Submitted:

07 July 2023

Posted:

10 July 2023

You are already at the latest version

Abstract

Keywords:

1. Introduction

1.1. Framework

1.2. Aim and Research Methodology

- a) Framing questions for a review;

- b) Identifying relevant work;

- c) Assessing the quality of studies;

- d) Summarizing the evidence;

- e) Interpreting the findings.

1.3. Research Questions

- While building an Asset Management System (AMS) is it a core element to measure its performance?

- How can measure the SAMP performance?

- Being the SAMP the central figure in the AMS, how can it be measured?

1.4. Paper Structure

- synthesizes relevant literature on Strategic Asset Management Plan performance measuring tools;

- presents the Scorecard;

- presents the Performance Measuring tool of a Strategic Asset Management Plan through a Balanced Scorecard;

- presents a discussion;

- offers the conclusions.

2. Literature Review

- Process understanding and system’s components identification;

- Identification of failures modes or stop causes of each component;

- Reliability, maintainability and operation data acquisition (TBF and TTR);

- Modelling of the as-is system through Reliability Block Diagram (RBD) logic;

- Simulation (Monte Carlo);

- Technical performance calculation of the system;

- Cost model setting;

- Cost data acquisition;

- Calculation of TCO.

- 1. Develop the AM strategy and identify AM objectives;

- 2. Select performance indicators;

- 3. Test for alignment or line of sight;

- 4. Reflect on the process and outcome.

- 1. Is it really only about delivering an absolute amount, like the produced volume, the availability of an asset or staying within budget limits?

- 2. Or is it more about assuring that the available resources are used in the most effective and efficient way, like driving towards the best value per unit of cost or the lowest cost per unit of production?

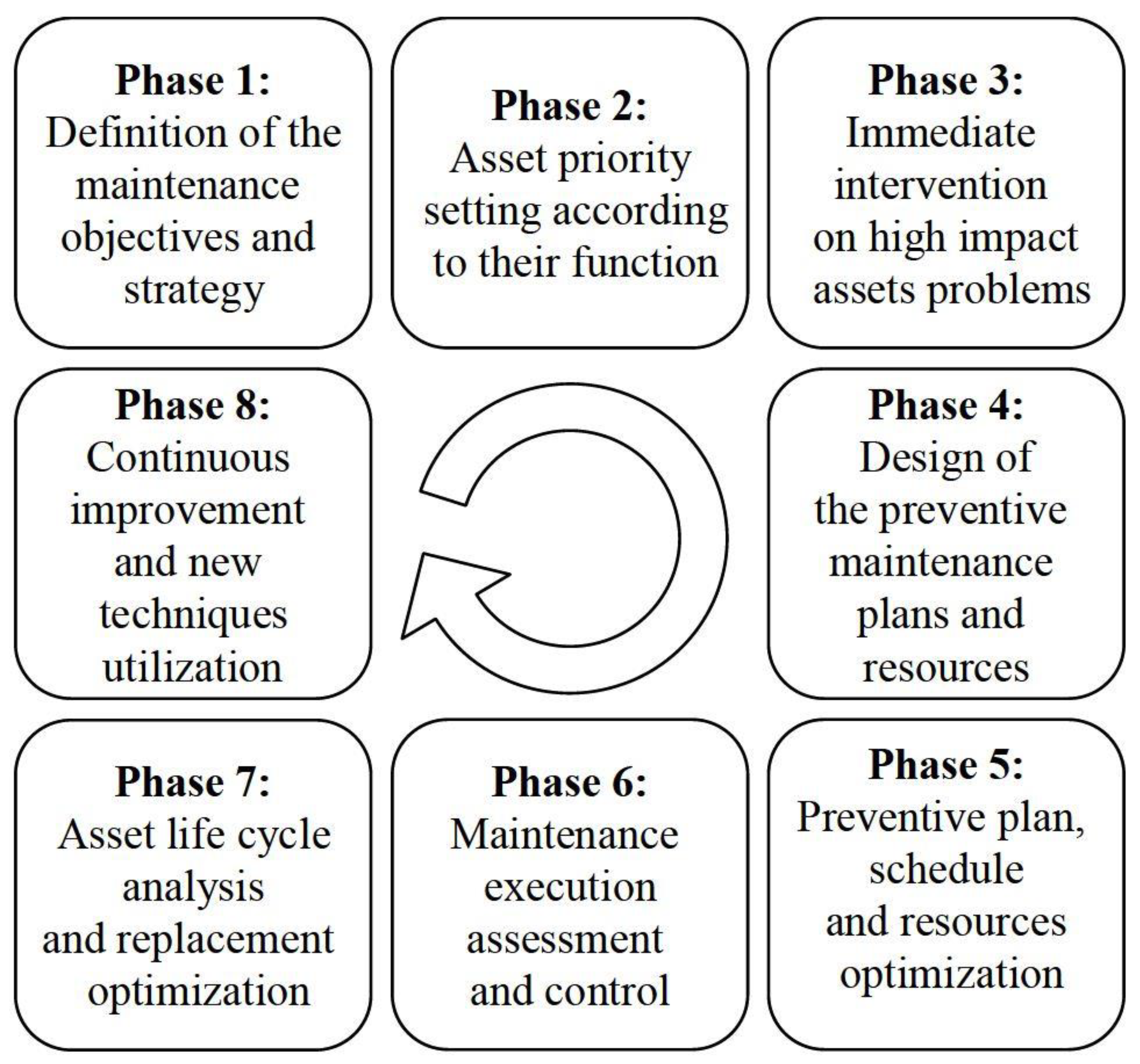

- 1. Definition of the maintenance objectives and KPI’s;

- 2. Asset priority and maintenance strategy definition;

- 3. Immediate intervention on high impact weak point;

- 4. Design of the preventive maintenance plans and resources;

- 5. Preventive plan, Schedule, and resources optimization;

- 6. Maintenance execution assessment and control;

- 7. Asset life cycle analysis and replacement optimization;

- 8. Continuous Improvement and new tech.

