1. Introduction

The digital economy has significantly accelerated the digital transformation across various industries, including agriculture, industry, and services. This transformation has had a profound impact on the development of these sectors. In order to capitalize on the opportunities presented by the digital economy, companies are increasingly investing in digital technologies to empower their employees and drive profitability [

1].

When organizations establish a digital infrastructure, it becomes imperative to consider how employees perceive these digital technologies. This perception is closely linked to several important aspects such as work environment satisfaction [

1], job satisfaction [

2], job involvement [

3], firm performance [

4], and work-life balance [

5]. Employee satisfaction is widely recognized as a critical outcome in the digital workplace. Companies assess job satisfaction as it is closely associated with performance ratings based on factors such as individual productivity improvement, error reduction, absenteeism, turnover, and more.

FinTech can improve both financial stability and access to services [

6]. According to Hanaysha [

7], there exists a strong correlation between satisfaction with digital technology and job satisfaction regarding access to services. In the digital era, where digital platforms have permeated almost all industries, the experience of using these technologies has become an integral part of employees' overall work experience. When employees are satisfied with the digital technology they use, they are better equipped to adapt to the ever-changing work conditions imposed by the digital landscape, ultimately leading to enhanced job satisfaction [

8].

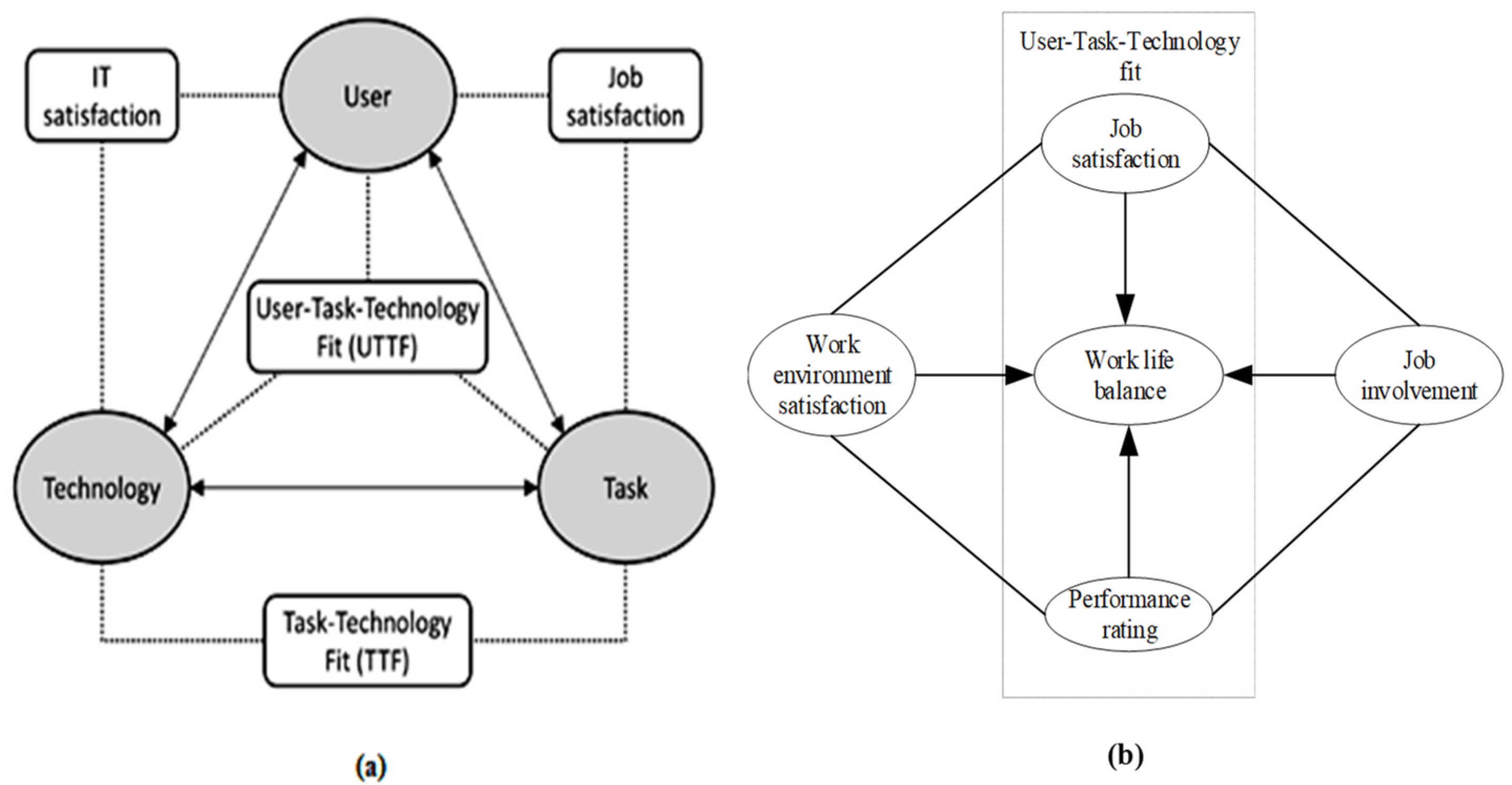

Therefore, it can be inferred that satisfaction with digital technology has the potential to positively influence overall job satisfaction relying on Fintech scopes, as depicted in

Figure 1.

Digital technologies have the capability to enable employees to handle complex tasks while reducing the burden of tedious and repetitive tasks. Moreover, satisfaction with digital technology can enhance users' sense of control over their work, leading to improved firm performance by generating benefits such as cost savings, increased connectivity, and greater agility and adaptability in complex and competitive environments [

9]. To fully leverage the potential of digital technologies and achieve optimal firm performance, it is crucial to align technology with the specific task requirements and the work environment of individual users [

