1. Introduction

Digitalisation has brought significant and different challenges in the development and implementation of IT strategy (Wynn, 2022), and raised new questions about the future management of IT in organisations. The German automotive industry has arguably been impacted more than most, as digitalisation - combined with the transition to electric vehicle production and automated driven cars - has required the industry to continuously reassess its business strategy and underpinning business model. This paper analyses how digitalisation is impacting the German automotive industry, focusing particularly on the management of IT, and develops a model for the future management of IT in the industry. In a second research phase, interviews were held with IT professionals in a cross-section of other organisations, to ascertain whether the changes taking place in the management of IT in the German automotive industry may be setting a precedent for what will follow in other industries, in particular where digital technologies are now embedded in the organisation’s products or services.

From the 1980s onwards, the nature of the German automotive industry began to change. Electronics started to feature in car development, for fuel injection, for example, and as electronics became more powerful, the software element in the car slowly increased. Since the beginning of the 2010s, electronics and software have dominated, and the transformation of the automobile into a mixed hardware and software product has gained momentum. Today, the industry is characterised by two disruptive and interrelated “megatrends”: firstly, the decarbonisation of the transport sector and the associated switch to alternative drive systems or fuels; secondly, the transition to digitalisation of industry processes and products. In combination, these two megatrends are having a major impact on vehicle production in the industry (Grimm et al., 2020), which consists of original equipment manufacturers (OEMs) and a three-tier supplier network. The German based OEMs Volkswagen, Daimler and BMW remain among the Top 10 car manufacturers worldwide by turnover in 2023 (mbaSkool, 2023).

In 2016, Daimler created the acronym C.A.S.E. for the main challenges faced by the automotive industry: connectivity, autonomous driving, sharing/subscription, and electrification (Simonazzi et al., 2020). Here C.A.S.E. is taken to be a part of digitalisation in the industry, which is undergoing a major transformation. Software for highly automated or autonomous driving and permanently internet-connected vehicles will account for a large share of the value creation of automotive mobility services in the future (Boes & Ziegler, 2021). Software expertise is becoming a central competency of automotive companies (Felser & Wynn, 2023). Automotive companies are having to find a new balance between the digital trends and new business models, and their established skills and assets that relate to the physical world (Czernich et al., 2021).

Although digital technologies are constantly being developed and evolving, they are generally associated with the terms SMAC - social media, mobile, analytics/Big data, Cloud - and BRAID - blockchain, robotics, automation of knowledge work/artificial intelligence, internet of things and digital fabrication (Procurious, 2016). The extant literature provides different perspectives and definitions of the terms “digitalisation” and “digital transformation”, and they are sometimes used interchangeably. Tonder et al. (2020) concluded that “there is no universally accepted, robust conceptual framework that can assist businesses, practitioners and academics to understand the constructs of digitalisation, digital transformation and business model innovation” (p. 112). Nevertheless, digitalisation is seen by some authors as the deployment of digital technologies to support improvements in existing processes, whereas digital transformation is viewed as constituting a more significant transition to a new business model or at least a new way of working in a major part of the business. This differentiation is discussed and assessed with reference to a variety of environments and contexts (Jackson, 2020; Kirvan, 2021; Tabrizi et al., 2019; Tucci, 2021). Pratt and Sparapani (2021, para.1), for example, define digital transformation as “the incorporation of computer-based technologies into an organization’s products, processes and strategies”. This distinction is discussed below in light of the research results.

Van Alstyne and Parker (2021) also stress the significance of external factors. They associate digital transformation with the transition to what they term the “inverted firm”, which involves “a change in organizational structure that affects not only the technology but also the managerial governance that attends it.” They conclude “digital transformation is about changing where value is created, and how your business model is structured. More and more, value creation comes from outside the firm not inside, and from external partners rather than internal employees” (para. 1). Ismail et al. (2018, p.6) also note the complexity of digital transformation and conceptualised it as “the process through which companies converge multiple new digital technologies” to achieve superior business performance and competitive advantage. This would involve “transforming multiple business dimensions, including the business model, the customer experience (comprising digitally enabled products and services) and operations (comprising processes and decision-making), and simultaneously impacting people (including skills talent and culture) and networks (including the entire value system).” This suggests digital transformation involves the deployment of digital technologies in the organisation’s products or services, which will be the catalyst for changes in operations, people skilling and value networks. These perspectives resonate with the current change environment in the German automotive industry, where the scale of change and business reinvention is such that the ownership and operation of the IT function may change significantly in the coming years.

The roles, tasks and competencies of the IT function, and specifically that of the Chief Information Officer (CIO), are evolving. Alt et al. (2020) argued that the increasing relevance of IT for the organisation would shift the strategic responsibility for IT from the CIO to the business executives, but Liebe (2020) concluded that the CIO has finally become a member of the top management team, responsible for developing the IT strategy, building and maintaining the IT architecture, and ensuring the smooth operation of all IT systems. There are clearly still many ambiguities about the role. According to Gerth and Peppard (2020), the variety of CIO roles is one of the main reasons why companies struggle with digital transformation, and additional positions have emerged as a result. Indeed, studies by Singh and Hess (2020) and Stockhinger and Teubner (2019) highlight emerging roles for digital innovation such as Chief Technology Officer (CTO) and Chief Digital Officer (CDO), sometimes located in the business areas, outside of the IT department. Singh et al. (2017) positioned the role of the CIO as a strategic IT specialist and the role of the CDO as a digital transformation specialist. They argue that the role of the CDO is most appropriate when both the pressure to innovate and the complexity of an organisation are particularly high.

In a similar vein, a number of authors have addressed the possible redefinition of the IT function as a result of digital transformation. Bergmann (2019, p. 370) claimed “the IT department in the classical form is an obsolete model,” and Urbach and Ahlemann (2016) concluded that digital transformation would lead to fundamental changes in process, personnel and cultural aspects of organisations. The term IT organisation usually refers to a corporate IT department or function, led by a CIO as the most senior IT professional in the organisation, but Schröder and Müller (2017) understood the term “IT organisation” holistically. The subject matter is the tasks associated with the use of IT, which are assigned to specific task holders - regardless of whether the task holders are located in the business area, the IT department or with external partners.

A related theme has been the growth of “shadow IT” in organisations. Kopper et al. (2018) view this phenomenon as any software, hardware or IT service that may be used or developed autonomously by the business without involving the company’s formal IT function. Despite the loss of transparency and control by the IT function, and the associated negative connotation of the term, shadow IT may nevertheless act as a driver for user-driven innovations and process improvements (Brenner et al., 2011). The increase in shadow IT is also due to the fact that more and more technically skilled employees are able to procure or develop IT solutions themselves, combined with the increased availability of Cloud services and user-friendly software development environments (Kopper et al., 2018).

Given the issues briefly discussed above, this article addresses the following research questions (RQs):

RQ1. What are the key issues and challenges impacting the management of IT in the German automotive industry?

RQ2. What new model is emerging for the management of IT in the German automotive industry?

RQ3. Are other industry sectors and organisations experiencing similar changes in the management of IT?

Following this brief introduction, the article comprises four further sections. In the following section, the research method for the two phases of the research is set out and discussed, being inductive and qualitative in nature and largely based on feedback from interviews and questionnaires with industry practitioners. The ensuing section reports on the study results and directly addresses the research questions. There then follows a discussion section which reviews and assesses some of the emerging themes from the research, notably some observations on implications for the conceptualisation of digitalisation and digital transformation. Finally, the concluding section pulls together some of the key aspects of the research and sets out possibilities for subsequent research agendas that could profitably build upon the research outcomes discussed in the article.