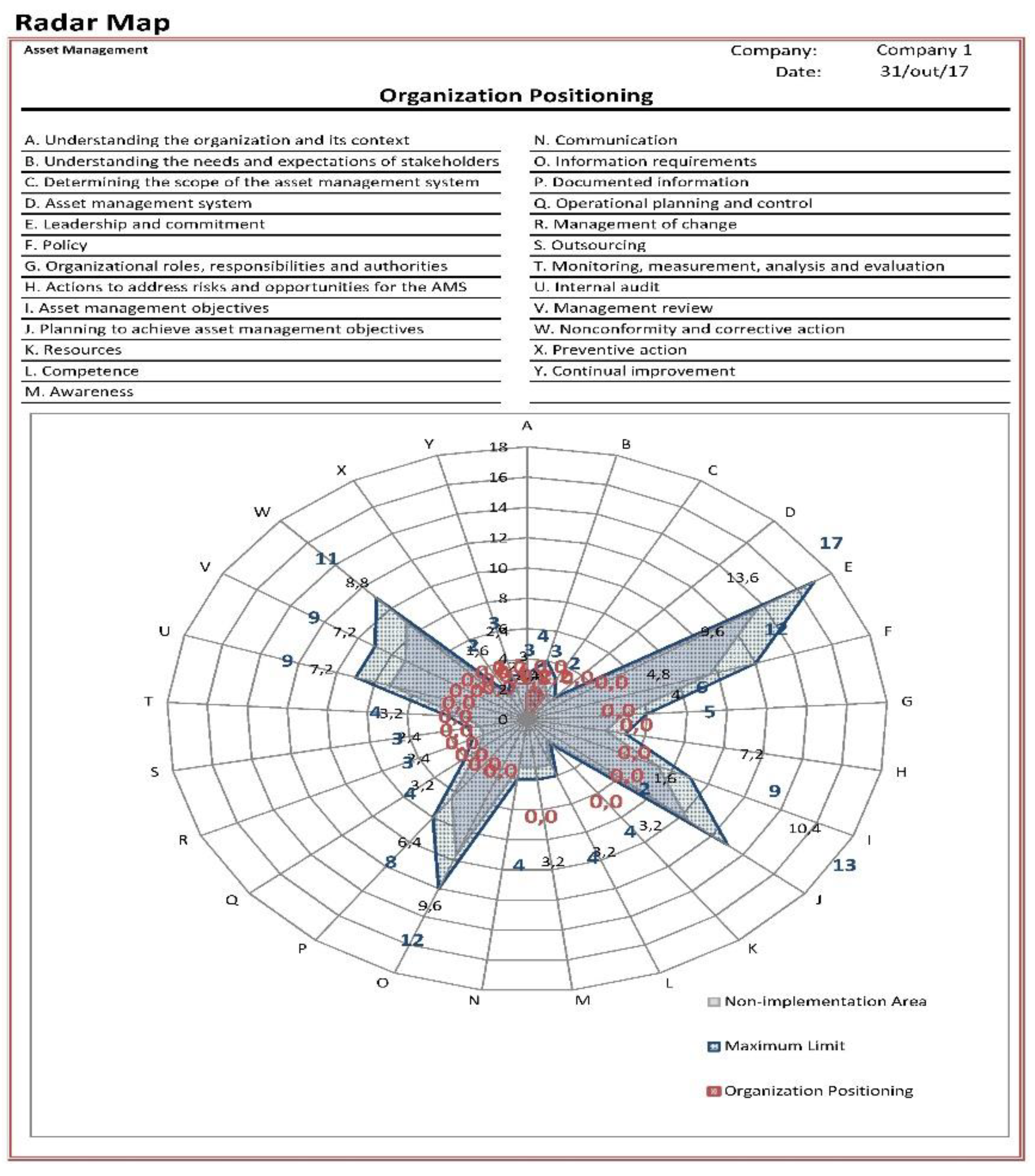

- 1. Context of the organization;

- 2. Leadership;

- 3. Planning;

- 4. Support;

- 5. Operation;

- 6. Performance evaluation;

- 7. Improvement.

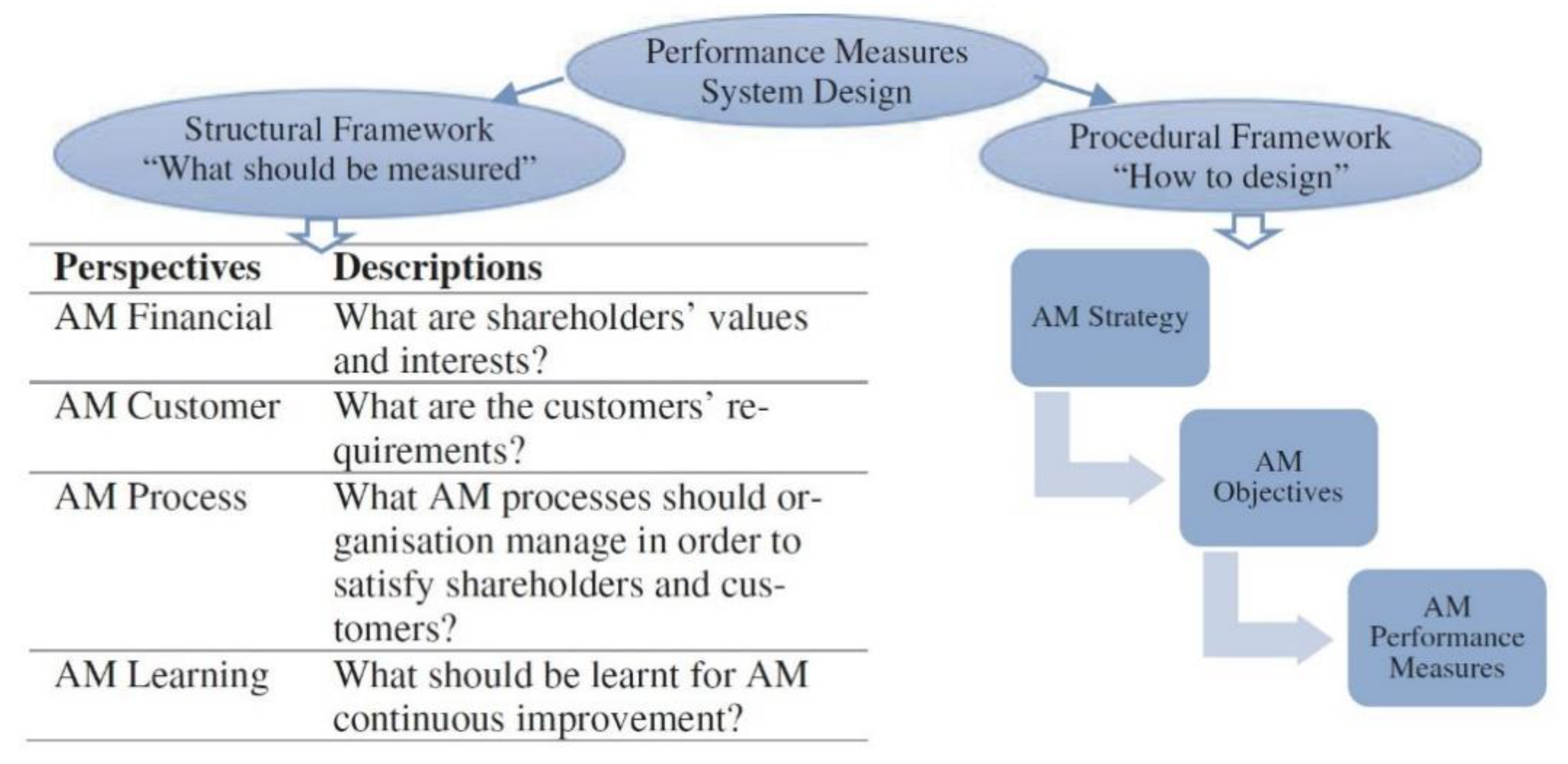

- 1. Recommendations for performance measures;

- 2. Recommendations and issues for PM framework and system design.

