1. Introduction

Tourism has long been a catalyst for economic growth and development, with retail shopping playing a significant role in attracting visitors and boosting local economies. With the booming of shopping tourism in recent decades, retail markets in some popular shopping tourists’ destinations have become highly dependent on tourism. However, the outbreak of the COVID-19 pandemic disrupted global travel patterns, providing a unique opportunity to examine the impacts of shopping tourism on retail sales and retail rents. By exploring the quasi-experiment presented by the pandemic, we can gain valuable insights into the relationship between tourism, retail, and economic resilience.

“Shopping tourists” are individuals who travel with the primary intention of engaging in shopping activities. They seek destinations known for their shopping opportunities, whether it’s for unique products, luxury goods, favourable prices, or exclusive shopping experiences. These tourists dedicate a significant portion of their travel itinerary to shopping, and their spending patterns can have profound effects on the retail sector.

The COVID-19 pandemic significantly disrupted shopping tourism, leading to a drastic decline in shopping tourist arrivals worldwide. The restrictions on international travel and lockdown measures implemented to curb the spread of the virus resulted in a substantial reduction in the number of shopping tourists and their spending capacity. As a consequence, retailers that heavily relied on shopping tourism experienced a significant downturn in sales.

The decline in shopping tourism had implications for retail rents as well. Prior to the pandemic, shopping tourist destinations often witnessed high demand for retail spaces, leading to increased rental prices. Property owners and landlords capitalised on the popularity of these areas, attracting tenants who catered specifically to shopping tourists. However, the pandemic-induced decline in shopping tourism reduced the demand for retail spaces, creating challenges for property owners in attracting tenants and maintaining rental income. There have been very few empirical studies on the impacts of shopping tourism on retail sales and rents, especially ones using exogenous shocks as a quasi-experiment to mitigate endogeneity biases.

This study takes Hong Kong as the city for studying the impact of shopping tourism on retail sales and rents, as its retail markets were one of the hardest hit markets during the pandemic. The year-on-year change of retail sales in Q1 2020 of Hong Kong was a record low at -35.0%. The depth of the plummet in Hong Kong was one of the deepest in the world and was almost seven times of that in the USA.

Hong Kong has long been recognized as a prominent shopping destination, attracting millions of shopping tourists each year. Its reputation as a shopping paradise was built on a combination of factors, including a wide range of retail options, competitive prices, and a favourable tax environment.

One of the key drivers of shopping tourism in Hong Kong was the presence of luxury brand stores and shopping malls offering high-end fashion, jewellery, and electronics. Tourists, particularly from Mainland China and neighbouring Asian countries, flocked to Hong Kong to take advantage of the diverse shopping opportunities and purchase luxury goods, often at lower prices compared to their home countries.

1.1. Tourism and Retail Sales of Hong Kong

Tourism is one of the four key industries in Hong Kong, inbound tourism contributed 3.7% of the GDP in 2018. The value added of inbound tourism industry had increased from HK$37b in 2008 to HK$99b in 2018, representing an average 10.3% annual growth rate. It was employing 5.8% of the labor population (HK C&SD, 2019). However, its contribution to GDP plummeted to 0.1% in 2021.

