1. Introduction

The Cuenca Declaration, which was formalised during the Habitat III International Conference (UN-Habitat, 2015), highlighted the importance of medium-sized cities (MSCs) as standard bearers for the polycentrism of regional areas and as connecting links between the urban and the rural, between the local and the global. In remote regions, these cities are the primary hubs for work, infrastructure and public services, whereas in congested metropolitan areas they challenge the supremacy of the central hub, attracting families and businesses seeking lower rents and better environmental conditions. Armed with an intermediate settlement density – neither too high nor too low – and the liveable nature of such places, MSCs are often considered to be sustainability laboratories. Many have leapfrogged the metropolises in the rankings of wellbeing and quality of life, which are drafted using indicators that are not only economic in nature. According to Rifkin (2022), these cities will play a crucial role in the transition towards the Age of Resilience. Even the European Union’s documents reveal a growing interest in MSCs in the variety of the settlement system. In particular, it is worth mentioning the Riga Declaration (2015), a decisive step towards the drafting of the Urban Agenda for the EU, which contains a meticulous list of the reasons for which it is necessary to carefully consider MSCs (and small-sized cities). Recently, many cities of this type have been involved, including as leaders, in pilot actions launched by the EU’s Territorial Agenda 2030 (CEC, 2020).

Despite all of this, very few studies have been conducted on the evolutionary trajectories of MSCs. We look primarily to the metropolitan hubs, which are at the forefront for many matters. We struggle to liberate ourselves from a metrocentric perspective, which is currently deeply entrenched (Bell & Jayne, 2009; Wagner & Growe, 2021). The TOWN (ESPON, 2014) project tried to change approach and to broaden the perspective, but it considered medium- and small-sized centres collectively; perhaps it would have been better to keep them separate as they have different characteristics and perform different roles in the settlement system (UCLG, 2017; Lazzaroni & Mayer, 2022).

With this in mind, this paper tackles the issue of employment transformation in Northern Italy’s MSCs over the 2012-2020 period. We will consider 189 municipalities in the 20,000-200,000 inhabitants range, divided according to whether or not they perform the role of a hub in the urban network. We will study the specialisation profiles and the evolutionary trajectories of this group of cities using employment trends in businesses between 2012 and 2019. We will also make an initial assessment of the events that occurred over the course of 2020, following the serious economic recession triggered by the COVID-19 pandemic.

Northern Italy is the most developed part of the country[1] and one of the economic engines of Europe (Perulli, 2012), with a complex settlement system described as the ‘Po Valley Megalopolis’ (see, among others, Turri, 2000). Furthermore, two development models coexist here. The first is that of the Northwest, the heart of the Italian ‘economic miracle’, where even today – despite intense restructuring – large companies and technologically advanced industries are present. The second is that of the Northeast – itself part of a wider geo-economic formation (‘Third Italy’) – which came to prominence in the ‘70s, with a dense fabric of small businesses gathered in industrial districts and specialising in labour-intensive sectors (Muscarà et al., 2011). In all of this, MSCs play different roles and reflect different economic structures.

Employment is a thorny issue on political agendas at various levels. If we then consider MSCs specifically, there are at least three factors to take into consideration. First of all, there is the renaissance of metropolises as sites chosen for businesses with a high level of knowledge and innovation, but also as new spaces in which to live, often following a long trajectory of demographic decline (Scott, 2008; Carter, 2016). This is also evident in Northern Italy, especially in the case of Milan. The balance of power between centres of different sizes is changing and we must understand how MSCs will reposition themselves.

The second factor to consider relates to the unique identity of MSCs, which find themselves in a «condition of urbanism somewhere between ‘no more’ and ‘not yet’ in terms of dimensions and qualities, an unresolved condition with the potential to become permanent» (Dicecca, 2019: 33). This influences their nature and evolutionary paths. Often, compared to large cities, the weight of industry is greater and the human capital is lower skilled. There is also a disadvantage in terms of economies of urbanisation – which are proportional to the size of the city – which underpin innovation and competitiveness in globalised capitalism. This problem could be overcome (or mitigated) through the creation of networks between cities, but this is not simple (Camagni & Salone, 1993; Camagni et al., 2015; Iommi, 2016; Meijers et al., 2018)

Lastly, returning to the Cuenca Declaration, the territorial centrality of MSCs must be considered. Even in the shadow of metropolises, where it is not easy to carve out their own local employment system, MSCs are often hubs (the incoming commuters outnumber the outgoing). In light of this, trajectories of low socio-economic dynamism in MSCs could transform into a weakness of their geographical surroundings, with negative effects on territorial cohesion. This is a critical issue – in Italy and elsewhere – with regard to the future of inland areas, which often gravitate around centres of a medium size; bridges on the road towards the metropolises.

With regard to the structure of the paper, after a brief summary of the studies on the diversified economic base of MSCs and their employment trends, we will explain the research methodology. One crucial point is the identification of the MSCs given that Italy has no official definition of the different levels of the urban hierarchy. We will then focus on the 189 MSCs of Northern Italy, investigating four topics:

employment performance between 2012 and 2019 compared to other categories of urban centres;

the specialisation profiles and their changes over time;

the evolutionary trajectories defined by the different combinations of workplace trends and the restructuring of local economies;

the disruption experienced in 2020 with the outbreak of the COVID-19 pandemic.

In the last section, we will discuss the outcomes of the research and the implications for policy makers.

2. Background

MSCs have an entirely unique position in the settlement network, but it is difficult to form an overarching account of their characteristics and evolutionary processes: even within the same country (and even within the same region) we find many scenarios, defined by a mix of factors linked to geographical position, the socio-economic fabric and local political stances. These cities form a group in appearance only, finding unity in their variety (Clerici, 2020).

There is widespread interest in the location of MSCs, a factor that impacts their socio-economic performance more than any other. There is a common distinction between centres located in metropolitan settings, in coastal areas and rural areas (Roberts, 2014; UCLG, 2017), but there is no lack of more complex classifications. For example, looking to Europe, Kunzmann (2010) identified four settlement locations that are typical of MSCs: 1) in metropolitan areas; 2) in an intermediate position between multiple metropolitan areas; 3) in rural regions; 4) in border regions. These four scenarios also differ in terms of their economic specialisations, which Kunzmann outlines with great care. Other authors concentrate on identifying the settlement networks, that is, more than just the topographical position, but the web of relationships generated by commuter movements. Thus, MSCs were found to be capable of having their own catchment area (local employment system) and a greater degree of autonomy from metropolises (Bolton & Hildreth, 2013). This perspective is also found in the TOWN (ESPON, 2014; Sýkora & Mulíček, 2017) research which distinguished between three cases: 1) autonomous cities, often isolated in remote regions; 2) agglomerations of cities in metropolitan areas; 3) polycentric networks of cities outside of the larger urban areas.

There are also many classifications of the functional profiles of MSCs. These range from the contrast between centres with an industrial and tertiary focus (Henderson, 1997), to the distinction between centres dominated by a residential or productive economy, or those with a mixed profile[2] (ESPON, 2014; Hamdouch et al., 2017), to ‘fine-grained’ interpretations, like that of the six profiles identified by Hildreth (2006): 1) industrial city; 2) gateway city; 3) heritage or tourism city; 4) university knowledge city; 5) city in a large or capital city-region; 6) regional services city. Starting with the Weberian distinction between ‘producer cities’ and ‘consumer cities’, Oberti (2000) divided MSCs into four categories: 1) those linked to large business; 2) those linked to small business; 3) modernisers, characterised by a wide range of public and private services; 4) those assisted and dependent, that is linked to the role of the State and policies for the redistribution of public spending. These profiles have a different weighting in European countries; in Italy in particular, many MSCs fall into group 2 (especially in the Central North-East) and group 4 (especially in the South). However, as the author mentions, the classification is not rigid and there is often a mixed profile.

If we look to move from the description of the varied universe of MSCs to understanding their employment performance, the picture of the research is not rich, at least in terms of comparisons on an international scale. Without doubt, location and functional specialisation influence local socio-economic dynamics, but on this point more detailed investigations should be conducted (Meili & Mayer, 2017; Lazzaroni & Mayer, 2022). A first distinction should be made between the academics who embrace the ‘bigger is better’ narrative conveyed by the New Economic Geography (Fujita et al., 1999) and those who distance themselves from this view, deeming it to be better suited to the United States and emerging economies than to Europe. Those that favour the former perspective refer to the many weaknesses of MSCs compared to ‘strong’ metropolises: they would cite, in particular, the less-varied production system, the lower skilled human capital, the lesser capacity of local administrations to plot a course and attract investment. They believe MSCs are not particularly innovative or attractive to knowledge-intensive businesses: a step backwards from metropolises, which for their part have the benefits of greater economies of urbanisation (Selada et al., 2012; Champion & Townsend, 2013; Léo et al., 2014, Yin & Derudder, 2021). However, those that adopt the latter perspective highlight how MSCs boast many competitive niches (Kresl & Ietri, 2016; Rodríguez-Pose & Griffiths, 2021) and how they performed well even during the Great Recession. They believe that the most dynamic cities are those committed to building networks of relationships on many scales, a mechanism that makes it possible to overcome the limitations of their ‘small’ size (Crouch, 2007; Dijkstra et al., 2013; Knox & Mayer, 2013; Camagni et al., 2015). Even in Italy, these two visions have their supporters: for example, Accetturo et al. (2019) cite a lack of large urban areas among the factors underlying low national competitiveness, while the group Mecenate 90 (2020) underlines the success of MSCs and their essential contribution to the development of the country even during periods of economic recession.

Aside from the individual national cases, the studies seem to converge on one point: the greater hardship of MSCs linked to the low-tech manufacturing industry (above all in Western Europe) and those that are more isolated, either because they are disconnected from the large infrastructure corridors, or as a result of the inability of local administrators to build relationships devoted to attracting new investments (Clayton & Morris, 2010; Escudero Gómez & Somoza Medina, 2010; ESPON, 2014; Garrido Cumbrera et al., 2016; Bole et al., 2019; Escudero Gómez et al., 2019; Vázques-Varela & Martínez-Navarro, 2020; ESPON, 2021). In proximity to or within metropolitan areas, there is generally greater vitality on a demographic and employment level. Here an advantage can be gained from the waves of suburbanisation, which bring many businesses and families out of the hearts of metropolitan areas (Adam, 2006; Runge, 2016; Meili & Mayer, 2017; Cebrián Abellán & Sánchez Ondoño, 2019; Kaufmann & Wittwer, 2019; Sikorski & Szmytkie, 2021). Moreover, it is possible to exploit the mechanism of ‘borrowed size’ (Meijers & Burger, 2016; Meijers et al., 2016), including as a means of attracting strategic and highly specialised businesses (Wagner & Growe, 2020). Another particularly vibrant group of MSCs – at least until the COVID-19 pandemic – comprised centres linked to tourism, university education and cultural activities (Lorentzen & van Heur, 2012; Lazzaroni & Piccaluga, 2015).

In this general context, it is not clear what role public policy plays. For certain authors it is fundamental in reinforcing the local social capital, in creating relationships that enable access to resources and knowledge that would otherwise be off-limits and in triggering creative journeys of urban development in response to economic shocks (Knox & Mayer, 2013; Hamdouch et al., 2017); for others, however, it is overvalued or in any case varies according to the type of local economy (Erickcek & McKinney, 2006; Wittwer, 2021).

Many regions linked to MSCs seem to have fallen into the ‘middle-income trap’: areas with a manufacturing industry which in the past had ensured good levels of per capita income, but which today are incapable of restoring their competitive advantages and moving towards activities with greater added value (Iammarino et al., 2020; Diemer et al., 2022). Despite being located in leading regions, these communities have a peripheral position and suffer from competition from large urban areas, which attract professional infrastructure and skills. Even in Italy, certain areas of the affluent central and northern regions, which revolve around MSCs, also find themselves in this situation (Viesti, 2021). This makes the pictures of territorial development increasingly molecular: the North/South dualism persists, but the North is less united than in the past, marked by growing internal divisions. A similar picture emerges when looking at the inner peripheries (ESPON, 2017), which are found encapsulated in many intermediate and even urban regions, where there are active trajectories of socio-economic decline in contrast to the lively surrounding areas: a movement against the tide which has become more evident over the last decade and has increased the number of territorial divisions.

