1. Introduction

The concept of electrification of all transportation systems has been rapidly evolving worldwide. Technological innovation in the transportation sector has made it possible to give this concept a real shape [

6]. Many contenders had derided Toyota when they launched the first hybrid vehicle (Prius) in 1997 [

7]. In 2003, Elon Musk started Tesla from ground zero because of the groundbreaking design and development work he was putting into the powertrain units for his vehicles. It took five years, but Tesla made phenomenally fast progress in the completely new territory. Tesla was not a prior manufacturer that had to diversify to survive but an entrepreneurial startup that did not follow traditional methods of the automotive manufacturer and came into being to fulfill an intuitively perceived need. Tesla has become the role model of modern electric vehicle development and also the developer of high-performance storage and recharging systems for electrified conveyance. Tesla develops and commercializes integrated system solutions, electric cars, charging infrastructure, and batteries for their vehicles and energy storage. Tesla demonstrates a total system solution approach.

Some of the significant issues, like the growing environmental warnings, increased pollution problem, and struggle for global market share, forced the transformation of traditional internal combustion engine (ICE) manufacturers towards electrification of the entire automotive and transportation industry. Also, the old successful, and prestigious European automakers such as Mercedes, BMW, Audi, and Volvo cars were finally forced to go electric due to decisive political pressure, new regulations, and new expectations from lawmakers, markets, and customers. Now in 2021, also the most prestigious brands such as Bentley, Porsche, Rolls-Royce, and Jaguar and super brands such as Ferrari and others are adopting electrical solutions with the increasing global awareness of the necessity for all nations to reduce their carbon footprint, nobody can afford to resist moving towards electrification of transport. One of the challenges is not ‘if’ but rather how fast the old automotive industries can transform successfully. The main question will be whether old established brands or newcomers will take the dominant positions in the coming electric vehicles (EVs).

Some countries such as China, Norway, and Sweden have already taken the initiative to an innovative approach to redesigning their governmental policies that supports the diffusion of the developed electrified transport systems (electric vehicles and charging infrastructure are seen as an entire system). Some countries are still in the early stages of development and are moving towards electric transportation systems at a slow-paced whereas others are being rapidly left behind as they are still waiting and wanting to evaluate the success rate of the adoption of all forms of electrified conveyance. The other challenge is which government will ‘grasp the nettle’ and steer its nation to a position where its citizens accept all necessary initial expenditures and introduce firmly resolved policymaking to ensure that all dimensions of the electrification of transport systems proceed in an expedient manner. Thus, the electrification of transport is becoming a political tool for global competition and battling the environmental consequences of fossil energy.

In this modern era, the technology used in electric vehicles is widely commercially available and possible to obtain in the Asian, European, and US markets as a commodity. The primary understanding is to know which countries are the buyers and which are the manufacturers, i.e., value creators and wealth distributors, and which countries have the capacity to develop the entire value chain in each country that brings value to the government, industry, and wealth to the people. Electrification of transport is a complex system associated with energy sourcing and distribution sub-systems all the way to electricity consumption [

8,

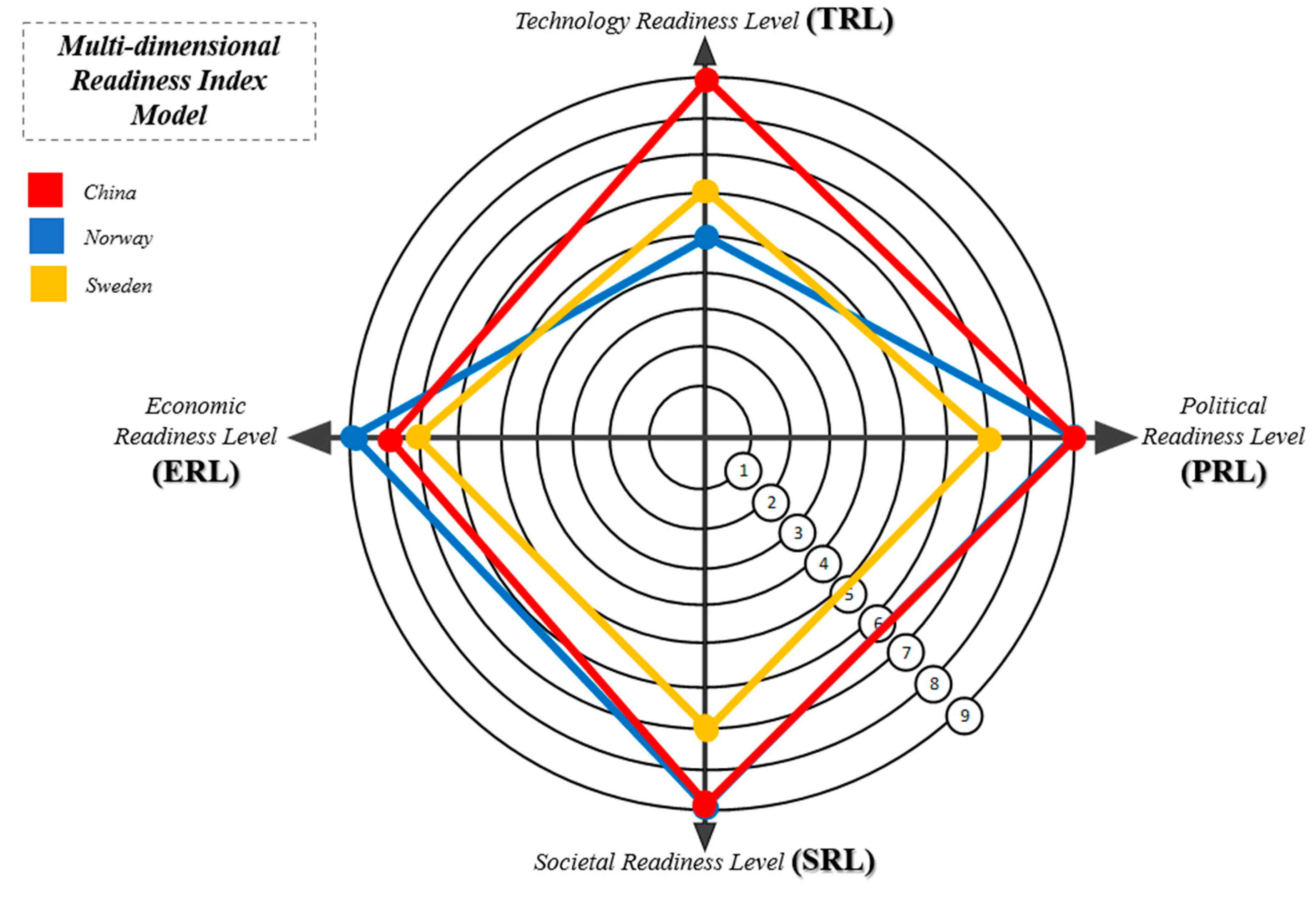

9]. The entire transport electrification system is interrelated and interdependent on technology, industrial politics, economic conditions, political and societal domains, and the global competition for controlling market shares. To understand the content and consequences of electrification and handle this transformation, it is necessary to observe, analyze and evaluate the interconnectivity of readiness levels of all four domains (technology, political, societal, and economy) of the electrification of the transportation system.

Thus, we aim to explore and understand how these factors influence the readiness of each country to go in the electrical direction of the transportation system. Also, we hope that our multidimensional readiness index model can serve and support policymakers in different countries to speed up the electrification process for the benefit of the environment and citizens of the world.

This paper aims to develop a readiness index model embedded with four dimensions, i.e., technology, political, societal, and economic. The idea of technology readiness is adopted from NASA, while the other three dimensions are empirically derived from our research on electrification of transportation system. Together these four dimensions form the readiness index model that we have used to i) analyze the development progress, ii) evaluate the readiness maturity level, and iii) determine the transitioning position of China, Norway, and Sweden in the electrification of transport. This paper also aims to that the ‘multidimensional readiness index model’ can assist decision-makers in identifying the essential and practical dimensions that can support the process of transforming the transportation system towards electrification.

2. Research Approach

We have selected China, Norway, and Sweden as empirical grounds to explore their approaches to the electrification of transport, analyze the different conditions and contextual aspects of importance for electrification or transport to identify major critical dimensions, and to design the proposed multidimensional readiness index model. China has been chosen as it is today the dominant and leading country in the electrification of transport equipment and systems. Norway as one of the most electrified transport countries globally, and Sweden as one country with ambitions to become one of the world-leading countries in the electrification of transport. The selected countries are characterized by their ambitions to diligently pursue the electrification of transport and our explicit understanding of their development directions, although they might choose different paths.

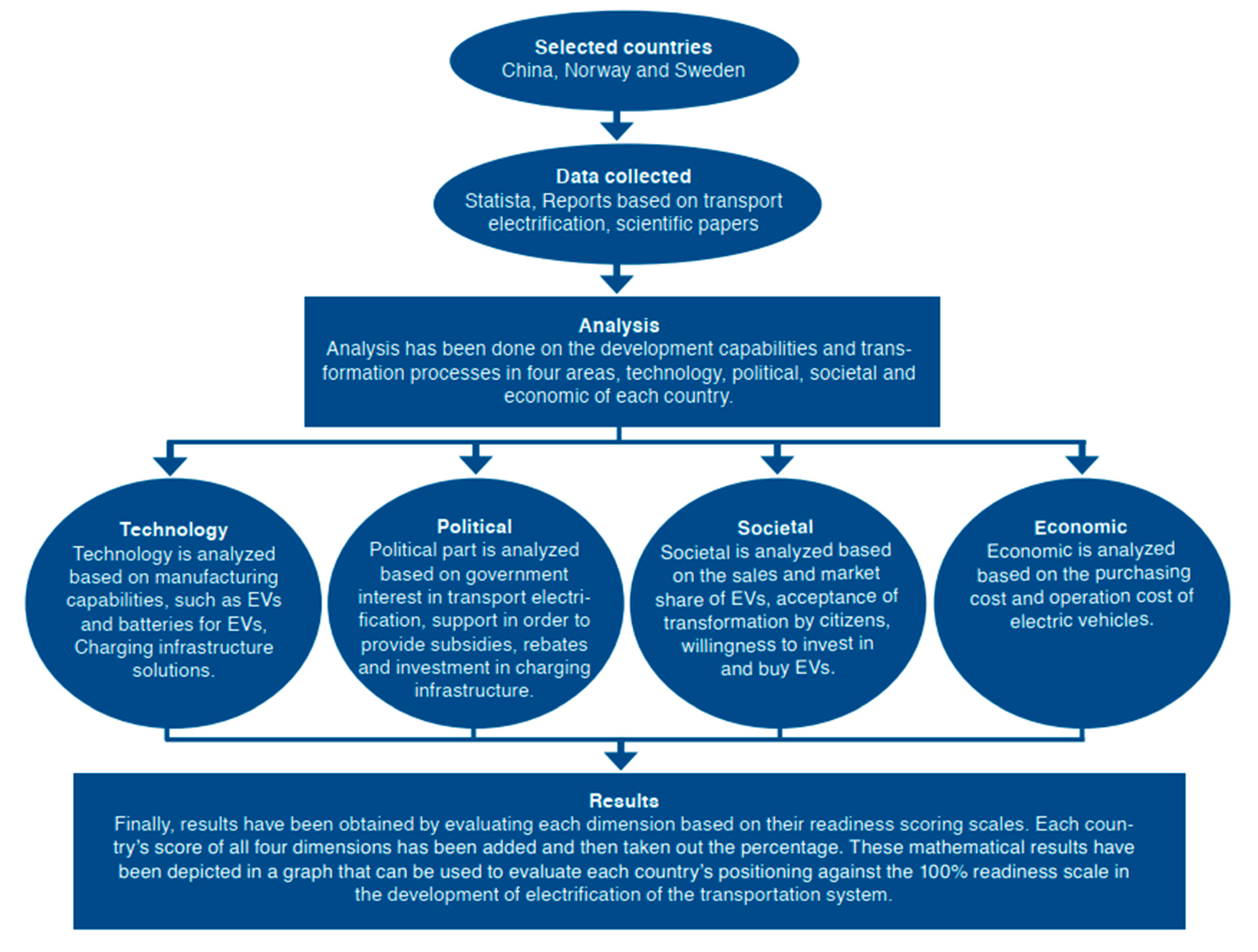

Figure 1 represents the procedure of research followed in this paper to obtain results that show the readiness of China, Norway, and Sweden in the area of transport electrification.

