Introduction

Creating favorable conditions to attract foreign direct investment (FDI) is critical to producing globally competitive goods and promoting economic growth. Free economic zones (FEZs) have proven to be important drivers in this regard. They have evolved from simple, low-cost operations focused on quick sales to complex, multisectoral, and capital-intensive choices. Uzbekistan has recognized the importance of FEZs in achieving high economic growth and has placed great emphasis on establishing and developing these zones. FEZ activity has increased significantly in recent years, especially since the change in state administration in 2017. Uzbekistan is focused on developing FEZs because of their potential to promote entrepreneurship, stimulate local economic growth, and contribute to overall national development. The government's successful policy reforms and proactive engagement in international dialog have led to a significant increase in foreign direct investment flowing into the Uzbek economy. However, despite these positive developments, certain obstacles remain that hinder the inflow of FDI into the free economic zones. These obstacles include various factors such as FEZ administrative systems, logistical infrastructure, energy issues, and other related challenges. It is critical to address these constraining factors because FEZs are not free of geographic dimensions, including their spatial patterns, location, and industrial positioning. Therefore, a comprehensive geographic study is essential to examine these variables and highlight the importance of economic geography in the context of FEZs.

In addition, it is important to shed light on the relationship between Uzbekistan and China in terms of foreign direct investment in FEZs. Deepening cooperation between the two countries has played a crucial role in attracting Chinese investment to Uzbekistan's FEZs. Chinese investors have shown great interest in taking advantage of the country's strategic location, abundant resources, and favorable investment climate. Analysis of Uzbekistan-China relations related to FDI in FEZs can provide valuable insights into the dynamics of international investment and highlight Uzbekistan's comparative advantages. So, in this study, we aim to explore the above variables and shed light on the crucial role of economic geography in understanding and addressing the limiting factors for FDI in Uzbek free trade zones. In this way, we aim to contribute to the existing literature on institutional change, political dynamics, and the performance of the Chinese economy while providing a comparative perspective that examines the development process in Uzbekistan relative to other countries.

Theoretical Background

Geographic research plays a critical role in the study of free trade zones by analyzing the spatial aspects of location, place, and space as they relate to FDI flows into these zones. This analysis helps in formulating effective policies to promote economic growth. In addition, government agencies can use the results of geographic studies to develop strategies for attracting FDI focused on technology and innovation in specific free economic zones. Investors can also benefit from spatial analysis by gaining valuable insights about a particular free trade zone. Economic geographers have developed scientific theories about the impact of FDI on regional development, particularly in the context of uneven economic growth (Suwala, 2013). Scholars such as Ray Vernon (1966), Richard Caves (1971), Peter Buckley and Mark Casson (1976), Stephen Hymer (1976), and John Dunning (1977) have made important contributions to understanding the conceptualization of FDI from a spatial perspective. They have also studied the long-term impact of FDI on local development in developing countries, including Uzbekistan (Cohen, 2007).

In this context, two crucial elements should be highlighted, especially in relation to the Chinese economy. First, in a capitalist system, companies are driven by profit-oriented strategies, and FDI becomes a necessity for investment companies. Consequently, the region's interests do not always take precedence. Second, the long-term impact of FDI on recipient regions can be both positive and negative, depending on various circumstances. The scale and nature of the investment are critical factors in this regard. In addition, the capabilities and absorptive capacity of firms in the host country play a crucial role (Farole et al., 2014; Dicken, 2015). Thus, the actual outcomes of FDI in specific locations depend on striking a balance between these different aspects. Understanding the multiple impacts of FDI requires a keen awareness of regional and local contexts. Scholars such as Caves (1971) have emphasized the distinction between horizontal and vertical FDI and the important differences between these two types. Horizontal FDI, driven by market creation and demand, tends to foster stronger and more stable linkages with the host economy (Pavlínek, 2018; Dicken, 2015). Vertical FDI, on the other hand, tends to be supply-driven, targeting efficiency or access to resources. This involves relocating certain production steps to other countries (Milberg et al., 2013). However, when more favorable opportunities arise elsewhere, this type of investment is often relocated. Consequently, these factors contribute to the regional economic impact of FDI (Santangelo, 2009), which has different effects on regional development depending on the concentration of FDI in different regions (Alvarado et al., 2017).

In the case of Uzbekistan's free economic zones, it is important to examine the dynamics of FDI in the context of relations with China. China's economic influence and investment activities are important both globally and in the Central Asian region. Analyzing interactions between China and Uzbekistan, particularly with regard to FDI in free economic zones, can provide valuable insights into Uzbekistan's comparative advantages, the role of Chinese investors, and the potential for bilateral economic cooperation. Understanding these dynamics is critical for a comprehensive analysis of institutional change, political dynamics, and the performance of the Chinese economy while comparing the development processes in China and Uzbekistan.

Free economic zones have become a significant global economic phenomenon that has attracted considerable attention in both theoretical and empirical studies. Classic studies have focused on the establishment and operation of international free trade zones (Balasubramanyan, 1998; Meng, 2005). In addition, numerous studies have examined the economic impact and role of special economic zones (SEZs) in developing countries (Wang, 2013; Brussevich, 2020). Export processing zones have also been the subject of extensive research examining their dynamics and impacts (Warr, 1989; De Armas et al., 2002; Engman et al., 2007). Theoretical foundations have provided a basis for understanding the economic consequences, including benefits and costs, of free economic zones. For example, the "Heck-Ohlin" trade model has been used to analyze these zones (e.g., the Heck-Ohlin trade model). Moreover, studies have examined the spatial evolution of free economic zones in addition to their broader theoretical framework (Grubel, 1982). In this study, we look at the theoretical and practical characteristics of free trade zones in different ways to examine how these zones develop economically and spatially and what factors underlie their development.

Thus, this study also sheds light on the relationship between free economic zones and regional economic integration. Because free economic zones often serve as catalysts for economic growth and international trade, it is critical to understand their role in promoting regional economic integration. Analyzing the interplay between free economic zones and regional economic integration offers valuable insights into the broader economic dynamics and potential synergies that arise from these zones. Moreover, in the context of Uzbekistan, examining the relationship between free economic zones and the Chinese economy is particularly important. China's extensive experience in establishing and operating various types of economic zones, including free trade zones and special economic zones, has attracted international attention. Assessing the similarities and differences between the Chinese experience and the development of free trade zones in Uzbekistan contributes to a comprehensive understanding of the institutional changes, policy dynamics, and performance of the Chinese economy. It also provides valuable comparative insights into the development processes in both countries and the potential for bilateral economic cooperation between China and Uzbekistan in the context of free trade zones. By combining theoretical perspectives, empirical analysis, and insights into the Chinese economic landscape, this study contributes to the existing literature on free economic zones, regional economic integration, and China's role in the global economic landscape.

Free economic zones as “place”

Free economic zones are conceived not only as economic entities, but also as distinct geographic locations with unique characteristics. However, there is no universally accepted definition for the term "free economic zone," leading to ambiguity in understanding and describing them. The Kyoto Convention outlines the basic characteristics of free economic zones and emphasizes their role as special places for the import and export of goods. Nonetheless, the different interpretations of free economic zones as places highlight two key challenges in contemporary economic research: 1) the use of the term as a generalized concept to capture a place, and 2) the need for a clear and comprehensive explanation of the nature of these places.

In academic literature and annual reports, international groups often use the term "free economic zone" to describe various "spaces" This term, however, does not capture the full essence of these zones. While economic regulations within free economic zones provide certain benefits and facilitations to companies operating there, they do not provide absolute freedom from legal and economic conditions. Uzbek economists Vahabov A., Khajibakiev Sh. and Muminov N. define free economic zones as places reserved for the activities of domestic and international companies and subject to certain restrictions. Similarly, Mirzalivea S., Raimjonova M. and Ostonakulov A. consider free economic zones as places with specific administrative and economic privileges.