2. Research Method

The overall research approach is qualitative and inductive, largely based on questionnaire feedback and in-depth interviews with industry practitioners. Phase 1 of the study focused on the German automotive industry (Felser, 2022). Expert interviews were the main applied methodology with the aim of acquiring a rich and deep understanding of the impacts of digitalisation in the German automotive industry, to provide answers to RQ1 and RQ2. This followed an initial scoping literature search that was first undertaken as “a means of gaining an initial impression” (Bell et al., 2018, p. 97) of relevant themes. The target group for the semi-structured interviews in Phase 1 consisted of IT executives from the German automotive industry (OEMs, suppliers and IT sourcing experts). An interview brief was distributed to 29 companies which also included a short project description with further explanations and definitions as well as the areas of discussion for guiding the interviews. In total, 19 semi-structured interviews were performed between February and May 2021. (These are coded P1 – P19 in the results section below). All interviewees were participants from middle or top management levels and were directly involved in decision making in the areas of IT strategy, IT sourcing, IT governance, or digital transformation (

Table 1). The data were analysed, coded, and recorded using a spreadsheet for the development of linkages between interviewee material and the identification of emergent themes. This was an iterative process that spanned several weeks of sifting through qualitative data and identifying relevant facts and quotations from the interview transcripts. This allowed the identification of key themes relating to the impact of digitalisation, and the construction of a model representing the on-going change in the management of IT in the German automotive industry. As Sandelowski (1998) observed, the generation of ideas and themes is a creative process, which is needed to fully appreciate the contextual meanings of the notes from the interviews.

The interview findings and transition model were validated using an online survey, comprising six statements and a five-point Likert scale (ranging from Strongly Agree to Strongly Disagree), covering the main elements of the developed model. The survey was conducted in January 2022 when the 19 participants from the semi-structured interviews were contacted and asked to participate in the follow-up survey. A total of 17 responses were received.

In Phase 2 of the research, a questionnaire was sent to eight IT professionals employed in eight different organisations in May 2022 to assess the applicability of the Phase 1 findings across other industries and organisations. More specifically, the objectives were first to establish the degree to which digital technologies were being deployed in other companies, and, second, to gain an impression of whether the transition in IT management experienced in the German automotive industry was in evidence in these organisations. Findings were based on the information provided by these eight professionals, who were known to the authors and who, it was considered, would give an honest and reliable assessment of the use of technologies in their organisations. The questionnaire replies were followed up by virtual interviews and subsequent emails, and the authors believe the data overall provide a reliable and useful snapshot of digital technology deployment in others sectors and its impact on the management of IT. The methodology was again mainly qualitative, focusing on detail provided by respondents on the use of digital technologies in their companies and the impact on IT management. The eight respondents (anonymised and coded C1-C8) and the outline profiles of their organisations are shown in

Table 2.

3. Results

In this section, the three RQs set out in the introduction are addressed in sub-sections 3.1–3.3.

3.1. What are the Key Issues and Challenges Impacting the Management of IT in the German Automotive Industry? (RQ1)

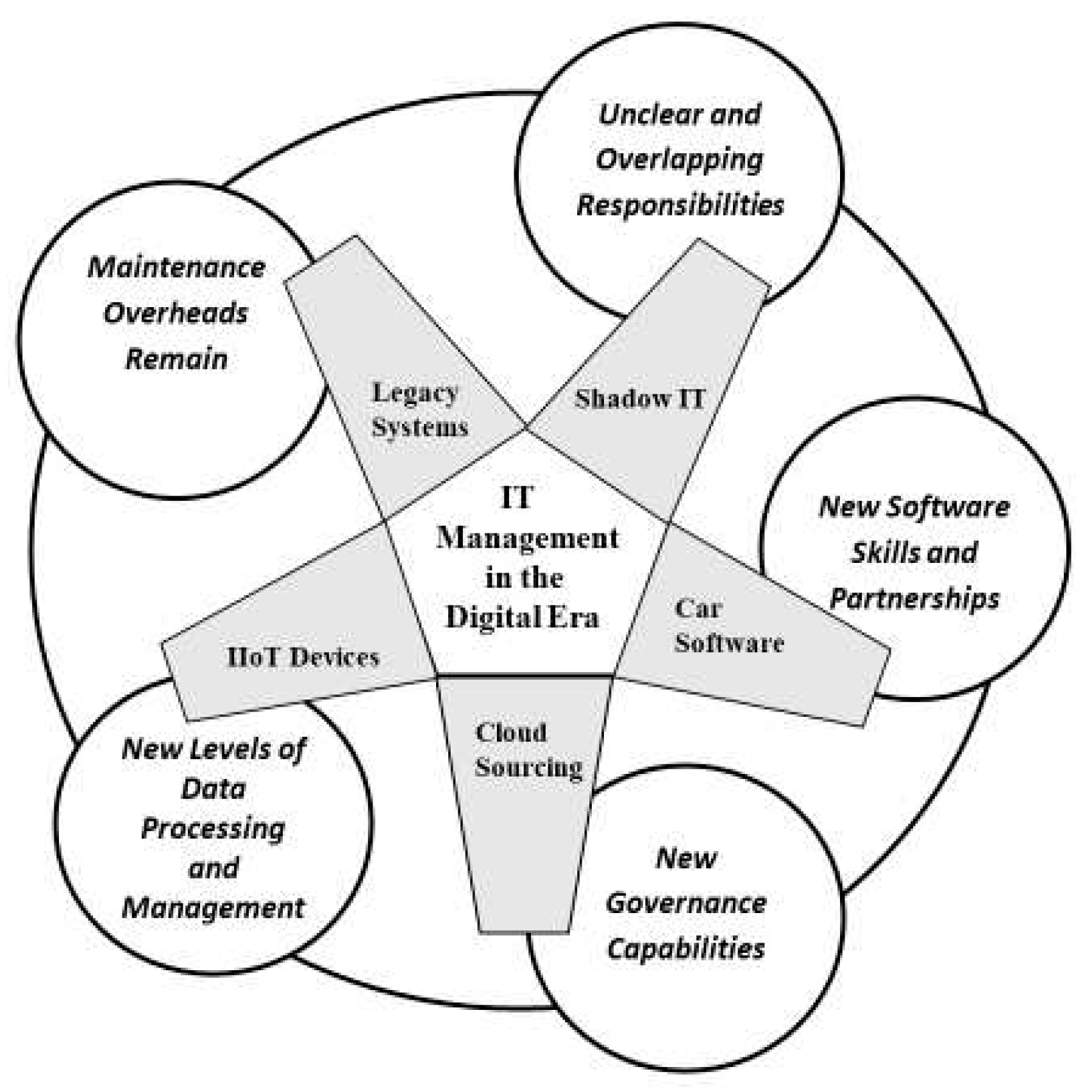

Many of the nineteen interviewees confirmed the general picture of a rapid transformation of the industry as a result of digitalisation and the associated megatrends. P9 summarised the situation thus: “everything is connected, everything is electric, everything is moving towards autonomous driving, and this affects the processes, the machines and the new business models. Under these megatrends, the industry will change dramatically,” and P3 confirmed “that the industry recognises that the end of the previous business model with internal combustion engines is in sight.” More specifically, P6 concluded “as a result of the megatrends, we have to rebuild practically the entire IT organisation.” The interviewees highlighted a number of issues of particular significance in this rebuilding and transition process (

Figure 1).

3.1.1. The Overhead of Legacy Systems

The typical IT department in the German automotive industry mirrors the functional organisation of the business in its management of the company’s main information systems, being structured into individual sections that support the main business areas (engineering, logistics and production, marketing, etc.). As a result, a myriad of functionally oriented IT systems has been developed or provided by multiple IT suppliers, leading to heterogeneous infrastructures and legacy systems, which represent a barrier to digital transformation. P9 gave examples of how one of the most important databases in the automotive industry - the bill of materials (BoM) - containing all the geometric product descriptions - is still stored and updated in several different systems. Databases are thus often inconsistent and incur high maintenance and support overheads.

Even standard software packages sometimes constitute a form of legacy. P15, for example, reported that his company had five separate instances of the SAP ERP system in operation, each one being heavily customised to the individual processes of the particular business area and no longer upgradeable. Legacy systems remain a barrier to effective Cloud sourcing and digitalisation in general. Almost all interviewees confirmed that their companies are suffering from fragmented IT systems, which have been developed, amended and customised over decades, and which preclude the cost-effective automation and re-engineering of business processes. Legacy systems no longer meet the latest technical standards, do not follow best practices and sometimes constitute considerable security problems, caused either by the technical deficiencies of the software or by the expiry of the software provider’s support agreement. Interviewees suggested that as much as 60% of a company’s total IT costs are spent on the maintenance of legacy systems.

