of wine. Several proposals for resolving the issue at hand have already been developed. Communication of FRGV could potentially be achieved through the use of cuvées, branded wines [

13,

20] or via mass media channels [

18]. Typically, there are limited consultation or tasting facilities available at the point of sale. Information about both the taste and the background of these grape varieties can only be conveyed to a limited extent. Hence, the sale of FRGV is primarily conducted through direct sales at wineries [

11]. Direct selling enables customers to sample the wines and simultaneously obtain information about the benefits of these grape varieties, which can reduce purchasing risk and thus increase purchasing power [

21,

22].

In situations where consultation is unavailable, a scenario commonly encountered in retail environments, alternative purchase criteria become paramount. According to scholarly works by Bruwer et al. [

23], Szolnoki et al. [

24] and Szolnoki and Hauck [

25], customers are mainly influenced by factors such as price, design, their rapport with producers and their familiarity with grape varieties when deciding to make a purchase. The usage of unconventional grape variety names, such as Bronner, Johanniter and Solaris, along with the prevalent lack of awareness surrounding resistant grape varieties, as asserted by Doye et al. [

12] and Fechter et al. [

13], presents a significant obstacle in the consumer decision-making process. This predicament is exacerbated by the elevated status of grape varieties in Germany, which significantly influences consumers’ purchase decisions, as noted by [

26]. Thus, the following research question is posited:

RQ 2. To what extent do grape variety denominations, in general and with regard to FRGV, impact consumers’ purchasing decisions?

Several studies have indicated that the quality of wines crafted from FRGV can be deemed equivalent to that of wines produced using conventional grape varieties [

3,

11,

12,

27,

28,

29,

30]. In particular, when paired with information about organic production methods, the subjective quality of FRGV wines can be heightened [

31]. Nevertheless, Espinoza et al. [

4] demonstrated a reduced willingness to pay for FRGV wine due to sensory differences, compared to traditional grape varieties, and as with organic wine, FRGV continue to grapple with quality issues from their early stages [

14,

32]. This leads us to the following research question:

RQ 3. What specific sensory traits do consumers associate with resistant grape varieties, and how do these traits influence their decision to purchase or consume these products?

The present literature review indicates that extant research exists on purchase motives and barriers pertaining to FRGV from a ‘consumer’ perspective. However, there is a paucity of research that delves deeper into the impact of grape varieties on the purchase process, particularly in relation to FRGV, as well as sensory preferences among various target groups. This study aims to examine consumers’ responses to information regarding resistant grape varieties and analyse the effectiveness of different modes of providing such information. Consequently, the aim of this study is to mitigate these knowledge gaps by conducting an initial analysis of consumers’ acceptance of resistant grape varieties, thereby providing answers to the aforementioned research questions.

3. Material and Methods

This study adopts a qualitative research approach to analyse the attitudes of wine consumers towards their acceptance and knowledge of and attitudes towards FRGV. The focus groups facilitated discussions among the participants, providing valuable insights into consumers’ perceptions of and attitudes towards the wine purchasing process. Since most previous studies [

