1. Introduction

Agriculture has played a significant role in the history of Angola, one of the largest countries in Africa. The nation's agriculture has evolved over time, influenced by various factors such as colonial rule, independence, civil war, and post-war reconstruction efforts.

Before the arrival of Portuguese colonizers in the 15th century, Angola had a diverse agricultural system. During the Portuguese colonization in Angola, from the late 15th century until 1975, the Portuguese introduced cash crops for export, primarily coffee, cotton, and later on, palm oil, rubber, and sisal.

After achieving independence from Portugal in 1975, the country soon plunged into a civil war that lasted for nearly three decades, until 2002. The conflict severely disrupted agricultural activities, as many farmers were displaced or killed, and infrastructure was destroyed. Agricultural production declined significantly during this period, exacerbating food shortages and increasing dependence on food aid.

Meanwhile, Angola suffered from the so-called Dutch disease, using its oil sector as its main supplier of hard currency to import more than 90% of its consumer goods and services. Angola’s economy is still overwhelmingly driven by its oil sector, being the first oil producer in Sub-Saharan Africa to produce 1.12 million barrels per day (bpd). The country’s oil sector accounts for approximately 28% of its GDP, 85% of its overall exports, and 65% of its overall tax revenue. Since 2018, Angola has been changing this paradigm, focusing on its comparative advantages, and especially on re-launching its agribusiness sector.

However, since 2003, Angola has embarked on a process of post-war reconstruction and agricultural reform. The government prioritized revitalizing the agricultural sector to promote food security, economic development, and poverty reduction. Efforts were made to rehabilitate infrastructure, provide technical assistance to farmers and improve access to credit.

In this regard, the background of the study is to evaluate possible drivers of agricultural growth, the focus in this work being access to credit in agriculture. The banking financing instruments and products are seen as a catalyst for increasing production and productivity in the productive sector and, in particular, the agricultural sector. Three main factors impact on agricultural growth in Angola, namely the business environment, farmers’ knowledge, and the financial system’s financing appetite. This study identifies the impact of agricultural credit on agricultural growth in Angola in the period 2003–2022. In particular, the study aims:

- (i)

To assess the factor of credit in the agricultural sector;

- (ii)

To critically evaluate the impact of credit on the growth of the agricultural sector;

- (iii)

To provide quantitative results regarding the impact of agri-credit on the growth of the agricultural sector;

- (iv)

To provide recommendations on the importance of credit for the growth of the agricultural sector.

Moreover, the study addresses the following research questions:

- (i)

Is credit provided to the agricultural sector a determinant of growth for the sector?

- (ii)

What is the impact of providing credit to the agricultural sector?

- (iii)

Should the amount of credit provided to the agricultural sector be increased?

The study is significant as it attempted to identify the impact of credit products provided to Angola’s agricultural sector on the growth of the sector from 2003 to 2022. In the research, preliminary analysis showed that there was a direct relationship between GDP and credit. Therefore, this relationship was examined to obtain quantitative results regarding the importance of agricultural credit to the growth of the agricultural sector in Angola and to provide policy recommendations. On the other hand, this is a first-of-a-kind study on the matter of the Angolan credit experience, specifically for the agricultural sector. Angola is still searching for a sustainable credit model that could be used as a catalyzer to boost growth and contribute to economic development.

The rest of this paper is structured as follows: the second section describes the information on the significance of agricultural sector in Angola’s economy, the third section provides a review of the important literature, the fourth section outlines the methodology used, the fifth section is reserved for the results, and the sixth provides conclusive remarks.

2. Contribution and Potential of Agriculture to Contribute to Angola’s GDP

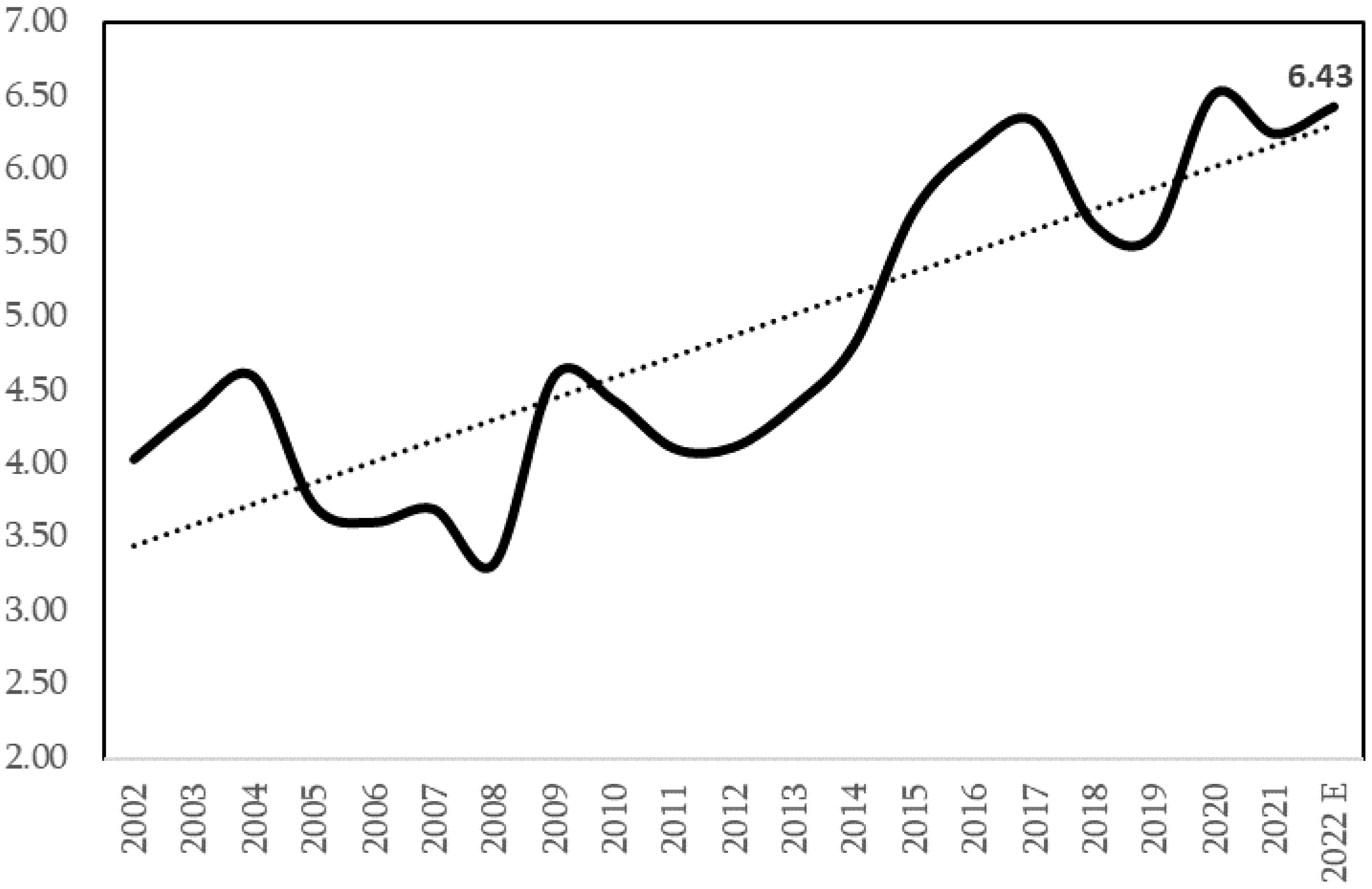

In Angola, the agricultural sector contributed just 6.43% of the total GDP in 2022. Nonetheless, agriculture is one of the biggest and fastest growing non-oil sectors of Angola’s economy.

