1. Introduction

1.1. Research Background

South Korea has a unique governance structure known as the chaebol. Scholars who view the chaebol governance structure positively have argued that when controlling shareholders participate directly in management as chief executive officer (CEO), they can address issues of low economic growth rates through strong leadership, thereby exerting a positive influence on corporate value [

1,

2,

3]. Conversely, scholars who view the chaebol governance structure negatively argue that when controlling shareholders and a small number of special-interest parties participate in management to pursue private benefits, their policy decisions can have a negative impact on corporate value [

4,

5].

In reality, there are cases where controlling shareholders assume the CEO role. However, there are also cases where they do not take on the CEO role yet still influence critical policy decisions within the company. An and Suh [

6] used compensation data to objectively measure the authority and responsibility of employees in a company to identify the CEO. They then analyzed the impact on the quality of a company's executive compensation disclosure when a top earner receives more compensation than the CEO. The analysis reveals that the quality of executive compensation disclosures is lower in companies with employees who receive more compensation than the CEO. This finding suggests that companies with employees receiving higher compensation than the CEO may have a non-transparent and vulnerable governance structure, warranting further analysis of its impact on corporate value.

However, interest in corporate sustainability management has recently increased. Corporate sustainability is perceived as managing environmental, social, and economic risks while growing a business, thereby enhancing shareholder value. Corporations are engaging in Environmental, Social, and Governance (ESG) activities to realize sustainable management, leading to a rising interest in ESG.

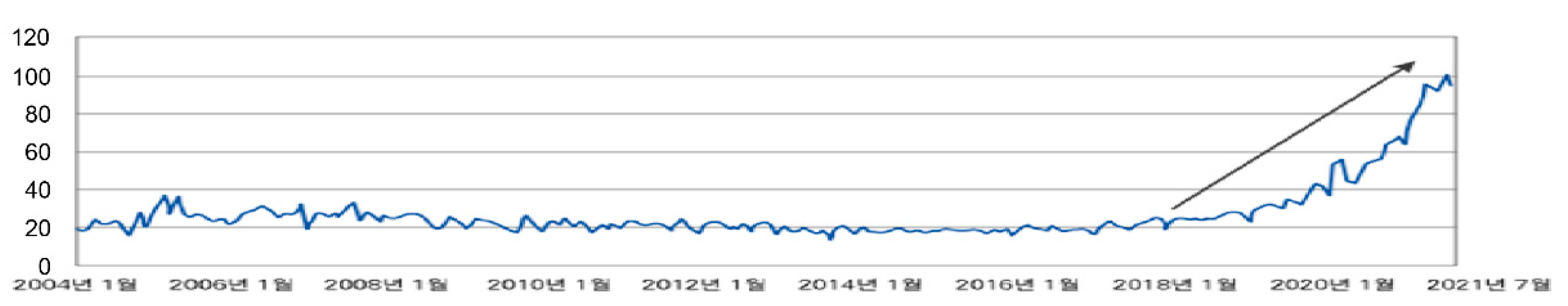

Figure 1 represents the frequency of searches for the term "ESG" from 2004 to 2021 on the Google Trends analysis site, demonstrating a sharp increase starting from 2018.

However, there is considerable debate within academia about whether the amount spent on ESG activities should be viewed as an investment or a cost. Scholars who approach ESG expenditures as an investment concept often associate them with corporate innovation. On the other hand, scholars who view expenses on ESG activities as a cost often describe these activities as a means to improve the negative image of controlling shareholders and the company and to form a favorable public opinion to defend management rights. Although the impact of ESG activities on corporate value varies slightly among scholars, many studies universally accept that ESG activities are necessary for a company's sustainable management. As ESG activities have increased, studies have been actively conducted investigating the factors that influence corporate ESG activities. These studies empirically analyze how ESG affects topics related to accounting research, such as corporate value, earnings management, and financial performance. Various determinants appear to influence ESG activity. Considering that corporate governance is a key variable in determining ESG activities, it may vary depending on CEO type. Thus, examining the impact of the presence or absence of CEOs in companies that exercise authority while avoiding legal responsibility for ESG activities is necessary.

1.2. Research Objective

This study analyzes the impact of the presence or absence of a substantial CEO on ESG activities and corporate value. In reality, while there are cases in which controlling shareholders directly participate in company management or delegate it to professional managers, there are also controlling shareholders who, under the nominal CEO, seek authority while avoiding legal responsibility. Samsung Electronics is a representative company in South Korea. Apart from Samsung Electronics, the controlling shareholders of socially criticized companies are not registered as CEOs who bear legal responsibilities; however, they exercise substantial influence through boards of directors and determine essential company policies.

Previous studies have asserted that firms with weak corporate governance can experience agency costs between professional and shareholder managers, thereby negatively influencing company value. Therefore, if a company pursues an increase in corporate value through profit maximization, the number of firms with de facto CEO and weak corporate governance should decrease. However, as shown in

Table 1, by examining the congruence between the CEO and the highest-paid employee in business reports from 2013 to 2021, we observe that the number of companies where employees are paid more than the CEO increases yearly.

