Introduction

In today's global economy, the functioning of payment and settlement systems (PSS) is of paramount importance. These systems facilitate secure and efficient transactions, enabling the flow of funds between individuals, businesses, and financial institutions. Policymakers worldwide recognize the significance of PSS and have focused on promoting their safety, efficiency, and accessibility. The Committee on Payment and Settlement Systems (CPSS), now part of the Bank for International Settlements (BIS), has played a leading role in these efforts. The CPSS's publication of the "Red Book" in 1990 established principles for PSS design and operation, and it continues to monitor and analyze PSS developments.

One crucial area of concern for PSS is their safety and soundness. To ensure resilience against risks like credit, liquidity, and operational challenges, many countries have established regulatory frameworks for PSS oversight. These frameworks typically include requirements for risk management, business continuity planning, and legal and operational structures. International standards and guidelines, such as the Principles for Financial Market Infrastructures (PFMI) issued by the CPSS and IOSCO, promote consistency and provide a common framework for PSS oversight across jurisdictions. Efficiency is another critical aspect of PSS. It encompasses transaction speed, cost-effectiveness, and customer usability. Technological advancements like blockchain and distributed ledger technology offer opportunities for PSS to enhance efficiency and foster innovation. However, they also introduce new challenges and risks, such as interoperability and cyber threats.

Accessibility is a key consideration, especially for underserved populations and small businesses. While initiatives like mobile money and digital identity systems have sought to improve financial inclusion and expand PSS access, significant gaps remain, particularly in low-income countries and rural areas.

India has witnessed a rapid digitalization in payments in recent years. This has been driven by a number of factors, including the demonetization of high-value currency notes in 2016, the government's push for digital payments, and the rise of smartphones and internet penetration. The shift to digital payments has had a significant impact on the Indian economy. It has made transactions more convenient and efficient, and has reduced the costs associated with cash handling. It has also helped to bring more people into the formal financial system. One of the key questions that arises in this context is whether the increase in digital payments has led to an increase in economic activity.

This study aims to examine the relationship between payment statistics and sector-wise gross value added (GVA) in the Indian economy over an 11-year period from 2011 to 2022. The findings of this study will provide insights into the impact of payment statistics on the economic performance of different sectors in India. It will contribute to a better understanding of how payment systems influence sector-wise GVA and can potentially guide policymakers, industry stakeholders, and regulators in enhancing the efficiency and effectiveness of payment and settlement systems to promote economic growth. The next sections will discuss the brief history of payments, Indian payment systems, regression analysis between payment stats and GVA of various economic sectors.

Background

The evolution of payment and settlement systems can be traced back to ancient civilizations, where various forms of exchange were utilized. One of the earliest systems was barter, where goods and services were exchanged directly. However, this method had limitations due to the need for a mutual desire for the exchanged items and the absence of a standardized value measure. The introduction of currency brought about significant advancements in payment systems. In the 7th century BC, Lydia (now Turkey) introduced the first coinage made of electrum, a natural gold and silver alloy. Coins became a standardized unit of value, facilitating transactions due to their portability and ease of counting.

During the Middle Ages, bills of exchange emerged as popular payment instruments. These documents represented promises to pay specific amounts in the future and were widely used by merchants to settle transactions and finance trade. Subsequently, banks began issuing their own notes, backed by gold and silver reserves, which gained acceptance as a means of payment. The advent of telegraphy in the 19th century revolutionized payment systems by enabling faster communication and more efficient settlement. Telegraphic transfers, involving the transfer of funds between banks via telegraph, became prominent payment instruments.

The 20th century witnessed further evolution with the introduction of electronic payment systems. The BankAmericard, launched in 1958, was the first electronic payment system, allowing customers to make credit-based purchases. The rise of the internet in the 1990s led to the emergence of online payment systems like PayPal, providing secure transactions without revealing credit card details. In recent years, blockchain technology and cryptocurrencies have garnered significant attention. Blockchain has the potential to revolutionize payment systems, enabling fast, secure, and cost-effective transactions. Cryptocurrencies, such as Bitcoin, offer an alternative to traditional currencies and are increasingly utilized for payments.