10]. Task-technology fit (TTF) refers to the alignment between the tasks performed and the technology utilized [

11], while user-task-fit technology extends the TTF theory by considering employees' needs for both immediate task accomplishment and work environment satisfaction, which contributes to ensuring work-life balance [

12] (see

Figure 1(a)). Given that jobs constitute a significant part of people's lives, companies must strive to maintain work-life balance, which is the harmony between job satisfaction and life satisfaction [

5], as depicted in

Figure 1(b).

Building upon these findings, this research aims to make two primary contributions. Firstly, it seeks to identify common factors influencing the digital economy from the perspectives of both managers and employees. Secondly, it aims to illustrate the interrelationships among the requirements of the digital economy. Consequently, this paper addresses the following research questions:

How can variables be selected to represent the three dimensions of sustainability in the context of the digital economy?

How can dependency be evaluated at different stages of a digital economy project under fintech scope?

To address these questions, we employ Principal Component Analysis (PCA) to identify the key requirements of the digital economy within a digital environment.

The rest of this research paper is planned as follows. After presenting an overview of the digital economy regarding social, economic, and environmental dimensions in section 1; In

Section 2, we present our research methodology.

Section 3 explores the digital economy of health care services in Africa leading by the World Bank. We conclude the paper in

Section 4.

2. Materials and Methods

This paper aims to assess the current state of digital economy development through virtual organized projects. It selects key indicators from three dimensions: science, technology, economy, and environment. The principal component analysis (PCA) method is used to evaluate the quality of the digital economy at two stages of digital transformation, namely the investment and development phases. Additionally, the paper explores the interactions that exist within the development process of the digital economy. The PCA analysis is conducted on relevant factors derived from World Bank projects in Africa, specifically in the context of healthcare services. The analysis is implemented and performed using the R software.

