Submitted:

07 July 2023

Posted:

13 July 2023

You are already at the latest version

Abstract

Keywords:

1. Introduction

2. Materials and Methods

2.1. Data Collection

2.2. Descriptive Analysis

2.3. Pearson Correlation Coefficient (r) and Coefficient of Determination (R2)

2.4. Cost Analysis

2.5. Monte Carlo Simulation

3. Analysis of Results

3.1. Characterization of Crops in the Study Area

3.2. Descriptive Analysis

3.3. Financial Analysis of Corn and Soybeans

3.4. Pearson Correlation Coefficient (r) and Coefficient of Determination (R2)

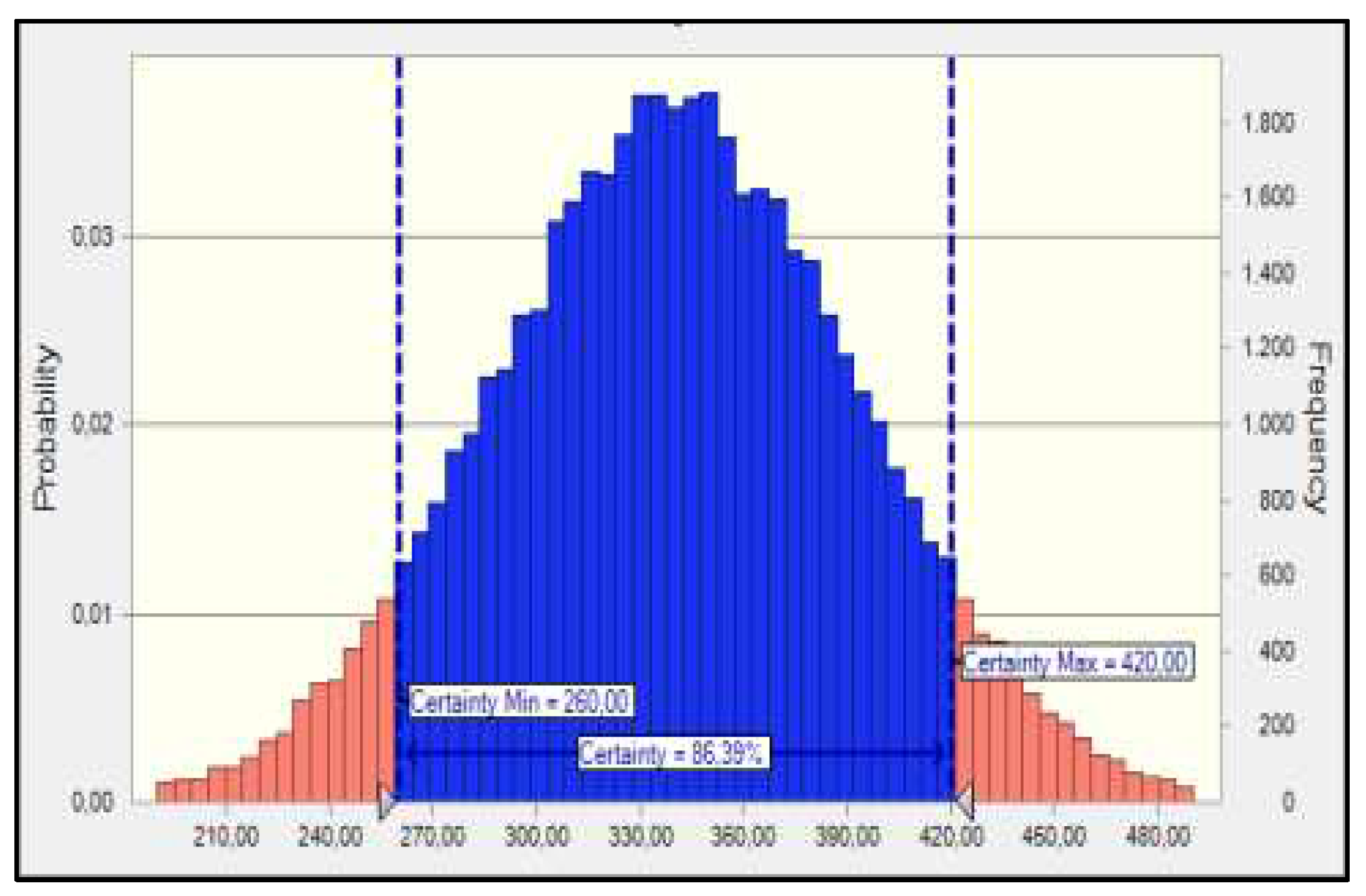

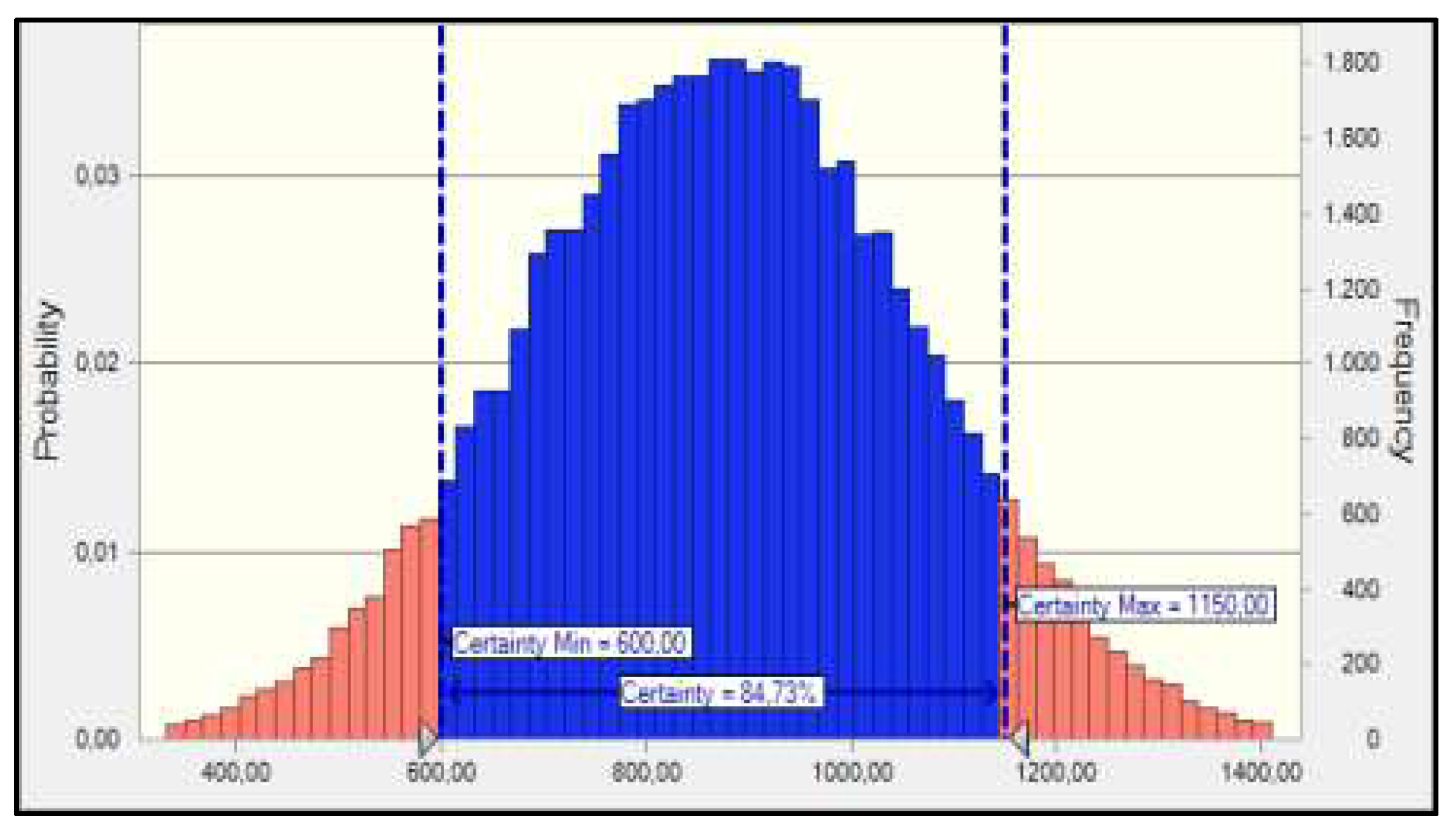

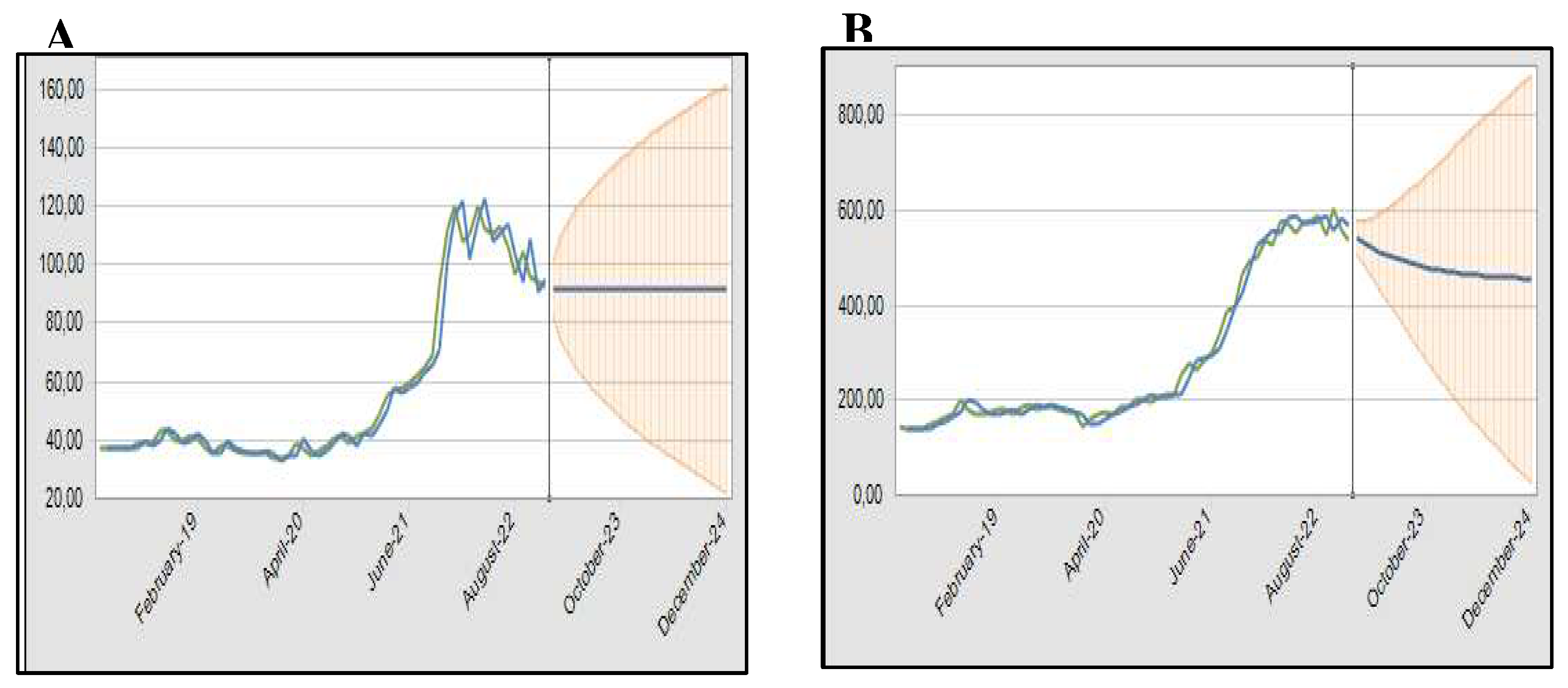

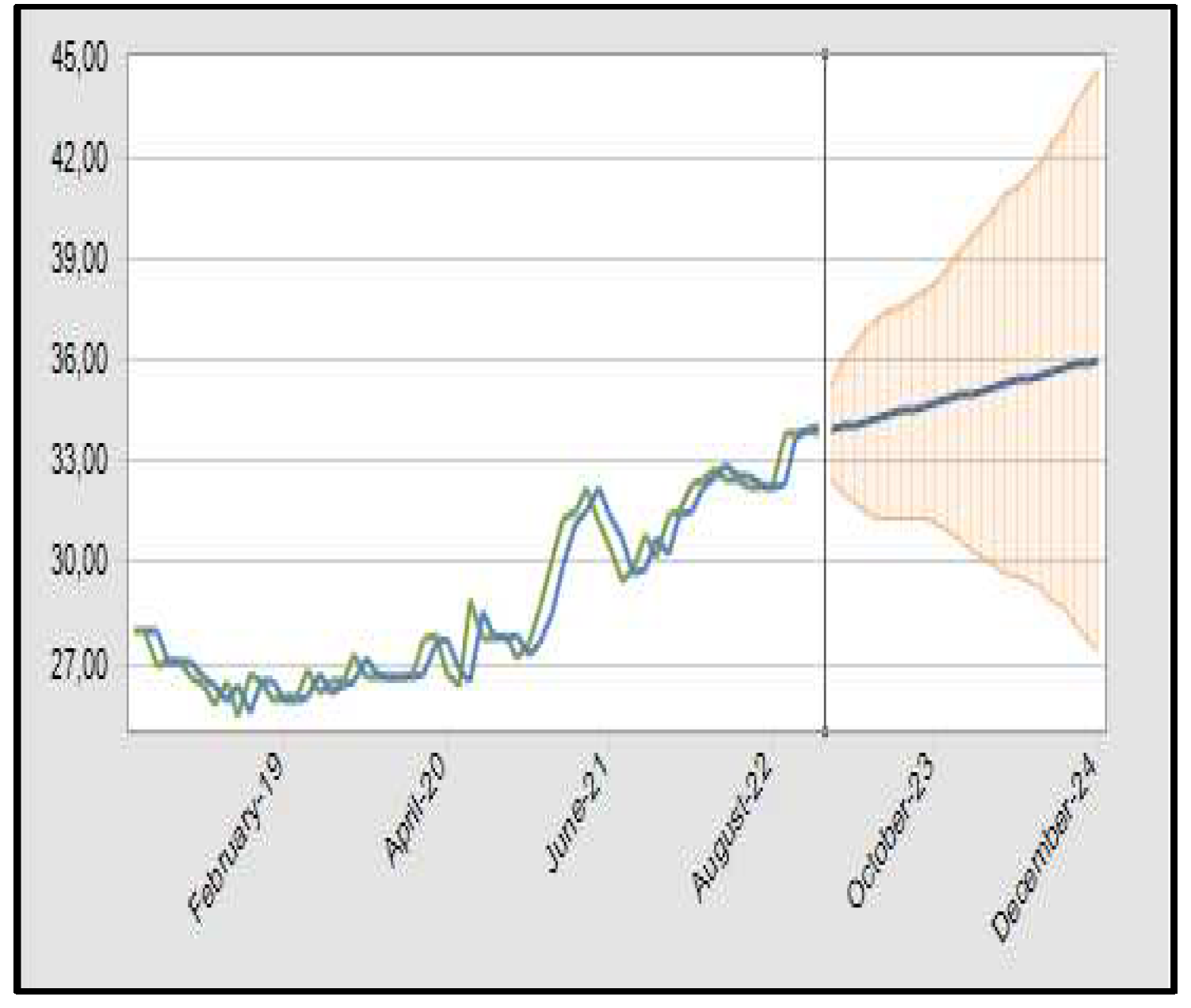

