2.a) Car Buying Behaviour in India: Pre-2010

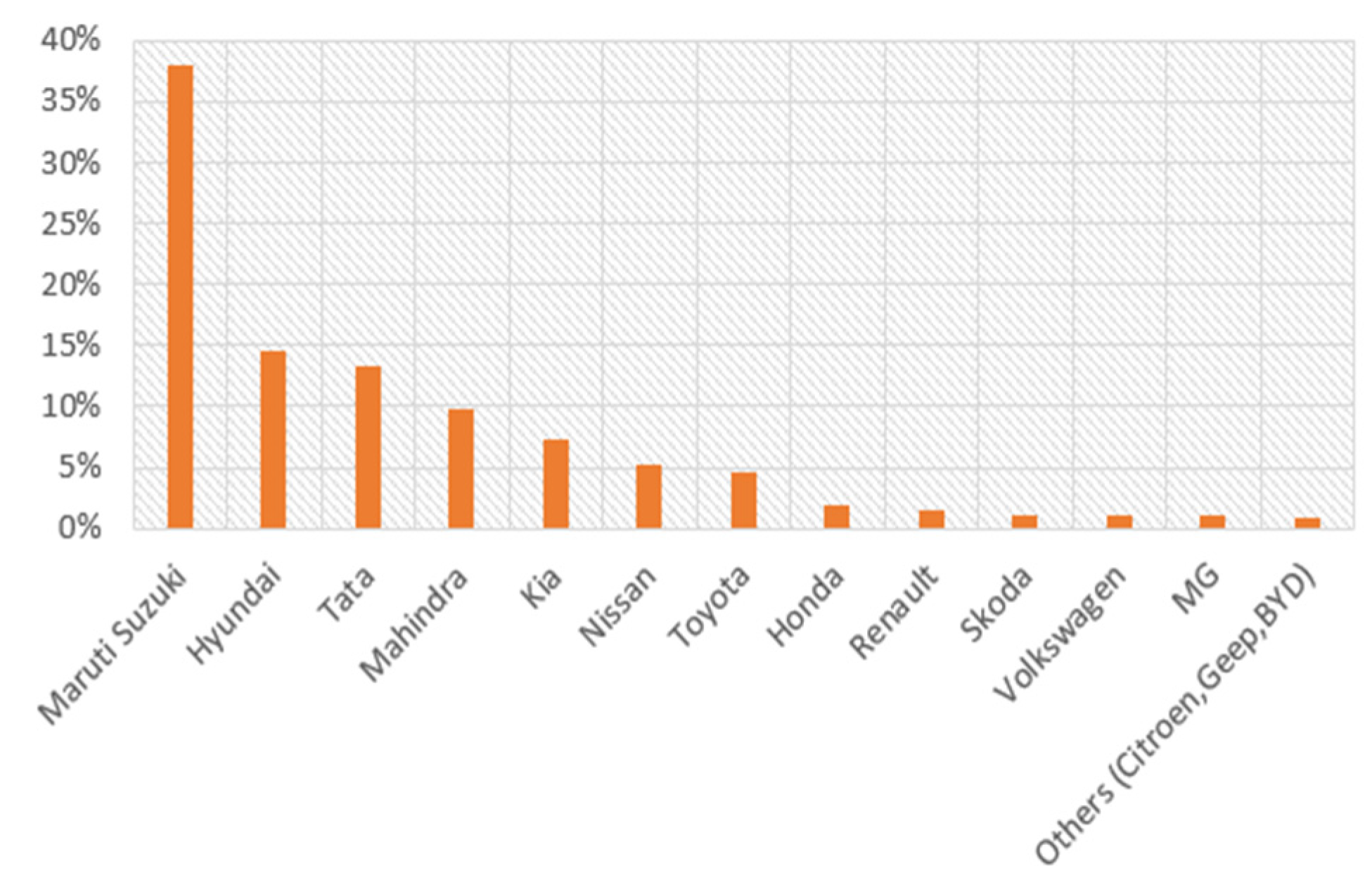

Prior to 2010, traditional consumer preferences played a significant role in shaping car buying behaviour in India. Indian consumers often prioritized factors such as affordability, fuel efficiency, and durability when considering a car purchase. Due to the price sensitivity of the market, cost-consciousness was a prevalent characteristic among buyers. This led to a higher demand for compact and entry-level cars that offered good value for money. According to industry data, the Indian automotive market witnessed a surge in the sales of compact cars during this period. In 2009-2010, compact cars accounted for approximately 70% of the total passenger vehicle sales in India (Source: Society of Indian Automobile Manufacturers, SIAM). Models like Maruti Suzuki Alto, Hyundai Santro, and Tata Indica were popular choices among consumers due to their affordability and fuel efficiency. Furthermore, brand reputation played a crucial role in consumer decision-making. Established and trusted brands, such as Maruti Suzuki, Tata Motors, and Hyundai, enjoyed a dominant market share during this period. Consumers sought vehicles from manufacturers known for their reliable performance, strong service networks, and favourable resale value.