3.1.2. Car Software

Software development and deployment is now a core competency in the industry, as the car - especially in the last decade - has become a complex IT product. Software has become the centrepiece of the vehicle, and the quality of the software, rather than the motorisation or the design, will become the decisive factor in the competition between car companies in the future. P1 forecast that “IT will become the defining technology in the automotive industry, and the majority of manufacturers in 2030 will be IT companies with connected car production.” P2 observed “creating an autonomous vehicle is perhaps one of the automotive industry’s biggest computing challenges.”

One major area of development concerns software-defined vehicle architectures and the operating systems for connected vehicles. P10 stated that the focus is primarily on everything that happens around the vehicle, but that “the current operating system of the car will not work in the future. This puts us at a digital-technological crossroads, where we say we’ll do the new things ourselves.” However, the automotive companies will need partners, due to a lack of expertise in software development for connected cars, and thus value-adding sourcing is of particular significance. In this context, P14 confirmed that the industry has now concluded a whole series of strategic partnerships in connection with Car-IT and automated/autonomous driving.

3.1.3. Industrial IoT (IIoT) Devices and Data Management

Almost all interviewees confirmed the importance of IIoT technologies in the future development of platforms for manufacturing that connect production facilities worldwide. IIoT devices, which combine a variety of digital technologies as part of Industry 4.0 (the so-called “Smart Factory”), will regulate the flow of data between plants and control all logistics for parts, procurement, production and distribution. This will entail integration with robotics and digital twin technologies, generating data for use in analytics and AI applications, which facilitate monitoring and support of production in real time. P16 reported that Siemens and Daimler are cooperating on the development of a fully digitised model factory for the Mercedes plant in Berlin-Marienfelde, which is to become a pioneer for all 30 Mercedes plants worldwide. P5 noted that IIoT combined with “digital assistance systems, data analytics, artificial intelligence and machine learning are rapidly changing the value creation processes in the industry.”

P2 added that “an important focus is on the Industrial Internet of Things, Big Data and Analytics, Artificial Intelligence and Cognitive Computing. In other words, the manageability of huge amounts of data with the vehicle at the centre of the Internet of Things.” An emphasis is placed on the combination of digital technologies as IIoT together with Big data/analytics and AI are considered important levers for change. P2 also noted, “put simply, IIoT collects the data and AI interprets it: everything that can be networked will be networked.” However, P16 observed that “implementation is not that simple, because what is now to be networked via the Internet, especially the production and logistics facilities, must now be integrated much more intensively with the rest of the company’s IT.”

The proliferation of IIoT devices – often termed edge computing – means there will be a huge number of smart endpoints in factories that operate autonomously with advanced sensor technology, computer vision and AI, and which produce and share large amounts of data. Interviewees noted two complementary characteristics of these technologies: first, cloud-based data management and second, reliable real-time capability via edge computing with low latencies and high security on the other. The same applies to the digital car, which is considered an edge device in the IIoT platform. Modern vehicles already collect a vast amount of data about themselves as vehicle lifecycle data and, with the widespread availability of driver assistance systems, increasingly more data about their environments will be collected as well. Several interviewees underlined the new relevance of data for future digital business models. P11 observed that “something very important has changed in our company and in the entire industry: we are becoming data-driven.”

3.1.4. The Growth of Shadow IT

Interview evidence suggests that collaboration between the IT function and user departments has been suboptimal in recent years. Business areas have often acted independently of the IT function when developing or buying IT based solutions for process innovations. Shadow IT activities have emerged in the business areas, and a considerable amount of IT expenditure is spent directly by the business lines independently of the central IT function, creating unclear or overlapping responsibilities for IT.

Digitalisation has been a catalyst for further expansion of shadow IT, with the emergence of new organisational units and roles outside of the IT function - incubators, innovation labs, design labs, new business functions for Car-IT, digital factories, plus the new roles of CDO and CTO, which are sometimes within the IT function, and sometimes outside of it. P4 observed “digitalisation teams have been placed in the company, just not in IT; these teams are organisationally very close to the Board, but work quite separately from IT.” All these initiatives have the aim of accelerating the development and adoption of digital innovations, working largely outside of the existing bureaucratic organisational structures and operating independently of, and usually not coordinated with, formal IT strategies and policies. The overall control of policies and standards by the central IT function is now in danger of being seriously undermined in practice by the emergence and development of shadow IT units. P8 concluded that there was a “disconnect between IT and Industrial Internet of Things devices, because most of these Internet-of-Things devices are completely decoupled from classic IT.”

3.1.5. Cloud and Sourcing Strategy Issues

Based on an analysis of the IT budgets of the OEMs in the study, the ratio of insourcing to outsourcing has evolved over the last two decades in the industry to be, on average, 20 to 25 percent insourcing and 75 to 80 percent outsourcing. There are some contrasting trends within this general picture. On the one hand, interviewees confirmed that the intention is to strengthen in-house software development, especially for Car-IT and in applications that are directly visible and tangible to the customer. New partner, contract, and supplier relationships are emerging with specialised software companies for the co-development of car operating systems or the networking of factories with IIoT technologies. On the other hand, commodities such as infrastructure will continue to be candidates for outsourcing, driven by the increasingly broad possibilities of Cloud sourcing. Companies no longer want to devote resources to running their own data centres. P13 cited the outsourcing of Daimler’s entire IT infrastructure to Infosys, for which both companies have announced a long-term strategic partnership, with strategic benefits for both parties: Daimler will expand its IT expertise, focusing on more mission-critical technologies, and Infosys will further strengthen its automotive industry knowledge and expertise (Infosys, 2020).

The perceived benefits of Cloud sourcing include the resulting elasticity and scalability of service provision, and most companies confirmed that they are adopting a multi-Cloud policy. P07 stated that “the Cloud is our most important backbone for digitalisation of our business. First and foremost, because of the scalability of services.” Nevertheless, interviewees noted a number of problematic issues as regards Cloud sourcing. P13 stated that “hyperscaler offerings vary widely, making it difficult to move from one Cloud to another,” and noted that “there is a lack of standards in the multi-Cloud world,” maintaining that systems run one way on platform A and quite differently on platform B. The Cloud providers may have world-class development platforms, but the interoperability between their Clouds is poor. P13 concluded “Cloud providers are sometimes deliberately pursuing a lock-in strategy. A lot of governance is required here. We need to know where our data is, we need to control it, and we also need to be able to restore it quickly in an emergency.” As part of corporate governance, companies are required to have mechanisms in place so that they can move data back and forth between different Cloud environments with minimal effort or additional costs. P13 questioned, however, “who likes to hear the word governance? There’s always the fundamental conflict with agility. One is almost always at the disadvantage of the other.”

P8 and P10 noted that a common misunderstanding is that unlimited resources are available within the Cloud. This can lead to uncontrolled and expensive growth in the consumption of Cloud resources. A highly competent central unit is needed that reviews cross-company requirements, serves them quickly, automates them, and has Cloud governance capabilities to monitor consumption. Without this, the Cloud can become a huge cost trap when everyone in the company is free to approach and engage the provider of their choice.