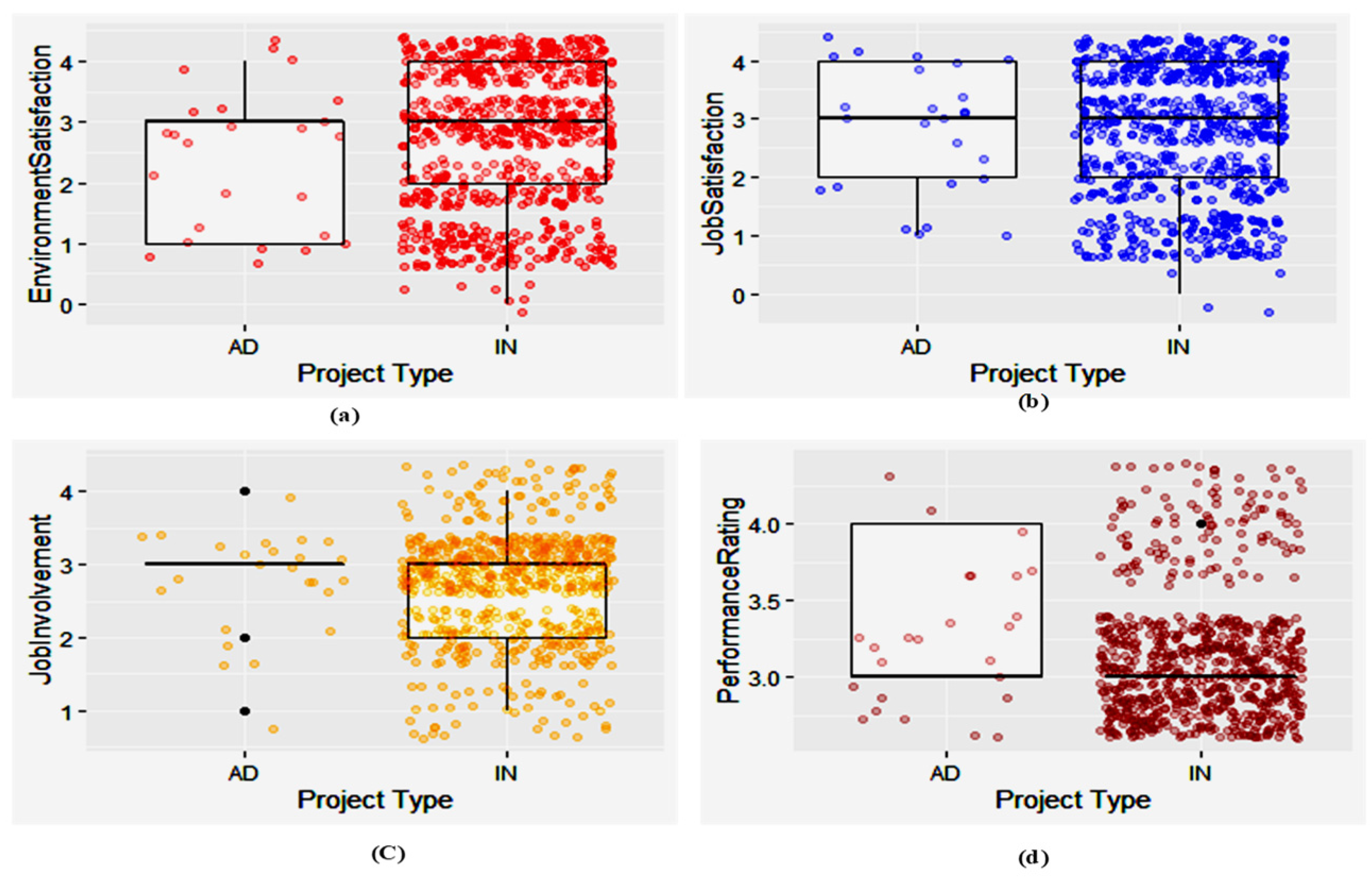

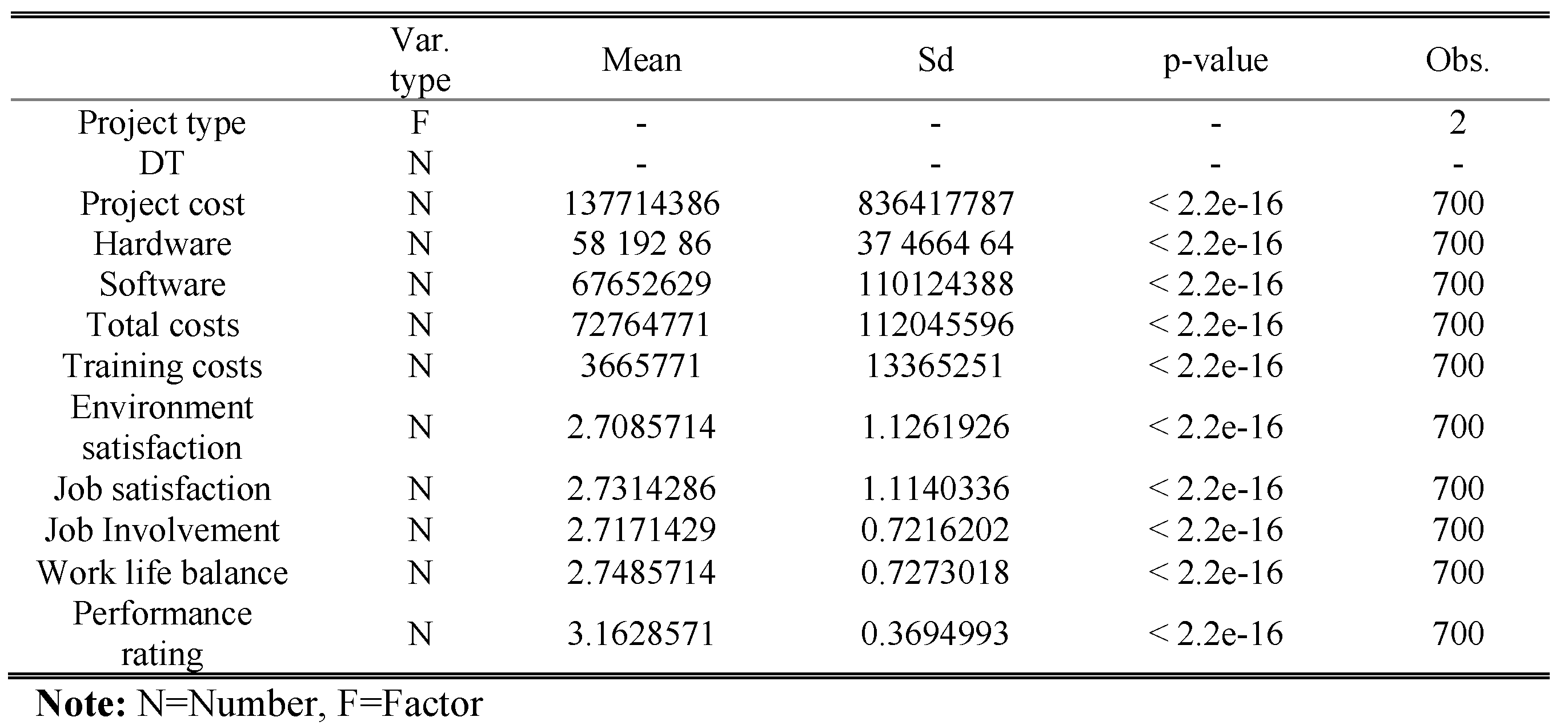

The primary goal of the World Bank in Africa is to digitize healthcare services. The project aims to ensure sustainable development through financial investment with blockchain solution (IN) and emphasizes development lending (AD). In this paper, we utilize PCA to illustrate the requirements for AD and IN in the digital transformation process, focusing on three sustainability perspectives: economic (such as costs for technology investment, including software and hardware, and costs for employee training), environmental (including ratings for environmental satisfaction, job satisfaction, and job involvement), and social (evaluating work-life balance and performance ratings). Therefore, a total of ten observed variables were considered, covering 700 categories of healthcare services across Africa.

As shown in

Table 1, the p-value < 2.2 e-16 rejects the null hypothesis at the critical value α=0.05, indicating a significant distribution between actual and forecast observations. This suggests that certain activities within the projects are in the digitalization phase, while others are in the digital transformation stage.

3. Results

This paper investigates three models in the line of the two projects categories (AD and IN). First, PCA considers both categories of projects to analyze the trends of each variable (project cost, hardware, software, training cost, total cost of hardware and software, environment satisfaction, job satisfaction, job involvement, work-life balance, performance rating).