3. Balanced Scorecard

- 1. profitability (measured by residual income);

- 2. market share;

- 3. productivity;

- 4. product leadership;

- 5. public responsibility (legal and ethical behaviour and responsibility to stakeholders including shareholders, vendors, dealers, distributors and communities);

- 6. personnel development;

- 7. employee attitudes;

- 8. balance between short-range and long-range objectives.

- Vision barrier - No one in the organization understands the strategies of the organization.

- People barrier - Most people have objectives that are not linked to the strategy of the organization.

- Resource barrier - Time, energy, and money are not allocated to those things that are critical to the organization. For example, budgets are not linked to strategy, resulting in wasted resources.

- Management barrier - Management spends too little time on strategy and too much time on short-term tactical decision making.

4. Balanced Scorecard in a Strategic Asset Management Plan

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abdul-Nour, G., Gauthier, F., Diallo, I., Komljenovic, D., Vaillancourt, R., & Côté, A. (2021). Development of a Resilience Management Framework Adapted to Complex Asset Systems: Hydro-Québec Research Chair on Asset Management. In Lecture Notes in Mechanical Engineering (pp. 126–136). [CrossRef]

- Afgan, N. H. , Gobaisi, D. Al, Carvalho, M. G., & Cumo, M. Sustainable energy development. Renewable and Sustainable Energy Reviews 1998, 2, 235–286. [Google Scholar] [CrossRef]

- Ahn, H. Applying the Balanced Scorecard Concept: An Experience Report. Long Range Planning 2001, 34, 441–461. [Google Scholar] [CrossRef]

- Aidemark, L.-G. The Meaning of Balanced Scorecards in the Health Care Organisation. Financial Accountability and Management 2001, 17, 23–40. [Google Scholar] [CrossRef]

- Akhkozov, L., Danilenko, I., Podhurska, V., Shylo, A., Vasyliv, B., Ostash, O., & Lyubchyk, A. Zirconia-based materials in alternative energy devices - A strategy for improving material properties by optimizing the characteristics of initial powders. International Journal of Hydrogen Energy 2022, 47, 41359–41371. [CrossRef]

- Amaechi, C. V., Reda, A., Kgosiemang, I. M., Ja’e, I. A., Oyetunji, A. K., Olukolajo, M. A., & Igwe, I. B. Guidelines on Asset Management of Offshore Facilities for Monitoring, Sustainable Maintenance, and Safety Practices. Sensors 2022, 22, 7270. [CrossRef]

- Anand, M., Sahay, B. S., & Saha, S. Balanced Scorecard in Indian Companies. Vikalpa: The Journal for Decision Makers 2005, 30, 11–26. [CrossRef]

- Arabameri, A., Saha, S., Chen, W., Roy, J., Pradhan, B., & Bui, D. T. Flash flood susceptibility modelling using functional tree and hybrid ensemble techniques. Journal of Hydrology 2020, 587, 125007. [CrossRef]

- Arthur, D., Schoenmaker, R., Hodkiewicz, M., & Muruvan, S. (2016). Asset Planning Performance Measurement (pp. 79–95). [CrossRef]

- Beard, D. F. Successful Applications of the Balanced Scorecard in Higher Education. Journal of Education for Business 2009, 84, 275–282. [Google Scholar] [CrossRef]

- BP. (2022). Statistical Review of World Energy. https://www.bp.com/en/global/corporate/energy-economics/statistical-review-of-world-energy.html.

- Chakraborty, D., & Mukherjee, S. The Relationship between Trade, Investment and Environment. Foreign Trade Review 2010, 45, 3–37. [CrossRef]

- Coutinho, M. L., Miller, A. Z., Rogerio-Candelera, M. A., Mirão, J., Cerqueira Alves, L., Veiga, J. P., Águas, H., Pereira, S., Lyubchyk, A., & Macedo, M. F. An integrated approach for assessing the bioreceptivity of glazed tiles to phototrophic microorganisms. Biofouling 2016, 32, 243–259. [CrossRef]

- Crespo Márquez, A., Parra Márquez, C., Gómez Fernández, J. F., López Campos, M., & González-Prida Díaz, V. (2012). Life cycle cost analysis. In T. Van der Lei, P. Herder, & Y. Wijnia (Eds.), Asset Management: The State of the Art in Europe from a Life Cycle Perspective (Vol. 9789400727, pp. 81–99). Springer Netherlands. [CrossRef]

- Cullen, J., Joyce, J., Hassall, T., & Broadbent, M. Quality in higher education: from monitoring to management. Quality Assurance in Education 2003, 11, 5–14. [CrossRef]

- Danilenko, I., Gorban, O., Shylo, A., Volkova, G., Yaremov, P., Konstantinova, T., Doroshkevych, O., & Lyubchyk, A. Humidity to electricity converter based on oxide nanoparticles. Journal of Materials Science 2022, 57, 8367–8380. [CrossRef]

- Dasgupta, P., & Heal, G. The Optimal Depletion of Exhaustible Resources. The Review of Economic Studies 1974, 41, 3. [CrossRef]

- De-Almeida-e-Pais, J. E., Cardoso, A. J.., Farinha, J. T., & Raposo, H. (2022). ISO 55001 - A Proposal For a Strategic Asset Management Plan. In J. F. Silva & S. A. Meguid (Eds.), Proseeding M2D2022 - 9th International Conference on Mechanics and Materials in Design (Issue July, pp. 577–590). https://paginas.fe.up.pt/~m2d/proceedings_m2d2022/.

- de Almeida Pais, J. E., Raposo, H. D. N., Farinha, J. T., Cardoso, A. J. M., & Marques, P. A. Optimizing the Life Cycle of Physical Assets through an Integrated Life Cycle Assessment Method. Energies 2021, 14, 6128. [CrossRef]

- Deng, Y., & Shi, X. An Accurate, Reproducible and Robust Model to Predict the Rutting of Asphalt Pavement: Neural Networks Coupled With Particle Swarm Optimization. IEEE Transactions on Intelligent Transportation Systems 2022, 23, 22063–22072. [CrossRef]

- Department of Economic and Social Affairs - United Nations. (2022). World Population Prospects 2022. https://population.un.org/wpp/.