Our research on electrification of transport systems has been conducted from a system perspective and the research approach is based on a collection of secondary material from databases, journals, and publications. We have collected and analyzed the data of each country based on their technology, political, societal, and economic capability, decisions, and actions towards the electrification of transport. Technology is analyzed based on the vehicle 'EVs' and 'EVs batteries' manufacturing capabilities and charging infrastructure solutions. Political is interpreted based on government interest and demonstrated actions in the transport electrification, government support to provide subsidies and rebates to EVs buyers and EVs manufacturers and investment in charging infrastructure solutions. Societal is analyzed based on the sales and market share of EVs and the willingness of citizens to adopt EVs. Economic is analyzed based on the economic conditions for diffusion of EVs, purchasing and charging cost, the operational cost of EVs and government subsidiary to support the diffusion of EVs.

The main focus of this research is on passenger vehicles, although there are many vehicles such as motorcycles, two and three-wheelers, trucks, and buses. The development of heavy-duty vehicles, trucks, and buses has recently become commercially available worldwide. Two-wheelers are very common in Asia and emerging countries but not in developed countries. The attention in the electrification of transport from media and decision-makers has been directed to passenger vehicles. For the reasons of development phases of passenger vehicles and the great attention as the leading automotive industry, our focus has been chosen to be passenger vehicles. We have reasons to believe that the readiness model we have developed based on our research of passenger vehicles also can be used for other electrified vehicles. Also, trucks and buses as those aspects included in the readiness analysis and the model are valid for all other electric vehicles, although the commercial context differs.

To examine each country's technology readiness capabilities, we have used NASA's original model estimating the technological readiness while developing rockets to the moon program as the technological challenges were the most prevailing at that time. The decision to go to the moon was political and it was embedded in the US politics, supported by the public side and economy was not considered as restriction. The remaining challenges were technology related.

Thus, the moon project served as inspiration, but in the case of electrification of transport, the other three dimensions political, societal, and economic emerged from our previous research on the electrification of transport. In our studies of electrification of transport in China and in Sweden, we have noticed that while technology is getting high attention the other dimensions have high impact on the outcome and speed of the electrification [

10,

11,

12]. In the case of electrification of transport these dimensions cannot be taken for granted, rather they must be explored, understood, and put into practice to support ongoing transformation of transport electrification.

Our research has developed a ‘multidimensional readiness index model’ that enables us to explore and understand any transport mode, including flight and shipping. But for this research, we have applied the model to China, Norway, and Sweden to evaluate the development progress of these countries in their electrification of transportation systems. We have also developed and classified the political and economic readiness levels based on empirical observations. For societal readiness levels, we have been inspired by the European societal readiness levels [

2] but adopted them based on our need that focuses on the adoption of electric vehicles by society. The pattern of each readiness scale that looks like a thermometer has been adopted from the “KTH Innovation Readiness Level.” Each readiness dimension is divided on a scale between 1 and 9. Each of the 1-9 levels shows a certain level of readiness; the 9

th level shows the highest readiness scoring, whereas the 1

st level shows the lowest readiness scoring of the countries in the electrification of the transportation system.

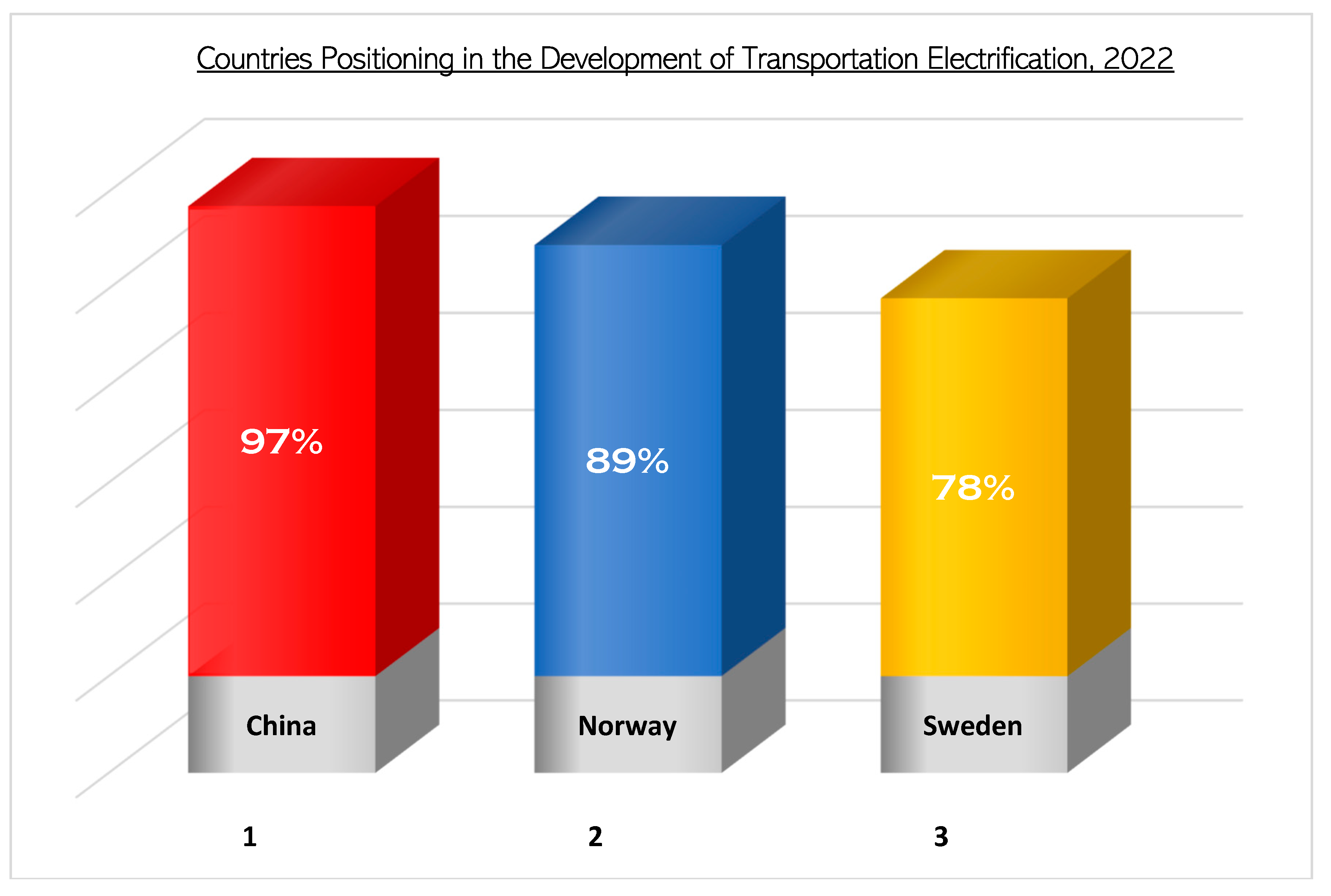

Finally, results have been obtained by evaluating each dimension based on their readiness scoring scales. The score of all dimensions (technology, political, societal, and economic) of each country has been summed up (Σ) and taken out as the percentage (%) by dividing the total score as shown in

Table 5 of the fifth section, i.e., discussion. These mathematical results have been used to plot a graph, as shown in figure 11 in section 5, which shows the positioning of each country in the development of electrification of the transportation system.

The proposed four-dimensional readiness index scales are tentative and should be further developed, elaborated, and thoroughly tested. As the diffusion of transport electrification continues, new technologies will be launched, and new experiences will be developed, thus creating reasons for re-evaluation of the scales of political, societal, and economic readiness to achieve high maturity levels.

3. Development of Multidimensional Readiness Index Model

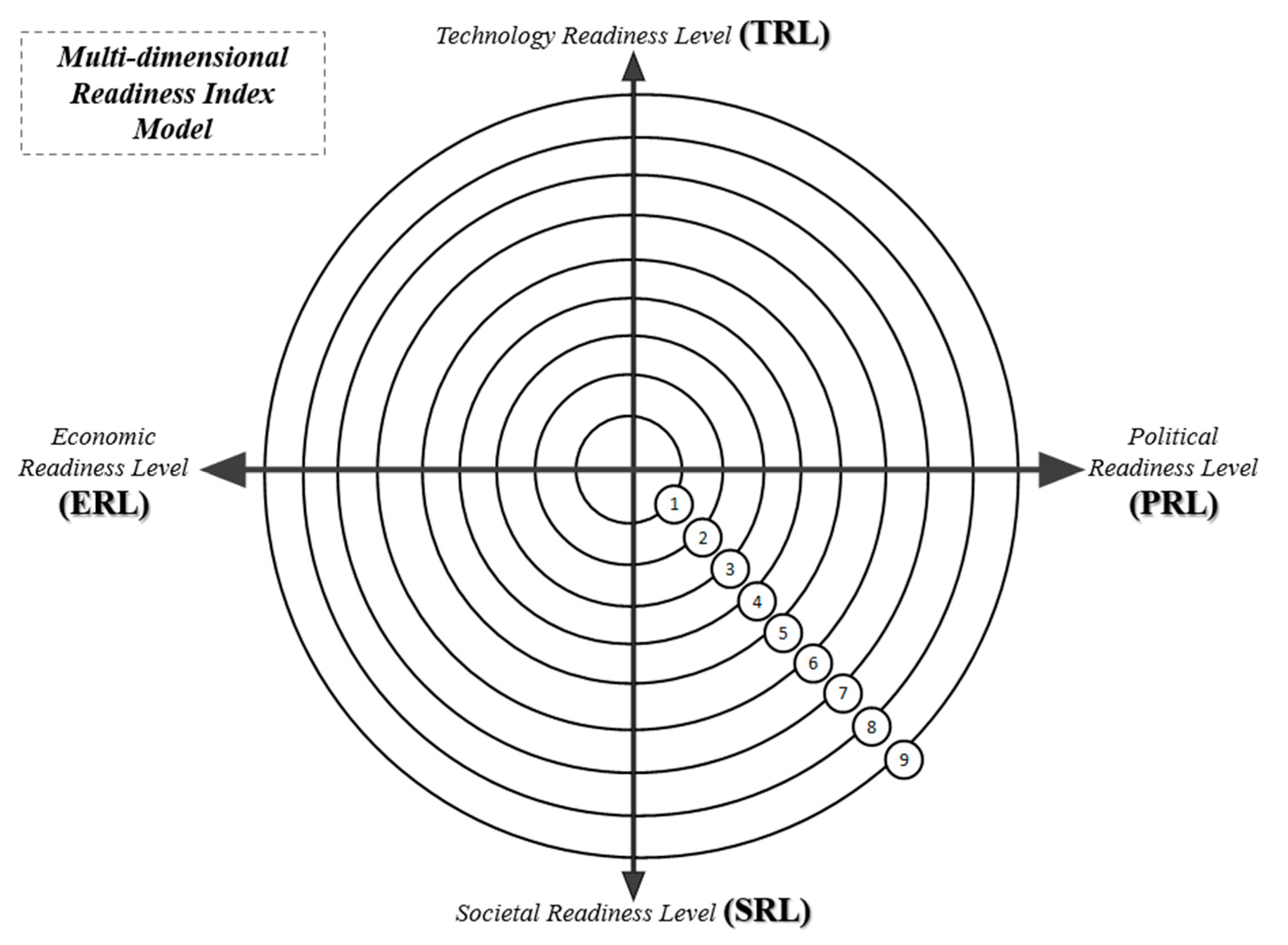

The multidimensional readiness index model is basically sourced from the technology readiness level (TRL) introduced by the National Aeronautics and Space Administration (NASA) in the early 1970s. The multidimensional readiness approach consists of four dimensions, technology readiness (TRL), political readiness (PRL), societal readiness (SRL), and economic readiness levels (ERL). These four dimensions form a web and, therefore, create a whole system where no one can be left out to gather a broader understanding of the electrification of the transportation system [

10], as shown in

Figure 2.