Added to all of this is the COVID-19 pandemic, which had a strong impact on employment, despite the exceptional measures introduced by the national government to support businesses, workers and families. The urban exodus that occurred during the health emergency (González-Leonardo et al., 2022; Stawarz et al., 2022) might benefit certain MSCs, especially those that are well-connected to metropolitan centres (van der Merwe & Doucet, 2021). New opportunities could be created for businesses linked to the residential economy. However, it is not clear whether this push for decentralisation is strong and destined to continue with the return to the ‘new normal’. Furthermore, we should consider the different impacts of the pandemic on the economic system (Doerr & Gambacorta, 2020; Herod et al., 2022; Verich et al., 2022; Webster et al., 2022). Many MSCs revolve around tourism, one of the sectors hardest hit during the first waves of the pandemic. This could herald a setback for certain MSCs – which have been leaders up to now – and the emergence of new territorial divisions even in developed areas (for Italy: Istat, 2021).

3. Materials and methods

Italy is a prime example of how MSCs are a vague category, genuine «unidentified real objects» (Brunet, 1997: 188). Together with those of a small size, they are a distinguishing feature of the ‘country of 100 cities’ for historical, geographical and economic reasons (Iommi, 2016), yet their identification remains controversial. Among the most recent studies, some rely on population figures, usually considering municipalities in the range of 50,000-250,000 inhabitants (Dicecca, 2019); others begin with the confluence of functions relevant to the organisation of relationships in settlement networks (Lemmi, 2012); others use a mix of demographic and functional criteria (ANCI-IFEL, 2013; Mecenate 90, 2020). The provincial capitals generally fall into the MSC category, but there are also many centres that do not carry this status.

In the absence of an official, accepted definition, we will look at municipalities with a population ranging from 20,000 to 200,000 inhabitants (in 2019), values that according to Kunzmann (2010) define MSCs well. Even certain Italian geographers consider these limits to be appropriate: Cori et al. (1978), in one of the first studies on urban hierarchy in the Po megalopolis, considered the allocation of five types of functions[3] and observed how MSCs fell primarily into the 20,000-200,000 inhabitants range.

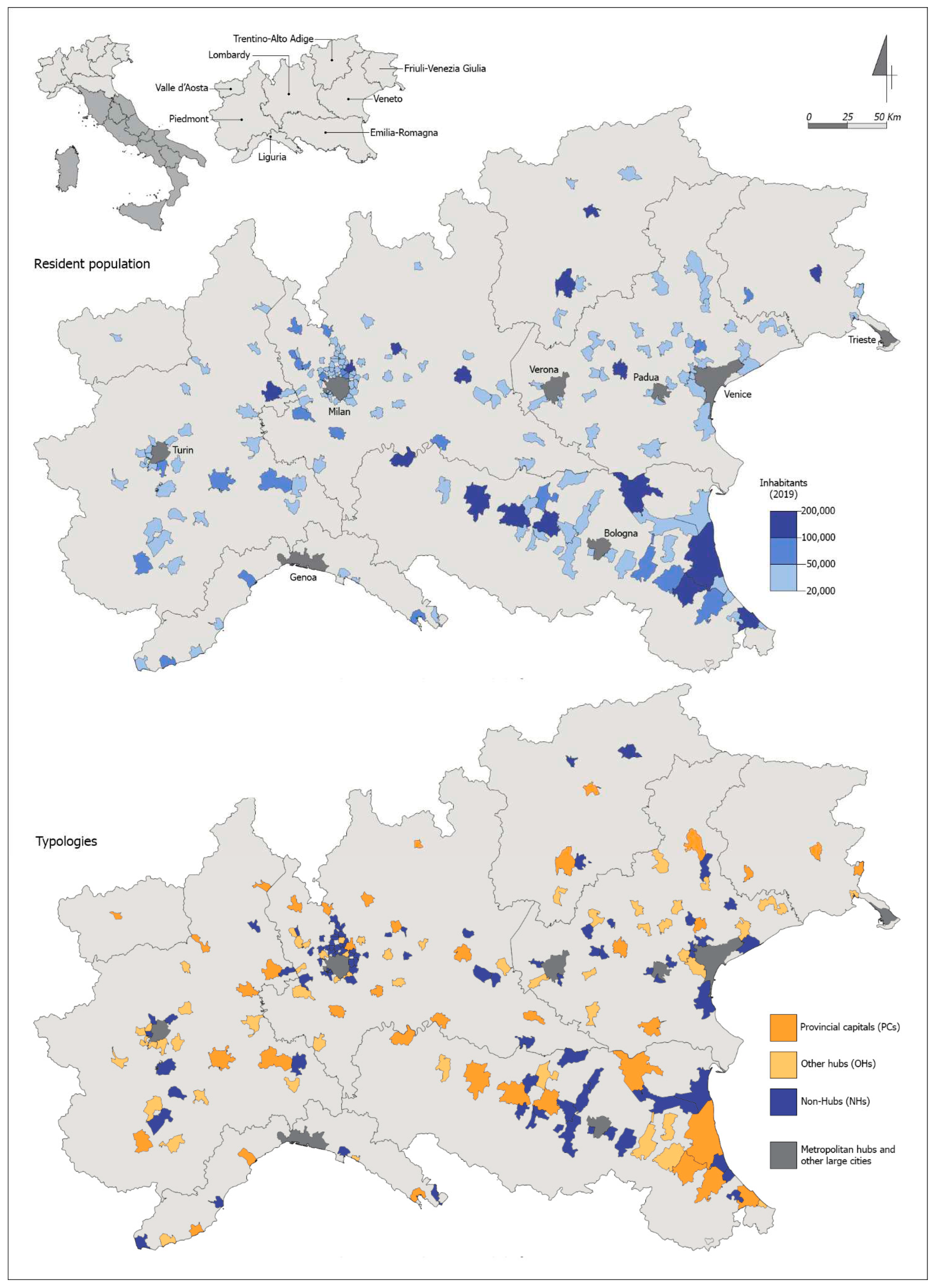

In Northern Italy today, there are 189 cities of this size: 111 in the regions of the Northwest and 78 in those of the Northeast. These are, for the most part, centres with between 20,000 and 50,000 inhabitants (

Table 1;

Figure 1). The cities selected have varied roles in the settlement networks, an aspect that has been evaluated by taking into account whether or not they are centres for the delivery of services in the sectors of healthcare, secondary education and railway transport. To this end, we used a classification of Italian municipalities that had been created as part of the National Strategy for Inner Areas (2021 update), an important benchmark both for public policy and territorial analysis. Using this classification, hubs are deemed to be municipalities that offer all three of the aforementioned services, which are essential for ensuring the rights of citizenship: municipalities that are larger or smaller in size, individual or aggregated (in the case of the so-called inter-municipal hubs), acting as magnets for areas with different degrees of remoteness. This made it possible to divide the MSCs into three categories:

hubs that hold provincial capital status (PC: 40 instances);

other hubs that do not hold provincial capital status (OH: 54 instances);

non-hubs (NH: 95 instances).

The methodology is similar to that which was used by the research group Mecenate 90 (2020), except for one aspect: we also considered the MSCs located within the perimeter of the metropolitan areas established by Law 56/2014[4]. The aforementioned research instead excluded them a priori. Nevertheless, as shown in the previous paragraph, the existence of MSCs in metropolitan areas is undeniable. This is not only a specific form of settlement, but often, precisely in the areas surrounding metropolises, there is notable socio-economic vitality, albeit with the negative impact of greater land consumption. A key point of our methodology relates to having considered cities as administrative bodies rather than as urban areas bound by morphological criteria (continuity and density of the built area) or functional criteria (commuter movements). In any case, we look at the focal points of the settlement system, which encompass almost a third of the population and job positions in Northern Italy, albeit with different weightings in the various regions.

MSCs gather in the most urbanised parts of Northern Italy: along the foothills (from Turin to Trieste), in the coastal belts (Ligurian and Adriatic) and along the ‘Via Emilia’ (from Milan to Rimini), a framework which Farinelli (2003: 178) called ‘Mesopolis’, «a galaxy of cities, a natural alliance of cities». There are many MSC in proximity to almost all of the metropolitan hubs and other large urban centres (>200,000 inhabitants), including some that qualify as hubs. In particular, the high density of MSCs surrounding Milan stands out. The network of MSCs becomes sparser in areas of low settlement density, in mountains and on the plains. Here monocentric provinces are often found (12 instances) gravitating around a single MSC with capital status.

In the following sections, we will tackle the four research areas mentioned in the introduction, using a descriptive analysis and employing certain indicators that will be introduced on a case-by-case basis. All data used in the research are from Istat (National Institute of Statistics).

4. Results

4.1. MSCs under strain

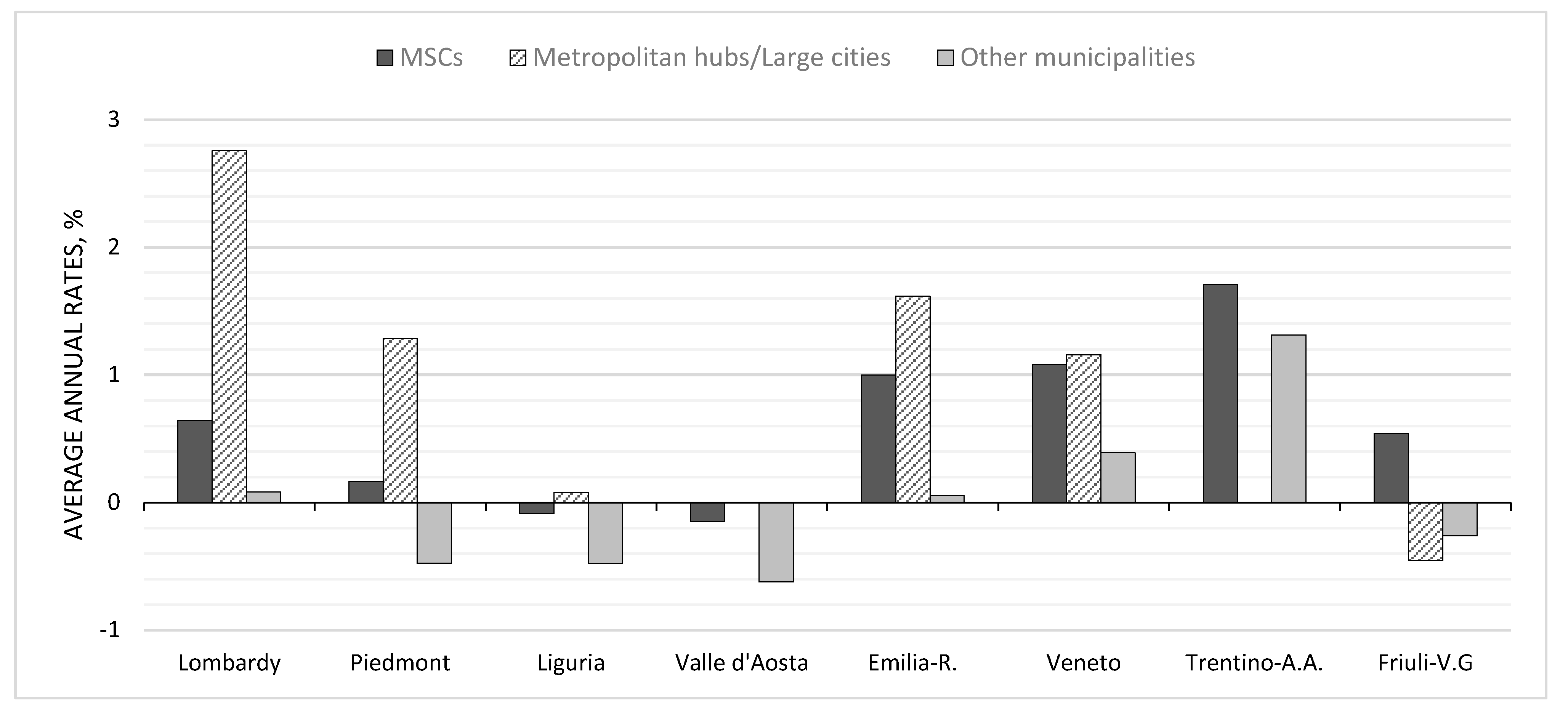

The seven-year period from 2012-2019 coincided with a period of gradual recovery of the Italian economy from the sovereign debt crisis (2010-2011) and more generally from the Great Recession. Over this time, the MSCs of the Northeast outdid those of the Northwest in terms of employment performance (

Figure 2). The differences are not insignificant: the average annual rates of employment in the Northeast were more than double those of the Northwest (1.1% compared to 0.5%). The MSCs of Trentino-Alto Adige (the Brenner corridor) recorded the strongest growth, but even those of Veneto and Emilia-Romagna were particularly dynamic. In the Northwest, only the performances of Lombardy’s MSCs stood out; in the other regions however, employment grew very little (Piedmont) or decreased (Liguria, Valle d’Aosta). This data reflects the GDP trends over the seven-year period in question, in terms of both the geographical breakdown and the single regions. Moreover, MSCs cannot be thought of as ‘free electrons’: their destiny does not depend on size restrictions, but rather it is deeply influenced by their attachment to regions of greater or lesser dynamism (ESPON, 2014; Servillo et al., 2017). In any case, as we will see below, this does not rule out locally differentiated evolutionary trajectories.

