1. Introduction

Over the past decades, great economic and social developments have been achieved in China, and China has become the largest energy consumer globally. However, there is an increasingly severe contradiction between economic growth and the ecological environment [

1]. Hence, the Chinese government proposed a green and low-carbon development concept aiming to achieve harmony of human beings and nature, thereby promoting coordinated development of economic growth and environmental protection. Currently, green and low-carbon development has become a global trend because of its significant role in ecological civilization and the development of a beautiful China [

2]. The key areas of green and low-carbon industries in China are relatively underdeveloped, and future development requires great financial support. However, the conventional financial mode is constrained by structural mismatch and fails to guide a green and low-carbon transformation. In digital finance, the efficiency of financial resource allocation can be significantly enhanced by using big data, blockchain, artificial intelligence, and cloud computing [

3], thereby alleviating the mismatch of financial resources [

4,

5]. Specifically, digital finance can allocate capital towards green and low-carbon projects and accelerate research and development and application of advanced green and low-carbon technologies [

6], thereby facilitating the ecological environment and green development [

7,

8,

9]. In the context of energy saving and carbon emission reduction [

10], green and low-carbon development is a must for the sustainable economic development of China [

11,

12,

13,

14].

Previous studies on digital finance mainly consider its impacts on economic growth, industrial structure, export, household consumption, and income inequality [

15,

16,

17,

18,

19], while few studies have discussed the impacts of digital finance on green and low-carbon cyclic development. Early studies focused on the impacts of financial development on environmental protection, but no conclusion is drawn [

20,

21,

22,

23]. Recently, the impact of digital finance on green and low-carbon development has attracted increasing attention. Most scholars believe that digital finance has positive impacts on green and low-carbon development. For example, Wu et al. claimed that the digitization level in digital finance has a positive impact on carbon emission efficiency [

24]; Razzaq & Yang found that digital finance can facilitate green growth by supporting the digital transformation of enterprises and addressing energy deficit [

25]. From the perspective of distorted element configuration, Yang conducted an empirical test regarding the role and working mechanism of digital finance in carbon emission reduction based on the panel data of 280 cities in China from 2011 to 2019. The results indicated that digital finance facilitates rational resource allocation and reduction of carbon emissions [

26]. From the perspective of capital bias towards technological advances, Li analyzed the impacts of digital finance on low-carbon energy transformation based on the panel data of 283 cities in China, and it was found that digital finance can improve carbon total factor productivity and the proportion of clean energy in total energy consumption, exhibiting positive impacts on low-carbon energy transformation [

27].

Some scholars believe that digital finance has nonlinear impacts on green growth [

28]: it has negligible impacts on green growth in the early stages, but the impact continuously increases with the level of digital finance. [

29]. Nevertheless, Fang et al. (2020) pointed out that financial development stimulates economic growth in China at the cost of increased carbon emissions [

30]. By using autoregressive distribution lag-bound test methods, some studies revealed the positive impacts of financial development on carbon emission [

31,

32].

In the context of carbon peaking and carbon neutrality, to what extent digital finance affects green and low carbon cyclic development? Through what mechanism does digital finance affect green and low-carbon cyclic development? This study focuses on digital finance and green and low-carbon cyclic development in China in terms of their correlations, working mechanisms, threshold effects, and heterogeneity. The contributions of this study are summarized as follows: (1) a green and low carbon cyclic development indicator system is constructed from the perspectives of ecological civilization and green economy and measured by adopting the spatio-temporal range entropy weight method. (2) The intrinsic mechanism of digital finance working on green and low carbon cyclic development is clarified, and the impacts of digital finance on green and low carbon cyclic development via technological innovation are studied by using the mediating effect model. (3) The nonlinear features and regional heterogeneity of the impacts of digital finance on green and low carbon cyclic development are investigated to clarify the mechanism of digital finance affecting green and low carbon cyclic development. To sum up, this study aims to provide references for the positive impacts of digital finance on green and low-carbon cyclic development by conducting empirical research from the perspectives of the ecological economy and digital economy.

The rest of this paper is as follows:

Section 2 investigates the working mechanism of digital finance affecting green and low carbon cyclic development, as well as the corresponding hypotheses;

Section 3 proposes a green and low carbon cyclic development indicator system and its measurement;

Section 4 constructs econometrics models, mediating effect models, and threshold effect models, and introduces relevant variables and data sources;

Section 5 presents an empirical test of the impacts of digital finance on green and low carbon cyclic development in terms of extent, mechanism, and threshold effect;

Section 6 presents an analysis of the significance of different variables by using machine learning models, heterogenic analysis by regions and basins, and robustness testing of reliability of the results, and provides some recommendations.

2. Theoretical Analysis and Hypotheses

2.1. Effects of Digital Finance on Green and Low Carbon Cyclic Development

Due to limitations in cost and technology, conventional finance cannot provide sufficient support for green and low-carbon cyclic development in China [

33,

34]. With advances in the Internet, big data, and artificial intelligence, digital finance as an integration of conventional finance and digital techniques has been emerging. As a novel financial pattern, digital finance has broken the bottleneck of conventional finance by increasing coverage and reducing transaction costs [

35]. On one hand, digital finance can reduce the financing threshold with its inclusiveness and assists financial institutions such as banks in risk assessment of real-time transactions and behavioral characteristics of small and medium-sized enterprises by using machine learning, thereby alleviating information asymmetry issues in lending [

36]. On the other hand, the unique and superior information collection and processing capabilities of digital finance allow optimizing the marketization configuration of capital factors. This enhances the interaction efficiency of information data in the factor market and the matching efficiency of different subjects [

37,

38] and improves the utilization efficiency of capital factors, thereby providing efficient and convenient financial services to various economic entities. Besides, digital finance is essentially a green development mode, and it can accurately identify green and low-carbon features of enterprises, drive the capital to environmentally friendly enterprises [

39], optimize the allocation of credit funds among environmental protection industries, and facilitate the transformation of energy-intensive industries to high profit, high value-added, and low-carbon industries [

40,

41], thereby promoting the development of the green and low-carbon cyclic economy.