4,

13,

14,

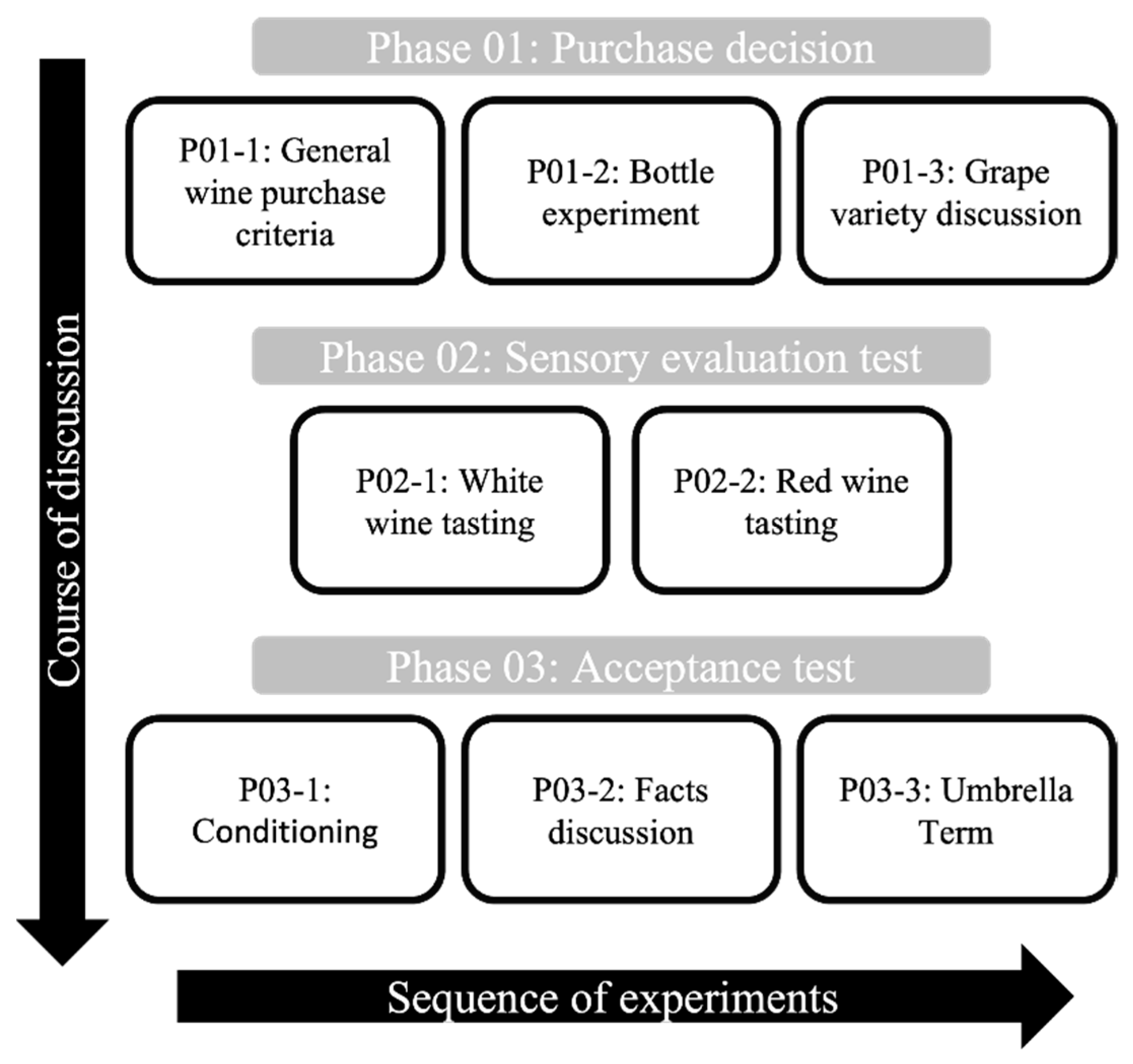

19] employed a quantitative approach to investigate the attitudes and behaviours of wine consumers, we utilised a qualitative method to gather more detailed information and obtain a deeper understanding of the market for FRGV. To prepare for the focus group discussions, a guide was developed based on the existing literature. The guide for the group discussions included several topics, such as the relevance of grape varieties in the purchasing decision process, the sensory evaluation and selection of wines from FRGV, attitudes towards various grape variety designations and the influence of various marketing instruments on purchasing decisions (see

Figure 2). To ensure their unbiased reactions, the participants were only informed about the study topic during the focus group discussion, enabling us to observe their responses to the specific attributes of these grape varieties.

In November 2020, focus groups consisting of 48 consumers were assembled. Based on the literature of Ritchie (2003) and Creswell (2014), the selected sample size was deemed adequate, since a larger sample would have presented challenges in managing the data collection and analysis, thereby compromising the quality of the study. Each focus group discussion was attended by 6–8 participants and lasted approximately 60 minutes. The specific group size was chosen to facilitate interaction and discussion among the group members, allowing sufficient time for all participants to express their opinions [

33]. The focus groups were composed of participants with heterogeneous sociodemographic characteristics to encourage lively discussions and diverse viewpoints. The participants were recruited by a panel provider and selected based on a screening quota for gender, age, wine consumption (at least once a month) and willingness to spend money on wine. Moreover, attention was given to regional boundaries to obtain a heterogeneous representation of German consumers. This geographical distribution encompassed a range of locations, from the centre (Frankfurt) to the northeast (Berlin) and southeast (Munich) of Germany. These cities were selected based on their proximity to wine-growing regions (Frankfurt) or their distance from wine-growing regions (Berlin and Munich). The sociodemographic and behavioural characteristics of the participants were determined using a pre-sent screener, and the participants were chosen accordingly.

Due to the Covid-19 situation in Germany at the time, the group discussions had to be conducted virtually using the Zoom videoconferencing software tool [

34]. To minimise participant bias prior to data collection, the participants were informed beforehand that they would be participating in a focus group discussion about wine, although it was not revealed that the discussion would specifically focus on FRGV. A trained moderator was responsible at each location for covering all relevant aspects of the study during the focus group discussions [

35,

36].

The focus groups commenced with a brief introduction to allow the participants to familiarise themselves with each other and the discussion format. To establish a general understanding of the participants and their wine-related preferences, the participants were asked to describe their frequency of wine consumption, preferred shopping and consumption locations and wine preferences.

3.1. Test Procedure

An experimental framework on purchasing decisions was undertaken to ascertain the significance of grape variety in the decision-making process and to illuminate the overarching predilections of consumers. The participants were asked to deliberate on general criteria pertaining to wine acquisition decisions (P01-1). To provide a more focused and substantiated foundation for the discussion, the participants were presented with an array of six distinct wine bottles and prompted to make a selection (P01-2). The aim was to emulate a retail environment featuring a finite assortment of wines, thereby capturing the participants’ overall inclinations and, more specifically, gauging the importance of grape variety as a product attribute in their purchasing choices. To facilitate this investigation, six bottles were chosen with congruent characteristics. The resistant grape varieties Muscaris and Cabernet Blanc, the ‘traditional’ grape varieties Weißburgunder (Pinot Blanc) and Chardonnay and a Cuvée with no grape variety specified were examined. To minimise the potential effects of price and taste, each bottle was meticulously chosen to display minimal differences. As a result, all the wines were classified as dry, had the same quality level (PDO) and originated from the 2019 vintage and the Palatinate region. Each bottle featured a screw cap closure, a uniform price of €6.99 and an alcohol content ranging from 12% to 12.5%. Moreover, a standardised bottle design approach was applied to reduce any possible impact on the decision-making process.