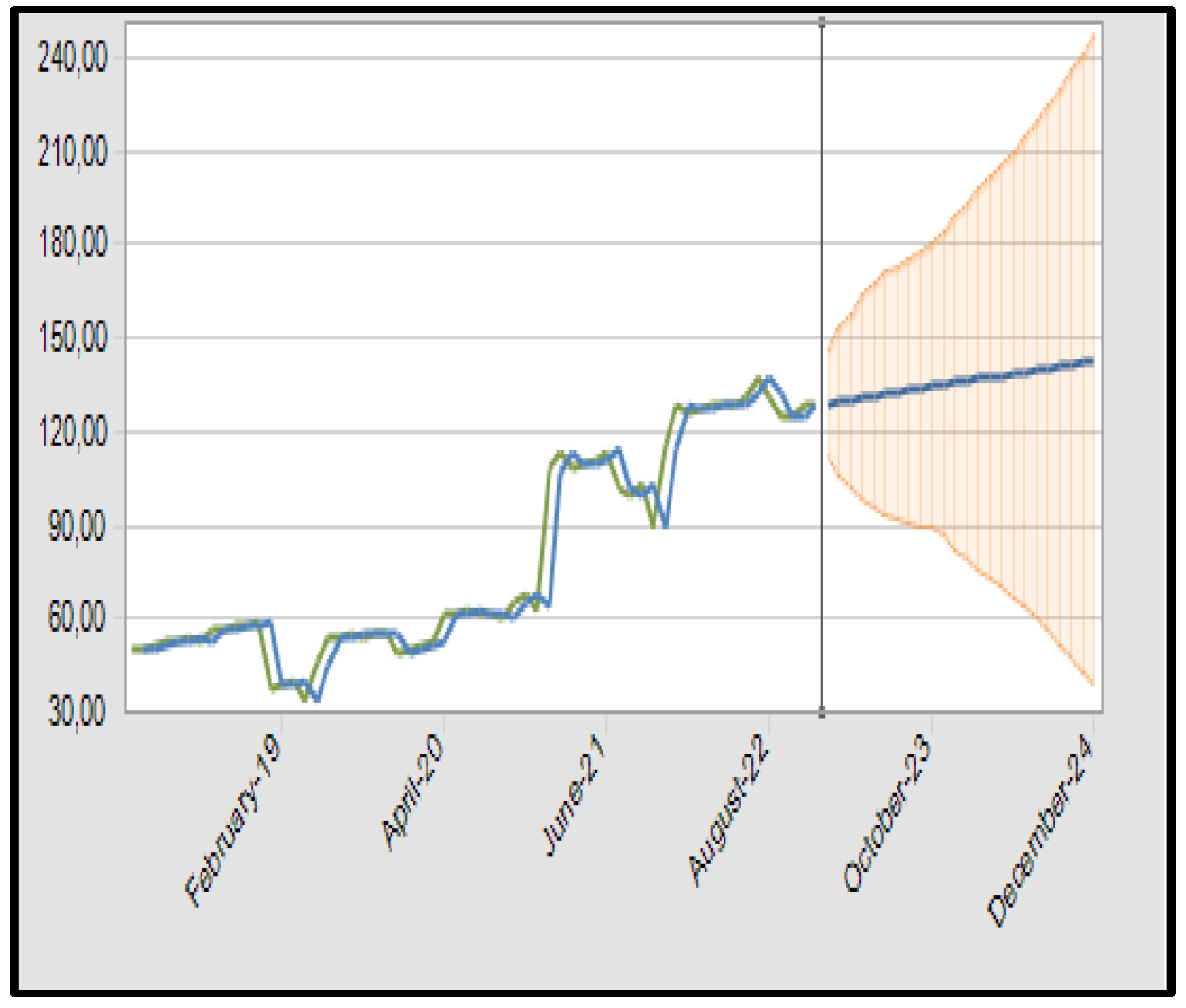

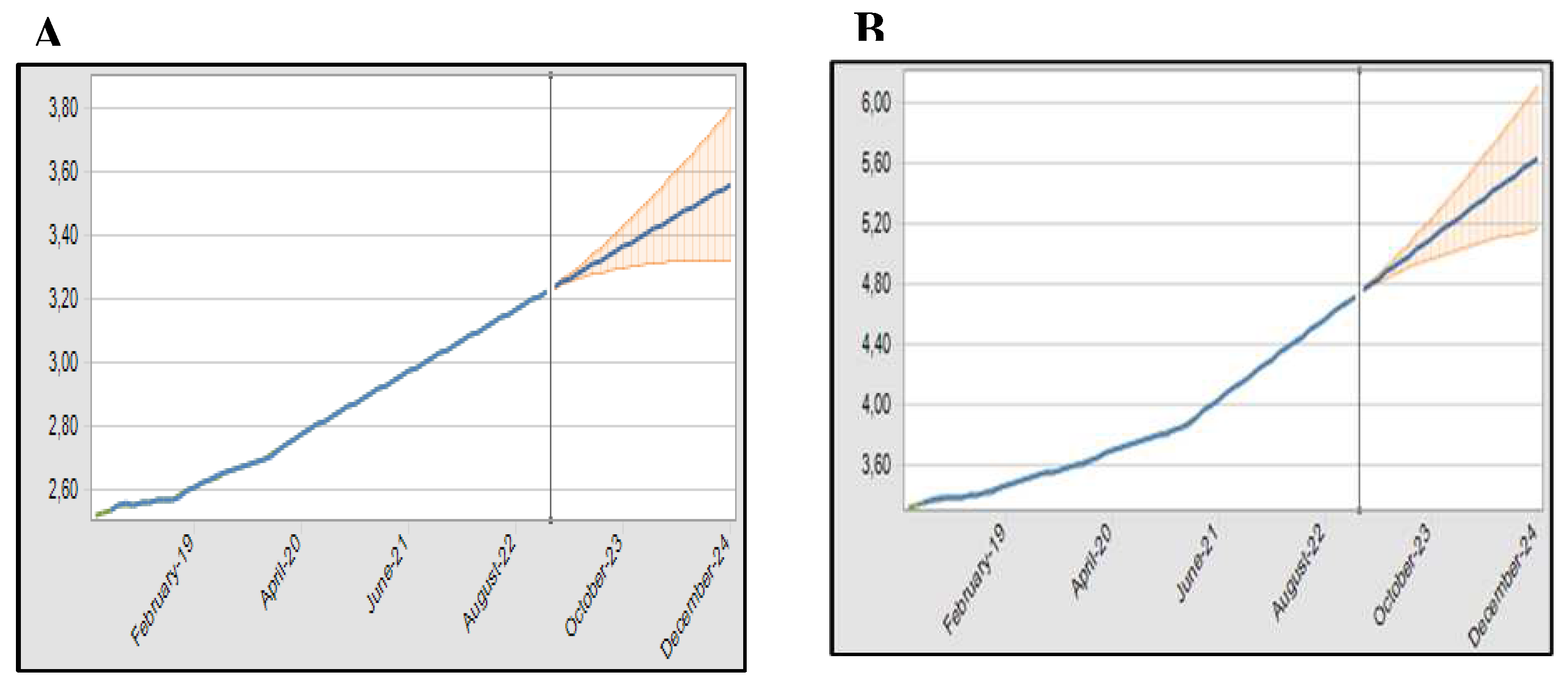

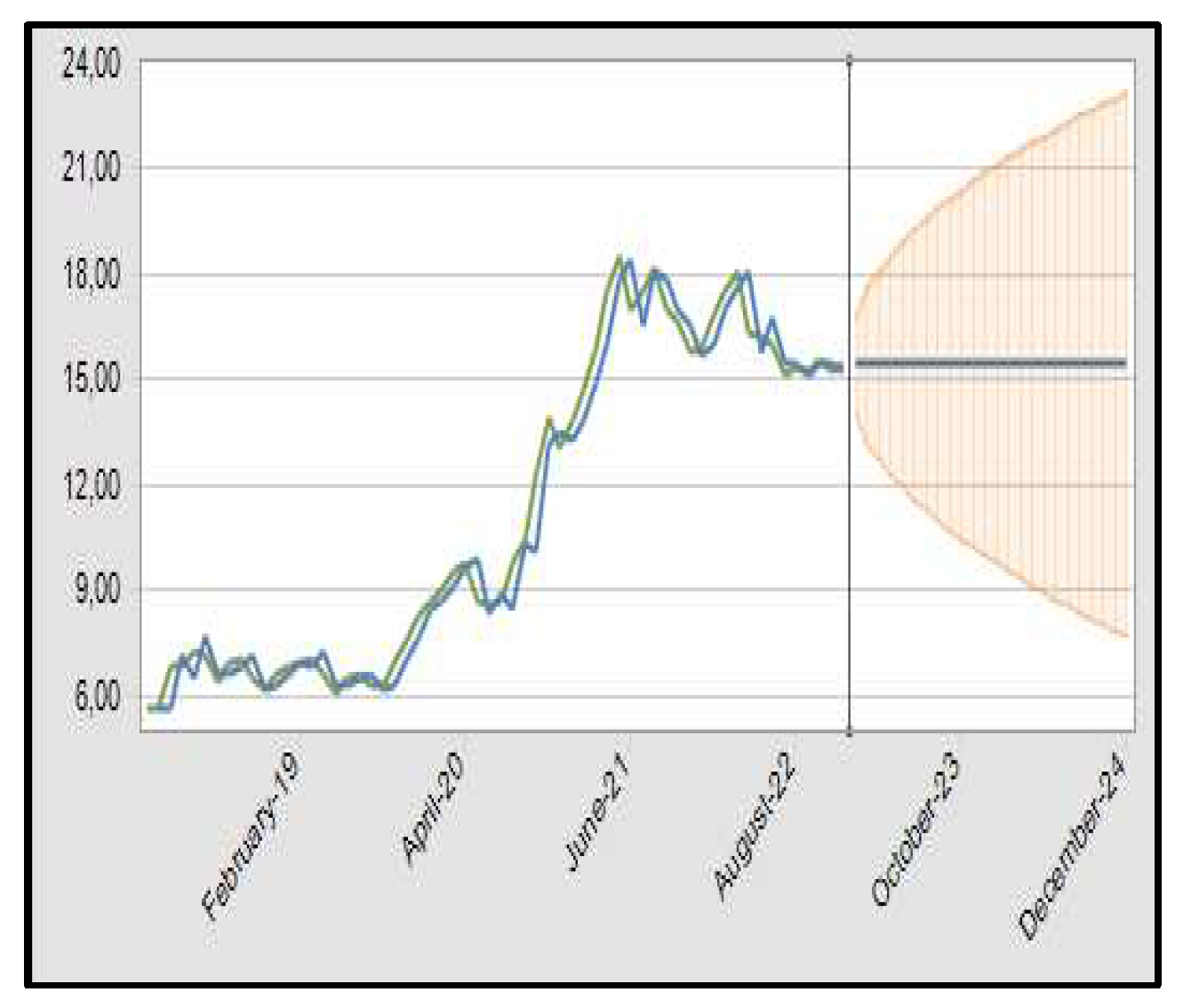

3.5. Monte Carlo Simulation – Predictor

4. Discussion and Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Aragão, A. , Contini, E. 2022. O agro no Brasil e no mundo: Um panorama do período de 2000 a 2021. Embrapa, Brasília, DF, Brasil. Available at:. https://www.embrapa.br/documents/10180/62618376/O+AGRO+NO+BRASIL+E+NO+MUNDO.pdf.

- Meade, B. , Puricelli, E., Mcbride, W., Valdes, C., Hoffman, L., Foreman, L., & Dohlman, E. 2016. Corn and Soybean Production Costs and Export Competitiveness in Argentina, Brazil, and the United States. World Bank Group Agricuture, Washington, DC, Estados Unidos.