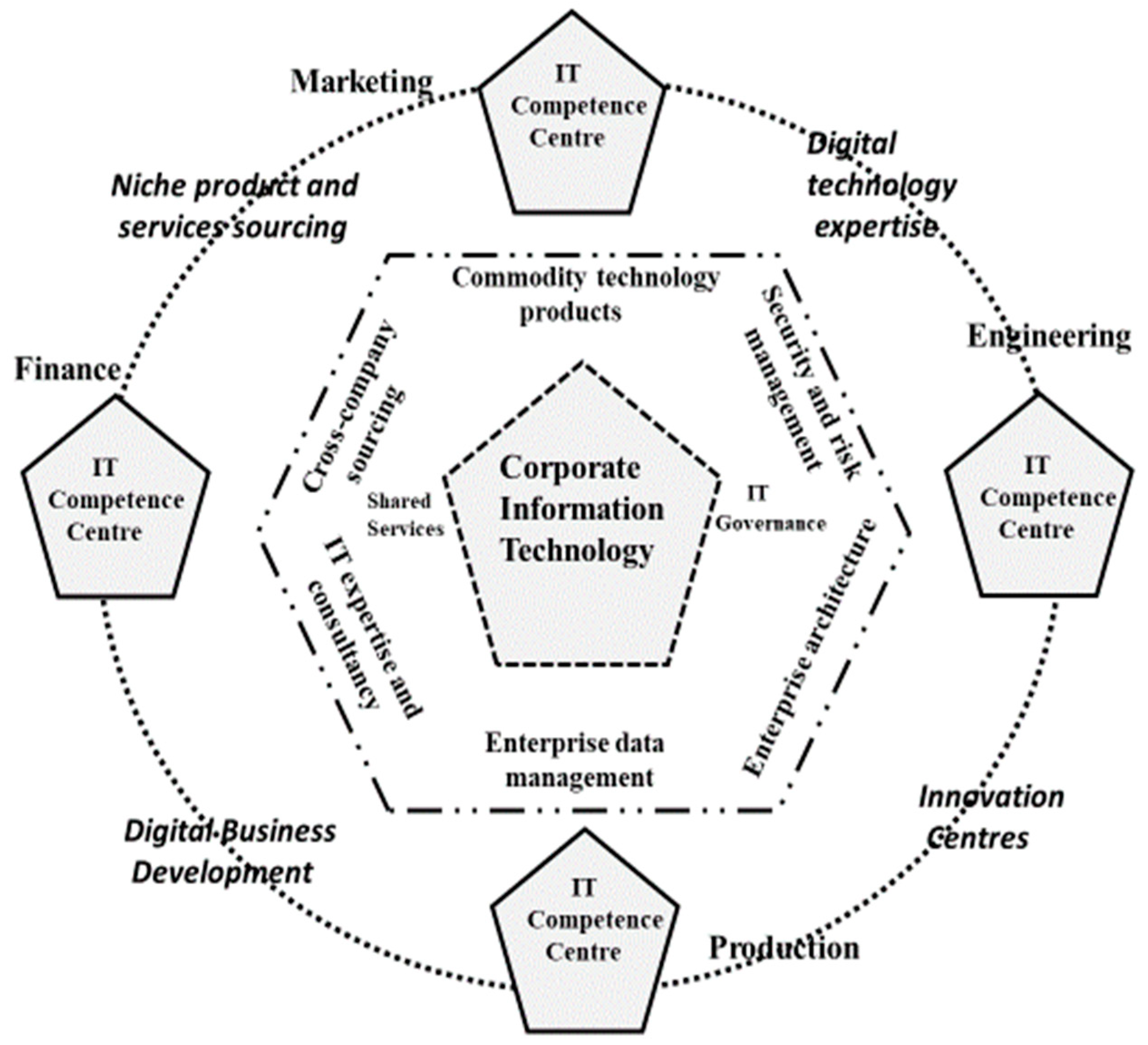

3.2. What New Model is Emerging for the Management of IT in the German Automotive in-Dustry? (RQ2)

The issues discussed above illustrate the tensions in the German automotive industry that are leading to a reallocation of responsibilities in the management of IT. P17 insisted that the IT function must move closer to the business, noting “we are firmly convinced that the current organisational model for digitalised IT must change to a decentralised or federal IT,” and P4 observed that “in the context of digital transformation, the Board must become aware that a new interaction between business and IT is necessary. Today’s divides between business and IT must disappear.” P17 concluded that IT solutions must “satisfy the customer 100% functionally and solve the real problem. Therefore, it is necessary to move away from such a centralized model, where IT is always very far away from the real business.” Interviews evidenced the emergence of a new model for the management of IT, involving a controlled transfer of IT roles and responsibilities into the business lines, and the emergence of two separate functions: “Business IT” – represented by IT Competence Centres in major business lines – and “Corporate IT”, which remains as the guardian of many cross-company standards and associated roles and responsibilities (

Figure 2).

3.2.1. Business Line IT Competence Centres (Business IT)

The redistribution of IT management gives the business functions greater autonomy to develop digital products and services. The model is based on establishing an IT Competence Centre in each business line or core process area in which digital technologies are actively deployed. This will apply to nearly all business lines, in which IT-specific competencies relating to digital technologies will be required, and where the focus is on digital innovations that are competition-differentiating. P17 envisioned this as creating “small, lean, business-oriented IT units that not only understand the IT problem and solve it from their IT perspective, but also understand how the business works and what the solution must look like from a business perspective.” This would give the business lines full responsibility for the creation of digital products and services. They would have ownership of their business requirements as well as the IT technologies and projects necessary for their implementation. This allows more flexibility in accelerating the development and adoption of digital innovations. Although a high level of domain-specific knowledge is required, there is usually only minimal interaction with other business areas, and thus business lines can act more or less autonomously. Complex and costly coordination processes and lengthy development cycles can be minimised or eradicated altogether.

Business embedded IT management will need new capabilities, including provider networking skills and an aptitude for taking responsibility for IT related matters. Strong leadership in IT sourcing is required to attract the appropriate partners from among the powerful technology companies and the promising start-ups. The development of multi-layered relationships with partners from the industrial automation and software technology sectors will require capabilities to negotiate contracts with previously unaccustomed partners, to prevent vendor lock-in and maintain the independence of the automotive companies. Due to the strategic importance of these collaborations, they will be made by the senior executives in the business lines, and require the cooperation of many employees from both the automotive company and its development partners, to develop joint solutions. In this scenario, the business function is the digital innovator, implements the innovation projects with its experts, collaborates with the IT providers, and business management decide which partner networks to work with.

3.2.2. Corporate IT

Corporate IT remains the provider of services with a high synergy across IT business functions, and responsible for the management of a range of corporate governance functions. Shared Service Centres will offer the business functions commodity IT services that are not competition-differentiating, but are nevertheless necessary for business operations. Corporate IT can provide these services more effectively and cost-efficiently than if they were devolved to the business functions. These services may be provided internally or by external service providers, but migrating these services to the Cloud is likely to be the norm, and is already well underway in some of the companies studied. This includes maintenance of all standard software products, notably the ERP modules, computer workstations with group-wide office software, networks, data centres and general service management functions such as incident management. However, certain services may be managed entirely in-house for strategic or other reasons. Sourcing partners will include the traditional IT providers who are engaged in the provision and maintenance of old legacy systems, as well as most of the standard software packages, and the operation of supporting infrastructures.

The Shared Service Centres will also offer specific IT expertise that can be used by the business functions, acting as an internal consultant to provide support on a range of IT issues. Interviewees P9 and P17 highlighted the importance of technology radar and supplier radar services as roles that the Corporate IT function should fulfil. The technology radar will investigate and assess new technologies under development, identifying where in the company they may be effectively implemented, and how they fit into the overall IT architecture of the company. The supplier radar provides a scouting service, having a global overview of mission critical IT resources. It assesses the reliability and risk profile of IT providers, determines for which competitors these companies currently work, and how these resources can be best utilised.

IT related governance functions remain in Corporate IT, with the overall aim of ensuring that all IT-related processes adhere to a coherent approach and are handled consistently for reasons of compliance. P8 suggested that the IT function should “always be the overall architect of the IT technologies and not allow an infrastructure circus via the many different providers,” whilst P18 asserted “a very critical issue is governance - this is taking on a whole new significance.” Corporate IT have the responsibility for overall enterprise architecture management (EAM) that aims to introduce standardisation initiatives and advanced architecture concepts that should improve systems integration and efficacy. This is clearly problematic when core data and information are stored in legacy systems that are often run and supported by third party, Cloud-based, entities. These issues have barely been addressed to date in the German automotive industry, and current IT architectures are often unsuitable for agile digital transformation projects.