After participants had made their individual choices, they were asked to elaborate on their decision-making strategies and the features that had influenced their purchasing decisions (P01-3). The discussion then focused on eight different grape variety names, four of which were resistant to fungal diseases (Muscaris, Solaris, Regent and Cabernet Blanc) and four were conventional grape varieties (Cabernet Sauvignon, Pinot Blanc, Riesling and Pinot Noir), to assess the participants’ experiences and associations with the grape varieties. This provided a more detailed understanding of the challenges associated with resistant grape varieties.

Subsequently, a sensory evaluation test (P02) was conducted that consisted of four white wines and four red wines, with Sauvignac representing the white wine and Satin Noir the red wine segment. A blind wine tasting was conducted using various vinification methods, including ‘premium’ wines from the field and comparative samples.

In the white wine segment, ‘Maceration’ is produced using Sauvignac grapes with a maceration time of 18 hours, resulting in a higher alcohol content (13.5%), moderate sugar content (4.3 g/l) and moderate acidity (6.8 g/l). In contrast, the Sauvignac ‘Chips’ is aged with medium toasted oak chips during the fermentation process, resulting in a higher alcohol content (13.8%), sugar content of 4.3 g/l and the highest acidity content (7.7 g/l) among the samples. The ‘Premium’ white wine is sourced from the Palatinate and classified as a Protected Geographical Indication (PGI). It is produced from the resistant Sauvignac grape variety and undergoes spontaneous fermentation for 45 days, followed by maturation in stainless steel tanks with biological acid reduction and manual racking. The wine has an alcohol content of 12.5% vol., residual sugar of 6.4 g/l and acidity of 7.3 g/l. The comparative sample of white wine from Sauvignon Blanc also undergoes 18 hours of maceration but has moderate alcohol content (12.7%), sugar content of 4.1 g/l and acidity of 5.2 g/l.

The red wine segment was characterised by the following samples. ‘Chips’, a Satin Noir, is known for its low alcohol content of 11.7%, low sugar content of 1.8 g/l and moderate acidity of 6.3 g/l. It is aged with medium roasted oak chips during fermentation. The Satin Noir ‘Heating’ is a red wine with a higher alcohol content of 13.3%, moderate sugar content of 3.8 g/l and lower acidity of 5.3 g/l. It is produced using a short-term heating process during fermentation. The ‘Premium’ red wine is a PDO from the Palatinate and is made from a new grape variety, Satin Noir. It is spontaneously fermented on the skins for 33 days, is matured in small oak barrels for 24 months with biological acid reduction and is unfiltered. It has an alcohol content of 13.18% vol., residual sugar of 2.10 g/l and acidity of 5.90 g/l. In comparison, the Cabernet Sauvignon red wine is made using a juice extraction method, resulting in lower sugar content and moderate acidity.

Prior to the session, the participants were sent 100 ml bottles of the wine samples and a glass to ensure standardised tasting conditions. They were also reminded not to consume any taste-altering substances before the tasting. Each wine category was tasted in full, and the participants were asked to take notes on each sample. Additionally, a Likert scale was provided to capture the participants’ preferences for each sample, ranging from 1 (‘do not like it at all’) to 5 (‘like it very much’). The group discussed each sample after the tasting.

Finally, an acceptance test (P03) was carried out. The participants were initially informed about the general use of pesticides in viticulture and the main differences between conventional, organic and fungus-resistant grape growing, presented in written form, followed by a group discussion. The discussion concluded with reflections and suggestions of how to effectively communicate this information to consumers in terms of form and extent. Furthermore, a discussion was initiated to introduce an umbrella term for these varieties. Similar to the grape variety discussion, various umbrella terms were presented to the participants. The following eight terms were selected: Nachhaltige Rebsorten (sustainable grape varieties), Pilzwiderstandsfähige Rebsorten (PIWI) (fungus-resistant grape varieties), Robuste Rebsorten (robust grape varieties), Innovative Rebsorten (innovative grape varieties), Neue Rebsorten (new grape varieties), Starke Reben (strong vines), Nachhaltige Pioniere (sustainable pioneers), Sustainable Grape Varieties, Pioneering Wine Grapes and Pioneer Wines. The selection was made by an expert panel consisting of representatives from different sectors within the wine industry.