In the context of place, a free economic zone refers to a geographically defined area that has specific economic characteristics within a country. Such zones provide an exclusive economic environment in which both local and international entrepreneurs can thrive. However, the "economic freedom" that prevails in free economic zones should not be interpreted as absolute freedom. From our perspective, a free economic zone is a controlled space within a state where the rule of law prevails and where imported goods are considered "free" from national customs jurisdiction. In essence, a free economic zone represents an "artificial trade zone" that contributes to the national economy. Geographically, these zones often have the characteristics of an "enclave" surrounded by the host country or neighboring states. The degree of government intervention in the economy within these zones is limited. Free economic zones enjoy certain privileges that do not exist in other parts of the country.

The purpose of this section is to examine the factors that impede the flow of foreign direct investment (FDI) in free economic zones, particularly in the context of Uzbekistan. Developing countries face several constraints that limit FDI, including a lack of highly skilled labor, limited technological progress, and small current or future markets (Pavlínek, 2022). A lack of local suppliers and potential business partners, as well as inadequate infrastructure and high transportation costs, further hinder FDI in free economic zones (Chang et al., 2020). In addition, the absence or weakness of local institutions and limited innovation capacity negatively affect FDI inflows. For FDI to have a positive impact, firms in export processing zones must have the capacity to innovate and absorb new ideas (Giroud et al., 2009; Santangelo, 2009; Sturgeon et al., 2010). Studies indicate that Uzbekistan exhibits these aforementioned variables (Musaev, 2019). While the state administration in Uzbekistan recognizes and prioritizes these challenges, there is a notable lack of economic geography research that focuses specifically on these factors. This study aims to fill this research gap and contribute to the existing literature by providing valuable insights into the economic geography of free economic zones and their impact on foreign direct investment in Uzbekistan.

Besides, this study also considers the relevance of China's experience in developing free trade zones. China has pioneered the establishment and operation of various types of economic zones, including free trade zones and special economic zones. Based on evidence from the Chinese economic landscape, this study aims to compare and contrast the development processes, institutional changes, political dynamics, and performance of free trade zones in China and Uzbekistan. Analyzing the similarities and differences between these two contexts contributes to a more comprehensive understanding of the economic dynamics, challenges, and potential opportunities for bilateral economic cooperation between China and Uzbekistan in the context of free trade zones. By conducting an economic geography analysis and combining theoretical perspectives with empirical evidence, this study aims to advance the understanding of free economic zones as unique places with distinctive economic characteristics. The results will shed light on the factors that influence FDI flows within these zones, provide insights into the challenges faced by developing countries such as Uzbekistan, and contribute to the existing literature on economic geography and the role of free trade zones in regional development and international trade.

Methods and Data Collection

This study employed document analysis as the primary qualitative research method. The research relied largely on electronic documents to gather relevant information and insights. Data sources included the state internet press, trade-related departments and agencies in Uzbekistan. In addition, raw data were collected from government agency reports available on websites such as

www.lex.uz, www.miit.uz, and

www.stat.uz. Annual reports from respected international organizations such as UNCTAD (

www.unctad.org), UNECE (

www.unece.org), and the World Bank (

www.data.worldbank.org) were also used to ensure a comprehensive analysis. Given the relatively limited research on FDI in free economic zones from an economic geography perspective in Uzbekistan, this study focused on identifying and analyzing the factors limiting FDI inflows. Although no empirical analysis or case study was conducted, the study recognizes the importance of examining each of the identified factors separately. By choosing a qualitative approach, the study aimed to provide insights, explanations, and potential solutions to the challenges associated with FDI in Uzbekistan's free economic zones, thereby contributing to the body of knowledge in economic geography. Given the emphasis on institutional change, policy, and the performance of the Chinese economy, this study recognizes the value of comparative analysis. Drawing on the experiences and lessons of China's development process, a comparative perspective is integrated into the discussion to highlight similarities and differences between China and Uzbekistan. This approach enhances the understanding of free economic zones in both countries and facilitates the identification of potential avenues for bilateral economic cooperation. By providing nuanced insights into the development paths of these two countries, this study contributes to the broader literature on economic geography and offers valuable perspectives on the role of free trade zones in regional development and international trade.

Direct Investment Flows in Uzbekistan

In this study, we target to examine the long-term impact of foreign direct investment (FDI) on regional growth in developing countries, focusing specifically on Uzbekistan. Although Uzbekistan has been independent for over 30 years, it still faces challenges such as a low median income ($2,572.7 per capita, World Bank, 2021), high unemployment (7.16%, stat.uz, 2021), a shortage of skilled labor (with an unemployment rate of 8.8% among the employed population, mehnat.uz, 2022), and relatively low levels of innovation (ranked 82 out of 131 countries in terms of innovative development, globalinnovationindex.org, 2022). These factors could potentially affect the country's ability to attract FDI. However, it is worth noting that the flow of FDI through official channels has increased in response to rapid changes in the Uzbek government. Despite the positive trends, the above challenges may still affect the actual growth of FDI. World Bank data indicate a significant increase in FDI since 2018, peaking in 2019. Multinational companies often use FDI as a strategy to expand their international operations (Phelps et al., 2018), and Uzbekistan, as a developing country, is naturally eager to benefit from the positive impact of FDI.

Recent data from Uzbekistan show that FDI increased by $0.6 million and the current account balance showed a positive surplus of $673.6 million in September 2022 (ceicdata.com and nbu.uz, 2022). However, it is critical to recognize that there are obstacles affecting FDI flows that, if not effectively addressed, may affect future growth indicators. Since 2017, the Uzbek government has initiated strategic alliances, cooperation agreements, and methods to promote the digital economy that aim to optimize the distribution of labor and facilitate the selection of suitable locations for regional growth (Casella et al., 2018; Alon et al., 2021). The current government in Uzbekistan is aware of these barriers and is actively implementing measures to address them (miit.uz, 2022). It is important to recognize the dynamic nature of FDI inflows and their potential impact on the economic landscape of Uzbekistan. By analyzing the patterns, trends, and challenges associated with FDI, this study aims to provide valuable insights and recommendations that contribute to a deeper understanding of the relationship between FDI and regional growth in Uzbekistan.

The impact of China's FDI policies and free economic zones on FDI flows to Uzbekistan.

China's foreign direct investment (FDI) policies have played a significant role in shaping China's economic landscape and have also affected FDI flows to other countries, including Uzbekistan. China has actively promoted FDI through various policies to attract foreign investors. The Chinese government has implemented a number of reforms to create a favorable business environment, streamline administrative procedures, and provide incentives for foreign investors. One of the most important policies that has facilitated the influx of foreign direct investment from China is the "Going Global" strategy, which encourages Chinese companies to invest overseas. This strategy has led to a surge in Chinese outbound investment, including investment in countries along the Belt and Road Initiative (BRI), which includes Uzbekistan. China's BRI aims to improve connectivity and promote economic cooperation between regions. This has opened up opportunities for Chinese companies to invest in Uzbek infrastructure development projects and other sectors. In recent years, the inflow of foreign direct investment from China to Uzbekistan has increased significantly. Chinese companies have invested in sectors such as energy, transportation, telecommunications, manufacturing, and agriculture. These investments have not only brought capital and technology transfer but also contributed to job creation and economic growth in Uzbekistan. The Chinese government has actively supported these investments through bilateral agreements, investment protection mechanisms, and the provision of financial assistance. China's experience and success in developing free economic zones (FEZs) has also influenced Uzbekistan's approach to establishing and developing its own FEZs. China has taken steps to attract foreign direct investment into its FEZs by offering tax incentives, simplified administrative procedures, and preferential treatment for foreign investors. These FEZs have served as a catalyst for economic growth, export promotion, and technology transfer in China.

Uzbekistan has recognized the potential benefits of EPZs and has also established its own zones to attract foreign direct investment and spur economic development. The Uzbek government has taken steps to create a business-friendly environment in these zones, including tax exemptions, simplified customs procedures, and infrastructure development. Uzbekistan's EPZs have sought to leverage the experience of successful Chinese zones by adopting best practices and learning from their strategies. The Chinese experience with FEZs provides Uzbekistan with valuable insights on policy design, infrastructure development, and attracting foreign investors. By studying the Chinese approach to FEZs and understanding the factors that have contributed to their success, Uzbekistan can adapt its own policies and strategies to increase the effectiveness and attractiveness of its FEZs. This knowledge transfer and experience sharing between China and Uzbekistan can further strengthen economic cooperation and contribute to the growth of both countries' economies. Thus, China's FDI policies, outward investment strategies, and experience with FEZs have had a significant impact on FDI flows from China to Uzbekistan. The mutually beneficial relationship between the two countries has promoted economic cooperation, technology transfer, and regional development. By benefiting from China’s FDI and FEZ experience, Uzbekistan can further improve its investment climate, attract more Chinese investment, and promote sustainable economic growth.