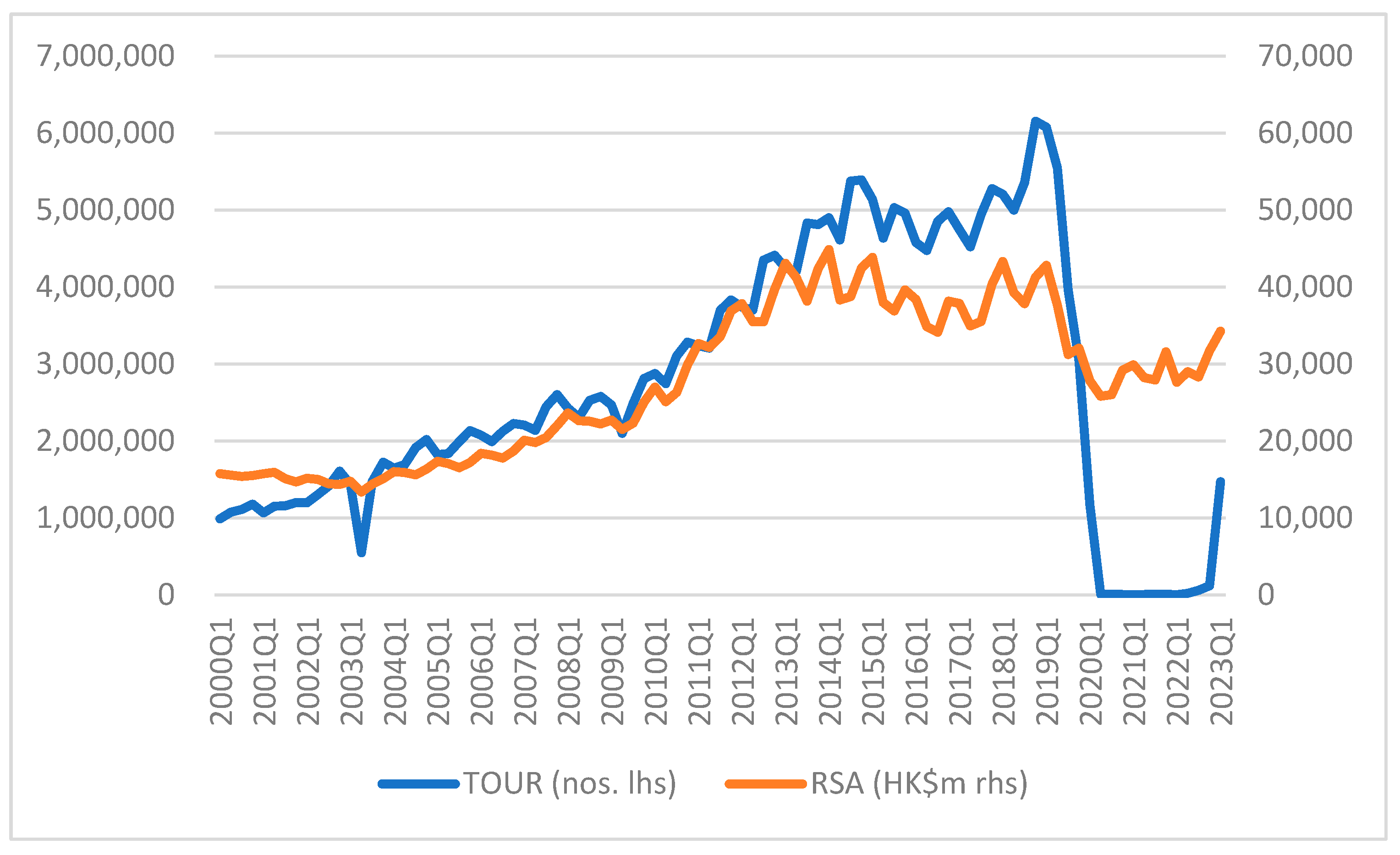

Before the pandemic, the growth of the number of tourists in Hong Kong was spectacular. The increase in the number of tourists by 523% (from 988,705 to 6,155,269 per month) increased substantially the demand of retail shops and was reflected in the 125% increase of the retail sales amount (in real terms) from Q1 2000 to Q4 2018. However, the association between the two was not strong before 2009 when shopping tourism was not common. It is since the implementation of the Individual Visit Scheme (IVS) in 2003 and then the Multiple-Entry Permit (MEP) scheme in 2009 that encompasses the trend of cross-border shopping tourism in Hong Kong (Li, Cheung & Han, 2018). IVS is a scheme that allows residents from a large number of cities of Mainland China to visit Hong Kong in their individual capacity, and MEP is a scheme that allows eligible residents in Shenzhen to have a multiple-entry permit to travel freely to Hong Kong for leisure and shopping activities.