Studies assert that companies with top executives are prone to weak corporate governance and incur agency costs. An and Suh [

6] identified the presence of executives who evaded legal responsibility while exercising power using compensation data and analyzed the impact of the highest-paid employee who receives more compensation than the CEO on the disclosure quality of corporate executive compensation. Their analysis suggests that de facto CEOs vigorously pursue personal benefits, asserting a negative correlation between this and disclosure quality.

In companies with de facto CEO, corporate governance tends to be opaque and fragile, increasing the likelihood that crucial policies will be determined by a minority who will prioritize personal interests over corporate profits. In cases where a de facto CEO with self-interest exists, they may exploit ESG activities to create favorable public opinion, such as to protect managerial rights. A de facto CEO may be proactive in ESG expenditure to form favorable public opinion, even if the company's financial performance declines. Recent studies have shown that environmental management (E), social responsibility (S), governance improvements (G), economic uncertainty, and volatility in operating profits can influence ESG activities [

8,

9]. Corporate governance significantly affects a company's performance and sustainability. Therefore, this study empirically analyzes the influence of a de facto CEO as a determining factor in ESG activities. Moreover, conflict can occur between the CEO and the de facto CEO, and the cost of resolving this conflict can negatively affect a company’s value. Thus, we empirically analyze the influence of a de facto CEO on corporate value.

The remainder of this paper is organized as follows. In Section I, the Introduction, we explain the background and purpose of this research. Section II examines previous studies on de facto CEO and ESG Activities. In Section III, we set up two research hypotheses and present a research model for testing these hypotheses, explaining the variables of the research model, data collection methods, and sample selection methods. In Section IV, we conduct descriptive statistical analysis, difference analysis between groups of interest variables, and correlation analysis and then explain the empirical analysis results of the hypotheses. Finally, Section V summarizes the study and discusses its contributions and limitations.

2. Literature Review

2.1. A De Facto CEO

Studies related to corporate governance transparency use the proportion of outside directors on the board and the presence of an independent audit committee as proxies for analyzing transparency. The results demonstrate that the higher the proportion of outside directors on a company's board and the presence of an independent audit committee, the more transparent and independent the company's decision-making process. There is consistent evidence that such companies, being proactive in investor protection, experience increased investments from investors, leading to increased corporate value [

1,

10] Giroud and Mueller [

10] demonstrate that under the assumption of inefficient markets, U.S. firms with better corporate governance have higher corporate value than those with weaker governance. Black et al. [

1] argue that even when effectively controlling for endogeneity issues using 2SLS (two-stage least squares), firms with good corporate governance still exhibit higher corporate value than firms with weaker governance. From these studies, we can infer that as the transparency of a company's corporate governance increases, its corporate value also rises.

When examining research related to chaebols (large business conglomerates), the presence or absence of such large business conglomerates has mixed effects on corporate value. Studies that argue against the existence of large business conglomerates have empirically shown that firms belonging to such conglomerates exhibit relatively lower financial efficiency [

4,

11] and corporate value than firms not affiliated with large business conglomerates [

3]. Studies that argue for the positive impact of large business conglomerates on corporate value claim that government tax incentives and various forms of support for these conglomerates increase corporate value [

30].

In the 2000s, there was growing interest in understanding how the influence and characteristics of CEOs impact a company's financial performance and corporate value [

12,

31]. Bebchuk et al. [

13] investigated the effect of CEOs on corporate financial performance and value. Bebchuk et al. [

13] introduce the CEO pay slice (CPS) measure to gauge a CEO's influence on corporate governance and analyze its relationship with corporate value. CPS represents the proportion of the CEO's compensation to the total compensation of the top five executives in the company. The analysis reveals a negative (-) correlation between CEO influence and corporate value. This finding supports traditional agency theory, suggesting that when the values pursued by managers and shareholders differ, CEOs may exercise their authority to maximize their interests, negatively affecting corporate value.

Studies have examined the relationship between de facto CEOs and various aspects of corporate governance, such as the disclosure quality of executive compensation, CEO overcompensation, human resource investment in internal accounting control systems, and cost stickiness. Particularly, research on the disclosure quality of executive compensation, CEO overcompensation, and human resource investment in internal accounting control systems analyzes how the board of directors’ independence and expertise play a role when a de facto CEO is present. These studies can be regarded as related to corporate governance.

In many studies on multiple CEOs, the representative director in a business report is defined as the CEO. However, An and Suh [

6] investigated the top ten companies with two or more executives receiving annual compensation of over 500 million KRW. Their findings revealed that the highest-paid executives were the dominant shareholders in most of these top companies, while the second-highest-paid executives were professional managers. Building on this insight, this study highlights the likelihood of a de facto CEO’s existence within a company.

Based on the executive compensation data disclosed since 2013, we define the top earner who receives more compensation than the CEO as the de facto CEO. By defining a company’s de facto CEO based on compensation data, we can identify employees or executives who exert the most significant influence, regardless of their official title. Additionally, this approach allows us to verify and identify the real CEO, even in companies where the representative director is not specified in the business report or where there are multiple co-CEOs. This method effectively identifies the individual with the highest influence and authority within the company, regardless of their position. It enables validation when the CEO's identity may not be explicitly indicated in the business report or companies with joint representation by multiple CEOs.

The analysis of the relationship between a de facto CEO and executive compensation disclosure quality revealed that companies with a de facto CEO tend to have lower executive compensation disclosure quality than companies without a de facto CEO. A de facto CEO’s pursuit of private interests significantly contributes to this finding.