Ownership of the enterprise data model (EDM) will also reside in Corporate IT, which will need to accommodate a range of Cloud-based data sources, sometimes termed data lakes, which need to adhere to the EDM. This may again be problematic and require regular review and update of the EDM and careful monitoring of the use of external data sources by the business functions. Corporate IT also have overall responsibility for IT security, cybersecurity and data protection. Recruiting a workforce with the requisite skills and know-how, and training the existing workforce to be resilient in the face of cyber-attacks, are current challenges. Interviewees reported that the appointment of a Chief Information Security Officer (CISO) is being discussed in some companies to take charge of these issues. Cars will be much more connected in the future, based on 5G networks, and new and different cybersecurity risks will arise that need to be addressed.

3.2.3. Summary

This new model for IT management is already being implemented in some automotive companies. Budget responsibility for IT projects and services is being transferred to business functions, and business process owners increasingly control the applications to be developed and the services to be delivered. Rather than emphasising the separation of business and IT, however, the model allows for distributed leadership with improved managerial processes for IT value creation. The previous orientation of the central IT function as a service provider is being replaced by a clearer role for Corporate IT as the provider of shared services and IT governance. This will allow shadow IT to be formally recognised and embedded as a core function of the business which empowers business lines to develop or attain all the IT competencies they need for their value creation. One of the most demanding challenges for Corporate IT governance is to find the right balance between the need for regulation on the one hand, and the required flexibility on the other, as strong formal IT governance practices may moderate, or reduce, the speed of digital transformation in the business lines. As concluded by Hsu et al. (2018, pp. 3-4) in the context of digitalization, “the transformation of IT departments should be considered part of a broader process of organizational transformation”, noting that “the transformation process is complex, chaotic, and dynamic, and may thus fashion a new form of cross-functional department”.

3.3. Are other Industry Sectors and Organisations Experiencing Similar Changes in the Management of IT? (RQ3)

In Phase 2 of the research, eight organisations of varying sizes and from a range of sectors (

Table 2) were contacted to ascertain to what extent digital technologies were deployed in the organisation, and the impact of digital transformation on the management of IT.

3.3.1. Digital Technology Deployment

Questionnaire responses indicated the wide adoption of the SMAC and BRAID technologies across the eight organisations (

Table 3). Social Media was used in all eight organisations, for a range of purposes mainly linked to marketing, recruitment and communications. For example, the IT director at C5 noted “marketing and global presence” as the main purpose of Social Media, whilst at C7, an aircraft maintenance, repair and overhaul (MRO) company, it was used for “image films and job offers within platforms like Facebook and Instagram.”

Mobile computing is also deployed in all these organisations for a range of purposes mainly related to field operations, data input for transaction processing, and at the mid-range university (C4) for “student engagement apps.” At the aircraft MRO business, the technology was used for “mobile teams at the customer for repair processes of aircraft engines.” Cloud was widely used for accessing systems and for data storage. At C4, they had “some hosted SaaS” applications, whilst C7 noted “data are stored in the Cloud for maintenance, repair and overhaul operations within a digital platform.” C2 had a “Cloud only approach” as part of its future IT strategy, whilst C8 were “migrating to Microsoft 365 during 2022,” but “Environmental, Health and Safety, HR [human resources], and CRM [customer relationship management] systems” were already Cloud-based. At C1, “Email and Intune” were accessed via the Cloud, and the company had a “plan to migrate further services to the Cloud in 2022-2023.”

Analytics and Big data were used in all organisations with the exception of C1 - a UK small to medium sized enterprise (SME), which assembles, sells and markets equipment for the elderly and disabled. Uses were aligned with the core business of these organisations and included “algorithms, forecasts, [and] cancellation predictions” (C6), “air quality measurements from over 100,000 devices” (C5), and “analysis of turbine spare parts” (C7). AI tools were used by six of the organisations, again for a similar range of applications, including “reduction of deviations during production” (C3), analysis of the hospitalization rate of clients (C6), and “automated paper documentation filing and route planning” (C1). IoT is also used in six of the organisations. In the aircraft MRO company (C7), IoT “digitizes product development and design processes,” and “the platform supports facility monitoring, automation and data-driven decision making.” At the semi-conductor manufacturer (C3), IoT has been deployed for “production automation and control” for the past 10 years, and at the university (C4) “building management IoT sensors” are deployed.

Five organisations are using robotics. At the aircraft MRO company (C7), it is “for maintenance, completions, repair, and overhaul of airplane parts,” and at manufacturers C3 and C5 “for material transfer and storage” and “process automation in manufacturing” respectively. At health insurance company C6, a somewhat different application is in evidence, robotics being used for “case management and payment of dental bills.” Digital fabrication/digital twin feature at the manufacturing companies, being used for “R&D prototyping” (C5), “smart factory based in the Cloud” (C2), and “engineering prototypes of applicators for surgical glue and sealant products” (C8). Only the two largest companies are deploying blockchain. At international conglomerate C2, blockchain is used for “logistics, pallet and container management,” whilst at the aircraft MRO company (C7), the respondent noted “blockchain technology makes the supply chain of aircraft components seamlessly and transparently documentable.” In summary, the findings suggest all organisations are engaged in digital technology deployment, and that, in some, this has been accompanied by significant changes in business processes and procedures.

3.3.2. The Impact of Digitalisation on the Management of IT

Respondents were asked about the impact of digitalisation on the management of IT in their organisation, and were offered four choices as set out in

Table 4. In four of the eight organisations, the IT respondent confirmed that digitalisation had been the catalyst for a major change in how the organisation operates, with the business lines now owning large elements of IT strategy development and implementation. Of these four organisations, three are in the manufacturing sector and the fourth is a health insurance company. The IT director at the Swiss manufacturing company (C5) saw this reallocation of responsibilities as the best way “to be early adopters of new technologies that lead us against our competitors in a global market. We want to use as many Cloud services as possible according to our global IT architecture and security policies, especially for our air quality data.” At the aircraft MRO company (C7), the respondent noted that “a new business area - Digital Fleet Solutions - was founded in 2017 to promote digitization,” and that this was the catalyst for a change in the management of IT. At the healthcare insurance company (C6), the respondent highlighted the growing significance of robotic process automation for a range of activities across the company as the main driver of change in the ownership of IT.

In contrast, the IT Director at the medical products company (C8) considered that digitalisation had had no major impact on the ownership of IT, noting “digital technologies are deployed to fulfil a need which is driven by the business. IT is an enabler and supporter for the requirements, rather than a driver.” However, the IT Director at the mid-range university (C4) considered that digitalisation had required a significant re-think of strategy (rather than a wider change in how the organisation operates), and observed that “the university increasingly depends on digital solutions to operate the business, to deliver high quality teaching and learning, and to support excellent research,” and that “IT systems are now considered one of the key pillars to enable successful delivery of the organisation’s strategy, alongside people, finance, estates and governance.”

Two companies offered alternative views on how the management of IT had been impacted by digitalisation. At the UK SME (C1), the IT manager highlighted the impact of COVID and a subsequent cyberattack as key issues that have prevented any serious consideration of changing responsibilities for IT management. He concluded that “digitalisation as a concept has been utilised to fight COVID-19, but existing plans were, and continue to be, disrupted.” A similar picture was in evidence at the semi-conductor company, where the IT department “struggle with hidden IT solutions and other legacy tools which are still critical for production. Hence, the IT strategy is still rather conservative.” At these two companies, digitalisation does not appear to have had any major impact on how IT is managed to date.

4. Discussion

The results derived from Phases 1 and 2 of this research raise some issues worthy of further discussion. Firstly, as regards the German automotive industry, there is a significant knowledge deficit as regards that required for successful transitioning to a new model of IT management. In the Corporate IT function, new skillsets and capabilities will be required in establishing their revised role as part of company-wide digitalisation, being less concerned with resource management but acting more as a guardian of company-wide governance functions. Corporate IT need to proactively manage and navigate the transition process of shifting roles, competencies and responsibilities to the Business IT Competence Centres. Changes in sourcing management, which involve mutual dependencies and relationships between the IT organisation and the business functions, will need careful management to ensure a balanced transformation process. Another key challenge requiring new skills will be to design and implement an alignment structure for corporate governance which is particularly important since all partners will be pursuing their individual business agendas. P13 stressed that in the future, IT executives must be better able to communicate the value of digital technologies for the future of the organisation. They must have the appropriate vision and be able to articulate it in the context of the digital transformation of the company.