3.1. Model 1: AD and IN

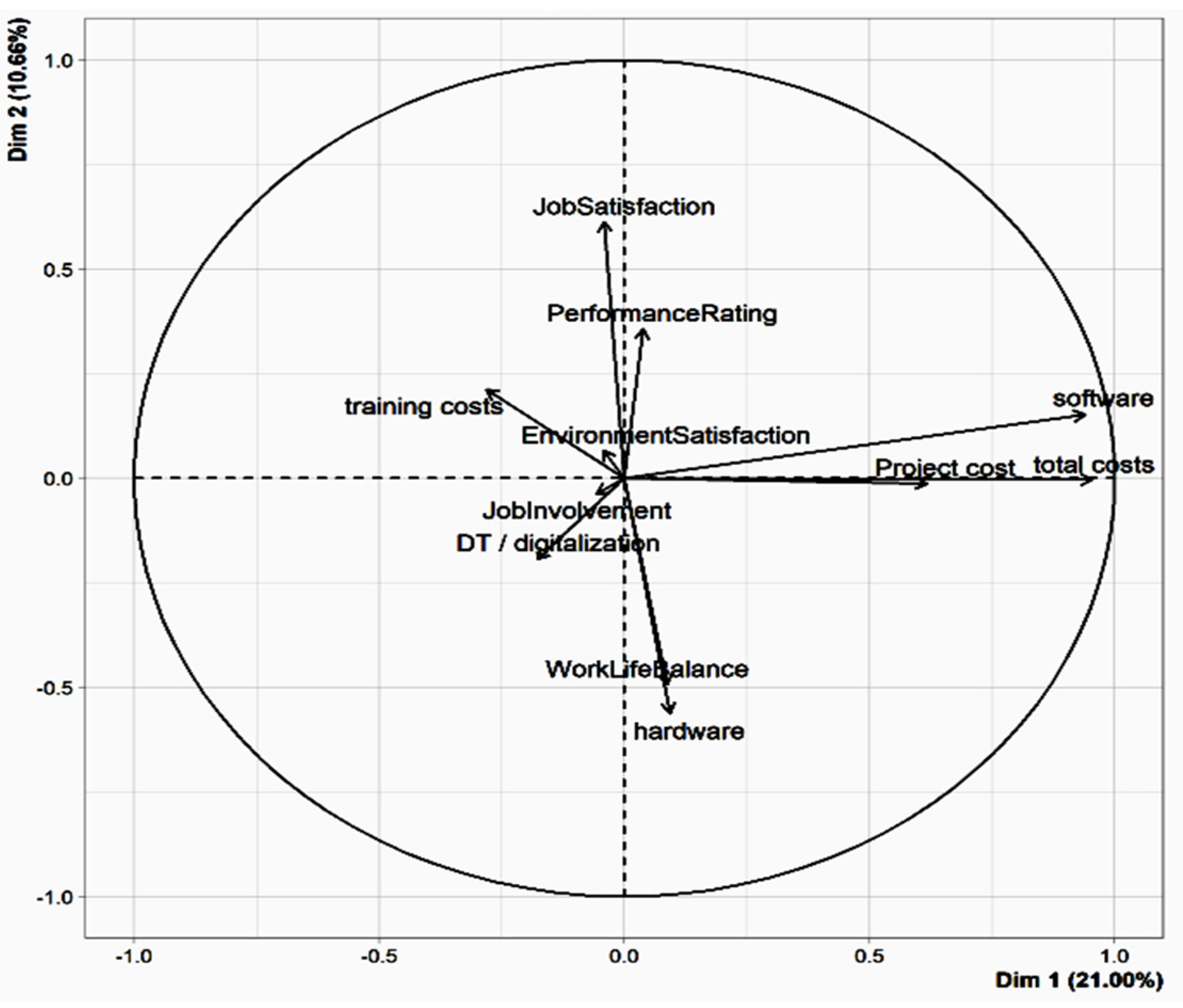

Based on

Figure 2, the ten variables are depicted with a significantly positive coordinate on the axis for certain individuals, while others are represented by a notably negative coordinate on the axis (located to the left of the graph). This visualization highlights the labeled variables that are most effectively represented on the map, and these variables contribute to the construction of the Principal Component Analysis (PCA) plan. The figure demonstrates that the PCA plan is built based on Job Satisfaction, training costs, performance rating, and variables with high values such as software and total costs. Additionally, Project cost, Work-Life Balance, and hardware exhibit strong coordination.