- Desing, H., Widmer, R., Beloin-Saint-Pierre, D., Hischier, R., & Wäger, P. Powering a sustainable and circular economy—an engineering approach to estimating renewable energy potentials within earth system boundaries. Energies 2019, 12. [CrossRef]

- Digalwar, A. K., Saraswat, S. K., Rastogi, A., & Thomas, R. G. A comprehensive framework for analysis and evaluation of factors responsible for sustainable growth of electric vehicles in India. Journal of Cleaner Production 2022, 378, 134601. [CrossRef]

- Doroshkevich, A. S., Asgerov, E. B., Shylo, A. V., Lyubchyk, A. I., Logunov, A. I., Glazunova, V. A., Islamov, A. K., Turchenko, V. A., Almasan, V., Lazar, D., Balasoiu, M., Doroshkevich, V. S., Madadzada, A. I., Kholmurodov, K. T., Bodnarchuk, V. I., & Oksengendler, B. L. Direct conversion of the water adsorption energy to electricity on the surface of zirconia nanoparticles. Applied Nanoscience 2019, 9, 1603–1609. [CrossRef]

- Doroshkevich, A. S., Lyubchyk, A. I., Shilo, A. V., Zelenyak, T. Y., Glazunova, V. A., Burhovetskiy, V. V., Saprykina, A. V., Holmurodov, K. T., Nosolev, I. K., Doroshkevich, V. S., Volkova, G. K., Konstantinova, T. E., Bodnarchuk, V. I., Gladyshev, P. P., Turchenko, V. A., & Sinyakina, S. A. Chemical-electric energy conversion effect in zirconia nanopowder systems. Journal of Surface Investigation: X-Ray, Synchrotron and Neutron Techniques 2017, 11, 523–529. [CrossRef]

- Drucker, P. (1954). The Practice of Management. HarperCollins.

- Duffuaa, S. O. Duffuaa, S. O. (2000). Mathematical Models in Maintenance Planning and Scheduling. In Maintenance, Modeling and Optimization (pp. 39–53). Springer US. [CrossRef]

- Duque, P., Parra, C., Pizarro, F., Aránguiz, A., & Vega. (n.d.). Audit models for asset management, maintenance and reliability processes: A case study applied to the copper mining sector.

- Dutt, N., & King, A. A. The judgment of garbage: End-of-pipe treatment and waste reduction. Management Science 2014, 60, 1812–1828. [CrossRef]

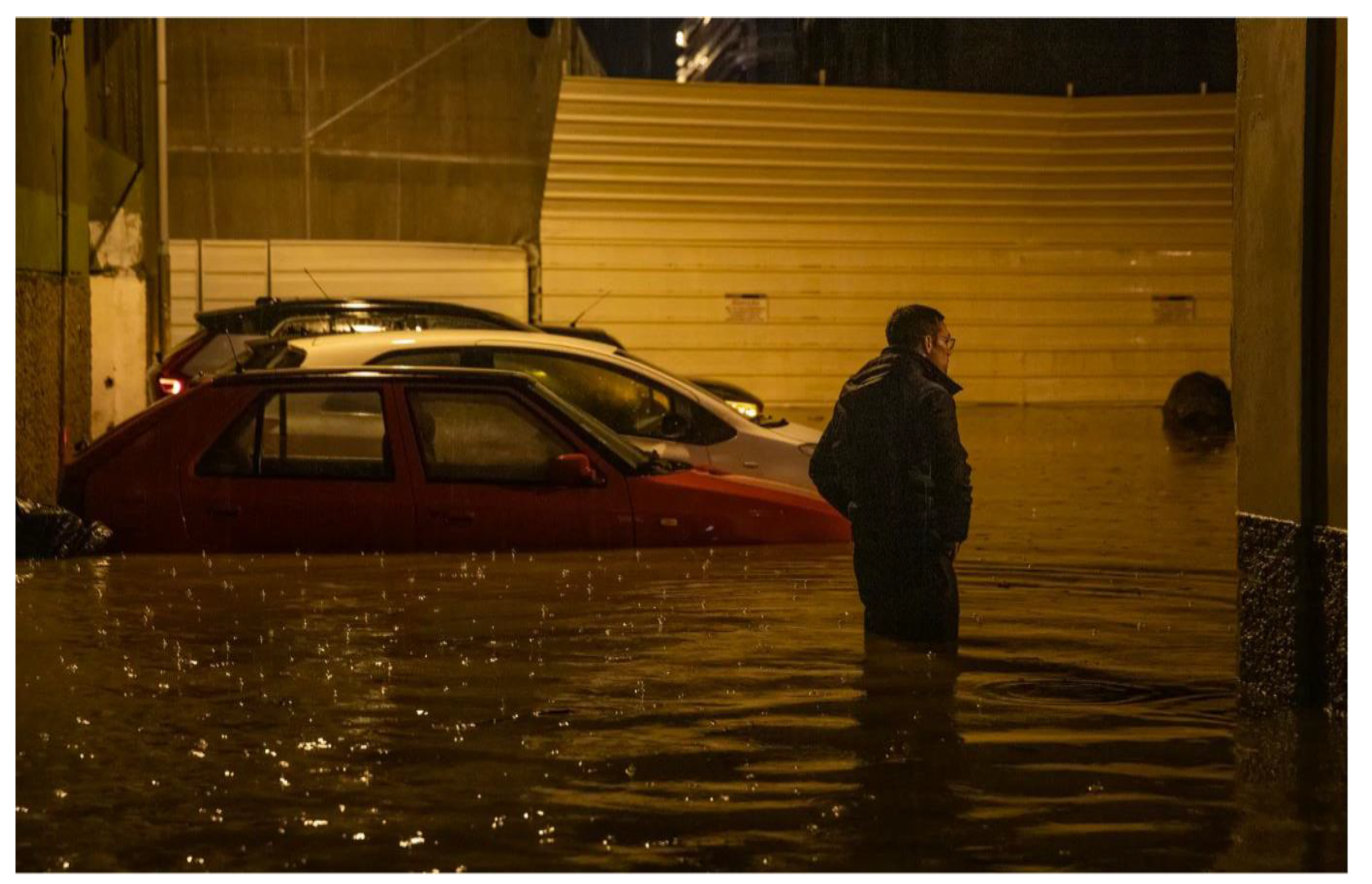

- Expresso. (2022). Mau tempo provoca uma morte, mais de 100 deslocados e 10 desalojados. https://expresso.pt/sociedade/2022-12-08-Mau-tempo-provoca-uma-morte-mais-de-100-deslocados-e-10-desalojados.-Houve-47-resgatados-de-veiculos-0c87fd50 . 2022.

- Folan, P., & Browne, J. A review of performance measurement: Towards performance management. Computers in Industry 2005, 56, 663–680. [CrossRef]

- Frolking, S., Milliman, T., Seto, K. C., & Friedl, M. A. A global fingerprint of macro-scale changes in urban structure from 1999 to 2009. Environmental Research Letters 2013, 8, 024004. [CrossRef]

- Ghaleb, M., & Taghipour, S. Assessing the impact of maintenance practices on asset’s sustainability. Reliability Engineering & System Safety 2022, 228, 108810. [CrossRef]

- Halkos, G., & Petrou, K. N. Analysing the Energy Efficiency of EU Member States: The Potential of Energy Recovery from Waste in the Circular Economy. Energies 2019, 12, 3718. [CrossRef]

- Hall, D. C., & Hall, J. V. Concepts and measures of natural resource scarcity with a summary of recent trends. Journal of Environmental Economics and Management 1984, 11, 363–379. [CrossRef]

- Hassan, A. M., Adel, K., Elhakeem, A., & Elmasry, M. I. S. Condition Prediction for Existing Educational Facilities Using Artificial Neural Networks and Regression Analysis. Buildings 2022, 12, 1520. [CrossRef]