Agricultural production is currently mostly carried out by smallholder farms, in which approximately three million households (approximately twelve million people, or approximately 30% of Angola’s population) are involved. The Angolan government has adopted a national program for the development of the agricultural sector in its National Development Plan 2018–2022, which has two principal objectives: (i) the modernization of smallholdings in order for them to become more market-orientated businesses and (ii) the establishment of large and modern industrial farming businesses. Smallholder farms, on which Angola’s agricultural sector is currently based, have much lower production efficiency levels than those in more developed countries.

The credit system in Angola, despite all efforts, remains selective, servicing an exclusive population made up of influential landowners. Furthermore, the system is characterized by high interest rates that involve high-value loans subject to onerous requirements and guarantees, in addition to careful analysis at the time of a loan’s concession.

To strengthen the nation’s value chain, in 2018, the Government adopted the Program to Support Production, Export Diversification, and Import Substitution (PRODESI), which contains five key initiatives to enhance the diversification of the Angolan economy, with the aim of significantly decreasing its historical over-reliance on oil export revenue and the importation of basic food products.

Having been, during its colonial era, one of the world’s largest exporters of coffee and other agricultural commodities such as cotton, sisal, maize, cassava, and bananas, today, Angola has crop and animal production levels far below their potential levels, forcing the country to spend large financial resources on food imports.

The government has identified several key productive areas that can promote investment and foster public–private partnerships, and it set out further initiatives to boost domestic agricultural production to mitigate the country’s current expenditure on the importation of basic food products.

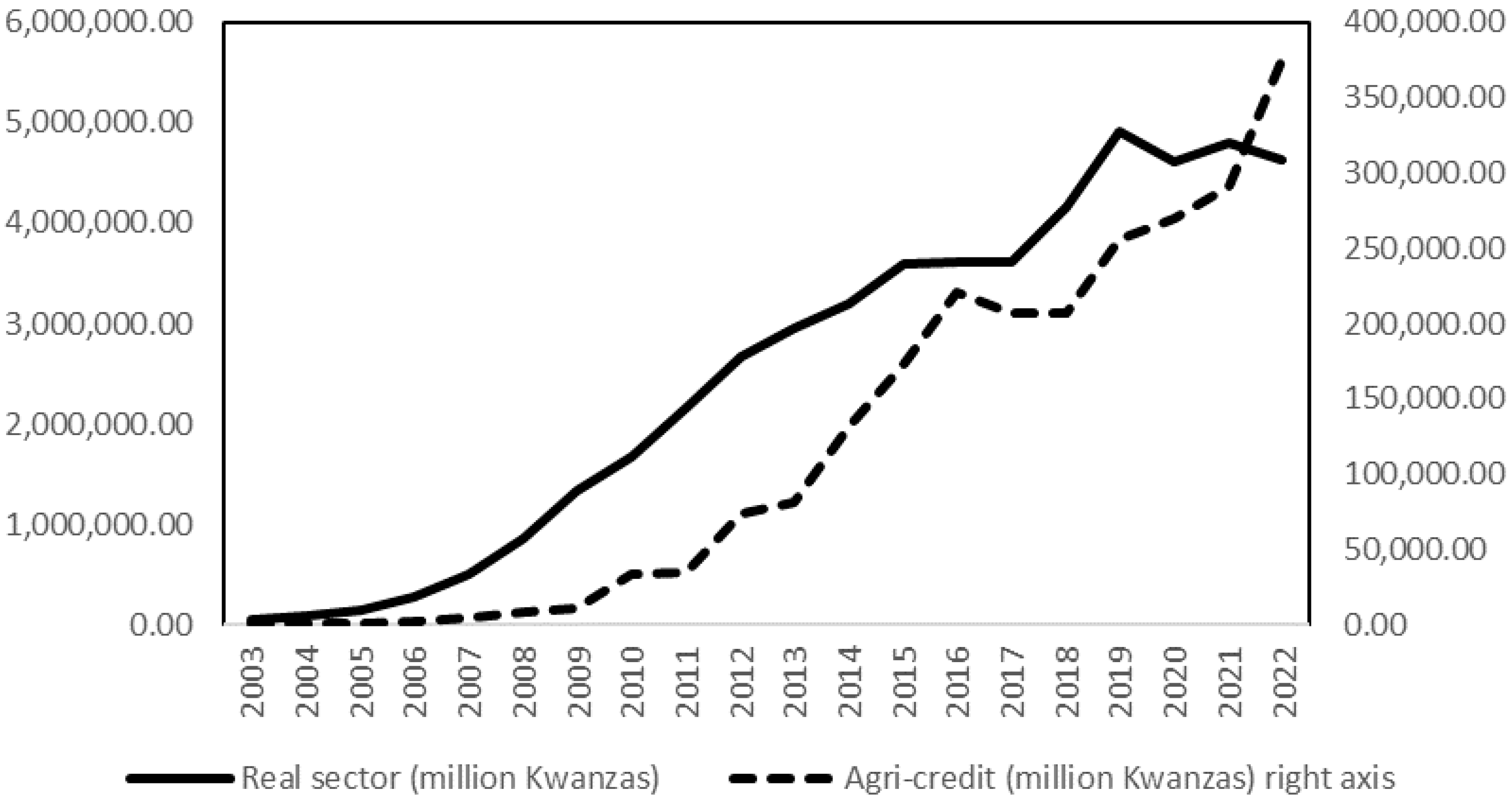

Figure 1 shows a graph of the credit provided to the real economy and the agricultural sector from 2003 to 2022. From 2003 to 2005, there was a linear relationship between both economic variables. From 2006 to 2013, less financing flowed to the agricultural sector. From 2014, this trend was reversed, in large part due to public policies, especially the Angola Investe program, which aimed to re-launch the nation’s agricultural sector. This trend was later accelerated by the government’s clear efforts towards diversifying the country’s economy, with the implementation of the PRODESI in 2018 garnering a strong reaction from the banking and private sectors in 2022.

Figure 1.

Credit provided to real economy and agriculture.

Figure 1.

Credit provided to real economy and agriculture.