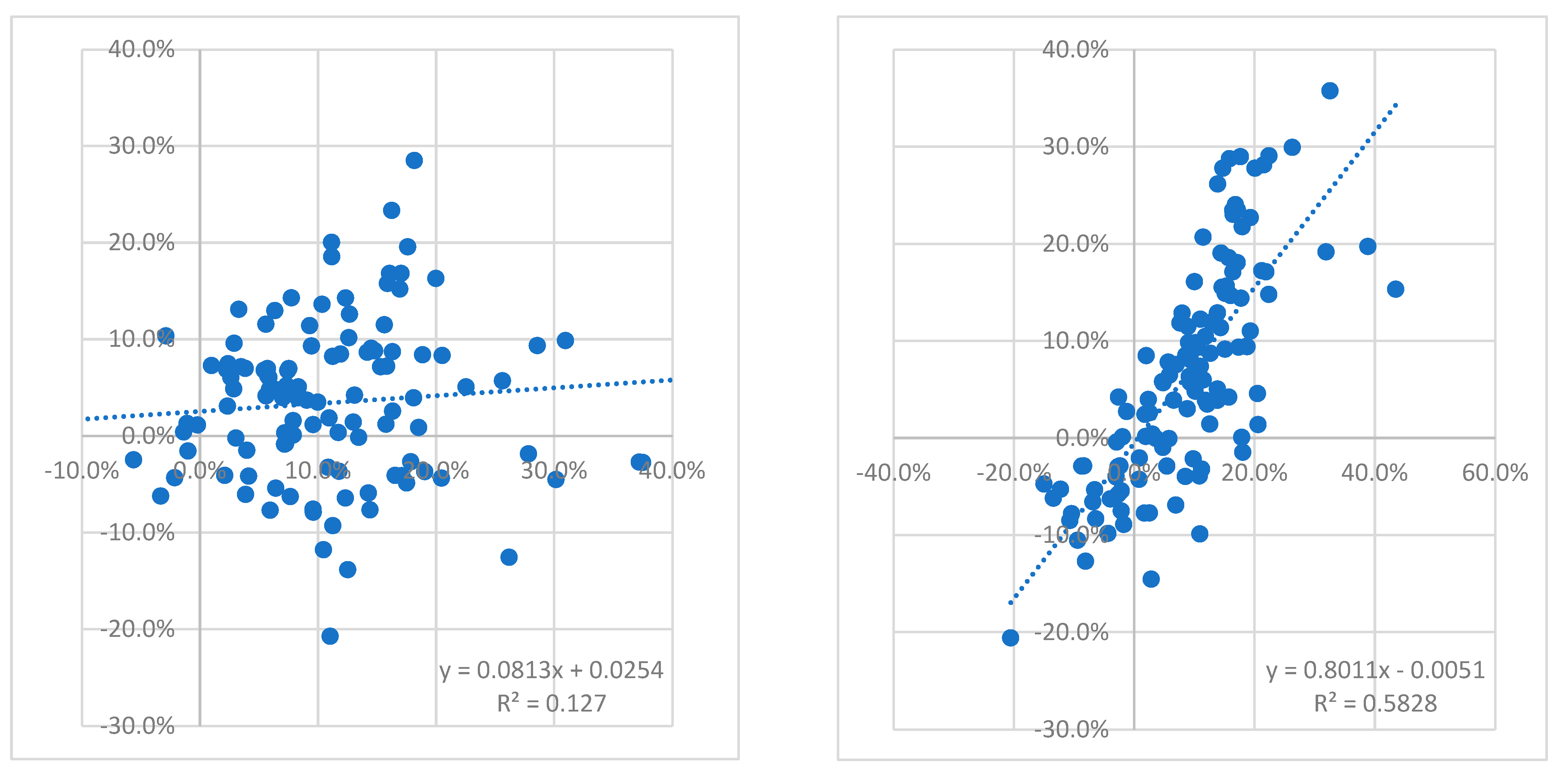

Figure 1a,b show the scatterplots between the year-on-year changes of retail sales amounts and number of tourists in the periods of 1999-2008 and 2009-2019. The former shows a weak association between the two when shopping tourism was not popular, whereas the latter shows a much stronger positive association between the two when same-day visitors, who are mostly shopping tourists, accounted for more than one half of the total number of tourists.

However, in the wake of the COVID-19 pandemic, there was a dramatic and unparalleled decline in tourist arrivals. The viral outbreak was officially declared by the Hong Kong government on 25 January 2020, leading to the suspension of High-Speed Rail services and most cross-border ferry services on 30 January. Subsequently, on 25 March, Hong Kong closed its borders to all non-residents. As a result, the number of tourists in Q2 2020 experienced a staggering 99.9% year-on-year decrease. The lowest recorded number of tourist arrivals occurred in Q1 2022, with only 3,830 arrivals, compared to 6,155,269 in Q4 2018. Consequently, shopping tourism virtually vanished, with the number of same-day tourists plummeting to a mere 81 in July 2021, in comparison with 3,486,420 in Q1 2019. Moreover, retail sales experienced an unprecedented decline of 35.0% year-on-year in Q1 2020. During the COVID-19 period, retail sales primarily relied on local residents' consumption, making it the dominant market segment.

Figure 2 shows the strong correlation between the two series after the SARS epidemic in 2003. The correlation coefficients between the two series in the period of Q1 2000 to Q4 2018 are 96.3%.