We have adopted an innovation perspective to examine the TRL and explore other key components to understand and incorporate into a system approach. Generally, the term ‘innovation’ refers to the introduction of new or recombined ideas or methods, however in the context of this analysis, ‘innovation’ is also about using technology to succeed with the commercialization, value creation, and diffusion in the society via a suitable business model. The technological element is merely one of the essential dimensions of the business concept. The technology requires a proper and relevant context to be embedded and integrated for its commercialization. Economic, societal, and political acceptance are the main elements needed for a potential technological solution to become a successful innovation accepted by a majority of the market. When it comes to some of the most successful innovations in our society, such as fast trains, airplanes, electric vehicles, and smartphones, we can see that they are all rooted in the political, economic, social, and socio-cultural contexts of their respective eras.

The diffusion and deployment of technologies are based on social acceptance; without socially being accepted, technology for technologies’ sake will face endless public resistance. It will be difficult to achieve commercial success for technology and attract investment and partners if political, institutional, and regulatory players do not support it. Therefore, the acceptance of developed technologies needs to be observed and examined in the context of a complex web of interactions that includes technical, political, societal, and economic elements.

Thus, the technology readiness levels can be used to evaluate the readiness of technology. The political readiness levels express the dedication and willingness of the government to adopt and promote the technology in the country. The societal readiness levels show the technology's adoption rate, and the technology has been supported by society. The economic readiness levels demonstrate the affordability of the technology for the buyers to consume the product. Thus, all the readiness levels are interdependent and interrelated to each other. However, the role of the political readiness levels is the most significant in holding all the other three readiness levels in one net to support the transformation.

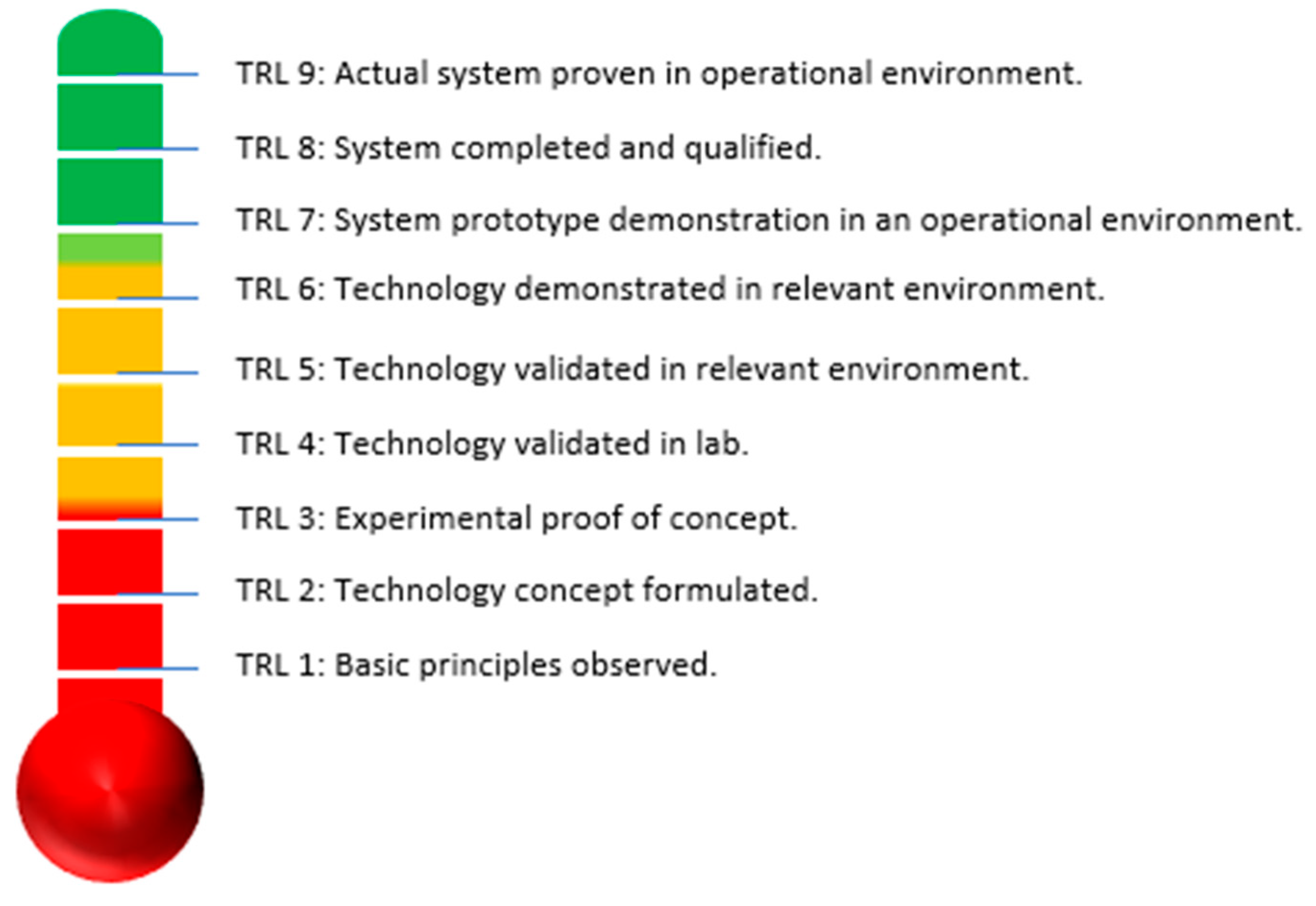

3.1. Technology Readiness Levels (TRL)

Technology readiness level (TRL) is an approach for conducting a logical analysis, assessment, and decision-making process when selecting an appropriate technological solution based on maturity of technologies. TRL has become a standard approach to measuring a particular technology's maturity. Fundamentally, TRL determines if technologies are ready for adoption by potential consumers [

1]. Level 1 is considered the lowest, and level 9 is the highest measuring criterion on the TRL scale.

Figure 3 demonstrates all nine levels of TRL.

Table 1 illustrates the nine steps of evaluating the maturity levels of technology that begin with an idea and transform to the fully functional technology that reaches the level where it can be deployed on a larger scale. The levels from 1 to 9 can assist the decision-makers in observing and analyzing the development progress and transitioning of technology into a desired form. It can be noted that the established TRL is focusing on technologies and not on system level where different technologies can be combined or recombined.

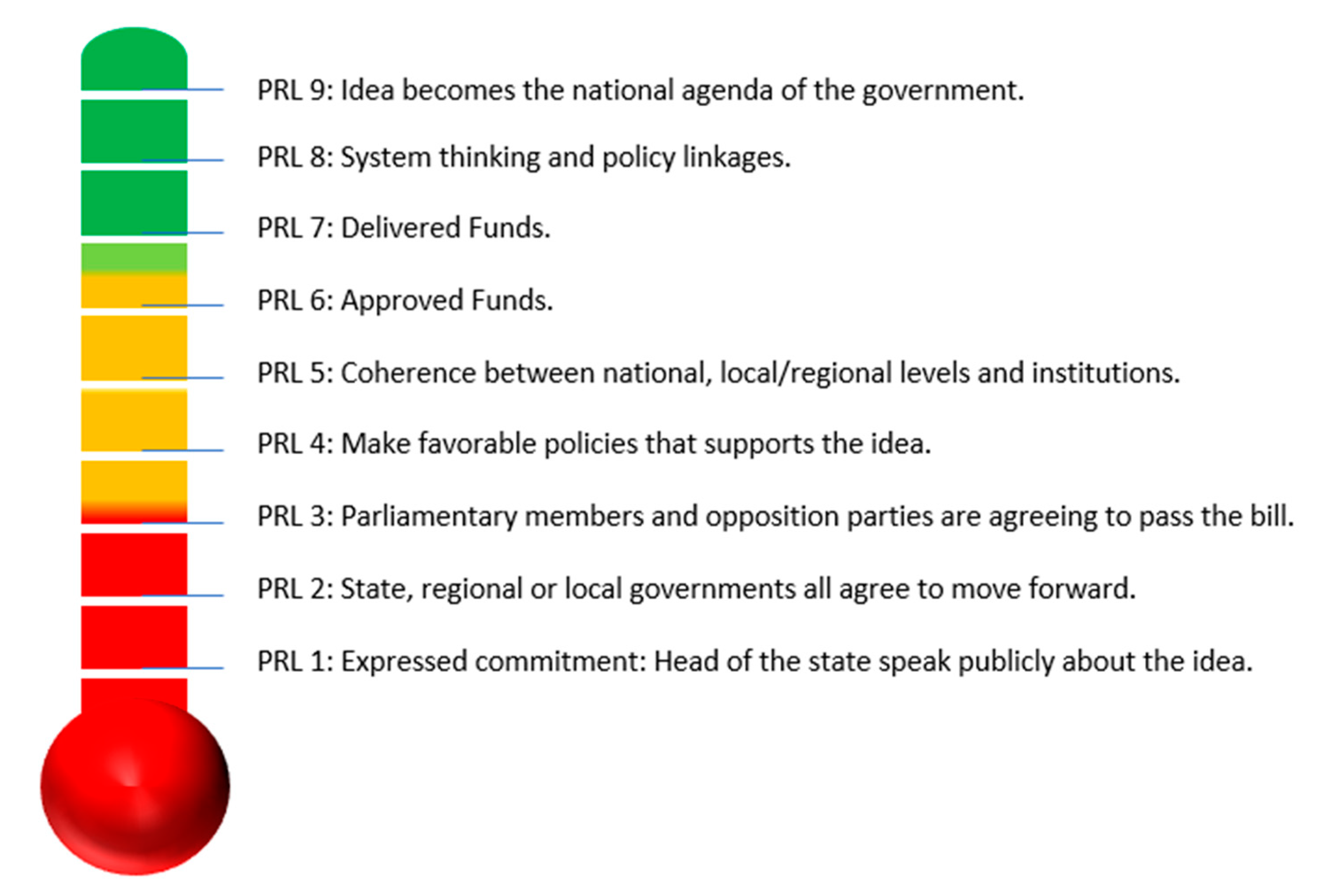

3.2. Political Readiness Levels (PRL)

We have experienced that technology has been one of the most critical driving forces of societal and industrial transformation. The advancement of technology has introduced various technological solutions for decarbonizing the environment, such as renewable energy, transport electrification, hydrogen-based transport, etc. However, large-scale R&D, implementing new technical solutions, and diffusion of new technologies are almost impossible without political decisiveness and determination to utilize technology to transform and develop society. This is especially valid for the electrification of transport as transport is one of the most harmful environmentally impacting industrial sectors globally. At the same time, it is directly associated with the coal and oil industry, which are an economic engine and a significant employer of many countries and will be the loser when transport is electrified. Some are suggesting that this ongoing electrification of the European automotive industry might lead to about 500,000 people losing their contemporary jobs. Political readiness is seen when the politicians recognize the problems and challenges and provide immediate support in framing new regulations, laws, and policies to support economic, industrial, and consumers for achieving the capabilities of purchasing expensive but desirable technologies that are costly in the beginning.

Figure 4 explains the nine levels of PRL.

Table 2 demonstrates the nine levels to assess the government's intention, willingness, and firm, decisive move towards adopting innovation or invention and implementing new favorable policies for the relevant stakeholders to encourage them to embrace it.