Secondly, there are clearly risks involved in such a transition. Despite the problems with multiple versions of mainstream ERP packages evidenced in the interviews, many companies - within the automotive sector and outside of it - have achieved hard-won standardisation and consolidation of IT applications and infrastructures since the turn of the century, which may be threatened by the new autonomy of the business functions. The re-distribution of IT tasks and responsibilities could complicate and delay compliance with new corporate standards for digital technology deployment, which may result in sub-optimal technology implementation and higher cost of ownership. Of particular importance will be agreeing standards and structures for data integration and adherence to the EDM so that different technologies can communicate with each other and have access to common data bases. Another dynamic that needs careful management is the fast pace of technology evolution – what are currently seen as competition-differentiating technologies will become commoditised in the future and will then be managed by Corporate IT.

Thirdly, the model developed in this research is more specific than existing literature (e.g., Urbach & Ahlemann, 2016; Schröder & Müller, 2017) as regards the reallocation of roles and responsibilities, and although it was developed from interview evidence from the German automotive industry, findings from the eight organisations interviewed in Phase 2 suggest this may be a blueprint that some other industries will adopt. Ismail et al. (2017) noted that digital transformation will likely involve the introduction of new digitally enabled products or services, and evidence from Phase 2 of the research suggests this is a key driver of the transition to greater user ownership of IT. In the four organisations in which there was perceived to be a major change in operations, with user functions now owning large elements of IT strategy development and implementation, digital technologies had already had a major impact on, and were integral to, the organisations’ products or services. At company C2, a multi-national manufacturing conglomerate, digital technologies were already used and integrated within the company’s products. At C7, the aircraft MRO company, digital technologies - notably analytics, AI, mobile and robotics - were embedded in their replacement products and in their services. Indeed, the respondent noted that the company’s main strategic objective was now to pursue “mobile solutions and digitalisation.” These two companies – the two largest of the eight studied – were the only two where all nine of the listed technologies were deployed. At C5 – a manufacturer of air purification systems – digital technologies were integral to their products and services, including the use of IoT and analytics for air quality measurement devices, AI for air quality predictions and forecasts, mobile computing in the company’s AirQuality app, and robotics for process automation in manufacturing. At the health insurance company (C6), robotics were used in many areas of the company for customer service enhancement and support. So here in this latter case, it was the service-oriented processes of the company, and notably the interface with the customer, rather than in its products, in which digital technologies were embedded. In these four organisations, the management of IT has already changed and moved towards the business user functions. In the other four organisations, although digital technologies were reasonably widely deployed, there was little direct impact on their products and services, and the ownership of IT remains largely in the central IT function.

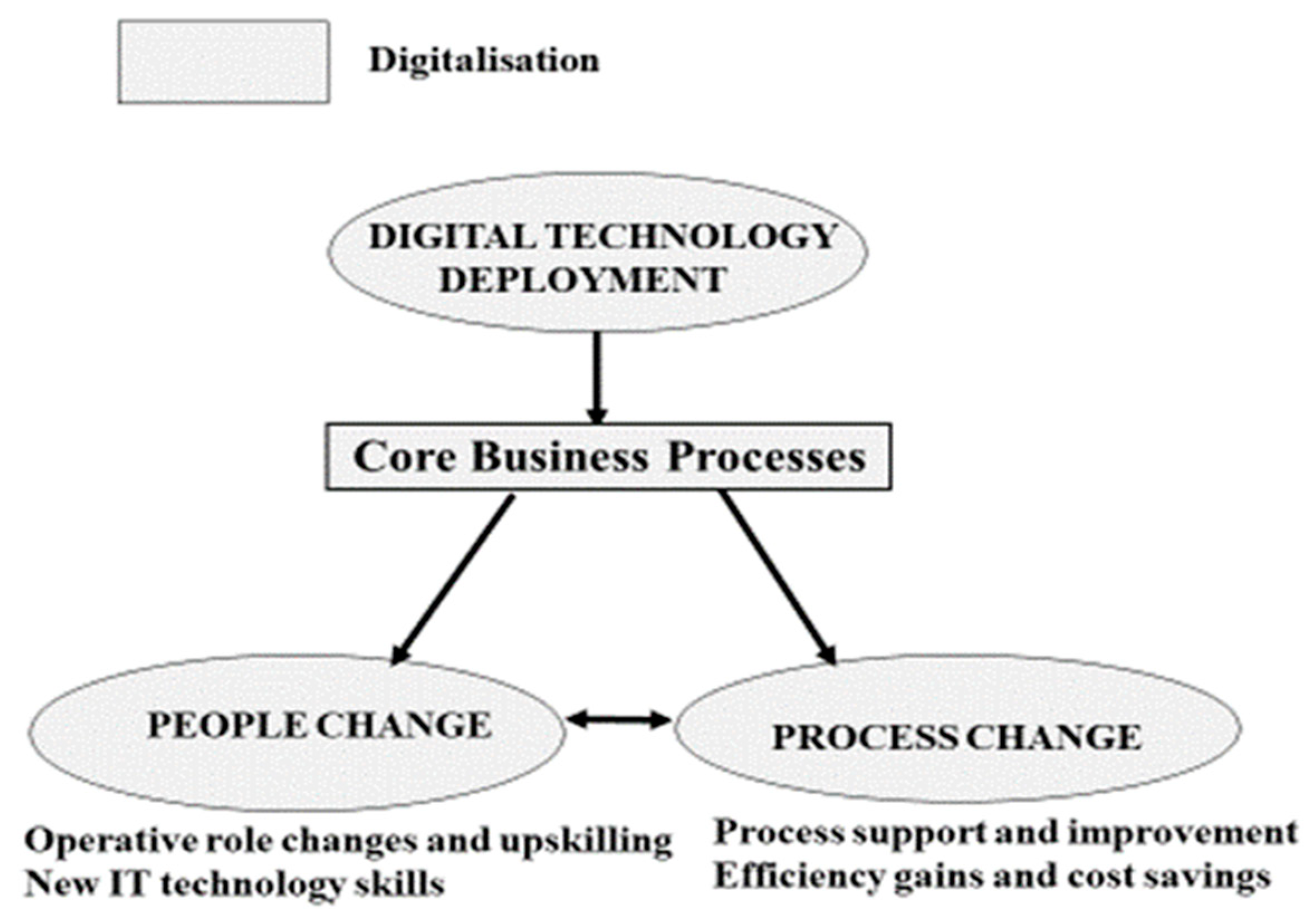

Fourthly, these results contribute to the development of theory regarding digitalisation, digital transformation and IT strategy. Hitherto, models of information technology adoption and strategy development have often had three main elements, relating to the technology itself, business processes - which are often reengineered as a result of technology implementation (sometimes combined with organisational or structural change) - and people skills and competencies, which are impacted both by the new technologies and the resultant changes in working practices. These three dimensions of change are evident, for example, in models of ERP implementation (Wynn & Rezaeian, 2015), and in the TOE (DePietro et al., 1990) and UTAUT (Venkatesh et al., 2016) models of technology adoption, which have been used in many research studies (e.g., Van Dyk & Van Belle, 2019; Faloye, 2014). Hitherto, the main impact of new technology has been on the processes of an organisation, with expected benefits that include greater efficiencies, lower costs and better customer service. Process owners were identified within the ranks of business line management to oversee process change; and data ownership and maintenance has also been in the main moved out of the IT function into end-user departments (

Figure 3).