Indian Financial System & PSS

The Indian financial system has a rich historical background, evolving from ancient barter systems to modern digital payment platforms. In the past, the financial system relied on direct exchanges of goods and the introduction of coins. The medieval period saw the advent of paper money through the hundi system, enabling long-distance transactions. European colonial powers introduced modern banking practices, leading to the establishment of the Bank of Bengal and the introduction of paper currency.

Post-independence, the Indian financial system experienced rapid growth and transformation. The Reserve Bank of India was established as the central regulatory authority, and nationalization of banks promoted financial inclusion. The introduction of electronic fund transfer systems, such as RTGS and NEFT, revolutionized the payment landscape. In recent years, technological advancements have further shaped the Indian financial system. Digital payment platforms like Paytm and PhonePe have gained popularity, offering convenient and secure transactions.

Overall, the Indian financial system has evolved over time, embracing technological innovations to provide efficient and accessible payment solutions for its diverse population. The government's demonetization drive in 2016 aimed to reduce cash transactions and promote digital payments. The adoption of block chain technology in the financial sector has the potential to revolutionize the payment and settlement system further. The Indian financial system has come a long way, from the barter system to modern digital payment platforms. Today, the Indian financial system is well-regulated, inclusive, and technologically advanced, offering a wide range of financial services to individuals and businesses alike.

Figure 1.

Overview Major Participants in Financial Sector.

Figure 1.

Overview Major Participants in Financial Sector.

Review of Literature

Coibion, Gorodnichenko, Weber (2020) brought to light a crucial revelation. In the throes of the pandemic, U.S. households utilized only 40% of their stimulus payments due to constrained spending opportunities. They held out hope for a brighter future, suggesting that as the pandemic recedes, forthcoming stimulus payments could prove more effective. To achieve this, they recommended a broader array of policies aimed at stimulating aggregate demand [

1].

Carstens (2019) guided our attention to the challenges posed by central bank digital currencies (CBDCs). He emphasized that the discourse surrounding CBDCs heralds fundamental transformations in the monetary system. Of notable concern was the apparent absence of a clear societal demand for CBDCs, and the considerable implications for the operational and financial stability of the entire system [

2].

Zandi, Singh, Irving (2013) offered a revelation of economic significance. They found that electronic payments, particularly those involving cards, catalyze economic growth by enhancing transaction efficiency, expanding consumer access to credit, and instilling confidence in the payment system. Their research unveiled a positive correlation between the penetration and usage of card payments and economic growth, and as a result, they championed policies that encourage the adoption of electronic payment methods [

3].

Noviana, Darma (2020) embarked on a journey into the realm of digital marketing strategies in Indonesia, with a focus on the effectiveness of content marketing and social media promotion during the COVID-19 pandemic. Notably, they crowned mobile banking as the preferred payment method in the "New Normal Era"[

4].

Hasan, De Renzis, Schmiedel (2012) emphasized the pivotal role of electronic retail payments in fostering economic growth, with a special nod to the positive impact of card payments. Their support for policies aimed at promoting electronic retail payment instruments underscored the importance of these choices in propelling economic progress [

5].

Moreno-Brid (1998) presented an insightful analytical model that laid bare the constraints on Mexico's economic growth. The primary impediment was the nation's inability to generate sufficient foreign exchange. Within this context, Moreno-Brid discussed strategies and challenges to promote economic growth and alleviate the balance-of-payments constraint [

6].

Nakaso (2017) offered a historical perspective on the evolution of central bank payment and settlement systems. He underscored their adaptability in the face of economic and technological shifts, notably the transition from outdated paper-based systems to efficient digital counterparts and the widespread adoption of real-time gross settlement (RTGS) systems [

7].