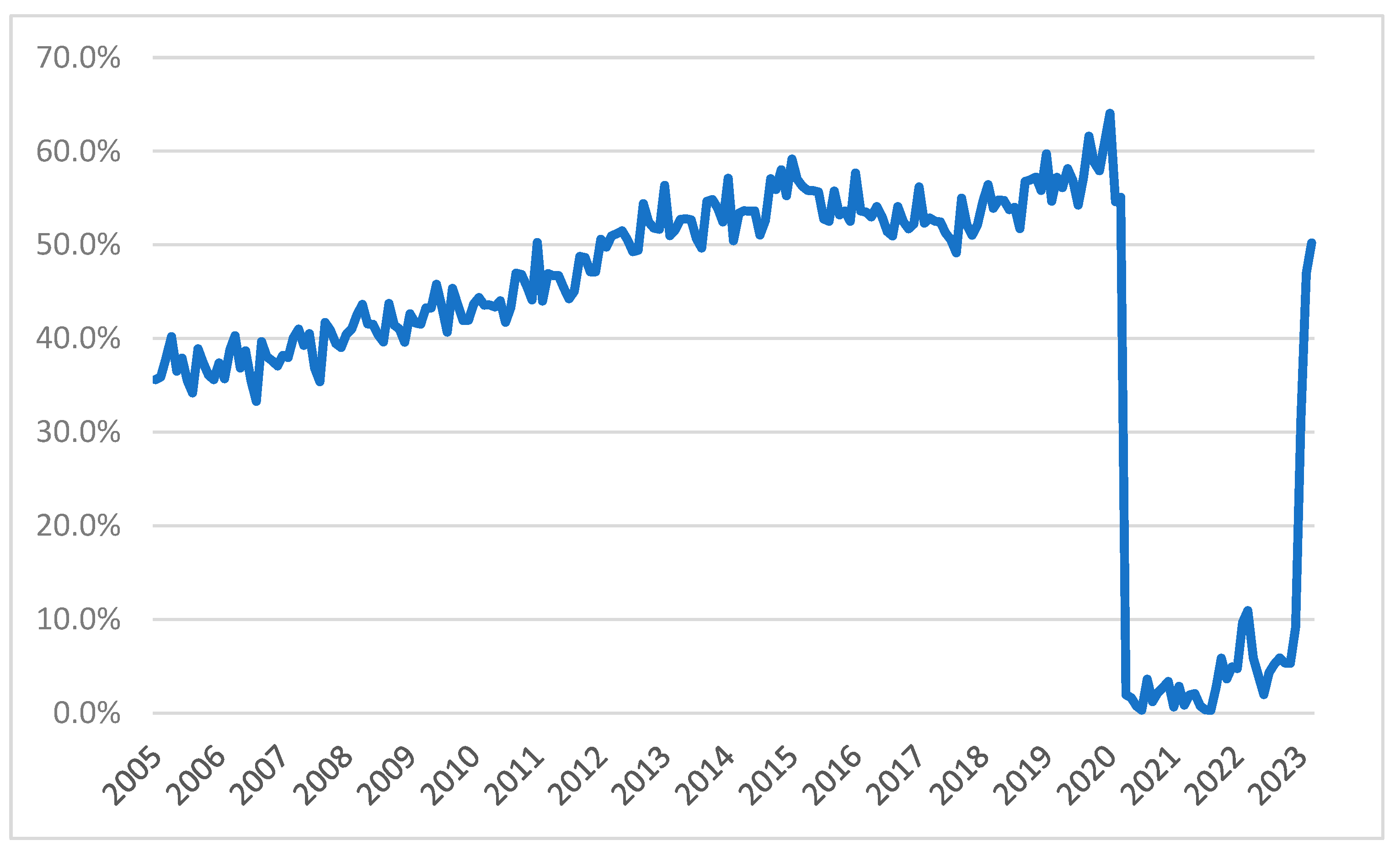

Between Q1 2000 and Q4 2018, the number of tourists in Hong Kong saw a significant increase, rising from 0.99 million to over 6.16 million per quarter. However, a majority of this growth can be attributed to same-day visitors, indicating a strong surge in shopping tourism. In 2018, their collective expenditure on tourism reached HK$328.2 billion (US$42.1 billion) (HKTB, 2023). Hong Kong was globally recognized as the most visited city that year (SCMP, 2019), establishing itself as a prime destination for shopping tourists. On average, 56% of tourists in the two years leading up to the pandemic (2018-2019) were same-day visitors. Same-day travel became a distinguishing characteristic of cross-border shopping tourists in Hong Kong, allowing cross-border parallel traders to minimize their accommodation costs by completing their shopping within a single day.

The COVID-19 pandemic had a profound impact on shopping tourism in Hong Kong, causing significant disruptions to international and cross-border travel. Travel restrictions, quarantine measures, and diminished consumer confidence resulted in a sharp decrease in the number of shopping tourists visiting the city. The absence of mainland Chinese shopping tourists, who constituted a substantial portion of Hong Kong's shopping tourists, particularly affected the retail sector. This decline is evident in the drastic reduction in the proportion of same-day visitors to the overall number of visitors during the pandemic, dropping from a peak of 64% in January 2020 to a mere 0.3% in August 2021 (

Figure 3). Hong Kong's tourism sector has been experiencing a rapid recovery since the reopening of borders in March 2023. The number of tourists has surged from 3,830 in Q1 2022 to 1,471,584 in Q1 2023. Shopping tourism has also started to regain momentum, with the ratio of same-day tourists to the total number of tourists climbing back up to 47% in Q1 2023.