Metropolitan hubs: Milan (Lombardy), Turin (Piedmont), Genoa (Liguria), Bologna (Emilia-R.), Venice (Veneto). Other large cities (>200,000 inhabitants): Padua, Verona (Veneto), Trieste (Friuli-V.G.).

Between 2012 and 2019, the MSCs of all regions did the lion’s share compared to small municipalities (with <20,000 inhabitants). The differences in the rates of employment growth are always clearly in favour of MSCs, including where there is a negative trend. Only in Trentino Alto-Adige did the small municipalities grow almost as much as the MSCs. The picture changes when looking to the top of the urban framework: metropolitan hubs and other cities with more than 200,000 inhabitants perform the best, and this is not surprising considering the ongoing process of reurbanisation. During the Great Recession, investors bet on the main cities to minimise risks; furthermore, liberal-shaped public policy allowed large cities to do away with their industrial past and to attract new inhabitants and new workers (skilled to a greater or lesser degree) at the expense of other areas. Hence, after 2012, MSCs were not able to keep pace with the thriving metropolises. This is most evident in the Northwest: Milan stands out with an average annual rate of employment growth (2.8%) approximately five times greater than that of Lombardy’s MSCs (0.6%). Furthermore, Milan outperforms the other metropolitan hubs of Northern Italy by far, armed with its status as a global city. Even in the Northeast, MSCs are in difficulty compared to the large urban hubs, but the difference in the rates is more modest. Only Friuli-Venezia Giulia made a name for itself: the MSCs, although not very dynamic, gained workers, a contrasting trend to that of Trieste. Taking into account the individual MSCs in their respective regions, only in 34 cases do employment growth rates prove to be greater than those of metropolitan hubs and other large cities.[5]

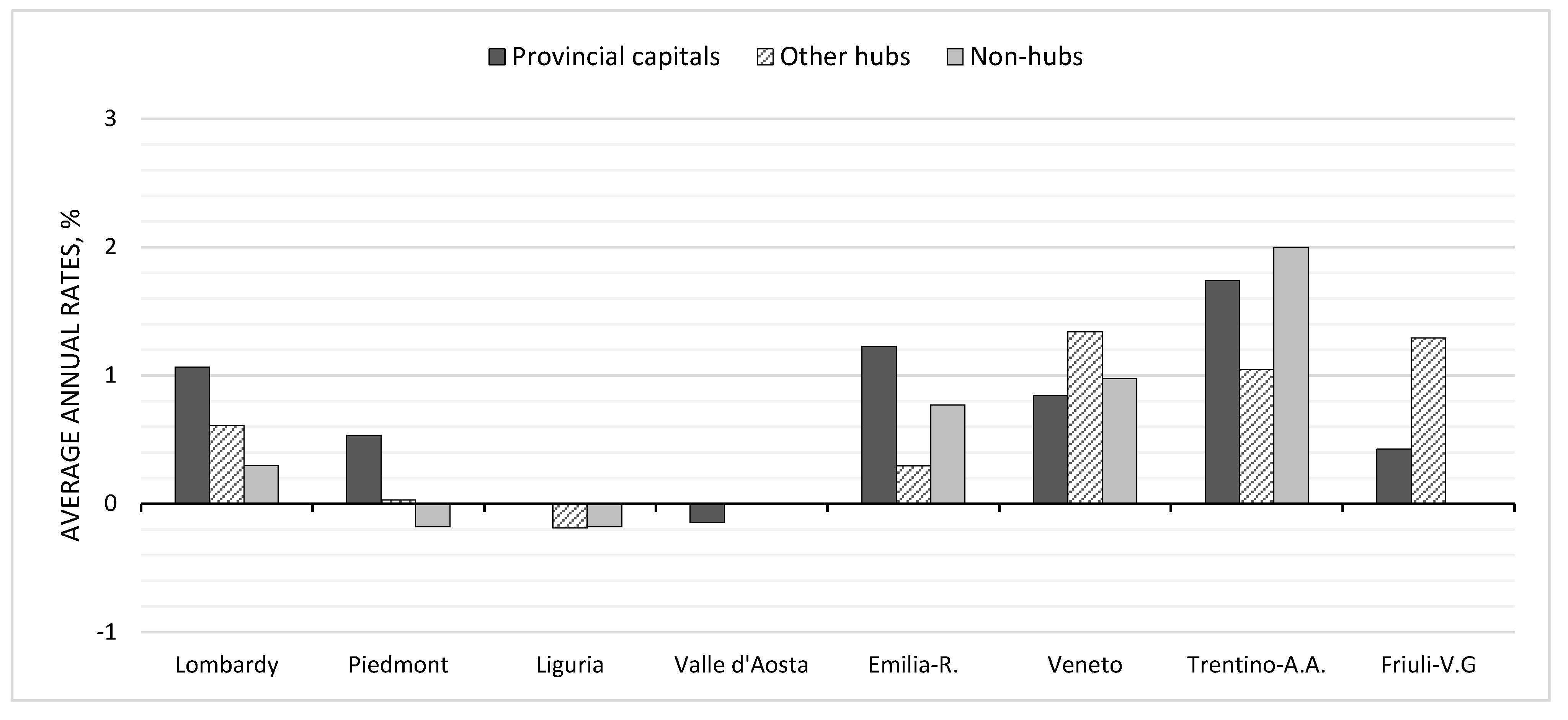

By disaggregating the data according to the hierarchy of the MSCs (

Figure 3), it is clear that the provincial capitals recorded the best employment performance, especially in the Northwest. However, in the Northeast this only occurs in Emilia-Romagna; in the other regions, again between 2012 and 2019, the push for decentralisation was strong, benefiting non-capital MSCs as epicentres of the urban sprawl.

4.2. The mosaic of specialisations

MSCs have heterogeneous profiles in terms of their employment sector distribution (

Table 2). We considered 12 distinct sectors broken down according to the level of technological and knowledge intensity (Eurostat classification). Manufacturing industry is divided into four categories: high-technology, medium-high-technology, medium-low-technology and low-technology (codes M1-M4). Energy-extraction (EN/ES) and construction (COS) activities also fall within the scope of industry. Knowledge-intensive services are divided into four groups: knowledge-intensive market services (KIS1), high-tech knowledge-intensive services (KIS2), knowledge-intensive financial (KIS3) and other knowledge-intensive services (KIS4) Lastly, there are less knowledge-intensive services, divided into two categories: less knowledge-intensive market services (LKIS1) and other less knowledge-intensive services (LKIS2).

In 2019, manufacturing industries still accounted for many jobs, particularly in the MSCs of the Northeast (20.6%). Here there is also a high proportion of workers in low-skilled services (44.4%). Meanwhile, in the Northwest, there is a greater weighting of non-manufacturing industry (8.3%) and more highly skilled services (28.4%). We must bear in mind that the differences between the geographical areas are modest but become accentuated on a regional scale.

One of the most widely used indicators for assessing the processes of agglomeration of economic activities, which generate different profiles of specialisation in the local economies, is the Location Quotient (LQ) (Nakamura & Paul, 2009). This index measures the relative concentration of a characteristic in one area compared to a wider aggregate. In our case, we considered the proportion of workers in each MSC in the sectors listed above compared to the data for Northern Italy:

where: A = workers in the local business units; i = industry i-

th; t = total industries, j = city;

LQ values greater than 1 indicate a gradually growing specialisation of the MSC in the activity in question. It should be remembered that this does not necessary imply a high number of workers in that sector, but merely an over-representation compared to the employment structure of Northern Italy.

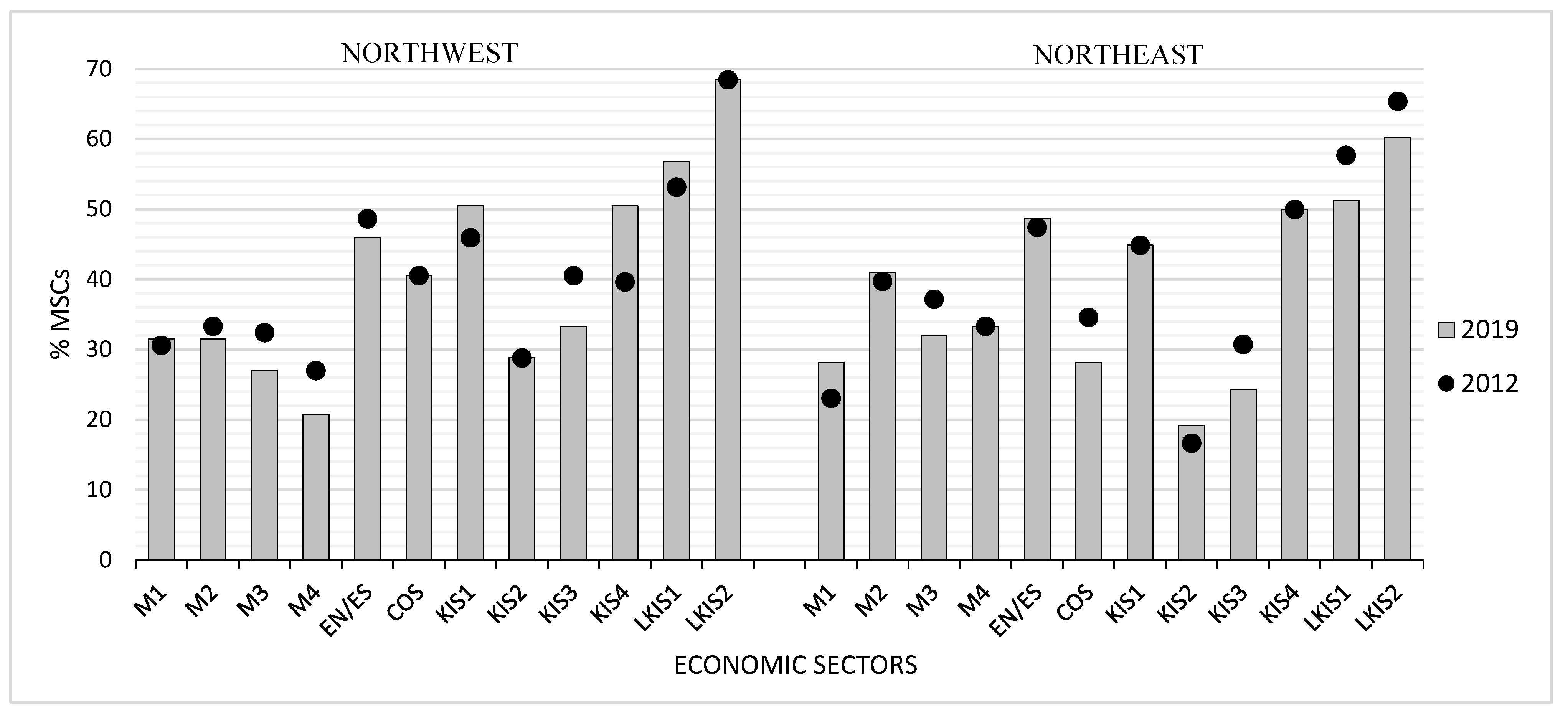

The number of specialisations accumulated by MSCs across the various sectors decreased between 2012 and 2019, both in the Northwest (from 543 to 539) and in the Northeast in particular (from 375 to 360). This is not a net loss as there is always a flux of specialisations lost and gained (

Table 3): a strong flux, indicative of the unstable position of MSCs compared to general trends. Hierarchy matters: the provincial capitals – large scale centres – on average have the highest number of specialisations (5.8 in 2019); followed by other hubs (5.0) and centres that are not hubs (4.2). There are some MSCs that are mono- or bi-specialised (12 in 2012 and 15 in 2019), almost all of which are located in industrial districts (for example: Cantù, Carpi, Castiglione delle Stiviere, Suzzara and Lumezzane).