This study examines the relationship between a de facto CEO and excess compensation and analyzes whether an independent and professionally diverse board of directors can effectively constrain a de facto CEO. This analysis provides evidence that companies with de facto CEOs exhibit significantly higher excess compensation for their top earners. Moreover, it was demonstrated that a higher proportion of outside directors, separation of CEO and board chair roles, and a higher level of expertise among board members could effectively restrain excess compensation for a de facto CEO. In particular, the presence of professionally diverse outside directors on a company’s board of directors showed a stronger inhibitory effect on excess compensation for a de facto CEO than for companies without such expertise. Based on these findings, it was argued that to enhance the effectiveness of a company's board of directors, it should operate independently to provide appropriate advice and practical constraints on the CEO's management policies and that including outside directors with expertise in various fields is essential.

This study examines how the presence of a de facto CEO affects human resource investment in internal accounting control systems and further analyzes whether the independence and expertise of the board of directors also influence this relationship. The analysis reveals that companies with de facto CEO tend to have a lower ratio of internal accounting personnel than companies without de facto CEO. Additionally, the effect of a de facto CEO on human resource investment in internal accounting control systems weakens as the board of directors’ independence increases [

6].

Ko and Jung [

14] conducted an empirical analysis of whether the presence of a de facto CEO influences the cost stickiness of selling expenses after the COVID-19 pandemic. The analysis revealed that companies with de facto CEO exhibited alleviated downward cost stickiness compared to companies without de facto CEO after the COVID-19 pandemic.

2.2. ESG Activities

ESG activities, representative decision factors for sustainable management, are being actively researched in various fields such as accounting, financial management, business strategy, and marketing. In accounting studies, research has been conducted on various topics such as accounting transparency, corporate value, financial performance, and earnings management. Prior research on corporate value has shown mixed results. Studies claiming a negative (-) correlation between ESG activities and corporate value argue that ESG activities are used by controlling shareholders and professional managers to pursue private benefits, thereby negatively affecting corporate value [

15,

32,

33]. Controlling shareholders do not engage in ESG activities to maximize corporate value but rather spend excessively on ESG activities to enhance their reputation or create favorable public opinion. They argue that this negatively affects corporate value [

16,

17,

18,

19]. Barnett and Salomon [

16] argue that when a corporation pursues ESG activities, it is difficult to seek financial performance and social benefits simultaneously. Therefore, the relationship between ESG activities and financial performance is not dichotomous but exhibits a curvilinear relationship. Surroca et al. [

17] recognized ESG activities as equivalent to a corporation's intangible resources such as reputation, brand value, and social networks, and conducted an empirical analysis of their impact on financial performance. Additionally, Fisher-Vanden and Thorburn [

18] proved that the value of corporations intensifying environmental management decreases due to negative (-) cumulative abnormal returns. Lyon et al. [

19] indicate that in the Chinese market, the corporate value of companies that are recognized for their environmental management and have won awards shows no significant difference or even decrease compared to those that are not recognized.

3. Research Methodology

3.1. Hypothesis Development

Numerous studies have been conducted on how an increase in ESG activities impacts accounting-related factors. However, research on the determinants of ESG activity is insufficient. Since 2011, the Korea ESG Standards Institute has announced annual ESG ratings. A corporation’s ESG activities are determined by the influence of each component constituting ESG (environmental management, social responsibility, and governance) [

9,

20,

21]. The ESG components (environmental management, social responsibility, and governance) are influenced by the CEO’s level of ethical consciousness [

22] and are affected by profitability indicators such as sales and operating profit. Research shows that they decrease as economic uncertainty increases [

21].

Unlike owner-managers, de facto CEOs informally influence a company; thus, they can receive a significant amount of scrutiny and criticism from civic groups and the media. If criticism becomes widespread, they may lose influence. Therefore, there are incentives for de facto CEO to actively participate in ESG activities, which are non-profit activities, for various reasons, such as forming favorable public opinion about themselves and strengthening their control over the company. De facto CEOs are likely to prefer increasing ESG-related expenditures rather than reducing them because using ESG to maximize their benefits and reputation is far more advantageous. Based on this fact, it was hypothesized (Hypothesis 1) that the presence of a de facto CEO positively impacts ESG activities.

Hypothesis 1: Companies with a de facto CEO are expected to be more proactive in ESG activities than those without one.

Studies have asserted that South Korea’s rapid economic growth is possible because of the unique corporate structure of chaebols. However, empirical results from most studies have reported that chaebol corporations, owing to their vulnerable governance structures, negatively influence corporate value [

3,

4,

10,

23]. Specifically, research has found that the corporate value of chaebol firms is lower than that of firms that do not belong to chaebols [

3], and it has been proven that the financial efficiency of chaebol firms is relatively low [

4]. Additionally, research has argued that stakeholders such as shareholders and managers, shareholders and bondholders, controlling shareholders and minority shareholders, management, and employees may have differing interests, leading to potential conflicts in the decision-making process, which can subsequently negatively impact corporate value [

23].