The agricultural sector is characterized by unpredictability in the profitability of its activities and an imbalance in the cash flow of producers due to the sector’s dependence on the climate, sanitary conditions, the seasonality of crops and the cycle of input and market access conditions. Some of this unpredictability is measurable risk and could be mitigated via information sharing and insurance policies, but a considerable part of it is caused by uncertainty. There are also uncertainties associated with institutional changes in agricultural policies in competing countries and the high volatility of commodity prices. These problems increase transaction costs.

Nevertheless,

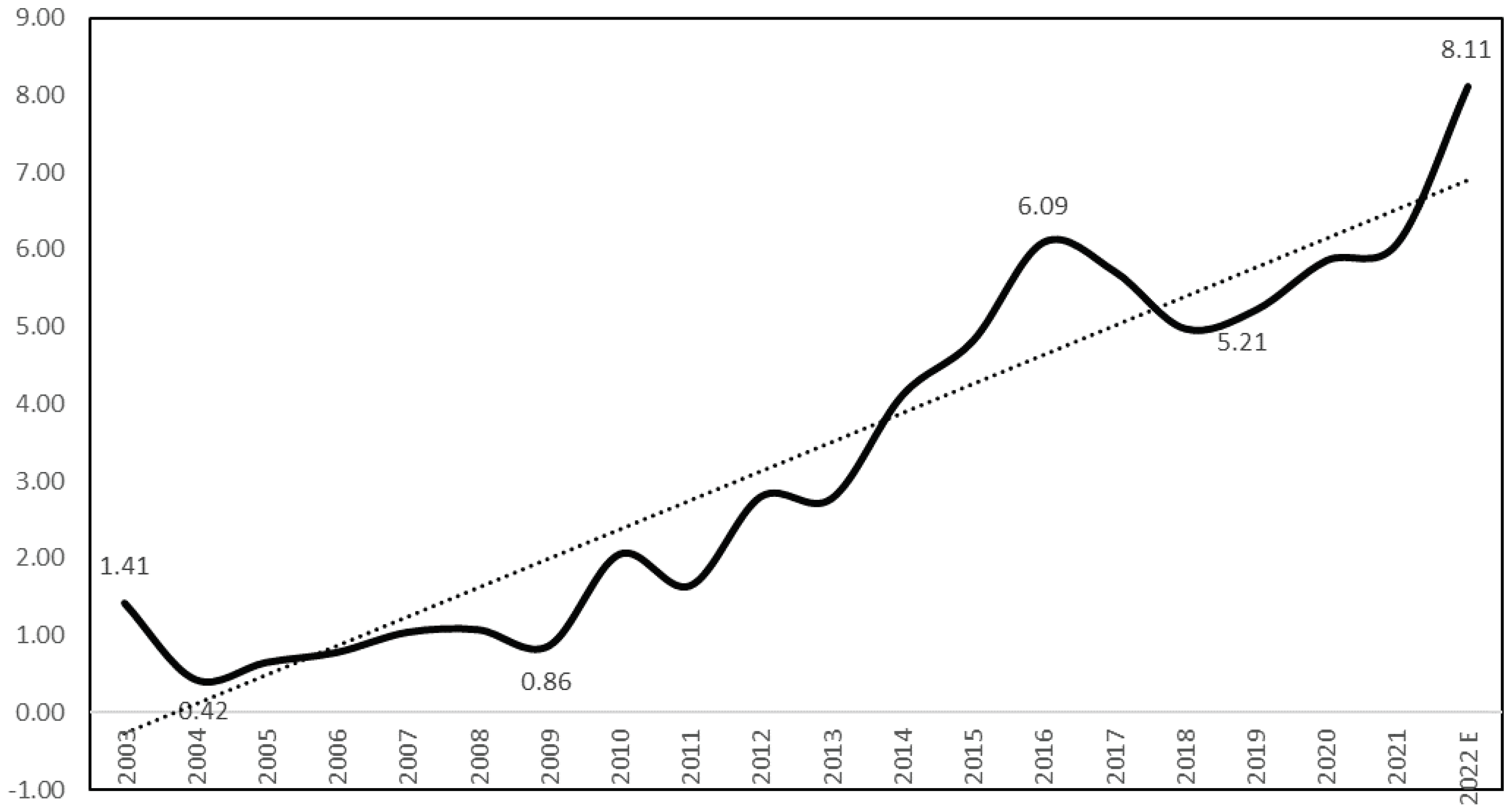

Figure 2 shows that in Angola, during the period 2010–2022, there was a steady increasing trend of credit finance provided to the agricultural sector, representing in 2022 a share of 8.11% of total credit provided to the real sector.

Figure 2.

Share of agri-credit in total credit provided to the economy (%).

Figure 2.

Share of agri-credit in total credit provided to the economy (%).

Over the last 20 years, several policies have been implemented by the government to mitigate risk, including the creation and operationalization of several financial instruments and products at the Angola Development Bank (BDA in Portuguese). Additionally, since 2006, various non-banking financial engineering products were made available, such as venture capital via the Angolan Venture Capital Active Fund (FACRA in Portuguese) and credit guarantees via the Credit Guarantee Fund (FGC in Portuguese). However, the first concrete steps towards commercial banking resources being broadly available to finance the agricultural sector were made possible with the publication of Notices 4 and 7/19, 10/20 and 10/22 of the National Bank of Angola (BNA). These notices allowed Angola’s commercial banks (25 in total) to use the mandatory reserves set by the central bank to provide agricultural credit amounting to a minimum of 2.5% of the total value of a lender’s net assets.