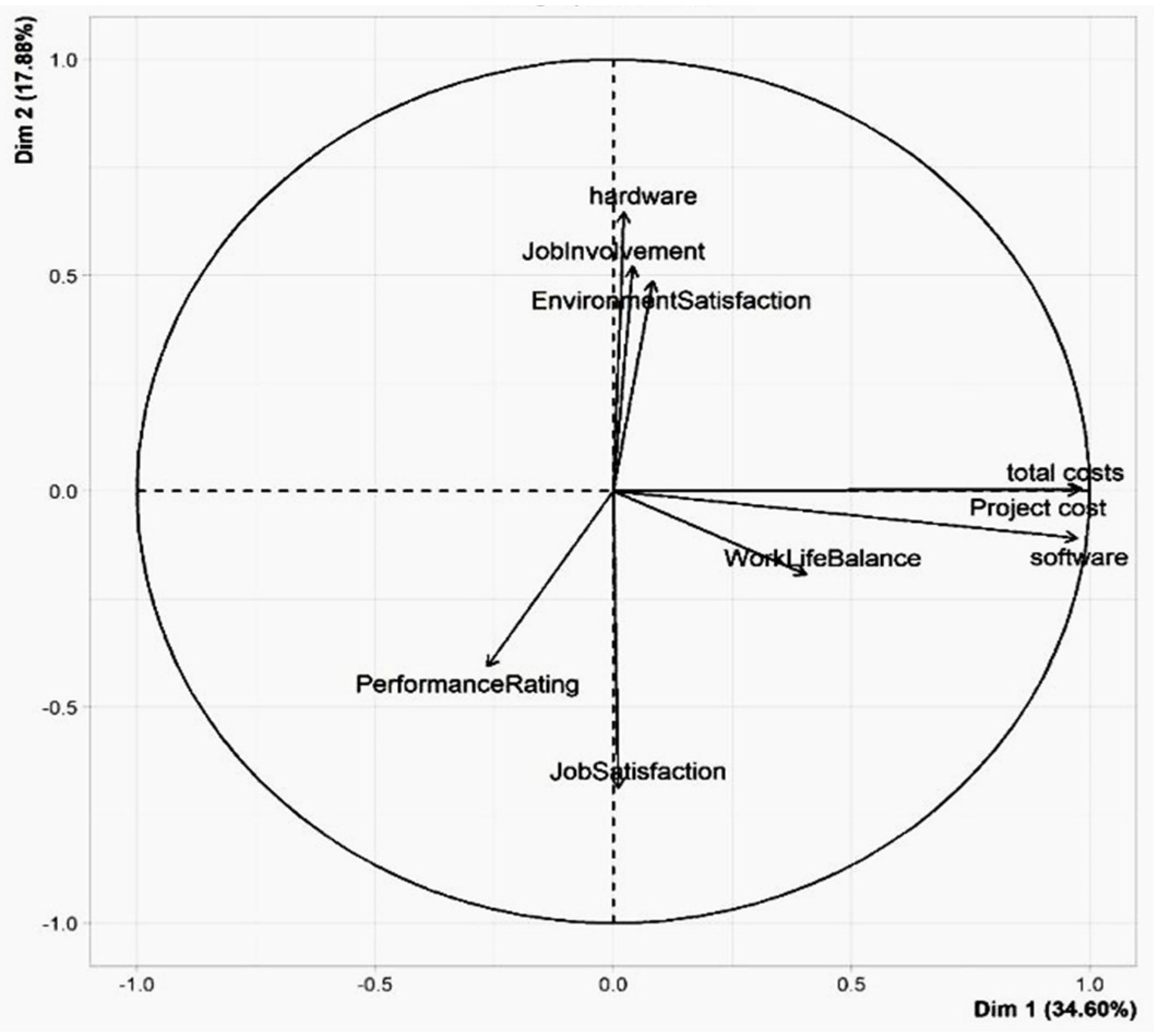

3.2. Model 2: AD without IN

Based on an estimation of the optimal number of axes for interpretation, it is suggested to focus the analysis on describing the first axis. These axes exhibit a higher amount of inertia compared to what would be expected from random distributions at the 0.95-quintile level (34.6% versus 26.82%), as depicted in

Figure 3. This finding indicates that the real information is primarily conveyed by this axis. Consequently, the description of the data will be based on these axes.

In this particular model, the most significant investments are directed towards software and hardware. This emphasis on software and hardware can be attributed to the total costs and project cost dedicated to the development and maintenance of the technology infrastructure.

Note that project cost, software, and total costs variables exhibit high correlations with this dimension, with respective correlation coefficients of 0.98, 0.97, and 0.98. These variables can effectively summarize the characteristics of dimension one, as illustrated in

Table 2. The strong correlations indicate that these variables play a crucial role in shaping the first dimension. The project cost represents the overall investment required for the digital transformation process, while software and total costs reflect the specific expenditures related to technology infrastructure. Consequently, these variables provide a comprehensive overview of the financial aspects associated with the digital economy and underscore their significance in driving the digital transformation initiatives.