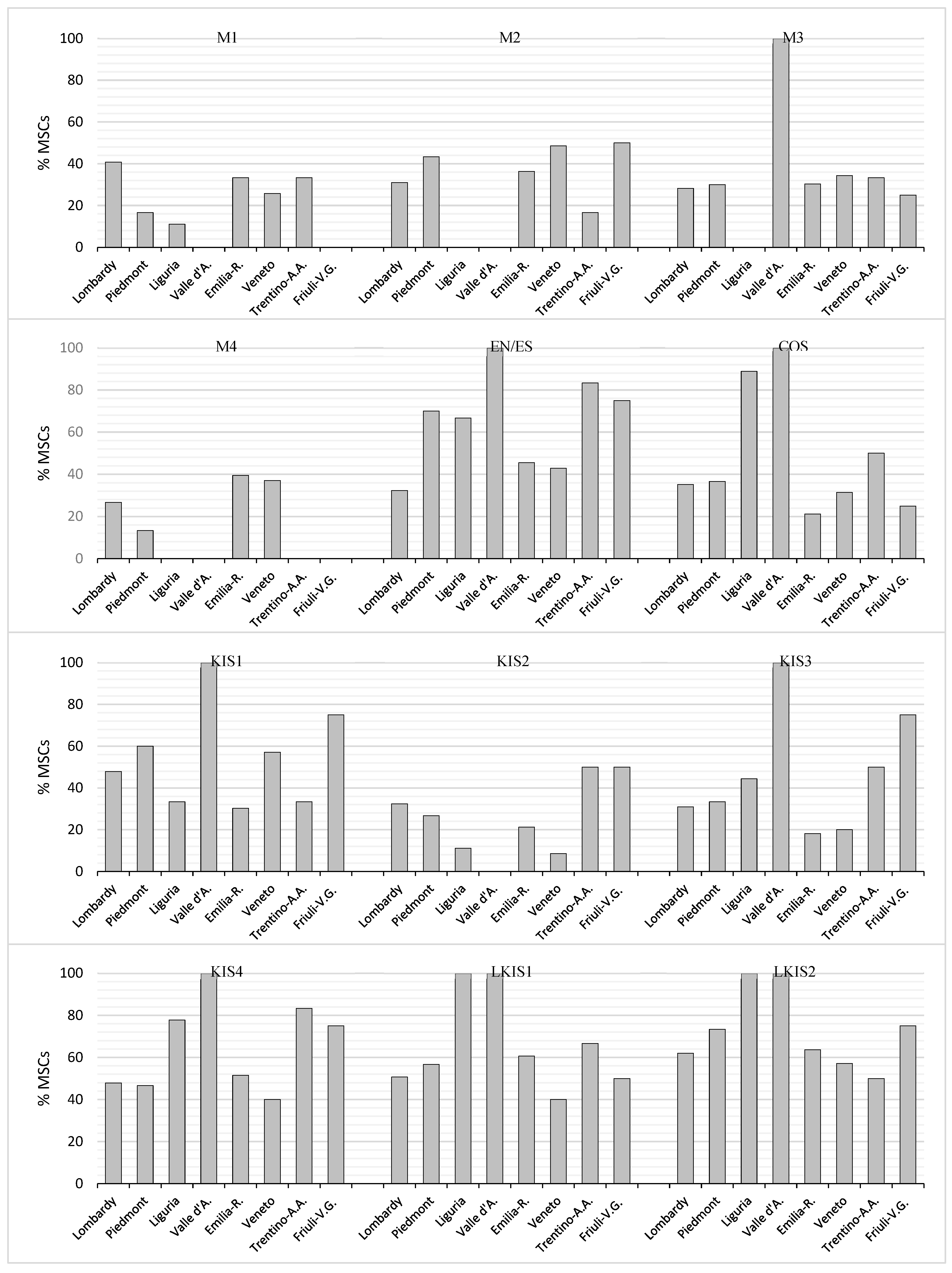

The most widespread specialisations relate to less knowledge-intensive services, above all those of the LKIS2 sector, which can be found in 60-70% of MSCs (

Figure 4). There are also often specialisations in skilled services falling under KIS4 and KIS1. Despite the weighting of tertiary services, there is often a manufacturing-oriented economic base: as much as 30-40% of the MSCs have a specialisation in the M2 sector, the most widely represented. If we look at the data in greater detail, different trends emerge. The MSCs of the Northwest are more closely linked to high-technology production (M1); those of the Northeast instead prioritise other categories. A considerable difference in the M4 sector stands out. Whereas in the Northeast approximately a third of the MSCs are specialised in these activities (26 of 78), in the Northwest the proportion drops drastically (23 of 111), to the point that specialisations in that sector are the rarest of all. The M1 sector data is also of interest, being as it is strongly impacted by the influence of the metropolitan hubs. The incidence of specialisations in these activities is greater in the Northwest – in particular around Milan – but the Northeast has gained ground over the years.

The MSCs of the Northwest are more tertiary-oriented than the others, with profiles more closely linked to skilled services. In the KIS4 sector – which includes healthcare and cultural services supplementary to public services – the differences are minimal. This is not the case in the other categories, where there is a gap of 5-10%. The KIS2 sector is the ‘Achilles heel’ of MSCs, especially in the Northeast: these activities are sensitive to economies of urbanisation and are more easily captured by metropolitan hubs and their surroundings. So far, we have considered the differences between macro areas, but the picture is also varied on a regional scale (

Figure 5).

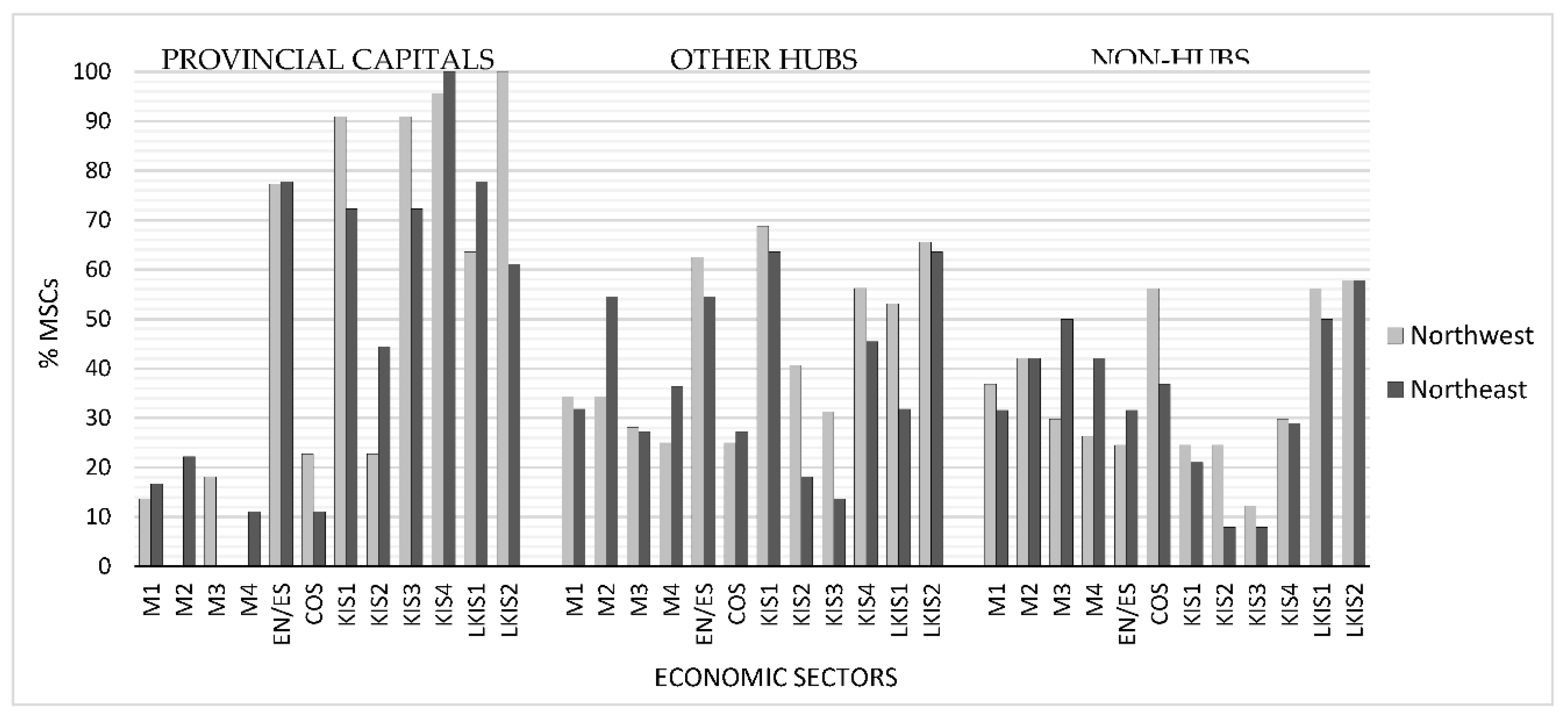

Moving our attention to the different types of MSCs, the extensive specialisation of provincial capitals in services of various kinds is not surprising (

Figure 6). Even utilities – falling with the EN/ES sector – are an important component of the economy of these cities, highlighting the large-scale hubs. Overall, the capitals of the Northeast demonstrate a peculiarity: KIS2 sector specialisations are more widespread – in the Northwest, the other hubs stand out – and those of manufacturing activities, including those that are low-tech. In the group of non-capital hubs, manufacturing is represented so widely that is a feature, in sector M2, of 55% of the cities of the Northeast. In the other area the proportions fluctuate around 30%. A good number of centres are specialised in the tertiary sector, with more highly skilled profiles in the Northwest. Lastly, the non-hub MSCs have an economic base linked to manufacturing activities, construction and traditional services. On the whole, there are no surprises: hierarchy counts and the classification adopted highlights this. There is however one less obvious piece of information: despite having equal status, there are marked difference between macro areas. This relates to manufacturing activities – most represented at all hierarchical levels in the Northeast – but also the skilled services – more widespread in the Northwest – which are often looked to as a source of competitive advantage.

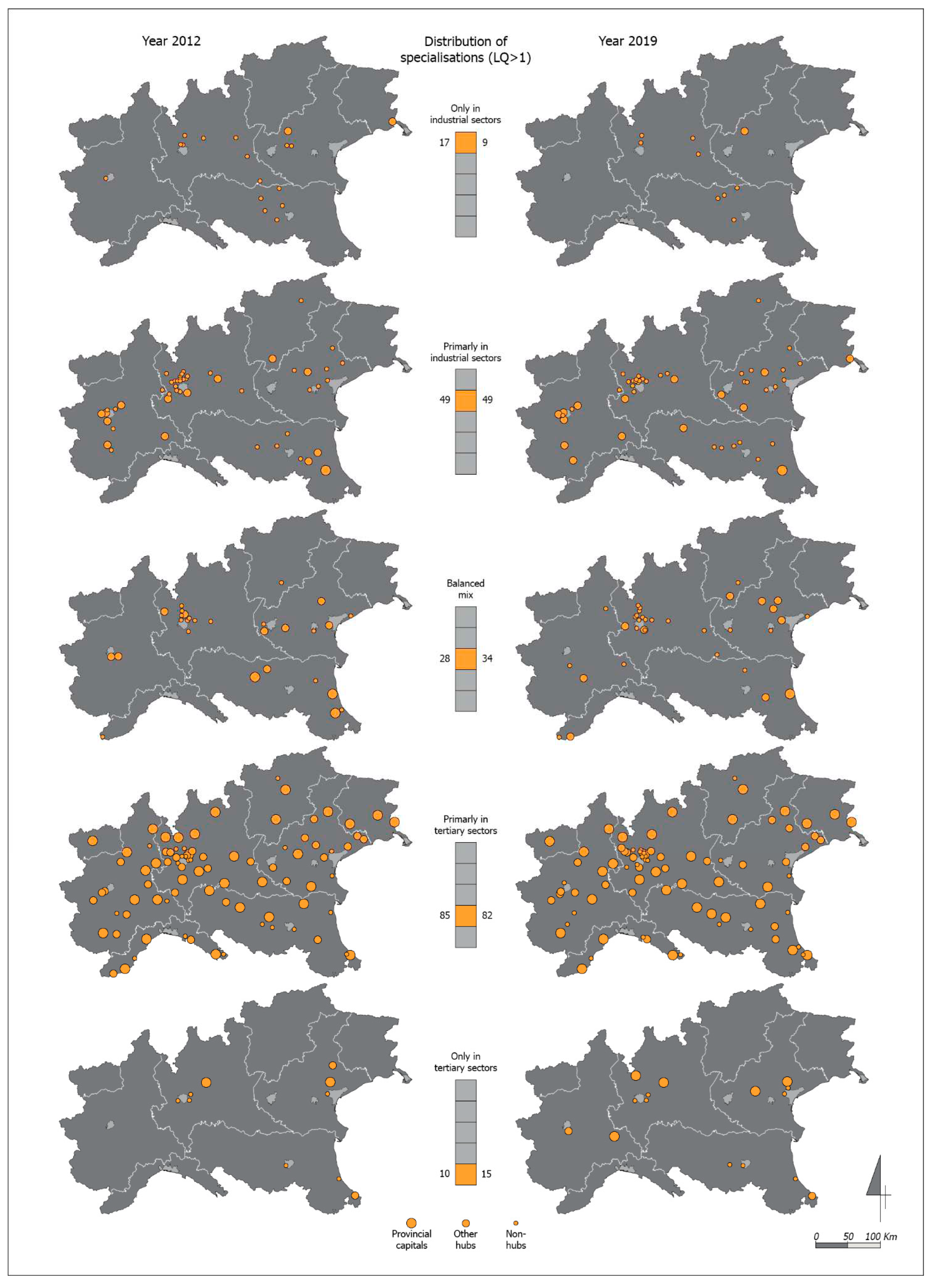

We can draw a summary considering whether the specialisations of each MSC (LQ values>1) are concentrated:

only in industrial sectors;

primarily in industrial sectors;

in equal measure in industrial and tertiary sectors;

primarily in tertiary sectors;

only in tertiary sectors.