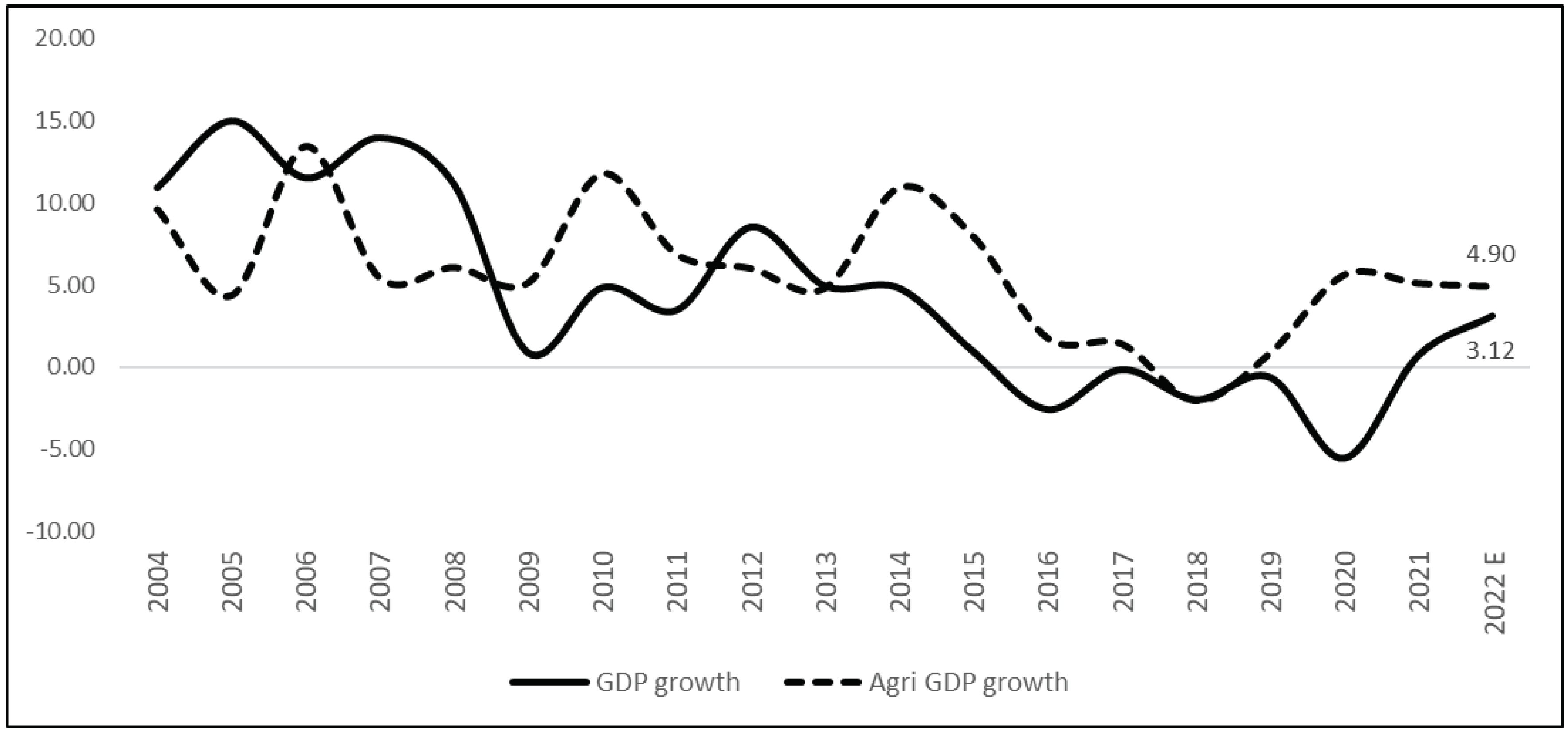

Figure 3 shows that, despite some peaks, there was a certain correlation between GDP growth and agricultural GDP growth in the study period, with the agricultural sector being resilient throughout the period and registering stable growth of 5% on average from 2020 to 2022.

Figure 3.

GDP and agricultural GDP growth rates (%).

Figure 3.

GDP and agricultural GDP growth rates (%).

Consequently

, Figure 4 shows that, in 2022, the agricultural sector accounted for 6.43% of the total gross domestic product (GDP) of Angola; however, its exports were still very limited, representing less than 1% of the country’s overall food produced.

Figure 4.

Contribution of agriculture to Angola’s GDP (%).

Figure 4.

Contribution of agriculture to Angola’s GDP (%).

By 2022, Angola’s commercial banks and the BDA had provided AOA 375.28 billion in credit to the country’s agricultural sector, equivalent to approximately USD 750 million, representing an 82% increase in nominal terms compared to 2018, when the PRODESI was implemented.

3. Literature Review

Many theoretical and empirical studies have analyzed the correlation between financial credit and economic growth. Some have found positive and others have found negative impacts of financial credit on economic growth, but the literature’s general conclusion is that strong financial systems increase credit activity and, subsequently, lead to economic growth.

Empirical studies such as Pistoresi and Venturelli’s (2012) show that countries with strong financial systems could benefit from sustainable economic growth. The authors developed a dynamic panel using a generalized method of moments to examine how venture capital and direct investment impact economic growth.

King and Levine (1993) proposed a model that examines how financial systems can impact economic growth, leading to improved productivity in four ways, namely, (i) refined selection of the best bankable projects; (ii) rationalization of the financial resources used to finance projects; (iii) enabling investors to diversify the risks associated with innovative activities; and (iv) potential compensation provided by financial systems for innovation.

Leitão (2012) proposed an endogenous model that analyzes the correlation between financial credit and economic growth by introducing variables such as domestic credit, savings, bilateral trade and inflation. The findings showed that savings encourage growth, while inflation is negatively correlated with economic growth.

Financing is used in the agricultural sector to support the supply of agricultural inputs and to support the production process, distribution, and marketing of agricultural products. The demand for agricultural finance is very high. Most smallholders and agricultural SMEs find it difficult to access finance and thus engage in agricultural practices that result in dismal agricultural yields (Carroll et al. 2012).

Castro and Teixeira (2004) analyzed the positive impact of interest rate equalization (ETJ) for smallholders and commercial agriculture on GDP growth through increases in the collection of taxes, comparing it with the amount spent on ETJ. Additionally, Castro and Teixeira (2010) measured the elasticity of demand for inputs in relation to rural credit in Brazil and found a very strong elasticity of 0.95 for fertilizers.

The results of Moura’s (2016) study using the different econometric models, including autoregressive distributed lag (ADL or ARDL), showed that there was a positive effect of agricultural credit on economic growth. Further, Akram et al. (2008) concluded not only that was there a positive effect of agricultural credit on agricultural GDP in Pakistan but also that there was an elasticity of agricultural credit in relation to poverty of −0.35% and –0.27% in the short term and long term, respectively.

Another important study that employed the VAR methodology was Melo et al.’s (2013), which concluded that an 1.9% increase in credit provided to agriculture generated an impact of 0.79% on agricultural GDP. Likewise, Gasques et al. (2017) found positive impacts of agricultural credit on agricultural GDP, reporting that a positive variation of 1% in agricultural credit generated a positive variation of 0.18% in agricultural GDP.

On the other hand, some authors, such as Robert Lucas (1988) and Nicholas Stern (1989), argue that the financial system–economic growth relationship is not significant. Koivu (2002) analyzed the correlation between economic growth and credit performance in the private sectors of 25 countries in transition from 1993 to 2000 and found that decreases in GDP caused by large amounts of credit were mostly related to counterproductive investments.

Pham and Nguyen (2020) studied the impact of credit on economic growth in Vietnam with the use of the ARDL model as the analysis method. Their results showed that there was a relationship between credit and GDP, but its expansion in the long term had a negative impact on economic growth in Vietnam. The study proposed a couple of recommendations to avoid the negative impact of credit on the economy, such as better central bank supervision.

On the other hand, Kaleemuddin and Masih (2017) also employed the ARDL model to examine the relationship between financial development and economic growth in India. In this case, in line with King and Levine (1993), the study findings show that financial development and economic growth are cointegrated in the long run, meaning that reforms in the financial banking and non-banking sectors can increase economic growth.