This study intends to identify the Chief Executive Officer (CEO) using compensation data, which have been employed in prior studies to assess the CEO's influence and analyze the impact on corporate value from a governance perspective. The company’s CEO should be the highest-paid individual with the greatest authority and responsibility. Various internal, external, legal, and institutional checks and balances exist within a corporation, making compensation one of the fairest measures to objectively assess the authority and responsibilities of employees and executives. CEOs representing ordinary shareholders' interests have incentives to maximize corporate value and extend their tenure. However, if a de facto CEO exists within a corporation, they may have incentives to make decisions that enhance their reputation or pursue personal benefits rather than benefits for the company. Thus, if conflicts arise between the formal CEO and de facto CEO during the corporate policy decision-making process, agency costs can occur to resolve these conflicts, potentially negatively impacting corporate value. An and Suh [

6] argue that if a registered or non-registered executive receives higher compensation than the CEO, the top compensated individual in the corporation could wield greater influence over important corporate policy decisions than the CEO through means such as the board of directors.

The direct influence of ESG activities on corporate value can be easily confirmed by reviewing previous studies. However, satisfying the objectives of both nonprofit activities for societal benefits, such as ESG, and profit-driven activities for financial benefits is not easy for corporations. As such, investing in ESG activities may entail considerable short-term expenditures, which could negatively affect financial performance [

9,

24,

25,

26]. Concentration on non-profit ESG activities may distract the core business, potentially lowering corporate competitiveness and resulting in a decline in corporate value [

27,

28]. Barnea and Rubin [

28] argue that CEO's ESG activities can enhance an individual rather than a corporate reputation, thus negatively impacting corporate value. Based on these facts, we set Hypothesis 2, expecting that the highest-paid individuals receiving more compensation than the CE, in the business report will negatively affect corporate value.

Hypothesis 2: The presence of a de facto CEO will result in lower corporate value as compared to firms without a de facto CEO

3.2. Methodology

ESG is measured as a dummy variable with a value of 1 if it is B+ or above, according to the Korea ESG Standards Institute, and 0 otherwise. A De Facto CEO is defined as a dummy variable set to 1 if the highest-paid individual in a firm is not the representative director and 0 if they are the same. The control variables include SIZE, the natural logarithm of total assets used to measure company size, and LEV, the debt-to-equity ratio used to measure leverage. As companies with a larger SIZE typically have lower unsystematic risk and those with a lower LEV indicate a better financial structure, these characteristics allow companies to focus not only on their core for-profit businesses but also on non-profit activities, such as ESG; hence, these variables are included in our model. We) calculate ROE by dividing net income by total equity, assuming that companies with a higher ROE have better profitability and can invest more resources in ESG activities. Sales growth (SG) is measured by subtracting the previous year's sales from the current sales and dividing it by the previous year's sales, reflecting the company's growth and potential to allocate more resources to ESG activities in the future. The CH variable is a dummy variable representing whether the company is part of the top 30 chaebols (large business groups) in South Korea, according to the Fair Trade Commission's statistics as of May 2022 (including affiliates), with 1 indicating membership and 0 meaning otherwise. We expect larger corporations to commit more to ESG activities due to their social responsibilities. Foreign ownership (Foreign) is measured using the foreign ownership ratio provided by KIS-Value, with the presumption that higher foreign ownership could demand stricter global ESG standards from a company. Year and industry effects were controlled by including year and industry dummy variables in the regression analysis.

In the model for Hypothesis 2, Tobin’s Q is used as a proxy for firm value, which serves as the dependent variable. Tobin’s Q value is calculated by dividing the sum of the market value of equity and book value of debt by the total assets. The control variables that may influence firm value (Tobin’s Q) include ESG activities (ESG), firm size (SIZE), leverage (LEV), return on equity (ROE), sales growth (SG), affiliation with a large business group (CH), ownership stake of the largest controlling shareholder (OwnerRate), and year and industry dummy variables. OwnerRate is measured using the stake of the largest controlling shareholder provided by the KIS-Value. A higher ownership rate may facilitate efficient and timely decision-making, such as facility investments. However, it also leads to the potential risk of unilateral decision-making.

ESG it = α0 + α1RealCEOit + α2SIZEit + α3LEVit + α4ROEit + α5SGit + α6CHit + α7Foreignit + α8ΣICODEit + α9ΣYRit + ε it

(1)

Tobin‵S Q it = α0 + α1RealCEOit + α2TotalESGit + α3SIZEit + α4CFOit + α5LEVit + α6ROEit + α7SGit + α7CHit + α8OwnerRateit + α9ΣICODEit + α10ΣYRit + ε it

(2)

3.3. Variables

3.3.1. A De Facto CEO

Finkelstein et al. [

29] defined the CEO as the individual who leads the overall performance and decision-making of the organization and bears ultimate responsibility. The concept of "a de facto CEO," the main variable of interest in this study, stems from the premise that employee compensation in a firm is an objective indicator that assesses employee abilities and is proportionally determined according to the extent of their impact on the company. The purpose of a company is to maximize profits for its continued survival; thus, it is expected that the highest compensation should be paid to the CEO, who holds legal responsibility and decision-making authority in company operations. However, if an employee receives more compensation than the CEO, it can be inferred that the individual exerts more influence on the company's policy decisions.