Hypothesis 1. digital finance improves utilization efficiency of capital factor and accelerates green and low carbon cyclic development, and the impacts are nonlinear.

2.2. Effects of Digital Finance on Green and Low Carbon Cyclic Development via Technological Innovation

Being inclusive, digital finance can alleviate the financing constraints of enterprises and promote the innovation and upgrade of the financial industry in various aspects [

42]. It increases the coverage of financial services and the depth of financial services, thereby alleviating the mismatch of financial resources [

43,

44]. Therefore4, digital finance can accelerate financial digitization and provide sufficient financial resources for small and micro enterprises and private enterprises with market potential [

45,

46]. Financing incentives can enhance the drive of enterprises on innovations. Digital techniques such as big data and cloud computing allow searching, analysis, and decision-making of consumption information of different users, thereby providing financing support for innovation activities with a high probability of success, which helps entities to explore innovations and improves the output and transformation of technological research and development achievements [

47]. In this way, a comprehensive graph of technology and financial application scenarios is developed, and the financing channels for innovations are expanded, thereby promoting urban innovations.

With positive impacts on economic growth, carbon emission, and environmental protection,the technological innovation is a key driving factor of green and low-carbon cyclic development [

48,

49]. On one hand, the technological innovation allows precise labor division, collaboration, and production in the production process, which effectively reduces resource factor loss during production and transmission and enhances energy utilization efficiency. In this way, the technological innovation can achieve carbon-free, carbon reduction, and decarbonization before, during, and after the production process, thus promoting intensification and circular utilization of resources. On the other hand, the technological innovation can optimize and upgrade carbon treatment and pollution control facilities and drive the transformation of the environmental governance mode from control-based end treatment to prevention-based clean production, thereby reducing pollution and enhancing environmental resilience. Attributed to advances in technological innovation and the concept of green development, the conventional production-circulation-consumption-discard linear mode is transformed into the green “production-circulation-consumption-discard-recycle” cyclic mode [

50]. To sum up, digital finance plays a key role in facilitating green technological innovation and optimizing resource allocation, thereby possessing indirect impacts on green growth [

51,

52].

Hypothesis 2. digital finance can indirectly facilitate green and low-carbon cyclic development via technological innovation.

3. Establishment of an Indicator System for Green and Low Carbon Cyclic Development

3.1. Establishment of an Indicator System

Green and low-carbon cyclic development is essentially an integration of green development, low-carbon development, and cyclic development. Specifically, green development emphasizes rational utilization of natural resources and environmental protection, low-carbon development focuses on carbon emission reduction, and cyclic development aims at efficient resource utilization. In this study, a green and low-carbon cyclic development indicator system (see

Table 1) is developed from four dimensions (low-carbon feature, green feature, cyclic feature, and economic feature) based on the connotation of green development, low-carbon development, and cyclic development, following objectivity, rationality, feasibility, and representativeness.

3.2. Measurement Method

At present, methods to determine indicator weights include subjective weighting methods, objective weighting methods, and integrated weighting methods. In this study, the green and low carbon cyclic development levels of 31 provinces in China from 2008 to 2019 are measured by using the spatiotemporal range entropy weight method. Conventional entropy weight methods can only determine indicator weights at a specific moment, while the spatiotemporal range entropy weight method can determine indicator weights in both temporal and spatial dimensions, thereby updating indicator weights dynamically.

Assume that a multi-level evaluation system consists of n evaluation indicators of m evaluation objects in k periods. The indicator system is Xi (i = 1, 2, ..., n), and its indicator in period t is Xijt (j = 1, 2, ..., m and t = 1, 2, ..., k).

(1) Data standardization: let xijt be X’ijt, a dimensionless decision matrix can be obtained:

If

Xi is a positive indicator,

If

Xi is a negative indicator,

(2) Calculation of weights based on information entropy:

(3) The weight of

Xi can be calculated by:

(4) Weighted summation of various indicators:

4. Research Design

4.1. Model Establishment

4.1.1. Baseline Regression Model

According to Hypothesis 1, digital finance has linear effects on green and low-carbon cyclic development. Here, a baseline regression model of digital finance on green and low-carbon cyclic development is developed as follows:

where

i denotes the city,

t denotes the year,

GLC denotes the green and low carbon cyclic development, which indicates the high-quality economic development level;

DUF is the digital inclusive finance index, which reflects the regional digital economy development level;

Edui,t is the education level;

Fdii,t represents the direct foreign investment level;

Govi,t represents the government expenditure level;

Popi,t represents the population level;

ui represents the individual fixed effect;

εi,t represents a stochastic disturbance term.

4.1.2. Verification of Working Mechanism

To clarify the mechanism of digital finance affecting green and low carbon cyclic development, a mediating effect model is constructed with technological innovation as the mediating variable:

where

i denotes the city,

t denotes the year, and

TEC denotes technological innovation level.

