Introduction

In today's global economy, the functioning of payment and settlement systems (PSS) is of paramount importance. These systems facilitate secure and efficient transactions, enabling the flow of funds between individuals, businesses, and financial institutions. Policymakers worldwide recognize the significance of PSS and have focused on promoting their safety, efficiency, and accessibility. The Committee on Payment and Settlement Systems (CPSS), now part of the Bank for International Settlements (BIS), has played a leading role in these efforts. The CPSS's publication of the "Red Book" in 1990 established principles for PSS design and operation, and it continues to monitor and analyze PSS developments.

One crucial area of concern for PSS is their safety and soundness. To ensure resilience against risks like credit, liquidity, and operational challenges, many countries have established regulatory frameworks for PSS oversight. These frameworks typically include requirements for risk management, business continuity planning, and legal and operational structures. International standards and guidelines, such as the Principles for Financial Market Infrastructures (PFMI) issued by the CPSS and IOSCO, promote consistency and provide a common framework for PSS oversight across jurisdictions. Efficiency is another critical aspect of PSS. It encompasses transaction speed, cost-effectiveness, and customer usability. Technological advancements like blockchain and distributed ledger technology offer opportunities for PSS to enhance efficiency and foster innovation. However, they also introduce new challenges and risks, such as interoperability and cyber threats.

Accessibility is a key consideration, especially for underserved populations and small businesses. While initiatives like mobile money and digital identity systems have sought to improve financial inclusion and expand PSS access, significant gaps remain, particularly in low-income countries and rural areas. This study aims to examine the relationship between payment statistics and sector-wise gross value added (GVA) in the Indian economy over a 12-year period from 2011 to January 2023. By analyzing the data on payment statistics and sector-wise GVA across various sectors, the study seeks to uncover any potential correlations or influences between these variables.

2. History

The evolution of payment and settlement systems can be traced back to ancient civilizations, where various forms of exchange were utilized. One of the earliest systems was barter, where goods and services were exchanged directly. However, this method had limitations due to the need for a mutual desire for the exchanged items and the absence of a standardized value measure. The introduction of currency brought about significant advancements in payment systems. In the 7th century BC, Lydia (now Turkey) introduced the first coinage made of electrum, a natural gold and silver alloy. Coins became a standardized unit of value, facilitating transactions due to their portability and ease of counting.

During the Middle Ages, bills of exchange emerged as popular payment instruments. These documents represented promises to pay specific amounts in the future and were widely used by merchants to settle transactions and finance trade. Subsequently, banks began issuing their own notes, backed by gold and silver reserves, which gained acceptance as a means of payment.

The advent of telegraphy in the 19th century revolutionized payment systems by enabling faster communication and more efficient settlement. Telegraphic transfers, involving the transfer of funds between banks via telegraph, became prominent payment instruments.

The 20th century witnessed further evolution with the introduction of electronic payment systems. The BankAmericard, launched in 1958, was the first electronic payment system, allowing customers to make credit-based purchases. The rise of the internet in the 1990s led to the emergence of online payment systems like PayPal, providing secure transactions without revealing credit card details. In recent years, blockchain technology and cryptocurrencies have garnered significant attention. Blockchain has the potential to revolutionize payment systems, enabling fast, secure, and cost-effective transactions. Cryptocurrencies, such as Bitcoin, offer an alternative to traditional currencies and are increasingly utilized for payments. This study aims to examine the role of payment and settlement systems in the Indian financial system and their impact on the economy.

3. Indian Financial System & PSS

The Indian financial system has a rich historical background, evolving from ancient barter systems to modern digital payment platforms. In the past, the financial system relied on direct exchanges of goods and the introduction of coins. The medieval period saw the advent of paper money through the hundi system, enabling long-distance transactions. European colonial powers introduced modern banking practices, leading to the establishment of the Bank of Bengal and the introduction of paper currency.