The "Capital Market and Financial Investment Business Act" and its enforcement regulations, which mandate the disclosure of individual executive compensation of 500 million KRW or more in business reports, were enacted on August 27, 2013. Consequently, publicly traded companies on the Korea Stock Exchange and KOSDAQ began disclosing executive compensations of 500 million KRW or more in their business reports. The compensation and positions of registered and nonregistered executives, which are used to determine the existence of a real CEO, can be verified using the data disclosed in business reports.

This study adopts the measurement method of a de facto CEO used by An and Suh [

6], defining the highest-remunerated individual as a de facto CEO when their remuneration exceeds that of the representative director, as per the business report. Specifically, the company’s compensation data were used to measure the de facto CEO variable. Compensation data were collected via the online open API provided by the Financial Supervisory Service's electronic disclosure system (dart.fss.or.kr) for individual compensation data, coupled with the manual collection of the names of the representative directors disclosed in the business reports. A dummy variable was defined for a de facto CEO: if the highest compensated individual in the company was the representative director, the value was 0; otherwise, it was 1.

3.3.2. ESG Activities

ESG activities, abbreviated as environmental management, social responsibility, and governance improvement, are defined as the actions taken by corporations in the pursuit of sustainable management. Through ESG activities, corporations can contribute to creating environmental, social, and economic value and positively impact stakeholders such as investors.

This study measured ESG activities using ESG ratings provided by the Korea ESG Standards Institute, which are most commonly used in South Korean research. The ESG evaluation model of the Korea ESG Standards Institute is designed to faithfully reflect not only international standards such as the OECD Corporate Governance Principles and ISO26000 but also domestic laws and business environments.

We used ESG grades provided by the Korea ESG Standards Institute, which is the most commonly utilized source for ESG activity measurement in South Korean research. The ESG evaluation model of the Korea ESG Standards Institute adheres to international standards such as the OECD's Principles of Corporate Governance and ISO 26000 and is also designed to faithfully reflect domestic laws and business environments. This model comprises five stages: (1) collection of basic data; (2) conducting preliminary and in-depth evaluations; (3) verification of evaluation results; (4) Sharing of ESG evaluation results with target companies and implementation of bidirectional feedback; and (5) finalizing and disclosing ESG evaluation grades. Specifically, the model utilizes corporate disclosure materials, institutional data (such as supervisory agencies and local governments), and media materials to collect over 900 basic data for approximately 900 listed companies. The basic data were categorized into 18 major classifications and 265 key evaluation items, after which a preliminary evaluation was conducted. An in-depth evaluation was then performed using 58 key evaluation items to determine whether ESG-related issues could impair corporate value. The completed evaluation results were verified, and bilateral feedback was provided to the evaluated companies through a web-based evaluation system, enhancing the reliability of the evaluation results. Based on the derived scores, the ESG Committee of the Korea ESG Standards Institute assigns grades. If an event that could affect the rating occurred after the evaluation period, the company was classified as a rating adjustment review candidate and reexamined. Additionally, they select excellent companies and disclose grades of B+ or higher in the overall market, corporate governance, and environmental and social sectors. Since 2011, the Korea ESG Standards Institute has announced annual ESG ratings, including social responsibility, governance, and environmental management. Therefore, in this study, we intend to measure ESG activities using a dummy variable that assigns 1 to companies with a comprehensive ESG rating of B+ or higher and 0 otherwise, based on the annual ESG ratings of approximately 900 companies announced by the Korea ESG Standards Institute.

3.4. Data

Data on the highest executives were collected using the Financial Supervisory Service’s Dart Electronic Disclosure System (dart.fss.or.kr). Aligned with the amendments to Article 159 (2) of the Capital Market Act of 2013, companies were required to disclose the top five registered executives who received over 500 million KRW. Further amendments in 2018 mandated the disclosure of the remuneration status of the top five employees and executives regardless of their registration status. Consequently, data were collected from the start of these disclosures, from 2013 to 2021. The names of the representative director listed in the business report and information on the top five earners in a company were manually collected. General company information and original disclosure documents provided by the Dart Electronic Disclosure System were received in XML format from 2013 to 2021. Data, including the names of the representative directors in the business report, the overall remuneration status of the directors and auditors (amount approved by the shareholders’ meeting), executive status, individual remuneration status of the directors and auditors, and individual remuneration payments (top five exceeding 500 million KRW), which began to be disclosed in 2018, were converted to Excel data for collection. The total compensation for individual executives included employment income and other income and retirement income, of which one-time income, such as other income and retirement income, were excluded from the sample.

The financial data for each company were obtained by downloading the massive amount of data provided by Kis-Value. The KOSDAQ market, which has significantly fewer individual executive compensation disclosures than the Korea Exchange (KOSPI) market, was excluded to ensure homogeneity with previous studies. Data are collected from companies listed on the KOSPI as of December 2021. Firms that continuously possess financial information from 2013 to 2021, have a December fiscal year-end, are not insolvent, and have not operated at a deficit for three consecutive years were selected as samples. To ensure homogeneity among the samples, the insurance and finance industries were excluded according to the industrial classification, and industries with fewer than ten firms per year based on the medium classification used in the Korean Standard Industrial Classification were also excluded to finalize the sample. The detailed sample selection process is presented in

Table 2. To control for the influence of outliers, winsorization was performed on the top and bottom 1% of the samples for the dependent and control variables, which were continuous. The criteria for sample selection are as follows.