FitzGerald (2006) studied institutional structures as important catalyzers of the financial sector’s impact on economic growth, especially via fiscal and monetary policy measures that should provide low and stable real interest rates and competitive exchange rates, as well as appropriate tax incentives.

Notably, all the above authors agreed on the positive impact of agri-credit on the formation of agricultural GDP. With regard to the development of the present study, the work of Borges and Parré (2022) served as a particularly important reference.

4. Methodology

An econometric data model has been chosen to help to define the inter-relationships between variables and to become easier to understand and use it as a catalyzer for long-term sustainable development. Additionally, it also serves to compare with the preliminary analysis of the relationship between the two variables in

Section 2.

4.1. Data gathering

The series was extracted from the Angolan Central Bank (BNA: Agricultural Credit Statistical Yearbook) and Angola Statistical Office (INE: Quarterly National Accounts). The time horizon is an annual series, covering the period 2003–2022, making a total of 20 observations. The determination or choice of this period is justified by the availability of data and political stability that occurred in Angola as a result of the peace achieved after 27 years of post-independence civil war (1975 to 2002). The political regime and party in power from 2003 to 2022 were the same.

It is worth noting that, throughout the colonial period, Angola was among the largest exporters of agricultural products worldwide. The recovery of this profile in the global agricultural sphere and the achievement of food security require a lot of effort both from the government and private sector.

To estimate elasticities, agricultural GDP values were chosen on an annual basis and, in real terms, adopted as the dependent (explained) variable of the model to be estimated. The independent (explanatory) variable used was the total agricultural credit. Thus, it is expected that the total agricultural credit, in this estimation, positively impacts on agricultural GDP.

It is important to highlight that the purpose of this study is to evaluate the relationship between total agricultural credit and agricultural GDP in the analyzed period, through robust methods, with the estimation of an econometric model using the ARDL test.

In order to address the research aims or questions, respectively, we use the reduced form of the transmission mechanism of monetary policy in a credit channel with focus on the agricultural sector. Moreover, we use the Keynesian assumption about the exogeneity of the transmission mechanism. That is, the economic model represents a functional relationship between Angola’s GDP as a dependent variable and agricultural credit as an independent variable.

To examine the association between the two variables (agricultural credit and agricultural GDP), the following hypotheses were put forward:

H0 : Agricultural credits have no significant impact on the agricultural GDP in Angola 1;

H1 : Agricultural credits have a significant impact on the growth of the agricultural GDP in Angola.

4.2. Econometric Model

The ARDL model has become an important tool for detecting the cointegration relationship based on the work of Pesaran and Shin (1999). The authors demonstrate that with an ARDL representation, it is possible to identify cointegration relationships in a system formed by variables that are all I(1), all I(0), or a mixture of stationary variables and variables I(1). This constitutes a great advantage compared to the Johansen cointegration method and even the FMOLS estimator, as both assume that all variables in the system are I(1).

For this reason, in the case of long-term time series for an economy with large probabilities of lag, we believe the choice to be better suited, that is, to test the model’s estimators/regressors using the ARDL test.

The dynamics of the relationship between GDP and agricultural credit are analyzed using the ARDL model given the agricultural credit exogeneity assumption. That is, ARDL(p,k) can be written as:

where

is the endogenous variable (GDP);

represents the lagged values of the endogenous variable;

is the exogenous variable included in the model (agricultural credit)

represents the lagged values of the exogenous variable;

α and β are the parameters;

are the error terms of the model.

According to Borges and Parré (2022), it is necessary to verify the degree of stationarity of the series used in the ARDL model. The Dickey and Fuller (1981) test is used to determine the level of integration of the series and to consider the possible differences that make the series stationary.

According to Borges and Parré, if the series are stationary with respect to 0 (zero), they will be conducted to the point where they are estimated in Equation (1). If the series are integrated into Equation (1), the equation uses the variables according to the first difference.

Moreover, we use the Granger test to investigate the causality between GDP and agricultural credit. Enders (2015) argues that the Granger test proposes testable definitions between the causality of two time series, based on the assumption that the cause precedes the effect. In this case, the test’s objectivity is restricted in the sense of observing how much of variable Y is explained by the values of variable X, that is, determining if variable X can explain the observed value of Y, meaning that it determines whether the values of X are statistically significant.

To assess the stationarity of the time series in the present study, the augmented ADF test was used; whose purpose is to guide the level of integration between series by measuring the number of differences required for a series to be stationary.

4.2.1. Dickey–Fuller (ADF) Test

For the analysis of the stationarity accuracy of the estimation model, it is common to use the augmented Dickey–Fuller (ADF) test since it is a single-root test that allows econometrical identification in time series of the significant existence of variables showing a stochastic trend through a hypothesis test; this is assessed using the following equation: .

The augmented Dickey–Fuller test suggests three different forms, under three different null hypothesis. For each case, the null hypothesis is , the series have a unit root and nonstationary (Forhad, Rahman, 2021):

1) is Random Walk:

2) is Random Walk with drift:

3) is Random Walk with drift and trend:

4.2.1.1. Dickey–Fuller Test for Unit Root Test

The tables below present the augmented ADF test of the time series. The results of augmented ADF test in first difference show that the TOTAL_AGR_CR series is I(0) stationary at a 5% level of significance. GDP_AGR was nonstationary at the same significance level. However, it was possible to make the GDP_AGR series stationary in first difference. This was achieved by generating the first difference variable and running the unit root test one more time.

Table 1.

Nonconstant lags (1).

Table 1.

Nonconstant lags (1).

| Variable |

ADF (1) |

Critical Value |

| |

nonconstant lags |

1% |

5% |

10% |

| GDP_AGR. |

-0.065 |

-2.660 |

-1.950 |

-1.600 |

| TOTAL_AGR_CR |

2.798 |

-2.660 |

-1.950 |

-1.600 |

Table 2.

Trend lags (1).

| Variable |

ADF (1) |

Critical Value |

| |

trend lags |

1% |

5% |

10% |

| GDP_AGR. |

-3,855 |

-4,380 |

-3,600 |

-3,240 |

| TOTAL_AGR_CR |

-1,279 |

-4,380 |

-3,600 |

-3,240 |

Table 3.

Drift lags (1).

| Variable |

ADF (1) |

Critical Value |

| |

drift lags |

1% |

5% |

10% |

| GDP_AGR. |

-1,463 |

-2,602 |

-1,753 |

-1,341 |

| TOTAL_AGR_CR |

1,821 |

-2,602 |

-1,753 |

-1,341 |

Table 4.

Generate (nonconstant lags (1)).

Table 4.

Generate (nonconstant lags (1)).

| Variable |

ADF (1) |

Critical Value |

| |

generate (noconstant lags) |

1% |

5% |

10% |

| GDP_AGR. |

-5,145 |

-2,660 |

-1,950 |

-1,600 |

| TOTAL_AGR_CR |

-0,511 |

-2,660 |

-1,950 |

-1,600 |

It is common to represent the null hypothesis for the augmented ADF test analysis as follows

1:

H0: Stochastic trends in time series.