Banerjee and Sinha (2023) delved into the impact of digital currencies on financial inclusion in India, with a specific focus on Central Bank Digital Currencies (CBDCs). They proposed that digital currencies could have a positive influence on various economic and financial aspects. However, they also acknowledged the need for further research to fully understand their potential [

8].

Ali and Salameh (2023) conducted an investigation into the payment and settlement system in Saudi Arabia. They uncovered a concerning trend: traditional payment methods were on the decline, while online payment methods like Mada and E-payment were on the rise. They also pointed out critical issues related to security, traceability, and privacy within the system, advocating for substantial improvements [

9].

Cipriani, Goldberg, La Spada (2023) explored the use of financial sanctions in the realm of international relations, with a particular focus on their impact on the international payment system and SWIFT. Notably, they highlighted the emergence of alternative systems in certain countries aiming to bypass Western-based infrastructures, underscoring the interplay between payments and global diplomacy [

10].

Žiˇckien˙e, Melnikien˙e, Mork¯ unas, Volkov (2022) embarked on an impact assessment of direct payments (DPs) within the context of agricultural resilience in the European Union. Their findings revealed a complex reality: DPs had a positive impact on economic resilience, but simultaneously exerted adverse effects on farm efficiency and other factors. In response, they recommended policy adjustments to enhance overall economic resilience [

11].

Polasik, Huterska, Iftikhar, Mikula (2020) ventured into the world of the PayTech sector in Europe, examining the impact of the Payment Services Directive 2 (PSD2). Their exploration uncovered significant growth in the sector, driven by market potential, regulatory support, and evolving consumer payment habits [

12].

The ECB Occasional Paper Series (2019) provided a comprehensive examination of the implications of crypto-assets for financial stability, monetary policy, and payment and market infrastructures. Importantly, they emphasized that, at the time of their analysis, the risks posed by crypto-assets to the EU financial system were deemed limited and manageable. Nevertheless, they stressed the importance of continuous monitoring and readiness for adverse scenarios [

13].

Hock-Han Tee and Hway-Boon Ong (2016) focused on the adoption of cashless payment methods and highlighted the role of technology, including RFID and NFC, in propelling the development of cashless payments. They underscored the enduring impact of embracing cashless payment methods on economic growth [

14].

Charles M. Kahn and William Roberds (2009) observed the intricate economics of payments. They emphasized that payment is a fundamental economic decision and called for a comprehensive understanding of payment economics among policymakers and economists. This understanding, they argued, is essential for making informed decisions regarding payment systems and their far-reaching impact on economic activities [

15].

Research Methodology

Payment and settlement systems, along with their impact on the economy, are critical components to understand in order to maintain the stability and growth of the financial system. The study will utilize a quantitative research design, analyzing secondary data from sources such as the Reserve Bank of India (Central Bank of India) and other reliable sources. Payment system indicators and sector-wise GVA data will be collected for the specified period, and regression analysis will be conducted to examine the relationship between payment statistics and sector-wise GVA.