Thus, we can capture the different tendencies of the local economies (

Figure 7). The first case is uncommon (9 MSCs in 2019) and mainly involves non-hub centres located in Lombardy and Emilia-Romagna. By contrast, there are 15 MSCs that fall under the fifth case (there were 10 in 2012); these are provincial capitals and tourism-orientated centres (such as Riccione and Cervia along the Adriatic Coast), but also centres that are home to the headquarters of large companies (such as Mogliano Veneto for insurance activities). The fourth case is the most frequent (82 MSCs), but the second is also well-represented (49 MSCs). If we consider the first two cases together, we find high proportions of MSCs still linked to industry (27% in the Northwest and 36% in the Northeast). This is more evident in the areas surrounding large cities, but especially in the east of Lombardy, in the central Veneto area and in Emilia-Romagna, a vast area that constitutes the country’s ‘new industrial triangle’ (Viesti, 2021).

To identify the overall specialisation profiles of the MSCs, we reaggregated the data into three sectors: industry, KIS and LKIS. By comparing the distribution of workers at a local level with the average values of the 189 cities in question, it is possible to identify six profiles defined by a specialisation in the following sectors (

Table 4):

- A)

industry;

- B)

industry + KIS;

- C)

industry + LKIS;

- D)

KIS + LKIS;

- E)

KIS;

- F)

LKIS.

Profile A is the most widespread and is a feature of approximately one third of the MSCs. These strongholds of industry, as already mentioned, are found in the outskirts of metropolitan areas and in the ‘new industrial triangle’. Among the MSCs with a mix of industrial and tertiary activities (profiles B and C) certain differences can be observed: profile B is prevalent in the Northeast, with a noticeable density in Veneto; in the Northwest, the picture was initially balanced, before profile C became established. This can be seen around Milan and Turin in particular. The number of tertiary-oriented MSCs linked to profile D has decreased over time, although there are many. This is most evident in the Northeast, where there has been a shift towards skilled services, which led to a surge for profile E. Lastly, there is profile F, which is growing in the Northwest and more stable in the Northeast. It is typical of tourism-oriented MSCs, but it can also be found in metropolitan outskirts, where essential low-skilled services for urban organisation gather.

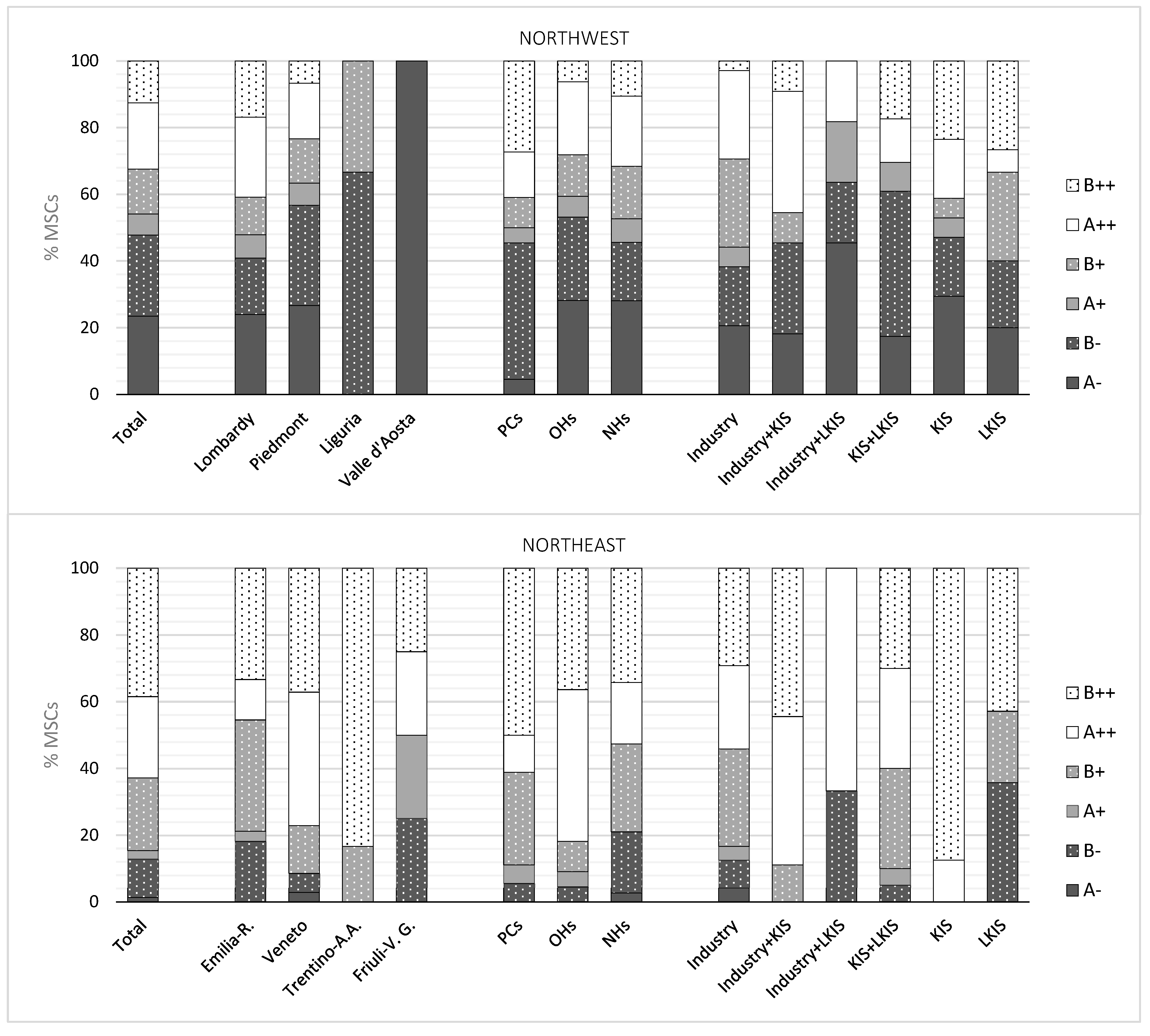

4.3. Evolutionary profiles

Returning to employment trends between 2012 and 2019, different situations can be seen. Certain MSCs have been strengthened by the effect of employment growth rates greater than those recorded across Northern Italy. In others, there has been less impetus, which has led to a trend of relative weakening compared to the wider picture. Lastly, there are MSCs that have lost workers – in contrast to the general trend – which have therefore followed a trend of decline (absolute weakening).

All of this is associated with varying degrees of transformation of the local productive structure, as can be seen from the Restructuring Index (RI) calculation:

where: Q = % of total workers; i = industry i-

th; t1, t2 = reference years

This index fluctuates between 0 and 1. High values identify a pronounced restructuring of the sectoral composition of workers over the period 2012-2019; vice versa, low values are associated with more stable configurations over time. Taking the average RI as a discriminant, we can distinguish between cities open to transformation and those that are more conservative. In both cases, a trend of employment growth can be triggered, but different situations are exploited: an impulse to modify their employment structure to a greater or lesser degree compared to other MSCs of Northern Italy.

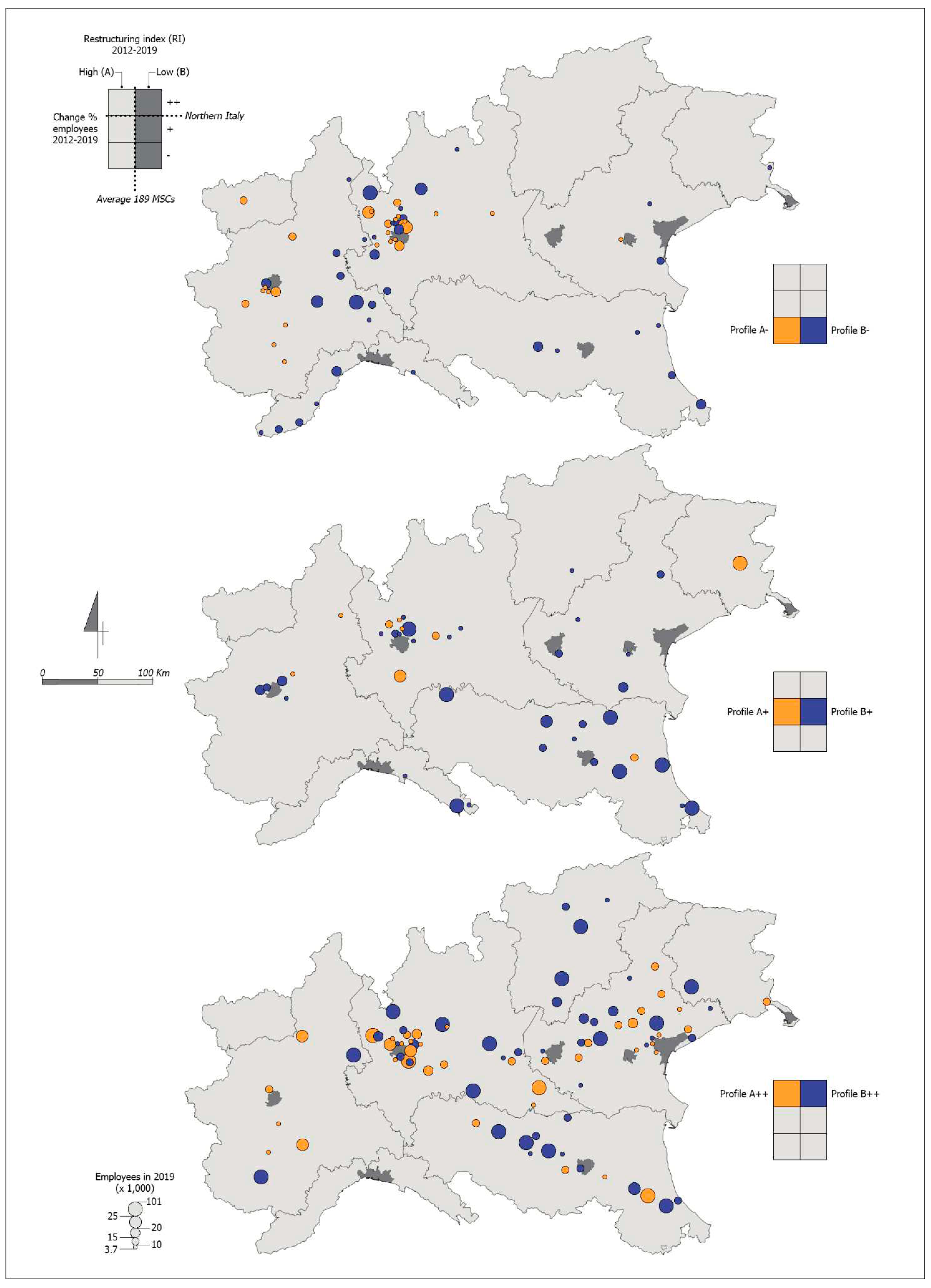

The combination of employment growth and the RI establishes six evolutionary profiles (

Figure 8 and

Figure 9). Observing their geographical distribution, the split between Northwest and Northeast is confirmed once again. The situation is more critical in the former. In 56 of 111 MSCs a trend towards decline is noticeable, with the loss of a total of 26,000 jobs over the period in question. In approximately half of cases there was intense restructuring of local economies (profile A-), but this was not sufficient to ‘protect’ employment. The many MSCs in decline are joined by those undergoing relative weakening (22 cases), primarily those with a low RI. The distressed MSCs (decline + relative weakness) are located in the west of Liguria, around the main urban hubs and in an intermediate position between Milan and Turin, in particular in the provinces of Asti, Alessandria and Novara. Here we can see trends typical of the ‘middle-income trap’, which we have already discussed. The epicentre of the growth moved towards the Northeast. There are however differences within this area. In Trentino-Alto Adige and in Veneto the trajectories of reinforcement are largely dominant and associated with an RI that is generally low. In the other regions there is more room for trends of decline and relative weakness. The latter, in particular, are well represented in the MSCs of Emilia-Romagna, which are generally distinguished by their greater inertia (prevalence of profiles with a low IR).