Moreover, the perception of owning a car as a symbol of social status and aspiration influenced consumer choices. As the middle class expanded, there was a growing desire to upgrade from two-wheelers to four-wheelers, leading to an increase in demand for mid-size and premium cars. Data from market research indicated that in the pre-2010 period, consumers relied heavily on word-of-mouth recommendations, personal experiences, and advice from friends and family when making car purchase decisions.

2.b) Factors influencing purchasing trends in the Indian Car Market Today

- i.

Changing demographics and income levels:

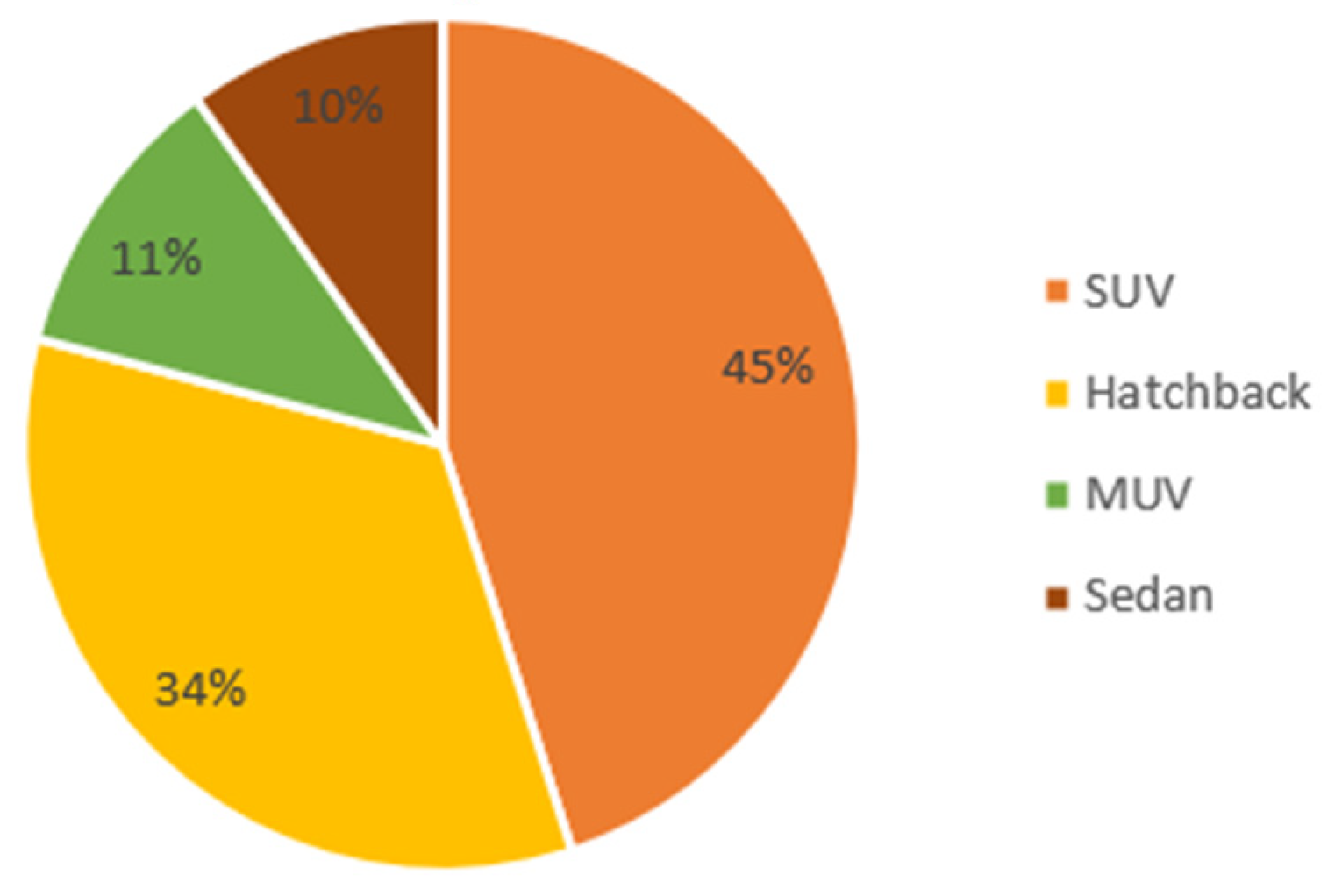

Changing demographics and income levels have played a significant role in shaping the evolution of car buying behaviour in India. The country has experienced a remarkable increase in its middle-class population and disposable incomes, leading to a shift in consumer preferences towards more aspirational and higher-priced cars. According to ([1] Shukla, 2010), India's middle-class population surged from 25 million in 1996 to over 600 million by 2019. This substantial growth in the middle class has contributed to the rise in car ownership aspirations and the demand for premium and feature-rich vehicles. The escalation of disposable incomes has further fuelled this evolution. India's per capita income witnessed a compound annual growth rate (CAGR) of approximately 7% between 2010 and 2020, reaching $2,104 in 2020, as reported by the ([2] International Monetory Fund, 2021). With more disposable income at their disposal, consumers are now able to allocate a larger portion of their earnings towards car purchases.

- ii.