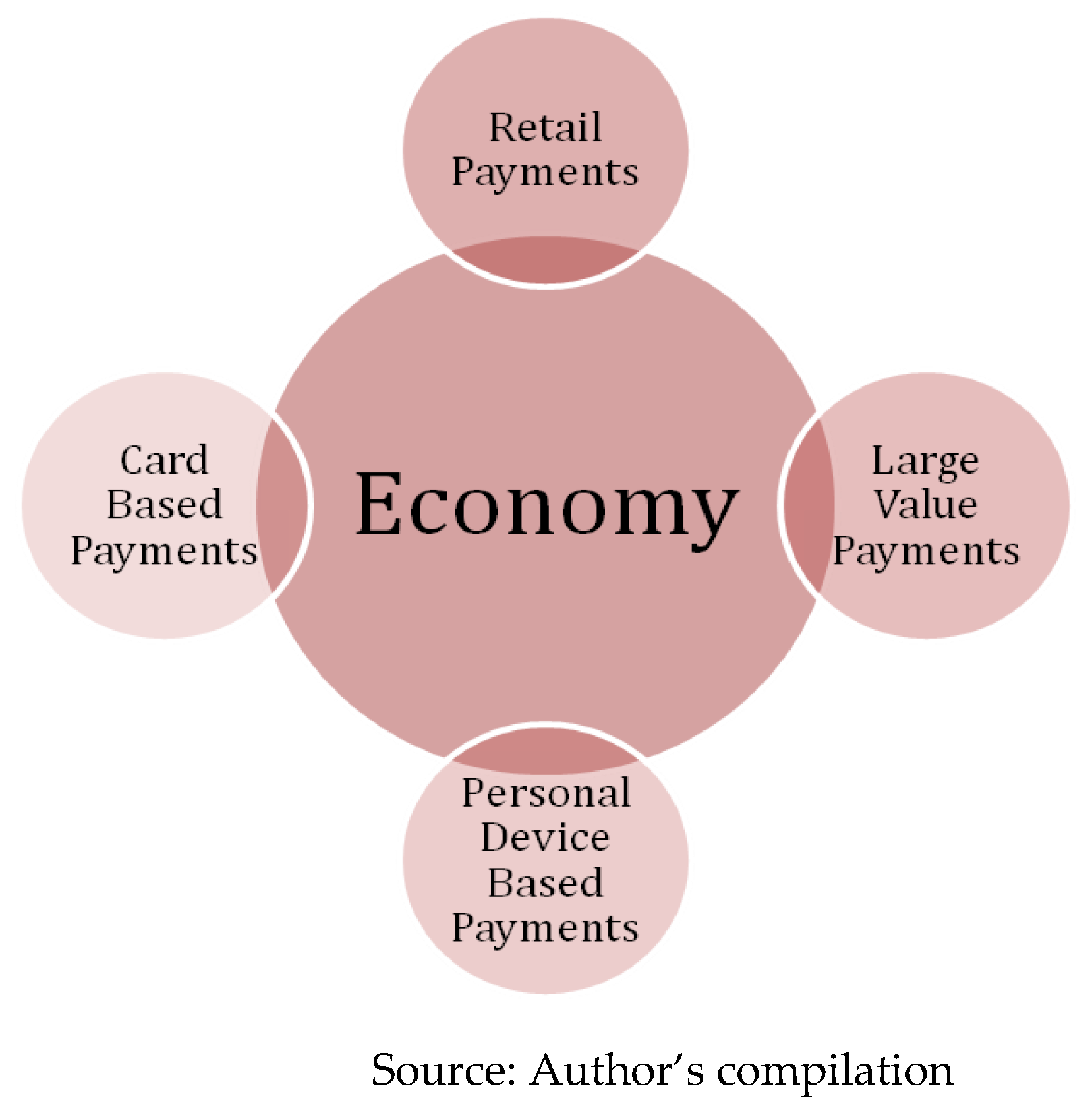

The research will assess the role of payment and settlement systems in facilitating economic transactions within different sectors. It will explore how payment statistics, including electronic transactions, paper-based payments, and other relevant indicators, contribute to the overall GVA of sectors such as manufacturing, agriculture, services. The work of Hock-Han Tee and Hway-Boon Ong (2016) is referred for classifying all the payments into four major groups of Large Value payments (LVP), Retail Payments (RP), Mobile based (CPDD) and Card based payments (ATP), and for application of regression [

14]. The Public Administration, Defence, and Other Services sector is typically excluded from payments and sector-wise GVA analysis because its activities are government-driven, non-profit oriented, have different data sources, and require specialized analysis. Focusing on market-based sectors provides a clearer economic picture. By focusing specifically on the analysis between sector-wise GVA and payment statistics, this study narrows down the research objective to provide a comprehensive understanding of the relationship between these variables in the Indian context.