Spatial Patterns of Free Economic Zones

-

1)

Location

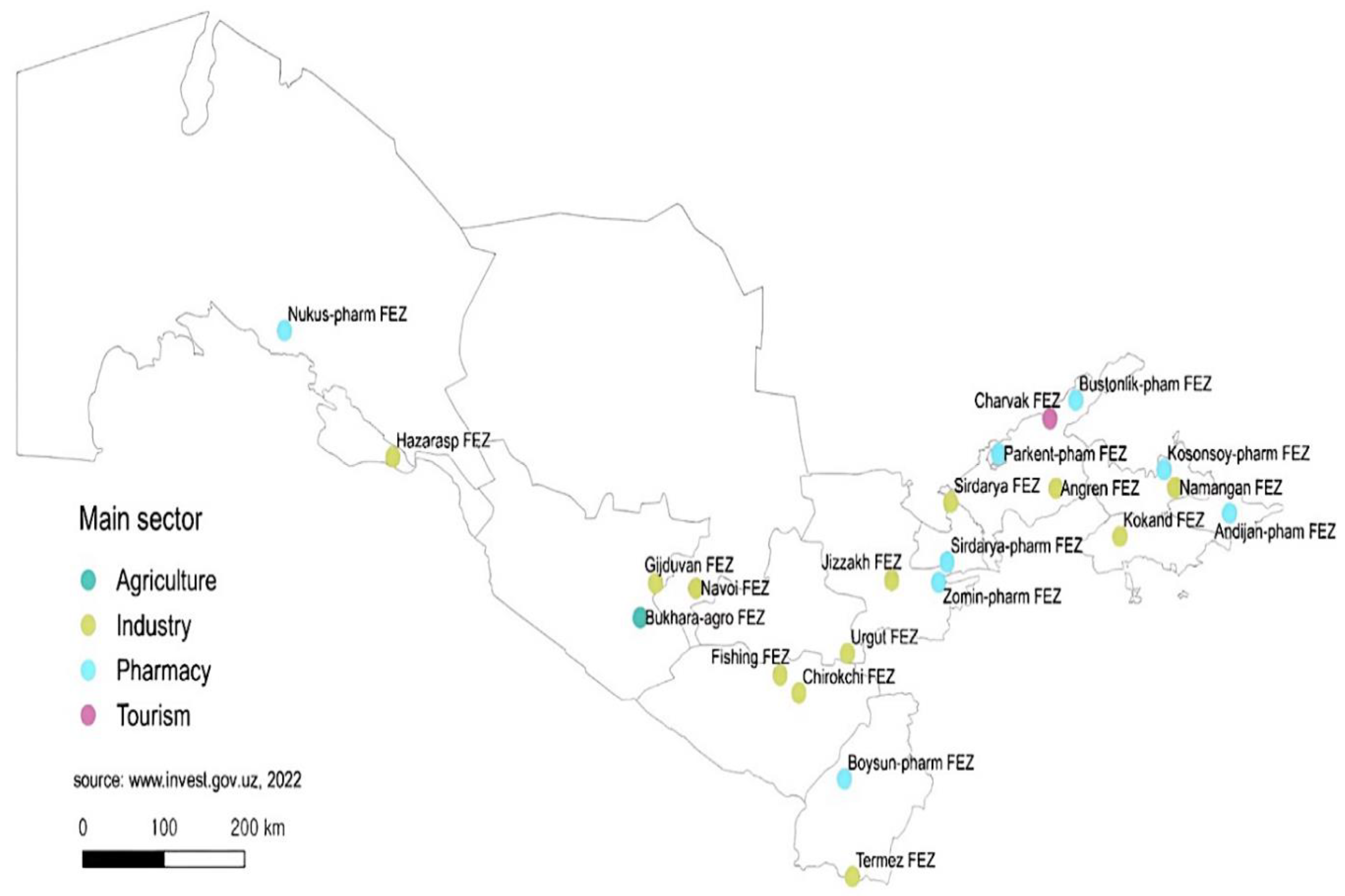

The establishment of free economic zones (FEZs) in Uzbekistan has shown a different spatial pattern. Between 2008 and 2022, 22 FEZs were established in 13 regions. These zones have been driven primarily by development initiatives and bilateral cooperation agreements. Most FEZs in Uzbekistan are specialized in the industrial sector, but there are also zones for the pharmaceutical, tourism, and agricultural sectors (Fig. 1). The concept of FEZs as an innovative mechanism for economic transformation in Uzbekistan was first introduced in the 1990s (Vahabov et al., 2010). Subsequently, on April 25, 1996, the government enacted a law entitled "On Free Economic Zones," which regulates the development of economic zones in the country, including free trade zones, industrial zones, and technology zones (

www.lex.uz).

Figure 1.

Free economic zone and their location. Source:

www.invest.gov.uz (Author drew the map using the source data).

Figure 1.

Free economic zone and their location. Source:

www.invest.gov.uz (Author drew the map using the source data).

-

A)

Navoi FEZ.

The first FEZ, "Navoi FEZ," was established in 2008 in Navoi province and covers an area of 500 hectares (

www.feznavoi.uz). The choice of Navoi as the location for this FEZ was influenced by several geographic factors. In particular, Navoi FEZ is strategically located near the E-40 European Highway, which connects Europe and China, and the railroad line that leads to the Persian Gulf. This advantageous spatial positioning makes Navoi an important transit point for major railroad lines, including the shortest connection between China and Europe (Khalilova, 2013). The importance of this route is that it provides Uzbekistan with access to extensive global markets that include Central Asia, CIS, Southeast Asia, Europe, the Middle East, and the Persian Gulf. However, the challenges associated with using this route are discussed in more detail in the "Discussion" section. In addition, Navoi Province is distinguished by its proximity to over 40 major cities in 11 countries, including Central Asia, the Middle East, India, and China, within a 2000-kilometer radius. Consequently, Navoi has excellent connectivity to international transportation corridors such as the Asian Highway Network, which provides access to ports in Iran, the Asia-Pacific region, Russia, and the Baltic States (

www.unescap.org).

-

B)

Angren FEZ and other provincial zones

The establishment of "Angren FEZ" in 2012 in the city of Angren in Tashkent Province aimed to exploit the region's production and resource potential while fostering economic ties with companies in the Fergana Valley, 250 kilometers away. The city of Angren is a major transportation hub connecting Uzbekistan's capital, Tashkent, with the Fergana Valley. It is also strategically located on the highway connecting Uzbekistan to China via Kyrgyzstan, further increasing its spatial importance. The provinces of Samarkand, Bukhara, Fergana, and Khorezm are well suited for industries such as agriculture, textiles, pharmaceuticals, and engineering. Therefore, FEZs such as "Urgut FEZ" (in Samarkand), "Gijduvon FEZ" (in Bukhara), "Kukon FEZ" (in Fergana), and "Hazorasp FEZ" (in Khorezm) were established after 2017 (

www.lex.uz: Decree PF -4931).

Other provinces, namely Jizzakh, Namangan, Syrdarya, Surkhandarya, Tashkent and the Republic of Karakalpakstan, have specific advantages for pharmaceutical industry and production of raw materials from medicinal plants. As a result, FEZs such as "Nukus-pharm FEZ" (in Karakalpakstan), "Zomin-pharm FEZ" (in Jizzakh), "Kosonsoy-pharm FEZ" (in Namangan), "Syrdaryo-pharm FEZ" (in Syrdarya), "Boysun-pharm FEZ" (in Surkhandarya), "Bustonlik-pharm FEZ" and "Parkent-pharm FEZ" (in Tashkent province) were established. In addition, the tourism potential of Tashkent Province led to the establishment of "Charvak FEZ"," while the presence of the Chirchik River, which is connected to the Shardara Reservoir and Lake Aydar in South Kazakhstan, enabled the establishment of a "Fishing FEZ" Another "Fishing FEZ" was established in Kashkadarya Province near the Chimkurgan Reservoir. In addition, two more FEZs, namely "Namangan FEZ" and "Andijan FEZ"," were established in Fergana Valley in 2018 to increase export potential with neighboring countries of Tajikistan and Kyrgyzstan. The establishment of these FEZs in Uzbekistan benefits from the experience of several developed countries, but the challenges in these zones may have a negative impact on FDI flows, which is discussed in the following section on limiting factors for FDI.