- Hatcher, W. E. ., Whittlestone, A. P. ., Sivorn, J. ., & Arrowsmith, R. A service framework for highway asset management. IET & IAM Asset Management Conference 2012 2012, 91–91. [CrossRef]

- Henriques, J. D., Azevedo, J., Dias, R., Estrela, M., Ascenço, C., Vladimirova, D., & Miller, K. Implementing Industrial Symbiosis Incentives: an Applied Assessment Framework for Risk Mitigation. Circular Economy and Sustainability 2022, 2, 669–692. [CrossRef]

- Henriques, J., Ferrão, P., Castro, R., & Azevedo, J. Industrial Symbiosis: A Sectoral Analysis on Enablers and Barriers. Sustainability 2021, 13, 1723. [CrossRef]

- Henriques, J., Ferrão, P., & Iten, M. Policies and Strategic Incentives for Circular Economy and Industrial Symbiosis in Portugal: A Future Perspective. Sustainability 2022, 14, 6888. [CrossRef]

- ISO 55002:2018. Asset management — Management systems — Guidelines for the application of ISO 55001, (2018) (testimony of International Organization for Standardization).

- IPMA. (2022a). Indice PDSI (Palmer Drought Severity Index). https://www.ipma.pt/pt/oclima/observatorio.secas/.

- IPMA. (2022b). Precipitação forte na região Lisboa. https://www.ipma.pt/pt/media/noticias/documentos/2022/Precipitacao-intensa-lisboa_vrs1.pdf.

- Jafari Shalamzari, M., & Zhang, W. Assessing Water Scarcity Using the Water Poverty Index (WPI) in Golestan Province of Iran. Water 2018, 10, 1079. [CrossRef]

- Jamwal, A., Agrawal, R., Sharma, M., Manupati, V. K., & Patidar, A. (2021). Industry 4.0 and Sustainable Manufacturing: A Bibliometric Based Review (pp. 1–11). [CrossRef]

- Johanson, U., Skoog, M., Backlund, A., & Almqvist, R. Balancing dilemmas of the balanced scorecard. Accounting, Auditing & Accountability Journal 2006, 19, 842–857. [CrossRef]

- Kamble, S. S., Gunasekaran, A., & Gawankar, S. A. Sustainable Industry 4.0 framework: A systematic literature review identifying the current trends and future perspectives. Process Safety and Environmental Protection 2018, 117, 408–425. [CrossRef]

- Kanani-Sadat, Y., Arabsheibani, R., Karimipour, F., & Nasseri, M. A new approach to flood susceptibility assessment in data-scarce and ungauged regions based on GIS-based hybrid multi criteria decision-making method. Journal of Hydrology 2019, 572, 17–31. [CrossRef]

- K, *!!! REPLACE !!!*. Kaplan , R. S. & Norton, D. P. The Balanced Scorecard: measures that drive performance. Harvard Business Review, January–February 1992, 71–79. 19 February.

- Kaplan, R. S. (2009). Conceptual Foundations of the Balanced Scorecard. In M. D. Chapman, Christopher S.; Hopwood, Anthony G. and Shields (Ed.), Handbook of Management Accounting Research (pp. 1253–1269). Elsevier Ltd. [CrossRef]

- Karathanos, D., & Karathanos, P. Applying the Balanced Scorecard to Education. Journal of Education for Business 2005, 80, 222–230. [CrossRef]

- Khan, I., Zakari, A., Dagar, V., & Singh, S. World energy trilemma and transformative energy developments as determinants of economic growth amid environmental sustainability. Energy Economics 2022, 108, 105884. [CrossRef]

- Khan, K. S., Kunz, R., Kleijnen, J., & Antes, G. Five steps to conducting a systematic review. JRSM 2003, 96, 118–121. [CrossRef]

- Khatibi, S., & Arjjumend, H. Water Crisis in Making in Iran. Grassroots Journal of Natural Resources 2019, 2, 45–54. [CrossRef]

- Kirchherr, J. Kirchherr, J., Reike, D., & Hekkert, M. Conceptualizing the circular economy: An analysis of 114 definitions. Resources, Conservation and Recycling 2017, 127(September), 221–232. [CrossRef]

- Kiriri, P. N.. Management of Performance in Higher Education Institutions: The Application of the Balanced Scorecard (BSC). European Journal of Education 2022, 5, 141–154. [CrossRef]

- Krautkraemer, J. A. (2005). Economics of Natural Resource Scarcity: The State of the Debate. Resources for the Future. Resources for the Future. [CrossRef]

- Kumar, U., Galar, D., Parida, A., Stenström, C., & Berges, L. Maintenance performance metrics: a state-of-the-art review. Journal of Quality in Maintenance Engineering 2013, 19, 233–277. [CrossRef]

- Lach, D., Rayner, S., & Ingram, H. Taming the waters: strategies to domesticate the wicked problems of water resource management. International Journal of Water 2005, 3, 1. [CrossRef]

- ., *!!! REPLACE !!!*. Lewis, R. W. (1955). Measuring, reporting and appraising results of operations with reference to goals, plans and budgets. Planning, Managing and Measuring the Business: A case study of management planning and control at General Electric Company. Controllership Foundation.

- Li, W., Elheddad, M., & Doytch, N. The impact of innovation on environmental quality: Evidence for the non-linear relationship of patents and CO2 emissions in China. Journal of Environmental Management 2021, 292, 112781. [CrossRef]

- Liu, H., Khan, I., Zakari, A., & Alharthi, M. Roles of trilemma in the world energy sector and transition towards sustainable energy: A study of economic growth and the environment. Energy Policy 2022, 170, 113238. [CrossRef]

- Liu, Y., Xu, W., Hong, Z., Wang, L., Ou, G., & Lu, N. Assessment of Spatial-Temporal Changes of Landscape Ecological Risk in Xishuangbanna, China from 1990 to 2019. Sustainability 2022, 14, 10645. [CrossRef]

- Liyanage, J. P., Badurdeen, F., & Ratnayake, R. M. C. Industrial asset maintenance and sustainability performance: Economical, environmental, and societal implications. Handbook of Maintenance Management and Engineering 2009, 665–693. [CrossRef]

- Luciani, G. (2020). The Impacts of the Energy Transition on Growth and Income Distribution (pp. 305–318). [CrossRef]

- Lyubchyk, A., Filonovich, S. A., Mateus, T., Mendes, M. J., Vicente, A., Leitão, J. P., Falcão, B. P., Fortunato, E., Águas, H., & Martins, R. Nanocrystalline thin film silicon solar cells: A deeper look into p/i interface formation. Thin Solid Films 2015, 591, 25–31. [CrossRef]

- Makarova, T. L., Zakharchuk, I., Geydt, P., Lahderanta, E., Komlev, A. A., Zyrianova, A. A., Lyubchyk, A., Kanygin, M. A., Sedelnikova, O. V., Kurenya, A. G., Bulusheva, L. G., & Okotrub, A. V. Assessing carbon nanotube arrangement in polystyrene matrix by magnetic susceptibility measurements. Carbon 2016, 96, 1077–1083. [CrossRef]