1.2. Retail Sales and Rents in Hong Kong

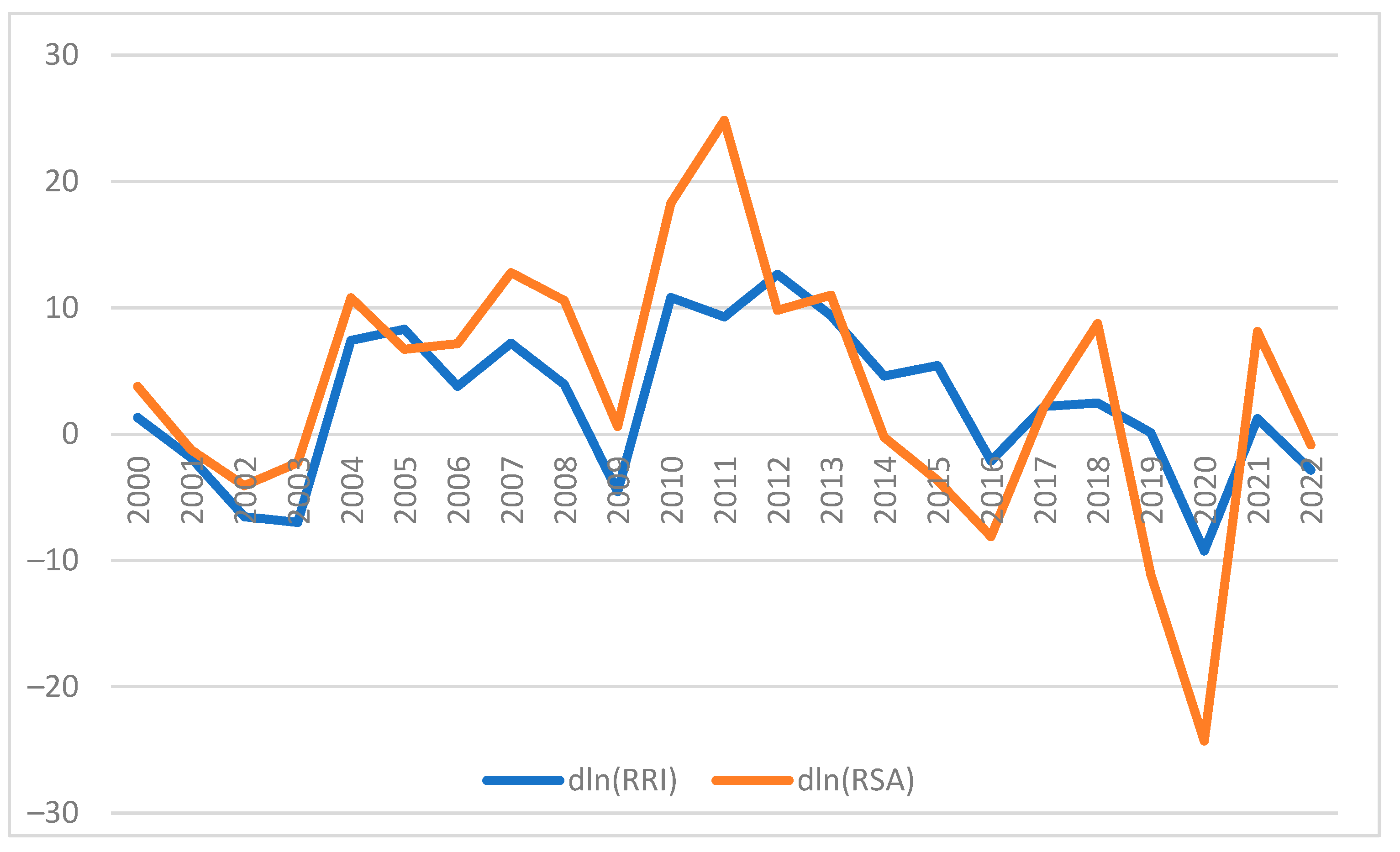

Figure 4 demonstrates a strong correlation between the change in retail rental index and the change in retail sales amount. Over the period from 2000 to 2022, their quarterly and yearly series exhibit correlation coefficients of 72.6% and 77.4% respectively. Notably, in 2020, when retail sales experienced a decline of 24.3%, retail rents also fell by 9.2%.

This study aims to analyze the shopping tourism hypothesis, which suggests that in destinations popular among shopping tourists, like Hong Kong, shopping tourism plays a significant role in shaping the demand for retail spaces, consequently impacting retail rents. The paper is structured as follows:

Section 2 critically reviews the existing literature on the shopping tourism hypothesis.

Section 3 outlines the research design, data sources, and methodology employed. The empirical results and robustness tests are presented in

Section 4.

Section 5 delves into the interpretation of the findings, discusses their implications, and concludes the study.

2. Literature Review

2.1. The Determinants of Retail Rents

Traditionally, the fields of retailing and retail properties have been treated as separate disciplines. Real estate researchers have primarily focused on studying the determinants of retail rents, with little consideration given to tourism, particularly shopping tourism, as a significant factor. Early studies, such as Sirman (1993), explored determinants of shopping center rents, primarily focusing on factors like architectural design, location, and general economic conditions.

Other studies examined supply and demand factors in the context of retail space. For instance, Ke & White (2015) highlighted the importance of supply and demand dynamics in retail space. Tsolacos (1995) and D'Arcy, Tsolacos, and McGought (1997) considered demand factors such as consumer spending and economic growth. Occasionally, consumer spending was further dissected into components like population growth and income levels (Kang, 2019), without incorporating the impact of tourism shopping or shopping tourism into the analysis.

2.2. The Impacts of Tourism on Retail Markets

In recent years the impact of tourism on retail markets has attracted many retailing researchers’ attention. Traditionally, shopping is only considered a secondary activity of a trip, which is coined as “tourist shopping”. It has been found to be a driver of retail sales in tourist destinations (Mehta, Jain & Jawale, 2014; Silva & Hassani, 2022).

However, the rise of "shopping tourism" has completely transformed the connection between tourism and the retail industry. Shopping tourism refers to a growing trend where shopping becomes the primary purpose of a trip (Timothy, 2005; UNWTO, 2014). It encompasses activities like cross-border shopping, parallel trade, and international out-shopping (Sharma, Chen & Luk, 2018). Extensive research has been conducted globally to understand the reasons behind cross-border shopping tourism, including the borders between Canada and the US, various European countries, Malaysia and Singapore, mainland China and Hong Kong, Germany and Denmark, Mexico and the US, and Thailand and Laos (Piron, 2002; Ghaddar & Brown, 2015; Lau, Sin & Chan, 2005; Nguyen, Chao, Sgro & Nabin, 2016; Makkonen, 2016; Hadjimarcou, Herrera & Salazar, 2017; Boonchai & Freathy, 2020). One common motivation for engaging in cross-border shopping tourism is the opportunity to benefit from differences in taxes and/or product quality (UNWTO, 2014). However, there is a lack of research exploring the impacts of shopping tourism on retail property markets. This paper, therefore, takes Hong Kong as one of the shopping tourist destinations for studying the impacts of shopping tourism on retail sales and rents, given the large number of cross-border shopping tourists from Mainland China to Hong Kong.

Since the boom of shopping tourism, retail sales in the shopping tourists’ destinations experienced substantial growths. Research by Lee & Choi (2019) indicates that shopping tourists tend to spend more on shopping compared to other tourist segments. Lau, Sin & Chan (2005) highlighted the importance of cross-border shopping in Hong Kong as a key factor in attracting shopping tourists. Liu & Wang (2010) also found a positive correlation between shopping tourism and destination attractiveness in Hong Kong.

Theoretically, retail spaces in tourist destinations were in higher demand would lead to rising rental prices. Landlords could capitalize on the popularity of tourist areas by increasing rents and seeking tenants that cater to tourist spending. More recently, Li et al. (2018) and Liu et al. (2020) found a positive relationship between retail shops’ price and shopping tourism. However, on the one hand, they related tourism to retail property prices without controlling investment factors, and on the other hand, they did not control endogeneity biases, such as confounding factors and reversal causality issue. This study, therefore, analyses retail rents instead of prices, and exploits the exogenous shocks on tourism during the pandemic period to analyse the impacts of shopping tourism on retail sales and rents. This quasi-experimental approach can establish the causality relationship between the variables.