3.3. Societal Readiness Levels (SRL)

Societal readiness level is a scale for analyzing and evaluating the readiness level of societal acceptance; for example, a product or a technology to be integrated into society needs to be accepted and desired by its citizens. Suppose we continuously design technologies, infrastructure, and policies in which people are not incorporated and do not see the benefits for them and their lives. In that case, there will be a risk in moving forward towards electrified solutions because it could be a failure [

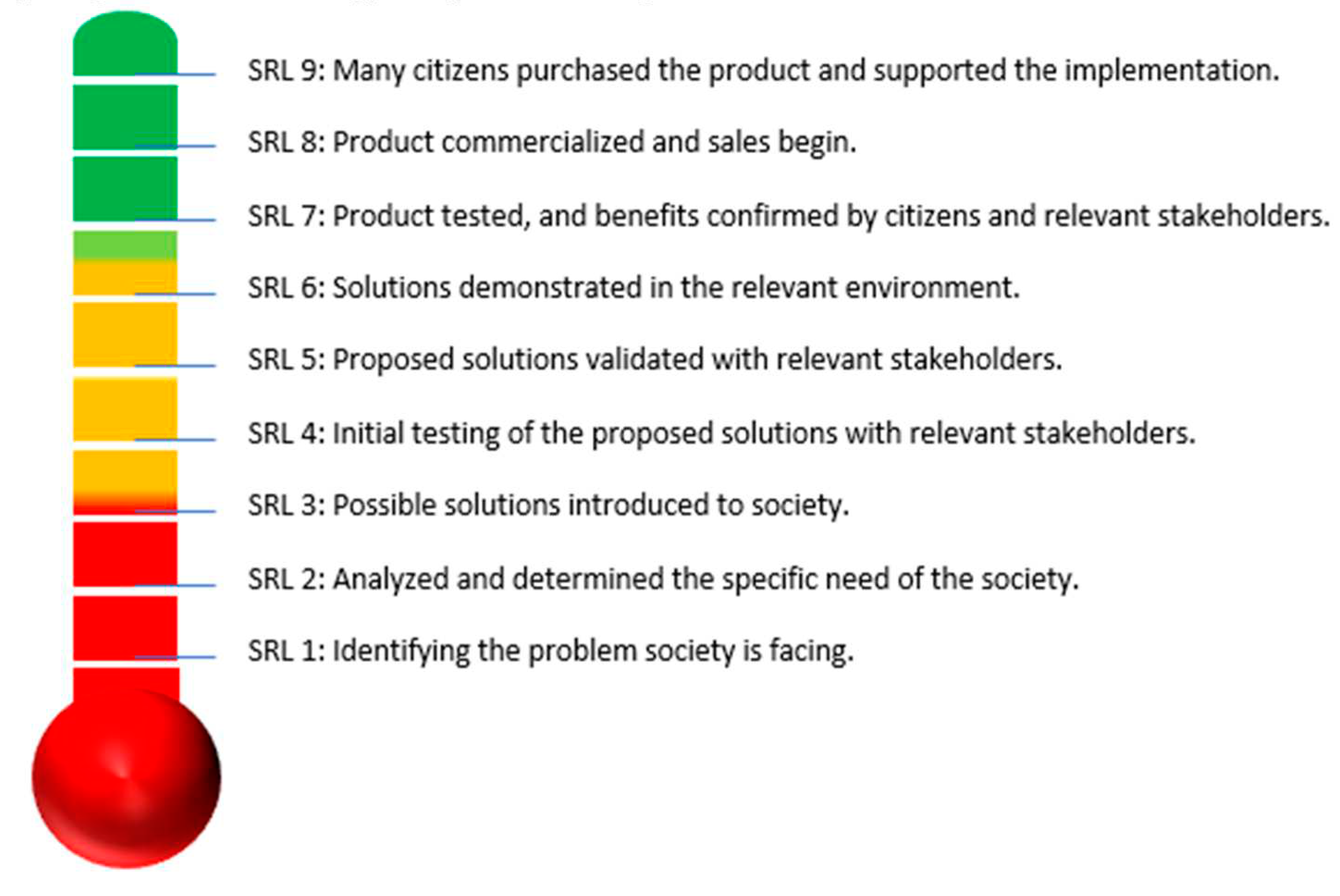

13]. SRL 1 is the lowest, and the SRL 9 is the highest level of readiness indicating that society has already started adopting new technology or product.

Figure 5 demonstrates all nine levels of SRL.

Table 3 illustrates the nine levels of evaluation of incorporating society in the transformation of an innovative product (electric vehicles) and the citizens' adoption and diffusion of EVs.

3.4. Economic Readiness Levels (SRL)

Economic readiness level is a dimension for analyzing and evaluating the readiness levels of cost affordability of a technology or a product by the industry that impacts them and by the large number of citizens expected to adopt electric vehicles. Economic readiness plays an important role in diffusing innovative products (electric vehicles) in society. The consumer's approach is to pay for something less expensive or better than they already have.

The word “economic” is a vast subject divided into microeconomics and macroeconomics. Microeconomics is a bottom-up approach that deals with individuals, business decisions and concentrates on supply – demand and forces that determine the price levels. Macroeconomics is a top-down approach that deals with decisions made by governments and countries. It focuses on the economy, where the government determines the investments in R&D, prices, imposes and reduces the taxes, and provides rebates and subsidies to balance the development and manufacturing cost for early technologies with the price level of the products in the market [

14]. After all, the business operators and citizens must afford to buy the new technology and products coming on the market.

The transformation of the transportation system is a national and international matter that involves facing national and international challenges such as global warming, pollution, and depletion of fossil fuels in the world. Being responsible nations, it is countries' governments' responsibility to deal with these challenges and support the transformation of the transportation system towards electrification. Therefore, we have used the macroeconomic concept to build the economic readiness levels where the government controls the prices to bring stability and affordability to the market. The government has the mandate to manage and set the minimum or maximum prices for specific products, including gasoline, electricity, and vehicles [

15].

To develop the economic readiness levels, we have focused on balancing cost of three main factors (manufacturing cost of EVs, energy supply for the transport infrastructure, and operational cost), where governments can support by providing subsidies, rebates, imposing /reducing taxes on the EVs to push the EVs in the market for societal diffusion to achieve certain benefits, for instance, decarbonizing the environment and less relying on fossil fuels. The government can support until the economic readiness reaches the highest level where the price balances for consumers and producers, which means that the consumers can afford the product, and the producers can still capture the value.

Figure 6 demonstrates all nine levels of ERL.

Table 4 illustrates the nine levels of government involvement to make economic readiness ready for each stakeholder participating in the transformation of the transportation system. The technology, political and societal readiness levels are more of general readiness levels that can be used for any technology, political and societal context, but the economic readiness levels depend on the development requirement of the product and the context where the product will be used.

Economic readiness is itself a complex dimension that is interrelated and interdependent on various factors such as government policies related to import/export, manufacturing companies’ capabilities (they have complete value chain capability or need to import the parts for manufacturing the product), and the market behavior. Not all the products require the same or specific infrastructure to operate. For instance, the airline and shipping industry follows international laws, customer segments vary from country to country, and the airplanes manufacturers are limited, so the economic policies are designed by considering these factors, which do not apply to the automotive industry. Therefore, the economic readiness levels are explicitly developed for electrification of transportation systems because economic readiness depends on the import/export policies of the government, requires specific infrastructure and support of energy companies to operate electric vehicles.

4. Analysis of the selected countries

4.1. China

4.1.1. Technology Readiness Level in China

The electrification of transport started in China already 15-20 years ago. China is presently taking the lead in developing electric vehicles, electric motors, batteries of all kinds, charging infrastructure and also the most important component of the EVs, the software based control and monitoring systems [

11,

12]. Different manufacturers introduced more than 200 brands of electric vehicles in China in 2020. Even though not all of those brands houses have manufacturing capabilities, they have outsourced a few large-scale electric vehicle manufacturers to design and use specific technology based on their required criteria [

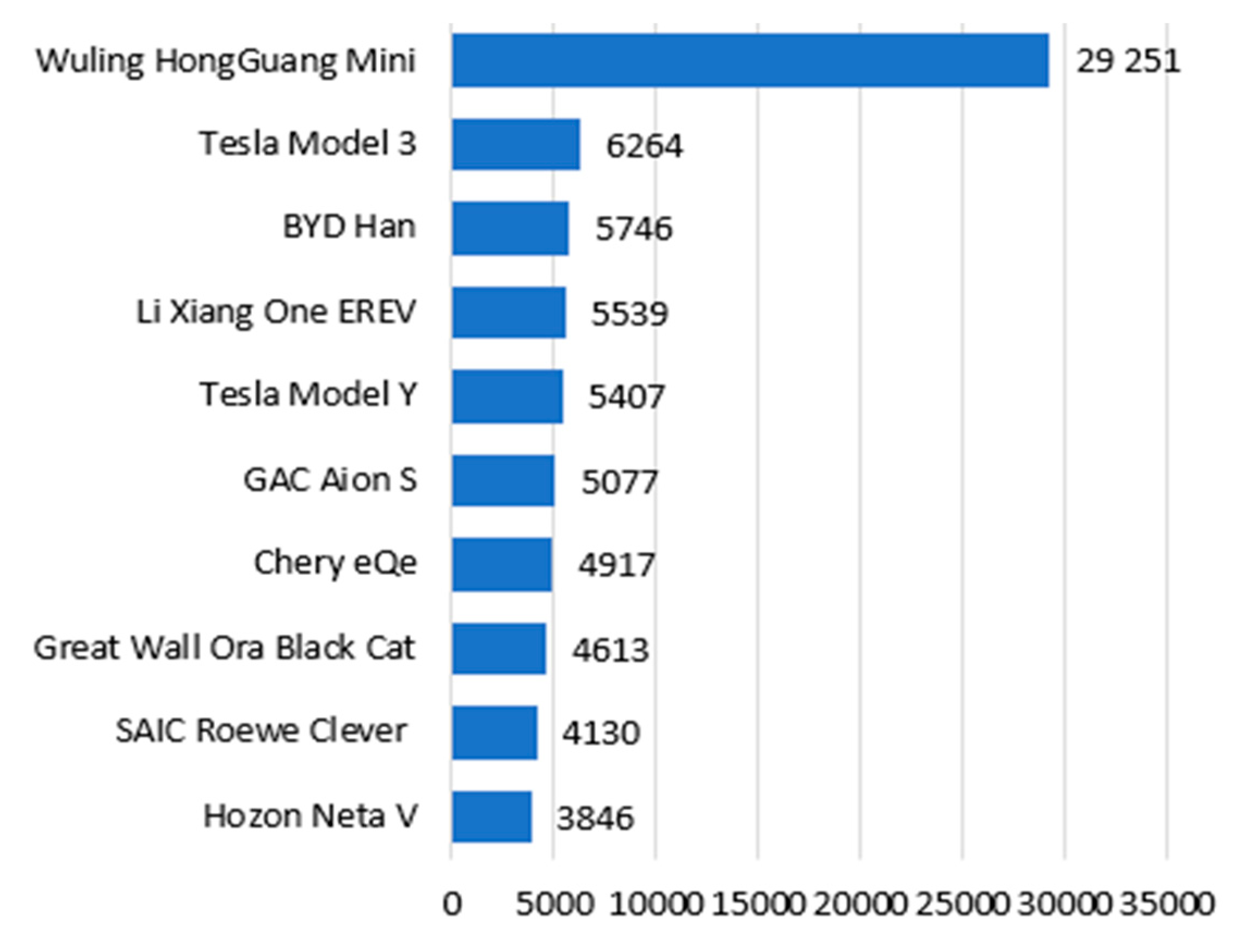

11]. In 2021 several Chinese EV manufacturers announced to export EVs to Europe, focusing on the Scandinavian market. The top 10 brands of EVs sold in China in April 2021, among 9 of them are Chinese brands except for Tesla, which is also manufactured in China, as stated in

Figure 7.

China has established the entire value chain and system from components to the fully integrated system for developing and manufacturing EVs. China is also taking the lead in developing the vehicle battery charging infrastructure as well has one of the largest battery manufacturing capabilities in the world, beside South Korea. The China Electric Vehicle Charging Infrastructure Promotion Alliance (EVCIPA) estimated that by the end of June 2021, China had almost 1.947 million EV charging piles available for public use, which represented an increase of 47.3% in one year. The installation of public chargers has risen rapidly in China and reached 923,381 by the end of June 2021. There were around 374,000 fast chargers, 550,000 slow chargers, and 426 DC-AC integrated charging piles. According to EVCIPA estimation, almost 30,400 public EV battery chargers were installed each month from July 2020 to June 2021. Five major cities of China hold the most EV chargers as of June 2021. These cities are Guangdong (10,514), Jiangsu (5,981), Zhejiang (5,355), Shanghai (5,337), and Beijing (5,190) [

16].