- Maktav, D., Erbek, F. S., & Jürgens, C. Remote sensing of urban areas. International Journal of Remote Sensing 2005, 26, 655–659. [CrossRef]

- Maletič, D., Maletič, M., Al-Najjar, B., & Gomišček, B. The role of maintenance in improving company’s competitiveness and profitability. Journal of Manufacturing Technology Management 2014, 25, 441–456. [CrossRef]

- Márquez, A. C. (2007). The Maintenance Management Framework. Springer London. [CrossRef]

- Martins, A. B., Farinha, J. T., & Cardoso, A. M. Calibration and certification of industrial sensors – a global review. WSEAS Transactions on Systems and Control 2020, 15, 394–416. [CrossRef]

- Martins, A. B., Fonseca, I., Farinha, J. T., Reis, J., & Marques Cardoso, A. J. (2022). Prediction Maintenance Based on Vibration Analysis and Deep Learning – a Case Study of a Drying Press Supported on a Hidden Markov Model. SSRN Electronic Journal. [CrossRef]

- Martins, A., Fonseca, I., Farinha, J. T., Reis, J., & Cardoso, A. J. M. Maintenance Prediction through Sensing Using Hidden Markov Models—A Case Study. Applied Sciences 2021, 11, 7685. [CrossRef]

- Mateus, B., Mendes, M., Farinha, J. T., Martins, A. B., & Cardoso, A. M. (2023). Data Analysis for Predictive Maintenance Using Time Series and Deep Learning Models—A Case Study in a Pulp Paper Industry (pp. 11–25). [CrossRef]

- Mizusawa D.; McNeil S. (2005). Trinitiy in transportation planning: Strategic planning, asset management, and performance measures. Annual Conference - Canadian Society for Civil Engineering (Vol. 2005).

- Mok, W. K., Tan, Y. X., & Chen, W. N. Technology innovations for food security in Singapore: A case study of future food systems for an increasingly natural resource-scarce world. Trends in Food Science & Technology 2020, 102, 155–168. [CrossRef]

- Neumayer, E. Scarce or Abundant? The Economics of Natural Resource Availability. Journal of Economic Surveys 2002, 14, 307–335. [Google Scholar] [CrossRef]

- Nørreklit, H. The Balanced Scorecard: what is the score? A rhetorical analysis of the Balanced Scorecard. Accounting, Organizations and Society 2003, 28, 591–619. [Google Scholar] [CrossRef]

- O’Neil, H. F., Bensimon, E. M., Diamond, M. A., & Moore, M. R. Designing and Implementing an Academic Scorecard. Change: The Magazine of Higher Learning 1999, 31, 32–40. [CrossRef]

- Orimoloye, I. R., Belle, J. A., Olusola, A. O., Busayo, E. T., & Ololade, O. O. Spatial assessment of drought disasters, vulnerability, severity and water shortages: a potential drought disaster mitigation strategy. Natural Hazards 2021, 105, 2735–2754. [CrossRef]

- Padilla-Lozano, C. P., & Collazzo, P. Corporate social responsibility, green innovation and competitiveness – causality in manufacturing. Competitiveness Review: An International Business Journal 2022, 32, 21–39. [CrossRef]

- Pais, E., Raposo, H., Meireles, A., & Farinha, J. T. ISO 55001 – A Strategic Tool for the Circular Economy – Diagnosis of the Organization’s State. Journal of Industrial Engineering and Management Science 2019, 2018, 89–108. [CrossRef]

- Parra, C., Viveros, P., Kristjanpoller, F., & Marquez, A. C. (2021). TÉCNICAS DE AUDITORÍA PARA LOS PROCESOS DE: MANTENIMIENTO, FIABILIDAD OPERACIONAL Y GESTIÓN DE ACTIVOS (AMORMS & AMS-ISO 55001) (Issue March). Universidad de Sevilla, Universidad Técnica Federico Santa María.

- Paul, G. C., Saha, S., & Hembram, T. K. Application of the GIS-Based Probabilistic Models for Mapping the Flood Susceptibility in Bansloi Sub-basin of Ganga-Bhagirathi River and Their Comparison. Remote Sensing in Earth Systems Sciences 2019, 2(2–3), 120–146. [CrossRef]

- Pink, G H; McKillop I, Schraa, EG; Preyra, C; Montgomery, C; Baker, G. R. Creating a balanced scorecard for a hospital system. Journal of Health Care Finance 2001, 27, 1–20.

- Posavljak, M., Tighe, S. L., & Godin, J. W. Strategic Total Highway Asset Management Integration. Transportation Research Record: Journal of the Transportation Research Board 2013, 2354, 107–114. [CrossRef]

- Prieto-Sandoval, V., Jaca, C., & Ormazabal, M. Towards a consensus on the circular economy. Journal of Cleaner Production 2018, 179, 605–615. [CrossRef]

- Procházka, P., Hönig, V., Maitah, M., Pljučarská, I., & Kleindienst, J. Evaluation of Water Scarcity in Selected Countries of the Middle East. Water 2018, 10, 1482. [CrossRef]

- Punniyamoorthy, M., & Murali, R. Balanced score for the balanced scorecard: a benchmarking tool. Benchmarking: An International Journal 2008, 15, 420–443. [CrossRef]

- Rajput, S., & Singh, S. P. Connecting circular economy and industry 4.0. P. Connecting circular economy and industry 4.0. International Journal of Information Management 2019, 49(November 2018), 98–113. [CrossRef]

- Roda, I., & Garetti, M. (2015). Application of a Performance-driven Total Cost of Ownership (TCO) Evaluation Model for Physical Asset Management. In 9th WCEAM Research Papers - Volume 1 Proceedings of 2014 World Congress on Engineering Asset Management (pp. 11–23). Springer International Publishing. [CrossRef]

- ., *!!! REPLACE !!!*. Rodrigues, J. A., Farinha, J. T., Cardoso, A. M., Mendes, M., & Mateus, R. (2023). Prediction of Sensor Values in Paper Pulp Industry Using Neural Networks (pp. 281–291). [CrossRef]

- Rodrigues, J. A., Farinha, J. T., Mendes, M., Mateus, R., & Cardoso, A. Short and long forecast to implement predictive maintenance in a pulp industry. Eksploatacja i Niezawodnosc - Maintenance and Reliability 2021, 24, 33–41. [CrossRef]

- Rodrigues, J. A., Farinha, J. T., Mendes, M., Mateus, R. J. G., & Cardoso, A. J. M. Comparison of Different Features and Neural Networks for Predicting Industrial Paper Press Condition. Energies 2022, 15, 6308. [CrossRef]

- Rodrigues, J. A., Martins, A., Mendes, M., Farinha, J. T., Mateus, R. J. G., & Cardoso, A. J. M. Automatic Risk Assessment for an Industrial Asset Using Unsupervised and Supervised Learning. Energies 2022, 15, 9387. [CrossRef]