3.2. Analysis

To gather the primary data, the focus group discussions were conducted and recorded, and the resulting audio and video files were transcribed. Prior to conducting a content analysis, theoretical assumptions were made using open, axial and selective coding techniques [

37], based on a thorough literature review. This involved identifying relevant themes and patterns within the transcribed data and grouping them into inductively created categories that were analysed using grounded theory [

38]. The data analysis process was supported by MAXQDA software [

39], which allowed for a systematic and efficient examination of the qualitative data.

In addition, the ratings of the wine samples and questionnaires capturing the participants’ sociodemographic and wine-related characteristics were analysed using R Studio statistical software [

40]. Descriptive analysis was conducted to examine the distribution of the responses to the questionnaires as well as to assess the ratings of the wine samples. The combination of focus group discussions, transcribing and coding, content analysis and specialised software facilitated a robust and detailed examination of the data. The theoretical assumptions made prior to the analysis process provided guidance and structure, while the use of MAXQDA and R Studio allowed for efficient and comprehensive data analysis.

3.3. Sample and Cluster Description

To recruit participants with at least a certain level of experience and knowledge of wine, the focus group discussions in this study targeted wine consumers who would drink wine at least once a month. The study aimed to recruit participants with a diverse range of sociodemographic characteristics to form a comprehensive picture of wine consumers in Germany, as shown in

Table 1.

To conduct target group–specific analyses, we segment the participants into clusters according to sociodemographic and behavioural data, using the segmentation research of Nesselhauf [

19] on resistant grape varieties. This approach ensured that the clusters would be meaningful and allow for specific insights into each group’s behaviour and preferences. The first cluster, ‘young wine enthusiasts’, was composed of individuals aged between 18 and 39 years who showed an interest in wine but had limited wine knowledge. The second cluster, ‘open-minded women’, consisted of women across all age groups who showed a clear preference for white wine and preferred to consume wine in company. They were also interested in the subject of wine and had an average level of wine knowledge. The third cluster, ‘LOHAS’, was composed of individuals who were deeply interested in organic cultivation, had below-average wine knowledge but had a desire to constantly improve it. In the ‘broad middle’ segment, wine consumption was above average, and wine knowledge was average. This cluster was predominantly composed of male consumers who favoured branded wines from abroad. Finally, the ‘expert’ cluster included individuals with very high levels of wine knowledge, wine interest and wine consumption.

Table 1.

Sample distribution separated into target groups (N = 48).

Table 1.

Sample distribution separated into target groups (N = 48).

4. Results

4.1. Purchasing Decision Experiment

The present study aimed to investigate the factors that influence consumer acceptance of wines produced from FRGV. A purchasing decision experiment (P01-1) was conducted to ascertain the significance of grape variety to consumers’ choices and to illuminate the prevailing preferences among wine buyers. Throughout the wine acquisition process, factors such as price, taste, provenance, label design and grape variety are customarily recognised as the most prominent determinants shaping consumer decision-making criteria. Notably, the young wine enthusiasts and open-minded women displayed a particular interest in high-quality label design, while the experts were more event-driven in their purchases, selecting appropriate wines depending on the occasion. The LOHAS group desired modern labels, attractive grape varieties and organically produced wines.

The bottle experiment (P01-2) revealed that the majority of consumers were familiar with the ‘traditional’ grape varieties presented and able to describe them in their own words. Grape variety familiarity was a clear purchasing argument, particularly for LOHAS and open-minded women, who associated grape varieties with tried and tested quality. These groups were less inclined to experiment, preferring familiarity in their wine choices. Grape variety familiarity also reduced the influence of other factors on purchase decisions, strengthening the position of the grape variety in the decision-making process. A few consumers equated a cuvée wine with high quality, with the grape varieties used being an important consideration. Therefore, the grape variety used significantly influenced purchase decisions.

Further discussion about the grape varieties (P01-3) themselves revealed a deeper insight into consumer preferences. The two resistant grape varieties presented, Cabernet Blanc and Muscaris, were positively received by the participants. Cabernet Blanc’s hybrid grape variety name was predominantly recognised by consumers, particularly the open-minded women and LOHAS, who were already familiar with the words ‘cabernet’ and ‘blanc’ from other grape varieties. Muscaris was mostly unknown to the participants, but its association with Muscat or Muskateller elicited positive responses, especially from the broad middle, who were more inclined to experiment with new products.