Post-independence, the Indian financial system experienced rapid growth and transformation. The Reserve Bank of India was established as the central regulatory authority, and nationalization of banks promoted financial inclusion. The introduction of electronic fund transfer systems, such as RTGS and NEFT, revolutionized the payment landscape. In recent years, technological advancements have further shaped the Indian financial system. Digital payment platforms like Paytm and PhonePe have gained popularity, offering convenient and secure transactions.

Overall, the Indian financial system has evolved over time, embracing technological innovations to provide efficient and accessible payment solutions for its diverse population. The government's demonetization drive in 2016 aimed to reduce cash transactions and promote digital payments. The adoption of block chain technology in the financial sector has the potential to revolutionize the payment and settlement system further. The Indian financial system has come a long way, from the barter system to modern digital payment platforms. Today, the Indian financial system is well-regulated, inclusive, and tech1nologically advanced, offering a wide range of financial services to individuals and businesses alike.

Figure 1.

Overview Major Participants in Financial Sector.

Figure 1.

Overview Major Participants in Financial Sector.

4. Review of Literature

Authors Chen et al. (2018) conducted a study on the impact of mobile payments on the settlement process. The study found that mobile payments significantly reduce transaction costs and settlement time. They concluded that mobile payments have the potential to revolutionize the settlement process, making it faster and more cost-effective [

1].

Kumar and Purohit (2019) conducted research on the challenges faced by small businesses in adopting digital payments and settlements. The study identified lack of awareness, cost, and inadequate infrastructure as significant barriers. The authors suggested that the government and financial institutions should focus on providing incentives and creating awareness to increase adoption [

2].

Adekunle et al. (2018) conducted a study on the adoption of e- payment systems in Nigeria. The research found that security concerns, lack of trust, and poor internet connectivity are major barriers to adoption. The authors suggested that addressing these challenges would increase adoption of e-payment systems [

3].

Wigginton and Smith (2017) conducted research on mobile payments and settlements in sub-Saharan Africa. The study found that mobile payments are transforming financial systems and improving financial inclusion. The authors suggested that increasing access to mobile phones and digital payment infrastructure would further promote financial inclusion [

4].

Hume and Mortimer (2018) investigated the impact of real-time payments on set

tlement processes. The research found that real-time payments reduce settlement risk and improve liquidity management. The authors concluded that real-time payments are beneficial for financial institutions and businesses [

5].

Ali et al. (2020) conducted research on the adoption of digital payments and settlements in Pakistan. The study identified the lack of digital literacy, trust, and the high cost of transactions as major challenges [

6].

Moustafa et al. (2019) conducted research on the impact of blockchain on cross-border payments and settlements. The study found that blockchain technology can significantly reduce costs and improve settlement times. The authors suggested that blockchain can increase efficiency and reduce settlement risk [

7].

Goyal and Srivastava (2019) conducted research on digital payments in India. The study found that mobile wallets are the preferred mode of payment due to their convenience and ease of use. The authors suggested that improving digital infrastructure and increasing awareness would further promote digital payments [

8].

Al-Tarawneh and Al-Husban (2018) conducted a study on the adoption of e-payment systems in Jordan. The research found that security concerns, lack of trust, and the high cost of transactions are major barriers to adoption. The authors suggested that addressing these challenges would increase adoption [

9].

Gouda and Alagarsamy (2019) conducted research on digital payments and settlements in Egypt. The study found that the lack of digital infrastructure and trust are major challenges to adoption. The authors suggested that improving digital infrastructure and creating trust would increase adoption [

10].

Nair and Mukherjee (2018) conducted research on the impact of digital payments on small businesses in India. The study found that digital payments improve cash flow and reduce transaction costs. The authors suggested that promoting digital payments would benefit small businesses [

11].

Kishore and Katoch (2018) conducted research on the adoption of mobile payments in India. The study found that lack of trust, awareness, and inadequate infrastructure are major challenges to adoption. The authors suggested that addressing these challenges would increase adoption [

12].

Hennig-Thurau et al. (2018) conducted a study on the impact of mobile payments on consumer behavior. The research found that mobile payments increase convenience and reduce perceived risk, leading to increased usage and loyalty among consumers. The authors suggested that businesses should invest in mobile payment infrastructure to improve customer experience [

13].