Innovative projects

In the period from 2008 to 2021, 448 projects were launched in the free economic zones of Uzbekistan, with a total value of

$2.4 billion and the creation of about 34,000 jobs (

Table 1). Among these investments, foreign direct investment (FDI) accounted for USD 764.6 million (

www.gazeta.uz, 2021). However, a breakdown of FDI by individual free economic zones, industries, or types of production is not readily available. Nevertheless, the data suggest that the "Bukhara-Agro" and "Angren" FEZs have played a significant role in terms of the number of projects and investment amounts. By 2020, 128 projects with a total volume of 487.4 million USD were completed in the EPZs (

www.miit.uz).

A significant part of the projects and financial resources was used for the construction of modern greenhouses (

Table 2). Although the official bulletin boards of relevant organizations contain raw data indicating an FDI amount of USD 162.1 million (

www.miit.uz; www.invest.gov.uz), the figures are not clear. There are inaccuracies in the approved funding amounts even when the project numbers are correct. It has been noted that the total approved funding exceeds the reported amount by

$168.8 million (see again

Table 2). In addition, it remains unclear how FDI was allocated to specific projects or sectors due to limited data transparency. These factors contribute to the difficulty in accurately determining the distribution of FDI within the free economic zones.

FDI flows into Free Economic Zones

It is important to look at the dynamics of direct investment flows and policies related to foreign direct investment (FDI) to gain a comprehensive understanding. The purpose of establishing free economic zones (FEZs) in Uzbekistan is to expand and support the production capacity of domestic companies to produce globally competitive goods. The government has granted residents of the free economic zones various tax and customs incentives based on the size of the investment, ranging from

$300,000 to

$10 million for a period of 3 to 10 years (

www.miit.uz). However, one challenge is the uneven distribution of investment attracted by the government (

www.gazeta.uz). The analysis of the FDI policy of China, a leading global investor, is particularly relevant in this context. China has its own successful experience in developing free economic zones. It has introduced a strategic FDI policy that promotes the establishment of Chinese free trade zones as attractive investment destinations. These zones offer preferential conditions such as tax incentives, simplified customs procedures and investment protection to attract foreign investors. China's focus on infrastructure development, technology transfer, and market access has been instrumental in attracting significant FDI inflows to its free economic zones.

FDI inflows from China to Uzbekistan have also been notable. Chinese investors have shown increasing interest in Uzbekistan's free economic zones, attracted by the country's strategic location, natural resources, and potential for economic growth. An accurate breakdown of FDI from China into each free economic zone or industry in Uzbekistan is not readily available. However, the government's promotion of free economic zones as attractive destinations for FDI has led to a significant increase in FDI inflows. According to official statistics, FDI inflows to Uzbekistan amounted to

$2.2 billion in 2017, and by the end of 2022, this figure had increased to

$3.3 billion (

www.i1.md.uz, 2022). Under the government program, USD 764.06 million in FDI was attracted to free economic zones. However, there is a lack of transparent data on the distribution of FDI among free economic zones. It is worth noting that the investment activity and optimistic forecasts in the government reports were associated with the implementation of new investment projects in the free economic zones. According to the reports, 443 new investment projects with a total value of USD 2.9 billion were expected to be implemented in 2021, which would lead to the production of 552 new types of industrial goods and the creation of 41,600 new jobs, with foreign direct investment amounting to USD 1.4 billion (

www.miit.uz). However, the specific breakdown of these figures or the actual implementation of these projects is not readily available.

As for international initiatives, there is still a lack of coordination between FDI in free economic zones and multinational projects. International projects focused on renewable energy and agriculture, for example, are not directly linked to activities in Uzbekistan's free economic zones. However, studies suggest that coordination and synergy between international initiatives and free economic zones can bring significant benefits. Improvement of energy, transport, and water infrastructure in free economic zones can be achieved through cooperation with international projects, which ultimately improves the investment climate. As we examine the uneven distribution of FDI and its impacts, it becomes clear that economic geography plays a critical role in understanding how FDI flows change and how economic activities reorganize spatially. A detailed case study of economic geography in the context of FDI distribution would shed light on this issue and provide valuable insights. In addition, it is essential to explore the factors that limit FDI, as discussed in the following section, as they contribute to the complex dynamics of FDI flows and their spatial patterns.

Government assistance

The creation of a legal framework to regulate the activities of free economic zones (FEZs) demonstrates the Uzbek government's commitment to supporting and promoting these zones. The government has taken steps to simplify the control and management of FEZ activities by decentralizing administrative functions and empowering FEZ management boards in different regions or provinces. This decentralization allows for more efficient decision-making and management processes within the zones.

The government has recognized that there are structural problems and deficiencies that hinder the establishment and functioning of the FEZs and has made additional investments to address these problems. Key challenges include the slow development of transportation and technical communications infrastructure and poor management of the zones. These factors contribute to a less attractive investment environment for potential investors and hinder the implementation of investment projects in FEZs. A notable challenge is the overlapping responsibilities of various state administrative agencies involved in coordinating the operation of the free economic zones. This leads to delays in resolving organizational issues related to the implementation of investment projects. In response, the President of the Republic of Uzbekistan has issued a decree aimed at streamlining the coordination and management system of activities in the free economic zones, with a particular focus on improving investment conditions (

www.lex.uz: President Decree N5600, December 21, 2018)

1. This demonstrates the government's commitment to addressing these challenges and creating a more favorable environment for investment in FEZs.

Table 3.

Expenditures for building access roads.

Table 3.

Expenditures for building access roads.

| Free economic zone |

Kilometers |

Expenditure amount (Billion UZS) |

Expenditure amount (thousand USD*) |

| Navoi |

6,4 |

5 |

411.1 |

| Jizzakh |

7 |

3 |

264.6 |

| Urgut |

65,1 |

15 |

1.3 |

| Nukus Pharm |

1,5 |

1 |

88.2 |

| Kosonsoy-Pharm |

5 |

2 |

176.4 |

| Bustonlik-Pharm |

4,5 |

0.1 |

8.8 |

| Parkent-Pharm |

9 |

1 |

88.2 |

| Total: |

21 |

7.1 |

626.4 |

Table 4.

Expenditures for road reconstruction.

Table 4.

Expenditures for road reconstruction.

| FEZ name |

Kilometers |

Expenditure amount (billion in UZS) |

Expenditure amount (million USD*) |

| Angren |

6,7 |

9.2 |

0.821 |

| Kukon |

10.8 |

15 |

1.33 |

| Hazorasp |

5,6 |

8.9 |

0.786 |

| Total |

10.8 |

33.1 |

2.92 |

Table 5.

Expenditures in the rehabilitation of water supply and sewerage networks.

Table 5.

Expenditures in the rehabilitation of water supply and sewerage networks.

| FEZ name |

Kilometers |

Expenditure amount (billion UZS) |

Expenditure amount (million USD*) |

| Angren |

11 |

11.8 |

1.1 |

| Urgut |

12.7 |

17.2 |

1.5 |

| Kukon |

17,96 |

6.7 |

0.5911 |

| Hazorasp |

4,8 |

1.8 |

0.1588 |

| Kosonsoy Pharm |

6 |

2.4 |

0.2117 |

| Bustonlik Pharm |

3 |

1.5 |

0.1323 |

| Total |

32.7 |

21.16 |

1860 |

However, despite these efforts, there are still factors that affect the flow of foreign direct investment (FDI) into the FEZs. In the following section, we will discuss these factors from an economic geography perspective and provide explanations and recommendations for increasing FDI inflows. It is important to consider these elements in order to further promote the growth and development of free economic zones in Uzbekistan. In addition, it is worth noting that China, as one of the world's leading economies, has also implemented various economic policies and strategies to support its own free trade zones. Understanding China's approach to free economic zones and the economic performance in these zones can provide Uzbekistan with valuable insights for developing its own FEZs.