4.2. Sensory Evaluation Test

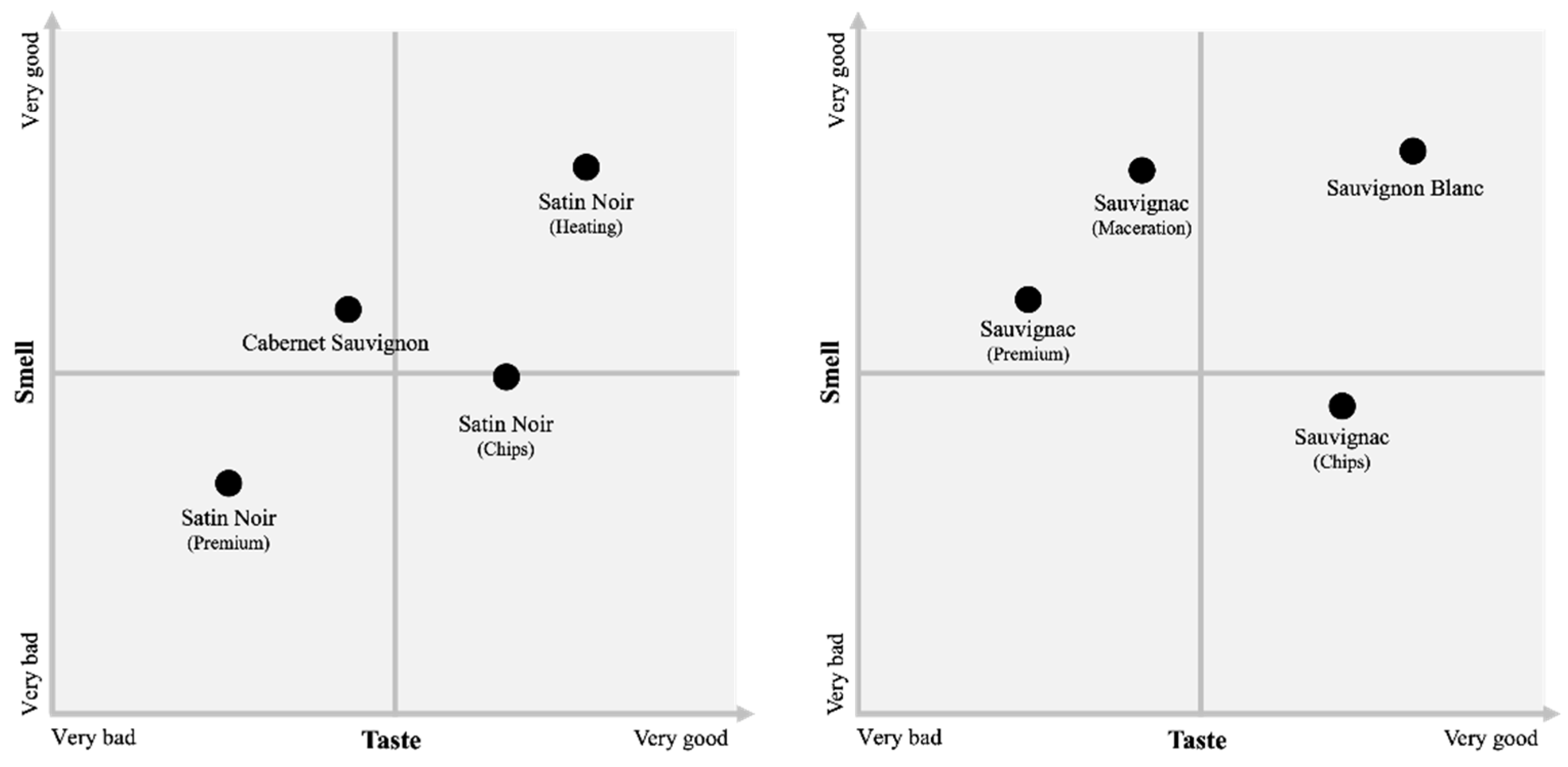

In the sensory evaluation test (P02), several wines from resistant grape varieties were evaluated by the different groups of wine consumers. The Sauvignac wine with maceration time was found to have a pleasant and subtle fruity aroma, but it was perceived as weak in both aroma and taste, with rapid disappearance in the mouth. However, when chips were added to the maceration process, the wine had an unknown and unpleasant aroma but a balanced and fruity taste. The premium Sauvignac wine had a pleasant and intense aroma, but some consumers found the acidity too strong and the wine too sweet. Additionally, the carbonation was a turn-off for some. In comparison, the Sauvignon Blanc was deemed to be an everyday wine with a pleasant floral and fruity aroma but too light for special occasions. The experts favoured the ‘premium’ wine for its complexity, whereas the young wine enthusiasts preferred the fruity and balanced taste of the Sauvignac ‘Maceration’ (refer to

Figure 3).

The Satin Noir wines with different processing methods were found to be harmonious, rounded and spicy in taste, but the premium version was too intense and alcoholic. The Cabernet Sauvignon was appreciated by the wine drinkers but perceived by red wine lovers as too mild. The LOHAS group found the wines from resistant grapes to have a pleasant and intense aroma but lost their taste, which resulted in lower ratings. The open-minded women preferred white wines with a balanced sweet and sour taste, and the Cabernet Sauvignon was the most acceptable red wine to them. The premium wines were appreciated by the experts and perceived as having a clear and typical character. The young wine enthusiasts found the premium wines to be too complex, preferring lighter summer wines or full-bodied red wines. The traditionalists preferred wines with a balance of strength, sweetness, and acidity, with the aroma present in the taste.

The wines from resistant grapes were found to be comparable to the traditional grape varieties and had a similar sensory profile. Often, the tested wines made from FRGV impressed with their aroma but failed to transfer this olfactory diversity to the palate, rendering them uninteresting to many participants. However, overall acceptance was above average, with considerable variation among the consumer segments. The most significant differences were observed in the ‘premium’ category, where the experts praised the wines’ complexity while the remaining segments rejected these wines. Overall, the results suggest that wines from resistant grapes have the potential to satisfy consumers’ demand for balanced and flavourful wines, although individual preferences varied significantly among the different consumer segments.