Tsai et al. (2019) conducted research on the impact of mobile payments on the hospitality industry. The study found that mobile payments improve efficiency and reduce wait times for customers. The authors suggested that businesses in the hospitality industry should adopt mobile payments to enhance customer experience [

14].

Li et al. (2020) conducted a study on the use of digital payments in China. The research found that digital payments are widely used and preferred due to their convenience and security. The authors suggested that businesses should invest in digital payment infrastructure to better serve Chinese consumers [

15].

5. Hypotheses, Model Fit Equation & Variables

Payment and settlement systems, along with their impact on the economy, are critical components to understand in order to maintain the stability and growth of the financial system. The study aims to analyze the relationship between payment statistics and sector-wise GVA in the Indian economy during the specified period. By examining the data on payment statistics and GVA across various sectors, the study seeks to uncover any potential correlations or influences between these variables.

The research will assess the role of payment and settlement systems in facilitating economic transactions within different sectors. It will explore how payment statistics, including electronic transactions, paper-based payments, and other relevant indicators, contribute to the overall GVA of sectors such as manufacturing, agriculture, services, and more.

The study will utilize a quantitative research design, analyzing secondary data from sources such as the Reserve Bank of India (RBI) and other reliable sources. Payment system indicators and sector-wise GVA data will be collected for the specified period, and regression analysis will be conducted to examine the relationship between payment statistics and sector-wise GVA. The findings of this study will provide insights into the impact of payment statistics on the economic performance of different sectors in India. It will contribute to a better understanding of how payment systems influence sector-wise GVA and can potentially guide policymakers, industry stakeholders, and regulators in enhancing the efficiency and effectiveness of payment and settlement systems to promote economic growth. By focusing specifically on the analysis between sector-wise GVA and payment statistics, this study narrows down the research objective to provide a comprehensive understanding of the relationship between these variables in the Indian context.

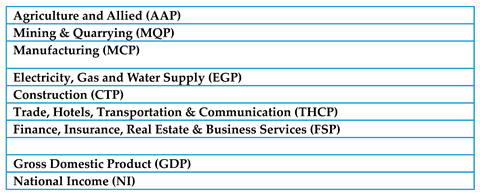

Additionally, macro-economic indicators like sector-wise GDP/GVA, Gross Domestic Product (GDP), and National Income (NI) provide valuable insights into the contributions of different sectors and the overall economic performance of a nation. Collectively, these indicators aid in understanding the complexities of payment systems and their impact on broader economic trends.

Monitoring and interpreting these indicators are vital for maintaining a stable and resilient financial ecosystem and facilitating informed decision-making and policy formulation.