4.1.3. Threshold Regression

As discussed, the impacts of digital finance and technological innovation on green and low-carbon cyclic development are investigated by using a panel baseline regression model and a mediating effect model. Because of the “online effect”, the impacts of digital finance on green and low-carbon cyclic development may be nonlinear. In this section, the linearity/nonlinearity of such impacts is further investigated and verified by using the following threshold regression model:

To further explore the nonlinearity of the impacts of digital finance on green and low-carbon cyclic development, a nonlinear effect model is developed with innovation input and innovation output as the threshold variables (

TEC):

where

γ1,

γ2, …

γn are the thresholds to be estimated;

I(·) is the indicator function, and its value is based on the expression in parentheses;

X represents the control variable, which is the same that in Eq. (1).

4.2. Variable Selection

4.2.1. Explained Variables

In this study, a multi-dimensional evaluation system consisting of four secondary indicators (economic development, green development, low-carbon development, and cyclic development) is constructed, with the green and low-carbon cyclic development level measured by the spatio-temporal range entropy weight method as explained variable (denoted as GLC).

4.2.2. Key Explanatory Variable

In this study, the regional digital finance development level is investigated from three dimensions: breadth (

bre), depth (

dep), and digitization (

dig), with the total index of digital inclusive finance (

DUF) of China as the proxy variable of regional digital finance development level [

4].

4.2.3. Mediating Variables

In this study, regional technological innovation is evaluated based on the proportion of technology expenditure in financial expenditure (Sci) and the number of patent applications per capita (Inv). This is in line with the investigation of the influences of digital finance on green and low-carbon cyclic development via technological innovation.

4.2.4. Control Variables

To clarify the impacts of digital finance on green and low-carbon cyclic development, the control variables that affect green and low-carbon cyclic development should also be set: (1) education level (Edu), which is evaluated based on the proportion of education expenditure in GDP; (2) direct foreign investment (Fdi), which is evaluated based on the proportion of direct foreign investment in GDP; (3) population (Pop), which is evaluated based on the permanent residents in this region; (4) government expenditure (Gov), which is evaluated based on the proportion of government expenditure in GDP.

4.3. Data sources and Descriptive Statistics

In this study, the impacts of digital finance on green and low-carbon cyclic development are investigated based on 31 provinces in China. The variables come from the Statistical Yearbook of China, the Energy Statistical Yearbook of China, and the Environment Statistical Yearbook of China from 2012 to 2020. The digital inclusive finance index comes from the Digital Inclusive Finance Indicator System and Index Compilation released by the Institute of Internet Finance, Peking University (Guo et al., 2020). The technological innovation data are collected from the website of the World Intellectual Property Organization (WIPO); missing data are determined by the interpolation method. The descriptive statistical results of the main variables are listed in

Table 2.

5. Empirical Test of Impacts of Digital Finance on Green and Low Carbon Cyclic Development

5.1. Results by Baseline Regression and Dimension-Reduction Regression

A regression analysis of the impacts of digital finance on green and low-carbon cyclic development is conducted.

Table 3 presents the impacts of the digital economy on green and low carbon cyclic development evaluated by baseline regression and dimension-reduction regression, respectively.

Model1 denotes the baseline regression results of digital finance, and the estimation coefficient of DUF is highly positive at the 1% level, indicating that digital finance is characterized by platformization and sharing. “Data + Algorithm + Computing Power” can break temporal and spatial limitations to achieve rapid flow of various resource elements, thereby realizing effective docking and precise matching. It may continuously induce revolutions in the industry and facilitate the green transformation of energy-intensive industries. Models 2~Model4 denote the dimension-reduction regression results of digital finance, where digital finance can be further divided into breadth, depth, and digitization. The results show that breadth, depth, and digitization have positive impacts on green and low-carbon cyclic development, especially digitization, demon stating that digitization favors green and low-carbon cyclic development to breadth and depth. This can be attributed to the fact that digital techniques such as artificial intelligence, big data, cloud computing, and blockchain significantly enhance labor productivity and decision-making efficiency, thereby reducing energy consumption and promoting green and low-carbon cyclic development.

5.2. Mechanism

The regression results illustrate significant positive impacts of digital finance on green and low carbon cyclic development. To investigate the feasibility of digital finance affecting green and low-carbon cyclic development via technological innovation, this study validates the presence of the mediating effect by using a stepwise testing method.

Table 4 shows the estimation results with innovation input and innovation output as the mediating variables. Model1 and Model3 demonstrate that the influence coefficients of digital finance on innovation input and innovation output are significantly positive, suggesting that digital finance favors the improvement of technological innovation and the increase in innovation output. Meanwhile, innovation input and innovation output are involved in Model2 and Model4 as mediating variables. Thus, the impacts of digital finance on green and low-carbon cyclic development are significantly positive in both models, while the influence coefficient of digital finance on green and low-carbon cyclic development is lower than that in the baseline regression model, indicating that technological innovation is the mechanism through which digital finance facilitates green and low carbon cyclic development.

5.3. Threshold Regression

As the effects of digital finance and technological innovation on green and low-carbon cyclic development have been verified in previous sections, the linearity of such effects is analyzed in this section by using the threshold regression model. Specifically, the panel threshold regression model involves verification of threshold effects on the variables and authenticity of estimated thresholds.

Table 5 presents the verification of threshold effects with digital finance, innovation input, and innovation output as the threshold variables based on 300 samples obtained by the Bootstrap method. It can be seen that the single threshold effect with digital finance and innovation input as the threshold variables is significant. Therefore, the effects of digital finance on regional technological innovation and green and low-carbon cyclic development have nonlinearity due to its development level and innovation input.