However, another implemented charging infrastructure solution has been developed for operating EVs as complementary charging solution, which is battery swapping technology. The Chinese government has put battery-swapping and hydrogen technology on the national strategic agenda. Hydrogen has been mulled as an alternative fuel for ICE powered vehicles as an alternative to hydrocarbon-based fuels, thus representing a further means of reducing the carbon footprint. Electric vehicle manufacturers' key leaders (NIO, Geely, BJEV, and Changan New Energy) have adopted battery swapping technology. By the end of June 2020, there were 452 battery-swapping stations in China. The growth of battery swapping stations continued and reached over 716 battery-swapping stations by the end of June 2021. Estimations indicate that there will be 25,000 swapping stations in 2025 for passenger vehicles [

11] and more than 400 swapping stations for heavy trucks in few years’ time [

12]. The electrification of Chinese mega cities is complex and complicated to manage through cable charging solutions only. Thus, swapping systems are introduced as complementary systems. Thus, China is positioned at level 9 in the technology readiness level of the multidimensional readiness index.

4.1.2. Political Readiness Level in China

In 2009, the central government of China started subsidizing EV sales for public and government fleets, and in 2013, it began supporting private EV owners. The subsidies were between

$5400 to

$9000 per vehicle in 2013, dependent on the vehicle's electric range. At the end of 2020, the government introduced a new EV subsidy policy for 2021. According to the new policy, 20% of the subsidy was reduced on pure electric vehicles. Vehicles with a driving range between 300 to 400 km dropped from

$2500 to

$2000 per vehicle, and vehicles with a driving range of 400 km or more decreased from

$3500 to

$2800 per vehicle. In addition, for hybrid vehicles, the subsidies dropped from

$1320 to

$1050 per vehicle. The unexpected drop of 20% subsidy on EVs sharply decreased the sales of EV’s in the industry. The government extended the EV subsidy support for two years until the end of 2022 to get the market back on track. The sales of EVs rebounded when the government approved the extension [

17].

The Chinese government decided in May 2020 to include battery swapping technology as a national strategic development technology which handles a new infrastructure policy that focuses on the whole life cycle value of the battery. By the end of 2020, the battery swapping technology was highly supported in the most significant Chinese national policy that drives industrial development in China, "The new energy vehicle development plan 2021 – 2035" [

11]. Battery swapping has become attractive to drivers since it decreases upfront costs and reduces re-charging time. In 2020, NIO introduced a new business model based on unbundling vehicle purchases, battery renting, and swapping subscriptions. The four major Chinese electric vehicle manufacturing companies that provide battery swapping services are NIO, Geely, BJEV, and Changan New Energy. Standardizing battery-swapping services has been a priority for the Chinese government. In April 2020, the Chinese government extended the subsidies for the EV manufacturing companies, with the condition that companies will only be eligible for grants if the prices of EVs are below about

$46000. However, this policy does not apply to battery swapping models. The policy indicates that most premium electric vehicle manufacturers will have to decrease the EV prices to meet the requirements for the subsidy scheme, and the policy also shows the clear intention of the government to boost the battery swapping business in China. The Chinese Finance Ministry has announced to cut down 30% subsidies on new electric vehicles (NEV) in 2022 and eliminate the subsidies from 31

st December 2022 [

18]. China will become the first country to eliminate all sorts of subsidies on NEVs by the end of this year, which might affect the sales of NEVs. However, the overall interest of the Chinese government in the diffusion and adoption of sustainable electrified transportation is very high. Therefore, China is placed at level 9 in the political readiness level of the multidimensional readiness index.

4.1.3. Societal Readiness Level in China

Chinese society has been introduced to the concept of electrification for more than 20 years. In 2019, battery electric vehicles (BEVs) sales reached almost one million, three times more than plug-in hybrid electric vehicles (PHEVs). The sale of electric vehicles continuously increased in 2020 and reached above one million. In July 2021, 271,000 electric vehicles were sold in China, which nearly broke another monthly record. Compared to July 2020, 164.4% of electric vehicle sales increased in just one year, indicating that the electric vehicle sector is booming, with numerous brands and models selling in large numbers. The overall market share of EVs, including 12% BEVs and 3% PHEVs have increased and reached 15% in the mid of 2021 [

19]. In the six largest Chinese cities, electric and hybrid vehicles now account for approximately a fifth of new car sales on average. Consumers in China's industrialized cities on the east coast have adopted electric vehicles more rapidly than their inland counterparts. The electric vehicle penetration rate in major cities is 8% higher than in other cities of China. Like Shanghai 31%, Beijing 16%, Guangzhou 13%, Shenzhen 25%, Hangzhou 21%, and Tianjin 12% [

20]. Already ten years ago, the 12 million inhabitant’s city of Shenzhen introduced electric vehicles on large-scale buses for the initial electrification of the public transport domain. Now, Shenzhen has 22,000 EV taxies, 18,000 EV buses, and 86,000 EV logistic transport vehicles. Now ordinary people see that the next step is full electrification of private vehicles. Chinese society is fully committed to moving expeditiously towards sustainable transport based on a fully electrified and fossil-fuel-free transportation system. Therefore, China is positioned at level 9 in the societal readiness level of the multidimensional readiness index.

4.1.4. Economic Readiness Level in China

The economic readiness analysis is based on the electric vehicle cost, the operational cost of the vehicle, subsidiaries' support to make the price and cost affordable for citizens, businesses, and the outcome in terms of value creation to the country and people. A survey was conducted in June 2019 by 'Rakuten Insight' on the "Acceptable price level for purchasing an electric car compared to a conventional car in China." Almost 26% of the Chinese consumers are only willing to pay the same price for an electric car as a conventional car, whereas 18.8% of the consumers agree to pay up to 10% and 22.4% of the consumers are ready to pay 11 to 30% higher than conventional cars [

21]. In total, 45% of the consumers are willing to pay a higher price for electric vehicles than traditional cars. In contrast, only 8% of the consumers are not willing to pay a higher price for electric vehicles than conventional cars. It means more people favor electrified transport in China besides the cost of the electric vehicle. One explanation behind this is that electric vehicles bring health improvements to citizens, especially in highly dense cities, which is values for citizens they are ready to pay.

The price of electric vehicles is continuously dropping in China. Consumers achieve cost competitiveness on electric vehicles many years earlier than expected, primarily due to the vehicles' fuel savings. In 2022–2026, electric cars provide a compelling new vehicle purchase proposition based on an analysis of first owners' 5-year vehicle ownership expenses. Electric vehicles' fuel and maintenance savings greatly surpass home chargers and other expenditures for the first buyers in 2025. The BEV ranges of 250–500 km and PHEV ranges of 40–100 km is compared to the conventional cars in these two categories. In 2020, the initial prices of electric vehicles were

$5,000 to

$17,000 more than similar gasoline vehicles. By reducing the cost of components and subsystems, and the assembling of EV and EV batteries, the projected prices of a short-range BEV in 2026 and a long-range BEV in 2030 will be equal to their similar types of gasoline vehicles. The charging cost of electric vehicles depends on the prices of electricity provided by the grid. Since China wants to encourage the use of electric vehicles, the charging prices have been set at low levels. There are time-of-use fees for EV charging in several provinces and cities in China. State Grid's charging stations also use time-of-use pricing. State Grid Beijing costs RMB 1.0044/kWh (approximately

$0.16) during peak hours, RMB 0.6950/kWh (approximately

$0.11) during shoulder hours, and RMB 0.3946/kWh (approximately

$0.062) during off-peak hours, plus a service fee RMB 0.8/kWh (approximately

$0.13) [

22]. However, the cost of electric vehicles is still not competitive compared with gasoline vehicles, and it is mostly the subsidies and rebates that encourage people to buy electric vehicles. Estimations are made that the EVs will be price neutral to ICE technology in 3-5 years. Therefore, China is placed at level 8 in the economic readiness level of the multidimensional readiness index.

4.2. Norway

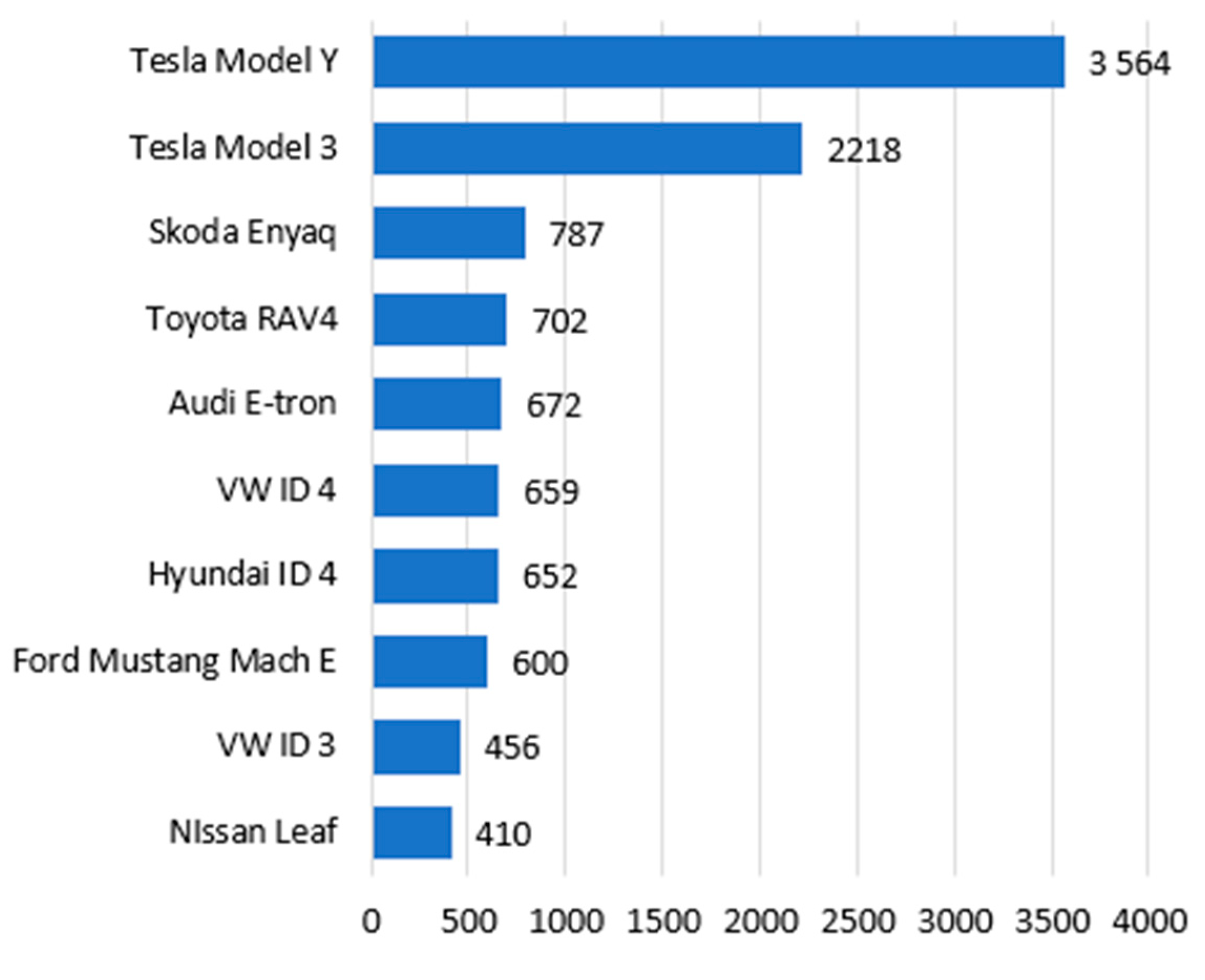

4.2.1. Technology Readiness Level in Norway

Norway does not produce electric vehicles but primarily imports them from other countries. The top ten selling brands of electric vehicles in Norway in September 2021 are imported from the Czech Republic (Skoda), Germany (Volkswagen and Audi), Japan (Nissan and Toyota), South Korea (Hyundai), and the USA (Ford and Tesla) as shown in

Figure 8.

In May 2021, NIO China, a BEV manufacturing company, started its operation in Norway to provide a full-fledged ecosystem incorporating cars, services, and charging infrastructure. NIO Norway has introduced its first smart electric vehicle model NIO ES8 SUV, but it was available on 3rd September 2021 at Honefoss Airport for a test drive. NIO provides a total system solution offering electric vehicles supported by charging infrastructure, battery swapping system and cable charging solutions. NIO plans to establish 20 battery swapping stations in Norway in 2022, and one is already operational outside Oslo. Sweden will follow in 2022 with 10 swapping stations followed by Denmark.