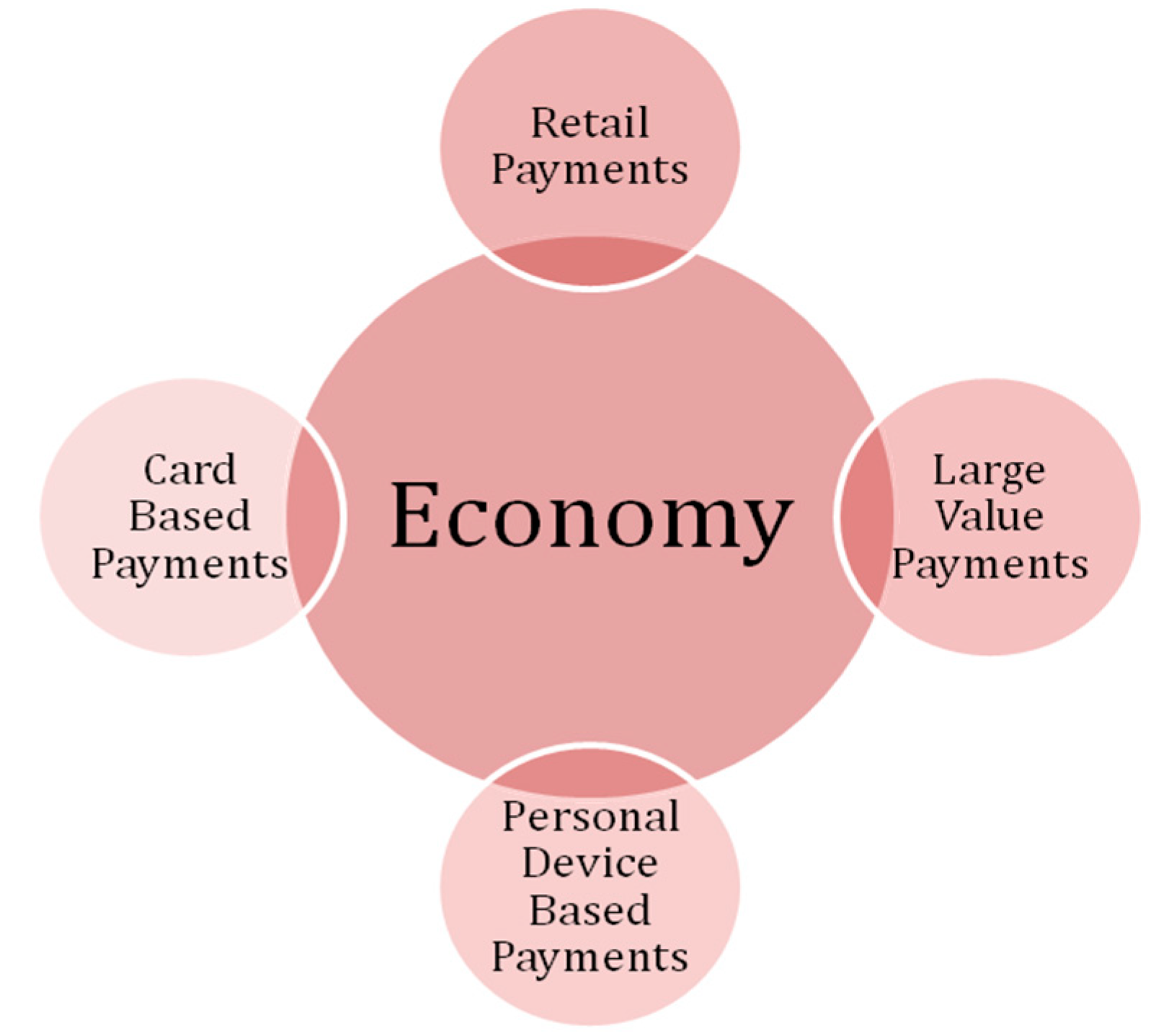

Figure 2.

Impact of Major Payment (Independent Variables) Classification on Economy (Dependent Variable).

Figure 2.

Impact of Major Payment (Independent Variables) Classification on Economy (Dependent Variable).

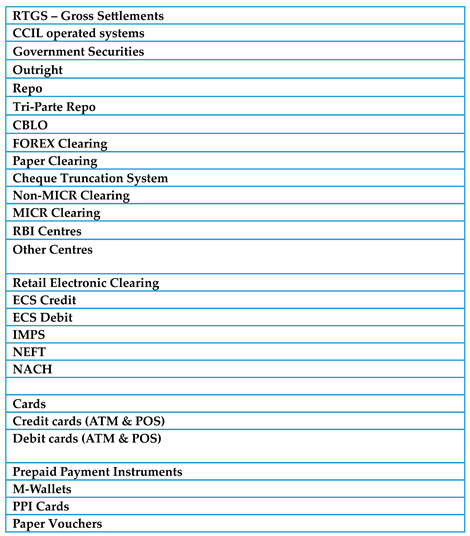

Payments Systems Indicators/Variables- Independent Variables

Macro-Economic Indicators – Dependent Variables

- A.

Agriculture and Allied (AAP):

- B.

Mining & Quarrying (MQP)

- C.

Manufacturing (MCP)

- D.

Electricity, Gas and Water Supply (EGP)

H0a4: Scalability of Payment & Settlements have no significant impact on Electricity, Gas and Water Supply

H1a4: Scalability of Payment & Settlements have significant impact on Electricity, Gas and Water Supply

- E.