The COVID-19 pandemic brought unprecedented disruptions to shopping tourism and its impacts on retail sales. Travel restrictions, lockdown measures, and health concerns significantly reduced tourist arrivals worldwide. Frago (2021) observed a sharp decline in the number of tourists and their spending capacity during the pandemic. This decline had a severe impact on retail sales, especially for businesses heavily reliant on shopping tourism.

The pandemic caused a downturn in the tourism industry, leading to a decrease in demand for retail spaces. This, in turn, impacted rental prices. Property owners and landlords faced challenges in attracting tenants, which led to a decline in rental prices as a means to fill vacancies. Even though there were lockdowns and more e-Commerce during the pandemic (Nanda, Xu & Zhang, 2021), their impacts were of much short-span than border closure. It provides an exogenous shock to test shopping tourism effects on retail markets.

3. Materials and Methods

3.1. Data

All the data used in this paper come from three official sources, they are the Census and Statistics Department (HK C&SD), the Hong Kong Rating and Valuation Department (HK RVD) of the Hong Kong SAR Government, and the Hong Kong Tourist Board (HKTB).

Table 1 lists out the descriptive statistics of the variables used in the analyses, their symbols, sources and units of measure are shown in the notes of the table. Since the issues will be analyzed by two sets of data series in different time frequency, a subscript

in each variable is used to represent yearly or quarterly series.

Furthermore, all the series are tested on their stationarity by two unit root tests.

Table 2 shows the results of the stationarity tests by applying the Augmented Dickey-Fuller (ADF) and the Philips-Perron (PP) test statistics. Almost all variables in both yearly and quarterly time series are non-stationary in their level terms and stationary in their first differences in either one test, except the yearly inflation variable

which is marginally stationary in its first difference with t-statistics = -2.33 (p-value = 0.17) and -2.36 (p-value = 0.16) in the ADF and PP tests.

3.2. Research Design

Before the outbreak of COVID-19, Hong Kong is one of the highest tourism shopping destinations with more than 6 million tourists per quarter. The period coincided with the long growing trend of retail rents in Hong Kong. There were two counterclaims on the phenomenon. One is about landlord hegemony that the escalation of retail rents caused retailers to raise prices of retail goods and thus resulting in higher retail sales amounts. A counterargument is that tourism shopping triggered higher retail sales and caused higher retail rents. Unfortunately, both hypotheses do not have empirical evidence to support. In fact, a Granger Causality test on the series could not tell the direction of causality, as both retail sales and retail rents Granger Cause each other in the quarterly series and both real retail sales and tourist arrivals Granger Cause each other in the yearly series, as shown in

Table 3. It requires a quasi-experiment to introduce an external shock as a treatment on some variables to identify the causal links.

This study leverages the COVID-19 period from 2020 to 2022 as a natural quasi-experiment to investigate the causal relationship between tourist arrivals, retail sales, and retail rents. The onset of the pandemic in 2020 led to a near-total shutdown of borders, which can be viewed as an external shock to the tourism industry. As a consequence, the number of tourist arrivals experienced a drastic decline, nearing zero. With the closure of borders, retail sales became largely dependent on local residents' consumption. The significant drop in both retail sales and rents can be primarily attributed to the decline in tourism shopping activities.

The causal link between retail sales and retail rents is well-acknowledged in both academic theory and market practices, particularly through turnover rent mechanisms (Cheung & Yiu, 2022). Model 1 examines this causal link by controlling for supply-side factors and inflation. As the supply-side data is available on a yearly basis, Model 1 operates on a yearly basis as well.

To explore the causal links between tourist arrivals, retail sales, and rents, three models using quarterly data series are employed. Model 2 serves as the baseline model, analyzing the overall impact of tourist arrivals on retail sales while keeping inflation and real economic growth constant. Models 3 and 4 utilize a differences-in-differences (DID) approach to identify the moderating effects of the MEP scheme and the COVID-19 pandemic on the relationship between tourist arrivals and retail sales, all else being equal. Lastly, Model 5 integrates the aforementioned models to investigate the causal link from tourist arrivals to retail rents in the yearly series, while controlling for other factors.

3.3. Empirical Models of the Quasi-Experiment

In this study, five time series regression models are examined, Model 1 tests the first hypothesis of the effect of retail sales on retail rents (Equation (1)). The dependent variable is the growth rates of retail rental index

d. Retail rental index can be explained by supply and demand factors and inflation

. Supply factors are proxied by the growth rates of commercial property stocks

and that of vacant commercial properties

. Demand factor is proxied by the growth rate of retail sales amount

. A first-order autoregressive, AR(1) model is applied. Due to data limitations, supply factors can only be studied by yearly series.

where

is the first-order serial correlation coefficient and

L is a lag operator.

,

,

, are consumer price index, retail sales amount, commercial property stock, and vacant commercial properties, of Hong Kong at time t, respectively.

represents the growth rates of the variables by taking the first difference of natural logarithm of the variables.

are coefficients to be estimated.

are the error terms.

Model 2 tests the second hypothesis of the effect of tourist arrivals on retail sales. The dependent variable is the growth rates of retail sales amount

, and the explanatory variables include inflation rate

economic real growth rate

. and growth rate of tourist arrivals

(Equation (2)). It can be studied by the quarterly series.

where

, and

, are real GDP, and number of tourist arrivals of Hong Kong at time

t, respectively.

Models 3 and 4 apply a DID approach to test the moderating effects of the MEP scheme (i.e., in 2009-2019, Equation (3)) and the Covid pandemic (i.e., in 2020-2022, Equation (4)) on the impacts of tourist arrivals on retail sales.