Table 2 shows the collected sample before the empirical analysis.

Table 3 shows the annual proportion of de facto CEO between 2013 and 2021. The figure shows the yearly percentage of companies with a de facto CEO out of the 2,300 sample companies, with 614 companies having a de facto CEO.

3.5. Descriptive Statistics and Correlation Analysis

Table 4 presents the descriptive statistics for the variables used in the empirical analysis.

Table 5 presents the t-test results conducted to ascertain if a statistical difference exists between companies with real CEOs (de facto CEO), a variable of interest in this study, and those without it. Of the sample of 2,300 companies, 614 (26.7 %) had a RealCEO. The average Tobin’s Q of companies with RealCEOs is 1.10, exhibiting a statistically significant 0.21 decrease at the 1% level, compared to the average of 1.32 for companies without RealCEOs. Therefore, there is a difference in corporate value between companies with and without real CEOs. Moreover, the differences between the groups can be confirmed at the 5% level for ESG activities (ESG) and the maximum controlling shareholder stake (Ownerrate). The average large corporate group value for companies with RealCEOs is 0.22, surpassing the average of 0.17 by 0.05. However, the maximum shareholder stake is 0.02 lower, suggesting that large corporate groups might have a vulnerable governance structure where the majority shareholder can wield significant influence over a company.

Table 6 presents the correlations between the variables used in this study. Tobin’s Q, the main variable of interest, has a statistically negative correlation with RealCEO at the 1% level. It showed a positive correlation at the 5% level with the ESG dummy variable, representing the ESG activities provided by the Korean ESG Standards Institute. Control variables—company Size(Size), cash flow from operations (Cfo), return on equity (ROE), sales growth rate (SG), and maximum controlling shareholder stake (OwnerRate)—were found to have a statistically positive correlation at the 5% level. The debt ratio (LEV) was found to have a statistically negative correlation at the 5% level. However, no statistically significant results were found for the chaebol (CH) dummy variable, representing large corporate groups.

4. Empirical Analysis

4.1. The Influence of De Facto CEOs on ESG Activities

To empirically test Hypothesis 1, where the dependent variable was a dummy variable, logistic analysis was conducted to analyze the impact of RealCEO presence or absence on ESG activities.

Table 7 is the result of the logistic analysis. The results show that the regression coefficient of RealCEO was 0.16, and it had a statistically significant positive (+) relationship at the 1% level. This implies heightened ESG activity among companies with RealCEOs.

4.2. The Influence of De Facto CEOs on Firm Value

This study uses Ordinary Least Squares (OLS) analysis to empirically test Hypothesis 2, where the dependent variable is a continuous variable and the variable of interest is a dummy variable. The impacts of a RealCEO presence or absence and ESG activities on Tobin’s Q, a proxy for firm value, are analyzed and divided into Z1, Z2, and Z3.

Z1 represents results from analyzing the impact of the presence or absence of a RealCEO on firm value. Z2 represents the results of the analysis on the impact of ESG activities on firm value. Z3 represents the analysis results of the effect of the presence or absence of a RealCEO on firm value, while controlling for the impact of ESG activities.

Table 8 is the result of the Ordinary Least Squares analysis. The results reveal a negative (-) statistically significant relationship with firm value for Z1, Z2, and Z3. Specifically, the regression coefficient value of RealCEO in the Z1 analysis was -0.14 at the 1% statistical level, and firms with RealCEOs had a negative relationship with firm value compared with firms without RealCEOs. To control for year and industry effects, year and industry dummy variables were included in the control variables; the maximum Variance Inflation Factor (VIF) among the variables was 2.220, confirming no multicollinearity problem.

The Z2 analysis revealed that the regression coefficient value for ESG activities (ESG) was -0.25, indicating a statistically significant negative relationship at the 1% level. Z3 is the result of an empirical analysis investigating whether a RealCEO’s presence or absence affects firm value, even when ESG activities are added to the control variables.

The analysis shows that the regression coefficient of RealCEO is -0.12, and that of ESG activities (ESG) is -0.24. This indicates a statistically significant negative relationship with firm value at the 1% level. This suggests that firms with RealCEOs have lower firm value than those without RealCEOs. The maximum VIF among the Z3 variables was 2.440, confirming the absence of multicollinearity.

5. Conclusion

Governance is influenced by CEO type. Previous studies have reported that whether the CEO is a professional manager or owner-manager differentially impacts corporate value and financial performance [

12]. However, in reality, controlling shareholders can have a significant influence on the crucial policy decisions of the company, whether or not they take office as CEO [

6]. Therefore, this study empirically analyzes how corporate value and ESG activities manifest in companies where employees receive higher salaries than the CEO.