Construction (CTP)

- F.

Trade, Hotels, Transportation & Communication (THCP)

H0a6: Scalability of Payment & Settlements have no significant impact on Trade, Hotels, Transportation & Communication

H1a6: Scalability of Payment & Settlements have significant impact on Trade, Hotels, Transportation & Communication

- G.

Finance, Insurance, Real Estate & Business Services (FSP)

H0a7: Scalability of Payment & Settlements have no significant impact on Finance, Insurance, Real Estate & Business Services

H1a7: Scalability of Payment & Settlements have significant impact on Finance, Insurance, Real Estate & Business Services

6. Analysis & Interpretation

In the period from 2011 to January 2023, the analysis of sector-wise Gross Value Added (GVA) influenced by payment statistics becomes the focus of this study. Descriptive statistics for the independent variables (payment statistics) are presented in Table 3, which provide insights into the distribution and variation of each variable. The analysis conducted in this study focuses on investigating the relationship between payment statistics and sector-wise gross value added (GVA) in the Indian economy. The data used for this analysis is presented in several tables, providing valuable insights into the variables under study.

Table 1, which presents the "Payment & Settlement Statistics of India," offers information on various payment and settlement indicators. These indicators include cash, electronic transactions, and digital payments. These statistics play a crucial role in evaluating the efficiency and reliability of financial transactions within the economy.

Moving to

Table 2, titled "Sector Wise GVA (Rupees in Crore) of India," it provides sector-specific GVA data. This table encompasses key sectors such as agriculture, forestry and fishing (AAP), mining and quarrying (MQP), manufacturing (MCP), electricity, gas, water supply, and other utility services (EGP), construction (CTP), trade, hotels, transport, communication, and services related to broadcasting (THCP), and financial, real estate, and professional services (FSP). These figures shed light on the economic output of each sector, forming the basis for the subsequent analysis.

Table 3 offers "Descriptive Statistics of Independent Variables," namely LVP, RP, CPDD, and ATP. This table presents descriptive measures such as the mean, standard error, median, standard deviation, sum, and count for each independent variable. These statistics provide an overview of the distribution and characteristics of the independent variables used in the analysis.

Similarly,

Table 4 provides "Descriptive Statistics of Dependent Variables." The dependent variables in this study include AAP, MQP, MCP, EGP, CTP, THCP, and FSP. The table presents descriptive measures, such as the mean, standard error, median, standard deviation, sum, and count for each dependent variable. These statistics offer insights into the central tendency, dispersion, and range of the dependent variables.

Lastly,

Table 5, titled "Regression Analysis: P-Values and Adjusted R-Square Values," presents the results of the regression analysis conducted in the study. The table showcases the p-values and adjusted R-square values for the relationship between the independent variables (LVP, RP, CPDD, ATP) and the dependent variables (AAP, MQP, MCP, EGP, CTP, THCP, FSP). The p-values assess the statistical significance of the relationships, while the adjusted R-square values indicate the proportion of the variation in the dependent variables explained by the independent variables.

The p-values indicate the level of statistical significance between each payment statistic and sector-wise GVA. An insignificant p-value suggests a lack of significant relationship between the payment statistic and sector-wise GVA.

The adjusted R-squared values provide insights into the proportion of the observed variation in sector-wise GVA explained by the payment statistics. The analysis reveals that none of the payment statistics exhibit a significant relationship with sector-wise GVA during the specified time frame. The p-values obtained are greater than the commonly accepted significance level of 0.05, indicating a failure to reject the null hypothesis of no relationship between payment statistics and sector-wise GVA.

Furthermore, the adjusted R-squared values suggest that the payment statistics explain only a moderate proportion of the observed variation in sector-wise GVA. This implies that factors beyond payment statistics, such as government policies, market conditions, infrastructure development, and macroeconomic factors, likely have a more substantial influence on sector-wise economic performance.