Despite the popular macro-economic indicators like Gross Domestic Product (GDP), and National Income (NI) which provide valuable insights comprehensively. This work is more relied on sector wise GVA, where the reflection of intrinsic play of payments can be more clearly seen. A government or an economist could use GVA sector-wise to identify which sectors are lagging behind and need support. This information could then be used to develop policies to promote growth in those sectors. Monitoring and interpreting these indicators are vital for maintaining a stable and resilient financial ecosystem and facilitating informed decision-making and policy formulation. All the payment indicators by central bank which are grouped into four main classifications are presented below. The equation for multiple regression analysis is presented for every hypothesis under consideration [

15].

Figure 2.

Impact of Major Payment (Independent Variables) Classification on Economy (Dependent Variable).

Figure 2.

Impact of Major Payment (Independent Variables) Classification on Economy (Dependent Variable).

| Payments Systems Indicators/Variables- Independent Variables. |

|

1. RTGS – Gross Settlements |

| A. CCIL operated systems |

| a. Government Securities |

| i. Outright |

| ii. Repo |

| iii. Tri-Parte Repo |

| b. CBLO |

| c. FOREX Clearing |

|

2. Paper Clearing |

| A. Cheque Truncation System |

| B. Non-MICR Clearing |

| C. MICR Clearing |

| a. RBI Centres |

| b. Other Centres |

|

3. Retail Electronic Clearing |

| A. ECS Credit |

| B. ECS Debit |

| C. IMPS |

| D. NEFT |

| E. NACH |

| |

|

4. Cards |

| A. Credit cards (ATM & POS) |

| B. Debit cards (ATM & POS) |

|

5. Prepaid Payment Instruments |

| A. M-Wallets |

| B. PPI Cards |

| C. Paper Vouchers |

| Macro-Economic Indicators – Dependent Variables. |

| |

| Sector wise GVA |

| A. Agriculture and Allied (AAP) |

| B. Mining & Quarrying (MQP) |

| C. Manufacturing (MCP) |

| D. Electricity, Gas and Water Supply (EGP) |

| E. Construction (CTP) |

| F. Trade, Hotels, Transportation & Communication (THCP) |

| G. Finance, Insurance, Real Estate & Business Services (FSP) |

| H. Community, Social & Personal Services (CSPP) |

- A.

-

Agriculture and Allied (AAP):

H0a1: Scalability of Payment & Settlements have no significant impact on Agriculture and Allied

H1a1: Scalability of Payment & Settlements have significant impact on overall Agriculture and Allied

- B.

-

Mining & Quarrying (MQP)

H0a2: Scalability of Payment & Settlements have no significant impact on Mining & Quarrying

H1a2: Scalability of Payment & Settlements have significant impact on overall Mining & Quarrying

- C.

-

Manufacturing (MCP)

H0a3: Scalability of Payment & Settlements have no significant impact on overall Manufacturing

H1a3: Scalability of Payment & Settlements have significant impact on overall Manufacturing

- D.

-

Electricity, Gas and Water Supply (EGP)

H0a4: Scalability of Payment & Settlements have no significant impact on Electricity, Gas and Water Supply

H1a4: Scalability of Payment & Settlements have significant impact on Electricity, Gas and Water Supply

- E.

-

Construction (CTP)

H0a5: Scalability of Payment & Settlements have no significant impact on Construction

H1a5: Scalability of Payment & Settlements have significant impact on Construction

- F.

-

Trade, Hotels, Transportation & Communication (THCP)

H0a6: Scalability of Payment & Settlements have no significant impact on Trade, Hotels, Transportation & Communication

H1a6: Scalability of Payment & Settlements have significant impact on Trade, Hotels, Transportation & Communication

- G.

-

Finance, Insurance, Real Estate & Business Services (FSP)

H0a7: Scalability of Payment & Settlements have no significant impact on Finance, Insurance, Real Estate & Business Services

H1a7: Scalability of Payment & Settlements have significant impact on Finance, Insurance, Real Estate & Business Services

Results & Discussion

In the period from 2011 to 2022, the analysis of sector-wise Gross Value Added (GVA) influenced by payment statistics becomes the focus of this study.