H1: Absence of stochastic trends in time series.

According to Noami (2023), in the augmented ADF test, the null hypothesis reflects the possibility of nonstationary data, which implies the presence of a unit root in the variables of the estimated model, and the alternative hypothesis is that the data are stationary. However, the following rule exists: if the t-statistic is greater than the critical 5% value, the null hypothesis is rejected. Therefore, the data are stationary. However, if the t-statistic is less than the critical value of 5%, the null hypothesis is accepted. Therefore, the data are nonstationary. In order to correct the variables (of the model), the first difference variables are generated and the unit root test is run once more.

4.2.2. Autoregressive Distributed Lag Model Estimation

Pereira, Gonçalves (2019) points out that, considering a linear model for time series:

where

, with L representing the lag operator, that is,

, where

represents the set of explanatory variables of the model and

is the error term. This the most explicit version of an ARDL model, for which the stability condition is assumed to be satisfied, |

| < 1, so there are unit root problems, although they are not very predictable in practice.

The same author outlines that among the strong points of this model is its generality, that is, because it has a more conservative perspective, the articular cases that come from this model are very extensive, ranging from the static regressions themselves, without dynamics (), until we reach the Error Correction Model (ECM).

According to Aparício, Azevedo (2018), “the Vector Error Correction Model contains a variety of applicability in economic series given its components that make it a flexible model.” Much of this is on account of it being a model capable of incorporating both short- and long-term mechanisms, as well as the speed of adjustment with which balance is re-established. In general, the VECM is a particular case of the ARDL model; to be more concise, an ARDL (1,1) model with only a single explanatory variable is expressed, as is the case of the present study:

which results in,

Looking at the previous equation, Aparício describes four characteristics of the ECM:

- a)

It is a short-term dynamic model since, if there are no imbalances, is driven only by ;

- b)

The existing cointegration is incorporated in the model (), and these quantities are specified in the model;

- c)

Therefore, one can estimate the speed with which equilibrium is re-established through ();

- d)

Finally, the long-term multiplier is expressed by , and, on the other hand, the short-term multiplier is given by due to the fact that quantities are specified in the model.

There is the issue of specification in the VECM model when estimating the regression parameters, that is, the coefficients of the explanatory variables are seen as a problem in the model, knowing that the OLS estimator is BLUE (Best Unbiased Linear Estimator), (Pereira 2019). On the other hand, to guarantee the satisfaction of this and other hypotheses necessary to validate the statistical inference and validity of the final chosen model, several tests are performed, such as the Breusch–Godfrey test, Durbin–Watson test, etc. Therefore, for the present study, we chose to perform the Durbin–Watson test

2.

There is an autocorrelation problem in the estimated model when the errors or residuals of the times series are correlated. Therefore, in order to diagnose autocorrelation problems in the time series studied, the Durbin–Watson (DW) t statistic was used, then analyzing the rule or decision diagram. In order to solve possible problems of autocorrelation in the model series, Prais estimation was used, and with this, the consistency of the predictability of the estimated econometric model was maintained.

5. Results

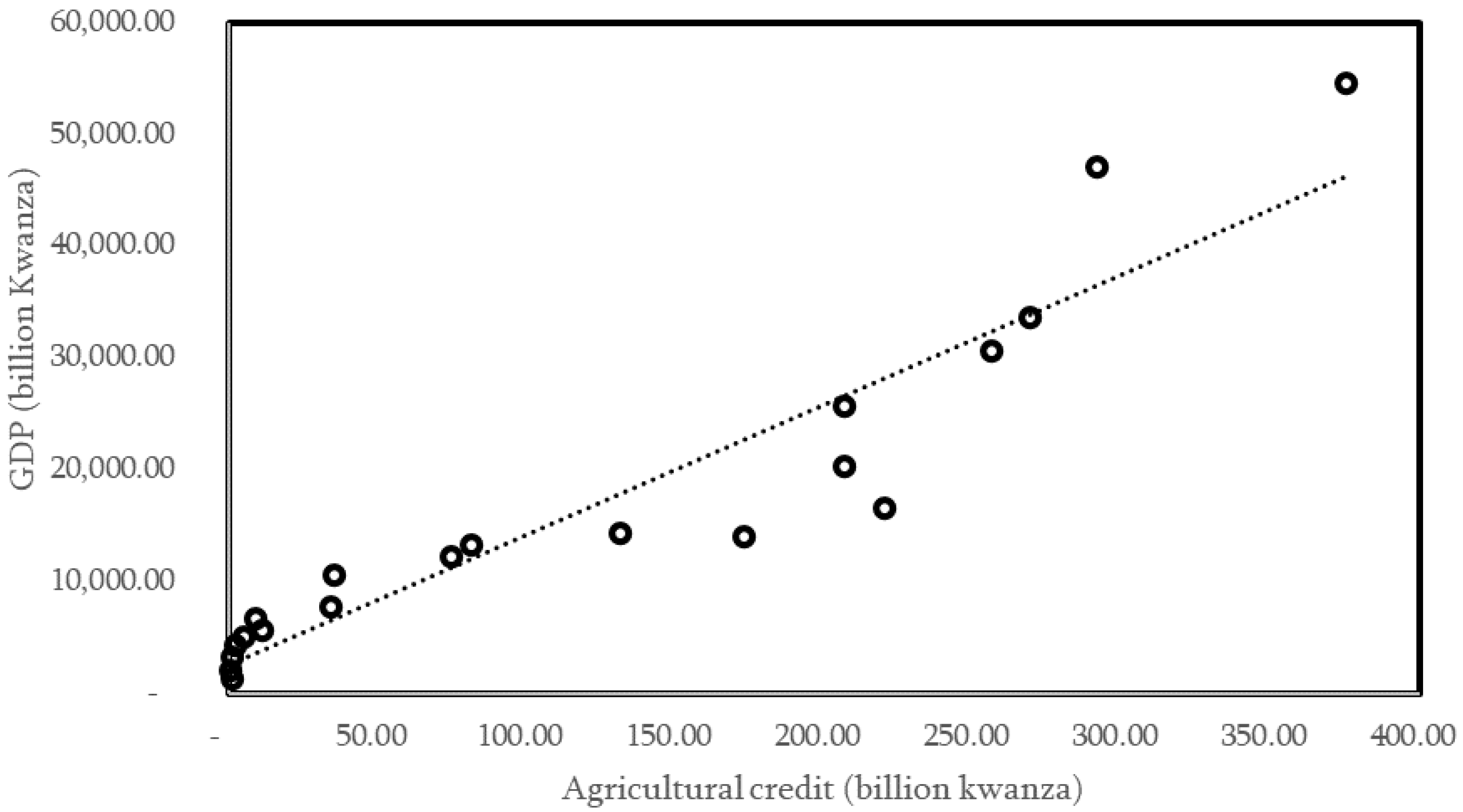

Preliminary analysis using the simple regression model, as shown in

Figure 5, found that there was a direct relationship between GDP and credit provided to agriculture, that is, every monetary unit resulted in an increase in product units.