4.3. Acceptance Test

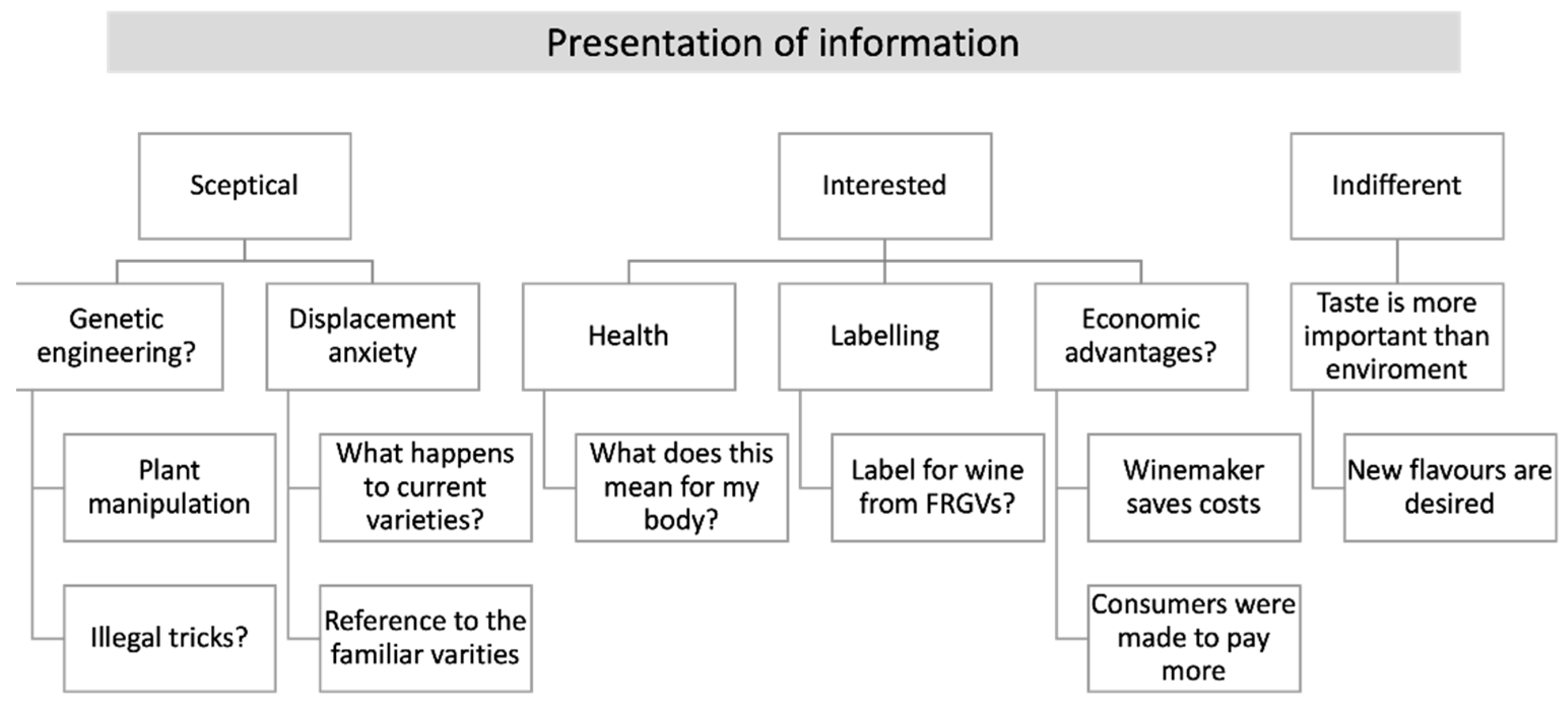

Consumer education (P03-1) played a crucial role in increasing the acceptance of FRGV wines. The acceptance test found that the participants had initially been unfamiliar with resistant grape varieties, but their perceptions varied depending on their respective target groups (as depicted in

Figure 4). The young wine enthusiasts were initially sceptical about the advantages of FRGV but found the topic exciting. The experts and broad middle groups prioritised taste over sustainability, while the LOHAS and open-minded women showed enthusiasm for resistant grape varieties and were concerned about the high level of pesticides used in viticulture. The latter groups showed a willingness to support FRGV wines and expressed a desire for specific labelling. Therefore, addressing the ambiguities of and assumptions about resistant grape varieties is necessary to minimise any misunderstandings.

The subsequent discussion (P03-2) identified several communication aspects that can impact consumer acceptance of resistant grape varieties. When presenting the benefits of PIWI varieties, it is vital to convey information factually while steering clear of mentioning ‘fungal diseases’. Instead, appealing keywords such as ‘gentle, sustainable cultivation through substantial pesticide reduction’ should be used.