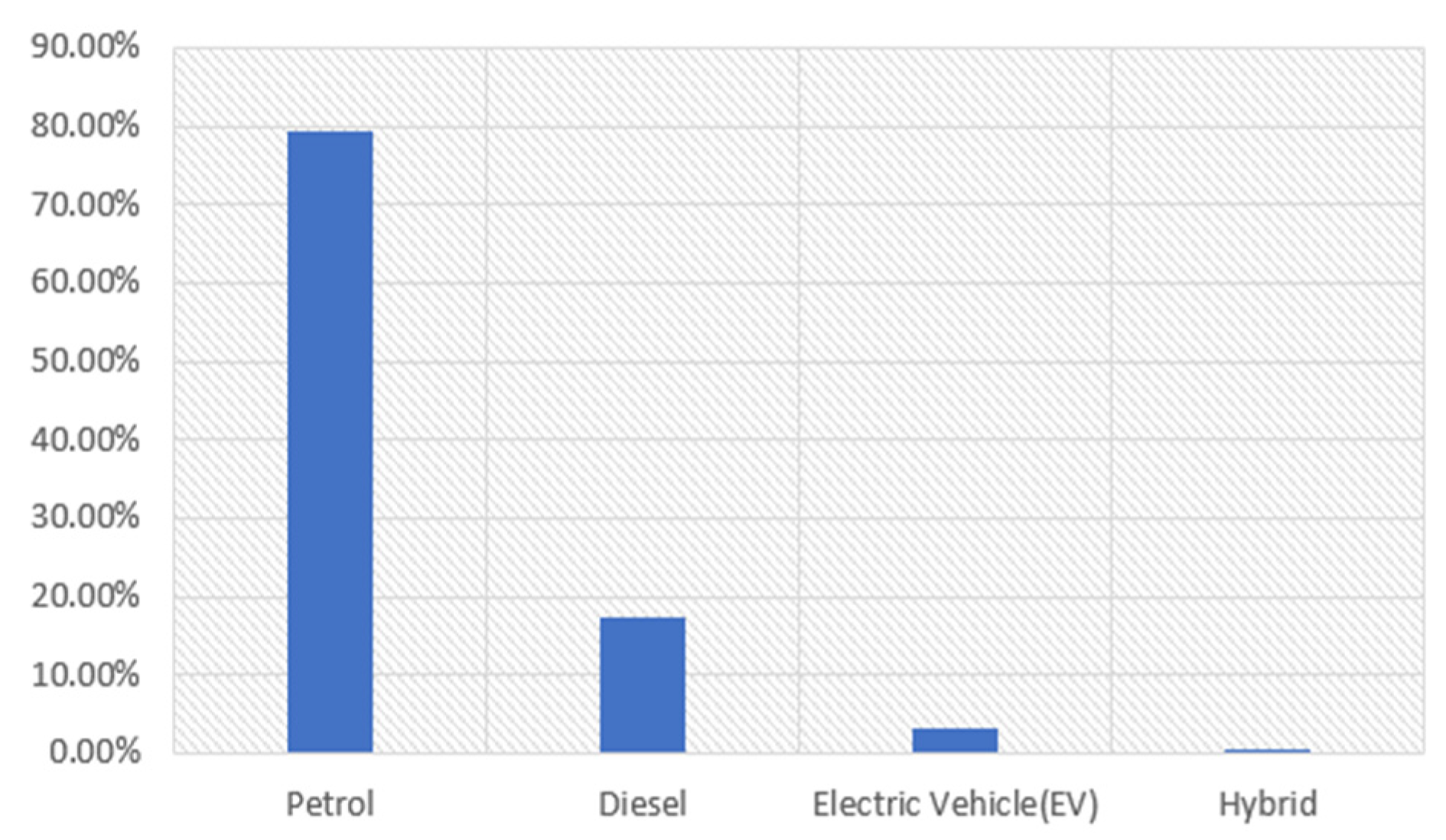

Environmental consciousness and sustainability:

Growing environmental consciousness and a focus on sustainability have had a significant impact on car buying behaviour in India. Consumers are increasingly seeking more eco-friendly and fuel-efficient options due to concerns about pollution and climate change. According to a study by ([3] Vatsa, 2021) approximately 70% of Indian consumers consider the environmental impact of their vehicle purchases. They are inclined to choose vehicles with lower carbon emissions and higher fuel efficiency. Furthermore, the availability of electric vehicle (EV) models has contributed to the rise in EV adoption. According to the market analysis report conducted by ([4] Grand View Research, 2021) the sales of electric vehicles in India grew by 37.5% in the fiscal year 2020-2021, reaching over 3.8 lakh EVs sold.

- iii.

Role of the internet and social media:

The advent of the internet and the widespread adoption of social media platforms have had a transformative impact on car buying behaviour. The availability of online information and social networking platforms has empowered consumers with easy access to a wealth of resources and opinions related to car purchases. According to a study by ([5] Sharma, 2018) around 80% of car buyers in India use the internet for research before making a purchase decision. This indicates the significant role of the internet in influencing consumer behaviour. Social media platforms, such as Facebook, Twitter, and Instagram, have emerged as influential channels for consumers to seek recommendations, reviews, and experiences from fellow car buyers.