Restructuring index (RI): high (A), low (B). Employment dynamics: strengthening (++), relative weakening (+), decline (-).

The differences between macro areas are also clear with regard to the individual types of MSCs (

Figure 8). In the Northwest, the non-capital hubs and non-hubs had the greatest problems, even if unlike the capitals they have profiles with a high RI. In the Northeast, the weak links are the non-hub MSCs: almost half of the centres of this type have experienced a trend of absolute or relative weakening, primarily associated with a low IR. It is non-capital hubs that were strengthened in particular, often in the presence of a high RI. This outlook is even better than that of the capitals, which are characterised by greater inertia and where the trends of relative weakening have a notable impact.

Looking at the overall specialisation profiles of the MSCs, there are some surprises (

Figure 8). The cities specialised in industry did not necessarily have the greatest problems. While there are cases of decline, the weighting is lower compared to MSCs with other profiles. If anything – in both the Northwest and the Northeast – there was moderate employment growth, which led to an over-concentration of the B+ trajectory.

The processes of decline primarily involve MSCs with a profile linked to industry and low-skilled services (LKIS). Here perhaps there was a shift of workers from the first sector to the second, but the latter must now come to terms with the expulsion of the workforce caused by the ‘robot apocalypse’ and other processes. Moreover, a wide range of commercial activities, which were punished by slowing consumption during the Great Recession, fall into the LKIS sector. A specialisation in only low-skilled services is also problematic.

The trajectories of reinforcement are more frequent where there is an economic base linked to skilled services (KIS) or to a combination of the same and industry. This is extremely evident in the Northeast. The picture is more contrasting in the MSCs with profiles based on a mix of services (KIS+LKIS). In these cases, particularly in the Northwest, there is a heavy weighting of trajectories of absolute and relative weakening. This tells us that the presence of skilled services is not always a panacea. One need only consider financial activities (KLIS3), where digitalisation and mergers between businesses have led to severe cuts in employment. In the Northwest, moreover, MSCs with a tertiary profile might suffer from competition from Milan, the primary hub of reference for KIS businesses.

4.4. The initial impact of the COVID-19 pandemic

The COVID-19 pandemic had serious repercussions in terms of healthcare, but also on an economic and social level. In Italy, GDP fell by 8% in 2020, a sharp drop which came after a long journey of recovery from the Great Recession. In the northern regions, the epicentre of the first wave of the pandemic, the drop was even greater, particularly in Piedmont (-8.3%) and in Veneto (-8.5%).

Reflecting only on 2020 certainly does not make it possible to draw a definitive outcome of the impact of the pandemic. In any case, we are already looking ahead: to the recovery of the GDP and employment, to the investments set out within the National Recovery and Resilience Plan and to the effects of the energy crisis and the Russia-Ukraine war which broke out in 2022. Nevertheless, 2020 marks a watershed moment and it is useful to isolate the initial impact of the pandemic as part of a larger story.

In just one year, the MSCs of Northern Italy lost as many as 103,307 jobs (

Table 5). They had gained 157,161 in the preceding seven-year period. Therefore, the balance compared to 2012 remains positive other than in Piedmont and Friuli-Venezia Giulia. MSCs suffered more than the metropolitan hubs, but less than the small centres. This ‘in between’ position was confirmed, even if in 2020 the balance of power changed compared to the past.

The picture of employment performance is worse for the MSCs of the Northeast – unlike the preceding seven-year period – and for those of Emilia-Romagna in particular. It felt the burden of an economy that is more closely linked to tourism and manufacturing activities (see §4.2) which were heavily impacted by the pandemic (restrictions on the movement of people, problems in logistics chains, lower export volumes).

The fall in workers was most evident in large- and medium-sized local businesses. This fact marks a break with the past. Between 2012 and 2019, employment growth – in both the Northwest and the Northeast – was driven by precisely these types of businesses and secondarily by small local businesses. Only the micro-businesses lost workers. The events of 2020 come as a surprise because jobs in the largest organisations should have been protected by unions and easier access to redundancy funds. Instead, in the face of sudden shocks, businesses of this type were more prepared to do away with the surplus workforce (especially if they had fixed-term contracts). Smaller businesses, albeit in the midst of many difficulties, tried to adapt without sacrificing too many jobs: they had the benefit of flexibility.

The pandemic disrupted the MSCs’ evolutionary trajectories (

Table 6). The fall in the number of workers, which previously affected the Northwest in particular, increased over the course of 2020 and also took hold in the Northeast. Here 58 MSCs passed from a trajectory of employment growth to one of loss. In as many as 40 cases, the rates of decrease were greater than those recorded across the entirety of Northern Italy: an abrupt turnaround. There are another 41 MSCs – almost all located in the Northwest – wrapped in a spiral of decline: they were already losing workers in the pre-pandemic period and continued in this manner in 2020. We should devote more attention to these cases, which are often hubs (22 cases, 8 of which are capitals). However, the picture is not always bleak: 26 MSCs gained workers even during the first year of the pandemic and 22 reversed the previous trajectory of decline.

5. Discussion and conclusions

Much attention is paid to the success of MSCs and their ability to provide a sustainable development model, balancing the strengths and weaknesses typical of metropolises and small communities. We should however abandon overarching views in order to highlight the nature and evolutionary trajectories of the individual MSCs. These form a varied universe and even in periods of recession they have a different capacity for resilience. Employment trends are a key indicator for studying the performance of MSCs and their position of strength or weakness in the settlement system. We worked on general data, without taking into account the differences of type and skills that impact competitiveness and the sustainability of development processes. Despite this limitation, our research reveals three significant results.

First of all, there is a rift between the MSCs of the Northwest and those of the Northeast in terms of employment trends. Between 2012 and 2019, the difficulties were greater in the former, where many MSCs followed trajectories of decline and relative weakening. Had we worked over a longer period (2001-2019), a worsening of the picture would have been revealed precisely after 2012. This data gives us pause for thought: established views should be readdressed and interpreted by taking into account the specific position of the cities of varying status. The Northwest is historically the strong area of Italy and its role as a driving force did not waver during the Great Recession. But the MSCs were not drivers, other than to a small extent. The trajectories of decline and relative weakening impact the most isolated centres above all – corroborating the studies cited in §2 – and the intermediate areas between Milan and Turin. However, coastal MSCs are also in a critical situation, as opposed to that which occurs in other countries of the Mediterranean Basin (see §2). Meanwhile, in the Northeast almost all of the MSCs gained workers and it is easy to find trajectories of reinforcement. Here there has always been a symbiosis between MSCs and industrial districts, which is still recognisable and provides strong results. Greater vitality stands out in the central area of Veneto and along infrastructure corridors, in particular along the Brenner route and the ‘Via Emilia’. The outbreak of the COVID-19 pandemic impacted the MSCs of the Northeast the most, but this is probably temporary. Aside from the differences between macro areas, there is also the turmoil of MSCs compared to larger centres (metropolitan hubs and other large cities), which recorded better employment performance between 2012 and 2019.

The second important outcome of the research relates to the variety of MSC specialisation profiles. There are many local scenarios, which do not make it easy to achieve the ambitious objectives of the cohesion policies for 2021-2027 and those of the National Recovery and Resilience Plan. It will be important to implement ‘inclusive’ policies, capable of mobilising the various local energies with a place-based approach. Aside from the range of local situations, a greater orientation towards industry emerges in the MSCs of the Northeast and towards skilled services in those of the Northwest. This difference is clear at all hierarchical levels: provincial capitals, other hubs and non-hubs. It is not necessarily MSCs linked to industry – of which there are still many – that have experienced the greatest problems over recent years. This is not entirely in keeping with the studies mentioned in §2. The trajectories of decline and relative weakening are well-represented in MSCs with a tertiary services profile. This is extremely evident in the Northwest. Here, despite the greater instability of the employment structure (high RI), the MSCs appear to suffer more greatly from the influence of the metropolises, especially that of Milan. This reduces the space for manoeuvre for a further transition towards services that are more highly skilled.

Lastly, the third important outcome of the research relates to the types of centres in distress. Taking into account the seven-year period prior to the pandemic, 63 MSCs were found to be in decline and 41 undergoing relative weakening. There is also a hardcore of 41 MSCs that also continued to lose workers in 2020. These problematic trajectories involve many hubs (including provincial capitals), especially in the Northwest. The poor employment performance of these MSCs could be a problem for the development of the surrounding areas. The system of local relationships should be rethought. ANCI (the National Association of Italian Municipalities) is sensitive to this problem and in 2021 it launched the ‘MediAree-Next Generation City’ project to support MSCs in developing wide scale strategies. However, the initiative only relates to provincial capitals. It would be beneficial to extend the intervention and to support non-capital hubs: smaller centres that are often the focal point of areas of low settlement density, which can plot a route in the transition towards a more sustainable development model.

References

- Accetturo, A., Lamorgese, A., Mocetti, S. & Sestito, P. (2019). Local development, urban economies and aggregate growth. Banca d’Italia. Questioni di economia e finanza (Occasional Papers), 490.

- Adam, B. (2006). Medium-sized cities in urban regions. European Planning Studies, 14(4), 547-555. [CrossRef]

- ANCI-IFEL (2013). L’Italia delle città medie. Quaderni di analisi, 4. Rome: Centro Documentazione e Studi ANCI-IFEL.

- Bell, D. & Jayne, M. (2009). Small cities? Towards a research agenda. International Journal of Urban and Regional Research, 33(3), 683-699. [CrossRef]

- Bole, D., Kozina, J. & Tiran, J. (2019). The variety of industrial towns in Slovenia: A typology of their economic performance. Bulletin of Geography. Socio-economic Series, 46(46), 71-83. [CrossRef]

- Bolton, T. & Hildreth, P. (2013). Mid-Sized Cities: Their Role in England’s Economy. London: Centre for Cities.

- Brunet, R. (1997). Territoires de France et d’Europe. Raisons de géographe. Paris: Belin.

- Camagni, R. & Salone, C. (1993). Network urban structures in northern Italy: Elements for a theoretical framework. Urban Studies, 30(6), 1053-1064. [CrossRef]

- Camagni, R., Capello, R. & Caragliu, A. (2015). The rise of second-rank cities: What role for agglomeration economies? European Planning Studies, 23(6), 1069-1089. [CrossRef]

- Carter, D.K. (Ed.) (2016). Remaking post-industrial cities. Lessons from North America and Europe. London & New York: Routledge.

- Cebrián Abellán, F. & Sánchez Ondoño, I. (2019). Urban sprawl in inner medium-sized cities: The behaviour in some Spanish case since the beginning of the 21st century. Urban Science, 3(1), 10. [CrossRef]

- CEC (2020). Territorial Agenda 2030. A Future for all Places. https://ec.europa.eu/regional_policy/en/information/publications/brochures/2021/territorial-agenda-2030-a-future-for-all-places.

- Champion, T. & Townsend, A. (2013), Great Britain’s second-order city regions in recessions. Environment and planning A, 45(2), 362-382. [CrossRef]

- Clayton, N. & Morris, K. (2010). Recession, Recovery and Medium-Sized Cities. London: The Work Foundation.

- Clerici, M.A. (2020). Unity in variety. Employment dynamics and specialisation profiles of medium-sized towns in the Asti-Rovigo area, Italy (2001-2017), Quaestiones Geographicae, 39(4), 5-22. [CrossRef]

- Cori, B. , Cortesi, G., Costa, M., Da Pozzo, C. & Formentini U. (1978). Il ruolo delle città medie e piccole nella rete urbana dell’Italia settentrionale. In C. Muscarà (a cura di), Megalopoli mediterranea, 159-170. Milan: Franco Angeli.