Table 1, which presents the Payment & Settlement Statistics of India, offers information of classified and grouped various payment and settlement indicators. These indicators include cash, electronic transactions, and digital payments. These statistics play a crucial role in evaluating the efficiency and reliability of financial transactions within the economy.

Table 2 offers descriptive statistics of Independent Variables, namely LVP, RP, CPDD, and ATP. This table presents descriptive measures such as the mean, standard error, median, standard deviation, sum, and count for each independent variable. These statistics provide an overview of the distribution and characteristics of the independent variables used in the analysis.

Moving to

Table 3, titled “Sector Wise GVA (Rupees in Crore) of India”, it provides sector-specific GVA data. This table encompasses key sectors such as agriculture, forestry and fishing (AAP), mining and quarrying (MQP), manufacturing (MCP), electricity, gas, water supply, and other utility services (EGP), construction (CTP), trade, hotels, transport, communication, and services related to broadcasting (THCP), and financial, real estate, and professional services (FSP). Similarly,

Table 4 provides descriptive statistics of dependent variables. Aftermath,

Table 5 presents the results of the regression analysis conducted in the study. The table showcases the p-values, multiple correlation coefficient (r) and adjusted R-square values for the assessing linear relationship between the independent variables (LVP, RP, CPDD, ATP) and the dependent variables (AAP, MQP, MCP, EGP, CTP, THCP, FSP).

It's important to note that the p-values, traditionally used to assess statistical significance, are not applicable in this context due to the reliable dataset compiled by Reserve Bank of India (Central bank of India), representing the entire population for the given period. This means that we do not need to rely on p-values to draw conclusions about the relationships between payments and GVA.

The findings show consistent and practical impact across all sectors. Sectors such as Agriculture, Manufacturing, Electricity, and Financial Services are strongly influenced by the types of payments, while THCP and Construction sectors are moderately impacted. In contrast, Mining exhibits relatively weaker relationships. The model provides a good fit for most sectors, especially Agriculture and Financial Services.

Conclusions

The study's findings signify the role that payments play in driving economic growth. An increase in payments translates to heightened demand for goods and services, subsequently stimulating production and employment. Agriculture, manufacturing, and financial, real estate, and professional services are highly dependent on efficient payment methods, including digital and card-based payments. Informal nature in other sectors might be a cause for lesser response to scalability of payments. The construction sector can benefit from diversifying payment methods, and utility services can enhance GVA through streamlined, digital payment processes. The trade, hotels, transport, communication, and services sector emphasizes the importance of payments. In the financial, real estate, and professional services sector, continuous innovation in payment technologies remains critical for growth.

To optimize GVA, sectors should consider enhancing payment methods and exploring digital, card-based, and other innovative payment solutions. However, it's important to recognize that while payments play a vital role, other sector-specific factors also contribute to GVA. Therefore, a holistic approach that includes streamlining payment processes and addressing broader industry dynamics is essential for sustained growth and competitiveness across these sectors. Additionally, sectors like mining and quarrying, which show less direct dependence on payments, should focus on investigating and understanding the unique determinants of GVA to formulate effective strategies for growth.Top of Form

Initiatives should be put in place to lower transaction costs, working collaboratively with the financial sector to minimize fees associated with transactions, such as ATM usage and bank transfers. Promoting financial inclusion is another imperative step, ensuring that individuals have easier access to banking services, thereby granting them access to the formal financial system and simplifying payment processes. Investments in digital infrastructure, including mobile broadband networks and digital payment platforms, should be prioritized to facilitate digital transactions for both individuals and businesses. In addition to these measures, governments and policymakers might consider providing incentives for businesses to adopt digital payment methods, possibly through tax breaks or subsidies, thus promoting the wider acceptance of digital payments.