Table 6 summarizes the regression results of threshold models. As indicated by the table, the impacts of digital finance on green and low-carbon cyclic development are positively nonlinear. In the first case, digital finance is employed as the threshold variable for threshold estimation. If the digital finance development level is lower than the threshold (5.38), the estimation coefficient of digital finance on green and low carbon cyclic development is 0.010; if the digital finance development level is higher than the threshold (5.38), the estimation coefficient of digital finance on green and low carbon cyclic development is 0.013. The results indicate that the positive impacts of digital finance on green and low-carbon cyclic development depend on the digital finance system, and such impacts are more significant in the late stage. In the second case, the innovation input is taken as a threshold variable for threshold estimation. If the innovation input is lower than the threshold (0.033), the positive impacts of digital finance on green and low-carbon cyclic development are low; if the innovation input is higher than the threshold (0.033), the positive impacts of digital finance on green and low carbon cyclic development are greatly enhanced. When the innovation level varies, the impacts of digital finance on green and low-carbon cyclic development change with the innovation input; as the innovation input increases, the impacts of digital finance on green and low-carbon cyclic development exhibit significant positive nonlinear features with increasing “marginal effect”.

6. Discussion

6.1. Machine Learning Model of Nonlinear Effects

As the impacts of digital finance on green and low carbon cyclic development are affected by various elements, multicollinearity, and DOF degradation can be alleviated by using the nonlinear random forest model and the nonlinear CatBoost model in machine learning. The contributions of variables are calculated by establishing the random forest model and the CatBoost model, respectively, to clarify the effects of different variables on green and low carbon cyclic development.

In random forest regression tree models, splitting nodes are selected by taking the least mean square error as the optimization criteria, and the variables are sorted according to their contributions to the reduction of the residual sum of square:

where

and

are the determined mean of each spurious copy of output variables;

j and

m refer to the splitting nodes of variables and threshold, respectively.

In the CatBoost model, more effective strategies are adopted to reduce over-fitting, and the entire dataset is used for training to effectively utilize the data information:

where

is the

jth data,

is the

kth discrete feature of the

ith data in the training set,

a is a priori weight, and

p is a priori distribution term.