- Rodrigues, Joao, Costa, I, Farinha, J., Mendes, M., & Margalho, L. Predicting motor oil condition using artificial neural networks and principal component analysis. Eksploatacja i Niezawodność – Maintenance and Reliability 2020, 22, 440–448. [CrossRef]

- Rodrigues, João, Farinha, J. M. T., & Cardoso, A. M. Predictive maintenance tools – a global survey. WSEAS Transactions on Systems and Control 2021, 16, 96–109. [CrossRef]

- Rokicki, T., Perkowska, A., Klepacki, B., Szczepaniuk, H., Szczepaniuk, E. K., Bereziński, S., & Ziółkowska, P. The importance of higher education in the EU countries in achieving the objectives of the circular economy in the energy sector. Energies 2020, 13. [CrossRef]

- Root, T. L., Price, J. T., Hall, K. R., Schneider, S. H., Rosenzweig, C., & Pounds, J. A. Fingerprints of global warming on wild animals and plants. Nature 2003, 421, 57–60. [CrossRef]

- Sadeghi Dastaki, M., Afrazeh, A., & Mahootchi, M. A two-phase decision-making model for product development based on a product-oriented knowledge inventory model. Journal of Knowledge Management 2022, 26, 943–971. [CrossRef]

- Saha, S., Gayen, A., & Bayen, B. Deep learning algorithms to develop Flood susceptibility map in Data-Scarce and Ungauged River Basin in India. Stochastic Environmental Research and Risk Assessment 2022, 36, 3295–3310. [CrossRef]

- Saleem, H., Khosravi, M., Maroufi, S., Sahajwalla, V., & O’Mullane, A. P. Repurposing metal containing wastes and mass-produced materials as electrocatalysts for water electrolysis. Sustainable Energy & Fuels 2022, 6, 4829–4844. [CrossRef]

- Sarmas, E., Marinakis, V., & Doukas, H. A data-driven multicriteria decision making tool for assessing investments in energy efficiency. Operational Research 2022, 22, 5597–5616. [CrossRef]

- Scopus. (n.d.). Scopus. Retrieved December 23, 2022, from https://www.scopus.com/. /: https, 23 December.

- Seto, K. C., Fragkias, M., Güneralp, B., & Reilly, M. K. A Meta-Analysis of Global Urban Land Expansion. PLoS ONE 2011, 6, e23777. [CrossRef]

- Sharaf-Addin, H. H., & Fazel, H. Balanced Scorecard Development as a Performance Management System in Saudi Public Universities: A Case Study Approach. Asia-Pacific Journal of Management Research and Innovation 2021, 17(1–2), 57–70. [CrossRef]

- Shen, S., Chang, R. H., Kim, K., & Julian, M. Challenges to maintaining disaster relief supply chains in island communities: disaster preparedness and response in Honolulu, Hawai’i. Natural Hazards 2022, 114, 1829–1855. [CrossRef]

- Shylo, A., Danilenko, I., Gorban, O., Doroshkevich, O., Nosolev, I., Konstantinova, T., & Lyubchyk, A. Hydrated zirconia nanoparticles as media for electrical charge accumulation. Journal of Nanoparticle Research 2022, 24, 18. [CrossRef]

- Shylo, A., Doroshkevich, A., Lyubchyk, A., Bacherikov, Y., Balasoiu, M., & Konstantinova, T. Electrophysical properties of hydrated porous dispersed system based on zirconia nanopowders. Applied Nanoscience 2020, 10, 4395–4402. [CrossRef]

- Silk, S. Automating the Balanced Scorecard. Management Accounting 1998, 79, 38–44. [Google Scholar]

- Simões, J. M., Gomes, C. F., & Yasin, M. M. A literature review of maintenance performance measurement. Journal of Quality in Maintenance Engineering 2011, 17, 116–137. [CrossRef]

- Simon, H. A. A Framework for Decision Making. Proceedings of a Symposium on Decision Theory 1963, 1– 9 , 22–28. 9.

- Simon, H., Guetzkow, H., Kozmetsky, G., & Tyndall, G. (1954). Centralization vs. Decentralization in Organizing the Controller’s Department. Controllership Foundation Scholars Book Co.

- Sinha, A., Mishra, S., Sharif, A., & Yarovaya, L. Does green financing help to improve environmental & social responsibility? Designing SDG framework through advanced quantile modelling. Journal of Environmental Management 2021, 292, 112751. [CrossRef]

- Smith, V. K. Natural Resource Scarcity: A Statistical Analysis. The Review of Economics and Statistics 1979, 61, 423. [Google Scholar] [CrossRef]

- Stahel, W. R. Circular economy. Nature 2016, 531, 435–438. [Google Scholar] [CrossRef] [PubMed]

- Stewart, A. C.; Carpenter-Hubin, J. Stewart, A. C.; Carpenter-Hubin, J. (2001). The balanced scorecard. Planning for higher education. 37–42.

- Subhoni, M., Kholmurodov, K., Doroshkevich, A., Asgerov, E., Yamamoto, T., Lyubchyk, A., Almasan, V., & Madadzada, A. Density functional theory calculations of the water interactions with ZrO 2 nanoparticles Y 2 O 3 doped. Journal of Physics: Conference Series 2018, 994, 012013. [CrossRef]

- Szwagrzyk, M., Kaim, D., Price, B., Wypych, A., Grabska, E., & Kozak, J. Impact of forecasted land use changes on flood risk in the Polish Carpathians. Natural Hazards 2018, 94, 227–240. [CrossRef]

- Tehrany, M. S., Pradhan, B., & Jebur, M. N. Flood susceptibility analysis and its verification using a novel ensemble support vector machine and frequency ratio method. Stochastic Environmental Research and Risk Assessment 2015, 29, 1149–1165. [CrossRef]

- Uva, J. S. 6.o Inventário Florestal Nacional (IFN6). https://www.icnf.pt/api/file/doc/c8cc40b3b7ec8541. 8541.

- Vaszkun, B., & Tsutsui, W. M. (2012). A modern history of Japanese management thought. Journal of Management History 2015, 18, 368–385. [CrossRef]

- Walter, F. Walter, F., Gasparetto, V., & Neto, F. J. K. (2001). THE BUILDING OF THE BALANCED SCORECARD FOR ACADEMICAL ENVIRONMENTS: APPLICATION IN A GERMAN ACADEMIC UNIT THE BUILDING OF THE BALANCED SCORECARD FOR ACADEMICAL ENVIRONMENTS: APPLICATION IN A GERMAN ACADEMIC UNIT. VIII Congresso Brasileiro de Custos.

- Wang, J., Z., & Parlikad, A. (2016). Designing Performance Measures for Asset Management Systems in Asset-Intensive Manufacturing Companies: A Case Study. In H. Koskinen, Kari T.; Kortelainen, T. Aaltonen, Jussi; Uusitalo, & J. Komonen, Kari; Mathew, Joseph; Laitinen (Eds.), Proceedings of the 10th World Congress on Engineering Asset Management (WCEAM 2015) (pp.; pp. 655–662. [CrossRef]

- Wang, X., Xu, Z., Qin, Y., & Skare, M. Innovation, the knowledge economy, and green growth: Is knowledge-intensive growth really environmentally friendly? Energy Economics 2022, 115, 106331. [CrossRef]

- WCED. (1987). Report of the World Commission on Environment and Development : Our Common Future Acronyms and Note on Terminology Chairman ’ s Foreword. Report of the World Commission on Environment and Development: Our Common Future.