Studies have analyzed the impact of factors, such as governance transparency, large corporate groups, and the influence and type of CEO, on corporate value and financial performance. Research on governance transparency has used metrics such as the proportion of outside directors on the board and the presence of an independent audit committee; empirical results suggest that a higher proportion of outside directors on the board and the presence of an independent audit committee positively correlate with increased corporate value and financial performance [

1,

2,

10]. Studies on large corporate groups have used the range of corporate groups provided by the Fair Trade Commission's corporate group portal for analysis. Empirical results suggest that the corporate value of companies belonging to large corporate groups is lower than that of companies that do not belong to such groups [

12]. Research related to the influence of the Chief Executive Officer (CEO) has analyzed the proportion of the CEO's salary to the total compensation of the management team. The empirical results suggest that corporate value decreases as the CEO’s influence increases [

13]. Studies concerning the type of CEO distinguish between professional managers and owner-managers based on business reports. They report that in companies with independent governance and transparent professional management, the positive effect (+) between the compensation gap among the CEO, executives, and corporate performance increases. Conversely, in owner-managed firms, the negative effect (-) is mitigated [

12].

In this study, we identify CEO using compensation data, which is an objective measure of the authority and responsibilities of employees and executives. Although not representative directors, executives who received higher compensation than the representative director were defined as de facto CEO.

Hypothesis 1 demonstrates a statistically significant positive (+) correlation at the 1% level between the presence of a de facto CEO and ESG (Environmental, Social, and Governance) activities. This finding suggests that firms with de facto CEO are more engaged in ESG activities than those without CEOs. A de facto CEO capable of forming favorable public opinion among entities that could hold them accountable for their pursuit of personal interests, such as the media and civic groups, has an incentive to actively pursue ESG to improve their reputation and positive image. Hence, while the impact on firm value may vary depending on how ESG activities are followed, it can be concluded that firms with de facto CEO are favorably disposed towards ESG as a means of pursuing personal benefits.

The analysis of Hypothesis 2 demonstrates a statistically significant negative (-) correlation at the 1% level between the presence of a de facto CEO and firm value, indicating that firms with a de facto CEO have lower firm value than those without. If a company wants to enhance its value, it should increase its corporate governance transparency, ensuring that the CEO effectively holds the greatest authority and responsibility and operates under accountable management through independent policymaking bodies.

This study makes three main contributions to the literature. First, it expands the research scope related to corporate governance and ESG by identifying and analyzing de facto CEO using compensation data, which is an objective indicator for evaluating the abilities and powers of executives. Although ESG has been actively researched in various fields worldwide in South Korea, most studies have focused on examining the relationship between ESG and its influencing factors. This study contributes academically by expanding the research scope, examining the decision variables that affect ESG activities, and conducting an empirical analysis. This approach can be utilized in various ways in future corporate governance and ESG studies.

Second, this study empirically demonstrates that operating the board of directors, the ultimate decision-making body for corporate policy, can independently increase the transparency of governance and enhance firm value. This suggests the need to improve policymaking bodies within a company to prevent the existence of a de facto CEO who delegates legal responsibilities to representative directors but makes significant policy decisions for company management. In the long-term, this can negatively affect a company's value.

Third, this study empirically illustrates that ESG activities do not always positively affect all firms. In companies with weak corporate governance, ESG activities can be used to pursue the private interests of controlling shareholders, resulting in inefficient management that reduces corporate profits and firm value. Therefore, companies must approach ESG activities cautiously and explore and implement ESG activities that suit their characteristics.

This study had some limitations. First, there is a limitation in defining the critical variable of interest, the de facto CEO, because it does not consider all corporate governance relationships beyond compensation. Second, measuring ESG activities using only ESG ratings provided by the Korea ESG Standards Institute may introduce some biases. Despite these limitations, identifying a de facto CEO using compensation, which is an objective indicator for assessing the abilities and powers of executives, and examining the impact of their existence on corporate value and ESG activities, can provide insights for future research related to de facto CEO, corporate governance, and ESG.

Author Contributions

Conceptualization, K.J.B. and Y.J.Y.; Data curation, K.J.B.; Formal analysis, K.J.B. and Y.J.Y.; Investigation, K.J.B.; Methodology, K.J.B. and Y.J.Y.; Project administration, K.J.B. and Y.J.Y.; Resources, K.J.B.; Software, K.J.B.; Supervision, Y.J.Y.; Validation, K.J.B. and Y.J.Y.; Visualization, K.J.B.; Writing – original draft, K.J.B; Writing – review & editing, Y.J.Y. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Acknowledgments

This paper has been written by modifying and supplementing a part of the first author's doctoral dissertation from the Department of Business Administration at Jeju National University. I would like to express my gratitude to Professor Young-Jun Yeo for guiding my doctoral dissertation and to Professors Gil-Hoon Kim, Soon-Yeo Jung, Chang-Youl Ko, and Jin-Soo Kim from Jeju National University for reviewing it. and I would like to thank Editage (

www.editage.co.kr) for English language editing.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Black, B.; Jang, H.; Kim,W.C. Does corporate governance affect firm’s market value? Evidence from Korea. J. Law Econ. Organ. 2006, 22(2), 366-413.

- Gompers, P.; Ishii, J.; Metrick, A. Corporate governance and equity prices. Q J Econ. 2003, 118(1), 107-155.

- Ferris, S.P.; Kim, K.A.; Kitsabunnarat, P. The costs (and benefits?) of diversified business groups: The case of Korean chaebols. J. Banking Fin. 2003, 27, 251–273. [CrossRef]

- Joh, S.W. Corporate governance and firm profitability: Evidence from Korea before the economic crisis. J. Financ. Econ. 2003, 68, 287–322. [CrossRef]

- Villalonga, B.; Amit, R. How do family ownership, control and management affect firm value? J. Financ. Econ. 2006, 80, 385–417. [CrossRef]

- An, J.I.; Suh, Y.S. Substantial CEO and disclosure quality of executive pay disclosure. Korean Acc. Rev. 2021, 46, 289–321. [CrossRef]

- Google Trends Analysis Site. Available online: https://trends.google.co.kr.