- BELIK, W. 2020. Sustainability and food security after COVID-19: relocalizing food systems? Agricultural and Food Economics, 8(1):23. [CrossRef]

- Amorim, F. R. de, Andrade, A. G. de., Silva, S. A., Pigatto, G. 2021. Reflexo pós-pandemia nos preços das ações de três grupos do setor sucroalcooleiro no Brasil. Navus Revista de Gestão e Tecnologia 11:1-19.

- Oliveira, S. C. de. , Amorim, F. R. de., Barbosa, C. C., Andrade, Alequexandre, G. de., Solfa, F. D. G. 2022. Effect of Production Costs on the Price per Ton of Sugarcane: The Case of Brazil. International Journal of Social Science Studies, 10(6):15-27. [CrossRef]

- Sun, Z. , Katchova, A. L., Lee, S. 2023. Economic perspective on the U.S. agricultural commodity market for the 2022/23 marketing year. Department of Agricultural, Environmental, and Development Economics. Available at https://aede.osu.edu/about-us/publications/economic-perspective-us-agricultural-commodity-market-202223-marketing-year.

- Grafton, M. , Manning, M. 2017. Establishing a risk profile for New Zealand pastoral farms. Agriculture,7(10):81. [CrossRef]

- Lips, M. 2017. Disproportionate allocation of indirect costs at individual-farm level using maximum entropy. Entropy19(9):453. [CrossRef]

- Gao, J. , Zeng W., Ren, Z., Ao, C., Lei, G., Gaiser, T., Srivastava, A. 2023. A Fertilization Decision Model for Maize, Rice, and Soybean Based on Machine Learning and Swarm Intelligent Search Algorithms. Agronomy 13(5):1400. [CrossRef]

- Pitrova, J. , Krejˇcí, I., Pilar, L., Moulis, P., Rydval, J., Hlavatý, R., Horáková, T., Tichá, I., 2020. The economic impact ofdiversification into agritourism. International Food and Agribusiness Management Review 23(5): 713-734. [CrossRef]

- Amorim, F. R. de, Patino, M. T. O., Bartmeyer, P. M., Santos, D. F. L. 2020. Productivity and Profitability of the Sugarcane Production in the State of Sao Paulo, Brazil. Sugar Tech 22:596–604. [CrossRef]

- Pengue, W. A. 2004. Transgenic crops in Argentina and its hidden costs. In Proceedings of IV Biennial International Workshop Advances in Energy Studies. Unicamp, Campinas, SP, Brazil.

- Goldsmith, P. 2019. Soybean costs of production. African Journal of Food, Agriculture, Nutrition and Development 19(5): 15140–15144. [CrossRef]

- Migliorin, A. D. S. , Milani, B. 2021. Análise dos custos de produção da cultura da soja em uma pequena propriedade rural de Jaguari – RS. Revista Gestão em Análise 10(2): 33-47. [CrossRef]

- Pratine, E. , Suave, R., Maris Lima Altoé, S. (2021). Custos e margem de contribuição da produção de soja de uma propriedade rural. Custos e agronegócio online 17(2): 464-490.

- Rocha, R. R. 2020. Avaliação de custos de produção de soja convencional: um estudo de caso no município de Nova Mutum (Mato Grosso). Meio Ambiente 2(4): 40-47.

- Silva, K. H. A. , Guzatti, N. C., & Franco, C. 2020. Análise de custo de produção e lucratividade na produção do milho convencional e transgênico em Mato Grosso. Custos e agronegócio online 16(1):250-275.

- Silva, A. C. C. J. da, Rossato, J. V., Kraetzig, E. R. S., da Silva, V. R. 2022. Custos de produção da soja em uma propriedade rural no interior do Estado do Rio Grande do Sul. Custos e agronegócio online 18(1):2-24.

- Ishikawa-Ishiwata, Y. , Furuya, J. 2021. Fungicide cost reduction with soybean rust-resistant cultivars in Paraguay: A supply and demand approach. Sustainability 13(2):887. [CrossRef]

- Ventura, M. V. A. , Batista, H. R. F., Bessa, M. M., Pereira, L. S., Costa, E. M., Oliveira, M. H. R. de. 2020. Comparison of conventional and transgenic soybean production costs in different regions in Brazil. Research, Society and Development 9(7): e154973977. [CrossRef]

- Huerta, A. I. , Martin, M. A. 2002. Soybean production costs: an analysis of the United States, Brazil, and Argentina. AAEA Annual Meeting Long Beach, California, Estados Unidos.

- Granjo, J. F. O. , Duarte, B. P. M., Oliveira, N. M. C. 2017. Integrated production of biodiesel in a soybean biorefinery: Modeling, simulation and economical assessment. Energy129(15): 273-291. [CrossRef]

- Olortegui, J. A. C.; Marçal, E. F.; Rocha, R.A.; Apolinário, H.C.F.; Teixeira, P.C.M. 2021. Avaliação De Áreas Agrícolas Através De Uma Abordagem De Opções Reais Por Simulação De Monte Carlo Com Mínimos Quadrados Ordinários. Brazilian Journal of Development 7(12): 118237-118255. [CrossRef]

- Osaki, M. , Aparecido, A.L. R., Lima, F.F., Ribeiro, R. G., Barros, G. S de C. 2017. Risks associated with a double-cropping production system - A case study in southern Brazil. Scientia Agricola 76(2): 130–138. [CrossRef]

- Thompson, N. M. , Armstrong, S. D., Roth, R. T., Ruffatti, M. D., Reeling, C. J. 2020. Short-run net returns to a cereal rye cover crop mix in a midwest corn–soybean rotation. Agronomy Journal 112(2): 1068–1083. [CrossRef]

- Arce, C. , Arias, D. 2015. Paraguay Agricultural Sector Risk Assessment. World Bank Group Agricuture, Washington, DC, Estados Unidos.

- Calviño, P. , Monzon, J. P. 2009. Farming systems of Argentina: yield constraints and risk management. Crop physiology: Applications for genetic improvement and agronomy 51:55-70. [CrossRef]

- Wu, H. , Hubbard, K. G., Wilhite, D. A. 2004. An agricultural drought risk-assessment model for corn and soybeans. International Journal of Climatology: A Journal of the Royal Meteorological Society 24(6):723-741. [CrossRef]

- Krah, K. Maize price variability, land use change, and forest loss: evidence from Ghana. 2023. Land Use Policy 125:106472- 106513. [CrossRef]

- Wang, W. , Wei, L. 2021 Impacts of agricultural price support policies on price variability and welfare: evidence from China's soybean market. Agricultural Economics 52(1): 3-17. [CrossRef]

- Hair, J. F. Jr. , Anderson, R. E., Tatham, R. L., Black, W. C. 2005. Análise Multivariada dos Dados. Bookman, Porto Alegre, RS, Brasil.