Discussing ‘cross-breeding’ without context may confuse consumers; therefore, it is essential to provide well-known examples when addressing this concept and ideally concentrate on pesticide reduction without explicitly stating the cause. Offering factual evidence or images to demonstrate decreased pesticide use would be beneficial. The language should balance emotion and pragmatism, ensuring consumer engagement while maintaining credibility.

Finally, the discourse surrounding the appropriate terminology for resistant grape varieties (P03-3) revealed that the participants demonstrated a favourable response to the overarching concept of Nachhaltige Rebsorten (sustainable grape varieties), which aptly conveys the eco-friendly and sustainable attributes of the product. To further highlight the benefits of these grape varieties, it is advisable to incorporate the well-established phrase ‘fungus-resistant grape varieties’ into the nomenclature. To optimise marketing efforts, it is suggested that a combination of the acronym ‘PIWI’ and the descriptive term Nachhaltige Rebsorten be employed. This strategy serves to enhance consumers’ understanding of the distinctive advantages associated with these grape varieties while emphasising their environmentally friendly and sustainable characteristics. Consequently, the product name should offer an accurate description of the product while not emphasising susceptibility to diseases. Therefore, ‘ecological’, ‘sustainable’ and ‘robust’ are among the appropriate key terms. Additionally, the use of Anglicisms should be avoided to ensure optimal comprehension among consumers.

5. Discussion

The implementation of FRGV presents a substantial opportunity for ecological and economic benefits, particularly concerning copper use and grape spraying practices [

10]. Nevertheless, despite the potential advantages, the adoption and commercialisation of FRGV have been limited. The current research seeks to identify the reasons for this limited acceptance and explore the factors that influence purchase decisions, as well as potential drivers for promoting and selling FRGV wines.

Several factors significantly influence purchase decisions, including price, taste, origin, label design and grape variety, which vary depending on the target group. Therefore, it is crucial to tailor products to the preferences and attitudes of such groups. While experts rely on their experience, consumers with little wine knowledge tend to gravitate towards appealing design. In this context, the grape variety plays a crucial role as a reference point for consumer decision-making, as Szolnoki et al. [

24] also showed. However, the relative novelty of FRGV has resulted in a lack of familiarity with these varieties among consumers, hindering their adoption [

11]. Thus, the focus should be on optimising factors such as price, taste, origin, label design, organic labelling, food recommendations and awards to attract specific target groups, such as open-minded women and young wine enthusiasts, who place less emphasis on grape variety.

When considering grape variety as a purchase driver, four attributes can influence its attractiveness. Familiarity is a crucial factor for German consumers when deciding which wine to purchase [

23], and common grape varieties such as Riesling, Chardonnay and Sauvignon Blanc are critical representatives of this category [

11]. Grape varieties with widespread cultivation and representation in the trade are thus important reference points in the complex wine purchasing process. Consumers prefer to avoid risky purchases and therefore seek orientation towards something familiar, such as a grape variety or a brand [

23]. Grape variety names based on French nomenclature, such as Souvignier Gris or Cabernet Blanc, are particularly attractive, given the long-standing tradition and reputation of French wines. FRGV can benefit from this phenomenon by following this trend and adopting suitable names to reduce the awareness gap with established grape varieties. Additionally, consumers associate certain grape varieties with familiar aromas and flavours, such as Muscat aromas for Muscaris. Finally, the image that a grape variety conveys to the consumer is a crucial factor driving both new and traditional grape varieties. For instance, Riesling and Regent may be perceived by specific target groups as either the ‘highest quality’ (the broad middle group) or ‘low quality’ (young wine enthusiasts).

The prosperity of wineries is reliant on their access to desirable grape varieties originating from the breeding industry [

13]. Despite the profusion of the resistant grape varieties currently available, and the yearly approval of new ones, the selection of an appropriate grape variety must consider not only its cultivation and oenological aspects but also its marketability and nomenclature to ensure sustained success. In Germany, where grape variety significantly influences consumer purchasing decisions, this factor carries significant weight [

11].

Even though attractive resistant grape varieties are already accessible on the market [

13], it is still crucial to promote less-appealing ones. An indispensable tool in achieving this goal is the creation of branded cuvées that shift the focus from the grape variety to the brand name, thereby circumventing the issue of unappealing grape variety nomenclature [

13,

20]. However, this brand-building approach incurs substantial costs and only resonates with consumers through targeted marketing. Alternatively, in the emerging markets for sparkling wines and non-alcoholic or low-alcohol wines, less emphasis could be placed on grape variety selection.

With regard to sensory quality, wines produced from resistant and traditional grape varieties are comparable [

3,

11,

12,

27,

28,

29,

30], their with taste influenced by vinification, thereby affecting subjective quality. Selecting the appropriate production process for each grape variety necessitates experience but can strongly influence certain target groups in their quality assessment. Consumers mainly prefer sensory ‘everyday wine typicities’ that are fruit-based and exhibit a balanced sweet–acid ratio. However, since wine experts are receptive to more complex wine styles, resistant grape varieties can be positioned in almost every price segment, with fruit-based typicities with a balanced sweet–acid ratio recommended for the lower and middle segments and complex wine styles feasible in the high-price segment [

21].