Model 5 is a combined regression model, which combines Eq(1) and (3) to test the effect of tourist arrivals on retail rents in the yearly series.

4. Results

Table 4 shows the results of Models 1 to 6. In Model 1, the results support the demand factor that retail sales and inflation impose positive impacts on retail rents, but not the supply factors. Model 2 establishes the positive association between tourist arrivals with retail sales amount, after controlling inflation and economic growth factors. Yet, as shown in Models 3 and 4, the effect was much stronger after the MEP scheme and before the pandemic, i.e. in the period of 2009 – 2019, implying that the effect was mainly derived from shopping tourism. The effect of number of tourists on retail sales increased by more than three folds during this period. It shows that one percent increase in number of tourists increased 0.49% of retail sales in the MEP period, in comparison with just 0.12% before 2009. However, the COVID-19 pandemic bought the effect of number of tourists on retail sales back to an unprecedentedly low magnitude at just about 0.02% (0.37-0.35).

Furthermore, Model 5 is the combined regression model in the yearly series. The combined results also confirm the tourism shopping hypothesis that one per cent increase per annum in tourist arrivals before the pandemic contributed 0.23% increase per annum in retail rents. The effect almost vanished during the COVID-19 period. The explanatory power of the model is reasonably high at almost 87% (Adj R-squared).

As a robustness test on the shopping tourism hypothesis, Model 6 is a DID model on the moderating effect of the same-day to total tourists ratio on the tourist impact on retail sales. The results of the quarterly series confirm the positive moderating effect of , implying that the weaker effect of number of tourist on retail sales amount in the period found in Model 4 is due to the sharp reduction in the same-day tourists, who are mostly cross-border shopping tourists.

5. Discussion and Conclusions

There have been some studies on the impacts of tourist arrivals on retail sales, but very few of them studied empirically the effects of shopping tourism on retail sales. Also, there have been no studies connecting the link of tourism and retail sales to the link of retail sales and rents. Some studies try to measure directly the impacts of tourism on the price of retail shops, but it is hard to control many other investment factors.

In fact, it is quite difficult to disentangle the effect of shopping tourism on retail sales amount from tourism shopping and local residents’ spending, because on one hand the data of shopping tourists is not available, and on the other hand, the actual tourists’ spending is hard to collect accurately. This study makes use of the period of MEP and the COVID-19 pandemic in Hong Kong to identify the emergence of shopping tourism after the implementation of the MEP, and the suspension of shopping tourism during the pandemic period. This study divides the time series into three sub-periods to test the hypothesis, representing (1) pre-MEP period, 2000 – 2008; (2) MEP period, 2009 – 2019; and (3) the Covid period, 2020 - 2022. It enables time series analyses on the impacts of shopping tourists on retail sales amount and rents. Due to the availability of data frequency, two levels of regression analysis are carried out, retail rental analysis is conducted on a yearly basis, whereas retail sales analysis is on a quarterly basis. The results confirm that the number of tourists is one of the major determinants of retail sales amount and retail rents in Hong Kong. However, the effect of number of tourists on retail sales was weak before the commonplace of cross-border shopping tourism, i.e. in the pre-MEP period, and after the outbreak of the pandemic, i.e. in the Covid period. Shopping tourism is found to increase the impacts of tourist arrivals on retail sales by more than three times. Furthermore, number of shopping tourists is proxied by the number of same-day tourists to conduct a robustness test on the hypothesis.

The COVID-19 pandemic served as a quasi-experiment that unveiled the intricate causal relationship between shopping tourism, retail sales, and retail rents. While the pandemic's disruption had detrimental effects on the retail sector, it also presented valuable lessons on urban governance and risk management (Blake & Sinclair, 2003). Shopping tourism may bring good businesses to retailers, but it could also cause high volatilities and high retail rents (Cheung & Yiu, 2022). By leveraging these insights, retailers can build resilience, attract customers, and thrive even in uncertain times, reducing their dependence on shopping tourism and ensuring a more sustainable future.

A practical implication of this study is on retail resilience by customer diversification. The COVID-19 pandemic underscored the importance of diversifying the customer base for retailers in tourist destinations. Overreliance on shopping tourism left businesses vulnerable to external shocks, emphasizing the need for a more balanced approach that caters to both locals and tourists.

Future research should further investigate the long-term impacts of shopping tourism on retail sales and retail rents after the pandemic. Comparative studies between destinations that heavily rely on shopping tourism and those with a diversified customer base would provide valuable insights into best practices for building resilient retail sectors.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Data available in a publicly accessible repository that does not issue DOIs. Publicly available datasets were analysed in this study. This data can be found in the following reference sources: RRI: retail rental index (1999=100), from HK RVD (2023); RSA: retail sales amount (in HK$M), from HK C&SD (2023); TOUR: tourist arrivals (in numbers), from HK C&SD (2023); CPI: consumer price index (2019M10-2020M9=100), from HK C&SD (2023); RGDP: gross domestic products (in chained 2021 dollars, HK$M), from HK C&SD (2023); STK: stock of private commercial properties at year end (in square meters), from HK RVD (2023); VAC: vacant private commercial properties at year end (in square meters), from HK RVD (2023); SDT: number of same-day tourists (in nos.), from HKTB (2023).