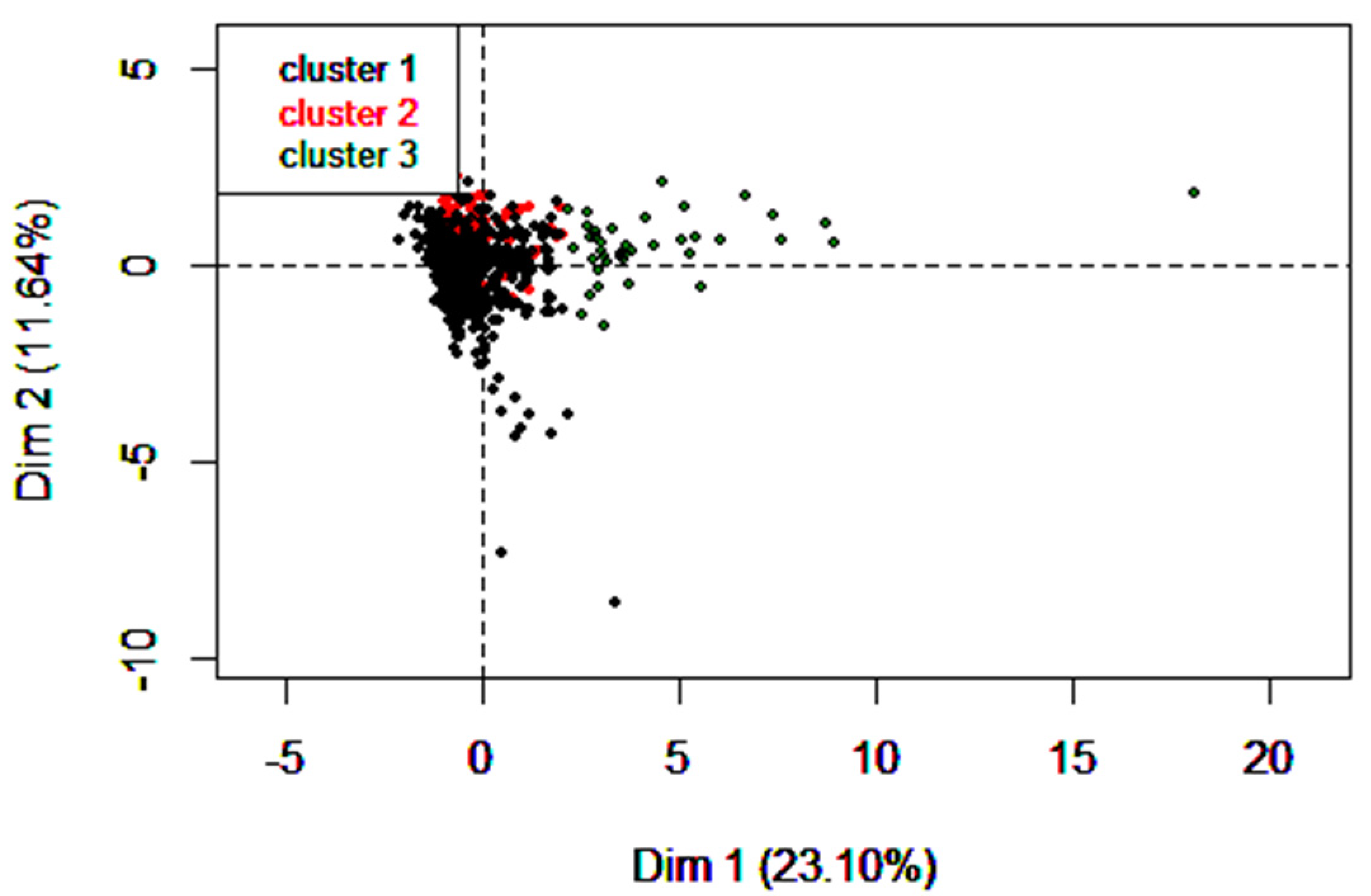

3.3. Model 3: IN witout AD

In this particular model, the focus is on IN projects, where investments are allocated towards technology and employees. This model is reflected in the hierarchical classification of three distinct clusters, as illustrated in

Figure 4.

The first cluster consists of variables such as training costs and hardware, which represent the convergence of human capital and technology infrastructure. This cluster signifies the importance of investing in employees' skills and competencies, as well as providing them with the necessary technological resources to support their work in the digital economy. Cluster 2 is characterized by the Performance Rating variable, which indicates that the World Bank evaluates the outcomes and results of its investments in the health care services sector. This variable serves as a measure of effectiveness and allows the World Bank to track its efforts and assess the impact of its initiatives in improving health care services.

On the other hand, the third cluster comprises variables such as software, total costs, and Project cost. This cluster emphasizes the significance given by the World Bank to equipping health care services employees with appropriate work tools and promoting their well-being. The inclusion of software, total costs, and Project cost variables highlights the organization's commitment to enhancing the digital infrastructure and supporting employees' effectiveness and satisfaction in their work.

4. Discussion and Conclusions

In the context of fintech, it is important to consider that the digital transformation process within the financial technology industry (fintech) also requires the development of employees' expertise, skills, and competence to ensure a satisfactory work environment and job satisfaction. Fintech encompasses the use of digital technologies and innovation to transform financial services, and organizations operating in this domain must invest in employee training and adapt their technology infrastructure to align with the specific requirements of fintech. By doing so, they can enhance their performance, deliver improved financial services, and achieve successful digital transformation outcomes.

Consequently, the World Bank, along with other stakeholders in the fintech industry, emphasizes investing in employee training to support their professional growth and enhance the overall digital transformation endeavors within the fintech scope.

The findings in figure 2 demonstrate how important is to incorporate the fintech scope into the analysis by considering specific indicators to the fintech industry: fintech investment, adoption of fintech solutions, integration of financial services with digital platforms and customer satisfaction with fintech services. These variables provide insights into the unique aspects of digital transformation within the financial technology sector.

As the model 2 and 3 reveals strong dependencies with economic perspectives, the correlation analysis attempt to emphasize the dependency degree between variables within the two types of Word Bank projects AD and IN.

Figure 5 (a, b) shows a strong correlation among four variables regarding social and environmental dimensions of the digital economy in Africa and stronger regarding IN. This situation is mostly explained by the investment of the World Bank in employees training. Also, it reveals that the performance rating is less correlated than other variables, which is explained that the project is still under the digitalization process (see

Figure 5(c, b)).