Figure 5.

The evolution of GDP and agricultural credit.

Figure 5.

The evolution of GDP and agricultural credit.

In terms of presentation,

Figure 5 demonstrates the simple linear regression econometric model, which has the following form:

where the values in parentheses represent the standard deviations of the estimated econometric model parameters.

As shown by the results, a very positive impact of total agricultural credit on the formation of agricultural GDP was found. This strong correlation allows for solid sustainable policies in the sense that every monetary unit of kwanza would result, ceteris paribus (keeping everything else constant), in a 14.41205 unit increase in agricultural GDP. However, this approach omits the dynamic relationship between agricultural GDP and agricultural credit that can be assumed to be highly relevant. That is why we use dynamic model specification in the form of the ARDL model.

Table 6.

Estimated Model.

Table 6.

Estimated Model.

| Variable and Test |

Coefficient |

Standard Error |

t statistic |

p-value |

| TOTAL_AGR_CR |

14.41205 |

3.57562 |

4.03 |

0.001 |

| Constant |

556.4833 |

636227.4 |

8.75 |

0.000 |

| Number of observ. |

20 |

- |

- |

- |

| F test |

16.25 |

- |

- |

- |

| Prob > F |

- |

- |

- |

0.0008 |

| R-squared |

0.4744 |

- |

- |

- |

| Adj R-squared |

0.4452 |

- |

- |

- |

Table 7.

Prais Estimation (Error Correction of Model).

Table 7.

Prais Estimation (Error Correction of Model).

| Variable and Test |

Coefficient |

Standard Error |

t statistic |

p-value |

| TOTAL_AGR_CR |

14.93363 |

2.274437 |

6.57 |

0.000 |

| Constant |

551.2012 |

393115.8 |

14.02 |

0.000 |

| Number of observ. |

20 |

- |

- |

- |

| F test |

51.86 |

- |

- |

- |

| Prob > F |

- |

- |

- |

0.0000 |

| R-squared |

0.7423 |

- |

- |

- |

| Adj R-squared |

0.7280 |

- |

- |

- |

| Durbin-Watson (original) |

2.876943 |

- |

- |

- |

| Durbin-Watson (transformed) |

2.172601 |

- |

- |

- |

As can be seen in the result of the DW test, the estimator of the time series estimated in the present study presents a test DW = 2.876943, with k = 2 and n = 20, where k represents the parameters and n represents the number of observations used in the model.

Analyzing the values after Prais Estimation, it can clearly be verified that there is a new value for the Durbin–Watson (DW) test = 2.172601.

The acceptance or rejection of the null hypothesis of a model largely depends on the choice of the level of significance, that is, on the value of α. For the model estimated in the present study, the level of significance (α) is equal to 5%.

Thus, analyzing the values extracted from the results of the estimated econometric model, the null hypothesis was found to be rejected because the ρ value (P>|t|) of the model parameters was lower than the significance level, which implies that the parameters of the present estimated model were statistically significant.

Further, it was observed that the ρ value (Prob > F) of the F statistic was lower than the significance level, implying that the econometric model estimated in the present study was globally significant.

6. Conclusions

This study attempted to determine the importance of agricultural credit to the overall performance of agricultural production in Angola.

According to the values of the estimated econometric model, a positive relationship was found between agricultural credit and agricultural GDP. In other words, agricultural credit has played a major role in the formation of agricultural GDP in Angola, and above all, in its progressive growth.

Clearly, the government’s current attempts to induce the banking sector to provide more credit to the agricultural sector need to continue and potentially even accelerate, which could be achieved through it making more financial resources available. The government’s implementation of different initiatives that provide negative real interest rates (subsidized interest rates) through banking financial instruments and products via the Angola Development Bank (BDA), or programs with local commercial banks, such as the Angola Investe program (Investing in Angola), BNA Notice 10/2022 and, most recently, the PAC (Credit Support Project), along with the technical assistance provided by the PRODESI, has brought a significant shift in the country’s agricultural sector’s performance.

In July 2022, the Government of Angola approved an ambitious and massive grain production plan called PLANAGRÃO (in Portuguese, Plano Nacional de Fomento para a Produção de Grãos). The government will secure an approximately USD 4 billion financial package via the Angola Development Bank aimed at inducing the private sector to produce four priority grains in the time period 2023–2027, namely maize, rice, wheat and soya, with a view to reducing the country’s dependence on food imports and ensuring its self-sufficiency and food security. The agricultural credit used to implement PLANAGRÃO might have a significant impact on the agricultural GDP of the period.

However, ensuring such initiatives are sustainable for their main objective (users) involves a much broader approach and does not end only with their implementation. Continuous monitoring is of the utmost importance to ensure that the financial credit granted is really applied to the development of agricultural activities and is not used elsewhere. Most agricultural agents have expressed enormous concerns about the transparency of access to credit, as a large number of farmers who truly produce and who need it the most to improve their productivity have often been excluded from this process.

In this study, a literature review found that most of the studies assessed reported a positive impact of agricultural credit on the formation of agricultural GDP, with similar findings to those of King and Levine (1993) and Kaleemuddin and Masih (2017), the latter also employing the ARDL model. Further, the study found that a variation of about 1% in agricultural credit would result in a positive variation of agricultural GDP of around 14.41%. Therefore, agricultural credit will, in principle, serve to expand the demand for agricultural goods, although this does depend on the expression of agricultural credit in the formation of agricultural GDP.

This study, aiming at defining the impact of agricultural credit on agricultural GDP, is closely related to sustainability in several ways. First, enhancing agricultural productivity: access to credit allows farmers to invest in modern agricultural practices, such as improved seeds, fertilizers, irrigation systems, and machinery. These investments can lead to increased productivity, higher crop yields, and more efficient resource utilization. Second, promoting sustainable farming practices: credit can be used to fund the adoption of sustainable farming techniques. For example, farmers can utilize credit to implement organic farming methods, integrate agroforestry systems, practice integrated pest management, or invest in renewable energy solutions for their farms. Third, encouraging investment in agri-businesses: credit can facilitate the growth of agri-businesses and value chains, such as storage facilities, processing plants, and distribution networks. These investments can help reduce post-harvest losses, improve food quality and safety, and enhance market access for farmers.

Although there are several studies related to the history of the Angolan economy, its economic growth, financial system, credit models, etc., it is worth noting that this is a first-of-a-kind study on the matter of the Angolan credit experience, specifically for the agricultural sector. Angola is still searching for a sustainable credit model that could be used as a catalyzer to boost growth and contribute to economic development.