- Moriasi, D. N. , Arnold, J. G., Liew, M. W. V., Bingner, R. L., Harmel, R. D.; Veith, T. L. 2007. Model evaluation guidelines for systematic Quantification of accuracy in watershed simulations. American Society of Agricultural and Biological Engineers, 50(3): 885-890, 2007. [Google Scholar] [CrossRef]

- Oracle. Como Trabalhar com Planejamento Preditivo no Smart View. 2023. Available at: https://docs.oracle.com/cloud/help/pt_BR/pbcs_common/CSPPU/title.htm.

- Silva, S. A. , Abreu, P. H. C., Amorim, F. R.; Santos, D. F. L. 2019. Application of Monte Carlo Simulation for Analysis of Costs and Economic Risks in a Banking Agency. IEEE Latin America Transactions 17(3): 409-41.

- Miura, M. 2022. Estimativa de Oferta e Demanda de Milho no Estado de São Paulo em 2022. Instituto de Economia Agrícola 17(8): 1-4.

- Seade – Sistema Estadual de Análise de Dados. 2022. Valor da produção agrícola da soja ultrapassa o da laranja em SP. Available at https://www.seade.gov.br/valor-da-producao-agricola-da-soja-ultrapassa-o-da-laranja-em-sp/#:~:text=O%20valor%20bruto%20da%20produ%C3%A7%C3%A3o,%2C%20que%20respondeu%20por%2011%25.

- Camargo, F. P. de, Fredo, C. E., Ghobril, C. N., Bini, D. L. de C., Angelo, J. A., Miura, M., Coelho, P. J., Martins, V. A., Nakama, L. M., Ferreira, T. T. 2022. Previsões e Estimativas das Safras Agrícolas do Estado de São Paulo, Levantamento Parcial, Ano Agrícola 2022/23 e Levantamento Final, Ano Agrícola 2021/2. Análises e Indicadores do Agronegócio 18(2): 1-20.

- Cepea - Centro de Estudos Avançados em Economia Aplicada. 2018. Custos grãos. Cepea, Piracicaba, SP, Brasil. Available at: https://www.cepea.esalq.usp.br/upload/revista/pdf/0845987001639146208.pdf.

- Cepea - Centro de Estudos Avançados em Economia Aplicada. 2019. Custos grãos. Cepea, Piracicaba, SP, Brasil. Available at: https://www.cepea.esalq.usp.br/upload/revista/pdf/0620053001581357527.pdf.

- Cepea - Centro de Estudos Avançados em Economia Aplicada. 2020. Custos grãos. Cepea, Piracicaba, SP, Brasil. Available at: https://www.cepea.esalq.usp.br/upload/revista/pdf/0723193001600198255.pdf.

- Cepea - Centro de Estudos Avançados em Economia Aplicada. 2021. Custos grãos. Cepea, Piracicaba, SP, Brasil. Available at: https://www.cepea.esalq.usp.br/upload/revista/pdf/0845987001639146208.pdf.

- Cepea - Centro de Estudos Avançados em Economia Aplicada. 2022. Custos grãos. Cepea, Piracicaba, SP, Brasil. Available at: https://www.cepea.esalq.usp.br/upload/revista/pdf/0603861001671131737.pdf.

- Shadidi, B. Najafi, G. 2021. Impact of covid-19 on biofuels global market and their utilization necessity during pandemic. Energy Equipment and Systems 9(4): 371-382.

- Lin, B. , Zhang, Y. Y. 2020. Impact of the COVID-19 pandemic on agricultural exports. Journal of Integrative Agriculture 19(12): 2937–2945. [CrossRef]

- Cepea - Centro de Estudos Avançados em Economia Aplicada. 2023. Após alcançar patamar recorde em 2021, PIB do agronegócio recua 4,22% em 2022. Cepea, Piracicaba, SP, Brasil. Available at: https://www.cepea.esalq.usp.br/upload/kceditor/files/PIB-DO-AGRONEGOCIO-2022.17MAR2023.pdf.

- Facuri, F. G. , Ramos, M. R. 2019. Fatores de influência na formação do preço dos herbicidas à base de glifosato no Brasil. Enciclopédia Biofesta 16(29): 882-894. [CrossRef]

- Rabelo, C. G. , Souza, L. H., Oliveira, F. G. 2017. Análise dos custos de produção de silagem de milho: estudo de caso. Caderno de Ciências Agrárias 9(2):08-15.

- Batista, A. , Lopes, A. C. V., Costa, J. R. M. 2022. Gestão de custos na produção agrícola: um estudo na cultura da soja. XXIX Congresso Brasileiro de Custos, João Pessoa, PB, Brasil. Available at: https://anaiscbc.emnuvens.com.br/anais/article/view/4960/4973. 4960. [Google Scholar]

- Palma, A. A. 2023. Balanço de pagamentos, balança comercial e câmbio – evolução recente e perspectivas. Instituto de Pesquisa Econômica Aplicada (IPEA), Brasília, Brasil. Available at: https://www.ipea.gov.br/cartadeconjuntura/index.php/2023/04/balanco-de-pagamentos-balanca-comercial-e-cambio-evolucao-recente-e-perspectivas-6/#:~:text=As%20expectativas%20do%20relat%C3%B3rio%20Focus,US%24%20ao%20final%20de%202024.

- Seidler, E. P. , Costa, N. L., Almeida, M de., Coronel, D. A., Santana, A. C. de. 2022. Formação de preços do milho em São Paulo e suas conexões com o mercado interno e internacional. Colóquio – Revista do Desenvolvimento Regional 19(2): 259-278.

- Conab – Companhia Nacional de Abastecimento. 2023. Preços de insumos. Conab, Brasília, DF, Brasil. Available at: https://consultaweb.conab.gov.br/consultas/consultaInsumo.do?method=acaoCarregarConsulta.

- Alves, L. R. A. , Costa, M. S. da, Lima, F. F. de, Filho, J. B de S., Osaki, M., Ribeiro, R. G. 2018. Diferenças nas estruturas de custos de produção de milho convencional e geneticamente modificado no Brasil, na segunda safra: 2010/11, 2013/14 e 2014/15. Custos e agronegócio online 14(2):364-389.

- Staugaitis, A. J. , Vaznonis, B. 2022. Short-Term Speculation Effects on Agricultural Commodity Returns and Volatility in the European Market Prior to and during the Pandemic. Agriculture, 12(5):623. [CrossRef]

- Brum, A. L. , Baggio, D. K., Souza, F. M., Batista, G., Schneider, I. N. 2023. Influência dos fundos de investimento na formação das cotações do milho na Bolsa de Cereais de Chicago. Revista de Economia e Sociologia Rural 61(1): e251575. [CrossRef]

- Diesse - Departamento Intersindical de Estatística e Estudos Socioeconômicos. 2022. Redução do ICMS dos combustíveis, energia elétrica, transportes e comunicação. Diesse (Nota Técnica número 270). Available at: https://www.dieese.org.br/notatecnica/2022/notaTec270ICMS.pdf.