- Yoon, B.; Lee, J.; Byun, R. Does ESG performance enhance firm value? Evidence from Korea. Sustainability 2018, 10, 3635. [CrossRef]

- Lee, J.; Park, C. Do CSR Activities improve financial performance? Focused on job satisfaction and firm size. kmr 2020, 49, 913–937. [CrossRef]

- Giroud, X.; Mueller, H.M. Corporate governance, product market competition, and equity prices. J. Fin. 2011, 66, 563–600. [CrossRef]

- Black, B.S.; Jang, H.; Kim, W.C. Does corporate governance predict firms’ market values? Evidence from Korea 2006, 22, 366–413. [CrossRef]

- Choi, J.M.; Cowing, T.G. Firm behavior and group affiliation: The strategic role of corporate grouping for Korean firms. J Asian Econ. 1999, 10(2), 195-209. [CrossRef]

- Bebchuk, L.A.; Cremers, K.J.M.; Peyer, U.C. The CEO pay slice. J. Financ. Econ. 2011, 102, 199–221. [CrossRef]

- Ko, C.Y.; Jung, H. The effect of substantial CEO on the relation between COVID-19 pandemic and asymmetric cost behavior. Korean Res. Assoc. Bus. Educ., 2023, 37, 51–70.

- Friedman, M. The social responsibility of business is to increase its profits. The New York Times. 1970. Available online: https://www.nytimes.com/1970/09/13/archives/a-friedman-doctrine-the-social-responsibility-of-business-is-to.html.

- Barnett, M.L.; Salomon, R.M. Beyond dichotomy: The curvilinear relationship between social responsibility and financial performance. Strat. Mgmt. J 2006, 27, 1101–1122. [CrossRef]

- Surroca, J.; Tribó, J.A.; Waddock, S. Corporate responsibility and financial performance: The role of intangible resources. Strat. Mgmt. J 2010, 31, 463–490. [CrossRef]

- Fisher-Vanden, K.; Thorburn, K.S. Voluntary corporate environmental initiatives and shareholder wealth. In J. Environ. Econ. Manag. 2011, 62, 430–445. [CrossRef]

- Lyon, T.; Lu, Y.; Shi, X.; Yin, Q. How do investors respond to Green Company Awards in China? Ecol. Econ. 2013, 94, 1–8. [CrossRef]

- Fatemi, A.; Glaum, M.; Kaiser, S. ESG performance and firm value: The moderating role of disclosure. Glob. Fin. J. 2018, 38, 45–64. [CrossRef]

- Rhee, C.S.; Jung, A.R.; Chun, H.M. A study on ESG determinants and firm value: Focusing on economic policy uncertainty and operating income volatility. Korean Acc. Rev. 2021, 46, 115–139.

- Kang, W.; Jung, M.K. Effect of ESG activities and firm’s financial characteristics. Korean J. Financ. Stud. 2020, 49, 681–707. [CrossRef]

- La Porta, R.; Lopez-De-Silanes, F.; Shleifer, A. Corporate ownership around the world. J. Fin. 1999, 54, 471–517. [CrossRef]

- Waddock, S.A.; Graves, S.B. The corporate social performance-financial performance link. Strateg. Manag. J. 1997, 18, 303–319. [CrossRef]

- Choi, J.S.; Kwak, Y.M.; Choe, C Corporate social responsibility and corporate financial performance: Evidence from Korea 2010, 35, 291–311. [CrossRef]

- Pedersen, L.H.; Fitzgibbons, S.; Pomorski, L Responsible investing: The ESG-efficient frontier. J. Financ. Econ. 2021, 142, 572–597. [CrossRef]

- Linthicum, C; Reitenga, A.L; Sanchez, J.M: Social responsibility and corporate reputation: The case of the Arthur Andersen Enron audit failure. J. Account. Public Policy. 2010, 29(2), 160-176. [CrossRef]

- 28. Barnea, A; Rubin, A: Corporate social responsibility as a conflict between shareholders. J. Bus. Ethics. 2010, 97, 71-86. [CrossRef]

- Finkelstein, S.; Hambrick, D.C.; Cannella Jr, A.A. Strategic Leadership; Oxford University Press: Oxford, 2009.

- Park, G.H.; Lee, J.W. The Effects of ESG Assessment of Firm Value based on Corporate Governance Structure. The Korean Journal of Financial Management 2022, 39, 147–184.

- Hong, J.Y.; Yoo, S.W. A study on the effectiveness of tournament theory in accordance with the type of CEO. Korean Acc. Rev. 2022, 47, 141–174.

- Kim, S.H.; Sunwoo, H.Y.; Lee, J.W.; Jung, A.R. Value implications of ESG performance. Korean Acc. J. 2022, 31, 31–60.

- Yang, S.H.; Chun, H.M. ESG leading firm and ESG performance: Focusing on business groups. Korean Acc. Rev. 2023, 48, 1–35.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).