State Support for Free Economic Zones in China

China has demonstrated a strong commitment to the development and success of its free economic zones (FEZs) through comprehensive government support measures. The Chinese government’s proactive approach and effective policies have contributed to the rapid growth and competitiveness of these zones. Some studies highlight the key aspects of government support for FEZs in China, and here we summarize some findings (Wang & Olivier, 2006; Farole & Akinci, 2011; Chaikouskaya, 2018).

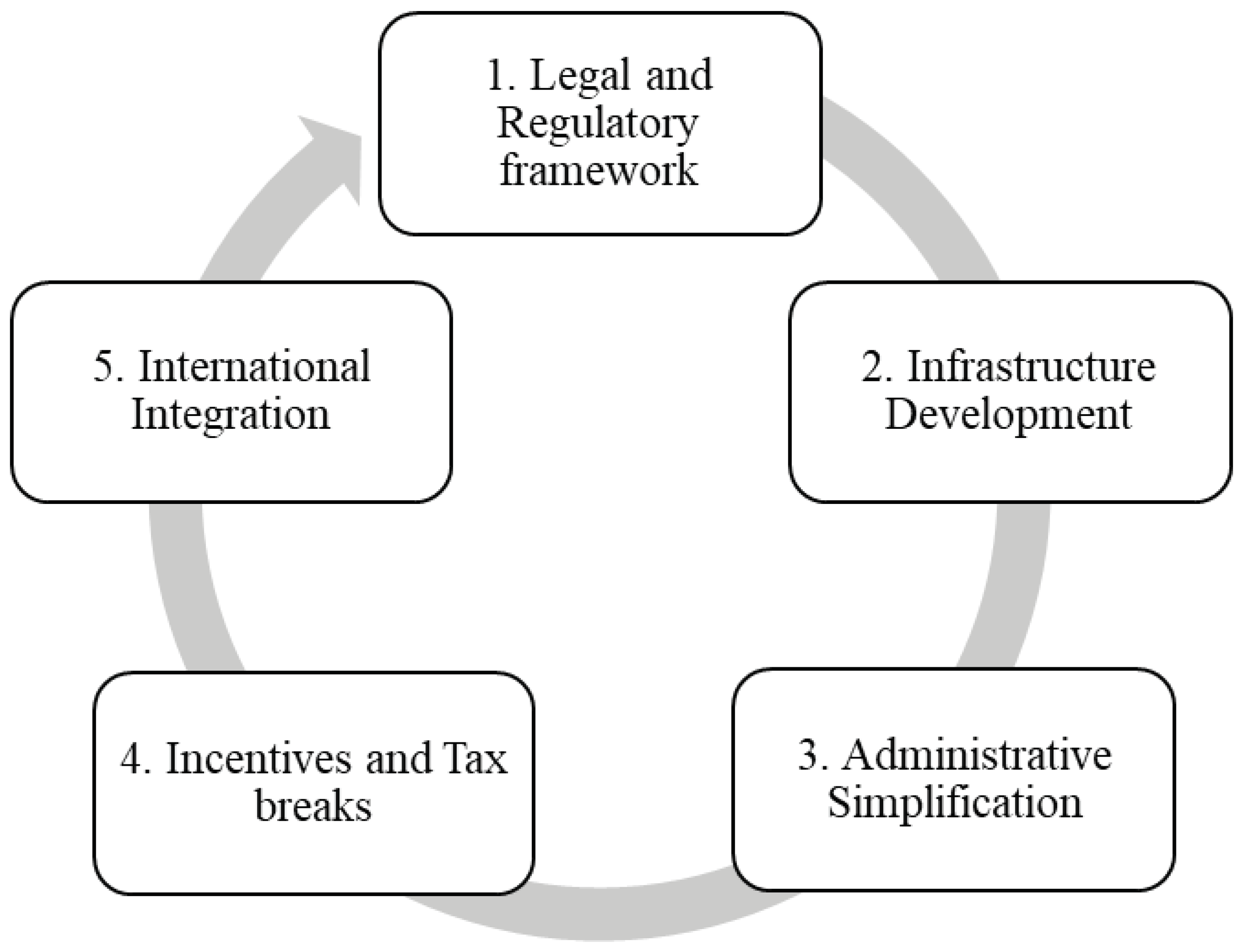

Figure 2.

Key Aspects of State Support for FEZs in China.

Figure 2.

Key Aspects of State Support for FEZs in China.

The first aspect is the legal and regulatory framework. The Chinese government has established a sound legal and regulatory framework that provides a clear and consistent environment for the activities of FEZ. This framework ensures transparency and protection of property rights and encourages domestic and foreign investment. It forms the basis for the effective management and development of FEZs (You, 2020).

The second aspect is infrastructure development. The Chinese government has made significant investments in infrastructure development within FEZs. This includes the construction of modern transportation networks, logistics facilities, advanced communications systems, and the development of industrial parks. The presence of state-of-the-art infrastructure has attracted businesses and investors, facilitated efficient operations and increasing the overall competitiveness of the zones (Wang et al., 2021).

The third point is administrative simplification. The Chinese government has recognized the importance of reducing bureaucratic hurdles and has introduced administrative simplification measures in FEZs. These measures aim to streamline approval procedures, minimize red tape and make it easier to do business (Huang et al., 2022). By reducing the administrative burden, China encourages both domestic and foreign investors to set up and operate in the zones.

Then there are the incentives and tax breaks. The Chinese government offers a number of incentives and tax breaks to companies operating in FEZs. These incentives can include tax breaks, reduced tariffs, preferential land terms, and access to financial support. By providing favorable conditions for businesses, China encourages investment, innovation, and the growth of industries within the FEZs (Dai & Chapman, 2022). In addition, the Chinese government ensures that enterprises in FEZs receive comprehensive support services. These include assistance in obtaining permits and licenses, access to market information, facilitation of trade and customs procedures, and support for technology transfer, research, and development. These services help create a favorable environment for businesses to flourish and contribute to the overall economic development of the zones (Fan et al., 2022).

Finally, international integration is also an important aspect to mention. China actively promotes international integration and cooperation in its FEZs. Through strategic partnerships, joint ventures, and participation in global supply chains, China’s FEZs attract foreign investment, facilitate technology transfer and promote trade (Bazaluk et al., 2022). The government's focus on international integration strengthens the zones' competitiveness and contributes to China's position as a global economic center. Thus, China's extensive government support of FEZs has led to their remarkable success. These zones have become vibrant economic centers that attract investment, foster innovation, and contribute significantly to China’s economic growth. The lessons learned from China's government support for FEZs can serve as valuable lessons for other countries seeking to establish and develop their own free economic zones.

Comparison: Government support for Free Economic Zones: Uzbekistan and China.

Government support plays an important role in promoting the development and success of Free Economic Zones (FEZs). Both Uzbekistan and China have recognized the importance of FEZs and have taken steps to support them (Sirojiddin, 2022), but there are notable differences in their approaches. Examining China's government support for its own FEZs can shed light on how Uzbekistan can benefit from the Chinese experience (Zoilboey, 2022; Jumaniyazov, 2022; Haqberdievich & Shavkiddinovich, 2022).

Table 6.

Comparison of State Support by Uzbekistan & China.

Table 6.

Comparison of State Support by Uzbekistan & China.

-

1.

Legal Framework & Administrative Simplification |

- Comprehensive legal framework

- Consistent regulatory environment

- Simplify bureaucratic processes |

- Legal framework

- Reorganizing administrative functions

- Expanding the powers of FEZ administrative boards |

-

2.

Infrastructure development |

|

- Providing robust transportation networks |

- Infrastructure development can be observed |

-

3.

Coordination & Management |

|

- Established special agencies and management systems |

- There is a challenge yet |

-

4.

International integration & Best practices |

|

- Actively sought international integration and cooperation. |

- Improving coordination and synergy between international initiatives began. |

1) Legal framework and administrative simplification.