- Richeti, A. , Ceccon, G. Viabilidade Econômica do Milho Safrinha 2021, em Mato Grosso do Sul. 2020. Comunicado Técnico Embrapa 1(1):1-12. Available: https://ainfo.cnptia.embrapa.br/digital/bitstream/item/220036/1/COT-260.pdf.

- Instituto de Economia Agrícola (IEA) 2023. Banco de dados. Available: http://www.iea.agricultura.sp.gov.br/out/Bancodedados.

- Conab – Companhia Nacional de Abastecimento. 2022. Série Histórica - Custos - Soja - 1997 a 2022. Conab, Brasília, DF, Brasil. Available at: https://www.conab.gov.br/info-agro/custos-de-producao/planilhas-de-custo-de-producao/itemlist/category/824-soja.

- Conab – Companhia Nacional de Abastecimento. 2022b. Série Histórica - Custos - Milho 2ª Safra - 2005 a 2022. Conab, Brasília, DF, Brasil. Available at: https://www.conab.gov.br/info-agro/custos-de-producao/planilhas-de-custo-de-producao/itemlist/category/821-milho.

- Münch, T. Berg, M., Mirschel, W., Wieland, R., Nendel, C. 2013. Considering cost accountancy items in crop production simulations under climate change. European Journal of Agronomy 54: 57-68. [CrossRef]

- Artuzo, F. D. , Foguesatto, C. R., Souza, A. R. L. de, Silva, L. X. da. 2018. Gestão de custos na produção de milho e soja. Revista Brasileira de Gestão de Negócios 20(2): 27-294. [CrossRef]

- Noia Júnior, R. de S., Sentelhas, P. C. 2019. Soybean-maize succession in Brazil: Impacts of sowing dates on climate variability, yields and economic profitability. European Journal of Agronomy 103:140-151. [CrossRef]

- Brokes, G. , Barfoot, P. 2020. GM crop technology use 1996-2018: farm income and production impacts. GM Crops & Food 11(4):242-261. [CrossRef]

- Baio, F. H. R.; Neves, D. C; Souza, H. B.; Leal, A. J. F.; Leite, R. C.; Molin, J. P.; Silva, S. P. 2018. Variable rate spraying application on cotton using an electronic fow controller. Precision Agriculture 19(1): 1-17. [CrossRef]

- Freitas, J. M. de, Vaz, M. C., Dutra, G. A., Souza, J. L. De, Rezende, C. F. A. 2021. Response of corn productivity to mineral and organomineral fertilization. Research, Society and Development 10(5):26810514301. [CrossRef]

- Costa, F. G. , Caixeta Filho, J. V., & Arima, E. (2019). Influence of Transportation on the use of the Land: Viabilization Potential of Soybean Production in Legal Amazon Due to the Development of the Transportation Infrastructure. Revista de Economia e Sociologia Rural 39(2):155-177.

- Marchuk, S. , Tait, S., Sinha, P., Harris, P., Antille, D. L., McCabe, B.K. 2023. 2023. Biosolids-derived fertilisers: A review of challenges and opportunities. Science of The Total Environment 875:162555. [CrossRef]

- Smith, W.B. , Wilson, M., Pagliari, P. 2020. Organomineral fertilizers and their application to field crops. Animal Manure: Production, Characteristics, Environmental Concerns, and Management 67:229–243. [CrossRef]

- Van Lenteren, J. C. , Bolckmans, K.,Köhl J., Ravensberg, W. J., Urbaneja, A. 2018. Biological control using invertebrates and microorganisms: plenty of new opportunities. BioControl 63:39-59. [CrossRef]

- Spark - Inteligência Estratégica. 2021. BIP Spark mostra aumento de 37% na movimentação do mercado de produtos biológicos, para R$ 1,7 bilhão. Available: https://www.noticiasagricolas.com.br/noticias/agronegocio/302521-bip-spark-mostra-aumento-de-37- na-movimentacao-do-mercado-de-produtos-biologicos-para-r-1-7-bilhao.html#.YeM053rMLIU.

- Cepea - Centro de Estudos Avançados em Economia Aplicada. 2018. Custos grãos. Cepea, Piracicaba, SP, Brasil. Available at: https://www.cepea.esalq.usp.br/upload/revista/pdf/0003812001534166207.pdf.

- Beerling, D. J, Leake, J. R., Long, S. P, Scholes, J. D., Ton, J., Nelson, P. N., Bird, M., Kantzas, E., Taylor, L. L., Sarkar, B., Kelland, Delucia, E., Kantola, I., M., Müller, C., Rau, G., Hansem, J. 2018. Farming with crops and rocks to address global climate, food and soil security. Nature Plants 4(3):138–147. [CrossRef]

- Graveline, N. , Loubier, S., Gleyses, G., Rinaudo, J. D. 2012. Impact of farming on water resources: assessing uncertainty with Monte Carlo simulations in a global change context. Agricultural systems 108:29-41. [CrossRef]

- Odavić, P. , Zekić, V., Milić, D. 2017. Life cycle cost of biomass power plant-Monte Carlo simulation of investment. Economics of Agriculture 64(2):587-599. [CrossRef]

- Dharmawan, K. 2017. Pricing European options on agriculture commodity prices using mean-reversion model with jump diffusion. In AIP Conference Proceedings 1827(1):020002. [CrossRef]

- Oktoviany, P. , Knobloch, R., Korn, R. 2021. A machine learning-based price state prediction model for agricultural commodities using external factors. Decisions in Economics and Finance 44(2):1063-1085. [CrossRef]

| DOIL | FUTT | HEGL | INTL | DLLC | NPKF | DLR | SOYB | CORB | SOYS | CORS | TRAC | DAI | PCF | URF | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| N | 60 | 60 | 60 | 60 | 60 | 60 | 60 | 60 | 60 | 60 | 60 | 60 | 60 | 60 | 60 |

| MIN | 0.57 | 16.95 | 18.91 | 29.59 | 14.8 | 278.4 | 3.18 | 12.61 | 5.66 | 0.57 | 2.33 | 302.26 | 13.25 | 352.38 | 339.04 |

| MAX | 1.41 | 22.66 | 92.02 | 48.68 | 40.98 | 1205.24 | 5.67 | 36.51 | 18.53 | 2.29 | 4.31 | 387.01 | 18.9 | 1256.63 | 1201.48 |

| RANGE | 0.84 | 5.71 | 73.11 | 19.09 | 26.18 | 926.84 | 2.49 | 23.9 | 12.87 | 1.72 | 1.98 | 84.75 | 5.65 | 904.25 | 862.43 |

| MEAN | 0.80 | 19.28 | 36.22 | 38.17 | 25.28 | 576.043 | 4.66 | 22.57 | 11.27 | 1.332 | 3.299 | 339.33 | 15.37 | 602.53 | 580.38 |