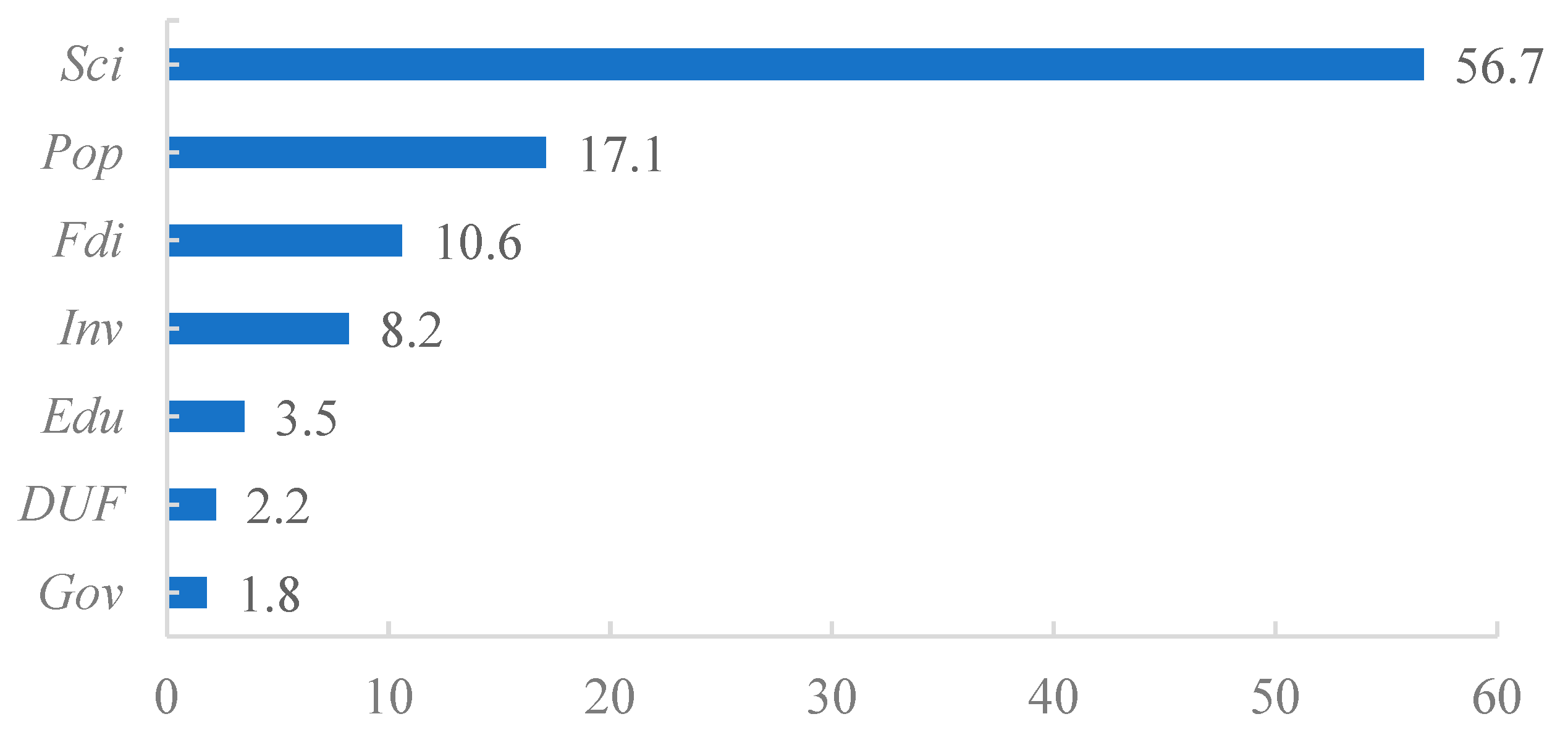

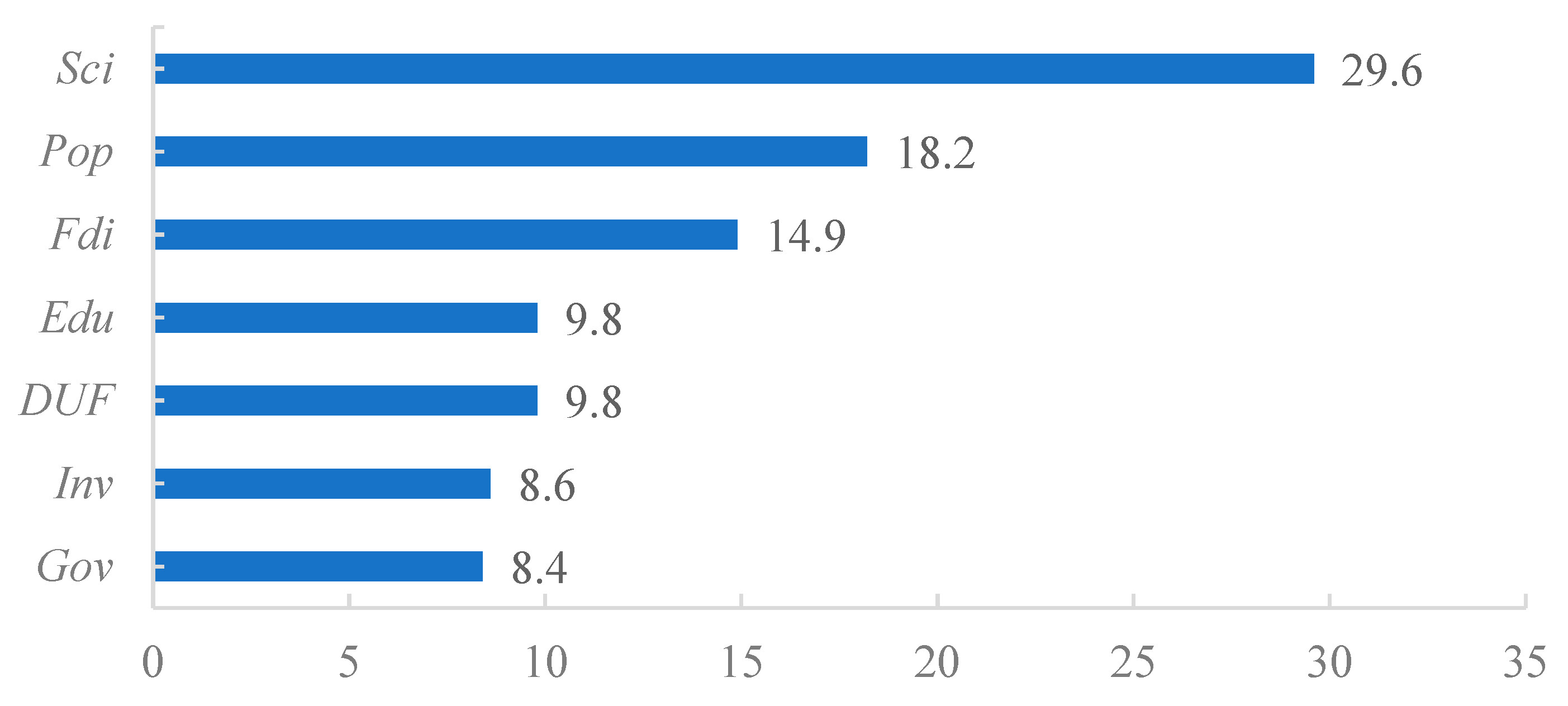

The explanatory variables, mediating variables, and control variables that affect green and low carbon cyclic development variables can be identified using the random forest model and the CatBoost model, and these variables are sorted according to their impacts on green and low carbon cyclic development. According to

Figure 1 and

Figure 2, green and low carbon cyclic development has a significantly positive correlation with digital finance, with a contribution rate of 2.2% and 9.8%, respectively, indicating that green and low carbon cyclic development can benefit from digital finance. Meanwhile, the other six characteristic variables have significantly positive impacts on green and low carbon cyclic development, which is consistent with the expectation. Herein, the proportion of technology expenditure and population exhibit significantly higher contribution rates than other economic factors, which indicates that technology and talent are determining factors in economic development. Technology is the primary factor of production, and talent is the primary resource, and they can promote green and low-carbon cyclic development.

6.2. Heterogeneity Analysis

The impacts of digital finance on green and low-carbon cyclic development, the transmission mechanism, as well as the threshold effect, have been discussed in previous sections. However, regional differences, which lead to varying impacts of digital finance on green and low-carbon cyclic development, are not considered.

Table 7 shows the impacts of digital finance on green and low-carbon cyclic development in different regions and basins. First, 31 provinces are divided into eastern, central, and western China, as shown in Model1 ~ Model3, respectively. Both “Development of the Yangtze River Economic Belt” and “Ecological Conservation and High-Quality Development of the Yellow River Basin” have become key national strategies and benchmarks for the governance of large rivers in China. To clarify such differences from the perspective of national strategy, the Yangtze River Economic Belt and the Yellow River Basin are taken for regression analysis, where the former includes Shanghai, Jiangsu, Zhejiang, Anhui, Jiangxi, Hubei, Hunan, Chongqing, Sichuan, Yunnan, and Guizhou, and the latter includes Qinghai, Sichuan, Gansu, Ningxia, Inner Mongolia, Shaanxi, Shanxi, Henan, and Shandong, as shown in Model4 and Model5.