Also, Online research and comparison platforms have become instrumental in the car buying process, allowing consumers to gather information, compare different models, and make informed decisions. Websites, mobile applications, and online automotive portals provide comprehensive details about car specifications, features, pricing, and user reviews. Popular online platforms, such as CarDekho, CarWale, and Autoportal, have witnessed significant growth and engagement, indicating the increasing reliance on digital platforms for car-related information.

- iv.

Social media influencers:

Social media influencers have become influential figures in the automotive industry, impacting consumer preferences and purchase decisions ([6] M, 2018).With a substantial following and expertise in the field, influencers shape perceptions and generate interest in specific car models and brands ([7] Brauer, 2022). Companies recognize the significance of social media influencers as a marketing factor and invest millions of dollars in influencer partnerships. These collaborations leverage the influencers' online presence and allow companies to reach a wider audience, increase brand awareness, and influence consumer behaviour.

- v.

Emphasis on safety features:

In recent years, Indian car buyers have shown a significant focus on safety features when purchasing vehicles. The safety of themselves and their families is now a top priority, resulting in increased demand for cars equipped with advanced safety technologies. Mandatory safety features such as dual airbags, anti-lock braking systems (ABS), seatbelt reminders, speed alert systems, and rear parking sensors, among others. under the Bharat Stage 6 (BS6) emission standards have played a crucial role in shaping these preferences.