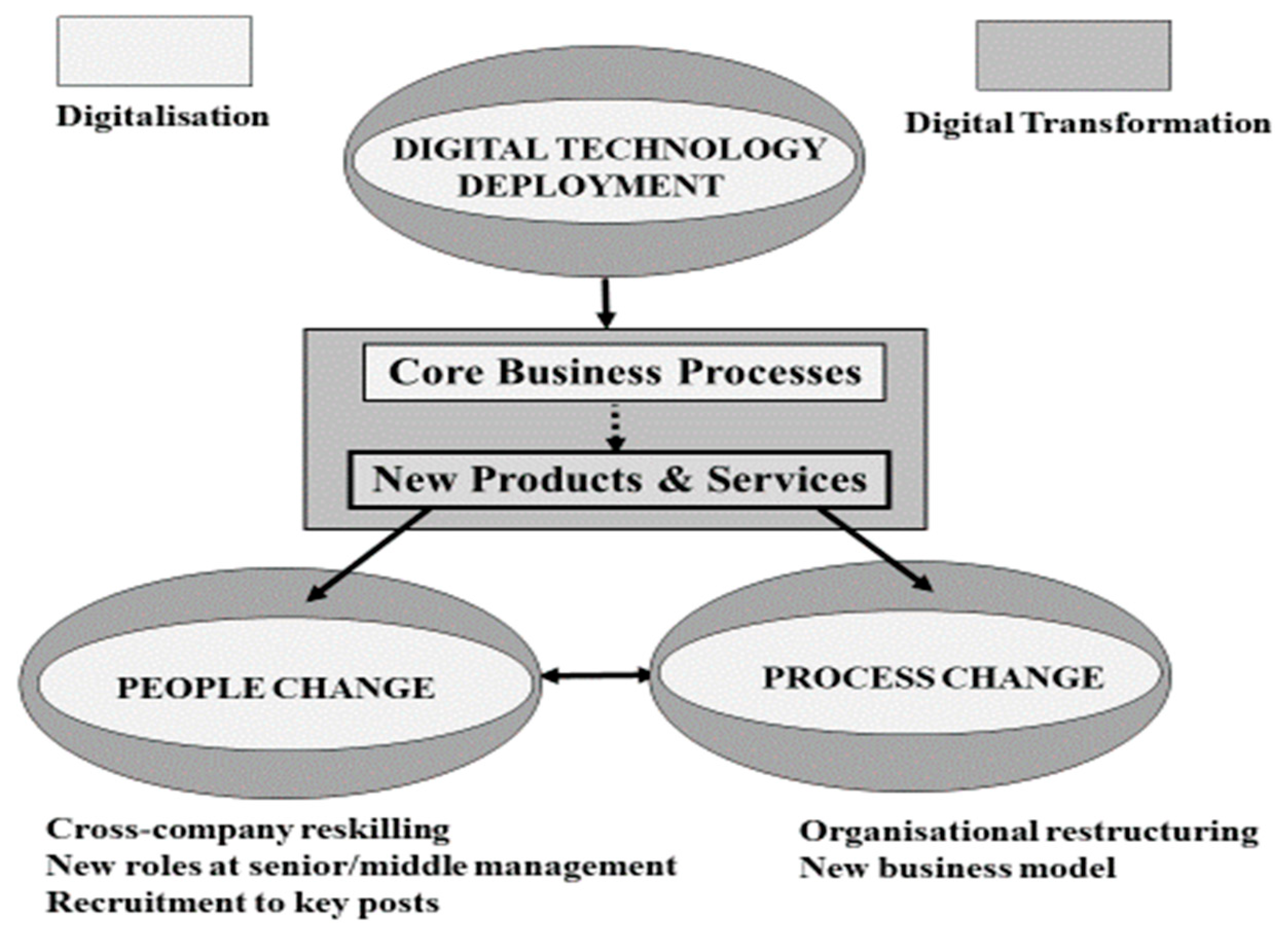

With digital transformation, a key difference is the deployment of digital technologies within the products or services offered by the organisation. When this happens, digitalisation becomes digital transformation, sparking significant additional change in business processes and people competencies, that may in some cases constitute the transitioning to a new business model (

Figure 4). The management of IT is part of this intensified change process: the more that digital technologies are deployed in the company’s products or services, the greater will be the transition of IT roles and responsibilities out of central IT and into the business lines. Technology ownership will be added to process and data ownership as business line management roles, as evidenced in the Business Line Competency Centres discussed above in the context of the German automotive industry.

5. Conclusions

Digitalisation in the German automotive industry has produced new technology environments that will be central to determining the future business success of the industry. The requirement for digital innovations and IT solutions goes far beyond the traditional strengths and competencies of the automotive industry. Automotive companies have to decide how to re-position their core competencies within the transition from a product-centric business model to a software-enabled car company and mobility service provider. As Van Alstyne and Parker (2021) note, “executives must understand and undertake partner relationship management, partner data management, partner product management, platform governance, and platform strategy” (para. 1).

There are clearly limitations to this study. Phase 1 findings were based on interviews with expert practitioners in the German automotive industry. Most other automotive industries world-wide (with the exception of the TESLA company) are subject to the same change dynamics, and it seems reasonable to generalise about the automotive industry in general as regards the change in the management of IT. Beyond this industry sector, evidence from the interviews with IT professionals undertaken in Phase 2 provides a snapshot of the situation in some other sectors. Although the number of interviewees was limited to eight, and just one from each organisation, the findings suggest the model for the future management of IT in the German automotive industry will likely be relevant to those organisations where digital technologies are an essential part of the product, or are directly and deeply involved in the value creation process, notably in the provision of services at the customer interface (e.g., by the use of chatbots and AI). This reallocation of IT roles and responsibilities can be seen as one element of digital transformation that entails a wider set of transitions in the process and people dimensions of digital technology deployment.

This points to some possible avenues for future investigation. Further research into industries where digital technologies are now embedded in company products or services could assess if the transition in the management of IT, reported upon here, is in evidence, and provide the basis for review and refinement of the model put forward here. This would allow further assessment of the significance of the deployment of digital technologies within the product or services of an organisation as the catalyst for digital transformation. The role of specific digital technologies could also be identified and researched, to determine which of the SMAC and BRAID technologies, if any, play the leading role in sparking digital transformation, and how this may differ in different industry sectors or business environments. Collectively, such initiatives could help develop the fledgling theoretical strands associated with digitalisation and digital transformation.

Author Contributions

Conceptualization, M.W. and K.F.; methodology, M.W. and K.F; validation, M.W. and K.F; formal analysis, M.W. and K.F.; investigation, M.W. and K.F.; data curation, M.W. and K.F.; writing—original draft preparation, M.W. and K.F.; writing—review and editing, M.W. and K.F.; visualization, M.W. and K.F.; supervision, M.W.; project administration, M.W. and K.F.; All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Interview transcripts and questionnaire returns are held by the authors but because of confidentiality cannot be put in the public domain.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Alt, R., Leimeister, J., Priemuth, T., Sachse, S., Urbach, N., & Wunderlich, N. (2020). Software-Defined Business. Business & Information Systems Engineering, 62(6), 609-621. [CrossRef]

- Bell, E., Bryman, A., & Harley, B. (2018). Business Research Methods. Oxford University Press. [CrossRef]

- Bergmann, P. (2019). Die IT-Abteilung in der klassischen Form ist ein Auslaufmodell [In English: The IT department in its traditional form is a discontinued model]. HMD Praxis der Wirtschaftsinformatik, 56(2), 370-384.

- Boes, A., & Ziegler, A. (2021). Umbruch in der Automobilindustrie: Analysen der Strategien von Schlüsselunternehmen an der Schwelle zur Informationsökonomie [In English: Upheaval in the Automotive Industry: Analyses of the Strategies of Key Companies on the Threshold of the Information Economy]. ISF München. [CrossRef]

- Brenner, W., Györy, A., Pirouz, M., & Uebernickel, F. (2011). Bewusster Einsatz von Schatten-IT: Sicherheit & Innovationsförderung [In English: Deliberate use of shadow IT: security and innovation issues]. Institut für Wirtschaftsinformatik, Universität St. Gallen.