Acknowledgments

Not applicable.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Blake, A. and Sinclair, M.T. (2003). Tourism Crisis Management: US Response to September 11. Annals of Tourism Research 2003, 30, 813–832. [CrossRef]

- Boonchai, P., & Freathy, P. (2020). Cross-border tourism and the regional economy: a typology of the ignored shopper. Current Issues in Tourism 2020, 23, 626–640.

- Chen, N. H., & Kim, S. H. (2010). What Drives Retail Agglomeration? The Case of Japanese Shopping Centers. Journal of Retailing 2010, 86, 193–204.

- Cheung, K.S. & Yiu, C.Y. (2022). Unfolding touristification in retail landscapes: Evidence from rent gaps on high street retail. Tourism Geographies. [CrossRef]

- D’Arcy, E., Tsolacos, S. & McGough, T. (1997). An empirical investigation of retail rents in five European cities. Journal of Property Valuation and Investment 1997, 15, 308–322.

- Frago, L. (2021). Impact of COVID-19 Pandemic on Retail Structure in Barcelona: From Tourism-Phobia to the Desertification of City Center. Sustainability 2021, 13, 8215.

- Ghaddar, S., & Brown, C. (2005). The cross-border Mexican shopper: A profile. Research Review 2005, 12, 46–50.

- Hadjimarcou, J., Herrera, J., & Salazar, D. (2017). Inward retail internationalisation and exogenous–based out-shopping on the US-Mexico border. Review of International Business and Strategy 2017, 27, 434–449.

- HK C&SD (2023). Monthly Series on Retail Sales Amount, 1998 – 2023, Census and Statistics Department, Hong Kong SAR Government.

- HK RVD (2023). Monthly Series on Private Retail Property Rental Index, 1998 – 2023, Ratings and Valuation Department, Hong Kong SAR Government.

- HKTB (2023). Latest Statistics, Research and Statistics (available for partners only), Hong Kong Tourist Board. https://partnernet.hktb.com/en/research_statistics/index.html.

- Kang, C-D. (2019). Effect of Neighbourhood Income and Consumption on Retail Viability: Evidence from Seoul, Korea. Habitat International 2019, 94, 102060. [CrossRef]

- Ke, Q. & White, M. (2015). Retail Rent Dynamics in Two Chinese Cities. Journal of Property Research 2015, 32, 324–340.

- Lau, H. F., Sin, L. Y. M., & Chan, K. K. C. (2005). Chinese cross-border shopping: An empirical study. Journal of Hospitality & Tourism Research 2005, 29, 110–133.

- Lee, J-S. & Choi, M. (2019). Examining the Asymmetric Effect of Multi-Shopping Tourism Attributes on Overall Shopping Destination Satisfaction. Journal of Travel Research 2019, 59, 295–314.

- Li, L.H., Cheung, K.S. & Han, S.Y. (2018). The impacts of cross-border tourists on local retail property market: An empirical analysis of Hong Kong. Journal of Property Research 2018, 35, 252–270.

- Liu, J. & Wang, R. (2010). Attractive model and marketing implications of Theme Shopping Tourism destination. Chinese Geographical Science 2010, 20, 562–567.

- Liu, Y., Yang, L. & Chau, K.W. (2020). Impacts of Tourism Demand on Retail Property Prices in a Shopping Destination. Sustainability 2020, 12, 1361. [CrossRef]

- Makkonen, T. (2016). Cross-border shopping and tourism destination marketing: The case of Southern Jutland, Denmark. Scandinavian Journal of Hospitality and Tourism 2016, 16, 36–50. [CrossRef]

- Mehta, S., Jain, A. & Jawale, R. (2014). Impact of Tourism on Retail Shopping in Dubai. International Journal of Trade, Economics and Finance 2014, 5, 530–535.

- Nanda, A., Xu, Y. & Zhang, F. (2021). How would the COVID-19 pandemic reshape retail real estate and high streets through acceleration of e-commerce and digitalization? Journal of Urban Management 2021, 10, 110–124.

- Nguyen, X., Chao, C.C., Sgro, P. & Nabin, M. (2016). Cross-border Travellers and Parallel Trade: Implications for Asian Economies. The World Economy 2016, 40, 1531–1546.

- Piron, F. (2002). International out-shopping and ethnocentrism. European Journal of Marketing 2002, 36, 189–210. [CrossRef]

- SCMP (2019). Hong Kong will keep crown world’s top destination for visitors in 2019 despite protests, research firm Euromontinor forecasts, South China Morning Post, Dec 3. https://www.scmp.com/news/hong-kong/politics/article/3040292/hong-kong-will-keep-crown-worlds-top-destination-visitors.

- Sharma, P., Chen, I., & Luk, S. (2018). Tourist shoppers’evaluation of retail service: A study of cross-border versus international outshoppers. Journal of Hospitality & Tourism Research 2018, 42, 392–419.

- Silva, E.S. & Hassani, H. (2022). ‘Modelling’ UK tourism demand using fashion retail sales. Annals of Tourism Research 2022, 95, 103428.

- Sirmans, C. & Guidry, K. (1993). The Determinants of Shopping Center Rents. Journal of Real Estate Research 1993, 8, 107–115.

- Timothy, D. J. (2005). Shopping tourism, retailing and leisure. Clevedon: Channel View.

- Tsolacos, S. (1995). An econometric model of retail rents in the United Kingdom. Journal of Real Estate Research 1995, 10, 519–529. [CrossRef]

- UNWTO (2014). Global Report on Shopping Tourism, AM Reports. Madrid: UNWTO. Available online at: https://www.e-unwto.org/doi/book/10.18111/9789284416172.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).