- Crouch, C. (2007). Specialisation and networking in medium-sized cities. In OECD Territorial Reviews: Competitive Cities in the Global Economy (pp. 317-328). Paris: OECD Publishing.

- Dicecca, M. (2019). La città media. Melfi: Libria.

- Diemer, A., Iammarino, S., Rodríguez-Pose, A. & Storper, M. (2022). The regional development trap in Europe. Economic Geography, 98(5), 487-509. [CrossRef]

- Dijkstra, L., Garcilazo, E. & McCann, P. (2013). The economic performance of European cities and city regions: Myths and realities. European Planning Studies, 21(3), 334-354. [CrossRef]

- Doerr, S. & Gambacorta, L. (2020). COVID-19 and regional employment in Europe. Bulletin of the Bank for International Settlements, 16.

- Erickcek, G.A. & McKinney, H. (2006). “Small cities blues”: Looking for growth factors in small and medium-sized cities. Economic Development Quarterly, 20(3), 232-258. [CrossRef]

- Escudero Gomez, L.A. & Somoza Medina, J. (2010). Medium-sized cities: polycentric strategies vs the dynamics of metropolitan area growth. The Open Urban Studies Journal, 3(1), 2-13. [CrossRef]

- Escudero Gómez, L.A., García González, J.A. & Martínez Navarro, J.M. (2019). Medium-sized cities in Spain and their urban area within national network. Urban Science, 3(1), 5. [CrossRef]

- ESPON (2014). TOWN. Small and Medium-Sized Towns in Their Functional Territorial Context. Final Report. Luxembourg: ESPON.

- ESPON (2017). PROFECY-Processes, Features and Cycles of Inner Peripheries in Europe, Final Report. Luxembourg: ESPON.

- ESPON (2021). IMAGINE-Developing a Metropolitan-Regional Imaginary in Milan-Bologna Urban Region. Final Report. Luxembourg: ESPON.

- Farinelli, F. (2003). Geografia: un’introduzione ai modelli del mondo. Turin: Einaudi.

- Fujita, M., Krugman, P.R. & Venables, A.J. (1999). The Spatial Economy. Cambridge (MA): MIT Press.

- Garrido Cumbrera, M. , Rodríguez Mateos, J.C. & López Lara, E. (2016). The role of inland mid-size towns and cities in regional development. The case of Andalusia, Boletín de la Asociación de Geógrafos Españoles, 71, 537-540.

- González-Leonardo, M., Rowe, F. & Fresolone-Caparrós, A. (2022). Rural revival? The rise in internal migration to rural areas during the COVID-19 pandemic. Who moved and where? Journal of Rural Studies, 96, 332-342. Journal of Rural Studies. [CrossRef]

- Hamdouch, A., Demazière, C. & Banovac, K. (2017). The socio-economic profiles of small and medium-sized towns: Insights from European case studies. Tijdschrift voor Economische en Sociale Geografie, 108(4), 456-471. [CrossRef]

- Hamdouch, A., Nyseth, T., Demazière, C., Førde, A., Serrano, J. & Aarsæther, N. (Eds.) (2017). Creative Approaches to Planning and Local Development. Insights from Small and Medium-Sized Towns in Europe. London & New York: Routledge.

- Henderson, V. (1997). Medium size cities. Regional Science and Urban Economics, 27(6), 583-612. [CrossRef]

- Herod, A., Gialis, S., Psifis, S., Gourzis, K. & Mavroudeas, S. (2022). The impact of the COVID-19 pandemic upon employment and inequality in the Mediterranean EU: An early look from a labour geography perspective. European Urban and Regional Studies, 29(1), 3–20. [CrossRef]

- Hildreth, P.A. (2006). Roles and Economic Potential of English Medium-Sized Cities: A Discussion Paper. https://www.researchgate.net/publication/228379144_Roles_and_Economic_Potential_of_English_Medium-Sized_Cities_A_Discussion_Paper.

- Iammarino, S., Rodríguez-Pose, A., Storper, M. & Diemer, A. (2020). Falling Into the Middle-Income trap? Luxembourg: Publications office of the European Union.

- Iommi, S. (2016). Città medie e nuove politiche di sviluppo. Scienze regionali/Italian Journal of Regional Science, 15(2), 5-14. [CrossRef]

- ISTAT (2021). Rapporto annuale 2021. La situazione del Paese. Rome: ISTAT.

- Kaufmann, D. & Wittwer, S. (2019). Business centre or bedroom community? The development of employment in small and medium-sized towns. Regional Studies, 53(10), 1483-1493. [CrossRef]

- Knox, P.L. & Mayer, H. (2013). Small Town Sustainability. Economic, Social, and Environmental Innovation. Basel: Birkhauser.

- Kresl, P.K. & Ietri, D. (2016). Smaller Cities in a World of Competitiveness. London & New York: Routledge.

- Kunzmann, K.R. (2010). Medium-sized towns, strategic planning and creative governance. In M. Cerreta, G. Concilio & V. Monno (Eds.), Making strategies in spatial planning: Knowledge and Values, 27-45. Dordrecht: Springer.

- Lazzaroni, M. & Piccaluga, A. (2015). Beyond “town and gown”: The role of the university in small and medium-sized cities, Industry & Higher Education, 29(1), 11–23. [CrossRef]

- Lazzaroni, M. & Mayer, H. (Eds.) (2022). A Research Agenda for Small and Medium-Sized Towns. Northampton (MA): Edward Elgar Publishing.

- Lemmi, E. (2012). Dinamiche e processi nella geografia delle città in Italia. Quadro storico di fine millennio. Milan: Franco Angeli.

- Léo, P.-Y., Philippe, J. & Monnoyer, M.-C. (2010). Services and high skills: A new challenge for developing medium-sized cities. The Service Industries Journal, 30(4), 513-529. [CrossRef]

- Lorentzen, A. & van Heur, B. (Eds.) (2012). Cultural Political Economy of Small Cities. London & New York: Routledge.

- Mecenate 90 (2020). L’Italia policentrica. Il fermento delle città intermedia. Milan: Franco Angeli.

- Meijers, E., Hoogerbrugge, M. & Cardoso, R. (2018). Beyond polycentricity: Does stronger integration between cities in polycentric urban regions improve performance? Tijdschrift voor Economische en Sociale Geografie, 109(1), 1-21. [CrossRef]

- Meijers, E.J. & Burger, M.J. (2016). Stretching the concept of “borrowed size”. Urban Studies, 54(1), 269-291. [CrossRef]

- Meijers, E.J., Burger, M.J. & Hoogerbrugge, M.M. (2016). Borrowing size in networks of cities: City size, network connectivity and metropolitan functions in Europe. Papers in Regional Science, 95(1), 181-199. [CrossRef]

- Meili, R. & Mayer, H. (2017). Small and medium-sized towns in Switzerland: Economic heterogeneity, socioeconomic performance and linkages. Erdkunde, 71(4), 313-332. [CrossRef]

- Muscarà, C., Scaramellini, G. & Talia, I. (a cura di) (2011). Tante Italie Una Italia. Dinamiche territoriali e identitarie. Milan: Franco Angeli.

- Nakamura, R. & Paul, C.J.M. (2009). Measuring agglomeration. In R. Capello & P. Nijkamp (Eds.), Handbook of Regional Growth and Development Theories (pp. 305-328). Northampton (MA): Edward Elgar Publishing.

- Oberti, M. (2000). Social structures in medium-sized cities compared. In A. Bagnasco & P. Le Galès (Eds.), Cities in Contemporary Europe (pp. 98-111). Cambridge: Cambridge University Press.

- Perulli, P. (a cura di) (2012). Nord. Una città-regione globale. Bologna: il Mulino.

- Rifkin, J. (2022). The Age of Resilience. Reimagining Existence on a Rewilding Earth. New York: St. Martin’s Press.

- Roberts, B.H. (2014). Managing Systems of Secondary Cities. Policy Responses in International Development. Brussels: Cities Alliance/UNOPS.

- Rodríguez-Pose, A. & Griffiths, J. (2021). Developing intermediate cities. Regional Science Policy & Practice, 13(3), 441-456. [CrossRef]

- Runge, A. (2016). Urban agglomerations and transformations of medium-sized towns in Poland. Environmental & Socio-economic Studies, 4(3), 41-55. [CrossRef]

- Scott, A.J. (2008). Social Economy of the Metropolis: Cognitive-Cultural Capitalism and the Global Resurgence of Cities. New York: Oxford University Press.

- Selada, C., Da Cunha, I.V. & Tomaz, E.A. (2012). Creative-based strategies in small and medium-sized cities: Key dimensions of analysis. Quaestiones Geographicae, 31(4), 43-51. [CrossRef]

- Servillo, L., Atkinson, R. & Hamdouch, A. (2017). Small and medium-sized towns in Europe: Conceptual, methodological and policy issues. Tijdschrift voor Economische en Sociale Geografie, 108(4), 365-379. [CrossRef]

- Sikorski, D. & Szmytkie, R. (2021). Changes in the distribution of economic activity in Wrocław and its suburban area, 2008-2016. Bulletin of Geography. Socio-economic Series, 54(54), 33-48. [CrossRef]

- Stawarz, N. , Rosenbaum-Feldbrügge, M., Sander, N., Sulak, H. & Knobloch, V. (2022). The impact of the COVID-19 pandemic on internal migration in Germany: A descriptive analysis. Population Space Place, 28(6), e66. [CrossRef]

- Sýkora, L. & Mulíček, O. (2017). Territorial arrangements of small and medium-sized towns from a functional-spatial perspective. Tijdschrift voor Economische en Sociale Geografie, 108(4), 438-455. [CrossRef]

- The Riga Declaration (2015). https://ec.europa.eu/futurium/en/system/files/ged/riga-declaration.pdf.

- Turri, E. (2000). La megalopoli padana. Venice: Marsilio.

- UCLG (2017). Co-Creating the Urban Future. The Agenda on Metropolises, Cities and Territories. Barcelona: UCLG.

- UN-Habitat (2015). Cuenca Declaration for Habitat III – Intermediate cities: Urban growth and renewal. https://habitat3.org/wp-content/uploads/Cuenca-Declaration.pdf.

- van der Merwe, J. & Doucet, B. (2021). Housing challenges, mid-sized cities and the Covid-19 pandemic: Critical reflections from Waterloo region. Canadian Planning and Policy 2021(1): 70-90. [CrossRef]

- Vázques-Varela, C. & Martínez-Navarro, J.M. (2020). Medium-sized Spanish inland cities and regional development in the Iberian Peninsula: Challenges and Opportunities. In J. Bański (Ed.), Dilemmas of regional and local development, 147-168. London & New York: Routledge.

- Verick, S., Schmidt-Klau, D. & Lee, S. (2022). Is this time really different? How the impact of the COVID-19 crisis on labour markets contrasts with that of the global financial crisis of 2008-09. International Labour Review, 161(1), 125-148. [CrossRef]

- Viesti, G. (2021). Centri e periferie. Europa, Italia, Mezzogiorno dal XX al XXI secolo. Rome & Bari: Laterza.

- Wagner, M. & Growe, A. (2020). Regional urbanization and knowledge-intensive business activities (KIBS): An example of small and medium-sized cities in the Greater Stuttgart region (Germany). Urban Science, 4(1), 1. [CrossRef]

- Wagner, M. & Growe, A. (2021). Research on small and medium-sized towns: Framing a new field of inquiry. World, 2(1), 105-126. [CrossRef]

- Webster, A., Khorana, S. & Pastore, F. (2022). The labour market impact of COVID-19: Early evidence for a sample of enterprises from Southern Europe. International Journal of Manpower, 43(4), 1054-1082. [CrossRef]

- Wittwer, S. (2021). How strong is local politics’ grip on local economic development? The case of Swiss small and medium-sized towns. Urban Affairs Review (in press). [CrossRef]

- Yin, M. & Derudder, B. (2021). Geographies of cultural industries across the global urban system. Geography Compass, 15(6), e12564. [CrossRef]

Figure 1.

The 189 MSCs of Northern Italy covered by the study. Source: our elaboration on Istat data.

Figure 1.

The 189 MSCs of Northern Italy covered by the study. Source: our elaboration on Istat data.

Figure 2.

MSCs and other cities in Northern Italy: rates of employment growth 2012-2019. Source: our elaboration on Istat data.

Figure 2.

MSCs and other cities in Northern Italy: rates of employment growth 2012-2019. Source: our elaboration on Istat data.

Figure 3.

Rates of employment growth in the MSCs, broken down by type, 2012-2019. Source: our elaboration on Istat data.