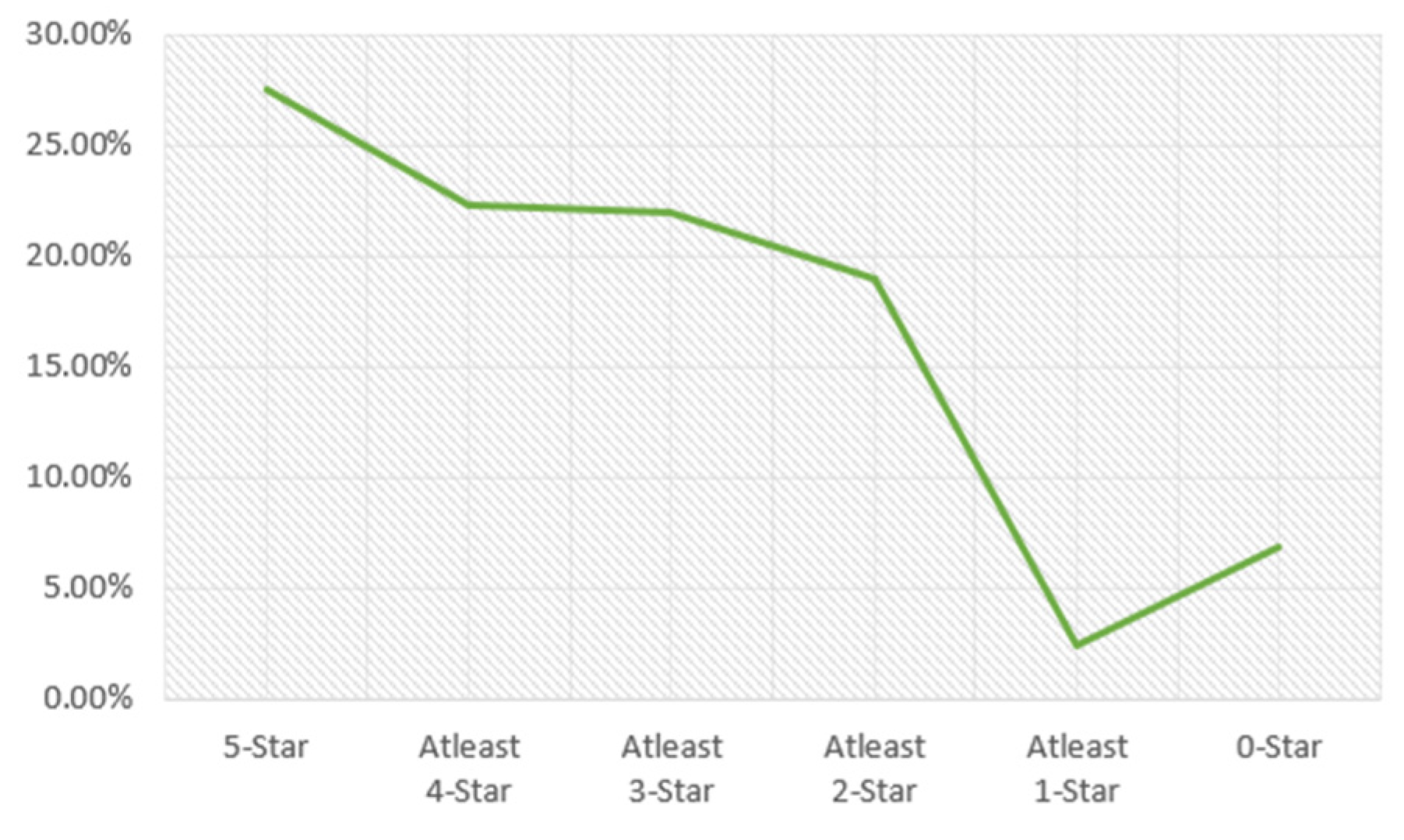

Furthermore, the Global New Car Assessment Program (Global NCAP) rating, particularly a 5-star rating, is highly valued by Indian consumers as it signifies a higher level of safety performance in the event of a crash.

- vi.

Importance of brand reputation and trust:

Consumer behaviour in India is influenced by brand reputation and trust ([8] Danish, 2018). Once satisfied with a brand, consumers tend to develop a strong affinity and loyalty towards it due to their habitual nature ([9] UNNIKRISHNAN, 2013). Thus, Brand reputation serves as a foundation for consumer trust and plays a crucial role in shaping purchase decisions. Research suggests that consumers consider factors such as reliability, quality, and after-sales service when evaluating a brand's reputation ([10] Hassanzade, 2019). Positive experiences with a brand lead to increased satisfaction and reinforce consumer loyalty.

- vii.