The primary objectives of this study are twofold: first, to propose and test an integrated model that enhances and improves the understanding and evaluation of the digital economy in practical settings, and second, to explore the phenomenon of digital transformation and digitalization in Africa within the context of an international corporation under fintech scope. Additionally, the study aims to extract valuable lessons from the empirical findings that can inform and enhance digital economy practices.

To achieve these objectives, the models have identified several key lessons. Firstly, results emphasize the importance of focusing the evaluation of digital economy projects on social and environmental aspects, taking into account the interests of stakeholders who have a close involvement in the project. This approach ensures that sustainability considerations are effectively incorporated into the evaluation process.

Secondly, the results highlight the need to differentiate between projects based on their unique goals, objectives, and constraints before evaluating digital transformation and digitalization. By recognizing the specific characteristics of each project, the evaluation process becomes more meaningful and enables a deeper understanding of the implications and outcomes of the digital economy initiatives.

Finally, practitioners can improve their digital economy practices and make informed decisions regarding digital transformation and digitalization initiatives under fintech solution in healthcare services.

Furthermore, fintech innovations such as blockchain-based platforms for secure transactions or digital payment systems can contribute to greater transparency, efficiency, and accountability within investment projects. These advancements can streamline financial operations and contribute to more reliable performance rating assessments.

By integrating financial fintech insights, organizations can leverage the power of technology to optimize financial management, improve decision-making, and mitigate risks in investment projects. This integration enables a more comprehensive evaluation framework that encompasses both financial and technological aspects, enhancing the overall understanding and effectiveness of the digital economy in the African context.

Funding

This research received no external funding.

Data Availability Statement

Acknowledgments

Author acknowledge technical contribution of Dr. Naima BENKHIDER (ORCID ID 0000-0001-6518-5163) for technical support regarding data visualization.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Wang, W.; Wang, Y.; Zhang, Y.; Ma, J. Spillover of workplace IT satisfaction onto job satisfaction: The roles of job fit and professional fit. Inter. J. Infor. Manag. 2020, 50, 341–352. [Google Scholar] [CrossRef]

- Ang, J.; Koh. , S. Exploring the relationships between user information satisfaction and job satisfaction. Inter. J. Inf. Manag. 1997, 17, 169–117. [Google Scholar] [CrossRef]

- Elias, S.; Barney, C. Age as a moderator of attitude towards technology in the workplace: Work motivation and overall job satisfaction. Behav. Inf. Techn. 2012, 31, 453–467. [Google Scholar] [CrossRef]

- Martínez-Caroa, E.; Cegarra-Navarrob, J.G.; Alfonso-Ruiz, F.J. Digital technologies and firm performance: The role of digital organisational culture. Techn. Forec. Soc. Chang. 2020, 154, 1–10. [Google Scholar] [CrossRef]

- McCloskey, D.W. Finding Work-Life Balance in a Digital Age: An Exploratory Study of Boundary Flexibility and Permeability. Infor. Resources Manag. J. 2016, 29, 53–70. [Google Scholar] [CrossRef]

- Philippon, T. The Fintech Opportunity. In Monetary Economics: International Financial Flows, 2016. [CrossRef]

- Hanaysha, J. Examining the Effects of Employee Empowerment, Teamwork, and Employee Training on Organizational Commitment. In Leadership, Technology, Innovation and Business Management, Sciences, Procedia - Social and Behavioral, 2016; 229, pp. 298–306. [CrossRef]

- Dittes, S.; Richter, S.; Richter, A.; Smolnik, S. Toward the workplace of the future: How organizations can facilitate digital work. Bus. Horiz. 2019, 62, 649–661. [Google Scholar] [CrossRef]

- Pagani, M.; Pardo, C. The impact of digital technology on relationships in a business network. Indus. Mark. Manag. 2017, 67, 185–192. [Google Scholar] [CrossRef]

- Lee, H.; Choi, H.; Lee, J.; Min, J. & Lee, H. Impact of IT Investment on Firm Performance Based on Technology IT Architecture. Proc. Comp. Sc. 2016, 91, 652–661. [Google Scholar] [CrossRef]

- Vanduhe, V.; Nat, M.; Hasan, F. Continuance Intentions to Use Gamification for Training in Higher Education: Integrating the Technology Acceptance Model (TAM), Social Motivation, and Task Technology Fit (TTF). IEEE Access 2020, 8, 21473–21484. [Google Scholar] [CrossRef]

- Nam, T. Technology use and work-life ba lance. Applied Res. Qual. Life 2014, 9, 1017–1040. [Google Scholar] [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).