To this end, several key measures are suggested to facilitate payments and bolster economic growth. Payments are undeniably a fundamental driver of economic growth, necessitating the attention of governments and policymakers. Strategies aimed at promoting payments should be a focal point, encompassing efforts to reduce transaction costs, enhance financial inclusion, and invest in digital infrastructure.

References

- Coibion, O., Gorodnichenko, Y., & Weber, M. (2020). How did US consumers use their stimulus payments? (No. w27693). National Bureau of Economic Research. https://www.nber.org/system/files/working_papers/w27693/w27693.pdf.

- Carstens, A. (2019). The future of money and payments. Speech held in Dublin, 22. https://www.suerf.org/docx/f_ffd2257b586a72d1fa75f4ba2ad914e6_5175_suerf.pdf.

- Zandi, M., Singh, V., & Irving, J. (2013). The impact of electronic payments on economic growth. Moody’s Analytics: Economic and Consumer Credit Analytics, 217(2). https://www.visa.com.my/content/dam/VCOM/download/corporate/media/moodys-economy-white-paper-feb-2013.pdf.

- Darma, G. S., & Noviana, I. P. T. (2020). Exploring digital marketing strategies during the new normal era in enhancing the use of digital payment. Jurnal Mantik, 4(3), 2257-2262. https://iocscience.org/ejournal/index.php/mantik/article/view/1084/775.

- Hasan, I., De Renzis, T., & Schmiedel, H. (2012). Retail payments and economic growth. Bank of Finland research discussion paper, (19). https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2100651.

- Moreno-Brid, J. C. (1998). Balance-of-payments constrained economic growth: the case of Mexico. PSL Quarterly Review, 51(207). https://rosa.uniroma1.it/rosa04/psl_quarterly_review/article/view/10604. [CrossRef]

- Nakaso, H. (2017, April). Future of Central Bank Payment and Settlement Systems: Under Economic Globalization and Technological Innovation. In Remarks at the Forum Towards Making Effective Use of the BOJ-NET https://www.boj.or.jp/en/about/press/koen_2017/data/ko170421a.pdf.

- Banerjee, S., & Sinha, M. (2023). Promoting Financial Inclusion through Central Bank Digital Currency: An Evaluation of Payment System Viability in India. Australasian Accounting, Business and Finance Journal, 17(1), 176-204. https://ro.uow.edu.au/cgi/viewcontent.cgi?article=2331&context=aabfj. [CrossRef]

- Anis Ali and Anas A. Salameh (2023). Payment and settlement system in Saudi Arabia: A multidimensional study. Banks and Bank Systems, 18(1), 38-52. [CrossRef]

- Cipriani, M., Goldberg, L. S., & La Spada, G. (2023). Financial Sanctions, SWIFT, and the Architecture of the International Payment System. Journal of Economic Perspectives; American Economic Association. [CrossRef]

- Žičkienė, A., Melnikienė, R., Morkūnas, M., & Volkov, A. (2022). CAP Direct Payments and Economic Resilience of Agriculture: Impact Assessment. Sustainability, 14(17), 10546. [CrossRef]

- Polasik, M., Huterska, A., Iftikhar, R., & Mikula, Š. (2020). The impact of Payment Services Directive 2 on the PayTech sector development in Europe. Journal of Economic Behavior & Organization, 178, 385-401. [CrossRef]

- Manaa, M., Chimienti, M. T., Adachi, M. M., Athanassiou, P., Balteanu, I., Calza, A. & Wacket, H. (2019). Crypto-Assets: Implications for financial stability, monetary policy, and payments and market infrastructures. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3391055.

- Tee, H. H., & Ong, H. B. (2016). Cashless payment and economic growth. Financial innovation, 2, 1-9. https://jfin-swufe.springeropen.com/counter/pdf/10.1186/s40854-016-0023-z.pdf. [CrossRef]

- Kahn, C. M., & Roberds, W. (2009). Why pay? An introduction to payments economics. Journal of Financial Intermediation, 18(1), 1-23. https://www.sciencedirect.com/science/article/abs/pii/S1042957308000533. [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).