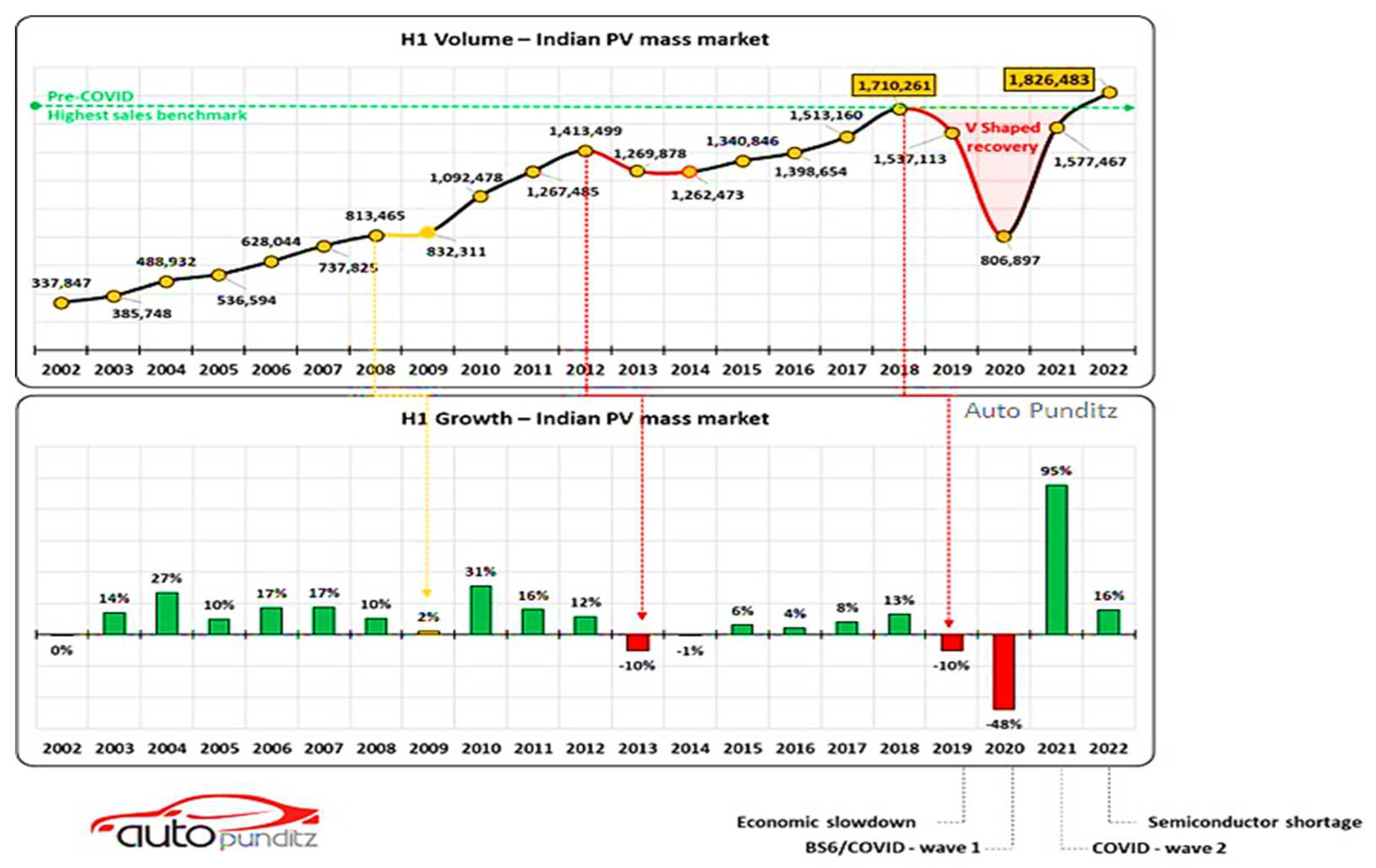

Impact of COVID-19 Pandemic:

The COVID-19 pandemic has had a profound impact on car buying behaviour in India. Concerns over public transportation and shared mobility options have led to a shift towards personal transportation, such as car ownership. Approximately 65% of Indian consumers expressed a preference for personal vehicles due to safety concerns during the pandemic, according to a study by ([11] Chatterje, 2021). The need for physical distancing and reduced exposure to crowded spaces have driven consumers to prioritize the convenience and perceived safety of owning a car. This shift has led to increased interest in car ownership, particularly in urban areas where public transportation was previously the primary mode of travel.

Additionally, the pandemic has accelerated the digitalization of the car buying process in India. With restrictions on physical showrooms and dealerships, consumers have increasingly turned to online platforms to research, compare, and purchase vehicles. Online inquiries for car purchases surged during the pandemic, according to a survey by CarDekho.com. Consumers have embraced virtual showrooms, video consultations, and digital transactions, providing convenience and safety while expanding access to a wider range of options and information. Car manufacturers and dealerships have adapted by offering virtual test drives, immersive online experiences, and contactless delivery options to meet the evolving needs of consumers in this digital era.