According to the sub-region heterogeneity regression results obtained by Model1 ~ Model3 shown in

Table 7, the impacts of digital finance on green and low carbon cyclic development are maximized in western China. This can be attributed to the fact that central and western China have abundant resources and energy-intensive industries. Digital finance can relieve this situation by significantly promoting digitalization and low-carbon transformation of traditional industries in western China. Specifically, energy digitalization will accelerate the growth of energy conservation and environmentally-friendly industries and continuously facilitate the low-carbon development of all industries.

According to the sub-region heterogeneity regression results obtained by Model4 and Model5, the impacts of digital finance on green and low-carbon cyclic development are significantly positive in both the Yangtze River Economic Belt and the Yellow River Basin. This is because digital finance can enhance the green technological innovation capability, optimize industrial structure and spatial layout in the region, and improve the utilization efficiency of energy and resources, thereby facilitating green and low-carbon cyclic development.

6.3. Robustness Testing

To demonstrate the reliability of the empirical results obtained, robustness testing is conducted in three aspects: (1) Beijing, Shanghai, Tianjin, and Chongqing are excluded due to their unique economic development level and economic policies. As indicated by Model1 in

Table 8, the regression coefficient of digital finance on green and low carbon cyclic development remains significantly positive (verified by a 1% significance level test), which is consistent with the results of baseline regression analysis. (2) Instrumental variable method: To mitigate endogeneity, estimation is conducted by using the two-stage least squares (2SLS) method with Internet popularity as the instrumental variable. As indicated by Model2 in

Table 8, the Internet popularity coefficient is significantly positive, which agrees with the conclusions of previous studies. (3) Change variation method: robustness testing is carried out by introducing the lagging phase of green and low carbon cyclic development into the model and using mixed OLS and dynamic panel system GMM models, as indicated by Model3 and Model4 in

Table 8. Model3 refers to the mixed OLS regression, and the coefficient is significantly positive. As illustrated in Model4, the regression coefficient of the previous phase of green and low carbon cyclic development level on the current phase of green and low carbon cyclic development level is significantly positive. That is, the process of green and low carbon cyclic development evolves dynamically, and the regression coefficient of digital finance on green and low carbon cyclic development levels remains significantly positive, indicating the high stability of the regression results.

7. Conclusions

This paper investigated the effects of digital finance on green and low-carbon cyclic development and its mechanism using the samples from 31 provinces in China between 2011 to 2019. We use panel regression models, mediating effect models, and threshold models to conduct the empirical study on the collected panel data to study the working mechanism of digital finance on green and low carbon cyclic development. The results demonstrate that digital finance has significant positive effect on green and low-carbon cyclic development and the technological innovation exerts a great force for this effect. Moreover, digital finance has an increasing “marginal effect” on green and low carbon cyclic development with its nonlinear characteristics. Both digital finance and conventional factors have significant effects on green and low carbon cyclic development.

The research outcome of this paper provides consolidate evidences on the positive effects of digital finance on green and low-carbon cyclic development by the empirical research from the perspectives of the ecological economy and digital economy. With this study, we propose the following suggestions to make use of digital finance to facilitate green and low-carbon cyclic development.

Firstly, we suggest to accelerate green transformation in key industries and fields to promote clean production, develop environmentally-friendly industries. This would further help to achieve low-carbon, safe, and efficient energy utilization of treatment sludge of domestic waste and sewage. For this reason, we should enhance the recycling of urban recycled water, and integrate the concept of green development into industry and daily life, to reduce carbon emission.

Secondly, we suggest that digital finance infrastructure should be constructed to facilitate the digital transformation of various industries, and the empowering channels of digital finance shall be expanded. Additionally, we should stimulate the innovation capability of digital finance and, improve digital productivity as well as strengthen the positive impacts of digital finance on green and low-carbon cyclic development.

Thirdly, based on regional differences in development levels, we suggest to encourage cooperation between regions, strengthen cooperation, mutual assistance, and market integration of different regions and basins with different resource endowments, and to improve the infrastructure of digital finance, thus to further unleash the spillover dividends of digital finance for green development.

Last but the least, technical cooperation and transactions can be achieved with the assistance of user-friendly and efficient digital platforms, which would help to promote the synergistic development of developed and underdeveloped regions and exploit the positive impacts of digital finance on green and low-carbon cyclic development.

Author Contributions

Conceptualization, X. Z. and X. A.; Data curation, X. Z.; Funding acquisition, G. Z.; Methodology, X. Z.; Resources, X. Z. and X. A.; Software, X. Z.; Supervision, X. W.; Writing–original draft, X. Z.; Writing–review & editing, X. A., X. W. and J. Z. All authors have read and agreed to the published version of the manuscript.

Funding

This research was supported by the Innovative Research Group Project of the National Natural Science Foundation of China (42121001), the National Natural Science Foundation of China (72164030), the Natural Science Foundation of Inner Mongolia (2023QN07008), and the Inner Mongolia Foundation of Philosophy and Social Sciences (2022NDB134).