| VAR | 0.0586 | 3.1021 | 625.35 | 24.85 | 64.30 | 104435 | 0.5986 | 72.132 | 20.392 | 0.3075 | 0.114 | 706.85 | 2.81 | 113307.91 | 85958.13 |

| SD | 0.24 | 1.7613 | 25.0071 | 4.9851 | 8.0191 | 323.1645 | 0.77 | 8.4931 | 4.5157 | 0.55 | 0.33 | 26.58 | 1.67 | 336.61 | 293.18 |

| CV | 30.1% | 9.1% | 69.0% | 13.1% | 31.7% | 56.1% | 16.6% | 37.6% | 40.0% | 41.6% | 10.2% | 7.8% | 10.9% | 55.8% | 50.5% |

| SKEW (g1) | 1.2158 | 0.5324 | 1.3291 | 0.3488 | 0.73 | 0.947 | -0.265 | 0.2153 | 0.2287 | 0.4712 | -0.2119 | 0.2294 | 0.6285 | 1.0545 | 1.0692 |

| KURT (g2) | 0.0765 | -1.2306 | 0.026 | -0.7111 | -0.7596 | -0.8431 | -1.443 | -1.7728 | -1.693 | -1.4971 | 1.1549 | -1.2933 | -0.8398 | -0.7136 | -0.5489 |

| Items | Description | Unit | Crop | Cost/ha (USD) | Cost/ha/corn (%) | Cost/ha/soybean (%) | |

|---|---|---|---|---|---|---|---|

| DOIL | 36 | L/ha | Corn/soybean | 29,8 | 4.7 | 5.8 | |

| FUTT | 0.750 | L/ha | Corn/soybean | 28,9 | 4.6 | 5.7 | |

| HEGL | 5 | L/ha | Corn/soybean | 36,2 | 5.8 | 7.1 | |

| INTL | 0.750 | L/ha | Corn/soybean | 28,6 | 4.6 | 5.6 | |

| DLLC | 1 | T/ha | Corn/soybean | 25,3 | 4.0 | 5.0 | |

| NPKF | 500 | T/ha | Corn/soybean | 288,0 | 45.9 | 56.5 | |

| DLR | 60 | Kg/ha | Soybean | 10,5 | NA | NA | |

| SOYB | 20 | Kg/ha | Corn | 11,3 | NA | NA | |

| SOYS | 60 | Kg/ha | Soybean | 79,9 | NA | 15.7 | |

| CORS | 20 | Kg/ha | Corn | 66,0 | 10.5 | NA | |

| TRAC | 2 | 2 h/ha | Corn/soybean | 2.83 | 0.5 | 0.6 | |

| DAI | 2 | 2 h/ha | Corn/soybean | 3.84 | 0.6 | 0.8 | |

| PCF | 100 | Kg/ha | Corn | 60,2 | 9.6 | NA | |

| URF | 100 | Kg/ha | Corn | 58,0 | 9.2 | NA | |

| TCOST | NA | ha | Corn | 627.7 | NA | NA | |

| NA | ha | Soybean | 509.5 | NA | NA | ||

| EPROD | 50 bag/ha | 60 kg/bag | Soybean | 22,6 | NA | NA | |

| 91 bag/ha | 60 kg/bag | Corn | 11,3 | NA | NA | ||

| Gross Income | USD | ||||||

| Corn | 1026,3 | ||||||

| Soybean | 1128,6 | ||||||

| DV | IV | r | R2 | DC | IV | r | R2 | DC |

|---|---|---|---|---|---|---|---|---|

| DOIL | Corn | 0.72 | 0.52 | Strong | Soy | 0.81 | 0.65 | Strong |

| FUTT | Corn | 0.88 | 0.77 | Strong | Soy | 0.92 | 0.85 | very strong |

| HEGL | Corn | 0.65 | 0.42 | moderate | Soy | 0.74 | 0.54 | Strong |

| INTL | Corn | 0.79 | 0.64 | Strong | Soy | 0.83 | 0.68 | Strong |

| DLLC | Corn | 0.81 | 0.65 | Strong | Soy | 0.87 | 0.77 | Strong |

| NPKF | Corn | 0.80 | 0.64 | Strong | Soy | 0.86 | 0.75 | Strong |

| DLR | Corn | 0.79 | 0.62 | Strong | Soy | 0.77 | 0.59 | Strong |

| SOYB | Corn | 0.92 | 0.93 | very strong | Soy | 0.97 | 0.93 | very strong |

| SOYS | Corn | 0.92 | 0.93 | very strong | Soy | 0.97 | 0.93 | very strong |

| CORS | Corn | 0.15 | 0.02 | negligible | Soy | 0.27 | 0.08 | negligible |

| TRAC | Corn | 0.91 | 0.83 | very strong | Soy | 0.95 | 0.90 | very strong |

| DAI | Corn | 0.87 | 0.75 | Strong | Soy | 0.92 | 0.85 | very strong |

| PCF | Corn | 0.72 | 0.54 | Strong | Soy | 0.81 | 0.66 | Strong |

| URF | Corn | 0.77 | 0.60 | Strong | Soy | 0.84 | 0.70 | Strong |

| Statistic D-W | Theil' s U | |||||

|---|---|---|---|---|---|---|

| DTN-S | Arima (1,1,2) | DES | DTN-S | Arima (1,1,2) | DES | |

| NPKF (soybean) |

1.92 | 1.92 | 1.97 | 0.96 | 0.96* | 0.97 |

| URF (soybean) |

Tans | Arima (0,1,1) | Sed | Tans | Arima (0,1,1) | Sed |

| 1.91 | 2.0 | 1.64 | 0.94 | 0.92* | 0.94 | |

| DLLC (soybean) |

DTN-S | DMA | DES | DTN-S | DMA | DES |

| 1.82 | 1.76 | 2.00 | 0.99* | 0.96 | 0.94 | |

| FUTT (soybean) |

DES | DTN-S | SES | DES | DTN-S | SES |

| 2.00 | 2.01 | 2.01 | 0.98* | 0.98 | 0.98 | |

| CORS | DES | DTN-S | SES | DES | DTN-S | SES |

| 1.99 | 1.99 | 1.99 | 0.96* | 0.96 | 0.97 | |

| TRAC (corn/soybean) |

DTN-S | Arima (0,2,0) | DES | DTN-S | Arima (0,2,0) | DES |

| 1.70 | 2.00 | 1.70 | 0.99 | 0.99* | 0.99 | |

| DIA (corn/soybean) |

DTN-S | Arima (0,2,0) | DES | DTN-S | Arima (0,2,0) | DES |

| 1.58 | 1.82 | 1.58 | 0.99 | 0.99* | 0.99 | |

| CORB (corn/soybean) |

DTN-S | Arima (1,1,1) | DES | DTN-S | Arima (1,1,1) | DES |

| 1.99 | 1.85 | 1.61 | 0.99 | 0.94* | 0.99 | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).