Finally, this study opens up different avenues for future scientific research regarding the state of the art of the agricultural sector credit and GDP, using different econometric model approaches.

7. Limitations

One of the main limitations of this work was that, as data for a longer series were not available, as well as the recognition of structural breaks, there may have been unexplained variability in the data sample; that is, statistical noise may not have been minimized as much as it could have been. Further, it is worth noting that agricultural products also depend on variables other than agricultural credit, such as infrastructure (especially roads destined for agricultural exploration areas and connecting these with shopping centers), utilities, technical assistance, scientific studies, etc.

Author Contributions

Conceptualization: 1; methodology: 2; software 2; validation: 1 and 2; formal analysis: 1; investigation: 1 and 2; resources: 1; data curation: 2; writing—original draft preparation: 1; writing—review and editing: 1 and 2; visualization: 1; supervision: 1; project administration: 1. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

The primary data used in this research can be found in the Angola National Accounts published by the Angola Statistical Office (

www.ine.gov.ao), and the credit data are published by Angola National Bank (

www.bna.ao).

Conflicts of Interest

The authors declare no conflict of interest.

References

- (Akram et al. 2008) Akram, Waqar, Zakir Hussain, Hazoor Sabir, and Ijaz Hussain. 2008. Impact of agriculture credit on growth and poverty in Pakistan. European Journal of Scientific Research 23: 243–51.

- (Borges and Parré 2022) Borges, Murilo José, and José Luiz Parré. 2022. O impacto do crédito rural no produto agropecuário brasileiro. Revista de Economia e Sociologia Rural 60: e230521. https://doi.org/10.1590/1806-9479.2021.230521. [CrossRef]

- (Carroll et al. 2012) Carroll, Tom, Andrew Stern, Dan Zook, Rocio Funes, Angela Rastegar, and Yuting Lien. 2012. Catalyzing Smallholder Agricultural Finance. New York: Dalberg Global Development Advisors.

- (Castro and Teixeira 2004) Castro, Eduardo Rodrigues, and Erly Cardoso Teixeira. 2004. Retorno dos gastos com a equalização das taxas de juros do crédito rural na economia brasileira. Revista de Política Agrícola 3: 52–57.

- (Castro and Teixeira 2010) Castro, Eduardo Rodrigues, and Erly Cardoso Teixeira. 2010. Crédito rural e oferta agrícola no Brasil. Revista de Política Agrícola XIX: 9–16.

- (Dickey and Fuller 1981) Dickey, David A., and Wayne A. Fuller. 1981. The Likelihood Ratio Statistics for Autoregressive Time Series with a Unit Root. Econometrica 49: 1057–72.

- (Enders 2015) Enders, Walter. 2015. Applied Econometric Time Series, 4th ed. New York: John Wiley & Sons.

- (FitzGerald 2006) FitzGerald, Valpy. 2006. Financial Development and Economic Growth: A Critical View, Background Paper for World Economic and Social Survey. Oxford University. Available online: http://www.un.org/en/development/desa/policy/wess/wess_bg_papers/bp_wess2006_fitzgerald.pdf (accessed on 4 June 2022).

- (Gasques et al. 2017) Gasques, José Garcia, Mirian Rumenos P. Bacchi, and Eliana Teles Bastos. 2017. Impactos do crédito rural sobre as variáveis do agronegócio. Revista de Política Agrícola 26: 132–40.

- (Kaleemuddin and Masih 2017) Kaleemuddin, Mohammed and Mansur Masih. 2017. Does financial development drive economic growth? an ARDL approach. MPRA Paper 110716, University Library of Munich, Germany: 1-23. Available online: https://mpra.ub.uni-muenchen.de/110716/.

- (King and Levine 1993) King, Robert G., and Ross Levine. 1993. Finance, entrepreneurship, and growth. Theory and evidence. Journal of Monetary Economics 32: 513–42.

- (Koivu 2002) Koivu, Tuuli. 2002. Do Efficient Banking Sectors Accelerate Economic Growth in Transition Countries? BOFIT Discussion Papers, No. 14/2002. Helsinki: Bank of Finland, Institute for Economies in Transition (BOFIT), pp. 1–29, ISBN 951-686-842-8. Available online: https://nbn-resolving.de/urn:NBN:fi:bof-201408071978 (accessed on 04 April 2022).

- (Leitão 2012) Leitão, Nuno Carlos. 2012. Bank, credit, and economic growth. A dynamic panel analysis. The Economic Research Guardian 2: 256–67. Available online: https://repositorio.ipsantarem.pt/bitstream/10400.15/761/1/NunoLeitao_ERG_2012.pdf (accessed on 22 July 2022).

- (Lucas 1988) Lucas, Robert E., Jr. 1988. On the mechanics of economic development. Journal of Monetary Economics 22: 3–42.

- (Melo et al. 2013) Melo, Marcelo Miranda, Émerson Lemos Marinho, and Almir Bittencourt Silva. 2013. O impulso do crédito rural no produto do seto primário brasileiro. Nexos Econômicos 7: 9–35.

- (Moura 2016) Moura, Fábio Rodrigues. 2016. O nexo causal entre crédito rural e crescimento do produto agro-pecuário na economia brasileira. PhD thesis, Escola Superior de Agricultura Luiz Queiroz, Piracicaba, Brazil. Available online: http://www.teses.usp.br/teses/disponiveis/11/11132/tde22062016-163722/en.php (accessed on 03 October 2022).

- (Pesaran and Shin 1999) Pesaran, Mohammad Hashem and Yongcheol Shin. 1999. An Autoregressive Distributed Lag Modelling Approach to Cointegration Analysis. Strom, S., Ed., Chapter 11 in Econometrics and Economic Theory in the 20th Century the Ragnar Frisch Centennial Symposium. Cambridge University Press, Cambridge: 371-413.

- (Pham and Nguyen 2020) Pham, Hung, and Phuong Minh Nguyen. 2020. Empirical research on the impact of credit on economic growth in Vietnam. Management Science Letters 10: 2897–2904.

- (Pistoresi and Venturelli 2012) Pistoresi, Barbara, and Valeria Venturelli. 2012. Credit, Venture Capital and Regional Economic Growth. Journal of Economics and Finance 39: 742–61. https://doi.org/10.1007/s12197-013-9277-8. [CrossRef]

- (Stern 1989) Stern, Nicholas. 1989. The Economics of Development: A Survey. The Economic Journal 99: 597–685.

- (Schumpeter 2021) Schumpeter, Joseph A. 2021, The Theory of Economic Development. London: Routledge.

- (Wheeler and Pélissier 2009) Wheeler, Douglas L., and René Pélissier. 2009. História de Angola. Lisboa: Tinta da China.

| 2 |

The Durbin–Watson test (DW, 1950) focuses on the null hypothesis of autocorrelation of the residuals:

H0: β0 = 0

H1: β0 ≠ 0

|

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).