References

- Khan, M.K.; Khan, M.I.; Rehan, M. The Relationship between Energy Consumption, Economic Growth and Carbon Dioxide emissions in Pakistan. Financ. Innov. 2020, 6, 1–13. [Google Scholar] [CrossRef]

- Fang, C.L.; Wang, Z.B.; Liu, H.M. Exploration On The Theoretical Basis and Evalution Plan of Beautiful China Construction. Acta Geogr. Sin. 2019, 74, 619–632. [Google Scholar]

- Awan, U.; Sroufe, R.; Shahbaz, M. Industry 4.0 and the Circular Economy: A Literature Review and Recommendations for Future Research. Bus. Strat. Environ. 2021, 30, 2038-2060.

- Moll, B. Productivity Losses from Financial Frictions: Can Self-Financing Undo Capital Misallocation? AER. 2014, 104, 3186–3221. [Google Scholar] [CrossRef]

- Klapper, L.; Miller, M.; Hess, J. Leveraging Digital Financial Solutions to Promote Formal Business Participation. World Bank Group. 2019.

- Shahbaz, M.; Shahzad, S.J.H.; Ahmad, N.; et al. Financial development and environmental quality: the way forward. En. Pol. 2016, 98, 353–364. [Google Scholar] [CrossRef]

- Feng, Y. Research on the impact evaluation of digital finance on the synergy between economic development and ecological environment. J. Environ. Public Health. 2022, 1714609. [Google Scholar]

- Feng, S.L.; Chong, Y.; Yu, H.J., et al. Digital financial development and ecological footprint: Evidence from green-biased technology innovation and environmental inclusion. J. Clean. Prod. 2022, 380.

- Liu, Y.; Xiong, R.C.; Lv, S.G.,et al. The impact of digital finance on green total factor energy efficiency: evidence at China’s city level. Energies. 2022, 15, 5455.

- Mi, Z.; Zhang, Y.; Guan, D., et al. Consumption-based emission accounting for Chinese cities. Appl. Energ. 2016, 184, 1073-1081.

- Li, J.; Wu, Y.; Xiao, J.J. The impact of digital finance on household consumption: evidence from China. Econ. Model. 2020, 86, 317–326. [Google Scholar] [CrossRef]

- Awan, U.; Kraslawski, A.; Huiskonen, J. Progress from blue to the green world: multilevel governance for pollution prevention planning and sustainability. Handbook of Environmental Materials Management, 2019,1-22.

- Mi, Z.; Meng, J., Guan, D., et al. Chinese CO2 emission flows have reversed since the global financial crisis.Nat. Commun. 2017,8(1):1-10.

- Mi, Z.; Wei, Y.M.; Wang, B., et al. Socioeconomic impact assessment of China's CO2 emissions peak prior to 2030. J. Clean. Prod. 2017, 142, 2227-2236.

- Miled, K.B.H.; Rejeb, J.E.B. Microfinance and poverty reduction: A review and synthesis of empirical evidence. Procedia Soc. Behav. Sci. 2015, 195, 705–712. [Google Scholar] [CrossRef]

- Mushtaq, R.; Bruneau, C. Microfinance, financial inclusion and ICT: Implications for poverty and in equality. Technol. Soc. 2019, 59, 101–154. [Google Scholar] [CrossRef]

- Ren, Y.M.; Gao, J.Y. Does the development of digital finance promote firm exports? Evidence from Chinese enterprises. Fin. Res. Lett. 2023, 53, 103514. [Google Scholar] [CrossRef]

- Xie, S.F.; Jin, C.M.; Song, T. ,et al. Research on the long tail mechanism of digital finance alleviating the relative poverty of rural households. PLOS ONE. 2023, 18, e0284988. [Google Scholar] [CrossRef] [PubMed]

- Syed, A.A.; Ahmed, F.; Kamal M., et al. Assessing the role of digital finance on shadow economy and financial instability: an empirical analysis of selected south asian countries. Mathematics. 2021, 9, 3018.

- Jalil, A.; Feridun, M. The impact of growth, energy and financial development on the environment in China: a cointegration analysis. Energ. Econ. 2011, 33, 284–291. [Google Scholar] [CrossRef]

- Shahbaz, M.; Khan, S.; Tahir, M.I. The dynamic links between energy consumption, economic growth, financial development and trade in China: fresh evidence from multivariate framework analysis. Energ. Econ. 2013, 40, 8–21. [Google Scholar] [CrossRef]

- Fang, Z.; Gao, X. , Sun, C. Do financial development, urbanization and trade affect environmental quality? Evidence from China. J. Clean. Prod. 2020, 256, 120892. [Google Scholar] [CrossRef]

- Umar, M.; Ji, X.; Kirikkaleli, D.; Xu, Q. COP21 Roadmap: do innovation, financial development, and transportation infrastructure matter for environmental sustainability in China? J. Environ. Manage. 2020, 271, 111026. [Google Scholar] [CrossRef]

- Wu, J.; Zhao, R.Z.; Sun, J. What role does digital finance play in low-carbon development? Evidence from five major urban agglomerations in China. J. Environ. Man. 2023, 341, 118060. [Google Scholar] [CrossRef]

- Razzaq, A.; Yang, X.D. Digital finance and green growth in China: Appraising inclusive digital finance using web crawler technology and big data. Technol. Forecast. Soc. Change. 2023, 188, 122262. [Google Scholar] [CrossRef]

- Yang, G.Q.; Ding, Z.Y.; Wu, M., et al.Can digital fnance reduce carbon emission intensity? A perspective based on factor allocation distortions: evidence from Chinese cities. Environ. Sci. Pollut. Res. 2023, 30, 38832-38852.

- Li, G.X.; Wu, H.Y.; Jiang, J.S.,et al.Digital finance and the low-carbon energy transition (LCET) from the perspective of capital-biased technical progress. Energ. Econ. 2023,120,106623.