A) Uzbekistan: Uzbekistan has established a legal framework to regulate the activities of FEZ and simplified control by decentralizing administrative functions. Expanding the powers of FEZ administrative boards in regions or provinces allows for more efficient decision-making and management processes.

B) China: China has also established a comprehensive legal framework for its FEZs, providing a clear and consistent regulatory environment. In addition, administrative simplification measures have been taken to streamline bureaucratic processes and make it easier to do business in FEZs.

2) Infrastructure development.

A) Uzbekistan: Infrastructure development, particularly in the areas of transportation and technical communications, is considered a challenge in Uzbekistan's FEZs. Slow progress in infrastructure development hinders investment and limits the attractiveness of the zones.

B) China: China has invested heavily in infrastructure development in its FEZs, providing robust transportation networks, advanced communications systems, and modern industrial parks. This infrastructure development attracts both domestic and foreign investors and supports the growth and competitiveness of China's FEZs.

3) Coordination and Management.

A) Uzbekistan: Uzbekistan faces the challenge of coordinating the activities of the various state administrative agencies involved in FEZ activities. This causes delays and organizational problems in the implementation of investment projects.

B) China: China has established special agencies and management systems to effectively coordinate and monitor the activities of FEZ. These agencies ensure streamlined processes, facilitate investment projects, and provide comprehensive support services to investors in the zones.

4) International integration and best practices.

A) Uzbekistan: Uzbekistan is committed to improving coordination and synergy between international initiatives and its FEZs. Integration of renewable energy, agriculture, and cross-border cooperation initiatives can enhance the development and success of Uzbekistan's FEZs.

B) China: China has actively sought international integration and cooperation in its FEZs to attract foreign investment and promote technology transfer. China's FEZs have become hubs for international trade, production, and innovation, benefiting from global supply chains and best practices.

Thus, learning from China’s experience can be valuable to Uzbekistan in several ways.

- (1)

Uzbekistan can study China's successful approaches to infrastructure development and apply similar strategies to improve its own infrastructure FEZ.

- (2)

Understanding China's coordination and management systems can help Uzbekistan streamline administrative processes and avoid overlapping responsibilities.

- (3)

Exploring China's international integration initiatives can help Uzbekistan leverage global partnerships and attract foreign investment into its FEZs.

By learning lessons from China's state support for its FEZs, Uzbekistan can adapt and implement effective policies and practices to strengthen its own FEZs, attract foreign direct investment, and promote economic growth.

Limiting Factors for Direct Investment: Economic Geographical Perspective

In the context of Uzbekistan’s free economic zones (FEZs), attracting foreign direct investment (FDI) faces several limiting factors, focusing on the inadequate environment and technology for innovation. The current infrastructure and management of FEZs in Uzbekistan lack efficiency and technological advances (

www.dentons.com, www.orbitax.com, and

www.sdgindex.org), resulting in relatively low FDI inflows. In order to promote industrial diversification, modernization, and integration into global value chains, it is critical for FEZs to attract substantial FDI. While the FEZs of highly developed countries offer advanced prospects and attract high-tech companies focused on services, value chain activities, and high value-added industries (

www.unctad.org, 2019), Uzbekistan, as an economy in an early stage of development, needs to address several challenges within its FEZs through science-based solutions.

These challenges include promoting technology adoption, integrating international value chains, and supporting industrial modernization. Uzbekistan has initiated significant changes in economic growth since 2017 (

www.miit.uz, 2022), indicating a shift toward innovation-driven development. The government recognizes the importance of FEZs in its innovation policy (

www.president.uz, 2021). However, there are still barriers to greater FDI inflows, especially in sectors that require innovation and technology (

www.sdgindex.org). Although innovative projects exist in creative enterprises in FEZs, the barriers that prevent greater FDI need to be addressed. Creating the necessary conditions, such as a developed market and robust intellectual property laws (

www.miit.uz), is essential to the success of creative projects.

To gain a comprehensive understanding of the innovation and technology potential in Uzbekistan's FEZs, an economic geography perspective is critical. This perspective involves conducting spatial studies of FDI flows in different industries and firms within the FEZs, focusing on sectors with low productivity differentials. In addition, case studies should examine domestic firms operating in technology- and innovation-related sectors within each FEZ. These analyzes may include comparisons of employment levels or income generated by investment-based firms in specific sectors, providing insights into the impact of FDI on manufacturing firms in FEZs. By improving the environment and technology for innovation, Uzbekistan can attract more FDI to its FEZs. Measures to improve technological infrastructure, promote innovation, and create a supportive ecosystem for creative projects will create favorable conditions for foreign investors and promote economic development in FEZs.

Another critical factor in attracting FDI and facilitating seamless integration into regional and global value networks is the logistical infrastructure in Uzbekistan's FEZs. Logistical infrastructure plays a critical role in enabling efficient production, trade, and development. However, logistical support within FEZs remains inadequate, which is exacerbated by extensive administrative procedures by local authorities (

www.spot.uz, 2019). The geographic location of FEZs, often outside of major economic centers (

www.review.uz), makes logistical challenges even greater. This location impacts the transportation of goods and services to national and international markets.

In addition, the FEZs have limited connections to global logistics centers, largely due to the fact that foreign companies own such centers in Uzbekistan. Customs clearance problems further complicate FEZ connectivity to international logistics centers. In addition, many FEZs have inadequate connectivity to major highways and railroads, which is due to the overall quality of local logistics services and the lack of skilled labor in the logistics sector (Kulmukhamedov, 2015).

To overcome these challenges, Uzbekistan needs to prioritize the development of young, experienced professionals in the logistics sector and invest in the road asset management system to improve access to global value chains. Government support plays a critical role in achieving these goals.

Discussion & Chinese Economic Policy Insights

Uzbekistan’s strategic geographical location along the historical Silk Road presents it with significant potential to become a thriving hub for trade, production, and logistics in the Euro-Asian region. However, it is crucial to address the factors that have hindered Uzbekistan from fully capitalizing on its location since gaining independence in 1991. One key aspect to consider is the country's relationship with regional organizations and its participation in international cooperation.

Following the dissolution of the USSR, Uzbekistan became a member of the Commonwealth of Independent States Organization (CIS), which encompasses various areas such as trade, economy, energy, digital economy, and the development of free economic zones among member states. However, from 1991 to 2016, the Uzbekistan government refrained from signing several agreements within the CIS due to its decision to distance itself from the political and military systems. This approach, while aimed at protecting the state's sovereignty, led to limited cooperation not only with the CIS but also with other regional groupings such as the Organization of Turkish States and the Eurasian Economic Union (

www.theglobaleconomy.com, 2021). Since the change of government in 2017, Uzbekistan has pursued a more open and engaged approach towards international cooperation. The country is actively increasing its involvement in international bodies and councils, taking initiatives to enhance transportation interdependence, and establishing comprehensive free economic zones.

The current administration has been proactive in engaging in trade and economic dialogues with international partners. Over the past 4-5 years, Uzbekistan has signed multilateral agreements with numerous prominent organizations, signaling its commitment to promoting the activation and growth of free economic zones (CIS). In analyzing Uzbekistan's economic development and its potential as a hub for regional and transcontinental trade, it is crucial to consider the evolving international relations landscape. As Uzbekistan seeks to strengthen its economic ties and attract foreign direct investment, understanding the country's engagement with regional organizations and its efforts to foster interdependence in transportation and trade becomes essential.

In examining Uzbekistan's economic potential and its aspiration to become a regional trade and logistics hub, insights from China's economic policies can offer valuable lessons. China has successfully transformed itself into a global economic powerhouse by leveraging its strategic location, investing in infrastructure development, and actively participating in international trade and cooperation initiatives such as the Belt and Road Initiative (BRI). Uzbekistan could benefit from studying China's experience and adopting similar strategies to enhance its connectivity, improve transportation infrastructure, and actively engage in regional and global economic collaborations.

China’s emphasis on creating free trade zones, promoting foreign investment, and fostering innovation-driven development aligns with the goals Uzbekistan seeks to achieve in its free economic zones. By studying China's policies and success stories, Uzbekistan can gain valuable insights into how to attract foreign direct investment, improve technology adoption, integrate into global value chains, and promote industrial modernization within its free economic zones. Collaborating with Chinese partners and leveraging their expertise in logistics, trade facilitation, and infrastructure development can further enhance Uzbekistan's potential as a regional trade and logistics hub.