- Weerasekara, S., Lu, Z., Ozek, B., Isaacs, J., & Kamarthi, S. Trends in Adopting Industry 4.0 for Asset Life Cycle Management for Sustainability: A Keyword Co-Occurrence Network Review and Analysis. Sustainability 2022, 14, 12233. [CrossRef]

- Wijnia, Y. (2022). Pragmatic Performance Management: Aligning Objectives Across Different Asset Portfolios. In Lecture Notes in Mechanical Engineering (pp. 163–172). [CrossRef]

- Zhang, Y., & Dilanchiev, A. Economic recovery, industrial structure and natural resource utilization efficiency in China: Effect on green economic recovery. Resources Policy 2022, 79, 102958. [CrossRef]

- Zink, T., & Geyer, R. Circular Economy Rebound. Journal of Industrial Ecology 2017, 21, 593–602. [CrossRef]

| Perspectives | Questions | Measurements | Physical Assets Intervention | ISO 55001 Requirements | KPI |

|---|---|---|---|---|---|

| Financial Perspective | How to reduce costs? | Revenue, Expenses, ROI, Net Income | Maintenance policies; Availability vs Production | 6.2.1; 6.2.2 | ROI, EPS, RG |

| How to increase profitability? | |||||

| How to increase revenue? | |||||

| Customer Perspective | What are the customer’s needs? | Customer Satisfaction, Customer Retention | Quality level related to Physical Assets performance | 4.1; 4.3; 5.3 | NPS, RPR, RC, CSAT |

| What stakeholders expect? | |||||

| What interested parts expect? | |||||

| Internal Business Process Perspective | What are my assets? | Inventory; Quality Control, Product Lead Time | Physical Assets Life-Cycle vs SAMP | 4.4; 5.3; 6.2.1; 6.2.2 | IQI, QCR, PLTF |

| What is the value of my assets? | |||||

| My assets are in line with the organization's objectives? | |||||

| What assets will focus on? | |||||

| How to extend the life-cycle of the assets? | |||||

| What are the non-core assets for the organization? | |||||

| What new assets are needed? | |||||

| How to dispose old assets? | |||||

| How to manage risk? | |||||

| Innovation Learning & Growth Perspective | Increase availability | Employee Skills, Employee Training, Employee Retention, Employee Satisfaction | Maintenance policies vs TPM | 6.2.1; 6.2.2 | ESR, ETR, ERR, ESI |

| Improve reliability |

| KPI | Description |

|---|---|

| ROI | Return on Investment |

| EPS | Earnings per Share |

| RG | Revenue Growth |

| NPS | Net Promoter Score |

| RPR | Repeat Purchase Rate |

| RC | Revenue Concentration |

| CSAT | Customer Satisfaction Score |

| QCR | Quality Control Rate |

| IQI | Inventory Quality Index |

| PLTF | Product Lead Time Forecast |

| ESR | Employee Skills Rate |

| ETR | Employee Training Rate |

| ERR | Employee Retention Rate |

| ESI | Employee satisfaction index |

| KPI | Grounding |

|---|---|

| ROI | Measures the return on investment |

| EPS | Presents the profit increase |

| RG | Presents the revenue increase |

| NPS | Measures customer experience |

| RPR | Measures the customers retention |

| RC | Measures the revenue generated from the highest paying client |

| CSAT | Measures the happiness of the costumer with a product or service |

| QCR | Measures the product / service quality |

| IQI | Measures the Inventory Quality |

| PLTF | Measures the time it takes to create a product and deliver it to a consumer |

| ESR | Measures the skills that employees have |

| ETR | Measures the training that employees have |

| ERR | Measures the retention on employees |

| ESI | Measures the employees satisfaction |

| KPI | Data |

|---|---|

| ROI | Current Value of Investment |

| Cost of Investment | |

| EPS | Net Income |

| Preferred Dividends | |

| End-of-Period Common Shares Outstanding | |

| RG | Initial Revenue |

| Final Revenue | |

| NPS | Percentage of Promoters |

| Percentage of Passives | |

| Percentage of Detractors | |

| RPR | Number of customers who made a repeat purchase |

| Number of customers | |

| RC | Amount of revenue that your business earned from the best customer |

| Amount by your business’s total revenue | |

| CSAT | Number of satisfied customers |

| Total customers asked | |

| QCR | Number of good products produced |

| Total of product produced | |

| IQI | Number of assets correctly inventoried |

| Total of assets | |

| PLTF | Estimated total time |

| Real total time | |

| ESR | Number of employees with skills to their work |

| Total number of employees | |

| ETR | Number of hours in training |

| Number of hours planned for training | |

| ERR | Total of new employees retained |

| Total of new employees | |

| ESI | How satisfied are you with your job? |

| How well does your job meet your expectations? | |

| How close is your workplace to your ideal job? |

| KPI | Data | Value | KPI Value | Unit |

|---|---|---|---|---|

| ROI | Current Value of Investment | 22,36 | 11,78 | % |

| Cost of Investment | 20,00 | |||

| EPS | Net Income | 106,05 | 6,88 | € |

| Preferred Dividends | 0,43 | |||

| End-of-Period Common Shares Outstanding | 15 | |||

| RG | Initial Revenue | 5,36 | 17,91 | % |

| Final Revenue | 6,32 | |||

| NPS | Percentage of Promoters | 85% | 62,00 | % |

| Percentage of Passives | 25% | |||

| Percentage of Detractors | 23% | |||

| RPR | Number of customers who made a repeat purchase | 86 | 68,25 | % |

| Number of customers | 126 | |||

| RC | Amount of revenue that your business earned from the best customer | 2,35 | 72,31 | % |

| Amount by your business’s total revenue | 3,25 | |||

| CSAT | Number of satisfied customers | 126 | 47,55 | % |

| Total customers asked | 265 | |||

| QCR | Number of good product produced | 12,69 | 88,37 | % |

| Total of product produced | 14,36 | |||

| IQI | Number of assets correctly inventoried | 64 | 77,11 | % |

| Total of assets | 83 | |||

| PLTF | Estimated total time | 54,00 | 90,00 | % |

| Real total time | 60,00 | |||

| ESR | Number of employees with skills to their work | 20 | 76,92 | % |

| Total number of employees | 26 | |||

| ETR | Number of hours in training | 58,00 | 100,00 | % |

| Number of hours planned for training | 50,00 | |||

| ERR | Total of new employees retained | 7 | 77,78 | % |

| Total of new employees | 9 | |||

| ESI | How satisfied are you with your job? | 9 | 85,19 | % |

| How well does your job meet your expectations? | 8 | |||

| How close is your workplace to your ideal job? | 9 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).