Norway has a lower population density than many other European nations and a relatively high percentage of private house ownership. It is simple to install private home-based electric vehicle chargers, and many electric vehicle owners utilize them as their primary source of power. The Norwegian Electric Vehicle Association surveyed in 2017 that electric vehicle owners living in apartments and houses were asked how often and where they charged their vehicles. The results indicate that electric vehicle owners rely very little on public charging and rely much more on charging EVs at home or work [

23]. However, the lack of public chargers is a challenge for travelers and tourists.

Norway is a long country with a low population, and the driving range between cities is long. A well-organized public charging infrastructure is required for long-distance travel. For this purpose, in 2017, the Norwegian government started funding for the construction to build at least two multi-standard fast-charging cable charging based stations on every 50 km along all of Norway's major highways.

One factor that will affect the technology readiness in Norway is the massive pressure on the nation's electrical grid due to the substantial number of electric vehicles conventionally charged at the same time, i.e., with charging stations or outlets. In that case, the power grid can experience massive spikes of stress during peak hours. However, the stress on the power grid can be flattened out by charging the vehicles outside the peak hours and ensuring that every charging stations has a solar panel array and battery storage to help reduce the peak loads drawn from the grid. The charging infrastructure is, to a large extent, private, and the lack of public charging piles is a barrier to the diffusion of BEVs. Besides having a well-organized home-based charging system, Norway is far behind in technology readiness, as Norway has to import each component used for electrification from other countries. Therefore, Norway is positioned at level 5 in technology readiness levels of the multidimensional readiness index.

4.2.2. Political Readiness Level in Norway

Norway introduced policies to encourage the use of electric vehicles by temporarily eliminating the electric vehicles import tax in the early 1990s. The Norwegian government has also launched various incentives (access to driving on the bus lanes, limited parking fees and no road tolls) for electric vehicles to eradicate vehicles and on-road taxes that reduce the upfront and lifetime cost of electric vehicles. The government's goal is to have all new vehicles sold from 2025 to be either electric or hydrogen driven. The incentives for electric and hydrogen-fueled vehicles can be considered to be the Norwegian government's strategy to promote electrification to Norwegian society.

In Norway, the existing electric vehicle policy incentives stabilized and successfully established the electric vehicle market, and in return, a profitable second-hand EV market emerged in Norway. The electric vehicle market is well established in the main cities of Norway, like Bergen and Oslo, whereas the electric vehicle market in rural areas is rapidly growing. One of the most prominent incentives applied in Norway is the 'vehicle tax system,' which allows the electric vehicle to become price competitive with ICE vehicles. The 'tax system' is based on the vehicle's weight, carbon dioxide and nitrogen oxide emissions, and value-added taxes. These combined taxes make EVs affordable to buy or import with very few added costs compared to ICE vehicles, which in some cases cost more than double the import price [

24]. These are some of the most significant incentives policies implemented by the Norwegian government that has led Norway to the massive adoption of electric vehicles.

The Norwegian government is working towards future policies to meet the goals of the Paris Agreement to reduce the nation's greenhouse gases by 40% by 2030 compared with the levels of the 1990s. Furthermore, the country is striving towards the following three goals to meet the criteria of the Paris Agreement [

25]:

All new private vehicles must be purchased as zero-emission configuration or using biogas by 2025.

Having all distribution of goods by near-zero-emission vehicles in major cities by 2030.

Have all new heavy vans, 75% of new long-distance buses, and half of all new trucks of zero-emission status by 2030.

Norway is at the global forefront in adopting electric transport. The Norwegian government played a decisive role in promoting electric vehicles by implementing favorable incentives policies. Therefore, Norway is positioned at level 9 in the political readiness levels of the multidimensional readiness index.

4.2.3. Societal Readiness Level in Norway

Norway has become the leading country in the world to sell more electric vehicles than vehicles with diesel, petrol, or hybrid engines already in 2020. Norway made a global record by selling 54.3% of all new battery electric vehicles in 2020. In contrast, in 2019, it was 42.4%, which means the sale of battery electric vehicles increased by 11.9% in only one year. This was achieved even though Norway is an oil-producing country. Norwegian policy exempts taxes for fully electric vehicles and imposes taxes on vehicles run by fossil fuels. The goal of the Norwegian government is to become the first country in the world to stop selling new diesel or petrol cars by 2025 [

26]. In March 2021, 8,624 electric passenger cars and 4,379 plug-in hybrid vehicles were sold. The sales of fully electric vehicles are increasing, whereas plug-in hybrid vehicle sales (PHEV) are declining. In March 2020, the sales of PHEV were 83.1%, but in March 2021, the sales of PHEV were at 28.6%, which means the sales of PHEV declined almost 54.5% in one year. However, it is still higher than the sales of vehicles run on diesel and petrol (4.7 and 4.8 percent, respectively) [

27]. Norway is a rich country where people get paid handsome salaries. The costs involved in generating and distributing electrical energy in Norway are very high. But consumers are willing to pay a premium fee for the fast-charging service as it costs them three times less than what they pay for electricity at home. We place Norway at level 9 in the societal readiness levels in the multidimensional readiness index.

4.2.4. Economic Readiness Level in Norway

In Norway, ten years ago, nobody could even predict that there would be more electric cars than non-electric in 2021, and there are not only cars that have gone electric, but bikes, trams, trains, and buses have all become propelled by electrical means. The Norwegian government policies and the incentives for the buyers are the leading cause for the rapid transition of the transportation system from fossil-based fuels to electric in Norway. The key to accelerating EV adoption in Norway was to make them affordable. The government reduced taxes and even exempted road tolls tax to keep the operating cost for EV’s down [

28].

The cost of buying an electric vehicle is also lower than buying a petrol-fueled car in Norway. In November 2020, the new Volkswagen Golf (petrol) price was higher than the Volkswagen Golf (Electric). To encourage the buyers to buy EVs, the Norwegian government reduced other taxes to make them affordable. The operational cost of EVs is much lower than gasoline vehicles.

Driving an electric vehicle for an operating distance of 12,300 km/year, which is moderate, can save NOK 12,000 (approximately

$1355). The service cost for electric vehicles is generally lower since moving components are very much less than gasoline vehicles. In addition, the traffic insurance tax is far lower for EVs in Norway [

29]. Thus, Norway is positioned at level 9 in the economic readiness levels of the multidimensional readiness index.

4.3. Sweden

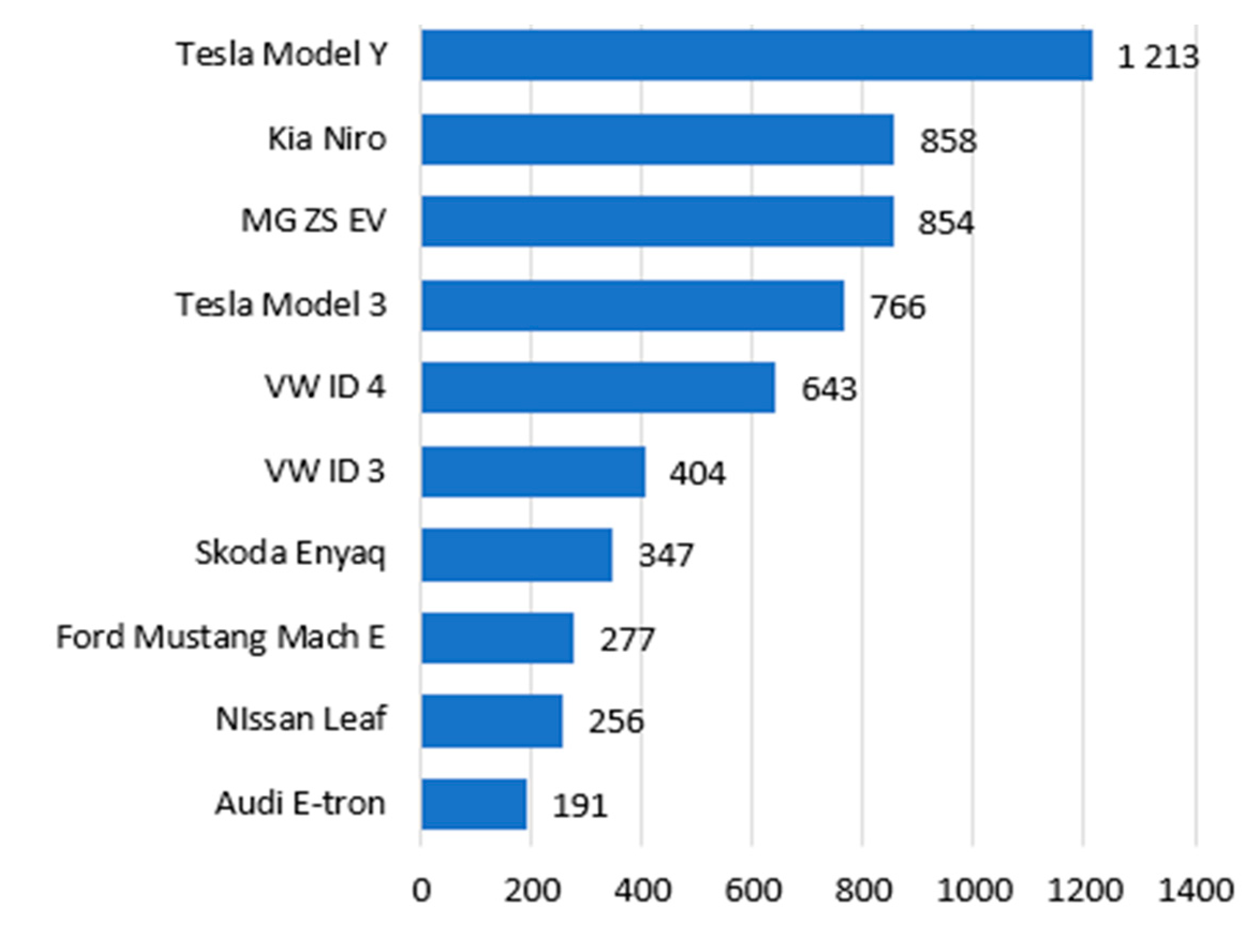

4.3.1. Technology Readiness Level in Sweden

Sweden is an innovative industrial country. Volvo, the Swedish automotive manufacturing company, has now become owned by the Chinese vehicle manufacturer Geely. In 2021, Volvo introduced two new EV brands, Volvo, and Polestar, which are so far manufactured in China. However, the top ten selling brands of electric vehicles in Sweden in September 2021 are imported from various countries, such as the Czech Republic (Skoda), Germany (Audi and Volkswagen), Japan (Nissan), South Korea (Kia), China (MG), and USA (Ford and Tesla) as shown in

Figure 9.

In Sweden, several alternative EV charging technologies are in the testing phase, such as dynamic (conductive and inductive), semi-dynamic and static charging, and further looking for battery swapping solutions. Static charging is considered a relatively mature technology that is primarily used to charge passenger vehicles. However, heavy-duty vehicles (HDVs) can utilize the current chargers used by cars. Still, it takes a longer time to charge the battery due to the battery capacity of heavy-duty vehicles. In Sweden, charging stations have gradually increased during the last three years and crossed almost 10,000 units with type 2 sockets and 610 charging stations with CCS/Combo sockets until mid-2020 [

30].

The electric trucks manufactured by Volvo and Scania can be charged through static chargers by using the latest CCS type 2 connectors. However, these CCS type 2 connectors are intended to charge regular EVs and not HDVs like Volvo's FE/FL and Scania's BEVs. Because of the lack of fast chargers designed for HDVs and the high demand for electric trucks, Volvo and Scania chose to use the existing charging solutions. The fast chargers for HDVs are available on the market and implemented in three major cities in Sweden. These fast chargers adapted for HDVs have a higher charging power and are less time-consuming than chargers for light vehicles. Installing fast chargers for HDVs near the most operated transport routes is crucial to aid electric truck diffusion. Moreover, the European Union and its members collaborate to develop and implement a common standard for Megawatt's chargers [

31].