7. Conclusions

The analysis conducted in this study explored the impact of payment statistics on sector-wise gross value added in the Indian economy. The findings reveal that, based on the regression analysis, there is no significant relationship between payment statistics and sector-wise GVA during the specified time frame. The calculated p-values, exceeding the significance level of 0.05, indicate a lack of statistical significance, suggesting that payment statistics may not have a discernible impact on sector-wise GVA in the Indian economy.

The adjusted R-squared values further emphasize that payment statistics explain only a moderate proportion of the observed variation in sector-wise GVA. This highlights the need to consider other factors that could play a more substantial role in driving sector-wise economic performance, such as government policies, market dynamics, infrastructure development, and macroeconomic conditions. These findings contribute to the understanding of the relationship between payment statistics and sector-wise GVA in the Indian economy. However, they also point to the need for further research to explore alternative factors that may have a more significant influence on sector-wise economic growth. Policymakers and industry stakeholders should consider a comprehensive range of variables and factors when formulating strategies to enhance growth and productivity in different sectors of the Indian economy. By acknowledging the limited impact of payment statistics on sector-wise GVA, they can focus on adopting a holistic approach that addresses various aspects of the economy to drive sustainable and inclusive growth.

References

- Chen, Y.; Lu, H.; Wang, Q. Impact of mobile payments on the settlement process. Journal of Payments Strategy & Systems 2018, 12, 68–85. [Google Scholar]

- Kumar, P.; Purohit, H. Challenges faced by small businesses in adopting digital payments and settlements. International Journal of Economics, Commerce and Management 2019, 7, 96–109. [Google Scholar]

- Adekunle, A.A.; Oludare, O.A.; Adeyemo, A.O. Adoption of e-payment systems in Nigeria: A qualitative study. Journal of Internet Banking and Commerce 2018, 23, 1–19. [Google Scholar]

- Wigginton, M.; Smith, M.L. Mobile payments and settlement systems in sub-Saharan Africa. African Journal of Science, Technology, Innovation and Development 2017, 9, 547–558. [Google Scholar]

- Hume, M.; Mortimer, G. The impact of real-time payments on the settlement process. Journal of Payments Strategy & Systems 2018, 12, 119–133. [Google Scholar]

- Ali, I.; Shah, S.A.A.; Bashir, M.F. Challenges of digital payments and settlements adoption in Pakistan. Journal of Information Systems and Technology Management 2020, 17, e2019180101. [Google Scholar]

- Moustafa, A.M.; Ali, N.; Al-Jayousi, O.; Al-Ayyoub, A. Impact of blockchain on cross-border payments and settlements. Journal of Information Systems and Technology Management 2019, 16, e2019150201. [Google Scholar]

- Goyal, D.; Srivastava, A. Digital payments in India: An empirical study. Journal of Emerging Technologies and Innovative Research 2019, 6, 133–139. [Google Scholar]

- Al-Tarawneh, M.; Al-Husban, M. Adoption of e-payment systems in Jordan: An empirical study. International Journal of Business and Management 2018, 13, 45–56. [Google Scholar]

- Gouda, S.K.; Alagarsamy, A.R. Digital payments and settlements in Egypt: Challenges and opportunities. Journal of Commerce and Management Thought 2019, 10, 156–168. [Google Scholar]

- Nair, G.; Mukherjee, A. Impact of digital payments on small businesses in India. Journal of Small Business and Entrepreneurship Development 2018, 6, 57–71. [Google Scholar]

- Kishore, A.; Katoch, S.S. Adoption of mobile payments in India: Issues and challenges. Journal of Economics and Management 2018, 32, 23–42. [Google Scholar]

- Hennig-Thurau, T.; Gwinner, K.P.; Walsh, G.; Gremler, D.D. Mobile payment adoption: A theoretical model and empirical investigation of consumer usage intentions. Journal of Retailing 2018, 94, 113–131. [Google Scholar]

- Tsai, H.T.; Hsu, H.C.; Hsiao, C.M. The impact of mobile payment on the hospitality industry. Journal of Global Business Insights 2019, 4, 66–74. [Google Scholar]

- Li, C.; Sun, W.; Li, J. Use of digital payments in China: A comparative study. Journal of Financial Management 2020. [Google Scholar]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).