So, Uzbekistan’s geographical location provides it with immense opportunities for economic growth and regional integration. By embracing international cooperation, engaging with regional organizations, and learning from successful economic policies, such as those implemented by China, Uzbekistan can position itself as a vibrant hub for trade, production, and logistics in the Euro-Asian region.

Conclusion

In conclusion, this study has shed light on the factors influencing foreign direct investment (FDI) in Uzbekistan and the role of economic geography in shaping investment patterns. Building upon the discussions presented earlier, the following key conclusions can be drawn. Firstly, the analysis reveals a significant shift in Uzbekistan's approach to FDI. Until 2016, the country maintained a relatively closed policy towards direct investment. However, since 2017, there has been a notable increase in regulatory changes aimed at creating a more favorable investment climate. This shift towards openness signals the government's recognition of the importance of attracting foreign investment to drive economic growth and development. The study also highlights the characteristics of Free Economic Zones (FEZs) in Uzbekistan. These zones have evolved from simple manufacturing centers to high-tech hubs, often strategically located near logistics centers and tourist sites. However, the absence of scientific zones within the FEZs is a notable gap. While government decrees indicate active efforts to attract foreign direct investment and support FEZs, further research is needed to assess the practical impact of these measures due to limited data transparency.

Furthermore, the study reveals that the support for FDI projects, particularly those promoting innovation and creative businesses in FEZs, remains inadequate. Greater emphasis should be placed on promoting FDI as a means to transfer technological know-how and foster innovation-driven development. Encouraging FDI initiatives that invest in research and development (R&D) can play a crucial role in driving technological advancements and enhancing the competitiveness of Uzbekistan's economy. To address the current challenges and maximize the potential of FEZs, it is recommended to conduct spatial analyses of each economic zone. Future case studies on FEZs should consider the efforts of foreign companies and specific industries operating within these zones. Additionally, the geographic locations of FEZs, including their clustering policy and their positioning in high-growth or economically weaker areas, should be examined using economic geography methodologies. By exploring these spatial aspects, policymakers can develop targeted strategies to promote FDI flows and harness the full potential of FEZs.

Thus, this study highlights the crucial role of economic geography in understanding and addressing key issues related to FDI flows and a country's attractiveness to investors. The findings emphasize the importance of comprehensive research and effective policymaking, utilizing geographic perspectives, to optimize investment strategies and enhance Uzbekistan's appeal as a destination for foreign direct investment. Incorporating insights from China's economic policies, particularly in terms of infrastructure development, technology transfer, and innovation-driven growth, can provide valuable guidance for Uzbekistan's journey towards becoming a thriving hub for regional and global economic activities. All in all, the study underscores the significance of economic geography in analyzing and shaping FDI patterns. By further exploring the spatial dynamics of economic zones, considering the efforts of foreign companies, and promoting innovative projects through FDI, Uzbekistan can create a conducive environment for investment and foster sustainable economic development in alignment with global economic trends.

Disclosure of Conflicts of Interest

The authors declare that they have no conflicts of interest to disclose in relation to this article. We also assert that all authors participated equally in the preparation, editing, and review of the manuscript. Each author made a significant contribution to the conception, design, analysis, and interpretation of the research findings presented in this paper. The collaboration of all authors was instrumental in ensuring the accuracy and quality of the manuscript.

References

- Alon, I. et al. (2021), A systematic review of international franchising, Multinational Business Review, 29(1), pp. 43-69. https://doi.org/10.1108/MBR-01-2020-0019. [CrossRef]

- Alvarado, R. et al. (2017). Foreign direct investment and economic growth in Latin America. Economic Analysis and Policy, 56, pp.176– 187 https://doi.org/10.1016/j.eap.2017.09.006. [CrossRef]

- Bazaluk, O., Yatsenko, O., Reznikova, N., Bibla, I., Karasova, N., & Nitsenko, V. (2022).International integration processes influence on welfare of country. Journal of Business Economics and Management, 23(2), 382-398. [CrossRef]

- Brussevich, M. (2020). The Socio-economic Impact of Special Economic Zones: Evidence from Cambodia, Asia & Pacific Department. IMF Working Paper, pp.5-9 https://www.imf.org/en/Publications/WP/Issues/2020/08/21/.

- Casella, B. et al. (2018). UNCTAD insights: FDI in the digital economy: A shift to asset-light international footprints. Transnational Corporations, 25(1), pp.101–130. [CrossRef]

- Caves, R. (1971). International Corporations: The Industrial Economics of Foreign Investment, Economica, 38, pp.1-27 https://www.jstor.org/stable/2551748.

- Chaikouskaya, Y. (2018). The role of the institute for Free Economic Zones in the development of the Chinese economy. Oikonomos: Journal of Social Market Economy, (2), 40-49.

- Chang, H.J. et al. (2020). Industrial policy in the 21st century. Development and Change, 51(2),324–351 https://doi.org/10.1111/dech.12570. [CrossRef]

- Cohen, S. D. (2007). Effects of Foreign Direct Investment on Less Developed Countries: Vagaries,Variables, Negatives, and Positives', Multinational Corporations and Foreign Direct Investment: Avoiding Simplicity, Embracing Complexity, pp. 179-204 https://doi.org/10.1093/acprof:oso/9780195179354.003.0009. [CrossRef]

- Dai, X., & Chapman, G. (2022). R&D tax incentives and innovation: Examining the role of programme design in China. Technovation, 113, 102419. [CrossRef]

- De Armas, E.B. et al. (2002). A Review of the Role and Impact of Export Processing Zones in World Trade: The Case of Mexico https://shs.hal.science/halshs-00178444.

- Dicken P. (2015). Global shift: mapping the changing contours of the world economy (7th). SAGE, pp.368-373 https://doi.org/10.1111/j.1467-9663.2008.468_2.x. [CrossRef]

- Dunning, J.H. (1977). Trade, Location of Economic Activity and the MNE: A Search for an Eclectic Approach. In: Ohlin, B., et al., Eds., The International Allocation of Economic Activity, MacMillan, pp.395-418.

- Engman, M, et al. (2007). Export Processing Zones: Past and Future Role in Trade and Development, OECD Trade Policy Papers, 53, pp.35-44 https://doi.org/10.1787/035168776831. [CrossRef]

- Fan, G., Xie, X., Chen, J., Wan, Z., Yu, M., & Shi, J. (2022). Has China's Free Trade Zone policy expedited port production and development?. Marine Policy, 137, 104951.

- Farole, T, et al. (2014). Making Foreign Direct Investment Work for Sub-Saharan Africa: Local Spillovers and Competitiveness in Global Value Chains, pp. 23–55 https://doi.org/10.1596/978-1-4648-0126-6. [CrossRef]

- Farole, T., & Akinci, G. (Eds.). (2011). Special economic zones: Progress, emerging challenges, and future directions. World Bank Publications.

- Gielen, D. et al. (2019). The role of renewable energy in the global energy transformation, Journal of Energy Strategy Reviews, 24, pp.38-50 https://doi.org/10.1016/j.esr.2019.01.006. [CrossRef]

- Giroud, A. et al. (2009). MNE linkages in international business: A framework for analysis. International Business Review, 18(6), 555–566 https://doi.org/10.1016/j.ibusrev.2009.07.004. [CrossRef]

- Grubel, H. G. (1982). Towards a Theory of Free Economic Zones. Weltwirtschaftliches Archiv, 118(1), 39–61. http://www.jstor.org/stable/40439002.

- Haqberdievich, K. D., & Shavkiddinovich, M. M. (2022). SWOT ANALYSIS OF FREE ECONOMIC ZONES (FEZ) IN UZBEKISTAN. Gospodarka i Innowacje., 22, 610-615.

- Huang, X., Meng, X., Chen, M., & Liu, X. (2022). The impact of administrative simplification on outward foreign direct investment: Evidence from a quasi-natural experiment in China. The Journal of International Trade & Economic Development, 31(3), 375-393. [CrossRef]

- Hymer, S. (1976). The international operations of national firms: A study of direct foreign investment. MIT, pp.147-154. http://hdl.handle.net/1721.1/27375.