Sweden is working on static and dynamic (conductive and inductive) road charging, which means that vehicles will be able to charge their batteries while in motion. Sweden has built its first electric roads for demonstration purposes at Arlanda (1.2 miles in length), at Sandviken, in Lund city and in Visby city. Sweden is further working on wireless charging and looking to have battery swapping technology. However, these technologies are still in the demonstration and testing phase on a small scale. On the other hand, inductive charging, considered a reliable solution, is in the development process. The charging output is limited, facing the technical standardization problem. Therefore, Sweden is positioned at level 6 in the technology readiness levels of the multidimensional readiness index.

4.3.2. Political Readiness Level in Sweden

Swedish policies support the transformation of the transportation system from fossil-fueled vehicles to electric vehicles and offer several incentives to electric vehicle owners. Sweden is transitioning to electrified vehicle transport systems with a 26% EV market share and a 253% rise in EV sales in 2019. Sweden has increased incentives such as municipal incentives, tax rebates, and government grants, contributing to the rising popularity of electric vehicles. In 2007, the Swedish government introduced a program called the "green car award." The purpose of this program was to offer a tax credit of 10,000 SEK (approximately

$1166.45) for new vehicles which satisfied the specified emission standards. The impact of the green car award program was positive, and this program raised the market share of green cars (with emissions of 50 g CO

2/100 km or less); however, it is claimed that the majority of buyers would have purchased green vehicles regardless of the subsidies being offered [

32].

The Swedish government plan is to reduce to 70% of the present level of greenhouse gas emissions from the transportation sector by 2030. To achieve this target, the government has further introduced a scheme of subsidies for low emission cars serviced before 2020 with CO2 emissions of up to 60 g/km and vehicles serviced during 2020 or after with CO2 emissions of up to 70 g/km, a grant of 60,000 SEK (approximately $6998.70). These subsidies are available for up to 25% of the new car's purchase price. This scheme applies to both individuals and businesses. Similarly, the grants are available for heavy-duty vehicles, especially for public transportation agencies, municipalities, and small businesses, a grant of 20% of the EV bus purchase price is available.

Furthermore, the incentive covers 40% of the difference between the cost of an electric bus and a comparable diesel bus for private transportation businesses. The Swedish government is also focusing on the development of charging infrastructures. The number of charging units has increased from 500 to 10,000 between 2012 and 2020. The major cities in Sweden, such as Stockholm, Gothenburg, and Malmö, also provide local charging incentives for the EV owners. In Stockholm, free charging of BEVs and PHEVs is available for parking space subscribers; only non-electric vehicle owners have to pay the parking fee. The local government of Gothenburg has decided to install 500 new charging stations at the public parking areas around the city during the autumn and winter of 2020 and 2021. Malmö has more than 150 public charging stations. The chargers are of different speeds - some of them are fast chargers of up to 22 kW/h, whereas others have only up to 3.7 kW/h to charge electric vehicles. The local government of Malmö is planning to equip 20% of parking spots with EV charging stations [

33]. However, while static charging is considered a reliable source of charging, EV drivers face technical standard problems with different sockets used at different charging stations for a plug-in to charge a vehicle. The absence of institutions and policymakers is prevailing. The role of institutions and policymakers is required to develop and implement a common standard plug connection for static charging. On the other hand, the dynamic solution (electric road technology) is still in the testing phase. Therefore, Sweden is located at level 7 in the political readiness of the multidimensional readiness index.

4.3.3. Societal Readiness Level in Sweden

Sweden is a well-educated society with substantial awareness of environmental concerns. Swedish society is rapidly adopting electric vehicles. In February 2020, the market share of electric and plug-in hybrid cars reached 24.3% in Sweden. The rapid adoption of electric vehicles has increased in Sweden since the Swedish government introduced a new subsidy scheme in January 2020.

In February 2020, around 6.4% of all Swedish new cars registered were battery electric vehicles (1,430), and approximately 18% of cars registered were plug-in hybrids (4,027). Compared with February 2019, the sale of electric cars has increased by 112% and plug-in hybrid vehicles by 59%. In January 2020, around 7.1% of all new cars registered were battery electric vehicles (1,269), and about 23.1% of cars registered were plug-in hybrids (4,113). Compared with January 2019, the sale of battery electric vehicles increased by 15% and plug-in hybrid vehicles by 160.8% [

34]. The adoption rate of plug-in hybrid vehicles is high in Sweden and is increasing faster than sales of fully battery electric vehicles. Therefore, Sweden is located at level 7 in the multidimensional readiness index in societal readiness levels.

4.3.4. Economic Readiness Level in Sweden

In 2018, Sweden introduced a new incentive scheme called "Bonus-Malus" to encourage buyers to buy electric cars, light trucks, and buses. The government announced 60,000 SEK (approximately

$6998.70), a purchase incentive bonus to the buyers of fully electric vehicles, and a 25% climate bonus of the vehicle's value. The government announced a 35% bonus on buying a climate-friendly vehicle for businesses. The incentive was a maximum of 35% difference between the new vehicle price and the similar fossil-fueled vehicle price. Six months after the car is registered, the incentive is paid straight to the owner, preventing the vehicle from being sold onward within that time frame. The bonus is decreased by 833 SEK (approximately

$97.17) per gram of CO

2 over zero and up to 60 g/km [

35].

To make the operating cost affordable, the Swedish government started supporting the development of increased charging infrastructure. Therefore, the government introduced the climate shift program in the Swedish language called "Klimatklivet." This program aims to reduce CO2 emissions at a local level. For this purpose, the government announced granting up to 50% of the installation cost for a single charging point to the local housing associations. Moreover, electric vehicles are much more affordable than fossil fuel-based vehicles in Sweden. The energy cost of running an electric car is SEK 2.25 (approximately $0.26) every 10 kilometers, compared to SEK 12 (approximately $1.40) for the same distance traveled in a fossil fuel-based vehicle.

Moreover, the maintenance cost of electric vehicles is lower than fossil fuel-based vehicles due to the fewer moving components [

36]. Additionally, electric vehicles are quiet and fun to drive due to their high-performance capabilities. Even though the government provides rebates on purchasing electric vehicles, the prices are still high. Because of the present lack of charging infrastructures, buying a fully electrified vehicle is not economical. Therefore, Sweden is positioned at level 7 in the economy readiness levels of the multidimensional readiness index.

5. Discussion

The data discussed in the above disclosure is based on the factors involved in assessing the state of global readiness for the electrification of all modes of electrical transportation equipment and supporting systems. This discussion leads us to conclude that merely relying on technical analysis will not lead us towards the complete transport system towards electrification. We need other political, societal, and economic perspectives to explore, understand, and support the whole system for the successful transformation of the transport system towards electrification.

As a result, to attain a high degree of diffusion of an electrical transportation system, additional factors such as political, societal, and economic readiness also must be considered and balanced alongside the available technology. Our research has noted that the major dimension in the public discussions of electrification has been globally focused on technology. Until all the readiness factors have been globally given their due consideration, the introduction of complete and effective electrification of all modes of transport equipment and their associated systems will not proceed effectively or expeditiously. From our point of view, all those four dimensions of the states of readiness are complementary and thus equally important, and all are needed to be fully integrated and implemented to support the development and diffusion of electrification of transport.

To evaluate the readiness level of technology, political, societal, and economics of each country, we have used TRL, PRL, SRL, and ERL scales. Each country is positioned in the multidimensional readiness index model based on the evaluation of the readiness scales as shown in

Figure 10.

We have taken out the percentage for further graphical representations based on the multidimensional readiness index model results.

Table 5 shows the status in the percent of each countries’ readiness level (technology, political, societal, and economic) and the position of each country (China, Norway, and Sweden) in the development of electrification of the transportation equipment and supporting systems.

Table 5.

status of the countries in the development of electrification of the transportation system.

Table 5.

status of the countries in the development of electrification of the transportation system.

| Scoring Index of Transport Electrification System |

|---|

| Countries |

Readiness scoring scale from 0 to 9. |

Total score of each country |

In Percentage (%) |

| Technology |

Political |

Societal |

Economy |

| China |

9 |

9 |

9 |

8 |

35 |

97% |

| Norway |

5 |

9 |

9 |

9 |

32 |

89% |

| Sweden |

6 |

7 |

7 |

7 |

27 |

75% |

Table 5 shows that China has scored 97% followed by Norway and Sweden 89% and 75% respectively, in the development of transport electrification. These results have been plotted in the form of graph in

Figure 11 below that shows the positioning of these countries in the process of transformation of the transportation system.

China is a leading country in the field of electromobility technology, industry, and market, according to the electric vehicle index in 2021. China is at the forefront of the transition from fossil-fueled vehicles to electric vehicles. Chinese society is rapidly moving towards BEVs. China is leading in manufacturing pure battery electric vehicles as well as in battery along with South Korea which is ranked 1

st in innovation, according to Bloomberg [

37]. Of the top 10 fully battery-electric vehicle manufacturers, nine are Chinese companies, and the other one, Tesla, is a US brand that is also manufactured in China. By the end of June 2021, 1.947 million charging piles and 716 battery swapping stations were available for charging electric vehicles in China. One key system for electrified road transportation is batteries. Asian companies are leading the electric vehicle battery industry. They are expanding their manufacturing capacity in Europe and the USA to gain secure profitable contracts from international electromobility manufacturers. LG Chem and Samsung SDI are the largest South Korean battery manufacturing companies.

From January 2020 to August 2020, the South Korean LG Chem was the top leading company in manufacturing lithium-ion batteries worldwide. Contemporary Amperex Technology Limited (CATL) and BYD are two of the leading Chinese batteries manufacturers. CATL is ranked second with a market share of over 29%. CATL is the biggest international electric vehicle battery exporter to BMW, Honda, Hyundai, Tesla, and Volkswagen. China and South Korea are leading in battery manufacturing for electric vehicles beside the Panasonic which is a Japanese battery-making company. China has a complete value chain in the electromobility industry from the initial reception of materials through its delivery to market and everything in between. The success behind China's leading in the field of electromobility is the Chinese government's implementation power of favorable electric transport policies and strategic positioning of EV in the process of upgrading the automotive industry, communication technology and smart-city development. The Chinese central government considers it to be a vital, national policy matter to promote the country's development and diffusion of electric transportation. In 2019, when the Chinese government stopped providing subsidies on EV purchases, the EV manufacturing industry reported five months of decreasing sales in the second half of 2019. Once the government revived the subsidies on EVs in 2020, EV sales sharply increased and reached 1.3 million units in 2020 compared with the 1.1 million units sold in 2019. The Chinese government provides rebates, subsidies, and tax exemptions and keeps the charging rates low for electric vehicles to promote clean electric transport in China. Therefore, China is positioned at level 9 in technology, political and societal, whereas at level 8 in the economic readiness of the multidimensional readiness index. The overall score of China is 35 based on the readiness scoring scale of transport electrification and 97% readiness in the field of transport electrification systems, as shown in

Figure 11.

Norway does not manufacture electric vehicles or electric vehicle batteries, but it imports from other countries such as the US, South Korea, Japan, and China. NIO Norway (Chinese BEV supplier) has also started its sales in 2021 and several other Chinese brands such as XPeng, LiAuto, BYD and other are moving to Europe. Norway is a small but geographically long country, and people need to travel long distances for their daily life activities. Almost 96% of electric vehicle owners have access to a charging station in their own homes or apartment. However, long-distance travelers or tourists with their electric vehicles need public charging stations, which presently lack in number and distribution. The government has started funding to construct at least two multi-standard fast-charging stations at every 50 km along all of Norway's major highways. Despite lacking in electromobility technology, Norwegian government policies are the game-changer positioning Norway as the global leader in EV adoption. The sales of electric vehicles are rapidly increasing over those for fossil-fueled vehicles in Norway, with a staggering 54% of new cars sold in 2020 being powered by electricity. In 2020, December was the best month, with sales reaching 66.7% of electric vehicles. The goal of the Norwegian government is to sell 100% electric cars by 2025. The cost of purchasing and operating fully electric vehicles is more affordable than fossil-fueled or hybrid vehicles. Even though Norway is an oil-producing country, the government has imposed high purchase and CO

2 taxes on fossil-fueled vehicles; in contrast, electric vehicles are exempted from purchase, VAT, and road tolling taxes along with free parking. The dedication of the Norwegian government in the ways that it has introduced electric transport in society is maintaining Norway’s position as a successful global leader in the world in the transformation of a clean transportation system. Therefore, Norway is positioned at level 9 in politics, societal, and economic readiness levels and 5 in technology readiness in the multidimensional readiness index. The overall score of Norway is 32 based on the readiness scoring scale and 89% readiness in the field of transport electrification systems, as shown in

Figure 11.