- Czernich, N., Falck, O., Erer, M., Keveloh, K., & Muineacháin, S. O. (2021). Transformation in der Automobilindustrie–welche Kompetenzen sind gefragt? [In English: Transformation in the automotive industry - what skills are needed?]. Available online: https://www.ifo.de/DocDL/sd-2021-12-digital-czernich-etal-kompetenzen-autoindustrie.pdf.

- DePietro, R., Wiarda, E., & Fleischer, M. (1990). The context for change: Organization, technology and environment. In L. Tornatzky & M. Fleischer (Eds.), The processes of technological innovation, (pp. 151-175). Lexington, MA: Lexington Books.

- Faloye, D. O. (2014). The adoption of e-commerce in small businesses: an empirical evidence from retail sector in Nigeria. Journal of Business and Retail Management Research, 8(2), 54–65.

- Felser, K. (2022). Evolving IT Sourcing Strategies in the German Automotive Industry: A Blueprint for Managing Transition. PhD thesis, University of Gloucestershire. [CrossRef]

- Felser, K., & Wynn, M. (2023). Managing the Knowledge Deficit in the German Automotive Industry. Knowledge, 3(2), 180-195. [CrossRef]

- Gerth, T., & Peppard, J. (2020). Taking the Reins as CIO: A Blueprint for Leadership Transitions. Springer Nature. [CrossRef]

- Grimm, A., Doll, C., Hacker, F., & Minnich, L. (2020). Nachhaltige Automobilwirtschaft: Strategien für eine erfolgreiche Transformation [In English: Sustainable automotive industry: Strategies for a successful transformation]. Sustainability and Innovation Working Paper, No. S19/2020. Karlsruhe: Fraunhofer ISI.

- Hsu, C-C., Tsaih, R.-H., & Yen, D.C. (2018). The Evolving Role of IT Departments in Digital Transformation. Sustainability, 10(10), 1-18. [CrossRef]

- Infosys (2020). Daimler and Infosys Announce Strategic Partnership to Drive Hybrid Cloud-powered Innovation & IT Infrastructure Transformation in the Automotive Sector. Available online: https://www.infosys.com/newsroom/press-releases/2020/partnership-hybrid-cloud-powered-innovation.html#:~:text=The%20partnership%20will%20enable%20the,and%20Infosys%2C%20its%20automotive%20expertise.

- Ismail M. H., Khater, M., & Zaki, M. (2018). Digital Business Transformation and Strategy: What Do We Know So Far? Working Paper. University of Cambridge/ Cambridge Service Alliance. [CrossRef]

- Jackson, M. (2020, June 30). 5 digital transformation strategies embracing the new normal. TechTarget/SearchCIO. Available online: https://searchcio.techtarget.com/feature/5-digital-transformation-strategies-embracing-the-new-normal?src=6434693&asrc=EM_ERU_133368381&utm_medium=EM&utm_source=ERU&utm_campaign=20200817_ERU%20Transmission%20for%2008/17/2020%20(UserUniverse:%20300539)&utm_content=eru-rd2-rcpC.

- Kirvan, P. (2021, March 8). Build a digital transformation roadmap in 6 steps. TechTarget/SearchCIO. Available online: https://searchcio.techtarget.com/tip/How-to-build-a-digital-transformation-roadmap-in-6-steps.

- Kopper, A., Strahringer, S., & Westner, M. (2018). Kontrollierte Nutzung von Schatten-IT [In English: Controlled use of Shadow-IT]. In M. Knoll, & S. Strahringer (Eds.) IT- GRC management–governance, risk und compliance: basics and applications, (pp. 129-150). Wiesbaden: Springer-Verlag. [CrossRef]

- Liebe, P. (2020). The different Roles of the Chief Information Officer (CIO) – A systematic Literature Review. In Seminar IT-Management in the Digital Age. FH Wedel. Available online: https://www.fh-wedel.de/fileadmin/Mitarbeiter/Records/Liebe_2020_-_The_different_Roles_of_the_Chief_Information_Officer__CIO__-_A_systematic_Literature_Review.pdf.

- mbaSkool (2023). Top Ten Car Brands in the World 2023. Available online: https://www.mbaskool.com/business-lists/top-brands/17621-top-10-car-brands-in-the-world.html.

- Pratt, M, & Sparapani, J. (2021). Digital Transformation. TechTarget/SearchCIO. Available online: https://searchcio.techtarget.com/definition/digital-transformation.

- Procurious (2016). How 9 Technologies Will Drive Global Supply Chain Disruption. Available online: https://www.procurious.com/procurement-news/9-technologies-supply-chain-disruption.

- Sandelowski, M. (1998). Writing a good read: Strategies for re-presenting qualitative data. Research in Nursing & Health, 21(4), 375-382.

- Schröder, H., & Müller, A. (2017). IT-Organisation in der digitalen Transformation [In English: IT organisation in digital transformation]. Springer Fachmedien. [CrossRef]

- Simonazzi, A., Sanginés, J. C., & Russo, M. (2020). The Future of the Automotive Industry: Dangerous Challenges or New Life for a Saturated Market? Working Paper No. 141. New York: Institute for New Economic Thinking.

- Singh, A., & Hess, T. (2020). How Chief Digital Officers promote the Digital Transformation of their Companies? In R. Galliers, D. Leidner, & B. Simeonova (Eds.), Strategic Information Management: Theory and Practice, (pp. 202-220). New York: Routledge.

- Singh, A., Barthel, P., & Hess, T. (2017). Der CDO als Komplement zum CIO [In English: The CDO as a complement to the CIO]. Wirtschaftsinformatik & Management, 9(1), 38-47.

- Stockhinger, J., & Teubner, A. (2019). How digitalization drives the IT/IS strategy agenda. ERCIS Working Paper No. 31. Westfälische Wilhelms-Universität Münster, European Research Center for Information Systems (ERCIS), Münster, Germany.

- Tabrizi, B., Lam, E., Girard, K., & Irvin, V. (2019, March 13). Digital Transformation is not about Technology. Harvard Business Review. Available online: https://hbr.org/2019/03/digital-transformation-is-not-about-technology.

- Tonder, C., Schachtebeck, C., Nieuwenhuizen, C. and Bossink, B. (2020) A framework for digital transformation and business model innovation. Management, 25(2), 111-132. [CrossRef]

- Tucci L. (2021, March 10). Ultimate guide to digital transformation for enterprise leaders. TechTarget/SearchCIO. Available online: https://searchcio.techtarget.com/feature/Ultimate-guide-to-digital-transformation-for-enterprise-leaders.

- Urbach, N., & Ahlemann, F. (2016). IT-Management im Zeitalter der Digitalisierung [In English: IT Management in the Digital Age]. Berlin Heidelberg: Springer Gabler. [CrossRef]

- Van Alstyne, M.W., & Parker, G.G. (2021). Digital Transformation Changes How Companies Create Value. Harvard Business Review. Available online: https://hbr.org/2021/12/digital-transformation-changes-how-companies-create-value.

- Van Dyk, R., & Van Belle, J.-P. (2019). Factors Influencing the Intended Adoption of Digital Transformation: A South African Case Study. In Proceedings of the Federated Conference on Computer Science and Information Systems, 18 (pp. 519–528). ISSN 2300-5963 ACSIS. [CrossRef]

- Venkatesh, V., Thong, J., & Xu, X. (2016). Unified Theory of Acceptance and Use of Technology: A Synthesis and the Road Ahead. Journal of the Association for Information Systems, 17(5). Available online: https://aisel.aisnet.org/jais/vol17/iss5/1. [CrossRef]

- Wynn, M. (2022). Conclusion: Digital Transformation and IT Strategy. In M. Wynn (Ed.), Handbook of Research on Digital Transformation, Industry Use Cases, and the Impact of Disruptive Technologies, (pp. 409-421). Hershey, USA: IGI-Global. Available online: https://eprints.glos.ac.uk/10126/.

- Wynn, M., & Rezaeian, M. (2015). ERP implementation in manufacturing SMEs: Lessons from the Knowledge Transfer Partnership scheme. InImpact: The Journal of Innovation Impact, 8(1), 75-92. Available online: https://eprints.glos.ac.uk/2930/.

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).