- Wen, H.; J. Yue J., Li J.,et al. Can digital finance reduce industrial pollution? New evidence from 260 cities in China. Plos one. 2022, 17, e0266564. [Google Scholar] [CrossRef]

- Zhong, K.Y. Does the digital finance revolution validate the environmental Kuznets Curve?Empirical findings from China. Plos one. 2022, 17, e0257498. [Google Scholar] [CrossRef]

- Fang, Z.; Gao, X.; Sun, C. Do financial development, urbanization and trade affect environmental quality? Evidence from China. J. Clean. Prod. 2020, 120892. [Google Scholar] [CrossRef]

- Liu, H.; Li, J.; Long, H. , et al, Promoting energy and environmental efficiency within a positive feedback loop: insights from global value chain. En. Pol. 2018, 121, 175–184. [Google Scholar] [CrossRef]

- Shen, Y.; Su, Z.W.; Malik, M.Y. , et al. Does green investment, financial development and natural resources rent limit carbon emissions? A provincial panel analysis of China. Sci. Total Environ. 2021, 755, 142538. [Google Scholar] [CrossRef]

- Wei, Z.; Yuguo, J.; Jiaping, W. Greenization of venture capital and green innovation of Chinese entity industry. Ecol. Indic. 2015, 51, 31–41. [Google Scholar] [CrossRef]

- Ji, Q.; Zhang, D. How much does financial development contribute to renewable energy growth and upgrading of energy structure in China? En. Pol. 2019, 128, 114–124. [Google Scholar] [CrossRef]

- Chen, H.; Zhang, X.; Wu, R.; Cai, T. Revisiting the environmental Kuznets curve for city-level CO2 emissions: based on corrected NPP-VIIRS nighttime light data in China. J. Clean. Prod. 2020, 268, 121575. [Google Scholar] [CrossRef]

- Lu, Z.; Wu, J.; Li, H. , et al. Local bank, digital fnancial inclusion and SME fnancing constraints: empirical evidence from China. Emerg. Mark. Finance Trade. 2021, 58, 1712–1725. [Google Scholar] [CrossRef]

- Niebel, T. ICT and economic growth–Comparing developing, emerging and developed countries. World Development. 2018, 104, 197–211. [Google Scholar] [CrossRef]

- Karakara, A.A.W.; Osabuohien, E. ICT adoption, competition and innovation of informal firms in West Africa: A comparative study of Ghana and Nigeria. J. Enterp. Communities. 2020, 14, 397–414. [Google Scholar] [CrossRef]

- Demertzis, M.; Merler, S.; Wolff, G.B. Capital markets union and the fintech opportunity. J. Financ. Regul. 2018, 4, 157–165. [Google Scholar] [CrossRef]

- Li, J.; Li, B. Digital inclusive fnance and urban innovation: evidence from China. Rev. Dev. Econ. 2021, 26, 1010–1034. [Google Scholar] [CrossRef]

- Liu, Y.; Xiong, R.C.; Lv, S.G. The impact of digital finance on green total factor energy efficiency: evidence at China’s city level. Environ. Sci. Pollut. 2022, 15, 5455. [Google Scholar] [CrossRef]

- Luo,S. ; Digital finance development and the digital transformation of enterprises: Based on the perspective of financing constraint and innovation drive. J. Math. 2022, 3, 1–10. [Google Scholar]

- Ryals, L.; Payne, A. Customer relationship management in financial services: towards information-enabled relationship marketing. J. Strat. Mark. 2001, 9, 3–27. [Google Scholar] [CrossRef]

- Serrano-Cinca, C.; Guti´errez-Nieto, B. Microfinance, the long tail and mission drift. Int. Bus. Rev. 2014, 23, 181–194. [Google Scholar] [CrossRef]

- Gomber, P.; Koch, J.A.; Siering, M. Digital Finance and FinTech: current research and future research directions. J. Bus. Econ. Stat. 2017, 87, 537–580. [Google Scholar] [CrossRef]

- Li, Y.; Ji, Q.; Zhang, D. Technological catching up and innovation policies in China: what is behind this largely successful story? Technol. Forecast. Soc. Chan. 2020, 153, 119918. [Google Scholar] [CrossRef]

- Wu, Y.; Huang, S. The effects of digital finance and financial constraint on financial performance: firm-level evidence from China’s new energy enterprises. Energy Econ. 2022, 112, 106158. [Google Scholar] [CrossRef]

- Anser, M.K., Khan, M.A.; Awan, U. et al.The role of technological innovation in a dynamic model of the environmental supply chain curve: Evidence from a panel of 102 countries. Proc. 2020, 8, 1033.

- Sun, C. Digital finance, technology innovation and marine ecological efficiency. J. Coastal Res. 2020, 108, 109–112. [Google Scholar] [CrossRef]

- Wang, H.R.; Cui, H.R.and Zhao, Q.Z. Effect of Green Technology Innovation on Green Total Factor Productivity in China: Evidence from Spatial Durbin Model Analysis. J. Clean. Prod. 2021, 288, 125624.

- Sun, H.; Kporsu, A.K.; Taghizadeh-Hesary, F., et al. Estimating Environmental Efficiency and Convergence: 1980 to 2016. Energ. 2020, 208, 118224.

- Wen, H.M.; Yue, J.L.; Li, J. , et al. Can digital finance reduce industrial pollution? New evidence from 260 cities in China. Plos one. 2022, 17, e0266564. [Google Scholar] [CrossRef]

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).