- Ibragimov, F. et al. (2019). Application of logistics in the innovative development of cluster activities in Uzbekistan. Business Expert Magazine, 5, pp.58-61.

- Jumaniyazov, I. T., & Hazratov, B. (2022). Foreign experience in the development of special economic zones in Uzbekistan. Science and Education, 3(5), 1628-1636.

- Karrieva, Y. et al., (2020). Foreign experience on transport and logistics cluster and its application in Uzbekistan, Journal of Logistics and Economics, 7:12, p.58 https://www.scholarexpress.net/.

- Khalilova, F. (2013). Improvement of attraction of foreign investments to Navoi FEZ // [in Russian: Sbornik statey slushateley, professorsko-propodavatelskogo sostava akademii gosudarskogo upravleniya pri prezidente Respubliki Uzbekistan], p.134.

- Komendantova, N, et al. (2021). Public attitudes, co-production, and polycentric governance in energy policy. Energy Policy, 153:112241 https://doi.org/10.1016/j.enpol.2021.112241. [CrossRef]

- Kulmuhamedov, J.R. et al. (2015). Basics of Logistics, Study guide, The Tashkent Automobile and Road Construction Institute, pp.109-123 (In Uzbek).

- Lafourcade, M., et al. (2011). Chapter 4: New Economic Geography: The Role of Transport Costs, In A Handbook of Transport Economics. Cheltenham, UK: Edward Elgar Publishing https://doi.org/10.4337/9780857930873.00010. [CrossRef]

- Meng, Gw. (2005). Evolutionary model of free economic zones. Chin.Geograph.Sc. 15:103-112 https://doi.org/10.1007/s11769005-0002-1. [CrossRef]

- Milberg, W. et al. (2013). Outsourcing economics: Global value chains in capitalist development. Cambridge University Press, pp.104-153 https://doi.org/10.1017/CBO9781139208772. [CrossRef]

- Pavlov, P.V., et al. (2019). Free economic zones: Global experience, perspectives and concept of development in global practice, 40(28), p.12.

- Peter J. Buckley, Mark Casson, (1976). Predictions and Policy Implications in book Future of the Multinational Enterprise, pp.114-116 https://doi.org/10.1007/978-1-349-02899-3. [CrossRef]

- Phelps, N. A., et al. (2018). Promoting the global economy: The uneven development of the location consulting industry. Environment and Planning A: Economy and Space, 50(6), 1336- 1354. https://doi.org/10.1177/0308518X17730832. [CrossRef]

- Rakhmanov, K. (2020). Formation of a national innovation system – one of the priority tasks of ensuring foreign economic security of the Republic of Uzbekistan. Journal of Critical Reviews, 7(5), pp.478-481.

- Raymond Vernon, (1966). International Investment and International Trade in the Product Cycle, Journal of Economics 80:2, pp.190–207 https://doi.org/10.2307/1880689. [CrossRef]

- Santangelo, D. (2018). The impact of FOREIGN DIRECT INVESTMENT in land in agriculture in developing countries on host country food security. Journal of World Business, 53(1), 75- 84 https://doi.org/10.1016/j.jwb.2017.07.006. [CrossRef]

- Sirojiddin, S. (2022). POSSIBILITIES OF APPLYING WORLD EXPERIENCE OF ORGANIZING FREE ECONOMIC ZONES IN UZBEKISTAN. Web of Scientist: International Scientific Research Journal, 3(11), 1388-1413.

- Spencer, W. (2008). The impact of multinational enterprise strategy on indigenous enterprises: Horizontal spillovers and crowding out in developing countries. Advances in Magnetic Resonance, 33(2), 341–361 https://doi.org/10.5465/amr.2008.31193230. [CrossRef]

- Stocker, A. et al., (2011). Sustainable energy development in Austria until 2020: Insights from applying the integrated model “e3.at”, Energy Policy, 39(10), pp.6082-6099 https://doi.org/10.1016/j.enpol.2011.07.009. [CrossRef]

- Sturgeon, J. et al. (2010). The prospects for Mexico in the North American automotive industry: A global value chain perspective. Actes du GERPISA, 42(6), 11–22 https://scholars.duke.edu/display/pub725362.

- Suwala, L. (2013). Multinationals & Economic Geography: Location, Technology, and Innovation, Regional Studies, 47:8, pp.1377-1379 https://doi.org/10.1080/00343404.2013.830363. [CrossRef]

- Thisse, J.F. (2008). New economic geography: A guide to transport analysis. HAL, pp.21-26 https://shs.hal.science/halshs00586878.

- Wang, C., Kim, Y. S., & Kim, C. Y. (2021). Causality between logistics infrastructure and economic development in China. Transport Policy, 100, 49-58.

- Wang, J. (2013). The economic impact of Special Economic Zones: Evidence from Chinese municipalities, Journal of Development Economics, 101, pp.133-147 https://doi.org/10.1016/j.jdeveco.2012.10.009. [CrossRef]

- Wang, J. J., & Olivier, D. (2006). Port–FEZ bundles as spaces of global articulation: the case of Tianjin, China. Environment and Planning A, 38(8), 1487-1503.

- Warr, P. G. (1989). Export Processing Zones: The Economics of Enclave Manufacturing. The World Bank Research Observer, 4(1), 65–88. http://www.jstor.org/stable/3986349.

- You, C. (2020). Law and policy of platform economy in China. Computer Law & Security Review, 39, 105493. [CrossRef]

- Zoilboev, J. (2022). THE CONCEPT AND SPECIFIC FEATURES OF A FREE ECONOMIC ZONES. World Bulletin of Management and Law, 12, 56-59.

-

Web Sites used in the work.

- www.ceicdata.com – Database for the global economy.

- www.data.worldbank.org – Index composed of large stocks in developed market countries.

- www.dentons.com – Major law firm with market insights and global solutions.

- www.globalinnovationindex.org – Global Innovation Index.

- www.i1.md.uz – Institute of Forecasting and Macroeconomic Research.

- www.invest.gov.uz – Investment Promotion Agency under the Ministry of Investments and Foreign Trade of Uzbekistan.

- www.isrs.uz – Institute for Strategic and Regional Studies under The President of Uzbekistan.

- www.lex.uz – National Database of Legislation of Uzbekistan: Decrees – President Decree N5517, President Decree N 4931, President Decree N 5600, etc.

- www.mehnat.uz – Ministry of Employment and Poverty Reduction of Uzbekistan.

- www.miit.uz – Ministry of Investments and Foreign Trade of Uzbekistan.

- www.nbu.uz – National Bank of Uzbekistan.

- www.feznavoi.uz – Web site of Navoi Free Economic Zone.

- www.gazeta.uz – Internet publication under Press and Information Agency of Uzbekistan.

- www.oeaw.ac.at – The Austrian Academy of Sciences (OeAW): “Energy Model Region”.

- www.orbitax.com – The platform of Global Tax Technology Experts.

- www.president.uz – Web press of President of the Republic of Uzbekistan.

- www.review.uz – Analytical reviews publisher on Uzbekistan in major areas.

- www.sez.gov.uz - Unified Portal of Free Economic Zones and Small Industrial Zones of the Republic of Uzbekistan.

- www.sdgindex.org – Index for sustainable development report distribution.

- www.spot.uz – Internet publication under Press and Information Agency of Uzbekistan.

- www.stat.uz – Statistics Agency under the President of Uzbekistan.

- www.theglobaleconomy.com – Internet publisher for researchers, academics, and investors who need reliable economic information on foreign countries.

- www.trade.gov – The Uzbek Agency for Technical Regulation under the Ministry of Investments and Foreign Trade of Uzbekistan.

- www.unctad.org – United Nations Conference on Trade and Development (UNCTAD).

- www.unece.org – The United Nations Economic Commission for Europe (UNECE).

- www.unescap.org – The Economic and Social Commission for Asia and the Pacific (ESCAP).

| 1 |

Note: Within the framework of the Investment Program of Uzbekistan for 2019, the amount of investments is given in millions of UZS. It was noted that the final parameters of the projects will be determined based on the results of the approval of project-estimate documents and the results of conducting tenders in the prescribed manner, - www.lex.uz. |

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).