The present level of consumer awareness of the advantages of utilising resistant grape varieties is limited. Nevertheless, it appears that consumers are amenable to these varieties, as indicated by Espinoza et al. [

4], whose study suggested that consumers are more inclined to embrace environmentally and health-friendly wines. It is vital to furnish interested consumers with comprehensive information to avoid misunderstandings, particularly given the restricted knowledge of biological fundamentals that may lead to misconceptions concerning the genetic modification of vines [

21,

32]. Educating informed consumers is particularly relevant for consumer segments such as the LOHAS and open-minded women groups, who have exhibited considerable interest in environmentally friendly viticulture and may be more receptive to resistant grape varieties [

19]. These groups may also prefer to witness the labelling of wines produced from resistant grape varieties, such as through logos or FRGV awards, although the current usage of such labels is not yet tangible for consumers, owing to their limited knowledge of these grape varieties [

2].

The efficacy of FRGV is often under-communicated, since their appeal is generally relegated to taste alone. The transparent acknowledgement of FRGV’ advantages presents practical hurdles for many wineries, since it may undermine the authenticity of their current product offerings [

13]. Consequently, a critical inquiry has emerged regarding how to effectively convey the benefits of FRGV to consumers. The findings suggest that the advantages of FRGV are most effectively communicated using a factual yet captivating tone that avoids direct allusion to ‘fungal diseases’. Instead, persuasive terminology, such as ‘gentle, sustainable cultivation with minimal pesticide usage’, ‘species-rich fields’ or ‘ecosystems that foster diverse insect populations’, proved to be more successful in conveying the advantages of FRGV. The topic of crossbreeding often perplexes consumers without appropriate context and should therefore be restricted to highlighting the decrease in pesticide use without specifying the reason for the reduction (i.e. fungal infection). To corroborate the veracity of such claims, the use of empirical evidence and visual aids can enhance consumers’ comprehension of the efficacy of FRGV. Lastly, the language utilised in such communications should strike a balance between emotional appeal and practicality to ensure maximum engagement and comprehension by consumers.

To increase the acceptance of resistant grape varieties, it is recommended that a unified term be established to describe wine produced from these grapes [

11]. However, providing information to the experts and broad middle groups will not necessarily lead to increased acceptance. From a marketing standpoint, emphasising the sustainability aspect of these grape varieties and/or creating a narrative around the product can be more effective than directly promoting the advantages of resistant grape varieties. This approach can position a winery as more innovative and sustainable without discrediting traditional grape varieties [

41].

5.1. Limitations and Future Research

Although this study provides valuable insights into German consumers’ attitudes to wines from resistant grape varieties, it has limitations that may affect the generalisability of its findings. Firstly, the study is limited to the German market and consumer preferences, which may not represent other cultures and markets with different wine consumption habits. Additionally, the qualitative data collected from consumers may introduce some bias and may not accurately reflect their actual purchasing behaviour.

Despite these limitations, the study’s qualitative approach provided a crucial first step to understanding consumer behaviour. Future research should quantify the collected data and conduct a comprehensive analysis to identify the underlying reasons behind consumers’ reluctance to purchase FRGV wines instead of other grape varieties. Such an approach would offer a more nuanced understanding of consumer behaviour and the different factors influencing their decision-making processes.

Moreover, future studies could explore the effectiveness of different marketing strategies, including digital marketing and social media, on influencing consumer perception and acceptance of FRGV wines. Such studies would offer valuable insights into promoting these wines to a broader audience, contributing to the development of a more sustainable and robust wine industry.

5.2. Conclusion and Practical Implications

In conclusion, this study provides valuable insights into the factors influencing consumer acceptance of wines produced from FRGV. Our findings show that price, taste, origin, label design and grape variety all significantly influence consumer purchasing decisions, which vary depending on the target group. Additionally, the lack of familiarity with FRGV among consumers hinders their adoption.

To promote and sell FRGV wines successfully, wineries must optimise factors such as price, taste, origin, label design, organic labelling, food recommendations and awards to attract specific target groups. Developing branded cuvées can shift the focus from grape variety to brand name, avoiding the issue of unappealing grape variety nomenclature. In emerging markets for sparkling wines and non-alcoholic or low-alcohol wines, less emphasis should be placed on grape variety selection.

In terms of sensory quality, wines from resistant and traditional grape varieties are comparable, but experience with resistant grape varieties is limited and must be further developed. Fruit-based typicities with a balanced sweet–acid ratio are recommended for lower and middle price segments and the complex wine styles available in the high-price segment.

Finally, increasing acceptance of FRGV requires informed consumer education, providing interested consumers with comprehensive information to avoid misinterpretations, particularly given the limited knowledge of biological fundamentals that may result in misconceptions about the genetic manipulation of vines. Emphasising the sustainability aspect of these grape varieties and/or creating a narrative around the product can be more effective than directly promoting the benefits of resistant grape varieties. Overall, this study’s results can assist in the development of effective marketing strategies and product development initiatives aimed at promoting and selling FRGV wines successfully.