Figure 3.

Rates of employment growth in the MSCs, broken down by type, 2012-2019. Source: our elaboration on Istat data.

Figure 4.

Frequency of specialisations by sector of activity: total MSCs, 2012 and 2019. Source: our elaboration on Istat data.

Figure 4.

Frequency of specialisations by sector of activity: total MSCs, 2012 and 2019. Source: our elaboration on Istat data.

Figure 5.

Frequency of specialisations by activity: MSCs broken down by region, 2019. Source: our elaboration on Istat data.

Figure 5.

Frequency of specialisations by activity: MSCs broken down by region, 2019. Source: our elaboration on Istat data.

Figure 6.

Frequency of specialisations by sector of activity: MSCs broken down by type, 2019. Source: our elaboration on Istat data.

Figure 6.

Frequency of specialisations by sector of activity: MSCs broken down by type, 2019. Source: our elaboration on Istat data.

Figure 7.

Overall picture of the specialisations of the MSCs, 2012 and 2019. Source: our elaboration on Istat data.

Figure 7.

Overall picture of the specialisations of the MSCs, 2012 and 2019. Source: our elaboration on Istat data.

Figure 8.

Evolutionary profiles of the MSCs, 2012-2019: frequency by region, type of city and specialisation. Source: our elaboration on Istat data.

Figure 8.

Evolutionary profiles of the MSCs, 2012-2019: frequency by region, type of city and specialisation. Source: our elaboration on Istat data.

Figure 9.

Overall summary of the evolutionary profiles of the MSCs, 2012-2019. Source: our elaboration on Istat data.

Figure 9.

Overall summary of the evolutionary profiles of the MSCs, 2012-2019. Source: our elaboration on Istat data.

Table 1.

MSCs of Northern Italy: general information, 2019. Source: our elaboration on Istat data.

Table 1.

MSCs of Northern Italy: general information, 2019. Source: our elaboration on Istat data.

| Areas |

Total |

Types of MSCs |

Resident population |

Employees |

| Provincial capitals (PCs) |

Other hubs (OHs) |

Non-hubs (NHb) |

N° |

% on region |

N° |

% on region |

| Northwest |

111 |

22 |

32 |

57 |

4,570,990 |

28.6 |

1,654,426 |

29.3 |

| Lombard |

71 |

11 |

16 |

44 |

2,963,590 |

29.6 |

1,112,952 |

29.7 |

| Piedmont |

30 |

7 |

14 |

9 |

1,200,896 |

27.9 |

418,425 |

30.2 |

| Liguria |

9 |

3 |

2 |

4 |

372,588 |

24.4 |

110,594 |

23.7 |

| Valle d’Aosta |

1 |

1 |

0 |

0 |

33,916 |

27.1 |

12,455 |

30.9 |

| Northeast |

78 |

18 |

22 |

38 |

3.849,051 |

33.1 |

1,520,130 |

36,2 |

| Emilia-R |

33 |

9 |

6 |

18 |

2,129,499 |

47.7 |

845,845 |

51.3 |

| Veneto |

35 |

4 |

14 |

17 |

1,151,793 |

23.6 |

441,678 |

24.8 |

| Trentino-A.A. |

6 |

2 |

1 |

3 |

353,997 |

32.8 |

147,253 |

37.6 |

| Friuli-V.G. |

4 |

3 |

1 |

0 |

213,762 |

17.7 |

85,354 |

22.6 |

| Total |

189 |

40 |

54 |

95 |

8,420,021 |

30.5 |

3,174,556 |

32.3 |

Table 2.

Employees in the MSCs broken down by level of technological and knowledge intensity, 2012 and 2019. Source: our elaboration on Istat data.

Table 2.

Employees in the MSCs broken down by level of technological and knowledge intensity, 2012 and 2019. Source: our elaboration on Istat data.

| Sectors |

Northwest |

Northeast |

| % 2012 |

% 2019 |

N° 2019 |

% 2012 |

% 2019 |

N° 2019 |

| Manufacturing industries |

21.3 |

19.2 |

318,245 |

21.7 |

20.6 |

313,093 |

| M1 – High-tecnology |

1.3 |

1.0 |

17,093 |

0.8 |

0.9 |

14,340 |

| M2 – Medium-high-tecnology |

6.8 |

6.6 |

109,410 |

7.2 |

6.9 |

104,554 |

| M3 – Mediu-low-tecnology |

6.6 |

6.0 |

99,798 |

6.1 |

5.9 |

89,950 |

| M4 – Low-tecnology |

6.6 |

5.6 |

91,944 |

7.6 |

6.9 |

104,249 |

| Other industries |

9.4 |

8.3 |

137,279 |

9.4 |

7.9 |

119,717 |

| EN/ES – Energy-extraction |

1.9 |

1.9 |

31,542 |

1.6 |

1.7 |

25,663 |

| COS – Construction |

7.5 |

6.4 |

105,737 |

7.8 |

6.2 |

94,054 |

| Knowledge-intensive services |

25.5 |

28.4 |

469,250 |

24.4 |

27.1 |

411,979 |

| KIS1 – Knowledge-intensive market services |

10.8 |

12.7 |

209,673 |

10.1 |

12.0 |

182,377 |

| KIS2 – High-tech knowledge-intensive services |

3.6 |

3.9 |

64,324 |

2.8 |

3.3 |

50,149 |

| KIS3 – Knowledge-intensive financial services |

4.2 |

3.7 |

60,519 |

4.2 |

3.6 |

54,369 |

| KIS4 – Other knowledge-intensive services |

6.9 |

8.1 |

134,734 |

7.3 |

8.2 |

125,084 |

| Less Knowledge-intensive services |

43.8 |

44.1 |

729,653 |

44.5 |

44.4 |

675,341 |

| LKIS1 – Less knowledge-intensive market services |

40.2 |

40.6 |

670,973 |

41.2 |

41.2 |

626,824 |

| LKIS2 – Other less knowledge-intensive services |

3.6 |

3.5 |

58,680 |

3.3 |

3.2 |

48,517 |

| Total activities |

100.0 |

100.0 |

1,654,426 |

100.0 |

100.0 |

1,520,130 |

Table 3.

Specialisations in the MSCs: evolution 2012-2019, absolute values. Source: our elaboration on Istat data.

Table 3.

Specialisations in the MSCs: evolution 2012-2019, absolute values. Source: our elaboration on Istat data.

| Sectors of specialisation |

Northwest (111 MSCs) |

Northeast (78 MSCs) |

| 2012 |

Lost |

Gained |

2019 |

2012 |

Lost |

Gained |

2019 |

| M1 |

34 |

4 |

5 |

35 |

18 |

1 |

5 |

22 |

| M2 |

37 |

10 |

8 |

35 |

31 |

1 |

2 |

32 |

| M3 |

36 |

9 |

3 |

30 |

29 |

7 |

3 |

25 |

| M4 |

30 |

8 |

1 |

23 |

26 |

3 |

3 |

26 |

| EN/ES |

54 |

15 |

12 |

51 |

37 |

5 |

6 |

38 |

| COS |

45 |

8 |

8 |

45 |

27 |

8 |

3 |

22 |

| KIS1 |

51 |

7 |

12 |

56 |

35 |

7 |

7 |

35 |

| KIS2 |

32 |

9 |

9 |

32 |

13 |

3 |

5 |

15 |

| KIS3 |

45 |

9 |

1 |

37 |

24 |

6 |

1 |

19 |

| KIS4 |

44 |

3 |

15 |

56 |

39 |

7 |

7 |

39 |

| LKIS1 |

59 |

14 |

18 |

63 |

45 |

8 |

3 |

40 |

| LKIS2 |

76 |

6 |

6 |

76 |

51 |

10 |

6 |

47 |

| Total |

543 |

102 |

98 |

539 |

375 |

66 |

51 |

360 |

Table 4.

Overall specialisation profiles of the MSCs, 2012 and 2019. Source: our elaboration on Istat data.

Table 4.

Overall specialisation profiles of the MSCs, 2012 and 2019. Source: our elaboration on Istat data.

| Profiles |

Northwest |

Northeast |

| Year 2012 |

Year 2019 |

Year 2012 |

Year 2019 |

| N° |

% |

N° |

% |

N° |

% |

N° |

% |

| Industry |

27 |

24.3 |

23 |

20.7 |

19 |

24.4 |

18 |

23.1 |

| Industry + KIS |

4 |

3.6 |

4 |

3.6 |

5 |

6.4 |

3 |

3.8 |

| Industry + LKIS |

13 |

11.7 |

14 |

12.6 |

6 |

7.7 |

8 |

10.3 |

| KIS + LKIS |

36 |

32.4 |

31 |

27.9 |

27 |

34.6 |

19 |

24.4 |

| KIS |

13 |

11.7 |

16 |

14.4 |

7 |

9.0 |

14 |

17.9 |

| LKIS |

18 |

16.2 |

23 |

20.7 |

14 |

17.9 |

16 |

20.5 |

| Total |

111 |

100.0 |

111 |

100.0 |

78 |

100.0 |

78 |

100.0 |

Table 5.

Employment trends in the MSCs, 2019-2020. Source: our elaboration on Istat data.

Table 5.

Employment trends in the MSCs, 2019-2020. Source: our elaboration on Istat data.

| Areas |

Balance of employees |

Change in % of employees by size classes of local business units |

| Total |

0-9 employees |

10-49 employees |

50-249 employees |

≥250 employees |

| Northwest |

-35,959 |

-2.2 |

-0.3 |

-1.1 |

-2.4 |

-9.5 |

| Lombardy |

-23,273 |

-2.1 |

-0.4 |

-1.5 |

-3.7 |

-5.9 |

| Piedmont |

-10,297 |

-2.5 |

0.1 |

-0.9 |

0.7 |

-16.4 |

| Liguria |

-1,631 |

-1.5 |

-0.6 |

1.1 |

1.3 |

-27.0 |

| Valle d’Aosta |

-757 |

-6.1 |

-2.6 |

10.2 |

-24.3 |

-21.8 |

| Northeast |

-67,348 |

-4.4 |

-0.6 |

-3.7 |

-3.2 |

-20.5 |

| Emilia-R. |

- 42,015 |

-5.0 |

-0.8 |

-4.8 |

-1.6 |

-23.0 |

| Veneto |

-15,453 |

-3.5 |

-0.6 |

-3.1 |

-5.7 |

-12.3 |

| Trentino-A.A. |

-5,896 |

-4.0 |

-0.7 |

-1.6 |

-4.4 |

-20.8 |

| Friuli-V.G. |

-3,984 |

-4.7 |

0.4 |

1.2 |

-2.3 |

-27.7 |

| Total MSCs |

-103,307 |

-3.3 |

-0.5 |

-2.4 |

-2.8 |

-14.6 |

| Northern Italy |

-243,671 |

-2.5 |

-0.3 |

-2.7 |

-2.0 |

-10.0 |

| Italy |

-300,172 |

-1.7 |

0.3 |

-1.8 |

-2.2 |

-9.6 |

Table 6.

Evolutionary trajectories in the MSCs, 2012-2019 and 2019-2020, absolute values. Source: our elaboration on Istat data.

Table 6.

Evolutionary trajectories in the MSCs, 2012-2019 and 2019-2020, absolute values. Source: our elaboration on Istat data.

|

Employment trend2012-2019

|

Employment trend2019-2020

|

Northwest(111 MSCs)

|

Northeast(78 MSCs)

|

Total(189 MSCs)

|

| Growth |

Growth |

16 |

10 |

26 |

| Growth |

Moderate decline |

19 |

18 |

37 |

| Growth |

Strong decline |

23 |

40 |

63 |

| Decline |

Growth |

17 |

5 |

22 |

| Decline |

Moderate decline |

19 |

0 |

19 |

| Decline |

Strong decline |

17 |

5 |

22 |

Notes

| 1 |

In 2019, Northern Italy generated 56.2% of the country’s GDP, with a GDP per capita amounting to €36,530 (Istat data). |

| 2 |

The former consists of activities that meet the need of local users (residents, commuters, tourists); the latter includes the production of goods and services intended primarily for the external market. |

| 3 |

Administrative, healthcare, schooling, banking and commercial functions. |

| 4 |

In Northern Italy: Milan, Turin, Genoa, Bologna and Venice. In the rest of the country: Florence, Rome, Naples, Bari, Reggio Calabria, Palermo, Catania, Messina and Cagliari. |

| 5 |

The data does not include Trentino-Alto Adige and Valle d’Aosta. As many as 18 cases were found in Veneto |

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).