Sweden is one of the top innovative countries in the world and the number one in EU. According to the Bloomberg innovation index 2021, Sweden is ranked 5

th in the innovative countries worldwide, while in the EU Innovation Scoreboard, it is ranked as 1

st. However, in the field of electromobility, Sweden still lags behind, despite manufacturing its own electric vehicles in Belgium and China. The Swedish Volvo manufactures its prestigious electric vehicle (Polestar) in China. The new Volvo XC-40 launched in 2021 is manufactured in Belgium and China. However, Sweden yet does not have its own battery manufacturing and thus Swedish EV manufacturers purchase batteries mainly from Asia, Europe, and the US. Volvo in the majority, manufacturers hybrid vehicles rather than fully electric vehicles. Scania and Volvo have launched their first electric trucks in 2020/2021. In Sweden, several charging technologies are in the testing phase, such as electric roads (conductive and inductive), and the government is considering to further looking into battery swapping solutions. Static cable-based charging is considered a relatively mature technology that is primarily used to charge passenger vehicles. However, static charging faces a standard technical problem in that there is no standardized charging plug. Buying electric vehicles and operational costs are still expensive in Sweden despite government rebates and the exemption of taxes. Therefore, Sweden is positioned at level 7 in politics, societal, and economic readiness levels and 6 in technology readiness in the multidimensional readiness index. The overall score of Sweden is 27 based on the readiness scoring scale of transport electrification and 75% readiness in the field of transport electrification systems, as shown in

Figure 11.

6. Conclusions

The development and implementation of electrification of the transportation system depends on society's readiness to pursue development, adoption, and diffusion of electrified transport. Technology itself is a crucial foundation for electrification and must be viewed and understood when commercialization and value creation to business, people, and benefits to the entire society are also considered. Technology cannot be diffused in society and create value without a well-developed interplay of industry, academia, politics, economic institutions, and policy systems pushing and supporting economic and policy tools and regulatory tools.

Our analysis shows that only focusing on technology will not lead us to the successful complete transformation of electrification of the transportation system. Therefore, to achieve a high level of diffusion of electric transport systems, it is important to balance the political dimension focusing on government support to develop and implement policies that promote the electrification of the transportation system. The other factors involved are the degree to which societal readiness to switch from fossil fuel to electric vehicles has been enrolled. The fourth is the economic readiness in which subsidiaries have met the transformation financial needs to compensate for any price difference. The motivation of people to preserve until the scale of the costs involved in the adaption and adaption of the new technology meets or betters the costs incurred for old fossil-based technology must be diligently fostered.

Our analysis shows that political readiness is one of the most crucial dimensions of the readiness to support the transformation to electric transport, followed by societal and economic readiness. The political readiness is demonstrated in the political willingness to reshape regulatory aspects, introduce, and change subsidiaries and use public fundings for R&D and building the charging infrastructure. Political readiness can be observed on the rhetoric level and in the action level. Our focus is on the real action level of politics and policy making.

We view the electrification of the transportation system from a complex system perspective. The electrification of transportation is not an isolated system that can be handled independently as a single technological entity. This system is interconnected and interdependent on the other subsystems such as energy production, electricity distribution in the grid system, and storage that form the whole technical system embedded in each country's political, social, and economic context. Therefore, a system approach is required to see the electrification of the transportation system from a holistic perspective. Other subsystems need to be brought into consideration besides technology alone, i.e., politics, society, and the economy. To help achieve this understanding, we have introduced the Multidimensional Readiness Index Model based on those key dimensions.

The depth of penetration of electrified transport system in the society is still very much premature and in the early phases of diffusion, thus still mainly relies on the economic policies developed and announced by the government, including the economics of new infrastructure, identification of solutions to electrified public transportation problems, providing rebates for EVs and tax exemptions, and imposing high taxes on CO2 emission vehicles. Government commitment is the key to success for the rapid transition from fossil fuels to electrified transport. The strong government and institutional execution power are the success story behind China's leading in the electrification of the transportation system in the world. Norway is the second leading country in the diffusion and adoption of electric vehicles because of its favorable government policies for transport electrification, even though Norway itself does not manufacture electric vehicles and charging equipment. Sweden is still lagging behind China and Norway, even though Sweden is one of the most prominent countries in innovation in the world and has built its own luxury hybrid electric vehicles. But due to the Swedish government not taking rapid actions, it has been held back in the electrification of the transportation system. Volvo Cars are manufacturing electric cars in China. Scania trucks and Volvo have started to market their first generation of electric trucks. Volvo has declared strategic collaboration with Daimler regarding the hydrogen technology for ICE vehicles, while Scania officially goes for battery-based heavy trucks.

Author Contributions

Conceptualization, H.J.; methodology, H.J.; formal analysis, H.J.; investigation, H.J.; resources, H.J.; data collection, H.J.; writing—original draft preparation, H.J.; writing—review and editing, M.D.; A.N.; visualization, H.J.; supervision, M.D.; A.N.; project administration, M.D.; funding acquisition, M.D. All authors have read and agreed to the published version of the manuscript.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

Not applicable.

Acknowledgments

This research is conducted within the Sweden-China Bridge—Collaborative Academic Platform for the Transportation Electrification Systems Project and has been funded by The Swedish Transportation Administration (Trafikverket, TRV).

Conflicts of Interest

The authors declare no conflict of interest.

References

- Hirshorn, S. and S. Jefferies, Final report of the NASA Technology Readiness Assessment (TRA) study team. 2016.

- Büscher, M. and N. Spurling. 2019. Social Acceptance and Societal Readiness Levels. DecarboN8. Available: https://decarbon8.org.uk/social-acceptance-and-societal-readiness-levels/ [Accessed 08 August 2021].

- Kane, M. 2021. Norway: All-Electric Car Sales Reach New Record In September 2021. INSIDEEVs. Available: https://insideevs.com/news/537973/norway-plugin-car-sales-september2021/ [Accessed 30 January 2022].

- Kane, M. , China: Plug-In Cars Grab 10% Market Share In April 2021. 2021: Online.

- Holland, M. , Sweden: Legacy Vehicles Left In The Dust As Plugin EVs Overtake & Accelerate Ahead. 2021: Online.

- Bhatti, H.J. , et al., Electric Roads: Energy Supplied by Local Renewable Energy Sources and Microgrid Distribution System. 2019.

- Stephen, Toyota Prius: The car that started a revolution. 2016: Online.

- Bhatti, H.J. and M. Danilovic, Making the World More Sustainable: Enabling Localized Energy Generation and Distribution on Decentralized Smart Grid Systems. World J. Eng. Technol. 2018, 6, 350. [Google Scholar] [CrossRef]

- Bhatti, H.J. and M. Danilovic, Business model innovation approach for commercializing smart grid systems. Am. J. Ind. Bus. Manag. 2018, 8, 2007–2051. [Google Scholar]

- Danilovic, M. , et al., A Multidimensional Approach for Assessing Technological Development Projects – The Example of Electric Road Systems, in 4th Electric Road Systems Conference 2020. 2020: Lund, Sweden.

- Danilovic, M. and J.L. Liu, Electrification of the Transportation System in China: Exploring Battery-Swapping for Electric Vehicles in China 1.0. 2021: Online.

- Liu, J.L. and M. Danilovic, Electrification of the Transportation System in China: Exploring Battery Swapping for Heavy Trucks in China 1.0. 2021: Online.

- Cardullo, P. and R. Kitchin, Being a ‘citizen’in the smart city: Up and down the scaffold of smart citizen participation in Dublin, Ireland. GeoJournal 2019, 84, 1–13. [Google Scholar] [CrossRef]

- Potters, C. and M. Logan. 2021. Microeconomics vs. Macroeconomics: What's the Difference? : Investopedia. Available: https://www.investopedia.com/ask/answers/difference-between-microeconomics-and-macroeconomics/#:~:text=Microeconomics%20is%20the%20study%20of,interdependent%20and%20complement%20one%20another. [Accessed 03 December 2021].

- Kenton, W. and C. Potters. 2021. Price Controls. Investopedia. Available: https://www.investopedia.com/terms/p/price-controls.asp [Accessed 03 December 2021].

- Nika. China’s number of EV charging piles jumps 47.3% YoY to 1.947 million by June 2021. 2021 [cited 2021 17 August]; Available from: https://autonews.gasgoo.com/m/70018413.html.

- Barrett, E. , China is rolling back the subsidies that fueled its electric-vehicle boom. 2021: Online.

- Randall, C. , China cuts NEV subsidies by 30 percent. 2022: Online.

- Kane, M. 2021. China: Plug-In Car Sales Almost Set A New Record In July 2021. InsideEVs. Available: https://insideevs.com/news/527614/china-plugin-car-sales-july2021/ [Accessed 31 August 2021].

- Bloomberg, In China’s Biggest Cities, One in Five Cars Sold Is Now Electric. 2021: Online.

- Wong, S. , Acceptable price level for purchasing an electric car compared to a conventional car in China as of June 2019. 2021: Online.

- Boya, T. and D. Jing. Beijing's new energy vehicle cancels the filing system, and the charging price is simultaneously released. 2018 [cited 05 September 2021 ]; Available from: http://auto.people.com.cn/n1/2018/0302/c1005-29842924.html.

- Lorentzen, E. , et al. Charging infrastructure experiences in Norway-the worlds most advanced EV market. in EVS30 Symposium. 2017.

- Haugneland, P. , et al. Put a price on carbon to fund EV incentives–Norwegian EV policy success. in EVS30 symposium, Stuttgart. 2017.

- Olsen, K.S. , National Transport Plan 2018–2029. 2017: Online:.

- Klesty, V. , Electric Cars Rise to Record 54% Market Share in Norway in 2020. Reuters. com (January 5), 2021.

- Manthey, N. Norway registers 84.8% market share of plug-in cars in March. 2021 [cited 2021 21 July]; Available from: https://www.electrive.com/2021/04/07/norway-registers-84-8-marketshare-of-plug-in-cars-in-march/.

- Reve. Why Norway Leads In Electric Vehicles. 2021 [cited 2021 22 July]; Available from: https://www.evwind.es/2021/06/20/why-norway-leads-in-electric-vehicles/81362.

- Elbillading. How much does it cost to charge an electric car? 2020 [cited 2021 22 July]; Available from: https://zaptec.com/en/how-much-does-it-cost-to-charge-an-electric-car/.

- Wagner, I. , Number of charging stations for electric cars in Sweden from 3rd quarter 2017 to 3rd quarter 2020, by type. 2020: Online.

- Hasselgren, B. and E. Näsström, Electrification of Heavy Road Transport: business models phase 5. 2021.

- Huse, C. and C. Lucinda, The market impact and the cost of environmental policy: evidence from the Swedish green car rebate. Econ. J. 2014, 124, F393–F419. [Google Scholar]

- Asunción, E. The Essential Guide To EV And EV Charger Incentives In Sweden. 2021 [cited 2021 27 July]; Available from: https://blog.wallbox.com/sweden-ev-incentives/.

- Randall, C. Sweden: marketshare for plug-in vehicles nears 25%. 2020 [cited 2021 31 July]; Available from: https://www.electrive.com/2020/03/25/swedens-electrification-boom-continues-despite-pandemic/.

- AG, V. How electric car incentives around the world work. 2019 [cited 2021 31 July]; Available from: https://www.volkswagenag.com/en/news/stories/2019/05/how-electric-car-incentives-around-the-world-work.html#.

- Dahlstrand, R. Why buy an Electric Car if I can not charge it. 2020 [cited 2021 31 July]; Available from: https://hammarbysjostad20.se/ladda-hemma/?lang=en.

- Jamrisko, M. , W.Lu, and A. Tanzi. 2021. South Korea Leads World in Innovation as U.S. Exits Top Ten. Bloomberg. Available: https://www.bloomberg.com/news/articles/2021-02-03/south-korea-leads-world-in-innovation-u-s-drops-out-of-top-10 [Accessed 06 January 2022].

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).